宏观经济学曼昆第七版第5章(2013)

布兰查德宏观经济学第七版第7版英文版chapter (5)

Macroeconomics, 7e (Blanchard)Chapter 5: Goods and Financial Markets. The IS-LM Model5.1 The Goods Market and the IS Relation1) The IS curve representsA) the single level of output where the goods market is in equilibrium.B) the single level of output where financial markets are in equilibrium.C) the combinations of output and the interest rate where the money market is in equilibrium.D) the combinations of output and the interest rate where the goods market is in equilibrium.E) none of the aboveAnswer: DDiff: 12) The IS curve will shift to the right when which of the following occurs?A) an increase in the money supplyB) an increase in government spendingC) a reduction in the interest rateD) all of the aboveE) none of the aboveAnswer: BDiff: 23) Which of the following occurs as the economy moves leftward along a given IS curve?A) An increase in the interest rate causes investment spending to decrease.B) An increase in the interest rate causes money demand to increase.C) An increase in the interest rate causes a reduction in the money supply.D) A reduction in government spending causes a reduction in demand for goods.E) An increase in taxes causes a reduction in demand for goods.Answer: ADiff: 24) During 2008 in the United States, consumer confidence fell significantly. Which of the following will occur as a result of this reduction in consumer confidence?A) The LM curve will shift up.B) The LM curve will shift down.C) The IS curve will shift rightward.D) The IS curve will shift leftward.E) The IS curve will shift rightward, and the LM curve will shift up.Answer: DDiff: 25) Suppose policy makers decide to reduce taxes. This fiscal policy action will cause which of the following to occur?A) The LM curve shifts and the economy moves along the IS curve.B) The IS curve shifts and the economy moves along the LM curve.C) Both the IS and LM curves shift.D) Neither the IS nor the LM curve shifts.E) Output will change causing a change in money demand and a shift of the LM curve. Answer: BDiff: 26) Suppose fiscal policy makers implement a policy to reduce the size of a budget deficit. Based on the IS-LM model, we know with certainty that the following will occur as a result of this fiscal policy action.A) Investment spending will decrease.B) Investment spending will increase.C) There will be no change in investment spending.D) Investment spending may increase, decrease, or not change.E) none of the aboveAnswer: DDiff: 37) For this question, assume that investment spending depends only on the interest rate and no longer depends on output. Given this information, a reduction in government spendingA) will cause investment to decrease.B) will cause investment to increase.C) may cause investment to increase or to decrease.D) will have no effect on output.E) will cause a reduction in output and have no effect on the interest rate.Answer: BDiff: 38) Suppose investment spending is not very sensitive to the interest rate. Given this information, we know thatA) the IS curve should be relatively flat.B) the IS curve should be relatively steep.C) the LM curve should be relatively flat.D) the LM curve should be relatively steep.E) neither the IS nor the LM curve will be affected.Answer: BDiff: 29) Explain the determinants of investment. Include in your answer an explanation of how a change in each determinant affects investment.Answer: Investment depends on the level of sales/output and on the interest rate. As output changes, the demand for goods will change and firms will change investment so that their capacity changes with the level of economic activity (and demand). I also depends on the interest rate. As the interest rate rises, the cost of borrowing rises. Firms will cut back on investment as borrowing costs rise.Diff: 210) What is the IS relation? Explain why IS curve is downward sloping.Answer: The IS relation shows the combinations of the interest rate and the level of output that are consistent with equilibrium in the goods market. An increase in the interest rate leads to a decline in output. Consequently, the IS curve is downward sloping.Diff: 211) Graphically derive the IS curve from the goods market equilibrium.Answer: Suppose the initial equilibrium in the goods market is at point A with interest rate i. Suppose now that the interest rate increases from its initial value i to a higher value i'. The increase in the interest rate decreases investment. The decrease in investment leads to a decrease in output. Now the new equilibrium point is at A', with a higher value of i and lower value of Y. After we plot the combinations of i and Y when the goods market is in equilibrium, we can connect these two points (A and A') to get a downward sloping IS curve.Diff: 25.2 Financial Markets and the LM Relation1) For each interest rate, the LM curve illustrates the level of output whereA) the goods market is in equilibrium.B) inventory investment equals zero.C) money supply equals money demand.D) all of the aboveE) none of the aboveAnswer: CDiff: 22) The LM curve shifts down (or, equivalently, to the right) when which of the following occurs?A) an increase in taxesB) an increase in outputC) an open market sale of bonds by the central bankD) an increase in consumer confidenceE) none of the aboveAnswer: EDiff: 23) Which of the following statements is consistent with a given (i.e., fixed) LM curve?A) A reduction in the interest rate causes investment spending to increase.B) A reduction in the interest rate causes money demand to decrease.C) A reduction in the interest rate causes an increase in the money supply.D) An increase in output causes an increase in demand for goods.E) An increase in output causes an increase in money demand.Answer: EDiff: 24) In late 2007 and early 2008, the U.S. Federal Reserve pursued expansionary monetary policy. Which of the following will occur as a result of this monetary policy action?A) The LM curve shifts down.B) The LM curve shifts up.C) The IS curve shifts rightward as the interest rate falls.D) The IS curve shifts leftward as the interest rate increases.E) none of the aboveAnswer: ADiff: 25) Suppose the demand for money is not very sensitive to the interest rate. Given this information, we know thatA) the IS curve should be relatively flat.B) the IS curve should be relatively steep.C) the LM curve should be relatively flat.D) the LM curve should be relatively steep.E) neither the IS nor the LM curve will be affected.Answer: DDiff: 36) Which of the following is the definition for the real supply of money?A) The stock of money measured in terms of goods, not dollars.B) The stock of high powered money only.C) The real value of currency in circulation only.D) The actual quantity of money, rather than the officially reported quantity.E) The ratio of the real GDP to the nominal money supply.Answer: ADiff: 17) First, define the LM curve. Second, explain why it has its particular shape.Answer: The LM curve illustrates