中级财务会计英会计分录汇总

中级财务会计英会计分录汇总

考点1调整分录和结账分录

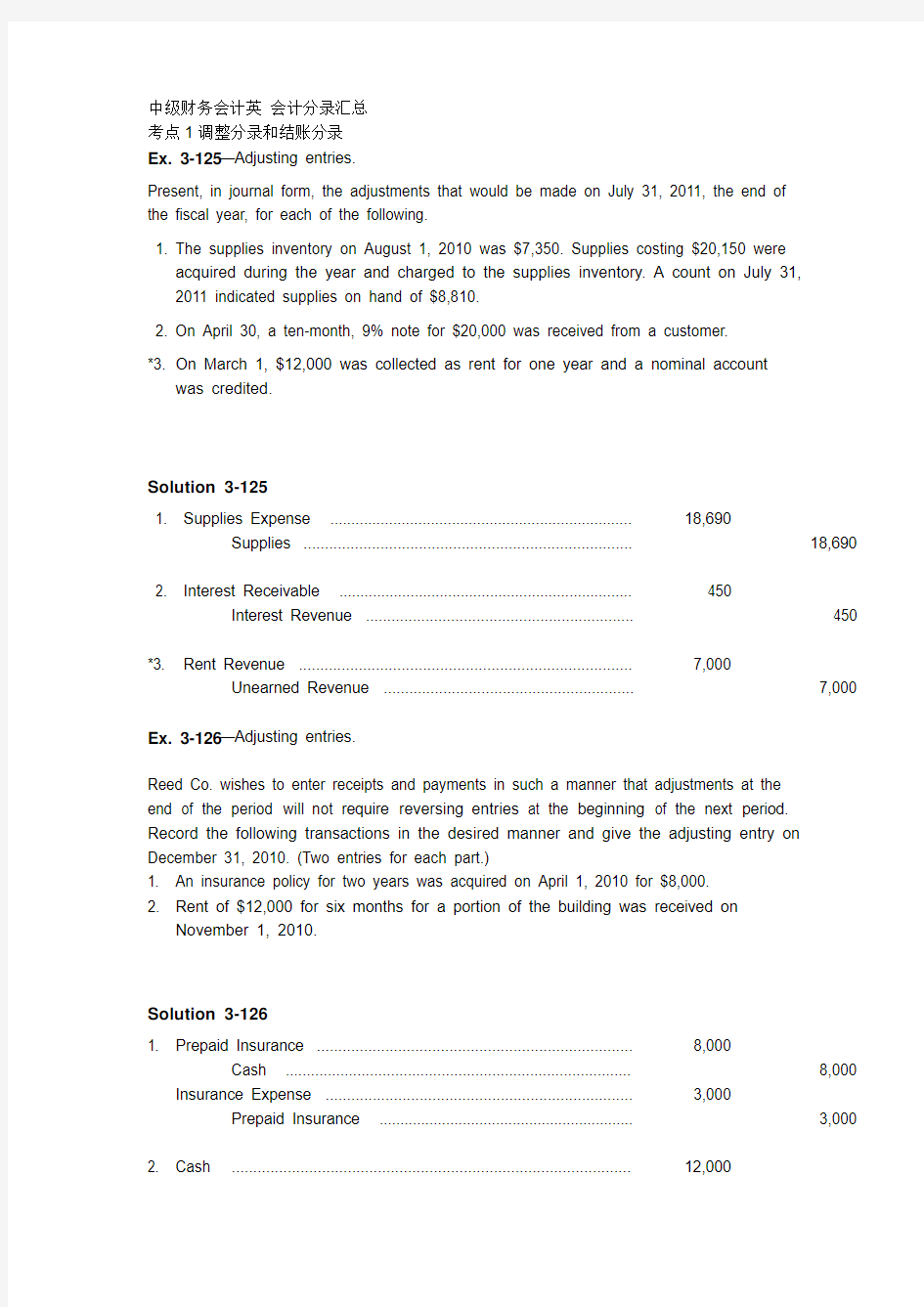

Ex. 3-125—Adjusting entries.

Present, in journal form, the adjustments that would be made on July 31, 2011, the end of

the fiscal year, for each of the following.

1. The supplies inventory on August 1, 2010 was $7,350. Supplies costing $20,150 were

acquired during the year and charged to the supplies inventory. A count on July 31,

2011 indicated supplies on hand of $8,810.

2. On April 30, a ten-month, 9% note for $20,000 was received from a customer.

*3. On March 1, $12,000 was collected as rent for one year and a nominal account was credited.

Solution 3-125

1. Supplies Expense ........................................................................ 18,690

Supplies ............................................................................. 18,690

2. Interest Receivable (450)

Interest Revenue (450)

*3. Rent Revenue .............................................................................. 7,000

Unearned Revenue ........................................................... 7,000 Ex. 3-126—Adjusting entries.

Reed Co. wishes to enter receipts and payments in such a manner that adjustments at the

end of the period will not require reversing entries at the beginning of the next period.

Record the following transactions in the desired manner and give the adjusting entry on December 31, 2010. (Two entries for each part.)

1. An insurance policy for two years was acquired on April 1, 2010 for $8,000.

2. Rent of $12,000 for six months for a portion of the building was received on

November 1, 2010.

Solution 3-126

1. Prepaid Insurance .......................................................................... 8,000

Cash .................................................................................. 8,000 Insurance Expense ........................................................................ 3,000

Prepaid Insurance ............................................................. 3,000 2. Cash ............................................................................................. 12,000

Unearned Rent .................................................................. 12,000 Unearned Rent .............................................................................. 4,000

Rent Revenue ................................................................... 4,000 Pr. 3-133—Adjusting entries and account classification.

Selected amounts from Trent Company's trial balance of 12/31/10 appear below:

1. Accounts Payable $ 160,000

2. Accounts Receivable 150,000

3. Accumulated Depreciation—Equipment 200,000

4. Allowance for Doubtful Accounts 20,000

5. Bonds Payable 500,000

6. Cash 150,000

7. Common Stock 60,000

8. Equipment 840,000

9. Insurance Expense 30,000

10. Interest Expense 10,000

11. Merchandise Inventory 300,000

12. Notes Payable (due 6/1/11) 200,000

13. Prepaid Rent 150,000

14. Retained Earnings 818,000

15. Salaries and Wages Expense 328,000

(All of the above accounts have their standard or normal debit or credit balance.)

Part A. Prepare adjusting journal entries at year end, December 31, 2010, based on the following supplemental information.

a. The equipment has a useful life of 15 years with no salvage value. (Straight-line

method being used.)

b. Interest accrued on the bonds payable is $15,000 as of 12/31/10.

c. Expired insurance at 12/31/10 is $20,000.

d. The rent payment of $150,000 covered the six months from November 30, 2010

through May 31, 2011.

e. Salaries and wages earned but unpaid at 12/31/10, $22,000.

Part B. Indicate the proper balance sheet classification of each of the 15 numbered accounts in the 12/31/10 trial balance before adjustments by placing

appropriate numbers after each of the following classifications. If the account

title would appear on the income statement, do not put the number in any of

the classifications.

a. Current assets

b. Property, plant, and equipment

c. Current liabilities

d. Long-term liabilities

e. Stockholders' equity

Solution 3-133

Part A.

a. Depreciation Expense—Equipment ($840,000 – 0) ÷ 15 ..................... 56,000

Accumulated Depreciation—Equipment .................................. 56,000

b. Interest Expense ................................................................................... 15,000

Interest Payable ....................................................................... 15,000

c. Prepaid Insurance ................................................................................. 10,000

Insurance Expense ($30,000 - $20,000) ................................. 10,000

d. Rent Expense ($150,000 ÷ 6) ................................................................ 25,000

Prepaid Rent ............................................................................ 25,000

e. Salaries and Wages Expense .............................................................. 22,000

Salaries and Wages Payable ................................................... 22,000 Pr. 3-134—Adjusting entries.

Data relating to the balances of various accounts affected by adjusting or closing entries

appear below. (The entries which caused the changes in the balances are not given.) You

are asked to supply the missing journal entries which would logically account for the changes in the account balances.

1. Interest receivable at 1/1/10 was $1,000. During 2010 cash received from debtors for

interest on outstanding notes receivable amounted to $5,000. The 2010 income

statement showed interest revenue in the amount of $5,400. You are to provide the

missing adjusting entry that must have been made, assuming reversing entries are

not made.

2. Unearned rent at 1/1/10 was $5,300 and at 12/31/10 was $8,000. The records indicate

cash receipts from rental sources during 2010 amounted to $40,000, all of which was

credited to the Unearned Rent Account. You are to prepare the missing adjusting

entry.

3. Accumulated depreciation—equipment at 1/1/10 was $230,000. At 12/31/10 the

balance of the account was $270,000. During 2010, one piece of equipment was sold.

The equipment had an original cost of $40,000 and was 3/4 depreciated when sold.

You are to prepare the missing adjusting entry.

4. Allowance for doubtful accounts on 1/1/10 was $50,000. The balance in the allowance

account on 12/31/10 after making the annual adjusting entry was $65,000 and during

2010 bad debts written off amounted to $30,000. You are to provide the missing

adjusting entry.

5. Prepaid rent at 1/1/10 was $9,000. During 2010 rent payments of $120,000 were

made and charged to "rent expense." The 2010 income statement shows as a general

expense the item "rent expense" in the amount of $125,000. You are to prepare the

missing adjusting entry that must have been made, assuming reversing entries are

not made.

6. Retained earnings at 1/1/10 was $150,000 and at 12/31/10 it was $210,000. During

2010, cash dividends of $50,000 were paid and a stock dividend of $40,000 was

issued. Both dividends were properly charged to retained earnings. You are to provide

the missing closing entry.

Solution 3-134

1. Interest Receivable ........................................................................ 1,400

Interest Revenue ............................................................... 1,400 Interest revenue per books $5,400

Interest revenue received related to 2010

($5,000 – $1,000) 4,000

Interest accrued $1,400

2. Unearned Rent Revenue ............................................................... 37,300

Rent Revenue ................................................................... 37,300 Cash receipts $40,000

Beginning balance 5,300

Ending balance (8,000)

Rent revenue $37,300

Solution 3-134(cont.)

