金融学专业外文翻译----私募股权投资在新兴市场全球化企业中的角色

中文3478字

本科毕业论文外文原文

外文题目:Financial Foreign Direct Investment: The Role of Private Equity Investments in the Globalization of Firms from

Emerging Markets

出处:Management International Review, 2009:11-26 DOI:10.1007 /s11575-008-0122-9

作者:Tamir Agmon and Avi Messica

原文:

1. Introduction

International business and economic development are closely related. When applying to emerging markets, foreign direct investment (FDI) and development economics are two sides of the same coin. In terms of the classical OLI model of the economics of international business, the multinational enterprises (MNE) brings into play the ownership advantage while the governments of emerging markets bring into play the location advantage (Dunning 2000). For most part, the economics and the strategy of international business focused on the MNE while economic geography from Koopman (1957) to Krugman (1991) and later (as well as development economics) have focused on the country in which the investment takes place.

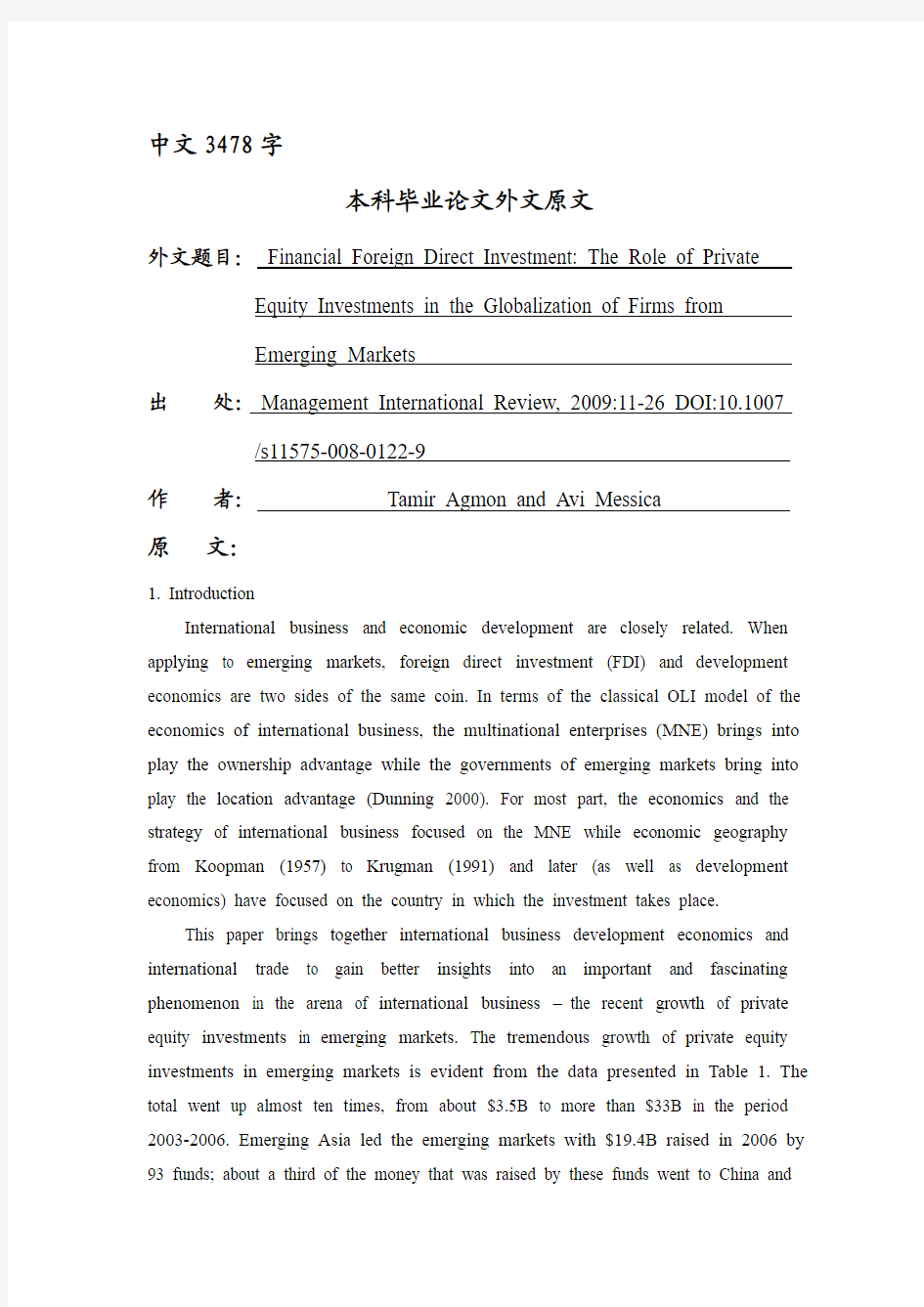

This paper brings together international business development economics and international trade to gain better insights into an important and fascinating phenomenon in the arena of international business –the recent growth of private equity investments in emerging markets. The tremendous growth of private equity investments in emerging markets is evident from the data presented in Table 1. The total went up almost ten times, from about $3.5B to more than $33B in the period 2003-2006. Emerging Asia led the emerging markets with $19.4B raised in 2006 by 93 funds; about a third of the money that was raised by these funds went to China and

India.

The main argument that is presented and discussed in this paper is that private equity investments in emerging markets is another expression of foreign direct investment (FDI) where firms from the developed countries export specific factors of production (their ownership advantage) to small countries and emerging markets (new locations) as a way to generate value to all stakeholders. The firms in the developed countries in this case are specialized financial institutions (private equity funds) (Yoshikawa et al. 2006) and the factor of production that they export is high-risk sector specific capital. We dubbed this form of FDI as financial foreign direct investment (FFDI), but the process and the rational are the same as in the classical FDI analysis. FFDI (synonymous–but not restricted to–for private equity throughout this paper) is a subset of FDI that is solely devoted–as the name implies–for investments in private firms in purpose of generating high return on- investment over a relatively short period (5-7 years). The term “short” is relative and in comparison with the typical investment periods of the investors of private equity funds (e.g., pension funds, endowment funds and the like). At the extreme, i.e., in venture capital investments, investors take into account upfront that some of their investments will be written off at the prospects that few will generate return that will more than compensate those sunk investments (hence the “high-risk” referral). Sector specific capital is a general phenomenon. In many industries such investment is more than mere financial investment and is augmented by specific information that the investor may posses in the form of managerial expertise, deal structuring specialty, networking capabilities and the like. In the case of the high-risk capital industry there is a need to bridge the gap between the risk perception of the investment project by the entrepreneurs or the “insiders” and the investors (most often risk-averse investors), the “outsiders”. This is accomplished by a combination of v alidation processes and screening mechanisms that are engaged by the private equity funds. In this regard they act as financial and risk intermediaries (Coval/Thakor 2005, provide an analytical framework for this approach). The value of the general partners of private equity funds depends on the quality of the risk intermediation that they perform for their investors. This makes them credible and reliable processors of information.

