会计专业英语模拟试题及答案word版本

会计专业英语模拟试题及答案word版本

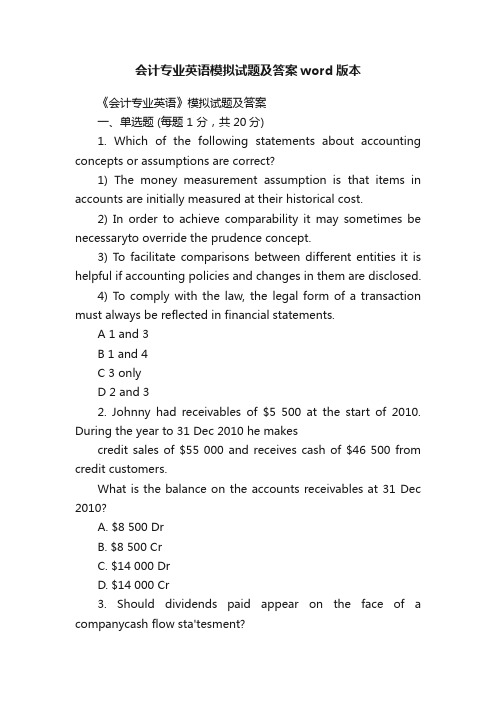

会计专业英语模拟试题及答案word版本《会计专业英语》模拟试题及答案一、单选题 (每题 1 分,共20分)1. Which of the following statements about accounting concepts or assumptions are correct?1) The money measurement assumption is that items in accounts are initially measured at their historical cost.2) In order to achieve comparability it may sometimes be necessaryto override the prudence concept.3) To facilitate comparisons between different entities it is helpful if accounting policies and changes in them are disclosed.4) To comply with the law, the legal form of a transaction must always be reflected in financial statements.A 1 and 3B 1 and 4C 3 onlyD 2 and 32. Johnny had receivables of $5 500 at the start of 2010. During the year to 31 Dec 2010 he makescredit sales of $55 000 and receives cash of $46 500 from credit customers.What is the balance on the accounts receivables at 31 Dec 2010?A. $8 500 DrB. $8 500 CrC. $14 000 DrD. $14 000 Cr3. Should dividends paid appear on the face of a companycash flow sta'tesment?A. YesB. NoC. Not sureD. Either4. Which of the following inventory valuation methods is likely to lead to the highest figure for closinginventory at a time when prices are dropping?A. Weighted Average costB. First in first out (FIFO)C. Last in first out (LIFO)D. Unit cost5. Which of following items may appear as non-currentassets in a company the'stsatement of financial position?(1) plant, equipment, and property(2) company car(3) ?4000 cash(4) ?1000 chequeA. (1), (3)C. (2), (3)D. (2), (4)6. Which of the following items may appear as current liabilities in a company ' s balance sheet?(1) investment in subsidiary(2) Loan matured within one year.(3) income tax accrued untill year end.(4) Preference dividend accruedA (1), (2) and (3)B (1), (2) and (4)C (1), (3) and (4)D (2), (3) and (4)7. The trial balance totals of Gamma at 30 September 2010 are:Debit $992,640Credit $1,026,480Which TWO of the following possible errors could, when corrected, cause the trial balance to agree? 1. An item in the cash book $6,160 for payment of rent has not been entered in the rent payable account.2. The balance on the motor expensesaccount $27,680 has incorrectly been listed in the trial balance as a credit.3. $6,160 proceeds of sale of a motor vehicle has been posted to the debit of motor vehicles asset account.4. The balance of $21,520 on the rent receivable account has been omitted from the trial balance.A 1 and 2B 2 and 3C 2 and 4D 3 and 48. Theta prepares its financial statements for the year to 30 April each year. The company pays rent for its premises quarterly in advance on 1 January, 1 April, 1 July and 1 October each year. The annual rent was $84,000 per year until 30 June 2010. It was increased from that date to $96,000 per year. What rent expense and end of year prepayment should be included in the financial statements for the year ended 30 April 2010?Expense PrepaymentA $93,000 $8,000B $93,000 $16,000C $94,000 $8,000D $94,000 $16,0009. At 30 September 2010, the following balances existed in the records of Lambda:Pla nt and equipme nt: $860,000Depreciati on for pla nt and equipme nt: $397,000During the year ended 30 September 2010, plant with a written down value of $37,000 was sold for $49,000. The plant had originally cost $80,000. Plant purchasedduring the year cost $180,000. It is the compa ny.s policy to charge a full year depreciati on in the year of acquisiti on of an asset and none in the year of sale, using a rate of 10% on the straight li ne basis. What net amount should appear in Lambda.s bala nee sheet at30 September 2010 for pla nt and equipme nt?A $563,000C $510,000D $606,00010. A company' s plant and machinery ledger account ithie year ended 30 September 2010 was as follows:Pla nt and machi neryostproporti on ate depreciati on in years of purchase and disposal. What is the depreciati on charge for the year e nded 30 September 2010?A $74,440B $84,040C $72,640D $76,84011. Listed below are some characteristics of finan cial informati on.(1) True⑵ Prude nee(3) Complete ness⑷ CorrectWhich of these characteristics con tribute to reliability?A (1),⑶ and ⑷ onlyB (1),⑵ and ⑷ onlyC (1),⑵ and ⑶ onlyD⑵,⑶and⑷only12. T he pla nt and mach inery cost acco unt of a compa ny is show n below. The compa ny policy is to charge depreciati on at 20% on the straight line basis, with proporti on ate depreciati on in years of acquisiti on and disposal.ostPla nt and machi neryA. $67,000B. $64,200D. $68,60013. In preparing its financial statements for the current year,a company ng inventory ' s closi was un derstated by $300,000. What will be the effect of this error if it remai ns un corrected?A The current year ' s profit will be overstated and next year ' s profit will be understB The current year' s profit will be understatedbut there will be no effect on next year' s profitC The current year ' s profit will be understated and next year ' s profit will be overstateD The current year' profit will be overstated but there will be no effect on next year' s profit.14. I n preparing a company's cash flow statement,which, if any, of the following items could form part of the calculati on of cash flow from financing activities?(1) Proceeds of sale of premises(2) Divide nds received(3) Issue of sharesA 1 onlyB 2 on lyC 3 on lyD No ne of them.15. At 31 March 2009 a compa ny had oil in ha nd to be used for heat ing costi ng $8,200 andan un paid heati ng oil bill for $3,600. At 31 March 2010 the heat ing oil in ha nd was $9,300 and there was an outstanding heating oil bill of $3,200. Payments made for heating oil duri ng the year en ded 31 March 2010 totalled $34,600. Based on these figures, what amount should appear in the compa ny ' s in come stateme nt for heati ngyefr theA $23,900B $36,100C $45,300D $33,10016. In times of inflation In times of rising prices, what effect does the use of the historicalcost concept have on a company ' s asset values and profit?A. Asset values and profit both un dervaluedB. Asset values and profit both overvaluedC. Asset values undervalued and profit overvaluedD. Asset values overvalued and profit undervalued17. Beta purchased some plant and equipment on 01/07/2010 for $60,000. The estimated residualvalue of the plant in 10 years time is estimated to be $6,000. Beta ' s policytois charge depreciation on the straight line basis, with a proportionate charge in the period of acquisition. What should the depreciation charge for the plant be in Beta 'asccounting period of 18 months to 30/09/2010 ?A. $5400B. $900C. $1350D. $67518. A company' isncome statement for the year ended 31 December 2005 showed a net profit of $83,600. It was later found that $18,000 paid for the purchase of a motor van had been debited to the motor expenses account. It is the company ' s policy to depreciate vans at 25 per cent per year on the straight line basis, with a full eyar ' s crhgae in the year of acquisition. What would the net profit be after adjusting for this error?A. $97,100B. $70,100C. $106,100D. $101,60019. Which of the following statements are correct?(1) to be prudent, company charge depreciation annually on the fixed asset(2) substance over form means that the commercial effect ofa transaction must always be shown in the financial statementseven if this differs from legal form(3) in order to achieve the comparable, items should be treated in the same way year on yearA. 2 and 3 onlyB. All of themC. 1 and 2 onlyD. 3 only20. which of the following about accruals concept are correct?(1) all financial statements are based on the accruals concept(2) the underlying theory of accruals concept and matching concept are same(3) accruals concept deals with any figure that incurred in the period irrelevant with it or notA. 2 and 3 onlyB. All of themC. 1 and 2 onlyD. 3 only。

