(金融保险类)金融英语速读吉姆-罗杰斯我的第一桶金

金融英语速读:吉姆罗杰斯,我的第一桶金.doc

吉姆-罗杰斯:我的第一桶金Jim Rogers: My First MillionPublished: November 20 2009 18:26 | Last updated: November 20 2009 18:26Since Jim Rogers, 67, co-founded the Quantum Fund with George Soros he has worked as a guest professor of finance at Columbia University and as an economic commentator. In 1998, he founded the Rogers International Commodities Index (RICI).He is the author of A Bull in China, Hot Commodities, Adventure Capitalist and Investment Biker. His latest book isA Gift to My Children, a father’s l essons for life and investing.EDITOR’S CHOICEMy first million: More columns about how the wealthy manage their money - Oct-31Raised in Alabama, Rogers started in business at the age of five, collecting empty soda bottles at the local baseball field. After graduating from Yale University in 1964, he won a scholarship to Balliol College, Oxford. He then got his first job on Wall Street.Rogers now lives in Singapore with his wife and their two young daughters.Did you think you would get to where you are?No, I am as surprised as anyone. I certainly wanted to get somewhere and was willing to work hard. I wanted to retire young, but I never thought I would retire before 40.When you realised that you had made your first million were you tempted to slow down?I can remember the exact day of my first million dollars’ net worth. It was in November 1977. I was 35. I knew I needed more than that to do what I wanted when I was 37 – the age I decided to stop working to seek adventure.What is the secret of your success?As I was not smarter than most people, I was willing to work harder than most. I was prepared to examine conventional wisdom. If everyone thinks one way, it is likely to be wrong. If you can figure out that it is wrong, you are likely to make a lot of money.What is your basic investment strategy?Buy low and sell high. I try to find something that is very cheap, where a positive change is taking place. Then I do enough homework to make sure I am right. It has got to be cheap so that, if I am wrong, I don’t lose much money. Everytime I make a mistake, it is usually because I did not do enough homework.Do not underestimate the value of due diligence. In the 1960s, General Motors was the world’s most successful company. One day, a GM analyst went to the board of directors with the message: “The Japanese are coming.” They ignored him. Investors who did their homework sold their GM stock – and bought Toyota instead.I’m not buying any stocks at the moment. If anything is undervalued now it is commodities and some currencies.What has been your most spectacular gain?The Quantum Fund. When we started the company in 1970, I had $600 in my pocket. Within 10 years, the portfolio had gained 4,200 per cent.Do you want to carry on till you drop?No. These days, I spend very few hours a day working, becauseI have two little girls and I want to spend as much time with them as possible.Both our girls have a Chinese governess and speak fluent Mandarin. For their generation, Mandarin and English will be the most important languages.Have you made any pension provision?I don’t have a pension because I hope I don’t need one. I have accumulated assets and that is what I live on.What is your commitment to charity?I have given money to students and schools around the world.I try to give scholarships to students rather than schools, because the students need the money more than administrators.Do you allow yourself the odd indulgence?I have been around the world twice. Setting off in 1990, I spent22 months travelling through six continents on a motorcycle.On my second trip, which started in 1999, my wife and I travelled for three years through 116 countries in a custom-made Mercedes.What is the most you have ever paid for a bottle of fine wine or champagne?I don’t have an upper limit for champagne, but I’ve never had the urge to spend $2,000 on a bottle of wine. I always remember my background. I did not have money as a kid.Picasso or Art Deco as an investment?I am at a stage where I am not interested in having or amassing stuff.Do you believe in passing your wealth to children?I’ve always thought that, if you give children too much, you will ruin them. I have set up my will so they don’t get muchuntil they are at least 30.I went to Yale and Oxford and a lot of rich kids were there who never had to work. I know I want my children to be well-educated and experience the workplace.Education and the necessity to work changed my life and yanked me out of the backwater of Alabama.Where should people put their money in the recession?Invest only in things you know something about. The mistake most people make is that they listen to hot tips, or act on something they read in magazines.Most people know a lot about something, so they should just stick to what they know and buy an investment in that area. That is how you get rich.You don’t get rich investing in things you know nothing about.Which of the following is a fact stated in this article?A:Jim Rogers is born rich.B:Jim Rogers still works long hours now.C:Jim Rogers speaks fluent Chinese.D:Jim Rogers had his daughters at relatively old age.………………………….……………………………………………….…………..DHe's 67 and have two young daughters.Which of the following is true about Jim Rogers' investing strategy? A: Buy assets at cheap priceB: Only buy into areas that he's familiar withC: Pay attention to the future growth.D: All of the above………………………….………………………..…………………..………………………...……..…DBuy low and sell high. I try to find something that is very cheap, where a positive change is taking place. Then I do enough homework to make sure I am right. It has got to be cheap so that, if I am wrong, I don’t lose much money. Every time I make a mistake, it is usually because I did not do enough homework.According to the article, which of the following does Jim Rogers hold to be true?A: Work is a necessity.B: Stock is the best investment.C: In order to get rich, you need to take risks.D: Family is above your career.…………………………….…………………….……………..………..……AEducation and the necessity to work changed my life and yanked me out of the backwater of Alabama.Which of the following is Jim Rogers most proud of?A: Raising two kidsB: The Quantum fundC: His charity contributionD: Travelling the world……………………………………………………………………………….……………………….….BWhat has been your most spectacular gain?The Quantum Fund. When we started the company in 1970, I had $600 in my pocket. Within 10 years, the portfolio had gained 4,200 per cent.。

