John Hull 经典书籍的课件

合集下载

金融工程课件4约翰郝尔john hull

n

P(X ≥ 8) =

r =8

n r

pr (1 − p)n −r

Question: Suppose there are M fund managers? How well should the best one do over the 10-year period ifபைடு நூலகம்none of them had any skill?

∞ ∞

E[ X ] =

r =0

r P(X = r ) =

r =0

r

λ r e −λ r!

∞

= = λ = λ

r

r =1 ∞

λr e −λ r!

λr −1 e −λ (r − 1)! r =1 λ r e −λ = λ. r! r =0

5

∞

Bayes’ Theorem

Let A and B be two events for which P(B ) = 0. Then P(A | B ) = = = P(A B ) P(B ) P(B | A)P(A) P (B ) P(B | A)P(A) j P(B | Aj )P(Aj )

M. Haugh

G. Iyengar

Department of Industrial Engineering and Operations Research Columbia University

Conditional Expectations and Variances

Let X and Y be two random variables. The conditional expectation identity says E[X ] = E [E[X |Y ]] and the conditional variance identity says Var(X ) = Var(E[X |Y ]) + E[Var(X |Y )]. Note that E[X |Y ] and Var(X |Y ) are both functions of Y and are therefore random variables themselves.

P(X ≥ 8) =

r =8

n r

pr (1 − p)n −r

Question: Suppose there are M fund managers? How well should the best one do over the 10-year period ifபைடு நூலகம்none of them had any skill?

∞ ∞

E[ X ] =

r =0

r P(X = r ) =

r =0

r

λ r e −λ r!

∞

= = λ = λ

r

r =1 ∞

λr e −λ r!

λr −1 e −λ (r − 1)! r =1 λ r e −λ = λ. r! r =0

5

∞

Bayes’ Theorem

Let A and B be two events for which P(B ) = 0. Then P(A | B ) = = = P(A B ) P(B ) P(B | A)P(A) P (B ) P(B | A)P(A) j P(B | Aj )P(Aj )

M. Haugh

G. Iyengar

Department of Industrial Engineering and Operations Research Columbia University

Conditional Expectations and Variances

Let X and Y be two random variables. The conditional expectation identity says E[X ] = E [E[X |Y ]] and the conditional variance identity says Var(X ) = Var(E[X |Y ]) + E[Var(X |Y )]. Note that E[X |Y ] and Var(X |Y ) are both functions of Y and are therefore random variables themselves.

Hull,经典衍生品教科书第9版,官方ppt,第14章

Chapter 14 Wiener Processes and Itô’s Lemma

Options, Futures, and Other Derivatives, 9th Edition, Copyright © John C. Hull 2014

1

Stochastic Processes

Describes the way in which a variable such as a stock price, exchange rate or interest rate changes through time Incorporates uncertainties

Options, Futures, and Other Derivatives, 9th Edition, Copyright © John C. Hull 2014

16

ItôProcess (See pages 308)

In an Itô process the drift rate and the variance rate are functions of time dx=a(x,t) dt+b(x,t) dz The discrete time equivalent

Options, Futures, and Other Derivatives, 9th Edition, Copyright © John C. Hull 2014

15

The Example Revisited

A stock price starts at 40 and has a probability distribution of f(40,100) at the end of the year If we assume the stochastic process is Markov with no drift then the process is dS = 10dz If the stock price were expected to grow by $8 on average during the year, so that the year-end distribution is f(48,100), the process would be dS = 8dt + 10dz

Options, Futures, and Other Derivatives, 9th Edition, Copyright © John C. Hull 2014

1

Stochastic Processes

Describes the way in which a variable such as a stock price, exchange rate or interest rate changes through time Incorporates uncertainties

Options, Futures, and Other Derivatives, 9th Edition, Copyright © John C. Hull 2014

16

ItôProcess (See pages 308)

In an Itô process the drift rate and the variance rate are functions of time dx=a(x,t) dt+b(x,t) dz The discrete time equivalent

Options, Futures, and Other Derivatives, 9th Edition, Copyright © John C. Hull 2014

15

The Example Revisited

A stock price starts at 40 and has a probability distribution of f(40,100) at the end of the year If we assume the stochastic process is Markov with no drift then the process is dS = 10dz If the stock price were expected to grow by $8 on average during the year, so that the year-end distribution is f(48,100), the process would be dS = 8dt + 10dz

Hull经典衍生品教科书第官方, ppt课件

Chapter 6 Interest Rate Futures

Options, Futures, and Other Derivatives, 9th Edition, Copyright ©

John C. Hull 2014

1

Day Count Convention

• Defines:

• the period of time to which the interest rate applies

• day count is Actual/Actual in period? • day count is 30/360?

