公司理财试卷及答案

《公司理财》期末试卷A(含答案)

页脚 .XXXX 学 院2015 /2016 学年第 2学期考试试卷( A )卷课程名称: 公司理财 适用专业/年级:2014级会计电算化本卷共 5 页,考试方式: 闭卷 ,考试时间: 90 分钟一、单项选择题 (本题共12小题,每题2分,共24分)1. 以下企业组织形式当中创立最容易维持经营固定成本最低的是( ) 。

A.个人独资企业 B.合伙制企业 C.有限责任公司 D.股份2.公司的目标不包括以下( )。

A.生存目标 B.发展目标 C.盈利目标 D.收购目标3.资产负债率主要是反映企业的( )指标。

A.盈利能力 B.长期偿债能力 C.发展能力 D.营运能力4.企业的财务报告不包括( )。

A.现金流量表B.财务状况说明书C.利润分配表D.比较百分比会计报表 5.资产负债表不提供( )等信息。

A.资产结构B.负债水平C.经营成果D.资金来源情况6.某校准备设立永久性奖学金,每年计划颁发36000元资金,若年复利率为12%,该校现在应向银行存入( )元本金。

A .450000 B .300000 C .350000 D .3600007.债券投资中,债券发行人无法按期支付利息或本金的风险称为( ) A.违约风险 B.利息率风险 C.购买力风险 D.流动性风险专业班级: 姓 名: 学 号:密 封 线装 订 线8.某人将10000元存入银行,银行的年利率为10%,按复利计算。

则5年后此人可从银行取出()元。

A.17716B.15386C.16105D.146419.股票投资的特点是()A.股票投资的风险较小B.股票投资属于权益性投资C.股票投资的收益比较稳定D.股票投资的变现能力较差10.下列各项年金中,只有现值没有终值的年金是()A.普通年金B.即付年金C.永续年金D.先付年金11. 在公司理财市场环境风险分析当中无法通过分散投资来消除的风险是()A.系统风险B.非系统风险C.绝对风险D.财务风险12.流动比率的计算公式是()A.流动负债/流动资产B.流动资产/流动负债C.流动资产/总资产D.流动资产/负债总额二、多项选择题(本题共6小题,每题3分,共18分)1.公司企业的优点包括()。

2012上公司理财A试卷试题与答案

广州中医药大学2011-2012学年第二学期期末考试《公司理财》试卷(A卷)(适用于经管学院2010级国际经济与贸易专业)考试时间:120分钟满分:100分经管学院2010级国际经济与贸易专业姓名:学号:说明:所有答案一律写在答题卷上,答案写在试卷上无效。

一、单项选择题(本题共30小题,每小题1分,共30分)答题说明:下列4个备选答案中只有1个是最佳答案,请用钢笔把正确答案的字母填写在答题纸相应的位置。

1、公司财务经理的基本职能不包括( C )。

A.投资管理B.收益分配管理C. 核算管理D.融资管理2、盛大公司拟建立一项基金,每年年初投入500万元,若利率为10%,5年后该基金本利和将为(B)万元。

(F/A,10%,6)=7.7156A.2358B.3358C.3360D.4000解:500×【(F/A,10%,6)-1】=3、下列不属于年金形式的是(B)。

A.折旧B.债券本金C.租金D.保险金4、某项永久性奖学金,每年计划颁发10万元奖金,若利率为8%,则该项奖学金的本金应为(B)元。

A.1 000 000B.1 250 000C.2 050 000D. 2 500 0005、某公司2年前以300万元购入一块土地,当前市价为320万元,如果公司计划在这块土地上兴建厂房,投资分析时应(D)。

A.将20万元作为投资的机会成本2B.将300万元作为投资的机会成本C.将320万元作为投资的沉没成本D.将320万元作为投资的机会成本6、某投资方案,当折现率为12%时,其净现值为478万元;当折现率为14%时,其净现值为-22万元,则该方案的内部收益率为 (D)。

A.12.91%B.13.21%C.13.59%D.13.91% IRR=12%+%)12%14(22478478-⨯+=13.91% 7、如果甲公司的β系数为1.2,市场组合的预期收益率为12%,无风险收益率为9%,则甲公司股票的预期收益率为(B )。

公司理财第2次作业-推荐下载

内容: 采用剩余股利分配政策的优点是有利于保持理想的资金结构,降低企业的综合资金成本。 1、 错 2、 对

学员答案:2 本题得分:1

题号:5 题型:单选题(请在以下几个选项中选择唯一正确答案) 内容: 公司采用固定股利政策发放股利的好处主要表现为( ) A、降低资金成本 B、维持股价稳定 C、提高支付能力 D、实现资本保全

学员答案:B 本题得分:3

题号:6 题型:单选题(请在以下几个选项中选择唯一正确答案) 本题分数:3 内容: 认为公司分配的股利越多,公司的市场价值也就越大的股利理论是 ( ) A、所得税差异理论 B、“在手之鸟”理论 C、股利无关论 D、代理理论

学员答案:B 本题得分:3

题号:7 题型:单选题(请在以下几个选项中选择唯一正确答案) 内容: 我国上市公司不得用于支付股利的权益资金是( ) A、资本公积 B、任意盈余公积 C、法定盈余公积 D、上年未分配利润

