江西财经大学国际会计期末考试试卷 A

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

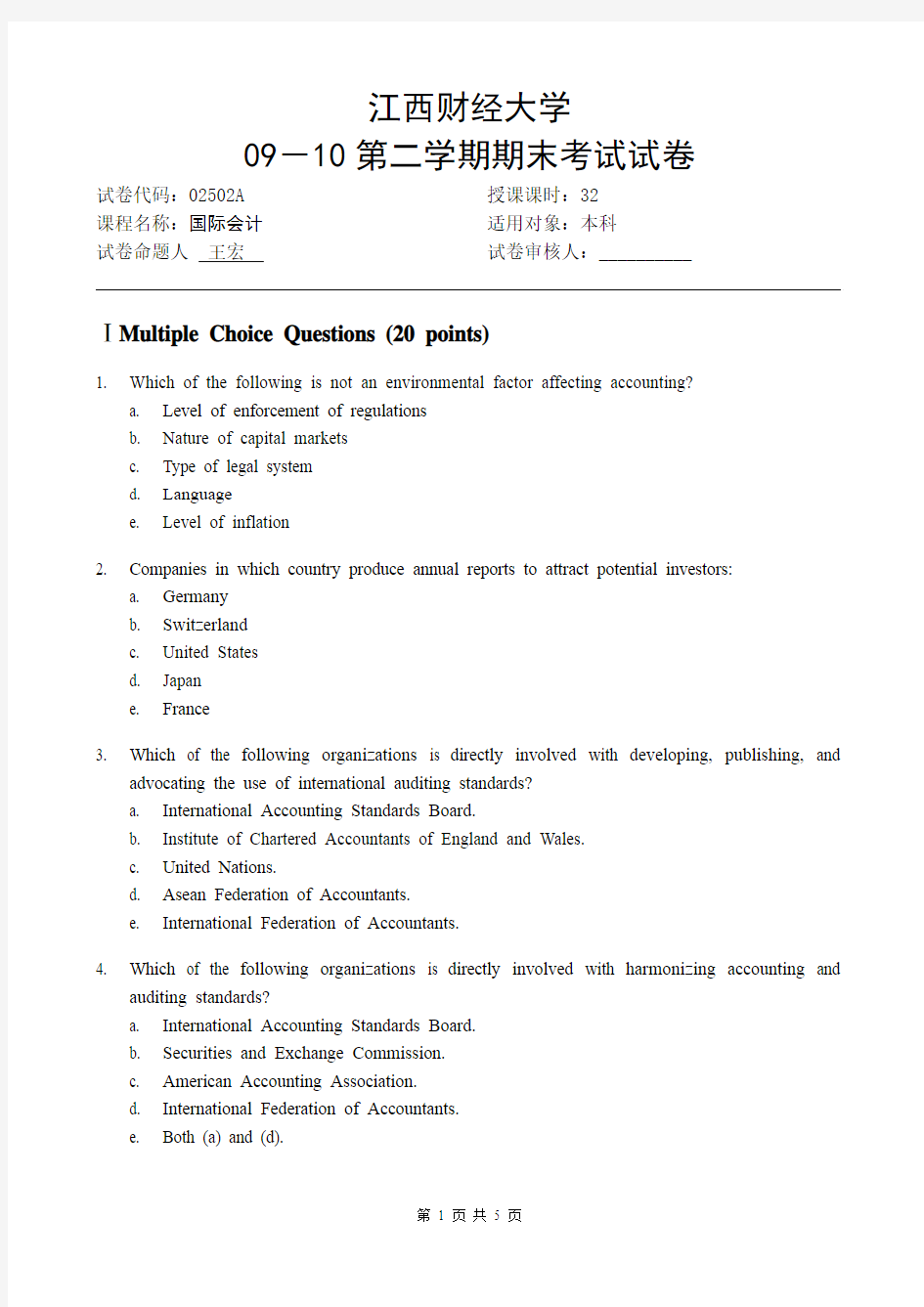

江西财经大学

09-10第二学期期末考试试卷

试卷代码:02502A 授课课时:32

课程名称:国际会计适用对象:本科

试卷命题人王宏试卷审核人:__________

ⅠMultiple Choice Questions (20 points)

1. Which of the following is not an environmental factor affecting accounting?

a. Level of enforcement of regulations

b. Nature of capital markets

c. Type of legal system

d. Language

e. Level of inflation

2. Companies in which country produce annual reports to attract potential investors:

a. Germany

b. Switzerland

c. United States

d. Japan

e. France

3. Which of the following organizations is directly involved with developing, publishing, and

advocating the use of international auditing standards?

a. International Accounting Standards Board.

b. Institute of Chartered Accountants of England and Wales.

c. United Nations.

d. Asean Federation of Accountants.

e. International Federation of Accountants.

4. Which of the following organizations is directly involved with harmonizing accounting and

auditing standards?

a. International Accounting Standards Board.

b. Securities and Exchange Commission.

c. American Accounting Association.

d. International Federation of Accountants.

e. Both (a) and (d).

5. Under the monetary/non-monetary method of foreign currency translation, depreciation

expense is translated at the:

a. Current rate

b. Weighted average rate

c. Historical rate

d. None of the above

6. Under the temporal method, translation gains and losses appear in:

a. the stockholders' equity section

b. the income statement as a normal operating item

c. the income statement as an extraordinary item

d. None of the above

7. The Graz Company's historical cost balance sheet showed equipment (at cost) of 20 million

schillings on December 31, 2000 and 24 million schillings on December 31, 2001. The equipment was being depreciated over a five year period on a straight line basis. Equipment costing 4 million schillings was acquired on January 1, 2001. A full year's depreciation was taken in the year of purchase. The December 31, 2000 balance of equipment (at cost) restated to reflect December 31, 2001 purchasing power was 25 million schillings. What amount of equipment should be shown in the general price level adjusted (GPLA) income statement if the general price level index was 120 at December 31, 2000 and 144 at December 31, 2001?

a. 29.00 million schillings

b. 29.80 million schillings

c. 28.80 million schillings

d. 25.00 million schillings

e. None of the above.

8. The Graz Company's historical cost balance sheet showed equipment (at cost) of 20 million

schillings on December 31, 2000 and 24 million schillings on December 31, 2001. The equipment was being depreciated over a five year period on a straight line basis. Equipment costing 4 million schillings was acquired on January 1, 2001. A full year's depreciation was taken in the year of purchase. The December 31, 2000 balance of equipment (at cost) restated to reflect December 31, 2001 purchasing power was 25 million schillings. What amount of depreciation expense should be shown in the general price level adjusted (GPLA) income statement if the general price level index was 120 at December 31, 2000 and 144 at December 31, 2001?

a. 5.96 million schillings

b. 5.80 million schillings

c. 5.76 million schillings

d. 5.00 million schillings

e. None of the above.