Options, Futures, and Other Derivatives, 9th Edition, Copyright ©

John C. Hull 2014

6

Treቤተ መጻሕፍቲ ባይዱsury Bill Prices in the US

John C. Hull 2014

2

Day Count Conventions in the U.S. (Page 132)

Treasury Bonds: Actual/Actual (in period)

Corporate Bonds: 30/360

Money Market Instruments:

John C. Hull 2014

4

Examples continued

• T-Bill: 8% Actual/360:

• 8% is earned in 360 days. Accrual calculated by dividing the actual number of days in the period by 360. How much interest is earned between March 1 and April 1?

Options, Futures, and Other Derivatives, 9th Edition, Copyright ©

John C. Hull 2014

1

Day Count Convention

• Defines:

• the period of time to which the interest rate applies

• day count is Actual/Actual in period? • day count is 30/360?

Options, Futures, and Other Derivatives, 9th Edition, Copyright ©

John C. Hull 2014

6

Treቤተ መጻሕፍቲ ባይዱsury Bill Prices in the US

John C. Hull 2014

2

Day Count Conventions in the U.S. (Page 132)

Treasury Bonds: Actual/Actual (in period)

Corporate Bonds: 30/360

Money Market Instruments:

John C. Hull 2014

4

Examples continued

• T-Bill: 8% Actual/360:

• 8% is earned in 360 days. Accrual calculated by dividing the actual number of days in the period by 360. How much interest is earned between March 1 and April 1?

John Hull课件PPT

(We ignore storage costs and gold lease rate)?

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

1.16

2. Gold: Another Arbitrage Opportunity?

• Over-the-counter (OTC)

– A computer- and telephone-linked network of dealers at financial institutions, corporations, and fund managers – Contracts can be non-standard and there is some small amount of credit risk

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

1.14

Examples of Futures Contracts

• Agreement to: – buy 100 oz. of gold @ US$300/oz. in December (COMEX) – sell £62,500 @ 1.5000 US$/£ in March (CME) – sell 1,000 bbl. of oil @ US$20/bbl. in April (NYMEX)

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

1.6

Forward Contracts

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

1.16

2. Gold: Another Arbitrage Opportunity?

• Over-the-counter (OTC)

– A computer- and telephone-linked network of dealers at financial institutions, corporations, and fund managers – Contracts can be non-standard and there is some small amount of credit risk

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

1.14

Examples of Futures Contracts

• Agreement to: – buy 100 oz. of gold @ US$300/oz. in December (COMEX) – sell £62,500 @ 1.5000 US$/£ in March (CME) – sell 1,000 bbl. of oil @ US$20/bbl. in April (NYMEX)

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

1.6

Forward Contracts

现代大学英语精读 Unit PPT课件

think Bob is a plausible character? • Do you think the friendship between Jimmy and Bob would sur vive after Bob’s arrest?

Give reasons to support your point of view.

settlers moved during the 19th century to establish new farms and new cities. In films it is often shown as a place where cowboys and Native Americans fight each other, and where cowboys use guns rather than law to settle arguments. Therefore, a situation where there are no laws or controls is sometimes described as being like the Wild West.

• Jimmy Wells: • The policeman on the beat moved up the avenue impressively(1)…Tr ying

doors as he went, swinging his club with many clever movements, turning now and then to cast his watchful eye down the peaceful street, the officer, with his strongly built form and light air of superiority, made a fine picture of guardian of the peace. (2)

Give reasons to support your point of view.

settlers moved during the 19th century to establish new farms and new cities. In films it is often shown as a place where cowboys and Native Americans fight each other, and where cowboys use guns rather than law to settle arguments. Therefore, a situation where there are no laws or controls is sometimes described as being like the Wild West.

