国际经济学理论与政策--双语各章练习

国际经济学英文题库(最全版附答案)

【国际经济学】英文题库Chapter 1: IntroductionMultiple-Choice Questions1. Which of the following products are not produced at all in the United States?*A. Coffee, tea, cocoaB. steel, copper, aluminumC. petroleum, coal, natural gasD. typewriters, computers, airplanes2. International trade is most important to the standard of living of:A. the United States*B. SwitzerlandC. GermanyD. England3. Over time, the economic interdependence of nations has:*A. grownB. diminishedC. remained unchangedD. cannot say4. A rough measure of the degree of economic interdependence of a nation is given by:A. the size of the nations' populationB. the percentage of its population to its GDP*C. the percentage of a nation's imports and exports to its GDPD. all of the above 5. Economic interdependence is greater for:*A. small nationsB. large nationsC. developed nationsD. developing nations6. The gravity model of international trade predicts that trade between two nations is larger A. the larger the two nationsB. the closer the nationsC. the more open are the two nations*D. all of the above7. International economics deals with:A. the flow of goods, services, and payments among nationsB. policies directed at regulating the flow of goods, services, and paymentsC. the effects of policies on the welfare of the nation*D. all of the above 8. International trade theory refers to:*A. the microeconomic aspects of international tradeB. the macroeconomic aspects of international tradeC. open economy macroeconomics or international financeD. all of the above 9. Which of the following is not the subject matter of international finance?A. foreign exchange marketsB. the balance of payments*C. the basis and the gains from tradeD. policies to adjust balance of payments disequilibria10. Economic theory:A. seeks to explain economic eventsB. seeks to predict economic eventsC. abstracts from the many detail that surrounds an economic event*D. all of the above11. Which of the following is not an assumption generally made in the study of inter national economics?A. two nationsB. two commodities*C. perfect international mobility of factorsD. two factors of production12. In the study of international economics:A. international trade policies are examined before the bases for tradeB. adjustment policies are discussed before the balance of paymentsC. the case of many nations is discussed before the two-nations case*D. none of the above13. International trade is similar to interregional trade in that both must overcome:*A. distance and spaceB. trade restrictionsC. differences in currenciesD. differences in monetary systems14. The opening or expansion of international trade usually affects all members of so ciety: A. positivelyB. negatively*C. most positively but some negativelyD. most negatively but some positively15. An increase in the dollar price of a foreign currency usually:A. benefit U.S. importers*B. benefits U.S. exportersC. benefit both U.S. importers and U.S. exportersD. harms both U.S. importers and U.S. exporters16. Which of the following statements with regard to international economics is true?A. It is a relatively new field*B. it is a relatively old fieldC. most of its contributors were not economistsD. none of the above思考题:1.为什么学习国际经济学非常重要?2.列举体现当前国际经济学问题的一些重要事件,它们为什么重要?3.当今世界面临的最重要的国家经济问题是什么?全球化的利弊各是什么?Chapter 2: The Law of Comparative Advantage Multiple-Choice Questions1. The Mercantilists did not advocate:*A.free tradeB. stimulating the nation's exportsC. restricting the nations' importsD. the accumulation of gold by the nation2. According to Adam Smith, international trade was based on:*A. absolute advantageB. comparative advantageC. both absolute and comparative advantageD. neither absolute nor comparative advantage3. What proportion of international trade is based on absolute advantage?A. AllB. most*C. someD. none4. The commodity in which the nation has the smallest absolute disadvantage is the commodity of its:A. absolute disadvantageB. absolute advantageC. comparative disadvantage*D. comparative advantage5. If in a two-nation (A and B), two-commodity (X and Y) world, it is established tha t nation A has a comparative advantage in commodity X, then nation B must have:A. an absolute advantage in commodity YB. an absolute disadvantage in commodity YC. a comparative disadvantage in commodity Y*D. a comparative advantage in commodity Y6. If with one hour of labor time nation A can produce either 3X or 3Y while nation B can produce either 1X or 3Y (and labor is the only input):A. nation A has a comparative disadvantage in commodity XB. nation B has a comparative disadvantage in commodity Y*C. nation A has a comparative advantage in commodity XD. nation A has a comparative advantage in neither commodity7. With reference to the statement in Question 6:A. Px/Py=1 in nation AB. Px/Py=3 in nation BC. Py/Px=1/3 in nation B*D. all of the above8. With reference to the statement in Question 6, if 3X is exchanged for 3Y:A. nation A gains 2X*B. nation B gains 6YC. nation A gains 3YD. nation B gains 3Y9. With reference to the statement of Question 6, the range of mutually beneficial tra de between nation A and B is:A. 3Y < 3X < 5YB. 5Y < 3X < 9Y*C. 3Y < 3X < 9YD. 1Y < 3X < 3Y10. If domestically 3X=3Y in nation A, while 1X=1Y domestically in nation B:A. there will be no trade between the two nationsB. the relative price of X is the same in both nationsC. the relative price of Y is the same in both nations*D. all of the above11. Ricardo explained the law of comparative advantage on the basis of:*A. the labor theory of valueB. the opportunity cost theoryC. the law of diminishing returnsD. all of the above12. Which of the following statements is true?A. The combined demand for each commodity by the two nations is negatively slope dB. the combined supply for each commodity by the two nations is rising stepwiseC. the equilibrium relative commodity price for each commodity with trade is giv en by the intersection of the demand and supply of each commodity by the two nati ons*D. all of the above13. A difference in relative commodity prices between two nations can be based upo difference in:n a difference A. factor endowmentsB. technologyC. tastes*D. all of the above14. In the trade between a small and a large nation:A. the large nation is likely to receive all of the gains from trade*B. the small nation is likely to receive all of the gains from tradeC. the gains from trade are likely to be equally sharedD. we cannot say15. The Ricardian trade model has been empirically*A. verifiedB. rejectedC. not testedD. tested but the results were inconclusive思考题:比较优势原理所带来的贸易所得是从何而来的?贸易利益又是如何分配的?现实世界中比较优势是如何度量的?你认为目前中国具有比较优势的商品有哪些?这意味着什么?比较优势会不会发生变化?什么样的原因可能会导致其变化?经济学家是如何验证比较优势原理的?Chapter 3: The Standard Theory of International TradeMultiple-Choice Questions1. A production frontier that is concave from the origin indicates that the nation incur s i ncreasing increasing opportunity costs in the production of:A. commodity X onlyB. commodity Y only*C. both commoditiesD. neither commodity2. The marginal rate of transformation (MRT) of X for Y refers to:A. the amount of Y that a nation must give up to produce each additional unit of XB. the opportunity cost of XC. the absolute slope of the production frontier at the point of production*D. all of the above3. Which of the following is not a reason for increasing opportunity costs:*A. technology differs among nationsB. factors of production are not homogeneousC. factors of production are not used in the same fixed proportion in the production of all commoditiesD. for the nation to produce more of a commodity, it must use resources that are le ss and less suited in the production of the commodity4. Community indifference curves:A. are negatively slopedB. are convex to the originC. should not cross*D. all of the above5. The marginal rate of substitution (MRS) of X for Y in consumption refers to the:A. amount of X that a nation must give up for one extra unit of Y and still remain o n the same indifference curve*B. amount of Y that a nation must give up for one extra unit of X and still remain on the same indifference curveC. amount of X that a nation must give up for one extra unit of Y to reach a higher indifference curveD. amount of Y that a nation must give up for one extra unit of X to reach a higher indifference curve6. Which of the following statements is true with respect to the MRS of X for Y?A. It is given by the absolute slope of the indifference curveB. declines as the nation moves down an indifference curveC. rises as the nation moves up an indifference curve*D. all of the above 7. Which of the following statements about community indifference curves is true?A. They are entirely unrelated to individuals' community indifference curvesB. they cross, they cannot be used in the analysis*C. the problems arising from intersecting community indifference curves can be over come by the application of the compensation principleD. all of the above. 