《国际财务报告准则第9号——金融工具》

《国际财务报告准则第9号——金融工具》

美洲 纽约 蒙特利尔

亚太地区 香港 墨尔本

欧洲-非洲

哥本哈根 法兰克福 约翰内斯堡 伦敦 巴黎

Robert Uhl Robert Lefrancois

Stephen Taylor Bruce Porter

Jan Peter Larsen Andreas Barckow Graeme Berry Veronica Poole Laurence Rivat

例如,开发投资性房地产的主体可能发 行固定利率债券,该债券的条款规定仅 仅从开发房地产的销售收入中支付债券 本金和利息,并且对发行主体没有追索 权。此类债券无法通过“合同现金流量 特征测试”,因为根据合同规定与债券 挂钩的基础资产没有本金和利息的现金 流量特征。

与合同挂钩的工具

对于金融资产产生的收入是由发行人以 优先于其他多项与合同挂钩工具的顺序 进行支付的情形,IFRS 9规定此类工具 的现金流量必须满足特定条件才能被视 为本金和利息的付款额。其中一个例子 是,特殊目的主体发行份额票据从而为 债务义务提供抵押,而对各份额的支付 具有不同的优先级别,导致某些份额相 对优于或次于其他份额。

IAS Plus 2009 年 11 月 第 1 页

准则提供了公允价值选择权作为以摊 余成本计量的替代方法(须满足某些 特定的条件)。

所有属于IFRS 9范围的权益投资在财 务状况表中均以公允价值计量,并且 在没有做出特别选择的情况下利得和 损失均计入损益。仅当权益投资并非 为交易而持有时,主体才能在初始确 认时作出不可撤消的选择,将其指定 为以公允价值计量且其变动计入其他 综合收益(只有股利收入是计入损 益)。

具有现金流量特征且不仅仅代表本金和利息付款额的金融负债必须整体以公允价值计量且其变动计入损益导致因其自身信用风险导致的公允价值变动要在损益中确认而相比之下根据现行的ias39在许多情况下此类金融工具只是部分以公允价值计量且其变动计入损益嵌入衍生工具而金融负债主合同则以摊余成本计量

IASB发布新金融工具准则(IFRS9)(套期会计)-致同研究之IFRS系列(十五)

IASB发布新金融工具准则(IFRS9)(套期会计)-致同研究之IFRS系列(十五)简介国际会计准则理事会(IASB)于2014年7月24日发布《国际财务报告准则第9号——金融工具》(IFRS 9)终稿,汇总了IASB关于金融工具分类和计量、减值和套期会计的阶段性项目,以取代《国际会计准则第39号——金融工具:确认和计量》(IAS 39)。

该版本增加了一个新的预期信用损失减值模型,引入了以公允价值计量且其变动计入其他综合收益的新计量类别,并对业务模式的评估和合同现金流量特征提供了更多的指引。

该版本取代IFRS 9之前的所有版本,于2018年1月1日或以后日期开始的年度期间生效。

《致同研究之IFRS系列》新金融工具准则专题将介绍金融工具的分类和计量、减值、套期会计及IASB和FASB在金融工具准则的主要差异等内容。

本篇内容主要介绍套期会计方面的主要规定。

一、金融工具项目背景2008年金融危机中,业界一直呼吁全面修订现行的IAS 39,以减少金融工具会计处理的复杂性。

为了响应此问题,在全球政府部门和监管机构的推动下,IASB于2008年启动制定金融工具综合项目,致力于制定新的原则导向、更为简单的金融工具准则,以全面取代原先的IAS 39。

IASB采取了分阶段逐个击破的策略,将整个项目分成若干阶段,对每个阶段采取单独的应循程序。

2009年6月,IASB将替代IAS 39的项目分为金融工具确认和分类、减值和套期会计三部分内容,并发布了阐述金融资产新的分类和计量模型的IFRS 9。

随后,IASB于2010年在IFRS 9中增加了涉及金融负债和终止确认的要求,并于2013年对IFRS 9作出修订,增加了关于一般套期会计的新规定。

关于金融工具减值的部分,为了应对金融危机中已发生损失模型带来利润的剧烈波动的情况,IASB建议启动使用预期信用损失模型计提减值的项目,但是预期信用损失如何计算以及何时确认仍然存在争议,该项目因为影响重大且缺乏可操作性问题,波折不断,经历了从“无组别”到“两组别”、再到“三组别”的过程。

国际会计准则九号

国际会计准则九号

国际会计准则九号是《国际财务报告准则第9号:金融工具》(IFRS 9 Financial Instruments)的简称,由国际会计准则理事会(IASB)于2014年7月24日正式发布。

该准则于2018年1月1日起生效,是针对金融工具的会计准则,主要对权益资产重新归类。

IFRS 9发布后,2017年3月31日,我国财政部正式发布了参照IFRS 9修订后的金融工具相关会计准则,包括《企业会计准则第22号——金融工具确认和计量》《企业会计准则第23号——金融资产转移》和《企业会计准则第24号——套期会计》。

2018年,在A 股和H股同时上市的企业开始使用新金融工具准则;2019年,新金融工具准则将进一步推广至全部A股上市公司。

IFRS9

IFRS9号准则对我国保险业的影响分析作者:郑欣来源:《财会通讯》2010年第08期2009年11月12日国际会计准则理事会(简称IASB)颁布了一项新的国际财务报告准则——《国际财务报告准则第9号一金融工具》(简称IFRS9),用于对金融资产的分类和计量。

该准则将分阶段取代原本广泛使用的金融工具计量准则——《国际会计准则第39号一公允价值:确认和计量》(简称IAS39)。

我国于2006年实现会计准则的重新调整后,已基本实现了我国会计准则与国际会计准则的趋同,因此该项会计准则的改革必然对国内金融行业产生巨大的影响,尤其对以金融资产为主的保险行业产生更为深远的影响。

本文通过保险公司的数据分析对可能产生的影响进行分析和探讨,为即将到来的准则变化提前做好相应的准备工作,以减少其对保险公司经营管理所带来的冲击。

一、国际会计准则的改革背景与变动(一)国际会计准则的改革背景金融工具会计准则改革的一个突出目的是为了简化金融工具会计处理的复杂性。

在2008年全球爆发金融危机后,人们对于现行金融工具会计分类和计量所暴露出来的问题日益关注。

由于现行金融工具会计分类和计量过于复杂,使得报表使用者难以清晰、准确地理解报表上所反映的经济实质,客观上为金融机构肆意地放大风险,获取高额利润创造了条件,从而造成了金融危机。

