会计英语 Expression

会计专业英语词汇大全

accountant genaral 会计主任 account balancde 结平的帐户 account bill 帐单 account books 帐 account classification 帐户分类 account current 往来帐 account form of balance sheet 帐户式资产负债表 account form of profit and loss statement 帐户式损益表 account payable 应付帐款 account receivable 应收帐款 account of payments 支出表 account of receipts 收入表 account title 帐户名称,会计科目 accounting year 或financial year 会计年度 accounts payable ledger 应付款分类帐 Accounting period(会计期间) are related to specific time periods ,typically one year(通常是一年) 资产负债表:balance sheet 可以不大写b 利润表: income statements (or statements of income) 利润分配表:retained earnings 现金流量表:cash flows1、部门的称谓 市场部Marketing 销售部 Sales Department (也有其它讲法,如宝洁公司销售部叫客户生意发展部CBD) 客户服务 Customer Service ,例如客服员叫CSR,R for representative 人事部 Human Resource 行政部 Admin. 财务部 Finance & Accounting 产品供应 Product Supply,例如产品调度员叫 P S Planner2、人员的称谓 助理 Assistant 秘书 secretary 前台接待小姐 Receptionist 文员 clerk ,如会计文员为Accounting Clerk 主任 supervisor 经理 Manager 总经理 GM,General Manager 入场费admission 运费freight 小费tip 学费tuition 价格,代价charge 制造费用 Manufacturing overhead 材料费 Materials 管理人员工资 Executive Salaries 奖金 Wages 退职金 Retirement allowance 补贴 Bonus 外保劳务费 Outsourcing fee 福利费 Employee benefits/welfare 会议费 Coferemce 加班餐费 Special duties 市内交通费 Business traveling 通讯费 Correspondence 电话费 Correspondence 水电取暖费 Water and Steam 税费 Taxes and dues 租赁费 Rent 管理费 Maintenance 车辆维护费 Vehicles maintenance 油料费 Vehicles maintenance 培训费 Education and training 接待费 Entertainment 图书、印刷费 Books and printing 运费 Transpotation 保险费 Insurance premium 支付手续费 Commission 杂费 Sundry charges 折旧费 Depreciation expense 机物料消耗 Article of consumption 劳动保护费 Labor protection fees 总监Director 总会计师 Finance Controller 高级 Senior 如高级经理为 Senior Manager 营业费用 Operating expenses 代销手续费 Consignment commission charge 运杂费 Transpotation 保险费 Insurance premium 展览费 Exhibition fees 广告费 Advertising fees 管理费用 Adminisstrative expenses 职工工资 Staff Salaries 修理费 Repair charge 低值易耗摊销 Article of consumption 办公费 Office allowance 差旅费 Travelling expense 工会经费 Labour union expenditure 研究与开发费 Research and development expense 福利费 Employee benefits/welfare 职工教育经费 Personnel education 待业保险费 Unemployment insurance 劳动保险费 Labour insurance 医疗保险费 Medical insurance 会议费 Coferemce 聘请中介机构费 Intermediary organs 咨询费 Consult fees 诉讼费 Legal cost 业务招待费 Business entertainment 技术转让费 Technology transfer fees 矿产资源补偿费 Mineral resources compensation fees 排污费 Pollution discharge fees 房产税 Housing property tax 车船使用税 Vehicle and vessel usage license plate tax(VVULPT) 土地使用税 Tenure tax 印花税 Stamp tax 财务费用 Finance charge 利息支出 Interest exchange 汇兑损失 Foreign exchange loss 各项手续费 Charge for trouble 各项专门借款费用 Special-borrowing cost 帐目名词一、资产类 Assets 流动资产 Current assets 货币资金 Cash and cash equivalents 现金 Cash 银行存款 Cash in bank 其他货币资金 Other cash and cash equivalents 外埠存款 Other city Cash in bank 银行本票 Cashier''s cheque 银行汇票 Bank draft 信用卡 Credit card 信用证保证金 L/C Guarantee deposits 存出投资款 Refundable deposits 短期投资 Short-term investments 股票 Short-term investments - stock 债券 Short-term investments - corporate bonds 基金 Short-term investments - corporate funds 其他 Short-term investments - other 短期投资跌价准备 Short-term investments falling price reserves 应收款 Account receivable 应收票据 Note receivable 银行承兑汇票 Bank acceptance 商业承兑汇票 Trade acceptance 应收股利 Dividend receivable 应收利息 Interest receivable 应收账款 Account receivable 其他应收款 Other notes receivable 坏账准备 Bad debt reserves 预付账款 Advance money 应收补贴款 Cover deficit by state subsidies of receivable 库存资产 Inventories 物资采购 Supplies purchasing 原材料 Raw materials 包装物 Wrappage 低值易耗品 Low-value consumption goods 材料成本差异 Materials cost variance 自制半成品 Semi-Finished goods 库存商品 Finished goods 商品进销差价 Differences between purchasing and selling price 委托加工物资 Work in process - outsourced 委托代销商品 Trust to and sell the goods on a commission basis 受托代销商品 Commissioned and sell the goods on a commission basis 存货跌价准备 Inventory falling price reserves 分期收款发出商品 Collect money and send out the goods by stages 待摊费用 Deferred and prepaid expenses 长期投资 Long-term investment 长期股权投资 Long-term investment on stocks 股票投资 Investment on stocks 其他股权投资 Other investment on stocks 长期债权投资 Long-term investment on bonds 债券投资 Investment on bonds 其他债权投资 Other investment on bonds 长期投资减值准备 Long-term investments depreciation reserves 股权投资减值准备 Stock rights investment depreciation reserves 债权投资减值准备 Bcreditor''s rights investment depreciation reserves 委托贷款 Entrust loans 本金 Principal 利息 Interest 减值准备 Depreciation reserves 固定资产 Fixed assets 房屋 Building 建筑物 Structure 机器设备 Machinery equipment 运输设备 Transportation facilities 工具器具 Instruments and implement 累计折旧 Accumulated depreciation 固定资产减值准备 Fixed assets depreciation reserves 房屋、建筑物减值准备 Building/structure depreciation reserves 机器设备减值准备 Machinery equipment depreciation reserves 工程物资 Project goods and material 专用材料 Special-purpose material 专用设备 Special-purpose equipment 预付大型设备款 Prepayments for equipment 为生产准备的工具及器具 Preparative instruments and implement for fabricate 在建工程 Construction-in-process 安装工程 Erection works 在安装设备 Erecting equipment-in-process 技术改造工程 Technical innovation project 大修理工程 General overhaul project 在建工程减值准备 Construction-in-process depreciation reserves 固定资产清理 Liquidation of fixed assets 无形资产 Intangible assets 专利权 Patents 非专利技术 Non-Patents 商标权 Trademarks, Trade names 著作权 Copyrights 土地使用权 Tenure 商誉 Goodwill 无形资产减值准备 Intangible Assets depreciation reserves 专利权减值准备 Patent rights depreciation reserves 商标权减值准备 trademark rights depreciation reserves 未确认融资费用 Unacknowledged financial charges 待处理财产损溢 Wait deal assets loss or income 待处理财产损溢 Wait deal assets loss or income 待处理流动资产损溢 Wait deal intangible assets loss or income 待处理固定资产损溢 Wait deal fixed assets loss or income二、负债类 Liability 短期负债 Current liability 短期借款 Short-term borrowing 应付票据 Notes payable 银行承兑汇票 Bank acceptance 商业承兑汇票 Trade acceptance 应付账款 Account payable 预收账款 Deposit received 代销商品款 Proxy sale goods revenue 应付工资 Accrued wages 应付福利费 Accrued welfarism 应付股利 