8. Which of the following is not true for a nation that is in equilibrium in isolation?*A. It consumes inside its production frontierB. it reaches the highest indifference curve possible with its production frontierC. the indifference curve is tangent to the nation's production frontierD. MRT of X for Y equals MRS of X for Y, and they are equal to Px/Py 9. If the internal Px/Py is lower in nation 1 than in nation 2 without trade:A. nation 1 has a comparative advantage in commodity YB. nation 2 has a comparative advantage in commodity X*C. nation 2 has a comparative advantage in commodity YD. none of the above10. Nation 1's share of the gains from trade will be greater:A. the greater is nation 1's demand for nation 2's exports*B. the closer Px/Py with trade settles to nation 2's pretrade Px/PyC. the weaker is nation 2's demand for nation 1's exportsD. the closer Px/Py with trade settles to nation 1's pretrade Px/Py11. If Px/Py exceeds the equilibrium relative Px/Py with tradeequilibr A. the nation exporting commodity X will want to export more of X than at e quilibr iumequilibri B. the nation importing commodity X will want to import less of X than at e quilibri umC. Px/Py will fall toward the equilibrium Px/Py*D. all of the above12. With free trade under increasing costs:A. neither nation will specialize completely in productionB. at least one nation will consume above its production frontierC. a small nation will always gain from trade*D. all of the above13. Which of the following statements is false?A.The gains from trade can be broken down into the gains from exchange and the gains from specializationB. gains from exchange result even without specialization*C. gains from specialization result even without exchangeD. none of the above14. The gains from exchange with respect to the gains from specialization are alway s:A. greaterB. smallerC. equal*D. we cannot say without additional information15. Mutually beneficial trade cannot occur if production frontiers are:A. equal but tastes are notB. different but tastes are the sameC. different and tastes are also different*D. the same and tastes are also the same.思考题:国际贸易的标准理论与大卫.李嘉图的比较优势原理有何异同?两国仅仅由于需求偏好不同可以进行市场分工和狐狸贸易吗?两国仅仅由于要素禀赋不同和/或生产技术不同可以进行分工和贸易吗?Chapter 4: Demand and Supply, Offer Curves, and the Terms of Trade Multiple Choice Questions1. Which of the following statements is correct? A. The demand for imports is given by the excess demand for the commodityB. the supply of exports is given by the excess supply of the commodityC. the supply curve of exports is flatter than the total supply curve of the commodity *D. all of the above2. At a relative commodity price above equilibriumA. the excess demand for a commodity exceeds the excess supply of the commodityB. the quantity demanded of imports exceeds the quantity supplied of exports*C. the commodity price will fallD. all of the above3. The offer curve of a nation shows:A. the supply of a nation's importsB. the demand for a nation's exportsC. the trade partner's demand for imports and supply of exports*D. the nation's demand for imports and supply of exports4. The offer curve of a nation bulges toward the axis measuring the nationsA. import commodity*B. export commodityC. export or import commodityD. nontraded commodity5. Export prices must rise for a nation to increase its exports because the nation:A. incurs increasing opportunity costs in export productionB. faces decreasing opportunity costs in producing import substitutesC. faces decreasing marginal rate of substitution in consumption*D. all of the above6. Which of the following statements regarding partial equilibrium analysis is false?A. It relies on traditional demand and supply curvesB. it isolates for study one market*C. it can be used to determine the equilibrium relative commodity price but not the equilibrium quantity with tradeD. none of the above7. Which of the following statements regarding partial equilibrium analysis is true?A. The demand and supply curve are derived from the nation's production frontier an d indifference mapB. It shows the same basic information as offer curvesC. It shows the same equilibrium relative commodity prices as with offer curves*D. all of the above 8. In what way does partial equilibrium analysis differ from general equilibrium analy sis?A. The former but not the latter can be used to determine the equilibrium price with tradeB. the former but not the latter can be used to determine the equilibrium quantity with tradeC. the former but not the latter takes into consideration the interaction among all ma rkets in the economy*D. the former gives only an approximation to the answer sought.9. If the terms of trade of a nation are 1.5 in a two-nation world, those of the tradepartner are:A. 3/4*B. 2/3C. 3/2D. 4/310. If the terms of trade increase in a two-nation world, those of the trade partner:*A. deteriorateB. improveC. remain unchangedD. any of the above11. If a nation does not affect world prices by its trading, its offer curve:A. is a straight lineB. bulges toward the axis measuring the import commodity*C. intersects the straight-line segment of the world's offer curveD. intersects the positively-sloped portion of the world's offer curve12. If the nation's tastes for its import commodity increases:A. the nation's offer curve rotates toward the axis measuring its import commodityB. the partner's offer curve rotates toward the axis measuring its import commodity C. the partner's offer curve rotates toward the axis measuring its export commodity *D. the nation's offer curve rotates toward the axis measuring its export commodity13. If the nation's tastes for its import commodity increases:A. the nation's terms of trade remain unchanged*B. the nation's terms of trade deteriorateC. the partner's terms of trade deteriorateD. any of the above14. If the tastes for a nation import commodity increases, trade volume:*A. increasesB. declinesC. remains unchangedD. any of the above15. A deterioration of a nation's terms of trade causes the nation's welfare to:A. deteriorateB. improveC. remain unchanged*D. any of the above思考题:提供曲线如何推导?有何用途?两国贸易时的均衡商品价格是如何决定的?受哪些因素影响?贸易条件的含义是?贸易条件的改善意味着什么?哪些因素可能导致贸易条件的改善?Chapter 5: Factor Endowments and the Heckscher-Ohlin Theory Multiple-Choice Questions1. The H-O model extends the classical trade model by:A. explaining the basis for comparative advantageB. examining the effect of trade on factor prices*C. both A and BD. neither A nor B2. Which is not an assumption of the H-O model:A. the same technology in both nationsB. constant returns to scale*C. complete specializationD. equal tastes in both nations3. With equal technology nations will have equal K/L in production if:*A. factor prices are the sameB. tastes are the sameC. production functions are the sameD. all of the above4. We say that commodity Y is K-intensive with respect to X when:A. more K is used in the production of Y than XB. less L is used in the production of Y than X*C. a lower L/K ratio is used in the production of Y than XD. a higher K/L is used in the production of X than Y5. When w/r falls, L/KA. falls in the production of both commodities*B. rises in the production of both commoditiesC. can rise or fallD. is not affected6. A nation is said to have a relative abundance of K if it has a:A. greater absolute amount of KB. smaller absolute amount of LC. higher L/K ratio*D. lower r/w 7. A difference in relative commodity prices between nations can be based on a diffe rence in:A. technologyB. factor endowmentsC. tastes*D. all of the above 8. In the H-O model, international trade is based mostly on a difference in:A. technology*B. factor endowmentsC. economies of scaleD. tastes 9. According to the H-O model, trade reduces international differences in:A. relative but not absolute factor pricesB. absolute but not relative factor prices*C. both relative and absolute factor pricesD. neither relative nor absolute factor prices10. According to the H-O model, international trade will:A. reduce international differences in per capita incomesB. increases international differences in per capita incomes*C. may increase or reduce international differences in per capita incomes D. lead to complete specialization11. The H-O model is a general equilibrium model because it deals with:A. production in both nationsB. consumption in both nationsC. trade between the two nations*D. all of the above12. The H-O model is a simplification of the a truly general equilibrium model b ecause because it deals with:A. two nationsB. two commoditiesC. two factors of production*D. all of the above13. The Leontief paradox refers to the empirical finding that U.S.