会计英语课后习题及参考答案

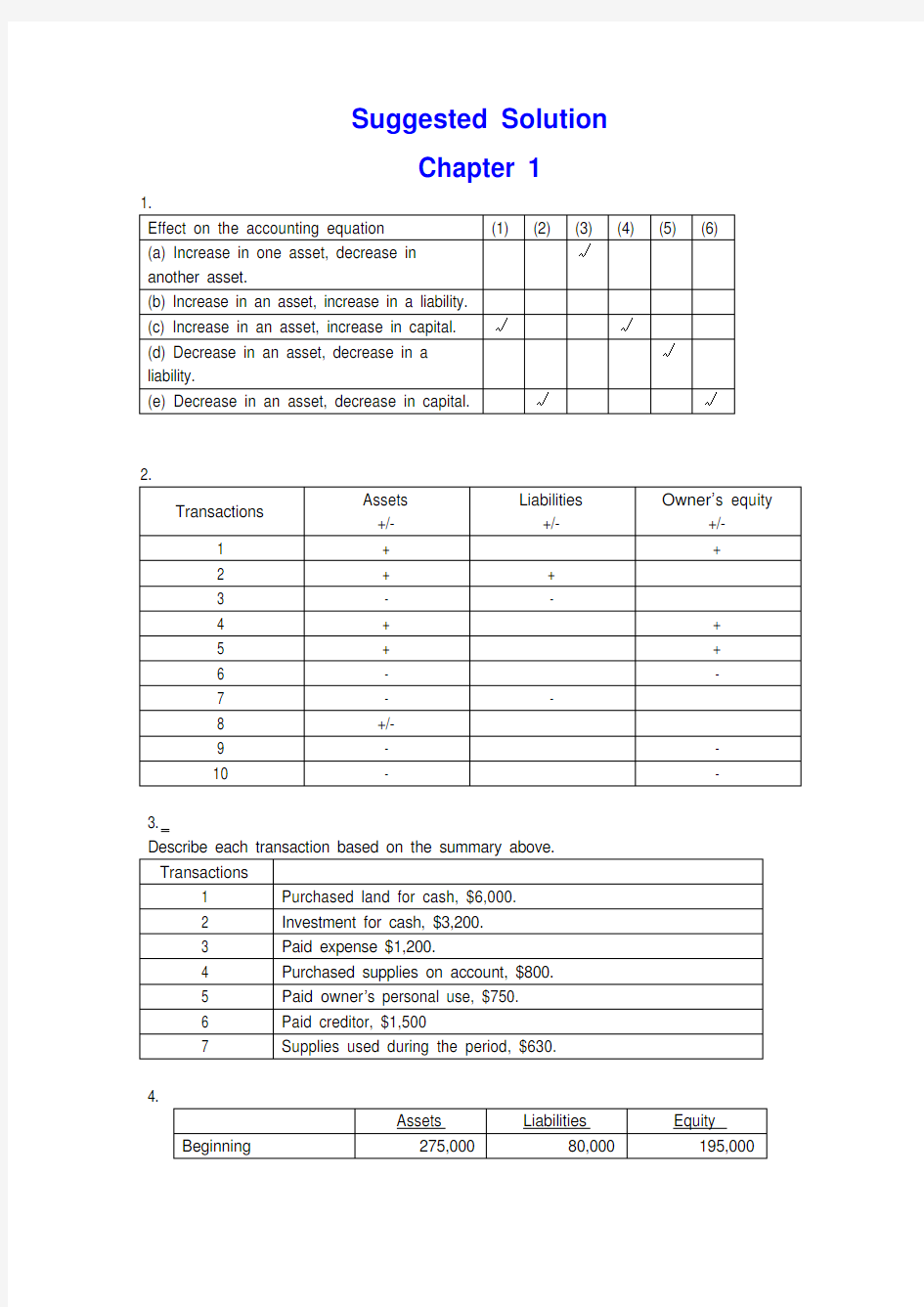

Suggested Solution

Chapter 1

3.

4.

5.