Dividends payable 应交税金 Tax payable 应交增值税 value added tax payable 进项税额 Withholdings on VAT 已交税金 Paying tax 转出未交增值税 Unpaid VAT changeover 减免税款 Tax deduction 销项税额 Substituted money on VAT 出口退税 Tax reimbursement for export 进项税额转出 Changeover withnoldings on VAT 出口抵减内销产品应纳税额 Export deduct domestic sales goods tax 转出多交增值税 Overpaid VAT changeover 未交增值税 Unpaid VAT 应交营业税 Business tax payable 应交消费税 Consumption tax payable 应交资源税 Resources tax payable 应交所得税 Income tax payable 应交土地增值税 Increment tax on land value payable 应交城市维护建设税 Tax for maintaining and building cities payable 应交房产税 Housing property tax payable 应交土地使用税 Tenure tax payable 应交车船使用税 Vehicle and vessel usage license plate tax(VVULPT) payable 应交个人所得税 Personal income tax payable 其他应交款 Other fund in conformity with paying 其他应付款 Other payables 预提费用 Drawing expense in advance 其他负债 Other liabilities 待转资产价值 Pending changerover assets value 预计负债 Anticipation liabilities 长期负债 Long-term Liabilities 长期借款 Long-term loans 一年内到期的长期借款 Long-term loans due within one year 一年后到期的长期借款 Long-term loans due over one year 应付债券 Bonds payable 债券面值 Face value, Par value 债券溢价 Premium on bonds 债券折价 Discount on bonds 应计利息 Accrued interest 长期应付款 Long-term account payable 应付融资租赁款 Accrued financial lease outlay 一年内到期的长期应付 Long-term account payable due within one year 一年后到期的长期应付 Long-term account payable over one year 专项应付款 Special payable 一年内到期的专项应付 Long-term special payable due within one year 一年后到期的专项应付 Long-term special payable over one year 递延税款 Deferral taxes三、所有者权益类 OWNERS'' EQUITY 资本 Capita 实收资本(或股本) Paid-up capital(or stock) 实收资本 Paicl-up capital 实收股本 Paid-up stock 已归还投资 Investment Returned 公积 资本公积 Capital reserve 资本(或股本)溢价 Cpital(or Stock) premium 接受捐赠非现金资产准备 Receive non-cash donate reserve 股权投资准备 Stock right investment reserves 拨款转入 Allocate sums changeover in 外币资本折算差额 Foreign currency capital 其他资本公积 Other capital reserve 盈余公积 Surplus reserves 法定盈余公积 Legal surplus 任意盈余公积 Free surplus reserves 法定公益金 Legal public welfare fund 储备基金 Reserve fund 企业发展基金 Enterprise expension fund 利润归还投资 Profits capitalizad on return of investment 利润 Profits 本年利润 Current year profits 利润分配 Profit distribution 其他转入 Other chengeover in 提取法定盈余公积 Withdrawal legal surplus 提取法定公益金 Withdrawal legal public welfare funds 提取储备基金 Withdrawal reserve fund 提取企业发展基金 Withdrawal reserve for business expansion 提取职工奖励及福利基金 Withdrawal staff and workers'' bonus and welfare fund 利润归还投资 Profits capitalizad on return of investment 应付优先股股利 Preferred Stock dividends payable 提取任意盈余公积 Withdrawal other common accumulation fund 应付普通股股利 Common Stock dividends payable 转作资本(或股本)的普通股股利 Common Stock dividends change to assets(or stock) 未分配利润 Undistributed profit四、成本类 Cost 生产成本 Cost of manufacture 基本生产成本 Base cost of manufacture 辅助生产成本 Auxiliary cost of manufacture 制造费用 Manufacturing overhead 材料费 Materials 管理人员工资 Executive Salaries 奖金 Wages 退职金 Retirement allowance 补贴 Bonus 外保劳务费 Outsourcing fee 福利费 Employee benefits/welfare 会议费 Coferemce 加班餐费 Special duties 市内交通费 Business traveling 通讯费 Correspondence 电话费 Correspondence 水电取暖费 Water and Steam 税费 Taxes and dues 租赁费 Rent 管理费 Maintenance 车辆维护费 Vehicles maintenance 油料费 Vehicles maintenance 培训费 Education and training 接待费 Entertainment 图书、印刷费 Books and printing 运费 Transpotation 保险费 Insurance premium 支付手续费 Commission 杂费 Sundry charges 折旧费 Depreciation expense 机物料消耗 Article of consumption 劳动保护费 Labor protection fees 季节性停工损失 Loss on seasonality cessation 劳务成本 Service costs五、损益类 Profit and loss 收入 Income 业务收入 OPERATING INCOME 主营业务收入 Prime operating revenue 产品销售收入 Sales revenue 服务收入 Service revenue 其他业务收入 Other operating revenue 材料销售 Sales materials 代购代售 包装物出租 Wrappage lease 出让资产使用权收入 Remise right of assets revenue 返还所得税 Reimbursement of income tax 其他收入 Other revenue 投资收益 Investment income 短期投资收益 Current investment income 长期投资收益 Long-term investment income 计提的委托贷款减值准备 Withdrawal of entrust loans reserves 补贴收入 Subsidize revenue 国家扶持补贴收入 Subsidize revenue from country 其他补贴收入 Other subsidize revenue 营业外收入 NON-OPERATING INCOME 非货币性交易收益 Non-cash deal income 现金溢余 Cash overage 处置固定资产净收益 Net income on disposal of fixed assets 出售无形资产收益 Income on sales of intangible assets 固定资产盘盈 Fixed assets inventory profit 罚款净收入 Net amercement income 支出 Outlay 业务支出 Revenue charges 主营业务成本 Operating costs 产品销售成本 Cost of goods sold 服务成本 Cost of service 主营业务税金及附加 Tax and associate charge 营业税 Sales tax 消费税 Consumption tax 城市维护建设税 Tax for maintaining and building cities 资源税 Resources tax 土地增值税 Increment tax on land value 5405 其他业务支出 Other business expense 销售其他材料成本 Other cost of material sale 其他劳务成本 Other cost of service 其他业务税金及附加费 Other tax and associate charge 费用 Expenses 营业费用 Operating expenses 代销手续费 Consignment commission charge 运杂费 Transpotation 保险费 Insurance premium 展览费 Exhibition fees 广告费 Advertising fees 管理费用 Adminisstrative expenses 职工工资 Staff Salaries 修理费 Repair charge 低值易耗摊销 Article of consumption 办公费 Office allowance 差旅费 Travelling expense 工会经费 Labour union expenditure 研究与开发费 Research and development expense 福利费 Employee benefits/welfare 职工教育经费 Personnel education 待业保险费 Unemployment insurance 劳动保险费 Labour insurance 医疗保险费 Medical insurance 会议费 Coferemce 聘请中介机构费 Intermediary organs 咨询费 Consult fees 诉讼费 Legal cost 业务招待费 Business entertainment 技术转让费 Technology transfer fees 矿产资源补偿费 Mineral resources compensation fees 排污费 Pollution discharge fees 房产税 Housing property tax 车船使用税 Vehicle and vessel usage license plate tax(VVULPT) 土地使用税 Tenure tax 印花税 Stamp tax 财务费用 Finance charge 利息支出 Interest exchange 汇兑损失 Foreign exchange loss 各项手续费 Charge for trouble 各项专门借款费用 Special-borrowing cost 营业外支出 Nonbusiness expenditure 捐赠支出 Donation outlay 减值准备金 Depreciation reserves 非常损失 Extraordinary loss 处理固定资产净损失 Net loss on disposal of fixed assets 出售无形资产损失 Loss on sales of intangible assets 固定资产盘亏 Fixed assets inventory loss 债务重组损失 Loss on arrangement 罚款支出 Amercement outlay 所得税 Income tax 以前年度损益调整 Prior year income adjustment。