同时现行国际会计准则特别是金融工具会计准则的亲周期现象,也使得投资者、监管机构还是中介机构都认为应加以改进。

在20国集团(简称G20)领导人就降低金融会计准则的复杂性、通过纳入更广泛的信息来完善贷款损失准备的确认等问题达成共识的情况下,国际会计准则理事会发布了一系列旨在简化金融工具处理的征求意见稿,并决定分阶段完成新旧会计准则的替换工作。

(二)国际会计准则的主要变动由于各国监管机构对金融资产减值损失、金融负债计量等方面仍存在分歧,因此IASB对本次准则替换工作分三个阶段进行:第一阶段为分类和计量,在2009年7月发布分类和计量征求意见稿,并于2009年11月发布正式稿;第二阶段为减值方法,于2009年lO月发布减值征求意见稿;第三阶段为套期会计,于2009年12月发布套期会计的征求意见稿。

国际财务报告准则-9号 金融工具

IFRS 9 is a 'work in progress' and will eventually replace IAS 39 in its entiretyOn 12 November 2009, the IASB issued IFRS 9 Financial Instruments as the first step in its project to replace IAS 39 Financial Instruments: Recognition and Measurement. IFRS 9 introduced new requirements for classifying and measuring financial assets that had to be applied starting 1 January 2013, with early adoption permitted. Click for IASB Press Release (PDF 101k).On 28 October 2010, the IASB reissued IFRS 9, incorporating new requirements on accounting for financial liabilities, and carrying over from IAS 39 the requirements for derecognition of financial assets and financial liabilities (the Basis for Conclusions was also restructured, and IFRIC 9 and the 2009 version of IFRS 9 were withdrawn). Click for IASB Press Release (PDF 33k).On 16 December 2011, the IASB issued Mandatory Effective Date and Transition Disclosures (Amendments to IFRS 9 and IFRS 7), which amended the effective date of IFRS 9 to annual periods beginning on or after 1 January 2015, and modified the relief from restating comparative periods and the associated disclosures in IFRS 7.On 19 November 2013, the IASB issued IFRS 9 Financial Instruments (Hedge Accounting and amendments to IFRS 9, IFRS 7 and IAS 39) amending IFRS 9 to include the new general hedge accounting model, allow early adoption of the treatment of fair value changes due to own credit on liabilities designated at fair value through profit or loss and remove the 1 January 2015 effective date. The IASB intends to expand IFRS 9 to add new requirements for impairment of financial assets measured at amortised cost and include limited amendments to the classification and measurement requirements. When these projects are completed an effective date will be added and IFRS 9 will be a complete replacement for IAS 39.Other sub-projects in the IASB's comprehensive project to replace IAS 39:o Impairment of financial assets measured at amortised costo Limited reconsideration of IFRS 9o Macro hedge accounting (now being treated as a separate project).Overview of IFRS 9Initial measurement of financial instrumentsAll financial instruments are initially measured at fair value plus or minus, in the case of a financial asset or financial liability not at fair value through profit or loss, transaction costs. [IFRS 9, paragraph 5.1.1] Subsequent measurement of financial assetsIFRS 9 divides all financial assets that are currently in the scope of IAS 39 into two classifications - those measured at amortised cost and those measured at fair value. Classification is made at the time the financial asset is initially recognised, namely when the entity becomes a party to the contractual provisions of the instrument. [IFRS 9, paragraph 4.1.1]Debt instrumentsA debt instrument that meets the following two conditions can be measured at amortised cost (net of any write down for impairment) [IFRS 9, paragraph 4.1.2]:o Business model test: The objective of the entity's business model is to hold the financial asset to collect the contractual cash flows (rather than to sell the instrument prior to its contractual maturity to realise its fair value changes).o Cash flow characteristics test: The contractual terms of the financial asset give rise on specified dates to cash flows that are solely payments of principal and interest on the principal outstanding.All other debt instruments must be measured at fair value through profit or loss (FVTPL). [IFRS 9, paragraph 4.1.4]Fair value optionEven if an instrument meets the two amortised cost tests, IFRS 9 contains an option to designate a financial asset as measured at FVTPL if doing so eliminates or significantly reduces a measurement or recognition inconsistency (sometimes referred to as an 'accounting mismatch') that would otherwise arise from measuring assets or liabilities or recognising the gains and losses on them on different bases. [IFRS 9, paragraph 4.1.5]IAS 39's AFS and HTM categories are eliminatedThe available-for-sale and held-to-maturity categories currently in IAS 39 are not included in IFRS 9. Equity instrumentsAll equity investments in scope of IFRS 9 are to be measured at fair value in the statement of financial position, with value changes recognised in profit or loss, except for those equity investments for which the entity has elected to report value changes in 'other comprehensive income'. There is no 'cost exception' for unquoted equities.'Other comprehensive income' optionIf an equity investment is not held for trading, an entity can make an irrevocable election at initial recognition to measure it at fair value through other comprehensive income (FVTOCI) with only dividend income recognised in profit or loss. [IFRS 9, paragraph 5.7.5]Measurement guidanceDespite the fair value requirement for all equity investments, IFRS 9 contains guidance on when cost may be the best estimate of fair value and also when it might not be representative of fair value. Subsequent measurement of financial liabilitiesIFRS 9 doesn't change the basic accounting model for financial liabilities under IAS 39. Two measurement categories continue to exist: fair value through profit or loss (FVTPL) and amortised cost. Financial liabilities held for trading are measured at FVTPL, and all other financial liabilities are measured at amortised cost unless the fair value option is applied. [IFRS 9, paragraph 4.2.1]Fair value optionIFRS 9 contains an option to designate a financial liability as measured at FVTPL if [IFRS 9, paragraph 4.2.2]:o doing so eliminates or significantly reduces a measurement or recognition inconsistency (sometimes referred to as an 'accounting mismatch') that would otherwise arise from measuringassets or liabilities or recognising the gains and losses on them on different bases, oro the liability is part or a group of financial liabilities or financial assets and financial liabilities that is managed and its performance is evaluated on a fair value basis, in accordance with a documented risk management or investment strategy, and information about the group is provided internally on that basis to the entity's key management personnel.A financial liability which does not meet any of these criteria may still be designated as measured at FVTPL when it contains one or more embedded derivatives that would require separation. [IFRS 9, paragraph 4.3.5]IFRS 9 requires gains and losses on financial liabilities designated as at fair value through profit or loss to be split into the amount of change in the fair value that is attributable to changes in the credit risk of the liability, which shall be presented in other comprehensive income, and the remaining amount of changein the fair value of the liability which shall be presented in profit or loss. The new guidance allows the recognition of the full amount of change in the fair value in the profit or loss only if the recognition of changes in the liability's credit risk in other comprehensive income would create or enlarge an accounting mismatch in profit or loss. That determination is made at initial recognition and is not reassessed. [IFRS 9, paragraphs 5.7.7-5.7.8]Amounts presented in other comprehensive income shall not be subsequently transferred to profit or loss, the entity may only transfer the cumulative gain or loss within equity.Derecognition of financial assetsThe basic premise for the derecognition model in IFRS 9 (carried over from IAS 39) is to determine whether the asset under consideration for derecognition is: [IFRS 9, paragraph 3.2.2]o an asset in its entirety oro specifically identified cash flows from an asset (or a group of similar financial assets) oro a fully proportionate (pro rata) share of the cash flows from an asset (or a group of similar financial assets). oro a fully proportionate (pro rata) share of specifically identified cash flows from a financial asset (or a group of similar financial assets)Once the asset under consideration for derecognition has been determined, an assessment is made as to whether the asset has been transferred, and if so, whether the transfer of that asset is subsequently eligible for derecognition.An asset is transferred if either the entity has transferred the contractual rights to receive the cash flows, or the entity has retained the contractual rights to receive the cash flows from the asset, but has assumed a contractual obligation to pass those cash flows on under an arrangement that meets the following three conditions: [IFRS 9, paragraphs 3.2.4-3.2.5]o the entity has no obligation to pay amounts to the eventual