lc draft

国际结算银行汇票与LC的对比

国际结算银行汇票与LC的对比银行汇票(banker's draft)是出票人和付款人均为银行的汇票。

在2000年度以前,因为国际及时汇兑的时间问题,长与LC一样出现在国际结算中。

但一般为了保证自身利益,多为跟单汇票(documentary bill)又称信用汇票、押汇汇票,是需要附带提单、仓单、保险单、装箱单、商业发票等单据,才能进行付款的汇票。

从这种意义上来讲与LC无多大的差异。

如果对方提出的不是是银行汇票(banker's draft)而是商业汇票(commercial draft)或者商业承兑汇票(commercial acceptance bill)。

那更是无法接受的。

我所接触到的银行汇票(banker's draft)多为即期汇票,用于支付合同定金或者是小额贸易交易,一般都在10万美元一下(而且是光票clean bill 汇票本身不附带货运单据),超过10万美元以上的国际银行汇票,尚未见过,大额的银行汇票对于进口方来讲风险很大,不如LC保险,除非是其开具的得是远期银行承兑汇票(banker's acceptance bill),对于企业来讲远期银行承兑汇票,如果是光票对于企业来讲更有利一些,除非对方银行信誉不行,否则的话,将优于LC.(合约中应该注明,在到期得到对方银行承付后发货条款更为保险),以上说的为:银行汇票(banker's draft)或者为银行承兑汇票(banker's acceptance bill),而非商业汇票(commercial draft)或者商业承兑汇票(commercial acceptance bill)。

同时为光票(clean bill)上述说了:银行汇票(banker's draft)或者为银行承兑汇票(banker's acceptance bill),比LC来讲对企业更有利,其重要的不利因素为:开具银行的信用和票据的真伪,现实中的例子是齐鲁银行以前年的大案,就是利用了所谓的国际银行银行承兑汇票(banker's acceptance bill),出现的抵押贷款风险。

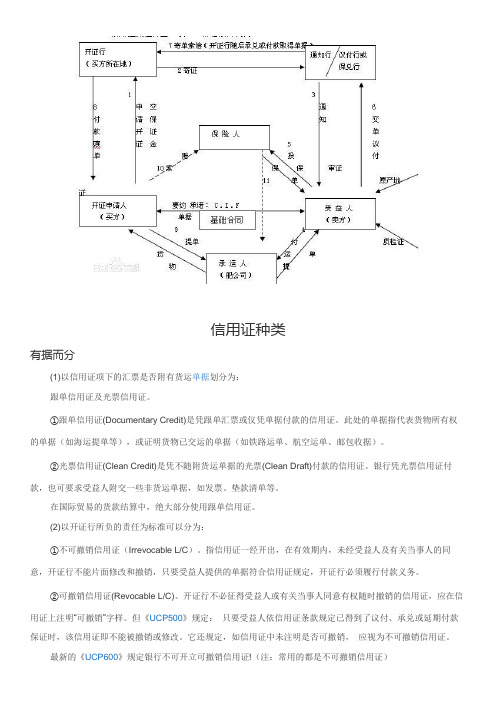

信用证Letter of Credit,LC

信用证种类有据而分(1)以信用证项下的汇票是否附有货运单据划分为:跟单信用证及光票信用证。

①跟单信用证(Documentary Credit)是凭跟单汇票或仅凭单据付款的信用证。

此处的单据指代表货物所有权的单据(如海运提单等),或证明货物已交运的单据(如铁路运单、航空运单、邮包收据)。

②光票信用证(Clean Credit)是凭不随附货运单据的光票(Clean Draft)付款的信用证。

银行凭光票信用证付款,也可要求受益人附交一些非货运单据,如发票、垫款清单等。

在国际贸易的货款结算中,绝大部分使用跟单信用证。

(2)以开证行所负的责任为标准可以分为:①不可撤销信用证(Irrevocable L/C)。

指信用证一经开出,在有效期内,未经受益人及有关当事人的同意,开证行不能片面修改和撤销,只要受益人提供的单据符合信用证规定,开证行必须履行付款义务。

②可撤销信用证(Revocable L/C)。

开证行不必征得受益人或有关当事人同意有权随时撤销的信用证,应在信用证上注明“可撤销”字样。

但《UCP500》规定:只要受益人依信用证条款规定已得到了议付、承兑或延期付款保证时,该信用证即不能被撤销或修改。

它还规定,如信用证中未注明是否可撤销,应视为不可撤销信用证。

最新的《UCP600》规定银行不可开立可撤销信用证!(注:常用的都是不可撤销信用证)(3)以有无另一银行加以保证兑付为依据,可以分为:①保兑信用证(Confirmed L/C)。