the combinations of the interest rate and level of output that maintain financial market equilibrium. The curve is upward sloping because as income increases, money demand will rise. This increase in money demand will cause an excess demand for money and an excess supply of bonds. Bond prices will fall and the interest rate will increase until equilibrium is restored.Diff: 25.3 Putting the IS and the LM Relations Together1) Suppose the economy is currently operating on both the LM curve and the IS curve. Which of the following is true for this economy?A) Production equals demand.B) The quantity supplied of bonds equals the quantity demanded of bonds.C) The money supply equals money demand.D) Financial markets are in equilibrium.E) all of the aboveAnswer: EDiff: 12) Suppose the economy is operating on the LM curve but not on the IS curve. Given this information, we know thatA) the goods market is in equilibrium and the money market is not in equilibrium.B) the money market and bond markets are in equilibrium and the goods market is not in equilibrium.C) the money market and goods market are in equilibrium and the bond market is not in equilibrium.D) the money, bond and goods markets are all in equilibrium.E) neither the money, bond, nor goods markets are in equilibrium.Answer: BDiff: 23) Suppose the current level of output and the interest rate are such that the economy is operating on neither the IS nor LM curve. Which of the following is true for this economy?A) Production does not equal demand.B) The money supply does not equal money demand.C) The quantity supplied of bonds does not equal the quantity demanded of bonds.D) Financial markets are not in equilibrium.E) all of the aboveAnswer: EDiff: 24) An increase in the money supply will cause an increase in which of the following variables?A) outputB) investmentC) consumptionD) all of the aboveE) none of the aboveAnswer: DDiff: 25) Suppose there is an increase in consumer confidence. Which of the following represents the complete list of variables that must increase in response to this increase in consumer confidence?A) consumptionB) consumption and investmentC) consumption, investment and outputD) consumption and outputE) consumption, output and the interest rateAnswer: EDiff: 26) Suppose there is a fiscal contraction. Which of the following is a complete list of the variables that must decrease?A) consumptionB) consumption and investmentC) consumption and outputD) consumption, output and the interest rateE) consumption, output and investmentAnswer: CDiff: 27) We know with certainty that a tax increase must cause which of the following?A) an increase in investmentB) a reduction in investmentC) no change in investmentD) none of the aboveAnswer: DDiff: 28) A fiscal contraction will tend to cause which of the following to occur?A) a reduction in the interest rate and a reduction in investmentB) a reduction in the interest rate and an upward shift in the LM curveC) a reduction in the interest rate and an ambiguous effect on investmentD) no change in output if the Fed simultaneously pursues contractionary monetary policy Answer: CDiff: 29) An increase in the money supply must cause which of the following?A) a leftward shift in the IS curveB) a reduction in the interest rate and ambiguous effects on investmentC) an increase in investment and a rightward shift in the IS curveD) no change in the interest rate if investment is independent of the interest rateE) no change in output if investment is independent of the interest rateAnswer: EDiff: 110) An increase in consumer confidence will tend to cause which of the following to occur?A) a rightward shift in the IS curveB) a leftward shift in the IS curveC) an upward shift in the LM curveD) a downward shift in the LM curveAnswer: ADiff: 111) Assume that investment does not depend on the interest rate. A reduction in government spending will cause which of the following for this economy?A) no change in the interest rateB) no change in outputC) no change in investmentD) an increase in investmentE) none of the aboveAnswer: EDiff: 312) Assume that investment does not depend on the interest rate. A reduction in the money supply will cause which of the following for this economy?A) no change in the interest rateB) no change in outputC) a reduction in investmentD) an increase in investmentAnswer: BDiff: 313) For this question, assume that investment spending depends only on output and no longer depends on the interest rate. Given this information, an increase in the money supplyA) will cause investment to decrease.B) will cause investment to increase.C) will cause a reduction in the interest rate.D) will have no effect on output or the interest rate.E) will cause an increase in output and have no effect on the interest rate.Answer: CDiff: 314) A reduction in consumer confidence will likely have which of the following effects?A) a rightward shift in the IS curveB) a leftward shift in the IS curveC) an upward shift in the LM curveD) a downward shift in the LM curveAnswer: BDiff: 215) An increase in the reserve deposit ratio, θ, will most likely have which of the following effects?A) a rightward shift in the IS curveB) a leftward shift in the IS curveC) an upward shift in the LM curveD) a downward shift in the LM curveAnswer: CDiff: 216) A Fed purchase of securities will most likely have which of the following effects?A) a rightward shift in the IS curveB) a leftward shift in the IS curveC) an upward shift in the LM curveD) a downward shift in the LM curveAnswer: DDiff: 217) A reduction in the aggregate price level, P, will most likely have which of the following effects?A) a rightward shift in the IS curveB) a leftward shift in the IS curveC) an upward shift in the LM curveD) a downward shift in the LM curveAnswer: DDiff: 218) An increase in the aggregate price level, P, will most likely have which of the following effects?A) a rightward shift in the IS curveB) a leftward shift in the IS curveC) an upward shift in the LM curveD) a downward shift in the LM curveAnswer: CDiff: 219) The IS curve will not shift when which of the following occurs?A) a reduction in government spendingB) a reduction in the interest rateC) a reduction in consumer confidenceD) all of the aboveE) none of the aboveAnswer: BDiff: 120) Which of the following best defines the IS curve?A) the combinations of i and Y that maintain equilibrium in the goods marketB) illustrates the effects of changes in i on investmentC) illustrates the effects of changes in i on desired money holdings by individualsD) the combinations of i and Y that maintain equilibrium in financial marketsAnswer: ADiff: 121) Which of the following best defines the LM curve?A) the combinations of i and Y that maintain equilibrium in the goods marketB) illustrates the effects of changes in i on investmentC) illustrates the effects of changes in i on desired money holdings by individualsD) the combinations of i and Y that maintain equilibrium in financial