2012年福建省CFA二级考试试题最新考试试题库

CFA考试《CFA二级》历年真题精选及答案1122-40

CFA考试《CFA二级》历年真题精选及答案1122-401、Based on Exhibit 1, the maximum loss of Strategy 1 is:【单选题】A.¥210.44.B.¥225.76.C.¥232.34.正确答案:A答案解析:A is correct. Strategy 1 is a covered call position using SMTC July 240 calls. A covered call position is a combination of a long position in the shares and a short call option. For this covered call position on SMTC, YCM would have a long position in SMTC shares and a short position in the July 240 call option on SMTC shares. The maximum loss for this covered call position would occur if the SMTC share price fell to zero. The loss on the shares would be reduced by the amount of the premium received from selling the call option. Therefore, the maximum loss of Strategy 1 is the difference between the original share price (S0) and the option premium (c2、Should Costa’s end-of-meeting comments result in changesto Hernández’s capital budgeting analysis?【单选题】A.No.B.Yes, but only to incorporate the possible delay.C.Yes, to incorporate both the possible delay and the cost of producing the prototype.正确答案:B答案解析:B is correct. Timing options (e.g., delay investing) should be included in the NPV analysis, but sunk costs should not.3、Are the two observations Berg records after the fixed income conference accurate?【单选题】A.Both statements are accurate.?B.Only Statement 1 is accurate.C.Only Statement 2 is accurate.正确答案:A答案解析:Statement 1 is correct. Swap markets tend to have more maturities with which to construct a yield curve as compared to government bond markets. Statement 2 is correct. Retail banks tend to have little exposure to swaps and hence are more likely to use the government spot curve as their benchmark.4、【单选题】。

CFA考试《CFA二级》历年真题精选及详细解析1107-74

CFA考试《CFA二级》历年真题精选及详细解析1107-741、Which of the notes made by Bourne regarding the valuation methods is least accurate? The note about the:【单选题】A.Market-based method.parable transactions method.C.Discounted cash flow method.正确答案:B答案解析:The comparable transactions method uses details from recent takeover transactions for comparable companies to make direct estimates of the target company\\\'s takeover value. However it is not necessary to separately estimate a takeover premium as this is already included in the multiples determined from the comparable transactions.2、Based on the relationship of Borgonovo’s stock to the SML, what is the most appropriate decision Benedetti should make regarding the Borgonovo stock?【单选题】A.Keep Borgonovo on the recommended list because it plots below the SML.B.Keep Borgonovo on the recommended list because it plotsabove the SML.C.Remove Borgonovo from the recommended list because it plots below the SML.正确答案:C答案解析:C is correct. The SML required return for Borgonovo is 2.5% + 1.2(7%) = 10.9%. With a forecasted return of 9.0%, Borgonovo lies below the SML (indicating it is overvalued) and should be removed from the bank’s recommended list.3、Based on the regression output in Exhibit 1, there is evidence of positive serial correlation in the errors in:【单选题】A.the linear trend model but not the log-linear trend model.B.both the linear trend model and the log-linear trend model.C.neither the linear trend model nor the log-linear trend model.正确答案:B答案解析:B is correct. The Durbin–Watson statistic for the linear trend model is 0.10 and, for the log-linear trend model, 0.08. Both of these values are below the critical value of 1.75. Therefore, we can reject the hypothesis of no positive serial correlation in the regression errors in both the linear trend model and the log-linear trend model.4、In accounting for the use of derivatives against the three risks that Minor has discovered, the entire gains or losses from the。

CFA考试《CFA二级》历年真题精选及答案1122-47

CFA考试《CFA二级》历年真题精选及答案1122-471、Prior to the president’s intervention, the actions by the farmers relative to the manufacturers over the disputed price of water is best described as:【单选题】A.moral hazard.B.adverse selection.C.regulatory arbitrage.正确答案:A答案解析:A is correct. The farmers’ having the ability to restrict the release of water to the detriment of the manufacturers during the pricing dispute is an example of a moral hazard.2、Based on Exhibit 1, which variable in the Beneish model has a year-over-year change that would increase Miland’s likelihood of manipulation?【单选题】A.DSRB.LEVIC.SGAI正确答案:A答案解析:A is correct. The DSR (days’ sales receivable index)variable in the Beneish model is related positively to the Beneish model M-score. Therefore, a year-over-year increase in DSR from 0.9 to 1.20 would lead to an increase in the M-score, which implies an increase in Miland’s likelihood of manipulation.3、ABC Investment Management acquires a new, very large account with two concentrated positions. The firm’s current policy is to add new accounts for the purpose of performance calculation after the first full month of management. Cupp is responsible for calculating the firm’s performance returns. Before the end of the initial month, Cupp notices that one of the significant holdings of the new accounts is acquired by another company, causing the value of the investment to double. Because of this holding, Cupp decides to account for the new portfolio as of the date of transfer, thereby allowing ABC Investment to reap the positive impact of that month’s portfolio return.【单选题】A.Cupp did not violate the Code and Standards because the GIPS standards allow composites to be updated on the date of large external cash flows.B.Cupp did not violate the Code and Standards because companies are allowed to determine when to incorporate new。