吉姆

投资风险和机会的判断标准

01

这个国家鼓励 投资,并且比 过去运转得好, 市场开放

02

货币可以自由 兑换,出入境 很方便。

03

这个国家的经 济政治状况要 比人们预期的 好。

04

股票便宜

1973年,埃、以战争时期,当埃及和叙利亚的 部队大举进攻时,以色列数千人伤亡,坦克、飞 机损失惨重,以色列震惊地发现自己虽然拥有较 佳的飞机与飞行员,但是,埃及空军却显然具有 不寻常的优势。 罗杰斯发现其中原因是前苏联供给埃及的电子 设备,是当时美国无法供给以色列的。因为越战 时期美国的国防工作集中在每天的补给,因此, 忽视了长期的科技发展。一旦美国国防部意识到 这一点,大规模的投入将势不可免。

经典案例

投资法则

a. 勤奋

b. 独立思考 c. 别进商学院 d. 绝不赔钱法则 e. 价值投资法则 f. 等待催化因素的出现 g. 静若处子法则

1984年,外界极少关注、极少了解的奥地利股市暴 跌到从1961年以来的一半时,罗杰斯亲往事奥地利实 地考查。而事实上,奥地利的经济正在稳步发展。 为了了解奥地利股票市场的情况,罗杰斯到奥地利 的最大银行的纽约分理处,询问如何投资奥地利股 票的事宜,回答是“我们没有股票市场”。作为奥地 利最大的银行,竟然没有人知道他们国家有一个股 票市场,更不知道该如何在他们国家的股市上购买 股票,内中玄机耐人寻味。 1984年5月,罗杰斯在维也纳做了一番调查。在经过 缜密的调查研究后,认定机会来了。他大量购买了 奥地利企业的股票、债券。当时的奥地利只有不到 30种股票上市,成员还不到20人。罗杰斯在交易市场 里连一个人也没见到。第二年,奥地利股市起死回 生,奥地利股市指数在暴涨中上升了145%,罗杰斯 在有斩获,因此被人称之为"奥地利股市之父。"正 所谓"人弃我取"。

