acca F5 2010年12月真题

2010年12月六级真题和答案

2010年12月大学英语六级考试真题(附听力原文)Part I Writing (30 minutes)Direction: For this part, you are allowed 30 minutes to write a short essay entitled My Views on University Ranking. You should write at least 150 words following the outline given below.1. 目前高校排名相当盛行;2. 对于这种做法人们看法不一;3. 在我看来……My Views on University RankingPart III Listening Comprehension (35 minutes)Section A注意:此部分试题请在答题卡2上作答。

11. [A] The man is the manager of the apartment building.[B] The woman is very good at bargaining.[C] The woman will get the apartment refurnished.[D] The man is looking for an apartment.12. [A] How the pictures will turn out. [C] What the man thinks of the shots.[B] Where the botanical garden is. [D] Why the pictures are not ready.13. [A] There is no replacement for the handle.[B] There is no match for the suitcase.[C] The suitcase is not worth fixing.[D] The suitcase can be fixed in time.14. [A] He needs a vehicle to be used in harsh weather.[B] He has a fairly large collection of quality trucks.[C] He has had his truck adapted for cold temperatures.[D] He does routine truck maintenance for the woman.15. [A] She cannot stand her boss’s bad temper.[B] She has often been criticized by her boss.[C] She has made up her mind to resign.[D] She never regrets any decisions she makes.16. [A] Look for a shirt of a more suitable color and size.[B] Replace the shirt with one of some other material.[C] Visit a different store for a silk or cotton shirt.[D] Get a discount on the shirt she is going to buy.17. [A] At a “Lost and Found”. [C] At a trade fair.[B] At a reception desk. [D] At an exhibition.18. [A] Repair it and move in. [C] Convert it into a hotel.[B] Pass it on to his grandson. [D] Sell it for a good price.Questions 19 to 21 are based on the conversation you have just heard.19. [A] Unique descriptive skills. [C] Colourful world experiences.[B] Good knowledge of readers’tastes. [D] Careful plotting and clueing.20. [A] A peaceful setting. [C] To be in the right mood.[B] A spacious room. [D] To be entirely alone.21. [A] They rely heavily on their own imagination.[B] They have experiences similar to the characters’.[C] They look at the world in a detached manner.[D] They are overwhelmed by their own prejudices.Questions 22 to 25 are based on the conversation you have just heard.22. [A] Good or bad, they are there to stay.[B] Like it or not, you have to use them.[C] Believe it or not, they have survived.[D] Gain or lose, they should be modernised.23. [A] The frequent train delays. [C]The food sold on the trains.[B] The high train ticket fares. [D] The monopoly of British Railways.24. [A] The low efficiency of their operation.[B] Competition from other modes of transport.[C] Constant complaints from passengers.[D] The passing of the new transport act.25. [A] They will be de-nationalised. [C] They are fast disappearing.[B] They provide worse service. [D] They lose a lot of money.Section BDirections: In this section, you will hear 3 short passages. At the end of each passage, you will hear some questions. Both the passage and the questions will be spoken only once. After you hear a question, you must choose the best answer from the four choices marked [A], [B], [C] and [D]. Then mark the corresponding letter on Answer Sheet 2 with a single line through the centre.注意:此部分试题请在答题卡2上作答。

12月ACCA考试F4最新模拟题及答案

12月ACCA考试F4最新模拟题及答案3 Compared to the obligations of the seller, the general obligations of the buyer under the UN Convention on the International Sale of Goods are less extensive and relatively simple; they are to pay the price for the goods and take delivery of them as required by the contract (Article 53)。

However, the convention does go on to detail how such action is to be conducted.As regards payment the following provisions apply.Firstly,the buyer‘s obligation to pay the price includes taking such steps and complying with such formalities as may be required under the contract or any laws and regulations to enable payment to be made (Article 54)。

Where a contract has been validly concluded but does not expressly or implicitly fix or make provision for determining the price, the parties are considered, in the absence of any indication to the contrary, to have impliedly made reference to the price generally charged at the time of the conclusion of the contract for such goods sold under comparable circumstances in the trade concerned (Article 55)。

ACCA F5 2010年12月真题答案

Actual volume

750 650

Sales price Variance

$ 15,000 A

6,500 A ––––––– 21,500 A –––––––

Sales volume contribution variance = (actual sales volume – budgeted sales volume) x standard margin

Cost of sales Cost of sales has decreased by 19·2% in 2010. This must be considered in relation to the decrease in turnover as well. In 2009, cost of sales represented 72·3% of turnover and in 2010 this figure was 63·7%. This is quite a substantial decrease. The reasons for it can be ascertained by, firstly, looking at the freelance staff costs.

