会计专业基础英语

Unit 4 Accounting

PART I Fundamentals to Accounting

第一部分会计基本原理

1.accounting [?'ka?nt??]n. 会计

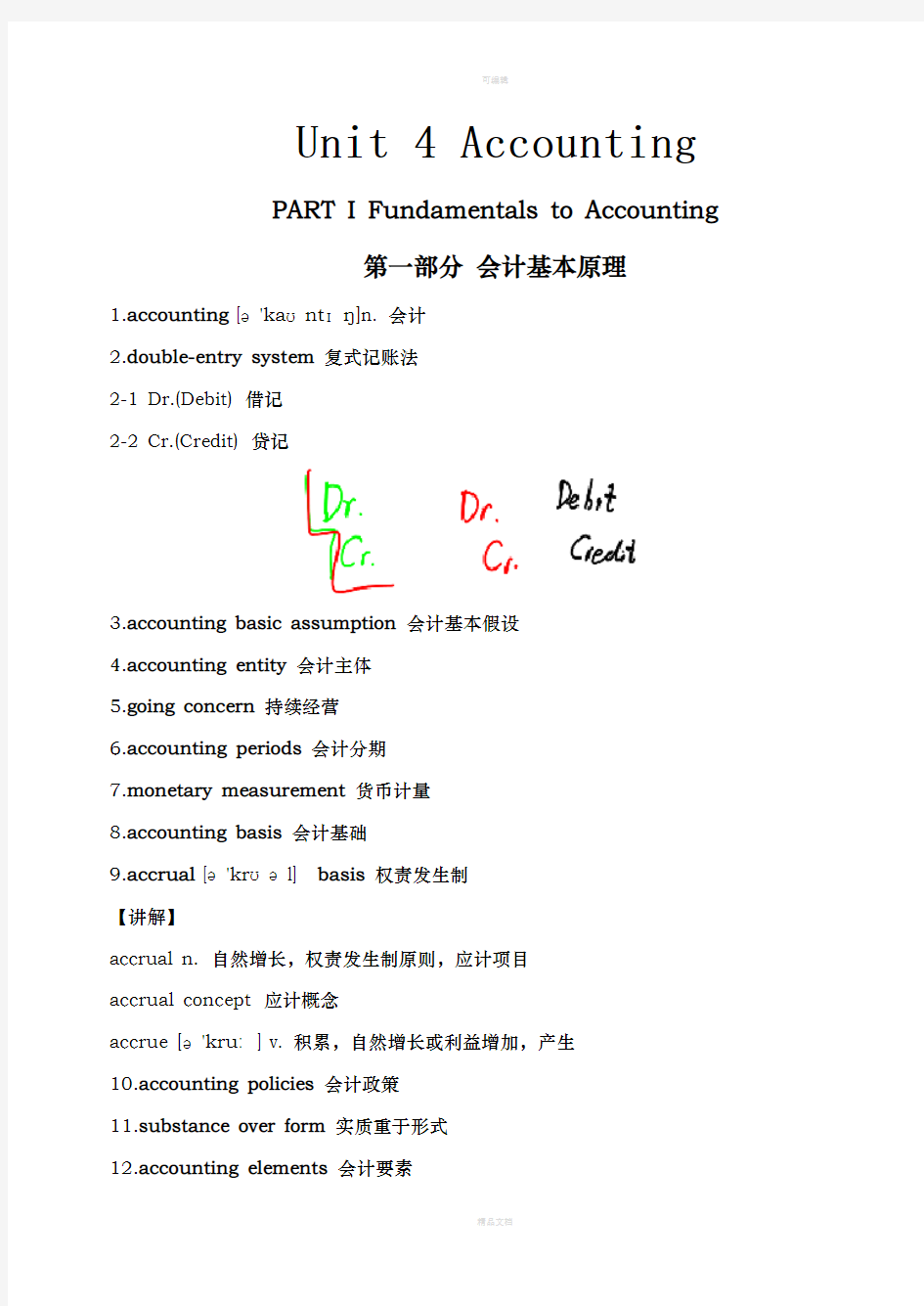

2.double-entry system复式记账法

2-1 Dr.(Debit) 借记

2-2 Cr.(Credit) 贷记

3.accounting basic assumption会计基本假设

4.accounting entity会计主体

5.going concern持续经营

6.accounting periods会计分期

7.monetary measurement货币计量

8.accounting basis会计基础

9.accrual [?'kr??l] basis权责发生制

【讲解】

accrual n. 自然增长,权责发生制原则,应计项目

accrual concept 应计概念

accrue [?'kru?] v. 积累,自然增长或利益增加,产生

10.accounting policies会计政策

11.substance over form实质重于形式

12.accounting elements会计要素

13.recognition [rek?g'n??(?)n] n. 确认

13-1 initial recognition [rek?g'n??(?)n] 初始确认

【讲解】

recognize ['r?k?g'na?z] v. 确认

14.measurement ['me??m(?)nt] n. 计量

14-1 subsequent ['s?bs?kw(?)nt] measurement 后续计量

15.asset['?set] n. 资产

16.liability [la??'b?l?t?] n. 负债

17.owners’ equity所有者权益

18.shareholder’s equity股东权益

19.expense [?k'spens; ek-] n. 费用

20.profit ['pr?f?t] n. 利润

21.residual [r?'z?dj??l] equity剩余权益

22.residual claim剩余索取权

23.capital['k?p?t(?)l] n. 资本

24.gains [ɡeinz] n. 利得

25.loss [l?s] n. 损失

26.Retained earnings留存收益

27.Share premium股本溢价

28.historical cost历史成本

【讲解】

historical [h?'st?r?k(?)l] adj. 历史的,历史上的

historic [h?'st?r?k] adj. 有历史意义的,历史上著名的

28-1 replacement [r?'ple?sm(?)nt] cost 重置成本

29.Balance Sheet/Statement of Financial Position资产负债表

29-1 Income Statement 利润表

29-2 Cash Flow Statement 现金流量表

29-3 Statement of changes in owners’equity (or shareholders’equity) 所有者权益(股东权益)变动表

29-4 notes [n??ts] n. 附注

PART II Financial Assets*

第二部分金融资产*

30.financial assets金融资产

e.g. A financial instrument is any contract that gives rise to a financial asset of one enterprise and a financial liability or equity instrument of another enterprise.

【讲解】

give rise to 引起,导致

31.cash on hand 库存现金

32.bank deposits [d?'p?z?t] 银行存款

33.A/R, account receivable应收账款

34.notes receivable应收票据

35.others receivable其他应收款项

36.equity investment股权投资

37.bond investment债券投资

38.derivative financial instrument衍生金融工具

39.active market活跃市场

40.quotation [kw?(?)'te??(?)n]n. 报价

41.financial assets at fair value through profit or loss以公允价值计量且其变动计入当期损益的金融资产

41-1 those designated as at fair value through profit or loss 指定为以公允价值计量且其变动计入当期损益的金融资产

41-2 financial assets held for trading 交易性金融资产

42.financial liability金融负债

43.transaction costs交易费用

43-1 incremental external cost 新增的外部费用

【讲解】

incremental [?nkr?'m?ntl] adj. 增量的,增值的

44.cash dividend declared but not distributed 已宣告但尚未发放的现金股利

