国际结算模拟试题

国际结算练习题

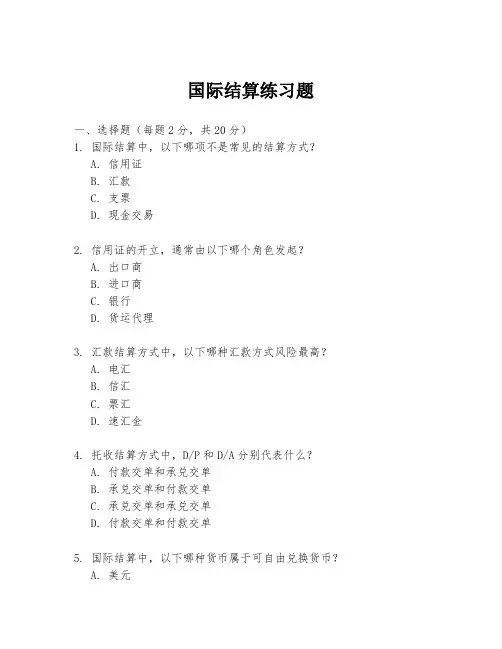

国际结算练习题一、选择题(每题2分,共20分)1. 国际结算中,以下哪项不是常见的结算方式?A. 信用证B. 汇款C. 支票D. 现金交易2. 信用证的开立,通常由以下哪个角色发起?A. 出口商B. 进口商C. 银行D. 货运代理3. 汇款结算方式中,以下哪种汇款方式风险最高?A. 电汇B. 信汇C. 票汇D. 速汇金4. 托收结算方式中,D/P和D/A分别代表什么?A. 付款交单和承兑交单B. 承兑交单和付款交单C. 承兑交单和承兑交单D. 付款交单和付款交单5. 国际结算中,以下哪种货币属于可自由兑换货币?A. 美元B. 人民币C. 印度卢比D. 巴西雷亚尔6. 信用证的到期地点通常在哪个国家?A. 出口国B. 进口国C. 第三国D. 任何国家7. 国际结算中,以下哪种支付方式属于非现金支付?A. 现金B. 支票C. 汇票D. 以上都是8. 以下哪种情况下,银行可以拒绝支付信用证下的款项?A. 单据不符B. 信用证过期C. 货物未按时到达D. 以上都是9. 托收结算方式中,如果进口商拒付,出口商应如何处理?A. 直接向银行索赔B. 向进口商追索C. 放弃追索权D. 重新议价10. 国际结算中,以下哪种风险属于信用风险?A. 汇率风险B. 政治风险C. 信用证欺诈D. 运输风险二、简答题(每题10分,共30分)1. 请简述信用证结算方式的一般流程。

2. 什么是远期信用证和即期信用证?它们的主要区别是什么?3. 在国际结算中,为什么需要进行风险管理?请列举至少三种常见的风险管理方法。

三、案例分析题(每题25分,共50分)1. 某出口商与进口商签订了一笔价值100万美元的货物销售合同,合同规定使用信用证结算。

出口商按照合同要求准备货物,并在货物装运后,向银行提交了所有必要的单据。

但是,银行发现单据中存在不符点,拒绝支付款项。

请问出口商应如何处理这种情况?2. 假设你是一家国际贸易公司的财务经理,公司最近与一家国外供应商达成了一笔交易,供应商要求使用托收结算方式。

国际结算模拟题

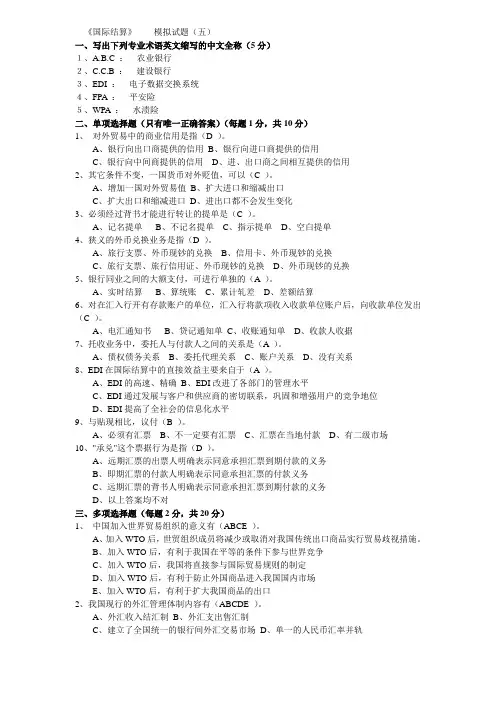

《国际结算》模拟试题(五)一、写出下列专业术语英文缩写的中文全称(5分)1、A.B.C :农业银行2、C.C.B :建设银行3、EDI :电子数据交换系统4、FPA :平安险5、WPA :水渍险二、单项选择题(只有唯一正确答案)(每题1分,共10分)1、对外贸易中的商业信用是指(D )。

A、银行向出口商提供的信用B、银行向进口商提供的信用C、银行向中间商提供的信用D、进、出口商之间相互提供的信用2、其它条件不变,一国货币对外贬值,可以(C )。

A、增加一国对外贸易值B、扩大进口和缩减出口C、扩大出口和缩减进口D、进出口都不会发生变化3、必须经过背书才能进行转让的提单是(C )。

A、记名提单B、不记名提单C、指示提单D、空白提单4、狭义的外币兑换业务是指(D )。

A、旅行支票、外币现钞的兑换B、信用卡、外币现钞的兑换C、旅行支票、旅行信用证、外币现钞的兑换D、外币现钞的兑换5、银行同业之间的大额支付,可进行单独的(A )。

