新个税英文解释 New IIT rate

税务专用英语

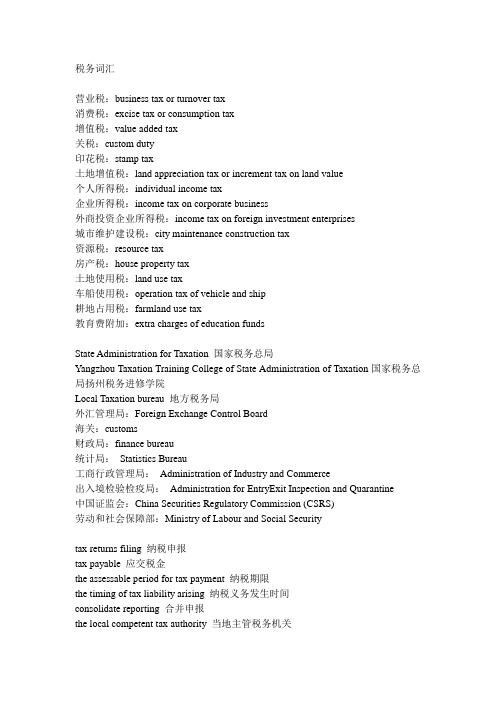

税务词汇营业税:business tax or turnover tax消费税:excise tax or consumption tax增值税:value added tax关税:custom duty印花税:stamp tax土地增值税:land appreciation tax or increment tax on land value个人所得税:individual income tax企业所得税:income tax on corporate business外商投资企业所得税:income tax on foreign investment enterprises城市维护建设税:city maintenance construction tax资源税:resource tax房产税:house property tax土地使用税:land use tax车船使用税:operation tax of vehicle and ship耕地占用税:farmland use tax教育费附加:extra charges of education fundsState Administration for Taxation 国家税务总局Yangzhou Taxation Training College of State Administration of Taxation国家税务总局扬州税务进修学院Local Taxation bureau 地方税务局外汇管理局:Foreign Exchange Control Board海关:customs财政局:finance bureau统计局:Statistics Bureau工商行政管理局:Administration of Industry and Commerce出入境检验检疫局:Administration for EntryExit Inspection and Quarantine中国证监会:China Securities Regulatory Commission (CSRS)劳动和社会保障部:Ministry of Labour and Social Securitytax returns filing 纳税申报tax payable 应交税金the assessable period for tax payment 纳税期限the timing of tax liability arising 纳税义务发生时间consolidate reporting 合并申报the local competent tax authority 当地主管税务机关精选文库the outbound business activity 外出经营活动Tax Inspection Report 纳税检查报告tax avoidance 逃税tax evasion 避税tax base 税基refund after collection 先征后退withhold and remit tax 代扣代缴collect and remit tax 代收代缴income from authors remuneration 稿酬所得income from remuneration for personal service 劳务报酬所得income from lease of property 财产租赁所得income from transfer of property 财产转让所得contingent income 偶然所得resident 居民non-resident 非居民tax year 纳税年度temporary trips out of 临时离境flat rate 比例税率withholding income tax 预提税withholding at source 源泉扣缴State Treasury 国库tax preference 税收优惠the first profit-making year 第一个获利年度refund of the income tax paid on the reinvested amount 再投资退税export-oriented enterprise 出口型企业technologically advanced enterprise 先进技术企业Special Economic Zone 经济特区accountant genaral 会计主任account balancde 结平的帐户account bill 帐单account books 帐account classification 帐户分类account current 往来帐account form of balance sheet 帐户式资产负债表account form of profit and loss statement 帐户式损益表account payable 应付帐款account receivable 应收帐款精选文库account of payments 支出表account of receipts 收入表account title 帐户名称,会计科目accounting year 或financial year 会计年度accounts payable ledger 应付款分类帐accept 受理accounting software 会计核算软件affix 盖章application letter 申请报告apply for reimbursement 申请退税apply for a hearing 申请听证apply for nullifying the tax registration 税务登记注销apply for reimbursement of tax payment 申请退税ask for 征求audit 审核author’s remuneration 稿酬;稿费averment 申辩bill/voucher 票证bulletin 公告bulletin board 公告牌business ID number 企业代码business license 营业执照call one’s number 叫号carry out/enforce/implement 执行check 核对check on the cancellation of the tax return 注销税务登记核查checking the tax returns 审核申报表city property tax 城市房地产税company-owned 公司自有的conduct an investigation/investigate 调查construction contract 建筑工程合同]cconsult; consultation 咨询<consulting service/advisory service 咨询服务contact 联系contract 承包copy 复印;副本deduct 扣除精选文库delay in filing tax returns 延期申报(缴纳)税款describe/explain 说明document 文件;资料examine and approve 审批extend the deadline for filing tax