3. Depreciation Expense .................................................................. 70,000

Accumulated Depreciation—Equipment ........................... 70,000 Ending balance $270,000

Beginning balance 230,000

Difference 40,000

Write-off at time of sale 3/4 × $40,000 30,000

$ 70,000

4. Bad Debt Expense ......................................................................... 45,000

Allowance for Doubtful Accounts ....................................... 45,000 Ending balance $65,000

Beginning balance 50,000

Difference 15,000

Written off 30,000

$45,000

5. Rent Expense ................................................................................ 5,000

Prepaid Rent ..................................................................... 5,000 Rent expense $125,000

Less cash paid 120,000

Reduction in prepaid rent account $ 5,000

6. Income Summary ........................................................................... 150,000

Retained Earnings ............................................................. 150,000 Ending balance $210,000

Beginning balance 150,000

Difference 60,000

Cash dividends $50,000

Stock dividends 40,000 90,000

$150,000

Pr. 3-135—Adjusting and closing entries.

The following trial balance was taken from the books of Fisk Corporation on December 31,

2010.

Account Debit

Credit

Cash $ 12,000

Accounts Receivable 40,000

Note Receivable 7,000

Allowance for Doubtful Accounts $ 1,800 Merchandise Inventory 44,000

Prepaid Insurance 4,800

Furniture and Equipment 125,000

Accumulated Depreciation--F. & E. 15,000 Accounts Payable 10,800 Common Stock 44,000 Retained Earnings 55,000 Sales 280,000

Cost of Goods Sold 111,000

Salaries Expense 50,000

Rent Expense 12,800

Totals $406,600 $406,600 Pr. 3-135 (cont.)

At year end, the following items have not yet been recorded.

a. Insurance expired during the year, $2,000.

b. Estimated bad debts, 1% of gross sales.

c. Depreciation on furniture and equipment, 10% per year.

d. Interest at 6% is receivable on the note for one full year.

*e. Rent paid in advance at December 31, $5,400 (originally charged to expense).

f. Accrued salaries at December 31, $5,800.

Instructions

(a) Prepare the necessary adjusting entries.

(b) Prepare the necessary closing entries.

Solution 3-135

(a) Adjusting Entries

a. Insurance Expense .............................................................. 2,000

Prepaid Insurance .............................................................. 2,000

b. Bad Debt Expense ...................................................................... 2,800

Allowance for Doubtful Accounts ....................................... 2,800

c. Depreciation Expense ................................................................. 12,500

Accumulated Depreciation--F. & E. .................................... 12,500

d. Interest Receivable (420)

Interest Revenue (420)

*e. Prepaid Rent ................................................................................ 5,400

Rent Expense ..................................................................... 5,400

f. Salaries Expense ........................................................................ 5,800

Salaries Payable ................................................................ 5,800

(b) Closing Entries

Sales ................................................................................................... 280,000

Interest Revenue (420)

Income Summary ..................................................................... 280,420

Income Summary ................................................................................ 191,500

Salaries Expense ..................................................................... 55,800

Rent Expense ........................................................................... 7,400

Depreciation Expense .............................................................. 12,500

Bad Debt Expense ................................................................... 2,800

Insurance Expense .................................................................. 2,000

Cost of Goods Sold .................................................................. 111,000

Income Summary ................................................................................ 88,920

Retained Earnings .................................................................... 88,920 考点2应收帐款总价净价法,坏账处理,应收票据折价

Ex. 7-136—Entries for bad debt expense.

A trial balance before adjustment included the following:

Debit Credit Accounts receivable $80,000

Allowance for doubtful accounts 730

Sales $340,000

Sales returns and allowances 8,000

Give journal entries assuming that the estimate of uncollectibles is determined by taking

(1) 5% of gross accounts receivable and (2) 1% of net sales.

Solution 7-136

(1) Bad Debt Expense ................................................................... 3,270

Allowance for Doubtful Accounts ................................ 3,270 Gross receivables $80,000

Rate 5%

Total allowance needed 4,000

Present allowance (730)

Adjustment needed $ 3,270

Solution 7-136(cont.)

(2) Bad Debt Expense ................................................................... 3,320

Allowance for Doubtful Accounts ................................ 3,320 Sales $340,000

Sales returns and allowances 8,000

Net sales 332,000

Rate 1%

Bad debt expense $ 3,320

Ex. 7-137—Accounts receivable assigned.

Accounts receivable in the amount of $250,000 were assigned to the Fast Finance Company by Marsh, Inc., as security for a loan of $200,000. The finance company charged a 4% commission on the face amount of the loan, and the note bears interest at

9% per year.

During the first month, Marsh collected $130,000 on assigned accounts. This amount was remitted to the finance company along with one month's interest on the note.

Instructions

Make all the entries for Marsh Inc. associated with the transfer of the accounts receivable,

the loan, and the remittance to the finance company.

Solution 7-137

Cash ...................................................................................................... 192,000

Finance Charge ..................................................................................... 8,000 Notes Payable ........................................................................... 200,000

Cash ...................................................................................................... 130,000 Accounts Receivable ................................................................. 130,000

Notes Payable ...................................................................................... 130,000

Interest Expense .................................................................................... 1,500 Cash ......................................................................................... 131,500

PROBLEMS

Pr. 7-138—Entries for bad debt expense.

The trial balance before adjustment of Risen Company reports the following balances:

Dr. Cr.

Accounts receivable $100,000

Allowance for doubtful accounts $ 2,500

Sales (all on credit) 750,000

Sales returns and allowances 40,000

Instructions

(a) Prepare the entries for estimated bad debts assuming that doubtful accounts are

estimated to be (1) 6% of gross accounts receivable and (2) 1% of net sales.

(b) Assume that all the information above is the same, except that the Allowance for

Doubtful Accounts has a debit balance of $2,500 instead of a credit balance. How

will this difference affect the journal entries in part (a)?

Solution 7-138

(a) (1) Bad Debt Expense .............................................................. 3,500

Allowance for Doubtful Accounts ............................ 3,500 Gross receivables $100,000

Rate 6%

Total allowance needed 6,000

Present allowance (2,500)

Bad debt expense $ 3,500

(2) Bad Debt Expense .............................................................. 7,100

Allowance for Doubtful Accounts ............................ 7,100 Sales $750,000

Sales returns and allowances (40,000)

Net sales 710,000

Rate 1%

Bad debt expense $ 7,100

(b) The percentage of receivables approach would be affected as follows:

Gross receivables $100,000

Rate 6%

Total allowance needed 6,000

Present allowance 2,500

Additional amount required $ 8,500

The journal entry is therefore as follows:

Bad Debt Expense .............................................................. 8,500

Allowance for Doubtful Accounts ............................ 8,500 The entry would not change under the percentage of sales method.

Pr. 7-140—Accounts receivable assigned.

Prepare journal entries for Mars Co. for:

(a) Accounts receivable in the amount of $500,000 were assigned to Utley Finance Co.

by Mars as security for a loan of $425,000. Utley charged a 3% commission on the

accounts; the interest rate on the note is 12%.

(b) During the first month, Mars collected $200,000 on assigned accounts after deducting

$450 of discounts. Mars wrote off a $530 assigned account.

(c) Mars paid to Utley the amount collected plus one month's interest on the note.

Solution 7-140

(a) Cash .............................................................................................. 410,000

Finance Charge ............................................................................... 15,000

Notes Payable ..................................................................... 425,000

(b) Cash .............................................................................................. 200,000

Sales Discounts (450)

Allowance for Doubtful Accounts (530)

Accounts Receivable........................................................... 200,980

(c) Notes Payable ................................................................................. 200,000

Interest Expense .............................................................................. 4,250

Cash .................................................................................... 204,250

考点三存货盘存方法,折扣

Ex. 8-148—Recording purchases at net amounts.

Flint Co. records purchase discounts lost and uses perpetual inventories. Prepare journal entries in general journal form for the following:

(a) Purchased merchandise costing $900 with terms 2/10, n/30.

(b) Payment was made thirty days after the purchase.

Solution 8-148

(a) Inventory (.98 × $900) (882)

Accounts Payable (882)

(b) Accounts Payable (882)

Purchase Discounts Lost (18)

Cash (900)

Ex. 8-149—Recording purchases at net amounts.

Dill Co. records purchases at net amounts and uses periodic inventories. Prepare entries for the following:

June 11 Purchased merchandise on account, $5,000, terms 2/10, n/30.

15 Returned part of June 11 purchase, $800, and received credit on account.

30 Prepared the adjusting entry required for financial statements.

Solution 8-149

June 11 Purchases (.98 × $5,000) ................................................... 4,900

Accounts Payable ................................................... 4,900

15 Accounts Payable (.98 × $800) (784)

Purchase Returns and Allowances (784)

30 Purchase Discounts Lost (.02 × $4,200) (84)

Accounts Payable (84)

Pr. 8-159—Accounting for purchase discounts.

Otto Corp. purchased merchandise during 2010 on credit for $300,000; terms 2/10, n/30.

All of the gross liability except $60,000 was paid within the discount period. The remainder

was paid within the 30-day term. At the end of the annual accounting period, December 31,

2010, 90% of the merchandise had been sold and 10% remained in inventory. The

company uses a periodic system.

Instructions

(a) Assuming that the net method is used for recording purchases, prepare the entries

for the purchase and two subsequent payments.

(b) What dollar amounts should be reported for the final inventory and cost of goods sold

under the (1) net method; (2) gross method? Assume that there was no beginning

inventory.

Solution 8-159

(a) Purchases ..................................................................................................... 294,000

Accounts Payable ............................................................................ 294,000

(To record the purchase at net amount:

.98 × $300,000 = $294,000.)

Accounts Payable ......................................................................................... 235,200 Cash ................................................................................................. 235,200

(To record payment within the discount period:

$300,000 – $60,000 = $240,000; .. .98 × $240,000 = $235,200.)

Accounts Payable ......................................................................................... 58,800

Purchase Discounts Lost .............................................................................. 1,200 Cash ................................................................................................. 60,000

(To record the final payment.)

考点四,存货减值跌价准备LCM

Ex. 9-143—Lower-of-cost-or-market.