A、实时结算B、算统账C、累计轧差D、差额结算6、对在汇入行开有存款账户的单位,汇入行将款项收入收款单位账户后,向收款单位发出(C )。

A、电汇通知书B、贷记通知单C、收账通知单D、收款人收据7、托收业务中,委托人与付款人之间的关系是(A )。

A、债权债务关系B、委托代理关系C、账户关系D、没有关系8、EDI在国际结算中的直接效益主要来自于(A )。

A、EDI的高速、精确B、EDI改进了各部门的管理水平C、EDI通过发展与客户和供应商的密切联系,巩固和增强用户的竞争地位D、EDI提高了全社会的信息化水平9、与贴现相比,议付(B )。

A、必须有汇票B、不一定要有汇票C、汇票在当地付款D、有二级市场10、"承兑"这个票据行为是指(D )。

A、远期汇票的出票人明确表示同意承担汇票到期付款的义务B、即期汇票的付款人明确表示同意承担汇票的付款义务C、远期汇票的背书人明确表示同意承担汇票到期付款的义务D、以上答案均不对三、多项选择题(每题2分,共20分)1、中国加入世界贸易组织的意义有(ABCE )。

国际结算模拟试题

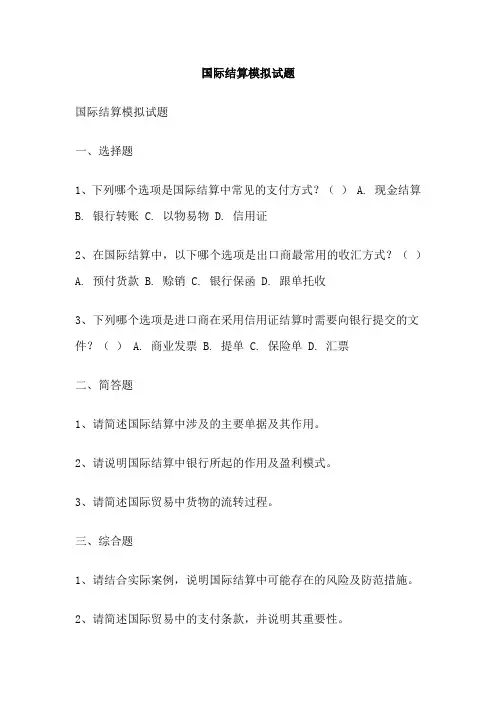

国际结算模拟试题国际结算模拟试题一、选择题1、下列哪个选项是国际结算中常见的支付方式?() A. 现金结算B. 银行转账C. 以物易物D. 信用证2、在国际结算中,以下哪个选项是出口商最常用的收汇方式?()A. 预付货款B. 赊销C. 银行保函D. 跟单托收3、下列哪个选项是进口商在采用信用证结算时需要向银行提交的文件?() A. 商业发票 B. 提单 C. 保险单 D. 汇票二、简答题1、请简述国际结算中涉及的主要单据及其作用。

2、请说明国际结算中银行所起的作用及盈利模式。

3、请简述国际贸易中货物的流转过程。

三、综合题1、请结合实际案例,说明国际结算中可能存在的风险及防范措施。

2、请简述国际贸易中的支付条款,并说明其重要性。

3、请比较分析国际结算中常用的三种支付方式的优缺点。

四、思考题1、请思考国际结算中存在的支付体系不统一的问题,并提出可能的解决方案。

2、请分析国际结算中电子化趋势的影响及应对策略。

3、请思考国际结算与国际贸易之间的相互影响及关系。

参考答案:一、选择题1、D 2. D 3. A二、简答题1、国际结算中涉及的主要单据包括商业发票、提单、保险单、汇票等。

商业发票是进出口双方报关、报验、清关、结算的重要凭证。

提单是承运人收到货物后出具的货物收据,是进出口双方换取提单前约定卸货港交货的必要依据。

保险单是保险公司对货物进行保险时出具的凭证,是进出口双方在货物运输过程中约定保险权利和义务的必要依据。

汇票是出口商向进口商收取货款时出具的凭证,是进出口双方进行结算的必要依据。

2、银行在国际结算中扮演着重要的角色,其作用包括提供结算服务、担保信用、融通资金等。

银行通过为客户提供结算服务,帮助进出口双方完成货款的收付,并通过收取手续费等方式盈利。

此外,银行还为客户提供信用担保和资金融通等服务,帮助客户解决贸易过程中的信用和资金问题。

银行的盈利模式主要包括手续费、利息、汇差等收入。

3、国际贸易中货物的流转过程包括出口商生产货物、出口商将货物交给承运人运输、承运人将货物运至进口国指定的港口、进口商在港口办理接货手续、进口商将货物运至目的地等步骤。