指开证行开出的信用证,由另一银行保证对符合信用证条款规定的单据履行付款义务。

对信用证加以保兑的银行,称为保兑行。

②不保兑信用证(Unconfirmed L/C)。

开证行开出的信用证没有经另一家银行保兑。

(4)根据付款时间不同,可以分为①即期信用证(Sight L/C)。

指开证行或付款行收到符合信用证条款的跟单汇票或装运单据后,立即履行付款义务的信用证。

②远期信用证(Usance L/C)。

LC小知识

LC小知识信用证附加条款翻译+UNLESS OTHERWISE EXPRESSLY STATED, DRAFT(S), INVOICE(S) AND BILL OF LADING MUST INDICATE THE DC NUMBER.除非是另外特别说明,所有单据,发票及提单都必须写名信用证号码+UNLESS OTHERWISE EXPRESSLY STATED, ALL SHIPPING DOCUMENTS SHOULD BEAR THEIR RESPECTIVE ISSUING DATES.除非是另外特别说明,所有运输单据都必须写名其开证时间+UNLESS OTHERWISE EXPRESSLY STATED, ALL DOCUMENTS CALLED FOR UNDER THE CREDIT MUST BE IN THE LANGUAGE OF THE CREDIT.除非是另外特别说明, 信用证要求的文件都要用信用证的语言开出+IN ACCORDANCE WITH THE PROVISIONS OF ARTICLE 16C (III)(B) OF UCP600,IF WE GIVE NOTICE OF REFUSAL OF DOCUMENTS PRESENTED UNDER THIS CREDIT WE SHALL HOWEVER RETAIN THE RIGHT TO ACCEPT A WAIVER OF DISCREPANCIES FROM THE APPLICANT AND,SUBJECT TO SUCH WAIVER BEING ACCEPTABLE TO US,TO RELEASE DOCUMENTS AGAINST THAT WAIVER WITHOUT REFERENCE TO THE PRESENTER PROVIDED THAT NO WRITTEN INSTRUCTIONS TO THE CONTRARY HAVE BEEN RECEIVED BY US FROM THE PRESENTER BEFORE THE RELEASE OF THE DOCUMENTS.ANY SUCH RELEASE PRIOR TO RECEIPT OF CONTRARY INSTRUCTIONS SHALL NOT CONSTITUTE A FAILURE ON OUR PART TO HOLD THE DOCUMENTS AT THE PRESENTER'S RISK AND DISPOSAL, AND WE WILL HAVE NO LIABILITY TO THE PRESENTER IN RESPECT OF ANY SUCH RELEASE.为了与UPC条款16C(III)规定的一至,如果我们给出拒收文件的通知,虽然我们仍保留对申请人接受的不符点的权利,放弃声明被我们接受的话,如果在我们放单之前没收到受益人相反书面指示,我们将不通知受益人直接放单。

外贸信用证(LC)用语大全(下)