Table 1: Emerging Markets Private Equity Funds Raising, 2003-2006 (US$ Millions)

Emerging Asia CEE

Russia

Latham Sub-Sah

ara

Africa

Middle-

East

Africa

Multi

ple

Regio

ns

Total

2003 2,200 406 417 NA 350 116 3,489 2004 2,800 1,777 714 NA 545 618 6,454 2005 15,446 2,711 1,272 791 1,915 3,630 25,765 2006 19,386 3,272 2,656 2,353 2,946 2,580 33,193 Source: EMPEA (Emerging Markets Private Equity Association) 2007.

The discussion and the analysis presented in this paper draw on three different bodies of literature; the literature of finance and growth from development economics, (Levine 1997, 2004), the literature on comparative advantage in the discussion of patterns of trade (Deardorff 2004) and the literature of imperfect contracts in micro economics and in financial economics (Hart 2001, Zingales 2000).

Financial foreign direct investment as practiced by private equity funds can be a powerful contributor to economic and business growth in emerging markets. FFDI changes the scene of international business as it contributes to a change in the relations between firms in developed countries and firms in the emerging markets. The unique relatively short term nature of a private equity investment makes it an appropriate instrument for the transition period that the world of international business is experiencing regarding the role of emerging markets and the role of China and India in particular. This is so because the short term nature of private equity investments allows firms in emerging markets for sufficient time for transfer of information and learning and yet allow the local stakeholders to resume full ownership once the process is completed.

The relations between the development economics literature on finance and growth and the international business literature is presented and discussed in the next section of the paper. It is shown that the two bodies of literatures are quite related once one penetrates the specific lingo employed by each one of them. The problems in the institutional setting and the lack of sufficient development of the capital

markets in most emerging markets are overcome by creating specific international alliances that generate local comparative advantage. In section three, the concept of local comparative advantage (Deardorff 2004) is used for better understanding of FFDI. The perfect and efficient financial market of the Modern Theory of Finance is replaced by a set of imperfect contracts negotiated and renegotiated between domestic firms in emerging markets and private equity funds from the US and other major capital markets. This issue is discussed and analyzed in section four of the paper. Private equity funds drew a fair amount of criticism lately. The potential of private equity investment in emerging markets is discussed in section five of the paper. The conclusions of the study are briefly discussed in section six, the last section of the paper.

2. Finance, Growth and International Business

In a survey paper on the relations between financial development and economic growth Levine (1997) states that: “…the development of financial markets and in stitutions are critical and inextricable part of the growth process”. He continues and says that: “…financial development is a good predictor of future rates of economic growth, capital accumulation

and technological change. Moreover, cross-country, case study, industry- and firm- level analyses document extensive periods when financial development-or the lack thereof-crucially affect the speed and the pattern of economic development”, (Levine 1997, p. 689). Levine makes two other important points; first that the discussion of finance and developments takes place outside the state-contingent world of Arrow (1964) and Debreu (1959) and the discussion takes place in an incomplete world with imperfect (monopolistic) competition. The second point is that there are three main research questions in the field of finance and development that needs more attention. (1) Why does financial structure change as countries grow? (2) Why do countries at similar stages of economic development have different looking financial systems? and (3) are there longterm economic growth advantages to adopting legal and policy changes that create one type of financial system vis-à-vis another?

The three research questions raised by Levine deal with different aspects of the location of foreign direct investment. In particular, the three research questions deal

with the gap between the potential of a certain country, or countries, as a site for an international oriented investment and the actual investment that has taken place. This is particularly true where the investment from the developed countries is in the form of high-risk sector specific capital such as provided by private equity funds. The potential of some countries in attracting private equity funds is not being fully realized due to the absence of an appropriate financial system. A well developed financial system is necessary to enhance the import of sector specific (high-risk) capital, a necessary condition for FFDI.

As the financial structure of a country changes (as the country grows), it is suggested by Levine in his first question that different types of FDI can be accommodated. The development of FDI in China is an evidence of this process. Yet, as it is proposed in Levine’s second question, the financial markets of countries w ith similar rate of growth develop in different pace and in a different way. There are long-term economic growth advantages of adopting certain patterns of development for the financial market of a given country. In many cases FDI and FFDI do depend on relatively transparent and enforceable corporate governance. Morck, Wolfenzon, and Yeung (2005) demonstrated that economic entrenchment has a high price in foregone growth opportunities.

There are three related problems in creating a domestic financial system for private equity and venture capital investments:

How to mobilize the type and the quantity of savings (capital) appropriate for such investments where most of the capital should be imported from the major capital markets of the world?

How to generate credible information and trust? How to monitor management and to exert corporate control?

The only feasible way to accommodate private equity and venture capital investments in emerging markets is to import sector specific high-risk capital from the US and other major capital markets. The term sector specific capital recognizes the fact that capital is not a unified factor of production (in the same way that there are different types of labor there are different types of capital). High-risk sector specific capital relates to the portfolio of the investors and to the relational capital of the

specific financial intermediaries (i.e., the private equity funds). Most of the high-risk capital in the world is coming from large institutional investors in the US and it is a part of their assets’ management program. (A good example of how such capital relates to the total portfolio is the investment policy of CALPERS the largest pension fund in the US). Due to internal and external regulations, financial institutions cannot make investment unless there is an acceptable level of transparency and corporate governance in the country where the money is invested. Whether such a process is possible in a given developing country and what are the chances that if implemented it will succeed is a very important question. Horii, Ohdoi, and Yamamoto (2005) deal with this issue. They address the question why some developing countries are less successful than others in adopting technologies and more effective financial markets techniq ues. To quote Horii et al. (2005, p. 2): “A fundamental question is why some countries are stuck with poor performance even though it results in primitive financial markets and unproductive technologies”. They conclude that in some cases the expected increase in the income inequality due to the financial led technological changes deters people from adopting financial, legal, and political reforms that will lead to financial, business, and economic development. Morck, Wolfenzon, and Yeung (2005) provide somewhat different answer, also focusing on income distribution but from a point of view of economic entrenchment and rent seeking behavior.