marketsAnswer: DDiff: 122) Based on our understanding of the IS-LM model that takes into account dynamics, we know that a reduction in the money supply will causeA) an immediate drop in Y and immediate increase in i.B) an immediate increase in i and no initial change in Y.C) a gradual increase in i and gradual reduction in Y.D) none of the aboveAnswer: BDiff: 223) Based on our understanding of the IS-LM model that takes into account dynamics, we know that a reduction in government spending will causeA) an immediate drop in Y and immediate increase in i.B) an immediate reduction in i and no initial change in Y.C) a gradual reduction in i and gradual reduction in Y.D) a gradual reduction in i and an immediate reduction in Y.Answer: CDiff: 224) Based on our understanding of the IS-LM model that takes into account dynamics, we know that an increase in the money supply will causeA) an immediate increase in i and no initial change in Y.B) an immediate decrease in i and no initial change in Y.C) a gradual decrease in i and gradual increase in Y.D) none of the aboveAnswer: BDiff: 225) Based on our understanding of the IS-LM model that takes into account dynamics, we know that an increase in government spending will causeA) a gradual increase in i and gradual increase in Y.B) an immediate increase in Y and immediate drop in i.C) an immediate increase in i and no initial change in Y.D) a gradual increase in i and an immediate increase in Y.Answer: ADiff: 226) An increase in government spending will likely have which of the following effects?A) a rightward shift in the IS curveB) a leftward shift in the IS curveC) an upward shift in the LM curveD) a downward shift in the LM curveAnswer: ADiff: 227) A reduction in the reserve depos it ratio, θ, will most likely have which of the following effects?A) a rightward shift in the IS curveB) a leftward shift in the IS curveC) an upward shift in the LM curveD) a downward shift in the LM curveAnswer: DDiff: 228) If government spending and taxes increase by the same amount,A) the IS curve does not shiftB) the IS curve shift leftwardC) the IS curve shifts rightwardD) the LM curve shifts downwardAnswer: CDiff: 229) If government spending and taxes decrease by the same amount,A) the IS curve does not shift.B) the IS curve shift leftward.C) the IS curve shifts rightward.D) the LM curve shifts downward.Answer: BDiff: 230) Which of the following triggered the U.S. recession of 2001?A) decline in investment demandB) decline in consumption demandC) increase in budget deficitD) increase in trade deficitAnswer: ADiff: 231) The IS curve will shift to the left when which of the following occurs?A) a reduction in the money supplyB) a reduction in government spendingC) an increase in the interest rateD) all of the aboveE) none of the aboveAnswer: BDiff: 232) Which of the following occurs as the economy moves rightward along a given IS curve?A) A reduction in the interest rate causes investment spending to decrease.B) A reduction in the interest rate causes money demand to increase.C) A reduction in the interest rate causes a reduction in the money supply.D) An increase in government spending causes a reduction in demand for goods.E) A reduction in taxes causes a reduction in demand for goods.Answer: ADiff: 233) When the central bank pursues contractionary monetary policy, we that this policy will result in an increase in the interest rate, a reduction in investment, a reduction in demand, and a lower level of equilibrium output. Explain what happens to the position of the IS curve as the central bank pursues contractionary monetary policy.Answer: Changes in the interest rate do cause changes in investment, demand, and output. However, they do not cause shifts of the IS curve. Changes in the interest rate cause movements along the IS curve.Diff: 234) A fiscal expansion (e.g. a tax cut) will result in an increase in income, an increase in money demand, and an increase in the equilibrium interest rate in financial markets. Explain what happens to the position of the LM curve as policy makers pursue expansionary fiscal policy. Answer: The fiscal expansion will cause an increase in output. However, changes in Y only cause movements along the LM curve. The effects of changes in Y on the interest rate are embedded in the shape of the LM curve.Diff: 2IS curve.Answer: A Fed sale of bonds will cause a reduction in H and a reduction in the money supply. This will cause an excess demand for money and the interest rate must increase to restore money market equilibrium. The LM curve will shift up as a result of this to reflect the now higher interest rate. The IS curve does not shift as a result of this. We would simply observe a movement along the IS curve.Diff: 236) Explain in detail what effect a reduction in government spending will have on: (1) the LM curve; and (2) the IS curve.Answer: A reduction in taxes will cause an increase in disposable income and an increase in consumption. The rise in C will cause an increase in demand and the equilibrium level of output in the goods market will be higher. This is reflected in a rightward shift in the IS curve. Goods market events such as this will not cause a shift in the LM curve (only a movement along it). Diff: 237) Based on your understanding of the IS-LM model, graphically illustrate and explain what effect a reduction in consumer confidence will have on output, the interest rate, and investment. Answer: A reduction in consumer confidence will cause a reduction in consumption and, therefore, a reduction in demand and a leftward shift in the IS curve. As Y decreases, money demand will decrease causing the interest rate to fall. The effects on I are ambiguous. The lower Y will cause I to fall while the lower interest rate will cause I to increase.Diff: 238) Based on your understanding of the IS-LM model, graphically illustrate and explain what effect a monetary expansion will have on output, the interest rate, and investment.Answer: An increase in M will cause the LM curve to shift down and the interest rate to fall. As the interest rate falls, firms will increase investment causing an increase in demand and subsequent increase in output. So, the interest rate will fall and Y will rise. I will be higher due to the rise in Y and drop in the interest rate.Diff: 239) Increases in the budget deficit are believed to cause reductions in investment. Based on your understanding of the IS-LM model, will a fiscal policy action that causes a reduction in the budget deficit cause an increase in investment? Explain.Answer: A policy that causes a reduction in the budget deficit will have an ambiguous effect on investment. Output will fall which will tend to depress I. However, the interest rate will also fall which will tend to increase I. I could increase, decrease, or remain unchanged.Diff: 2the IS curve.Answer: A Fed purchase of bonds will cause an increase in H and an increase in the money supply. This will cause an excess supply of money