会计专业英语

会计专业英语-CAL-FENGHAI.-(YICAI)-Company One1一、words and phrases1.残值 scrip value2.分期付款 installment3.concern 企业4.reversing entry 转回分录5.找零 change6.报销 turn over7.past due 过期8.inflation 通货膨胀9.on account 赊账10.miscellaneous expense 其他费用11.charge 收费12.汇票 draft13.权益 equity14.accrual basis 应计制15.retained earnings 留存收益16.trad-in 易新,以旧换新17.in transit 在途18.collection 托收款项19.资产 asset20.proceeds 现值21.报销 turn over22.dishonor 拒付23.utility expenses 水电费24.outlay 花费25.IOU 欠条26.Going-concern concept 持续经营27.运费 freight二、Multiple-choice question1.Which of the following does not describe accounting( C )A. Language of businessB. Useful ofr decision makingC. Is an end rathe than a means to an end.ed by business, government, nonprofit organizations, and individuals.2.An objective of financial reporting is to ( B )A. Assess the adequacy of internal control.B.Provide information useful for investor decisions.C.Evaluate management results compared with standards.D.Provide information on compliance with established procedures.3.Which of the following statements is(are) correct( B )A.Accumulated depreciation represents a cash fund being accumulated for the replacement of plant assets.B.A company may use different depreciation methods in its financial statements and its income tax return.C.The cost of a machine includes the cost of repairing damage to the machine during the installation process.D.The use of an accelerated depreciation method causes an asset to wear out more quickly than does use of the unit-of-product method.4. Which of the following is(are) correct about a company’s balance sheet( B )A.It displays sources and uses of cash for the period.B.It is an expansion of the basic accounting equationC.It is not sometimes referred to as a statement of financial position.D.It is unnecessary if both an income statement and statement of cash flows are availabe.5.Objectives of financial reporting to external investors and creditors include preparing information about all of the following except. ( A )rmation used to determine which products to poducermation about economic resources, claims to those resources, and changes in both resources and claims.rmation that is useful in assessing the amount, timing, and uncertainty of future cash flows.rmation that is useful in making ivestment and credit decisions.6.Each of the following measures strengthens internal control over cash receipts except. ( C )A.The use of a petty cash fund.B.Preparation of a daily listing of all checks received through the mail.C.The use of cash registers.D.The deposit of cash receipts in the bank on a daily basis.7.The primary purpose for using an inventory flow assumption is to. ( A )A.Offset against revenue an appropriate cost of goods sold.B.Parallel the physical flow of units of merchandise.C.Minimize income taxes.D.Maximize the reported amount of net income.8.In general terms, financial assets appear in the balance sheet at. ( B )A.Current valueB.Face valueC.CostD.Estimated future sales value.9.If the going-concem assumption is no longer valid for a company except. ( C )nd held as an ivestment would be valued at its liquidation value.B.All prepaid assets would be completely written off immediately.C.Total contributed capital and retained earnings would remain unchanged.D.The allowance for uncollectible accounts would be eliminated.10.Which of the following explains the debit and credit rules relating to the recording of revenue and expenses( C )A.Expenses appear on the left side of the balance sheet and are recorded by debits;revenue appears on the right side of the balance sheet and is reoorded by credits.B. Expenses appear on the left side of the income statement and are recorded by debits; Revenue appears on the right side of the income statement and is recorded by credits.C.The effects of revenue and expenses on owners’ equity.D.The realization principle and the matching principle.11.Which of the following statements is(are) correct( B )A.Accumulated depreciation represents a cash fund being accumulated for the replacement of plant assets.B.The cost of a machine do not includes the cost of repairing damage to the machine during the installation prcess.C.A company may use same depreciation methods in its finacial statements and its income tax return.D.The use of an accelerated depreciation method causes an asset to wear out more quickly than does use of the straight-line method.12.A set of financial statements ( B ) except.A.Is intended to assist users in evaluating the financial position, profitability, and future prospects of an entity.B.Is intended to assist the Intemal Revenue Service in detemining the amount of income taxes owed by a business organization.C.Includes notes disclosing information necessary for the proper interpretation of the statements.D.Is intended to assist investors and creditors in making decisions inventory the allocation of economic resources.13.The primary purpose for using an inventory flow assumption is to. ( B )A.Parallel the physical flow of units of merchandise.B.Offset against revenue an appropriate cost of goods soldC.Minimize income taxes.D.Maximize the reported amount of net income.14.Indicate all correct answers. In the accounting cycle. ( D )A.Transactions are posted before they are journalized.B.A trial balance is prepared after journal entries haven’t been posted.C.The Retained Earnings account is not shown as an up-to-date figure in the trial balance.D.Joumal entries are posted to appropriate ledger accounts.15.According to text, Objectives of Financial Reporting by Business Enterprises. ( D )A.Extemal users have the ability to prescribe information they want.rmation is always based on exact measures.C.Financial reporting is usually based on industries or the economy as a whole.D.Financial accounting does not directly measure the value of a business enterprise.16.Indicate all correct answers. Dividends except ( A )A.Decrease owners’ equity.B.Decrease net incomeC.Are recorded by debiting the Cash accountD.Are a business expense17.Which of the following practices contributes to efficient cash management ( C )A.Never borrow money-maintain a cash balance sufficient to make all necessary payments.B.Record all cash receipts and cash payments at the end of the month when reconciling the bank statements.C.Prepare monthly forecasts of planned cash receipts, payments, and anticipated cash balances up to a year in advance.D.Pay each bill as soon as the invoice arrives.18.Which of the following would you expect to find in a correctly prepared income statement ( A )A.Revenues earned during the period.B.Cash balance at the end of the period.C.Contributions by the owner during the period.D.Expenses incurred during the next period to earn revenues.19.Which of the following are important factors in ensuring the integrity of accounting information ( D )A.Institutional factors, such as standards for preparing information.B.Professional organizations, such as the American Institute of CPAs.petence’ judgment’ and ethical behavior of individual accountants’D.All of the above.三、Practices11.On Jan.1, 2000, Mark Co, acquired equipment to use in its operations. The equipment has an estimated useful life of 10 years and an estimated salvage value of $5,000. The depreciation applicable to this equipment was $40,000 for 2000, calculated under the sum-of –the-years’–digits method. Required: Determine the acquisition cost of the equipment. ( C )A.$210,000B.$250,000C.$225.000D.$200,0002. On Jan.2, 2002, Mark Co, acquired equipment to use in its operations. The equipment has an estimated useful life of 10 years and an estimated salvage value of $5,000. The depreciation applicable to this equipment was $24,000 for 2004, calculated under the sum-of –the-years’–digits method (4%). Required: Determine the acquisition cost of the equipment. ( C )A.$220,000B.$250,000C.$224.000D.$200,0003. October 1, 2005, Coast Financial Ioaned Bart Corporation $3000,000, receiving in exchange a nine-month, 12 percent note receivable. Coast ends its fiscal year on December 31 and makes adjusting entries to accrue interest earned on all notes receivable. The interest earned on the note receivable from Bart Corporation during 2006 will amount to. ( A )A.$9,000B.$18,000C.$27.000D.$36,000Question: What is the reconciled balance ( B )A.$4,187B.$4,085C.$4,090D.$4,000Required: Choose the reconciled balance. ( D )A.$3,220B.$3,250C.$3,200D.$3,225Required:Calculate the cost of goods available for sale(C)A.$475,000B.$474,000C.$470,000D.$473,000Required: Calculate the cost of goods sold ( D )A.$225,000B.$254,000C.$250,000D.$253,0008.At the end of the current year, the accounts receivable account has a debit balance of $60,000 and net sales for the year total $100,000. The allowance account before adjunstment has adebit balance of a $500, and uncollectible accounts expense is estimated at 1% of net sales. Question: The entry for the above bad debts is ( A )A.Dr. Bad Debt Accts. $1,500B.Dr. Bad Debt Accts. $500Cr. Allowance Doubtful Accts. $1,500 Cr. Allowance Doubtful Accts. $500C. Dr. Bad Debt Accts. $1,000D. Dr. Bad Debt Accts. $1,500Cr. Accts Rec. $1,000 Cr. Accts Rec. $1,5009.The balance sheet items to The Oven Bakery(arranged in alphabetical order)were as follows at August 1,2005.(You are to compute the missing figure for retained earnings.)(4%)REQUIRED:Find Retained earnings at August 1 2005(D)A.$420,000B.$44,000C.$40,000D.$48,000Practices2Sue began a public accounting practice and completed these transactions during first month of the current year.Required: Choose the entries to record the following transactons.1.Invested $50,000 cash in a public accounting practice begun this day. ( A )A.Dr. Cash $50,000B.Dr. Capital Stock $50,000Cr. Capital Stock $50,000 Cr. Cash $50,0002.Paid cash for three monts’ office rent in advance $900(B)A.Dr. Rent Exp. $900B.Dr. Prepaid Rent $900Cr. Cash $900 Cr. Cash $9003.Paid the premium on two insurance policies, $300. ( )A.Dr. Prepaid Insurance $300B.Dr. Insurance Exp $300Cr. Cash $300 Cr. Cash $300pleted accounting work for Sun Bank on credit $1000. ( A )A.Dr. Accts Rec $1000B.Dr. Cash $1000Cr.Accounting Revenue $1000 Cr.Accounting Revenue $10005.Paid the monthly utility bills of the accounting office $300 ( A )A.Dr Utility Exp $300B.Dr office Exp $300Cr. Cash $300 Cr. Cash $300Linda began a public accounting practice and completed these transactons during first month of the current year.Required: Choose the entries to record the following transactons.6.Invested $20,000 cash in a public accounting practice begun this day. ( A )A.Dr Cash $20,00B.Dr Capital Stock $20,000Cr. Capital Stock $20,000 Cr. Cash $20,007.Paid cash for three months’ office rent in advance $1200.( B )A.Dr. Rent Exp $1200B.Dr. Prepaid Rent $1200Cr. Cash $1200 Cr. Cash $12008.Purchased offfice supplies $100 and office equipment $2,000 on credit. ( B )A.Dr. Office Equipment $2,000B.Dr.Office Equipment $2,000Office Supplies $100 Office Supplies $100Cr. Accts Rec. $2,100 Cr.Accts Pay. $2,100pleted accounting work for Jack Hall and collected $2000 cash therefore. ( B )A.Dr. Accts Rec $2000B.Dr. Cash $2000Cr.Accounting Revenue $2000 Cr.Accounting Revenue $200010.Purchase additional office equipment on credit $2500.( A )A.Dr.Office equipment $2500B.Dr. Office equipment $2500Cr.Accts Pay $2500 Cr.Accts Rec $2500四、Translation:1)The mechanics of double-entry accounting are such that every transaction is recorded in the debit side of one or more accounts and in the credit side of one or more accounts with equal debits and credits. Such form of combination is called accounting entry. Where there are only two accounts affected. 2)the debit and credit amounts are equal. If more than two accounts are affceted, the total of the debit entries must equal the total of the credit entries. The double-entry accounting is used by virtually every business organization, regardless of whether the company’s accounting records are maintained manually or by computer.1.The mechanics of double-entry accounting.( B )A.会计两次记账的制度B.复式记账机制C.会计的重复记账体制2.the debit and credit amounts are equal. ( A )A.借方金额与贷方金额是相等的B.借出金额与贷款金额是相等的C.借入金额与贷款金额是相等的Most accounting methods are based on the assumption that the business enterprise will have a long life. Experience indicates that.1)inspite of numerous business failures, companies have a fairly highcontinuance rate. Accountants do not believe that business firms will last indefinitely, but they do expect them to last long enouthto 2)fulfill their objectives and commitments.3.in spite of numerous business failures, companies have a fairly high continuance rate. ( B )A.可惜有许多企业失败,但公司仍有较高的持续经营比率。