(b) net income = 9,260-7,470=1,790

(c) net income = 1,790+2,500=4,290

Chapter 2

1.

a.To increase Notes Payable -CR

b.To decrease Accounts Receivable-CR

c.To increase Owner, Capital -CR

d.To decrease Unearned Fees -DR

e.To decrease Prepaid Insurance -CR

f.To decrease Cash - CR

g.To increase Utilities Expense -DR

h.To increase Fees Earned -CR

i.To increase Store Equipment -DR

j.To increase Owner, Withdrawal -DR

2.

a.

Cash 1,800

Accounts payable ................................................... 1,800 b.

Revenue ................................................................... 4,500

Accounts receivable ...................................... 4,500

c.

Owner’s withdrawals ................................................ 1,500

Salaries Expense ............................................ 1,500 d.

Accounts Receivable (750)

Revenue (750)

3.

Prepare adjusting journal entries at December 31, the end of the year.

Advertising expense 600

Prepaid advertising 600

Insurance expense (2160/12*2) 360

Prepaid insurance 360

Unearned revenue 2,100

Service revenue 2,100

Consultant expense 900

Prepaid consultant 900

Unearned revenue 3,000

Service revenue 3,000 4.

1. $388,400

2. $22,520

3. $366,600

4. $21,800

5.

1. net loss for the year ended June 30, 2002: $60,000

2. DR Jon Nissen, Capital 60,000

CR income summary 60,000

3. post-closing balance in Jon Nissen, Capital at June 30, 2002: $54,000

Chapter 3

1. Dundee Realty bank reconciliation

October 31, 2009

Reconciled balance $6,220 Reconciled balance $6,220

2. April 7 Dr: Notes receivable—A company 5400

Cr: Accounts receivable—A company 5400

12 Dr: Cash 5394.5

Interest expense 5.5

Cr: Notes receivable 5400

June 6 Dr: Accounts receivable—A company 5533

Cr: Cash 5533

18 Dr: Cash 5560.7

Cr: Accounts receivable—A company 5533

Interest revenue 27.7

3. (a) As a whole: the ending inventory=685

(b) applied separately to each product: the ending inventory=625

4. The cost of goods available for sale=ending inventory + the cost of goods=80,000+200,000*500%=80,000+1,000,000=1,080,000

5.(1) 24,000+60,000-90,000*0.8=12000

(2) (60,000+24,000)/( 85,000+31,000)*( 85,000+31,000-90,000)=18828

Chapter 4

1. (a) second-year depreciation = (114,000 – 5,700) / 5 = 21,660;

(b) second-year depreciation = 8,600 * (114,000 – 5,700) / 36,100 = 25,800;

(c) first-year depreciation = 114,000 * 40% = 45,600

second-year depreciation = (114,000 – 45,600) * 40% = 27,360;

(d) second-year depreciation = (114,000 – 5,700) * 4/15 = 28,880.

2. (a) weighted-average accumulated expenditures (2008) = 75,000 * 12/12 + 84,000 * 9/12 + 180,000 * 8/12 + 300,000 * 7/12 + 100,000 * 6/12 = 483,000

(b) interest capitalized during 2008 = 60,000 * 12% + ( 483,000 –60,000) * 10% =49,500

3. (1) depreciation expense = 30,000

(2) book value = 600,000 – 30,000 * 2=540,000

(3) depreciation expense = ( 600,000 – 30,000 * 8)/16 =22,500

(4) book value = 600,000 – 30,000 * 8 – 22,500 = 337,500

4. Situation 1:

Jan 1st, 2008 Investment in M 260,000

Cash 260,000

June 30 Cash 6000

Dividend revenue 6000

Situation 2:

January 1, 2008 Investment in S 81,000

Cash 81,000

June 15 Cash 10,800

Investment in S 10,800

December 31 Investment in S 25,500

Investment Revenue 25,500

5. a. December 31, 2008 Investment in K 1,200,000

Cash 1,200,000

June 30, 2009 Dividend Receivable 42,500

Dividend Revenue 42,500

December 31, 2009 Cash 42,500

Dividend Receivable 42,500

b. December 31, 2008 Investment in K 1,200,000

Cash 1,200,000 December 31, 2009 Cash 42,500

Investment in K 42,500

Investment in K 146,000

Investment revenue 146,000 c. In a, the investment amount is 1,200,000

net income reposed is 42,500

In b, the investment amount is 1,303,500

Net income reposed is 146,000

Chapter 5

1.

a. June 1: Dr: Inventory 198,000

Cr: Accounts Payable 198,000 June 11: Dr: Accounts Payable 198,000

Cr: Notes Payable 198,000 June 12: Dr: Cash 300,000

Cr: Notes Payable 300,000

b. Dr: Interest Expenses (for notes on June 11) 12,100

Cr: Interest Payable 12,100

Dr: Interest Expenses (for notes on June 12) 8,175

Cr: Interest Payable 8,175

c. Balance sheet presentation:

Notes Payable 498,000 Accrued Interest on Notes Payable 20,275

d. For Green:

Dr: Notes Payable 198,000 Interest Payable 12,100

Interest Expense 7,700

Cr: Cash 217,800

For Western:

Dr: Notes Payable 300,000

Interest Payable 8,175

Interest Expense 18,825

Cr: Cash 327,000

2.

(1) 20?8 Deferred income tax is a liability 2,400

Income tax payable 21,600 20?9 Deferred income tax is an asset 600

Income tax payable 26,100

(2) 20?8: Dr: Tax expense 24,000

Cr: Income tax payable 21,600 Deferred income tax 2,400 20?9: Dr: Tax expense 25,500

Deferred income tax 600

Cr: Income tax payable 26,100 (3) 20?8: Income statement: tax expense 24,000

Balance sheet: income tax payable 21,600 20?9: Income statement: tax expense 25,500 Balance sheet: income tax payable 26,100

3.

a. 1,560,000 (20000000*12 %* (1-35%))

b. 7.8% (20000000*12 %* (1-35%)/20000000)

5.

Notes Payable 14,400 Interest Payable 1,296 Accounts Payable 60,000 +Unearned Rent Revenue 7,200 Current Liabilities 82,896

Chapter 6

1. Mar. 1

Cash 1,200,000

Common Stock 1,000,000

Paid-in Capital in Excess of Par Value 200,000

Mar. 15

Organization Expense 50,000

Common Stock 50,000

Mar. 23

Patent 120,000

Common Stock 100,000

Paid-in Capital in Excess of Par Value 20,000

The value of the patent is not easily determinable, so use the issue price of $12 per share on March 1 which is the issuing price of common stock.

2. July.1

Treasury Stock 180,000

Cash 180,000

The cost of treasury purchased is 180,000/30,000=60 per share.

Nov. 1

Cash 70,000

Treasury Stock 60,000

Paid-in Capital from Treasury Stock 10,000

Sell the treasury at the cost of $60 per share, and selling price is $70 per share. The treasury stock is sold above the cost.

Dec. 20

Cash 75,000

Paid-in Capital from Treasury Stock 15,000

Treasury Stock 90,000

The cost of treasury is $60 per share while the selling price is $50 which is lower than the cost.

3. a. July 1

Retained Earnings 24,000

Dividends Payable—Preferred Stock 24,000

b.Sept.1

Dividends Payable—Preferred Stock 24,000

Cash 24,000

c. Dec.1

Retained Earnings 80,000

Dividends Payable—Common Stock 80,000

d. Dec.31

会计专业英语期末试题)