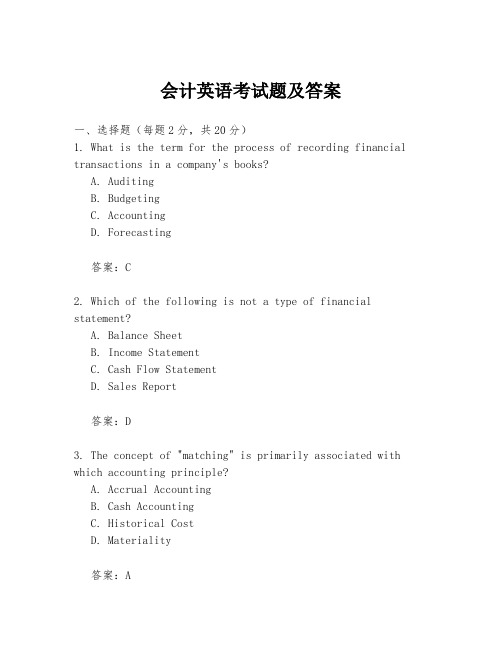

会计英语考试题及答案

会计英语考试题及答案一、选择题(每题2分,共20分)1. What is the term for the process of recording financial transactions in a company's books?A. AuditingB. BudgetingC. AccountingD. Forecasting答案:C2. Which of the following is not a type of financial statement?A. Balance SheetB. Income StatementC. Cash Flow StatementD. Sales Report答案:D3. The concept of "matching" is primarily associated with which accounting principle?A. Accrual AccountingB. Cash AccountingC. Historical CostD. Materiality答案:A4. What does the term "double-entry bookkeeping" refer to?A. Recording transactions twiceB. Keeping two sets of booksC. Balancing debits and creditsD. Recording transactions in two different accounts答案:C5. The process of verifying the accuracy of a company's financial records is known as:A. ReconciliationB. CompilationC. ReviewD. Appraisal答案:A6. What is the purpose of depreciation in accounting?A. To increase the value of an assetB. To allocate the cost of a tangible asset over its useful lifeC. To sell an assetD. To recognize an asset's gain答案:B7. The accounting equation is:A. Assets = Liabilities + EquityB. Assets - Liabilities = EquityC. Liabilities + Equity = AssetsD. All of the above答案:D8. Which of the following is an example of a current liability?A. Long-term debtB. Accounts payableC. Common stockD. Property, plant, and equipment答案:B9. What is the term used for the difference between the cost and the net selling price of inventory?A. Gross profitB. Net profitC. Cost of goods soldD. Inventory valuation答案:C10. The primary goal of financial statement analysis is to:A. Prepare tax returnsB. Evaluate a company's financial performance and positionC. Determine the market value of a companyD. Audit a company's financial records答案:B二、填空题(每空1分,共10分)1. The __________ is a summary of a company's financial performance over a specific period of time.答案:Income Statement2. The __________ is a statement that shows the changes in a company's financial position from one accounting period to the next.答案:Cash Flow Statement3. The __________ is the process of allocating the cost of an asset over its useful life.答案:Depreciation4. In accounting, the __________ principle states that revenue and expenses should be recognized in the period in which they are earned or incurred.答案:Matching5. __________ is the process of adjusting account balances to reflect the actual financial position of a company at the end of an accounting period.答案:Closing the Books6. The __________ is the difference between the total assets and total liabilities of a company.答案:Net Worth7. __________ is the process of comparing a company's financial statements with those of another company in the same industry to evaluate its performance.答案:Comparative Analysis8. The __________ is the estimated useful life of a tangible asset.答案:Useful Life9. __________ is the process of estimating the value of a company's assets at the time of a transaction.答案:Valuation10. The __________ is a method of accounting where revenues and expenses are recognized when cash is received or paid.答案:Cash Accounting三、简答题(每题5分,共20分)1. Explain the purpose of an audit in the context offinancial reporting.答案:An audit serves to provide an independent assessment of a company's financial statements, ensuring their accuracy, reliability, and compliance with accounting standards. It increases the credibility of financial reports and helps stakeholders make informed decisions.2. What are the main components of a balance sheet?答案:The main components of a balance sheet are assets, liabilities, and equity. Assets represent what a company owns, liabilities represent what a company owes, and equity is the residual interest in the assets after deducting liabilities.3. Describe the difference between revenue recognition and realization in accounting.答案:Revenue recognition is the process of recording revenue in the accounting period when it is earned, regardless of when payment is received. Realization, on the other hand, refers to the point at which revenue is considered。

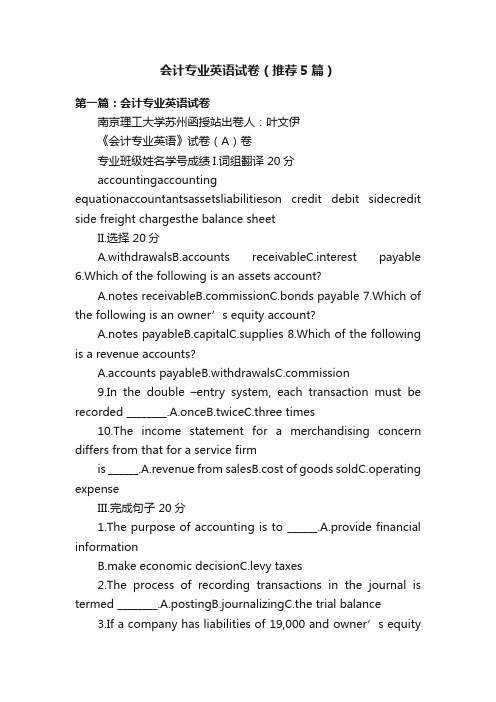

会计专业英语试卷(推荐5篇)

A.withdrawalsB.accounts receivableC.interest payable 6.Which of the following is an assets account?

A.notes missionC.bonds payable 7.Which of the following is an owner’s equity account?

Passage 1

Many rule govern drivers on the streets and highways.The most common one is the speed limit.The speed limit controls how fast a car may go.On streets in the city, the speed limit is usually 25 or 35 miles per hour.On the highways between cities, the speed limit is usually 55 miles per hour.When people drive faster than the speed limit, a policeman can stop them.The policeman gives them pieces of paper which call traffic tickets.Traffic tickets tell the drivers how much they must pay.When drivers receive too many tickets, they probably cannot drive for a while.The rush hour is when people are going to or returning from work.At rush hour there are many cars on the streets and traffic moves very slowly.Nearly al big cities have rush hours and traffic jams.Drivers do not get tickets very often for speeding during the rush hour because they cannot drive fast.1.The most common rule to govern drivers on the streets and highways is _____.A.the traffic lightB.the traffic licenseC.the traffic jamD.th计专业英语试卷(推荐5篇)