It can also be seen from the non-financial performance indicators that 20% of students in 2010 are students who have transferred over from alternative training providers. It is likely that they have transferred over because they have heard about the improved service that AT Co is providing. Hence, they are most likely the reason for the increased market share that AT Co has managed to secure in 2010.

2010年12月大学英语A级考试真题

√

B. They dance well. C. They look strong.

D. They appear friendly.

6 A. In a store.

B. In a company. C. In a travel agency.

√

D. In a bank.

7 A. Opening an account.

√

B. 280 dollars.ቤተ መጻሕፍቲ ባይዱD. 300 dollars.

10 A. 2 percent. C. 4 percent.

√

B. 3 percent. D. 5 percent.

11. What is John Wilson?

general manager He is the __________________ of a

interested to be ( interest ) __________ in them.

36. In the author's opinion, which of

the following is vital for a company to be successful? A. Specialized knowledge. B. Highly-skilled staff.

D. To build up their own confidence.

40. What is the best title of the passage?

√

A. Team Building B. Problem Solving C. Communication Skills D. Company Management

A. hiring employees with special talent

2010年12月大学英语三级(A级)真题试卷(题后含答案及解析)

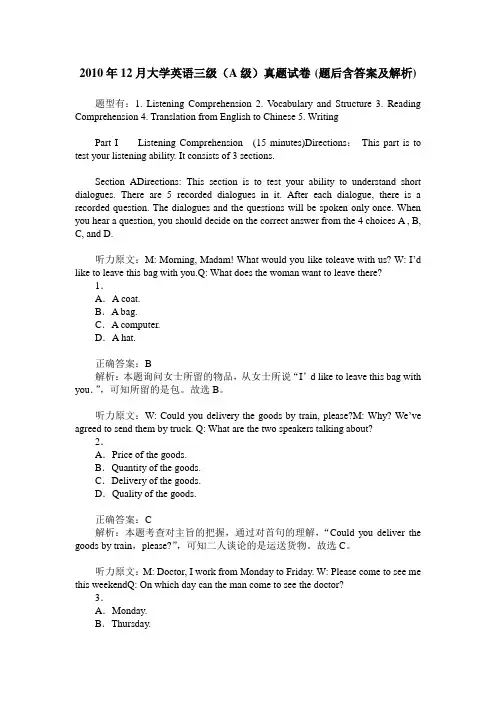

2010年12月大学英语三级(A级)真题试卷(题后含答案及解析)题型有:1. Listening Comprehension 2. V ocabulary and Structure 3. Reading Comprehension 4. Translation from English to Chinese 5. WritingPart I Listening Comprehension (15 minutes)Directions:This part is to test your listening ability. It consists of 3 sections.Section ADirections: This section is to test your ability to understand short dialogues. There are 5 recorded dialogues in it. After each dialogue, there is a recorded question. The dialogues and the questions will be spoken only once. When you hear a question, you should decide on the correct answer from the 4 choices A , B, C, and D.听力原文:M: Morning, Madam! What would you like toleave with us? W: I’d like to leave this bag with you.Q: What does the woman want to leave there?1.A.A coat.B.A bag.C.A computer.D.A hat.正确答案:B解析:本题询问女士所留的物品,从女士所说“I’d like to leave this bag with you.”,可知所留的是包。

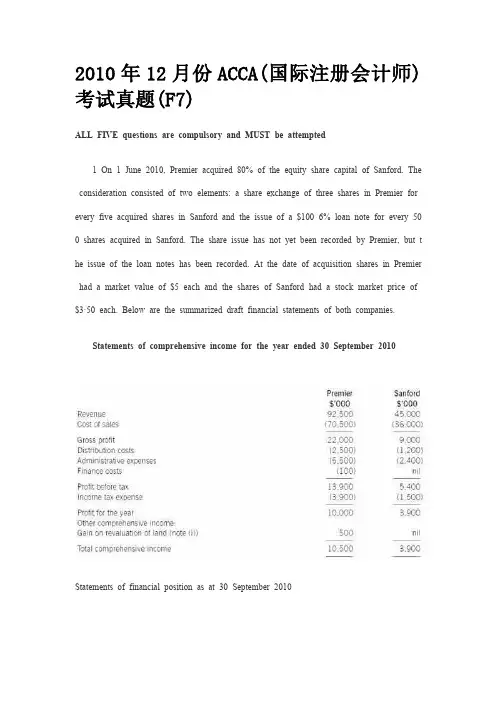

2010年12月份ACCA考试真T(F7)