• Jimmy Wells: • The policeman on the beat moved up the avenue impressively(1)…Tr ying

doors as he went, swinging his club with many clever movements, turning now and then to cast his watchful eye down the peaceful street, the officer, with his strongly built form and light air of superiority, made a fine picture of guardian of the peace. (2)

衍生金融工具概论

相对定价法的基本思想就是利用基础产品价格与衍生 工具价格之间的内在关系,直接根据基础产品价格求 出衍生工具价格。该方法并不关心基础产品价格的确 定,它仅仅把基础产品的价格假定为外生给定的,然 后运用风险中性定价法或无套利定价法为衍生工具定 价

无套利假设

套利是指利用一个或多个市场存在的价格差异,在不 冒任何损失风险且无需投资者自有资金的情况下,获 取利润的行为

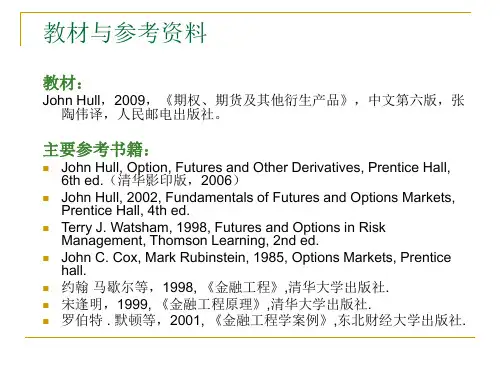

John C. Cox, Mark Rubinstein, 1985, Options Markets, Prentice hall.

约翰 马歇尔等,1998, 《金融工程》,清华大学出版社. 宋逢明,1999, 《金融工程原理》,清华大学出版社. 罗伯特 . 默顿等,2001, 《金融工程学案例》,东北财经大学出版社.

金融产品和金融衍生产品

持有金融衍生工具或金融衍生品意味着拥有一 种“或有求偿权”(contingent claims)

商品衍生工具和金融衍生工具

常见的金融衍生产品包括远期、期货、期权和 互换

衍生产品举例:

原油期货 认股权证 抵押贷款衍生证券CDO等

金融衍生品交易是一种“零和博弈” 衍生工具的两面性 衍生工具和金融工程的关系

市场参与者:如何进行投机(Speculating)、 套利(Arbitraging)和套期保值(Hedging)?

四、金融衍生产品的基本定价方法

绝对定价法 相对定价法:无套利定价原理 积木分析法

绝对定价法就是根据金融工具未来现金流的特征,运 用恰当的贴现率将这些现金流贴现成现值,该现值就 是绝对定价法要求的价格。

John Hull, 2002, Fundamentals of Futures and Options Markets, Prentice Hall, 4th ed.

无套利假设

套利是指利用一个或多个市场存在的价格差异,在不 冒任何损失风险且无需投资者自有资金的情况下,获 取利润的行为

John C. Cox, Mark Rubinstein, 1985, Options Markets, Prentice hall.

约翰 马歇尔等,1998, 《金融工程》,清华大学出版社. 宋逢明,1999, 《金融工程原理》,清华大学出版社. 罗伯特 . 默顿等,2001, 《金融工程学案例》,东北财经大学出版社.

金融产品和金融衍生产品

持有金融衍生工具或金融衍生品意味着拥有一 种“或有求偿权”(contingent claims)

商品衍生工具和金融衍生工具

常见的金融衍生产品包括远期、期货、期权和 互换

衍生产品举例:

原油期货 认股权证 抵押贷款衍生证券CDO等

金融衍生品交易是一种“零和博弈” 衍生工具的两面性 衍生工具和金融工程的关系

市场参与者:如何进行投机(Speculating)、 套利(Arbitraging)和套期保值(Hedging)?

四、金融衍生产品的基本定价方法

绝对定价法 相对定价法:无套利定价原理 积木分析法

绝对定价法就是根据金融工具未来现金流的特征,运 用恰当的贴现率将这些现金流贴现成现值,该现值就 是绝对定价法要求的价格。

John Hull, 2002, Fundamentals of Futures and Options Markets, Prentice Hall, 4th ed.