国际结算考试题及答案

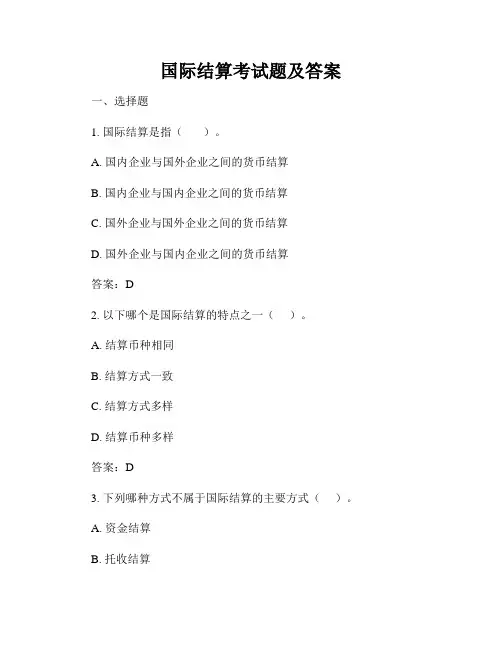

国际结算考试题及答案一、选择题1. 国际结算是指()。

A. 国内企业与国外企业之间的货币结算B. 国内企业与国内企业之间的货币结算C. 国外企业与国外企业之间的货币结算D. 国外企业与国内企业之间的货币结算答案:D2. 以下哪个是国际结算的特点之一()。

A. 结算币种相同B. 结算方式一致C. 结算方式多样D. 结算币种多样答案:D3. 下列哪种方式不属于国际结算的主要方式()。

A. 资金结算B. 托收结算C. 信用证结算D. 缴纳税款答案:D4. 以下哪个不是外汇市场的主要参与者()。

A. 商业银行B. 中央银行C. 政府机构D. 零售客户答案:D5. 外汇市场的主要参与者通过()进行交易。

A. 交割行B. 交易平台C. 清算行D. 结算行答案:B二、简答题1. 请简要介绍国际结算的分类方式。

答:国际结算可以按照结算币种、结算方式和结算地点等进行分类。

按照结算币种可以分为单币结算和多币结算;按照结算方式可以分为付款结算、托收结算、信用证结算等;按照结算地点可以分为跨境结算和同城结算。

2. 请简要说明托收结算的流程。

答:托收结算是指出口商通过银行将出口商品的单据托收给进口商的银行,进口商的银行负责收款并通知进口商。

托收结算流程一般包括出口商将单据交给本地银行,本地银行经过审核后将单据发送到进口商的银行,进口商的银行收到单据后通知进口商进行付款,最后进口商付款给进口商的银行,进口商的银行再将款项转给出口商的银行。

三、应用题某公司与境外供应商A签订了一份货物销售合同,合同金额为50,000美元,合同约定采用信用证结算方式。

合同条款如下:1. 信用证金额:50,000美元2. 信用证有效期:2019年1月1日至2019年12月31日3. 装运期限:2019年3月1日至2019年3月31日4. 单据要求:商业发票、装箱单、产地证明等请回答以下问题:1. 请列出双方在信用证结算方式下的权利和义务。

答:供应商A的权利:在合同有效期内向信用证银行提交符合信用证要求的单据,并获得款项支付。

国际结算业务试题及参考答案

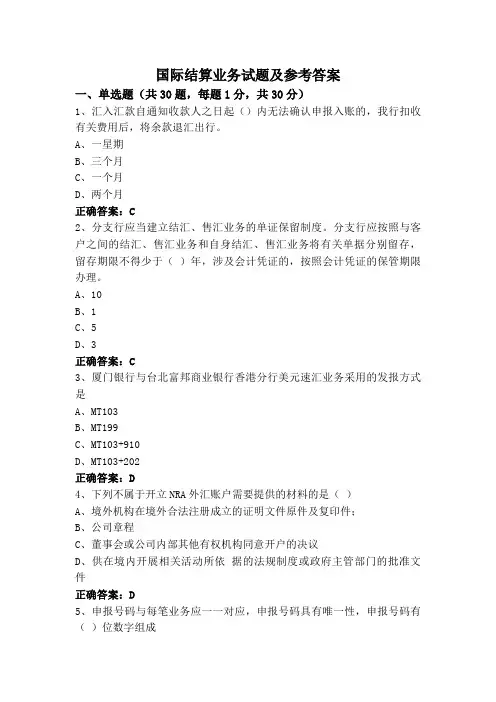

国际结算业务试题及参考答案一、单选题(共30题,每题1分,共30分)1、汇入汇款自通知收款人之日起()内无法确认申报入账的,我行扣收有关费用后,将余款退汇出行。

A、一星期B、三个月C、一个月D、两个月正确答案:C2、分支行应当建立结汇、售汇业务的单证保留制度。

分支行应按照与客户之间的结汇、售汇业务和自身结汇、售汇业务将有关单据分别留存,留存期限不得少于()年,涉及会计凭证的,按照会计凭证的保管期限办理。

A、10B、1C、5D、3正确答案:C3、厦门银行与台北富邦商业银行香港分行美元速汇业务采用的发报方式是A、MT103B、MT199C、MT103+910D、MT103+202正确答案:D4、下列不属于开立NRA外汇账户需要提供的材料的是()A、境外机构在境外合法注册成立的证明文件原件及复印件;B、公司章程C、董事会或公司内部其他有权机构同意开户的决议D、供在境内开展相关活动所依据的法规制度或政府主管部门的批准文件正确答案:D5、申报号码与每笔业务应一一对应,申报号码具有唯一性,申报号码有()位数字组成A、23B、22C、24D、21正确答案:B6、根据货物贸易外汇管理规定,纸质文件资料,包括商业单据、有效凭证、证明材料的原件或复印件,以及申请书、《登记表》、《分类结论告知书》以及《现场核查通知书》的原件,均应作为重要业务档案留存备查。

企业、金融机构以及国家外汇管理局应当妥善保管相关业务档案,留存()备查。

A、2年B、5年C、永久D、10年正确答案:B7、银行对客户办理衍生产品业务,应当坚持()原则,客户办理衍生产品业务具有对冲外汇风险敞口的真实需求背景,并且作为交易基础所持有的外汇资产负债、预期未来的外汇收支按照外汇管理规定可以办理即期结售汇业务。