会计英语词汇精编WORD版

会计英语词汇精编W O R D版IBM system office room 【A0816H-A0912AAAHH-GX8Q8-GNTHHJ8】Chapter1Accounting 会计,会计学Accountant 会计师,会计人员Accounting information 会计信息Financial data 财务数据Business 企业,经营,商业,业务Business transaction 经济业务,经济交易Enterprise 企业Economic information 经济信息Business organization 经济组织Financial activity 财务活动,筹资活动Profitability 获利能力,盈利能力End product 最终产品Creditor 债权人Performance 业绩Favorable 有利的Unfavorable 不利的Accounting system 会计系统,会计制度Financial condition 财务状况Investor 投资人Result of operations 经营成果Financial report 财务报告To make decision 制定决策Accounting principles 会计原则Business activity 经济活动Accounting concepts 会计概念Financial accounting 财务会计Economic unit 经济单位Owner 业主,拥有者Governmental agency 政府机构Generally accepted accounting principles 公认会计原则Employ 采用Prepare 准备,编制Annual report 年度报告Stockholder 股东Audit 审计,审查,查帐Auditing 审计,审计学Accounting records 会计记录Public accountant 公共会计师Fairness 公正性,公允性Reliability 可靠性Periodic audit 定期审计Corporation 股份有限公司Internal auditor 内部审计人员Cost accounting 成本会计Cost data 成本数据Management accounting 管理会计Selling price 销售价格Management advisory service 管理咨询服务Management service 管理服务Tax accounting 税务会计Tax returns 纳税申报单,税单Budgetary accounting 预算会计International accounting 国际会计International trade 国际贸易Not-for-profit accounting 非盈利组织会计Not-for-profit organization 非盈利组织Social accounting 社会会计Measurement 计量Chapter2Accounting practice 会计实务Accounting theory 会计理论Decline 方针,指南Assumption 假设Business entity 经济主体Accounting entity 会计主体Economic activity 经济活动Bookkeeping 簿记Double-entry bookkeeping system 复试记账系统Entry分录,记录Single proprietorship独资Partnership合伙Accounting purpose会计目的Separate entity独立主体Asset资产Going-concern持续经营Historical cost历史成本Current market value 当前市场价值Accounting period会计期间Stable-monetary-unit货币计量单位Objective principle客观性原则Operating result经营成果Cost principle成本原则Actual cost实际成本Book value账面价值Equivalent当量,约当量Depreciation折旧Consistency principle一贯性原则Accounting method会计方法Financial statement 财务报告Comparability可比性Materiality principle重要性原则Conservatism principle谨慎性原则Revenue收入Expense费用Cost of goods商品成本Net income净收入Net loss净损失Accrual-basis 权责发生制Cash-basis 现金收付制Journal 日记账Realization principle 实现原则Matching principle 配比原则Recognize 确认Transfer转让,转帐,过户Income statement收益表,损益表Full-disclosure principle充分揭示原则Chapter3Accounting element会计要素Accounting equation会计等式Liability负债Owner s’ equity业主权益,所有者权益Current asset长期资产Long-term asset长期资产Operating cycle 经营周期Bank deposit 银行存款Short-term investment短期投资Long-term investment长期投资Accounts receivable应收账款Note receivable应收票据Prepayment 预付款项Inventory 存货Fixed asset 固定资产Plant and equipment 厂房和设备Intangible asset 无形资产Store fixtures店面装置Office equipment办公设备Delivery equipment运输设备Creditors’ equity债权人权益Obligation责任,义务Debt债务Current liability流动负债Long-term liability长期负债Short-time loans payable应付短期贷款Long-term loans payable长期应付贷款Notes payable应付票据Accounts payable应付账款Accrued expense应计费用Bonds payable应付债券Long-term accounting payable长期应付账款Interest 股份,利息Claim 要求权Net assets 净资产Capital资本Stockholder’s equity 股东权益Cost of goods sold 商品销售成本Administrative expenses 管理费用Selling expenses销售费用Financial expense 财务费用Occur 发生Dividend payable 应付股利Retained earnings留存收益Chapter4Classification分类,分级Day-to-day 随时Account title 账户名称Ledger 分类帐Debit side 借方Credit side 贷方Charge借记,收取费用Memorandum 摘要,备忘录Insert 插入,嵌入,写入Cash on hand 库存现金subgrouping子目,细目supplies 物料用品prepaid expenses 预付费用face value 面值check 支票bank draft 银行汇票money order 汇款单debtor 债务人bearer 持票人salaries payable 应付工资taxes payable 应付税费interest payable 应付利息long-term notes payable 长期应付票据mortgage payable 应付抵押借款bonds payable 应付公司债券drawing提款income summary收益汇总professions fees职业服务费commissions revenues 佣金收入interest income利息收入chart of accounts账户一览表executive salaries主管人员薪金office salaries办公人员薪金sales salaries销售人员薪金prepaid rent预付租金accumulated depreciation累计折旧depreciation expense折旧费用sales销售收入sales returns and allowance销售退回与折让purchases returns and allowance购买退回与折让Chapter5Accounting cycle会计循环Accounting procedures会计程序,会计方法Trial balance试算平衡表Post-closing trial balance结算后试算平衡表Journalize 做分录,记账Post to the ledger过入分类帐Assemble汇集Work sheet工作底表Adjusting entry调整分录close结账,结清,关闭ledger accounts分类账户general ledger总分类帐two-column account两栏式账户source document原始凭证check stub支票存根journal日记帐journal entry日记帐分录records(book) of original entry原始记录簿transcribe抄录post过账,誊帐manually手工的chronological按时间顺序的enter登记,计入general journal普通日记账special journal特殊日记帐sales journal销售日记帐purchases journal购买日记帐cash receipts journal现金收入日记帐cash disbursements journal现金支出日记帐division of labor分工Chapter6Adjusting procedures调整程序Accrual(basis) accounting权责发生制Align调整,使成一线,(转做)使一致Apportion(按比例)分配,摊配Accrue自然积累(如利息等),计提Outlay支出Expire期满,耗尽,失效Insurance expense保险费用Prepaid insurance 预付保险费Supplies expense物料用品费Supplies on hand在用物料Subscription预订Deferred credit递延贷项Accrued salaries payable应计应付工薪Accrued revenue应计收入Closing entry结账分录Closing procedure结账程序Temporary account临时性账户,名义账户,虚账户Permanent account 永久性账户,实账户Withdrawals提款Statement of cash flow现金流量表Financial position财务状况Portray描绘Dispose处理Inflows流入Outflows流出Chapter7Working paper工作底稿Adjusted trial balance调整后试算平衡表Cross-reference交叉参考Occasion需要,机会,工作场合Salaries accrued应计薪金Combine结合,联合Extend(会计)将数字转入。