金融工程课件1约翰郝尔john hull

3

Modeling financial markets

Two kinds of market models Discrete time models

Single period models Multi-period models

Continuous time models Discrete time models vs Continuous time models Pros: All important concepts with less sophisticated mathematics Cons: No closed form solutions ... have to resort to numerical calculations. Focus of this course: Discrete time multi-period models Caveat: Some continuous time concepts covered, e.g. the Black-Scholes formula.

A 1+r .

No-arbitrage: c1 ≥ 0 implies c0 ≤ 0, i.e. p ≥

Sell contract at price p and lend A/(1 + r ) at interest rate r Same arguments imply that p ≤

A 1+r

Weak No-Arbitrage: ck ≥ 0 for all k ≥ 1 ⇒ c0 ≤ 0 Strong No-Arbitrage: ck ≥ 0 for all k ≥ 1 and cl > 0 for some l ⇒ c0 < 0

Hull经典衍生品教科书第9版官方PPT,第21章

Binomial trees are frequently used to approximate the movements in the price of a stock or other asset In each small interval of time the stock price is assumed to move up by a proportional amount u or to move down by a proportional amount d

Options, Futures, and Other Derivatives, 9th Edition, Copyright © John C. Hull 2014

3

Movements in Time Dt

(Figure 21.1, page 451)

Su

S

Sd

Options, Futures, and Other Derivatives, 9th Edition, Copyright © John C. Hull 2014

Backwards Induction

We know the value of the option at the final nodes We work back through the tree using risk-neutral valuation to calculate the value of the option at each node, testing for early exercise when appropriate

Options, Futures, and Other Derivatives, 9th Edition, Copyright © John C. Hull 2014

Options, Futures, and Other Derivatives, 9th Edition, Copyright © John C. Hull 2014

3

Movements in Time Dt

(Figure 21.1, page 451)

Su

S

Sd

Options, Futures, and Other Derivatives, 9th Edition, Copyright © John C. Hull 2014

Backwards Induction

We know the value of the option at the final nodes We work back through the tree using risk-neutral valuation to calculate the value of the option at each node, testing for early exercise when appropriate

Options, Futures, and Other Derivatives, 9th Edition, Copyright © John C. Hull 2014

会计学原理-约翰·J·怀尔德版-上海交通大学幻灯片PPT

会计学原理-约翰·J·怀尔德 版-上海交通大学幻灯片

PPT

McGraw-Hill/Irwin

本课件PPT仅供大家学习使用 学习完请自行删除,谢谢! 本课件PPT仅供大家学习使用 学习完请自行删除,谢谢!

© The McGraw-Hill Companies, Inc., 2007

课程要求--教材与辅助资料

The primary external users of financial information are investors and creditors.

Return on Inve s tme nt

Return of Inve s tme nt

教材

Fundamental Accounting Principles (18 edition), John Wild, Kermit Larson and Barbara Chiappetta, McGraw Hill

会计学原理 〔第18版〕, 约翰.J.怀尔德, 克米特.D.拉森, 巴巴拉.基亚佩塔 著, 崔学刚, 饶菁 改编, 中国人民大学出版社

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2007

Accounting Information and Stock Price

Best Buy Co. Inc Fiscal Quarter (Feb,11 – May, 10, 2021) Quarterly Earnings Announcement: June

Accountin g

Informatio

of their decisions.

n

Actions (decisions)

PPT

McGraw-Hill/Irwin

本课件PPT仅供大家学习使用 学习完请自行删除,谢谢! 本课件PPT仅供大家学习使用 学习完请自行删除,谢谢!

© The McGraw-Hill Companies, Inc., 2007

课程要求--教材与辅助资料

The primary external users of financial information are investors and creditors.