returns 延期税务申报feedback 反馈file tax returns(online) (网上)纳税申报fill out/in 填写foreign-owned enterprise 外资企业hearing 听证ID(identification) 工作证`Identical with the original 与原件一样IIT(Individual income tax) 个人所得税Implementation 稽查执行income 收入;所得inform/tell 告诉information desk 咨询台inspect 稽查inspection notice 稽查通知书instructions 使用说明invoice book(purchase) 发票购领本invoice 发票invoice tax control machine 发票税控机legal person 法人代表letter of settlement for tax inspection 稽查处理决定书list 清单local tax for education 教育地方附加费lunch breakmake a supplementary payment 补缴make one’s debut in handling tax affairs 初次办理涉税事项manuscript 底稿materials of proof 举证材料material 资料modify 修改modify one’s tax return 税务变更登记Nanjing Local Taxation Bureau 南京市地方税务局Notice 告知nullify 注销精选文库office building 办公楼office stationery 办公用品on-the-spot service 上门服务on-the-spot tax inspection 上门稽查opinion 意见original value 原值pay an overdue tax bill 补缴税款pay 缴纳penalty 处罚penalty fee for overdue payment 滞纳金penalty fee 罚款personal contact 面谈post/mail/send sth by mail 邮寄procedure/formality 手续proof material to backup tax returns 税收举证资料purchase 购领real estate 房产receipt 回执;反馈单record 记录reference number 顺序号register outward business administration 外出经营登记relevant materials of proof 举证资料rent 出租reply/answer 答复sell and pay foreign exchange 售付汇service trade 服务业settlement 处理settle 结算show/present 出示special invoice books of service trade 服务业发票stamp 公章submit a written application letter 提供书面申请报告supervision hotline 监督电话tax inspection bureau 稽查局tax inspection permit 税务检查证tax inspection 税务稽查tax law 税法tax officer 办税人精选文库tax payable/tax applicable 应缴税tax payment assessment 纳税评估tax payment receipt 完税凭证tax payment 税款tax rate 税率tax reduction or exemption 减免税tax registration number 纳税登记号tax registration certificate 税务登记证tax registration 税务登记tax related documents 涉税资料tax return/tax bill 税单tax return forms and the acknowledgement of receipt 申报表回执tax returns 纳税申报表tax voucher 凭证the accounting software 会计核算软件the acknowledgement of receipt 送达回证the application for an income refund 收入退还清单the author’s remuneration 稿费the business ID number 企业代码the certificate for outward business administration 外出经营管理证明the certificate for exchange of invoice 换票证the deadline 规定期限the inspection statement/report 检查底稿the legal person 法人代表the letter of statement and averment 陈述申辩书the online web address for filling tax returns 纳税申报网络地址the penalty fee for the overdue tax payment 税款滞纳金the penalty notice 处罚告知书the real estate 房产the registration number of the tax returns 纳税登记号the special invoice of service trade 服务业专用发票the special nationwide special invoice stamp 发票专用章the special nationwide invoice stamp 发票专用章the State Administration of Taxation 国家税务局supervision of taxation 税收监督tax inspection department 税务稽查局tax inspection permit 税务检查证tax officer 办税人员精选文库tax return form 纳税申报表格tax voucher application for the sale and purchase of foreign exchange 售付汇税务凭证申请审批表the use of invoice 发票使用trading contract 购销合同transportation business 运输业under the rate on value method 从价urban house-land tax 城市房地产税V AT(value-added tax, value added tax) 增值税Written application letter 书面申请报告资产负债表:balance sheet 可以不大写b利润表:income statements (or statements of income)利润分配表:retained earnings现金流量表:cash flows。