*A. import substitutes are more K-intensive than exportsB. imports are more K-intensive than exportsC. exports are more L-intensive than importsD. exports are more K-intensive than import substitutes14. From empirical studies, we conclude that the H-O theory:A. must be rejectedB. must be accepted without reservations*C. can be accepted while awaiting further testingD. explains all international trade15. For factor reversal to occur, two commodities must be produced with:*A. sufficiently different elasticity of substitution of factors B. the same K/L ratioC. technologically-fixed factor proportionsD. equal elasticity of substitution of factors思考题:H-O理论有哪些假设?各假设的含义是什么?为什么要做出这些假设?如何检验H-O理论的正确性?H-O-S定理的假设条件又是什么?他与生产要素国际间的流动有何关系?如何检验H-O-S定理在现实中的可靠性?Chapter 6: Economies of Scale, Imperfect Competition, and International T radeMultiple-Choice Questions:1. Relaxing the assumptions on which the Heckscher-Ohlin theory rests:A. leads to rejection of the theoryB. leaves the theory unaffected*C. requires complementary trade theoriesD. any of the above.Which of the following assumptions of the Heckscher-Ohlin theory, when relaxed, leav ethe theory unaffected? t he A. Two nations, two commodities, and two factorsB. both nations use the same technologyC. the same commodity is L-intensive in both nations*D. all of the aboveWhich of the following assumptions of the Heckscher-Ohlin theory, when relaxed, require new trade theories? r equire *A. Economies of scaleB. incomplete specializationC. similar tastes in both nationsD. the existence of transportation costsInternational trade can be based on economies of scale even if both nations have ide ntical:A. factor endowmentsB. tastesC. technology*D. all of the above5. A great deal of international trade:A. is intra-industry tradeB. involves differentiated productsC. is based on monopolistic competition*D. all of the above6. The Heckscher-Ohlin and new trade theories explains most of the trade:A. among industrial countriesB. between developed and developing countriesC. in industrial goods*D. all of the aboveThe theory that a nation exports those products for which a large domestic market e xistswas advanced by: w as *A. LinderB. VernonC. LeontiefD. Ohlin8. Intra-industry trade takes place:A. because products are homogeneous*B. in order to take advantage of economies of scaleC. because perfect competition is the prevalent form of market organizationD. all of the aboveIf a nation exports twice as much of a differentiated product that it imports, its intra- i ndustry industry (T) index is equal to:A. 1.00B. 0.75*C. 0.50D. 0.2510. Trade based on technological gaps is closely related to:A. the H-O theory*B. the product-cycle theoryC. Linder's theoryD. all of the above11. Which of the following statements is true with regard to the product-cycle theor y?A. It depends on differences in technological changes over time among countriesB. it depends on the opening and the closing of technological gaps among countriesC. it postulates that industrial countries export more advanced products to less advanced countries*D. all of the above12. Transport costs:A. increase the price in the importing countryB. reduces the price in the exporting country*C. both of the aboveD. neither A nor B.13. Transport costs can be analyzed:A. with demand and supply curvesB. production frontiersC. offer curves*D. all of the above14. The share of transport costs will fall less heavily on the nation:*A. with the more elastic demand and supply of the traded commodityB. with the less elastic demand and supply of the traded commodityC. exporting agricultural productsD. with the largest domestic market15. A footloose industry is one in which the product:A. gains weight in processingB. loses weight in processingC. both of the above*D. neither A nor B.思考题:本章的贸易理论与基于比较优势的贸易理论有哪些不同?这两类贸易理论是互相排斥的吗?H-O理论与心贸易理论之间有什么经验关联?运输成本对H-O定理和H-O-S定理有何影响?不同的环保标准时如何影响产业选址及国际贸易的?2009年底联合国哥本哈根气候大会中的议题与国际贸易有何关系?这对我国经贸发展有何影响?Chapter 7: Economic Growth and International Trade Multiple-Choice Questions1. Dynamic factors in trade theory refer to changes in:A. factor endowmentsB. technologyC. tastes*D. all of the above2. Doubling the amount of L and K under constant returns to scale:A. doubles the output of the L-intensive commodityB. doubles the output of the K-intensive commodityC. leaves the shape of the production frontier unchanged*D. all of the above.3. Doubling only the amount of L available under constant returns to scale:A. less than doubles the output of the L-intensive commodity*B. more than doubles the output of the L-intensive commodityC. doubles the output of the K-intensive commodityD. leaves the output of the K-intensive commodity unchanged4. The Rybczynski theorem postulates that doubling L at constant relative commodity prices:A. doubles the output of the L-intensive commodity*B. reduces the output of the K-intensive commodityC. increases the output of both commoditiesD. any of the above5. Doubling L is likely to:A. increases the relative price of the L-intensive commodityB. reduces the relative price of the K-intensive commodity*C. reduces the relative price of the L-intensive commodityD. any of the aboveTechnical progress that increases the productivity of L proportionately more than the productivity of K is called: p roductivity *A. capital savingB. labor savingC. neutralD. any of the above7. A 50 percent productivity increase in the production of commodity Y:A. increases the output of commodity Y by 50 percentB. does not affect the output of XC. shifts the production frontier in the Y direction only*D. any of the above8. Doubling L with trade in a small L-abundant nation:*A. reduces the nation's social welfareB. reduces the nation's terms of tradeC. reduces the volume of tradeD. all of the above 9. Doubling L with trade in a large L-abundant nation:A. reduces the nation's social welfareB. reduces the nation's terms of tradeC. reduces the volume of trade*D. all of the aboveIf, at unchanged terms of trade, a nation wants to trade more after growth, then the n ation's nation's terms of trade can be expected to:*A. deteriorateB. improveC. remain unchangedD. any of the above A proportionately greater increase in the nation's supply of labor than of capital is lik ely to result in a deterioration in the nation's terms of trade if the nation exports: to A. the K-intensive commodity*B. the L-intensive commodityC. either commodityD. both commodities12. Technical progress in the nation's export commodity:*A. may reduce the nation's welfareB. will reduce the nation's welfareC. will increase the nation's welfareD. leaves the nation's welfare unchanged13. Doubling K with trade in a large L-abundant nation:A. increases the nation's welfareB. improves the nation's terms of tradeC. reduces the volume of trade*D. all of the above14. An increase in tastes for the import commodity in both nations:A. reduces the volume of trade*B. increases the volume of tradeC. leaves the volume of trade unchangedD. any of the above15. An increase in tastes of the import commodity of Nation A and export in B:*A. will reduce the terms of trade of Nation AB. will increase the terms of trade of Nation AC. will reduce the terms of trade of Nation BD. any of the above思考题:要素积累和技术进步如何影响一国的生产可能性曲线的形状和位置?何种类型的经济增长最可恩能够导致国家福利的下降?那种类型的经济增长最可能导致国家福利的改善?Chapter 8: Trade Restrictions: TariffsMultiple-choice Questions1. Which of the following statements is incorrect?A. An ad valorem tariff is expressed as a percentage of the value of the traded com modityB. A specific tariff is expressed as a fixed sum of the value of the traded commodity.C. Export tariffs are prohibited by the U.S. Constitution*D. The U.S. uses exclusively the specific tariff 2. A small nation is one:A. which does not affect world price by its tradingB. which faces an infinitely elastic world supply curve for its import commodityC. whose consumers will pay a price that exceeds the world price by the amount of t he tariff*D. all of the above3. If a small nation increases the tariff on its import commodity, its:A. consumption of the commodity increasesB. production of the commodity decreasesC. imports of the commodity increase*D. none of the aboveThe increase in producer surplus when a small nation imposes a tariff is measured by the area:*A. to the left of the supply curve between the commodity price with and without th e tariffB. under the supply curve between the quantity produced with and without the tariffC. under the demand curve between the commodity price with and without the tariffD. none of the above.。