投资收益

45.profit and loss arising from fair value changes公允价值变动损益

46.Held-to-maturity investments持有至到期投资

47.amortized cost摊余成本

【讲解】

amortized [?'m?:taizd]adj. 分期偿还的,已摊销的

48.effective interest rate实际利率

49.loan [l??n] n. 贷款

50.receivables [ri'si:v?blz] n. 应收账款

51.available-for-sale financial assets可供出售金融资产

52.impairment of financial assets金融资产减值

52-1 impairment loss of financial assets 金融资产减值损失

53.transfer of financial assets金融资产转移

53-1 transfer of the financial asset in its entirety 金融资产整体转移

53-2 transfer of a part of the financial asset 金融资产部分转移

54.derecognition [di?'rek?g'n???n] n. 终止确认,撤销承认

54-1 derecognize [di?'rek?gna?z] v. 撤销承认

e.g. An enterprise shall derecognize a financial liability (or part of it) only when the underlying present obligation (or part of it) is discharged/cancelled.

【译】金融负债的现时义务全部或部分已经解除的,才能终止确认该金融负债或其一部分。【讲解】

(1)前缀de-,意为“除去、取消、否定、非、相反”

(2)discharge [d?s't?ɑ?d?] n. 排放,卸货,解雇v. 解雇,写下,免除

(3)cancel ['k?ns(?)l] n. n.取消v. 取消,删去

PART III Inventory

第三部分存货

55.inventory ['?nv(?)nt(?)r?] n. 存货

56.finished goods产成品

57.WIP, work in progress在产品

58.raw materials 原材料

59.semi-finished goods半成品

60.merchandize [di?'rek?gna?z] n. 商品

61.cost of inventory存货成本

62.cost of purchase 采购成本

63.cost of conversion [k?n'v???(?)n]加工成本

64.production overhead制造费用

65.storage ['st??r?d?] costs仓储成本

66.FIFO method, first in first out method先进先出法

67.provision for impairment of inventory存货跌价准备

67-1 reverse of provision for impairment of inventory 存货跌价准备转回

【讲解】

reverse [r?'v??s] n. 相反,背面,倒退,失败adj. 后面的,颠倒的v. 颠倒,倒转,倒退

68.NRV, net realizable ['rila?z?bl]value可变现净值

69.loss of inventories discovered in an inventory counting存货盘亏

70.losses or damages of inventories存货损毁

PART IV Long-term Equity Investments*

第四部分长期股权投资*

71.long-term equity investments长期股权投资

72.business combination企业合并

73.jointly controlled enterprise/joint venture合营企业

74.equity securities权益性证券

75.ownership level所有权比例

76.affiliated companies关联公司

【讲解】

affiliate [?'f?l?e?t] n. 联号,隶属的机构v. 使附属,接纳,加入,发生联系

77.associate[?'s????e?t; -s?e?t] n.联营企业

78.joint control共同控制

79.significant [s?g'n?f?k(?)nt] influence ['?nfl??ns] 重大影响

80.investee [in,ves'ti] n. 被投资企业

81.cost method成本法

82.non-cash assets非现金资产

83.initial investment cost初始投资成本

84.book value账面价值

85.long-term equity investment acquired by paying cash以支付现金取得的长期股权投资

【讲解】

acquire [?'kwa??] v. 获得,取得,学到

86.long-term equity investment acquired by the issue of equity securities以发行权益性证券方式取得的长期股权投资

