国际结算模拟试题1

国际结算练习一

国际结算练习题(一)Practices for International settlement1. Choose the true answer of the following sentences.(1).A bill shows: Pay to ABC Co. the sum of ten thousand US dollars on condition that shipment of the goods has been made.( )(A) acceptable (B) unacceptable (2).drawerpayee the first transferee the second transfereeD CE A(drawee)C ( ) is a(A) holder in due course (B) holder for value (C) holder(3)A holder of a crossed cheque wants to get payment by cash through presenting it at the counter of paying bank. ( )(A) yes (B)no(4)Draft is correctly endorsed if necessary. Draft ( ) bear restrictive endorsement “ withoutrecourse ”(A)should (B)should not(5) The person paying the money is a ( ) of the check.(A) payee (B) endorser (C) drawer (D) endorser(6) A check is valid for ( ) months from the date of issue. Unless a shorter period is written on the face of it.(A) six (B) nine (c) three (D) one(7) If a check is dated 1st Feb. 2001 was presented on the 5th Nov. 2000, it would be ( )(A) pre-dated (B) out of date (C) post dated (D) undated(8) If a check is dated 1st Feb. 2001 was presented on the 5th Nov. 2001, it would be ( )(A) pre-dated (B) out of date (C) post dated (D) undated(9) The effect of a blank endorsement is to make the check payable to the ( )(A) order of a specified person (B) specified person(C) bearer (D) named person(10) Banks usually ask for endorsement when checks in favor of ( ) payee are credited to a ( ) account.(A) joint , joint (B) joint , sole (C) bearer (D) sole ,joint(11) “ Payee James Smith endorsed James Smith pay to L. Green ”, This is a ( ) endorsement(A) specific (B) blank (C) general (D) restrictive(12) If a bill is payable “ 60 days after date ” the date of payment is decided according to ( )(A) the date of acceptance (B) the date of presentation( C ) the date of the bill (D) the date of maturity(13) A ( ) carries comparatively little risks and can be discounted at the finest rate of interest.(A) sight bill (B) bank bill (C) commercial bill (D) trade bill(14) A term bill may be accepted by the ( )(A) drawer (B) drawee (C) holder (D) payee(15) The party to whom the bill is addressed is called the ( )(A) drawer (B) drawee (C) holder (D) payee(16) When financing is without recourse, this means that the bank has no recourse to the ( ) if such drafts are dishonored.(17) Only by endorsement can the interest in the bill be transferred by ( )(A) drawer (B) drawee (C) holder (D) any person to the bill(18) A promissory note is “inchoate” until it has been delivered to the ( )(A) payer or bearer (B) payee or drawee (C) payee or bearer (D) holder or drawer(19) The ( ) of a promissory note has prime liability while the other parties have secondary liabilities(A) holder (B) drawee (C)maker (D) acceptor(20) An acceptance with the wording “ payable on delivery of bill of lading” is ( )(A) a general acceptance (B) qualified acceptance(C) non acceptance (D) partial acceptance(21) ( ) must be accepted by the drawee before payment(A) A sight bill (B) A bill payable xx days after sight(C )A promissory note (D) A bill payable xx days after date(22) A(n) ( ) is a financial document(A) bill of exchange (B) bill of lading (C) insurance policy (D) commercial invoice(23) In order to retain the liabilities of the other parties, a bill that has been dishonored must be( )(A) protested (B) given to the acceptor (C) retained in the file (D) presented to the advising bank2.Please fill the blanks of the following sentences.(1)A bill is payable at several days after sight. What date is the day from which time of payment begins to run?(2) A bill is payable at several days after date. What date is the day from which time of payment begins to run?(3)The maturity of a draft is one month after 31 Jan. It is .(4)Order of liability after acceptance is as follows: takes primary liability for payment. ________ takes second liability for payment.(5) The differences between a bill and a note are as followsA bill is an unconditional order to pay. A note is an unconditional to pay.A bill has three basic parties . A note has .(6) The differences between a bill and a cheque are as followsThe drawee of a bill may be any person. The drawee of a cheque must beThere are four kinds of tenor for the bills. The tenor is merely payableA bill can be drawn in a set. A cheque can not be drawn in a .(7)Remittance through a bank from one country to another may usually be made by one of the following methods: 1 2 3 .(8)Financial documents mean , promissory note and cheque. Commercial document mean , transport document and insurance document.(9) account means your account .(10) Control document are lists of and3、Decide whether the following statement are true or false(1) In a promissory note, the drawer and the payer are the same person. ( )(2) A promissory note is an unconditional order in writing. ( )(3) There is no acceptor in a promissory note. ( )(4) A bank draft is a check drawn by one bank on another. ( )(5) A trade bill is usually a documentary bill. ( )(6) The interest in the bill of exchange can only be transferred by endorsement. ( )(7) An endorser of a bill is liable on it to subsequent endorsers as holders of the bill. ( )(8) the person who draws the bill is called the drawer. ( )(9) Bills of exchange drawn by and accepted commercial firms are known as trade bills. (t )(10) Trade bills are usually documentary bills. ( )(11) Endorsements are needed when checks in favor of a sole payee are credited to a jointed account. ( )(12) An open check can be paid into a bank account. ( )(13) An open check can be cashed over the counter. ( )(14) A crossed check can be cashed over the counter. ( )(15) The payment of a check cannot depend upon certain conditions being met. ( t )(16) In a check, the drawer and the payer are the same person. ( )(17) If a check is presented un dated, the payee can insert a date ( )(18) A draft is a conditional order in writing. ( )(19) If a bill is payable “at 30 days after date”, the date of payment is decided according to the date of acceptance.(20) A bill payable “ at 90 days after sight” is a sight bill. ( )4.Draw a bill of exchange according to the requisite items as follows. (15 points) date: 24 Feb, 2003 amount: USD 4,242.00 tenor: 22 May, 2003drawer: Sherman Motor Incorporation, New Yorkdrawee: The Chase Bank N. A. , New Yorkpayee: Sherman Motor Incorporation’s order5..In accordance with the following conditions, please write a able text of remittance.(10 points)Remitting bank: Bank of China , Tianjin. Paying bank: Midland Bank Ltd., London.Date of cable : 10 June. Test: 3561 Ref No:208TT0992Amount: GBP 54,420.00 Value on:10 JunePayee: ABC Co., London. Account No.3698044 with Midland Bank Ltd.Message: Contract No. 201541 Remmitter: Tianjin Trust & Investment Corp., TianjinCover: Debit our H.O. account FM:TO:DA TETEST OUR REF PAY VALUE TOFOR CREDIT OF ACCOUNT NO. OFMESSAGEB/O。