金融英语速读:吉姆-罗杰斯,我的第一桶金

吉姆-罗杰斯:我的第一桶金Jim Rogers: My First MillionPublished: November 20 2009 18:26 | Last updated: November 20 2009 18:26Since Jim Rogers, 67, co-founded the Quantum Fund with George Soros he has worked as a guest professor of finance at Columbia University and as an economic commentator. In 1998, he founded the Rogers International Commodities Index (RICI).He is the author of A Bull in China, Hot Commodities, Adventure Capitalist and Investment Biker. His latest book isA Gift to My Children, a father’s l essons for life and investing.EDITOR’S CHOICEMy first million: More columns about how the wealthy manage their money - Oct-31Raised in Alabama, Rogers started in business at the age of five, collecting empty soda bottles at the local baseball field. After graduating from Yale University in 1964, he won a scholarship to Balliol College, Oxford. He then got his first job on Wall Street.Rogers now lives in Singapore with his wife and their two young daughters.Did you think you would get to where you are?No, I am as surprised as anyone. I certainly wanted to get somewhere and was willing to work hard. I wanted to retire young, but I never thought I would retire before 40.When you realised that you had made your first million were you tempted to slow down?I can remember the exact day of my first million dollars’ net worth. It was in November 1977. I was 35. I knew I needed more than that to do what I wanted when I was 37 – the age I decided to stop working to seek adventure.What is the secret of your success?As I was not smarter than most people, I was willing to work harder than most. I was prepared to examine conventional wisdom. If everyone thinks one way, it is likely to be wrong. If you can figure out that it is wrong, you are likely to make a lot of money.What is your basic investment strategy?Buy low and sell high. I try to find something that is very cheap, where a positive change is taking place. Then I do enough homework to make sure I am right. It has got to be cheap so that, if I am wrong, I don’t lose much money. Everytime I make a mistake, it is usually because I did not do enough homework.Do not underestimate the value of due diligence. In the 1960s, General Motors was the world’s most successful company. One day, a GM analyst went to the board of directors with the message: “The Japanese are coming.” They ignored him. Investors who did their homework sold their GM stock – and bought Toyota instead.I’m not buying any stocks at the moment. If anything is undervalued now it is commodities and some currencies.What has been your most spectacular gain?The Quantum Fund. When we started the company in 1970, I had $600 in my pocket. Within 10 years, the portfolio had gained 4,200 per cent.Do you want to carry on till you drop?No. These days, I spend very few hours a day working, becauseI have two little girls and I want to spend as much time with them as possible.Both our girls have a Chinese governess and speak fluent Mandarin. For their generation, Mandarin and English will be the most important languages.Have you made any pension provision?I don’t have a pension because I hope I don’t need one. I have accumulated assets and that is what I live on.What is your commitment to charity?I have given money to students and schools around the world.I try to give scholarships to students rather than schools, because the students need the money more than administrators.Do you allow yourself the odd indulgence?I have been around the world twice. Setting off in 1990, I spent22 months travelling through six continents on a motorcycle.On my second trip, which started in 1999, my wife and I travelled for three years through 116 countries in a custom-made Mercedes.What is the most you have ever paid for a bottle of fine wine or champagne?I don’t have an upper limit for champagne, but I’ve never had the urge to spend $2,000 on a bottle of wine. I always remember my background. I did not have money as a kid.Picasso or Art Deco as an investment?I am at a stage where I am not interested in having or amassing stuff.Do you believe in passing your wealth to children?I’ve always thought that, if you give children too much, you will ruin them. I have set up my will so they don’t get muchuntil they are at least 30.I went to Yale and Oxford and a lot of rich kids were there who never had to work. I know I want my children to be well-educated and experience the workplace.Education and the necessity to work changed my life and yanked me out of the backwater of Alabama.Where should people put their money in the recession?Invest only in things you know something about. The mistake most people make is that they listen to hot tips, or act on something they read in magazines.Most people know a lot about something, so they should just stick to what they know and buy an investment in that area. That is how you get rich.You don’t get rich investing in things you know nothing about.Which of the following is a fact stated in this article?A:Jim Rogers is born rich.B:Jim Rogers still works long hours now.C:Jim Rogers speaks fluent Chinese.D:Jim Rogers had his daughters at relatively old age.………………………….……………………………………………….…………..DHe's 67 and have two young daughters.Which of the following is true about Jim Rogers' investing strategy? A: Buy assets at cheap priceB: Only buy into areas that he's familiar withC: Pay attention to the future growth.D: All of the above………………………….………………………..…………………..………………………...……..…DBuy low and sell high. I try to find something that is very cheap, where a positive change is taking place. Then I do enough homework to make sure I am right. It has got to be cheap so that, if I am wrong, I don’t lose much money. Every time I make a mistake, it is usually because I did not do enough homework.According to the article, which of the following does Jim Rogers hold to be true?A: Work is a necessity.B: Stock is the best investment.C: In order to get rich, you need to take risks.D: Family is above your career.…………………………….…………………….……………..………..……AEducation and the necessity to work changed my life and yanked me out of the backwater of Alabama.Which of the following is Jim Rogers most proud of?A: Raising two kidsB: The Quantum fundC: His charity contributionD: Travelling the world……………………………………………………………………………….……………………….….BWhat has been your most spectacular gain?The Quantum Fund. When we started the company in 1970, I had $600 in my pocket. Within 10 years, the portfolio had gained 4,200 per cent.。