新个税介绍及简单案例说明修订版

新个税介绍及简单案例说明修订版IBMT standardization office【IBMT5AB-IBMT08-IBMT2C-ZZT18】新个税介绍及简单案例说明新个税法将于2019年1月1日起施行,2018年10月1日起施行最新起征点和税率。

以下是根据相关法规整理的新个税测算的要点,分享给各位同事参考。

一、居民与非居民概念在中国境内有住所,或者无住所而一个纳税年度内在中国境内居住满一百八十三天的个人,为居民个人,其从中国境内和境外取得的所得,依照本法规定缴纳个人所得税。

在中国境内无住所又不居住,或者无住所而一个纳税年度内在中国境内居住不满一百八十三天的个人,为非居民个人,其从中国境内取得的所得,依照本法规定缴纳个人所得税。

居民个人和非居民个人的概念比较二、所得项目的基本分类1.个人所得纳税项目分类根据新法规定,个人所得税应税项目分为9个明细项目,即:工资、薪金所得;劳务报酬所得;稿酬所得;特许权使用费所得;经营所得;利息、股息、红利所得;财产租赁所得;财产转让所得;偶然所得。

根据新个税的计算方式,将个税分为三类:(1)综合所得:具体包括工资、薪金所得;劳务报酬所得;稿酬所得;特许权使用费所得四个项目所得。

(2)经营所得:将经营所得一项实行单独的计算。

(3)特定所得:新法对利息、股息、红利所得;财产租赁所得;财产转让所得;偶然所得四项归类一起,采用比例税率,但没有归集名称,根据其都是针对特定性质的所得项目的特点,简称为特定所得。

2.税率的基本适用(1)综合所得,适用百分之三至百分之四十五的超额累进税率;(2)经营所得,适用百分之五至百分之三十五的超额累进税率;(3)特定所得,适用比例税率,税率为百分之二十。

三、综合所得的计算表新个税法将个人所得税纳税人分为居民个人和非居民个人两大类,且计税有所不同。

1.居民个人居民个人的综合所得,是以自公历1月1日起至12月31日止的每一纳税年度进行计税,并在日常由扣缴义务人按月(如基本的工资薪金等按月发放的个人所得)或者按次(如稿酬等)进行扣缴税款。

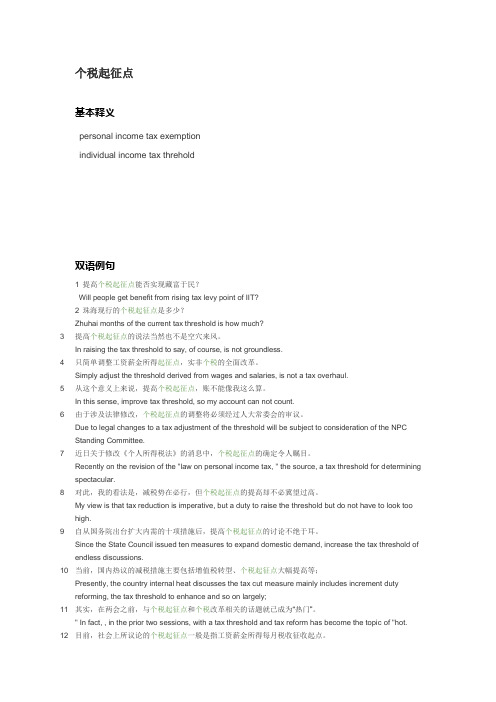

个税起征点

个税起征点基本释义personal income tax exemptionindividual income tax threhold双语例句1 提高个税起征点能否实现藏富于民?Will people get benefit from rising tax levy point of IIT?2 珠海现行的个税起征点是多少?Zhuhai months of the current tax threshold is how much?3 提高个税起征点的说法当然也不是空穴来风。

In raising the tax threshold to say, of course, is not groundless.4 只简单调整工资薪金所得起征点,实非个税的全面改革。

Simply adjust the threshold derived from wages and salaries, is not a tax overhaul.5 从这个意义上来说,提高个税起征点,账不能像我这么算。

In this sense, improve tax threshold, so my account can not count.6 由于涉及法律修改,个税起征点的调整将必须经过人大常委会的审议。

Due to legal changes to a tax adjustment of the threshold will be subject to consideration of the NPC Standing Committee.7 近日关于修改《个人所得税法》的消息中,个税起征点的确定令人瞩目。