国际经济学理论与政策__双语各章练习题

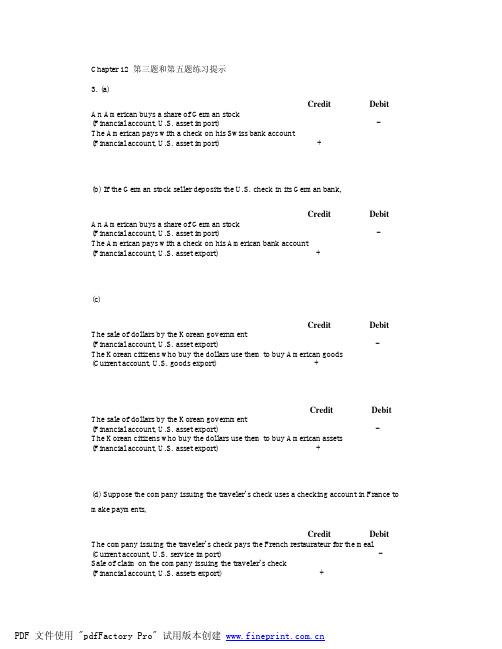

Quiz for Chapter 12Ⅰ. Fill the following blanks with the proper word or expression1. Y-( )=CA2、National income equals GNP less ( ),plus ( ),less ( ).3. GNP equals GDP ( ) net receipts of factor income from the rest of the world.4. The national income identity for an open economy is ( ).5. When a country 's exports exceed its imports, we say the country has a current account ( ).6. The current account includes ( )7. Any transaction resulting in a payment to foreigners is entered in the balance of payment account as a ( ).8. In a closed economy, national saving always equals ( ).9.When official reserves increase, this will be recorded in the ( ), with ( )sign.10. When debit is bigger than net decrease of the reserve, the difference will go to the ( ).Ⅱ. True or false1. The balance of payments accounts always balance in practice as they must in theory.( )2. Net unilateral transfers are considered part of the current accounts but not a part of national income .( )3. The GNP a country generates over some time period must equal its national income ,the income earned in that period by its factors of production. ( )4. When you buy a share of Microsoft stock , you are buying neither a good or a service , so your purchase dose not show up in GNP. ( )5. If the government deficit rises and private saving and investment do not change much ,the current account surplus must fall by roughly the same account as the increase in the fiscal deficit. ( )6. We include income on foreign investment in the current account because that income really is compensation for the services provided by foreign investments.( )7. Remember that foreign borrowing may not always be a bad idea :a country that borrows abroad to undertake profitable domestic investment can pay its creditors and still have money left over.( )8. Government agencies including central banks can freely hold foreign reserves and intervene officiallyin exchange market.( )9. When the United States lends abroad, a payment is made to foreigners and the capital account is credited.10. One reason intervention is important is that central banks use it as a way of altering the amount of money in circulation.Ⅲ. Answer the following questions:1.Why account keepers adds the account a statistical discrepancy to the balance of payment?2.The nation of Pecunia had a current account deficit of $1 billion and a nonreserve financial account surplusof $550 million in 2005.(1)What was the balance of payments of Pecunia in that year? What happened to the country’s net foreignassets?(2)Assume that foreign central banks neither buy nor sell Pecunian assets. How did the Pecunian central bankshad purchased $600 million of Pecunian assets in 2005? How would this official intervention show up in the balance of payments accounts?(3)How would your answer to (2) change if you learned that foreign central banks had purchased enter foreignbalance of payments accounts?Ⅳ. Fill the following blanks:China's balance of payment in 2000Quiz for Chapter 13Ⅰ. Fill the following blanks with the proper word or expression1. Changes in exchange rates are described asor .2. Foreign exchange deals sometimes specify a value date farther away than two-days-30 days, 90days, 180 days, or even several years. The exchange rates quoted in such transactions are called3. is the most liquid of assets4. The ease with which the asset can be sold or exchange for goods, we call the character is5. A foreignis a spot sale of a currency combined with a forward repurchase of the currency.6. The foreign exchange market is inwhen deposits of all currencies offer the same expected rate of return.7. The price of one currency in terms of another is called an8. All else equal, ain the expected future exchange rate causes a rise in the current exchange rate.9. is the percentage increase in value, it offers over some time period.10. All else equal, anin the interest paid on deposits of a currency causes that currency to appreciate againstforeign currencies.Ⅱ. True or false1. A rate of appreciation of the dollar against the euro is the rate of depreciation of the euro against dollar.( )2. The exchange rate quoted as the price of foreign currency in terms of domestic currency is called direct quotation. ( )3. all else equal, an appreciation of a country's currency makes its goods cheaper for foreigners. ( )4. The foreign exchange market is in equilibrium when deposits of all currencies offer the same expected rate of return. ( )5. All else equal., When a country's currency depreciated, domestic residents find that imports from abroad are more expensive. ( )6. Central bank is at the center of the foreign exchange market.( )7. A depreciation of the dollar against euro today makes euro deposit less attractive on the condition that expected future dollar/euro rate and interest rates do not change.( )8. all else equal, a decrease of the interest paid on deposit of US dollars causes dollars to appreciate against foreign currency.( )9. New York. is the largest foreign exchange market in the world. ( )10. A fall in the expected future exchange rate causes a fall in the current exchange rate.Ⅲ. Answer the following questions:1. Currently, the spot exchange rate is US$1=SF1.50 and the expected exchange rate for six month is SF1.55. the interest rate is 8% in the US per annum and 10% in the Switzerland per annum. (1)Determine whether interest rate parity is currently holding.(2)If it is not holding, what will happen in the foreign exchange market?.(3)If the expected exchange rate is unchanged, what is the spot rate when foreign exchange rate is inequilibrium?2.Suppose the dollar interest rate and the pound sterling interest rate are the same, 5 percent per year. What is the relation between the current equilibrium $/£exchange rateand its expected future level? Suppose the expected future $/£exchange rate, $1.52 per pound, remains constant as Britain’s interest rate rises to 10 percent per year. If the U.S. interest rate also remains constant, what is the new equilibrium $/£exchange rate?Quiz for Chapter 14Ⅰ. Fill the following blanks with the proper word or expression1. M1 includes __________.2. An economy 's money supply is controlled by _________________.3. Three main factors that determine aggregate money demand are4. When money supply equals money demand, we say that the money market is _______________________.5. A rise in the average value of transactions carried out by a household or firm cause its demand for money to.6. is an important phenomenon because it helps explain why exchange rates move so sharply from day to day.7. If the economy is initially at full employment, a permanent increase in the money supply eventually be followed byin the price level.8. Overshooting is a direct consequence of the short-run9. An economy’sis the position it would eventually reach if no new economic shocks occurred during the adjustment to full employment.10. All else equal, a permanent in a country’s money supply causes a proportional long-rundepreciation of its currency against foreign currencies.