87.reliable measurement/ be reliably measured 可靠计量

88.fair value of identifiable net assets 可辨认净资产公允价值

89.disposal [dis'p?uz?l] of long-term equity investment长期股权投资的处置

PART V Non-Current Assets

第五部分固定资产

90.fixed assets固定资产

https://www.360docs.net/doc/b21220376.html,eful life/service life使用寿命

92.tangible assets 有形资产

93.purchased fixed assets 外购固定资产

94.self-constructed fixed asset自行建造

95.lump sum payment 整笔付款,一次总付,一次总算

【讲解】

lump [l?mp] n. 块,块状adj. 成团的,总共的v. 混在一起,使成块状

96.delivery cost 运输费

【讲解】

delivery [d?'l?v(?)r?] n. 交付,交货,递送

97.handling costs装卸费

【讲解】

handling ['h?ndl??] n. 处理adj. 操作的

98.installation costs安装费

【讲解】

installation [?nst?'le??(?)n]n. 安装,装置,就职

99.packing charges包装费

100.professional fees专业人员服务费

101.costs of abandoning the asset at the end of its use 弃置费用【讲解】

abandon [?'b?nd(?)n] v. 遗弃,放弃

102.depreciation [d?,pri???'e??(?)n; -s?'e?-] n. 折旧102-1 accumulated depreciation 累计折旧

102-2 original cost原值

103.estimated net residual value预计净残值

104.depreciable amount 应计折旧额

105.provision for impairment 减值准备

106.non-physical deterioration 无形损耗

【讲解】

deterioration [di,ti?ri?'rei??n] n. 恶化,退化

106-1 physical wear and tear 有形损耗

【讲解】

(1)wear n. 穿着,磨损,耐久性v. 穿着,用旧,耗损

(2)tear n. 眼泪,(撕破的)洞或裂缝,撕扯

107.depreciation rate 折旧率

108.depreciation method折旧方法

e.g. A change in the useful life or estimated net residual value of a fixed asset or the depreciation method used shall be accounted for a change in an accounting estimate.【译】固定资产使用寿命、预计净残值和折旧方法的改变应当作为会计估计变更。

108-1 straight-line method 年限平均法

108-2 units of production method 工作量法

108-3 the double declining balance method 双倍余额递减法

108-4 the sum-of-the-years-digits method 年数总和法

108-5 accelerated depreciation 加速折旧

109.subsequent expenditure后续支出

110.disposal of fixed assets 固定资产处置

111.losses of fixed assets discovered in an asset count固定资产盘亏

PART VI Intangible Assets

第六部分无形资产

112.intangible assets 无形资产

113.expenditure on research and development (R&D)研究开发费用

114.self-generated goodwill自创商誉

115.amortization of intangible assets 无形资产摊销

116.intangible assets with uncertain useful life使用寿命不确定的无形资产116-1 indefinite[?n'def?n?t] useful life 不确定的使用寿命

116-2 finite useful life 有限的使用寿命

【讲解】

finite['fa?na?t] adj. 有限的,限定的n. 有限之物

117.disposal of intangible assets 无形资产的处置

118.sales of intangible assets 无形资产出售

119.retirements of intangible asset 无形资产的报废

PART VII Investment Property

第七部分投资性房地产

120.investment Property 投资性房地产

121.a land use right that is leased out已出租的土地使用权

【讲解】

(1)land use right 土地使用权

(2)lease out 出租

121-1 a building that is leased out 已出租的建筑物

122.a land use right held for transfer upon capital appreciation持有并准备增值后转让的土地使用权

123.owner-occupied property自用房地产

【讲解】

occupy ['?kj?pa?] v. 占据,占领,占有

124.property held as inventories 作为存货的房地产

125.purchased investment property外购投资性房地产

125-1 self-constructed investment property 自行建造投资性房地产

126.cost model for subsequent measurement of investment property 采用成本模式进行后续计量的投资性房地产

126-1 fair value model for subsequent measurement of investment property采用公允价值模式进行后续计量的投资性房地产

【讲解】

subsequent ['s?bs?kw(?)nt]adj. 后来的,随后的

e.g. For investment property accounted for using the fair value model, a change from the fair value model to the cost model is not permitted.

127.transfer [tr?ns'f??; trɑ?ns-; -nz-]n. 转换

128.date of transfer 转换日

e.g. For a transfer from investment property carried at the fair value model to owner-occupied property, its fair value at the date of transfer is regarded as the carrying amount of the owner-occupied property. The difference between the fair value and the original carrying amount is recognized in profit or loss for the current period.