Recently on the revision of the "law on personal income tax, " the source, a tax threshold for determining spectacular.8 对此,我的看法是,减税势在必行,但个税起征点的提高却不必冀望过高。

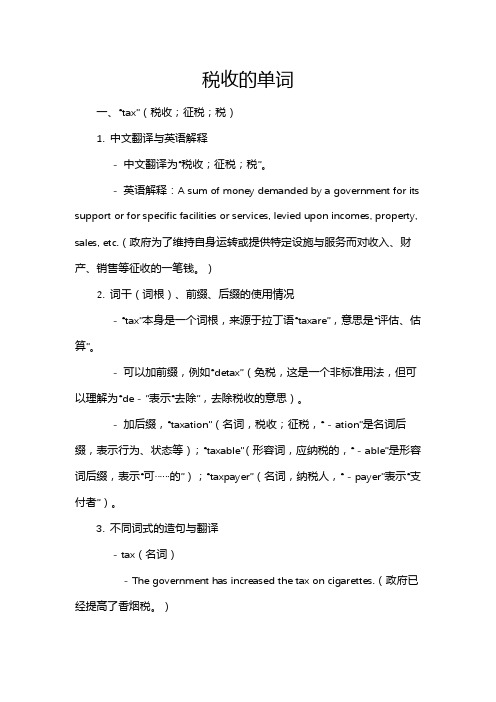

税收的单词

税收的单词一、“tax”(税收;征税;税)1. 中文翻译与英语解释- 中文翻译为“税收;征税;税”。

- 英语解释:A sum of money demanded by a government for its support or for specific facilities or services, levied upon incomes, property, sales, etc.(政府为了维持自身运转或提供特定设施与服务而对收入、财产、销售等征收的一笔钱。

)2. 词干(词根)、前缀、后缀的使用情况- “tax”本身是一个词根,来源于拉丁语“taxare”,意思是“评估、估算”。

- 可以加前缀,例如“detax”(免税,这是一个非标准用法,但可以理解为“de - ”表示“去除”,去除税收的意思)。

- 加后缀,“taxation”(名词,税收;征税,“ - ation”是名词后缀,表示行为、状态等);“taxable”(形容词,应纳税的,“ - able”是形容词后缀,表示“可……的”);“taxpayer”(名词,纳税人,“ - payer”表示“支付者”)。

3. 不同词式的造句与翻译- tax(名词)- The government has increased the tax on cigarettes.(政府已经提高了香烟税。

)- 这家公司必须缴纳高额的企业税。

The company has to pay a high corporate tax.- 他们正在抗议新的财产税。

They are protesting against the new property tax.- tax(动词)- The authorities decided to tax luxury goods at a higher rate.(当局决定对奢侈品征收更高的税率。

)- 政府不应该过度征税穷人。

The government should not over - tax the poor.- 他们计划对进口汽车征税。

IIT-filing-return-个人所得税纳税申报表(中英文版)教学文稿

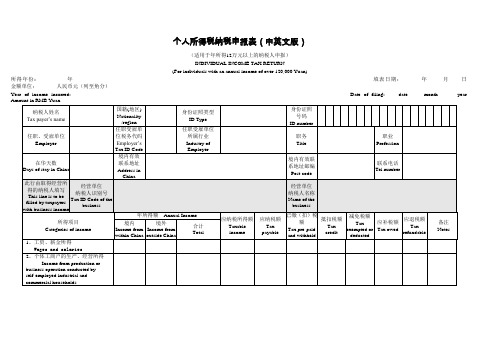

个人所得税纳税申报表(中英文版)(适用于年所得12万元以上的纳税人申报)INDIVIDUAL INCOME TAX RETURN(For individuals with an annual income of over 120,000 Yuan)所得年份: 年填表日期:年月日金额单位:人民币元(列至角分)Year of income incurred: Date of filing: date month year Amount in RMB Yuan章):Signature of responsible tax officer : Filing date: Time: Year/Month/Date Responsible tax offic填表须知一、本表根据《中华人民共和国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上纳税人的年度自行申报。