Ⅱ. True or false1. An increase in real output lowers the interest rate. ( )2. In the short run, a reduction in a country's money supply causes its currency to appreciate in the foreign exchange market. ( )3. All else equal, an increase in a country 's money supply causes a proportional increase in its price level in the long run. ( )3. All else equal, a rise in the interest rate causes the demand for money to fall. ( )4. If there is initially an excess demand of money, the interest rate falls in the short-run. ( )5. A rise in the average value of transactions carried out by a household or firm causes its demand for money to fall. ( )6. Given the price level and out put, an increase in the money supply lowers the interest rate. ( )7. A change in the supply of money has effect on the long-run values of the interest rate or real output. ( )8.The higher the interest rate, the more you sacrifice by holding wealth in the form of money. ( )9. An increase in real output lowers the interest rate, given the price level and the money supply( )10. An economy experiences inflation when its price level is falling. ( )Ⅲ. Answer the following questions:1. What is the short-run effect on the exchange rate when US government increases the money supply? (expectations about future exchange rate are unchanged)2.Please draw a group of pictures to show the time paths of U.S. economic variables after a permanent increase in the U.S. money supply growth rate according to the following:(1)The u.s. decided to increase the money supply growth rate permanently.The vertical axis is money supply and the horizontal axis is time.(2)The interest rate change,. The vertical axis is Dollar interest rate and the horizontal axis is time.(3)The price level change. The vertical axis is U.S price level and the horizontal axis is time.(4)The exchange rate change,. The vertical axis is the Dollar/Euro exchange rate and the horizontal axis is time.Ⅳ. CALCULATIONSuppose that the spot rate is €1 = US$1.2468 -78 and the six-month forward rate is €1 = US$1.2523-33, the interest rate per annum is 4% in the euro zone and 6% in the US. After carrying out interest arbitrage with €5,000,000 borrowed at the above-mentioned rate, please calculate your net interest arbitrage profit ( other costs ignored ).Quiz for Chapter 15Ⅰ. Fill the following blanks with the proper word or expression1. The equation for real interest parity is.2. The long-run relationship between inflation and interest rates is called .3. The equation for absolute PPP is _________________________.4. The equation for relative PPP is _________________________.5. The law of_______________ states that under free competition and in the absence of trade impediments, a good must sell for a single price regardless of where in the world it is sold.6. Equation$/$/()/E US q E P P ∈∈=⨯ shows that at unchanged output prices, nominal depreciation implies real.7. According to Fisher effect, if U.S. inflation were to rise, then U.S. dollar interest rates would_________________.8. _________________is the relative price of two output baskets, while _________________is the relative price of two currencies.9. Transport costs and government trade restrictions make it expensive to move goods between markets located in different countries and therefore weaken the _________________mechanism underlying PPP. 10. refer to those goods and services that can never be traded internationally at a profit.Ⅱ. True or false1. According to monetary approach, a rise in the interest rate on dollar will lead to the depreciation of the dollar in the long run.( )2. According to monetary approach, a rise in European output causes the Euro to appreciate. ( )3. When demand for American products rises, there will be a long-run real depreciation of the dollar. ( )4. According to monetary approach, a rise in European output causes the Euro to appreciate. ( )5. When European output supply increases, there will be an appreciation of the euro. ( )6. Expected real interest rates are the same in different countries when relative PPP is expected to hold. ( )7. Based on the monetary approach, other things equal, a permanent rise in the U.S. money supply causes a proportional long-run appreciation of the dollar against euro. ( )8. At unchanged output prices, nominal depreciation implies real appreciation. ( )9. Departures from PPP may be even greater in the short run than in the long run because many prices in the economy are sticky and take time to adjust fully. ( )10. If all U.S. prices increase by 10% and the dollar depreciates against foreign currencies by 10%, absolute PPP will be satisfied (assuming there are no changes abroad) for any domestic and foreign choices of price level indexes. ( )Ⅲ. Answer the following questions :1. Suppose America’s inflation rate is 6% over one year, but the inflation rate in Italy is 12%. According to relative PPP, what should happen over the year to the dollar ’s exchange rate against the lira?2.How to explain the problems with PPP? Give the reasons.Quiz for Chapter 16Ⅰ. Fill the following blanks with the proper word or expression1. The aggregate demand for an open economy’s output consists of four components:2. The current account balance is determined by two main factors: and3. Equilibrium in the economy as a whole requires equilibrium in theas well as in the4. An temporary increase in the money supply causes aof the domestic currency, of output,and thereforein employment.5. Given a fixed exchange rate, when government demand increases, DD schedule will shift6. A reduction in money demand would shift AA ___________.7. __________ policy works through changes in government spending or taxes.8. If the economy starts at long-run equilibrium, a permanent change in fiscal policy has no net effect on .9. J-curve effects amplify the of exchange rates10. Because a permanent fiscal expansion changes exchange-rate expectations, the effect on output isif the economy stats in long-run equilibrium.Ⅱ. True or false1. If there is a decline in investment demand, the DD schedule will shift to the right. ( )2. The effect of real exchange rate increase on IM is ambiguous. ( )3. A temporary increase in the money supply, which does not alter the long-run expected exchange rate, causes a depreciation of the currency and a rise in output. Temporary fiscal expansion also has the same result. ( )4. Other things equal, a real depreciation of the home currency lowers aggregate demand for home output. ( )5. The DD Schedule shows all exchange rate and output levels at which the outputmarket is in short-run equilibrium. DD Schedule slopes upward. ( )6. A permanent fiscal expansion does not changes exchange-rate expectations. ( )7. Since the effect is the same of that of an increase in G, an increase in T must cause the DD Schedule to shift rightward. ( )8. A rise in R* causes an upward shift of AA. ( )9. Either an increase in the money supply or temporary fiscal ease can be used to maintain full employment. The two polices have no different effects at all. ( )10.If exports and imports adjust gradually to real exchange rate changes, the current account may follow a J-curve pattern after a real currency appreciation, first worsening and then improving. ( )11. The greater the upward shift of the asset market equilibrium schedule, the greater the appreciation of the currency. ( )12. Monetary expansion causes the current account balance to decrease in the short run. ( )13. Expansionary fiscal policy reduces the current account balance. ( )Ⅲ. Answer the following questions:1. A new government is elected and announces that once it is inaugurated, it will increase the money supply. Use the DD-AA model to study the economy’s response to this announcement.2. Please use AA and DD schedules to describe “The adjustment to a permanent increase in the money supply. ” The original point is at full employment.The vertical axis is exchange rate, the horizontal axis is output.3. If an economy does not start out at full employment,is it still true that a permanent change in fiscal policy has no current effect on output? Please use AA and DD schedules to describe it.Quiz for Chapter 17Ⅰ. Fill the following blanks with the proper word or expression1. Any central bank purchase of assets automatically results in an in the domestic money supply.2. The condition of the foreign exchange market equilibrium under a fixed exchange rate is .3. Under a fixed exchange rate, central bankpolicy tools is more effective.4. The expectation of a future devaluation causes ain the home interest rate above the world level.5. The main factor that may lead to imperfect asset substitutability in the foreign exchange market is .6. Between the end of World War II and 1973, was the main reserve currency.7. Under a gold standard, each country fixes the price of its currency in terms of .8. Under a _________, central bank monetary policy tools are powerless to affect the economy’s money supply or its output.9. A system which governments may attempt to moderate exchange rate movements without keeping exchangerates rigidly fixed is____________.10. Half way between the gold standard and a pure reserve currency standard is the __________.