期期末测试题 Ⅰ、Translate The Following Terms Into Chinese . 1. entity concept 主题概念 2.depreciation折旧 3. double entry system 4.inventories 5. stable monetary unit 6.opening balance 7.current asset 8.financial report 9.prepaid expense 10.internal control 11.cash flow statement 12.cash basis 13.tangible fixed asset 14.managerial accounting 15. current liability 16.internal control 17.sales return and allowance 18.financial position 19.balance sheet 20.direct write-off method Ⅱ、Translate The Following Sentences Into Chinese . 1. Accounting is often described as an information system. It is the system that measures business activities, processes into reports and communicates these findings to decision makers. 2. The primary users of financial information are investors and creditors. Secondary users include the public, government regulatory agencies, employees, customers, suppliers, industry groups, labor unions, other companies, and academic researchers. 3. There are two sources of assets. One is liabilities and the other is owner’s equity. Liabilities are obligations of an entity arising from past transactions or events, the settlement of which may result in the transfer or use of assets or services in the future. 资产有两个来源,一个是负债,另一个是所有者权益。负债是由过去的交易或事件产生的实体的义务,其结算可能导致未来资产或服务的转让或使用。 4. Accounting elements are basic classification of accounting practices. They are essential units to present the financial position and operating result of an entity. In China, we have six groups of accounting elements. They are assets, liabilities, 可复制、编制,期待你的好评与关注!

会计专业英语模拟试题及答案

《会计专业英语》模拟试题及答案 一、单选题(每题1分,共 20分) 1. Which of the following statements about accounting concepts or assumptions are correct? 1) The money measurement assumption is that items in accounts are initially measured at their historical cost. 2) In order to achieve comparability it may sometimes be necessary to override the prudence concept. 3) To facilitate comparisons between different entities it is helpful if accounting policies and changes in them are disclosed. 4) To comply with the law, the legal form of a transaction must always be reflected in financial statements. A 1 and 3 B 1 and 4 C 3 only D 2 and 3 Johnny had receivables of $5 500 at the start of 2010. During the year to 31 Dec 2010 he makes credit sales of $55 000 and receives cash of $46 500 from credit customers. What is the balance on the accounts receivables at 31 Dec 2010? $8 500 Dr $8 500 Cr $14 000 Dr $14 000 Cr Should dividends paid appear on the face of a company’s cash flow statement? Yes No Not sure Either Which of the following inventory valuation methods is likely to lead to the highest figure for closing inventory at a time when prices are dropping? Weighted Average cost First in first out (FIFO) Last in first out (LIFO) Unit cost 5. Which of following items may appear as non-current assets in a company’s the statement of financial position? (1) plant, equipment, and property (2) company car (3) €4000 cash (4) €1000 cheque A. (1), (3)

财务会计英语 练习及答案ch03

CHAPTER 3 THE MATCHING CONCEPT AND THE ADJUSTING PROCESS

Chapter 3—The Matching Concept and the Adjusting Process Chapter 3—The Matching Concept and the Adjusting Process TRUE/FALSE 1. The system of accounting where revenues are recorded when they are earned and expenses are recorded when they are incurred is called the cash basis of accounting. ANS: F DIF: 2 OBJ: 01 2. The accrual basis of accounting requires revenue be recorded when cash is received from customers. ANS: F DIF: 2 OBJ: 01 3. Generally accepted accounting principles require accrual-basis accounting. ANS: T DIF: 2 OBJ: 01 4. The revenue recognition concept states that revenue should be recorded in the same period as the cash is received. ANS: F DIF: 2 OBJ: 01 5. The matching concept requires expenses be recorded in the same period that the related revenue is recorded. ANS: T DIF: 2 OBJ: 01 6. The financial statements measure precisely the financial condition and results of operations of a business. ANS: F DIF: 2 OBJ: 01 7. Adjusting entries are made at the end of an accounting period to adjust accounts on the balance sheet. ANS: F DIF: 2 OBJ: 02 8. Adjusting entries affect only expense and asset accounts. ANS: F DIF: 2 OBJ: 02 9. Prepaid Rent is a deferred expense. ANS: T DIF: 1 OBJ: 02 63