Nowhere the relationship between finance, growth, and international business is more pronounced than in the impressive development of the private equity funds devoted for investment in emerging markets. Table 1 presents data on the growth of private equity funds raised for investment in emerging markets by regions.

The amounts of money raised by private equity funds dedicated for investments in emerging markets went up tremendously in the last five years. More importantly significant amounts were invested to support domestic companies in emerging markets to become more competitive in the global markets by providing their own brands of products to the world’s consumers. Lenovo is a case in point when a major investment by three American private equity funds (Texas Pacific Group, General Atlantic, and Newbridge Capital) was made in a Chinese company with the purpose of making Lenovo a leading competitor in the global market.

译文:

金融类对外直接投资:私募股权投资在新兴市场全球

化企业中的角色

一、简介

国际商业和经济发展密切相关。当应用到新兴市场时,对外直接投资(FDI)和经济的发展是一个问题的两个方面。就国际商务经济传统的OLI模型而言,多国企业(跨国公司)带来发挥所有权优势而新兴市场的政府发挥区位优势(邓宁2000年)。对于大部分,经济学和国际经营战略的重点是跨国公司,而经济地理从库普曼(1957)到克鲁格曼(1991年),后来(还是经济的发展)重点在于一个能够发生投资的国家。

本文汇集了国际业务的发展经济学和国际贸易在国际商业领域里对一个重要的并具有极大吸引力的现象获得更好的见解——私人股权投资在新兴市场近年的增长。从表1中的数据可以呈现出在新兴市场的私人股权投资的巨大增长是显而易见的。在2003-2006年期间,从约3.5b美元到多于33B美元,总计上升了近十倍。亚洲新兴市场在2006年引导新兴市场以93基金筹集19.4B美元,相关的基金所筹集的三分之一的资金是流向中国和印度。

本文提出并探讨的主要论点是,新兴市场的私人股本投资是对外直接投资(FDI)的另一种表现地方,公司从发达国家出口产品的具体因素(其所有权优势)到达小国家和新兴市场(新地点),作为对所有利益相关者创造价值的一种途径。在这种情况下这种公司在发达国家就是专门的金融机构(私募基金)(吉川等人。2006年)和产品因素即他们的出口是高风险行业的特定资本。我们称这种对外直接投资是金融类对外直接投资(FFDI)的形式,但过程和理性在经典的对外直接投资分析中是相同的。 FFDI(同义——但不局限于——贯穿整个文件的私募股权)是对外直接投资仅仅投入的一个子集,-顾名思义-在私人公司投资是为了在一个相对较短的时间(5-7 年)内获得高投资回报的目的。所谓“短”是相对的,而且与私募基金(如养老基金,捐赠基金等)的投资者典型的投资期相比较。在极端情况下,例如,在风险资本投资中,投资者考虑到预付账目,它们的较少产生回报的部分投资将被写入计划中,,以更多补偿那些亏本投资(因此推荐“高风险”)。特定行业的资本是一种普遍的现象。在许多行业,例如投

资不仅仅是金融投资,还是增加了具体的信息使得投资者可以具备管理经验,交易结构设计专业化,具有网络功能之类的形式。以高风险资本业为例需要缩小企业家或行内人和投资者(通常是风险厌恶的投资者)及行外人在投资项目中的风险认知差距。这是通过所从事的私募基金流程的验证和筛选机制的结合完成的。在这方面,他们(科瓦尔/ Thakor 2005年,为这一途径提供了一个分析框架)成为了金融和风险中介机构。私人股权基金的普通合伙人的价值取决于他们为他们的投资者履行的风险中介的质量。这使它们的信息和处理能力是可靠的。

