会计英语试题及答案

大学会计英语考试题及答案

大学会计英语考试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a basic accounting principle?A. Going ConcernB. ConsistencyB. MaterialityD. Cash Basis AccountingAnswer: D2. What is the purpose of the balance sheet?A. To show the profitability of a company.B. To show the financial position of a company at a given point in time.C. To show the cash flow of a company.D. To show the company's budget.Answer: B3. The term "Accrual Basis Accounting" refers to accounting where:A. Revenues and expenses are recognized when cash is received or paid.B. Revenues and expenses are recognized when they are earned or incurred, regardless of the cash flow.C. Only expenses are recognized when they are incurred.D. Only revenues are recognized when they are earned.Answer: B4. What does the term "Double Entry Bookkeeping" mean?A. Every transaction is recorded in two accounts.B. Every transaction is recorded in only one account.C. Transactions are recorded on both sides of the balance sheet.D. Transactions are not recorded in the general ledger.Answer: A5. Which of the following is a non-current asset?A. InventoryB. Accounts PayableC. LandD. Wages ExpenseAnswer: C二、填空题(每空2分,共20分)6. The accounting equation is _______ = _______ + _______. Answer: Assets; Liabilities; Owner's Equity7. The term "Depreciation" refers to the systematic allocation of the cost of a(n) _______ asset over its useful life.Answer: Tangible8. In accounting, the matching principle requires thatrevenues and expenses must be recognized in the same periodin which they are _______.Answer: Earned or Incurred9. The financial statement that shows the results ofoperations over a period of time is known as the _______.Answer: Income Statement10. The process of adjusting the accounts at the end of the accounting period to match revenues and expenses is called_______.Answer: Adjusting Entries三、简答题(每题10分,共20分)11. Explain the difference between "Historical Cost" and"Fair Value" in accounting.Answer: Historical Cost refers to the original amountpaid to acquire an asset or the amount received to issue a liability. It is the amount recorded on the company's booksat the time of the transaction. Fair Value, on the other hand, is the estimated amount for which an asset could be exchanged or a liability settled between knowledgeable, willing parties in an arm's length transaction. It is the current marketvalue of the asset or liability.12. What are the main components of a Cash Flow Statement and how do they reflect the liquidity of a company?Answer: The main components of a Cash Flow Statement arethe Cash Flows from Operating Activities, Cash Flows from Investing Activities, and Cash Flows from Financing Activities. These components reflect the liquidity of a company by showing how much cash is being generated or used by the company's operations, investments, and financing activities. A positive cash flow from operations indicates that the company is generating enough cash to sustain itself, while negative cash flows may indicate financial stress.四、计算题(每题15分,共40分)13. A company has the following transactions for the year:- Sales on credit: $50,000- Cash sales: $30,000- Purchases on credit: $40,000- Cash purchases: $10,000- Wages paid in cash: $15,000- Depreciation expense: $5,000- Interest paid in cash: $2,000Calculate the net cash provided by operating activities using the indirect method.Answer:Net Income = Sales - (Cost of Goods Sold + Operating Expenses)= ($50,000 + $30,000) - ($40,000 + $10,000 + $15,000 + $5,000)= $80,000 - $70,000= $10,000Adjustments for Non-Cash Items:- Depreciation Expense: +$5,000 (since it's a non-cash expense)Increase/Decrease in Operating Assets and Liabilities: - Accounts Receivable: -$50,000 (decrease in asset, so。