CFA考试《CFA二级》历年真题精选及详细解析1007-4

CFA考试《CFA二级》历年真题精选及详细解析1007-41、If the US dollar were chosen as the functional currency for Acceletron in 2007, Redline could reduce its balance sheet exposure to exchange rates by:【单选题】A.selling SGD30 million of fixed assets for cash.B.issuing SGD30 million of long-term debt to buy fixed assets.C.issuing SGD30 million in short-term debt to purchase marketable securities.正确答案:A答案解析:A is correct. If the US dollar is the functional currency, the temporal method must be used, and the balance sheet exposure will be the net monetary assets of 125 + 230 – 185 – 200 = –30, or a net monetary liability of SGD30 million. This net monetary liability would be eliminated if fixed assets (non-monetary) were sold to increase cash. Issuing debt, either short-term or long-term, would increase the net monetary liability.2、In relation to Kostecka’s handling of the Jabbertalk stockrecommendation, which of the following CFA Institute Standards of Professional Conduct did he least likely violate?【单选题】A.Priority of TransactionsB.Fair Dealingmunication with Clients正确答案:B答案解析:B is correct. Standard III(B)–Fair Dealing requires members and candidates to deal fairly and objectively with all clients when providing investment analysis, making investment recommendations, taking investment action, or engaging in other professional activities. When Kostecka informs clients of the upcoming investment recommendation by Forkson, he has treated all clients fairly because this disclosure is provided to all of his current clients.A is incorrect because Kostecka has violated Standard VI(B)–Priority of Transactions. There is a potential conflict of interest because the client and the adviser hold the same stock, so the client should be given first priority to trade Jabbertalk.C is incorrect because according to Standard V(B)–Communication with Clients and Prospective Clients, Kostecka should have distinguished fact from opinion. In addition, Kostecka should also disclose to clients andprospective clients the basic format and general principles of the investment processes used to analyze investments, select securities, and construct portfolios and must promptly disclose any changes that might materially affect those processes and use reasonable judgment in identifying which factors are important to his investment analyses, recommendations, or actions and include those factors in communications with clients and prospective clients.3、Zhang\'s statement to support using the harmonic mean is best described as:【单选题】A.incorrect with respect to large outliers.B.incorrect with respect to small outliners.C.correct.正确答案:B答案解析:B is correct. Zhang’s statement is incorrect with respect to small outliers. The harmonic mean tends to mitigate the impact of large outliers. It may aggravate the impact of small outliers, but such outliers are bounded by zero on the downside.A is incorrect. The harmonic mean may aggravate the impact of small outliers, but such outliers are bounded by zero on the downside.C is incorrect. The harmonic mean may aggravate the impact of small outliers, but such outliers arebounded by zero on the downside.4、Based on the mean-reverting level implied by the AR(1) model regression output in Exhibit 1, the forecasted oil price for September 2015 is most likely to be:【单选题】A.4、Is Dua most likely correct with regard to the factors that drive demand for different commercial real estate property types?【单选题】A.No, he is incorrect about retail space.B.Yes.C.No, he is incorrect about industrial and warehouse space.正确答案:A答案解析:A is correct. Dua is correct about factors that drive demand for office space and industrial and warehouse space but incorrect about retail space. Employment growth drives demand for office space, while warehouse space demand depends broadly on economic strength. The level of import and export activity is more directly related to demand for industrial and warehouse space, not retail space. Demand for retail space depends on consumer spending, job growth, and economic strength.B is incorrect. Dua is correct about factors that drive demand for office space and industrial and warehouse spacebut incorrect about retail space.C is incorrect. Dua is correct about factors that drive demand for and industrial and warehouse space.5、Bickchip’s cash-flow-based accruals ratio in 2009 is closest to:【单选题】A.9.9%.B.13.4%.C.23.3%.正确答案:A答案解析:A is correct. The cash-flow-based accruals ratio = [ni – (cfo + cfi)]/(Average NOA) =<span style="font-style: " microsoft="" yahei",="" 微软雅黑;"="">[4,038 – (9,822 – 10,068)]/43,192 = 9.9%.6、The fraction of SGC\'s market price that is attributable to the value of growth is closest to:【单选题】A.21%.B.34%.C.50%.正确答案:B答案解析:Using the Pastor-Stambaugh model to calculate SGC\'s cost of equity:0.04 + (1.20 × 0.05) + (0.50 × 0.02) + (–0.20 × 0.04) + (0.20 × 0.045) =11.10%<imgsrc="https:///bkwimg/up/201911/1118 8395e98f83e5435892d6bc291037a70f.png" alt="" width="222" height="45" title="" align="">$28.45 = $18.74 + PVGOPVGO = $9.71PVGO/Price = $9.71/$28.45 = 34.13%7、Based on Exhibit 2, the implied credit and liquidity risks as indicated by the historical three-year swap spreads for Country B were the lowest:【单选题】A.1 month ago.B.6 months ago.C.12 months ago.正确答案:B答案解析:B is correct. The historical three-year swap spread for Country B was the lowest six months ago. Swap spread is defined as the spread paid by the fixed-rate payer of an interest rate swap over the rate of the “on the run” (most recently issued) government bond security with the same maturity as the swap. The lower (higher) the swap spread, the lower (higher) the return that investors require for credit and/or liquidity risks.The fixed rate of the three-year fixed-for-floating Libor swap was 0.01% six months ago, and the three-year government bond yield was –0.08% six months ago. Thus theswap spread six months ago was 0.01% – (–0.08%) = 0.09%.One month ago, the fixed rate of the three-year fixed-for-floating Libor swap was 0.16%, and the three-year government bond yield was –0.10%. Thus the swap spread one month ago was 0.16% – (–0.10%) = 0.26%.Twelve months ago, the fixed rate of the three-year fixed-for-floating Libor swap was 0.71%, and the three-year government bond yield was –0.07%. Thus, the swap spread 12 months ago was 0.71% – (–0.07%) = 0.78%.8、Using the data in Exhibit 2, the portfolio’s annual 1% parametric VaR is closest to:【单选题】A.CAD 17 million.B.CAD 31 million.C.CAD 48 million.正确答案:B答案解析:B is correct. The VaR is derived as follows:VaR = [(e(rp) – 2.33σp)(–1)](Portfolio value)whereE(Rp) = Annualized daily return = (0.00026 × 250) = 0.065250 = Number of trading days annually2.33 = Number of standard deviations to attain 1% VaR<imgsrc="https:///bkwimg/up/201910/1025 1224ff09b79546919adff44ced35b5d9.png" alt="" width="613" height="50" title="" align="">Portfolio value = CAD260,000,000VaR = –(0.065 – 0.184571) × CAD 260,000,000= CAD31,088,4609、Confabulated’s reported interest income would be lower if the cost was the same but the par value (in € thousands) of:【单选题】A.Bugle was €28,000.B.Cathay was €37,000.C.Dumas was €55,000.正确答案:B答案解析:B is correct. The difference between historical cost and par value must be amortized under the effective interest method. If the par value is less than the initial cost (stated interest rate is greater than the effective rate), the interest income would be lower than the interest received because of amortization of the premium.10、Is his response to Scahill’s question regarding the impact of changes in interest rate volatility on the OAS of callable and putable bonds, Morgan is most likely:【单选题】A.incorrect about callable and putable bonds.B.correct about callable bonds and incorrect about putable bonds.C.correct about putable bonds and incorrect about callablebonds.正确答案:A答案解析:A is correct. Morgan’s response to Scahill is incorrect. As interest rate volatility declines, the embedded call option becomes cheaper; thus, the higher the arbitrage-free value (or model value) of the callable bond.Callable bond value = Value of straight bond – Value of call optionA higher value for the callable bond means that a higher spread needs to be added to one-period forward rates to make the arbitrage-free bond value equal to the market price (i.e., the OAS is higher). For putable bonds as interest rate volatility declines, the value of the put option declines as does the arbitrage-free value of the putable bond.Putable bond value = Value of straight bond + Value of put optionThis implies that a lower spread needs to be added to one-period forward rates to make the arbitrage free bond value equal to the market price. Thus, in this instance, the OAS is lower.B is incorrect. Morgan is correct about the impact on OAS for callable bonds.C is incorrect. Morgan is correct about the impact on OAS for putable bonds.。