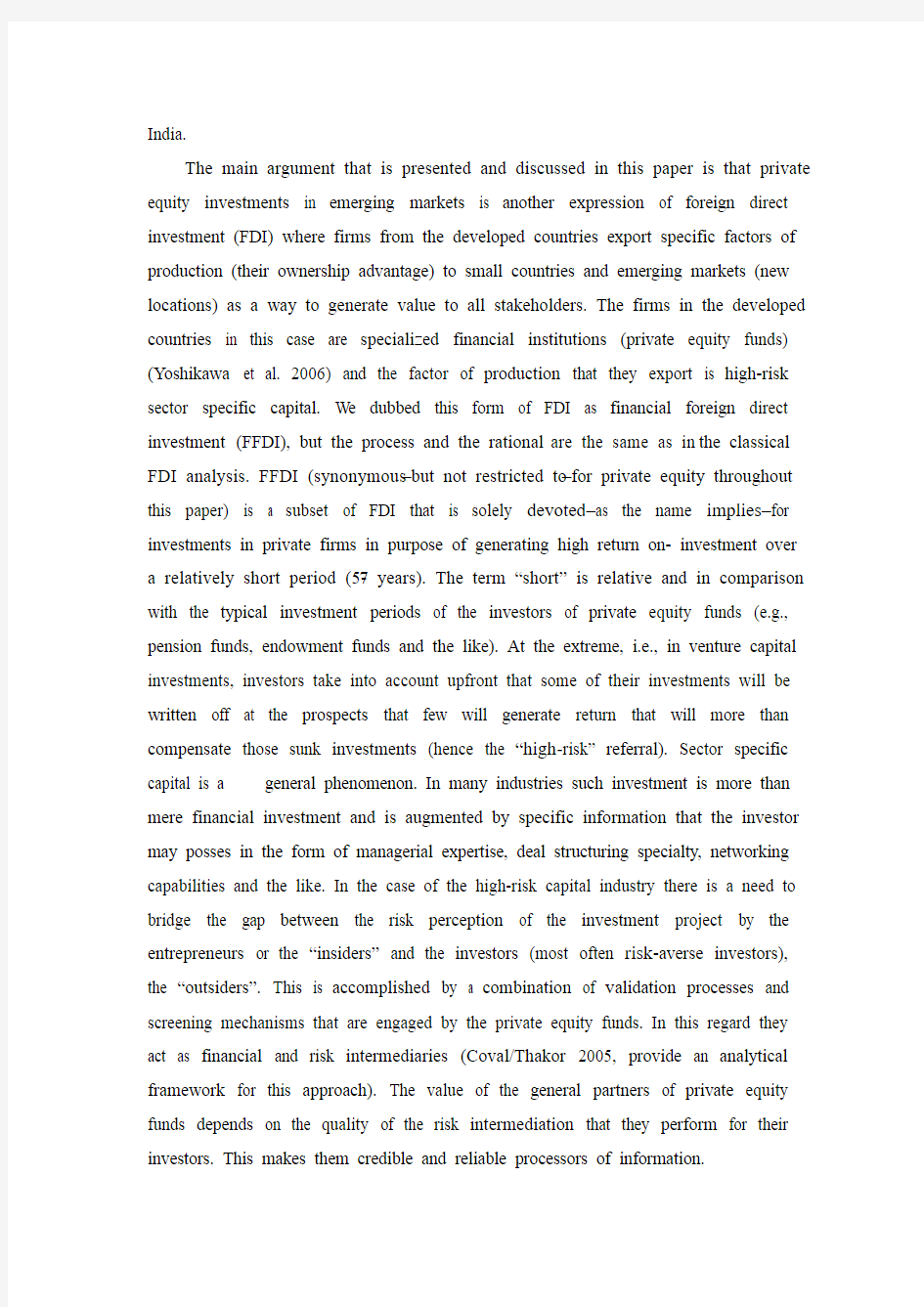

表1:新兴市场私募股权集资,2003-2006(百万美元)

亚洲新兴市场中欧和

东欧俄

罗斯

拉丁美

洲

撒哈拉

以南非

洲

中东非

洲

多区域总计

2003 2,200 406 417 NA 350 116 3,489 2004 2,800 1,777 714 NA 545 618 6,454 2005 15,446 2,711 1,272 791 1,915 3,630 25,765 2006 19,386 3,272 2,656 2,353 2,946 2,580 33,193 来源:EMPEA(新兴市场私募股权协会)2007。

这篇论文的讨论和分析动用了三个不同机构的文献;财政文献和发展经济学的增长(莱文1997年,2004年),在讨论贸易模式中具有比较优势的文献(迪尔多夫2004年),在微观经济学和金融经济学中存在不完善的合同的文献(哈特2001年,津加莱斯2000年)。

作为实行私募股权投资基金,金融类对外直接投资是经济和新兴市场业务增长的强大贡献者。 FFDI改变了国际商业界,因为它改变了在新兴市场与发达国家的公司之间的关系。独特的相对短期性质的私人股权投资使其成为过渡期适当的工具,国际商业界正在经历有关新兴市场的作用,特别是中国和印度的作用。之所以如此,是因为短期的私人股本投资允许公司在新兴市场中有在哦够时间转让信息和学习,一旦过程完成还允许当地利益相关者回复全部所有权。

发展经济学文献对金融和经济增长与国际商业文献之间的关系在论文的下一节提出和讨论。据文献表明,一旦其中一个越过行情迅速增长,这两个机构都相当相当相关。在机构设置问题和资本市场的缺乏充分发展在大多数新兴市场通过创建特定的国际联盟来克服,以产生局部相对的优势。在第三部分,地方比较优势的概念(迪尔多夫2004年)用于FFDI对更好地了解。现代金融理论中完美

和高效的金融市场在新兴市场的国内企业和美国私募投资基金以及其他主要资本市场被一种不确切的合同谈判和重新谈判设置所取代。这个问题在论文的第四节进行了讨论和分析。私募基金最近引起了相当多的批评。私人股权投资在新兴市场的潜力在论文的第五部分进行了讨论。这项研究的结论在第六部分即论文的最后一节进行了简要讨论。

二、财务,经济增长和国际商务

在关于金融发展与经济增长的关系调查的文件中莱文(1997)指出:“...金融市场和机构的发展是成长过程中至关重要的和不可分割的一部分。”他继续说,说:“......金融发展是对未来经济增长利率,资本积累及技术变革很好的预测。此外,绕过国内、个案研究,当金融业的发展或缺乏其中的关键影响速度和经济发展模式,是行业和企业层面的分析文件的广泛时期”,(莱文1997年,第689页)。莱文另外提出了两个重要观点:第一,金融和发展的讨论发生在代表区域(1964年)和德布鲁(1959)之外,以及辩论发生在存在不完美(即垄断)竞争的地方。第二个观点是,在需要更多关注的金融和发展领域有三个主要研究问题。(1)为什么当国家成长时金融结构会发生变化?(2)一国为什么在同样的经济发展阶段有不同表现的金融体系?(三)长期经济增长的优势通过法律和政策变化,能创建一个与另一个相对的金融体系吗?

莱文提出的三个研究问题处理与区域对外直接投资不同的方面。尤其,当一个国际化的投资和实际投资的地点已经产生时,三个研究问题处理的某个国家或所有国家之间的潜在差距。这一点尤其如此,发达国家的投资在高风险行业有特定的资本形式,如由私募股权基金提供。一些国家在吸引私募股权基金的潜力由于缺乏适当的金融体系没有得到充分实现。一个成熟的金融体系是加强特殊行业(高风险)资本的进口的需要,也是FFDI的必要条件。

当一个国家金融结构发生变化(如国家成长),莱文在他的第一个问题里建议不同类型的对外直接投资可以得到满足。对外直接投资在中国的发展是这过程的凭据。还有,国家金融市场以不同速度和不同的方式于经济发展有相似的比率,这是莱文的第二个问题里所提到的。某个国家的金融市场采取一定的发展模式有长期经济增长优势。在许多情况下,FDI和FFDI取决于相对透明和可实施的企业管治。 Morck,Wolfenzon,和Yeung(2005)表明,经济优势已经在放弃价格高增长机会。

有三个与开创国内私人股本和风险资本投资的金融系统相关的问题:

如何调动储蓄(资本)的类型和数量适合大部分资金从世界主要资本市场进口的投资?

如何产生可靠的信息和信任?如何监控管理和发挥企业控制?