二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以内向主管税务机关报送本表。

不能按照规定期限报送本表时,应当在规定的报送期限内提出申请,经当地税务机关批准,可以适当延期。

三、填写本表应当使用中文,也可以同时用中、外两种文字填写。

四、本表各栏的填写说明如下:(一)所得年份和填表日期:申报所得年份:填写纳税人实际取得所得的年度;填表日期,填写纳税人办理纳税申报的实际日期。

(二)身份证照类型:填写纳税人的有效身份证照(居民身份证、军人身份证件、护照、回乡证等)名称。

(三)身份证照号码:填写中国居民纳税人的有效身份证照上的号码。

(四)任职、受雇单位:填写纳税人的任职、受雇单位名称。

纳税人有多个任职、受雇单位时,填写受理申报的税务机关主管的任职、受雇单位。

(五)任职、受雇单位税务代码:填写受理申报的任职、受雇单位在税务机关办理税务登记或者扣缴登记的编码。

(六)任职、受雇单位所属行业:填写受理申报的任职、受雇单位所属的行业。

浅析新时期个人所得税纳税筹划外文资料及翻译(可编辑)

浅析新时期个人所得税纳税筹划外文资料及翻译Superficial analysis of the design of new ear personal income taxBy Jody BlazekAbstractWith China's economic development, personal income increased dramatically, followed by personal income tax burden will increase significantly. Personal income tax planning it caused widespread concern. So the premise of how the tax law, through planning, reduce the tax burden, the article introduced in detail the significance of personal income tax planning and the necessity, personal income tax planning major tax-related items.Keywords: Individual income tax; tax planning; significance; necessity; major tax-related itemsWith the economy growing, gradually raise the living standards of our people, the sources and forms of personal income are becoming increasingly diverse, more and more people become personal income taxpayers. Accordingly, revenue from personal income tax in the proportion also showed a rising trend year by year, to maintain the vitalinterests of the perspective of reducing the tax burden, personal income tax planning more and more taxpayers are highly valued. So how to make the taxpayers under the premise of not against the law, reduce the tax burden as much as possible, to gain imum benefit has become an important research content, the personal income tax planning has become increasingly important.The significance of personal income tax planning and the necessity Many taxpayers from the past secretly or unconsciously adopt various methods to reduce their tax burden, development of active tax planning through to reduce the tax burden. However, in some tax planning ideas and knowledge are often opportunistic together. At the same time some people puzzled: "Tax Planning in the premise is not illegal, but the plan itself is not a violation of the spirit of national legislation and tax policy-oriented it? Desirable tax planning it?" In this context, the correct income tax guide taxpayers on tax planning and tax of the economic development of the more important practical significance, great deal of research necessary.1. Personal income tax planning is conducive to long-term development units.2. Helps to reduce the unit's tax expenditures.3. Helps to reduce the individual's own tax evasion, tax evasion and other illegal acts occur, and enhance tax awareness and realizationof tax honesty.Third, personal income tax planning for tax-related itemsPlanning ideas. First of all, develop a reasonable tax avoidance scheme. Is through the study of the current tax law, income of individuals expected in the near future to make the revenue arrangements, through the time and amount of income, payment, and reaches purpose of reducing the amount of nominal income, thus reducing tax level to reduce the tax burden or exempt taxes. Second, take reasonable tax avoidance strategy. Personal income tax planning can be reasonable to consider the following aspects: improving the level of employee benefits and reduce the nominal income; equilibrium level of wage income each month; can deduct the cost of seizing all opportunities and make full use; use of tax incentives.2. The main tax-related project planning application.1 wage and salary income planning. Progressive tax rates from the nine tables can be seen over, because of the wage and salary income is taken over nine progressive tax rate, so the higher the income, the higher the tax rate applicable to the tax burden heavier. In the periphery of each level, the income may be only a difference of a dollar, but the personal income tax borne by the tax burden will be very different. However, by taking some of the legitimate means of planning, can avoid such an unfair place. There are many specific methods, are:Equilibrium income method. Personal income tax with progressiverates usually, if the taxpayer's taxable income the more, the highest marginal tax rate applicable to the higher, so the average taxpayer's income tax rate and effective tax rate may increase. Therefore, the total income of the taxpayer a period of time given the circumstances, its contribution to the income of each tax period should be balanced, not ups and downs, in order to avoid increasing the tax burden of taxpayers. For example: a staff of 1,500 yuan monthly salary, the company usually taken to the payment of wages, end of year performance-based management approach to implement the pay award. Assuming that the end of the year employees 12 month and get a bonus of 6,000 yuan, then the employee's personal income tax to be paid throughout the year as [1500 +6000 - 2000] × 20% - 375 725 dollars. If the company will be 500 yuan per month by year-end awards along with the payment of wages, the wages of employees for 2000 yuan a month, the annual income for tax purposes.Use of employee benefits planning. Tax payable Taxable income × Applicable tax