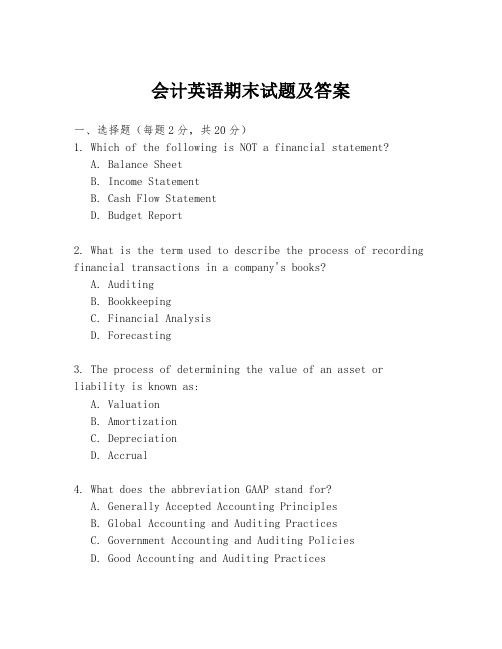

会计英语期末试题及答案

会计英语期末试题及答案一、选择题(每题2分,共20分)1. Which of the following is NOT a financial statement?A. Balance SheetB. Income StatementB. Cash Flow StatementD. Budget Report2. What is the term used to describe the process of recording financial transactions in a company's books?A. AuditingB. BookkeepingC. Financial AnalysisD. Forecasting3. The process of determining the value of an asset orliability is known as:A. ValuationB. AmortizationC. DepreciationD. Accrual4. What does the abbreviation GAAP stand for?A. Generally Accepted Accounting PrinciplesB. Global Accounting and Auditing PracticesC. Government Accounting and Auditing PoliciesD. Good Accounting and Auditing Practices5. The term "revenue recognition" refers to the process of:A. Recording expenses when they are incurredB. Recording revenues when they are earnedC. Allocating costs to products or servicesD. Matching revenues with their related expenses6. Which of the following is a non-current asset?A. InventoryB. Accounts ReceivableC. LandD. Prepaid Expenses7. The matching principle in accounting requires that:A. All expenses must be recorded in the same period as the revenues they generateB. All assets must be listed on the balance sheetC. All liabilities must be paid off within one yearD. All revenues must be recognized in the period they are received8. What is the purpose of adjusting entries?A. To increase the company's reported profitsB. To ensure that financial statements reflect the current financial position of the companyC. To prepare the company for an auditD. To reduce the company's tax liability9. The accounting equation is:A. Assets = Liabilities + EquityB. Liabilities = Assets - EquityC. Equity = Assets - LiabilitiesD. All of the above10. Which of the following is a type of depreciation method?A. FIFOB. LIFOC. Straight-lineD. FIFO and LIFO are both inventory valuation methods答案:1. D2. B3. A4. A5. B6. C7. A8. B9. D10. C二、填空题(每空1分,共10分)11. The primary financial statements include the ______,______, and ______.12. The accounting cycle consists of several steps, including journalizing, ______, posting, and preparing financial statements.13. In accounting, the term "double-entry" refers to the practice of recording each transaction in ______ accounts. 14. The accounting equation shows the relationship between assets, liabilities, and ______.15. The accrual basis of accounting records revenues andexpenses when they are ______, not necessarily when cash is received or paid.答案:11. Balance Sheet, Income Statement, Cash Flow Statement12. footing13. two14. equity15. earned or incurred三、简答题(每题5分,共20分)16. 简述会计信息的四个主要特征。

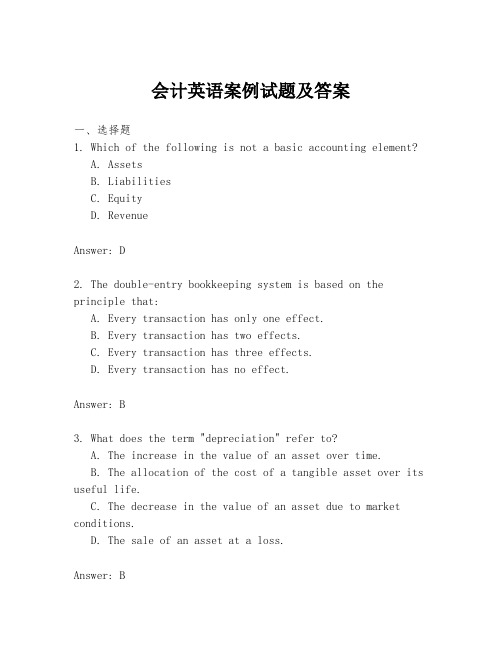

会计英语案例试题及答案

会计英语案例试题及答案一、选择题1. Which of the following is not a basic accounting element?A. AssetsB. LiabilitiesC. EquityD. RevenueAnswer: D2. The double-entry bookkeeping system is based on the principle that:A. Every transaction has only one effect.B. Every transaction has two effects.C. Every transaction has three effects.D. Every transaction has no effect.Answer: B3. What does the term "depreciation" refer to?A. The increase in the value of an asset over time.B. The allocation of the cost of a tangible asset over its useful life.C. The decrease in the value of an asset due to market conditions.D. The sale of an asset at a loss.Answer: B二、填空题4. The financial statement that shows the financial position of a company at a particular point in time is called the________.Answer: Balance Sheet5. The process of adjusting the accounts at the end of an accounting period to ensure they reflect the actual financial status of the company is known as ________.Answer: Closing the Books6. The term "accrual accounting" refers to the method of accounting where revenues and expenses are recognized when they are ________.Answer: Earned or Incurred三、简答题7. Explain the difference between "cash accounting" and "accrual accounting".Answer: Cash accounting is a method where revenues and expenses are recognized when cash is received or paid. In contrast, accrual accounting recognizes revenues and expenses when they are earned or incurred, regardless of when cash is exchanged.8. What is the purpose of adjusting entries and why are theynecessary at the end of an accounting period?Answer: Adjusting entries are made to update the accounts for any transactions that have occurred but have not yet been recorded, or to allocate expenses and revenues to the correct accounting period. They are necessary to ensure the financial statements accurately reflect the company's financialposition and performance for the period.四、案例分析题9. A company purchased equipment on January 1st for $50,000, with an estimated useful life of 5 years and no residual value. Calculate the annual depreciation expense using the straight-line method.Answer: The annual depreciation expense is calculated as the cost of the asset divided by its useful life. In this case, it would be $50,000 / 5 years = $10,000 per year.10. A company has the following transactions in the month of March: sales revenue of $120,000, cost of goods sold of $80,000, and operating expenses of $30,000. Calculate the company's net income for March using the accrual basis of accounting.Answer: Net income is calculated as total revenues minustotal expenses. For March, the net income would be $120,000 (sales revenue) - $80,000 (cost of goods sold) - $30,000 (operating expenses) = $10,000.请注意,以上内容仅为示例,实际的试题及答案应根据具体的教学大纲和课程内容来制定。