and the interest rate must decline to restore money market equilibrium. The LM curve will shift down as a result of this to reflect the now lower interest rate. The IS curve does not shift as a result of this. We would simply observe a movement along the IS curve.Diff: 241) Explain in detail what effect an increase in government spending will have on: (1) the LM curve; and (2) the IS curve.Answer: An increase in government spending will cause an increase in demand and the equilibrium level of output in the goods market will be higher. This is reflected in a rightward shift in the IS curve. Goods market events such as this will not cause a shift in the LM curve (only a movement along it).Diff: 25.4 Using a Policy Mix1) Suppose there is a simultaneous fiscal expansion and monetary expansion. We know with certainty thatA) output will increase.B) output will decrease.C) the interest rate will increase.D) the interest rate will decrease.E) both output and the interest rate will increase.Answer: ADiff: 22) Suppose there is a simultaneous fiscal expansion and monetary contraction. We know with certainty thatA) output will increase.B) output will decrease.C) the interest rate will increase.D) the interest rate will decrease.E) both output and the interest rate will increase.Answer: CDiff: 23) For this question, assume that investment spending depends only on output and no longer depends on the interest rate. Given this information, an increase in government spendingA) will cause investment to decrease.B) will cause investment to increase.C) may cause investment to increase or to decrease.D) will have no effect on output.E) will cause an increase in output and have no effect on the interest rate.Answer: BDiff: 34) A reasonable dynamic assumption for the IS-LM model is thatA) the economy is always on both the IS and LM curves.B) the economy is always on the IS curve, but moves only slowly to the LM curve.C) the economy is always on the LM curve, but moves only slowly to the IS curve.D) the money market is quick to adjust, but the bond market adjusts more slowly.E) adjustment to the new IS-LM equilibrium is instantaneous after an LM shift, but not after an IS shift.Answer: CDiff: 25) Under the reasonable dynamic assumptions discussed in the text, a monetary contraction should result inA) an immediate rise in the interest rate, and no further interest rate changes.B) an immediate rise in the interest rate, and then a fall in the interest rate over time.C) an immediate rise in the interest rate, and then a further rise over time.D) a very gradual but steady rise in the interest rate to its new equilibrium level.E) no change in the interest rate initially, and then a sudden rise to its new equilibrium value. Answer: BDiff: 26) For this question, assume that investment spending depends only on the interest rate and no longer depends on output. Given this information, a reduction in the money supplyA) will cause investment to decrease.B) will cause investment to increase.C) may cause investment to increase or to decrease.D) will have no effect on output.E) will cause a reduction in output and have no effect on the interest rate.Answer: ADiff: 37) Suppose there is a Fed purchase of bonds and simultaneous tax cut. We know with certainty that this combination of policies must causeA) an increase in the interest rate (i).B) a reduction in i.C) an increase in output (Y).D) a reduction in Y.Answer: CDiff: 28) Suppose there is a simultaneous Fed sale of bonds and increase in consumer confidence. We know with certainty that these two simultaneous events will causeA) an increase in the interest rate (i).B) a reduction in i.C) an increase in output (Y).D) a reduction in Y.Answer: ADiff: 29) Suppose there is a simultaneous central bank purchase of bonds and increase in taxes. We know with certainty that this combination of policies must causeA) an increase in the interest rate (i).B) a reduction in i.C) an increase in output (Y).D) a reduction in Y.Answer: BDiff: 210) Suppose there is a simultaneous central bank sale of bonds and tax increase. We know with certainty that this combination of policies must causeA) an increase in the interest rate (i).B) a reduction in i.C) an increase in output (Y).D) a reduction in Y.Answer: DDiff: 211) First, briefly explain what is meant by the policy mix. Second, explain what effect different policy mixes might have on the level of output, investment, and the interest rate.Answer: The policy mix refers to the possible combinations of monetary (exp. or contr.) and fiscal (exp. or contr.) that can be simultaneously implemented. There are a number of different answers that could be given to the latter part of the question. The effects on output, the interest rate, and investment will depend on the type of mix.Diff: 212) Use the IS-LM model to answer this question. Suppose there is a simultaneous increase in government spending and reduction in the money supply. Explain what effect this particular policy mix will have on output and the interest rate. Based on your analysis, do we know with certainty what effect this policy mix will have on investment? Explain.Answer: In this case, the LM curve shifts up and the IS curve shifts to the right. The interest rate will clearly be higher. The effects on output depend on the relative magnitude of the two policies. The effects on I are also ambiguous. If output falls, I will be lower. However, it is possible that output will rise here which creates the ambiguity.Diff: 213) Use the IS-LM model to answer this question. Suppose there is a simultaneous increase in taxes and reduction in the money supply. Explain what effect this particular policy mix will have on output and the interest rate. Based on your analysis, do we know with certainty what effect this policy mix will have on investment? Explain.Answer: In this case, the LM curve shifts up and the IS curve shifts to the left. In this case, output will clearly fall. What happens to the interest rate depends on the relative magnitude of the two policies. The effects on I are again ambiguous.Diff: 214) Use the IS-LM model to answer this question. Suppose there is a simultaneous increase in government spending and increase in the money supply. Explain what effect this particular policy mix will have on output and the interest rate. Based on your analysis, do we know with certainty what effect this policy mix will have on investment? Explain.Answer: In this case, the LM curve shifts down and the IS curve shifts to the right. The output will clearly be higher. The effects on interest rate depend on the relative magnitude of the two policies. The effects on I are also ambiguous. If interest rate falls, I will be higher. However, it is possible that interest rate will rise here which creates the ambiguity.Diff: 25.5 How does the IS-LM Model Fit the Facts?1) Empirically it takes nearly ________ years for monetary policy to have its full effect on output.A) 2B) 1C) 3D) 4Answer: ADiff: 1。