【译】采用公允价值模式计量的投资性房地产转换为自用房地产时,应当以其转换当日的公允价值作为自用房地产的账面价值,公允价值与原账面价值的差额计入当期损益。

PART VIII Impairment of Assets*

第八部分资产减值*

129.impairment of assets资产减值

【讲解】

impairment [?m'p?rm?nt] n. 损害,伤害

129-1 impairment loss for an asset 资产减值损失

129-2 recognizing an impairment loss for an asset 资产减值损失的确认

130.recoverable amount可收回金额

【讲解】

recoverable [r?'k?v?r?bl]adj. 可收回的,可补偿的,可恢复的

130-1 measuring recoverable amount of an asset 资产可回收金额的计量

e.g. The recoverable amount of an asset is the higher of its fair value less costs to sell and the present value of the future cash flows expected to be derived from the asset.【译】可收回金额应当根据资产的公允价值减去处置费用后的净额与资产预计未来现金流量的现值两者之间较高者确定。

131.indicators of assets impairment 资产减值的迹象

【讲解】

indicator ['?nd?ke?t?]n. 指标,指示器

131-1 testing of assets impairment 资产减值的测试

132.internal transferring price 内部转移价格

133.asset group 资产组

134.impairment testing for corporate assets/to test corporate assets for impairment 总部资产的减值测试

134-1 corporate assets 总部资产

135.goodwill/business reputation 商誉

e.g. Where the recoverable amount of an asset group or a set of asset groups is less than its carrying amount (that carrying amount shall include the allocated portion of any goodwill and corporate asset, if goodwill and corporate asset are allocated to that asset group or set of asset groups), impairment loss shall be recognized accordingly.【译】资产组或者资产组组合的可收回金额低于其账面价值的(总部资产和商誉分摊至某资产组或者资产组组合的,该资产组或者资产组组合的账面价值应当包括相关总部资产和商誉的分摊额),应当确认相应的减值损失。

136.carrying amount 账面价值

e.g. The carrying amount of an impaired asset shall not be reduced to an amount below the highest of the three items below: (i) its fair value less costs to sell (if determinable); (ii) its present value of future cash flows (if determinable); and (iii) zero.

【译】抵减后的各资产的账面价值不得低于以下三者之中最高者:该资产的公允减值减去处置费用后的净额(如可确定的)、该资产预计未来现金流量的现值(如可确定的)和零。

137.an arm’s length transaction 公平交易

138.projection [pr?'d?ek?(?)n] of cash flows 现金流预计

139.provision for impairment loss of the asset 资产减值损失计提

【讲解】

provision [pr?'v??(?)n] n. 准备,条款,规定,供应,(会计上)预计负债

PART IX Liabilities & Equities

第九部分负债和所有者权益

140.current liability 流动负债

141.non-current liability非流动负债

142.short-term loan 短期借款

142-1 long-term loan 长期借款

143.accounts payable and receipts in advance 应付及预收款项

【讲解】

receipt [r?'si?t]n. 收到

会计专业英语重点1

Unit 1 Financial information about a business is needed by many outsiders .These outsiders include owners, bankers, other creditors, potential investors, labor unions, government agencies ,and the public ,because all these groups have supplied money to the business or have some other interest in the business that will be served by information about its financial position and operating results. 许多企业外部的人士需要有关企业的财务信息,这些外部人员包括所有者、银行家、其他债权人、潜在投资者、工会、政府机构和公众,因为这些群体对企业投入了资金,或享有某些利益,所以必须得到企业财务状况和经营成果信息。 Unit 2 Each proprietorship, partnership, and corporation is a separate entity. 每一独资企业、合伙企业和股份公司都是一个单独的主体。 In accrual accounting, the impact of events on assets and equities is recognized on the accounting records in the time periods when services are rendered or utilized instead of when cash is received or disbursed. That is revenue is recognized as it is earned, and expenses are recognized as they are incurred –not when cash changes hands .if the cash basis accounting were used instead of the accrual basis, revenue and expense recognition would depend solely on the timing of various cash receipts and disbursements. 在权责发生制下,视服务的提供而非现金的收付在本期对资产和权益的影响作出会计记录。即,收入是在赚取时确认,费用是在发生时确认——而不是在现金转手时。如果现金收付制替代权责发生制,那么收入和费用仅仅依靠各种现金收付活动的时间确定来确认。 Unit 3 During each accounting year ,a sequence of accounting procedures called the accounting cycle is completed. 在每一会计年度内,要依次完成被称为会计循环的会计程序。 Transactions are analyzed on the basis of the business documents known as source documents and are recorded in either the general journal or the special journal, i. e . the sales journal ,the purchases journal (invoice register ) ,cash receipts journal and cash disbursements journal . 根据业务凭证即原始凭证分析各项交易,并记入普通日记账或特种日记账,也就是销货日记账,购货日记账(发票登记簿),现金收入日记账和现金支出日记账。 A trial balance is prepared from the account balance in the ledger to prove the equality of debits and credits. 根据分类账户的余额编制试算平衡表,借以验证借项和贷项是否相等。 A T-account has a left-hand side and a right-hand side, called respectively the debit side and credit side. 一个T 型账户有左方和右方,分别称做借方和贷方。 After transactions are entered ,account balance (the difference between the sum of its debits and the sum of its credits ) can be computed.