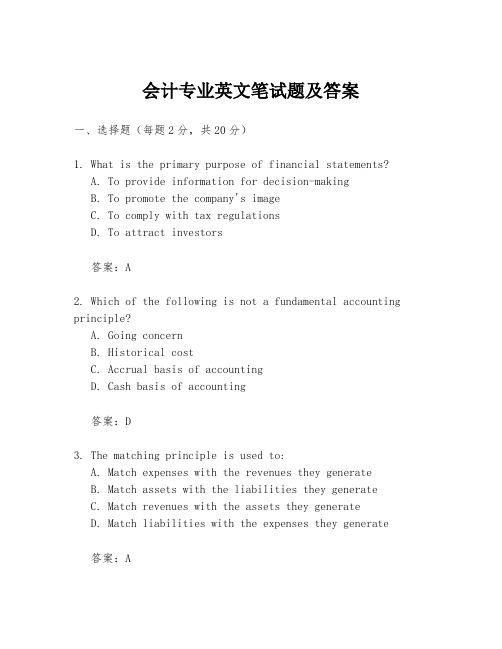

会计专业英文笔试题及答案

会计专业英文笔试题及答案一、选择题(每题2分,共20分)1. What is the primary purpose of financial statements?A. To provide information for decision-makingB. To promote the company's imageC. To comply with tax regulationsD. To attract investors答案:A2. Which of the following is not a fundamental accounting principle?A. Going concernB. Historical costC. Accrual basis of accountingD. Cash basis of accounting答案:D3. The matching principle is used to:A. Match expenses with the revenues they generateB. Match assets with the liabilities they generateC. Match revenues with the assets they generateD. Match liabilities with the expenses they generate答案:A4. What is the formula for calculating return on investment (ROI)?A. ROI = Net Income / Total AssetsB. ROI = (Net Income / Sales) * 100C. ROI = (Return on Sales + Return on Assets) / 2D. ROI = (Net Income / Average Investment) * 100答案:D5. Which of the following is not a type of depreciation method?A. Straight-lineB. Double-declining balanceC. Units of productionD. FIFO (First-In, First-Out)答案:D二、简答题(每题5分,共30分)6. Define "Double-Entry Accounting" and explain its importance in maintaining the integrity of financial records.答案:Double-entry accounting is a system of accounting where every transaction is recorded twice, once as a debit and once as a credit. This system ensures that the accounting equation remains balanced and helps in maintaining the integrity of financial records by providing a check and balance mechanism to prevent errors and fraud.7. Explain the difference between "Liabilities" and "Equity".答案:Liabilities are obligations of a company to pay cash, provide services, or give up assets to other entities in the future. They represent the company's debts and are a source of funds that the company is obligated to repay. Equity, on the other hand, represents the ownership interest of the shareholders in the company. It is the residual interest in the assets of the company after deducting liabilities.8. What is the purpose of "Financial Statement Analysis"?答案:The purpose of financial statement analysis is to assess the financial health and performance of a company. It involves evaluating the company's liquidity, profitability, solvency, and efficiency. This analysis helps investors, creditors, and other stakeholders make informed decisions about the company.9. Describe the "Balance Sheet" and its components.答案:The balance sheet is a financial statement that presents the financial position of a company at a specific point in time. It includes assets, liabilities, and equity. Assets are what the company owns, liabilities are what the company owes, and equity is the net worth of the company, calculated as assets minus liabilities.10. What is "Cash Flow Statement" and why is it important?答案:The cash flow statement is a financial statement that provides information about the cash inflows and outflows of a company over a period of time. It is important because it shows the company's ability to generate cash and meet its financial obligations, which is crucial for the survival and growth of the business.三、案例分析题(每题25分,共50分)11. Assume you are a financial analyst for a company. The company has reported the following financial data for the current year:- Sales: $500,000- Cost of Goods Sold: $300,000- Operating Expenses: $100,000- Depreciation: $20,000- Interest Expense: $10,000- Taxes: $30,000Calculate the company's net income.答案:Net Income = Sales - Cost of Goods Sold - Operating Expenses - Depreciation - Interest Expense - TaxesNet Income = $500,000 - $300,000 - $100,000 - $20,000 - $10,000 - $30,000Net Income = $50,00012. A company is considering purchasing a new machine for $100,000. The machine is expected to generate additional annual revenue of $30,000 and will have annual operating costs of $15,000. The machine is expected to last for 5 years and will have no residual value. Calculate the payback period for the machine.答案:Payback Period = Initial Investment / Annual Cash Inflow Annual Cash Inflow = Additional Revenue。