At 12/31/10, the end of Jenner Company's first year of business, inventory was $4,100

and $2,800 at cost and at market, respectively.

Following is data relative to the 12/31/11 inventory of Jenner:

Original NetNet Realizable

Appropriate

Cost Replacement Realizable Value Less Inventory

Item Per Unit Cost Value Normal Profit Value

A $ .65 $ .45

B .45 .40

C .70 .75

D .75 .65

E .90 .85

Selling price is $1.00/unit for all items. Disposal costs amount to 10% of selling price and a "normal" profit is 30% of selling price. There are 1,000 units of each item in the 12/31/11 inventory.

Instructions

(a) Prepare the entry at 12/31/10 necessary to implement the lower-of-cost-or-market

procedure assuming Jenner uses a contra account for its balance sheet.

(b) Complete the last three columns in the 12/31/11 schedule above based upon the

lower-of-cost-or-market rules.

(c) Prepare the entry(ies) necessary at 12/31/11 based on the data above.

(d) How are inventory losses disclosed on the income statement?

Solution 9-143

(a) Loss Due to Market Decline of Inventory ........................................ 1,300

Allowance to Reduce Inventory to Market .......................... 1,300 Solution 9-143(Cont.)

(b) Original NetNet Realizable Appropriate

Cost Replacement Realizable Value Less Inventory

Item Per Unit Cost Value Normal Profit Value

A $ .65 $ .45 $ .90 $ .60 $ .60

B .45 .40 .90 .60 .45

C .70 .75 .90 .60 .70

D .75 .65 .90 .60 .65

E .90 .85 .90 .60 .85

$3.45 $3.25*

*$3.25 × 1,000 = $3,250

(c) Allowance to Reduce Inventory to Market....................................... 1,300

Cost of Goods Sold ............................................................. 1,300

Loss Due to Market Decline of Inventory (200)

Allowance to Reduce Inventory to Market (200)

(Cost of inventory at 12/31/07 = $7,250)

OR

A student can record a recovery of $1,100.

(d) Inventory losses can be disclosed separately (below gross profit in operating

expenses) or they can be shown as part of cost of goods sold.

Pr. 9-149—Gross profit method.

On December 31, 2010 Felt Company's inventory burned. Sales and purchases for the

year had been $1,400,000 and $980,000, respectively. The beginning inventory (Jan. 1, 2010) was $170,000; in the past Felt's gross profit has averaged 40% of selling price.

Instructions

Compute the estimated cost of inventory burned, and give entries as of December 31,

2010 to close merchandise accounts.

Solution 9-149

Beginning inventory $ 170,000

Add: Purchases 980,000

Cost of goods available 1,150,000

Sales $1,400,000

Less 40% (560,000) 840,000

Estimated inventory lost $ 310,000

Sales ...................................................................................... 1,400,000

Income Summary ...................................................................... 1,400,000

Cost of Goods Sold ................................................................................ 840,000

Fire Loss ................................................................................................ 310,000 Inventory .................................................................................... 170,000 Purchases .................................................................................. 980,000

处置出售捐赠Ex. 10-136—Donated assets.

Cheng Company has recently decided to accept a proposal from the City of Bel Aire that publicly owned property with a large warehouse located on it will be donated to Cheng if Cheng will build a branch plant in Bel Aire. The appraised value of the property is

$490,000 and of the warehouse is $980,000.

Instructions

Prepare the entry by Cheng for the receipt of the properties.

Solution 10-136

Building (Warehouse) ............................................................................ 980,000

Land ....................................................................................................... 490,000 Contribution Revenue................................................................ 1,470,000

Ex. 11-132—Composite depreciation.

Kemp Co. uses the composite method to depreciate its equipment. The following totals

are for all of the equipment in the group:

Initial Residual Depreciable Depreciation

Cost Value Cost Per Year $700,000 $100,000 $600,000 $60,000

Instructions

(a) What is the composite rate of depreciation? (To nearest tenth of a percent.)

(b) A machine with a cost of $18,000 was sold for $11,000 at the end of the third year.

What entry should be made?

Solution 11-132

(a) $60,000

———— = 8.6%

$700,000

(b) Cash ............................................................................................... 11,000

Accumulated Depreciation ............................................................. 7,000

Equipment ........................................................................... 18,000 Pr. 11-135—Adjustment of Depreciable Base.

A truck was acquired on July 1, 2008, at a cost of $216,000. The truck had a six-year

useful life and an estimated salvage value of $24,000. The straight-line method of depreciation was used. On January 1, 2011, the truck was overhauled at a cost of $20,000, which extended the useful life of the truck for an additional two years beyond that originally estimated (salvage value is still estimated at $24,000). In computing

depreciation for annual adjustment purposes, expense is calculated for each month the

asset is owned.

Instructions

Prepare the appropriate entries for January 1, 2011 and December 31, 2011.

Solution 11-135

Cost $216,000

Less salvage value 24,000

Depreciable base, July 1, 2008 192,000

Less depreciation to date [($192,000 ÷ 6) × 2 1/2] 80,000

Depreciable base, Jan. 1, 2011 (unadjusted) 112,000

Overhaul 20,000

Depreciable base, Jan. 1, 2011 (adjusted) $132,000

January 1, 2011

Accumulated Depreciation ..................................................................... 20,000 Cash .......................................................................................... 20,000

December 31, 2011

Depreciation Expense ............................................................................ 24,000 Accumulated Depreciation ($132,000 ÷ 5.5 yrs) ....................... 24,000

Ex. 12-130

Barkley Corp. obtained a trade name in January 2009, incurring legal costs of $15,000.

The company amortizes the trade name over 8 years. Barkley successfully defended

its trade name in January 2010, incurring $4,900 in legal fees. At the beginning of

2011, based on new marketing research, Barkley determines that the fair value of the

trade name is $12,000. Estimated total future cash flows from the trade name are

$13,000 on January 4, 2011.

Instructions

Prepare the necessary journal entries for the years ending December 31, 2009, 2010,

and 2011. Show all computations.

Solution 12-130

2009

Dec. 31 Amortization Expense - Trade Name 1,875

Trade Name 1,875

($15,000 ÷ 8 years)

2010

Dec. 31 Amortization Expense – Trade Name 2,575

Trade Name 2,575

[($15,000 - $1,875 + $4,900) ÷7 years]

2011

Dec. 31 Loss on Impairment 3,450

Trade Name 3,450

Carrying value = $15,000 - $1,875 + $4,900 - $2,575 = $15,450

Total future cash flows

= 13,000

Therefore, an impairment loss has occurred

Carrying value = $15,450

Fair value = (12,000)

Loss on impairment = $ 3,450

2011

Dec. 31 Amortization Expense – Trade Name 2,000

Trade Name 2,000

($12,000 ÷ 6 years)

Pr. 12-145—Goodwill, impairment.

On May 31, 2011, Armstrong Company paid $3,500,000 to acquire all of the common

stock of Hall Corporation, which became a division of Armstrong. Hall reported the following balance sheet at the time of the acquisition:

Current assets $ 900,000 Current liabilities $ 600,000 Noncurrent assets 2,700,000 Long-term liabilities 500,000

Stockholders’ equity2,500,000

Total liabilities and

Total assets $3,600,000 stockholders’ equity$3,600,000

It was determined at the date of the purchase that the fair value of the identifiable net

assets of Hall was $2,800,000. At December 31, 2011, Hall reports the following balance

sheet information:

Current assets $ 800,000

Noncurrent assets (including goodwill recognized in purchase) 2,400,000

Current liabilities (700,000)

Long-term liabilities (500,000) Net assets $2,000,000

It is determined that the fair market value of the Hall division is $2,100,000. The recorded

amount for Hall’s net assets (excluding goodwill) is the same as fair value, except f or property, plant, and equipment, which has a fair value of $200,000 above the carrying

value.

Instructions

(a) Compute the amount of goodwill recognized, if any, on May 31, 2011.

(b) Determine the impairment loss, if any, to be recorded on December 31, 2011.

(c) Assume that the fair value of the Hall division is $1,900,000 instead of $2,100,000.

Prepare the journal entry to record the impairment loss, if any, on December 31,

2011.

Solution 12-145

(a) Goodwill = Fair value of the division less the fair value of the identifiable assets.

$3,500,000 – $2,800,000 = $700,000.

(b) No impairment loss is recorded, because the fair value of Hall ($2,100,000) is greater

than the carrying value ($2,000,000) of the new assets.

Solution 12-145(Cont.)

(c) Computation of impairment loss:

Implied fair value of goodwill = Fair value of division less the carrying value of the

division (adjusted for fair value changes), net of goodwill:

Fair value of Hall division $1,900,000 Carrying value of division $2,000,000

Increase in fair value of PP&E 200,000

Less goodwill (700,000)

(1,500,000) Implied value of goodwill 400,000 Carrying amount of goodwill (500,000) Loss on impairment $ (100,000)

Loss on Impairment ....................................................................... 100,000

Goodwill............................................................................... 100,000

Ex. 12-135—Accounting for patent.

In early January 2009, Lerner Corporation applied for a patent, incurring legal costs of $50,000. In

January 2010, Lerner incurred $9,000 of legal fees in a successful defense of its patent.

Instructions

(a) Compute 2009 amortization, 12/31/09 carrying value, 2010 amortization, and 12/31/10

carrying value if the company amortizes the patent over 10 years.

(b) Compute the 2011 amortization and the 12/31/11 carrying value, assuming that at the

beginning of 2011, based on new market research, Lerner determines that the fair value of the patent is $44,000. Estimated future cash flows from the patent are $45,000 on January 3, 2011.

Solution 12-135

(a) 2009 amortization: $50,000 ÷ 10 yrs. = $5,000

12/31/09 carrying value: $50,000 – $5,000 = $45,000

2010 amortization: ($45,000 + $9,000) ÷ 9 yrs. = $6,000

12/31/10 carrying value: ($45,000 + $9,000) – $6,000 = $48,000

(b) Since the expected future cash flows ($45,000) are less than the carrying value ($48,000), an

impairment loss must be computed.