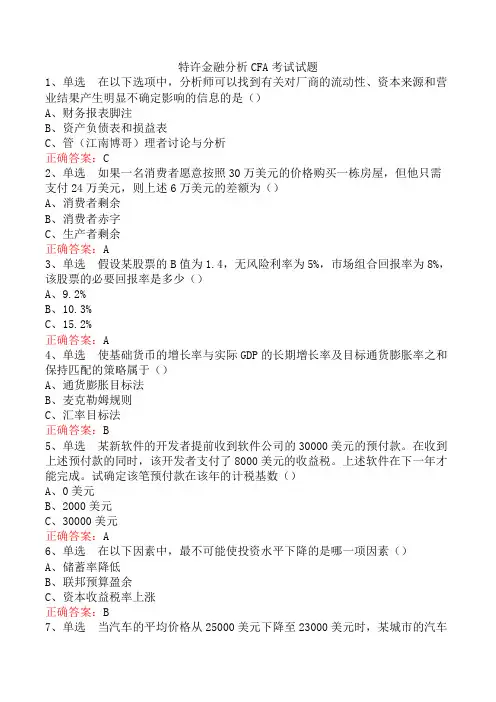

特许金融分析CFA考试试题

特许金融分析CFA考试试题1、单选在以下选项中,分析师可以找到有关对厂商的流动性、资本来源和营业结果产生明显不确定影响的信息的是()A、财务报表脚注B、资产负债表和损益表C、管(江南博哥)理者讨论与分析正确答案:C2、单选如果一名消费者愿意按照30万美元的价格购买一栋房屋,但他只需支付24万美元,则上述6万美元的差额为()A、消费者剩余B、消费者赤字C、生产者剩余正确答案:A3、单选假设某股票的B值为1.4,无风险利率为5%,市场组合回报率为8%,该股票的必要回报率是多少()A、9.2%B、10.3%C、15.2%正确答案:A4、单选使基础货币的增长率与实际GDP的长期增长率及目标通货膨胀率之和保持匹配的策略属于()A、通货膨胀目标法B、麦克勒姆规则C、汇率目标法正确答案:B5、单选某新软件的开发者提前收到软件公司的30000美元的预付款。