吉姆罗杰斯:为中国投资者把脉指点

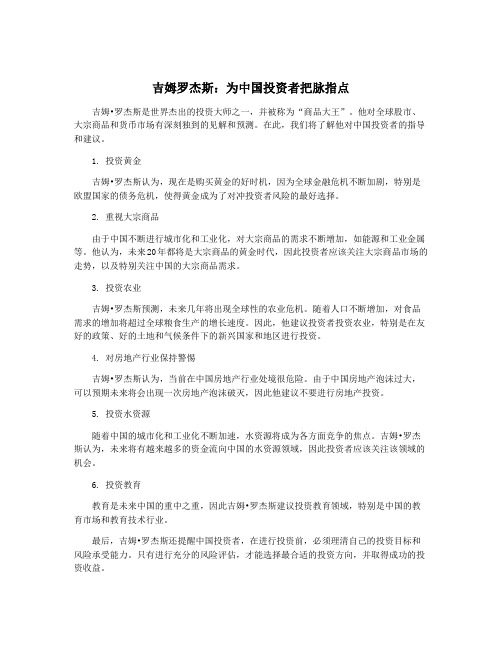

吉姆罗杰斯:为中国投资者把脉指点吉姆•罗杰斯是世界杰出的投资大师之一,并被称为“商品大王”。

他对全球股市、大宗商品和货币市场有深刻独到的见解和预测。

在此,我们将了解他对中国投资者的指导和建议。

1. 投资黄金吉姆•罗杰斯认为,现在是购买黄金的好时机,因为全球金融危机不断加剧,特别是欧盟国家的债务危机,使得黄金成为了对冲投资者风险的最好选择。

2. 重视大宗商品由于中国不断进行城市化和工业化,对大宗商品的需求不断增加,如能源和工业金属等。

他认为,未来20年都将是大宗商品的黄金时代,因此投资者应该关注大宗商品市场的走势,以及特别关注中国的大宗商品需求。

3. 投资农业吉姆•罗杰斯预测,未来几年将出现全球性的农业危机。

随着人口不断增加,对食品需求的增加将超过全球粮食生产的增长速度。

因此,他建议投资者投资农业,特别是在友好的政策、好的土地和气候条件下的新兴国家和地区进行投资。

4. 对房地产行业保持警惕吉姆•罗杰斯认为,当前在中国房地产行业处境很危险。

由于中国房地产泡沫过大,可以预期未来将会出现一次房地产泡沫破灭,因此他建议不要进行房地产投资。

5. 投资水资源随着中国的城市化和工业化不断加速,水资源将成为各方面竞争的焦点。

吉姆•罗杰斯认为,未来将有越来越多的资金流向中国的水资源领域,因此投资者应该关注该领域的机会。

6. 投资教育教育是未来中国的重中之重,因此吉姆•罗杰斯建议投资教育领域,特别是中国的教育市场和教育技术行业。

最后,吉姆•罗杰斯还提醒中国投资者,在进行投资前,必须理清自己的投资目标和风险承受能力。

只有进行充分的风险评估,才能选择最合适的投资方向,并取得成功的投资收益。

外国名人励志小故事

外国名人励志小故事外国名人励志小故事(一)吉姆罗杰斯的投资故事,美国证券界最成功的实践家吉姆罗杰斯,现代华尔街的风云人物,被誉为最富远见的国际投资家,是美国证券界最成功的实践家之一。

他毕业于耶鲁大学和牛津大学,选择投资管理行业开始了自己的职业生涯。

1970年和索罗斯共同创建量子基金。

量子基金连续十年的年均收益率超过50%。

1980年,37岁的罗杰斯从量子基金退出,他为他自己积累了数千万美元的巨大财富。

1980年后,罗杰斯开始了自己的投资事业。

已经成为全世界最伟大的投资家之一。

1947年,5岁的吉姆罗杰斯得到了自己人生中的第一份工作——在棒球场上捡拾空可乐瓶,每24个瓶子可以换来5美分,最多的一个下午,他捡了552个瓶子,挣了1.15美元。

不久,6岁的他又发现了少年棒球联合会比赛场地中没人卖软饮料和花生的“商业空白”,并从父亲那里得到了100美元的“贷款”购置必需的花生烘烤机。

5年后,11岁的罗杰斯不仅还清了父亲的100美元,还把剩余的100美元存入了自己的银行户头。

也许正是这些来自童年时期对商品和市场的朴素理解,直接奠定了日后罗杰斯的投资价值观:不是天天盯着市场曲线和趋势看,投资之前,要脚踏实地的观察、分析和思考,不能追随别人,必须要自己做出判断。