会计专业英语模拟试题及答案

《会计专业英语》模拟试题及答案 一、单选题(每题1分,共20分) 1. Which of the following statements about accounting concepts or assumptions are correct? 1)The money measurement assumption is that items in accounts are initially measured at their historical cost. 2)In order to achieve comparability it may sometimes be necessary to override the prudence concept. 3)To facilitate comparisons between different entities it is helpful if accounting policies and changes in them are disclosed. 4)To comply with the law, the legal form of a transaction must always be reflected in financial statements. A 1 and 3 B 1 and 4 C 3 only D 2 and 3 Johnny had receivables of $5 500 at the start of 2010. During the year to 31 Dec 2010 he makes credit sales of $55 000 and receives cash of $46 500 from credit customers. What is the balance on the accounts receivables at 31 Dec 2010? $8 500 Dr $8 500 Cr $14 000 Dr $14 000 Cr Should dividends paid appear on the face of a company’s cash flow statement? Yes No Not sure Either Which of the following inventory valuation methods is likely to lead to the highest figure for closing inventory at a time when prices are dropping? Weighted Average cost First in first out (FIFO) Last in first out (LIFO) Unit cost 5. Which of following items may appear as non-current assets in a company’s the statement of financial position? (1) plant, equipment, and property (2) company car (3) €4000 cash (4) €1000 cheque A. (1), (3) B. (1), (2) C. (2), (3)

会计专业英语期末试题 )

期期末测试题 Ⅰ、Translate The Following Terms Into Chinese 、 1、entity concept 主题概念 2、depreciation折旧 3、double entry system 4、inventories 5、stable monetary unit 6、opening balance 7、current asset 8、financial report 9、prepaid expense 10、internal control 11、cash flow statement 12、cash basis 13、tangible fixed asset 14、managerial accounting 15、current liability 16、internal control 17、sales return and allowance 18、financial position 19、balance sheet 20、direct write-off method Ⅱ、Translate The Following Sentences Into Chinese 、 1、Accounting is often described as an information system、It is the system that measures business activities, processes into reports and communicates these findings to decision makers、 2、The primary users of financial information are investors and creditors、Secondary users include the public, government regulatory agencies, employees, customers, suppliers, industry groups, labor unions, other companies, and academic researchers、 3、There are two sources of assets、One is liabilities and the other is owner’s equity、Liabilities are obligations of an entity arising from past transactions or events, the settlement of which may result in the transfer or use of assets or services in the future、 资产有两个来源,一个就是负债,另一个就是所有者权益。负债就是由过去得交易或事件产生得实体得义务,其结算可能导致未来资产或服务得转让或使用。 4、Accounting elements are basic classification of accounting practices、They are essential units to present the financial position and operating result of an entity、In China, we have six groups of accounting elements、They are assets, liabilities, owner’s equity, revenue, expense and profit (income)、会计要素就是会计实践得基础分类。它们就是保护财务状况与实体经营

(完整版)会计专业英语词汇大全

一.专业术语 Accelerated Depreciation Method 计算折旧时,初期所提的折旧大于后期各年。加速折旧法主要包括余额递减折旧法 declining balance depreciation,双倍余额递减折旧法 double declining balance depreciation,年限总额折旧法 sum of the years' depreciation Account 科目,帐户 Account format 帐户式 Account payable 应付帐款 Account receivable 应收帐款 Accounting cycle 会计循环,指按顺序进行记录,归类,汇总和编表的全过程。在连续的会计期间周而复始的循环进行 Accounting equation 会计等式:资产= 负债+ 业主权益 Accounts receivable turnover 应收帐款周转率:一个时期的赊销净额/ 应收帐款平均余额 Accrual basis accounting 应记制,债权发生制:以应收应付为计算基础,以确定本期收益与费用的一种方式。凡应属本期的收益于费用,不论其款项是否以收付,均作为本期收益和费用处理。 Accrued dividend 应计股利 Accrued expense 应记费用:指本期已经发生而尚未支付的各项费用。 Accrued revenue 应记收入 Accumulated depreciation 累计折旧 Acid-test ratio 酸性试验比率,企业速动资产与流动负债的比率,又称quick ratio Acquisition cost 购置成本 Adjusted trial balance 调整后试算表,指已作调整分录但尚未作结账分录的试算表。 Adjusting entry 调整分录:在会计期末所做的分录,将会计期内因某些原因而未曾记录或未适当记录的会计事项予以记录入帐。 Adverse 应收帐款的帐龄分类 Aging of accounts receivable 应收帐款的帐龄分类 Allocable 应分配的 Allowance for bad debts 备抵坏帐 Allowance for depreciation 备抵折旧 Allowance for doubtful accounts 呆帐备抵 Allowance for uncollectible accounts 呆帐备抵 Allowance method 备抵法:用备抵帐户作为各项资产帐户的抵销帐户,以使交易的费用与收入相互配合的方法。 Amortization 摊销,清偿 Annuity due 期初年金 Annuity method 年金法 Appraisal method 估价法 Asset 资产 Bad debt 坏帐 Bad debt expense 坏帐费用:将坏帐传人费用帐户,冲销应收帐款 Balance sheet 资产负债表 Bank discount 银行贴现折价 Bank reconciliation 银行往来调节:企业自身的存款帐户余额和银行对帐单的余额不符时,应对未达帐进行调节。 Bank statement 银行对帐单,银行每月寄给活期存款客户的对帐单,列明存款兑现支票和服务费用。