recipient unless it collects equivalent amounts on the original asseto the entity is prohibited from selling or pledging the original asset (other than as security to the eventual recipient),o the entity has an obligation to remit those cash flows without material delayOnce an entity has determined that the asset has been transferred, it then determines whether or not it has transferred substantially all of the risks and rewards of ownership of the asset. If substantially all the risks and rewards have been transferred, the asset is derecognised. If substantially all the risks and rewards have been retained, derecognition of the asset is precluded. [IFRS 9, paragraphs 3.2.6]If the entity has neither retained nor transferred substantially all of the risks and rewards of the asset, then the entity must assess whether it has relinquished control of the asset or not. If the entity does not control the asset then derecognition is appropriate; however if the entity has retained control of the asset, then the entity continues to recognise the asset to the extent to which it has a continuing involvement in the asset. [IFRS 9, paragraph 3.2.9]These various derecognition steps are summarised in the decision tree in paragraph B3.2.1. Derecognition of financial liabilitiesA financial liability should be removed from the balance sheet when, and only when, it is extinguished, that is, when the obligation specified in the contract is either discharged or cancelled or expires. [IFRS 9,paragraph 3.3.1] Where there has been an exchange between an existing borrower and lender of debt instruments with substantially different terms, or there has been a substantial modification of the terms of an existing financial liability, this transaction is accounted for as an extinguishment of the original financial liability and the recognition of a new financial liability. A gain or loss from extinguishment of the original financial liability is recognised in profit or loss. [IFRS 9, paragraphs 3.3.2-3.3.3]DerivativesAll derivatives, including those linked to unquoted equity investments, are measured at fair value. Value changes are recognised in profit or loss unless the entity has elected to treat the derivative as a hedging instrument in accordance with IAS 39, in which case the requirements of IAS 39 apply.Embedded derivativesAn embedded derivative is a component of a hybrid contract that also includes a non-derivative host, with the effect that some of the cash flows of the combined instrument vary in a way similar to a stand-alone derivative. A derivative that is attached to a financial instrument but is contractually transferable independently of that instrument, or has a different counterparty, is not an embedded derivative, but a separate financial instrument. [IFRS 9, paragraph 4.3.1]The embedded derivative concept of IAS 39 has been included in IFRS 9 to apply only to hosts that are not assets within the scope of the standard, Consequently, embedded derivatives that under IAS 39 would have been separately accounted for at FVTPL because they were not closely related to the financial host asset will no longer be separated. Instead, the contractual cash flows of the financial asset are assessed in their entirety, and the asset as a whole is measured at FVTPL if any of its cash flows do not represent payments of principal and interest. The embedded derivative concept of IAS 39 is now included in IFRS 9 and continues to apply to financial liabilities and hosts not within the scope of the standard (e.g. leasing contracts, insurance contracts, contracts for the purchase or sale of a non-financial items).ReclassificationFor financial assets, reclassification is required between FVTPL and amortised cost, or vice versa, if and only if the entity's business model objective for its financial assets changes so its previous model assessment would no longer apply. [IFRS 9, paragraph 4.4.1]If reclassification is appropriate, it must be done prospectively from the reclassification date. An entity does not restate any previously recognised gains, losses, or interest.IFRS 9 does not allow reclassification where:o the 'other comprehensive income' option has been exercised for a financial asset, oro the fair value option has been exercised in any circumstance for a financial assets or financial liability.Hedge accountingThe hedge accounting requirements in IFRS 9 are optional. If certain eligibility and qualification criteria are met, hedge accounting allows an entity to reflect risk management activities in the financial statements by matching gains or losses on financial hedging instruments with losses or gains on the risk exposures they hedge.The hedge accounting model in IFRS 9 is not designed to accommodate hedging of open, dynamic portfolios. As a result for a fair value hedge of interest rate risk of a portfolio of financial assets or liabilities an entity can apply the hedge accounting requirements in IAS 39 instead of those in IFRS 9. [IFRS 9 paragraph 6.1.3]In addition when an entity first applies IFRS as amended in November 2013, it may choose as its accounting policy choice to continue to apply the hedge accounting requirements of IAS 39 instead of the requirements of Chapter 6 of IFRS 9 [IFRS 9 paragraph 7.2.16]Qualifying criteria for hedge accountingA hedging relationship qualifies for hedge accounting only if all of the following criteria are met:1. the hedging relationship consists only of eligible hedging instruments and eligible hedged items.2. at the inception of the hedging relationship there is formal designation and documentation of thehedging relationship and the entity’s risk management objective a nd strategy for undertaking the hedge.3. the hedging relationship meets all of the hedge effectiveness requirements (see below) [IFRS 9paragraph 6.4.1]Hedging instrumentsOnly contracts with a party external to the reporting entity may be designated as hedging instruments. [IFRS 9 paragraph 6.2.3]A hedging instrument may be a derivative (except for some written options) or non-derivative financial instrument measured at FVTPL unless it is a financial liability designated as at FVTPL for which changes due to credit risk are presented in OCI. For a hedge of foreign currency risk, the foreign currency risk component of a non-derivative financial instrument, except equity investments designated as FVTOCI, may be designated as the hedging instrument. [IFRS 9 paragraph 6.2.1-6.2.2]IFRS 9 allows a proportion (e.g. 60%) but not a time portion (eg the first 6 years of cash flows of a 10 year instrument) of a hedging instrument to be designated as the hedging instrument. IFRS 9 also allows only the intrinsic value of an option, or the spot element of a forward to be designated as the hedging instrument. An entity may also exclude the foreign currency basis spread from a designated hedging instrument. [IFRS 9 paragraph 6.2.4]IFRS 9 allows combinations of derivatives and non-derivatives to be designated as the hedging instrument. [IFRS 9 paragraph 6.2.5]Combinations of purchased and written options do not qualify if they amount to a net written option at the date of designation. [IFRS 9 paragraph 6.2.6]Hedged itemsA hedged item can be a recognised asset or liability, an unrecognised firm commitment, a highly probable forecast transaction or a net investment in a foreign operation and must be reliably measurable. [IFRS 9 paragraph 6.3.1-6.3.3]An aggregated exposure that is a combination of an eligible hedged item as described above and a derivative may be designated as a hedged item. [IFRS 9 paragraph 6.3.4]The hedged item must generally be with a party external to the reporting entity however as an exception the foreign currency risk of an intragroup monetary item may qualify as a hedged item in the consolidated financial statements if it results in an exposure to foreign exchange rate gains or losses that are not fully eliminated on consolidation. In addition, the foreign currency risk of a highly probable forecast intragroup transaction may qualify as a hedged item in consolidated financial statements provided that the transaction is denominated in a currency other than the functional currency of the entity entering into that transaction and the foreign currency risk will affect consolidated profit or loss. [IFRS 9 paragraph 6.3.5 -6.3.6]An entity may designate an item in its entirety or a component of an item as the hedged item. The component may be a risk component that is separately identifiable and reliably measurable; one or more selected contractual cash flows; or components of a nominal amount. [IFRS 9 paragraph 6.3.7]A group of items (including net positions is an eligible hedged item only if:1. it consists of items individually, eligible hedged items;2. the items in the group are managed together on a group basis for risk management purposes;and3. in the case of a cash flow hedge of a group of items whose variabilities in cash flows are