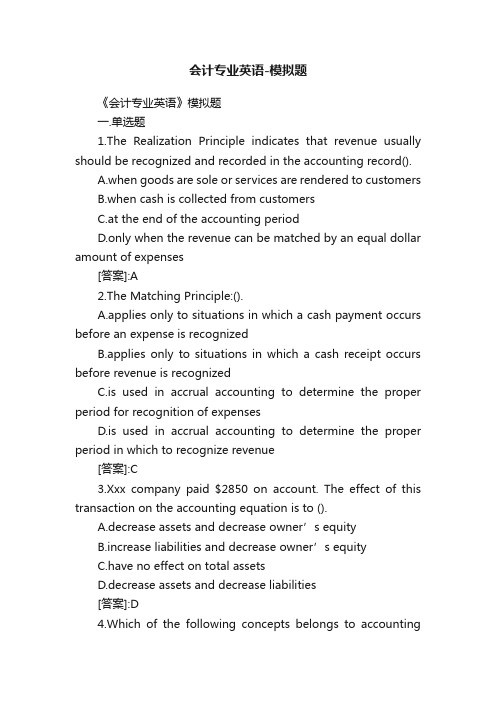

会计专业英语-模拟题

会计专业英语-模拟题《会计专业英语》模拟题一.单选题1.The Realization Principle indicates that revenue usually should be recognized and recorded in the accounting record().A.when goods are sole or services are rendered to customersB.when cash is collected from customersC.at the end of the accounting periodD.only when the revenue can be matched by an equal dollar amount of expenses[答案]:A2.The Matching Principle:().A.applies only to situations in which a cash payment occurs before an expense is recognizedB.applies only to situations in which a cash receipt occurs before revenue is recognizedC.is used in accrual accounting to determine the proper period for recognition of expensesD.is used in accrual accounting to determine the proper period in which to recognize revenue[答案]:C3.Xxx company paid $2850 on account. The effect of this transaction on the accounting equation is to ().A.decrease assets and decrease owner’s equityB.increase liabilities and d ecrease owner’s equityC.have no effect on total assetsD.decrease assets and decrease liabilities[答案]:D4.Which of the following concepts belongs to accountingassumption?().A.ConservationB.Money measurementC.MaterialityD.Consistency[答案]:B5.Which of these is/are an example of an asset account?___A.service revenueB.withdrawalsC.suppliesD.all of the above[答案]:C6.Which of these statements is false?().A.increase in assets and increase in revenues are recorded with a debitB.increase in liabiliti es and increase in owner’s equity are recorded with a c reditC.increase in both assets and withdrawals are recorded with a debitD.decreases in liabilities and increase in expenses are recorded with a debit[答案]:A7.Note payable has a normal beginning balance of $30 000. During the period, new borrowings total $63,000 and the ending balance in Note Payable is $41,000. Determine the payments on loans during the period. ______A.$74000B.$52000C.$134000D.[答案]:B8.Typical liability accounts include _____.A.accounts payable, bank loan, wages payable, drawingsB.Accounts payable, bank overdraft, wages payable, stationaryC.Accounts receivable, bank overdraft, wages payableD.Accounts payable, borrowing from the public, bank overdraft, wages payable.[答案]:D9.Which of these accounts has a normal debit balance?_____.A.Rent ExpenseB.WithdrawalsC.Service RevenueD.Both A and B have a normal debit balance[答案]:D二.判断题1.Accounting provides financial information that is only useful to business management.()[答案]:F2.The accounting process generates financial reports for both “internal” and “external” u sers.() [答案]:T3.The basic concept of double-entry accounting is that total debits must equal total credits for every business transaction.() [答案]:T4.A trial balance represents a listing of the ledger accounts and balances at a particular moment in time.()[答案]:T5.The ledger account provides a chronological order of transactions.()6.Post reference columns are found only in the journal, notin the ledger.()[答案]:F/doc/169122957.html,ually two signatures are required on a business check for it to be valid.() [答案]:T8.When a check is written by a business, the immediate effect is to reduce both the balance shown in the checkbook and the balance on the bank's records. ()[答案]:F9.The final amounts shown on both sides of the bank reconciliation statement are labeled "Adjusted Balances."() [答案]:T10.A leasehold is an example of a long-life asset.()[答案]:F11.The accounting reporting period agrees to the calendar year. ()[答案]:F12.An increase in permanent capital is recorded as a credit to the account. ()[答案]:T13.Dollar signs are used in the amount areas of the ledger accounts. ()[答案]:F14.If the trial balance shows that the ledger is in balance, this means that the individual business transactions were recorded to the appropriate ledger accounts. ()[答案]:F15.Every business transaction is first recorded in the journal. ()[答案]:T16.Internal control of operations is equally complex in a small and in a large organization. ()[答案]:F17.Two documents used in preparing a bank reconciliation statement are the bank statement and the checkbook stubs.() [答案]:T18.A common cause of inequality between the balances on the bank statement and in the checkbook is outstanding checks. ()19.Depreciation expense is usually recorded at least once a year. ()[答案]:T20.Amortization is the conversion of the cost of an intangible asset to an expense. ()[答案]:T21.Two methods of recognizing accelerated depreciation are the straight-line and the double-declining balance method.() [答案]:F22.Research and development costs represent an intangible asset. ()[答案]:T23.A present reduction in cash required to generate revenues is called “an expense”[答案]:F24.The revenue expenses are paid to influence the current operating result.[答案]:F25.Advertising expense is usually collected as period expense.[答案]:T26.There are only two parties to a check: the person who writes it (the drawee) and the person to whom it is written (the payee). ()[答案]:F27.Repair of a generator is a capital expenditure. ()[答案]:F28.Revenue increases owner's equity.()[答案]:T29.Revenue is recognized when we receive cash from the buyers.()[答案]:F30.Interest revenue should be measured based on the length of time. ()[答案]:T三.翻译题1.Sole Proprietorship Enterprises[答案]:独资企业2.Profit cost and capital cost principle[答案]:划分收益性支出与资本性支出3.Double entry system[答案]:复式记帐法4.Source documents[答案]:原始凭证5.Environmental accounting[答案]:环境会计6.Matching principle[答案]:配比原则7.Gross profit[答案]:毛利8.Perpetual inventory system[答案]:永序盘存制9.Intangible assets[答案]:无形资产10.fixed asset[答案]:固定资产11.Statement of cash flows[答案]:现金流量表12.Bank Reconciliation[答案]:银行余额调节表13.Low-valued and easily-damaged implements [答案]:低值易耗品14.Physical depreciation[答案]:有形损耗15.Short-term debt-paying ability[答案]:短期偿债能力16.Accelerated depreciation method[答案]:加速折旧法17.notes receivable[答案]:应收票据18.long-term solvency[答案]:长期偿债能力四.论述题1.完成下列等式:1. Accounting Equation:Assets =2. Perpetual inventory system:Ending Inv. =[答案]:1. Accounting Equation:Assets = Liabilities + Owner's Equity2. Perpetual inventory system:Ending Inv. =Beg. Inv.+ Purchases-Cost of goods sold。