会计专业英语翻译

. 1. Accounting first is an economic calculation. Economic calculation includes both static phenomenon on the economy's stock of the situation, including the situation of the period of dynamic flow, including both pre-calculated plan, but also after the actual calculation. Accounting is a typical example of economic calculation, calculation of economic calculation in addition to accounting, which includes statistical computing and business computing. 2. Accounting is an economic information systems. It would be a company dispersed into the business activities of a group of objective data, providing the company's performance, problems, and enterprise funds, labor, ownership, income, costs, profits, debt, and other information. Clearly, the accounting is to provide financial information-based economy information systems, business is the licensing of a points, thus accounting has been called "corporate language." 3. Accounting is an economic management.The accounting is social production develops to a certain stage of the product development and production is to meet the needs of the management, especially with the development of the commodity economy and the emergence of competition in the market through demand management on the economy activities strict control and supervision. At the same time, the content and form of accounting constantly improve and change, from a purely accounting, scores, mainly for accounting operations, external submit accounting statements, as in prior operating forecasts, decision-making, on the matter of economic activities control and supervision, in hindsight, check. Clearly, accounting whether past, present or future, it is people's economic management activities.

《财会专业英语》期末试卷及答案

《财会专业英语》期终试卷 I.Put the following into corresponding groups. (15 points) 1.Cash on hand 2.Notes receivable 3.Advances to suppliers 4. Other receivables 5.Short-term loans 6.Intangible assets 7.Cost of production 8.Current year profit 9. Capital reserve 10.Long-term loans 11.Other payables 12. Con-operating expenses 13.Financial expenses 14.Cost of sale 15. Accrued payroll II.Please find the best answers to the following questions. (25 Points) 1. Aftin Co. performs services on account when Aftin collects the account receivable A.assets increase B.assets do not change C.owner’s equity d ecreases D.liabilities decrease 2. A balance sheet report . A. the assets, liabilities, and owner’s equity on a particular date B. the change in the owner’s capital during the period C. the cash receipt and cash payment during the period D. the difference between revenues and expenses during the period 3. The following information about the assets and liabilities at the end of 20 x 1 and 20 x 2 is given below: 20 x 1 20 x 2 Assets $ 75,000 $ 90,000 Liabilities 36,000 45,000 how much the owner’sequity at the end of 20 x 2 ? A.$ 4,500 B.$ 6,000 C.$ 45,000 D.$ 43,000

常用会计类英语词汇汇总

常用会计类英语词汇汇总基本词汇 A (1)account 账户,报表 A (2)accounting postulate 会计假设 A (3)accounting valuation 会计计价 A (4)accountability concept 经营责任概念 A (5)accountancy 会计职业 A (6)accountant 会计师 A (7)accounting 会计 A (8)agency cost 代理成本 A (9)accounting bases 会计基础 A (10)accounting manual 会计手册 A (11)accounting period 会计期间 A (12)accounting policies 会计方针 A (13)accounting rate of return 会计报酬率 A (14)accounting reference date 会计参照日 A (15)accounting reference period 会计参照期间A (16)accrual concept 应计概念 A (17)accrual expenses 应计费用 A (18)acid test ratio 速动比率(酸性测试比率) A (19)acquisition 收购 A (20)acquisition accounting 收购会计 A (21)adjusting events 调整事项 A (22)administrative expenses 行政管理费 A (23)amortization 摊销 A (24)analytical review 分析性复核 A (25)annual equivalent cost 年度等量成本法 A (26)annual report and accounts 年度报告和报表A (27)appraisal cost 检验成本 A (28)appropriation account 盈余分配账户 A (29)articles of association 公司章程细则 A (30)assets 资产 A (31)assets cover 资产担保 A (32)asset value per share 每股资产价值 A (33)associated company 联营公司 A (34)attainable standard 可达标准 A (35)attributable profit 可归属利润 A (36)audit 审计 A (37)audit report 审计报告 A (38)auditing standards 审计准则 A (39)authorized share capital 额定股本 A (40)available hours 可用小时 A (41)avoidable costs 可避免成本 B (42)back-to-back loan 易币贷款

(完整版)会计专业英语重点词汇大全

?accounting 会计、会计学 ?account 账户 ?account for / as 核算 ?certified public accountant / CPA 注册会计师?chief financial officer 财务总监?budgeting 预算 ?auditing 审计 ?agency 机构 ?fair value 公允价值 ?historical cost 历史成本?replacement cost 重置成本?reimbursement 偿还、补偿?executive 行政部门、行政人员?measure 计量 ?tax returns 纳税申报表 ?tax exempt 免税 ?director 懂事长 ?board of director 董事会 ?ethics of accounting 会计职业道德?integrity 诚信 ?competence 能力 ?business transaction 经济交易?account payee 转账支票?accounting data 会计数据、信息?accounting equation 会计等式?account title 会计科目 ?assets 资产 ?liabilities 负债 ?owners’ equity 所有者权益 ?revenue 收入 ?income 收益