在耶鲁、牛津先后读完历史、政治、经济、哲学专业后,罗杰斯怀揣600美元闯进华尔街。

接下来便是那一系列足以令整个世界瞩目的业绩:与金融大鳄乔治索罗斯共同设立1997年令东南亚各国闻风丧胆的“量子基金”,在1970~1980年的10年间该基金收益率达4200%;1980年,与罗索斯拆伙成立自己的投资公司,1982年,看好西德的投资价值,开始分批买入西德股票,又在1985年和1986年分批卖出,获得3倍利润;1984年,外界极少关注的奥地利股市暴跌至1961年的一半时,大量买进奥地利企业的股票和债券,第二年奥地利股指上升了145%,他因此获称“奥地利股市之父”??“金融界的印地安那琼斯(美国大片《夺宝奇兵》系列中的冒险家)”,是《时代》周刊给他的评价。

金融专业《投资骑士:吉姆·罗杰斯》

投资骑士:吉姆·罗杰斯吉姆·罗杰斯吉姆·罗杰斯国际著名的投资家和金融学教授。

他具有传奇般的投资经历。

从他与金融大鳄e,Jac Schwager’s MaretWiards等著名年鉴收录,无不令世人为之叹服。

吉姆罗杰斯是第三位介绍量子的核心人物,也是最为潇洒的一位,一边环球旅行一边投资,这就是量子创始人之一、人称"奥地利之父" 、周游列国全球投资的Rogers〕是在1997年令东南亚国家闻风丧胆的"量子"的前合伙人,是国际著名的投资家和金融学教授。

曾被Jon Train's ?现代投资大师?, Jac Schwager's ?市场奇才?等著名年鉴收录。

罗杰斯还是?时代?〔?Time?〕、华盛顿邮报〔The Washington es〕、巴伦周刊〔es〕长期撰稿人。

投资哲学:脚踏实地“我人生中最成功的投资是我11个月大的女儿,我有过很多成功的、失败的投资经验,但从成功中学到的东西远不及从失败中学到的多。

〞当记者问及他辉煌的投资历史时,罗杰斯的答复有点出人意料,却又在情理之中。

他举了个例子。

“在我非常年轻的时候,有一年,我判断将要崩盘。

在美国,你可以通过卖空来。

后来确实如我所料,大跌,金融机构纷纷破产,一瞬间我的资金翻了三倍,当时我觉得自己实在是太聪明了。

〞尝了甜头后,罗杰斯判断市场将近一步下跌,于是集中了自己所有的资金大力卖空,而却极不合作地上涨了“最后只能斩仓,账户里一分不剩。

我当时穷得把自己的摩托车都卖掉了。

〞事后,他觉察自己当时根本不清楚自己在做什么,自己对继续下跌的判断其实没有任何研究做支撑,于是他翻然醒悟,“获得成功后往往会被胜利冲昏头脑,这种时候尤其需要平静的思考。

〞事实上,罗杰斯一直成功地扮演着传奇投资家的角色,这一点在他六岁的时候就已经显现。

当时他获准在青年联赛上出售软饮料和花生,于是罗杰斯向爸爸借了100美元买了个烘花生的设备,五年后,他不仅归还了当初借来的“启动资金〞100美元,还获得了100美元的利润。

吉姆.罗杰斯

吉姆·罗杰斯一、个人简介詹姆斯·吉姆·比伦·罗杰斯(英语:James "Jim" Beeland Rogers, Jr,1942年10月19日-)为美国著名投资者、经济分析师、大学教授及作家,曾与索罗斯共同创立量子基金,以投资于商品期货闻名,有“商品大王”之称。