Ⅱ. True or false1. Any central bank sale of assets automatically causes the money supply to decline. ( )2. If central banks are not sterilizing and the home country has a balance of payments surplus, any increase in the home central bank’s foreign assets implies an decreased home money supply. ( )3. Under a fixed exchange rate, central bank monetary policy tools are powerful to affect the economy’s money supply. ( )4. The expectation of a future revaluation causes a rise in foreign reserves. ( )5 When domestic and foreign currency bonds are imperfect substitutes, equilibrium in the foreign market requires that the domestic interest rate equal the expected domestic currency return on foreign bonds subtract a risk premium. ( )6. Between the end of World War II and 1973, the exchange rate system was one in which exchange rate between any two currencies were floating. ( )7.Under the reserve currency standard, the center country has to intervene the exchange rate. ( )8. The central bank can negate the money supply effect of intervention through sterilization.( )9. A system of managed floating allows the central bank to retain some ability to control the domestic money supply, but at the cost of greater exchange rate instability.( )10. A world system of fixed exchange rates in which countries peg the prices of their currencies in terms of a reserve currency does not involve a striking asymmetry.()Ⅲ. Answer the following questions:1. Why governments sometimes choose to devalue their currencies?2. How does fiscal expansion affect a country’s output and the central bank’s balance sheet under fixed exchange rate?3. Can you think of reasons why a government might willingly sacrifice some of its ability to use monetary policy so that it can have stable exchange rates?4. Explain why temporary and permanent fiscal expansions do not have different effects under fixed exchange rates, as they do under floating.Quiz for Chapter 18—21Ⅰ. Fill the following blanks with the proper word or expression1. The channels of interdependence depend, in turn, on the monetary and exchange rate arrangements that countries adopt-a set of institutions called the ().2. In open economies, policymakers are motivated by the goals of internal and external balance. Simply defined, ( )requires the full employment of a country’s resources and domestic price level stability.3. A country is said to be in( ) when the sum of its current and its no reserve capital accounts equals zero, so that the current account balance is financed entirely by international lending without reserve movements.4. The gold standard contains some powerful automatic mechanisms that contribute to the simultaneous achievement of balance of payments equilibrium by all countries .That mechanisms is( ).5. ( ) is one currency that may be freely exchanged for foreign currencies.6、Under the Bretoon Woods system ,( ) or ( )can be used to influence output and thus help the government achieve its internal goal of full employment.7、Fiscal policy is also called ( ),because it alters the level of the economy’s total demand for goods and services.; The accompanying exchange rate adjustment is called ( ), Because it changes the direction of demand ,shifting it between domestic output and imports.8、Bretton Woods system give ( )the leading position in the world economy.9、Bretton Woods system require that other currency should peg with ( )10、Under the fixed rate system, if the exchange rate change, the foreign reserves will ( )11、( ) symmetry and exchange rate as automatic stabilizers are the advantages of floating rate system.12、( ) predict the collapse of the Bretton Woods system.13、The level of ( ) in the European Union is too small to cushion member countries from adverse economic events.14、The ( ) schedule shows the relationship between the monetary efficiency gain and the degree of economic integration.Ⅱ. True or false1. In an open economy, macroeconomic policy has two basic goals, internal balance (full employment with price stability) and external balance (avoiding excessive imbalances in international payments)( )2. The gold standard era starts in 1861 and end in 1914.( )3. The countries with the weak investment opportunities should be net importers of currently available output (and thus have current account surpluses), while countries with the good investment opportunities should be net exporters of current output (and have current account deficits).( )4. Each member of IMF contributed to the Fund an amount of gold equal in value to three-fourth of its quota. The remaining one-fourths of its quota took the form of a contribution of its own national currency. ( )5、Balance of payment crisis became increasingly frequent and violent throughout the 1960 and early 1970s.The events led to the Bretoon Woods system’s collapse.()6、One interpretation of the Bretoon Woods system’s collapse is that the foreign countries were forced to import US. Inflation through the mechanism to stabilize their price levels and regain internal balance, they had toabandon fixed exchange rates and allow their currency to float.()7、Speculation on changes in exchange rats could lead to instability in foreign exchange markets . ()8.Under the fixed rate system, the government is required to use foreign reserve to stabilize exchange rate.()9.The U.S. Federal Reserve played the leading role in determining their owns domestic money supply.()10.Advocates of floating argued that floating rates would allow each country to choose its own desired long-run inflation rate rather than passively importing the inflation rate established abroad. ()11.The eight original participant in the EMS’s exchange rate mechanism------France, German, Italy, Belgium, Denmark, Ireland, Luxembourg, and the Netherlands. ( )。

国际经济学双语习题1.docx

International Economics, 8e (Krugman)Chapter 1 Introduction1.1 What Is International Economics About?1)Historians of economic thought often describe written by and published in asthe first real exposition of an economic model.A)"Of the Balance of Trade/' David Hume, 1776B)"Wealth of Nations," David Hume, 1758C)"Wealth of Nations," Adam Smith, 1758D)"Wealth of Nations," Adam Smith, 1776E)"Of the Balance of Trade/' David Hume, 1758Answer: EQuestion Status: Previous Edition2)From 1959 to 2004,A)the U.S. economy roughly tripled in size.B)U.S. imports roughly tripled in size.C)the share of US Trade in the economy roughly tripled in size.D)U.S. Imports roughly tripled as compared to U.S. exports.E)U.S. exports roughly tripled in size.Answer: CQuestion Status: Previous Edition3)The United States is less dependent on trade than most other countries becauseA)the United States is a relatively large country.B)the United States is a ''Superpower.