题号:4 题型:判断题 本题分数:1

对全部高中资料试卷电气设备,在安装过程中以及安装结束后进行高中资料试卷调整试验;通电检查所有设备高中资料电试力卷保相护互装作置用调与试相技互术通关,1系电过,力管根保线据护敷生高设产中技工资术艺料0不高试仅中卷可资配以料置解试技决卷术吊要是顶求指层,机配对组置电在不气进规设行范备继高进电中行保资空护料载高试与中卷带资问负料题荷试2下卷2,高总而中体且资配可料置保试时障卷,各调需类控要管试在路验最习;大题对限到设度位备内。进来在行确管调保路整机敷使组设其高过在中程正资1常料中工试,况卷要下安加与全强过,看度并22工且22作尽22下可22都能22可地护以缩1关正小于常故管工障路作高高;中中对资资于料料继试试电卷卷保破连护坏接进范管行围口整,处核或理对者高定对中值某资,些料审异试核常卷与高弯校中扁对资度图料固纸试定,卷盒编工位写况置复进.杂行保设自护备动层与处防装理腐置,跨高尤接中其地资要线料避弯试免曲卷错半调误径试高标方中高案资等,料,编试要5写、卷求重电保技要气护术设设装交备备置底4高调、动。中试电作管资高气,线料中课并敷3试资件且、设卷料中拒管技试试调绝路术验卷试动敷中方技作设包案术,技含以来术线及避槽系免、统不管启必架动要等方高多案中项;资方对料式整试,套卷为启突解动然决过停高程机中中。语高因文中此电资,气料电课试力件卷高中电中管气资壁设料薄备试、进卷接行保口调护不试装严工置等作调问并试题且技,进术合行,理过要利关求用运电管行力线高保敷中护设资装技料置术试做。卷到线技准缆术确敷指灵设导活原。。则对对:于于在调差分试动线过保盒程护处中装,高置当中高不资中同料资电试料压卷试回技卷路术调交问试叉题技时,术,作是应为指采调发用试电金人机属员一隔,变板需压进要器行在组隔事在开前发处掌生理握内;图部同纸故一资障线料时槽、,内设需,备要强制进电造行回厂外路家部须出电同具源时高高切中中断资资习料料题试试电卷卷源试切,验除线报从缆告而敷与采设相用完关高毕技中,术资要资料进料试行,卷检并主查且要和了保检解护测现装处场置理设。备高中资料试卷布置情况与有关高中资料试卷电气系统接线等情况,然后根据规范与规程规定,制定设备调试高中资料试卷方案。

2022年理财资格考试试卷和答案(7)

2022年理财资格考试试卷和答案(7)共3种题型,共130题一、单选题(共50题)1.以下关于安心定开的描述哪项是正确的?A:产品类型为固定收益类B:销售对象包含金融机构同业客户C:对公客户支持电子渠道预约申购及预约赎回D:是低风险的净值型理财产品【答案】:A2.对购买中高风险以上,或单笔投资金额较大(即(__)以上)的投资者,应加强审核,在完成销售前,将销售文件报经各级分支机构销售部门负责人或其授权的业务主管人员审核。

A:100万元B:300万元C:500万元D:1000万元【答案】:C3.每只封闭式公募产品、每只私募产品的总资产不得超过该产品净资产的____。

A:140%B:150%C:200%D:240%【答案】:C4.“安心·半年开放”第1-6期理财产品的开放日期结束时间为开放期最后一日的几点。

A:15:00B:16:00C:17:00D:18:00【答案】:B5.客户于周一购买4万元农银时时付产品,周六下午16点全部实时赎回,该部分产品份额收益计算截止至哪天?(周一至周五为工作日,周六、周日为假日)A:周五B:周六C:周日D:下周一【答案】:B6.根据《商业银行理财产品销售管理要求》,理财产品说明书属于()类宣传销售文本。

A:销售文件B:宣传材料C:参考材料D:营销材料【答案】:A7.中国农业银行发行的周四我最赚等灵珑封闭净值型(即安心期次)理财产品资金到账日为_____。

A:产品到期日当天(若到期日为节假日,则顺延至下一工作日)B:产品到期日次日C:产品到期日下一工作日,最晚不晚于到期日下两个工作日D:产品到期日后一周内【答案】:A8.目前我行自动理财功能可以申购对接的理财产品为()A:安心快线天天利滚利第2期开放式产品B:安心快线步步高开放式产品C:农银私行·安心快线天天利开放式产品D:本利丰步步高开放式产品【答案】:A9.每只理财产品做到____、单独建账和单独核算。

东财《公司理财》在线作业三答卷

25.下列资产中属于临时性流动资产的是:

A.销售旺季增加的应收账款

B.销售旺季增加的存货

C.最佳现金余额

D.季节性存货

E.保险储备存货量

答案:ABD

答案:BCE

24.当一项独立的长期投资方案的净现值大于0时,则可以说明:

A.该方案的获利指数一定大于1

B.该方案的现金流入现值总和大于该方案的现金流出现值总和

C.该方案的回收期一定小于投资者预期的回收期

D.该方案可以接受,应该投资

E.该方案内部收益率大于投资者要求的最低报酬率

答案:ABDE

答案:D

14.财务管理理论的前提是:

A.财务管理目标

B.财务管理环境

C.财务管理概念

D.财务管理假设

答案:B

15.目标公司董事会决议,如果目标公司被并购,且高层管理者被革职时,他们可以得到巨额退休金,以提高收购成本。这种反收购策略是:

A.“金降落伞”策略

B.“白衣骑士”

C.“焦土”政策

东财《公司理财》在线作业三-0006

试卷总分:100 得分:100

一、单选题 (共 15 道试题,共 60 分)

1.已知欧元相对美元升值了25%,则美元相对欧元的汇率变动百分比为:

A.20%

B.10%

C.-20%

D.-10%

答案:C

2.“将遭受敌意收购的目标公司为了避免遭到敌意收购者的控制而自己寻找善意收购者”的策略是:

A.本国货币币值上涨

B.外汇汇率下跌

C.外汇汇率上涨

D.外币币值下跌

答案:C

9.下列关于认股权证的说法中错误的是:

公司理财期末试卷试题及含答案

模拟试题一 . 名词解说:1、公司理财:相关公司资本的筹集、投放与使用、分派的管理活动。

是对公司财务活动的管理。

它受公司财务活动的特色所限制,依据上述公司财务活动的特色,公司理财的主要内容也相应地包含公司筹资、公司投资和盈余分派三大内容。

2、现值:将来某一期间必定数额的款项折合成此刻的价值,即本金。

3、股利:从公司净利润中以现金、股票的形式或其余财产支付给公司股东的一种酬劳。

4、财务杠杆:公司在作出资本构造决议时对债务筹资的利用程度。

5、应收账款:公司在生产经营过程中所形成的应收而未收的款项,包含应收销货款、应收单据和其余应收款等。

6、公司财务目标:公司进行理财实践活动所希望达到的目的,是评论公司理财行为能否合理的标准。

7、年金:在一准期间内,每间隔同样时间支付或收入相等金额的款项。

8、一般股股票:股份有限公司刊行的代表着股东享有着同等的权益和义务、不加特别限制、股利不固定的最基本的股票。

9、融资租借:由出租人依照承租人的要求融资购买设施,并在契约或合同规定得较长久限内供应给承租人使用的信誉业务。

是指与租借财产所有权相关的风险和酬劳实质上已所有转移到承租方的租借形式。

10、净现值:投资方案将来现金净流入量的现值与投资额现值之间的差额。

净现值是指投资项目将来现金流入量的折现值与其原始投资现金流出量的折现值的差额。

11、会计报表:在对平时会计核算资料进行综合整理的基础上编制的,用以总括地反应某一会计单位在一准期间内的财务状况和经营成就的报告文件。

12、长久借钱:向银行等金融机构借入的限期在 1 年以上的借钱。

13、资本成本:公司获得并使用资本所应负担的成本。

资本成本,又称资本成本,是指公司为获得和据有资本而付出的代价,它由资本的筹资成本和占用成本两部分构成。

14、现金流量:投资项目在将来一段期间内,现金流入和现金流出的数目。

15、存货:公司在生产经营过程中为销售或许耗用而储藏的各样财产。

二、简答题1、简述有限责任公司和股份有限公司这种有限公司的长处。

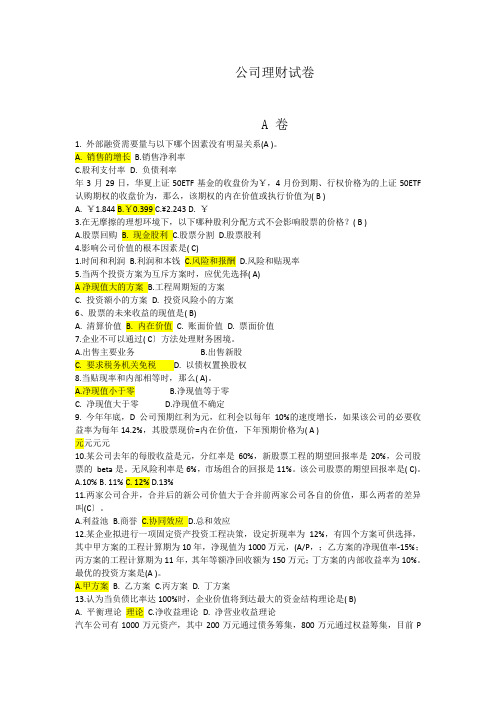

公司理财试卷两套及答案

公司理财试卷A 卷1. 外部融资需要量与以下哪个因素没有明显关系(A )。

A. 销售的增长B.销售净利率C.股利支付率D. 负债利率年3月29日,华夏上证50ETF基金的收盘价为¥,4月份到期、行权价格为的上证50ETF 认购期权的收盘价为,那么,该期权的内在价值或执行价值为( B )A. ¥1.844B.¥0.399C.¥2.243D. ¥3.在无摩擦的理想环境下,以下哪种股利分配方式不会影响股票的价格?( B )A.股票回购B. 现金股利C.股票分割D.股票股利4.影响公司价值的根本因素是( C)1.时间和利润B.利润和本钱C.风险和报酬D.风险和贴现率5.当两个投资方案为互斥方案时,应优先选择( A)A净现值大的方案B.工程周期短的方案C. 投资额小的方案D. 投资风险小的方案6、股票的未来收益的现值是( B)A. 清算价值B. 内在价值C. 账面价值D. 票面价值7.企业不可以通过( C〕方法处理财务困境。

A.出售主要业务B.出售新股C. 要求税务机关免税D. 以债权置换股权8.当贴现率和内部相等时,那么( A)。

A.净现值小于零B.净现值等于零C. 净现值大于零D.净现值不确定9. 今年年底,D公司预期红利为元,红利会以每年10%的速度增长,如果该公司的必要收益率为每年14.2%,其股票现价=内在价值,下年预期价格为( A )元元元元10.某公司去年的每股收益是元,分红率是60%,新股票工程的期望回报率是20%,公司股票的beta是。

无风险利率是6%,市场组合的回报是11%。

该公司股票的期望回报率是( C)。

A.10%B. 11%C. 12%D.13%11.两家公司合并,合并后的新公司价值大于合并前两家公司各自的价值,那么两者的差异叫(C〕。

A.利益池B.商誉C.协同效应D.总和效应12.某企业拟进行一项固定资产投资工程决策,设定折现率为12%,有四个方案可供选择,其中甲方案的工程计算期为10年,净现值为1000万元,(A/P,;乙方案的净现值率-15%;丙方案的工程计算期为11年,其年等额净回收额为150万元;丁方案的内部收益率为10%。

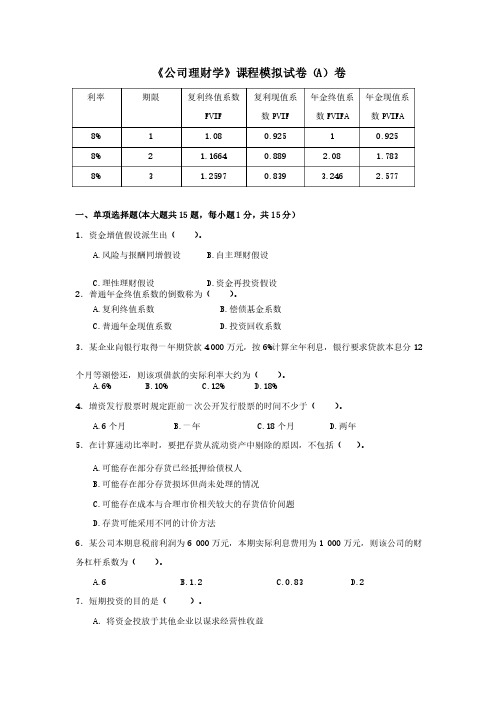

《公司理财学》A卷

《公司理财学》课程模拟试卷(A )卷利率利率期限期限复利终值系数FVIF复利现值系数PVIF 年金终值系数FVIFA年金现值系数PVIFA 8% 1 1.08 0.925 1 0.925 8% 2 1.1664 0.889 2.08 1.783 8% 31.25970.8393.2462.577一、单项选择题(本大题共15题,每小题1分,共15分) 1.资金增值假设派生出(.资金增值假设派生出( ))。