notexpected to be approximately proportional to the overall variability in cash flows of the group:1. it is a hedge of foreign currency risk; and2. the designation of that net position specifies the reporting period in which the forecasttransactions are expected to affect profit or loss, as well as their nature and volume[IFRS 9 paragraph 6.6.1]For a hedge of a net position whose hedged risk affects different line items in the statement of profit or loss and other comprehensive income, any hedging gains or losses in that statement are presented in a separate line from those affected by the hedged items. [IFRS 9 paragraph 6.6.4]Accounting for qualifying hedging relationshipsThere are three types of hedging relationships:Fair value hedge: a hedge of the exposure to changes in fair value of a recognised asset or liability or an unrecognised firm commitment, or a component of any such item, that is attributable to a particular risk and could affect profit or loss (or OCI in the case of an equity instrument designated as at FVTOCI). [IFRS 9 paragraph 6.5.2(a) and 6.5.3]For a fair value hedge, the gain or loss on the hedging instrument is recognised in profit or loss (or OCI, if hedging an equity instrument at FVTOCI and the hedging gain or loss on the hedged item adjusts the carrying amount of the hedged item and is recognised in profit or loss. However, if the hedged item is an equity instrument at FVTOCI, those amounts remain in OCI. When a hedged item is an unrecognised firm commitment the cumulative hedging gain or loss is recognised as an asset or a liability with a corresponding gain or loss recognised in profit or loss. [IFRS 9 paragraph 6.5.8]If the hedged item is a financial instrument measured at amortised cost any hedge adjustment is amortised to profit or loss based on a recalculated effective interest rate. Amortisation may begin as soon as an adjustment exists and shall begin no later than when the hedged item ceases to be adjusted for hedging gains and losses. [IFRS 9 paragraph 6.5.10]Cash flow hedge: a hedge of the exposure to variability in cash flows that is attributable to a particular risk associated with all, or a component of, a recognised asset or liability (such as all or some future interest payments on variable-rate debt) or a highly probable forecast transaction, and could affect profit or loss. [IFRS 9 paragraph 6.5.2(b)]For a cash flow hedge the cash flow hedge reserve in equity is adjusted to the lower of the following (in absolute amounts):o the cumulative gain or loss on the hedging instrument from inception of the hedge; ando the cumulative change in fair value of the hedged item from inception of the hedge.The portion of the gain or loss on the hedging instrument that is determined to be an effective hedge is recognised in OCI and any remaining gain or loss is hedge ineffectiveness that is recognised in profit or loss.If a hedged forecast transaction subsequently results in the recognition of a non-financial item or becomes a firm commitment for which fair value hedge accounting is applied, The amount that has been accumulated in the cash flow hedge reserve is removed and included directly in the initial cost or other carrying amount of the asset or the liability. In other cases The amount that has been accumulated in the cash flow hedge reserve is reclassified to profit or loss in the same period(s) as the hedged cash flows. [IFRS 9 paragraph 6.5.11]When an entity discontinues hedge accounting for a cash flow hedge, if the hedged future cash flows are still expected to occur, the amount that has been accumulated in the cash flow hedge reserve remains there until the future cash flows occur; if the hedged future cash flows are no longer expected to occur, that amount is immediately reclassified to profit or loss [IFRS 9 paragraph 6.5.12]A hedge of the foreign currency risk of a firm commitment may be accounted for as a fair value hedge or a cash flow hedge. [IFRS 9 paragraph 6.5.4]Hedge of a net investment in a foreign operation (as defined in IAS 21), including a hedge of a monetary item that is accounted for as part of the net investment, is accounted for similarly to cash flow hedges:o the portion of the gain or loss on the hedging instrument that is determined to be an effective hedge is recognised in OCI; ando the ineffective portion is recognised in profit or loss. [IFRS 9 paragraph 6.5.13]The cumulative gain or loss on the hedging instrument relating to the effective portion of the hedge is reclassified to profit or loss on the disposal or partial disposal of the foreign operation. [IFRS 9 paragraph 6.5.14]Hedge effectiveness requirementsIn order to qualify for hedge accounting, the hedge relationship must meet the following effectiveness criteria at the beginning of each hedged period:o there is an economic relationship between the hedged item and the hedging instrument;o the effect of credit risk does not dominate the value changes that result from that economic relationship; ando the hedge ratio of the hedging relationship is the same as that actually used in the economic hedge [IFRS 9 paragraph 6.4.1(c)]Rebalancing and discontinuationIf a hedging relationship ceases to meet the hedge effectiveness requirement relating to the hedge ratio but the risk management objective for that designated hedging relationship remains the same, an entity adjusts the hedge ratio of the hedging relationship (i.e. rebalances the hedge) so that it meets the qualifying criteria again. [IFRS 9 paragraph 6.5.5]An entity discontinues hedge accounting prospectively only when the hedging relationship (or a part of a hedging relationship) ceases to meet the qualifying criteria (after any rebalancing). This includes instances when the hedging instrument expires or is sold, terminated or exercised. Discontinuing hedge accounting can either affect a hedging relationship in its entirety or only a part of it (in which case hedge accounting continues for the remainder of the hedging relationship). [IFRS 9 paragraph 6.5.6]Time value of optionsWhen an entity separates the intrinsic value and time value of an option contract and designates as the hedging instrument only the change in intrinsic value of the option, it recognises some or all of the change in the time value in OCI which is later removed or reclassified from equity as a single amount or on an amortised basis (depending on the nature of the hedged item) and ultimately recognised in profit or loss. [IFRS 9 paragraph 6.5.15] This reduces profit or loss volatility compared to recognising the change in value of time value directly in profit or loss.Forward points and foreign currency basis spreadsWhen an entity separates the forward points and the spot element of a forward contract and designates as the hedging instrument only the change in the value of the spot element, or when an entity excludes the foreign currency basis spread from a hedge the entity may recognise the change in value of the excluded portion in OCI to be later removed or reclassified from equity as a single amount or on an amortised basis (depending on the nature of the hedged item) and ultimately recognised in profit or loss. [IFRS 9 paragraph 6.5.16] This reduces profit or loss volatility compared to recognising the change in value of forward points or currency basis spreads directly in profit or loss.Credit exposures designated at FVTPLIf an entity uses a credit derivative measured at FVTPL to manage the credit risk of a financial instrument (credit exposure) it may designate all or a proportion of that financial instrument as measured at FVTPL if:o the name of the credit exposure matches the reference e ntity of the credit derivative (‘name matching’); ando the seniority of the financial instrument matches that of the instruments that can be delivered in accordance with the credit derivative.An entity may make this designation irrespective of whether the financial instrument that is managed for credit risk is within the scope of IFRS 9 (for example, it can apply to loan commitments that are outside the scope of IFRS 9). The entity may designate that financial instrument at, or subsequent to, initial recognition, or while it is unrecognised and shall document the designation concurrently. [IFRS 9 paragraph 6.7.1]If designated after initial recognition, any difference in the previous carrying amount and fair value is recognised immediately in profit or loss [IFRS 9 paragraph 6.7.2]An entity discontinues measuring the financial instrument that gave rise to the credit risk at FVTPL if the qualifying criteria are no longer met and the instrument is not otherwise required to measure the instrument at FVTPL. The fair value at discontinuation becomes its new carrying amount. [IFRS 9 paragraph 6.7.3 and 6.7.4]DisclosuresIFRS 9 amends some of the requirements of IFRS 7Financial Instruments: Disclosures including added disclosures about investments in equity instruments designated as at FVTOCI.。