2010年12月份ACCA(国际注册会计师)考试真题(F7)ALL FIVE questions are compulsory and MUST be attempted1On1June2010,Premier acquired80%of the equity share capital of Sanford.The consideration consisted of two elements:a share exchange of three shares in Premier for every five acquired shares in Sanford and the issue of a$1006%loan note for every50 0shares acquired in Sanford.The share issue has not yet been recorded by Premier,but t he issue of the loan notes has been recorded.At the date of acquisition shares in Premier had a market value of$5each and the shares of Sanford had a stock market price of $3·50each.Below are the summarized draft financial statements of both companies.Statements of comprehensive income for the year ended30September2010Statements of financial position as at30September2010The following information is relevant:(i)At the date of acquisition,the fair values of Sanford‘s assets were equal to their c arrying amounts with the exception of its property.This had a fair value of$1·2million below its carrying amount.This would lead to a reduction of the depreciation charge(in cost of sales)of$50,000in the post-acquisition period.Sanford has not incorporated this value change into its entity financial statements.Premier‘s group policy is to revalue all properties to current value at each year end.On 30September2010,the value of Sanford’s property was unchanged from its value at ac quisition,but the land element of Premier‘s property had increased in value by$500,000 as shown in other comprehensive income.(ii)Sales from Sanford to Premier throughout the year ended30September2010had consistently been$1million per month.Sanford made a mark-up on cost of25%on these sales.Premier had$2million.(at cost to Premier)of inventory that had been supplied i n the post-acquisition period by Sanford as at30September2010.(iii)Premier had a trade payable balance owing to Sanford of$350,000as at30Sep tember2010.This agreed with the corresponding receivable in Sanford‘s books.(iv)Premier‘s investments include some available-for-sale investments that have increas ed in value by$300,000during the year.The other equity reserve relates to these invest ments and is based on their value as at30September2009.There were no acquisitions or disposals of any of these investments during the year ended30September2010.(v)Premier‘s policy is to value the non-controlling interest at fair value at the date of acquisition.For this purpose Sanford’s share price at that date can be deemed to be repr esentative of the fair value of the shares held by the non-controlling interest.(vi)There has been no impairment of consolidated goodwillRequired:(a)Prepare the consolidated statement of comprehensive income for Premier for the y ear ended30September2010.(b)Prepare the consolidated statement of financial position for Premier as at30Septe mber2010.The following mark allocation is provided as guidance for this question:(a)9marks(b)16marks(25marks)2The following trial balance relates to Cavern as at30September2010:The following notes are relevant:(i)Cavern has accounted for a fully subscribed rights issue of equity shares made on 1April2010of one new share for every four in issue at42cents each.The company pa id ordinary dividends of3cents per share on30November2009and5cents per share o n31May2010.The dividend payments are included in administrative expenses in the trial balance.(ii)The8%loan note was issued on1October2008at its nominal(face)value of $30million.The loan note will be redeemed on30September2012at a premium which gives the loan note an effective finance cost of10%per annum.(iii)Non-current assets:Cavern revalues its land and building at the end of each accounting year.At30Septembe r2010the relevant value to be incorporated into the financial statements is$41·8million. The building‘s remaining life at the beginning of the current year(1October2009)was 18years.Cavern does not make an annual transfer from the revaluation reserve to retaine d earnings in respect of the realization of the revaluation surplus.Ignore deferred tax on t he revaluation surplus.Plant and equipment includes an item of plant bought for$10million on1October 2009that will have a10-year life(using straight-line depreciation with no residual value).P roduction using this plant involves toxic chemicals which will cause decontamination costs to be incurred at the end of its life.The present value of these costs using a discount r ate of10%at1October2009was$4million.Cavern has not provided any amount for t his future decontamination cost.All other plant and equipment is depreciated at12·5%per annum using the reducing balance method.No depreciation has yet been charged on any non-current asset for the year ended30 September2010.All depreciation is charged to cost of sales.(iv)The available-for-sale investments held at30September2010had a fair value of $13·5million.There were no acquisitions or disposals of these investments during the yea r ended30September2010.(v)A provision for income tax for the year ended30September2010of$5·6million is required.The balance on current tax represents the under/over provision of the tax lia bility for the year ended30September2009.At30September2010the tax base of Caver n‘s net assets was$15million less than their carrying amounts.The movement on deferre d tax should be taken to the income statement.The income tax rate of Cavern is25%.Required:(a)Prepare the statement of comprehensive income for Cavern for the year ended30 September2010.(b)Prepare the statement of changes in equity for Cavern for the year ended30Septe mber2010.