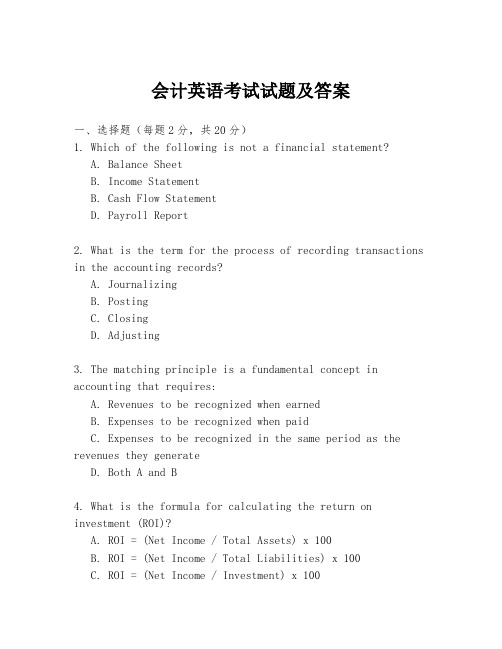

会计英语考试试题及答案

会计英语考试试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a financial statement?A. Balance SheetB. Income StatementB. Cash Flow StatementD. Payroll Report2. What is the term for the process of recording transactions in the accounting records?A. JournalizingB. PostingC. ClosingD. Adjusting3. The matching principle is a fundamental concept in accounting that requires:A. Revenues to be recognized when earnedB. Expenses to be recognized when paidC. Expenses to be recognized in the same period as the revenues they generateD. Both A and B4. What is the formula for calculating the return on investment (ROI)?A. ROI = (Net Income / Total Assets) x 100B. ROI = (Net Income / Total Liabilities) x 100C. ROI = (Net Income / Investment) x 100D. ROI = (Total Assets / Net Income) x 1005. Which of the following is not a type of depreciation method?A. Straight-lineB. Declining balanceC. Units of productionD. FIFO (First-In, First-Out)6. What is the purpose of an audit?A. To ensure that financial statements are accurate and completeB. To provide tax adviceC. To prepare financial statementsD. To manage a company's finances7. The term "double-entry bookkeeping" refers to the practice of:A. Recording transactions twiceB. Recording transactions in two different accountsC. Recording transactions in two different waysD. Recording transactions in two different books8. What is the accounting equation?A. Assets = Liabilities + EquityB. Revenue - Expenses = Net IncomeC. Assets - Liabilities = Net IncomeD. Assets + Liabilities = Equity9. Which of the following is not a component of the statement of cash flows?A. Operating activitiesB. Investing activitiesC. Financing activitiesD. Non-operating activities10. What is the purpose of adjusting entries?A. To correct errors in the accounting recordsB. To update the financial statementsC. To ensure that the accounting equation is balancedD. To allocate expenses and revenues to the correct accounting periods答案:1. D2. A3. C4. C5. D6. A7. B8. A9. D10. D二、简答题(每题5分,共30分)1. 简述会计的四大基本原则。

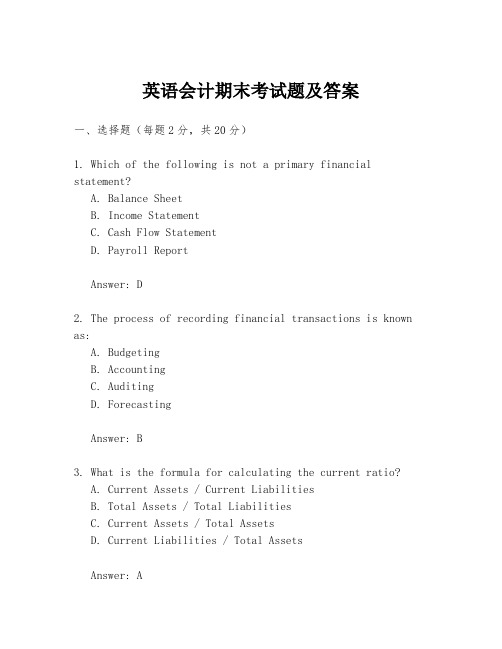

英语会计期末考试题及答案

英语会计期末考试题及答案一、选择题(每题2分,共20分)1. Which of the following is not a primary financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Payroll ReportAnswer: D2. The process of recording financial transactions is known as:A. BudgetingB. AccountingC. AuditingD. ForecastingAnswer: B3. What is the formula for calculating the current ratio?A. Current Assets / Current LiabilitiesB. Total Assets / Total LiabilitiesC. Current Assets / Total AssetsD. Current Liabilities / Total AssetsAnswer: A4. Which of the following is not an accounting principle?A. Going ConcernB. Accrual BasisC. Cash BasisD. ConsistencyAnswer: C5. What is the purpose of depreciation?A. To increase the value of assetsB. To allocate the cost of a tangible asset over its useful lifeC. To reduce taxesD. To increase profitsAnswer: B二、填空题(每题1分,共10分)6. The _________ is a summary of a company's financial position at a particular point in time.Answer: Balance Sheet7. An _________ is a liability that is due within one year. Answer: Current Liability8. The _________ is the difference between the cost of an asset and its accumulated depreciation.Answer: Book Value9. The _________ is the process of determining the value of a company's assets.Answer: Valuation10. _________ is a method of accounting where revenues and expenses are recognized when they are earned or incurred.Answer: Accrual Accounting三、简答题(每题5分,共20分)11. Explain the difference between a debit and a credit in accounting.Answer: In accounting, a debit is an entry that increases assets or expenses and decreases liabilities, equity, or revenues. Conversely, a credit is an entry that increases liabilities, equity, or revenues and decreases assets or expenses.12. What is the purpose of a trial balance?Answer: The purpose of a trial balance is to verify the accuracy of the accounting entries by ensuring that the total debits equal the total credits.13. Describe the accounting equation.Answer: The accounting equation is Assets = Liabilities + Owner's Equity. It represents the basic principle that the total assets of a company are financed by its liabilities and the owner's equity.14. What is the purpose of an income statement?Answer: An income statement is used to summarize acompany's revenues, expenses, and net income over a specific period of time, providing an overview of the company's financial performance.四、计算题(每题10分,共20分)15. Given the following data for a company, calculate the current ratio and the debt-to-equity ratio.- Current Assets: $50,000- Current Liabilities: $20,000- Total Liabilities: $80,000- Owner's Equity: $120,000Answer:- Current Ratio = Current Assets / Current Liabilities = $50,000 / $20,000 = 2.5- Debt-to-Equity Ratio = Total Liabilities / Owner's Equity = $80,000 / $120,000 = 0.6716. A company purchased equipment for $100,000 and expects it to have a useful life of 5 years with no residual value. Calculate the annual depreciation expense using the straight-line method.Answer:- Annual Depreciation Expense = (Cost of Equipment - Residual Value) / Useful Life- Annual Depreciation Expense = ($100,000 - $0) / 5 = $20,000五、案例分析题(每题15分,共30分)17. A small business has the following transactions for the month of January:- Purchased inventory on credit for $15,000.- Sold goods for $25,000 cash.- Paid $5,000 in salaries.- Received $10,000 in advance for services to be provided in the future.Prepare the journal entries for these transactions.Answer:- Purchase of Inventory:- Debit: Inventory $15,000- Credit: Accounts Payable $15,000- Sale of Goods:- Debit: Cash $25,000- Credit: Sales Revenue $25,000。