会计英语试题及复习资料

会计英语试题及答案 会计专业英语是会计专业人员职业发展的必要工具。学习会计专业英语就是学习如何借助英语解决与完成会计实务中涉外的专业性问题和任务。以下为你收集了会计英语练习题及答案,希望给你带来一些参考的作用。 一、单选题 1. ? 1) . 2) . 3) . 4) , a . A 1 3 B 1 4 C 3 D 2 3 2. $5 500 2010. 31 2010 $55 000 $46 500 . 31 2010? A. $8 500 B. $8 500 C. $14 000 D. $14 000 3. a ’s ? A. B. C. D. 4. a ? A. B. () C. () D. 5. a ’s ? (1) , , (2) (3) 4000 (4) 1000 A. (1), (3) B. (1), (2) C. (2), (3) D. (2), (4)

6. a ’s ? (1) (2) . (3) . (4) A (1), (2) (3) B (1), (2) (4) C (1), (3) (4) D (2), (3) (4) 7. 30 2010 : $992,640 $1,026,480 , , ? 1. $6,160 . 2. $27,680 a . 3. $6,160 a . 4. $21,520 . A 1 2 B 2 3 C 2 4 D 3 4 8. . (1) (2) (3) (4) ? A (1), (3) (4) B (1), (2) (4) C (1), (2) (3) D (2), (3) (4) ( = [])({ : "u3054369" }); 9. ? (1) , (2) a (3) , A. 2 3 B. C. 1 2 D. 3 10. ? (1)

会计英语课后习题及参考答案

Suggested Solution Chapter 1 3. 4.

5. (b) net income = 9,260-7,470=1,790 (c) net income = 1,790+2,500=4,290

Chapter 2 1. a.To increase Notes Payable -CR b.To decrease Accounts Receivable-CR c.To increase Owner, Capital -CR d.To decrease Unearned Fees -DR e.To decrease Prepaid Insurance -CR f.To decrease Cash - CR g.To increase Utilities Expense -DR h.To increase Fees Earned -CR i.To increase Store Equipment -DR j.To increase Owner, Withdrawal -DR 2. a. Cash 1,800 Accounts payable ................................................... 1,800 b. Revenue ................................................................... 4,500 Accounts receivable ...................................... 4,500 c. Owner’s withdrawals ................................................ 1,500 Salaries Expense ............................................ 1,500 d. Accounts Receivable (750) Revenue (750) 3. Prepare adjusting journal entries at December 31, the end of the year. Advertising expense 600 Prepaid advertising 600 Insurance expense (2160/12*2) 360 Prepaid insurance 360

财务会计英语 练习及答案ch10

CHAPTER 10 FIXED ASSETS AND INTANGIBLE ASSETS

Chapter 10—Fixed Assets and Intangible Assets Chapter 10—Fixed Assets and Intangible Assets TRUE/FALSE 1. Long-lived assets that are intangible in nature, used in the operations of the business, and not held for sale in the ordinary course of business are called fixed assets. ANS: F DIF: 1 OBJ: 01 2. The acquisition costs of property, plant, and equipment should include all normal, reasonable and necessary costs to get the asset in place and ready for use. ANS: T DIF: 1 OBJ: 01 3. When land is purchased to construct a new building, the cost of removing any structures on the land should be charged to the building account. ANS: F DIF: 2 OBJ: 01 4. Land acquired as a speculation is reported under Investments on the balance sheet. ANS: T DIF: 1 OBJ: 01 5. To a major resort, timeshare properties would be classified as property, plant and equipment. ANS: T DIF: 2 OBJ: 01 6. Standby equipment held for use in the event of a breakdown of regular equipment is reported as property, plant, and equipment on the balance sheet. ANS: T DIF: 2 OBJ: 01 7. The cost of repairing damage to a machine during installation is debited to a fixed asset account. ANS: F DIF: 1 OBJ: 01 8. During construction of a building, the cost of interest on a construction loan should be charged to an expense account. ANS: F DIF: 2 OBJ: 01 9. The cost of computer equipment does not include the consultant's fee to supervise installation of the equipment. ANS: F DIF: 1 OBJ: 01 237