宏观经济学第七版课后习题答案

8.国民收入核算恒等式(national income accounts identity) 答:国民收入核算恒等式指储蓄—投资恒等式,即I?S。从支出法、收入法与生产法所得出的国内生产总值的一致性,可以说明国民经济中的一个基本平衡关系。总支出代表了社会对最终产品的总需求,而总收入和总产量代表了社会对最终产品的总供给。因此,从国内生产总值的核算方法中可以得出这样一个恒等式:总需求=总供给。这种恒等关系在宏观

答:劳动力参与率是成年人口中属于劳动力的人数的百分比,用公式表示为:

劳动力参与率?劳动力?100% 成年人口

二、复习题

1.列出GDP衡量的两样东西。GDP怎么能同时衡量这两样东西呢?

答:(1)国内生产总值(GDP)主要衡量社会总收入和社会总支出,即全社会所有经济单位获得的收入总和,以及用于购买最终产品与服务的总支出。在理论上,类似于以收入法、支出法来计算GDP。

国民经济核算一词最早出现于1941年。荷兰经济学家范·克利夫在荷兰杂志1941年7月号和11月号上,先后发表两篇文章,首次使用了“国民经济核算”一词。 国民收入核算一般有三种方法:生产法、支出法和收入法,常用的为后两者。其核算的理论基础是总产出等于总收入、总产出等于总支出。

3.存量与流量(stocks and flows)

经济学中是十分重要的,可以从两部门经济入手研究国民经济的收入流量循环模型与国民经济中的恒等关系,进而研究三部门经济与四部门经济。

两部门经济中可以得出储蓄—投资恒等式:I?S。值得注意的是,这里的恒等是从国民收入核算的角度来说,就整个经济而言,事后的储蓄和事后的投资总量相等。而在分析宏观经济均衡时投资等于储蓄,是指计划投资(事前投资)等于计划储蓄(事前储蓄)所形成的经济均衡状态。

曼昆经济学原理第五章

0

100

Quantity

2. . . . leaves the quantity demanded unchanged.

Copyright©2003 Southwestern/Thomson Learning

Figure 1 The Price Elasticity of Demand

(b) Inelastic Demand: Elasticity Is Less Than 1 Price

Copyright © 2004 South-Western/Thomson Learning

THE ELASTICITY OF DEMAND

• Price elasticity of demand is a measure of how much the quantity demanded of a good responds to a change in the price of that good. • Price elasticity of demand is the percentage change in quantity demanded given a percent change in the price.

$5 4 1. A 22% increase in price . . . Demand

0

90

100

Quantity

2. . . . leads to an 11% decrease in quantity demanded.

Figure 1 The Price Elasticity of Demand

Demand is price elastic

Copyright © 2004 South-Western/Thomson Learning

人大802考研曼昆《宏观经济学》(第7版)重点章节及重点课后习题(精细版修订版)