在收到上述预付款的同时,该开发者支付了8000美元的收益税。

上述软件在下一年才能完成。

试确定该笔预付款在该年的计税基数()A、0美元B、2000美元C、30000美元正确答案:A6、单选在以下因素中,最不可能使投资水平下降的是哪一项因素()A、储蓄率降低B、联邦预算盈余C、资本收益税率上涨正确答案:B7、单选当汽车的平均价格从25000美元下降至23000美元时,某城市的汽车需求数量从3300辆上升至34000辆,则价格需求弹性等于()A、-1.87B、-0.36C、-0.15正确答案:B8、单选当宏观经济处于充分就业的GDP水平时,货币供给的增长最有可能导致的长期影响是()A、更高的产出B、更高的价格C、更低的失业率水平正确答案:B9、单选金融资本最不可能受到以下哪一项的影响?()A、利率B、消费者的收入C、实物资本的MRP正确答案:C10、单选由64名超市顾客组成的随机样本显示顾客的平均消费金额为43美元。

假设该分布符合正态分布,且总体标准差为15美元,则总体平均值的90%的置信区间最接近于()A、41.085~44.915B、40.218~45.782C、39.916~46.084正确答案:C11、问答题特许金融分析师CFA考试科目有哪些?正确答案:①职业标准和操守;②财务报表分析;③量化分析;④经济学参考解析:试题答案①职业标准和操守;②财务报表分析;③量化分析;④经济学;⑤固定收益投资分析;⑥股权分析;⑦投资组合管理;⑧企业金融;⑨衍生工具;⑩其他投资分析等等。

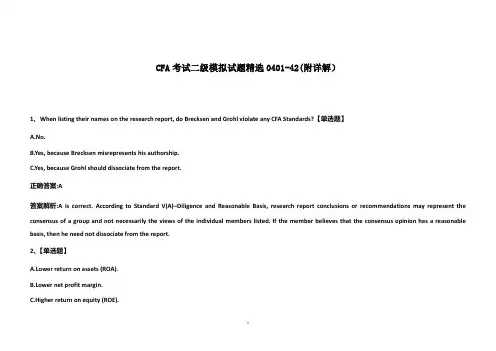

CFA考试二级模拟试题精选0401-42(附详解)

CFA考试二级模拟试题精选0401-42(附详解)1、When listing their names on the research report, do Brecksen and Grohl violate any CFA Standards?【单选题】A.No.B.Yes, because Brecksen misrepresents his authorship.C.Yes, because Grohl should dissociate from the report.正确答案:A答案解析:A is correct. According to Standard V(A)–Diligence and Reasonable Basis, research report conclusions or recommendations may represent the consensus of a group and not necessarily the views of the individual members listed. If the member believes that the consensus opinion has a reasonable basis, then he need not dissociate from the report.2、【单选题】A.Lower return on assets (ROA).B.Lower net profit margin.C.Higher return on equity (ROE).正确答案:A答案解析:In 2012, Cupernico and Glace shared joint control. Cupernico must use the equity method under US GAAP; if the ownership structure had not changed, Cupernico would have continued to use the consolidation method.3、All else equal, the use of long-maturity debt is expected to be greater in those markets in which:【单选题】A.inflation is low.B.capital markets are passive and illiquid.C.the legal system’s protection of bondholders’ interests is weak.正确答案:A答案解析:A is correct. The use of long-maturity debt is expected to be inversely related to the level4、If the NexTec floater had a 3% cap, the value of this embedded cap for the issuer would be closest to:【单选题】A.1.57.B.1.09.C.0.49.正确答案:C答案解析:C is correct. Value of capped bond = Value of the straight bond – Value of embedded cap. To calculate this value, we need to calculate the value from the binomial interest rate tree, capping all cash flows at $3 (3% of $100). The valuation is highlighted below.5、Which of MacPhail's observations about the new executive compensation plan is most accurate?【单选题】A.1B.2C.3正确答案:A答案解析:6、Using the approach suggested by Medeva and the data in Exhibit 1, which of the three countries most likely indicates the highest growth rate in potential GDP?【单选题】A.Country X.B.Country Y.C.Country Z.正确答案:B答案解析:Using the labor productivity growth accounting equation, Country Z indicates the highest growth rate in potential GDP.7、If Gronola is reclassified as available for sale, the balance sheet carrying value of Nelson's investment portfolio (in € thousands) at December 31, 2016 would be closest to:【单选题】A.128,000.B.165,000.C.134,000正确答案:C答案解析:Basin and Gronola will be measured at their market value where Cathay is measured at cost. Therefore, the value will be €26,000+34,000+74,000 = €134,000. A is incorrect because Gronola should be valued at market value. B is incorrect because held to maturity asset is valued at cost.8、【单选题】A.37.3%.B.58.2%.C.62.8%.正确答案:A答案解析:If the company plans on spending $160 million on net investments, then only 60% of the funds need to come from retained9、Which of the following analysts most likely provides the correct answer to Yusuf’s question on the contribution to active return?【单选题】A.QuekB.CerraC.Singh正确答案:B答案解析:B is correct. Cerra is correct. To determine which factor contributes most to active return, note the following:10、Based on each firm's forecasts of the estimated NPV of synergies from a merger between Alertron and Carideo, what payment method is each firm likely to prefer in the deal?【单选题】A.Both firms prefer a cash deal.B.Only Alertron prefers a cash deal.C.Only Carideo prefers a cash deal.正确答案:A。