会计专业英语习题答案共73页word资料

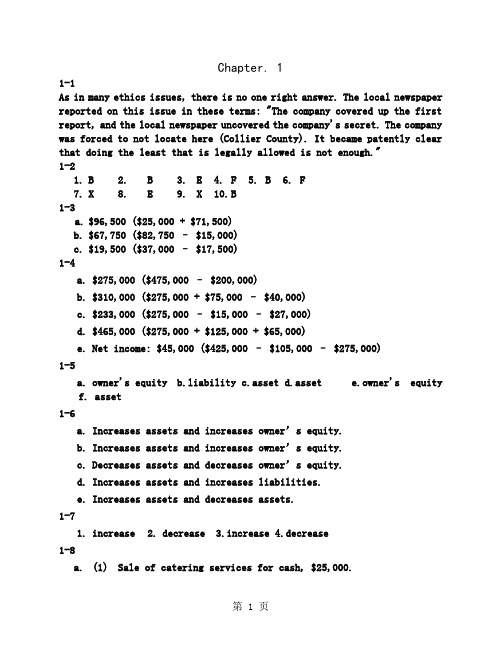

Chapter. 11-1As in many ethics issues, there is no one right answer. The local newspaper reported on this issue in these terms: "The company covered up the first report, and the local newspaper uncovered the company's secret. The company was forced to not locate here (Collier County). It became patently clear that doing the least that is legally allowed is not enough."1-21. B2. B3. E4. F5. B6. F7. X 8. E 9. X 10. B1-3a. $96,500 ($25,000 + $71,500)b. $67,750 ($82,750 – $15,000)c. $19,500 ($37,000 – $17,500)1-4a. $275,000 ($475,000 – $200,000)b. $310,000 ($275,000 + $75,000 – $40,000)c. $233,000 ($275,000 – $15,000 – $27,000)d. $465,000 ($275,000 + $125,000 + $65,000)e. Net income: $45,000 ($425,000 – $105,000 – $275,000)1-5a. owner's equityb.liabilityc.assetd.assete.owner's equityf. asset1-6a. Increases assets and increases owner’s equity.b. Increases assets and increases owner’s equity.c. Decreases assets and decreases owner’s equity.d. Increases assets and increases liabilities.e. Increases assets and decreases assets.1-71. increase2. decrease3.increase4.decrease1-8a. (1) Sale of catering services for cash, $25,000.(2) Purchase of land for cash, $10,000.(3) Payment of expenses, $16,000.(4) Purchase of supplies on account, $800.(5) Withdrawal of cash by owner, $2,000.(6) Payment of cash to creditors, $10,600.(7) Recognition of cost of supplies used, $1,400.b. $13,600 ($18,000 – $4,400)c. $5,600 ($64,100 – $58,500)d. $7,600 ($25,000 – $16,000 – $1,400)e. $5,600 ($7,600 – $2,000)1-9It would be incorrect to say that the business had incurred a net loss of $21,750. The excess of the withdrawals over the net income for the period is a decrease in the amount of owner’s equity in the business.1-10Balance sheet items: 1, 3, 4, 8, 9, 101-11Income statement items: 2, 5, 6, 71-12MADRAS COMPANYStatement of Owner’s EquityFor the Month Ended April 30, 2006Leo Perkins, capital, April 1, 2006 ........ $297,200Net income for the month ................... $73,000Less withdrawals ........................... 12,000Increase in owner’s equity................ 61,000Leo Perkins, capital, April 30, 2006 ....... $358,2001-13HERCULES SERVICESIncome StatementFor the Month Ended November 30, 2006Fees earned ................................ $232,120Operating expenses:Wages expense ............................ $100,100Rent expense ............................. 35,000Supplies expense ......................... 4,550Miscellaneous expense .................... 3,150Total operating expenses ............... 142,800 Net income ................................. $ 89,3201-14Balance sheet: b, c, e, f, h, i, j, l, m, n, oIncome statement: a, d, g, k1-151. b–investing activity2.a–operating activity3. c–financing activity4.a–operating activity1-16a. 2003: $10,209 ($30,011 – $19,802)2002: $8,312 ($26,394 – $18,082)b. 2003: 0.52 ($10,209 ÷ $19,802)2002: 0.46 ($8,312 ÷ $18,082)c. T he ratio of liabilities to stockholders’ equity increased from 2002to 2003, indicating an increase in risk for creditors. However, the assets of The Home Depot are more than sufficient to satisfy creditor claims.Chapter. 22-1AccountAccount NumberAccounts Payable 21Accounts Receivable 12Cash 11Corey Krum, Capital 31Corey Krum, Drawing 32Fees Earned 41Land 13Miscellaneous Expense 53Supplies Expense 52Wages Expense 512-2Balance Sheet Accounts Income Statement Accounts1. Assets11 Cash12 Accounts Receivable13 Supplies14 Prepaid Insurance15Equipment2. Liabilities21 Accounts Payable22Unearned Rent3. Owner's Equity31 Millard Fillmore, Capital32 Millard Fillmore, Drawing4. Revenue41Fees Earned5. Expenses51 Wages Expense52 Rent Expense53 Supplies Expense59 Miscellaneous Expense2-3a. andb.Account Debited Account Credited Transaction Type Effect Type Effect(1) asset + owner's equity +(2) asset + asset –(3) asset + asset –liability +(4) expense + asset –(5) asset + revenue +(6) liability –asset –(7) asset + asset –(8) drawing + asset –(9) expense + asset –Ex. 2–4(1) Cash ................................... 40,000Ira Janke, Capital .................. 40,000(2) Supplies ............................... 1,800Cash ................................ 1,800(3) Equipment .............................. 24,000Accounts Payable .................... 15,000Cash ................................ 9,000(4) Operating Expenses ..................... 3,050Cash ................................ 3,050(5) Accounts Receivable .................... 12,000Service Revenue ..................... 12,000(6) Accounts Payable ....................... 7,500Cash ................................ 7,500(7) Cash ................................... 9,500Accounts Receivable ................. 9,500(8) Ira Janke, Drawing ..................... 5,000Cash ................................ 5,000(9) Operating Expenses ..................... 1,050Supplies ............................ 1,050 2-51. debit and credit (c)2. debit and credit (c)3. debit and credit (c)4. credit only (b)5. debit only (a)6. debit only (a)7. debit only (a)2-6a. Liability—credit f. Revenue—creditb. Asset—debit g. Asset—debitc. Asset—debit h. Expense—debitd. Owner's equity i. Asset—debit(Cindy Yost, Capital)—credit j. Expense—debite. Owner's equity(Cindy Yost, Drawing)—debit2-7a. credit g. debitb. credit h. debitc. debit i. debitd. credit j. credite. debit k. debitf. credit l. credit2-8a. Debit (negative) balance of $1,500 ($10,500 –$4,000 –$8,000).Such a nega tive balance means that the liabilities of Seth’s business exceed the assets.b. Yes. The balance sheet prepared at December 31 will balance,with Seth Fite, Capital, being reported in the owner’s equity section as a negative $1,500.2-9a. The increase of $28,750 in the cash account does not indicateearnings of that amount. Earnings will represent the net change in all assets and liabilities from operating transactions.b. $7,550 ($36,300 – $28,750)2-10a. $40,550 ($7,850 + $41,850 – $9,150)b. $63,000 ($61,000 + $17,500 – $15,500)c. $20,800 ($40,500 – $57,700 + $38,000)2-112005Aug. 1 Rent Expense ........................... 1,500Cash ................................ 1,5002 Advertising Expense (700)Cash (700)4 Supplies ............................... 1,050Cash ................................ 1,0506 Office Equipment ....................... 7,500Accounts Payable .................... 7,5008 Cash ................................... 3,600Accounts Receivable ................. 3,60012 Accounts Payable ....................... 1,150Cash ................................ 1,15020 Gayle McCall, Drawing .................. 1,000Cash ................................ 1,00025 Miscellaneous Expense (500)Cash (500)30 Utilities Expense (195)Cash (195)31 Accounts Receivable .................... 10,150Fees Earned ......................... 10,15031 Utilities Expense (380)Cash (380)2-12a.JOURNAL Page 43Post.Date Description Ref. Debit Credit 2006Oct. 27 Supplies ........................ 15 1,320Accounts Payable .............. 21 1,320 Purchased supplies on account.b.,c.,d.Supplies 15Post.BalanceDate Item Ref. Dr. Cr.Dr. Cr.2006Oct. 1 Balance ................ ..... ..... 585 .....27 ....................... 43 1,320 ..... 1,905 ..... Accounts Payable 21 2006Oct. 1 Balance ................ ..... ..... ..... 6,15027 ....................... 43 ..... 1,320 ..... 7,4702-13Inequality of trial balance totals would be caused by errors described in (b) and (d).2-14ESCALADE CO.Trial BalanceDecember 31, 2006Cash ................................. 13,375Accounts Receivable ............................ 24,600Prepaid Insurance .............................. 8,000 Equipment ...................................... 75,000Accounts Payable ............................... 11,180 Unearned Rent .................................. 4,250 Erin Capelli, Capital .......................... 82,420 Erin Capelli, Drawing .......................... 10,000Service Revenue ................................ 83,750 Wages Expense .................................. 42,000 Advertising Expense ............................ 7,200 Miscellaneous Expense .......................... 1,425 181,600 181,6002-15a. Gerald Owen, Drawing ................... 15,000Wages Expense ....................... 15,000b. Prepaid Rent ........................... 4,500Cash ................................ 4,500 2-16题目的资料不全, 答案略.2-17a. KMART CORPORATIONIncome StatementFor the Years Ending January 31, 2000 and 1999(in millions)Increase (Decrease)2000 1999 Amount Percent1. Sales ........................ $37,028 $35,925 $ 1,103 3.1%2. Cost of sales................. (29,658) (28,111) 1,547 5.5%3. Selling, general, and admin.expenses ..................... (7,415) (6,514) 901 13.8%4. Operating income (loss)before taxes.................. $ (45) $ 1,300 $(1,345) (103.5%) b. The horizontal analysis of Kmart Corporation revealsdeteriorating operating results from 1999 to 2000. While salesincreased by $1,103 million, a 3.1% increase, cost of salesincreased by $1,547 million, a 5.5% increase. Selling, general,and administrative expenses also increased by $901 million, a13.8% increase. The end result was that operating incomedecreased by $1,345 million, over a 100% decrease, and createda $45 million loss in 2000. Little over a year later, Kmart filedfor bankruptcy protection. It has now emerged from bankruptcy,hoping to return to profitability.3-11. Accrued expense (accrued liability)2. Deferred expense (prepaid expense)3. Deferred revenue (unearned revenue)4. Accrued revenue (accrued asset)5. Accrued expense (accrued liability)6. Accrued expense (accrued liability)7. Deferred expense (prepaid expense)8. Deferred revenue (unearned revenue)3-2Supplies Expense (801)Supplies (801)3-3$1,067 ($118 + $949)3-4a. Insurance expense (or expenses) will be understated. Net incomewill be overstated.b. Prepaid insurance (or assets) will be overstated. Owner’sequity will be overstated.3-5a.Insurance Expense ............................. 1,215Prepaid Insurance ...................... 1,215 b.Insurance Expense ............................. 1,215Prepaid Insurance ...................... 1,215 3-6Unearned Fees ................................... 9,570Fees Earned ............................ 9,570 3-7a.Salary Expense ................................ 9,360Salaries Payable ....................... 9,360 b.Salary Expense ................................ 12,480Salaries Payable ....................... 12,480 3-8$59,850 ($63,000 – $3,150)3-9$195,816,000 ($128,776,000 + $67,040,000)3-10Error (a) Error (b)Over- Under- Over- Under-stated stated stated stated1. Revenue for the year would be .... $ 0 $6,900 $ 0 $ 02. Expenses for the year would be ... 0 0 0 3,7403. Net income for the year would be . 0 6,900 3,740 04. Assets at December 31 would be ... 0 0 0 05. Liabilities at December 31 would be 6,900 0 0 3,7406. Owner’s equity at December 31would be ......................... 0 6,900 3,740 03-11$175,840 ($172,680 + $6,900 – $3,740)3-12a.Accounts Receivable ........................... 11,500Fees Earned ............................ 11,500b. No. If the cash basis of accounting is used, revenues arerecognized only when the cash is received. Therefore, earned butunbilled revenues would not be recognized in the accounts, andno adjusting entry would be necessary.3-13a. Fees earned (or revenues) will be understated. Net income willbe understated.b. Accounts (fees) receivable (or assets) will be understated.Owner’s equity will be unde rstated.3-14Depreciation Expense ............................ 5,200Accumulated Depreciation ............... 5,200 3-15a. $204,600 ($318,500 – $113,900)b. No. Depreciation is an allocation of the cost of the equipmentto the periods benefiting from its use. It does not necessarilyrelate to value or loss of value.3-16a. $2,268,000,000 ($5,891,000,000 – $3,623,000,000)b. No. Depreciation is an allocation method, not a valuationmethod. That is, depreciation allocates the cost of a fixed assetover its useful life. Depreciation does not attempt to measuremarket values, which may vary significantly from year to year.3-17a.Depreciation Expense .......................... 7,500Accumulated Depreciation ............... 7,500b. (1) Depreciation expense would be understated. Net income wouldbe overstated.