适应私人股本和风险资本在新兴市场的投资唯一可行的办法是从美国和其他主要资本市场进口特定行业的高风险资本。长期的特定行业资本承认这样一个事实,即资本不是一个统一的产品要素(劳动类型不同,资本类型不同而用同样的方式)。高风险行业特定资本关系到投资者的投资组合以及金融中介的关系资本(例如,私人股权基金)。在世界上的大多高风险资本是来自美国的大型机构投资者,这是他们的资产管理计划的一部分。(一个关于这些资本如何涉及到总投资组合的很好的例子是美国最大的养老基金加利福尼亚政府雇员退休系统)。由于内部和外部法规,除非有一个提供投资资金的国家的透明度和公司治理达到可接受的水平,否则金融机构不能进行投资。这个过程是在一个特定的发展中国家是否可能以及什么是其实施成功的机会,将是一个非常重要的问题。Horii, Ohdoi, 和 Yamamoto(2005)解决了这个问题。他们处理了这个问题:为什么一些发展中国家比其他在通过技术和更为有效的使用金融市场技术的国家不成功。引用于Horii等。(2005年,第2页):“一个根本的问题是,尽管他导致了原始的金融市场和非生产性技术,为什么一些国家表现欠佳。”他们得出结论,在某些情况下,预期增加的收入不平等导致阻碍了人们通过金融主导的致力于金融,商务和经济发展的金融,法律和政治改革。 Morck, Wolfenzon, 和 Yeung(2005)提供的答案有所不同,重点在于收入分配而不是经济巩固观点和寻租行为。

任何地方的金融,经济增长和国际商务之间的关系比在新兴市场投入资金私人股本投资骄人的发展更为明显。表一列出投资在地区的新兴市场的私人股权投资资金增长数据。

在过去的五年由私募基金筹集的资金款项专用于新兴市场的投资大幅上升。更重要的是大量投资于以支持支持新兴市场的国内公司向全世界的消费者提供自己的品牌产品,从而在全球市场更有竞争力。联想是一个很好的例子,一个中国公司以使联想在全球市场领先竞争对手的目的,作出主要由三个美国私募股本基金(德克萨斯太平洋集团,美国泛大西洋投资集团和新桥资本集团)组成的投资。

零售企业营销策略中英文对照外文翻译文献

零售企业营销策略中英文对照外文翻译文献(文档含英文原文和中文翻译)

译文: 零售企业的营销策略 Philip Kotlor 今天的零售商为了招徕和挽留顾客,急欲寻找新的营销策略。过去,他们挽留顾客的方法是销售特别的或独特的花色品种,提供比竞争对手更多更好的服务提供商店信用卡是顾客能赊购商品。可是,现在这一切都已变得面目全非了。现在,诸如卡尔文·克连,依佐和李维等全国性品牌,不仅在大多数百货公司及其专营店可以看到,并且也可以在大型综合商场和折扣商店可以买到。全国性品牌的生产商为全力扩大销售量,它们将贴有品牌的商品到处销售。结果是零售商店的面貌越来越相似。 在服务项目上的分工差异在逐渐缩小。许多百货公司削减了服务项目,而许多折扣商店却增加了服务项目。顾客变成了精明的采购员,对价格更加敏感。他们看不出有什么道理要为相同的品牌付出更多的钱,特别是当服务的差别不大或微不足道时。由于银行信用卡越来越被所有的商家接受,他们觉得不必从每个商店赊购商品。 百货商店面对着日益增加的价格的折扣店和专业商店的竞争,准备东山再起。历史上居于市中心的许多商店在郊区购物中心开设分店,那里有宽敞的停车场,购买者来自人口增长较快并且有较高收入的地区。其他一些则对其商店形式进行改变,有些则试用邮购盒电话订货的方法。超级市场面对的是超级商店的竞争,它们开始扩大店面,经营大量的品种繁多的商品和提高设备等级,超级市场还增加了它们的促销预算,大量转向私人品牌,从而增加盈利。 现在,我们讨论零售商在目标市场、产品品种和采办、服务以及商店气氛、定价、促销和销售地点等方面的营销策略。 一、目标市场 零售商最重要的决策时确定目标市场。当确定目标市场并且勾勒出轮廓时,零售商才能对产品分配、商店装饰、广告词和广告媒体、价格水平等作出一致的决定。如沃尔玛的目标市场相当明确:

计算机专业毕业设计说明书外文翻译(中英对照)

Talking about security loopholes Richard S. Kraus reference to the core network security business objective is to protect the sustainability of the system and data security, This two of the main threats come from the worm outbreaks, hacking attacks, denial of service attacks, Trojan horse. Worms, hacker attacks problems and loopholes closely linked to, if there is major security loopholes have emerged, the entire Internet will be faced with a major challenge. While traditional Trojan and little security loopholes, but recently many Trojan are clever use of the IE loophole let you browse the website at unknowingly were on the move. Security loopholes in the definition of a lot, I have here is a popular saying: can be used to stem the "thought" can not do, and are safety-related deficiencies. This shortcoming can be a matter of design, code realization of the problem. Different perspective of security loo phole s In the classification of a specific procedure is safe from the many loopholes in classification. 1. Classification from the user groups: ● Public loopholes in the software category. If the loopholes in Windows, IE loophole, and so on. ● specialized software loophole. If Oracle loopholes, Apach e,