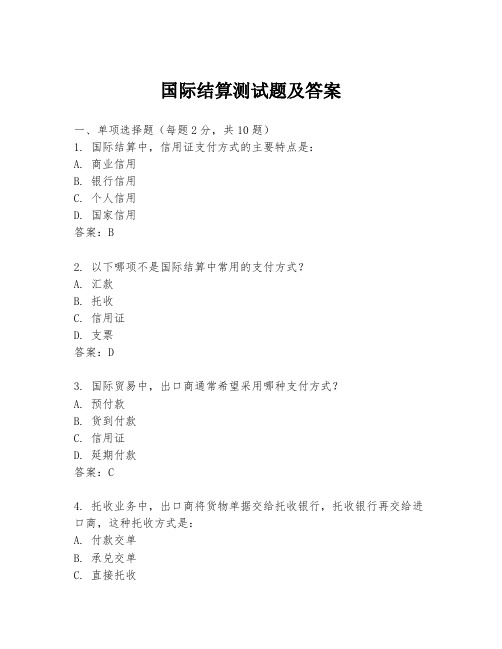

国际结算测试题及答案

国际结算测试题及答案一、单项选择题(每题2分,共10题)1. 国际结算中,信用证支付方式的主要特点是:A. 商业信用B. 银行信用C. 个人信用D. 国家信用答案:B2. 以下哪项不是国际结算中常用的支付方式?A. 汇款B. 托收C. 信用证D. 支票答案:D3. 国际贸易中,出口商通常希望采用哪种支付方式?A. 预付款B. 货到付款C. 信用证D. 延期付款答案:C4. 托收业务中,出口商将货物单据交给托收银行,托收银行再交给进口商,这种托收方式是:A. 付款交单B. 承兑交单C. 直接托收D. 间接托收答案:A5. 信用证中的“不可撤销”意味着:A. 信用证一经开出,不能更改或撤销B. 信用证可以由开证行随时撤销C. 信用证只能在特定条件下撤销D. 信用证的金额可以随意更改答案:A6. 在国际结算中,汇票的持票人向付款人提示汇票,要求付款的行为称为:A. 提示B. 承兑C. 贴现D. 背书答案:A7. 国际结算中,出口商为了减少汇率风险,可能采用的结算方式是:A. 即期信用证B. 远期信用证C. 汇款D. 托收答案:B8. 国际贸易中,如果出口商希望尽快获得货款,他们可能会选择:A. 信用证B. 托收C. 汇款D. 延期付款答案:C9. 在国际结算中,银行保函是一种:A. 支付承诺B. 信用证C. 担保文件D. 汇票答案:C10. 国际结算中,如果出口商希望减少信用风险,他们可能会要求:A. 提前付款B. 信用证支付C. 托收D. 延期付款答案:B二、多项选择题(每题3分,共5题)1. 国际结算中,以下哪些因素会影响结算方式的选择?A. 交易双方的信用状况B. 货物的性质和价值C. 交易双方的关系D. 汇率波动答案:ABCD2. 信用证结算方式中,以下哪些文件是必须提交的?A. 发票B. 提单C. 装箱单D. 汇票答案:ABCD3. 托收结算方式中,以下哪些是付款交单(D/P)和承兑交单(D/A)的主要区别?A. 付款时间B. 风险承担C. 单据传递方式D. 银行费用答案:AB4. 国际结算中,以下哪些是汇款方式的特点?A. 快速B. 灵活C. 费用较低D. 风险较高答案:ABCD5. 国际结算中,以下哪些是信用证结算方式的优点?A. 降低信用风险B. 提高交易效率C. 增加交易成本D. 保护买卖双方利益答案:ABD结束语:以上是国际结算测试题及答案,希望能够帮助您更好地理解和掌握国际结算的相关知识。

国际结算模拟试题1

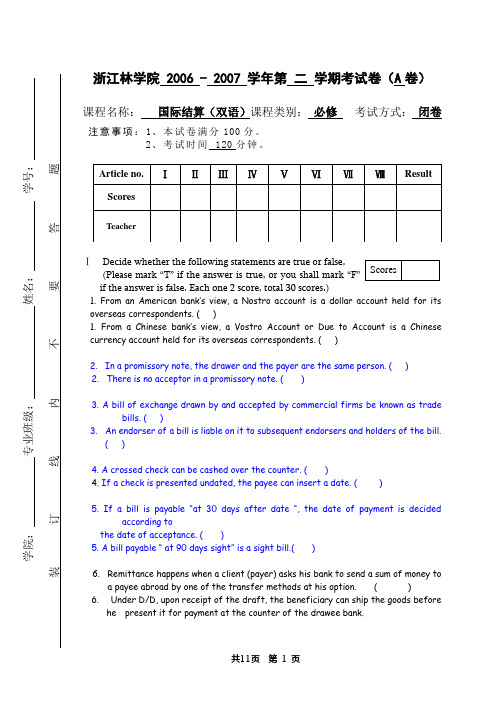

浙江林学院 2006 - 2007 学年第 二 学期考试卷(A 卷) 课程名称: 国际结算(双语)课程类别: 必修 考试方式: 闭卷 注意事项:1、本试卷满分100分。