曼昆《宏观经济学》(第7版)重点章节及重点课后习题I 曼昆《宏观经济学》重点章节或知识点一、导言(第1、2章)1、宏观经济学科学(第1章)(1)宏观经济学。

掌握宏观经济学的研究对象、三个重要的宏观经济变量(宏观经济学的核心,后面所有章节都是围绕这三个变量展开的)、本书框架(有利于加深对宏观体系的认识)。

(2)价格黏性与伸缩性。

短期和长期,价格情形,也是不同学派分析的角度或出发点。

(3)宏观经济学与微观经济学的关系。

了解下即可。

2、宏观经济学的数据(第2章)(1)国内生产总值(GDP、国民收入,总产出)。

重点掌握:概念和内涵;核算中的特殊处理;名义GDP、实际GDP和GDP平减指数;GDP核算指标的缺陷和改进。

(2)国民收入核算。

重点掌握:国民收入核算三种方法的区别和联系,GDP与其他国民收入指标(GNP、NNP、NI、PI、PPI)的关系。

(3)消费者价格指数(CPI)。

重点掌握:CPI的含义。

CPI与GDP平减指数的关系。

说明:第1、2章比较基础,初级宏观看过的考生,可以直接看讲义,教材直接略过就行。

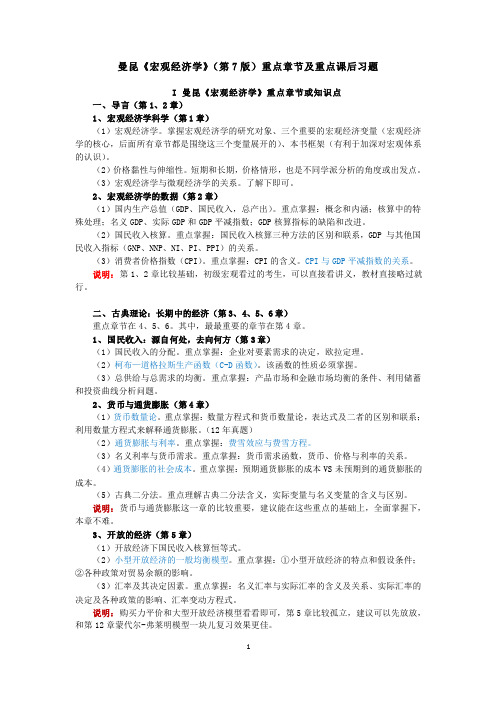

二、古典理论:长期中的经济(第3、4、5、6章)重点章节在4、5、6。

其中,最最重要的章节在第4章。

1、国民收入:源自何处,去向何方(第3章)(1)国民收入的分配。

重点掌握:企业对要素需求的决定,欧拉定理。

(2)柯布—道格拉斯生产函数(C-D函数)。

该函数的性质必须掌握。

(3)总供给与总需求的均衡。

重点掌握:产品市场和金融市场均衡的条件、利用储蓄和投资曲线分析问题。

2、货币与通货膨胀(第4章)(1)货币数量论。

重点掌握:数量方程式和货币数量论,表达式及二者的区别和联系;利用数量方程式来解释通货膨胀。

(12年真题)(2)通货膨胀与利率。

重点掌握:费雪效应与费雪方程。

(3)名义利率与货币需求。

重点掌握:货币需求函数,货币、价格与利率的关系。

(4)通货膨胀的社会成本。

重点掌握:预期通货膨胀的成本VS未预期到的通货膨胀的成本。

曼昆《宏观经济学》完整版

国际收支平衡表的解 读方法

在解读国际收支平衡表时,需要关注 各个账户的余额情况以及它们之间的 相互关系。例如,经常账户余额可以 反映一国的贸易竞争力;资本和金融 账户余额可以反映一国的对外投资和 国际融资情况;净误差与遗漏则可以 反映国际收支统计的质量和准确性。

06

金融市场、金融机构 及其监管

金融市场结构和功能介绍

行为宏观经济学主要研究个体和群体在宏观经济环境中的 决策行为,以及这些行为如何影响宏观经济运行和结果。 它关注的核心问题包括消费、储蓄、投资、就业、货币政 策和财政政策等方面。行为宏观经济学强调心理因素、社 会因素和文化因素对宏观经济行为的影响,试图揭示这些 非经济因素如何与经济因素相互作用,共同决定宏观经济 结果。

• 法定存款准备金率:调整商业银行存款准备金率,影响银行信贷能力和市场利率。 • 再贴现政策:通过调整再贴现率,影响商业银行借款成本和市场利率。 • 公开市场业务:中央银行在公开市场上买卖有价证券,调节市场货币供应量。 • 实施效果:货币政策工具的运用可以调节市场利率、货币供应量和信贷规模,进而影响总需求和物价水平,达到宏观经济

05

国际贸易与汇率制度

国际贸易理论基础:比较优势原理

要点一

比较优势原理的含义

比较优势原理是指一个国家在生产某 种产品时,相对于其他国家具有更低 的相对成本,因此具有比较优势,应 该专业化生产并出口该产品。

要点二

比较优势与绝对优势 的区别

绝对优势是指一个国家在生产某种产 品时,相对于其他国家具有更低的绝 对成本。比较优势则考虑了相对成本 ,即使一个国家在所有产品的生产上 都不具有绝对优势,仍然可以通过专 业化生产和贸易获得利益。

生产法

通过核算一定时期内各生产单位创造的增加值总和来计算GDP,包括总产出减去中间投入 得到增加值。

曼昆《宏观经济学》(第七版)考研笔记 - 2

第2篇古典理论:长期中的经济本篇主干知识框架:第3章 国民收入:源自何处,去向何方(一般均衡模型)本章分析的出发点(教材图3-1)本章主干知识框架:3.1 什么决定了产品与服务的总生产(略) 3.2 国民收入如何分配给生产要素:新古典分配理论②对任何一种生产要素支付的价格都取决于该要素服务的供给和需求。

由于已假设供给是固定的,所以供给曲线是一条垂直线。

需求曲线向下倾斜。

两曲线的交点决定了均衡的要素价格。

为了理解要素价格和收入分配,必须考察生产要素的需求,为此我们从研究一个典型企业使用多少生产要素的决策问题开始。

②新古典分配理论,neoclassical theory of distribution.3.2.1 企业如何决策→要素需求→要素价格(一)竞争性企业面临的决策:利润=PF (K,L )−WL −RK假设企业是竞争性的,将产出和投入的价格都视为由市场条件决定(价格接受者)。

(二)MPL ↓⇒劳动需求曲线大多数生产函数具有边际产量递减的性质:在资本量不变的情况下,随着劳动量的增加,劳动边际产量递减。

企业多雇佣一单位劳动的利润变化是: ∆利润=P x MPL-W 。

竞争性企业对劳动的需求由下式决定:P x MPL=W 或者MPL=W/P (实际工资)为了使利润最大化,企业雇佣劳动,直到劳动的边际产量等于实际工资这一点为止。

由于MPL 随着L 增加而递减,故MPL 曲线向下倾斜。

企业雇用工人知道司机工资等于MPL 位置。

因此,MPL 曲线也就是企业的劳动需求曲线。

(三)资本MPK(↓)与资本需求:MPK=R/P (实际租赁价格) (四)总结:总之,竞争性的追求利润最大化的企业关于要素使用的决策都遵循着一个简单规划:企业需要每一种生产要素,直到该要素的边际产量减少到等于其实际要素价值为止。