《国际财务报告准则第9号——金融工具》评析

《国际财务报告准则第9号——金融工具》评析作者:朱小平夏璐来源:《财会通讯》2010年第11期全球金融危机促使国际准则理事会(IASB)提出以《国际财务报告准则第9号》(IFRS9)替代《国际会计准则第39号——金融工具:确认和计量》(IAS39)的计划,其目标是使准则更简化和审慎。

该次准则变革对与金融监管、行业发展和公司经营将产生深远的影响,同时也提出了更大的挑战。

一、我国金融工具会计准则改革及影响(一)我国会计准则体系改革的重要意义我国的会计标准是随着我国经济体制改革、法律法规不断健全和资本市场的发展而逐步修正和完善起来。

从1993年开始进行的一系列大规模的会计制度改革,到2006年财政部发布了包括39项准则在内的一整套新的企业会计准则体系,会计制度改革既提升了会计信息质量,又进一步加强了会计信息的可靠性,充分满足了会计信息使用者对会计信息的使用需求。

(二)金融工具变革的影响2007年1月1日起实施的《企业会计准则》标志着我国自1993年开始的会计改革进人最为重要的阶段。

其中,与保险公司和资产管理公司密切相关的金融工具准则体系,其制定的主要思路是参照国际财务报告准则。

实施前期广泛采纳了各方面专家的意见和建议,在充分考虑我国现阶段国情的前提下,坚持与国际会计准则趋同的原则。

此次变革改变了成本与市价孰低的计价方法,引入公允价值计量要求,反映企业金融工具所隐含的风险及其对企业财务状况和经营成果的影响,但该准则的实施也导致了金融企业在不同期间业绩波动的加剧。

面临新准则的实施,企业必须加强资产配置的能力,以避免经营业绩的不稳定性。

通过不断地实践与磨合,我国顺利完成了新准则的平稳过渡。

实践证明,与国际准则接轨的新准则为我国进一步吸引外资创造了优越的软环境,显著提高了我国财务数据的国际公信力,促使我国金融行业与国际金融行业的进一步融合,降低了金融行业的交易和会计遵循成本,大大增强我国在国际资本市场上的筹资能力。