市场营销_外文翻译_外文文献_英文文献_顾客满意策略与顾客满意

顾客满意策略与顾客满意营销 原文来源:《Marketing Customer Satisfaction 》自20世纪八十年代末以来, 顾客满意战略已日益成为各国企业占有更多的顾客份额, 获得竞争优势的整体经营手段。 一、顾客满意策略是现代企业获得顾客“货币选票”的法宝随着时代的变迁, 社会物质财富的极大充裕, 顾客中的主体———消费者的需求也先后跨越了物质缺乏的时代、追求数量的时代、追求品质的时代, 到了20世纪八十年代末进入了情感消费时代。在我国, 随着经济的高速发展,我们也已迅速跨越了物质缺乏时代、追求数量的时代乃至追求品质的时代, 到今天也逐步迈进情感消费时代。在情感消费时代, 各企业的同类产品早已达到同时、同质、同能、同价, 消费者追求的已不再是质量、功能和价格, 而是舒适、便利、安全、安心、速度、跃动、环保、清洁、愉快、有趣等,消费者日益关注的是产品能否为自己的生活带来活力、充实、舒适、美感和精神文化品位, 以及超越消费者期望值的售前、售中、售后服务和咨询。也就是说, 今天人们所追求的是具有“心的满足感和充实感”的商品, 是高附加值的商品和服务,追求价值观和意识多元化、个性化和无形的满足感的时代已经来临。 与消费者价值追求变化相适应的企业间的竞争, 也由产品竞争、价格竞争、技术竞争、广告竞争、品牌竞争发展到现今的形象竞争、信誉竞争、文化竞争和服务竞争, 即顾客满意竞争。这种竞争是企业在广角度、宽领域的时空范围内展开的高层次、体现综合实力的竞争。它包括组织创新力、技术创新力、管理创新力、产业预见力、产品研发力、员工向心力、服务顾客力、顾客亲和力、同行认同力、社会贡献力、公关传播沟通力、企业文化推动力、环境适应力等等。这些综合形象力和如何合成综合持久的竞争力, 这就是CSft略所要解决的问题。CS寸代,企业不再以“自己为中心”,而是以“顾客为中心”;“顾客为尊”、“顾客满意”不再是流于形式的口号, 而是以实实在在的行动为基础的企业经营的一门新哲学。企业不再以质量达标, 自己满意为经营理念, 而是以顾客满意, 赢得顾客高忠诚度为经营理念。企业经营策略的焦点不再以争取或保持市场占有率为主, 而是以争取顾客满意为经营理念。因此, 营销策略的重心不再放在竞争对手身上而是放在顾客身上, 放在顾客现实的、潜在的需求上。当企业提供的产品和服务达到了顾客事先的期望值, 顾客就基本满意;如果远远超越顾客的期望值, 且远远高于其他同行, 顾客才真正满意;如果企业能不断地或长久地令顾客满意, 顾客就会忠诚。忠诚的顾客不仅会经常性地重复购买, 还会购买企业其它相关的产品或服务;忠诚的顾客不仅会积极向别人推荐他所买的产品, 而且对企业竞争者的促销活动具有免疫能力一个不满意的顾客会将不满意告诉16-20个人, 而每一个被告知者会再传播给12-15个人。这样, 一个不满意者会影响到二、三百人。在互联网普及的今天, 其影响则更大。据美国汽车业的调查, 一个满意者会引发8笔潜在的生意, 其中至少有一笔会成交。而另一项调查表明, 企业每增加5%的忠诚顾客, 利润就会增长25%-95%。一个企业的80%的利润来自20%的忠诚顾客;而获取一个新顾客的成本是维持一个老顾客成本的6倍。所以,美国著名学者唐?佩 珀斯指出: 决定一个企业成功与否的关键不是市场份额, 而是在于顾客份额。 于是, 企业纷纷通过广泛细致的市场调研、与消费者直接接触、顾客信息反馈等方式来了解顾客在各方面的现实需求和潜在需求。依靠对企业满意忠诚的销售、服务人员, 定期、定量地对顾客满意度进行综合测定, 以便准确地把握企业经营中与“顾客满意” 目标的差距及其重点领域, 从而进一步改善企业的经营活动。依靠高亲和力的企业文化、高效率的人文管理和全员共同努力, 不断地向顾客提供高附加值的产品, 高水准的亲情般的服

金融学专业外文翻译---对简便银行的简单见解

中文3696字 本科毕业论文外文翻译 出处:Infosys Strategic Vision 原文: Insights from Banking Simple By Ashok Vemuri Introduction “A simpler way of banking.We treat with you respect. No extraneous features. No hidden fees.” For the unini tiated, this is the mantra of BankSimple, a Brooklyn-based startup which has positioned itself as a consumer-friendly alternative to traditional banks. BankSimple pushes a message of user experience—sophisticated personal finance analytics, a single “do-it-all” card, superior customer service, and no overdraft fees.Though branchless and primarily online-based, BankSimple is also planning to provide some traditional customer service touches, including phone support and mail-in deposits. Interestingly, BankSimple will also likely not be a bank—at least not in the technical, FDIC sense of the word. Rather, BankSimple’s strategy is to be a front-end focused on the customer experience. The back-end core “bank” component will be FDIC-insured partner banks. Unfettered by years of IT investments and entrenched applications, BankSimple’s team has the freedom to build an innovative, user-friendly online interface, customer service program, and the associated mobile and social bells and whistles that more and more consumers are demanding. One way to look at it is as a wrapper insulating the consumer from the accounting, compliance, and technology challenges that many banks face. Like personal finance sites https://www.360docs.net/doc/d415926246.html, and Wesabe before it, BankSimple is looking to tap into a perceived gap between what major banks provide and what consumers want. A recent survey by ForeSee Results and Forbes found that consumers view online banking as more satisfying than banking done offline. Though good news for the industry as a whole, the survey also found that the five largest banks in the country scored the lowest in the study. Cheaper and more customer friendly, digital banking is the future—but many consumers are finding it is better done with credit unions, community banks, and (down-the-road) startups like BankSimple. As you read, significant investments are being made by banks to improve their online, mobile, and IVR customer-friendliness. Major banks are embracing these channels, and customer satisfaction will likely improve over time. Even so, startups like Bank- Simple should be viewed as a learning opportunity. Their ideas are disruptive and often highlight pain points that need to be addressed. BankSimple’s first two stated philosophies are a good place to start: “A simpler way of banking” and “We treat you with respect.”

中小企业融资外文翻译

本科毕业论文(设计) 外文翻译 原文: Financing of SMEs Abstract The main sources of financing for small and medium sized enterprises (SMEs) are equity, trade credit paid on time, long and short term bank credits, delayed payment on trade credit and other debt. The marginal costs of each financing instrument are driven by asymmetric information and transactions costs associated with nonpayment. According to the Pecking Order Theory, firms will choose the cheapest source in terms of cost. In the case of the static trade-off theory, firms choose finance so that the marginal costs across financing sources are all equal, thus an additional Euro of financing is obtained from all the sources whereas under the Pecking Order Theory the source is determined by how far down the Pecking Order the firm is presently located. In this paper, we argue that both of these theories miss the point that the marginal costs are dependent of the use of the funds, and the asset side of the balance sheet primarily determines the financing source for an additional Euro. An empirical analysis on a unique dataset of Portuguese SME’s confirms that the composition of the asset side of the balance sheet has an impact of the type of financing used and the Pecking Order Theory and the traditional Static Trade-off theory are https://www.360docs.net/doc/d415926246.html, For SME’s the main sources of financing are equity (internally generated cash), trade credit, bank credit and other debt. The choice of financing is driven by the costs of the sources which is primarily determined by costs of solving the asymmetric information problem and the expected costs associated with non-payment of debt. Asymmetric information costs arise from collecting and analysing information to support the decision of extending credit, and the non-payment costs are from