Certificate of Origin1.certificate of origin of China showing中国产地证明书 stating 证明 evidencing 列明 specifying 说明 indicating 表明 declaration of 声明2.certificate of Chinese origin中国产地证明书3.Certificate of origin shipment of goods of … origin prohibited产地证,不允许装运……的产品4.declaration of origin产地证明书(产地⽣明)5.certificate of origin separated单独出具的产地证6.certificate of origin “form A”“格式A”产地证明书7.genetalised system of preference certificate of origin form “A”普惠制格式“A”产地证明书Packing List and Weight List1.packing list deatiling the complete inner packing specification and contents of each package 载明每件货物之内部包装的规格和内容的装箱单2.packing list detailing…详注……的装箱单3.packing list showing in detail…注明……细节的装箱单4.weight list 重量单5.weight notes 磅码单(重量单)6.detailed weight list 明细重量单Other Documents1. full tet of forwarding agents' cargo receipt全套运输⾏所出具之货物承运收据2.air way bill for goods condigned to…quoting our credit number以……为收货⼈,注明本证号码的空运货单3.parcel post receipt 邮包收据4.Parcel post receipt showing parcels addressed to…a/c accountee邮包收据注明收件⼈:通过……转交开证⼈5.parcel post receipt evidencing goods condigned to…and quoting our credit number以……为收货⼈并注明本证号码的邮包收据6.certificate customs invoice on form 59A combined certificate of value and origin for developing countries适⽤于发展中国家的包括价值和产地证明书的格式59A海关发票证明书7.pure foods certificate 纯⾷品证书bined certificate of value and Chinese origin价值和中国产地联合证明书9.a declaration in terms of FORM 5 of New Zealand forest produce import and export and regultions 1966 or a declaration FORM the exporter to the effect that no timber has been used in the packing of the goods, either declaration may be included on certified customs invoice依照1966年新西兰林⽊产品进出⼝法格式5条款的声明或出⼝⼈关于货物⾮⽤⽊器包装的实绩声明,该声明也可以在海关发票中作出证明10.Canadian custtoms invoice(revised form)all signed in ink showing fair market value in currency of country of export⽤出⼝国货币标明本国市场售价,并进⾏笔签的加拿⼤海关发票(修订格式)11.Canadian import declaration form 111 fully signed and completed完整签署和填写的格式111加拿⼤进⼝声明书The Stipulation for Shipping Terms1. loading port and destinaltion装运港与⽬的港(1)despatch/shipment from Chinese port to…从中国港⼝发送/装运往……(2)evidencing shipment from China to…CFR by steamer in transit Saudi Arabia not later than 15th July, 1987 of the goods specified below列明下⾯的货物按成本加运费价格⽤轮船不得迟于1987年7⽉15⽇从中国通过沙特阿拉伯装运到……2.date of shipment 装船期(1)bills of lading must be dated not later than August 15, 1987提单⽇期不得迟于1987年8⽉15⽇(2)shipment must be effected not later than(or on)July 30,1987货物不得迟于(或于)1987年7⽉30⽇装运(3)shipment latest date… 最迟装运⽇期:……(4)evidencing shipment/despatch on or before…列明货物在…年…⽉…⽇或在该⽇以前装运/发送(5)from China port to … not later than 31st August, 1987不迟于1987年8⽉31⽇从中国港⼝⾄……3.partial shipments and transhipment分运与转运(1)partial shipments are (not) permitted(不)允许分运(2)partial shipments (are) allowed (prohibited)准许(不准)分运(3)without transhipment不允许转运(4)transhipment at Hongkong allowed允许在⾹港转船(5)partial shipments are permissible, transhipment is allowed except at…允许分运,除在……外允许转运(6)partial/prorate shipments are perimtted允许分运/按⽐例装运(7)transhipment are permitted at any port against, through B/lading凭联运提单允许在任何港⼝转运Date & Address of Expiry1. valid in…for negotiation until…在……议付⾄……⽌2.draft(s) must be presented to the negotiating(or drawee)bank not later than…汇票不得迟于……交议付⾏(受票⾏)3.expiry date for presention of documents…交单满期⽇4.draft(s) must be negotiated not later than…汇票要不迟于……议付5.this L/C is valid for negotiation in China (or your port) until 15th, July 1977本证于1977年7⽉15⽇⽌在中国议付有效6.bills of exchange must be negotiated within 15 days from the date of bills of lading but not later than August 8, 1977汇票须在提单⽇起15天内议付,但不得迟于1977年8⽉8⽇7.this credit remains valid in China until 23rd May, 1977(inclusive)本证到1977年5⽉23⽇为⽌,包括当⽇在内在中国有效8.expiry date August 15, 1977 in country of beneficiary for negotiation于1977年8⽉15⽇在受益⼈国家议付期满9.draft(s) drawn under this credit must be presented for negoatation in China on or before 30th August,1977 根据本证项下开具的汇票须在1977年8⽉30⽇或该⽇前在中国交单议付10.this credit shall cease to be available for negotiation of beneficairy's drafts after 15th August,1977 本证将在1977年8⽉15⽇以后停⽌议付受益⼈之汇票11.expiry date 15th August, 1977 in the country of the beneficiary unless otherwise除⾮另有规定,(本证)于1977年8⽉15⽇受益⼈国家满期12.draft(s) drawn under this credit must be negotiation in China on or before August 12, 1977 after which date this credit expires凭本证项下开具的汇票要在1977年8⽉12⽇或该⽇以前在中国议付,该⽇以后本证失效13.expiry (expiring) date…满期⽇……14.…if negotiation on or before…在……⽇或该⽇以前议付15.negoation must be on or before the 15th day of shipment⾃装船⽇起15天或之前议付16.this credit shall remain in force until 15th August 197 in China本证到1977年8⽉15⽇为⽌在中国有效17.the credit is available for negotiation or payment abroad until…本证在国外议付或付款的⽇期到……为⽌18.documents to be presented to negotiation bank within 15 days after shipment单据需在装船后15天内交给议付⾏19.documents must be presented for negotiation within…days after the on board date of bill of lading/after the date of issuance of forwarding agents' cargo receipts单据需在已装船提单/运输⾏签发之货物承运收据⽇期后……天内提⽰议付The Guarantee of the Opening Bank1. we hereby engage with you that all drafts drawn under and in compliance with the terms of this credit will be duly honored我⾏保证及时对所有根据本信⽤证开具、并与其条款相符的汇票兑付2.we undertake that drafts drawn and presented in conformity with the terms of this credit will be duly honoured开具并交出的汇票,如与本证的条款相符,我⾏保证依时付款3.we hereby engage with the drawers, endorsers and bona-fide holders of draft(s) drawn under and in compliance with the terms of the credit that such draft(s) shall be duly honoured on due presentation and delivery of documents as specified (if drawn and negotiated with in the validity date of this credit)凡根据本证开具与本证条款相符的汇票,并能按时提⽰和交出本证规定的单据,我⾏保证对出票⼈、背书⼈和善意持有⼈承担付款责任(须在本证有效期内开具汇票并议付)4.provided such drafts are drawn and presented in accordance with the terms of this credit, we hereby engage with the drawers, endorsors and bona-fide holders that the said drafts shall be duly honoured on presentation凡根据本证的条款开具并提⽰汇票,我们担保对其出票⼈、背书⼈和善意持有⼈在交单时承兑付款5.we hereby undertake to honour all drafts drawn in accordance with the terms of this credit所有按照本条款开具的汇票,我⾏保证兑付In Reimbursement1.instruction to the negotiation bank议付⾏注意事项(1)the amount and date of negotiation of each draft must be endorsed on reverse hereof by the negotiation bank每份汇票的议付⾦额和⽇期必须由议付⾏在本证背⾯签注(2)this copy of credit is for your own file, please deliver the attached original to the beneficaries本证副本供你⾏存档,请将随附之正本递交给受益⼈(3)without you confirmation thereon(本证)⽆需你⾏保兑(4)documents must be sent by consecutive airmails单据须分别由连续航次邮寄(注:即不要将两套或数套单据同⼀航次寄出)(5)all original documents are to be forwarded to us by air mail and duplicate documents by sea-mail全部单据的正本须⽤航邮,副本⽤平邮寄交我⾏(6)please despatch the first set of documents including three copies of commercial invoices direct to us by registered airmail and the second set by following airmail请将包括3份商业发票在内的第⼀套单据⽤挂号航邮经寄我⾏,第⼆套单据在下⼀次航邮寄出(7)original documents must be snet by Registered airmail, and duplicate by subsequent airmail单据的正本须⽤挂号航邮寄送,副本在下⼀班航邮寄送(8)documents must by sent by successive (or succeeding) airmails单据要由连续航邮寄送(9)all documents made out in English must be sent to out bank in one lot⽤英⽂缮制的所有单据须⼀次寄交我⾏2.method of reimbursement 索偿办法(1)in reimbursement, we shall authorize your Beijing Bank of China Head Office to debit our Head Office RMB Yuan account with them, upon receipt of relative documents偿付办法,我⾏收到有关单据后,将授权你北京总⾏借记我总⾏在该⾏开⽴的⼈民币帐户(2)in reimbursement draw your own sight drafts in sterling on…Bank and forward them to our London Office,accompanied by your certificate that all terms of this letter of credit have been complied with偿付办法,由你⾏开出英镑即期汇票向……银⾏⽀取。

LC主要流程及注意事项

根据个人操作L/C过程中,常见的几个问题及注意事项,提醒大家:1.买卖双方签订合同(Payment Terms: 100% L/C At Sight)。

2.买方(客户方)根据合同去当地银行(开证行)去申请开立信用证,(买方在信用证中称作“申请人”),买方在开立信用证后,把L/C Draft通过Email 传给卖方(信用证的受益人)让卖方审核。

3. 卖方审核L/C中各个条款没问题后,以Email形式告知客户开立L/C正本; 等到卖方所在地银行(通知行)受到信用证后,会审核该L/C各项条款,以避免软条款出现,对卖方造成不必要的损失;通知行审核L/C没问题后,就以电话的方式通知卖方:从某某国家开来一个信用证,让什么时间去银行拿L/C正本去。