会计专业英语词汇大全

一.专业术语Accelerated Depreciation Method 计算折旧时,初期所提的折旧大于后期各年。

加速折旧法主要包括余额递减折旧法declining balance depreciation,双倍余额递减折旧法double declining balance depreciation,年限总额折旧法sum of the years' depreciationAccount 科目,帐户Account format 帐户式Account payable 应付帐款Account receivable 应收帐款Accounting cycle 会计循环,指按顺序进行记录,归类,汇总和编表的全过程。

在连续的会计期间周而复始的循环进行Accounting equation 会计等式:资产= 负债+ 业主权益Accounts receivable turnover 应收帐款周转率:一个时期的赊销净额/ 应收帐款平均余额Accrual basis accounting 应记制,债权发生制:以应收应付为计算基础,以确定本期收益与费用的一种方式。

凡应属本期的收益于费用,不论其款项是否以收付,均作为本期收益和费用处理。

Accrued dividend 应计股利Accrued expense 应记费用:指本期已经发生而尚未支付的各项费用。

Accrued revenue 应记收入Accumulated depreciation 累计折旧Acid-test ratio 酸性试验比率,企业速动资产与流动负债的比率,又称quick ratioAcquisition cost 购置成本Adjusted trial balance 调整后试算表,指已作调整分录但尚未作结账分录的试算表。

Adjusting entry 调整分录:在会计期末所做的分录,将会计期内因某些原因而未曾记录或未适当记录的会计事项予以记录入帐。

会计英语词汇

accounting principle 会计原则accounting element 会计要素accounting equation 会计方程式(会计等式)shareholder / stockholder n. 股东asset n. 资产liability fn. 负债owner’s equity 所有者权益shareholders’equity 股东权益revenue n. 收益,收入expense n. 费用New Words and Expressions (2)accounting period 会计期间ledger n .分类账general ledger 总账ledger account 分类账账户chart of accounts 会计科目表financial position 财务状况creditor n. 债权人transaction n. 经济业务T account 丁字账户account number 账户编号New Words and Expressions (3)debit n. & vt. 借方;借记credit n. & vt. 贷方;贷记enter vt. 登录,记账double-entry a. 复式的,复式记账的entry n. 分录balance n. 余额vi. 平衡posting n. 过账accounting cycle 会计循环,会计周期New Words and Expressions (4)journal n. 日记账general journal 普通日记账journalizing n. 登日记账payroll n. 工资表cash receipts 现金收入cash disbursements 现金支出sales on account 赊销purchases on account 赊购adjusting and closing entries 调整及结账分录现金Cash银行存款Cash in bank现金等价物cash equivalents银行汇票Bank draft信用卡Credit card短期投资Short-term investmentsNew Words and Expressions (2)股票stock债券bonds基金funds应收账款Accounts receivable应收票据Notes receivable银行承兑汇票Bank acceptance商业承兑汇票Trade acceptance应收股利Dividend receivable应收利息Interest receivable坏账准备allowance for bad debts预付项目prepaid存货Inventories原材料Raw materials低值易耗品Low-value consumption goods半成品Semi-Finished goods产成品Finished goods商品进销差价Differences between purchasing and selling price 本金Principal利息Interest证券交易所Securities ExchangeSection 1New Words and Expressionsasset n. 资产enterprise n. 企业tangible assets 有形资产economic benefit 经济利益rental n. 租赁,租金额administrative 管理的,行政的accounting year 会计年度fixed assets 固定资产Section 1New Words and Expressionsproperty n. 财产,地产,资产warehouse n. 库房exchange n. 交换issuance of securities 发行股票donation n. 捐助long-term assets 长期资产lump sum purchase 整批购买recognition criteria确认条件historical cost 历史成本,原始成本Section 1acquisition cost 购置成本original cost 原始成本actual cost 实际成本,原始成本additional cost 附加费用expenditure n. 支出,花费,开销intended use 预定可使用状态installation cost 安装费professional fees 专业人员服务费overhead cost 管理费building permit fee 建设许可费Section 2economic value 经济价值useful life 使用寿命depreciation n. 折旧estimated net residual value 预计净残值net salvage value 净残值depreciation rate折旧率depreciable amount应计折旧额Section 2disposal n. 处置,处理deduct vt. 扣除straight-line method 年限平均法(直线法)units of production method 工作量法double declining balance method 双倍余额递减法sum-of-the-years-digits method 年数总和法conservative a. 保守的,守旧的depreciation expense 折旧费depreciation charge 折旧费wear and tear 磨损,损耗Section 2straight-line rate 直线折旧率book value 账面价值double straight-line rate双倍直线折旧率SYD 年数总和depreciation base折旧基数functional value功能价值annual depreciation amount 年折旧额disposal expenses 弃置费用Section 3intangible assets 无形资产identifiable a.可以确认的physical substance 实物形态privilege n. 特权,特别待遇finite intangibles 使用寿命有限的无形资产indefinite intangibles 使用寿命不确定的无形资产Section 3franchise n. 特许权,公民权license n. 营业执照,许可证Internet domain name 互联网域名construction permit 建筑许可证land utilization right 土地使用权assessed value 评估价格amortization n. 摊销Section 3impairment test 减值测试amortization charge 摊销费profit and loss 损益provision n. 条款,规定common practice惯例disposal proceeds处置收益accumulated amortization累计摊销额organization cost 开办费Section 1New Words and Expressions短期负债Current liability透支overdraft应付票据Notes payable应付账款Account payable预收账款unearned revenue应付工资Accrued wages应付股利Dividends payableSection 1应交税金Tax payable应交增值税value added tax payable应交消费税Consumption tax payable应交所得税Income tax payable应交个人所得税Personal income tax payable其他应付款Other payables预提费用Drawing expense in advance或有负债Contingent LiabilitiesSection 2New Words and Expressions长期负债Long-term Liabilities长期借款Long-term loans一年内到期的长期借款Long-term loans due within one year 一年后到期的长期借款Long-term loans due over one year 债券debentures , bondsSection 2应付债券Bonds payable债券面值Face value, Par value到期日the maturity date债券溢价Premium on bonds债券折价Discount on bonds应计利息Accrued interest或有负债contingent liability未履行责任defaultNew Words and Expressionspartnership n. 合伙partner n. 合伙人proprietorship n. 独资corporation n. 公司distribution n. 分配divide v. 划分share v. 分配分享issuance 发行Common stock n. 普通股Preferred stock n. 优先股Shareholder(Stockholder) n. 股东dividend 股利股息owner’s equity 所有者权益par value stock 有面值股票no-par value stock 无面值股票paid-in capital 实收资本additional paid-in capital 多收资本,增收资本capital surplus 资本公积retained earnings 留存收益cash dividend 现金股利stock dividend 股票股利declaration of dividend 股利宣布股利公告dividend distribution 股利分配reserve 计提准备金准备金stockholders’equity 股东权益appropriation of retained earnings 留存收益的分拨appropriated retained earnings 拨定的留存收益reserve found / surplus reserve 盈余公积stock split 股票分割charter 宪章章程bylaw 附则、细则、公司章程New Words and Expressionssales revenue 销售收入cash discount 现金折扣sales allowances 销售折让trade discount 商业折扣service revenue 劳务收入proportion of A to B A占B的比例prime operating revenue 主营业务收入render 提供(服务等)period expense 期间费用operating/sales expense 营业/销售费用administrative expense 行政管理费用financial expense 财务费用freight charges 运输费advertising expenses 广告费direct material cost 直接材料成本direct labor cost 直接人工成本manufacturing overhead 制造费用leasing charge 租赁费maintenance 维修费allocate 分摊New Words and Expressionsfinancial position财务状况operating results经营成果the balance sheet资产负债表the income statement 利润表multiple-step income statement多步式利润表single-step income statement单步式利润表accounts payable应付账款long-term assets长期资产net income净收益net loss净损失the cost of goods sold商品销售成本gross profit毛利income tax expenses所得税费用the statement of cash flows现金流量表cash receipts现金收入cash payments现金支出cash equivalents现金等价物operating activities经营活动financing activities筹资活动(融资行为)New Words and Expressionsauditing 审计,查账,审计学examination of financial statements 财务报表审查audit report/ auditor’s report 审计报告,审计师报告internal auditing 内部审计external auditing 外部审计governmental auditing 政府审计audit fee 审计费audit process 审计程序,审计过程system of internal control 内部控制系统Statement of Auditing Standards 审计准则公告engagement letter 审计委托书audit working paper 审计工作底稿test of compliance 符合性测试substantive test 实质性测试audit procedure 审计程序unqualified opinion 无保留意见书,无保留意见qualifield audit report 保留意见的审计报告adverse opinion 否定意见书,否定意见disclaimer 无法发表意见的(审计)报告。