?gains 利得 ?abnormal loss 非常损失 ?bookkeeping 账簿、簿记 ?double-entry system 复式记账法 ?tax bearer 纳税人 ?custom duties 关税 ?consumption tax 消费税 ?service fees earned 服务性收入 ?value added tax / VAT 增值税?enterprise income tax 企业所得税?individual income tax 个人所得税?withdrawal / withdrew 提款、撤资?balance 余额 ?mortgage 抵押 ?incur 产生、招致 ?apportion 分配、分摊 ?accounting cycle会计循环、会计周期?entry分录、记录 ?trial balance试算平衡?worksheet 工作草表、工作底稿?post reference / post .ref过账依据、过账参考?debit 借、借方 ?credit 贷、贷方、信用 ?summary/ explanation 摘要?insurance 保险 ?premium policy 保险单 ?current assets 流动资产 ?long-term assets 长期资产 ?property 财产、物资 ?cash / currency 货币资金、现金

会计专业英语期末考试练习卷(new)

会计专业英语期末考试练习卷(new)

1. The economic resources of a business are called : B A. Owner ’s Equity B. Assets C. Accounting equation D. Liabilities 2. DTK Company has a $3500 accounts receivable from GRS Company. On January 20, GRS Company makes a partial payment of $210 0 to DTK Company. The journal entry made on January 20 by DTK Company to record this transaction includes: D A. A debit to the cash receivable account of $2100. B. A credit to the accounts receivable account of $2100. C. A debit to the cash account of $1400. D. A debit to the accounts receivable account of $1400. 3. In general terms, financial assets appear in the balance sheet at: A A. Face value. 账面价值 B. Current value. 现值 C. Market value. 市场价值 D. Estimated future sales value. 4. Each of the following measures strengthens intern al control over cash receipts except : D A. The use of a voucher system. B. Preparation of a daily listing of all checks received through the mail. C. The deposit of cash receipts intact in the bank on a daily basis. D. The use of cash registers. 5. Which of the following items is the greatest in dollar amount? D A. Beginning inventory B. Cost of goods sold. C. Cost of goods available for sale D. Ending inventory 6. Why do companies prefer the LIFO inventory 后进先出法method during a period of rising prices? B A. Higher reported income B. Lower income taxes C. Lower reported income D. Higher ending inventory 7. Which of the following characteristics would prevent an item from being included in the classification of plant and equipment? D A. Intangible

(财务会计)英语学习会计专业英语必备

弃我去者,昨日之日不可留 乱我心者,今日之日多烦忧 过急会计术语英汉对照 Accounting system 会计系统 American Accounting Association 美国会计协会 American Institute of CPAs 美国注册会计师协会 Audit 审计 Balance sheet 资产负债表Bookkeepking 簿记 Cash flow prospects 现金流量预测Certificate in Internal Auditing 内部审计证书 Certificate in Management Accounting 管理会计证书 Certificate Public Accountant注册会计师Cost accounting 成本会计 External users 外部使用者 Financial accounting 财务会计 Financial Accounting Standards Board 财务会计准则委员会 Financial forecast 财务预测 Generally accepted accounting principles 公认会计原则 General-purpose information 通用目的信息Government Accounting Office 政府会计办公室 Income statement 损益表 Institute of Internal Auditors 内部审计师协会 Institute of Management Accountants 管理会计师协会 Integrity 整合性 Internal auditing 内部审计 Internal control structure 内部控制结构Internal Revenue Service 国内收入署Internal users 内部使用者 Management accounting 管理会计 Return of investment 投资回报 Return on investment 投资报酬Securities and Exchange Commission 证券交易委员会 Statement of cash flow 现金流量表Statement of financial position 财务状况表 Tax accounting 税务会计 Accounting equation 会计等式 Articulation 勾稽关系 Assets 资产 Business entity 企业个体 Capital stock 股本 Corporation 公司 Cost principle 成本原则 Creditor 债权人 Deflation 通货紧缩 Disclosure 批露 Expenses 费用 Financial statement 财务报表 Financial activities 筹资活动 Going-concern assumption 持续经营假设 Inflation 通货膨涨 Investing activities 投资活动 Liabilities 负债 Negative cash flow 负现金流量 Operating activities 经营活动 Owner's equity 所有者权益 Partnership 合伙企业 Positive cash flow 正现金流量 Retained earning 留存利润 Revenue 收入 Sole proprietorship 独资企业 Solvency 清偿能力 Stable-dollar assumption 稳定货币假设 Stockholders 股东 Stockholders' equity 股东权益 Window dressing 门面粉饰 Account 帐户 基本词汇 A (1)account 账户,报表 A (2)accounting postulate 会计假设 A (3)accounting valuation 会计计价 A (4)accountability concept 经营责任 概念 A (5)accountancy 会计职业 A (6)accountant 会计师 A (7)accounting 会计 A (8)agency cost 代理成本 A (9)accounting bases 会计基础 A (10)accounting manual 会计手册 A (11)accounting period 会计期间 A (12)accounting policies 会计方针 A (13)accounting rate of return 会计报 酬率 A (14)accounting reference date 会计 参照日 A (15)accounting reference period 会 计参照期间 A (16)accrual concept 应计概念 A (17)accrual expenses 应计费用 A (18)acid test ratio 速动比率(酸性测 试比率) A (19)acquisition 收购 A (20)acquisition accounting 收购会计 A (21)adjusting events 调整事项 A (22)administrative expenses 行政管 理费 A (23)amortization 摊销 A (24)analytical review 分析性复核 A (25)annual equivalent cost 年度等量 成本法 A (26)annual report and accounts 年度 报告和报表 A (27)appraisal cost 检验成本 A (28)appropriation account 盈余分配 账户 A (29)articles of association 公司章程 细则 A (30)assets 资产 A (31)assets cover 资产担保 A (32)asset value per share 每股资产 价值 A (33)associated company 联营公司 A (34)attainable standard 可达标准 A (35)attributable profit 可归属利润 A (36)audit 审计 A (37)audit report 审计报告 A (38)auditing standards 审计准则 A (39)authorized share capital 额定股 本 A (40)available hours 可用小时 A (41)avoidable costs 可避免成本 B (42)back-to-back loan 易币贷款 B (43)backflush accounting 倒退成本 计算 B (44)bad debts 坏帐 B (45)bad debts ratio 坏帐比率 B (46)bank charges 银行手续费 B (47)bank overdraft 银行透支 B (48)bank reconciliation 银行存款调 节表 B (49)bank statement 银行对账单 B (50)bankruptcy 破产 B (51)basis of apportionment 分摊基 础 B (52)batch 批量 B (53)batch costing 分批成本计算