备注:银行通知卖方不是免费的,会有200元的通知费。

(如果卖方公司账户上有钱,银行会直接从账户上扣除相应的费用;否则,拿到正本之前,先去银行柜台缴纳相应的费用。

)4. 卖方拿到L/C正本后,根据L/C规定条款,准备相应单据(Commercial Invoice, Packing List, B/L, Insurance Certificate, Certificate of Origin and etc)、抓紧备货、订舱。

备注:找货运代理订舱时,务必要仔细看L/C规定相应条款中:是否允许分批装运、是否允许转船等相关条款。

5. 在开船前后,B/L、Insurance Certificate、Certificate of Origin等OK件就出来了,此时如果卖方对单据不放心,可以拿着L/C中规定的单据去一下银行(通知行),让银行工作人员先审核一下单据这样活着那样做是否符合L/C中相应条款规定;工作人员通常都会告知卖方做单据时有哪些注意事项,卖方要一一记清楚,按银行工作人员告知的做单据即可。

6. 卖方拿到L/C规定的所有单据正本后,要在信用证规定的交单期内同时也要在信用证有效期内,去银行交单,从银行交单回来后,通过Email要及时告知买方(开证申请人)什么时间已去银行交单;银行(通知行)会根据实际情况,尽快审核单据,单据没问题后,银行工作人员会告知卖方(信用证受益人)单据审核情况并及时把单据通过国际快递(通常情况下用DHL)快递给卖方所在地银行(开证行)。

LC主要条款翻译

LC 主要条款翻译20 DOCUMENTARY CREDIT NUMBER(信用证号码)23 REFERENCE TO PRE-ADVICE(预先通知号码)如果信用证是采取预先通知的方式,该项目内应该填入"PREADV/",再加上预先通知的编号或日期。

27 SEQUENCE OF TOTAL(电文页次)31C DATE OF ISSUE(开证日期)如果这项没有填,则开证日期为电文的发送日期。

31D DATE AND PLACE OF EXPIRY(信用证有效期和有效地点)该日期为最后交单的日期。

32B CURRENCY CODE, AMOUNT(信用证结算的货币和金额)39A PERCENTAGE CREDIT AMOUNT TOLERANCE(信用证金额上下浮动允许的最大范围)该项目的表示方法较为特殊,数值表示百分比的数值,如:5/5,表示上下浮动最大为5%。

39B与39A不能同时出现。

39B MAXIMUM CREDIT AMOUNT(信用证最大限制金额)39B与39A不能同时出现。

39C ADDITIONAL AMOUNTS COVERED(额外金额)表示信用证所涉及的保险费、利息、运费等金额。

40A FORM OF DOCUMENTARY CREDIT(跟单信用证形式)跟单信用证有六种形式:(1) IRREVOCABLE(不可撤销跟单信用证)(2) REVOCABLE(可撤销跟单信用证)(3) IRREVOCABLE TRANSFERABLE(不可撤销可转让跟单信用证)(4) REVOCABLE TRANSFERABLE(可撤销可转让跟单信用证)(5) IRREVOCABLE STANDBY(不可撤销备用信用证)(6) REVOCABLE STANDBY(可撤销备用信用证)41a AVAILABLE WITH...BY...(指定的有关银行及信用证兑付的方式)(1)指定银行作为付款、承兑、议付。

LC条款中英文对照[1]..

![LC条款中英文对照[1]..](https://img.taocdn.com/s3/m/9cacd608ae45b307e87101f69e3143323968f5bf.png)