*'C)the military power of the United States makes it less dependent on anything.D)the United States invests in many other countries.E)many countries invest in the United States.Answer: AQuestion Status: Previous Edition4)Ancient theories of international economics from the 18th and 19th Centuries areA)not relevant to current policy analysis.B)are only of moderate relevance in today*s modern international economy.C)are highly relevant in today*s modern international economy.D)are the only theories that actually relevant to modern international economy.E)are not well understood by modern mathematically oriented theorists.Answer: CQuestion Status: Previous Edition5)An important insight of international trade theory is that when countries exchange goods and services one withthe other itA)is always beneficial to both countries.B)is usually beneficial to both countries.C)is typically beneficial only to the low wage trade partner country.D)is typically harmful to the technologically lagging country.E)tends to create unemployment in both countries.Answer: BQuestion Status: Previous Edition6)If there are large disparities in wage levels between countries, thenA)trade is likely to be harmful to both countries.B)trade is likely to be harmful to the country with the high wages.C)trade is likely to be harmful to the country with the low wages.D)trade is likely to be harmful to neither country.E)trade is likely to have no effect on either country.Answer: DQuestion Status: Previous Edition7)Benefits of international trade are limited toA)tangible goods.B)intangible goods.C)all goods but not services.D)services.E)None of the above.Answer: EQuestion Status: Previous Edition8)Which of the following does not belong?A)NAFTAB)Uruguay RoundC)World Trade OrganizationD)None Tariff BarriersE)None of the above.Answer: DQuestion Status: Previous Edition9)International economics does not use the same fundamental methods of analysis as other branches ofeconomics, becauseA)the level of complexity of international issues is unique.B)the interactions associated with international economic relations is highly mathematical.C)international economics takes a different perspective on economic issues.D)international economic policy requires cooperation with other countries.E)None of the above.Answer: EQuestion Status: New10)Because the Constitution forbids restraints on interstate trade,A)the U.S. may not impose tariffs on imports from NAFTA countries.B)the U.S. may not affect the international value of the $ U.S.C)the U.S. may not put restraints on foreign investments in California if it involves a financial intermediaryin New York State.D)the U.S. may not impose export duties.E)None of the aboveAnswer: EQuestion Status: New11)Which of the following is not a major concern of international economic theory?A)protectionismB)the balance of paymentsC)exchange rate determinationD)Bilateral trade relations with ChinaE)None of the aboveAnswer: DQuestion Status: New12)"Trade is generally harmful if there are large disparities between countries in wages."A)This is generally true.B)This is generally false.C)Trade theory has nothing to say about this issue.D)This is true if the trade partner ignores child labor laws.E)This is true if the trade partner uses prison labor.Answer: BQuestion Status: New13)Who sells what to whomA)has been a major preoccupation of international economics.B)is not a valid concern of international economics.C)is not considered important for government foreign trade policy since such decisions are made in theprivate competitive market.D)is determined by political rather than economic factors.E)None of the aboveAnswer: AQuestion Status: New14)The insight that patterns of trade are primarily determined by international differences in labor productivity wasfirst proposed byA)Adam Smith.B)David Hume.C)David Ricardo.D)Eli Heckscher.E)Lerner and Samuelson.Answer: CQuestion Status: New15)Since the mid 1940s, the United States, has pursued a broad policy ofA)strengthening "Fortress America" protectionism.B)removing barriers to international trade.C)isolating Iran and other axes of evil.D)protecting the U.S. from the economic impact of oil producers.E)None of the above.Answer: BQuestion Status: New16)The balance of payments has become a central issue for the United States becauseA)when the balance of payments is not balanced, society is unbalanced.B)the U.S. economy cannot grow when the balance of payments is in deficit.C)the U.S. has run huge trade deficits in every year since 1982.D)the U.S. never experienced a surplus in its balance of payments.E)None of the above.Answer: CQuestion Status: New17)The euro, a common currency for most of the nations of Western Europe, was introducedA)before 1900.B)before 1990.C)before 2000.D)in order to snub the pride of the U.S.E)None of the above.Answer: CQuestion Status: New18)During the first three years of its existence, the euroA)depreciated against the $U.S.B)maintained a strict parity with the $U.S.C)strengthened against the $U.S.D)proved to be an impossible dream.E)None of the above.Answer: AQuestion Status: New19)The study of exchange rate determination is a relatively new part of international economics, since,A)for much of the past century, exchange rates were fixed by government action.B)the calculations required for this were not possible before modern computers became available.C)economic theory developed by David Hume demonstrated that real exchange rates remain fixed overtime.D)dynamic overshooting asset pricing models are a recent theoretical development.E)None of the aboveAnswer: AQuestion Status: New20) A fundamental problem in international economics is how to produceA) a perfect degree of monetary harmony.B)an acceptable degree of harmony among the international trade policies of different countries.C) a world government that can harmonize trade and monetary policiesD)a counter-cyclical monetary policy so that all countries will not be adversely affected by a financial crisisin one country.E)None of the above.Answer: BQuestion Status: New21)For the 50 years preceding 1994, international trade policies have been governedA)by the World Trade Organization.B)by the International Monetary Fund.by the World.D)by an international treaty known as the General Agreement on Tariffs and Trade (GATT).E)None of the above.Answer: DQuestion Status: New22)The international capital market isA)the place where you can rent earth moving equipment anywhere in the world.B)a set of arrangements by which individuals and firms exchange money now for promises to pay in thefuture.C)the arrangement where banks build up their capital by borrowing from the Central Bank.D)the place where emerging economies accept capital invested by banks.E)None of the above.Answer: BQuestion Status: New23)International capital markets experience a kind of risk not faced in domestic capital markets, namelyA)"economic meltdown" risk.B)Flood and hurricane crisis risk.C)the risk of unexpected downgrading of assets by Standard and Poor.D)exchange rate risk.E)None of the above.Answer: DQuestion Status: New24)Since 1994, trade rules have been enforced byA)the WTO.B)the GIO.C)the GATT.D)The U.S. Congress.E)None of the above.Answer: AQuestion Status: New25)In 1998 an economic and financial crisis in South Korea caused it to experienceA) a surplus in their balance of payments.B) a deficit in their balance of payments.C) a balanced balance of payments.D)an unbalanced balance of payments.E)None of the above.Answer: AQuestion Status: New26)In 1999, demonstrators representing a mix of traditional and new ideologies disrupted a major internationaltrade meeting in Seattle ofA)the OECD.B)NAFTA.C)WTO.D)GATT.E)None of the above.Answer: CQuestion Status: New27)International Economists cannot discuss the effects of international trade or recommend changes in governmentpolicies toward trade with any confidence unless they knowA)their theory is the best available.B)their theory is internally consistent.C)their theory passes the "reasonable person*' legal criteria.D)their theory is good enough to explain the international trade that is actually observed.E)None of the above.Answer: DQuestion Status: New28)Trade theorists have proven that the gains from tradeA)must raise the economic welfare of every country engaged in trade.B)must raise the economic welfare of everyone in every country engaged in trade.C)must harm owners of ''specific" factors of production.D)will always help "winners" by an amount exceeding the losses of "losers."E)None of the above.Answer: EQuestion Status: New1.2 International Economics: Trade and Money1)Cost-benefit analysis of international tradeA)is basically useless.B)is empirically intractable.C)focuses attention primarily on conflicts of interest within countries.D)focuses attention on conflicts of interests between countries.E)None of the above.Answer: CQuestion Status: Previous Edition2)An improvement in a country's balance of payments means a decrease in its balance of payments deficit, or anincrease in its surplus. In fact we know that a surplus in a balance of paymentsA)is good.B)is usually good.C)is probably good.D)may be considered bad.E)is always bad.Answer: DQuestion Status: Previous Edition3)The GATT wasA)an international treaty.B)an international U.N. agency.C)an international IMF agency.D) a U.S. government agency.E) a collection of tariffs.Answer: AQuestion Status: Previous Edition4)The international debt crisis of early 