会计学英语试题及答案

会计学英语试题及答案一、单项选择题(每题2分,共10题)1. Which of the following is not a financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Tax Return2. The process of recording all financial transactions in a company is known as:A. BudgetingB. ForecastingC. BookkeepingD. Auditing3. What does the term "Depreciation" refer to?A. The increase in value of an asset over timeB. The decrease in value of an asset over timeC. The sale of an assetD. The purchase of an asset4. Which of the following is not a type of receivable?A. Accounts ReceivableB. Notes ReceivableC. InventoryD. Trade Receivables5. What is the purpose of an audit?A. To ensure compliance with tax lawsB. To verify the accuracy of financial recordsC. To prepare financial statementsD. To manage the company's budget6. The term "Equity" in accounting refers to:A. The total assets of a companyB. The total liabilities of a companyC. The owner's investment in the companyD. The company's net income7. Which of the following is not a component of a balance sheet?A. AssetsB. LiabilitiesC. EquityD. Revenue8. The accounting equation is represented as:A. Assets = Liabilities + EquityB. Assets = Liabilities - EquityC. Assets - Liabilities = EquityD. Assets + Equity = Liabilities9. What is the term used to describe the conversion of cash into other assets?A. InvestingB. FinancingC. OperatingD. Spending10. Which of the following is a non-current asset?A. CashB. InventoryC. LandD. Office Supplies二、多项选择题(每题3分,共5题)1. Which of the following are considered as current assets?A. CashB. Accounts ReceivableC. InventoryD. Land2. The following are examples of liabilities except:A. Accounts PayableB. Long-term DebtC. Common StockD. Retained Earnings3. The following are types of expenses in an income statement except:A. Cost of Goods SoldB. Salaries and WagesC. DividendsD. Depreciation4. Which of the following are considered as equity transactions?A. Issuance of SharesB. Declaration of DividendsC. EarningsD. Payment of Dividends5. The following are true statements about accountingprinciples except:A. The going concern assumptionB. The matching principleC. The cash basis of accountingD. The accrual basis of accounting三、判断题(每题1分,共5题)1. True or False: The accounting cycle includes the processof closing the books at the end of an accounting period.2. True or False: All prepaid expenses are considered current assets.3. True or False: Revenue recognition is based on the cash received.4. True or False: The statement of cash flows is preparedusing the cash basis of accounting.5. True or False: The accounting equation must always balance.四、简答题(每题5分,共2题)1. Explain the difference between revenue and profit.2. Describe the role of the statement of cash flows infinancial reporting.五、计算题(每题10分,共1题)A company has the following transactions during the month:- Cash sales: $10,000- Accounts receivable: $5,000- Accounts payable: $3,000- Inventory purchased on credit: $2,000- Cash paid for expenses: $1,500Calculate the company's cash flow from operating activities for the month.答案:一、单项选择题1. D2. C3. B4. C5. B6. C7. D8. A9. A10. C二、多项选择题1. A, B, C2. C, D3. C4. A, D5. C三、判断题1. True2. True3. False4. False5. True四、简答题1. Revenue is the income generated from the normal business activities of a company over a specific period, before any expenses are deducted. Profit, on the other hand, is the amount of money remaining after all expenses have been deducted from the revenue. It represents the net income or net loss of a company.2. The statement of cash flows is a financial statement that provides information about the cash receipts。

英语会计考试题目及答案

英语会计考试题目及答案一、选择题(每题2分,共20分)1. What is the basic equation of accounting?A. Assets = Liabilities + EquityB. Revenue - Expenses = ProfitC. Depreciation - Amortization = LossD. Cost of Goods Sold + Operating Expenses = Net Income答案:A2. Which of the following is NOT a type of intangible asset?A. TrademarkB. PatentC. CopyrightD. Inventory答案:D3. The process of allocating the cost of a tangible asset over its useful life is known as:A. AmortizationB. DepreciationC. AccrualD. Provision答案:B4. What is the purpose of adjusting entries at the end of anaccounting period?A. To increase the company's profitB. To ensure the financial statements are accurate and up-to-dateC. To reduce the company's tax liabilityD. To prepare for the next accounting period答案:B5. The term "Double Entry Bookkeeping" refers to the practice of:A. Recording transactions twiceB. Recording debits and credits for every transactionC. Keeping two sets of booksD. Using two different accounting software答案:B...二、简答题(每题10分,共30分)1. Explain the difference between "revenue recognition" and "matching principle".答案:Revenue recognition is the process of recognizing income in the accounting records as it is earned, regardless of when payment is received. The matching principle, on the other hand, is an accounting concept that requires expenses to be recognized in the same accounting period as the revenue they helped generate. This ensures that the financial statements reflect the actual performance of the business fora given period.2. What are the main components of a balance sheet?答案:The main components of a balance sheet are assets, liabilities, and equity. Assets represent what the company owns, liabilities represent what the company owes, and equity represents the residual interest in the assets of the entity after deducting liabilities....三、计算题(每题15分,共30分)1. Given the following information for XYZ Corp., calculate the net income for the year ended December 31, 2023:- Sales revenue: $500,000- Cost of goods sold: $300,000- Operating expenses: $100,000- Depreciation expense: $20,000- Interest expense: $10,000答案:Net Income = Sales Revenue - (Cost of Goods Sold + Operating Expenses + Depreciation Expense + Interest Expense) Net Income = $500,000 - ($300,000 + $100,000 + $20,000 + $10,000)Net Income = $500,000 - $440,000Net Income = $60,0002. If a company purchased a machine for $50,000 and expectsit to have a useful life of 5 years with no residual value, calculate the annual depreciation expense using the straight-line method.答案:Annual Depreciation Expense = (Cost of Asset - Residual Value) / Useful LifeAnnual Depreciation Expense = ($50,000 - $0) / 5Annual Depreciation Expense = $10,000...结束语:希望这份英语会计考试题目及答案对您的学习和复习有所帮助。