rate - quick deduction. In the file under the conditions of constant tax rates, reducing their income by way of making their use a lower tax rate, while the tax base is also smaller. Approach is feasible and units agreed to change their payment method of wages and salaries, which some of the units to provide the necessary benefits, such enterprises to provide shelter, it is reasonable tax personal income tax effective way. Enterprises can also provide holiday travel allowance,provide staff welfare facilities, free lunches, etc., to offset their wage and salary income.Cost difference between using the standard deduction. Tax law, deduct the cost of wage and salary income amounted to 2,000 yuan, labor income from more than 4,000 yuan a single 20% of the costs incurred. In some cases, the wage and salary income and income from remuneration for separately, and in some cases the wages and salaries combined with the services will save the tax return, and thus its tax planning to have some possibilities.Cases, Lee February 2006 A company from wages and salaries of 1,000 yuan, the unit wage is too low, the same month in the B Lee to find a part-time company achieved income of 5,000 yuan. If Li and B company does not have fixed employment relationship, in accordance with tax law, wage and salary income and income from remuneration for personal income tax should be calculated separately. A company has made from the wages, salaries did not exceed the deduction limit, do not pay taxes. Obtained from the B company taxable amount of remuneration: 5000 × 1 - 20% × 20% 800 yuan, the Wang in February were 800 individual income tax to be paid; if Mr. Lee and the existence of a fixed B Company the employment relationship, the two should be combined by income wage and salary income to pay personal income tax: 5000 +1000- 2000 × 15% - 125 475 million.Clearly, in this case, the use of wage and salary income tax payablecalculated is wise, therefore, Lee B should be signed with a fixed employment contract, will the income from B Company to the way wages and salaries paid to Lee.2 income from remuneration planning. On income from remuneration of a 20% rate applies, but for the case of a one-time implementation of high income plus collection, in effect amounts to three levels of progressive rates. Income from remuneration has its own characteristics, the following for its characteristics, the analysis of tax planning. Number of planning law. With different wage and salary income, income from remuneration for taxation is based on the number of the standard, rather than months, so the number of times to determine the income tax paid, which is critical to planning for the labor income tax return as a factor when the first considerationRemuneration is based on the standard number of times, deducted a fee each time, so that within one month, the number of labor remuneration paid more the more deductible expenses, the tax should be paid less. So when the taxpayers in the provision of services, reasonable arrangements for tax time, the number of monthly remuneration received, you can deduct legal fees many times, reducing the amount of taxable income each month to avoid the higher tax rates apply, so that their net increased.For example: a public listed company of an expert advisory services, according to the contract, each of the listed company of the expertadvisory fees paid 60,000 yuan. If a tax declaration by a person if their taxable income as follows:One-time reporting taxable income 6-6 × 20% 4.8 million Tax payable 4.8 × 20% × 1 +50% 1.44 millionIf it is 3 times per month, every 2 million tax returns, the amount of tax payable as follows:Payable monthly reporting 2 - 2 * 20% 1.6 millionTax payable 1.6 × 20% 0.32 millionMonthly tax payable 0.32 * 3 0.94 millionWhen comparing the two tax saving 1.44-0.94 0.5 millionCosts offset method. That by reducing the nominal income from remuneration in the form of planning, will cost the taxpayers should be replaced by the owners, to achieve the reduction in nominal labor compensation purposes. Wage and salary income conversion method. Through the wage and salary income into income from remuneration, pay personal income tax by labor income, is more conducive to reducing tax expenditures.Example: Mr. Song is a senior engineer, May 2008 to obtain a company income of 63,700 yuan of wages. Song and the company if the existence of a stable employment relationship, according wage and salary income tax, the tax payable 63700-2000 × 35% -6375 15220 yuan. If the Song and the company a stable employment relationship does not exist, this income istaxed according to perjury.Amount of tax payable 63700 × 1-20% × 40% -7000 13384 yuan. If he can save taxes 1,836 yuan.Summary:As China's economic development, the personal income tax impact on our lives will become increasingly large, and its position will become increasingly important. Making tax planning, each taxpayer must be the extent permitted by laws and regulations reasonably expected taxable income, which is the basic premise. On the basis of protection of interests of the taxpayers through the tax planning to imize personal income tax for the improvement and popularity, with significant practical significance.浅析新时期个人所得税纳税筹划By Jody Blazek摘要随着中国经济的发展,个人收入也急剧增加,随之而来的个人所得税负担也就明显加重。