(c)Prepare the statement of financial position of Cavern as at30September2010.Notes to the financial statements are not required.The following mark allocation is provided as guidance for this question:(a)11marks(b)5marks(c)9marks(25marks)3Hardy is a public listed manufacturing company.Its summarized financial statement s for the year ended30September2010(and2009comparatives)are:I n c o m e s t a t e m e n t s f o r t h e y e a r e n d e d30S e p t e m b e r:Statements of financial position as at30September:The following information has been obtained from the Chairman's Statement and the notes to the financial statements:'Market conditions during the year ended30September2010proved very challenging d ue largely to difficulties in the global economy as a result of a sharp recession which has led to steep falls in share prices and property values.Hardy has not been immune from these effects and our properties have suffered impairment losses of$6million in the year.' The excess of these losses over previous surpluses has led to a charge to cost of sal es of$1·5million in addition to the normal depreciation charge.'Our portfolio of investments at fair value through profit or loss has been'marked to market'(fair valued)resulting in a loss of$1·6million(included in administrative expense s).'There were no additions to or disposals of non-current assets during the year.'In response to the downturn the company has unfortunately had to make a number o f employees redundant incurring severance costs of$1·3million(included in cost of sales) and undertaken cost savings in advertising and other administrative expenses.' 'The difficulty in the credit markets has meant that the finance cost of our variable r ate bank loan has increased from4·5%to8%.In order to help cash flows,the company made a rights issue during the year and reduced the dividend per share by50%.' 'Despite the above events and associated costs,the Board believes the company's unde rlying performance has been quite resilient in these difficult times.'Required:Analyze and discuss the financial performance and position of Hardy as portrayed by the above financial statements and the additional information provided.Your analysis should be supported by profitability,liquidity and gearing and other ap propriate ratios(up to10marks available).(25marks)4(a)IAS8Accounting Policies,Changes in Accounting Estimates and Errors contain s guidance on the use of accounting policies and accounting estimates.Required:Explain the basis on which the management of an entity must select its accounting p olicies and distinguish,with an example,between changes in accounting policies and chan ges in accounting estimates.(5marks)(b)The directors of Tunshill are disappointed by the draft profit for the year ended30 September2010.The company's assistant accountant has suggested two areas where she b elieves the reported profit may be improved:(i)A major item of plant that cost$20million to purchase and install on1October2 007is being depreciated on a straight-line basis over a five-year period(assuming no resi dual value).The plant is wearing well and at the beginning of the current year(1October 2009)the production manager believed that the plant was likely to last eight years in total (i.e.from the date of its purchase).The assistant accountant has calculated that,based on a n eight-year life(and no residual value)the accumulated depreciation of the plant at30Sep tember2010would be$7·5million($20million/8years x3).In the financial statements for the year ended30September2009,the accumulated depreciation was$8million($20mil lion/5years x2).Therefore,by adopting an eight-year life,Tunshill can avoid a depreciati on charge in the current year and instead credit$0·5million($8million–$7·5million)to the income statement in the current year to improve the reported profit.(5marks) (ii)Most of Tunshill's competitors value their inventory using the average cost(AVCO) basis,whereas Tunshill uses the first in first out(FIFO)basis.The value of Tunshill's in ventory at30September2010(on the FIFO basis)is$20million;however on the AVCO basis it would be valued at$18million.By adopting the same method(AVCO)as its co mpetitors,the assistant accountant says the company would improve its profit for the year ended30September2010by$2million.Tunshill‘s inventory at30September2009was reported as$15million,however on the AVCO basis it would have been reported as$1 3·4million.(5marks)Required:Comment on the acceptability of the assistant accountant‘s suggestions and quantify h ow they would affect the financial statements if they were implemented under IFRS.Ignor e taxation.Note:the mark allocation is shown against each of the two items above.(15marks)5Manco has been experiencing substantial losses at its furniture making operation wh ich is treated as a separate operating segment.The company‘s year end is30September. At a meeting on1July2010the directors decided to close down the furniture making op eration on31January2011and then dispose of its non-current assets on a piecemeal basis.Affected employees and customers were informed of the decision and a press announce ment was made immediately after the meeting.The directors have obtained the following i nformation in relation to the closure of the operation:(i)On1July2010,the factory had a carrying amount of$3·6million and is expecte d to be sold for net proceeds of$5million.On the same date the plant had a carrying a mount of$2·8million,but it is anticipated that it will only realize net proceeds of$500, 000.(ii)Of the employees affected by the closure,the majority will be made redundant at cost of$750,000,the remainder will be retrained at a cost of$200,000and given work in one of the company's other operations.(iii)Trading losses from1July to30September2010are expected to be$600,000an d from this date to the closure on31January2011a further$1million of trading losses are expected.Required:Explain how the decision to close the furniture making operation should be treated in Manco‘s financial statements for the years ending30September2010and2011.Your an swer should quantify the amounts involved.(10marks)。