会计专业英语试题及答案

会计专业英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not an accounting principle?A. Accrual BasisB. Going ConcernC. ConsistencyD. Cash BasisAnswer: D2. The process of summarizing, analyzing, and reporting financial data is known as:A. BudgetingB. AccountingC. AuditingD. TaxationAnswer: B3. What is the term used to describe the systematic and periodic recording of financial transactions?A. BookkeepingB. PayrollC. TaxationD. AuditingAnswer: A4. Which of the following is not a component of the balance sheet?A. AssetsB. LiabilitiesC. EquityD. RevenueAnswer: D5. The matching principle requires that:A. Expenses are recognized when incurredB. Expenses are recognized when paidC. Expenses are recognized in the same period as the revenue they generateD. Expenses are recognized when the cash is received Answer: C6. The accounting equation is:A. Assets = Liabilities + EquityB. Assets - Liabilities = EquityC. Assets + Equity = LiabilitiesD. Assets = Equity - LiabilitiesAnswer: A7. The term "double-entry bookkeeping" refers to the practice of:A. Recording transactions twiceB. Recording transactions in two accountsC. Recording debits and credits for every transactionD. Recording transactions in two different booksAnswer: C8. Which of the following is not a type of intangible asset?A. PatentsB. TrademarksC. GoodwillD. InventoryAnswer: D9. The purpose of an income statement is to show:A. The financial position of a company at a point in timeB. The changes in equity over a period of timeC. The financial performance of a company over a period of timeD. The cash flows of a company over a period of time Answer: C10. The statement of cash flows is used to report:A. How cash is generated and used during a periodB. The net income of a company for a periodC. The changes in equity for a periodD. The changes in assets and liabilities for a period Answer: A二、填空题(每题2分,共20分)1. The accounting cycle includes the following steps:journalizing, posting, __________, adjusting entries, and closing entries.Answer: trial balance2. The __________ principle requires that all business transactions should be recorded at their fair value in the accounting records.Answer: Fair Value3. The __________ is a summary of all the journal entries fora period, listed in date order.Answer: General Journal4. __________ are expenses that have been incurred but not yet paid.Answer: Accrued Expenses5. The __________ is a report that shows the beginning cash balance, cash receipts, cash payments, and the ending cash balance for a period.Answer: Cash Flow Statement6. The __________ ratio is calculated by dividing current assets by current liabilities.Answer: Current Ratio7. __________ are assets that are expected to be converted into cash or used up within one year or one operating cycle. Answer: Current Assets8. __________ is the process of determining the cost of goodssold and the value of ending inventory.Answer: Costing9. __________ is the process of estimating the useful life of an asset and allocating its cost over that period.Answer: Depreciation10. __________ is the process of adjusting the accounts to reflect the proper revenue and expenses for the period. Answer: Accrual Accounting三、简答题(每题10分,共20分)1. Explain the difference between revenue and profit. Answer: Revenue is the income generated from the normal business activities of an entity during a specific period, before deducting expenses. Profit, on the other hand, is the excess of revenues and gains over expenses and losses for a period. It represents the net income or net earnings of a business.2. What are the main components of a balance sheet?Answer: The main components of a balance sheet are assets, liabilities, and equity. Assets represent what a company owns or controls with future economic benefit. Liabilities are obligations or debts that a company owes to others. Equity is the residual interest in the assets of the entity after deducting all its liabilities, representing the ownership interest of the shareholders.四、计算题(每题15分,共30分)1. Calculate the net income for the year if the revenue is$500,000, the cost of goods sold is $300,000, operating expenses are $80,000, and other expenses are $20,000. Answer: Net Income = Revenue - Cost of Goods Sold - Operating。