2、考试时间 120分钟。

Ⅰ Decide whether the following statements are true or false. (Please mark “T ” if the answer is true, or you shall mark “F ” if the answer is false. Each one 2 score, total 30 scores.) 1. From an American bank’s view, a Nostro account is a dollar account held for its overseas correspondents. ( ) 1. From a Chinese bank’s view, a Vostro Account or Due to Account is a Chinese currency account held for its overseas correspondents. ( ) 2. In a promissory note, the drawer and the payer are the same person. ( ) 2. There is no acceptor in a promissory note. ( ) 3. A bill of exchange drawn by and accepted by commercial firms be known as trade bills. ( ) 3. An endorser of a bill is liable on it to subsequent endorsers and holders of the bill. ( ) 4. A crossed check can be cashed over the counter. ( ) 4. If a check is presented undated, the payee can insert a date. ( ) 5. If a bill is payable “at 30 days after date “, the date of payment is decided according to the date of acceptance. ( ) 5. A bill payable “ at 90 days sight” is a sight bill.( ) 6. Remittance happens when a client (payer) asks his bank to send a sum of money to a payee abroad by one of the transfer methods at his option. ( ) 6. Under D/D, upon receipt of the draft, the beneficiary can ship the goods before he present it for payment at the counter of the drawee bank.学院:专业班级:姓名:学号:装订线内不要答题7. If the collecting bank is not located near the importer, it would send the documents to a presenting bank in the importer’s city mostly.7. Under D/A, after acceptance, the buyer gains possession of the goods before payment and is able to dispose of the goods as he wishes .8. Under documentary credit, the nominated bank has no obligation to examinedocuments. ( )8. Usually the advising bank is the bank resides in the same city as the buyer. ( )9. Under UCP600, Unless otherwise stipulated in the credit, a transferable credit can be transferred only once and the issuing bank can transfer a credit by itself. ( ) 9. A transferable credit can be transferred only to one party and all the terms andconditions cannot be changed while it is transferred.( )10. An irrevocable confirmed credit gives the beneficiary a double assurance ofpayment. ( )10. In a reciprocal credits, the advising bank itself gives a packing loan to the beneficiary. ( )11. If a credit is issued by airmail , it ought to be authenticated by test key .( ) 11. The issuing bank’s signature is only to be placed on the advice for the beneficiary .( )12. Banks will not accept a document bearing a date lf issuance prior to that of thecredit .( )12 . If the credit is a deferred payment credit, there is no need to draw a draft. ( )13. Commercial invoice need not be signed.( )13. A clean bill of lading is one that is not stained.( )14.When an issuing bank determines that a presentation is complying, it must honour.A credit must not be issued available by a draft drawn on the applicant.14. Negotiate, without recourse, if the credit is available by negotiation with the confirming bank.15. A bank utilizing the services of an advising bank or second advising bank to advise a credit must use the same bank advise any amendment thereto.15.A bank assumes no liability or responsibility for the consequences arising out of theinterruption of its business by Acts of God, riots, civil commotions, insurrections, wars, acts of terrorism, or by any strikes or lockouts or any other causes beyond itscontrol. A bank will not, upon resumption of its business, honor or negotiate under a credit that expired during such interruption of its business.ⅡChoose the correct or best answer to each of the following statements.the line. 2 scores per sub-article, total 28 scores)1. Usually, foreign trade can be conducted on the following terms except for _________.A. open accountB. documentary collectionC. documentary creditD. public bonds1. International cash settlement has the following disadvantages except _______ .A. expensiveB. safeC. riskyD. time-consuming2. The person who pay money is a ______ of a check.A. payeeB. endorserC. drawerD. endorsee2. A check is valid for ______months from the date of issue, unless a shorter period iswritten on the face of it.A .six B. nine C. three D. one3. If a bill is payable “60 days after date”, the date of payment is decided accordingto_____.A. the date of acceptanceB. the date of presentationC. the date of the billD. the date of maturity3. A______carries comparatively little risks and can be discounted at the finest rate of interest.A. sight billB. bank draftC. commercial billD. trade bill4. An acceptance with the wording “payable on delivery of bill of lading ” is ______.A. a general acceptanceB. qualified acceptanceC. non acceptanceD. partial acceptance4. _______must be accepted by the drawee before payment.A. A sight billB. A check payable ×× days after sightC.A promissory noteD.A bill payable ×× days after date5.The same methods of transfer may be used both in advance payment and open account business except___________A. remitting the payment by a banker’s draftB. by mail transferC. by telegraphic transferD. reimbursement5. If the paying bank opens a current account with the remitting bank, the reimbursementmay be effected by ______.A. Instructing the paying bank to claim reimbursement from another branch of the samebank or another bank with which the remitting bank opens an account.B. Debiting remitting bank’s nostro accountC. Instructing a reimbursing bank to pay the paying bank by debiting the remitting bank’snostro account.D. Crediting vostro account of the paying bank.6. ____________ offers the greatest security to the exporter?A. Documents against acceptanceB. Documents against paymentC. Clean collectionD. Acceptance D/P6. ___________ is not a risk that the exporter assumes on documentary collection basis?A. Non-acceptance of merchandiseB. Harm to the reputation due to dishonorC. Exchange restrictionsD. Non-payment of trade acceptance7. With an unconfirmed irrevocable letter of credit, .A. the terms and conditions can be amended or cancelled unilaterally by any partyB. only the exporter can amend the creditC. the advising bank transmits details without commitment to the beneficiaryD. the issuing bank has the ability to cancel the credit at any time7. A confirmed irrevocable letter of credit .A. carries the confirmation of the issuing bankB. always involves at least two banksC. is issued by the advising bankD. creates the highest level of security against sovereign risk8. A standby letter of credit .A. is never revokedB. is not a letter of creditC. is revoked in the event of non-compliance by buyer or seller with the terms of anoriginal creditD. is revoked in the event of non-compliance by buyer or seller with the terms of thesales contract.8. __________is not included in the category of payment guaranteeA Deferred payment bondB Guarantee for compensation tradeC Loan guaranteeD Bid bond9. The sum of the transferred