LC条款中英文对照[1]..信用证类别----Kinds of L/C1.revocable L/C/irrevocable L/C 可撤销信用证/不可撤销信用证2.confirmed L/C/unconfirmed L/C 保兑信用证/不保兑信用证3.sight L/C/usance L/C 即期信用证/远期信用证4.transferable L/C(or)assignable L/C(or)transmissible L/C / untransferable L/C 可转让信用证/不可转让信用证5.divisible L/C/indivisible L/C 可分割信用证/不可分割信用证6.revolving L/C 循环信用证7.L/C with T/T reimbursement clause 带电汇条款信用证8.without recourse L/C/with recourse L/C 无追索权信用证/有追索权信用证9.documentary L/C/clean L/C 跟单信用证/光票信用证10.deferred payment L/C/anticipatory L/C 延付信用证/预支信用证11.back to back L/ Reciprocal L/C 对背信用证/对开信用证12.traveller’s L/C(or: circular L/C) 旅行信用证有关当事人----Names of Parties Concerned1.opener 开证人(1)applicant 开证人(申请开证人)(2)principal 开证人(委托开证人)(3)accountee 开证人(4)accreditor 开证人(委托开证人)(5)opener 开证人(6)for account of Messrs 付(某人)帐(7)at the request of Messrs 应(某人)请求(8)on behalf of Messrs 代表某人(9)by order of Messrs 奉(某人)之命(10)by order of and for account of Messrs 奉(某人)之命并付其帐户(11)at the request of and for account of Messrs 应(某人)得要求并付其帐户(12)in accordance with instruction received from accreditors根据已收到得委托开证人得指示2.beneficiary 受益人(1)beneficiary 受益人(2)in favour of 以(某人)为受益人(3)in one’s favour 以……为受益人(4)favouring yourselves 以你本人为受益人3.drawee 付款人(或称受票人,指汇票)(1)to drawn on (or :upon) 以(某人)为付款人(2)to value on 以(某人)为付款人(3)to issued on 以(某人)为付款人4.drawer 出票人5.advising bank 通知行(1)advising bank 通知行(2)the notifying bank 通知行(3)advised through…bank 通过……银行通知(4)advised by airmail/cable through…bank 通过……银行航空信/电通知6.opening bank 开证行(1)opening bank 开证行(2)issuing bank 开证行(3)establishing bank 开证行7.negotiation bank 议付行(1)negotiating bank 议付行(2)negotiation bank 议付行8.paying bank 付款行9.reimbursing bank 偿付行10.the confirming bank 保兑行信用证金额Amount of the L/C1.amount RMB¥…金额:人民币2.up to an aggregate amount of Hongkong Dollars…累计金额最高为港币……3.for a sum (or :sums) not exceeding a total of GBP…总金额不得超过英镑……4.to the extent of HKD…总金额为港币……5.for the amount of USD…金额为美元……6.for an amount not exceeding total of JPY…金额的总数不得超过……日元的限度跟单文句---- The Stipulations for the shipping Documents available against surrender of the following documents bearing our credit number and the full name and address of the opener 凭交出下列注名本证号码和开证人的全称及地址的单据付款1. drafts to be accompanied by the documents marked(×)below汇票须随附下列注有(×)的单据2. accompanied against to documents hereinafter 随附下列单据4.accompanied by following documents 随附下列单据5.documents required 单据要求6.accompanied by the following documents mark ed(×)in duplicate随附下列注有(×)的单据一式两份7.drafts are to be accompanied by…汇票要随附(指单据)……汇票----Draft(Bill of Exchange)1.the kinds of drafts 汇票种类(1)available by drafts at sight 凭即期汇票付款(2)draft(s) to be drawn at 30 days sight 开立30天的期票(3)sight drafs 即期汇票(4)time drafts 远期汇票2.drawn clauses 出票条款(注:即出具汇票的法律依据)(1)all darfts drawn under this credit must contain the clause “Drafts drawn Under Bank of…credit No.…dated…”本证项下开具的汇票须注明“本汇票系凭……银行……年……月……日第…号信用证下开具”的条款(2)drafts are to be drawn in duplicate to our order bearing theclause “Drawn under United Malayan Banking Corp.Bhd.IrrevocableLetter of Credit No.…dated July 12, 1978”汇票一式两份,以我行为抬头,并注明“根据马来西亚联合银行1978年7月12日第……号不可撤销信用证项下开立”(3)draft(s) drawn under this credit to be marked:“Drawn under…Bank L/C No.……Dated (issuing date of credit)”根据本证开出得汇票须注明“凭……银行……年……月……日(按开证日期)第……号不可撤销信用证项下开立”(4)drafts in duplicate at sight bearing the clauses“Drawnunder…L/C No.…dated…”即期汇票一式两份,注明“根据……银行信用证……号,日期……开具”(5)draft(s) so drawn must be in scribed with the number and date of this L/C 开具的汇票须注上本证的号码和日期(6)draft(s) bearing the clause:“Drawn under documentary credit No.…(shown above) of…Bank”汇票注明“根据……银行跟单信用证……号(如上所示)项下开立”发票---Invoice1.signed commercial invoice 已签署的商业发票in duplicate 一式两份in triplicate 一式三份in quadruplicate 一式四份in quintuplicate 一式五份in sextuplicate 一式六份in septuplicate 一式七份in octuplicate 一式八份in nonuplicate 一式九份in decuplicate 一式十份2.beneficiary’s original signed commercial invoices at least in 8 copies issued in the name of the buyer indicating (showing/evidencing/specifying/declaration of) the merchandise, country of origin and any other relevant information.以买方的名义开具、注明商品名称、原产国及其他有关资料,并经签署的受益人的商业发票正本至少一式八份3.Signed attested invoice combined with certificate of origin and value in 6 copies as reuired for imports into Nigeria.以签署的,连同产地证明和货物价值的,输入尼日利亚的联合发票一式六份4.beneficiary must certify on the invoice…have been sent to the accountee 受益人须在发票上证明,已将……寄交开证人5.4% discount should be deducted from total amount of the commercial invoice 商业发票的总金额须扣除4%折扣6.invoice must be showed: under A/P No.…date of expiry 19th Jan.1981 发票须表明:根据第……号购买证,满期日为1981年1月19日7.documents in combined form are not acceptable 不接受联合单据/doc/d610718767.html,bined invoice is not acceptable 不接受联合发票提单--- Bill of Loading1.full set shippin g (company’s) clean on board bill(s) of lading marked “Freight Prepaid“ to order of shipper endorsed to … Bank,notifying buyers 全套装船(公司的)洁净已装船提单应注明“运费付讫”,作为以装船人指示为抬头、背书给……银行,通知买方2.bills of lading made out in negotiable form 作成可议付形式的提单3.clean shipped on board ocean bills of lading to order and endorsed in blank marked “Freight Prepaid“ notify: importer(openers,accountee) 洁净已装船的提单空白抬头并空白背书,注明“运费付讫”,通知进口人(开证人)4.full set of clean “on board“bills of lading/cargo receipt made out to our order/to order and endorsed in blank notify buyers M/S …Co. calling for shipment from China to Hamburg marked “Freight prepaid“ / “Freight Payable at Destination“全套洁净“已装船”提单/货运收据作成以我(行)为抬头/空白抬头,空白背书,通知买方……公司,要求货物字中国运往汉堡,注明“运费付讫”/“运费在目的港付”5.bills of lading issued in the name of…提单以……为抬头6.bills of lading must be dated not before the date of this credit and not later than Aug. 15, 1977 提单日期不得早于本证的日期,也不得迟于1977年8月15日7.bill of lading marked notify: buyer,“FreightPrepaid”“Liner terms”“received for shipment” B/L not acceptable提单注明通知买方,“运费预付”按“班轮条件”,“备运提单”不接受8.non-negotiable copy of bills of lading 不可议付的提单副本保险(一)保险单(或凭证)-----Insurance Policy (or Certificate)Risks & Coverage 险别(1)free from particular average (F.P.A.) 平安险(2)with particular average (W.A.) 水渍险(基本险)(3)all risk 一切险(综合险)(4)total loss only (T.L.O.) 全损险(5)war risk 战争险(6)cargo(extended cover)clauses 货物(扩展)条款(7)additional risk 附加险(8)from warehouse to warehouse clauses 仓至仓条款(9)theft,pilferage and nondelivery (T.P.N.D.) 盗窃提货不着险(10)rain fresh water damage 淡水雨淋险(11)risk of shortage 短量险(12)risk of contamination 沾污险(13)risk of leakage 渗漏险(14)risk of clashing & breakage 碰损破碎险(15)risk of odour 串味险(16)damage caused by sweating and/or heating 受潮受热险(17)hook damage 钩损险(18)loss and/or damage caused by breakage of packing 包装破裂险(19)risk of rusting 锈损险(20)risk of mould 发霉险(21)strike, riots and civel commotion (S.R.C.C.) 罢工、暴动、民变险(22)risk of spontaneous combustion 自燃险(23)deterioration risk 腐烂变质险(24)inherent vice risk 内在缺陷险(25)risk of natural loss or normal loss 途耗或自然损耗险(26)special additional risk 特别附加险(27)failure to delivery 交货不到险(28)import duty 进口关税险(29)on deck 仓面险(30)rejection 拒收险(31)aflatoxin 黄曲霉素险(32)fire risk extension clause-for storage of cargo at destinationHongkong, including Kowloon, or Macao 出口货物到香港(包括九龙在内)或澳门存仓火险责任扩展条款(33)survey in customs risk 海关检验险(34)survey at jetty risk 码头检验险(35)institute war risk 学会战争险(36)overland transportation risks 陆运险(37)overland transportation all risks 陆运综合险(38)air transportation risk 航空运输险(39)air transportation all risk 航空运输综合险(40)air transportation war risk 航空运输战争险(41)parcel post risk 邮包险(42)parcel post all risk 邮包综合险(43)parcel post war risk 邮包战争险(44)investment insurance(political risks) 投资保险(政治风险)(45)property insurance 财产保险(46)erection all risks 安装工程一切险(47)contractors all risks 建筑工程一切险保险(二)the stipulations for insurance 保险条款(1)marine insurance policy 海运保险单(2)specific policy 单独保险单(3)voyage policy 航程保险单(4)time policy 期限保险单(5)floating policy (or open policy) 流动保险单(6)ocean marine cargo clauses 海洋运输货物保险条款(7)ocean marine insurance clauses (frozen products) 海洋运输冷藏货物保险条款(8)ocean marine cargo war clauses 海洋运输货物战争险条款(9)ocean marine insurance clauses (woodoil in bulk) 海洋运输散装桐油保险条款(10)overland transportation insurance clauses (train, trucks)陆上运输货物保险条款(火车、汽车)(11)overland transportation insurance clauses (frozen products)陆上运输冷藏货物保险条款(12)air transportation cargo insurance clauses 航空运输货物保险条款(13)air transportation cargo war risk clauses 航空运输货物战争险条款(14)parcel post insurance clauses 邮包保险条款(15)parcel post war risk insurance clauses 邮包战争保险条款(16)livestock & poultry insurance clauses (by sea, land or air)活牲畜、家禽的海上、陆上、航空保险条款(17)…risks clauses of the P.I.C.C. subject to C.I.C.根据中国人民保险公司的保险条款投保……险(18)marine insurance policies or certificates in negotiableform, for 110% full CIF invoice covering the risks of War & W.A. as per the People’s Insurance Co. of China dated 1/1/1976. with extended cover up to Kuala Lumpur with claims payable in (at) Kuala Lumpur in the currency of draft (irrespective of percentage) 作为可议付格式的海运保险单或凭证按照到岸价的发票金额110%投保中国人民保险公司1976年1月1日的战争险和基本险,负责到吉隆坡为止。