会计专业英语词

会计专业英语词汇acceptance 承兑account 账户accountant 会计员accounting 会计accounting system 会计制度accounts payable 应付账款accounts receivable 应收账款accumulated profits 累积利益adjusting entry 调整记录adjustment 调整administration expense 管理费用advances 预付advertising expense 广告费agency 代理agent 代理人agreement 契约allotments 分配数allowance 津贴amalgamation 合并amortization 摊销amortized cost 应摊成本annuities 年金applied cost 已分配成本applied expense 已分配费用applied manufacturing expense 己分配制造费用apportioned charge 摊派费用appreciation 涨价article of association 公司章程assessment 课税assets 资产attorney fee 律师费audit 审计auditor 审计员average 平均数average cost 平均成本bad debt 坏账balance 余额balance sheet 资产负债表bank account 银行账户bank balance 银行结存bank charge 银行手续费bank deposit 银行存款bank discount 银行贴现bank draft 银行汇票bank loan 银行借款bank overdraft 银行透支bankers acceptance 银行承兑bankruptcy 破产bearer 持票人beneficiary 受益人bequest 遗产bill 票据bill of exchange 汇票bill of lading 提单bills discounted 贴现票据bills payable 应付票据bills receivable 应收票据board of directors 董事会bonds 债券bonus 红利book value 账面价值bookkeeper 簿记员bookkeeping 簿记branch office general ledger 支店往来账户broker 经纪人brought down 接前brought forward 接上页budget 预算by-product 副产品by-product sales 副产品销售capital 股本capital income 资本收益capital outlay 资本支出capital stock 股本capital stock certificate 股票carried down 移后carried forward 移下页cash 现金cash account 现金账户cash in bank 存银行现金cash on delivery 交货收款cash on hand 库存现金cash payment 现金支付cash purchase 现购cash sale 现沽cashier 出纳员cashiers check 本票certificate of deposit 存款单折certificate of indebtedness 借据certified check 保付支票certified public accountant 会计师charges 费用charge for remittances 汇水手续费charter 营业执照chartered accountant 会计师chattles 动产check 支票checkbook stub 支票存根closed account 己结清账户closing 结算closing entries 结账纪录closing stock 期末存货closing the book 结账columnar journal 多栏日记账combination 联合commission 佣金commodity 商品common stock 普通股company 公司compensation 赔偿compound interest 复利consignee 承销人consignment 寄销consignor 寄销人consolidated balance sheet 合并资产负债表consolidated profit and loss account 合并损益表consolidation 合并construction cost 营建成本construction revenue 营建收入contract 合同control account 统制账户copyright 版权corporation 公司cost 成本cost accounting 成本会计cost of labour 劳工成本cost of production 生产成本cost of manufacture 制造成本cost of sales 销货成本cost price 成本价格credit 贷方credit note 收款通知单creditor 债权人crossed check 横线支票current account 往来活期账户current asset 流动资产current liability 流动负债current profit and loss 本期损益debit 借方debt 债务debtor 债务人deed 契据deferred assets 递延资产deferred liabilities 递延负债delivery 交货delivery expense 送货费delivery order 出货单demand draft 即期汇票demand note 即期票据demurrage charge 延期费deposit 存款deposit slip 存款单depreciation 折旧direct cost 直接成本direct labour 直接人工director 董事discount 折扣discount on purchase 进货折扣discount on sale 销货折扣dishonoured check 退票dissolution 解散dividend 股利dividend payable 应付股利documentary bill 押汇汇票documents 单据double entry bookkeeping 复式簿记draft 汇票drawee 付款人drawer 出票人drawing 提款duplicate 副本duties and taxes 税捐earnings 业务收益endorser 背书人entertainment 交际费enterprise 企业equipment 设备estate 财产estimated cost 估计成本estimates 概算exchange 兑换exchange loss 兑换损失expenditure 经费expense 费用extension 延期face value 票面价值factor 代理商fair value 公平价值financial statement 财务报表financial year 财政年度finished goods 制成品finished parts 制成零件fixed asset 固定资产fixed cost 固定成本fixed deposit 定期存款fixed expense 固定费用foreman 工头franchise 专营权freight 运费funds 资金furniture and fixture 家俬及器具gain 利益general expense 总务费用general ledger 总分类账goods 货物goods in transit 在运货物goodwill 商誉government bonds 政府债券gross profit 毛利guarantee 保证guarantor 保证人idle time 停工时间import duty 进口税income 收入income tax 所得税income from joint venture 合营收益income from sale of assets 出售资产收入indirect cost 间接成本indirect expense 间接费用indirect labour 间接人工indorsement 背书installment 分期付款insurance 保险intangible asset 无形资产interest 利息interest rate 利率interest received 利息收入inter office account 内部往来intrinsic value 内在价值inventory 存货investment 投资investment income 投资收益invoice 发票item 项目job 工作job cost 工程成本joint venture 短期合伙journal 日记账labour 人工labour cost 人工成本land 土地lease 租约leasehold 租约ledger 分类账legal expense 律师费letter of credit 信用状liability 负债limited company 有限公司limited liability 有限负债limited partnership 有限合伙liquidation 清盘loan 借款long term liability 长期负债loss 损失loss on exchange 兑换损失machinery equipment 机器设备manufacturing expense 制造费用manufacturing cost 制造成本market price 市价materials 原村料material requisition 领料单medical fee 医药费merchandise 商品miscellaneous expense 杂项费用mortgage 抵押mortgagor 抵押人mortgagee 承押人movable property 动产net amount 净额net asset 资产净额net income 净收入net loss 净亏损net profit 纯利net value 净值notes 票据notes payable 应付票据notes receivable 应收票据opening stock 期初存货operating expense 营业费用order 订单organization expense 开办费original document 原始单据outlay 支出output 产量overdraft 透支opening stock 期初存货operating expense 营业费用order 订单organization expense 开办费original document 原始单据quotation 报价rate 比率raw material 原料rebate 回扣receipt 收据receivable 应收款recoup 补偿redemption 偿还refund 退款remittance 汇款rent 租金repair 修理费reserve 准备residual value 剩余价值retailer 零售商returns 退货revenue 收入salary 薪金sales 销货sale return 销货退回sale discount 销货折扣salvage 残值sample fee 样品scrap 废料scrap value 残余价值securities 证券security 抵押品selling commission 销货佣金selling expense 销货费用selling price 售价share capital 股份share certificate 股票shareholder 股东short term loan 短期借款sole proprietorship 独资spare parts 配件standard cost 标准成本stock 存货stocktake 盘点stock sheet 存货表subsidies 补助金sundry expense 杂项费用supporting document 附表surplus 盈余suspense account 暂记账户taxable profit 可征税利润tax 税捐temporary payment 暂付款temporary receipt 暂收款time deposit 定期存款total 合计total cost 总成本trade creditor 进货客户trade debtor 销货客户trademark 商标transaction 交易transfer 转账transfer voucher 转账传票transportation 运输费travelling 差旅费trial balance 电子表格trust 信托turnover 营业额unappropriated surplus 未分配盈余unit cost 单位成本unlimited company 无限公司unlimited liability 无限责任unpaid dividend 未付股利valuation 估价value 价值vendor 卖主voucher 传票wage rate 工资率wage 工资wage allocation sheet 工资分配表warehouse receipt 仓库收据welfare expense 褔利费wear and tear 秏损work order 工作通知单year end 年结。