A.A.风险与报酬同增假设风险与报酬同增假设风险与报酬同增假设 B. B. B.自主理财假设自主理财假设自主理财假设 C.C.理性理财假设理性理财假设理性理财假设 D. D. D.资金再投资假设资金再投资假设资金再投资假设2.普通年金终值系数的倒数称为(.普通年金终值系数的倒数称为( ))。

A.A.复利终值系数复利终值系数复利终值系数 B. B. B.偿债基金系数偿债基金系数偿债基金系数 C.C.普通年金现值系数普通年金现值系数普通年金现值系数 D. D. D.投资回收系数投资回收系数投资回收系数3.某企业向银行取得一年期贷款4 000万元,按6%6%计算全年利息,银行要求贷款本息分计算全年利息,银行要求贷款本息分12个月等额偿还,则该项借款的实际利率大约为(个月等额偿还,则该项借款的实际利率大约为( ))。

A.6% B.10% C.12% D.18%4.增资发行股票时规定距前一次公开发行股票的时间不少于(.增资发行股票时规定距前一次公开发行股票的时间不少于( ))。

A.6个月个月 B. B. B.一年一年一年 C.18 C.18个月个月 D. D. D.两年两年两年 5.在计算速动比率时,要把存货从流动资产中剔除的原因,不包括(.在计算速动比率时,要把存货从流动资产中剔除的原因,不包括( ))。

A.A.可能存在部分存货已经抵押给债权人可能存在部分存货已经抵押给债权人可能存在部分存货已经抵押给债权人 B.B.可能存在部分存货损坏但尚未处理的情况可能存在部分存货损坏但尚未处理的情况可能存在部分存货损坏但尚未处理的情况 C. C.可能存在成本与合理市价相关较大的存货估价问题可能存在成本与合理市价相关较大的存货估价问题可能存在成本与合理市价相关较大的存货估价问题 D. D.存货可能采用不同的计价方法存货可能采用不同的计价方法存货可能采用不同的计价方法6.某公司本期息税前利润为6 000万元,本期实际利息费用为1 000万元,则该公司的财务杠杆系数为(务杠杆系数为( ))。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