A、利润优先B、外汇管理C、实需交易D、展业三原则正确答案:C8、下列机构不能在我行开立NRA账户的是:A、在香港注册成立的机构B、在台湾注册成立的机构C、在澳门注册成立的机构D、在开曼群岛注册成立并在香港上市的机构正确答案:C9、我行通过()操作小币种汇款。

国际结算考试题及答案

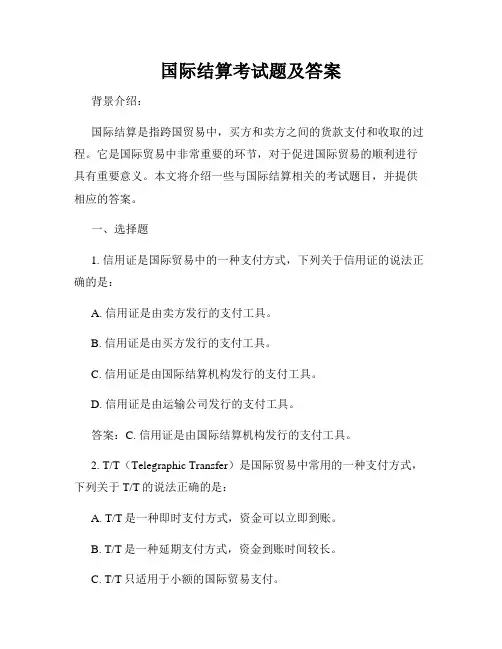

国际结算考试题及答案背景介绍:国际结算是指跨国贸易中,买方和卖方之间的货款支付和收取的过程。

它是国际贸易中非常重要的环节,对于促进国际贸易的顺利进行具有重要意义。

本文将介绍一些与国际结算相关的考试题目,并提供相应的答案。

一、选择题1. 信用证是国际贸易中的一种支付方式,下列关于信用证的说法正确的是:A. 信用证是由卖方发行的支付工具。

B. 信用证是由买方发行的支付工具。

C. 信用证是由国际结算机构发行的支付工具。

D. 信用证是由运输公司发行的支付工具。

答案:C. 信用证是由国际结算机构发行的支付工具。

2. T/T(Telegraphic Transfer)是国际贸易中常用的一种支付方式,下列关于T/T的说法正确的是:A. T/T是一种即时支付方式,资金可以立即到账。

B. T/T是一种延期支付方式,资金到账时间较长。

C. T/T只适用于小额的国际贸易支付。

D. T/T是由卖方向买方发出的支付工具。

答案:A. T/T是一种即时支付方式,资金可以立即到账。

二、简答题1. 请简要说明国际结算中的汇率风险是什么?并提出相应对策。

汇率风险是指由于汇率波动导致国际贸易中货款金额的不确定性,可能导致收款或付款方在结算时面临损失的风险。

为降低汇率风险,可采取以下对策:- 使用远期汇率协议,锁定未来汇率,降低汇率波动带来的不确定性。

- 多元化货币使用,将风险分散在不同的货币中。

- 建立汇率风险管理策略,根据市场走势及时调整结算计划。

2. 请分析电汇和托收两种国际结算方式的特点,并比较它们的优缺点。

电汇和托收是国际结算中常用的两种方式。

其特点及优缺点如下:- 电汇:电汇是一种即时支付方式,资金可以立即到账,速度较快。

优点是快捷便利,适用于对资金到账速度有要求的贸易。

缺点是手续费较高,且一旦支付完成,无法撤销。

- 托收:托收是指卖方将汇票交由银行代收,买方在付款时银行才向卖方支付。

优点是安全可靠,银行承担了一定的责任,适用于双方信任度较低的贸易。

国际结算练习题

国际结算练习题一、选择题1. 在国际贸易中,最常用的结算方式是:A. 信用证B. 托收C. 票汇D. 认可汇票2. 提单是属于以下哪种贸易方式的必备单证?A. CIFB. CFRC. FOBD. DDP3. 下列哪种货币不是国际贸易中的常用货币?A. 美元B. 欧元C. 日元D. 人民币4. 在国际结算中,SWIFT电文是用来:A. 传输结算相关信息B. 获取汇率信息C. 购买外汇D. 编制结算报告5. 贸易融资中,下列哪种银行承兑汇票的前提条件最严格?A. 商业银行B. 国家开发银行C. 国际开发银行D. 政策性银行二、简答题1. 请简要介绍国际结算的基本流程。

国际结算的基本流程分为五个步骤:1) 客户与供应商通过合同确定交易条件。

2) 双方在合同中约定结算方式和货币。

3) 贸易完成后,买方按合同支付货款。

4) 卖方提供相应的单证,如发票、提单等。

5) 银行进行结算,确保资金的正常流转。

2. 请简述信用证的定义及其作用。

信用证(Letter of Credit,简称LC)是由买方的银行(开证行)开立,向卖方的银行(受益人行)发出的一种付款保函。

其作用是确保卖方在按合同约定提供货物或服务后能获得支付。

信用证的作用主要体现在以下几个方面:1) 对买卖双方提供了一种安全、可靠的支付方式,减少了交易的风险。

2) 增加了买方对卖方的信任度,有助于吸引更多的合作伙伴。

3) 为买卖双方提供了单证的标准化要求,便于操作和管理。

3. 请简述托收的定义及其适用场景。

托收(Collection)是指买卖双方通过各自的银行进行结算,买方的银行根据买卖合同的要求,向卖方的银行提交付款要求及相关单证,要求卖方的银行向卖方提取款项。

托收适用于以下场景:1) 交易中的风险较低,双方之间具有一定的信任度。

2) 买方和卖方之间没有建立信用关系,无法使用信用证。

3) 交易金额较小,不能承担信用证的高额费用。

三、论述题请以国际贸易中常见的信用证和托收为例,分析两种结算方式的优缺点,并给出适用场景的建议。

国际结算试题精选-..