Loss on impairment: $48,000 carrying value – $44,000 fair value = $4,000

2011 amortization: $44,000 ÷ 8 yrs. = $5,500

12/31/11 carrying value: $44,000 – $5,500 = $38,500

Ex. 12-138

Leon Corp. purchased Spinks Co. 4 years ago and at that time recorded goodwill of $300,000. The Sinks Division’s net assets, including goodwill, have a carrying amount of $700,000. The fair value of the division is estimated to be $750,000.

Instructions

(a) Explain whether or not Leon Corp. must prepare an entry to record impairment of the

goodwill. Include the entry, if necessary.

(b) Repeat instruction (a) assuming that the fair value of the division is estimated to be

$650,000 and the implied goodwill is $225,000.

Solution 12-138

(a) The fair value of the division ($750,000) exceeds the carrying amount of its assets

($700,000). Therefore, goodwill is not impaired and no entry is necessary.

(b) The fair value of the division ($650,000) is less than the carrying amount of its assets

($700,000). Therefore, goodwill is impaired. The amount of the impairment loss is

$75,000, the difference between the recorded goodwill ($300,000) and the implied

goodwill ($225,000).

Loss on Impairment 75,000

Goodwill 75,000

Ex. 12-139—Impairment of copyrights.

Presented below is information related to copyrights owned by Wamser Corporation at December

31, 2010.

Cost $2,700,000

Carrying amount 2,350,000

Expected future net cash flows 2,100,000

Fair value 1,400,000

Assume Wamser will continue to use this asset in the future. As of December 31, 2010, the copyrights have a remaining useful life of 5 years.

Instructions

(a) Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2010.

(b) Prepare the journal entry to record amortization expense for 2011.

(c) The fair value of the copyright at December 31, 2009 is $1,500,000. Prepare the journal entry

(if any) necessary to record this increase in fair value.

Solution 12-139

(a) December 31, 2010

Loss on Impairment ..................................................................................... 950,000 Copyrights ....................................................................................... 950,000 Carrying amount $2,350,000

Fair value 1,400,000

Loss on impairment $ 950,000

(b) December 31, 2011

Amortization Expense ................................................................................. 280,000 Copyrights ....................................................................................... 280,000 New carrying amount $1,400,000

Useful life ÷ 5 years

Amortization $ 280,000

(c) No entry necessary. Restoration of any impairment loss is not permitted for assets held for

future use.

Ex. 12-142—Acquisition of tangible and intangible assets.

Vasquez Manufacturing Company decided to expand further by purchasing Wasserman Company.

The balance sheet of Wasserman Company as of December 31, 2011 was as follows:

Wasserman Company

Balance Sheet

December 31, 2011

Assets Liabilities and Equities

Cash $ 210,000 Accounts payable $ 375,000 Receivables 550,000 Common stock 800,000 Inventory 275,000 Retained earnings 885,000 Plant assets (net) 1,025,000

Total assets $2,060,000 Total liabilities and equities $2,060,000

An appraisal, agreed to by the parties, indicated that the fair market value of the inventory was $350,000 and that the fair market value of the plant assets was $1,225,000. The fair market value

of the receivables is equal to the amount reported on the balance sheet. The agreed purchase price

was $2,075,000, and this amount was paid in cash to the previous owners of Wasserman Company.

Instructions

Determine the amount of goodwill (if any) implied in the purchase price of $2,075,000. Show calculations.

Solution 12-142

Purchase price $2,075,000 Less tangible net assets acquired:

Book value ($2,060,000 – $375,000) $1,685,000

Appraisal increment—inventory 75,000

Appraisal increment—plant assets 200,000

Total fair market value of tangible net assets acquired 1,960,000 Goodwill $ 115,000

*Ex. 12-143

MacroSoft Inc. has capitalized $600,000 of software costs. Sales from this product were

$360,000 in the first year. MacroSoft estimates additional revenues of $840,000 over the

product’s economic life of 5 years.

Instructions

Prepare the journal entry to record software cost amortization for the first year. Show all

computations.

Solution 12-143

Computations: Percent of revenue approach

$600,000 x [$360,000/($360,000 + $840,000)] = $180,000

Straight-line approach

中级财务会计习题

作业 【银行存款的核对】 1. 甲公司2008年12月份发生与银行存款有关的业务如下: (1) ①12月28日,甲公司收到A公司开出的480万元转账支票,交存银行。该笔款项系A公司违约支付的赔款,甲公司将其计入当期损益。 ②12月29日,甲公司开出转账支票支付B公司咨询费360万元,并于当日交给B公司。 (2)12月31日,甲公司银行存款日记账余额为432万元,银行转来对账单余额为664万元。经逐笔核对,发现以下未达账项: ①甲公司已将12月28日收到的A公司赔款登记入账,但银行尚未记账。 ②B公司尚未将12月29日收到的支票送存银行。 ③甲公司委托银行代收C公司购货款384万元,银行已于12月30日收妥并登记入账,但甲公司尚未收到收款通知。 ④12月份甲公司发生借款利息32万元,银行已减少其存款,但甲公司尚未收到银行的付款 通知。 要求: (1)编制甲公司上述业务(1)的会计分录。 (2)根据上述资料编制甲公司银行存款余额调节表。 『答案』 (1) ①借:银行存款480 贷:营业外收入480? ②借:管理费用360 贷:银行存款360? (2)银行存款余额调节表

2. 乙企业20x4-20x7年应收账款相关业务如下: (1 )该企业从20x4年开始计提坏账准备,这一年年末应收账款余额为50万元。 (2)20x5年和20x6年年末应收账款的余额分别为125万元和110万元,这两年均未发生坏账损失。 (3)20x7年7月,确认一笔坏账,金额为9000元. (4)20x7年12月,上述已核销的坏账又收回2500元 (5)20x7年末应收账款余额为100万元。 乙企业采用应收账款余额百分比法计提坏账准备,提取坏账准备的比例为%。 要求:根据上面的材料编制20x4-20x7甲企业相应的会计分录 『答案』 (1 )该企业从20x4年开始计提坏账准备,这一年年末应收账款余额为50万元。 借:资产减值损失 2 500 贷:坏账准备 2 500 (2)20x5年和20x6年年末应收账款的余额分别为125万元和110万元,这两年均未发生坏账损失。 20x5 年 借:资产减值损失 3 750 贷:坏账准备 3 750 20x6 年 借:坏账准备750 贷:资产减值损失750 (3)20x7年7月,确认一笔坏账,金额为9000元. 借:坏账准备9 000 贷:应收账款9 000 (4)20x7年12月,上述已核销的坏账又收回2500元 借:银行存款 2 500 贷:应收账款 2 500

《中级财务会计B(2-1)》习题

中级财务会计B(2-1)》习题 第2章货币资金与应收款项 □学习指导 本章针对流动资产中除交易性金融资产和存货以外的项目进行了阐述。在全面说明货币资金构成及其会计处理的基础上,重点介绍了应收票据、应收账款、其他应收款及预付款项的各自内涵及基本业务的会计处理,最后专门针对各应收款项的坏账处理进行了详细介绍。 本章重点应掌握货币资金包括的内容及对货币资金管理的主要方法,熟悉库存现金、银行存款及其他货币资金在收发核算及清查方法上的特点,掌握应收票据、应收账款、其他应收款、预付账款等核算内容的区别及一般业务的会计处理。本章难点:银行存款余额调节表的编制目的和方法;应收票据贴现的会计处理;应收账款的让售,坏账估计方法及会计处理。 □练习题 二、判断题 1.货币资金一般包括硬币、纸币、存于银行或者其他金融机构的活期存款以及本票和汇票存款等可以支付使用的交换媒介物。( ) 2.企业在任何情况下,都不得从本单位的现金收入中坐支现金。( ) 3.库存现金清查包括两部分内容:一是出纳人员每日营业终了进行账款核对;二是清查小组进行定期或不定期的盘点和核对。( ) 4.对库存现金进行账实核对,如发现账实不符,应立即查明原因,及时更正;对发生的长款或者短款,应查找原因,并按规定进行处理;为简化处理,可以以今日长款弥补他日短款。( ) 5.为了总括反映企业货币资金的基本情况,资产负债表上一般只列示货币资金项目,不再按货币资金的组成项目单独列示或披露。( ) 6.一个企业只能选择一家银行的一个营业机构开立一个基本存款户,不得在多家银行机构开立基本存款户,但可以在同一个银行的几个分支机构开立多个一般存款户。( ) 7.银行本票可以用于转账也可以用于支取现金。( ) 8.支票上印有“现金”字样的为现金支票,现金支票只能用于支取现金。支票上印有“转账”字样的为转账支票,转账支票只能用于转账。支票上未印有“现金”或“转账”字样的为普通支票,可以用于支取现金,也可以用于转账。( ) 9.办理托收承付的款项,必须是商品交易以及因商品交易而产生的劳务供应的款项。代销、寄销、赊销商品的款项,也可以办理托收承付结算。( ) 10.企业与银行核对银行存款账目时,对发现的未达账项,应当编制银行存款余额调节表进行调节,并进行相应的账务处理。( ) 11.银行对临时采购户一般实行半封闭式管理,即只付不收,付完清户,不得支取现金,所有支出一律转账。( )

中级财务会计练习题以及答案

中级财务会计练习题以 及答案 Company number:【WTUT-WT88Y-W8BBGB-BWYTT-19998】

浙江大学远程教育学院 《中级财务会计》练习题 姓名:学号: 年级:学习中心:—————————————————————————————第二章 一、练习题 1.某企业从开户银行取得银行对帐单,余额为180245元,银行存款日记帐余额为165974元。经逐项核对,发现如下未达帐项: (1)企业送存银行的支票8000元,银行尚未入帐。 (2)企业开出支票13200元,收款人尚未将支票兑现。 (3)银行扣收的手续费115元,企业尚未收到付款通知。 (4)银行代收应收票据款10900元,企业尚未收到收款通知。 (5)银行上月对某存款多计利息1714元,本月予以扣减,企业尚未收到通知。 要求:根据以上未达帐项,编制企业的银行存款余额调节表。