会计英语词汇英文解释

1.Accounting(会计)The process of indentifying,recording, summarizing and reporting economic information to decision makers.2.Financial accounting(财务会计)The field of accounting that serves external decision makers,such as stockholders,suppliers, banks and government agencies.3.Management accounting(管理会计)The field of accounting that serves internal decision makers,such as top executives,department headsand people at other management levels within an organization.4.Annual report(年报)A combination of financial statements,management discussion and analysis and graphs and charts that is provided annually to investors.5.Balance sheet (statement of financial position,statement of financial condition)(资产负债表)A financial statement that shows the financial status of a business entity at a particular instant in time.6.Balance sheet equation(资产负债方程式)Assets = Liabilities + Owners' equity.7.Assets(资产)Economic resources that are expected to help generate future cash inflows or help reduce future cash outflows.8.Liabilities (负债)Economic obligations of the organization to outsiders ,or claims against its assets by outsiders.9.Owners’ equity (所有者权益)The residual interest in the organization’s assets after deducting liabilities.10.Notes payable (应付票据)Promissory notes that are evidence of a debt and state the terms of payment.11.Entity (实体)An organization or a section of an organization that stands apart from other organization and individuals as a separate economics unit.12.Transaction (交易)Any event that both affects the financial position of an entity and be reliably recorded in money terms.13.Inventory (存货)Goods held by a company for the purpose of sale to customers.14.Account (帐户)A summary record of the changes in a particular assets,liability,or owne r’ equity.15.Account payable (应付帐款)A liability that results from a purchase of goods or services on account.17.Creditor (债权人)A person or entity to whom money is owed.18.Debtor (债务人)A person or entity that owes money to another.19.Sole proprietorship (个体经营、独资经营)A separate organization with a single owner.20.Partnership (合伙)A form of organization that joins two or more individuals together as co-owners(共有人).21.Corporation (公司)A business organization that is created by individual state laws.22.Limited liability (有限责任)A feature of the corporate form of organization whereby corporate creditors ordinarily have claims against the corporate assets only.23.Publicly owned (公有)A corporation in which shares in the ownership are sold to thepublic.24.Privately owned (私有)A corporation owned by a family,a small group of shareholders,or a single individual,in which shares of ownership are not publicly sold.25.Stockholders’ equity (shareholders’ equity) (股东权益)Own ers’ equity of a corporation.The excess of assets over liabilities of a corporation.26.Paid-in capital(实际投入资本)The total capital investment in a corporation by its owners both at and subsequent to the inception of business.27.Par value(票面值)The nominal dollar amount printed on stock certificates.29.Auditor (审计师)A person who examines the information used by managers to prepare the financial statements and attests to the credibility of those statements.31.Audit (审计)An examination of transactions and financial statement made in accordance with generally accepted auditing standards.33. Fiscal year (会计、财政年度)The year established for accounting purposes.34.Interim periods (中期)The time spans established for accounting purposes that are less than a year.35.Revenues(sales) (收入OR商品销售收入)Increases in owners’ equity arising from increases in assets received in exchange for the delivery of goods or services to customers.36.Expenses (费用)Decreases in owners’ equity that arise because goods or services are delivered to customers.37.Income (profit ,earnings) (收益、利润)The excess of revenues over expenses.39.Accrual basis (应计制、权责发生制)Accounting method that recognizes the impact of transactions on the financial statements in the time periods when revenues and expenses occur.40.Cash basis (收付实现制)Accounting method that recognizes the impact of transactions on the financial statements only when cash is received or disbursed.43.Cost of goods sold (cost of sales) (销售成本)The original acquisition cost of the inventory that was sold to customers during the reporting period.44.Matching (配比)The recording of expenses in the same time period as the related revenues are recognized.47.Depreciation (折旧)The systematic allocation of the acquisition cost of long-lived of fixed assets to the expenses accounts of particular periods that benefit from the use of the assets. income (净利润)The remainder after all expenses has been deducted from revenues.49.Income statement (statement of earnings, operating statement) (收益表)A report of all revenues and expenses pertaining to a specific time period.50.Statement of cash flows (cash flow statement) (现金流量表)A required statement that reports the cash receipts and cash payments of an entity during a particular period. loss (净损失)The difference between revenues and expenses when expenses exceed revenues.52.Cash dividends (现金股利)Distribution of cash to stockholders that reduce retained income.53.Statement of retained income (利润分配表)A statement that lists the beginning balance in retained income, followed by a description of any changes that occurred during the period, and the ending balance.54.Statement of income and retained income (收入及利润分配表)A statement that included a statement of retained income at the bottom of an income statement.55.Earnings per share (EPS) (每股收益)Net income divided by average number of common shares outstanding.56.Price-earnings ratio (P-E) (市盈率)Market price per share of common stock divided by earnings per share of common stock.57.Dividend-yield ratio (股息率)Common dividends per share dividend by market price per share.58.Dividend-payout ratio (派息率)Common dividends per share dividend by earnings per share.59.Double-entry system (复试记账法)The method usually followed for recording transactions, whereby at least two accounts are always affected by each transaction.60.Ledger (分类账)The records for a group of related accounts kept current in asystematic manner.61.General ledger (总分类账)The collection of accounts that accumulates the amounts reported in the major financial statements.62.T-account (T形账户)Simplified version of ledger accounts that takes the form of the capital letter T.63.Balance (余额)The difference between the total left-side and right-side amounts in an account at any particular time.64.Debit (借方)An entry or balance on the left side of an account.65.Credit (贷方)An entry or balance on the right side of an account.66.Charge (Debit)A word often used instead of debit.67.Source documents (原始凭证)The supporting original records of any transactions.68.Book of original entry (原始分录帐本)A formal chronological record of how the entity’s transactions affect the balances in pertinent accounts.69.General journal (普通日记账)The most common example of a book of original entry; a complete chronological record of transactions.70.Trial balance (试算表)A list of all accounts in the general ledger with their balance.71.Journalizing (记入分类帐)The process of entering transactions into the journal.72.Journal entry (日记帐分录)An analysis of the affects of a transaction on the accounts, usually accompanied by an explanation.81.Accumulated depreciation (allowance for depreciation) (累计折旧)The cumulative sum of all depreciation recognized since the date of acquisition of the particular assets described.82.Data processing 数据处理The totality to the procedures used to record, analyze store, and report on chosen activities.83.Explicit transactions (显性交易)Events such as cash receipts and disbursements, credit purchases, and credit sales that trigger nearly all day-to-day routine entries.84.Implicit transactions (非显性交易)Events (such as the passage of time) that do not generate source documents or visible evidence of the event and are not recognized in the accounting records until the end of an accounting period.85.Adjustments (adjusting entries) (调帐)End-of-period entries that assign the financial effects of implicit transactions to the appropriate time periods.86.Accrue (应计)To accumulate a receivable or payable during a given period eventhough no explicit transactions occurs.87.Unearned revenue (revenue received in advance, deferred revenue, deferred credit) (未实现收入)Revenue received and recorded before it is earned.88.Pretax income (税前利润)Income before income taxes.89.Classified balance sheet (分类资产负债表)A balance sheet that groups the accounts into subcategories to help readers quickly gain a perspective on the company’s financial position.90.Current assets (流动资产)Cash plus assets that are expected to be converted to cash or sold or consumed during the next 12 months or within the normal operating cycle if longer that a year.91.Current liabilities (流动负债)Liabilities that fall due within the coming year or within the normal operating cycle if longer than a year.92.Working capital (营运资金、资本)The excess of current assets over current liabilities.93.Solvency (偿付能力)An entity’s ability to meet its immediate financial obligations as they become due.94.Current ratio (working capital ratio) (流动比率)Current assets divided by current liabilities.Current ratio = Current assets / Current liabilities.95.Report format (报表格式之一)A classified balance sheet with the assets at the top. Example:Balance Sheet, January 31,20X2Assets 1999 1998Current assetsCashAccounts receivable……Total current assetsLong-term assetsStore equipmentAccumulated depreciationTotal assetsLiabilities and Owners’ Equity 1999 1998 Current liabilitiesNote payableAccounts payable…Total current liabilities Stockholder’s equityPaid-in capitalRetained incomeTotal liabilities and owners’ equity96.Account format (报表格式之二)A classified balance sheet with the assets at the left. Example:Balance Sheet, January 31,20X2Assets Liabilities and Owners’ EquityCurrent assets Current liabilitiesCash Note payableAccounts receivable Accounts payable… …Total current assets Total current liabilitiesLong-term assets Stockholder’s equityStore equipment Paid-in capitalAccumulated depreciation Retained incomeTotal Total97.Single-step income statement (单一步骤收入表)An income statement that groups all revenues together and then lists and deducts all expenses together without drawing any intermediate subtotals.98.Multiple-step income statement (复合步骤收入表)An income statement that contains one or more subtotals that highlight significant relationships.99.Gross profit (gross margin) (毛利)The excess of sales revenue over the cost of the inventory that was sold.100.Operating income (operating profit) (营业收入)Gross profit less all operating expenses.101.Profitability (收益能力)The ability of a company to provide investors with a particular rate of return on their investment.102.Gross profit percentage (gross margin percentage) (毛利率)Gross profit divided by sales.Gross profit percentage=Gross profit / Sales103.Return on sales ratio (销售收益率)Net income divided by sales,104.Return on stockholders’ equity ratio (股东权益收益率)Net income divided by invested capital (measured by average stockholder’s equity)。