国际结算模拟试题1一、名词解释(20分)1.贴现:2.头寸调拨: 3.信用证:4.租船合约提单:5.实质一致:二、填空(每空一分,共16分)1.如汇票金额为About Five Thousand Dollars,则此汇票为效汇票。

2.有权在保险单据上签字。

3.据UCP500,信用证若未注明是否可撤销,则默认其为。

4.某提单上注明“三箱坏损”这种提单是提单,一般情况下,银行对这种提单将。

5.按照汇款使用的支付工具不同,汇款可分为三种方式,其中以最为快捷,使用最为广泛。

6.在汇票的使用过程中,使汇票一切债务终止的环节是。

7.托收按交单条件不同,可分为和两种。

其中就卖方风险而言,风险小些。

8.支票划线的作用在于。

9.审单的两种工作方法是和。

10.信用证支付方式的特点为:信用证是、是、是。

三、选择题(每题只有一个正确答案,每题1.5分,共15分)1.某公司签发一张汇票,上面注明“At 90 days after sight”,则这是一张()。

A.即期汇票 B.远期汇票C.跟单汇票 D.光票2.属于汇票必要项目的是()。

A.“付一不付二”的注明B.付款时间C.对价条款D.禁止转让的文字3.属于顺汇方法的支付方式是()。

A.汇付B.托收C.信用证D.银行保函4.D/P·T/R意指()。

A.付款交单 B.承兑交单 C.付款交单凭信托收据借单 D.承兑交单凭信托收据借单5.背书人在汇票背面只有签字,不写被背书人名称,这是()A.限定性背书B.特别背书C.记名背书D.空白背书6.承兑以后,汇票的主债务人是()A.出票人B.持票人 C.承兑人D.保证人7.不可撤销信用证的鲜明特点是()A.给予受益人双重的付款承诺B.有开证行确定的付款承诺C.给予买方最大的灵活性 D.给予卖方以最大的安全性8.以下关于承兑信用证的说法正确的是()A.在该项下,受益人可自由选择议付的银行B.承兑信用证的汇票的期限是远期的C.其起算日是交单日D.对受益人有追索权9.以下关于海运提单的说法不正确的是()A.是货物收据B.是运输合约证据C.是无条件支付命令D.是物权凭证10.开证行在审单时发现不符点,以下哪一项不是开征行所必须做的()A.说明全部不符点 B.拒付时必须以单据为依据 C.应用书信方式通知寄单行 D.必须在7个工作日内拒付四、不定项选择题(每题有一个或一个以上正确答案,多选、少选、错选均不给分,每题3分,共12分)1.本票与汇票的区别在于()A.前者是无条件支付承诺,后者则是要求他人付款B.前者的票面当事人为两个,后者则有三个 C.前者在使用过程中需要承兑,后者则无需承兑D.前者的主债务人不会变化,后者的主债务人因承兑而发生变化E.前者包含着两笔交易,而后者只包含着一笔交易。

国际结算模拟试题

—国际结算模拟试题(七)一、单项选择题(每小题2分,共20分)1、以下由(B)带来的结算被归入国际非贸易结算中。

A.国际运输、成套设备输出、国际旅游 B.国际金融服务、侨民的汇款、国际旅游 C. 侨民的汇款、国际商品贸易、国际技术贸易 D.有形贸易、无形贸易、国际文化交流2、属于顺汇方法的支付方式是(A)。

A.票汇 B.托收 C.保函 D.直接托收3、某汇票关于付款到期日的表述为:出票日后30天付款。

则应如何计算汇票到期日?(B) A.从出票日当天开始算,出票日作为30天的第一天 B.从出票日第二天算起,出票日不计在内 C.从出票日第二天算起,出票日计算在内作为30天的第一天 D.可以由汇票的基本当事人约定选择按照上述何种方法计算4、以下是国际贸易中经常用到的结算方式,其中哪种不属于汇款方式?(A) A.押汇 B.预付货款C.寄售 D.凭单付汇5、以下关于托收指示说法错误的是:(D)。

A.是根据托收申请书缮制的 B.是代收行进行托收业务的依据 C.是托收行制作的 D.是托收行进行托收业务的依据6、信用证被广泛使用到,其中有一个重要原因在于信用证对于出口商和进口商来说有资金融通的作用,以下选项不一定是信用证对于出口商的融资方式的是(C)。

A.打包放款 B.汇票贴现 C.押汇D.红条款信用证7、某信用证上,若想表达“远期付款”这一内容,应该在(C)之前的方框上作标记。

A.By payment at sight B.By negotiation C.By deferred payment at: D.By acceptance of drafts at:8、以下关于可转让信用证说法错误的是:(B)。

A.可转让信用证适用于中间商贸易 B.信用证可以转让给一个或一个以上的第二受益人,而且这些第二受益人又可以转让给两个以上的受益人 C.未经过信用证授权的转让行办理,受益人自行办理的信用证转让业务视为无效 D.可转让信用证中只有一个开证行9、跟单信用证统一惯例规定,商业发票必须有信用证受益人开具,必须以(B)为抬头。