2.某企业2007年5月发生如下经济业务: (1)5月2日向南京某银行汇款400000元,开立采购专户,委托银行汇出该款项。 借:其他货币资金——外埠存款 400 000 贷:银行存款 400 000 (2)5月8日采购员王某到武汉采购,采用银行汇票结算,将银行存款15000元专为银行汇票存款。 借:其他货币资金——银行汇票 15 000 贷:银行存款 15 000 (3)5月19日采购员李某在南京以外埠存款购买材料,材料价款300000元,增值税进项税额51000,材料已入库。 借:原材料 300 000 应交税费——应交增值税(进项税额) 51 000 贷:其他货币资金——外埠存款 315 000 (4)5月20日,收到采购员王某转来进货发票等单据,采购原材料1批,进价10000元,增值税进项税额1700元,材料已入库。 借:原材料 10 000 应交税费——应交增值税(进项税额) 1 700 贷:其他货币资金——银行汇票 11 700 (5)5月21日,外埠存款清户,收到银行转来收帐通知,余款收妥入帐。借:银行存款 49 000

中级财务会计 存货总结

第三章存货 存货的初始计量: 一、外购的存货 存货成本=买价+运杂费×(1-可抵扣税率)+入库前挑选整理费+相关税费+关税 【PS:(资料:)☆计入成本的有: 1.运杂费(运输费、保险费、装卸费、包装费等),其中专门的运输费若取得了增值税专用发票,则可以按7%抵扣增值税进项税额。 2.运输过程中的合理损耗 3. 入库前的挑选整理费,也包括相应的存储费用。 4.相关税费:计入存货的消费税、资源税、不能抵扣的增值税、关税。(书上原话:直接归属于存货采购成本的费用:仓储费、包装费、运输途中的合理损耗、大宗物资的市内运杂费、入库前的挑选整理费用;但不包括:市内零星货物运杂费、采购人员的差旅费、采购机构的经费以及供应部门经费等。) ☆计入管理费用的有:1.采购人员差旅费2.不合理损耗3.入库后发生的一些存储费用4. 印花税、土地使用税、车船税、房产税 ☆外购的过程中出现自然灾害造成的损失,应计入营业外支出。 (书上见P42)】 1、验收入库和货款结算同时完成 借:原材料(或周转材料,库存商品) 应交税费——应交增值税(进项税额) 贷:银行存款 2、货款已结算但存货尚在途中 借:在途物资 应交税费——应交增值税(进项税额) 贷:银行存款 验收入库后: 借:原材料 贷:在途物资 3、存货已验收入库但货款尚未结算(若月末结算凭证仍未到达) 借:原材料(或周转材料,库存商品) 贷:应付账款——暂估应付账款 月初红字记账凭证冲回估价入账分录 借:原材料 贷 收到结算凭证 借:原材料 应交税费——应交增值税(进项税额) 贷:银行存款 4、预付货款方式购入存货(定金—结算—补付) 借:预付账款——X公司 贷:银行存款 借:原材料 应交税费——应交增值税(进项税额) 贷:预付账款——X公司 支付余额 借:预付账款——X公司 贷:银行存款 5、赊购方式 ①没有现金折扣 借:原材料(或周转材料、库存商品等) 应交税费——应交增值税(进项税额) 贷:应付账款——X公司 收到后: 借:应付账款——X公司 贷:银行存款 ②有现金折扣 借:应付账款——X公司 贷:银行存款 财务费用 ③分期付款(画出融资费用分摊表) 购进原材料: 借:原材料 未确认融资费用 贷:长期应付款——X公司 每年末分摊融资费用: (增值税按题要求分摊或一次付清) 借:长期应付款——X公司 应交税费——应交增值税(进项税额)

中级财务会计真题及答案

精心整理 全国2014年10月高等教育自学考试 中级财务会计试题 课程代码:00155 选择题部分 注意事项: 1.答题前,考生务必将自己的考试课程名称、姓名、准考证号用黑色字迹的签字笔或钢笔填写在答题纸规定 2. 1 A 2C)A 3 A 4 A 5 A 6 A C 7 A、已宣告而未发放的应付股利 B、收到投资者投入的资本 C、从净利润中提取的法定盈余公积 D、资产评估增值 8、下列行为中,违背会计核算一贯性原则的是(B) A、鉴于某项无形资产已无任何价值,将该无形资产的帐面余额转销 B、鉴于本期经营状况不佳,将固定资产折旧方法由年数总和法改为直线法 C、鉴于当期现金状况不佳,将原来采用现金股利分配政策改为分配股票股利 D、上期提取存货跌价损失准备10万元,鉴于其可变现净值继续降低,本期提取5万元 9、下列选项中,不满足确认坏帐情形的是(B)

A、债务人破产,破产程序清偿后仍无法收回部分 B、债务人的企业被兼并失去法人资格,并且无归还意愿 C、债务人死亡,遗产清偿后仍无法收回的部分 D、债务人愈期末履行还款义务,并且有足够证据无法收回或收回的能性及小 10、下列选项中,不是企业对被投资企业拥有实质控制权的判断标准的是(A) A、投资企业在董事会或类似机构会议上有1/3以上的席位 B、依据章程和协议,企业控制被投资企业的财务和经营决策 C、投资企业有权任免被投资企业董事会等类似权利机构的多数成员 D、通过与其他投资者的协议,投资企业拥有被投资企业50%以上的表决权投本的控制权 112 A、 12 A C 13 A C 14 A C 15 A 16 A、 B、一家企业如果需要开立两个或以上基本存款帐户,须开立在不同银行 C、银行存款总帐由出纳保管并核对银行存款日记帐与银行对帐单的金额 D、银行存款帐户分为基本存款帐户、一般存款帐户、临时存款帐户和专用存款帐户 E、基本存款帐户是企业办理日常转帐结算和现金支付的帐户,工资奖金等现金支取只能通过本帐户办理 17、下列各种会计处理方法中,体现谨慎性原则的有(ABCDE) A、期末存货采用成本与可变现净值孰低法计价 B、采用成本法对长期股权投资核算 C、对固定资产计提减值准备 D、加速折旧法 E、先进先出法 18、下列现金流量中,属于投资活动产生的现金流量的有(ABC)

中级财务会计分录大全(word)

中级财务会计分录短缺(XX个人)②重新收回时贷:应付账款-暂估应付账其他业务支岀(单独计价) 第一章货币资金及应收款其他应收款-应收保险赔借:应收账款款贷:包装物 项款贷:管理费用注:下月初,用红字冲回,(3)包装物的岀租、岀借 1 ?现金管理费用-现金溢余(无法借:银行存款等收到发票再处理①第一次领用新包装物时 ⑴备用金查明原因的)贷:应收账款(2)发出借:其他业务支岀(岀租) ①开立备用金贷:待处理财产损溢-待处⑵备抵法平时登记数量,月末结转营业费用(岀借) 借:其他应收款-备用金理流动资产损溢①提取坏账准备金时借:生产成本/在建工程/委贷:包装物 贷:现金 2 ?银行存款借:管理费用托加工物资/…注:岀租、岀借金额较大时 ②报销时补回预定现金①企业有确凿证据表明存贷:坏账准备贷:原材料可分期摊销 借:管理费用等在银行或其他金融机构的款项②发生坏账时2.委托加工物资②收取押金 贷:现金已经部分或全部不能收回借:坏账准备①发出委托加工物资借:银行存款 ③撤销或减少备用金时借:营业外支岀贷:应收账款借:委托加工物资贷:其他应付款 借:现金贷:银行存款③重新收回时贷:原材料③收取租金 贷:其他应收款-备用金 3 ?其他货币资金(外埠存借:应收账款②支付加工费、运杂费、增借:银行存款 ⑵现金长短款款)贷:坏账准备值税贷:应交税金—增(销) ①库存现金大于账面值①开立采购专户借:银行存款借:委托加工物资其他业务收入 借:现金借:其他货币资金-外埠存贷:应收账款应交税金-应交增值税④退还包装物(不管是否 贷:待处理财产损溢-待处款 5 ?应收票据(见后)(进)报废), 理流动资产损溢贷:银行存款第二章存货贷:银行存款等借:其他应付款(按退还包查明原因后作如下处理:②用此专款购货1材料③交纳消费税(见应交税装物比例退回押金)借:待处理财产损溢-待处借:物资采购(1)取得金)贷:银行存款 理流动资产损溢贷:其他货币资金-外埠存①发票与材料同时到④加工完成收回加工物资⑤损坏、缺少、逾期未归还贷:其他应付款-应付现金款借:原材料借:原材料(验收入库加工等原因没收押金 溢余(X单位或个人)③撤销采购专户应交税金—增(进)物资+剩余物资)借:其他应付款营业外收入-现金溢余(无借:银行存款贷:银行存款贷:委托加工物资其他业务支出(消费税) 法查明原因的)贷:其他货币资金-外埠存②发票先到 3.包装物贷:应交税金—增(销) ②库存现金小于账面值款借:在途物资(含运费)(1 )生产领用,构成产品应交税金-应交消费税 借:待处理财产损溢-待处 4 .坏账损失应交税金—增(进)组成部分其他业务收入(押金部分) 理流动资产损溢⑴直接转销法贷:银行存款借:生产成本⑥不能使用而报废时,按其贷:现金①实际发生损失时③材料已到,月末发票账单贷:包装物残料价值 查明原因后作如下处理:借:管理费用未到(2)随产品出售且借:原材料 借:其他应收款-应收现金贷:应收账款借:原材料借:营业费用(不单独计价)贷:其他业务支出(出租)

2020年中级财务会计心得体会

中级财务会计心得体会 “实践是检验真理的唯一标准”。眼看着,两周的实训就要在这两天画上圆满的句号了。对于会计专业的我们来说,这是一个充满挑战却又赋予激-情的过程! 一、实训时间:xx年6月8日至6月21日 二、实训目的:通过会计实训,使得学生较系统地练习企业会计核算的基本程序和具体方法,加强学生对所学专业理论知识的理解、实际操作的动手能力,提高运用会计基本技能的水平,也是对学生所学专业知识的一个检验。使每位学生掌握填制和审核原始凭证与记账凭证,登记账薄的会计工作技能和方法,而且能够切身的体会出纳员、材料核算员、记账员等会计工作岗位的具体工作,从而对所学理论有一个较系统、完整的认识,最终达到会计理论与会计实践相结合的目的。 三、实训内容:以企业的实际经济业务为实训资料,运用会计工作中的证、账等对会计核算的各步骤进行系统操作实验,包括账薄建立和月初余额的填制、原始凭证、记账凭证的审核和填制,各种账薄的登记、对账、结账等。 四、实训心得:两天的实训是在我们充实、奋斗的过程中完成的,记得实训的开始是那样的忙碌和疲惫,甚至是不知所措,只能依靠老师的引导和帮助。通过这十几天来的会计实训我深刻的体会到会计的客观性原则、实质重于形式原则、相关性原则、一贯性原则、可比性原则、及时性原则、明晰性原则、权责发生制原则、配比原则、历史