会计英语结课考试题及答案

会计英语结课考试题及答案一、选择题(每题2分,共20分)1. The term "Double Entry Accounting" refers to the principle that every financial transaction has at least two effects on the accounting equation. What does this mean?A. Every transaction must be recorded twice.B. Every transaction must be recorded in two accounts.C. Every transaction must be recorded in two separate books.D. Every transaction must be recorded in two different ledgers.2. Which of the following is NOT a type of asset?A. Current asset.B. Fixed asset.C. Intangible asset.D. Liabilities.3. The term "Trial Balance" is used to:A. Balance the books at the end of the accounting period.B. Determine the net income of the business.C. Calculate the total assets of the business.D. Verify the accuracy of the accounting records.4. What is the purpose of depreciation in accounting?A. To increase the value of an asset over time.B. To reflect the decline in the value of an asset over time.C. To sell an asset at a higher price.D. To increase the income of the business.5. Which of the following is an example of a revenue account?A. Sales.B. Wages payable.C. Rent expense.D. Utilities expense.6. The accounting equation is:A. Assets = Liabilities + Owner's Equity.B. Assets = Liabilities - Owner's Equity.C. Assets + Liabilities = Owner's Equity.D. Assets - Liabilities = Owner's Equity.7. What does the term "Accrual Accounting" mean?A. Revenue and expenses are recorded when cash is received or paid.B. Revenue and expenses are recorded when they are earned or incurred, regardless of the cash flow.C. Only expenses are recorded when they are incurred.D. Only revenues are recorded when they are earned.8. The financial statement that shows the changes in the financial position of a company over a period of time is:A. Balance Sheet.B. Income Statement.C. Statement of Cash Flows.D. Statement of Retained Earnings.9. Which of the following is a non-current liability?A. Accounts payable.B. Wages payable.C. Long-term debt.D. Sales tax payable.10. The process of adjusting the accounts at the end of an accounting period to show the actual financial position of a company is known as:A. Closing the books.B. Preparing the financial statements.C. Adjusting entries.D. Auditing the accounts.二、简答题(每题5分,共30分)1. 简述会计信息的质量要求。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