市场营销策略论文中英文资料对照外文翻译

市场营销策略 1 市场细分和目标市场策略 具有需求,具有购买能力并愿意花销的个体或组织构成了市场。然而,在大多数市场中,购买者的需求不一致。因此,对整个市场采用单一的营销计划可能不会成功。一个合理的营销计划应以区分市场中存在的差异为起点,这一过程被称为市场细分,它还包括将何种细分市场作为目标市场。 市场细分使公司能更加有效地利用其营销资源。而且,也使得小公司可以通过集中在一两个细分上场上有效地参与竞争。市场细分的明显缺点是,其导致了比单一产品、单一大市场策略更高的生产和营销成本。但是,如果市场细分得当的话,更加符合消费者的需求,实际上将生产更高的效率。 确定目标市场有三种可供选择的策略,它们是统一市场、单一细分市场和多重细分市场。统一市场策略即采取一种营销组合用到一个整体的、无差异的市场中去。采取单一细分市场策略,公司仍然仅有一种营销组合,但它只用在整个市场的一个细分市场中。多重细分市场策略需要选择两个或更多的细分市场,并且每个细分市场分别采用一种单独的营销组合。 2 产品定位 管理者将注意力集中于一种品牌,并以恰当的方式将其与类似的品牌相区分,但这并不意味着该品牌就一定能够最后赢利。因此,管理者需要进行定位,即塑造与竞争品牌和竞争对手的其他品牌相关的自我品牌形象。 市场营销人员可以从各种定位策略中加以选择。有时,他们决定对某一特定产品采用一种以上的策略。以下是几种主要的定位策略: 2.1与竞争者相关的定位 对一些产品来说,最佳的定位是直接针对竞争对手。该策略特别适用于已经具有固定的差别优势或试图强化这种优势的厂商。为排挤微处理器的竞争对手,Intel公司开展了一项活动使用户确信它的产品优于竞争对手的产品。公司甚至为电脑制造商出钱,让它们在自己的广告中带上“Intel Inside”标志。作为市场领导者,可口可乐公司推出新产品并实施其市场营销策略。同时,它密切注视百事可乐公司,以确保对主要竞争对手的任何一次巧妙、有效的营销举措采取相应的对策。 2.2 与产品类别和属性相关的定位 有时候,公司的定位策略有必要将自己的产品与其类别和属性相联系(或相区别)。一些公司尽力将其产品定位在期望的类别中,如“美国制造”。用一句某顾问的话来说,“当你说‘美国制造’的时候,有一种强烈的感情因素在吸引着你”。因此,一家名为Boston Preparatory的规模不大的运动服制造商正在运用这种定位策略,以期胜过那些并非所有产品都在美国制造的势力强大的竞争对手如Calvin Kiein和Tommy Hilfiger。 2.3 通过价格和质量定位 某些生产者和零售商因其高质量和高价格而闻名。在零售行业,Saks Fifth Avenue和Neiman Marcus公司正是定位于该价格—质量策略的。折扣店Target Kmart则是定位于该策略的反面。我们不是说折扣商店忽视质量,而是说它们更加强调低廉的价格。Penny's公司努力—并且大多获得了成功—通过升级高级服装线和强调设计者的名字将其商店定位于价格—质量策略上。 “品牌”一词是个综合性的概念,它包含其他更狭义的理解。品牌即一个名称和(或)标志,用以识别一个销售者或销售集团的产品,并将之与竞争产品相区别。 品牌名称由能够发音的单词、字母和(或)数字组成。品牌标志是品牌的一部分,它以符号、图案或醒目的颜色、字体的形式出现。品牌标志通过视觉识别,但当人们仅仅读出品牌名称的时候,品牌标志并不能够被表达出来。Crest、Coors、Gillette都是品牌名称。AT&T由醒目的线条构成的地球以及Ralph Lauren's Polo的马和骑手是品牌标志,而Green Giant(罐装冷冻菜蔬产品)和Arm&Hammer(面包苏打)既是品牌名称又是品牌标志。 商标是销售者已经采用并且受到法律保护的品牌。商标不仅包括品牌标志,如许多人所认为的那样,也包括品牌名称。1946年的The Lanham Art法案允许厂商向联邦政府注册商标,以保护它们免受其他厂商的使用或误

计算机专业外文文献翻译6

外文文献翻译(译成中文2000字左右): As research laboratories become more automated,new problems are arising for laboratory managers.Rarely does a laboratory purchase all of its automation from a single equipment vendor. As a result,managers are forced to spend money training their users on numerous different software packages while purchasing support contracts for each. This suggests a problem of scalability. In the ideal world,managers could use the same software package to control systems of any size; from single instruments such as pipettors or readers to large robotic systems with up to hundreds of instruments. If such a software package existed, managers would only have to train users on one platform and would be able to source software support from a single vendor. If automation software is written to be scalable, it must also be flexible. Having a platform that can control systems of any size is far less valuable if the end user cannot control every device type they need to use. Similarly, if the software cannot connect to the customer’s Laboratory Information Management System (LIMS) database,it is of limited usefulness. The ideal automation software platform must therefore have an open architecture to provide such connectivity. Two strong reasons to automate a laboratory are increased throughput and improved robustness. It does not make sense to purchase high-speed automation if the controlling software does not maximize throughput of the system. The ideal automation software, therefore, would make use of redundant devices in the system to increase throughput. For example, let us assume that a plate-reading step is the slowest task in a given method. It would make that if the system operator connected another identical reader into the system, the controller software should be able to use both readers, cutting the total throughput time of the reading step in half. While resource pooling provides a clear throughput advantage, it can also be used to make the system more robust. For example, if one of the two readers were to experience some sort of error, the controlling software should be smart enough to route all samples to the working reader without taking the entire system offline. Now that one embodiment of an ideal automation control platform has been described let us see how the use of C++ helps achieving this ideal possible. DISCUSSION C++: An Object-Oriented Language Developed in 1983 by BjarneStroustrup of Bell Labs,C++ helped propel the concept of object-oriented programming into the mainstream.The term ‘‘object-oriented programming language’’ is a familiar phrase that has been in use for decades. But what does it mean? And why is it relevant for automation software? Essentially, a language that is object-oriented provides three important programming mechanisms:

国际贸易、市场营销类课题外文翻译——市场定位策略(Positioning_in_Practice)