吉姆·罗杰斯是第三位介绍量子基金的核心人物,主要特点是一边环球旅行一边投资。

罗杰斯曾在1980年代驾驶摩托车在中国大陆旅游,1990年至1992年则驾驶摩托车环游世界,在世界六大洲横越65,065里,并因此被列入吉尼斯世界纪录大全。

由1999年1月1日至2002年2月5日,他又创下另一项世界纪录,旅程经过116个国家,横越245,000公里。

旅程自冰岛开始,在2002年1月5日,他们返回纽约市Riverside Drive的家。

罗杰斯在ADVENTURE CAPITALIST的中文版序言中写到:“在我游历的这116个国家中,我最喜欢中国,很想在中国上海定居。

”他也曾经在很多个场合中说,“19世纪是英国的世纪,20世纪是美国的世纪,21世纪是中国的世纪。

”二、主要作品:1、《旅行, 人生最有价值的投资》出版社:中信出版社出版日期:2013年9月1日2、《街头智慧》出版社:机械工业出版社出版时间:2013 - 063、《世界地图就是你的财富版图:投资大师罗杰斯环球投资笔记》出版日期:2012年10月1日4、《水晶球: 吉姆·罗杰斯和他的投资预言》出版社:机械工业出版社出版时间:2009 - 035、《玩赚地球——吉姆·罗杰斯的环球投资之旅》出版社:中国社会科学出版社出版时间:2008 - 066、《中国牛市》出版社:中信出版社出版日期:2008年1月1日7、《投资骑士》出版社:中信出版社出版时间:20078、《热门商品投资》出版社:中信出版社出版日期:2005年9月1日。

你好,吉姆·罗杰斯

你好,吉姆·罗杰斯他多次环游世界,有时骑着摩托车,有时开着奔驰旅游车,一边欣赏风景,一边布局投资。

他就是吉姆?罗杰斯,被巴菲特称为“对大势的把握无人能及”的投资大师,也是国际金融界最富盛名的中国人的老朋友。

73岁的吉姆?罗杰斯又来中国了。

当他从北京首都国际机场到达通道走出,几个接机人员正举着写着他名字的牌子,在人群中翘首以盼。

可是,没有人注意到他。

直到罗杰斯走到几个年轻人面前,指着牌子说:“你们是来接我的吗?”没有人能猜出,这个外表普通至极的外国老头究竟有多少钱。

他与巴菲特、索罗斯并称全球三大金融巨头,所有试图接近他的人,都希望从他的嘴里问出最靠谱的投资逻辑。

2015年1月31日,博雅总裁论坛年会上,以特聘教授身份出席的罗杰斯,主动热情地与记者们交换着名片,遇到女记者还会细心地问对方的生日,并在采访后献上绅士的吻手礼。

距离罗杰斯第一次来中国,已经整整过去了30年。

这段不短的岁月里,他从华尔街的金融大鳄变成了中国概念的倡导者,大力推广亚洲与中国的投资机会更是令人侧目。

吉姆?罗杰斯,几乎已经成为最著名的“中国人民的老朋友”之一。

罗杰斯说,“在我游历的所有国家中,我最喜欢中国。

”骑着摩托车他就来了8岁那年的一天,在美国亚拉巴马老家,罗杰斯与比他大十个月的表哥一起玩挖洞探险的游戏,表哥说:“如果我们一直挖下去,就能到中国了!”这是罗杰斯第一次听到“中国”这个词。

他问母亲,中国是什么样的。

母亲告诉他:中国还有很多小朋友在挨饿,所以你不能浪费!1980年,38岁的罗杰斯与索罗斯分道扬镳,离开量子基金。

之后,他几乎以一人之力开创了一个“学科”:投资地理学――在周游世界的快乐旅途中发现投资的机会。

1984年,罗杰斯发现奥利地股市已经不到1963年时的一半,便风风火火地跑到维也纳考察。

他看到的是:整个奥地利根本没有人关心股票,交易大厅空空如也,政府也没有反对外国人投资股市。

于是,他果断抄底。

不久,来自欧美国家的游击资金追随着罗杰斯纷纷抢滩奥地利股市,一年便上涨125%,而罗杰斯则至少在这波行情中赚取4倍利润。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