LC draft信用证样本

MT700 LETTER OF CREDIT DRAFTRECEIVER : BHFBDEFF50027: Sequence of Total1/140A: Form of Documentary CreditIRREVOCABLE20: Documentary Credit NumberOLC/1111/00005931C: Date of Issue11110140E: Applicable RulesUCP LATEST VERSION31D: Date and Place of ExpiryNovember 23, 201150: Applicant59: Beneficiary - Name & Address Xinfeng Biotechnology Limited32B: Currency Code, AmountCurrency : USDAmount : 28,200.0041A: Available With...By... – BICBHFBDEFF500BHF BANK AKTIENGESELLSCHAFT BY PAYMENT43P: Partial ShipmentsNOT ALLOWED43T: TranshipmentALLOWED44F:Port of Loading/Airport of Dep.QINGDAO, CHINA44C: Port of Discharge /Airport of Dest.TEMA, GHANA44C: Latest Date of Shipment111123 (IS THIS NOVEMBER 23, 2011 ??)45A: Description of Goods &/or Services+ FISHMEAL INGREDIENTS FOR POULTRY FEED FORMULATION+ CIF, TEMA PORTAS PER PROFORMA INVOICE NO. P/1110121 DATED 12/10/201146A: Documents Required1. FULL SET CLEAN ON BOARD OCEAN BILL OF LADING TO THE ORDER OF UT BANK LTD.FOREIGN OPERATIONS DEPARTMENT P.O.BOX BOX CT1778, CANTONMENTS ACCRA AND MARKED “FREIGHT PREPAID” NOTIFY FDN ENTERPRISES (GH) LTD, P.O. BOX AN8708,ACCRA-NORTH, GHANA2. COMMERCIAL INVOICE IN SIX COPIES ESTABLISHED IN THE NAME OF FEEDTIMEVENTURES LTD.3. PACKING LIST IN SIX COPIES4. BENEFICIARY’S CERTIFICATE INDICATING T HAT THEY HAVE MAILED BY COURIER ONESET OF NON NEGOTIABLE DOCUMENTS AND COPIES OF ALL DOCUMENTS DIRECTLY TO THE APPLICANT.5. CERTIFICATE OF QUALITY AND WEIGHT ISSUED BY SGS - QINGDAO6. CERTIFICATE OF ORIGIN ISSUED BY THE CHAMBER OF COMMERCE IN CHINA7. PHYTOSANITARY CERTIFICATE TO BE ISSUED BY GOVERNMENT AUTHORITY8. INSURANCE CERTIFICATE COVERING 110% VALUE OF GOODS47A: Additional Conditions1. LETTER OF CREDIT NUMBER OLC/1111/000059 NAD IDF NO.CD201110MOTIIDF10000537970 MUST BE QUOTED ON ……………………………………2. SGS-QINGDAO CSTC STANDARDS TECHNICAL SERVICES CO., LTD. AS 3RD INSPECTIONPARTY3. SHIPMENT MUST BE EFFECTED BY LINER VESSEL4. THIRD PARTY DOCUMENTS ALLOWED71B: ChargesALL CHARGES OUTSI DE GHANA ARE FOR THE BENEFICIARY’S ACCOUNT48: Period for PresentationALL DOCUMENTS ARE TO BE PRESENTED WITHIN 7 DAYS OF THE ISSUE OF THE BILL OF LADING BUT IN ANY EVENT WITHIN THE CREDIT VALIDITY.49: Confirmation InstructionsCONFIRM78: Instr to Paying/Accptg/Negotg BankKINDLY DEBIT OUR USD CURRENT A CCOUNT NO………….. WITH THE LETTER OF CREDIT VALUE AND CREDIT OUR USD COLLATERAL ACCOUNT WITH YOURSELVES AND ADD YOUR CONFIRMATION.ON PRESENTATION OF CREDIT CONFORMING DOCUMENTS, PLEASE PAY AS PER LETTER OF CREDIT TERMS AND CLAIM REIMBURSEMENT BY DEBITING OUR USD COLLATERAL ACCOUNT QUOTING OUR LETTER OF CREDIT REFERENCE NO ……………………..57A: 'Advise Through' Bank/SVRN US33SOVEREIGN BANK239 LITTLETON ROADPARSIPPANY, NJ 07054, USAA/C NO. 1471038939。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

