环境会计方面的外文文献汇总

会计英文期刊目录

精品文档就在这里 -------------各类专业好文档,值得你下载,教育,管理,论文,制度,方案手册,应有尽有-------------------------------------------------------------------------------------------------------------------------------------------------------

--

Journal of Finance. Journal of Financial and Quantitative Analysis. Journal of Financial Economics. Journal of Financial Planning. Journal of Financial Research, Journal of Portfolio Management. MIT Sloan Management Review. Newsweek. (Domestic Ed.) Quantative Finance. Review of Accounting Studies. (Print and Online) Review of Derivatives Research. Review of Financial Studies, Time. (Domestic Ed.) The Journal of Derivativ and Analysis.

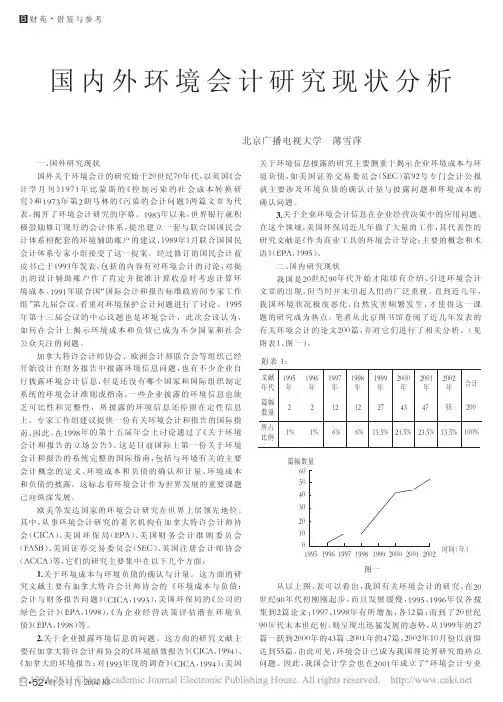

国内外环境会计研究现状分析

"# 财 苑 · 借 鉴 与 参 考

国内外环境会计研究现状分析

北京广播电视大学 薄雪萍

#" 关 于 环 境 会 计 要 素 确 认 与 计 量 的 研 究 。如 徐 泓 、朱 小 平

的《环 境 会 计 要 素 的 确 认 》(《财 务 与 会 计 》*--$年"$期 ),文 中 就环境资产 、环 境 费 用 、环 境 效 益 的 确 认 标 准 、方 法 及 各 要 素 的 特 征 、分 类 和 计 价 问 题 作 了 探 讨 ;再 如 徐 泓 、包 小 刚 、刘 铭 的 《环境会计 计 量 的 基 本 理 论 与 方 法 》(《经 济 理 论 与 经 济 管 理 》 *---年"!期 ),此 文 从 环 境 会 计 计 量 的 基 础 理 论 出 发 ,总 结 了 环 境 会 计 计 量 方 法 的 特 点 :计 量 的 单 位 仍 然 采 用 货 币 单 位 ;计 量的基础可 以 采 用 机 会 成 本 、边 际 成 本 、替 代 成 本 等 ;采 用 模 糊 数 学 进 行 计 量 。提 出 环 境 会 计 的 计 量 方 法 有 :费 用 效 益 分 析 法(包 括 边 际 成 本 法 、影 子 价 格 、机 会 成 本 法 )和 数 学 模 型 法 (包 括 模 糊 数 学 模 型 、数 学 公 式 法 、皮 尔 数 学 模 型 、效 益 数 学 模 型 )。可 见 这 些 文 献 分 别 从 不 同 角 度 对 环 境 会 计 的 确 认 和 计 量 的 原 则 、方 法 等 进 行 了 探 讨 。

外国重要财务会计文献和期刊

外国重要财务会计文献和期刊Abacus 《算盘》一个著名的会计理论刊物,1965年开始发行,由澳大利亚悉尼大学出版社出版,悉尼大学会计系主编。

每年两期,其内容侧重于会计理论研究,在2001年获得优秀期刊金奖,是世界上十大著名会计期刊之一。

网址:http://.auABI Journal 《美国破产学会期刊》美国破产学会(American Bankruptcy institute)的出版物。

每年发行10期。

读者在互联网上可以查阅其中文章,以及《防范破产手册》。

网址:http//www.abiword/Accountancy Magazine 《会计杂志》英格兰和威尔士特许会计师协会(ICAEW)所发行的一种刊。

于1889年开始发行。

1938年开始由季刊改为月刊。

是英国最重要的会计期刊,会计师可以在互联网直接查阅其文章内容。

网址:http://www.accountancy /Accountants Index 《会计师索引》美国注册公共会计师协会所出版的索引。

在这个索引中收集有会计著作的详细目录。

自1974年按季发行。

网址:http:///Accounting and Business Research 《会计和工商业研究》英格兰和威尔特许会计师协会(ICAEW)自1970年起发行的一种研究性会计刊物。

一年发行四期。

网址:http://www.icaew /Accounting and the Public Interest 《会计和公众利益》美国会计学会(AAA)出版的一种学术性期刊。

其主要内容包括财务会计和审计,社会和环境会计、职业道德、信息技术、会计教育,以及会计机构的管理等内容。

网址:http:///Accounting Evolution to1900《1900年以前的会计发展演变》美国著名会计学家利特尔顿(A.C.Limeton)在1993年出版的一本著作。