CFA二级练习题精选及答案0531-5

CFA二级练习题精选及答案0531-5CFA二级练习题精选及答案0531-51、Under the option analogy of the structural model, owninga company's debt is economically equivalent to owning a riskless bond and simultaneously:【单选题】A.buying an American put option on the assets of the company.B.selling a European put option on the assets of the company.C.buying a European put option on the assets of the company.正确答案:B答案解析:Under the structural model's debt option analogy, owning a company's debt is economically equivalent to owning a riskless bond that pays K dollars at time T, plus simultaneously selling a European put option on the assets of the company with maturity T and strike price K.2、Based on the given Z-spreads for Bonds 1, 2, and 3, which bond has the greatest credit and liquidity risk?【单选题】A.Bond 1B.Bond 2C.Bond 3正确答案:C答案解析:C is correct. Although swap spreads provide a convenient way to measure risk, a more accurate measure of credit and liquidity risk is called the zero-spread (Z-spread). It is the constant spread that, added to the implied spot yield curve, makes the discounted cash flows of a bond equal to its current market price. Bonds 1, 2, and 3 are otherwise similar but have Z-spreads of 0.55%, 1.52%, and 1.76%, respectively. Bond 3 has thehighest Z-spread, implying that this bond has the greatest credit and liquidity risk.3、Is Madison correct in describing key differences in equilibrium and arbitrage-free models as they relate to the number of parameters and model accuracy?【单选题】A.Yes.B.No, she is incorrect about which type of model requires fewer parameter estimates.C.No, she is incorrect about which type of model is more precise at modeling market yield curves.正确答案:A答案解析:A is correct. Consistent with Madison’s statement, equilibrium term structure models require fewer parameters to be estimated relative to arbitrage-free models, and arbitrage-free models allow for time-varying parameters.Consequently, arbitrage-free models can model the market yield curve more precisely than equilibrium models.4、Tyo’s assistant should calculate a forward rate closest to:【单选题】A.9.07%.B.9.58%.C.9.97%.正确答案:A答案解析:A is correct. From the forward rate model, f(3,2), is found as follows:[1 + r(5)]5 = [1 + r(3)]3[1 + f(3,2)]2Using the three-year and five-year spot rates, we find(1 + 0.107)5 = (1 + 0.118)3[1 + f(3,2)]2, so5、Based on Exhibit 1, the best action that an investor shouldtake to profit from the arbitrage opportunity is to:【单选题】A.buy on Frankfurt, sell on Eurex.B.buy on NYSE Euronext, sell on Eurex.C.buy on Frankfurt, sell on NYSE Euronext.正确答案:A答案解析:A is correct. This is the same bond being sold at three different prices so an arbitrage opportunity exists by buying the bond from the exchange where it is priced lowest and immediately selling it on the exchange that has the highest price. Accordingly, an investor would maximize profit from the arbitrage opportunity by buying the bond on the Frankfurt exchange (whi ch has the lowe st price of €103.7565) and selling it on the Eurex exchange (which has the highest price of €103.7956) to generate a risk-free profit of €0.0391 (as mentioned, ignoring transaction costs) per €100 par.B is incorrect because buying on NYSE Euronext and selling on Eurex would result in an €0.0141 profit per €100 par (€103.7956 –€103.7815 = €0.0141), which is not the maximum arbitrage profit available. A greater profit would be realized if the bond were purchased in Frankfurt and sold on Eurex.C is incorrect because buying on Frankfurt and selling on NYSE Euronext would result in an €0.0250 profit per €100 par (€103.7815 –€103.7565 = €0.0250). A greater profit would be realized if the bond were purchased in Frankfurt and sold on Eurex.。

CFA考试《CFA二级》历年真题精选及详细解析1107-33

1、Based on Exhibit 2, forecasted interest expense will reflect changes in Chrome’s debt level under the forecast assumptions used by:【单选题】

A.62.7%.

B.67.0%.

C.69.1%.

正确答案:C

答案解析:C is correct. The calculation of Archway’s gross profit margin for 2015, which reflects the industry-wide 8% inflation on cost of goods sold (COGS), is calculated as follows:

A.Candidate A.

B.Candidate B.

C.Candidate C.

正确答案:A

答案解析:A is correct. In forecasting financing costs such as interest expense, the debt/equity structure of a company is a key determinant. Accordingly, a method that recognizes the relationship between the income statement account (interest expense) and the balance sheet account (debt) would be a preferable method for forecasting interest expense when compared with methods that forecast based solely on the income statement account. By using the effective interest rate (interest expense divided by average gross debt), Candidate A is taking the debt/equity structure into account whereas Candidate B (who forecasts 2013 interest expense to be thesame as 2012 interest expense) and Candidate C (who forecasts 2013 interest expense to be the same as the 2010–2012 average interest expense) are not taking the balance sheet into consideration.