国际结算模拟试卷及答案

国际结算期末试卷及答案第一题:单项选择题(20*1=20分).以下方式不属于逆汇的有()A.光票托收B.信用证C.汇款D.跟单托收.根据UCP600的规定,开证行审单的合理期限为()A. 1天 B. 3天 C. 5天 D. 7天.汇票经承兑后,主债务人为()A.出票人B.承兑人C.背书人D.受票人. Smith向银行申请开立信用证,银行开立了信用证并把它寄给Thomas,那么Smith是()A.进口商B.出口商C.开证行D.通知行.银行接受某公司委托办理托收业务,由于银行未发现单据中存在错误,最后单到国外,付款人提出单据有误拒绝付款,按照《托收统一规那么》的规定,这种情况()A.银行有责任B.银行无责任C.银行有局部责任D.说不清.在信用证交易中,开证行或议付行付款给出口商的条件是()A.单据与信用证一致,单据与单据一致B.买方收到货物C.出口商交来单据1).货物与合同描述一致1.托收方式下的D/P是指()A.跟单托收B.光票托收 C.付款交单D.承兑交单2.以下关于可转让信用证的操作,错误的选项是()A.转让信用证的银行多为原始信用证的通知行B.开证行承当所有的付款责任C.第二受益人可以是多个D.第二受益人有权继续转让信用证给第三受益人9,海运提单的签发人不应由()签发。

A.非承运人的运输行B.承运人C.承运人的代理D.船长及其代理.信用证金额为USD10000,货物以吨计算数量,并且未作其他说明,那么银行不能接受的发票金额是()oA. USD10500B. USD9500C. USD11000D. USD9000.就汇款业务而言,当客户希望自行转移资金给收款人时,经常采用()oA.即期汇票B.信汇C.电汇D. SWIFT汇款.如付款行在汇款行开设账户,资金偿付的指示应为()oA.借记付款行的往帐B.借记汇款行的往帐C.贷记付款行的来帐D.贷记汇款行的来帐13.海运提单是()的运输合同。

A.开证行与承运人B.发货人与承运人C.申请人与承运人D.出口商与进口商.商业发票必须做成()的抬头。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

如对您有帮助,欢迎下载支持,谢谢!浙江林学院 2006 - 2007 学年第 二 学期考试卷(A 卷)课程名称: 国际结算(双语)课程类别: 必修 考试方式: 闭卷注意事项:1、本试卷满分100分。