其中详细地阐述了会计理论的历史发展过程。

企业环境信息披露中英文对照外文翻译文献

文献信息:文献标题:The impact of environmental information disclosures on shareholder returns in a company: An empirical study(企业环境信息披露对股东回报的影响:一项实证研究)国外作者:Ragothaman Srinivasan;Carr David文献出处:《International Journal of Management》,2008,25(4), p613-620字数统计:英文 2030 单词,10523 字符;中文 3653 汉字外文文献:The impact of environmental information disclosures onshareholder returns in a company: An empirical studyThe Emergency Planning and Community Right to Know Act (1986) has mandated Toxic Release Inventory (TRI) disclosures in the United States. This Act requires all manufacturing companies (SIC code 20-39) who employ more than 10 people to provide an annual report about the release of more than 300 specified toxic chemicals. Similar legislation exists in other countries as well. How is this information used by investors and corporations? We develop and test a regression model to answer this question. We also perform a few robustness tests. Our sample comes from TRI disclosures for “top 100” corporate polluters ba sed on COMPUSTAT data. Descriptive statistics and correlation measures are also provided. The higher the return on assets the higher is Tobin’s q (a proxy for firm value or shareholder wealth). The waste disposal variable (toxic air release) is a statistically significant predictor of Tobin’s q. As expected, the sign of the regression coefficientfor waste disposal is negative. In addition, firm size has a significant impact on Tobin’s q. A firm’s beta, P/E ratio, and the corporate governance variable are all statistically insignificant.1. IntroductionThe disastrous Union Carbide accident that occurred in India in 1984 and other smaller chemical accidents have caused anxiety in the public’s mind about the release of chemicals from factories. The Emergency Planning and Community Right to Know Act (1986) has mandated Toxic Release Inventory TRI disclosures. This Act requires all manufacturing companies (SIC code 20-39) in the United States who employ more than 10 people to provide an annual report about release of more than 300 specified toxic chemicals. The TRI program offers environmental performance information to the public and is administered by the Environmental Protection Agency (EPA). How is this information used by investors and corporations?EPA’s Environmental Economics Research Strategy (EPA, 2004) identifies measuring the benefits of environmental information disclosures as one of its high priority research areas. Some interesting research results have already been published. For example, Konar and Cohen (1997) report negative stock price reactions to TRI disclosures in 1989. These negative stock returns forced companies to change their behavior. Those firms with the largest negative stock market returns to TRI announcements in 1989 subsequently reduced their emissions more than other firms in their industry. The purpose this research project is to examine the association between the TRI disclosures and firm value as measured by Tobin’s q. The goal of examining the association between the TRI disclosures and firm value will be accomplished through the development and testing of a regression model. A few robustness tests are also conducted. Tobin’s q is a widely used proxy for firm value in the finance literature (Gompers, Ishii and Metrick,2003) and is used in this study as the dependent variable.Several researchers have conducted event studies and documented negative stock price reactions to TRI announcements (Hamilton 1995 and Khanna et al. 1998). Eventstudies examine the stock price reactions on one or two days when the environmental information is disclosed. Klassen and McLaughlin (1996) also reported significant negative stock price reactions to bad environmental news such as oil spills. These event studies do not analyze longer-term stock price trends. These studies have generally used smaller samples. Moreover, they have used data from 1989 which are eighteen years old. To overcome these difficulties, a new regression model is developed which uses more recent data from 2000 TRI disclosures. The TRI disclosure data is compiled from raw data reported to the EPA on a facility-by-facility basis and not on a company-bycompany basis. The difficulty of aggregating to company-level data makes the 2000 TRI disclosures the most recent data currently available.2. Prior ResearchKarpoff and Lott (1993) report that when corporate illegal activities and other fraudulent financial schemes are revealed, stock price declines have been the result. In order to estimate the value of intangible assets, we propose to include environmental performance information among the explanatory variables (see Konar and Cohen 2001). Good environmental performance can translate into a good reputation for the firm as an ecology-friendly company and this can increase investor trust (Ragothaman and Lau, 2000). Similarly, bad environmental performance can lead to stock price declines.This research builds on prior research and expands knowledge in several different and new ways. 1) Data used in this study are more recent (than 1989) and come from TRI disclosures for the year 2000; 2) Tobin’s q is measured in accordance with suggestions from finance scholars; 3) The regression model includes some new variables; and a cross-sectional regression model is used. Descriptive statistics and correlation measures are also provided. New insights are gained about the impact of environmental disclosure programs on stockholders’ wealth. Our formulation for Tobin’s q follows that of Chung and Pruitt (1994) and Hirschey and Connolly (2005), where q is measured as the market value of common shares outstanding plus the bookvalue of total assets minus common equity, all divided by the book value of total assets. Tobin’s q is viewed as a market-based measure of firm valuation. In this paper, the effect of environmental disclosures on the market valuation of firms, proxied by Tobin’s q, is examined.Beta is a measure of the risk associated with owning shares in a firm and is commonly used to measure market risk. Konar and Cohen (1997) utilize beta to control for the systematic risk in security returns. Beta is included in this study as a control variable. Various measures of firm size appear in the literature. Dowell, Hart, and Young (2000) use the logarithm of total assets with mixed results in examining whether corporate global standards create or destroy market value. Hamilton (1995) uses the number of employees as a proxy for firm size in examining the relationship between Toxic Release Inventory data and media and stock market reactions. The logarithm of the number of employees (LEMP) is used as a proxy for firm size, and is included in the model as another control variable.Waste (toxic air release) is measured as waste disposal in pounds per revenue- dollar. Waste should be negatively related to Tobin’s q, as it measures the extent to which firms are “dirty.” Konar and Cohen (1997) use toxic chemi cal releases and the number of lawsuits to proxy waste. Hamilton (1995) uses the number of superfund sites to proxy waste. Return on assets (ROA), defined as net income divided by total assets, is used as a measure of firm-level performance. It is a proxy for profitability. ROA should be positively related to Tobin’s q, since better performing firms should be more highly valued in the marketplace, ceteris paribus. Hirschey and Connolly (2005) use profit margin to measure profitability.Another control variable used in this study is the price-to-earnings ratio. The price-to-earnings (PE) ratio is measured as the market price of a firm’s common stock divided by the firm’s income-per-share of common stock. The PE ratio is included in the model as a control variable to pick up the effect of firm-level growth. Firms that are growing rapidly should have a higher market valuation, as measured by Tobin’s q. Yet another control variable used in this paper is “audit opinion” which is a proxy for the corporate governance mechanism. Li et al. (2005) found that firms with higherstock market return tended to receive more clean (unqualified) audit opinions. In other words, audit opinion is negatively related to market value of the firm. Hodge et al. (2004) conducted an experimental research project and concluded that investors reacted to audit qualifications as if it signaled that management was strategically understating financial results. It could be posited that management was concerned about future performance and consequently understated the current performance. According to Choi and Jeter (1992), audit qualifications indicate that uncertainties associated with future cash flows have increased and consequently, the future market value of the firm can be adversely affected.3. Methodology and data sourcesResearchers at the Political Economy Research Institute (PERI) at the University of Massachusetts released, in 2004, the list of the top 100 corporate air polluters based on TRI data disclosed by companies in the year 2000. The toxic (air release) waste data are reported in pounds per revenue dollar. Data from COMPUSTAT were used to compute several operating and financial ratios for these 100 firms. The following independent variables were obtained from the COMPUSTAT database: market beta, return on assets, logarithm of number of employees, P/E ratio and audit opinion. Following Hirschey (2005), the following formula is used to estimate Tobin’s q: Tobin’s q = [Total assets + Total market value of equity –Book value of equity] / Total assets. Tobin’s q was also computed from the data obtained from the COMPUSTAT data base. Due to missing variables in the COMPUSTAT database, 9 companies were dropped. One more firm was deleted because of an extreme outlier. The final sample used in this study contains data from 90 companies.The multiple regression model used in this study is:Tobin’s q = f {market beta (risk), logarithm of number of employees, waste discharge per revenue dollar, return on assets, P/E ratio and audit opinion} The research questions are transformed into null hypotheses as given below:H1: Beta has no significant effect on Tobin’s q.H2: Size as measured by number of employees has no significant effect on Tobin’s q.H3: Waste discharge has no significant effect on Tobin’s q.H4: Return on assets has no significant effect on Tobin’s q.H5: Growth as measured by the P/E ratio has no significant effect on Tobin’s q.H6: Corporate governance as measured by audit opinion has no significant effect on Tobin’s q.4. Results and discussionThe descriptive statistics are reported in Table 1. The average Tobin’s q for the sample firms is 2.176. The average amount of toxic air release (waste discharge) is 0.0009 pounds per revenue dollar. The mean for return of assets is 4.648 percent. The average beta (risk measure) is 1.121.Q ratio = Tobin’s QBeta = Market beta (risk)LEMP = Logarithm of number of employeesWaste = Waste disposal per revenue-dollarROA = Return on assetsP/E ratio = Price Earnings ratioAUOP = Audit opinionA correlation analysis of these six explanatory variables with the Tobin’s q and other independent variables was performed. The correlation results are reported inTable 2.The correlation analysis results indicate that Tobin’s q is strongly related to return on assets. The higher the return on assets, the higher is Tobin’s q. Beta, firm size and waste discharge are all negatively related to Tobin’s q. Beta and return on assets have strong negative correlation. Firm size and waste discharge are negatively correlated.Multicollinearity among independent variables may be present in the data and can potentially lead to unstable regression coefficients. A rule of thumb is suggested by Judge et al. (1985) to assess the impact of multicollinearity. They argue that a serious multicollinearity problem arises only when correlations among the explanatory variables are higher than 0.8. In our dataset, the highest correlation is between return on assets and beta at -0.411. Hence, the degree of collinearity present appears to be too small to invalidate estimation results.An ordinary least-squares regression model was developed to investigate the relationship between Tobin’s q and toxic air release, beta, return on assets, growth and other independent variables. Regression methodology permits the testing of six null hypotheses simultaneously. Tobin’s q was the dependent variable and the six explanatory variables mentioned earlier were the independent variables. The regression coefficients, t-statistics (in parentheses), and significance levels are reported in Table 3, column I. The multiple regression model has a respectable adjusted R-squared of 31.3 percent.Thbk 3: Mnhlpie Regression Resultse CONSTANT 2.565 2.450 2.62I 1.416(4.295)*°°(2.273)”(4. t40)*°’(1.320) BETA-0.029 -0.025 -0.025 •0.600(-0.186) (-0. I58) (-0. IG2) (-0.353)LOCi EMPLOYEES -0.363(-3.319)***-0.371(-2.919)**•-0.354(-3.219)***-0.506(-2.880)***WAS SALES -163.186(-2.244)*^-166.038(-2.172)**-137.856(- l.785)•-522.126(-l,846)•RETURH ON 0.1S6 0.157 0.149 0.138 ASSETS (4.343)*••(4.285)*••(4.049)**^ (3.407)**•PPE RATIO 0.013 0.013 0.015 0.010(1.574) (1.569) (1.787)* (1.158)0.030 0.029 0.023 0.I70(0.290) (0.278) (0,213) (1.329)0.016 0. I99(0.129) (1.323) CAPITAL-EXPEN/ -1.413SALES (-0.770)R&D £XP/SALES L236‹i.x8)â7610313 0.3W0.294 0.342 ‘The dependent verieble is Tobin’s O•Sintistically e igaificant at Um l evel**Statistically significant at 5& level***Statistically significant at IN level中文译文:企业环境信息披露对股东回报的影响:一项实证研究在美国,应急计划和社区知情权法案(1986)被授权披露企业有毒排放清单。