个人所得税培训课件2024更新PPT

个人

公民个人

依法登记为个体工商的公民

个人独资企业投资者

合伙企业自然人合伙人

境内无住所又不居住或者境内无住所居住一年累计不满183天

类型

具体情况

纳税义务

居民纳税人

二者满足其一:1、境 内有住所;2、境内无 住所但居住,一年内累 计满18二者满足其一:1、境 内有住所;2、境内无 住所但居住,一年内累 计满183天

查遗补缺

汇总收支

按年查账

多退少补

计算公式

全部工资薪资税前收入 全部劳务报酬税前收入x (1-20%) 全部特许权使用税前收入x (1-20%)

全部稿酬税前收入x (1-20%) x (1-30%)

每年60000元 三险一金

子女教育支出 继续教育支出 大病医疗支出 住房贷款利息

住房租金收入 赡养老人支出 婴幼儿照护费用

第二章节

个人应知应会点

The individual should know the point

什么是个税

征税对象:个人

偶然的、临时的, 货币、有价证券、

实物

关于”个人“的身份

个人

居民/非居民 纳税人

类型

自然人 个体工商业户 个人融资企业 合伙企业 非居民纳税人 判断标准

住所标准/居住时间 标准

个人自行申报指南

一、实名注册(未注册用户)

1、下载“个人所得税”APP 2、下载完成后打开APP,可选择大厅注册码 注册、人脸识别认证注册。

个人自行申报指南

二、找回密码(已注册用户)

1、 找回密码需进行身份验证,先填写本人注册时的正确的身份证件信息,然后输入随机验证码。 2、完成上述内容,点击页面“下一步” 3、选择“验证方式”,目前有“通过已绑定的手机号码验证”和“通过本人银行卡进行验证“二 选其一。注意:如果选择“通过本人银行卡进行验证”前提是要原先在APP端或WEP端里面添加过 银行卡才可操作。 4、输入“短信验证码”,点击“下一步 5、设置新密码,然后点击“保存”码修改成功。注意:密码规则必须要由大写、小写字数字组合, 必须8位以上。

IIT filing return 个人所得税纳税申报表(中英文版)

个人所得税纳税申报表(中英文版)(适用于年所得12万元以上的纳税人申报)INDIVIDUAL INCOME TAX RETURN(For individuals with an annual income of over 120,000 Yuan)所得年份: 年填表日期:年月日金额单位:人民币元(列至角分)Year of income incurred: Date of filing: date month year Amount in RMB Yuan章):Signature of responsible tax officer : Filing date: Time: Year/Month/Date Responsible tax offic填表须知一、本表根据《中华人民共和国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上纳税人的年度自行申报。

二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以内向主管税务机关报送本表。

不能按照规定期限报送本表时,应当在规定的报送期限内提出申请,经当地税务机关批准,可以适当延期。

三、填写本表应当使用中文,也可以同时用中、外两种文字填写。

四、本表各栏的填写说明如下:(一)所得年份和填表日期:申报所得年份:填写纳税人实际取得所得的年度;填表日期,填写纳税人办理纳税申报的实际日期。

(二)身份证照类型:填写纳税人的有效身份证照(居民身份证、军人身份证件、护照、回乡证等)名称。

(三)身份证照号码:填写中国居民纳税人的有效身份证照上的号码。

(四)任职、受雇单位:填写纳税人的任职、受雇单位名称。

纳税人有多个任职、受雇单位时,填写受理申报的税务机关主管的任职、受雇单位。

(五)任职、受雇单位税务代码:填写受理申报的任职、受雇单位在税务机关办理税务登记或者扣缴登记的编码。

(六)任职、受雇单位所属行业:填写受理申报的任职、受雇单位所属的行业。