(2) Accumulated depreciation would be understated, and totalassets would be overstated. Owner’s equity would beoverstated.3-181.Accounts Receivable (4)Fees Earned (4)2.Supplies Expense (3)Supplies (3)3.Insurance Expense (8)Prepaid Insurance (8)4.Depreciation Expense (5)Accumulated Depreciation—Equipment (5)5.Wages Expense (1)Wages Payable (1)3-19a. Dell Computer CorporationAmount Percent Net sales $35,404,000 100.0Cost of goods sold (29,055,000) 82.1Operating expenses (3,505,000) 9.9Operating income (loss) $ 2,844,000 8.0 b. Gateway Inc.Amount Percent Net sales $4,171,325 100.0 Cost of goods sold (3,605,120) 86.4 Operating expenses (1,077,447) 25.8 Operating income (loss) $ (511,242) (12.2) c. Dell is more profitable than Gateway. Specifically, Dell’s costof goods sold of 82.1% is significantly less (4.3%) than Gateway’s cost of goods sold of 86.4%. In addition, Gateway’s operating expenses are over one-fourth of sales, while Dell’s operating expenses are 9.9% of sales. The result is that Dell generates an operating income of 8.0% of sales, while Gateway generates a loss of 12.2% of sales. Obviously, Gateway must improve its operations if it is to remain in business and remain competitive with Dell.4-1e, c, g, b, f, a, d4-2a. Income statement: 3, 8, 9b. Balance sheet: 1, 2, 4, 5, 6, 7, 104-3a. Asset: 1, 4, 5, 6, 10b. Liability: 9, 12c. Revenue: 2, 7d. Expense: 3, 8, 114-41. f2. c3. b4. h5. g6. j7. a8. i9. d10. e4–5ITHACA SERVICES CO.Work SheetFor the Year Ended January 31, 2006AdjustedTrial Balance Adjustments Trial BalanceAccount Title Dr. Cr. Dr. Cr. Dr. Cr.1 Cash 8 8 12 Accounts Receivable 50 (a) 7 57 23 Supplies 8 (b) 5 3 34 Prepaid Insurance 12 (c) 6 6 45 Land 50 50 56 Equipment 32 32 67 Accum. Depr.—Equip. 2 (d) 5 7 78 Accounts Payable 26 26 89 Wages Payable 0 (e) 1 1 910 Terry Dagley, Capital 112 112 1011 Terry Dagley, Drawing 8 8 1112 Fees Earned 60 (a) 7 67 1213 Wages Expense 16 (e) 1 17 1314 Rent Expense 8 8 1415 Insurance Expense 0 (c) 6 6 1516 Utilities Expense 6 6 1617 Depreciation Expense 0 (d) 5 5 1718 Supplies Expense 0 (b) 5 5 1819 Miscellaneous Expense 2 2 1920 Totals 200 200 24 24 213 213 20 ContinueITHACA SERVICES CO.Work SheetFor the Year Ended January 31, 2006Adjusted Income BalanceTrial Balance StatementSheetAccount Title Dr. Cr. Dr. Cr. Dr. Cr.1 Cash 8 8 12 Accounts Receivable 57 57 23 Supplies 3 3 34 Prepaid Insurance 6 6 45 Land 50 50 56 Equipment 32 32 67 Accum. Depr.—Equip. 7 7 78 Accounts Payable 26 26 89 Wages Payable 1 1 910 Terry Dagley, Capital 112 112 1011 Terry Dagley, Drawing 8 8 1112 Fees Earned 67 67 1213 Wages Expense 17 17 1314 Rent Expense 8 8 1415 Insurance Expense 6 6 1516 Utilities Expense 6 6 1617 Depreciation Expense 5 5 1718 Supplies Expense 5 5 1819 Miscellaneous Expense 2 2 1920 Totals 213 213 49 67 164 146 2021 Net income (loss) 18 182122 67 67 164 164 22 4-6ITHACA SERVICES CO.Income StatementFor the Year Ended January 31, 2006Fees earned .................................... $67Expenses:Wages expense .............................. $17Rent expense (8)Insurance expense (6)Utilities expense (6)Depreciation expense (5)Supplies expense (5)Miscellaneous expense (2)Total expenses ............................49Net income ..................................... $18ITHACA SERVICES CO.Statemen t of Owner’s EquityFor the Year Ended January 31, 2006Terry Dagley, capital, February 1, 2005 ........ $112Net income for the year ........................ $18Less withdrawals (8)Increase in owner’s equity....................10Terry Dagley, capital, January 31, 2006 ........ $122ITHACA SERVICES CO.Balance SheetJanuary 31, 2006Assets LiabilitiesCurrent assets: Current liabilities: Cash ............... $ 8 Accounts payable ... $26Accounts receivable 57 Wages payable (1)Supplies ........... 3 Total liabilities $ 27 Prepaid insurance .. 6Total current assets $ 74Property, plant, and Owner’s E quity equipment: Terry Dagley, capital 122 Land ............... $50Equipment .......... $32Less accum. depr. .. 7 25Total property, plant,and equipment 75 Total liabilities andTotal assets ......... $149 owner’s equity .. $149 4-72006Jan. 31 Accounts Receivable (7)Fees Earned (7)31 Supplies Expense (5)Supplies (5)31 Insurance Expense (6)Prepaid Insurance (6)31 Depreciation Expense (5)Accumulated Depreciation—Equipment .. 531 Wages Expense (1)Wages Payable (1)4-82006Jan. 31 Fees Earned (67)Income Summary (67)31 Income Summary (49)Wages Expense (17)Rent Expense (8)Insurance Expense (6)Utilities Expense (6)Depreciation Expense (5)Supplies Expense (5)Miscellaneous Expense (2)31 Income Summary (18)Terry Dagley, Capital (18)31 Terry Dagley, Capital (8)Terry Dagley, Drawing (8)4-9SIROCCO SERVICES CO.Income StatementFor the Year Ended March 31, 2006Service revenue ................................$103,850Operating expenses:Wages expense .............................. $56,800Rent expense ............................... 21,270Utilities expense .......................... 11,500Depreciation expense ....................... 8,000Insurance expense .......................... 4,100Supplies expense ........................... 3,100Miscellaneous expense ...................... 2,250Total operating expenses ............ 107,020 Net loss ....................................... $ (3,170) 4-10SYNTHESIS SYSTEMS CO.Statement of Owner’s EquityFor the Year Ended October 31, 2006Suzanne Jacob, capital, November 1, 2005 ....... $173,750 Net income for year ............................ $44,250 Less withdrawals ............................... 12,000 Increase in owner’s equity....................32,250Suzanne Jacob, capital, October 31, 2006 ....... $206,0004-11a. Current asset: 1, 3, 5, 6b. Property, plant, and equipment: 2, 44-12Since current liabilities are usually due within one year, $165,000($13,750 × 12 months) would be reported as a current liability onthe balance sheet. The remainder of $335,000 ($500,000 –$165,000)would be reported as a long-term liability on the balance sheet.4-13TUDOR CO.Balance SheetApril 30, 2006Assets LiabilitiesCurrent assets Current liabilities:Cash $31,500 Accountspayable ...................... $9,500Accounts receivable 21,850 Salaries payable1,750Supplies .............. 1,800 Unearned fees .................Prepaid insurance ..... 7,200 Total liabilities Prepaid rent .......... 4,800Total current assets $67,150Owner’s EquityProperty, plant, and equipment: Vernon Posey, capital .............Equipment ........... $80,600Less accumulated depreciation 21,100 59,500 Totalliabilities andTotal assets $126,650 owner’s equity......... $126 4-14Accounts Receivable ............................. 4,100Fees Earned ......................... 4,100 Supplies Expense ....................... 1,300Supplies ............................ 1,300 Insurance Expense ...................... 2,000Prepaid Insurance ................... 2,000 Depreciation Expense ................... 2,800Accumulated Depreciation—Equipment .. 2,800 Wages Expense .......................... 1,000Wages Payable ....................... 1,000 Unearned Rent .......................... 2,500Rent Revenue ........................ 2,5004-15c. Depreciation Expense—Equipmentg. Fees Earnedi. Salaries Expensel. Supplies Expense4-16The income summary account is used to close the revenue and expense accounts, and it aids in detecting and correcting errors. The $450,750 represents expense account balances, and the $712,500 represents revenue account balances that have been closed.4-17a.Income Summary ................................ 167,550Sue Alewine, Capital ................... 167,550 Sue Alewine, Capital ............................ 25,000Sue Alewine, Drawing ................... 25,000 b. $284,900 ($142,350 + $167,550 – $25,000)4-18a. Accounts Receivableb. Accumulated Depreciationc. Cashe. Equipmentf. Estella Hall, Capitali. Suppliesk. Wages Payable4-19a. 2002 2001Working capital ($143,034) ($159,453)Current ratio 0.81 0.80b. 7 Eleven has negative working capital as of December 31, 2002and 2001. In addition, the current ratio is below one at the endof both years. While the working capital and current ratios haveimproved from 2001 to 2002, creditors would likely be concernedabout the ability of 7 Eleven to meet its short-term creditobligations. This concern would warrant further investigationto determine whether this is a temporary issue (for example, anend-of-the-period phenomenon) and the company’s plans toaddress its working capital shortcomings.4-20a. (1) Sales Salaries Expense .................. 6,480Salaries Payable ........................ 6,480(2) Accounts Receivable ..................... 10,250Fees Earned ............................. 10,250 b. (1) Salaries Payable ........................ 6,480Sales Salaries Expense .................. 6,480(2) Fees Earned ............................. 10,250Accounts Receivable ..................... 10,250 4-21a. (1) Payment (last payday in year)(2) Adjusting (accrual of wages at end of year)(3) Closing(4) Reversing(5) Payment (first payday in following year)b. (1) Wages Expense .......................... 45,000Cash .................................... 45,000(2) Wages Expense ........................... 18,000Wages Payable ........................... 18,000(3) Income Summary .......................... 1,120,800Wages Expense ........................... 1,120,800(4) Wages Payable ........................... 18,000Wages Expense ........................... 18,000(5) Wages Expense ........................... 43,000Cash .................................... 43,000 Chapter6(找不到答案,自己处理了哦)Ex. 8–1a. Inappropriate. Since Fridley has a large number of credit salessupported by promissory notes, a notes receivable ledger shouldbe maintained. Failure to maintain a subsidiary ledger whenthere are a significant number of notes receivable transactionsviolates the internal control procedure that mandates proofs and security. Maintaining a notes receivable ledger will allow Fridley to operate more efficiently and will increase the chance that Fridley will detect accounting errors related to the notes receivable. (The total of the accounts in the notes receivable ledger must match the balance of notes receivable in the general ledger.)b. Inappropriate. The procedure of proper separation of duties isviolated. The accounts receivable clerk is responsible for too many related operations. The clerk also has both custody of assets (cash receipts) and accounting responsibilities for those assets.c. Appropriate. The functions of maintaining the accountsreceivable account in the general ledger should be performed by someone other than the accounts receivable clerk.d. Appropriate. Salespersons should not be responsible forapproving credit.e. Appropriate. A promissory note is a formal credit instrumentthat is frequently used for credit periods over 45 days.Ex. 8–2-aa.Customer Due Date Number of Days PastDueJanzen Industries August 29 93 days (2 + 30 + 31+ 30)Kuehn Company September 3 88 days (27 + 31 + 30)Mauer Inc. October 21 40 days (10 + 30)Pollack Company November 23 7 daysSimrill Company December 3 Not past dueEx. 8–3Nov. 30 Uncollectible Accounts Expense ......... 53,315*Allowances for Doubtful Accounts..... 53,315 *$60,495 – $7,180 = $53,315Ex. 8–4Estimated Uncollectible Accounts Age Interval Balance Percent AmountNot past due .............. $450,000 2% $ 9,0001–30 days past due ....... 110,000 4 4,40031–60 days past due ...... 51,000 6 3,06061–90 days past due ...... 12,500 20 2,50091–180 days past due ..... 7,500 60 4,500Over 180 days past due .... 5,500 80 4,400 Total .................. $636,500 $27,860Ex. 8–52006Dec. 31 Uncollectible Accounts Expense ......... 29,435*..... Allowance for Doubtful Accounts 29,435 *$27,860 + $1,575 = $29,435Ex. 8–6a. $17,875 c. $35,750b. $13,600 d. $41,450Ex. 8–7a.Allowance for Doubtful Accounts ............... 7,130Accounts Receivable .................... 7,130b.Uncollectible Accounts Expense ................ 7,130Accounts Receivable .................... 7,130Ex. 8–8Feb. 20 Accounts Receivable—Darlene Brogan .... 12,100Sales ............................... 12,10020 Cost of Merchandise Sold ............... 7,260Merchandise Inventory ............... 7,260 May 30 Cash ................................... 6,000Accounts Receivable—Darlene Brogan .. 6,00030 Allowance for Doubtful Accounts ........ 6,100Accounts Receivable—Darlene Brogan .. 6,100 Aug. 3 Accounts Receivable—Darlene Brogan .... 6,100Allowance for Doubtful Accounts ..... 6,1003 Cash ................................... 6,100Accounts Receivable—Darlene Brogan .. 6,100 Ex. 8–9$223,900 [$212,800 + $112,350 –($4,050,000 × 2 1/2%)]Ex. 8–10Due Date Interesta. Aug. 31 $120b. Dec. 28 480c. Nov. 30 250d. May 5 150e. July 19 100a. August 8b. $24,480c. (1) Notes Receivable .......................... 24,000Accounts Rec.—Magpie Interior Decorators 24,0(2) Cash ...................................... 24,480Notes Receivable ....................... 24,000Interest Revenue (480)Ex. 8–121. Sale on account.2. Cost of merchandise sold for the sale on account.3. A sales return or allowance.4. Cost of merchandise returned.5. Note received from customer on account.6. Note dishonored and charged maturity value of note tocustomer’s account recei vable.7. Payment received from customer for dishonored note plus interestearned after due date.。