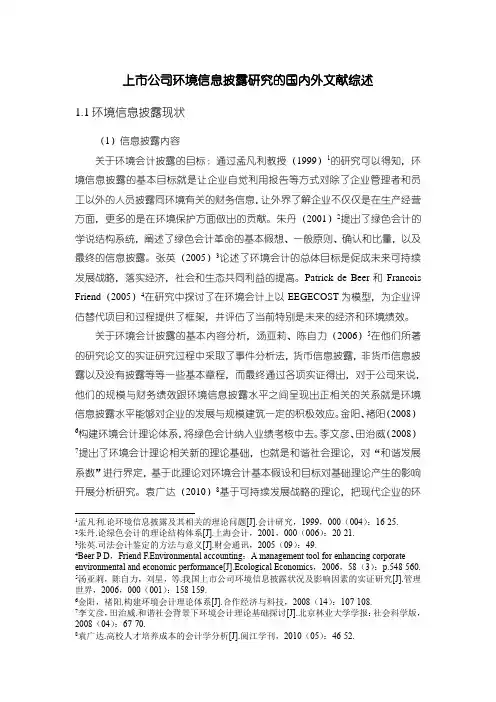

《上市公司环境信息披露研究的国内外文献综述3600字》

上市公司环境信息披露研究的国内外文献综述1.1环境信息披露现状(1)信息披露内容关于环境会计披露的目标:通过孟凡利教授(1999)1的研究可以得知,环境信息披露的基本目标就是让企业自觉利用报告等方式对除了企业管理者和员工以外的人员披露同环境有关的财务信息,让外界了解企业不仅仅是在生产经营方面,更多的是在环境保护方面做出的贡献。

朱丹(2001)2提出了绿色会计的学说结构系统,阐述了绿色会计革命的基本假想、一般原则、确认和比量,以及最终的信息披露。

张英(2005)3论述了环境会计的总体目标是促成未来可持续发展战略,落实经济,社会和生态共同利益的提高。

Patrick de Beer和Francois Friend(2005)4在研究中探讨了在环境会计上以EEGECOST为模型,为企业评估替代项目和过程提供了框架,并评估了当前特别是未来的经济和环境绩效。

关于环境会计披露的基本内容分析,汤亚莉、陈自力(2006)5在他们所著的研究论文的实证研究过程中采取了事件分析法,货币信息披露,非货币信息披露以及没有披露等等一些基本章程,而最终通过各项实证得出,对于公司来说,他们的规模与财务绩效跟环境信息披露水平之间呈现出正相关的关系就是环境信息披露水平能够对企业的发展与规模建筑一定的积极效应。

金阳、褚阳(2008)6构建环境会计理论体系,将绿色会计纳入业绩考核中去。

李文彦、田治威(2008)7提出了环境会计理论相关新的理论基础,也就是和谐社会理论,对“和谐发展系数”进行界定,基于此理论对环境会计基本假设和目标对基础理论产生的影响开展分析研究。

袁广达(2010)8基于可持续发展战略的理论,把现代企业的环1孟凡利.论环境信息披露及其相关的理论问题[J].会计研究,1999,000(004):16-25.2朱丹.论绿色会计的理论结构体系[J].上海会计,2001,000(006):20-21.3张英.司法会计鉴定的方法与意义[J].财会通讯,2005(09):49.4Beer P D,Friend F.Environmental accounting:A management tool for enhancing corporate environmental and economic performance[J].Ecological Economics,2006,58(3):p.548-560. 5汤亚莉,陈自力,刘星,等.我国上市公司环境信息披露状况及影响因素的实证研究[J].管理世界,2006,000(001):158-159.6金阳,褚阳.构建环境会计理论体系[J].合作经济与科技,2008(14):107-108.7李文彦,田治威.和谐社会背景下环境会计理论基础探讨[J].北京林业大学学报:社会科学版,2008(04):67-70.8袁广达.高校人才培养成本的会计学分析[J].阅江学刊,2010(05):46-52.境经济活动与环境管理活动当做研究对象,把生态环境的有关信息引进会计信息系统,着重叙述了环境风险控制、环境会计的成本核计,探索了有关企业实现维护环境与可持续发展的目标的途径。

2024年财务管理论文英文参考文献

[10]Atkin, C. K. Instrumental utilities and information seeking. New models for mass communication research, Oxford,England: Sage,1973.

[8]Bass, B., Granke, R. Societal influences on student perceptions of how to succeed in organizations. Journal of Applied Psychology, 1972,56(4),312-318.

[4Casson, M. The economics of family firms [J]. Scandinavian Economic History Review, 1999' 47(1):10 - 23.

[5]Alchian,A.,Demsetz, H. Production, information costs, and economic organization. American Economic Review [J]. 1972,62(5): 777-795.

[4]Aragon-Comea, J. A. Strategic proactivity and firm approach to the natural environment. Academy of Management Journal,1998,41(5),556-567.

环境会计信息披露研究【文献综述】

环境会计信息披露研究【⽂献综述】毕业论⽂(设计)⽂献综述题⽬:环境会计信息披露研究专业:会计学⼀、前⾔部分(⼀)写作⽬的我国作为世界上经济发展最快的国家之⼀,环境的破坏⽇益成为经济发展的瓶颈,严重阻碍了我国经济的发展。

学者们在环境会计信息披露的必要性⽅⾯都有着⼀致的看法。

如耿建新(2002)等学者认为应不断规范我国企业有关环境会计信息的披露,以满⾜不同利益相关者的需要。

但环境会计信息披露⽬前存在着理论研究滞后、对企业环境信息披露的⽐例不⾼、内容不全⾯、信息披露⽅式不⾜、披露不对称或不充分等等问题,使其⽆法满⾜社会公众、政府等利益相关者的需要。

因此需要进⼀步地进⾏研究探讨。

(⼆)相关概念环境会计指以货币为主要计量单位,以有关的环境法律、法规为依据,研究经济发展与环境资源之间的联系,确认、计量、记录、报告环境资产与负债,以及环境污染、防治、开发和利⽤的成本与费⽤,分析环境绩效与环境活动对企业财务成果影响的⼀门新兴学科。

环境信息披露是指将与环境保护有关的各种显性和隐性的信息加以收集整理,并在⼀定范围内以适当形式公开,⽤以提供各种刺激与激励机制,从⽽改进环境⾏为,改善环境质量。

环境会计信息披露就是指以⼀定的信息载体公开企业环境会计⽅⾯的信息。

(三)综述范围通过收集2005-2010年间发表于《财会研究》、《中国会计评论》、《财经理论与实践》等学术杂志中的研究论⽂,借鉴西北⼤学、青岛⼤学等⼤学学报⽂章及部分硕博⼠论⽂,通过分析与总结这些⽂章,对环境会计信息披露和国内外研究现状进⾏总体把握。

(四)相关主题及争论焦点我国环境会计信息披露还处于起步阶段,研究内容缺乏系统性,研究成果尚⽋实践指导性。

在环境会计信息披露的内容⽅⾯基本上达成了⼀致意见,但在环境信息披露的形式⽅⾯却仍有差异。

⼆、主题部分(⼀)国外研究综述从九⼗年代开始,由于国际社会对环境会计问题的重视,⼀些重要的国际会计组织和国家对于环境会计信息的披露在理论上和实践上进⾏了初步的尝试和探索。

环境会计信息披露论参考文献

环境会计信息披露论参考文献

1. 马明.环境会计信息披露:现实困境与政策选择[J].财经研究,2006,(8):70-76.