credit will not be .A. the same as in the credit before transferB. less than in the credit beforetransferC. more than in the credit before transferD. equal to the original credit9. Which of the following details on the transferred credit may not be different to that of the credit before transfer? .A. The shipping dateB. The expiry date of the creditC. The description of the goodsD. The name of the applicant10 If a bill of lading is dated on March 15 ,2007 ,the insurance should be covered ___A. on March 15 ,2007B. before March 15 ,2007C after March 15, 2007D on or before March 15 ,200110 Commercial invoice must be made out in the name of ___A the applicantB the beneficiaryC the issuing bankD the advising bank11. A bank will not accept______.A. an insurance policyB. an insurance certificateC. an open coverD. a cover note11. If a credit calls for an insurance policy, banks will accept_______.A. an insurance policyB. an insurance certificateC. both A and BD. open policy12. The seller can get assistance from the factor by latter’s providing an assessment ofthe creditworthiness of the overseas bu yers as well as by latter’s offering credit control and ____________A sales accountingB development of new marketsC international salesD bad debt protection12.F o r f a i t i n g m a k e s t h e s e l l e r t o e vade various risks, except________A.interest-rate risk & currency risk,B.credit riskC.political risk;D. risks due to stop payment order received by the forfaitor in accordance withinternational convention13. ___________ is not the obligation of the trustee?A. To arrange for the goods to be warehoused and insured in the trustee’s name.B. To pay all the proceeds of sale to the bank or to hold them on behalf of the bank.C. Not to put the goods in pledge to other persons.D. To settl e claims of the bank prior to liquidation in case of the trustee’sbankruptcy.13. Measures for a bank before issuing a credit except for_________A.Credit lineB.Importer’s creditworthinessC.Liquidity of the goodsD. Complying presentation14. When the issuing bank decides to refuse to honor or negotiate, it must give a singlenotice to that effect to the presenter.The notice must stateexcept_______A.that the bank is refusing to honor or negotiate;B.each discrepancies in respect of which the bank refuses to honor or negotiate;C.that the bank is holding the documents pending further instructions from thepresenter; or that the issuing bank is holding the documents until it receives awaiver from the applicant and agrees to accept it, or receiving furtherinstructions from the presenter prior to agreeing to accept a waiver, or that thebank is returning the documents; or that the bank is acting in accordance withinstructions previously received from the presenter.D. The notice required to be given by telecommunication only.14. Events regarding to handle trade financing difficulty under credit _____A. Negotiate restrictivelyB. Actions of the issuing bank and his/her customary operationC. Time credit exceeding at 180 daysD. All aboveⅢPlease answer the following questions.(Total 22 scores)Array1.Please translate the following terms of credit and give yoursuggestions on them. ( 4 scores with each sub-article 2 scores)(1)This credit will become operative provided that the necessary authorization beobtained from exchange authority,we shall inform you as soon as theauthorization obtained.(2)copy of telex from applicant to suppliers approving the counter samples(1) This credit is only a preliminary advice and will become effective upon receipt ofour authenticated cable to the advising bank confirming that applicants have receivedand approved the advanced sample.(2) It is an conditions of letter of credit that it only become available provided that allbank charges of this credit are for the beneficiary’s account.2. Please have an analysis on the difference between forfaiting and factoring. ( 6 scores)2. Please have an analysis on the difference between a documentary credit and a standbycredit. ( 6 scores)3. How to measure & evade risks under international settlement? ( 6 scores)3. Please list kinds of export finance and their application. ( 6 scores)4. how can the Importer & the Exporter to apply financing under credit business? ( 6 scores)4. How to evade risks under documentary collection? ( 6 scores)ⅣPractice combination:① To judge kinds of the credit at least 3 kinds. (3 scores)② Which kinds of documents should be presented to the nominated bank and it’scopies. (8 Scores)③ Issuance a bill of exchange. Remarks: the actual shipment date was 040610.(5 Scores)④ How to show“ Blank endorsement” on the bill of exchange.(2 scores)⑤At the beneficiary’s end, should the terms and conditions of this credit beemended? Please give me a reasonable comments on it. ( 2 scores)FORM OF DOC.CREDIT: IRREVOCABLECREDIT NUMBER: 50000585DATE OF ISSUE: 040506EXPIRY DATE AND PLACE: DATE 040630 PLACE CHINAAPPLICANT BANK: REPUBLIC NATIONAL BANK OF NEW YORK NEW YORK USA APPLICANT: NANCY FABRICS INC, 5 STREET NO.43 AVENUE 5, NEW YORK USA BENEFICIARY: HANGZHOU TENGLONG WEAVING CO., LTD. #198 JIANSHE NO.1 ROAD, XIAOSHAN ECONOMIC &TECHNOLOGICAL DEVELOPMENT ZONE,HANGZHOU CHINA 311215AMOUNT: CURRENCY USD AMOUNT 132,000,00(SAY U.S.DOLLARS ONE HUNDRED AND THIRTY TWO THOUSAND ONLY.) VAILABLE WITH/BY: ISSUING BANKBY ACCEPTANCE AT 60 DAYS AFTER SIGHTDRAWEE TO : OURSELVESPARTIAL SHIPMENTS: PARTIAL SHIPMENTS PROHIBITEDTRANSSHIPMENT: TRANSSHIPMENT ALLOWED.LOADING IN CHARGE: SHANGHAI, CHINAFOR TRANSPORT TO: NEW YORKLATEST DATE OF SHIP: 040615DESCRIPT.OF GOODS: UPHOLSTERY FABRICS AS PER APPLICANT’S ORDER SHEETNO.NKY201 (CIF) SUBJECT TO INCOTERMS 2000 DOCUMENTS REQUIRED:+SIGNED COMMERCIAL INVOICE 2 ORIGINALS AND 3 COPIES+DETAILED PACKING LIST 2 ORIGINALS + 2 COPIES+CERTIFICATE OF ORIGIN 1 ORIGIN AND 2 COPIES+FULL SET NEGOTIABLE CLEAN ON BOARD OCEAN BILLS OF LADING CONSIGNED TO ORDER OF REPUBLIC NATIONAL BANK OF NEW YORK, NEWYORK USA MARKED NOTIFY APPLICANT AND MARKED FREIGHT PREPAID+ ORIGINAL TEXTILE EXPORT LICENSE+INSURANCE POLICY IN DUPLICATE COVERING AT LEAST 110% OF COMMERCIAL VALUE WITH CLAIM PAYABLE IN NEW YORK IN USD AGAINST ICC(A) AND WAR RISKS AND SRCC RISKS.+ORIGINAL EXPORT LINCENCE+ORIGINAL INSPECTION CERTIFICATION QUALITY AND QUANTITIESISSUED BY APPLICANT’S AUTHORIZED AGENT AND HIS SIGNATURE HASBEEN REMAINED IN THE ISSUING BANK.ADDITIONAL REQUIREMENTS:+D RAFTS ARE TO BE MARKED”DRAWN UNDER REPUBLIC NATIONAL BANK OF NEW YORK NEW YORK USA AND BEARING CREDIT NUMBERAND THE ISSUING DATE.+A DISCRIPANCY FEE OF USD 50.00 WILL BE DEDUCTED FROM THE PROCEEDS OF ANY DRAWING PRESENTED WITHDISCRIPANCIES+ IT IS A CONDITION OF THIS CREDIT THAT ALL DOCUMENTS ARE TO FORWARDED IN ONE COMPELETE MAILING TO REPUBLICNATIONAL BANK OF NEW YORK NEW YORK USA, INTERNATIONALDEPARTMENT.DETAILS OF EXHARGES: IT IS AN CONDITIONS OF LETTER OF CREDIT THAT IT ONLY BECOME AVAILABLE PROVIDED THAT ALL BANK CHARGES OUTSIDEUSA ARE FOR THE BENEFICIARY’S ACCOUNT。