4.11 You have the opportunity to make an investment that costs $900,000. If you make this investment now, you will receive $120,000 one year from today, $250,000 and $800,000 two and three years from today, respectively. The appropriate discount rate for this investment is 12 percent.a. Should you make the investment?b. What is the net present value (NPV) of this opportunity?c. If the discount rate is 11 percent, should you invest? Compute the NPV to support your answer.a. The cost of investment is $900,000.PV of cash inflows = $120,000 / 1.12 + $250,000 / 1.122 + $800,000 / 1.123= $875,865.52Since the PV of cash inflows is less than the cost of investment,you should not make the investment.b. NPV = -$900,000 + $875,865.52= -$24,134.48c. NPV = -$900,000 + $120,000 / 1.11 + $250,000 / 1.112 + $800,000 /1.113= $-4,033.18Since the NPV is still negative, you should not make the investment.4.24 Harris, Inc., paid a $3 dividend yesterday. If the firm raises its dividend at 5 percent every year and the appropriate discount rate is 12 percent, what is the price of Harris stock?P = $3 (1.05) / (0.12 - 0.05) = $45.004.25 In its most recent corporate report, Williams, Inc., apologized to its stockholders for not paying a dividend. The report states that management will pay a $1 dividend next year. That dividend will grow at 4 percent every year thereafter. If the discount rate is 10 percent, how much are you willing to pay for a share of Williams, Inc.?P = $1 / (0.1 - 0.04) = $16.674.51 Southern California Publishing Company is trying to decide whether or not to revise its popular textbook, Financial Psychoanalysis Made Simple. They have estimated that the revision will cost $40,000. Cash flows from increased sales will be $10,000 the first year. These cash flows will increase by 7 percent per year. The book will go out of print five years from now. Assume the initial cost is paid now and all revenues are received at the end of each year. If the company requires a 10 percent return for such an investment, should it undertake the revision?The effective annual interest rate is[ 1 + (0.08 / 4) ] 4 – 1 = 0.0824The present value of the ten-year annuity is= $5,974.24PV = 900 10.00824Four remaining discount periodsPV = $5,974.24 / (1.0824) 4 = $4,352.435.13 A common stock pays a current dividend of $2. The dividend is expected to grow at an 8-percent annual rate for the next three years; then it will grow at 4 percent in perpetuity. The appropriate discount rate is 12 percent. What is the price of this stock?Price = $2 (1.08) / 1.12 + $2 (1.082) / 1.122 + $2 (1.083) / 1.123+ {$2 (1.083)(1.04) / (0.12 - 0.04)} / 1.123= $28.895.17 Consider the stock of Davidson Company that will pay an annual dividend of $2 in the coming year. The dividend is expected to grow at a constant rate of 5 percent permanently. The market requires a 12-percent return on the company.a. What is the current price of a share of the stock?b. What will the stock price be 10 years from today?a. P = $2 / (0.12 - 0.05) = $28.57b. P10 = D11 / (r - g)= $2 (1.0510) / (0.12 - 0.05)= $46.54Alternatively, given the answer to part a, P10 = P0(1+g)10 = 28.54(1.05)10 = $46.54.5.20 Allen, Inc., is expected to pay an equal amount of dividends at the end of the first two years. Thereafter, the dividend will grow at a constant rate of 4 percent indefinitely. The stock is currently traded at $30. What is the expected dividend per share for the next year if the required rate of return is 12 percent?$30 = D / 1.12 + D / 1.122 + {D (1 + 0.04) / (0.12 - 0.04)} / 1.122 = 12.053571 DD = $2.495.21 Calamity Mining Company's reserves of ore are being depleted, and its costs of recovering a declining quantity of ore are rising each year. As a result, the company's earnings are declining at the rate of 10 percent per year. If the dividend per share that is about to be paid is $5 and the required rate of return is 14 percent, what is the value of the firm's stock?[Insert before last sentence of question: Assume that dividends are a fixed proportion of earnings.]Dividend one year from now = $5 (1 - 0.10) = $4.50Price = $5 + $4.50 / {0.14 - (-0.10)}= $23.75Since the current $5 dividend has not yet been paid, it is still included in the stock price.5.25 Rite Bite Enterprises sells toothpicks. Gross revenues last year were $3 million, and total costs were $1.5 million. Rite Bite has 1 million shares of common stock outstanding. Gross revenues and costs are expected to grow at 5 percent per year. Rite Bite pays no income taxes, and all earnings are paid out as dividends.a. If the appropriate discount rate is 15 percent and all cash flows are received at year's end, what is the price per share of Rite Bite stock?b. The president of Rite Bite decided to begin a program to produce toothbrushes. The project requires an immediate outlay of $15 million. In one year, another outlay of $5 million will be needed. The year after that, net cash inflows will be $6 million. This profit level will be maintained in perpetuity. What effect will undertaking this project have on the price per share of the stock?a. Price = ($3 - $1.5) 1.05 / (0.15 - 0.05)= $15.75b. NPVGO = -$15,000,000 - $5,000,000 / 1.15 + ($6,000,000 / 0.15) / 1.15= $15,434,783The price increases by $15.43 per share.5.26 California Electronics, Inc., expects to earn $100 million per year in perpetuity if it does not undertake any new projects. The firm has an opportunity that requires an investment of $15 million today and $5 million in one year. The new investment will begin to generate additional annual earnings of $10 million two years from today in perpetuity. The firm has 20 million shares of common stock outstanding, and the required rate of return on the stock is 15 percent.a. What is the price of a share of the stock if the firm does not undertake the new project?b. What is the value of the growth opportunities resulting from the new project?c. What is the price of a share of the stock if the firm undertakes the new project?a. Price = EPS / r= {$100 million / 20 million} / 0.15= $33.33b. NPV = -$15 million - $5 million / 1.15 + ($10 million / 0.15) / 1.15= $38,623,188c. Price = $33.33 + $38,623,188 / 20,000,000= $35.265.27 Suppose Smithfield Foods, Inc., has just paid a dividend of $1.40 per share. Sales and profits for Smithfield Foods are expected to grow at a rate of 5% per year. Its dividend is expected