吉姆-罗杰斯:我的第一桶金Jim Rogers: My First MillionPublished: November 20 2009 18:26 | Last updated: November 20 2009 18:26Since Jim Rogers, 67, co-founded the Quantum Fund with George Soros he has worked as a guest professor of finance at Columbia University and as an economic commentator. In 1998, he founded the Rogers International Commodities Index (RICI).He is the author of A Bull in China, Hot Commodities, Adventure Capitalist and Investment Biker. His latest book isA Gift to My Children, a father’s l essons for life and investing.EDITOR’S CHOICEMy first million: More columns about how the wealthy manage their money - Oct-31Raised in Alabama, Rogers started in business at the age of five, collecting empty soda bottles at the local baseball field. After graduating from Yale University in 1964, he won a scholarship to Balliol College, Oxford. He then got his first job on Wall Street.Rogers now lives in Singapore with his wife and their two young daughters.Did you think you would get to where you are?No, I am as surprised as anyone. I certainly wanted to get somewhere and was willing to work hard. I wanted to retire young, but I never thought I would retire before 40.When you realised that you had made your first million were you tempted to slow down?I can remember the exact day of my first million dollars’ net worth. It was in November 1977. I was 35. I knew I needed more than that to do what I wanted when I was 37 – the age I decided to stop working to seek adventure.What is the secret of your success?As I was not smarter than most people, I was willing to work harder than most. I was prepared to examine conventional wisdom. If everyone thinks one way, it is likely to be wrong. If you can figure out that it is wrong, you are likely to make a lot of money.What is your basic investment strategy?Buy low and sell high. I try to find something that is very cheap, where a positive change is taking place. Then I do enough homework to make sure I am right. It has got to be cheap so that, if I am wrong, I don’t lose much money. Everytime I make a mistake, it is usually because I did not do enough homework.Do not underestimate the value of due diligence. In the 1960s, General Motors was the world’s most successful company. One day, a GM analyst went to the board of directors with the message: “The Japanese are coming.” They ignored him. Investors who did their homework sold their GM stock – and bought Toyota instead.I’m not buying any stocks at the moment. If anything is undervalued now it is commodities and some currencies.What has been your most spectacular gain?The Quantum Fund. When we started the company in 1970, I had $600 in my pocket. Within 10 years, the portfolio had gained 4,200 per cent.Do you want to carry on till you drop?No. These days, I spend very few hours a day working, becauseI have two little girls and I want to spend as much time with them as possible.Both our girls have a Chinese governess and speak fluent Mandarin. For their generation, Mandarin and English will be the most important languages.Have you made any pension provision?I don’t have a pension because I hope I don’t need one. I have accumulated assets and that is what I live on.What is your commitment to charity?I have given money to students and schools around the world.I try to give scholarships to students rather than schools, because the students need the money more than administrators.Do you allow yourself the odd indulgence?I have been around the world twice. Setting off in 1990, I spent22 months travelling through six continents on a motorcycle.On my second trip, which started in 1999, my wife and I travelled for three years through 116 countries in a custom-made Mercedes.What is the most you have ever paid for a bottle of fine wine or champagne?I don’t have an upper limit for champagne, but I’ve never had the urge to spend $2,000 on a bottle of wine. I always remember my background. I did not have money as a kid.Picasso or Art Deco as an investment?I am at a stage where I am not interested in having or amassing stuff.Do you believe in passing your wealth to children?I’ve always thought that, if you give children too much, you will ruin them. I have set up my will so they don’t get muchuntil they are at least 30.I went to Yale and Oxford and a lot of rich kids were there who never had to work. I know I want my children to be well-educated and experience the workplace.Education and the necessity to work changed my life and yanked me out of the backwater of Alabama.Where should people put their money in the recession?Invest only in things you know something about. The mistake most people make is that they listen to hot tips, or act on something they read in magazines.Most people know a lot about something, so they should just stick to what they know and buy an investment in that area. That is how you get rich.You don’t get rich investing in things you know nothing about.Which of the following is a fact stated in this article?A:Jim Rogers is born rich.B:Jim Rogers still works long hours now.C:Jim Rogers speaks fluent Chinese.D:Jim Rogers had his daughters at relatively old age.………………………….……………………………………………….…………..DHe's 67 and have two young daughters.Which of the following is true about Jim Rogers' investing strategy? A: Buy assets at cheap priceB: Only buy into areas that he's familiar withC: Pay attention to the future growth.D: All of the above………………………….………………………..…………………..………………………...……..…DBuy low and sell high. I try to find something that is very cheap, where a positive change is taking place. Then I do enough homework to make sure I am right. It has got to be cheap so that, if I am wrong, I don’t lose much money. Every time I make a mistake, it is usually because I did not do enough homework.According to the article, which of the following does Jim Rogers hold to be true?A: Work is a necessity.B: Stock is the best investment.C: In order to get rich, you need to take risks.D: Family is above your career.…………………………….…………………….……………..………..……AEducation and the necessity to work changed my life and yanked me out of the backwater of Alabama.Which of the following is Jim Rogers most proud of?A: Raising two kidsB: The Quantum fundC: His charity contributionD: Travelling the world……………………………………………………………………………….……………………….….BWhat has been your most spectacular gain?The Quantum Fund. When we started the company in 1970, I had $600 in my pocket. Within 10 years, the portfolio had gained 4,200 per cent.。