国际结算模拟试题

国际结算模拟试题国际结算模拟试题一、选择题1、下列哪个选项是国际结算中常见的支付方式?() A. 现金结算B. 银行转账C. 以物易物D. 信用证2、在国际结算中,以下哪个选项是出口商最常用的收汇方式?()A. 预付货款B. 赊销C. 银行保函D. 跟单托收3、下列哪个选项是进口商在采用信用证结算时需要向银行提交的文件?() A. 商业发票 B. 提单 C. 保险单 D. 汇票二、简答题1、请简述国际结算中涉及的主要单据及其作用。

2、请说明国际结算中银行所起的作用及盈利模式。

3、请简述国际贸易中货物的流转过程。

三、综合题1、请结合实际案例,说明国际结算中可能存在的风险及防范措施。

2、请简述国际贸易中的支付条款,并说明其重要性。

3、请比较分析国际结算中常用的三种支付方式的优缺点。

四、思考题1、请思考国际结算中存在的支付体系不统一的问题,并提出可能的解决方案。

2、请分析国际结算中电子化趋势的影响及应对策略。

3、请思考国际结算与国际贸易之间的相互影响及关系。

参考答案:一、选择题1、D 2. D 3. A二、简答题1、国际结算中涉及的主要单据包括商业发票、提单、保险单、汇票等。

商业发票是进出口双方报关、报验、清关、结算的重要凭证。

提单是承运人收到货物后出具的货物收据,是进出口双方换取提单前约定卸货港交货的必要依据。

保险单是保险公司对货物进行保险时出具的凭证,是进出口双方在货物运输过程中约定保险权利和义务的必要依据。

汇票是出口商向进口商收取货款时出具的凭证,是进出口双方进行结算的必要依据。

2、银行在国际结算中扮演着重要的角色,其作用包括提供结算服务、担保信用、融通资金等。

银行通过为客户提供结算服务,帮助进出口双方完成货款的收付,并通过收取手续费等方式盈利。

此外,银行还为客户提供信用担保和资金融通等服务,帮助客户解决贸易过程中的信用和资金问题。

银行的盈利模式主要包括手续费、利息、汇差等收入。

3、国际贸易中货物的流转过程包括出口商生产货物、出口商将货物交给承运人运输、承运人将货物运至进口国指定的港口、进口商在港口办理接货手续、进口商将货物运至目的地等步骤。

国际结算模拟试题及答案

《国际结算》模拟试题一、名词解释:(每题4分,共20分)1、本票:2、汇款:3、沉默保兑:4、完全背书:5、背对信用证:二、单项选择题(每题2分,共20分)1、甲国向乙国提供援助款100万美元,由此引起的国际结算是()。

A.国际贸易结算B.非贸易结算C.有形贸易结算D.无形贸易结算2、属于顺汇方法的支付方式是()。

A.票汇B.托收C.保函D.直接托收3、公司签发一张汇票,上面注明“At 90 day s after sight”,则这是一张()。

A.即期汇票B.远期汇票C.跟单汇票D.光票4、以下是国际贸易中经常用到的结算方式,其中哪种不属于汇款方式?()A.押汇 B.预付货款 C.寄售 D.凭单付汇5、收款最快,费用较高的汇款方式是()。

A.T/TB.M/TC.D/DD.D/P6、信用证被广泛使用到,其中有一个重要原因在于信用证对于出口商和进口商来说有资金融通的作用,以下选项不一定是信用证对于出口商的融资方式的是()。