《财会英语》

《财会英语》教学大纲 课程编号:GZC06016 学分:2 学时:34(其中实践学时:4 )授课学期:4 一、课程的性质、地位、作用及与其他课程的联系 本课程作为财信专业的一门专业基础课,难度较大,主要是和学生的英语水平有一定的联系。在授课过程中与会计基础内容相联系,让英语和会计二者合一。希望通过本课程的教学,使财信专业学生能够用英文进行简单的帐目登录,读懂英文会计报表。对理论知识要求:重点的会计专用英语术语,一般性的专业阅读对能力、技能要求:掌握有关会计常用专用术语,重在打基础及学以致用。对素质要求提高财会专业英语水平,为进一步学习西方会计打下基础。 二、课程的教学内容与要求 Chapter 1 The Fundamental Accounting Concepts and Principles 会计概述 [教学目的和要求] 掌握会计概述相关的重要会计名词的英语表述。 [教学内容] Section 1 会计学习 1.1 引言 1.2 会计职业 1.3 会计信息系统 1.4 会计原则和概念 1.5 会计基本要素:会计等式 Section II 复习与练习 Section III 阅读材料 [教学重点与难点] 会计信息系统;会计基本要素——会计等式 Chapter 2 Debits and Credits: The Double-Entry System 借方与贷方:复式记账法 [教学目的和要求] 掌握借贷记账法的英语表述和会计科目的表述和运用。 [教学内容] Section 1 会计学习 2.1 账户 2.2 借贷记账规则

2.3 会计分类账与会计科目表 2.4 试算平衡表 Section II 复习与练习 Section III 阅读材料 [教学重点与难点] 借贷记账规则和试算平衡表 [实践内容] 能根据所给英语实践题目用借贷记账法进行正确登账。 Chapter 3 Journalizing and Posting Transactions 记账和过账 [教学目的和要求] 熟练掌握英语记账和过账 [教学内容] Section 1 会计学习 3.1 日记账 3.2 登记日记账 3.3 过账 Section II 复习与练习 Section III 阅读材料 [教学重点与难点] 日记账登账和过账。 Chapter 4 Financial Statements 财务报表 [教学目的和要求] 掌握主要的几种财务报表的英语表达,并做分析。 [教学内容] Section 1 会计学习 4.1 会计学习 4.2 资产负债表 4.3 资本变动表 4.4 财务报表概述 4.5 分类财务报表 Section II 复习与练习

财务管理专业英语期末复习

财务管理专业英语期末重点 一、单词 Topic1 财务管理financial management 资本预算capital budgeting 资本结构capital structure 股利政策dividend policy 存货inventory 风险规避risk aversion 股东权益stockholder s’ equity 流动负债current liability Topic2 财务风险financial risk 合伙制企业partnership 私人业主制企业sole proprietorship 收入revenue 主计长controller 财务困境financial distress 股票期权stock option 首次公开发行股票(IPO) initial public offering Topic 3 盈利能力profitability 偿付能力solvency 利润表income statement 有价证券marketable securities 提款withdrawal 应收账款accounts receivable 递延税款deferred tax Topic4 流动性比率liquidity ratio 权益乘数equity multiplier 资产收益率(ROA) return on assets 毛利gross profit margin 权益报酬率return on equity 市盈率P/E ratio 杠杆比率leverage ratio 息税前盈余(EBIT) earnings before interest and taxes Topic5 货币时间价值time value of money 年金annuity 折现率discount rate 机会成本opportunity cost