2. 王炳章.环境会计信息披露的原则与方法探析[J].国际会计,2011,(6):25-28.

3. 金宏.环境会计信息披露对公司绩效的影响研究[J].财经问题研究,2014,(6):72-77.

4. 周杰.环境会计信息披露对投资者财务决策的影响研究[J].经济管理,2015,(1):34-39.

5. 荣华.环境会计信息披露的财务分析[J].会计研

究,2016,(2):45-49.

6. 陈希.环境会计信息披露对企业社会责任的影响研究[J].社会科学,2017,(1):64-69.

7. 李德明.环境会计信息披露的国际比较研究[J].财会研

究,2018,(3):26-31.

8. 赵凯.环境会计信息披露与环境治理的关系研究[J].环境保护,2019,(4):52-57.

9. 王铭.环境会计信息披露的重要性与现状分析[J].财贸研究,2020,(1):45-50.

10. 吴云.环境会计信息披露的法律规制及其改进思路[J].法学研究,2021,(2):62-68.。

- 1 -。

会计专业参考英文文献

The Impact of Cash Budgets on Poverty Reduction in Zambia: A Case Study of the Conflict between Well-Intentioned Macroeconomic Policy and Service Delivery to the Poor Hinh T. Dinh World Bank Abebe Adugna World Bank C. Bernard Myers World Bank October 2002 World Bank Policy Research Working Paper No. 2914 Abstract: Facing runaway inflation and budget discipline problems in the early 1990s, the Zambian government introduced the so-called cash budget in which government domestic spending is limited to domestic revenue, leaving no room for excess spending. Dinh, Adugna, and Myers review Zambia's experience during the past decade, focusing on the impact of the cash budget on poverty reduction. They conclude that after some initial success in reducing hyperinflation, the cash budget has largely failed to keep inflation at low levels, created a false sense of fiscal security, and distracted policymakers from addressing the fundamental issue of fiscal discipline. More important, it has had a deeply pernicious effect on the quality of service delivery to the poor. Features inherent to the cash budgeting system facilitated a substantial redirection of resources away from the intended targets, such as agencies and ministries that provide social and economic services. The cash budget also eliminated the predictability of cash releases, making effective planning by line ministries difficult. Going forward, Zambia must adopt measures that over time will restore the commitment to budget discipline and shelter budget execution decisions from the pressures of purely short-term exigencies. This paper - a product of the Poverty Reduction and Economic Management Division 1, Africa Region - is part of a larger effort in the region to review public expenditure management. Number of Pages in PDF File: 34 working papers series Download This PaperDecember 21, 2004Date posted: D ecember 21, 20042 Principles of Cash Management from IndianManagement Thought: ThirukkuralChendrayan ChendroyaperumalAnna University of Technology Chennai - Saveetha Engineering College; Deceased June 9, 2008Abstract: Wise management of cash is essential for the survival and success of any business organization. Textbooks prescribe a set of principles for successful management of cash, a key component of working capital but the least productive for the firm holding it. This paper attempts to highlight the principles of cash management propounded in Thirukkural - an Indian work on management written more than 2000 years ago but very relevant, practicable and consistent with that of the modern thought!Number of Pages in PDF File: 6Keywords: Cash Management, Working Capital, Financial Management, ThirukkuralJEL Classification: G11, G15, G31working papers series3 Management Accounting Systems Adoption Decisions:Evidence and Performance Implications from StartupCompaniesTony DavilaUniversity of Navarra - IESE Business School George FosterStanford Graduate School of Business October 2004Stanford GSB Research Paper No. 1874 Abstract: Adopting management accounting systems are important events in the life of young and growing companies. Using a sample of 78 startup companies, we document cross-sectional differences in the adoption of operating budgets as well as seven other management accounting systems. We find that our proxies for agency costs, perceived benefits and costs, complexity of the firm, and culture explain cross-sectional differences in time-to-adoption of budgets. In particular, the presence of venture capital, CEO experience, firm size, and the culture of the organization are associated with this adoption decision. We further investigate the effect of hiring a financial manager as an endogenous variable. In the first stage of a two-stage model, we find that CEO total experience, the presence of venture capital funds, culture, and firm size are associated with cross-sectional variation in this hiring decision. When treating this decision as endogenous, time to hiring a financial manager is unrelated to operating budget adoption. The paper also examines the association between the time-to-adoption of operating budgets and company performance. We find a significant increase in the size of the company around the adoption of operating budgets; moreover faster adoption of operating budgets is associated with faster growing companies. We extend the findings to additional management accounting systems including: cash budgets, variance analysis, operating expense approval policies, capital expenditure approval policies, product profitability, customer profitability, and customer acquisition costs. The influence of industry choice (biotechnology, information technology, or non-tech) is examined in each stage of the research.Number of Pages in PDF File: 47Keywords: Management accountingJEL Classification: G34, G31, M40, M46working papers series 。

环境设计英文参考文献(精选文献)

伴随人类社会不断的进步,人与自然,建筑与环境之间的关系密不可分.从当代人们所生活的环境中,我们可以看出环境艺术也在经历着自身的发展,而人们只有从尊重自然环境,尊重人类自身,才能够真正将环境艺术更好地融入建筑设计中去。