CFA考试《CFA二级》历年真题精选及详细解析1007-3

CFA考试《CFA二级》历年真题精选及详细解析1007-41、In replying to Hextall’s recollection of the financial crisis, Klink most likely considered which risk measure?【单选题】A.VaRB.Scenario analysisC.Sensitivity analysis正确答案:B答案解析:B is correct. Scenario analysis is used for estimating how a portfolio might perform under conditions of market stress. Scenario risk measures estimate the portfolio returns that would result from a hypothetical change in markets. Stress tests and reverse stress tests are closely related to scenario risk measures. In addressing the possibility of direct exposure to extreme, negative events, Klink is describing a reverse stress test in which specific exposures of the portfolio (10 in this example) are identified. A hypothetical stress test (“reverse stress test”) is designed to measure its effect on each of these exposures.A is incorrect. VaR is used to measure the probabilityof a large loss. One limitation of VaR is its failure to take into account illiquidity.C is incorrect. Sensitivity analysis is used to estimate how gains and losses in the portfolio change with changes in the underlying risk factors. For a short-term investment portfolio consisting entirely of short-duration, high-credit-quality fixed-income securities, there is likely little or no exposure to market sensitivity risk measures, such as beta, duration, convexity, delta, and gamma.2、Stephenson’s return objective and risk tolerance are most appropriately described as:【单选题】A.Return Objective: Below average; Risk Tolerance: Above average.B.Return Objective: Above average; Risk Tolerance: Below average.C.Return Objective: Above average; Risk Tolerance: Above average.正确答案:C答案解析:C is correct.Risk: Stephenson has an above-average risk tolerance based on both his ability and willingness to assume risk. His large asset base, long time horizon, ample income to cover expenses, and lack of need for liquidity or cash flow indicate an above-average ability to assume risk. Hisconcentration in US small-capitalization stocks and his desire for high returns indicate substantial willingness to assume risk.Return: Stephenson’s financial circumstances (long time horizon, sizable asset base, ample income, and low liquidity needs) and his risk tolerance warrant an above-average total return objective. His expressed desire for a continued return of 20 percent, however, is unrealistic. Coppa should counsel Stephenson on what level of returns to reasonably expect from the financial markets over long periods of time and to define an achievable return objective.3、Stephenson’s time horizon is best characterized as:【单选题】A.short-term and single-stage.B.long-term and single-stage.C.long-term and multistage.正确答案:C答案解析:C is correct. Stephenson’s time horizon is long—he is currently only 55 years old. The time horizon consists of two stages: the first stage extends to his retirement in 15 years; the second stage may last for 20 years or more and extends from retirement until his death.4、Is Quek’s response to Yusuf most likely correct?【单选题】A.Yes.B.No, she is incorrect regarding the number of factors.C.No, she is incorrect regarding the identity of the factors.正确答案:B答案解析:B is correct. Quek is incorrect in stating that APT specifies the number of factors in a multifactor model but is correct in stating that APT does not specify the identity of factors in a multifactor model. APT does not indicate the number of factors or their identity.A is incorrect. Quek is incorrect in stating that APT specifies the number of factors in a multifactor model but correct in stating that APT does not specify the identity of factors in a multifactor model. APT does not indicate the number of factors or their identity.C is incorrect. Quek is correct in stating that APT does not specify the identity of factors in a multifactor model. APT does not indicate the number of factors or their identity.5、Is Hextall’s statement regarding the private wealth division likely correct?【单选题】A.Yes.B.No, it is incorrect about forward-looking beta.C.No, it is incorrect about ex ante tracking error.正确答案:A答案解析:A is correct. Hextall’s statement is correct. Riskmeasures for banks are typically focused on liquidity, solvency, and capital sufficiency, whereas risk measures for traditional asset managers are typically focused on investment performance. Ex ante tracking error correctly compares the current portfolio with its benchmark in attempting to measure future potential performance. Forward-looking beta is a current risk measure of a current portfolio and measures an equity portfolio’s sensitivity to the broad equity market.B is incorrect. Hextall’s statement about forward-looking beta is correct.C is incorrect. Hextall’s statement about ex ante tracking error is correct.。