《财会专业英语》期末试卷及答案

《财会专业英语》期终试卷 I.Put the following into corresponding groups. (15 points) 1.Cash on hand 2.Notes receivable 3.Advances to suppliers 4. Other receivables 5.Short-term loans 6.Intangible assets 7.Cost of production 8.Current year profit 9. Capital reserve 10.Long-term loans 11.Other payables 12. Con-operating expenses 13.Financial expenses 14.Cost of sale 15. Accrued payroll II.Please find the best answers to the following questions. (25 Points) 1. Aftin Co. performs services on account when Aftin collects the account receivable A.assets increase B.assets do not change C.owner’s equity d ecreases D.liabilities decrease 2. A balance sheet report . A. the assets, liabilities, and owner’s equity on a particular date B. the change in the owner’s capital during the period C. the cash receipt and cash payment during the period D. the difference between revenues and expenses during the period 3. The following information about the assets and liabilities at the end of 20 x 1 and 20 x 2 is given below: 20 x 1 20 x 2 Assets $ 75,000 $ 90,000 Liabilities 36,000 45,000 how much the owner’sequity at the end of 20 x 2 ? A.$ 4,500 B.$ 6,000 C.$ 45,000 D.$ 43,000

考研会计专业英语试题

考研会计专业英语试题 1.Give a brief explanation for the following terms(10%) (1)Journal entry (2)Going concern (3)Matching principle (4)Working capital (5)Revenue expenditure 2.Please read the following passage carefully and fill in each of the 11 blanks with a word most appropriate to the content (10%) (1)The double-entry system of accounting takes its name from the fact that every business transaction is recorded by (____)types of entries: 1: (_____)entries to one or more accounts and 2credit entries to one or more accounts. In recording any transaction,the total dollar amount of the (______)entries must (_____)the total dollar amount of credit entries. (2)Often a transaction affects revenues or expenses of two or more different periods,in these cases,an (_____)entries are needed to (_____)to each period the appropriate amounts of revenues and expenses. These entries are performed at the (_____)of each accounting period but (_____)to preparing the financial statements. (3)Marketable securities are highly (_____)investments,primarily in share stocks and bounds,(____)can be sold (_____)quoted market prices in organized securities exchanges. 3.Translate the following Chinese statements into English (18%) (1)财务报表反映一个企业的财务状况和经营成果,是根据公认会计准则编制的。这些报表是为许多不同的决策者,许多不同的目的而提供的。 纳税申报单则反映应税收益的计算,是由税法和税则规定的概念。在许多情况下,税法和公认会计准则相似,但两者却存在实质上的不同。 (2)审计师不保证财务报表的准确性,他们仅就财务报表的公允性发表专家意见。然而注册会计师事务所的声誉来自于他们对审计工作的一丝不苟和审计报告的可靠性。

会计英语试题及答案

精品文档 会计英语试题及答案 会计专业英语是会计专业人员职业发展的必要工具。学 习会计专业英语就是学习如何借助英语解决与完成会计实务中涉外的专业性问题和任务。以下为你收集了会计英语练习题及答案,希望给你带来一些参考的作用。 一、单选题 1. Which of the following statements about accounting concepts or assumptions are correct? 1) The money measurement assumption is that items in accounts are initially measured at their historical cost. 2) In order to achieve comparability it may sometimes be necessary to override the prudence concept. 3) To facilitate comparisons between different entities it is helpful if accounting policies and changes in them are disclosed. 4) To comply with the law, the legal form of a transaction must always be reflected in financial statements. A 1 and 3 B 1 and 4 C 3 only D 2 and 3 2. Johnny had receivables of $5 500 at the start of 2010. During the year to 31 Dec 2010 he makes credit sales of $55 000 and receives cash of $46 500 from credit 2016 全新精品资料-全新公文范文-全程指导写作–独家