浅析IFRS9下金融工具减值问题

浅析IFRS9下金融工具减值问题作者:杨国林来源:《财会学习》 2018年第28期摘要:国际会计准则理事会(IASB)发布了《国际财务报告准则第9 号——金融工具》(IFRS9),确定了以“预期损失模型”为基础的减值方式。

根据我国会计准则国际趋同要求,IFRS9 关于金融工具损失计提模型的变动引起我国企业会计准则的调整,财政部发布了新修订的《企业会计准则第22 号——金融工具确认和计量》。

但是,根据IFRS9 修订的金融工具减值方式依然存在着一些问题。

因此本文基于此背景下,对金融工具减值方面的问题进行分析。

关键词:IFRS9;金融工具;减值一、前言财务报告中,金融工具的确认和计量是极为复杂的内容。

为了使金融工具的确认和计量简单、便于理解,国际会计准则理事会(IASB) 决定从改革,用IFRS9 取代现行的IAS39 的内容。

基于这样的背景,国际会计准则理事会(IASB) 着手修订国际会计准则,提出“预期损失模型(ECL)”的概念。

而我国也在国际会计准则趋同要求下,修订了新的金融会计准则,提出“以预期信用损失为基础”的减值模式。

二、金融工具减值存在的问题按照IFRS9 的规定,金融工具的信用损失是指会计报表编报主体根据合同应收的所有本金及利息现金流与预期将收取的所有现金流的差额的现值;预期信用损失,计算的是以违约风险为权重的加权平均信用损失。

评估预期信用损失,可以按照对手方信用风险变化的阶段化特征,IFRS9 采用了“三阶段” 法( 也称“通用模型”或“一般模型”) 以提取相应拨备。

此修订突破了金融资产减值评估的原则,对已经发生损失模型的“顺周期性”问题做出了解决。

( 一) 预期信用损失计量存在偏差预期信用损失,是指以发生违约的风险为权重的金融工具信用损失的加权平均值。

信用损失,是指企业按照原实际利率折现的、根据合同应收的所有合同现金流量与预期收取的所有现金流量之间的差额,即全部现金短缺的现值。

其中,对于企业购买或源生的已发生信用减值的金融资产,应按照该金融资产经信用调整的实际利率折现。

浅析国际财务报告准则第9号的改进和影响

2 0 ̄ 9 0

了 国际 财务 报 告 准 则 第9 —— 金 融 工 价 值 。 当金 融市 场陷入 危 机的非正 常状 为以公允 价 值 计 量 并将 其变 动计 入 损益 号 而 具)I RS ) 企 业 金融 资产 的分类 和估 态 时 , 多金 融 资 产 事 实 上 已 不 存 在 一 的金 融 资产 或可 供出售的金 融 资产。 ) F 9, ( 对 许 不是 值 方式 做 了新 的规 定, 是国际会计 准 则 个 “ 实而公 允 ” 这 真 的市场 价 格 , 如果 仍 然按 所 有 企 业在 金 融 工具 计量 时 都会 运用公 理 事 会拟 定的 国际会 计 准 则第3 号 9 替 照 公允 价 值 法 的 理 念 评 估 资 产 , 造 成 允 价 值 选 择 权 , 不 是 所 有 企 业 在 运 用 将 也

方 法 本 身 , 是 要 解 决 具 体 应 用 环 节 上 意图。 于 权 益 类 投 资 , 以公 告准 则第9 的出台背 景 号

次 贷危 机 的爆 发 在 冲击 世 界 经 济 和 的问题 , 金 融 机 构 提 供 更 好 、 一 致 的 行 计 量 , 于 债 权 类 投 资 , 为 更 对 以企 业 管理 金 银行 风 险管 理体 系的同时 , 在 规 则层面 准 则指引。 还

_国际财务报告准则第9号_金融工_省略_实施对于债券投资业务的影响及对策_潘丽娜

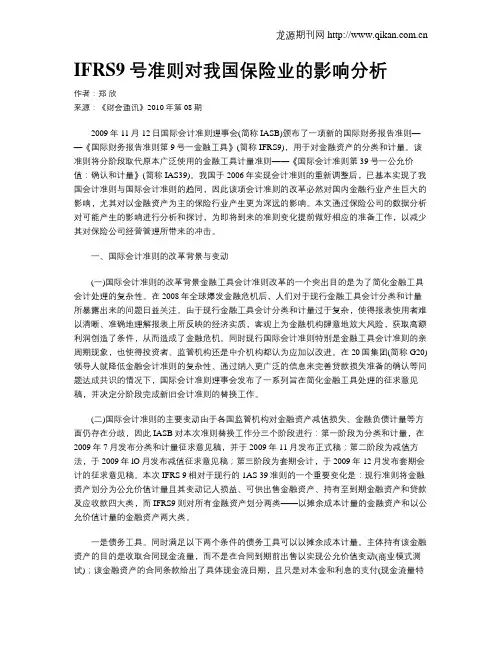

图 1 金融资产分类判断示意图

ਸ਼⧠䠁⍱ᱟӵѪᵜ

• 䠁઼࡙

ԕݱޜԧ٬䇑䟿фަਈࣘ 䇑ޕᖃᵏᦏ⳺˄)973/˅

ᱟ

•

ᱟ

୶ъ⁑ᔿᱟѪᤱᴹᒦ

᭦ਆ• ਸ਼⧠䠁⍱

᩺։ᡀᵜ䇑䟿

ᱟ

୶ъ• ⁑ᔿᱟ਼ᰦѪ᭦

ਆਸ਼⧠䠁⍱઼ࠪ䠁

㶽䍴• ӗ

ԕݱޜԧ٬䇑䟿ф ަਈࣘ䇑ަޕԆ㔬 ਸ᭦⳺˄)972&,˅

不再依赖于信用损失事件的发生。 在实务上,IFRS9 提出了“三阶段法”,每个阶

段采用不同方法来确认金融资产预期信用损失和利 息收入。

第一阶段 :对在资产负债表日具有低信用风 险或初始确认后信用质量没有显著恶化的金融工 具,按照 12 个月的预期信用损失金额确认减值准 备,并根据资产的账面总额(即不扣减预期信用损 失)来计算利息收入。