下面是环境设计英文参考文献的分享,供大家参考阅读。

环境设计英文参考文献一: [1]Jianlong Ma,Xiaofeng Lu,Honglin Zhai,Qiang Li,Li Qiao,Yong Guo. Rational design of a near-infrared fluorescence probe forhighly selective sensing butyrylcholinesterase (BChE) and its bioimaging applications in living cell[J]. Talanta,2020,219. [2]Takada Sae,Ober Allison J,Currier Judith S,Goldstein NoahJ,Horwich Tamara B,Mittman Brian S,Shu Suzanne B,Tseng Chi-Hong,Vijayan Tara,Wali Soma,Cunningham William E,Ladapo Joseph A. Reducing cardiovascular risk among people living with HIV: Rationale and design of the INcreasing Statin Prescribing in HIV Behavioral Economics REsearch (INSPIRE) randomized controlled trial.[J]. Progress in cardiovascular diseases,2020,63(2). [3]Duvall Samuel W,Childers W Seth. Design of a Histidine Kinase FRET Sensor to Detect Complex Signal Integration within Living Bacteria.[J]. ACS sensors,2020. [4]Eisapour Mazhar,Cao Shi,Boger Jennifer. Participatory design and evaluation of virtual reality games to promote engagement in physical activity for people living with dementia.[J]. Journal of rehabilitation and assistive technologies engineering,2020,7. [5]Laura Fiorini,Kasia Tabeau,Grazia D’Onofrio,LuigiCoviello,Marleen De Mul,Daniele Sancarlo,IsabelleFabbricotti,Filippo Cavallo. Co-creation of an assistive robot for independent living: lessons learned on robot design[J].International Journal on Interactive Design and Manufacturing (IJIDeM),2020,14(2). [6]. CarexTech Inc.; CarexTech's Smile Platform, Designed to Connect Families and Senior Living Communities, Sees Usage Spike Over 300 Percent in Wake of COVID-19 Pandemic[J]. Medical Letter on the CDC & FDA,2020. [7]Mazhar Eisapour,Shi Cao,Jennifer Boger. Participatory design and evaluation of virtual reality games to promote engagement in physical activity for people living with dementia[J]. Journal of Rehabilitation and Assistive Technologies Engineering,2020,7. [8]OZ Architecture. OZ Architecture releases insight report on future of senior living design[J]. Building Design &Construction,2020. [9]Gang Zhao,Chunxue Yi,Gang Wei,Rongliang Wu,Zhengye Gu,Shanyi Guang,Hongyao Xu. Molecular design strategies of multifunctional probe for simultaneous monitoring of Cu 2+ , Al 3+ , Ca 2+ and endogenous l -phenylalanine (LPA) recognition in living cells and zebrafishes[J]. Journal of Hazardous Materials,2020,389. [10]. Veterinary Medicine; Data on Veterinary Medicine Detailed by Researchers at Hubei University of Education (Impact of Chimpanzee Living Habits On the Design of Zoo Ecological Environment Transformation)[J]. Ecology, Environment & Conservation,2020. [11]Weichao Cai,Xianhui Wang. Design of Health Care for Elderly Living Alone Based on ZigBee[J]. Journal of Physics: Conference Series,2020,1550(4). [12]Pandya. Older Adults Who Meditate Regularly Perform Better on Neuropsychological Functioning and Visual Working Memory Tests: A Three-month Waitlist Control Design Study with a Cohort of Seniorsin Assisted Living Facilities[J]. Experimental AgingResearch,2020,46(3). [13]Pandya Samta P. Older Adults Who Meditate Regularly Perform Better on Neuropsychological Functioning and Visual Working Memory Tests: A Three-month Waitlist Control Design Study with a Cohort of Seniors in Assisted Living Facilities.[J]. Experimental aging research,2020,46(3). [14]Bogza Laura-Mihaela,Patry-Lebeau Cassandra,FarmanovaElina,Witteman Holly O,Elliott Jacobi,Stolee Paul,HudonCarol,Giguere Anik Mc. User-Centered Design and Evaluation of a Web-Based Decision Aid for Older Adults Living With Mild Cognitive Impairment and Their Health Care Providers: A Mixed MethodsStudy.[J]. Journal of medical Internet research,2020. [15]Zhao Gang,Yi Chunxue,Wei Gang,Wu Rongliang,Gu Zhengye,Guang Shanyi,Xu Hongyao. Molecular design strategies of multifunctional probe for simultaneous monitoring of Cu<sup>2+</sup>,Al<sup>3+</sup>, Ca<sup>2+</sup> and endogenous l-phenylalanine (LPA) recognition in living cells and zebrafishes.[J]. Journal of hazardous materials,2020,389. [16]Laurie Gries,Blake Watson,Jason P. Kalin,Jaqui Pratt,Desiree Dighton. (Re)designing Innovation Alley: fostering civic living and learning through visual rhetoric and urban design[J]. Review of Communication,2020,20(2). [17]Donna Boss. Refreshing Drab Design at a Senior LivingFacility[J]. Foodservice Equipment & Supplies,2020,73(4). [18]Ding Haiyuan,Peng Longpeng,Yuan Gangqiang,Zhou Liyi. Design, synthesis and bioimaging application of a novel two-photon xanthene fluorescence probe for ratiometric visualization of endogenous peroxynitrite in living cells and zebrafish[J]. Dyes andPigments,2020,176. [19]Sae Takada,Allison J. Ober,Judith S. Currier,Noah J. Goldstein,Tamara B. Horwich,Brian S. Mittman,Suzanne B. Shu,Chi-Hong Tseng,Tara Vijayan,Soma Wali,William E. Cunningham,Joseph A. Ladapo. Reducing cardiovascular risk among people living with HIV: Rationale and design of the INcreasing Statin Prescribing in HIV Behavioral Economics REsearch (INSPIRE) randomized controlled trial[J]. Progress in Cardiovascular Diseases,2020,63(2). [20]Ray Sarkar Arpita,Sanyal Goutam,Majumder Somajyoti. Participatory design for selection of icons to represent daily activities of living for a vision-based rehabilitation-cum-assistance system for locked-in patients.[J]. Disability and rehabilitation. Assistive technology,2020,15(3). [21]Arpita Ray Sarkar,Goutam Sanyal,Somajyoti Majumder. Participatory design for selection of icons to represent daily activities of living for a vision-based rehabilitation-cum-assistance system for locked-in patients[J]. Disability and Rehabilitation: Assistive Technology,2020,15(3). [22]Haiyuan Ding,Longpeng Peng,Gangqiang Yuan,Liyi Zhou. Design, synthesis and bioimaging application of a novel two-photon xanthene fluorescence probe for ratiometric visualization of endogenous peroxynitrite in living cells and zebrafish[J]. Dyes andPigments,2020,176. [23]Amal Said Taha,Rawia Ali Ibrahim. Effect of a Design Discharge Planning Program for Stroke Patients on Their Quality of Life and Activity of Daily Living[J]. International Journal of Studies in Nursing,2020,5(1). [24]Melania Reggente,Sara Politi,Alessandra Antonucci,Emanuela Tamburri,Ardemis A. Boghossian. Design of Optimized PEDOT‐Based Electrodes for Enhancing Performance of Living Photovoltaics Based on Phototropic Bacteria[J]. Advanced MaterialsTechnologies,2020,5(3). [25]Kjersti Benedicte Blom,Kaja Knudsen Bergo,Emil Knut Stenersen Espe,Vigdis Rosseland,Ole J?rgen Gr?tta,Geir Mj?en,Anders?sberg,Stein Bergan,Helga Sanner,Tone Kristin Bergersen,ReidarBj?rnerheim,Morten Skauby,Ingebj?rg Seljeflot,B?rd Waldum-Grevbo,Dag Olav Dahle,Ivar Sjaastad,Jon Arne Birkeland. Cardiovascular rEmodelling in living kidNey donorS with reduced glomerularfiltration rate: rationale and design of the CENS study[J]. Blood Pressure,2020,29(2). [26]. Sustainability Research; Researchers at University of Oradea Have Reported New Data on Sustainability Research (Design and Operation of Constructions: A Healthy Living Environment-Parametric Studies and New Solutions)[J]. Energy & Ecology,2020. [27]Carly Elizabeth Guss,Elizabeth R. Woods,Ellen R.Cooper,Sandra Burchett,Julia Fuller,Olivia Dumont,Y.X. Ho,MerynRobinson,Dallas Swendeman,Jessica Haberer,Shelagh Mulvaney,Vikram Kumar. 252. Pluscare: A Mobile Platform Designed to Increase Linkage to Care for Youth Living with HIV/AIDS[J]. Journal of Adolescent Health,2020,66(2). [28]Rachel Soo Hoo Smith,Christoph Bader,Sunanda Sharma,Dominik Kolb,Tzu‐Chieh Tang,Ahmed Hosny,Felix Moser,James C.Weaver,Christopher A. Voigt,Neri Oxman. Hybrid Living Materials: Digital Design and Fabrication of 3D Multimaterial Structures with Programmable Biohybrid Surfaces[J]. Advanced FunctionalMaterials,2020,30(7). [29]Epps Fayron,Choe Jenny,Alexander Karah,Brewster Glenna. Designing Worship Services to Support African-American PersonsLiving with Dementia.[J]. Journal of religion and health,2020. [30]. Biotechnology - Biohybrids; Recent Research from Massachusetts Institute of Technology Highlight Findings in Biohybrids (Hybrid Living Materials: Digital Design and Fabrication of 3d Multimaterial Structures With Programmable BiohybridSurfaces)[J]. Biotech Week,2020. [31]Thangavelu Karthick,Hayward Joshua A,Pachana Nancy A,Byrne Gerard J,Mitchell Leander K,Wallis Guy M,Au Tiffany R,Dissanayaka Nadeeka N. Designing Virtual Reality Assisted Psychotherapy for Anxiety in Older Adults Living with Parkinson's Disease: Integrating Literature for Scoping.[J]. Clinical gerontologist,2020. [32]Cun Li. The Design of a System to Support Storytelling Between Older Adults Living in a Nursing Home and Their Children[J]. The Design Journal,2020,23(1). [33]. Living in town and the invention of “culture”: development images designed from the countryside[J]. Etnográfica,2019,23(2). [34]Marleen Prins MSc,Bernadette M. Willemse PhD,Ceciel H. Heijkants MSc,Anne Margriet Pot PhD. Nursing home care for people with dementia: Update of the design of the Living Arrangements for people with Dementia (LAD)‐study[J]. Journal of AdvancedNursing,2019,75(12). [35]Laura E. Simons,Lauren E. Harrison,Shannon F. O'Brien,Marissa S. Heirich,Nele Loecher,Derek B. Boothroyd,Johan W.S. Vlaeyen,Rikard K. Wicksell,Deborah Schofield,Korey K. Hood,MichaelOrendurff,Salinda Chan,Sam Lyons. Graded exposure treatment for adolescents with chronic pain (GET Living): Protocol for a randomized controlled trial enhanced with single case experimental design[J]. Contemporary Clinical Trials Communications,2019,16. [36]Akira Hirao,Yuri Matsuo,Raita Goseki. Synthesis of novel block polymers with unusual block sequences by methodology combining living anionic polymerization and designed linking chemistry[J]. Journal of Polymer Research,2019,26(12). 