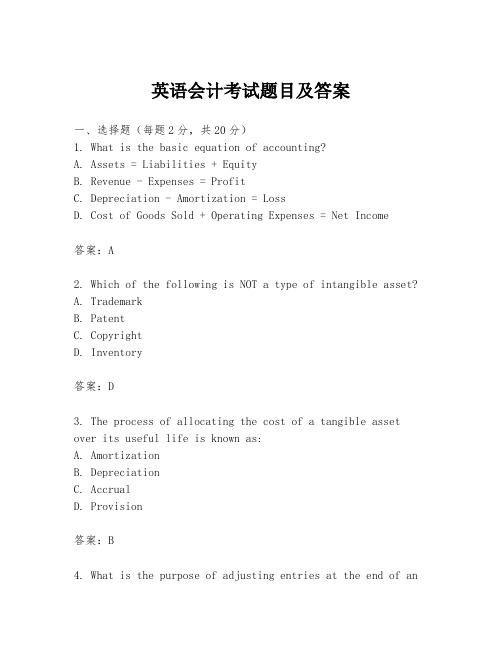

英语会计考试题目及答案

英语会计考试题目及答案一、选择题(每题2分,共20分)1. What is the basic equation of accounting?A. Assets = Liabilities + EquityB. Revenue - Expenses = ProfitC. Depreciation - Amortization = LossD. Cost of Goods Sold + Operating Expenses = Net Income答案:A2. Which of the following is NOT a type of intangible asset?A. TrademarkB. PatentC. CopyrightD. Inventory答案:D3. The process of allocating the cost of a tangible asset over its useful life is known as:A. AmortizationB. DepreciationC. AccrualD. Provision答案:B4. What is the purpose of adjusting entries at the end of anaccounting period?A. To increase the company's profitB. To ensure the financial statements are accurate and up-to-dateC. To reduce the company's tax liabilityD. To prepare for the next accounting period答案:B5. The term "Double Entry Bookkeeping" refers to the practice of:A. Recording transactions twiceB. Recording debits and credits for every transactionC. Keeping two sets of booksD. Using two different accounting software答案:B...二、简答题(每题10分,共30分)1. Explain the difference between "revenue recognition" and "matching principle".答案:Revenue recognition is the process of recognizing income in the accounting records as it is earned, regardless of when payment is received. The matching principle, on the other hand, is an accounting concept that requires expenses to be recognized in the same accounting period as the revenue they helped generate. This ensures that the financial statements reflect the actual performance of the business fora given period.2. What are the main components of a balance sheet?答案:The main components of a balance sheet are assets, liabilities, and equity. Assets represent what the company owns, liabilities represent what the company owes, and equity represents the residual interest in the assets of the entity after deducting liabilities....三、计算题(每题15分,共30分)1. Given the following information for XYZ Corp., calculate the net income for the year ended December 31, 2023:- Sales revenue: $500,000- Cost of goods sold: $300,000- Operating expenses: $100,000- Depreciation expense: $20,000- Interest expense: $10,000答案:Net Income = Sales Revenue - (Cost of Goods Sold + Operating Expenses + Depreciation Expense + Interest Expense) Net Income = $500,000 - ($300,000 + $100,000 + $20,000 + $10,000)Net Income = $500,000 - $440,000Net Income = $60,0002. If a company purchased a machine for $50,000 and expectsit to have a useful life of 5 years with no residual value, calculate the annual depreciation expense using the straight-line method.答案:Annual Depreciation Expense = (Cost of Asset - Residual Value) / Useful LifeAnnual Depreciation Expense = ($50,000 - $0) / 5Annual Depreciation Expense = $10,000...结束语:希望这份英语会计考试题目及答案对您的学习和复习有所帮助。

