估值模型

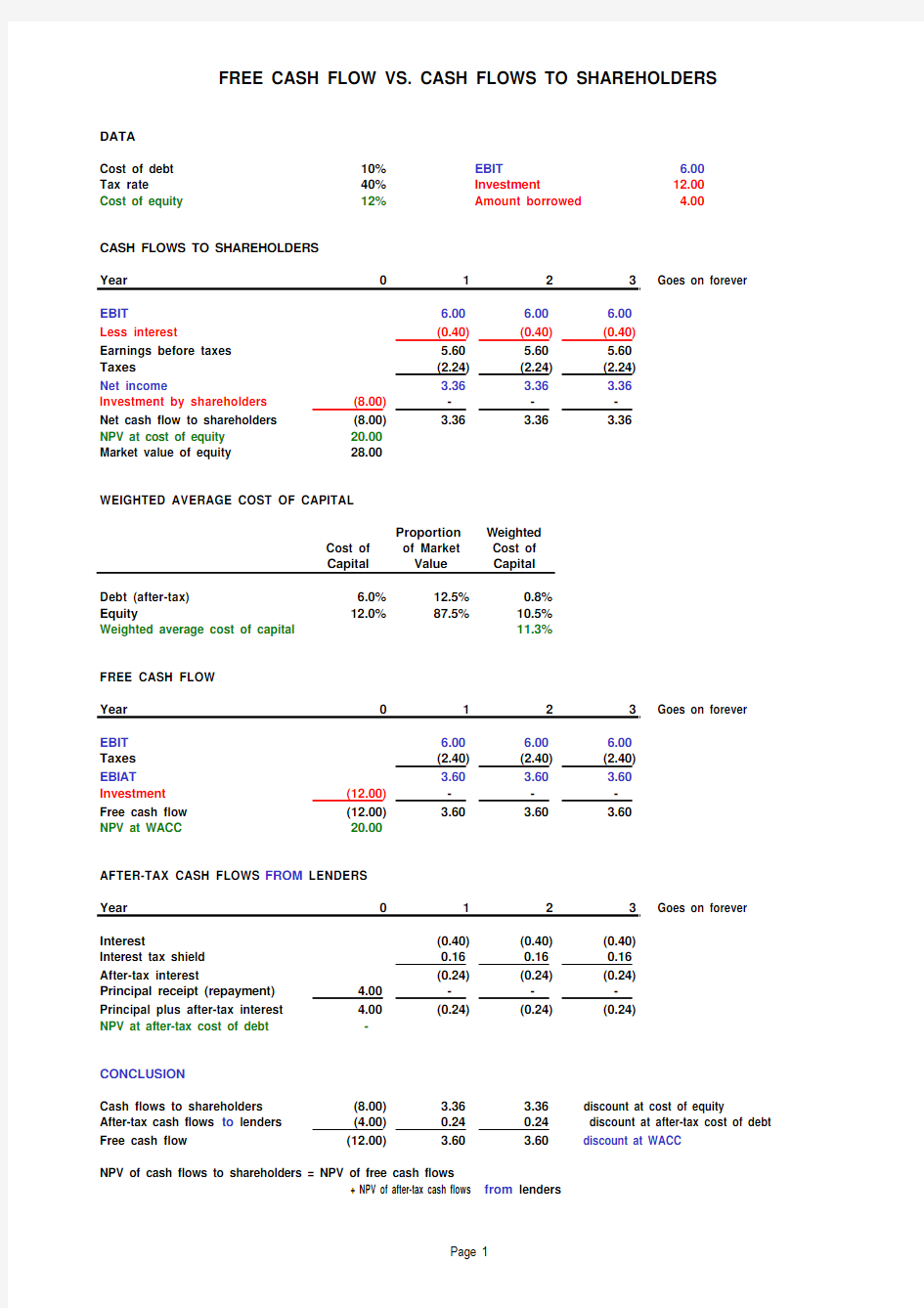

FREE CASH FLOW VS. CASH FLOWS TO SHAREHOLDERS

DATA

Cost of debt10%EBIT 6.00

Tax rate40%Investment12.00

Cost of equity12%Amount borrowed 4.00

CASH FLOWS TO SHAREHOLDERS

Year0123 Goes on forever

EBIT 6.00 6.00 6.00

Less interest(0.40)(0.40)(0.40)

Earnings before taxes 5.60 5.60 5.60

Taxes(2.24)(2.24)(2.24)

Net income 3.36 3.36 3.36

Investment by shareholders---

Net cash flow to shareholders 3.36 3.36 3.36

NPV at cost of equity20.00

Market value of equity28.00

WEIGHTED AVERAGE COST OF CAPITAL

Proportion Weighted

Cost of of Market Cost of

Capital Value Capital

Debt (after-tax) 6.0%12.5%0.8%

Equity12.0%87.5%10.5%

Weighted average cost of capital11.3%

FREE CASH FLOW

Year0123 Goes on forever EBIT 6.00 6.00 6.00

Taxes(2.40)(2.40)(2.40)

EBIAT 3.60 3.60 3.60

Investment(12.00)---

Free cash flow(12.00) 3.60 3.60 3.60

NPV at WACC20.00

AFTER-TAX CASH FLOWS FROM LENDERS

Year0123 Goes on forever Interest(0.40)(0.40)(0.40)

Interest tax shield0.160.160.16

After-tax interest(0.24)(0.24)(0.24)

Principal receipt (repayment) 4.00---

Principal plus after-tax interest 4.00(0.24)(0.24)(0.24)

NPV at after-tax cost of debt-

CONCLUSION

Cash flows to shareholders(8.00) 3.36 3.36 discount at cost of equity

After-tax cash flows to lenders(4.00)0.240.24 discount at after-tax cost of debt Free cash flow(12.00) 3.60 3.60 discount at WACC

NPV of cash flows to shareholders = NPV of free cash flows

+ NPV of after-tax cash flows from lenders

Page 1