2、考试时间 120分钟。

Ⅰ Decide whether the following statements are true or false.(Please mark “T ” if the answer is true, or you shall mark “F ”if the answer is false. Each one 2 score, total 30 scores.)1. From an American bank’s view, a Nostro account is a dollar account held for itsoverseas correspondents. ( )1. From a Chinese bank’s view, a Vostro Account or Due to Account is a Chinese currency account held for its overseas correspondents. ( )2. In a promissory note, the drawer and the payer are the same person. ( ) 2. There is no acceptor in a promissory note. ( )3. A bill of exchange drawn by and accepted by commercial firms be known as tradebills. ( )3. An endorser of a bill is liable on it to subsequent endorsers and holders of the bill.( )4. A crossed check can be cashed over the counter. ( )4. If a check is presented undated, the payee can insert a date. ( )5. If a bill is payable “at 30 days after date “, the date of payment is decidedaccording tothe date of acceptance. ( )5. A bill payable “ at 90 days sight” is a sight bill.( )6. Remittance happens when a client (payer) asks his bank to send a sum of money toa payee abroad by one of the transfer methods at his option. ( )6. Under D/D, upon receipt of the draft, the beneficiary can ship the goods beforehe present it for payment at the counter of the drawee bank.学院: 专业班级:姓名: 学号:装 订 线 内 不 要 答 题7. If the collecting bank is not located near the importer, it would send the documents to a presenting bank in the importer’s city mostly.7. Under D/A, after acceptance, the buyer gains possession of the goods before payment and is able to dispose of the goods as he wishes .8. Under documentary credit, the nominated bank has no obligation to examinedocuments. ( )8. Usually the advising bank is the bank resides in the same city as the buyer. ( )9. Under UCP600, Unless otherwise stipulated in the credit, a transferable credit can be transferred only once and the issuing bank can transfer a credit by itself. ( ) 9. A transferable credit can be transferred only to one party and all the terms andconditions cannot be changed while it is transferred.( )10. An irrevocable confirmed credit gives the beneficiary a double assurance ofpayment. ( )10. In a reciprocal credits, the advising bank itself gives a packing loan to the beneficiary. ( )11. If a credit is issued by airmail , it ought to be authenticated by test key .( ) 11. The issuing bank’s signature is only to be placed on the advice for the beneficiary .( )12. Banks will not accept a document bearing a date lf issuance prior to that of thecredit .( )12 . If the credit is a deferred payment credit, there is no need to draw a draft. ( )13. Commercial invoice need not be signed.( )13. A clean bill of lading is one that is not stained.( )14.When an issuing bank determines that a presentation is complying, it must honour.A credit must not be issued available by a draft drawn on the applicant.14. Negotiate, without recourse, if the credit is available by negotiation with the confirming bank.15. A bank utilizing the services of an advising bank or second advising bank to advise a credit must use the same bank advise any amendment thereto.15.A bank assumes no liability or responsibility for the consequences arising out of theinterruption of its business by Acts of God, riots, civil commotions, insurrections, wars, acts of terrorism, or by any strikes or lockouts or any other causes beyond itscontrol. A bank will not, upon resumption of its business, honor or negotiate under a credit that expired during such interruption of its business.ⅡChoose the correct or best answer to each of the following statements.the line. 2 scores per sub-article, total 28 scores)1. Usually, foreign trade can be conducted on the following terms except for _________.A. open accountB. documentary collectionC. documentary creditD. public bonds1. International cash settlement has the following disadvantages except _______ .A. expensiveB. safeC. riskyD. time-consuming2. The person who pay money is a ______ of a check.A. payeeB. endorserC. drawerD. endorsee2. A check is valid for ______months from the date of issue, unless a shorter period iswritten on the face of it.A .six B. nine C. three D. one3. If a bill is payable “60 days after date”, the date of payment is decided accordingto_____.A. the date of acceptanceB. the date of presentationC. the date of the billD. the date of maturity3. A______carries comparatively little risks and can be discounted at the finest rate of interest.A. sight billB. bank draftC. commercial billD. trade bill4. An acceptance with the wording “payable on delivery of bill of lading ” is ______.A. a general acceptanceB. qualified acceptanceC. non acceptanceD. partial acceptance4. _______must be accepted by the drawee before payment.A. A sight billB. A check payable ×× days after sightC.A promissory noteD.A bill payable ×× days after date5.The same methods of transfer may be used both in advance payment and open account business except___________A. remitting the payment by a banker’s draftB. by mail transferC. by telegraphic transferD. reimbursement5. If the paying bank opens a current account with the remitting bank, the reimbursementmay be effected by ______.A. Instructing the paying bank to claim reimbursement from another branch of the samebank or another bank with which the remitting bank opens an account.B. Debiting remitting bank’s nostro accountC. Instructing a reimbursing bank to pay the paying bank by debiting the remitting bank’snostro account.D. Crediting vostro account of the paying bank.6. ____________ offers the greatest security to the exporter?A. Documents against acceptanceB. Documents against paymentC. Clean collectionD. Acceptance D/P6. ___________ is not a risk that the exporter assumes on documentary collection basis?A. Non-acceptance of merchandiseB. Harm to the reputation due to dishonorC. Exchange restrictionsD. Non-payment of trade acceptance7. With an unconfirmed irrevocable letter of credit, .A. the terms and conditions can be amended or cancelled unilaterally by any partyB. only the exporter can amend the creditC. the advising bank transmits details without commitment to the beneficiaryD. the issuing bank has the ability to cancel the credit at any time7. A confirmed irrevocable letter of credit .A. carries the confirmation of the issuing bankB. always involves at least two banksC. is issued by the advising bankD. creates the highest level of security against sovereign risk8. A standby letter of credit .A. is never revokedB. is not a letter of creditC. is revoked in the event of non-compliance by buyer or seller with the terms of anoriginal creditD. is revoked in the event of non-compliance by buyer or seller with the terms of thesales contract.8. __________is not included in the category of payment guaranteeA Deferred payment bondB Guarantee for compensation tradeC Loan guaranteeD Bid bond9. The sum of the transferred credit