Positioning in Practice Strategic Role of Marketing For large firms that have two or more strategic business units (SBUs), there are generally three levels of strategy: corporate-level strategy, strategic-business-unit-level (or business-level) strategy, and marketing strategy. A corporate strategy provides direction on the company's mission, the kinds of businesses it should be in, and its growth policies. A business-level strategy addresses the way a strategic business unit will compete within its industry. Finally, a marketing strategy provides a plan for pursuing the company's objectives within a specific market segment. Note that the higher level of strategy provides both the objectives and guidelines for the lower level of strategy. At corporate level, management must coordinate the activities of multiple strategic business units. Thus the decisions about the organization's scope and appropriate resource deployments/allocation across its various divisions or businesses are the primary focus of corporate strategy.Attempts to develop and maintain distinctive competencies tend to focus on generating superior financial, capital, and human resources; designing effective organizational structures and processes; and seeking synergy among the firm's various businesses. At business-level strategy, managers focus on how the SBU will compete within its industry. A major issue addressed in business strategy is how to achieve and sustain a competitive advantage. Synergy for the unit is sought across product-markets and across functional department within the unit. The primary purpose of a marketing strategy is to effectively allocate and coordinate marketing resources and activities to accomplish the firm's objectives within a specific product-market. The decisions about the scope of a marketing strategy involve specifying the target market segment(s) to pursue and the breadth of the product line to offered. At this level of strategy, firms seek competitive advantage and synergy through a well-integrated program of marketing mix elements tailored to the needs and wants of customers in the target segment(s). Strategic Role of Positioning Based on the above discussion, it is clear that marketing strategy consists of two parts: target market strategy and marketing mix strategy. Target market strategy consists of three processes: market segmentation, targeting (or target market selection), and positioning. Marketing mix strategy refers to the process of creating a unique

金融学专业外文翻译(中英对照、翻译专业修改好了的)

论文题目:关于巴塞尔II:新巴塞尔资本协议的影响 学院名称:财经学院专业班级:金融0814班学生姓名:王庆贺 外文题目:Dealing with Basel II: the impact of the New Basel Capital Accord 出处:Balance Sheet,2003,Vol.11(No.4) 作者:Thomas Garside and Jens Bech 译文: 关于巴塞尔II:新巴塞尔资本协议的影响 托马斯·加赛德和杰尼斯·伯克 摘要:国际监管机构在2003年完成新资本协议,银行决定在2006年底执行这个协议。巴塞尔协议是对全球银行业改革的监管。在本文中,我们回顾新巴塞尔资本协议内容以及一些我们所期望对欧洲银行业发生的重要影响。正如在第一届巴塞尔协议修正案(Basel I)中,我们得出结论,新巴塞尔协议不仅对持有资本额的数量做了规定,还对银行业的战略格局进行展望。 关键词:银行,流动性,监管,风险管理 新巴塞尔资本协议的新规则 巴塞尔委员会虽然只是公布了三分之一,但这很可能是协商的最后新资本协议(Basel II)文件。这项建议如获通过,将会深刻地改变银行的偿付能力的方式,监管机构监管银行风险管理实施过程和银行必须对市场参与者公布的风险信息量,经过讨论会,巴塞尔委员会预计将在2003年底发布的新资本协议的最后草案。 目前的巴塞尔资本协议(Basel I)对达到加强国际金融体系的稳定的既定目标已经有了显著成效,通过在不同国家持续应用本协议的同时,增加了资本水平,创造了一个更公平的竞争领域。总的来说,目前的全球一级资本的平均水平从1993年的约6%升至8%,此外,巴塞尔资本协议已经应用于100多个国家,远远超过最初的预期。 尽管实现其最初目标的成效很明显,很显然,对于巴塞尔我有一些意想不到的不

中小企业融资的英文文献

中小企业融资的英文文献 Automatically translated text: The definition of lease financing Finance leases (Financial Leasing) also known as the Equipment Leasing (Equipment Leasing), or modern leasing (Modern Leasing), and is essentially transfer ownership of the assets of all or most of the risks and rewards of the lease. The ultimate ownership of assets to be transferred, or may not transfer. It refers to the specific content of the lessee to the lessor under the lease object and the specific requirements of the supplier selection, vendor financing to purchase rental property, and the use of leased to a lessee, the lessee to the lessor to pay instalments rent, the lease term lease ownership of objects belonging to the lessor of all, the tenant has the right to use the leased items. Term expired, and finished the lessee to pay rent under the lease contract financing to fulfil obligations in full, leasing objects that vesting ownership of all the lessee. Despite the finance lease transactions, the lessors have the identity of the purchase of equipment, but the substantive content of the purchase of equipment suppliers such as the choice of the specific requirements of the equipment, the conditions of the purchase contract negotiations by the lessee enjoy and exercise, lessee leasing object is essentially the purchaser. , Is a finance lease extension of loans and trade and technology updates in the new integrated financial industry. Because of its extension of loans and combination of features, there is a problem in leasing companies can recycling, treatment of leasing, and

计算机专业外文翻译

专业外文翻译 题目JSP Technology Conspectus and Specialties 系(院)计算机系 专业计算机科学与技术 班级 学生姓名 学号 指导教师 职称讲师 二〇一三年五月十六日

JSP Technology Conspectus and Specialties The JSP (Java Server Pages) technology is used by the Sun micro-system issued by the company to develop dynamic Web application technology. With its easy, cross-platform, in many dynamic Web application programming languages, in a short span of a few years, has formed a complete set of standards, and widely used in electronic commerce, etc. In China, the JSP now also got more extensive attention; get a good development, more and more dynamic website to JSP technology. The related technologies of JSP are briefly introduced. The JSP a simple technology can quickly and with the method of generating Web pages. Use the JSP technology Web page can be easily display dynamic content. The JSP technology are designed to make the construction based on Web applications easier and efficient, and these applications and various Web server, application server, the browser and development tools work together. The JSP technology isn't the only dynamic web technology, also not the first one, in the JSP technology existed before the emergence of several excellent dynamic web technologies, such as CGI, ASP, etc. With the introduction of these technologies under dynamic web technology, the development and the JSP. Technical JSP the development background and development history In web brief history, from a world wide web that most of the network information static on stock transactions evolution to acquisition of an operation and infrastructure. In a variety of applications, may be used for based on Web client, look no restrictions. Based on the browser client applications than traditional based on client/server applications has several advantages. These benefits include almost no limit client access and extremely simplified application deployment and management (to update an application, management personnel only need to change the program on a server, not thousands of installation in client applications). So, the software industry is rapidly to build on the client browser multilayer application. The rapid growth of exquisite based Web application requirements development of