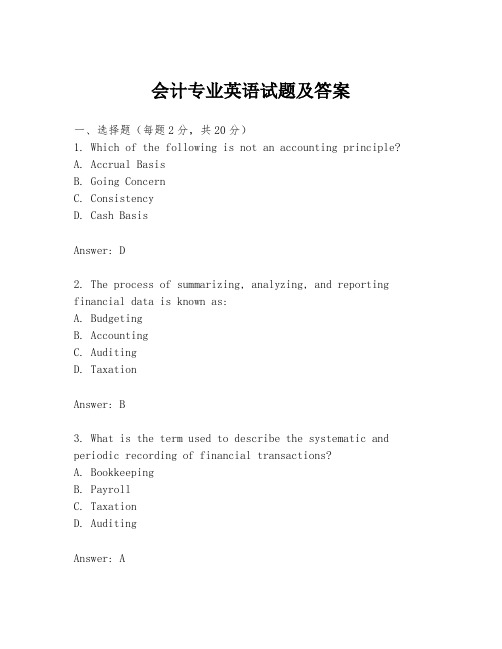

会计专业英语试题及答案

会计专业英语试题及答案一、选择题(每题2分,共20分)1. Which of the following is not an accounting principle?A. Accrual BasisB. Going ConcernC. ConsistencyD. Cash BasisAnswer: D2. The process of summarizing, analyzing, and reporting financial data is known as:A. BudgetingB. AccountingC. AuditingD. TaxationAnswer: B3. What is the term used to describe the systematic and periodic recording of financial transactions?A. BookkeepingB. PayrollC. TaxationD. AuditingAnswer: A4. Which of the following is not a component of the balance sheet?A. AssetsB. LiabilitiesC. EquityD. RevenueAnswer: D5. The matching principle requires that:A. Expenses are recognized when incurredB. Expenses are recognized when paidC. Expenses are recognized in the same period as the revenue they generateD. Expenses are recognized when the cash is received Answer: C6. The accounting equation is:A. Assets = Liabilities + EquityB. Assets - Liabilities = EquityC. Assets + Equity = LiabilitiesD. Assets = Equity - LiabilitiesAnswer: A7. The term "double-entry bookkeeping" refers to the practice of:A. Recording transactions twiceB. Recording transactions in two accountsC. Recording debits and credits for every transactionD. Recording transactions in two different booksAnswer: C8. Which of the following is not a type of intangible asset?A. PatentsB. TrademarksC. GoodwillD. InventoryAnswer: D9. The purpose of an income statement is to show:A. The financial position of a company at a point in timeB. The changes in equity over a period of timeC. The financial performance of a company over a period of timeD. The cash flows of a company over a period of time Answer: C10. The statement of cash flows is used to report:A. How cash is generated and used during a periodB. The net income of a company for a periodC. The changes in equity for a periodD. The changes in assets and liabilities for a period Answer: A二、填空题(每题2分,共20分)1. The accounting cycle includes the following steps:journalizing, posting, __________, adjusting entries, and closing entries.Answer: trial balance2. The __________ principle requires that all business transactions should be recorded at their fair value in the accounting records.Answer: Fair Value3. The __________ is a summary of all the journal entries fora period, listed in date order.Answer: General Journal4. __________ are expenses that have been incurred but not yet paid.Answer: Accrued Expenses5. The __________ is a report that shows the beginning cash balance, cash receipts, cash payments, and the ending cash balance for a period.Answer: Cash Flow Statement6. The __________ ratio is calculated by dividing current assets by current liabilities.Answer: Current Ratio7. __________ are assets that are expected to be converted into cash or used up within one year or one operating cycle. Answer: Current Assets8. __________ is the process of determining the cost of goodssold and the value of ending inventory.Answer: Costing9. __________ is the process of estimating the useful life of an asset and allocating its cost over that period.Answer: Depreciation10. __________ is the process of adjusting the accounts to reflect the proper revenue and expenses for the period. Answer: Accrual Accounting三、简答题(每题10分,共20分)1. Explain the difference between revenue and profit. Answer: Revenue is the income generated from the normal business activities of an entity during a specific period, before deducting expenses. Profit, on the other hand, is the excess of revenues and gains over expenses and losses for a period. It represents the net income or net earnings of a business.2. What are the main components of a balance sheet?Answer: The main components of a balance sheet are assets, liabilities, and equity. Assets represent what a company owns or controls with future economic benefit. Liabilities are obligations or debts that a company owes to others. Equity is the residual interest in the assets of the entity after deducting all its liabilities, representing the ownership interest of the shareholders.四、计算题(每题15分,共30分)1. Calculate the net income for the year if the revenue is$500,000, the cost of goods sold is $300,000, operating expenses are $80,000, and other expenses are $20,000. Answer: Net Income = Revenue - Cost of Goods Sold - Operating。

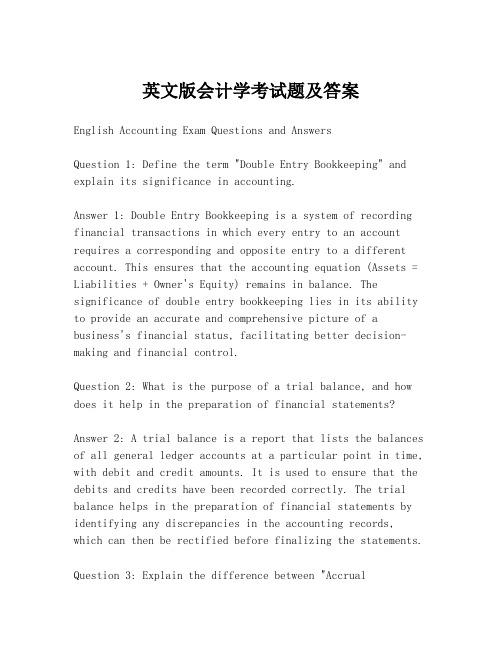

英文版会计学考试题及答案

英文版会计学考试题及答案English Accounting Exam Questions and AnswersQuestion 1: Define the term "Double Entry Bookkeeping" and explain its significance in accounting.Answer 1: Double Entry Bookkeeping is a system of recording financial transactions in which every entry to an account requires a corresponding and opposite entry to a different account. This ensures that the accounting equation (Assets = Liabilities + Owner's Equity) remains in balance. The significance of double entry bookkeeping lies in its ability to provide an accurate and comprehensive picture of a business's financial status, facilitating better decision-making and financial control.Question 2: What is the purpose of a trial balance, and how does it help in the preparation of financial statements?Answer 2: A trial balance is a report that lists the balances of all general ledger accounts at a particular point in time, with debit and credit amounts. It is used to ensure that the debits and credits have been recorded correctly. The trial balance helps in the preparation of financial statements by identifying any discrepancies in the accounting records, which can then be rectified before finalizing the statements.Question 3: Explain the difference between "AccrualAccounting" and "Cash Accounting."Answer 3: Accrual Accounting is a method of accounting where revenues and expenses are recognized when they are earned or incurred, not necessarily when cash is received or paid. This method provides a more accurate representation of a company's financial performance over a period. Cash Accounting, on the other hand, records transactions only when cash is exchanged. It is simpler and is often used by small businesses or those that operate on a cash basis.Question 4: Describe the process of preparing an income statement.Answer 4: Preparing an income statement involves several steps:1. List all the revenues for the period, such as sales and service income.2. Deduct all the expenses incurred to generate those revenues, including cost of goods sold, operating expenses, and taxes.3. Calculate the net income by subtracting total expenses from total revenues.4. The income statement should reflect the company's profitability over a specified period, typically a month, quarter, or year.Question 5: What are the main components of a balance sheet, and how do they relate to each other?Answer 5: The main components of a balance sheet are:1. Assets: What the company owns or controls with future economic benefit, divided into current assets (short-term) and non-current assets (long-term).2. Liabilities: Obligations the company owes to others, classified as current liabilities (due within one year) and long-term liabilities (due after one year).3. Owner's Equity: The residual interest in the assets of the entity after deducting liabilities, also known as shareholders' equity or net assets.These components are related through the fundamental accounting equation: Assets = Liabilities + Owner's Equity.Question 6: How does depreciation affect a company'sfinancial statements?Answer 6: Depreciation is a non-cash accounting method used to allocate the cost of tangible assets over their useful lives. It affects a company's financial statements in the following ways:1. It reduces the book value of the asset on the balance sheet.2. It increases the accumulated depreciation account, whichis a contra-asset account.3. It decreases net income on the income statement, as depreciation is an expense.4. It can lower taxable income, potentially reducing the company's tax liability.Question 7: What is the purpose of the statement of cash flows, and how does it differ from the income statement?Answer 7: The purpose of the statement of cash flows is to provide information about a company's cash receipts and payments during a period, showing how these cash flows affect the company's financial position. It differs from the income statement in that:1. It focuses on cash transactions, not accrual-basis accounting.2. It categorizes cash flows into operating, investing, and financing activities.3. It does not report net income but rather the net change in cash and cash equivalents.Question 8: Explain the concept of "Going Concern" and its importance in financial reporting.Answer 8: The Going Concern concept assumes that a businesswill continue to operate for the foreseeable future, allowing it to realize its assets and discharge its liabilities in the normal course of business. It is important in financial reporting because it underpins the accrual basis of accounting, which assumes that the business will continue to operate and therefore can recognize revenues and expensesover time.Question 9: What are the ethical considerations in accounting, and why are they important?Answer 9: Ethical considerations in accounting include honesty, integrity, objectivity, and confidentiality. Theyare important because they ensure the reliability andcredibility of financial information, which is crucial for stakeholders to make informed decisions. Ethical behavior also helps maintain public trust。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