环境设计英文参考文献二: [37]Soyeon Kim,Seyun An,Hannah Ju. Study on Citizens’ Awareness of Smart City Living Lab based on User Participatory design[J]. ? ICCC ?,2019. [38]Prins Marleen,Willemse Bernadette M,Heijkants Ceciel H,Pot Anne Margriet. Nursing home care for people with dementia: Update of the design of the Living Arrangements for people with Dementia (LAD)-study.[J]. Journal of advanced nursing,2019,75(12). [39]. Nanotechnology - Nanomaterials; Data on Nanomaterials Reported by Researchers at CAS Center for Excellence in Nanoscience (Programmable Construction of Peptide-based Materials In Living Subjects: From Modular Design and Morphological Control To Theranostics)[J]. Biotech Week,2019. [40]Diao Quanping,Guo Hua,Yang Zhiwei,Luo Weiwei,Li Tiechun,Hou Dongyan. Design of a Nile red-based NIR fluorescent probe for the detection of hydrogen peroxide in living cells.[J]. Spectrochimica acta. Part A, Molecular and biomolecular spectroscopy,2019,223. [41]Quanping Diao,Hua Guo,Zhiwei Yang,Weiwei Luo,TiechunLi,Dongyan Hou. Design of a Nile red-based NIR fluorescent probe for the detection of hydrogen peroxide in living cells[J]. Spectrochimica Acta Part A: Molecular and Biomolecular Spectroscopy,2019,223. [42]Simons Laura E,Harrison Lauren E,O'Brien Shannon F,Heirich Marissa S,Loecher Nele,Boothroyd Derek B,Vlaeyen Johan W S,Wicksell Rikard K,Schofield Deborah,Hood Korey K,Orendurff Michael,Chan Salinda,Lyons Sam. Graded exposure treatment for adolescents with chronic pain (GET Living): Protocol for a randomized controlledtrial enhanced with single case experimental design.[J]. Contemporary clinical trials communications,2019,16. [43]Wenda Zhang,Yu Wang,Junqiang Dong,Yonggao Zhang,JiawenZhu,Jianbo Gao. Rational design of stable near-infrared cyanine-based probe with remarkable large Stokes Shift for monitoring Carbon monoxide in living cells and in vivo[J]. Dyes and Pigments,2019,171. [44]Bodo D. Wilts,Silvia Vignolini. Living light : optics, ecology and design principles of natural photonic structures[J]. Journal of the Royal Society Interface Focus,2019,9(1). [45]Aprameya Ganesh Prasad,Dominick Salerno,Alaina K. Howe,Omkar Mandar Bhatavdekar,Stavroula Sofou. Location-Location-Location: Designing Cationic Charge Placement on Lipid Vesicles Determines their Interactions with Living Cells[J]. BiophysicalJournal,2019,116(3). [46]Zhang Gaobin,Ni Yun,Zhang Duoteng,Li Hao,Wang Nanxiang,Yu Changmin,Li Lin,Huang Wei. Rational design of NIR fluorescenceprobes for sensitive detection of viscosity in living cells.[J]. Spectrochimica acta. Part A, Molecular and biomolecular spectroscopy,2019,214. [47]Chi Chia-Fen,Dewi Ratna Sari,Samali Priska,Hsieh Dong-Yu. Preference ranking test for different icon design formats for smart living room and bathroom functions.[J]. Applied ergonomics,2019,81. [48]Seth Christopher Yaw Appiah,Adeyemi Olu Adekunle,Adesina Oladokun,Jonathan Mensah Dapaah,Karikari Mensah Nicholas. Designing a Need Based Social Protection Intervention Package for Children and Adolescents Living with HIV and AIDS in Ghana—An Eclectic Perspective on Desired Social Protection InterventionPackage/Framework[J]. Health,2019,11(10). [49]Ioulia V. Ossokina,Theo A. Arentze,Dick van Gameren,Dirk van den Heuvel. Best living concepts for elderly homeowners: combining a stated choice experiment with architectural design[J]. Journal of Housing and the Built Environment,2019(prepublish). [50]Blom Kjersti Benedicte,Bergo Kaja Knudsen,Espe Emil Knut Stenersen,Rosseland Vigdis,Gr?tta Ole J?rgen,Mj?en Geir,?sberg Anders,Bergan Stein,Sanner Helga,Bergersen Tone Kristin,Bj?rnerheim Reidar,Skauby Morten,Seljeflot Ingebj?rg,Waldum-Grevbo B?rd,Dahle Dag Olav,Sjaastad Ivar,Birkeland Jon Arne. Cardiovascular rEmodelling in living kidNey donorS with reduced glomerularfiltration rate: rationale and design of the CENS study.[J]. Blood pressure,2019. [51]Li Li-Li,Qiao Zeng-Ying,Wang Lei,Wang Hao. Programmable Construction of Peptide-Based Materials in Living Subjects: From Modular Design and Morphological Control to Theranostics.[J]. Advanced materials (Deerfield Beach, Fla.),2019,31(45). [52]Li‐Li Li,Zeng‐Ying Qiao,Lei Wang,Hao Wang. Programmable Construction of Peptide‐Based Materials in Living Subjects: From Modular Design and Morphological Control to Theranostics[J]. Advanced Materials,2019,31(45). [53]Li‐Li Li,Zeng‐Ying Qiao,Lei Wang,Hao Wang. Self‐Assembly: Programmable Construction of Peptide‐Based Materials in Living Subjects: From Modular Design and Morphological Control to Theranostics (Adv. Mater. 45/2019)[J]. AdvancedMaterials,2019,31(45). [54]Chia-Fen Chi,Ratna Sari Dewi,Priska Samali,Dong-Yu Hsieh. Preference ranking test for different icon design formats for smart living room and bathroom functions[J]. Applied Ergonomics,2019,81. [55]Liu Sam,Marques Isabela Gouveia,Perdew Megan A,Strange Karen,Hartrick Teresa,Weismiller Joy,Ball Geoff D C,M?sse LouiseC,Rhodes Ryan,Naylor Patti-Jean. Family-based, healthy living intervention for children with overweight and obesity and theirfamilies: a 'real world' trial protocol using a randomised wait list control design.[J]. BMJ open,2019,9(10). [56]Sam Liu,Isabela Gouveia Marques,Megan A Perdew,Karen Strange,Teresa Hartrick,Joy Weismiller,Geoff D C Ball,Louise CM?sse,Ryan Rhodes,Patti-Jean Naylor. Family-based, healthy living intervention for children with overweight and obesity and their families: a ‘real world’ trial protocol using a randomised wait list control design[J]. BMJ Open,2019,9(10). [57]Shu-Yen Wang,Shyh-Huei Hwang. Research on Field Reconstruction and Community Design of Living Settlements—An Example of Repairing a Fish Stove in the Hua-Zhai Settlement on Wang-An Island, Taiwan[J]. Sustainability,2019,11(21). [58]Diana Sherifali,Anka Brozic,Pieter Agema,Hertzel C. Gerstein,Zubin Punthakee,Natalia McInnes,Daria O'Reilly,Sarah Ibrahim,R. Muhammad Usman Ali. The Diabetes Health Coaching Randomized Controlled Trial: Rationale, Design and Baseline Characteristics of Adults Living With Type 2 Diabetes[J]. Canadian Journal of Diabetes,2019,43(7). [59]Sherifali Diana,Brozic Anka,Agema Pieter,Gerstein HertzelC,Punthakee Zubin,McInnes Natalia,O'Reilly Daria,Ibrahim Sarah,Usman Ali R Muhammad. The Diabetes Health Coaching Randomized Controlled Trial: Rationale, Design and Baseline Characteristics of Adults Living With Type 2 Diabetes.[J]. Canadian journal ofdiabetes,2019,43(7). [60]Paula Barros,Linda Ng Fat,Leandro M.T. Garcia,Anne Dorothée Slovic,Nikolas Thomopoulos,Thiago Herick de Sá,Pedro Morais,Jennifer S. Mindell. Social consequences and mental health outcomes of living in high-rise residential buildings and the influence of planning, urban design and architectural decisions: A systematic review[J]. Cities,2019,93. [61]Jane Rohde. Book Review: Housing design for an increasingly older population: Redefining assisted living for the mentally and physically frail[J]. HERD: Health Environments Research & Design Journal,2019,12(4). [62]Kyazze Michael,Wesson Janet,Naudé Kevin. A conceptual framework for designing Ambient assisted living services for individuals with disabilities in Uganda and South Africa.[J].African journal of disability,2019,8. [63]. University of Tokyo; Inspired by natural signals in living cells, researchers design artificial gas detector[J]. NewsRx Health & Science,2019. [64]Rania Magdi Fawzy. Neoliberalism in your living room: A spatial cognitive reading of home design in IKEA catalogue[J]. Discourse, Context & Media,2019,31. [65] Living light: optics, ecology and design principles of natural photonic structures[J]. Journal of the Royal Society Interface Focus,2019,9(1). [66]F. G. García González,G. Agugiaro,R. Cavallo. AN INTERACTIVE DESIGN TOOL FOR URBAN PLANNING USING THE SIZE OF THE LIVING SPACE AS UNIT OF MEASUREMENT[J]. ISPRS - International Archives of the Photogrammetry, Remote Sensing and Spatial InformationSciences,2019,XLII-4/W15. [67]. Energy; Researchers from University of Sannio ReportDetails of New Studies and Findings in the Area of Energy (Numerical Optimization for the Design of Living Walls In the Mediterranean Climate)[J]. Energy Weekly News,2019. [68]. Astronomy; Investigators from NASA Goddard Space Flight Center Zero in on Astronomy (Optical Design of the Extreme Coronagraph for Living Planetary Systems Instrument for the Luvoir Mission Study)[J]. Science Letter,2019. [69]Roterman Irena,Konieczny Leszek. The living organism: evolutionary design or an accident[J]. Bio-Algorithms and Med-Systems,2019,15(3). [70]Hailiang Nie,Yanhong Liang,Chuang Han,Rubo Zhang,Xiaoling Zhang,Hongyuan Yan. Rational design of cyanovinyl-pyrene dual-emission AIEgens for potential application in dual-channel imaging and ratiometric sensing in living cells[J]. Dyes andPigments,2019,168. [71]Anonymous. Faulkner Design Group Earns Silver Aurora Awards for Excellence in Multifamily and Senior Living and Communities[J]. Design Cost Data,2019,63(5). [72]Rosa Francesca De Masi,Filippo de Rossi,SilviaRuggiero,Giuseppe Peter Vanoli. Numerical optimization for the design of living walls in the Mediterranean climate[J]. Energy Conversion and Management,2019,195. 