公司理财复习题

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

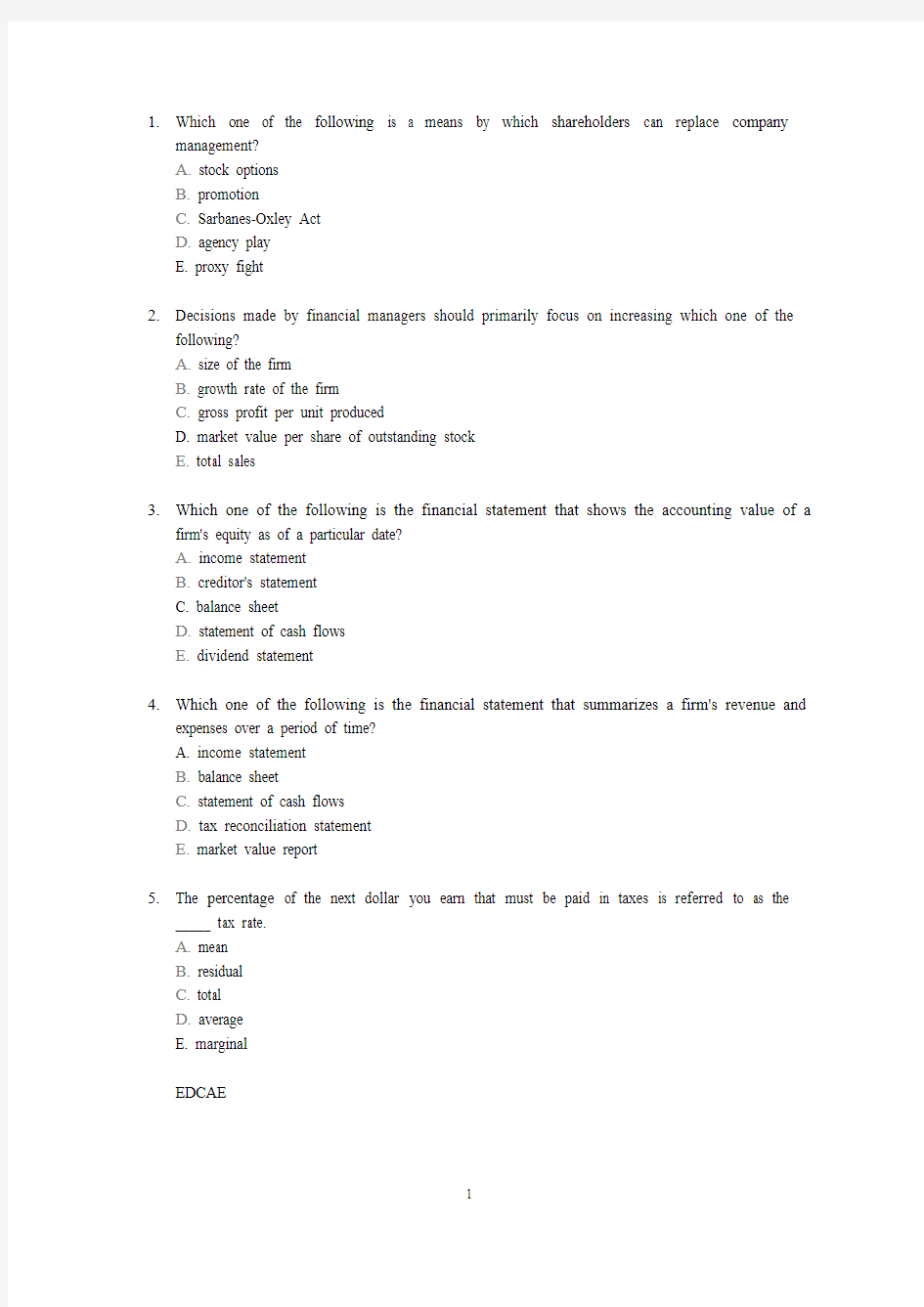

1.Which one of the following is a means by which shareholders can replace company

management?

A. stock options

B. promotion

C. Sarbanes-Oxley Act

D. agency play

E. proxy fight

2.Decisions made by financial managers should primarily focus on increasing which one of the

following?

A. size of the firm

B. growth rate of the firm

C. gross profit per unit produced

D. market value per share of outstanding stock

E. total sales

3.Which one of the following is the financial statement that shows the accounting value of a

firm's equity as of a particular date?

A. income statement

B. creditor's statement

C. balance sheet

D. statement of cash flows

E. dividend statement

4.Which one of the following is the financial statement that summarizes a firm's revenue and

expenses over a period of time?

A. income statement

B. balance sheet

C. statement of cash flows

D. tax reconciliation statement

E. market value report

5.The percentage of the next dollar you earn that must be paid in taxes is referred to as the

_____ tax rate.

A. mean

B. residual

C. total

D. average

E. marginal

EDCAE

6.The cash flow of a firm which is available for distribution to the firm's creditors and

stockholders is called the:

A. operating cash flow.

B. net capital spending.

C. net working capital.

D. cash flow from assets.

E. cash flow to stockholders.

7.Canine Supply has sales of $2,200, total assets of $1,400, and a debt-equity ratio of 0.3. Its

return on equity is 15 percent. What is the net income?

A. $138.16

B. $141.41

C. $152.09

D. $156.67

E. $161.54

8.Beach Wear has current liabilities of $350,000, a quick ratio of 1.65, inventory turnover of 3.2,

and a current ratio of 2.9. What is the cost of goods sold?

A. $980,000

B. $1,060,000

C. $1,200,000

D. $1,400,000

E. $1,560,000

9.The sustainable growth rate of a firm is best described as the:

A. minimum growth rate achievable assuming a 100 percent retention ratio.

B. minimum growth rate achievable if the firm maintains a constant equity multiplier.

C. maximum growth rate achievable excluding external financing of any kind.

D. maximum growth rate achievable excluding any external equity financing while

maintaining a constant debt-equity ratio.

E. maximum growth rate achievable with unlimited debt financing.

10.The internal growth rate of a firm is best described as the:

A. minimum growth rate achievable assuming a 100 percent retention ratio.

B. minimum growth rate achievable if the firm maintains a constant equity multiplier.

C. maximum growth rate achievable excluding external financing of any kind.

D. maximum growth rate achievable excluding any external equity financing while

maintaining a constant debt-equity ratio.

E. maximum growth rate achievable with unlimited debt financing.

DEDDC