(APPENDIX 1 / 附件1)ORIGINAL RECEIVED FROM SWIFTPRIORTY : NORMALMESSAGE OUTPUT REFERENCE : F01MBBEMYKLAXXXXXXXXX CORRESPONDENT INPUT REF : XXXXX ………………………………………MESSAGE HEADER………………………………………………….SWIFT OUTPUT信用证类型: 700SENDER开具人:RECEIVER接受人:ICBCINDUSTRY AND COMMERCIAL BANK OF CHINA………………………………………MESSAGE TEXT格式………………………………………………….: 27 : SEQUENCE OF TOTAL页数: 1/1: 40A : FORM OF LETTER OF CREDIT信用证类型: IRREVOCABLE NON-TRANSFERABLE不可撤销不可转账: 20 : LETTER OF CREDIT NUMBER信用证号: XXXXXXXXXXXXX: 31C : DATE OF ISSUE开具日期: XXXXX: 40E : APPLICABLE RULES约束规则: UCP LATEST VERSION最新版的UCP: 31D : DATE AND PLACE OF EXPIRY信用证有效期和有效地点: XXXXX MALAYSIA: 50 : BUYER 买家XXXXXXXXXX: 59 : SELLER 卖家XXXXXXXX: 32B : CURRENCY CODE, AMOUNT货币代码,数量: US$ 0,000,000.00: 39A : PERCENTAGE CREDIT AMOUNT TOLERANCE信用证金额上下浮动允许的最大范围: 10/10: 41D : AVAILABLE WITH……. BY …….指定的有关银行及信用证兑付的方式: ANY BANK任何银行: BY NEGOTIATION议付: 42C : DRAFT AT ….汇票付款日期: DRAFT AT 90 DAYS AFTER SIGHT FOR 100: PERCENT OF INVOICE VALUE 九十天内按照发票金额全值支付: 42D : DRAWEE汇票付款人: ISSUING BANK开票行: 43P : ALLOWED BUT NOT LESS THAN 100MT(+/-10PCT)PER SHIPMENT每船可以有浮动但不能超过100MT(+/-10PCT): NOT ALLOWED不允许: 43T : TRANSHIPMENT转运: NOT ALLOWED不允许: 44E : PORT OF LOADING/AIRPORT OF DEPARTURE装货海港/装货空港: ANY SAFE PORT, OPEN SEA,任何安全港口,公海: 44F : PORT OF DISCHARGE/AIRPORT OF DESTINATION卸货海港/卸货空港: XXXXX, CHINA: 44C : LATEST DATE OF SHIPMENT最近的出港日期: XXXXXXX: 45A : DESCRIPTION OF GOODS AND/OR SERVICE货物描述/服务描述: Kwila Log菠萝格/印加木COUNTRY OF ORIGIN原产地: Papua New Guinea: USD00.00/CIF XXXX PORT OF CHINA PER METRIC TONNE 每公吨CIFUSD00.00发到中国XXXX港口: TO BE LOADED AT ANY SAFE OPEN SEA ANCHORAGE KALIMANTAN, Papua New Guinea. 装货地点为巴布亚新几内亚的任何安全公海港口: COMMODITY商品: Kwila Log 巴布亚新几内亚产菠萝格/印加木: SPECIFICATION OF Kwila 规格(前面已经有了): AS PER STANDARD标准:: QUANTITY /AMOUNT: 100,000 METRIC TON /USD00.00/MT (+/- 10PCT): INCOTERMS: FOB - (Free on Board): 46A : DOCUMENT REQUIRED所需文件: 1.SIGNED COMMERCIAL INVOICE ISSUED BY SELLER IN 03 ORIGINAL AND: 02 COPIES.卖家提供的签署过的商业发票,3份正本2份副本。