环境设计英文参考文献三: [73]Michael Kyazze,Janet Wesson,Kevin Naudé. A conceptual framework for designing Ambient assisted living services for individuals with disabilities in Uganda and South Africa[J]. African Journal of Disability,2019,8. [74]Ma Yanyan,Tang Yonghe,Zhao Yuping,Lin Weiying. Rational Design of a Reversible Fluorescent Probe for Sensing SulfurDioxide/Formaldehyde in Living Cells, Zebrafish, and LivingMice.[J]. Analytical chemistry,2019,91(16). [75]Liu Guang-Jian,Zhang Yuan,Zhou Lingyun,Jia Li-Yan,Jiang Guohua,Xing Guo-Wen,Wang Shu. A water-soluble AIE-active polyvalentglycocluster: design, synthesis and studies on carbohydrate-lectin interactions for visualization of Siglec distributions in livingcell membranes.[J]. Chemical communications (Cambridge,England),2019,55(66). [76]Jaffar Ali,Javed Iqbal,Shabbir Majeed,Imran AhmedMughal,Awais Ahmad,Salman Ahmed. Wireless sensor network design for smart grids and Internet of things for ambient living using cross-layer techniques[J]. International Journal of Distributed Sensor Networks,2019,15(7). [77]Rosmina A. Bustami,Chris Brien,James Ward,Simon Beecham,Robyn Rawlings. A Statistically Rigorous Approach to Experimental Designof Vertical Living Walls for Green Buildings[J]. UrbanScience,2019,3(3). [78]Teksin Kopanoglu,Katie Beverley,Dominic Eggbeer,Andrew Walters. Uncovering self-management needs to better design for people living with lymphoedema[J]. Design for Health,2019,3(2). [79]Kerri Akiwowo,Lucy Dennis,George Weaver,Guy Bingham. The Living Archive: Facilitating Textile Design Research at Undergraduate Level Through Collaboration, Co-Creation and Student Engagement[J]. Journal of Textile Design Research andPractice,2019,7(2). [80]Vanessa Bartlett. Digital design and time on device; how aesthetic experience can help to illuminate the psychological impact of living in a digital culture[J]. Digital Creativity,2019,30(3). [81]Maree McCabe,Stuart Favilla,Sonja Pedell,Jeanie Beh,Andrew Murphy,Tanya Petrovich. O2‐01‐05: DESIGNING A BETTER VISIT: TOUCH SCREEN APPS FOR PEOPLE LIVING WITH DEMENTIA AND THEIR VISITORS[J]. Alzheimer's & Dementia,2019,15. [82]Maree McCabe,Stuart Favilla,Sonja Pedell,Jeanie Beh,Andrew Murphy,Tanya Petrovich. TD‐P‐33: DESIGNING A BETTER VISIT: TOUCH SCREEN APP FOR PEOPLE LIVING WITH DEMENTIA AND THEIR VISITORS[J]. Alzheimer's & Dementia,2019,15. [83]Ning Zhang-Wei,Wu Song-Ze,Liu Guang-Jian,Ji Yan-Ming,Jia Li-Yan,Niu Xiao-Xiao,Ma Rong-Fang,Zhang Yuan,Xing Guo-Wen. Water-soluble AIE-Active Fluorescent Organic Nanoparticles: Design, Preparation and Application for Specific Detection of Cysteine over Homocysteine and Glutathione in Living Cells.[J]. Chemistry, an Asian journal,2019,14(13). [84]Zhang‐wei Ning,Song‐ze Wu,Dr. Guang‐jian Liu,Yan‐ming Ji,Li‐yan Jia,Xiao‐xiao Niu,Rong‐fang Ma,Dr. Yuan Zhang,Prof. Guo‐wen Xing. Water‐soluble AIE‐Active Fluorescent Organic Nanoparticles: Design, Preparation and Application for Specific Detection of Cysteine over Homocysteine and Glutathione in Living Cells[J]. Chemistry – An Asian Journal,2019,14(13). [85]Turgeon Philippe,Laliberte Thierry,Routhier Francois,Campeau-Lecours Alexandre. Preliminary Design of an Active Stabilization Assistive Eating Device for People Living with MovementDisorders.[J]. IEEE ... International Conference on Rehabilitation Robotics : [proceedings],2019,2019. [86]Switzer Sarah,Chan Carusone Soo,Guta Adrian,Strike Carol. A Seat at the Table: Designing an Activity-Based Community Advisory Committee With People Living With HIV Who Use Drugs.[J]. Qualitative health research,2019,29(7). [87]Kui Du,Jian Liu,Runpu Shen,Pengfei Zhang. Design andsynthesis of a new fluorescent probe for cascade detection of Zn2+ and H<sub>2</sub>PO<sub>4</sub>? in water and targeted imaging of living cells[J]. Luminescence,2019,34(4). [88]Du Kui,Liu Jian,Shen Runpu,Zhang Pengfei. Design andsynthesis of a new fluorescent probe for cascade detection of Zn2+ and H<sub>2</sub> PO<sub>4</sub> - in water and targeted imaging of living cells.[J]. Luminescence : the journal of biological and chemical luminescence,2019,34(4). [89]Sarah Switzer,Soo Chan Carusone,Adrian Guta,Carol Strike. A Seat at the Table: Designing an Activity-Based Community Advisory Committee With People Living With HIV Who Use Drugs[J]. Qualitative Health Research,2019,29(7). [90]Zhang Jiahang,Shi Liang,Li Zhao,Li Dongyu,Tian Xinwei,Zhang Chengxiao. Near-infrared fluorescence probe for hydrogen peroxide detection: design, synthesis, and application in living systems.[J]. The Analyst,2019,144(11). [91]Peterson Erin L,Carlson Susan A,Schmid Thomas L,Brown David R,Galuska Deborah A. Supporting Active Living Through Community Plans: The Association of Planning Documents With Design Standards and Features.[J]. American journal of health promotion :AJHP,2019,33(2). [92]Mohamed El Amrousi,Feda Isam AbdulHafiz. Assessment of Modern Architecture in the Living City of UAE: Incorporating Sustainable Design into Covered Bazaar Buildings[J]. MATEC Web ofConferences,2019,266. [93]Tian Zhenhao,Ding Lele,Li Kun,Song Yunqing,Dou Tongyi,Hou Jie,Tian Xiangge,Feng Lei,Ge Guangbo,Cui Jingnan. Rational Design of a Long-Wavelength Fluorescent Probe for Highly Selective Sensing of Carboxylesterase 1 in Living Systems.[J]. Analyticalchemistry,2019,91(9). [94]. Wellness and glass: Designing better spaces to promote better living[J]. Building Design & Construction,2019. [95]Molly Mitchell,Donna Marie Bilkovic. Embracing dynamic design for climate‐resilient living shorelines[J]. Journal of Applied Ecology,2019,56(5). [96]Erguera Xavier A,Johnson Mallory O,Neilands Torsten B,Ruel Theodore,Berrean Beth,Thomas Sean,Saberi Parya. WYZ: a pilot study protocol for designing and developing a mobile health applicationfor engagement in HIV care and medication adherence in youth and young adults living with HIV.[J]. BMJ open,2019,9(5). [97]Gaobin Zhang,Yun Ni,Duoteng Zhang,Hao Li,NanxiangWang,Changmin Yu,Lin Li,Wei Huang. Rational design of NIR fluorescence probes for sensitive detection of viscosity in living cells[J]. Spectrochimica Acta Part A: Molecular and Biomolecular Spectroscopy,2019,214. [98]Xavier A. Erguera,Mallory O. Johnson,Torsten B.Neilands,Theodore Ruel,Beth Berrean,Sean Thomas,Parya Saberi. WYZ: a pilot study protocol for designing and developing a mobile health application for engagement in HIV care and medication adherence in youth and young adults living with HIV[J]. BMJ Open,2019,9(5). [99]John F. Barber. Designed for HI-FI Living: The Vinyl LP in Midcentury America ed. by Janet Borgerson and Jonathan Schroeder (review)[J]. Leonardo,2019,52(2). [100]Udeshika Weerakkody,John W. Dover,Paul Mitchell,Kevin Reiling. Topographical structures in planting design of living walls affect their ability to immobilise traffic-based particulatematter[J]. Science of the Total Environment,2019,660. [101]JohnF. Barber. Designed for Hi-Fi Living: The Vinyl LP in MidcenturyAmerica[J]. Leonardo,2019,52(2). [102]. Luminescence Research; Study Data from Shaoxing University Provide New Insights into Luminescence Research (Design andsynthesis of a new fluorescent probe for cascade detection of Zn2+ and H2 PO4 - in water and targeted imaging of living cells)[J]. Science Letter,2019. [103]Euan Winton,Paul Anthony Rodgers. Designed with Me. Empowering People Living with Dementia[J]. The DesignJournal,2019,22(sup1). [104]Steve Reay,Claire Craig,Nicola Kayes. Unpacking two design for health living lab approaches for more effectiveinterdisciplinary collaboration[J]. The DesignJournal,2019,22(sup1). [105]Louise Mullagh,Stuart Walker,Martyn Evans. Living Design. The future of sustainable maker enterprises: a case study inCumbria[J]. The Design Journal,2019,22(sup1). [106]Zubair Khalid,Usman Khalid,Mohd Adib Sarijari,Hashim Safdar,Rahat Ullah,Mohsin Qureshi,Shafiq Ur Rehman. Sensor virtualization Middleware design for Ambient Assisted Living based on the Priority packet processing[J]. Procedia ComputerScience,2019,151. [107]A.EL ALAMI,Y. GHAZAOUI,S. DAS,S.D. BENNANI,M.EL GHZAOUI. Design and Simulation of RFID Array Antenna 2x1 for Detection System of Objects or Living Things in Motion[J]. Procedia Computer Science,2019,151. [108]Tao Jia,Zhi-Hang Chen,Peng Guo,Junping Yu. An insight into DNA binding properties of newly designed cationicδ,δ′?diazacarbazoles: Spectroscopy, AFM imaging and living cells staining studies[J]. Spectrochimica Acta Part A: Molecular and Biomolecular Spectroscopy,2019,211. 以上就是环境设计英文参考文献的全部内容,希望看后对你有一点点帮助。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