A.打包放款 B.汇票贴现 C.押汇 D.红条款信用证7、审核单据,购买受益人交付的跟单信用证项下汇票,并付出对价的银行是()。

A.开证行B.保兑行C.付款行D.议付行8、以下关于可转让信用证说法错误的是:()。

A.可转让信用证适用于中间商贸易B.信用证可以转让给一个或一个以上的第二受益人,而且这些第二受益人又可以转让给两个以上的受益人C.未经过信用证授权的转让行办理,受益人自行办理的信用证转让业务视为无效D.可转让信用证中只有一个开证行9、以下关于承兑信用证的说法正确的是()。

A.在该项下,受益人可自由选择议付的银行B.承兑信用证的汇票的期限是远期的C.其起算日是交单日D.对受益人有追索权10、以下不属于出口商审证的内容的是:()。

A.信用证与合同的一致性B.信用证条款的可接受性C.价格条件的完整性D.开证申请人的资信三、判断正误题(以下各命题,请在正确命题后的括号内打“√”,错误的打“×”,每题1分,共10分)1、信用证的基本当事人包括:出口商、进口商、开证行。

国际结算模拟试题一

《国际结算》模拟试题(一)一、写出下列专业术语英文缩写的中文全称(5分)1、 :2、 : ;3、:4、 : ;5、 :二、单项选择题(只有唯一正确答案)(每题1分, 共10分)1.福费廷业务中的远期汇票应得到()。

A.进口商担保B.进口商银行担保C.出口商担保D.出口商银行担保2、根据《500》的规定, 信用证项下汇票的付款人应是()。

A.开证行B.议付行C.通知行D.开证申请人3.签发联运提单()的承运人其责任是()。

A.必须对全程运输负责B、只对第一程运输负责C、只对第二程运输负责D.只对第一程与第二程交接部分负责4.旅行支票是以()的操作理论设计的。

A.汇票B.本票C.支票D.信用证5.最早采用电交换的国家是()。

A.英国B.美国C.日本D.瑞士6.收款速度最快的汇款方式是()。

A.票汇 B、电汇 C、信汇 D、货到付款7、下列属于汇付法的结算方式是()。

A.票汇B.信用证C.跟单托收D.非贸易的支票托收8、以下信用证的()付款是终局性的付款。

A.付款后, 对受益人无追索权, 但对开证行有索偿权B.付款后, 对议付行无追索权, 但对开证行有索偿权C.付款后, 对受益人有追索权, 但对开证行无索偿权D、付款后, 对受益人无追索权, 但对进口商有索偿权9、信用证项下汇票遭到拒付时, 首先行使追索权的是()。

A.付款行 B、议付行 C、开证行 D、通知行10、票据是一种设权证券是指()。

A.票据在于证明已经存在的权利B.票据建立了付给一定金额的请求权C.票据是书面债务凭证D.票据上的权利可以背书、交付和转让三、多项选择题(每题2分, 共20分)1.光票信用证的主要特点有()。

A.限制在一个国家、一个城市、一家银行兑取B、有效期一般为一年C.期满可继续使用D.可为循环信用证E、不可撤销2.下列有关的理解, 正确的有()。

A、是面向"商业文件"的, 这些文件必须根据相应的统一标准格式编制B.信息传递不需人工干预C.信息的最终用户是计算机应用软件系统D.网络的用户通过银行连到中心 E、最广阔的市场是国际贸易3.下列可成为银行保函申请人的是()。

国际结算模拟试卷和答案(1)

国际结算模拟试卷和答案(1)一、名词说明(每题3分,共15分)一、国际结算单据:二、单据行为:3、承兑:4、银行保函:五、国际清算:二、填空题(将正确的答案填入括号中,每空1分,共15分)一、国际结算中利用的金融工具主若是(),要紧包括()、()。

二、我国于()年5月10日正式发布了《中华人民共和国单据法》,并于()年1月1日起实施。

3、汇票按承兑人的不同可分为()和()。

4、出票是产生单据关系的基础。

出票包括两个动作,一是();二是()。

五、汇款按支付授权书的投递方式不同,可分为电汇,信汇,票汇三种,它们的英文简称别离为()、()和()。

六、即期付款交单托收方式中利用的汇票为()而承兑交单托收方式中利用的汇票为()。

7、议付信誉证中若是开证行没有指定某家银行议付,那么受益人能够向()请求议付。

三、选择题(请将正确答案的英文字母填入括号中。

1至5小题为多项选择题,每题有2至4个正确答案;6至10小题为单项选择题,每题只有1个正确答案。

每题2分,共20分)一、以下属于国际结算方式的是()A、跟单托收B、光票托收C、议付信誉证D、银行保函二、汇票付款人名称写成以下哪一种形式时汇票无效()A、John Smith and Mary SmithB、John Smith or Mary SmithC、John SmithD、First John Smith than Mary Smith3、跟单托收中的商业单据要紧包括()A、商业发票B、运输单据C、远期汇票D、保险单4、以下国际结算方式中属于商业信誉的是()A、汇款B、托收C、信誉证D、银行保函5、以下属于短时间出口贸易融资的是()A、打包放款B、出口押汇C、银行承兑D、提货担保6、以下即是一种国际结算方式,又不单纯是一种结算方式,其作用也并非仅仅局限于国际结算领域的是()A、汇款B、托收C、信誉证D、银行保函7、以下属于短时间入口贸易融资的是()A、开证授信额度B、打包放款C、单据贴现D、银行承兑8、在所有商业单据中处于中心单据地位的是()A、商业发票B、海关发票C、海运提单D、保险单9、英镑的清算中心在()A、伦敦B、法兰克福C、香港D、纽约10、以下哪一种结算方式的结算费用较高()A、汇款B、托收C、银行保函D、信誉证四、判定题(以下说法若是是对的请在括号内打"√",若是是错的请在括号内打"×",每题1分共10分)一、国际旅行、国际保险引发的国际间债权债务的结算属于国际贸易结算。