会计英语试题及答案

函授点《会计英语》期末试卷 姓名------ 专业------ 分数------ 一、单项选择题(20分) 1. Listed below are some characteristics of financial information. (1) True (2) Pru dence (3) Completeness (4) Correct Which of these characteristics contribute to reliability? A (1), (3) and (4) only B (1), (2) and (4) only C (1), (2) and (3) only D (2), (3) and (4) only 2. In preparing its financial statements for the current year, a company’s closing i nventory was understated by $300,000. What will be the effect of this error if it re mains uncorrected? A The current ye ar’s profit will be overstated and next year’s profit will be unders tated B The current year’s profit will be understated but there will be no effect on next year’s profit C The current year’s profit will be understated and next year’s profit will be overs tated D The current year’s profit will be overstated but there will be no effect on next y ear’s profit. 3. In preparing a company’s cash flow statement, which, if any, of the following it ems could form part of the calculation of cash flow from financing activities? (1) Proceeds of sale of premises (2) Dividends received (3) Issue of shares A 1 only B 2 only C 3 only D None of them. 4. At 31 March 2009 a company had oil in hand to be used for heating costing $8 ,200 and an unpaid heating oil bill for $3,600. At 31 March 2010 the heating oil in hand was $9,300 and there was an outstanding heating oil bill of $3,200. Payme nts made for heating oil during the year ended 31 March 2010 totalled $34,600. Based on these figures, what amount should appear in the co mpany’s income st atement for heating oil for the year? A $23,900 B $36,100 C $45,300 D $33,100 5. In times of inflation In times of rising prices, what effect does the use of the his torical cost concept have on a company’s asset values and profit? A. Asset values and profit both undervalued B. Asset values and profit both overvalued C. Asset values undervalued and profit overvalued D. Asset values overvalued and profit undervalued 二、将下列报表翻译成中文(每个3分,共60分) 1. ABC group the statement of financial position as at 31/Dec/2010 € 2. Non-current assets 3. Intangible assets 4. Property, plant and equipment 5. Investment in associates 6. Held-for-maturity investment 7. Deferred income tax assets

会计专业英语模拟题(开卷)

《会计专业英语》模拟题(补) 1.Complete the translation between Chinese and English: (1)salvage value (2)depreciation (3)ratio analysis (4)所有者权益 (5)fiscal year (6)uncollectible accounts (7)double entry system (8)petty cash (9)流动资产 (10)gross profit (11)first in first out (12)资产负债表 (13)common-size analysis (14)corporations (15)经济业务 (16)short-term debt-paying ability 2.Label the following accounts as asset (A), liability (L), owner’s equity (OE), revenues (R) or expense (E) (1)Office Supplies (2)Professional Fees (3)Prepaid Insurance (4)Salary expense (5)Accounts Payable (6)Service Income (7)R. L. Osborn, Capital (8)Rent Expense (9)Accounts Receivable (10)Notes payable 3. Answer the question related to the topic of the conversation W h y I s n’t T h e A c c o u n t i n g A M i r r o r o f W h a t H a p p e n e d? J o h n:L e a n n e,c a n y o u e x p l a i n w h a t’s g o i n g o n h e r e w i t h t h e s e m o n t h l y s t a t e m e n t s? L e a n n e:S u r e,J o h n.H o w c a n I h e l p y o u? J o h n:I d o n’t u n d e r s t a n d t h i s l a s t–i n,f i r s t–o u t i n v e n t o r y p r o c e d u r e.I t j u s t d o e s n’t m a k e s e n s e. L e a n n e:W e l l,w h a t i t m e a n s i s t h a t w e a s s u m e t h a t t h e l a s t g o o d s w e r e c e i v e a r e t h e f i r s t o n e s s o l d.S o t h e i n v e n t o r y i s m a d e u p o f t h e i t e m s w e p u r c h a s e d f i r s t. John: Yes, but that’s my problem. It doesn’t work that way! We always distribute the oldest produce first. Some o f that produce is perishable! We can’t keep any of it very long or it’ll spoil. L e a n n e:J o h n,y o u d o n’t u n d e r s t a n d.W e o n l y a s s u m e t h a t t h e p r o d u c t s w e d i s t r i b u t e a r e t h e l a s t o n e s r e c e i v e d.W e d o n’t a c t u a l l y h a v e t o d i s t r i b u t e t h e g o o d s i n t h i s w a y. J o h n:I a l w a y s t h o u g h t t h a t a c c o u n t i n g w a s s u p p o s e d t o s h o w w h a t r e a l l y h a p p e n e d.I t a l l s o u n d s l i k e“m a k e b e l i e v e”t o m e!W h y n o t r e p o r t w h a t r e a l l y h a p p e n s? Q u e s t i o n:

会计专业英语期末试题期期末测试题

会计专业英语期末试题期期末测试题 Ⅰ、Translate The Following Terms Into Chinese. 1.entity concept主题概念 2.depreciation折旧 3.double entry system 4.inventories 5.stable monetary unit 6.opening balance 7.current asset8.financial report 9.prepaid expense10.internal control 11.cash flow statement12.cash basis 13.tangible fixed asset14.managerial accounting 15.current liability16.internal control 17.sales return and allowance18.financial position 19.balance sheet20.direct write-off method Ⅱ、Translate The Following Sentences Into Chinese. 1.Accounting is often described as an information system. It is the system that measures business activities, processes into reports and communicates these findings to decision makers. 2.The primary users of financial information are investors and creditors.Secondary users include the

《会计专业英语》期末试题(A卷)答案

2001会计专业英语试题答案 1. (1) Journal entry—A chronological record of transactions, showing for each transaction the debits and credits to be entered in specific ledger accounts. (2) Going concern ——An assumption that a business entity will continue in operation indefinitely and thus will carry out its existing commitments. (3) Matching principle——The revenue earned druing an accounting period is offset with the expenses incurred in generating this revenue. (4) Working capital——Current assets minus current liabilities (5) Revenue expenditure——Any expenditure that will benefit only the current accounting period. 2. 每空1分,其中两个debit合计1分 (1) (two). (debit). (debit). (equal). (2) (adjusting). (assign). (end). (prior) (3) (liquid). (that). (at) 3.题一10分,第一小段6分,第二小段4分。题二8分 (1) Financial statements show the financial position of a business and the results of its operations, presented in conformity with generally accepted accounting principles. These statements are intended for use by many different decision makers, for many different purposes. Tax returns show the computation of taxable income, legal concept by tax laws and regulations. In many cases, tax laws are similar to generally accepted accounting principles, but substantial differences do exist. (2) Auditors do not guarantee the accuracy of financial statements; they express only their expert opinion as to the fairness of the statements. However, CPA firms stake their reputations on the thoroughness of their audits and the dependability of their audit reports. 4.每小题6分,每小题包括三小句,每小句2分。 (1) 会计原则不象自然法则,从性质上来说不是等待人们去发现,而是我们考虑财务报告 的最重要目标后据此由人制定的。在很多方面公认会计准则类似于为有组织的体育比赛, 如足球或篮球比赛制定的比赛规则。 (2) 会计师制定了一些会计程序,据此将现金收支分配于一定期间,以某种方式确定出收 益,该收益代表这个企业特定期间的经济成果。收益概念应用于现实生活涉及许多的抉择 和判断。 5.每小题选对1分 (1)C,(2)A,(3)B,(4)C,(5)C,(6)A,(7)C,(8)C,(9)B,(10)B 6.(1)全对4分,(2)全对5分,(3)全对6分 (1) Debit: cash Credit: Bonds payable Premium on bonds payable 36000 (2) Debit: Interest Expenses 28302 Premium on bonds payable 198 Credit: Cash 28500 (3) Debit: Interest Expenses 14137 Premium on bonds payable 113 Credit: Interest payable 14250 7.共6个调整数据,做对一个2分,合计数对2分,计14分。 Cash flows from operating activities: Net income …………………………………………………………… $ Adjustment for non cash revenue and expenses: Added (less): depreciation ………………………..$90000 Loss on sale of machine ry ………..$2400 Patent amortization ……………...$14800 Amortization of premium on bond ….($4600) $ Working capital changes: Accounts receivable increase ……..($2000) Accounts payable increase …………$8400 $6400 Cash flows from operating activities ………………………………$ 8.项目1和项目3正确表述各4分,项目2正确表述3分。 Item 1: This item is a prepaid expenses and not properly recorded. Half of this expenses should be charged to the