EVOLUTION OF AN ENVIRONMENTAL AUDIT PROGRAM

J. H. Maday T. L. Kuusinen

October 1991 Presented at the Environmental Auditing Conference October 22-23, 1991 Seattle, Washington

Work supported by the U.S. Department of Energy under Contract DE-ACO6-76RLO 1830

Pacific Northwest Laboratory Richland, Washington 99352 DISCLAIMER This report was prepared as an account of work sponsored by an agency of the United States。Government. Neither the United States Government nor any agency thereof, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of any information, apparatus, product, or process disclosed, or represents that its use would not infringe privately owned rights. Reference herein to any specific commercial product, process, or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply its endorsement, recommendation, or favoring by the United States Government or any agency thereof. The views and opinions of authors expressed herein do not necessarily state or reflect those of the United States Government or any agency thereof. Evolution of an Environmental Audit Program

Joseph H. Maday, Jr. (ASQC-CQA) Technical Group Leader - Quality Verification Department and Tapio Kuusinen Senior Research Scientist Environmental Policy and Compliance Group Pacific Northwest Laboratory Richland, Washington 99352 ACKNOWLEDGEMENT This document was prepared under the direction of the U.S. Environment Protection Agency’s (EPA) Small Business Division. There were numerous reviewers from government and private organizations. Additionally, the following provided important advice and/or reference materials: * Small Business Ombudsman, Maine Department of Environmental Protection * Tennessee Small Business Assistance Program * New Jersey Department of Environmental Protection * Massachusetts Office of Technical Assistance for Toxics Use Reduction (OTA) * Iowa Waste Reduction Center, University of Northern Iowa * Florida Small Business Assistance Program The products and services included in this document were contributed for review by commercial and government sources. The project team is thankful for their timely cooperation. ABSTRACT International and national standards, and in some cases corporate policies require that planned and scheduled audits be performed to verify all aspects of environmental compliance and to determine effective implementation of the environmental management program. An example of this can be found in the definition of auditing as provided by U. S. Environmental Protection Agency (EPA) Policy Statement on Environmental Auditing. It defines environmental auditing as follows:

"Environmental auditing is a systematic, documented, periodic and objective review by regulated entities of facility operations and practices related to meeting environmental requirements. Audits can be designed to accomplish any or all of the following: verify compliance with environmental requirements, evaluate the effectiveness of environmental management systems already in place, or assess risks from regulated and unregulated materials and practices.

Auditing serves as a quality assurance check to help improve the effectiveness of basic environmental management by verifying that management practices are in place, functioning and adequate. ''

Many specifications further emphasize that the audit be performed to written procedures or checklists (to provide later documentation) by personnel who do not have direct responsibility for performing the activities being audited. The results of such audits are generally required to be documented, reported to, and reviewed by, responsible management. Follow-up action will be taken where indicated. The responsible organization can then take follow-up action as needed.

An effective auditing program is a useful tool for improving environmental compliance. If developed properly, the program will point out areas of weakness and areas of potential problems. An auditing program will also identify environmental compliance activities that meet or exceed expectations.