成本原则、划分收益支出于资本性支出原则、谨慎性原则、重要性原则,和会计工作在企业的日常运转中的重要性,以及会计工作对我们会计从业人员的严格要求。让我掌握了记账的基本程序,锻炼了自己的动手操作能力,使我深一步了解到里面的乐趣,更重要的是发现了自己的不足之处,它使我全面系统地掌握会计操作一个完整的业务循环,即从期初建账,原始凭证和记账凭证的填制、审核,账簿的登记、核对,错账的更正,会计处理程序的运用到会计报表的编制,从而对企业会计核算形成一个完整的概念。也让我了解到这一年来到底学到了什么,使我更加爱好这个专业。 俗话说:“要想为事业多添一把火,自己就得多添一捆材”。此次实训,我深深体会到了积累知识的重要性。有些题目书本上没有提及,所以我就没有去研究过,做的时候突然间觉得自己真的有点无知,虽所现在去看依然可以解决问题,但还是浪费了许多时间,这一点是我必须在以后的学习中加以改进的。另外一点,也是在每次实训中必不可少的部分,就是同学之间的互相帮助,有些东西感觉自己做的是时候明明没什么错误,偏偏对账的时候就是有错误,让其同学帮忙看了一下,发现其实是个很小的错误。所以说,相互帮助是很重要的一点。这在以后的工作或生活中也很关键的。 两个星期的实训结束了,收获颇丰,总的来说我对这次实训还是比较满意的,它使我学到了很多东西,虽说很累,但是真的很感谢学校能够给学生这样实训的机会,尤其是会计专业,毕竟会计吃的是经验饭,只有多做帐,才能熟能生巧,才能游刃有余。我深刻理解了什

中级财务会计真题及答案

中级财务会计真题及答 案 集团档案编码:[YTTR-YTPT28-YTNTL98-UYTYNN08]

全国2014年10月高等教育自学考试 中级财务会计试题 课程代码:00155 选择题部分 注意事项: 1.答题前,考生务必将自己的考试课程名称、姓名、准考证号用黑色字迹的签字笔或钢笔填写在答题纸规定的位置上。 2.每小题选出答案后,用2B铅笔把答题纸上对应题目的答案标号涂黑。如需改动,用橡皮擦干净后,再选涂其他答案标号。不能答在试题卷上。 一、单项选择题(本大题共14小题,每小题1分,共14分) 在每小题列出的四个备选项中只有一个是符合题目要求的,请将其选出并将“答题纸”的相应代码涂黑。未涂、错涂或多涂均无分。 1、下列各项目中,符合资产定义的是(A) A、购入的某项专利权 B、经营租入的设备 C、待处理的财产损失 D、计划投资的资产 2、企业赊销一批商品,规定的付款条件为:1/10,N/30,如果客户在现金折扣期内付款,那么该折扣记入(C) A、商品成本 B、制造费用 C、财务费用 D、管理费用 3、企业按应收帐款余额的一定比例提取坏帐准备,这是遵循会计的(B) A、真实性原则 B、谨慎性原则 C、配比原则 D、一致性原则 4、按照我国企业会计准则,下列不能作为发出存货成本计量方法的是(D) A、先进先出法院 B、月末一次加权平均法 C、移动加权平均法 D、后进先出法 5、按照提供劳务交易的完工进度确认收入与费用的方法是(D) A、收款法 B、销售法 C、生产法 D、完工百分比法 6、下列关于无形资产特征的描述,错误的是(C) A、无形资产属于非货币性长期资产 B、无形资产是可辨认的 C、无形资产可能具有实物形态 D、无形资产具有可控制性 7、下列项目中,属于留存收益的是(C) A、已宣告而未发放的应付股利 B、收到投资者投入的资本 C、从净利润中提取的法定盈余公积 D、资产评估增值 8、下列行为中,违背会计核算一贯性原则的是(B) A、鉴于某项无形资产已无任何价值,将该无形资产的帐面余额转销 B、鉴于本期经营状况不佳,将固定资产折旧方法由年数总和法改为直线法 C、鉴于当期现金状况不佳,将原来采用现金股利分配政策改为分配股票股利 D、上期提取存货跌价损失准备10万元,鉴于其可变现净值继续降低,本期提取5万元

第一学期《中级财务会计》各章综合业务练习

第一学期《中级财务会计》各章综合业务练习 注意:选课班所有同学必须在2013年12.20日前完成以下作业(要检查并记平 时分)。因本期练习题部分题目与上期相同,已经做了上期题目的同学,可以 只做本期增加的题目和有数字变动的题目。 第二章货币资金: 1.A公司为一般纳税人,年1月发生以下与原材料相关的业务: (1)申请取得银行本票一张,面值120万元。 (2)用上述银行本票结算购入乙材料一批,买价100万元,增值税率17%。A公司采用计划 成本法核算原材料。 (3)用转账支票支付上述材料运杂费0.5万元。 (4)上述甲材料验收入库,计划成本105万元。 (5)多余的银行本票存款3万元已经退回A公司开户银行。 (6)生产产品领用甲材料一批,计划成本80万元。 (7)将多余的甲材料100公斤出售,售价500元/公斤,增值税率17% ,收到转账支票。 (8)按计划成本45000元结转销售甲材料成本。 要求:编制A公司上述业务的会计分录。 2.P 公司2013年10月8日将一般存款户存款3000万元转入证券专户。10月15日,用上述专户资金购买A公司股票400万股,P 公司决定将上述股票投资划分为交易性金融资产,买价6元/股,相关税费10万元。2013年2月31日,A股票市价5.3元/股。2014年2月15日,A公司宣告发放现金股利0.2元/股。2014年3月1日A公司支付上述现金股利。2014年3月20日,P公司以6.5元/股的价格出售A公司股票200万股,相关税费5.4万元。 要求:编制P上述业务会计分录。 第三章应收款项 1. 甲公司2010年开始采用备抵法核算坏账损失,各年均按年末应收款项余额合计的3%估计坏账损失。2010年末应收款项余额合计1500万元。 2011年4月公司确认应收账款50万元为坏账。2011年末应收款项余额1800万元。2012年3月公司确认其他应收款10万元为坏账,当年收回2011年已核销的坏账50万元,2012年末公司应收款项余额为1000万元。 要求:用备抵法对甲公司上述业务作出会计分录。 2. P企业为一般纳税人,2013年10月5日采用委托收款结算方式销售自产商品一批给乙企 业,该批商品价目单标价为100000元,增值税率17%,代垫运杂费2000元。商品成本80000 元。当日办妥托收手续。销售合同约定的商业折扣为10%,现金折扣为5/30,2/60,N/90。 计算现金折扣不考虑增值税及代垫运杂费。乙企业与2013年10月30日支付全部价款给 P企业。2013年11月20日,上述商品由于质量问题全部退回P企业,P企业用银行存款 支付退货款。 要求:采用总价法编制甲企业确认销售收入、结转销售成本、折扣期内收到价款及销售退 回的会计分录 第四章存货