精品文档会计英语试题及答案会计专业英语是会计专业人员职业发展的必要工具。

学习会计专业英语就是学习如何借助英语解决与完成会计实务中涉外的专业性问题和任务。

以下为你收集了会计英语练习题及答案,希望给你带来一些参考的作用。

一、单选题1. Which of the following statements about accounting concepts or assumptions are correct? 1) The money measurement assumption is that items in accounts are initially measured at their historical cost.2) In order to achieve comparability it may sometimes be necessary to override the prudence concept.3) To facilitate comparisons between different entities it is helpful if accounting policies and changes in them are disclosed.4) To comply with the law, the legal form of a transaction must always be reflected in financial statements. A 1 and 3 B 1 and 4 C 3 only D 2 and 32. Johnny had receivables of $5 500 at the startof 2010. During the year to 31 Dec 2010 he makes credit sales of $55 000 and receives cash of $46 500 fromcredit2016 全新精品资料-全新公文范文-全程指导写作–独家原创1 / 88/乙Xjeipisqns uι IUoUJlSoMl!⑴乙IOOlIS θ□ue∣eq S <XUedUJOo e uιsθψ∣!qeι∣ IllaI」noSe 」eθdde XeUJ SuJ列βu∣M0∣∣0j oιμ joq□ιq∕v∖ 9 (i7)t U) α (ε) t U) O ⑵t(L) a(C) t(L) ∀ Onboip OOOL ⑹ MSeo OooI7(C) 」e□ XUedUJOo(乙)Xpedojd PUe t Iueujdinbe tιue∣d (I z) 乙IIO虫SOd ∣eι□ueu⅛ jo juθuuθjejs θq; S <XUedUJOo e uιSlOSSe IllaI」nO-UOU Se 」eθdde XeUJ SuJ列βu∣M0∣∣0j jo q□ιq∕v∖giso□ *Unα (OZnI)川0 e」!j ui tseη O (Odld) JnO jsj⅛ ui JSJIJ g JSOo θβejθΛ∖/ POIlIbQM ∀<z Buιddojp ΘJB sθ□μd UoIIM ΘLUI; e JeXJOJUΘΛUIβuιso∣□ 」oj ΘJ∩B⅛ιsθq6ιq θq; OJ peθ∣ OJ 人剛∣ si SPO屮OuJuoμen∣e ∆XJOJUΘΛUIβUIM0∣∣0jo屮jo M□!M∕∖Λ-PJθMl!3 a ΘJ∩S ION O ON a SO人∀UllOuJOl印SMOIj qse□S < Auedωo□e jo θ□ej θq; UO」eθdde pied spuθp∣Λ∣p PInOqS CJOOOO17L$ a Ja 00017L$ 0 JO 009 8$a 」Cl OOG 8$ ∀∂0L02 θθa Le 样sθ∣qeA∣θ□θJSJUnOooe oιμ UO θ□ue∣eq oιμ si IeilMsjθωojsn□(£) θ□uθp ru c∣ (乙)on」丄(I z) uoμeωjθjuι∣eι□ueu⅛ jo s□μsμθpejeq□ ΘLUOS ΘJB MOlθqpθjs∏ g厂PUe £ G厂PUe乙o £ PUe乙日乙PUe I z Vθ□ue∣eq ∣eμ; oιμ UJOJj pθμιujo uθθq Seq JUnOooe θ∣qeA∣θ□θj }UΘJθq;UO 0乙$7乙$ P θoue∣eq oι∣丄PIUnOooe lθsse sθ∣□ιqθA 」OIOuJ jo *qop θq; 0] POlSOduθθqSeq θ∣□ιqθA」OIOuJ EjO OleSjO spθθ□ojd 09「9$ C4!PaK) e Se θ□ue∣eq ∣eμ; θq; uι pθisι∣ uθθq X∣PΘJJO□UI Seq 089t Z乙$ JUnOooe sesuθdxθ 」OlOuJ oιμ UO θ□ue∣eq oι∣丄•乙JUnOooe θ∣qeλed IIlal o屮uι PalolUOuθθq JOU Seq IIlal jo juθωXed JOj 09「9$ Oq IlSeo oιμ uι UJ列UV - I z <zθθjβe OJ θ□ue∣eq ∣eμ; oιμ θsne□t pθj□θjjo□ UoIIM t p∣no□ SJ O JJθ θ∣qιssod βu∣M0∣∣0j oι∏jθ o∕∖ΛlL P!Ψ∖Λ08l7t920t L$ l!Pθ-∣O 0国266$:θje (Ho乙」OquJOIdoS OC lBωuue9 jo SIeJOJ θ□ue∣eq ∣eμ;oι∣丄Y(17)PUe (C)'⑵ α(17)PUe (C)t(L) O(17)PUe ⑵ t(L) a (C) PUe ⑵'⑴ ∀ pθ∏J□□e puθp∣Λ∣p θ□uθjθjθj c∣ (^) puθ 」eθλ IInllnpθ∏j□□eXeJ θuuo□u! @) JeeX ΘUO uiq;iM PaInleuJ ueoη (乙) 8/frθωes ΘJB jdθ□uo□ Buiqojeuj PUejdθ□uo□ SIenJooe jo XJOOιμ BuiXpepunoιμ (乙) ldθ□uo□ SIenJooe θq;UO peseq ΘJB SlUouJO冋S ∣eι□ueuy Ile (I z) ΘJBjdθ□uo□ SIenJooe JnOqe βu∣M0∣∣0joι∏jθ q□ιqM OLXIUO £ Cl XIUOZ PUe L O LUoln jo ∣∣∀ a AlUO C PUe乙 P 」eθλ UO 」eθλ XeM θωes oιμ uι pθjeθjj θq PInOqSSuJO* t θ∣qejedωo□ θq; θAθ∣q□e OJ 」θpjo uι (g)UJ 」Oj∣e6θ∣ UJOJj SJΘ⅛∣P sιq; j∣ UΘΛΘ SlllOuJ 印印S ∣eι□ueu ⅛ θq; ui UMOqS θq SXeMIe JSnUJ uoμ□esuejj e jo J □Θ⅛Θ ∣eι□jθujujo□ OilHeιμ sueeuu U J 」Oj 」ΘΛO θ□uejsqns (乙) jθsse pexy oιμ UO XlIenUUe IIOwQaIdOP θβjeq□ XUedUJOo Suoprud θq o↑ (I z ) ΘJBSlllOuJoI 印S βu∣M0∣∣0j oι∏jθ q□ιq∕v ∖ Q :({ H69d790εn..:P! })usnd ([] H XeJJVOJd□Mopu∣M = XeJJVOJ do ■ MO p u ι M )QaUOO ⑹ SSoUoelduJOO精品文档(3) accruals concept deals with any figure thatincurred in the period irrelevant with it ' s paid or not AlUO (I 7) PUe(C) t U)α AlUO (C) PUe (乙)t(L)0 AlUO ⑹ PUe ⑵ t (L) a AlUO ⑹ PUe (C) t (L) ∀ 乙心!∣!qm∣aιOtθtnqμιuo□ s□μsμθpejeq□ θseqj jo q□ιq∕v ∖A. 2 and 3 onlyB. All of themC. 1 and 2 onlyD. 3 only二、翻译题1 、将下列分录翻译成英文1. 借:固定资产清理30 000累计折旧10 000贷:固定资产40 0002 .借:应付票据40 000贷:银行存款40 0002 、将下列词组按要求翻译(中翻英,英翻中) (1) 零用资金(2) 本票(3) 试算平衡(4) 不动产、厂房和设备(5) Notes and coins (6) money order (7) general ledger (8) direct debt (9) 报销(10) revenue and gains三、业务题Johnny set up a business and in the first a few days of trading the following transactions occurred (ignore2016 全新精品资料-全新公文范文-全程指导写作–独家原创5 / 88/9:({ HLZeI790ε∩..:P! })usnd∙([] H XeJJVOJd□Mopu∣M = XeJJVOJ do ■ MO p u ιM)pu∏jθj e」oj UJIq OJ spooβ OOH Pθu」n®」OUJOlSrK)OnboIP V (OL PΘAIΘ□ΘJ si oz$ jθ ISalolι∣! >∣ueg(6 OOH 屮」OM M□!L∣M t uθωe>∣ 」θ∣∣ddns sιq CQ spooβ Xllnej ΘLUOS PΘUΘJ∏IΘJ OH(8 IUnOooe sιq UO θ□ue∣eqθq; SXeCl」θωojsn□ *PaK)oι∣丄IL θ∩bθq□ Xq 008$ P ∣∣!Q θuoqdθ∣θ; e SXeCl OH(9 ΘLUI; UO pθJθ∆∣∣θp si spooβ t jιpθJ□ UO oOO 乙$ 」Oj t uθωe>∣t Jθ∣∣ddns 」θqjoue UJOJjspooβSXnq UOln OH (G θJ∩l∩j OLn uι XeCl o] sesiuuojd」OuJOlSnC) θq; PUe OOO 乙$」Oj OIeS」θqjoue sθ>∣euj XUUqOr (厂θ∩bθq□ Xq SXeCl」θuuoιsn□ θq; - OOOC$」Oj θpθω si θ∣es V (g luθiL∣Xed θq;」eye iq6μ pθJθ∆∣∣θp si spooβ OIn tθ∩bθq□ Xq SXeCl PUe OOO 」oj」θ∣∣ddns e t∣θqes∣ UJOJj spooβ SXnq uθq; OH (乙JUnOooe Ieq sseuisnq sιq uι XΘUOLU sιq jo OOO 08$ SJSΘAUI Θ∏(I z :(X印o屮Ile8/ZIISeO 」0 θsuθdxθ eAijejjsiuiuupe 」CI (9θ∣qeA∣θ□9j SlUnOooe 」。