国际结算练习题1

国际结算练习题1国际结算练习题(一)一、单项选择题1、在国际贸易结算中,普遍实行"推定交货",推定交货的实质是(A )A、货物单据化 B、快速收汇 C、奖出限入 D、转帐结算2、办理国际结算时,国际性的商业银行对往来银行的选择中,最佳选择是(C )A、海外联行B、代表处C、代理行中的帐户行D、代理行中的非帐户行3、办理国际结算时,若甲行在国外乙行开设有帐户,当甲行从乙行所在国进口商处托收一笔款项时,乙行给甲行发送的报单上的意思表示概括为(A )A、"已贷记你行帐户" B、"已借记你行帐户" C、"请借记我行帐户" D、"请贷记我行帐户"4、汇票的本质和核心是(A )A、无条件的书面付款命令B、必须要签字盖章C、要载明确定的货币金额D、背书转让5、在西方,汇票的收款人栏内有"BEARER"一词的汇票,称为( C)A、限制性抬头的汇票B、指示性抬头的汇票C、持票人抬头的汇票D、不允许转让的汇票6、中国〈票据法〉规定,见票即付的汇票有效期为(D )A、1年B、2年C、半年D、1个月7、本票付款人是(A )A、出票人B、持票人C、债务人D、背书人8、汇款业务中,汇款人与汇出行之间的关系是( B)A、债权债务关系B、委托与被委托关系C、帐户往来关系D、代理关系9、跟单信用证是银行有条件的付款承诺,这里所谓的"有条件"指的是(A )A、出口方提交信用证上规定要提交的货运单据B、货物的质量、规格、数量符合和约规定C、必须附有货运单据、保险单据D、必须附有银行汇票10、备用信用证的开证行承担(A )A、第一性付款责任B、第二性付款责任C、保证付款责任D、担保付款责任11、向以下国家出口货物时,必须提交海关发票的是(A )A、美国B、日本C、德国D、法国12、下列国际结算方式中,使用最广泛的是(B )A、汇款方式B、跟单信用证方式C、托收方式D、银行保函13、假设我国一进口商欲向外国出口商预付一笔货款,则出口商最理想的结算方式是(C )A、汇款方式B、托收方式C、跟单信用证方式D、银行保函方式14、商业汇票生效的前提条件是( C )A、贴现B、出票C、承兑D、背书15、下列各项单据,属于附属单据的是(A )A、普惠制产地证B、保险单C、空运提单D、商业发票16、下列各项中,属于非贸易国际结算的是(C )A、货物买卖结算B、外商直接投资结算C、外国政府援助款项结算D、买方信贷资金结算17、国际标准化组织制定的国际标准化货币符号中规定,中国人民币的标准代码是(A )A、CNYB、RMBC、RMD18、《日内瓦统一法》规定,即期汇票的有效期是从出票日起的(A )A、1年B、2年C、三个月D、半年19、出票地点为汇票(B )A、绝对应记载事项B、相对应记载事项C、必须应记载事项D、必备事项20、银行承兑汇票的第一付款人是( A)A、承兑银行B、债务人C、持票人D、背书人21、我国对外贸易最主要、最普遍采用的结算方式是( C)A、汇款方式B、托收方式C、跟单信用证方式D、银行保函方式22、跟单信用证业务中,负第一性付款责任的是(A )A、开证行B、债务人C、通知行D、保付行23、无条件保函的第一性付款人是(A )A、担保行B、通知行D、收益人25、下列各项中,不可转让的海运提单是(A )A、记名提单B、不记名提单C、提单上收货人一栏内写有"ORDER"一词的提单D、提单上收货人一栏内写有"BEARER"一词的提单。

国际结算期末模拟试题和答案

《国际结算》模拟试题一一、名词解释1.信用证2.跟单信用证3.SWIFT4.单独海损二、单项选择题1.信用证上如未明确付款人,则制作汇票时,受票人应为()A.开证申请人 B.开证银行 C.议付银行2.所谓信用证“严格相符”的原则,是指受益人必须做到()A.单证与合同严格相符 B.单据与信用证严格相符 C.信用证和合同严格相符3.使用L/C、D/P、D/A三种支付方式结算货款,就卖方的收汇风险而言,从小到大依次排序为()A. D/P、D/A和L/C B. D/A、D/P和L/C C. L/C、D/P和D/A4. UCP500规定即要规定交单的时间又要规定交单地点的信用证是()A.自由议付信用证 B. 限制议付信用证 C. 备用信用证5.当今世界上最大的贸易集团是()A.北美自由贸易区 B.亚太经合组织 C.欧盟6.在一般情况下,不能被进口商接受的提单是()A.清洁提单 B.指示提单 C.备用提单7.仓至仓条款是()A.承运人负责运输责任起讫的条款 B.保险人负责保险责任起讫的条款C.出口人负责交货责任起讫的条款8.在国际贸易结算中,汇票通常是()开立的,委托当地银行向国外进口商或指定银行收取货款的票据。

A.进口商 B.出口商 C.代理商 D.经销商9.当出口人按信用证规定向开证银行要求付款时,开证银行在()履行付款义务。

A.征得进口人同意后 B.货物到达后 C.货物检查合格后 D.单证相符条件下10.海运提单的签发人是()A.托运人 B.收货人 C.承运人或其代理人三、问答题1.使用商业汇票结算债权债务必须具备哪些条件?2.比较可转让信用证与背对背信用证的异同点?3.简述海运提单的性质和作用。

4.试分析包买业务对进出口商的利弊。

四、分析题天津M出口公司出售一批给香港G商,价格条件为GIF香港,付款条件为D/P见票后30天付款,M出口公司并同意G商指定香港汇丰银行为代收行。

M出口公司在合同规定的装船期限内将货物装船,取得清洁提单,随即出具汇票,连同提单和商业发票等委托中行通过香港汇丰银行向G商收取货款。

国际结算模拟题1

模拟试题一一、任意项选择题(每小题2分,共20分)1.国际收支记录的经济交易是指发生在---------之间的交易。

A、居民与非居民;B、居民与居民;C、非居民与非居民;D、居民与国际组织2.国际货币基金组织建议各国在编报国际收支报表时,对货物价格的记录应使用------A、货物成本价;B、货物市场价;C、货物到岸价;D、货物离岸价3.利息平价理论的创始人是------。