中级财务会计学(人民大学出版社)课后重点总结

(1+i)^n./1(1+i)^n 债券利息费用(实际票价*实际利率),债券支付利息(面值*票面利率) 流动比率=流动资产/流动负债,库藏债券=库藏股。 酸性实验比率=(现金+短期投资+应收账款)/流动负债 与员工有关的债务:工薪扣款、支付者(员工)借:工资与薪水费用。贷:应付(代扣所得税)。 带薪休假(当年工资)借:工资费用。贷:应付假期工资 债券的清偿(回购价):账面净值=面值-未摊销发行利得 优先股:最积优先股,参与优先股,可转换…可提前兑回…..可赎回…. 普通股权益利率=(净利润—优先股股利)/普通股权益均值 股利支付率=现金股利/(净利润—优先股股利) 每股账面价值=普通股权益/在外发行数量 13章流动负债与或有事项 l描述流动负债的性质、种类及计价。流动负债是一种义务,公司合理地预期其清偿需要使用流动资产或增加新的流动负债。从理论上来讲,债务应当按照未来清偿所耗用现金数额的现值进行计量。在实践中,公司通常按照流动负债的到期值对其进行记录和报告。流动负债有几大类:(1)应付债款,(2)应付票据,(3)即将到期的长期负债,(4)应付股利(5)顾客预收款与保证金.(6预收,(7)应交税金,(8)与员工相关的债务。2解释与预期再融资的短期债务分类相关的问题。当同时满足以下两个条件时,短期债务被排除在流动负债之外;(1)公司必须打算在长期基础上对债务进行再融资; (2)公司必须对其完成再融资的能力进行说明。3确定与员工相美债务的种类。与员工相美的债务是:1.工薪扣款(2)带薪缺勤;(3)奖金协议。 4.确定对或有利得及或有损失进行会计处理爰披露所使用的标准。或有利得是不被记录的。当或有利得发生的可能性较高时,在附注中对其进行披露。只有在以下的两个条件同时满足的时候,公司才应当按照应甘制记录费用和负债,确认或有损失所估计的损失:(1)财务报表报出前所能获得的信息说明,在财务报表日该债务很可能已经发生了(2)损失的金额能够合理估计。5解释对不同种类的或有损失进行的会计处理。对于决定是否就未决的或可能发生的诉讼以厦实际的或可能的索赔和税捐,确认一项负债,必须考虑下列因素:(1)产生结果的潜在原因所发生的时期;(2)不利结果发生的可能性;(3)对损失金额做出合理估计的能力。如果在与售出商品和服务相关的保修条款之下,顾客可能会提出索赔要求,并且能够合理地估计出其成本,那么公司应当使用应计制。在应甘制的基础之1.将保修成本借记销售当期的营业费用。奖励、提供的赠券以厦折扣是用来刺激销售的。公司应当将它们的成本借记奖励计捌获益当期的费用。当公司对相关长期资产的报废负有法定责任,并且金额能够合理估计时,公司必须确认资产报废义务。6.指出如何对负俄殛或有事项进行披露和分析。流动负债账户通常被列示在资产负债表中负债与股东权益部分的第一级分类中。在流动负债部分,公司可能按照到期日的顺序、金额的顺序或者清算优先权的顺序进行列示。有关流动负债的详细信息及补充信息应当满足充分披露的要求。如果或有损失或是可能发生,或是能够被估计,但是并不同时满足两者,并且至少还存在合理的可能性公司会承担债务,那么公司应当在附注申披露该或有事项的性质以及对可能损失的估计。用于分析流动性的两个指标分别是流动比率与酸性试验比率。 14章长期负债 l描述发行长期债务的正式程序。发行长期债务通常有一个正式的程序,企业的章程一般会要求经董事会和股东的同意,公司才能发行债券或者从事其他长期债务安排。通常长期债务具有各种条款或者限制。借款人和贷款人之间的这些条款以厦协议的其他条件会在债券契约或者票据协议中注明。2辨别债券发行的种类。债券的类型包括:(1)担保债券和无担保债券,(2)定期债券、分期还本债券、可赎回债券.(3)可转换债券、与商品绑定债券以及高折扣债券,(4)记名债券和不记名债券,(5)收益债券和收入债券。债券区分为这么多类型是为了吸引不同投资者和风险承受者的资本,以满足债券发行公司的现金流需求。3描述债券发行日的会计计量。投资者是按照债券本金和利息产生的未来现金流的现值对债券进行计价的,用来计算这些现金流现值的利率是与债券发行公司债券的风险特征相适应的可接受的投资报酬率。这一写入债券契约中、井通常在债券凭证上注明的利率是票面利率或者叫做名义利率。债券发行公司设定这一利率,并把它表示成债券面值(也被称做本金)定百分比的形式。如果债券购买者所用利率与票面利率不同,他们计算的债券现值就台不等于债券面值。债券面值和现值之间的差异就构成折价或者溢价。4应用债券折溢价的摊销方法。折价(溢价)应在债券存续期内进行摊销并借记或者贷记利息贽用中。折价的摊销会增加债券的利息费用,而溢价的摊销会减少债券的利息费用。会计职业界倾向于采用实际利率法摊销折价或者溢价。在实际利率法下:(1)债券的利息费用是用期初的实际利率与债券账面价值相乘而得;(2)债券折价或者溢价的摊销是通过比较债券利息赞用与应当支付的利息来确定的。5描述债券清偿的会计处理。在回购长期负债时,未摊销的滥价或者折价以及债务的发行成本应当直摊销壬回购日。回购价格是指在债务到期前清偿或者齄回债务所支付的金额,包括赎回溢价和回购费用。在任一时点上,债务的账面净值等于经未摊销溢竹或者折价以及发行费用调整后的到期时应付款项。回购价格超过账面净值的部分属于债务清偿损失。债务清偿利得和损失应当在当期收益中加以确认。6解释长期应付票据的会计处理。票据和债券的会计程序类似。像债券那样,票据也是按照它的预期未来利息和本金的现金流的现值计价的,相关的折价或者溢价也要在票据的存续期内摊销。每当票据面值不能合理地代表上述现值时,公司必须对整个债务安排进行估计,以便正确记录交易及其后续利息。7解释对表外融资安排的报告。表外融资是指公司试图避免在报表上报告负债的融资方式。表外融资安排的例子包括:(1)非合并子公司;(2)特殊目的实体(3)经营租赁。8说明如何列报和分析长期债务。具有大量、多种长期债务的公司常常在资产负债表上只报告一个金额,而在报表附注中加以评论和列示。任何用作债务担保的资产都应列在资产负债表的资产部分。在1年内到期的长期负债应当列示为流动负债,除非公司准备用非流动资产偿还。如果公司计划以再融资、将债务转换成股票,或者用偿债基金的方式偿债,公司必须继续将债务报告为非流动负债,同时在附注中说明债务清偿的方法。公司需要披露未来5年内每年偿债基金偿付情况以及长期债务的本金。资产负债率和利息保障倍数是提供公司偿债能力和长期偿付能力信息的两个财务比率。 15章股东权利 1.讨论不同公司组织形式的特征。在众多公司形式的具体特征中, 影响会计处理的是:(1)州公司法的影响;(2)股本或者股票制的使用;(3)各种所有者利益的发屉。如果没有其他限制性条款,每股股票按比例分享以下权利:(1)利润或者损失.(2)管理权(选择董事会的投票权).(3)清算后的公司资产(4)新发行的同类股票(被称为优先购股权)。2识别股东权益的关键组成部分。所有者权益被划分为以下两类:投入资本和赚得资本,投入资本(实收资本)表示在股奉上投入的所有金额。换言之,也就是股票持有者预支给公司用于经营话动的金额。投入资本包括所有发行在外的股票面值和扣减发行折扣后的溢价。赚得资本来自公司经营盈利累积的资本。它包含所有留存并投资于公司中的未分配利润。3解释发行股票的会 计处理程序。根据不同的股票类型设置不同的会计科目:面值股票:(a)优先股或者普通股,(b)超过面值的股本溢价或者追加缴入资本,(c)股票折扣。无面值股票:普通股;在使用设定价值时:普通股和追加缴人资本。同其他证券一起发行的股票(揽子交易)可以使用的两种方法是:(a)比例分配法}(b)增量法。非现金交易的股票:公司应当按照发行股票的公兜价值或 者非现金资产对价的公允价值来记录为获得服务或实物资产而不是现金的股票发行,选择哪种标准应视哪个价格更容易取得。4描述库藏股的会计 处理。公司一般使用成本法进行库藏股相芰会计处理。这种方法之所以这样命名,是因为公司按照回购这些股份的成本来记录库藏股票科目。在成本法下,公司按照股票的取得成本借记库存股票科目。在重新发行时,按照相同金额贷记库藏股科目。股份的原始价格不影响回购或重新发行时的分录。5解释优先股的会计处理和报告。优先股是一类特殊的股票,拥有 与普通股不样的优先权或者特点。通常与优先股相关的一些特点包括:(1)优先获得股利权;(2)优先分配清算资产权(3)可转换为普通股(4)公司拥有可提前兑回选择权;(5)无投票权。发行优先股时的会计处理和发行普通股类似。当可转换优先股被实施转换时,公司应当使用账面价值法借记优先股和相关的追加缴_凡资本;贷记普通股和追加缴人资本(如果存在超额)。6描述各种胜利支付政策。州公司法通常会提供与股利支付相关的法定限制条款。但是几乎没有公司会按照合法可用的限制金额来支付股利。这部分归因于公司使用留存收益所代表的资产来进行经营。如果公司考虑进行股利发放,那么它必须先弄清楚两个问题:1公司支付股利的条件符合法律 的要求吗2公司支付股利的条件经济合理吗?7识别各种股利支付的形式。股利通常有如下类型:(1)现金股利l(2)财产股利;(3)清算 股利(柬源于除了留存收益以外科目的股利);(4)股票股利(股票股利是 公司向原有股东币需任何对价的等比例发行)。8解释小额、大额股票艘利相股票分割的会计处理。GAAP要求小额股票股利(小于20“或25)的会计处理需要基于已发行股票的公允价值来进行。当宣告股豢股利时,公司按照发行股票的公允价值借记留存收益。分录还包括按照每股面值乘以股票份额贷记可支付的普通股股利科目,同时将二者的差额贷记超过面值的实收资本。如果发行的股票股利超过发行在外般票的20%或25% (大额股票 股利).公司应当按照发行股票的面值总额借记留存收益和贷记可分配的普通股——这个分录中投有实收资本溢价科目。股票股利是~种对留存收益的资本化,通过减少留存收益,增加某些缴^资本科目,没有改变每股面值和股东权益总额。股东保持了与原来相同的股东权益比例。而股票分割导致发行在外股票数目的增加或减少,相应地减少或增加每股票面价值或设定价值。股票分割不需要作会计分录。9.筒述如何到报和分析股东权益。 资产负债表中所有者权益部分包括:实收资本、实收资本滥价和留存收益。有些公司可能还包括额外项目,比如库藏股聚和累积其他综合收A。公司缝常提供所有者权益报表。通常使用的所有者权益金额的指标包括普通股权益净利率、股利支付率和每股账面价值。 17章投资 l识别债务证券的三种类别,分荆描述各种类别债务证券的合计和报告 处理方法。(1)采用摊余成本记录和报告持有至到期债务证券。(2)出于报告目的,采用公允价值计量交易性债务证券,同时将未实现持有利得或损失计入净收益。(3)出于报告目的,采用公允价值计量可供出售债务证券,同时将来实现持有利得或损失报告为其他全面收益,井作为股东权益的独立组成部分。2理解债券投资的折价和溢价摊销程序。类似于应付缋券, 公司必须采用实际利率法摊销债券投资的折价或溢价。将实际利率或收益率乘以各个利息期间投资的期初账面价值,以计算取得的利息收入。3识 别权益证券的种类,井分别描述各种类别权益证券的盒计和报告处理方法。