Return on Inve s tme nt

Return of Inve s tme nt

教材

Fundamental Accounting Principles (18 edition), John Wild, Kermit Larson and Barbara Chiappetta, McGraw Hill

会计学原理 〔第18版〕, 约翰.J.怀尔德, 克米特.D.拉森, 巴巴拉.基亚佩塔 著, 崔学刚, 饶菁 改编, 中国人民大学出版社

McGraw-Hill/Irwin

© The McGraw-Hill Companies, Inc., 2007

Accounting Information and Stock Price

Best Buy Co. Inc Fiscal Quarter (Feb,11 – May, 10, 2021) Quarterly Earnings Announcement: June

Accountin g

Informatio

of their decisions.

n

Actions (decisions)

金融工程课件5约翰郝尔john hull

107 P P

t=0

t=1

t=2

t=3

A risk-free asset or cash account also available

- $1 invested in cash account at t = 0 worth Rt dollars at time t

3

Some Questions

The 1-Period Binomial Model

a 107 = uS0

p S0 = 100

ah hhhh

hhh hh

1−p

ha 93.46 = dS0

t=0

t=1

Can borrow or lend at gross risk-free rate, R

- so $1 in cash account at t = 0 is worth $R at t = 1

1 2n

But would you pay an infinite amount of money to play this game?

- clear then that (1) does not give correct option price.

5

The St. Petersberg Paradox

Daniel Bernouilli resolved this paradox by introducing a utility function, u (·)

- u (x ) measures how much utility or benefit you obtains from x units of wealth - different people have different utility functions - u (.) should be increasing and concave

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

7.14

Executive Stock Options

continued • They become vested after a period ot time • They cannot be sold • They often last for as long as 10 or 15 years

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

7.5

Terminology

Moneyness : –At-the-money option –In-the-money option –Out-of-the-money option

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

7.6

Terminology

(continued)

• • • •

Option class Option series Intrinsic value Time value

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

7.9

Market Makers

• Most exchanges use market makers to facilitate options trading • A market maker quotes both bid and ask prices when requested • The market maker does not know whether the individual requesting the quotes wants to buy or sell

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

7.11

Warrants

• Warrants are options that are issued (or written) by a corporation or a financial institution • The number of warrants outstanding is determined by the size of the original issue and changes only when they are exercised or when they expire

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

7.8

Dividends & Stock Splits

(continued) • Consider a call option to buy 100 shares for $20/share • How should terms be adjusted: – for a 2-for-1 stock split? – for a 5% stock dividend?

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

7.3

Assets Underlying Exchange-Traded Options

Page 151-152

• • • •

Stocks Foreign Currency Stock Indices Futures

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

7.13

Executive Stock Options

• Option issued by a company to executives • When the option is exercised the company issues more stock • Usually at-the-money when issued

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

7.10

Margins (Page 158-159)

• Margins are required when options are sold • When a naked option is written the margin is the greater of: 1 A total of 100% of the proceeds of the sale plus 20% of the underlying share price less the amount (if any) by which the option is out of the money 2 A total of 100% of the proceeds of the sale plus 10% of the underlying share price • For other trading strategies there are special rules

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

7.16

Convertible Bonds

(continued) • Very often a convertible is callable • The call provision is a way in which the issuer can force conversion at a time earlier than the holder might otherwise choose

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

7.15

Convertible Bonds

• Convertible bonds are regular bonds that can be exchanged for equity at certain times in the future according to a predetermined exchange ratio

7.1

Mechanics of Options Markets

Chapter 7

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

7.2

Types of Options

• A call is an option to buy • A put is an option to sell • A European option can be exercised only at the end of its life • An American option can be exercised at any time

Options, Futures, and Other Derivatives, 5th edition © 2002 by s, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

7.4

Specification of Exchange-Traded Options

• • • • Expiration date Strike price European or American Call or Put (option class)

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

7.7

Dividends & Stock Splits

(Page 154-155) • Suppose you own N options with a strike price of K : – No adjustments are made to the option terms for cash dividends – When there is an n-for-m stock split, • the strike price is reduced to mK/n • the no. of options is increased to nN/m – Stock dividends are handled in a manner similar to stock splits

Options, Futures, and Other Derivatives, 5th edition © 2002 by John C. Hull

7.12

Warrants

(continued) • Warrants are traded in the same way as stocks • The issuer settles up with the holder when a warrant is exercised • When call warrants are issued by a corporation on its own stock, exercise will lead to new treasury stock being issued