A-level2010年经济学真题

This document consists of 12 printed pages.IB10 11_9708_11/3RP© UCLES 2010[Turn over*6354831023*UNIVERSITY OF CAMBRIDGE INTERNATIONAL EXAMINATIONS General Certificate of EducationAdvanced Subsidiary Level and Advanced LevelECONOMICS 9708/11Paper 1 Multiple Choice (Core)October/November 20101 hourAdditional Materials: Multiple Choice Answer Sheet Soft clean eraserSoft pencil (type B or HB is recommended)READ THESE INSTRUCTIONS FIRSTWrite in soft pencil.Do not use staples, paper clips, highlighters, glue or correction fluid.Write your n ame, Cen tre n umber an d can didate n umber on the An swer Sheet in the spaces provided unless this has been done for you.There are thirty questions on this paper. Answer all questions. For each question there are four possible answers A , B , C and D .Choose the one you consider correct and record your choice in soft pencil on the separate Answer Sheet.Read the instructions on the Answer Sheet very carefully.Each correct answer will score one mark. A mark will not be deducted for a wrong answer. Any rough working should be done in this booklet.1What is the central problem for an economy? A to achieve maximum growth in production B to allocate resources between alternative uses C to ensure all resources are fully exploited D to overcome inequalities in income distribution2What are most likely to be disadvantages found in a market economy? A economic growth and state-owned companies B merit goods and free competition C public goods and economic specialisation D unemployment and external costs3 The diagram shows the production possibility curve of an economy.goodscapital goodsWhich statement explains the shape of this curve?A More efficient workers are drawn away from the production of consumer goods.B Resources cannot be switched between producing capital and consumer goods.C The economy is more efficient at producing capital than consumer goods.D The opportunity cost of producing capital goods increases the more capital goods are made. 4What is a correct statement about money?A Its functions mean the characteristics that it possesses.B Its liquidity means its use as legal tender.C Its supply means the total value of banknotes in circulation.D Its value means its purchasing power.5What might shift an individual’s demand curve for petrol to the left? A a fall in the price of parking B a fall in the price of petrol C a rise in the price of carsD a rise in the price of public transport6 The diagram shows a consumer’s short-run and long-run demand curves for coconuts. Initially,the consumer purchases quantity Q 0 at price P 0.price quantityP 0If the price of coconuts increases from P 0, the consumer’s short-run response is greater than his long-run response. If the price decreases from P 0 his short-run response is smaller than his long-run response.What is the consumer’s short-run demand curve? A VYW B VYZ C XYZ D XYW7 The table shows a consumer’s expenditure on a range of goods at different levels of income. For which good does the consumer have an income elasticity of demand greater than zero, butless than one?consumer’s income ($)40 50 100 good consumer’s expenditure ($)A 10 18 40B 10 11 20C 10 10 10 D10868 The diagram shows the demand curve for a product.priceWhich statement is correct?A Demand is less elastic at higher prices than at lower prices.B Consumer expenditure on the product always rises when price falls.C Price elasticity of demand is different at every price.D Price elasticity of demand equals one at every price.9 The table shows the market demand for a product and the individual supply of the three firms X, Y and Z in the industry.price $market demand (000)supply by X (000)supply by Y (000)supply by Z (000)40 60 50 10 20 30 70 41 11 18 20 80 34 10 16 10 90 30 9 11What is the equilibrium market price? A $40B $30C $20D $1010 Domino Pizza, the largest US pizza chain, said that its profits had been reduced by price inflationon ingredients and by a reduction in consumers’ disposable income.How would these changes affect the demand and supply curve for its products?demand supply A move to the left