CFA考试《CFA二级》历年真题精选及详细解析1007-15

CFA考试《CFA二级》历年真题精选及详细解析1007-151、In regard to calculating Wadgett's FCFF, the comment that is most appropriate is the one dealing with:【单选题】A.working capital adjustments.B.treatment of all non-cash charges.C.treatment of net borrowing.正确答案:A答案解析:A is correct. Cash flow from operations (CFO) already reflects changes in working capital items, therefore Paschel\\\\'s first comment is correct. EBITDA has the non-cash charges of depreciation and amortization added back, so Covey\\\\'s statement is incorrect, not all non-cash charges will need to be added back. Net borrowing is added back for FCFE not FCFF, so Paschel\\\\'s second statement is incorrect.B is incorrect. Depreciation has already been added back to EBITDA, though there may be other items that still need to be added back.C is incorrect. Adjusting for net borrowing is not necessary for FCFF (just FCFE).2、Honoré describes three potential consequences of multicollinearity. Are all three consequences correct?【单选题】A.Yes.B.No, 1 is incorrectC.No, 2 is incorrect正确答案:B答案解析:B is correct. The R2 is expected to increase, not decline, with a new independent variable. The other two potential consequences Honoré describes are correct.3、Ibarra wants to know the credit spread of bond B2 over a theoretical comparable-maturity government bond with the same coupon rate as this bond. The foregoing credit spread is closest to:【单选题】A.108 bps.B.101 bps.C.225 bps.正确答案:A答案解析:A is correct. The corporate bond’s fair value is computed in the solution to Question 8 as €1,101.24The YTM can be obtained by solving the following equation for IRR:The solution to this equation is 3.26%.Valuation of a four-year, 6% coupon bond under no default (VND) is computed in thesolution to Question 8 as 1,144.63. So, the YTM of a theoretical comparable-maturity government bond with the same coupon rate as the corporate bond B2 can be obtained by solving the following equation for IRR:The solution to this equation is 2.18%. So, the credit spread that the analyst wants to compute is3.26% – 2.18% = 1.08%, or 108 bps.B is incorrect, because that is the spread over the four-year government par bond that has a YTM of 2.25% in Exhibit 2: 3.26% – 2.25% = 1.01%, or 101 bps. Although this spread is commonly used in practice, the analyst is interested in finding the spread over a theoretical 6% coupon government bond.C is incorrect, because that is the YTM of the coupon four-year government bond in Exhibit 2.4、Based on Exhibit 1, which independent variables in Varden’s model are significant at the 0.05 level?【单选题】A.ESG onlyB.10.957%.C.Tenure onlyD.Neither ESG nor tenure正确答案:C答案解析:B is correct. The t-statistic for tenure is 2.308, which is significant at the 0.027 level. The t-statistic for ESG is 1.201, with a p-value of 0.238. This result is not significant at the 0.05level.5、Based on Exhibit 1 and Tyo’s expectations, which country’s term structure is currently best for traders seeking to ride the yield curve?【单选题】A.Country AB.Country BC.Country C正确答案:A答案解析:A is correct. Country A’s yield curve is upward sloping—a condition for the strategy—and more so than Country B’s.6、To correct the problem Hake encounters when using a Monte Carlo simulation, he would most likely:【单选题】A.adjust the volatility assumption.B.increase the number of simulations.C.add a constant to all interest rates on all paths.正确答案:C答案解析:Using a Monte Carlo simulation, the model will produce benchmark bond values equal to the market prices only by chance. A constant is added to all interest rates on all paths such that the average present value for each benchmark bond equals its market value.A is incorrect because adjustingthe volatility assumption will generate another random value not equal to the benchmark bond value. The benchmark bond is option-free, so its value should not be affected by interest rate volatility.B is incorrect because increasing the model beyond 2000 paths will not lead to a different average value for the benchmark bond.7、Which forward rate cannot be computed from the one-, two-, three-, and four-year spot rates? The rate for a:【单选题】A.one-year loan beginning in two years.B.two-year loan beginning in two years.C.three-year loan beginning in two years.正确答案:C答案解析:C is correct. There is no spot rate information to provide rates for a loan that terminates in five years. That is f(2,3) is calculated as follows: The equation above indicates that in order to calculate the rate for a three-year loan beginning at the end of two years you need the five year spot rate r(5) and the two-year spot rate r(2). However r(5) is not provided.8、Cannan has been working from home on weekends and occasionally saves correspondence with clients and completed work on her home computer. Because of worsening market conditions, Cannan is one of several employees released by herfirm. While Cannan is looking for a new job, she uses the files she saved at home to request letters of recommendation from former clients. She also provides to prospective clients some of the reports as examples of her abilities.【单选题】A.Cannan violated the Code and Standards because she did not receive permission from her former employer to keep or use the files after her employment ended.B.Cannan did not violate the Code and Standards because the files were created and saved on her own time and computer.C.Cannan violated the Code and Standards because she is prohibited from saving files on her home computer.正确答案:A答案解析:Answer A is correct. According to Standard V(C)–Record Retention, Cannan needed the permission of her employer to maintain the files at home after her employment ended. Without that permission, she should have deleted the files. All files created as part of a member’s or candidate’s professional activity are the property of the firm, even those created outside normal work hours. Thus, answer B is incorrect. Answer C is incorrect because the Code and Standards do not prohibit using one’s personal computer to complete work for one’s employer.9、Based on the data in Exhibit 1, current real short-term interest rates would most likely be highest in:【单选题】A.Country #1.B.Country #2.C.Country #3.正确答案:B答案解析:B is correct. Real short-term interest rates are positively related to both real GDP growth and the volatility of real GDP growth. Country #1 and Country #2 have the highest real GDP growth, as estimated by the difference between nominal GDP growth and average inflation (6.5% – 4.0% = 2.5% and 5.0% – 2.5% = 2.5%, respectively), while Country #3 has the lowest real GDP growth (3.5% – 2.0% = 1.5%). Looking at the volatility of real GDP growth, Country #2 has high real GDP growth volatility, whereas Country #1 and Country #3 have low real GDP growth volatility. Therefore, Country #2 would most likely have the highest real short-term interest rates.10、Which approach would an appraiser most likely use for valuing Property #2?【单选题】A.Cost approach.B.Income approach.C.Sales comparison approach.正确答案:B答案解析:Property #2 is an older office building with unique characteristics that could not be easily reproduced using current architectural designs and materials. Therefore, the cost approach would be less appropriate than the income approach as a basis for appraisal. The sales comparison approach would also be less suitable as the property is relatively unique.。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