1982 was precipitated when could not pay its internationaldebts.A)RussiaB)MexicoC)BrazilD)MalaysiaE)ChinaAnswer: BQuestion Status: Previous Edition5)International economics can be divided into two broad sub-fieldsA)macro and micro.B)developed and less developed.C)monetary and barter.D)international trade and international money.E)static and dynamic.Answer: DQuestion Status: Previous Edition6)International monetary analysis focuses onA)the real side of the international economy.B)the international trade side of the international economy.C)the international investment side of the international economy.D)the issues of international cooperation between Central Banks.E)None of the above.Answer: EQuestion Status: New7)The distinction between international trade and international money is not useful sinceA)real developments in the trade accounts have monetary implications.B)the balance of payments includes both real and financial implications.C)developments caused by purely monetary changes have real effects.D)trade models focus on real, or barter relationships.E)None of the above.Answer: EQuestion Status: New8)It is argued that small countries tend have more open economies than large ones. Is this empirically verified?What are the logical underpinnings of this argument?Answer: Yes. They do not have sufficient resources to satisfy consumption needs; and also do not have a sufficiently large market to enable their industries to avail themselves of scale economy possibilities.Another answer would rely on a location argument. Assume that the "natural" market for any givenplant is a circle with a radius of n miles with the plant at its center. Assuming that the production plantsare located randomly throughout the country, then the probability that the typical circular market willencompass some foreign country is greater the smaller is the country.Question Status: Previous Edition9)It is argued that if a rich high wage country such as the United States were to expand trade with a relatively poorand low wage country such as Mexico, then U.S. industry would migrate south, and U.S. wages would fall to the level of Mexico's. What do you think about this argument?Answer: The student may think anything. The purpose of the question is to set up a discussion, which will lead to the models in the following chapters.Question Status: Previous Edition10)Some patterns of international trade are easier to explain than others. Give several examples and explain.Answer: Historical circumstance can explain some patterns such as the relatively large trade flows from West Africa to France. The relatively sparse trade between countries within South America seems curious.Question Status: Previous Edition11)International trade tends to prove that international trade is beneficial to all trading countries. However, casualobservation notes that official obstruction of international trade flows is widespread. How might you reconcile these two facts?Answer: This question is meant to allow students to offer preliminary discussions of issues, which will be explored in depth later in the book.Question Status: Previous Edition12)It is argued that small countries tend have more open economies than large ones. Is this empirically verified?What are the logical underpinnings of this argument?Answer: Yes. They do not have sufficient resources to satisfy consumption needs; and also do not have a sufficiently large market to enable their industries to avail themselves of scale economy possibilities.Another answer would rely on a location argument. Assume that the "natural" market for any givenplant is a circle with a radius of n miles with the plant at its center. Assuming that the production plantsare located randomly throughout the country, then the probability that the typical circular market willencompass some foreign country is greater the smaller is the country.Question Status: Previous Edition13)It is argued that if a rich high wage country such as the United States were to expand trade with a relatively poorand low wage country such as Mexico, then U.S. industry would migrate south, and U.S. wages would fall to the level of Mexico's. What do you think about this argument?Answer: The student may think anything. The purpose of the question is to set up a discussion, which will lead to the models in the following chapters.Question Status: Previous Edition14)Some patterns of international trade are easier to explain than others. Give several examples and explain.Answer: Historical circumstance can explain some patterns such as the relatively large trade flows from West Africa to France. The relatively sparse trade between countries within South America seems curious.Question Status: Previous Edition15)International trade tends to prove that international trade is beneficial to all trading countries. However, casualobservation notes that official obstruction of international trade flows is widespread. How might you reconcile these two facts?Answer: This question is meant to allow students to offer preliminary discussions of issues, which will be explored in depth later in the book.Question Status: Previous Edition16)International Trade theory is one of the oldest areas of applied economic policy analysis. It is also an area for whichdata was relatively widely available very early on. Why do you suppose this is the case?Answer: In ancient times, public finance was not well developed. Most of the population was not producing and consuming within well-developed market economies, so that income and sales taxes were not efficient. Oneof the most convenient ways for governments to obtain resources was to set up custom posts at borders andtax. Hence international trade was of great policy interest to princes and kings, as was precise data of theirmain tax base.Question Status: Previous Edition(SP-ICUA bsWine Million Liters17)The figure above is the Production Possibility Frontier (PPF) of Baccalia, where only two products are produced,clothing and wine. In fact Baccalia is producing on its PPF at point A. By and large the people of Baccalia are content, as both their external and internal needs for warmth are satisfied in the most economically efficient manner possible, given their available productive resources (and known technology). How much wine is being produced? How much cloth? If a person in this country wanted to purchase a liter of wine, what would be the price he or she would have to pay?Judging from what you learned in the previous paragraph, can you indicate at which point (if at all) the Community Indifference Curve is tangent to the Production Possibility Frontier? Explain your reasoning. Answer: 6 million liters of wine are being produced.3 million square yards of cloth are being produced.The price of 1 liter of wine is one half of a square yard of cloth.The tangency is at point A. We know this because otherwise the country would not be producing at thepoint of maximum economic efficiency.Question Status: Previous Edition18) One day, Baccalia joined the WTO and joined the Global Village. They discovered that in the LWE (London WineExchange), 1 liter of wine is worth 1 square yard of cloth. What is the logical production point they should strive for? (See figure.)Answer: 10 million liters of wine.Question Status: Previous Edition19) Baccalia wishes to enjoy to the fullest from the gains from trade, but is not willing to give up imbibing even one dropof wine from the 6 million liters they consumed in their original autarkic state. If their new consumption point is a point we shall designate as point b, describe where this point would be found. (See figure.)Answer: Vertically above point aQuestion Status: Previous Edition20) Where is the Community Indifference Curve family of curves tangent to their new Consumption Possibility Frontier?Answer: At point b.Question Status: Previous Edition21) How can you prove that Baccalia has in fact gained from the availability of trade, and that their new situation issuperior to the pre-trade situation (with which they were quite content)?Answer: The country was consuming at point a before trade. It is now consuming at point b with trade. Point brepresents a superior welfare combination of goods as compared to point a, since at b the country has moreof each of the goods.Question Status: Previous Edition6 10Wine Million Liters(SP 」EA 另UO=M)。

国际经济学英文题库(最全版附答案)