会计类英语单词

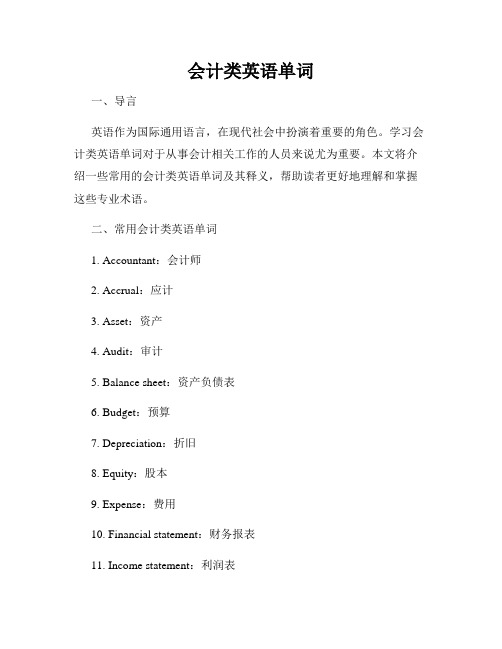

会计类英语单词一、导言英语作为国际通用语言,在现代社会中扮演着重要的角色。

学习会计类英语单词对于从事会计相关工作的人员来说尤为重要。

本文将介绍一些常用的会计类英语单词及其释义,帮助读者更好地理解和掌握这些专业术语。

二、常用会计类英语单词1. Accountant:会计师2. Accrual:应计3. Asset:资产4. Audit:审计5. Balance sheet:资产负债表6. Budget:预算7. Depreciation:折旧8. Equity:股本9. Expense:费用10. Financial statement:财务报表11. Income statement:利润表12. Interest:利息13. Ledger:总账14. Liabilities:负债15. Profit:利润16. Revenue:收入17. Tax:税收18. Trial balance:试算平衡表19. Wage:工资20. Working capital:营运资本三、对会计类英语单词的进一步解读1. Accountant(会计师)Accountant指的是负责处理和记录财务和税务事务的专业人员。

他们负责准确地记录和分析财务数据,并根据法律法规进行合规处理。

2. Accrual(应计)Accrual是指在会计报表中记录收入和费用时,以实际发生的时间为准。

这意味着即使在现金流发生之前或之后,也要将相关项目计入账目。

3. Asset(资产)Asset是指企业所拥有的有形或无形的东西,具有经济价值。

资产可以包括现金、股票、土地、建筑物等。

4. Audit(审计)Audit是指对企业的财务记录进行全面检查和评估的过程。

审计的目的是确认财务数据的真实性和准确性,以及检查企业是否遵守财务相关法规和准则。

5. Balance sheet(资产负债表)Balance sheet是一份会计报表,用于呈现企业在特定时间点上的资产、负债和所有者权益的情况。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Ch04 New words and ExpressionP86 (1)P88 (2)P91 (2)P92 (4)P95 (4)P96 (4)P98 (6)P86lead tov. 导致, 通向ready [ ❒♏♎♓]adj.有准备的,现成的, 迅速的vt. 使…准备好; 预备work sheet工作底表Work sheetSpreadsheet used to draft an unadjusted trial balance, adjusting entries, adjusted trial balance, and financial statements.working papern.工作底稿,工作文件、工作论文Analyses and other informal reports prepared by accountants and managers when organizing information for formal reports and financial statements.benefit [ ♌♏⏹♓♐♓♦]n. 利益, 好处aid [eid]n. 帮助, 援助preparation [ ☐❒♏☐☜❒♏♓☞☜⏹]n.编制propose [☐❒☜☐☜◆]vt. 提议, 建议, 主张推荐, 提(名)打算, 计划proposed所推荐的、假设的what if万一、如果…将来会怎么样Shows the effects of proposed or “what if” transactions 反映各种预计的或假设的交易所带来的影响。

推定:推测判定P88predictable [☐❒✋♎✋♦☜♌☎☜✆●]adj. 可预言的recur [❒♓☜]vi. 复发, 重现再发生appropriate [☜☐❒☜◆☐❒♓♓♦]adj. 适当的squeeze [♦♦♓]n.压榨, 挤v.压榨, 挤In the unusual case在特殊(罕见)情况下key [ki:]n. 钥匙, 关键, (打字机等的)键, 音调, 要害vt. 调节...的音调, 锁上,提供线索vi. 使用钥匙keying the adjustments给“调整”加关键字P91extended [♓♦♦♏⏹♎♓♎]adj. 伸出的, 延长的(得到的)pro forma [☐❒☜◆♐❍☜]adj.估计的,假定的Pro forma financial statements预测财务报表Statements that show the effects of proposed transactions and events as if they had occurredClosing process结账过程(程序)结账工作包括:(1)结算各种收入、费用账户,并据以计算本期的利润和亏损,把经营成果在账上提示出来;(2)结算各资产、负债和所有者权益的总分类账户和明细分类账户、分别结出它们的本期发生额及期末余额,并将期末余额结转为下期的期初余额。

其中,在第(1)项结账工作中,需要编制必要的结账分录。

post-作为前缀,表示“在...后”之义post [☐☜◆♦♦]adv. [拉]在...之后, 在后post-closing trial balance结账后的试算平衡twofold [ ♦◆♐☜☺●♎]adj. 两部分的, 双重的nominal [ ⏹❍♓⏹●]adj.名义上的, 有名无实的, [语]名词性的n.名词性词The closing process applies only to temporary accounts结账程序只适用于临时账户real [ ❒♓☜●]adj. 真的, 真实的, 不动产的P92Income Summary损益汇总Step 1: Close Credit Balances in Revenue Accounts to Income Summary结转收入账户的贷方余额到“损益汇总”(账户)P95Accounting cycle会计循环Recurring steps performed each accounting period, starting with analyzing transactions and continuing through the post-closing trial balance (or reversing entries).reversing entries转回分录为便于按常规程序进行会计处理,于本期期初对上期期末应计项目的调整分录进行转回而编制的会计分录。

转回分录的特点是,其所使用的账户及金额与上一期期末的调整分录一样,但借贷方向调整分录恰好相反。

需要指出的是,转回分录并非是常规会计处理程序中必须要编制的会计分录。

reverse [ ]n.相反, 背面, 反面, 倒退adj.相反的, 倒转的, 颠倒的vt.颠倒, 倒转P96Classified Balance Sheet分类的资产负债表A classified balance sheet is a balance sheet in which assets and liabilities are subdivided into current and long-term categories.A classified balance sheet allows the readers to determine the working capital of the company by seperating the current portion of assets and liabilities from the non-current portion.An unclassified balance sheet does not distinguish the difference between current and non-current for the assets and liabilities (therefore working capital is not available to the reader). GAAP suggests that most companies use a classified balance sheet unless the classification distinction provides little to no relevance for the audience of the financial statements.See SFAS 6 paragraph 7.Unclassified balance sheet未分类资产负债表对资产和负债不作“流动”与“非流动”的划分An Unclassified balance sheet is a balance sheet that groups the assets, liabilities, and owner's equity into very broad groups. Usually only banks and financial institutions do this as it's not easy to identify which customer's deposits are for more or less than 12 months.Certain industries follow special rules that are different than GAAP because of special circumstances in that industry. This is permissible. For example, the banking industry which allows banks to report an unclassified balance sheet (with no current or long-term sections).If the financial institution has an unclassified balance sheet, there is no need to separate balances into current and long-term portions.How to I prepare an unclassified balance sheet?1. An "unclassified balance sheet" balance Sheet is where you group your assets, liabilities and Equity in to very broad groups.2. All you do is just put all assets accounts into the Assets grouping, all liabilities accounts into the Liabilities grouping, and all equity accounts in Owners' Equity.3. A "classified balance sheet" breaks the assets and liabilities into smaller group such as current and non-current. Equity is sub-grouped in capital, additional paid in capital, retained earnings and so on.See SFAS 6 paragraph 7.In a classified balance sheet, assets and liabilities are grouped into sub-classifications; in an unclassified balance sheet, assets and liabilities are not grouped into sub-classifications, they are simply listed.broadly adv.宽广地, 粗略地layout [ ●♏♓♋◆♦]n. 规划, 设计, (书刊等)编排, 版面span [♦☐✌⏹]n. 跨度, 跨距, 范围current [ ✈❒☜⏹♦]adj.当前的, 通用的, 最近的n.涌流, 电流, 水流, 气流due [dju:]adj.应支付的应得的; 充分的; 足够的预定的(票据等)到期的; 期满的Operating cycle营业周期(经营周期)Normal time between paying cash for merchandise or employee services and receiving cash from customers.营业周期是指从取得存货开始到销售存货并收回现金为止的这段时间。