《国际财务报告准则第9号——金融工具减值(征求意见稿)》内容

附件:《〈国际财务报告准则第9号——金融工具:减值征求意见稿》简介一、国际会计准则理事会(“IASB”)发布该征求意见稿的背景现行会计准则中的已发生信用损失减值模型(“已发生损失模型”)将信用损失延迟到损失事件发生时确认,金融危机中,由于贷款和其他金融工具的信用损失延迟确认,业内普遍认为这是现行会计准则的不足。

金融危机咨询小组建议开发已发生损失模型的替代模型,使其采用的信息更具前瞻性1。

现行会计准则包含多种减值模型,带来的复杂性也被认为是额外的不足之处。

本征求意见稿主要是为财务报表使用者提供更多有用的信息,以理解有关金融资产和信贷承诺的预期信用损失。

本征求意见稿建议的模型提供了有关预期信用损失及对信用损失预期变化的信息,而且也要求采用更多合理及可支持的信息来确定预期信用损失。

针对现行实务的复杂性,本征求意见稿要求对所有金融工具采用相同的减值模型。

该征求意见稿是IASB取代《国际会计准则第39号——金融工具:确认和计量》整体项目的一部分,并且最终将被加入《国际财务报告准则第9号——金融工具》,以对减值进行会计处理。

二、受本征求意见稿修订影响的企业1为了共同应对金融危机中出现的财务报告问题,IASB与美国会计准则制定者,即美国财务会计准则委员会(FASB)于2008年10月成立了金融危机咨询小组来考虑如何改善财务报告以增强投资者对金融市场的信心。

持有金融资产和信贷承诺的企业将会受到影响。

本征求意见稿适用的金融工具如下:1.以摊余成本计量的金融资产,或强制以公允价值计量且其变动计入其他综合收益的金融资产2;2.应收账款及应收租赁款;3.其他面临信用风险的金融工具,如:(1)某些贷款承诺;及(2)某些财务担保合同。

三、本征求意见稿中的主要建议本征求意见稿中的主要建议要求企业于资产负债表日对金融资产和信贷承诺按照现行估计的未来现金流量不足确认其预期信用损失,并确认金融资产减值准备或信贷承诺拨备。

本征求意见稿不再要求企业以识别信用损失事件为确认信用损失的前提。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

业务模式测试

IFRS 9 引入了业务模式测试,要求主 体评估其针对债务工具的业务目标是 否收取工具的合同现金流量而不是在 合同到期之前通过出售来实现公允价 值变动产生的利得。这是在比个别金 融工具层次更高的层次上(例如,资 产组合或业务单位层次)进行确定, 而非根据管理层对个别金融工具的意 图来确定。

合同现金流量特征测试

嵌入衍生工具

IFRS 9 中有关评估金融资产合同现金流 量特征的要求是根据 IASB 近期发布的 《中小型企业的国际财务报告准则》中 采用的类似方法修订而成。该概念是只 有那些合同现金流量为产生本金和本金 利息(以下简称“本金和利息”)的金 融工具才可符合以摊余成本计量的标 准。IFRS 9 将利息描述为货币的时间价 值以及特定期间内未付本金的相关信用 风险的对价。因此,对可转换贷款票据 的投资并不符合以摊余成本计量的标 准,因为此类投资包含的转换选择权不 被视为代表本金和利息的支付。

dk_iasplus@deloitte.dk iasplus@deloitte.co.de iasplus@deloitte.co.za iasplus@ iasplus@deloitte.fr

IAS Plus 2009 年 11 月 第 1 页

准则提供了公允价值选择权作为以摊 余成本计量的替代方法(须满足某些 特定的条件)。

仅对以摊余成本计量的资产进行减 无标价权益投资不再按成本减去减

值评估

值计量

背景

对于IFRS 9未涵盖的属于IAS 39范围

国际会计准则理事会(IASB)于

的金融工具,提前采用IFRS 9的主体

2009 年 11 月 12 日发布了《国际财务 将继续采用IAS 39的其他会计要求

报告准则第 9 号——金融工具》

例如,开发投资性房地产的主体可能发 行固定利率债券,该债券的条款规定仅 仅从开发房地产的销售收入中支付债券 本金和利息,并且对发行主体没有追索 权。此类债券无法通过“合同现金流量 特征测试”,因为根据合同规定与债券 挂钩的基础资产没有本金和利息的现金 流量特征。

与合同挂钩的工具

对于金融资产产生的收入是由发行人以 优先于其他多项与合同挂钩工具的顺序 进行支付的情形,IFRS 9规定此类工具 的现金流量必须满足特定条件才能被视 为本金和利息的付款额。其中一个例子 是,特殊目的主体发行份额票据从而为 债务义务提供抵押,而对各份额的支付 具有不同的优先级别,导致某些份额相 对优于或次于其他份额。

具有明确到期日,并允许借款人选 择对期限为三个月的工具按三个月 的LIBOR进行支付、或对期限为一 个月的工具按一个月的LIBOR进行 支付的浮动利率金融工具;

对于主合同是一项属于 IFRS 9 范围的金 融资产的情况,IFRS 9 没有保留 IAS 39 中混合合同的嵌入衍生工具的概念。因 此,由于并非与金融资产主合同紧密相 关而按照 IAS 39 应单独以公允价值计量 且其变动计入损益的嵌入衍生工具,将 不再进行分离。取而代之的是,金融资 产的合同现金流量应作为整体进行评 估,并且如果金融资产的任何现金流量 不代表 IFRS 9 所述的本金和利息付款 额,则该资产整体应以公允价值计量且 其变动计入损益。

建议汇总

现时属于 IAS 39 范围的所有已确认 金融资产将以摊余成本计量或者以公 允价值计量。

预计 IFRS 9 将于 2010 年增加有关金 融负债分类和计量、金融工具终止确

认、减值和套期会计的新要求(参见

下页的时间表)。因此,IFRS 9 最终 将完全取代《国际会计准则第 39 号——金融工具:确认和计量》

现金流量特征测试:金融资产的合同 条款导致在特定日期产生仅仅支付本 金以及未付本金利息的现金流量。

满足上述两项标准的债务工具仍可以在 初始确认时被指定为以公允价值计量且 其变动计入损益,前提是该指定将消除 或显著减少以摊余成本计量该工具时所 产生的会计不匹配(等同于现行IAS 39针 对会计不匹配的公允价值选择权)。