: 2. CERTIFICATE OF ANALYSIS FROM CCIC AT THE POINT OF: STOCKPILE IN 01 ORIGINAL AND 02 COPIE 由CCIC在产地堆放处出具的分析化验报告,1份正本2份副本: 3. BENEFICIARY'S LETTER OF IMDEMNITY, IMDENIFYING THE BUYER THAT: THE SELLER WILL DELIVER THE GOODS IN GOOD ORDER AS PER AGREED : DELIVERY SCHEDULE IN 01 ORIGINAL收款人出具的赔偿承诺正本一份,承诺如果卖家未能按时发送合格货品,收款人将赔偿买家。

: 4. PERFORMANCE BOND FOR THE VALUE OF 2% OF THE LETTER OF CREDIT 信用证百分之2的履约保证金。

: 5. BENEFICIARY CERTIFICATE CERTIFYING THAT ONE (1) SET OF: SHIPPING DOCUMENTS SENT TO THE BUYER BY FAX WITHIN THREE (3): DAYS AFTER DATE OF B/L 收款人书面承诺在出具提单3天后将船运文件传真给买家: 6. CERTIFICATE OF ORIGIN ISSUED BY THE CHAMBER OF COMMERCE OR: AUTHORIZED ORGANIZATION IN 01 ORIGINAL AND 02 COPIES由商会或者其他权威机构出具的产地证明,正本一份,副本2份。

: 7. CERTIFICATE OF QUALITY AND WEIGHT ISSUED BY CCIC ON BOARD: OF VESSEL IN 01 ORIGINAL AND 02 COPIES由CCIC在船上验货出具的质量和重量检验报告,正本一份,副本2份。

: 8. FINAL DRAFT SURVEY ISSUED BY CCIC IN 01 ORIGINAL AND 02: COPIES 由CCIC出具的最终水尺计重报告,正本1份,副本2份: 9. ORIGINAL QUALITY AND WEIGHT INSPECTION CERTIFICATE ISSUED BY: CHINESE CIQ AT THE DISCHARGE PORT, IN 1 (ONE) ORIGINAL AND 1: (ONE) COPY由中国检验检疫局在卸货港检验后出具的质量和重量报告,正本和副本各一份: 10. 2/3 SET ON BOARD BILL OF LADING OR CHARTER PARTY BILL OF: LADING MADE OUT TO ORDER OF (ISSUEING BANK) AND BLANK ENDORSED: MARKED FREIGHT PREPAID.2套(正本一共3套)提单正本或租船提单正本,空白背书并注明“船运费已付”: 11. FULL SET OF INSURANCE CERTIFICATE STATING THE NUMBER OF: ORIGINAL ISSUED, FOR 110PCT OF INVOICE VALUE BLANK ENDORSED: WITH CLAIMS PAYABLE AS DESTINATION COVERING INSTITUTE CARGO: CLAUSE (A).全套保单,空白背书,保价为货品价值的110%。

: UPON THE VESSEL ARRIVAL AT THE DESTINATION PORT THE SURVEY: CERTIFICATE AT THE DISCHARGE PORT SHALL REACH TO THE SELLER: WITHIN 30 DAYS FROM THE DATE OF B/L, AFTER 30 DAYS IF NO DISCHARGE PORT: SURVEY CERTIFICATE IS AVAILABLE THEN THIS CONDITION SHALL BE: WAIVED AND THE LOADING PORT SURVEY CERTIFICATE SHALL BECOME THE: ONLY SURVEY CERTIFICATE AS REQUIRED BY THE DLC.提单签发的30天内验货报告必须送给卖方,如30天内卖家未收到此报告,装货港检验报告将成为跟单信用证的唯一付款文件。

: 47A : ADDITIONAL CONDITIONS附加条款: 1.3RD PARTY DOCUMENTS ARE ACCEPTABLE.买卖双方接受第三方文件: 2.CHARTER PARTY BILL OF LADING IS ALLOWED.租船提单同样有效: 3.WE, (ISSUING BANK'S NAME) BOUND TO HONOUR THE PAYMENT AS PER: ARTICLE 7 OF UCP 600, IRREGARDLESS TO ANY INJUCTION OR COURT: ORDER RESTRAINING US TO HONOUR PAYMENT.我们开证行会按跟单信用证条款7规定的内容付款,不受任何国家法律禁令限制。

: 4.TERMS OF PAYMENT:支付方式: PART A. – US 0,000,000.00I.E. 95PCT (+/- 10PCT) OF LETTER OF CREDIT VALUE IS: PAYABLE 90 DAYS AFTER SIGHT AGAINST THE FOLLOWING DOCUMENTS 第一种方式:买家得到以下文件的90天后,银行将支付卖方XXXXX美元,(XXXXX一般为信用证价值的85%到100%): I. DOCUMENT AS PER 46A 1 在信用证46A 1中提及的文件: 2. DOCUMENT AS PER 46A 2 在信用证46A 2中提及的文件: 3. DOCUMENT AS PER 46A 3 在信用证46A 3中提及的文件: 4. DOCUMENT AS PER 46A 4 在信用证46A 4中提及的文件: PART B. - US 000,000.00 I.E. 5PCT (+/-10PCT) OF TOTAL SHIPMENT VALUE: ARE PAYABLE 90 DAYS AT SIGHT AGAINST THE FOLLOWING DOCUMENTS 第二种方式(第一种和第二种不能同时出现):以下文件递交后的90天后,银行将支付卖方XXXXX美元,(XXXXX一般为信用证价值的85%到100%):: 1. DOCUMENT AS PER 46A 5: 2. DOCUMENT AS PER 46A 6: 3. DOCUMENT AS PER 46A 7: 4. DOCUMENT AS PER 46A 8: 5. DOCUMENT AS PER 46A 9: 6. DOCUMENT AS PER 46A 10: 7. DOCUMENT AS PER 46A 11: 8. SHIPPER MUST SEND 1 COPY OF BILL OF LADING VIA DHL / FEDX ONE DAY : AFTER B/L DATE.船主必须将在提单开具后一天内,把提单的复印将通过DHL/FEDX发送: 9. PROVE OF COURIER MUST BE PRESENTED FOR NEGOTIATION 快递证明也将保存作日后用。