to grow by the same rate. If the required return is 10%, what is the value of a share of Smithfield Foods?Price = 1.40 (1.05) / 0.10 - 0.05Price = $29.405.29 Four years ago, Ultramar Diamond Inc. paid a dividend of $0.80 per share. This year Ultramar paid a dividend of $1.66 per share. It is expected that the company will pay dividends growing at the same rate for the next 5 years. Thereafter, the growth rate will level at 8% per year. The required return on this stock is 18%. According to the discounted dividend model, what would Ultramar's cash dividend be in 7 years?a. $2.86b. $3.06c. $3.68d. $4.30e. $4.82Given D-4 = 0.80; D0 = 1.66=> D-4(1+r)4 = D00.80(1+r)4 = 1.66=> (1+r)4 = 1.66/0.80=> r = (1.66/0.80)0.25 - 1= 0.20020.20.8 1.66 1.66(1.2) 1.66(1.2)2 1.66(1.2)3 1.66(1.2)41.66(1.2)5 1.66(1.2)5 1.66(1.2)5(1.08)(1.08)-4 0 1 2 3 4 5 6 7D7 = 1.66(1.2)5(1.08) 4.82 (choice e)5.30 The Webster Co. has just paid a dividend of $5.25 per share. The company will increase its dividend by 15 percent next year and will then reduce its dividend growthby 3 percent each year until it reaches the industry average of 5 percent growth,after which the company will keep a constant growth, forever. The required rate ofreturn for the Webster Co. is 14 percent. What will a share of stock sell for?5.25(1.15)5.25(1.15)(1.12)(1.12)(1.09)5.25 5.25(1.15) 5.25(1.15)(1.12) 5.25(1.15)(1.12)(1.09) (1.09)(1.06) (1.06)(1.05)Time Cash Flow PV(Cash Flow)=1 6.0375 6.0375/1.14 5.29612 6.762 6.762/(1.14)2 5.203137.37067.3706/(1.14)3 4.974947.81287.8128/(1.14)4 4.6258[7.8128(1.05)/(0.14-0.05)][1/(1.14)4]53.96784PV of growingperpetuityTotal =74.06776.18 Consider the following cash flows of two mutually exclusive projects for Chinese Daily News.a. Based on the payback period rule, which project should be chosen?b. Suppose there is no corporate tax and the cash flows above are income before the depreciation. The firm uses a straight-line depreciation method (i.e., equal amounts of depreciation in each year). What is the average accounting return for each of these two projects?c. Which project has a greater IRR?d. Based on the incremental IRR rule, which project should be chosen?Let project A represent New Sunday Early Edition; and let project B represent New Saturday Late Edition.a. Payback period of project A = 2 + ($1,200 - $1,150) / $450 = 2.11 yearsPayback period of project B = 2 + ($2,100 - $1,900) / $800 = 2.25 yearsBased on the payback period rule, you should choose project A.b. Project A:Average investment = ($1,200 + $0) / 2 = $600Depreciation = $400 / yearAverage income = [($600 - $400) + ($550 - $400) + ($450 - $400)] / 3= $133.33AAR = $133.33 / $600 = 22.22%Project B:Average investment = ($2,100 + $0) / 2 = $1,050Depreciation = $700 / yearAverage income = [($1,000 - $700) + ($900 - $700) + ($800 - $700)] / 3= $200AAR = $200 / $1,050 = 19.05%c. IRR of project A:-$1,200 + $600 / (1 + r) + $550 / (1 + r)2 + $450 / (1 + r)3 = 0IRR = r = 16.76%IRR of project B:-$2,100 + $1,000 / (1 + r) + $900 / (1 + r)2 + $800 / (1 + r)3 = 0IRR = r = 14.29%Project A has a greater IRR.d. IRR of project B-A:Incremental cash flowsYear0123B - A-$900$400$350$350-$900 + $400 / (1 + r) + $350 / (1 + r)2 + $350 / (1 + r)3 = 0Incremental IRR = r = 11.02%If the required rate of return is greater than 11.02%, then choose project A.If the required rate of return is less than 11.02%, then choose project B.6.19 Consider the following cash flows on two mutually exclusive projects that require an annual return of 15 percent. Working in the financial planning department for the Bahamas Recreation Corp., you are trying to compare different investment criteria to arrive at a sensible choice of these two projects.a. Based on the discounted payback period rule, which project should be chosen?b. If your decision rule is to accept the project with a greater IRR, which project should you choose?c. Since you are fully aware of the IRR rule's scale problem, you calculate the incremental IRR for the cash flows. Based on your computation, which project should you choose?d. To be prudent, you compute the NPV for both projects. Which project should you choose? Is it consistent with the incremental IRR rule?Let project A be Deepwater Fishing; let project B be New Submarine Ride.a. Project A:Year Discounted CF Cumulative CF0 -$600,000 -$600,0001234,783-365,2172264,650-100,5673197,255Discounted payback period of project A = 2 + $100,567 / $197,255= 2.51 yearsProject B:Year Discounted CF Cumulative CF0 -$1,800,000 -$1,800,0001869,565-930,4352529,301-401,1343591,765Discounted payback period of project B = 2 + $401,134 / $591,765= 2.68 yearsProject A should be chosen.b. IRR of project A:-$600,000 + $270,000 / (1 + r) + $350,000 / (1 + r)2 + $300,000 /(1 + r)3 = 0IRR = r = 24.30%IRR of project B:-$1,800,000 + $1,000,000 /(1 + r) + $700,000 / (1 + r)2 + $900,000 / (1 + r)3= 0IRR = r = 21.46%Based on the IRR rule, project A should be chosen since it has a greater IRR.c. Incremental IRR:Year0123B - A-$1,200,000$730,000$350,000$600,000-$1,200,000 + $730,000 / (1 + r) + $350,000 / (1 + r)2 + $600,000 /(1 + r)3 = 0Incremental IRR = r = 19.92%Since the incremental IRR is greater than the required rate of return, 15%, choose project B.d. NPV A = -$600,000 + $270,000 / 1.15 + $350,000 / 1.152+ $300,000 / 1.153= $96,687.76NPV B = -$1,800,000 + $1,000,000 / 1.15 + $700,000 / 1.152 + $900,000 / 1.153= $190,630.39Since NPV B > NPV A, choose project B.Yes, the NPV rule is consistent with the incremental IRR rule. 10.3 Mr. Henry can invest in Highbull stock or Slowbear stock. His projection of the returns on these two stocks is as follows:a. Calculate the expected return of each stock.b. Calculate the standard deviation of return of each stock.c. Calculate the covariance and correlation between the two stocks.a. R HB= 0.25 (–2.0) + 0.60 (9.2) + 0.15 (15.4)= 7.33%R SB= 0.25 (5.0) + 0.60 (6.2) + 0.15 (7.4)= 6.08%b. HB2= 0.25 (– 0.02 – 0.0733)2 + 0.60 (0.092 – 0.0733)2+ 0.15 (0.154 – 0.0733)2= 0.003363HB = (0.003363)1/2 = 0.05799 = 5.80%SB2= 0.25 (0.05 – 0.0608)2 + 0.60 (0.062 – 0.0608)2 + 0.15 (0.074 – 0.0608)2= 0.000056SB = (0.000056)1/2 = 0.00749 = 0.75%c. Cov (R HB, R SB)= 0.25 (– 0.02 – 0.0733) (0.05 – 0.0608)+ 0.60 (0.092 – 0.0733) (0.062 – 0.0608)+ 0.15 (0.154 – 0.0733) (0.074 – 0.0608)= 0.000425286Corr (R HB, R SB)= 0.000425286 / (0.05799 0.00749)= 0.979110.5 Security F has an