如果贷款的现金流量在整体上是固定 的(例如,固定利率贷款或零息债 券)、或者利息采用浮动利率(例 如,根据合同规定利息与英镑伦敦银 行同业拆借利率(LIBOR)挂钩的英 镑贷款)、或固定利率和浮动利率相 结合(例如利息为LIBOR加上固定差 幅),则允许以摊余成本计量。

IFRS 9中提供的满足上述标准的其他金 融工具示例包括:

国际财务报告Βιβλιοθήκη 则全球办公室 全球国际财务报告准则领导人

Ken Wild kwild@

国际财务报告准则卓越中心

美洲 纽约 蒙特利尔

亚太地区 香港 墨尔本

欧洲-非洲

哥本哈根 法兰克福 约翰内斯堡 伦敦 巴黎

Robert Uhl Robert Lefrancois

Stephen Taylor Bruce Porter

(IAS 39)。

(1) 在以收取合同现金流量为目标的 业务模式下持有;并且 (2) 其合同现 金流量仅仅是本金和未付本金的利息 的付款额的债务工具(如,应收贷 款)通常必须以摊余成本计量。所有 其他债务工具必须以公允价值计量且 其变动计入损益。

IAS Plus 网站

已有超过九百 万人次浏览 www.iasplus.c om网站。我 们的目标旨在 成为互联网上 最全面的国际 财务报告信息 来源。敬请定 期查阅。

(如,金融负债的分类和计量、金融

(IFRS 9)。IFRS 9 引入了有关金融 资产和金融负债的确认和终止确认、

资产分类和计量的新要求,并自 2013 金融资产的减值、套期会计等)。

年 1 月 1 日起生效,允许提前采用。

有关IFRS 9的征求意见稿的范围包括 金融资产以及金融负债,但是由于 对金融负债的有关建议存有疑虑, IFRS 9的范围仅限于金融资产。

2009 年 11 月

IAS Plus 最新资讯.

《国际财务报告准则第 9 号——金融工具》

内容提要

有关金融资产分类和计量的新要求 取消可供出售的资产

有关以摊余成本计量的新标准

取消持有至到期的资产和“感染”

新的计量类别 - 以公允价值计量且 规则

其变动计入其他综合收益

取消金融资产中的嵌入衍生工具

尽管主体业务模式的目标可能是持有 金融资产以收取合同现金流量,但主 体无需将所有此类金融资产都持有至 到期。因此,即使发生了金融资产的 出售,主体的业务模式仍可能是持有 金融资产以收取合同现金流量。例 如,即使主体会出售投资以为资本支 出提供资金,主体持有投资以收取合 同现金流量的评估结果仍然有效。但 是,如果多次出售资产组合中的金融 资产,主体必须评估此类出售是否及 如何与其收取合同现金流量的目标相 一致。

设有浮动利率上限的固定期限浮动 市场利率债券;以及

本金和利息付款额与金融工具的发 行货币的非杠杆通货膨胀指数挂钩 的固定期限债券。

不满足上述标准的金融工具示例包 括:

可转换为发行人权益工具的债券; 以及

以反浮动利率支付的贷款(例如8% 减去LIBOR)。

IFRS 9包含说明该标准应用的实施指南 和进一步示例。

Jan Peter Larsen Andreas Barckow Graeme Berry Veronica Poole Laurence Rivat

iasplusamericas@ iasplus@deloitte.ca

iasplus@ iasplus@.au

所有属于IFRS 9范围的权益投资在财 务状况表中均以公允价值计量,并且 在没有做出特别选择的情况下利得和 损失均计入损益。仅当权益投资并非 为交易而持有时,主体才能在初始确 认时作出不可撤消的选择,将其指定 为以公允价值计量且其变动计入其他 综合收益(只有股利收入是计入损 益)。

尽管 IFRS 9 要求所有权益投资均以公允 价值计量,但仍包含有关何时成本可能 是公允价值的最佳估计以及何时成本可 能并不代表公允价值的指引。

债务工具

债务工具将以摊余成本计量,或者以 公允价值计量且其变动计入损益。现 行 IAS 39 中可供出售及持有至到期的 类别(包括相关的“感染”规则)已 从 IFRS 9 中删除。如果一项债务工具 同时满足“业务模式测试”和“合同 现金流量特征测试”,则通常必须以 摊余成本计量。

业务模式测试:主体业务模式的目标 是持有金融资产以收取合同现金流量 (而并非在合同到期前出售该工具以 实现公允价值变动产生的利得)。

IFRS 9 承认主体可能拥有以不同方式 管理的多个业务单位。例如,主体可 能拥有零售银行业务(其目标是收取 贷款资产的合同现金流量)和投资银 行业务(其目标是通过在贷款资产到 期前出售来实现公允价值变动产生的 利得)。在这种情况下,假设金融工 具产生的现金流量是本金和利息的付 款额(参见下文的现金流量特征测 试),则零售银行业务内的此类金融 工具可能符合以摊余成本计量的标准 - 即使投资银行业务内的类似金融工 具并不符合该标准。符合现行 IAS 39 中“为交易而持有”定义的金融工具 应以公允价值计量且其变动计入损 益,因为此类金融工具并非为了收取 金融工具的合同现金流量而持有。

是

以公允价值计量且 其变动计入其他综合收益*

以公允价值计量且 其变动计入损益

是

是 主体是否运用了公允价值 计量选择权以减少会计计 量的不匹配? 否

以摊余成本计量

* 代表投资回报的股利收入应计入损益。 ** IAS 39的套期会计规定仍适用于在有效套期关系中被指定的衍生工具。 *** 当且仅当主体改变其管理金融资产的业务模式时才需进行重分类。

如果一项以摊余成本计量的债务工具在 到期之前被终止确认,修订后的《国际 会计准则第1号——财务报表的列报》 (IAS 1)将要求在综合收益表中单独列 报处置产生的利得/损失,而修订后的 《国际财务报告准则第7号——金融工 具:披露》(IFRS 7)将要求对该利得/ 损失及出售原因进行分析。