3.2.2 国民收入的划分经济利润=Y −MPL ∗L −MPK ∗K 或,Y =MPL ∗L +MPK ∗K +经济利润经济利润有多少呢? 若生产函数具有规模报酬不变的性质,则经济利润必为零。

曼昆经济学原理宏观经济学分册第7版课后答案完整

23章答案一、概念题1.微观经济学(microeconomics)答:微观经济学指研究家庭和企业如何做出决策,以及他们如何在市场上相互交易的经济学。

微观经济学以市场经济中的单个消费者(或称家户、家庭)和生产者(或称厂商、企业)为研究对象,通过分析他们的消费决策或生产决策,来说明消费品和生产要素的价格的决定及其变动,进而说明稀缺性的资源如何得到最有效的配置。

微观经济学的理论目的是为了论证亚当·斯密“看不见的手”原理,这只“看不见的手”就是价格机制。

因此,微观经济学又被称为价格理论。

微观经济学主要解决的问题可以概括为:生产什么、生产多少、如何生产、为谁生产。

其基本假设为:(1)经济行为个体是进行自由的、分散化决策的理性经济人,即消费者追求自身效用的最大化,生产者追求自身利润的最大化。

(2)完全竞争和完全信息。

微观经济学从这两个基本假定出发对上述问题的解决就构成了它的主要内容,具体地,它包括:① 供求规律;② 消费者行为理论,它构成消费品价格决定的需求方面;③ 生产者行为理论或厂商理论,它构成消费品价格决定的供给方面;④ 生产要素的价格决定理论或分配理论;⑤ 一般均衡理论;⑥ 福利经济学;⑦ 市场失灵和微观经济政策。

2.宏观经济学(macroeconomics)答:宏观经济学是与“微观经济学”相对而言的,指研究整体经济现象,包括通货膨胀、失业和经济增长的经济学。

宏观经济学以国民经济总体作为考察对象,研究经济生活中有关总量的决定与变动,解释失业、通货膨胀、经济增长与波动、国际收支与汇率的决定与变动等经济中的宏观整体问题,所以又称之为总量经济学。

宏观经济学的中心和基础是总供给—总需求模型。

具体来说,宏观经济学主要包括总需求理论、总供给理论、失业与通货膨胀理论、经济周期与经济增长理论、开放经济理论、宏观经济政策等内容。

对宏观经济问题进行分析与研究的历史十分悠久,但现代意义上的宏观经济学直到20世纪30年代才得以形成和发展起来。

曼昆《宏观经济学》

法方算核的入收民国 节二第

00.1 52.0 02.0 02.0 51.0 01.0 01.0 �元�值价加附

59.2 00.1 57.0 55.0 53.0 02.0 01.0 �元�值价场市

计合 �售销�商售零

�发批�商发批

�包面烤�厂包面

� � �

。衡均济经民国,J = W 。张扩济经民国,J < W 。缩收济经民国,J > W 。中之入注于入归又,入注于之来出漏 系关的入注和出漏.5

)Lz ,Kz( F = Yz :变不益收模规

) L ,K ( F = Y 给供的务劳与品物 .3 ) L ,K ( F = Y 数 函 产 生 .2 本资 动劳 素 要 产 生 .1

值总产生内国 :值价的动活济经量衡 节一第 型模济经观宏与考思济经观微 .4 性粘

据数的学济经观宏 章2第

性缩伸 清出场市 性 粘 与 性 缩 伸 : 格 价 .3

性 样 多 的 型 模 .2

出支 总

)PDG(出支 务劳与品物

入收 总

业企 素要产生

庭家

)PDG(入收 程流环循和出支,入收 .1 。和总值价加附或�和总值价场市的 务劳和品产终最部全的产生所素要产生用运内 期时定一在 �区地一或国一 � 会社济经 指

�

)hcaorppA rotceS(法门部.3

付支收税非 - 税得所人个 - IP = IDP emocnI elbasopsiD lanosreP )IDP(入收配支可人个 .5 emocnI lanosreP)IP(入收人个.4

�

息股+息利人个+付支移转的人个对府政+税 险 保 会 社 - 税 得 所 司 公 - 润 利 配 分 未 司 公 -IN=IP 贴补府政+付支移转业企-税接间-PDN = IN

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

27

经济学院经济系

戴天仕2013

名义汇率 与通胀率差异(证据)

35 名义汇率的 百分比变动 30 25 20 15 10 5

_

0 -5 -5 0 5 10 15 20 25 30 通胀率差异 22

经济学院经济系

戴天仕2013

购买力平价

一价定律(law of one price)

同样的产品在同一时间不同地点只能以同一个价 格出售。

两个国家通货的相对价格。 本书用e表示,e为一单位本国货币可换得的外 币额。e上升称本币“升值”,e下降称“贬值”。 当人们提到两国汇率时,通常就是指名义汇率

实际汇率(real exchange rate)

两国产品的相对价格。

P ε = e× * P

经济学院经济系

14

戴天仕2013

实际汇率和净出口

I (r ) I1

S, I

10

经济学院经济系

戴天仕2013

世界利率变化对均衡的影响

世界利率上升.

r

NX 2

S1

r 2* r

导致:

* 1

NX 1

∆I < 0

∆NX = −∆I > 0

I (r )

经济学院经济系

* 2

I (r )

I (r 1* )

S, I

11

戴天仕2013

投资需求变化对均衡的影响

r

投资需求上升. 导致: ∆I > 0, ∆S = 0, 资本净流出和 NX 减少∆I

小型开放经济模型

经济产出: 消费:

Y= Y= F K , L = C C (Y − T )

*

(

)

I I= (r ), r r 投资: =

净出口:

NX = (Y − C − G ) − I = S − I

均衡结果: NX= S − I r

经济学院经济系

( )

*

7

戴天仕2013

封闭经济

ε

S −I

ε2 ε1 NX 2 (ε ) NX 1 (ε ) NX

20

导致:

ε 上升

NX不变

经济学院经济系

NX

戴天仕2013

名义汇率 的决定因素

名义汇率=实际汇率×(外国物价/国内物 价) *

P e = ε× P

名义汇率的变动率

= g e gε + (π − π )

*

21

经济学院经济系

戴天仕2013

戴天仕2013

课堂练习

复习题4:

如果一个小型开放经济禁止日本DVD播放机的 进口,则储蓄、投资、贸易余额、利率和汇率会发 生什么变动?

26

经济学院经济系

戴天仕2013

本章小结

本章介绍了开放经济相关的一些概念

如净出口、贸易余额、名义汇率、实际汇率

本章还介绍了关于小型开放经济的两个模 型

第5章 开放经济

The Open Economy

经济学院经济系

戴天仕2013

第5章 开放经济

5.1 5.2 5.3 5.4 资本和产品的国际流动 小型开放经济中的储蓄和投资 汇率 结论:美国作为一个大型开放经济

2

经济学院经济系

戴天仕2013

5.1 资本和产品的国际流动

净出口(NX)

G上升或者 T下降, 会减少储蓄.

S2 −I

S1 − I

ε2 ε1 NX (ε ) NX 2 NX 1

NX

17

导致:

ε 上升

NX下降

经济学院经济系

戴天仕2013

国外财政政策对实际汇率的影响

外国进行扩张性财 政政策, 世界利率上升, 国内投资下降 导致:

ε

ε1 ε2

S 2 − I ( r 2* )

NX (ε ) NX 1 NX 2

购买力平价(purchasing-power parity)

1块钱(人民币)在每个国家都应该有同样的购 买力。

23

经济学院经济系

戴天仕2013

购买力平价学说现实吗

虽符合逻辑,但它没有对世界提供一个完 全准确的描述 许多产品不易于交易,如理发等服务 可贸易产品未必可完全替代,产品需求 还取决于人们的偏好 提供了一个实际汇率的变动要受到限制的 理由

ε

0

NX (ε ) NX

15

说明:ε与NX负相关;由于进口可以大与出口,所以 横轴部分NX有负值。

经济学院经济系

戴天仕2013

实际汇率的决定因素

ε

S 1 − I (r *)

ε1 NX (ε ) ( ε )

经济学院经济系

戴天仕2013

国内财政政策对实际汇率的影响

ε

24

经济学院经济系

戴天仕2013

案例研究

世界各国的巨无霸汉堡包

表5-2列出了2008年巨无霸在世界各地的价格。 根据购买力平价定律,利用这些价格数据计算 出了预期的汇率。 对比这个预期的汇率和现实的汇率可以发现: 1、预期的汇率和现实的汇率比较接近 2、预期的汇率和现实的汇率也有一些差距

25

经济学院经济系

5

经济学院经济系

戴天仕2013

5.2 小型开放经济中的储蓄和投资

小型开放经济

小型:这个经济是世界经济的一小部分,其 本身对世界的影响可忽略不计。 开放:产品与资本可以很容易地进出国界。

世界利率

由于资本可完全流动,该小型开放经济的利 率必定等于一个外生的世界利率。

r=r

经济学院经济系

*

6

戴天仕2013

经济学院经济系

r*

NX 1

NX 2

S

I (r )2 I (r )1

I1

I2

S, I

12

戴天仕2013

课堂练习

复习题3(部分):

如果一个小型开放经济削减国防支出,则储 蓄、投资、贸易余额、利率会发生什么影响?

13

经济学院经济系

戴天仕2013

5.3 汇率

名义汇率(nominal exchange rate)

NX

18

ε 下降

NX上升

经济学院经济系

戴天仕2013

投资需求变动对实际汇率的影响

ε

由于出现了巨大技 术进步,投资需求 大幅增加 导致:

S −I2

S −I1

ε2 ε1 NX (ε ) NX 2 NX 1

NX

19

ε 上升

NX下降

经济学院经济系

戴天仕2013

贸易政策对实际汇率的影响

本国执行贸易保护 政策, 净出口需求上升,

NX = EX − IM

资本净流出(S-I)

S−I = NX

3

经济学院经济系

戴天仕2013

贸易盈余

S-I和NX是正的,出口大于进口

贸易赤字

S-I和NX是负的,出口小于进口

平衡的贸易

S-I和NX等于零,出口等于进口

4

经济学院经济系

戴天仕2013

参考资料

双边贸易余额的无关紧要性

美国与某一国(比如中国)的贸易余额是盈余 还是赤字重要吗? 不重要。 重要的是,美国与其它所有国家的总的贸易余 额。 这个逻辑同样适合于个人。 那为什么美国最近那么在乎美中之间的双边贸 易赤字?

r

S

rc I (r )

I (r c ) = S

经济学院经济系

S, I

8

戴天仕2013

小型开放经济模型

r

NX

S

r* rc I (r ) I*

经济学院经济系

I0

S, I

9

戴天仕2013

国内政策对均衡的影响

r

G上升或者 T下降, 会减少储蓄.

S 2 S1

NX 2 NX 1

r

* 1

导致:

∆I = 0 ∆NX = ∆S < 0