1、( )反映自年度资产负债表日至财务报告批准报出Et之间发生的需要告诉或说明的事项。

A.会计政策

B.会计估计

C.或有事项

D.资产负债表日后事项

2、在证券业绩评估的各指标中,以证券市场线为基准的是( )。

A.詹森指数

B.特雷诺指数

C.夏普指数

D.威廉指数

3、证券分析师的主要职能包括( )。

A.运用各种有效信息,对证券市场或个别证券的未来走势进行分析预测,对投资证券的可行性进行分析评判

B.为投资者的投资决策过程提供分析、预测、建议等服务,传授投资技巧,倡导投资理念,引导投资者进行理性投资

C.为涉及上市公司收购、兼并、重组等方面的业务提供财务顾问服务

D.为主管部门、地方政府等的决策提供依据

4、某债券面值100元,每半年付息一次,利息4元,债券期限为5年,若有一投资者在该债券发行时以10

5、宏观经济分析的总量分析法侧重对经济系统中各组成部分及其对比关系变动规律的分析。

( )

6、资产负债表仅提供期末有关资产、负债、所有者权益的数据。

( )

7、资产负债表仅提供期末有关资产、负债、所有者权益的数据。

( )

8、证券A和B组成的证券组合P中,相关系数决定组合线在A与B之间的弯曲程度。

随着AB间相关系数的增大,弯曲程度将增加。

( )

9、从利率角度分析,( )形成了利率下调的稳定预期。

A.温和的通货膨胀

B.严重的通货膨胀

C.恶性通货膨胀

D.通货紧缩

10、间接信用指导包括( )。

A.规定利率限额与信用配额

B.道义劝告

C.窗口指导

D.信用条件限制

11、标准行业分类法把国民经济分为( )个门类。

A.6

B.8

C.10

D.12

12、25元;复利:9

13、电子信息、生物医药等行业处于行业生命周期的( )。

A.幼稚期

B.成长期

C.成熟期

D.衰退期

14、14元;复利:10

15、( )是上市公司建立健全公司法人治理机制的关键。

A.规范的股权结构

B.建立有效的股东大会制度

C.董事会权力的合理界定与

D.完善的独立董事制度

16、国内生产总值的增长速度一般用经济增长率来衡量。

( )

17、针对不同偏好的投资者,分析师应有不同的投资建议选择。

如对于收益型的投资者,可以建议优先选择处于成熟期的行业。

( )

18、80元

C.单利:10

19、指数型证券组合只是一种模拟证券市场组合的证券组合。

( )

20、头肩顶形态是一个长期趋势的转向形态,一般出现在一段升势的尽头,这一形态具有( )的特征。

A.一般来说,左肩与右肩高点大致相等,有时右肩较左肩低,即颈线向下倾斜

B.就成交量而言,左肩最大,头部次之,而右肩成交量最小,即呈梯形递减

C.突破颈线不一定需要大成交量配合,但日后继续下跌时,成交量会放大

D.突破颈线需要大成交量配合,突破后继续下跌时,不一定需要大成交量

21、2002年3月17日,正式取消额度制,改用采取股票发行核准制。

( )

22、证券分析师的主要职能包括( )。

A.运用各种有效信息,对证券市场或个别证券的未来走势进行分析预测,对投资证券的可行性进行分析评判

B.为投资者的投资决策过程提供分析、预测、建议等服务,传授投资技巧,倡导投资理念,引导投资者进行理性投资

C.为涉及上市公司收购、兼并、重组等方面的业务提供财务顾问服务

D.为主管部门、地方政府等的决策提供依据

23、技术含量高的行业成熟期历时相对较长,而公用事业行业成熟期持续的时间较短( )

24、或有事项准则规定,只有同时满足( )条件时,才能将或有事项确认为负债,列示于资产负债表上。

A.该义务是企业承担的现时的义务

B.该义务是企业承担的过去的义务

C.该义务的履行很可能导致经济利益流出企业

D.该义务的金额能够可靠地计量

25、一般来说,可以将技术分析方法分为如下常用类别( )。

A.指标类

B.切线类

C.形态类

D.K线类

26、( )反映自年度资产负债表日至财务报告批准报出Et之间发生的需要告诉或说明的事项。

A.会计政策

B.会计估计

C.或有事项

D.资产负债表日后事项

27、指数型证券组合只是一种模拟证券市场组合的证券组合。

( )

28、所谓市场组合,是指由风险证券构成,并且其成员证券的投资比例与整个市场上风险证券的相对市值比例一致的证券组合。

( )

29、反转变化形态主要包括( )。

A.头肩形态

B.双重顶(底)形态

C.圆弧顶(底)形态

D.喇叭以及V形反转形态

30、套利定价理论的几个基本假设不包括( )。

A.投资者是追求收益的,同时也是厌恶风险的

B.资本市场没有摩擦

C.所有证券的收益都受到一个共同因素F的影响

D.投资者能够发现市场上是否存在套利机会,并利用该机会进行套利。