will not be .A. the same as in the credit before transferB. less than in the credit beforetransferC. more than in the credit before transferD. equal to the original credit9. Which of the following details on the transferred credit may not be different to that of the credit before transfer? .A. The shipping dateB. The expiry date of the creditC. The description of the goodsD. The name of the applicant10 If a bill of lading is dated on March 15 ,2007 ,the insurance should be covered ___A. on March 15 ,2007B. before March 15 ,2007C after March 15, 2007D on or before March 15 ,200110 Commercial invoice must be made out in the name of ___A the applicantB the beneficiaryC the issuing bankD the advising bank11. A bank will not accept______.A. an insurance policyB. an insurance certificateC. an open coverD. a cover note11. If a credit calls for an insurance policy, banks will accept_______.A. an insurance policyB. an insurance certificateC. both A and BD. open policy12. The seller can get assistance from the factor by latter’s providing an assessment ofthe creditworthiness of the overseas bu yers as well as by latter’s offering credit control and ____________A sales accountingB development of new marketsC international salesD bad debt protection12.F o r f a i t i n g m a k e s t h e s e l l e r t o e vade various risks, except________A.interest-rate risk & currency risk,B.credit riskC.political risk;D. risks due to stop payment order received by the forfaitor in accordance withinternational convention13. ___________ is not the obligation of the trustee?A. To arrange for the goods to be warehoused and insured in the trustee’s name.B. To pay all the proceeds of sale to the bank or to hold them on behalf of the bank.C. Not to put the goods in pledge to other persons.D. To settl e claims of the bank prior to liquidation in case of the trustee’sbankruptcy.13. Measures for a bank before issuing a credit except for_________A.Credit lineB.Importer’s creditworthinessC.Liquidity of the goodsD. Complying presentation14. When the issuing bank decides to refuse to honor or negotiate, it must give a singlenotice to that effect to the presenter.The notice must stateexcept_______A.that the bank is refusing to honor or negotiate;B.each discrepancies in respect of which the bank refuses to honor or negotiate;C.that the bank is holding the documents pending further instructions from thepresenter; or that the issuing bank is holding the documents until it receives awaiver from the applicant and agrees to accept it, or receiving furtherinstructions from the presenter prior to agreeing to accept a waiver, or that thebank is returning the documents; or that the bank is acting in accordance withinstructions previously received from the presenter.D. The notice required to be given by telecommunication only.14. Events regarding to handle trade financing difficulty under credit _____A. Negotiate restrictivelyB. Actions of the issuing bank and his/her customary operationC. Time credit exceeding at 180 daysD. All aboveⅢPlease answer the following questions.(Total 22 scores)Array1.Please translate the following terms of credit and give yoursuggestions on them. ( 4 scores with each sub-article 2 scores)(1)This credit will become operative provided that the necessary authorization beobtained from exchange authority,we shall inform you as soon as theauthorization obtained.(2)copy of telex from applicant to suppliers approving the counter samples(1) This credit is only a preliminary advice and will become effective upon receipt ofour authenticated cable to the advising bank confirming that applicants have receivedand approved the advanced sample.(2) It is an conditions of letter of credit that it only become available provided that allbank charges of this credit are for t he beneficiary’s account.2. Please have an analysis on the difference between forfaiting and factoring. ( 6 scores)2. Please have an analysis on the difference between a documentary credit and a standbycredit. ( 6 scores)3. How to measure & evade risks under international settlement? ( 6 scores)3. Please list kinds of export finance and their application. ( 6 scores)4. how can the Importer & the Exporter to apply financing under credit business? ( 6 scores)4. How to evade risks under documentary collection? ( 6 scores)ⅣPractice combination:① To judge kinds of the credit at least 3 kinds. (3 scores)② Which kinds of documents should be presented to the nominated bank and it’scopies. (8 Scores)③ Issuance a bill of exchange. Remarks: the actual shipment date was 040610.(5 Scores)④ How to show“ Blank endorsement” on the bill of exchange.(2 scores)⑤At the beneficiary’s end, should the terms and conditions of this credit beemended? Please give me a reasonable comments on it. ( 2 scores)FORM OF DOC.CREDIT: IRREVOCABLECREDIT NUMBER: 50000585DATE OF ISSUE: 040506EXPIRY DATE AND PLACE: DATE 040630 PLACE CHINAAPPLICANT BANK: REPUBLIC NATIONAL BANK OF NEW YORK NEW YORK USA APPLICANT: NANCY FABRICS INC, 5 STREET NO.43 AVENUE 5, NEW YORK USA BENEFICIARY: HANGZHOU TENGLONG WEAVING CO., LTD. #198 JIANSHE NO.1 ROAD, XIAOSHAN ECONOMIC &TECHNOLOGICAL DEVELOPMENT ZONE,HANGZHOU CHINA 311215AMOUNT: CURRENCY USD AMOUNT 132,000,00(SAY U.S.DOLLARS ONE HUNDRED AND THIRTY TWO THOUSAND ONLY.) VAILABLE WITH/BY: ISSUING BANKBY ACCEPTANCE AT 60 DAYS AFTER SIGHTDRAWEE TO : OURSELVESPARTIAL SHIPMENTS: PARTIAL SHIPMENTS PROHIBITEDTRANSSHIPMENT: TRANSSHIPMENT ALLOWED.LOADING IN CHARGE: SHANGHAI, CHINAFOR TRANSPORT TO: NEW YORKLATEST DATE OF SHIP: 040615DESCRIPT.OF GOODS: UPHOLSTERY FABRICS AS PER APPLICANT’S ORDER SHEETNO.NKY201 (CIF) SUBJECT TO INCOTERMS 2000 DOCUMENTS REQUIRED:+SIGNED COMMERCIAL INVOICE 2 ORIGINALS AND 3 COPIES+DETAILED PACKING LIST 2 ORIGINALS + 2 COPIES+CERTIFICATE OF ORIGIN 1 ORIGIN AND 2 COPIES+FULL SET NEGOTIABLE CLEAN ON BOARD OCEAN BILLS OF LADING CONSIGNED TO ORDER OF REPUBLIC NATIONAL BANK OF NEW YORK, NEWYORK USA MARKED NOTIFY APPLICANT AND MARKED FREIGHT PREPAID+ ORIGINAL TEXTILE EXPORT LICENSE+INSURANCE POLICY IN DUPLICATE COVERING AT LEAST 110% OF COMMERCIAL VALUE WITH CLAIM PAYABLE IN NEW YORK IN USD AGAINST ICC(A) AND WAR RISKS AND SRCC RISKS.+ORIGINAL EXPORT LINCENCE+ORIGINAL INSPECTION CERTIFICATION QUALITY AND QUANTITIESISSUED BY APPLICANT’S AUTHORIZED AGENT AND HIS SIGNATURE HASBEEN REMAINED IN THE ISSUING BANK.ADDITIONAL REQUIREMENTS:+DRAFTS ARE TO BE MARKED”DRAWN UNDER REPUBLIC NATIONALBANK OF NEW YORK NEW YORK USA AND BEARING CREDIT NUMBERAND THE ISSUING DATE.+A DISCRIPANCY FEE OF USD 50.00 WILL BE DEDUCTED FROM THE PROCEEDS OF ANY DRAWING PRESENTED WITHDISCRIPANCIES+ IT IS A CONDITION OF THIS CREDIT THAT ALL DOCUMENTS ARE TO FORWARDED IN ONE COMPELETE MAILING TO REPUBLICNATIONAL BANK OF NEW YORK NEW YORK USA, INTERNATIONALDEPARTMENT.DETAILS OF EXHARGES: IT IS AN CONDITIONS OF LETTER OF CREDIT THAT IT ONLY BECOME AVAILABLE PROVIDED THAT ALL BANK CHARGES OUTSIDEUSA ARE FOR THE BENEFICIARY’S ACCOUNT。