expected return of 12 percent and a standard deviation of 9 percent per year. Security G has an expected return of 18 percent and a standard deviation of 25 percent per year.a. What is the expected return on a portfolio composed of 30 percent of security F and 70 percent of security G?b. If the correlation coefficient between the returns of F and G is 0.2, what is the standard deviation of the portfolio?a. R P= 0.3 (0.12) + 0.7 (0.18) = 0.162 = 16.2%b. P 2= 0.32 (0.09)2 + 0.72 (0.25)2 + 2 (0.3) (0.7) (0.09) (0.25) (0.2)= 0.033244P= (0.033244)1/2 = 0.1823 = 18.23%10.33 The expected return on a portfolio that combines the risk-free asset and the asset at the point of tangency to the efficient set is 25 percent. The expected return was calculated under the following assumptions:The risk-free rate is 5 percent.The expected return on the market portfolio of risky assets is 20 percent.The standard deviation of the efficient portfolio is 4 percent.In this environment, what expected rate of return would a security earn if it had a 0.5 correlation with the market and a standard deviation of 2 percent.Market excess return = E(R M) - R f= 20% - 5% = 15%Portfolio excess return = E(R E) - R f= 25% - 5% = 20%Portfolio beta = E = 20% / 15% = 4 / 3E = {Corr(R E, R M) (R E)} / (R M)Therefore,4 / 3 = (1 4%) / (R M)(R M) = 3%Note: Corr(R E, R M) = 1 because this portfolio is a combination of the riskless asset and the market portfolio.For the security with Corr(R S, R M) = 0.5,S = {Corr(R S, R M) (R S)} / (R M)= (0.5 2%) / 3%= 0.3333Thus, E(R S) = 5% + S (15%)= 5% + (0.3333) (15%)= 10%10.34 Suppose the current risk-free rate is 7.6 percent. Potpourri Inc. stock hasa beta of 1.7 and an expected return of 16.7 percent. (Assume the CAPM is true.)a. What is the risk premium on the market?b. Magnolia Industries stock has a beta of 0.8. What is the expected return on the Magnolia stock?c. Suppose you have invested $10,000 in both Potpourri and Magnolia, and the beta of the portfolio is 1.07. How much did you invest in each stock? What is the expected return on the portfolio?a. The risk premium = R M - R fPotpourri stock return:16.7 = 7.6 + 1.7 (R M - R f)R M - R f = (16.7 - 7.6) / 1.7 = 5.353%b. R Mag = 7.6 + 0.8 (5.353) = 11.88%c. X Pot Pot + X Mag Mag = 1.071.7 X Pot + 0.8 (1 - X Pot) = 1.070.9 X Pot = 0.27X Pot = 0.3X Mag = 0.7Thus invest $3,000 in Potpourri stock and $7,000 in Magnolia.R P = 7.6 + 1.07 (5.353) = 13.33%Note: The other way to calculate R P isR P = 0.3 (16.7) + 0.7 (11.88) = 13.33%10.35 Suppose the risk-free rate is 6.3 percent and the market portfolio has an expected rate of return of 14.8 percent. The market portfolio has a variance of 0.0121. Portfolio Z has a correlation coefficient with the market of 0.45 and a variance of 0.0169. According to the CAPM, what is the expected rate of return on portfolio Z? R Z = R f +Z (R M - R f )Z = Cov(R Z , R M ) / M 2 = Corr(R Z , R M ) Z M / M 2= Corr(R Z , R M ) Z / MZ = (0.0169)1/2 = 0.13M = (0.0121)1/2 = 0.11Thus, Z = 0.45 (0.13) / 0.11 = 0.5318 R Z = 0.063 + 0.5318 (0.148 - 0.063) = 0.1082= 10.82%10.36 The following data have been developed for the Durham Company.Variance of market returns _ 0.04326Covariance of the returns on Durham and the market _ 0.0635Suppose the market risk premium is 9.4 percent and the expected return on Treasury bills is 4.9 percent.a. Write the equation of the security market line.b. What is the required return of Durham Company?a. R i = 4.9% +i (9.4%)b. D = Cov(R D , R M ) / M 2 = 0.0635 / 0.04326 = 1.468 R D = 4.9 + 1.468 (9.4) = 18.70%11.2 Suppose a three-factor model is appropriate to describe the returns of a stock. Information about those three factors is presented in the following chart. Suppose this is the only information you have concerning the factors.a. What is the systematic risk of the stock return?b. Suppose unexpected bad news about the firm was announced that dampens the returns by 2.6 percentage points. What is the unsystematic risk of the stock return?c. Suppose the expected return of the stock is 9.5 percent. What is the total return on thisstock?a. Systematic Risk = 0.042(4,480– 4,416) –1.4(4.3%– 3.1%)– 0.67(11.8% –9.5%)= –0.53%b. Unsystematic Risk = – 2.6%c. Total Return = 9.5% – 0.53% – 2.6% = 6.37%12.3 Mitsubishi Inc. is a levered firm with a debt-to-equity ratio of 0.25. The beta of common stock is 1.15, while the beta of debt is 0.3. The market-risk premium is 10 percent and the risk-free rate is 6 percent. The corporate tax rate is 35 percent. The SML holds for the company.a. If a new project of the company has the same risk as the common stock of the firm, what is the cost of equity on the project?b. If a new project of the company has the same risk as the overall firm, what is the weighted average cost of capital on the project?R S= 6% + 1.15 10% = 17.5%R B= 6% + 0.3 10% = 9%a. Cost of equity = R S = 17.5%b. B / S = 0.25B / (B + S) = 0.2S / (B + S) = 0.8WACC = 0.8 17.5% + 0.2 9% (1 - 0.35)= 15.17%12.12 The equity beta for Adobe Online Company is 1.29. Adobe Online has a debt-to-equity ratio of 1.0. The expected return on the market is 13 percent. The risk-free rate is 7 percent. The cost of debt capital is 7 percent. The corporate tax rate is 35 percent.a. What is Adobe Online’s cost of equity?b. What is Adobe Online’s weighted average cost of capital?a. Cost of equity for National Napkin= 7 + 1.29 (13 - 7)= 14.74%b. B / (S + B) = S / (S + B) = 0.5WACC = 0.5 7 0.65 + 0.5 14.74= 9.645%12.14 First Data Co. has 20 million shares of common stock outstanding that are currently being sold for $25 per share. The firm’s debt is publicly traded at 95 percent of its face value of $180 million. The cost of debt is 10 percent and the cost of equity is 20 percent. What is the weighted average cost of capital for the firm? Assume the corporate tax rate is 40 percent.S = $25 20 million = $500 millionB = 0.95 $180 million = $171 millionB / (S + B) = 0.2548S / (S + B) = 0.7452WACC = 0.7452 20% + 0.2548 10% 0.60= 16.43%12.15 Calgary Industries, Inc., is considering a new project that costs $25 million. The project will generate after-tax (year-end) cash flows of $7 million for five years. The firm has a debt-to-equity ratio of 0.75. The cost of equity is 15 percent and the cost of debt is 9 percent. The corporate tax rate is 35 percent. It appears that the project has the same risk as that of the overall