A、佛里德曼B、凯恩斯C、斯旺D、米德4.国际清算银行建立时间--------------。

A、1930年B、1947年C、1945年D、1973年5.国际金本位制的基本特点有--------。

A、各国货币以黄金为基础,保持固定比价关系B、实行自由多边的国际结算制度C、特别提款权作为主要的国际储备资产D、国际收支依靠市场机制自发调节E、纸币与黄金自由兑换F、在市场机制自发作用下的国际货币制度需要国际金融组织的监督6.外债的结构管理内容包括------。

A、币种管理B、期限管理C、利率管理D、来源管理7.国际金融风险按对象划分,可以分为------。

A、政治风险B、外汇风险C、国家风险D、利率风险8.欧洲债券的面值货币为-------。

A、投资人所在国货币B、发行人所在国货币C、发行地所在国货币D、第三国货币9.一国国际储备包括-------。

A、黄金B、在国际货币基金组织的储备头寸C、特别提款权D、商业银行持有的外汇资产10.外汇市场最原始的传统业务是---------。

A、即期交易;B、远期交易;C、期货交易;D、期权交易二、判断改错题:(每题3分共15分)1.IMF是一个区域性的国际金融机构。

2.当某外汇的即期价格低于其远期价格时,表明该外汇发生了贴水。

3.布雷顿货币体系下的固定汇率制是自发形成的国际汇率安排。

4.欧洲货币市场的存贷利差一般大于各国国内金融市场。

5.如果所持有的外汇头寸汇率上升,则不仅没有汇率风险,而且还会有收益。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

assurance of payment. ( )

10. In a reciprocal credits, the advising bank itself gives a packing

loan to the beneficiary. ( )

11. If a credit is issued by airmail , it ought to be authenticated by test key .( ) 11. The issuing bank’s signature is only to be placed on the advice for the beneficiary .( )

Scores

1. Usually, foreign trade can be conducted on the following terms

except for _________.

A. open account

B. documentary collection

C. documentary credit

6. Under D/D, upon receipt of the draft, the beneficiary can ship the goods before he present it for payment at the counter of the drawee bank.

7. If the collecting bank is not located near the importer, it would send the documents to a presenting bank in the importer’s city mostly. 7. Under D/A, after acceptance, the buyer gains possession of

浙江林学院 2006 - 2007 学年第 二 学期考试卷 (A卷)

学院:

专业班级:

姓名:

学

号:

装订 线 内 不 要 答

题

课程名称: 国际结算(双语)课程类别: 必修 考试方式: 闭卷

注意事项:1、本试卷满分100分。 2、考试时间 120分钟。

Article no.

Ⅰ

Ⅶ

Ⅷ

Result Ⅰ

C. non acceptance

D. partial acceptance

4. _______must be accepted by the drawee before payment.

Scores

Teacher

Decide whether the following statements are true or false. Scores

(Please mark “T” if the answer is true, or you shall mark “F” if the answer is false. Each one 2 score, total 30 scores.)

B. bank draft

C. commercial bill

D. trade bill

4. An acceptance with the wording “payable on delivery of bill of

lading ” is ______.

A. a general acceptance B. qualified acceptance

12. Banks will not accept a document bearing a date lf issuance prior to that of the credit .( ) 12 . If the credit is a deferred payment credit, there is no need to draw a draft. ( )

1. From an American bank’s view, a Nostro account is a dollar account held for its overseas correspondents. ( ) 1. From a Chinese bank’s view, a Vostro Account or Due to

9. A transferable credit can be transferred only to one party and

all the terms and conditions cannot be changed while it is

transferred.

()

10. An irrevocable confirmed credit gives the beneficiary a double

13. Commercial invoice need not be signed.( ) 13. A clean bill of lading is one that is not stained.( )

14. When an issuing bank determines that a presentation is complying, it must honour. A credit must not be issued available by a draft drawn on the applicant.

2. There is no acceptor in a promissory note. ( )

3. A bill of exchange drawn by and accepted by commercial firms be known as trade bills. ( ) 3. An endorser of a bill is liable on it to subsequent endorsers and holders of the bill. ( )

A. payee B. endorser C. drawer D. endorsee

2. A check is valid for ______months from the date of issue, unless a

shorter period is

written on the face of it.

9. Under UCP600, Unless otherwise stipulated in the credit, a

transferable credit can be transferred only once and the issuing

bank can transfer a credit by itself. ( )

14. Negotiate, without recourse, if the credit is available by negotiation with the confirming bank.

15. A bank utilizing the services of an advising bank or second advising bank to advise a credit must use the same bank advise any amendment thereto.

4. A crossed check can be cashed over the counter. ( ) . If a check is presented undated, the payee can insert a date. ( )

5. If a bill is payable “at 30 days after date “, the date of payment is decided according to

D. public bonds

1. International cash settlement has the following disadvantages

except _______ .

A. expensive C. risky

B. safe D. time-consuming

2. The person who pay money is a ______ of a check.

the goods before payment and is able to dispose of the goods as he wishes .

8. Under documentary credit, the nominated bank has no obligation to examine documents. ( ) 8. Usually the advising bank is the bank resides in the same city as the buyer. ( )

the date of acceptance. ( ) 5. A bill payable “ at 90 days sight” is a sight bill.( )

6. Remittance happens when a client (payer) asks his bank to send a sum of money to a payee abroad by one of the transfer methods at his option. ( )

Ⅱ Choose the correct or best answer to each of the following statements. (Each only has a correct answer or best answer, mark your option on the line. 2 scores per sub-article, total 28 scores)