中级财务会计含答案

中级财务会计模拟卷 一、判断(对者划√,错者划×) 1、企业在支付现金时,若库存现金不够用,可以直接用当日收入的现金支付。(×) 2、固定资产在计提折旧时,当月增减的固定资产不影响当月计提折旧的数额。(√) 3、现金折扣也就是商业折扣,是企业为了尽快回笼资金而发生的理财费用。(×) 4、在物价上涨时,根据稳健性原则,企业应该采取先进先出法。(×) 5、当市场利率低于票面利率时,债券应溢价发行。(√) 6、银行存款余额调节表用来核对企业与银行双方的记帐有无差错,不能作为记帐的依据。(√) 7、固定资产由于使用或受自然力的影响而发生的自然损耗称为无形损耗。(√) 8、企业在筹集资本过程中,吸收投资者的无形资产的出资最高不得超过企业注册资本的 30% 。(×) 9、永久性差异是由于会计与税收在计算收益时所确认的收支口径不同所造成的,差异在本 期内发生,在以后各期转回。(×) 10、主营业务收入和其他业务收入的划分不是绝对的,一个企业的主营业务收入可能是其他 企业的附营业务收入。(√) 二、选择(1 - 5单选,6 - 10多选) 1、外购存货的实际成本中不包含下列(○3) ○1买价○2运杂费○3增殖税○4途中合理损耗 2、下列(○1)不属于企业的期间费用。 ○1制造费用○2管理费用○3财务费用○4营业费用 3、收到职工的未领工资,应借记“现金”,贷记(○3) ○1应付工资○2应付帐款○3其他应付款○4其他应收款 4、企业在收到下列(○2)时,应在“应收票据”科目核算 ○1银行汇票○2商业汇票○3支票○4银行本票 5、资产负债表的存货项目不应该包括下列(○4) ○1生产成本○2产成品○3原材料○4固定资产 6、下列固定资产中应计提折旧的有(○1○2○4) ○1房屋、建筑物○2融资租入固定资产 ○3经营租赁方式租入固定资产○4经营租赁方式租出固定资产 7、“材料成本差异”帐户的贷方应记录(○2○3)

《中级财务会计》历年试题及答案完整版

中央广播电视大学2002—2003学年度第二学期“开放专科”期末考试 金融、会计学专业中级财务会计试题 2003年7月 一、单项选择:在下列各题的选项中选择一个正确的,并将其序号字母填入题后的括号内(每小题1分,共20分) 1.接受捐赠是企业净资产增加的一个因素,企业对收到的捐赠资产应列作()。 C.资本公积 2.下列不通过“应交税金”账户核算的税种是()。 B.印花税 3.下列各项中,应作为营业费用处理的是()。 D.随商品出售不单独计价的包装物成本 4.摊销开办费时,应借记的账户是()。 D.管理费用 5.企业购进货物存在现金折扣的情况下,应付账款若采用总价法核算,在折扣期内付款得到的现金折扣应作为()。 B.财务费用的减少 6.企业到期的商业汇票无法收回,则应将应收票据本息一起转入()。 D.应收账款 7.盈余公积的来源是()。 C.从税后利润中提取 8.出借包装物的摊余价值应列支的账户是()。 A.营业费用 9.企业生产经营过程中发生的下列支出,应作为长期待摊费用核算的是()。 D.经营租入固定资产改良支出 10.出资者缴付的出资额超过注册资本的差额,会计上应计入()。 D.资本公积 11.下列项目中不属于管理费用的是()。 B.展览费 12.企业发生的亏损,可以用以后年度的税前利润弥补,其弥补期是()。 D.5年 13.下列项目中属于投资活动产生的现金流出是()。 A.购买固定资产所支付的现金 14.下列项目中没有减少现金流量的是()。 B.计提固定资产折旧 15.在存货价格持续上涨的情况下,导致期末存货价值最大的存货计价方法是()。 A.先进先出法 16.下列项目中不属于存货的是()。 C.工程物资

中级财务会计分录题目教学提纲

中级财务会计模拟训练题 一、单项业务题 1、企业开出一张转账支票,支付广告费10000元,请根据该业务编制会计分录。 2、企业于月末计算结转本月的城建税7000元、教育附加费3000元,请根据该业务编制会计分录。 3、甲公司将一项价值200000元、有效期10年的商标使用权,在使用3年后将其对外转让,转让收入180000元已存入银行,营业税率5%。 要求:编制相关的会计分录。 4、某企业月初原材料的计划成本为218000元,材料成本差异为贷方余额2000元,本月购入原材料计划成本为582000元,实际成本为576000元,本月领用材料的计划成本为500000元,其中:产品生产用380000元,车间一般耗用90000元,厂部耗用30000元。(8分) 要求:(1)计算该企业材料成本差异率 (2)编制相关的会计分录。 5、甲公司共有职工500名,其中:生产工人400人,生产车间技术、管理人员40名,企业管理人员60名。2007年4月公司将自己生产的A产品400台作为福利发放给公司全体职工。A产品的单位生产成本为200元,售价为每台310元,甲公司适用的增值税税率为17%。要求:编制相关的会计分录。 6、随同商品出售单独计价的包装物售价40000元,增值税额6800元。商品和包装物价款已全部收取并存入银行,该包装物成本32000元。 要求:编制出售包装物及结转该包装物成本的分录。 7、某企业购入一台需安装设备,购入时支付买价、增值税及运费共计242500元,该设备交付安装时发生安装费15000元,以银行存款支付,设备安装完毕交付使用。 要求:编制相关会计分录。 8.甲企业因销售产品收到乙公司签发的商业承兑汇票一张,票面金额46800元,年利率6%,期限4个月,要求编制票据到期日收到票款的会计分录。 9.某生产企业购入一批材料,实际成本150000元,增值税额25500元,已经运到并验收入库,货款以银行存款支付。该批材料的计划成本为158000元。 要求:编制材料验收入库的分录。 10.某企业购入一台需要安装的设备,购入时发票价格200 000元,税额34 000元,运费8 500元。均以银行存款支付。要求:编制有关会计分录。

中级财务会计 负债总结

负债 一、流动负债 (一)短期借款 (二)应付票据 如果企业在商业汇票到期时无法支付票据款项:①如果是商业承兑汇票,结转至“应付账款”②如果是银行承兑汇票,贷记“短期借款”。 (三)应付账款 注意:①发票先到而货物未到时,用“在途物资”科目记录原材料②货物先到而发票未到时,先按暂估金额或计划成本确定,待下月初将暂估价值冲销③确实无法支付应付账款的,计入“营业外收入”。 (四)预收账款 (五)应付职工薪酬 (1)货币性职工薪酬的计量 ①计提工资应付金额对应科目基本生产车间——生产成本 车间管理部门——制造费用 行政管理部门财务部门销售部门——销售费用 工程部门——在建工程 研发部门——研发支出 ②发钱时 借:应付职工薪酬——工资 贷:银行存款(实际支付总额) 应交税费——应交个人所得税(应由职工个人负担由企业代扣代缴的职工个人所得税) 其他应付款(应由职工个人负担由企业代扣代缴的医疗保险费、养老保险费及住房公积金等) (2)非货币性职工薪酬的计量 ①将自产产品作为非货币性福利发放给职工 (做销售处理) S1:决定向职工发放非货币性福利时 借:生产成本 制造费用(销售费用、管理费用等等) 贷:应付职工薪酬——非货币性福利 S2:向职工实际发放非货币性福利时 借:应付职工薪酬 贷:主营业务成本 应交税费——应交增值税(销项税额) 借:主营业务成本 贷:库存商品 ②将外购商品作为非货币性福利发放给职工时 (计入相关资产成本或当期损益) S1:决定向职工发放非货币性福利时 借:库存商品 贷:库存商品 应交税费——借:生产成本 贷:应付职工薪酬——非货币性福利 S2:向职工实际发放非货币性福利时 借:应付职工薪酬——非货币性福利 贷:库存商品 ③将拥有的住房或租赁的住房等固定资产无偿提供给职工作为非货币性福利时 ?将拥有的住房无偿提供给职工时,按企业对该固定资产每期计提的折旧计量应付职工薪酬 借:(相关科目,参见上面计提工资应付金额对应科目) 贷:应付职工薪酬——非货币性福利 借:应付职工薪酬——非货币性福利

中级财务会计总结

中级财务会计总结 中级财务会计上了两个学期的课程了,最最深刻的一个体会就是“难”,我们刚接触会计是在大一上学期的时候开设的会计基础课程,那时候还老抱怨说太难了,现在才发现那个时候的我们是一群幸福的孩子。还记得上基础会计的时候,李玉萍老师对一班的孩子们说过的一句话,“等你们学完会计估计就只记得一句话,‘有借必有贷,借贷必相等’。”现在想想,要是我们班不跟着四班一块上中财,估计现在那句话就已经灵验了。所以,中级财务会计不仅难,而且很重要。 其实,之前一直都对中财有一种恐惧。一方面,老是觉得我们是工商班,以后可能也不会接触会计方面的课程了,就算学也学不过会计班的,以后找跟会计专业有关的工作时,也会被学会计专业的人比下去的,因为人家企业更乐意去找专业会计,带着这样的想法上课自然是很容易走神的。另一方面,因为我们班不是专业会计,所以在会计上花费的时间自然没有四班的多,或许,他们在自习看会计的时候,我们在上别的课程。这样恶性循环,一班的学习进度和水平就比四班的低了一大截。就上学期的中财期末成绩来看,很明显差距不是一般的大,四班的平均成绩比我们班高出许多,而且我们班还有不少人挂了课,不过我应该是比较幸运的人中的一个,鉴于上学期我们这学班的惨状,这学期我更不敢怠慢了,在中财上下了更多的功夫,特别是期末考试前一段时间。 这学期一开始,我改变了原来看待中财的态度,不管是不是专业学会计的,能学点东西总是好的,或多或少,在以后的职业生涯中会

有用武之地的。相比于上学期课堂上的效率,这学期有了明显的改善和提高,也许是态度决定一切吧。其实从讲课来看,老师懂得东西很多,可是大部分时候我觉得不太容易理解,有较多的专业名词和需要记忆的东西,但是我并没有放弃,课后及时找同学帮忙解释,然后自己再慢慢消化老师课堂上讲解的但是没有听懂的地方。另外我发现中财需要自己动手做一些题才能发现自己到底会不会,只看书也许你能看懂,但是再自己做的时候并没有想象中那么简单。正如上学期一样,考试下来感觉还行,可是成绩并不是很理想。所以吸取教训后,我决定这学期一定要多做题,将书本上的东西理解的更加透彻。不过由于平时看书还是有些欠缺的,所以在期末考试前一段时间,每天早出晚归,将书本从第八章看到十四章完完全全看了好几遍,将习题册上的题也都做了,效果明显比上学期好了许多。 这是我在这一学期的学习状态和感悟,希望老师在新的一年里工作顺利。