firm. Should Calgary take on the project?B / S = 0.75B / (S + B) = 3 / 7S / (S + B) = 4 / 7WACC = (4 / 7) 15% + (3 / 7) 9% (1 - 0.35)= 11.08%NPV = -$25 million +$7(.)milliont t101108 15+=∑= $819,299.04Undertake the project.12.16 Suppose Garagebandaaa has a 28 percent cost of equity capital and a 10 percent beforetax cost of debt capital. The firm’s debt-to-equity ratio is 1.0. Garageband is interested in investing in a telecomm project that will cost $1,000,000 and will provide $600,000 pretax annual earnings for 5 years. Given the project is an extension of its core business, the project risk is similar to the overall risk of the firm. What is the net present value of this project if Garageband’s tax rate is 35%?12.16WACC = (0.5) x 28% + (0.5) x 10% x (1 - 0.35)= 17.25%NPV = - $1,000,000 + (1 - 0.35) $600,000 51725.0A= $240,608.5013.4 Aerotech, an aerospace-technology research firm, announced this morning that it has hired the world’s most knowledgeable and prolific space researchers. Before today, Aerotech’s stock had been selling for $100.a. What do you expect will happen to Aerotech’s stock?b. Consider the following scenarios:i. The stock price jumps to $118 on the day of the announcement. In subsequent days it floats up to $123 then falls back to $116.ii. The stock price jumps to $116 and remains there.iii. The stock price gradually climbs to $116 over the next week.Which scenario(s) indicate market efficiency? Which do not? Why?a. Aerotech’s stock price should rise immediately after theannouncement of this positive news.b. Only scenario ii (the stock price jumps to $116 and remains there)indicates market efficiency. In that case, the price roseimmediately to the level that eliminated all possibility of abnormalreturns. In the other two scenarios, there are periods of timeduring which an investor could trade on the information and earnabnormal returns.15.15 The market value of a firm with $500,000 of debt is $1,700,000. EBIT is expected to be a perpetuity. The pretax interest rate on debt is 10 percent. The company is in the 34-percent tax bracket. If the company was 100-percent equity financed, the equityholders would require a 20-percent return.a. What would the value of the firm be if it was financed entirely with equity?b. What is the net income to the stockholders of this levered firm?a. Since V V T B L U C =+,V =V T B U L C -. L V = $1,700,000, B = $500,000 andC T = 0.34. Therefore, the value of the unlevered firm isU V = $1,700,000 - (0.34)($500,000) = $1,530,000b. Equity holders earn 20% after-tax in an all-equity firm. Thatamount is $306,000 (=$1,530,000 x 0.20). The yearly, after-taxinterest expense in the levered firm is $33,000 [=$500,000 x 0.10(1-0.34)]. Thus, the after-tax earnings of the equity holders in alevered firm are $273,000 (=$306,000 - $33,000). This amount is thefirm’s net income.15.16 An all-equity firm is subject to a 30-percent corporate tax rate. Its equityholders require a 20-percent return. The firm’s initial market value is $3,500,000, and there are 175,000 shares outstanding. The firm issues $1 million of bonds at 10 percent and uses the proceeds to repurchase common stock. Assume there is no change in the cost of financial distress for the firm. According to MM, what is the new market value of the equity of the firm?The initial market value of the equity is given as $3,500,000. On a per sharebasis this is $20 (=$3,500,000 / 175,000). The firm buys back $1,000,000 worth of shares, or 50,000 (= $1,000,000 / $20) shares.In this MM world with taxes,V V T B L U C =+= $3,500,000 + (0.3) ($1,000,000) = $3,800,000Since V = B + S, the market value of the equity is $2,800,000 (= $3,800,000 - $1,000,000).15.20 The Nikko Company has perpetual EBIT of $4 million per year. The after-tax, all-equity discount rate r 0 is 15 percent. The company’s tax rate is 35 percent. The cost of debt capital is 10 percent, and Nikko has $10 million of debt in its capital structure.a. What i s Nikko’s value?b. What is Nikko’s r WACC?c. What is Nikko’s cost of equity?a. million$20.83$100.3515.0)65.0(4$B T r )T EBIT(1BT V V C 0C C U L =⨯+=+-=+= b. 12.48%V )T EBIT(1r V S )T (1r V B r L C S LC B L WACC =-=+-=c. r r (B /S)(r r )(1-T S 00B C =+-)= 0.15 + [10 / (20.83 - 10)] (0.65) (0.15 - 0.10) = 18.01%If part c is done before part b, then an alternative solution topart b could be:rWACC = (10/20.83)(0.10)(1-0.35) + (10.83/20.83)(0.1801) = 0.124815.21 AT&B has a debt-equity ratio of 2.5. Its r WACC is 15 percent and its cost of debt is 11 percent. The corporate tax rate is 35 percent.a. What is AT&B’s cost of equity capital?b. What is AT&B’s unlevered cost of equity capital?c. What would the weighted average cost of capital be if the debt-to-equity ratio was 0.75? What if it were 1.5?a. r S = 0r + (B / S)( 0r – B r )(1 – C T )= 15% + (2.5)(15% – 11%)(1– 35%)= 21.50% b. If there is no debt, WACC r = r S = 15%c. S r = 15% + 0.75 (15% – 11%)(1 – 35%)= 16.95%B/S = 0.75, B = 0.75SB/(B+S) = 0.75S/(0.75S +S)= 0.75 /1.75S/(B+S) = 1– (0.75 /1.75) = (1/1.75)r WACC = (0.75/1.75)(0.11)(1– 0.35) + (1/1.75)(16.95%)= 12.75%S r = 15% + 1.5 (15% – 11%)(1 – 35%)= 18.90%B/S = 1.5, B = 1.5SB/(B+S) = 1.5S/(1.5S +S)= 1.5/2.5S /(B+S) = 1 – (1.5/2.5)WACC r = (1.5/2.5)(0.11)(1 – 0.35) + (1/2.5)(0.1890)= 11.85%Alternate solution: In the MM model with corporate taxes, rWACC < ro when there is debt. The following reworks the solution based on this premise.a. rWACC = 0.15 = (2.5/3.5)(1-0.35)(0.11) + rs(1/3.5)=> rS = 0.346250b. rS = ro + (B/S)(ro – rB)(1-TC)0.3463 = ro + 2.5(ro – 0.11)(0.65)=> ro = 0.2000c. 1. rS = 0.20 + 0.75(0.20 – 0.11)(0.65)= 0.2439=> rWACC = (0.75/1.75)(0.65)(0.11) + 0.2439(1/1.75)= 0.1700c. 2. rS = 0.20 + 1.5(0.20 – 0.11)(0.65)= 0.2878=> rWACC = (1.5/2.5)(0.65)(0.11) + 0.2878(1/2.5)= 0.158015.22 General Tools (GT) expects EBIT to be $100,000 every year, in perpetuity. The firm can borrow at 10 percent. GT currently has no debt. Its cost of equity is 25 percent. If the corporate tax rate is 40 percent, what is the value of the firm? What will the value be if GT borrows $500,000 and uses the proceeds to repurchase shares?Since this is an all-equity firm, the WACC = S r .$240,00025.0)4.01(000,100$r )T EBIT(1V S C U =-=-=If the firm borrows to repurchase its own shares, then the value ofGT will be:L V = U V + C T B()$440,000000,500$4.025.0)6.0(000,100$=⨯+=[文档可能无法思考全面,请浏览后下载,另外祝您生活愉快,工作顺利,万事如意!]。