《会计专业英语》模拟试题及答案一、单选题 (每题 1 分,共20分)1. Which of the following statements about accounting concepts or assumptions are correct?1) The money measurement assumption is that items in accounts are initially measured at their historical cost.2) In order to achieve comparability it may sometimes be necessaryto override the prudence concept.3) To facilitate comparisons between different entities it is helpful if accounting policies and changes in them are disclosed.4) To comply with the law, the legal form of a transaction must always be reflected in financial statements.A 1 and 3B 1 and 4C 3 onlyD 2 and 32. Johnny had receivables of $5 500 at the start of 2010. During the year to 31 Dec 2010 he makescredit sales of $55 000 and receives cash of $46 500 from credit customers.What is the balance on the accounts receivables at 31 Dec 2010?A. $8 500 DrB. $8 500 CrC. $14 000 DrD. $14 000 Cr3. Should dividends paid appear on the face of a companycash flow sta'tesment?A. YesB. NoC. Not sureD. Either4. Which of the following inventory valuation methods is likely to lead to the highest figure for closinginventory at a time when prices are dropping?A. Weighted Average costB. First in first out (FIFO)C. Last in first out (LIFO)D. Unit cost5. Which of following items may appear as non-currentassets in a company the'stsatement of financial position?(1) plant, equipment, and property(2) company car(3) ?4000 cash(4) ?1000 chequeA. (1), (3)C. (2), (3)D. (2), (4)6. Which of the following items may appear as current liabilities in a company ' s balance sheet?(1) investment in subsidiary(2) Loan matured within one year.(3) income tax accrued untill year end.(4) Preference dividend accruedA (1), (2) and (3)B (1), (2) and (4)C (1), (3) and (4)D (2), (3) and (4)7. The trial balance totals of Gamma at 30 September 2010 are:Debit $992,640Credit $1,026,480Which TWO of the following possible errors could, when corrected, cause the trial balance to agree? 1. An item in the cash book $6,160 for payment of rent has not been entered in the rent payable account.2. The balance on the motor expensesaccount $27,680 has incorrectly been listed in the trial balance as a credit.3. $6,160 proceeds of sale of a motor vehicle has been posted to the debit of motor vehicles asset account.4. The balance of $21,520 on the rent receivable account has been omitted from the trial balance.A 1 and 2B 2 and 3C 2 and 4D 3 and 48. Theta prepares its financial statements for the year to 30 April each year. The company pays rent for its premises quarterly in advance on 1 January, 1 April, 1 July and 1 October each year. The annual rent was $84,000 per year until 30 June 2010. It was increased from that date to $96,000 per year. What rent expense and end of year prepayment should be included in the financial statements for the year ended 30 April 2010?Expense PrepaymentA $93,000 $8,000B $93,000 $16,000C $94,000 $8,000D $94,000 $16,0009. At 30 September 2010, the following balances existed in the records of Lambda:Pla nt and equipme nt: $860,000Depreciati on for pla nt and equipme nt: $397,000During the year ended 30 September 2010, plant with a written down value of $37,000 was sold for $49,000. The plant had originally cost $80,000. Plant purchasedduring the year cost $180,000. It is the compa ny.s policy to charge a full year depreciati on in the year of acquisiti on of an asset and none in the year of sale, using a rate of 10% on the straight li ne basis. What net amount should appear in Lambda.s bala nee sheet at 30 September 2010 for pla nt and equipme nt?A $563,000C $510,000D $606,00010. A company' s plant and machinery ledger account ithie year ended 30 September 2010 was as follows:Pla nt and machi neryostproporti on ate depreciati on in years of purchase and disposal. What is the depreciati on charge for the year e nded 30 September 2010?A $74,440B $84,040C $72,640D $76,84011. Listed below are some characteristics of finan cial in formati on.(1) True⑵ Prude nee(3) Complete ness⑷ CorrectWhich of these characteristics con tribute to reliability?A (1),⑶ and ⑷ onlyB (1),⑵ and ⑷ onlyC (1),⑵ and ⑶ onlyD⑵,⑶and⑷only12. T he pla nt and mach inery cost acco unt of a compa ny is show n below. The compa ny policy is to charge depreciati on at 20% on the straight line basis, with proporti on ate depreciati on in years of acquisiti on and disposal.ostPla nt and machi neryA. $67,000B. $64,200D. $68,60013. In preparing its financial statements for the current year, a company ng inventory ' s closi was un derstated by $300,000. What will be the effect of this error if it remai ns un corrected?A The current year ' s profit will be overstated and next year ' s profit will be understB The current year' s profit will be understatedbut there will be no effect on next year' s profitC The current year ' s profit will be understated and next year ' s profit will be overstateD The current year' profit will be overstated but there will be no effect on next year' s profit.14. I n preparing a company's cash flow statement,which, if any, of the following items could form part of the calculati on of cash flow from financing activities?(1) Proceeds of sale of premises(2) Divide nds received(3) Issue of sharesA 1 onlyB 2 on lyC 3 on lyD No ne of them.15. At 31 March 2009 a compa ny had oil in ha nd to be used for heat ing costi ng $8,200 andan un paid heati ng oil bill for $3,600. At 31 March 2010 the heat ing oil in ha nd was $9,300 and there was an outstanding heating oil bill of $3,200. Payments made for heating oil duri ng the year en ded 31 March 2010 totalled $34,600. Based on these figures, what amount should appear in the compa ny ' s in come stateme nt for heati ngyefr theA $23,900B $36,100C $45,300D $33,10016. In times of inflation In times of rising prices, what effect does the use of the historicalcost concept have on a company ' s asset values and profit?A. Asset values and profit both un dervaluedB. Asset values and profit both overvaluedC. Asset values undervalued and profit overvaluedD. Asset values overvalued and profit undervalued17. Beta purchased some plant and equipment on 01/07/2010 for $60,000. The estimated residualvalue of the plant in 10 years time is estimated to be $6,000. Beta ' s policytois charge depreciation on the straight line basis, with a proportionate charge in the period of acquisition. What should the depreciation charge for the plant be in Beta 'asccounting period of 18 months to 30/09/2010 ?A. $5400B. $900C. $1350D. $67518. A company' isncome statement for the year ended 31 December 2005 showed a net profit of $83,600. It was later found that $18,000 paid for the purchase of a motor van had been debited to the motor expenses account. It is the company ' s policy to depreciate vans at 25 per cent per year on the straight line basis, with a full eyar ' s crhgae in the year of acquisition. What would the net profit be after adjusting for this error?A. $97,100B. $70,100C. $106,100D. $101,60019. Which of the following statements are correct?(1) to be prudent, company charge depreciation annually on the fixed asset(2) substance over form means that the commercial effect of a transaction must always be shown in the financial statements even if this differs from legal form(3) in order to achieve the comparable, items should be treated in the same way year on yearA. 2 and 3 onlyB. All of themC. 1 and 2 onlyD. 3 only20. which of the following about accruals concept are correct?(1) all financial statements are based on the accruals concept(2) the underlying theory of accruals concept and matching concept are same(3) accruals concept deals with any figure that incurred in the period irrelevant with it or notA. 2 and 3 onlyB. All of themC. 1 and 2 onlyD. 3 only。