move to the left B move to the left move to the right C move to the right move to the left Dmove to the rightmove to the right11 Which area in the diagram represents the amount of consumer surplus that would occur in amarket if a government enforced an effective maximum price?pricequantityA f onlyB f + g + h onlyC f + g + i onlyD f + g + h + i + j + k12 Rising demand for oil from China and other countries is leading to concerns that there may be aworld shortage of oil.How should a change in the price of oil prevent such a shortage developing?A Price should fall to reduce demand and encourage a search for more oil.B Price should fall to reduce supply and encourage a reduction in fuel use.C Price should rise to reduce demand and encourage a search for alternative fuels.D Price should rise to reduce supply and encourage a switch to alternative fuels.13 In the diagram OS 1 and OS 2 are two straight-line supply curves.pricequantityAs price increases, the elasticity of supply A decreases along both OS 1 and OS 2.B increases less rapidly along OS 1 than along OS 2.C increases more rapidly along OS 1 than along OS 2.D is constant along both OS 1 and OS 2.14 What is the most likely reason economists will give to explain why large hospital projects areoften funded by governments?A Governments usually control the construction industry.B Hospitals benefit many people who do not use them.C Hospitals are non-excludable.D Hospitals are an essential service.15 How would net external benefit be calculated?A external benefit minus external costB external benefit plus private benefitC private benefit plus social benefitD social benefit minus private cost16 The table shows the expected costs and benefits from four government projects. The governmentcan afford only one project.Which project should the government choose?private benefits$mexternal benefits$mprivate costs$mexternal costs$mA 40 200 60 70B 6016010020C 100 210 100 120 D150 90120 14017 What will make it more likely that road tolls will reduce traffic congestion?A Cross-elasticity of demand between private and public transport is zero.B Demand for car use is income-elastic.C Demand for car use is price-elastic.D Supply of public transport is price-inelastic.18 In the diagram, S 1S 1 and DD represent the original supply and demand curves for an agriculturalproduct.pricequantityP 123Bad weather then reduces supply to S 2S 2.The government does not allow the price to rise above OP 1.How much of the product will the government have to supply from stocks if the price is to be maintained at OP 1? A OQ 3B Q 1Q 3C Q 1Q 2D Q 2Q 319Steel is produced in a number of countries, including China, Japan and the US. It is used in the manufacture of cars. The US protects its domestic steel industry by imposing high tariffs on foreign steel imports.Which two groups would benefit from the removal of the US tariffs?A Chinese steel producers and Japanese car manufacturersB Japanese steel producers and US car manufacturersC US steel producers and Chinese steel workersD the US government and Japanese steel workers20The supply of an imported good is shown by curve S.What will be the new supply curve if an ad valorem (percentage) tariff is imposed on the good? Array21What is found in a customs union but not a free trade area?A a common currencyB a common external tariffC fixed exchange ratesD free movement of labour22The table shows how much rice and wheat two countries, X and Y, can grow when each country divides its resources equally between growing rice and wheat.country X country Yrice (units) 900m 100mwheat (units) 300m 50mAssume that each country now specialises according to comparative advantage and trades with the other country.Which terms of trade would benefit both countries?A 1 wheat = 5 riceB 1 wheat = 3 riceC 1 wheat = 2.5 riceD 1 wheat = 2 rice23What must fall when the rate of unemployment rises?A the effectiveness of the use of resourcesB the level of labour productivityC the number of workers in employmentD the size of the labour force24The table shows the percentage price changes in some items in the UK Consumer Price Index (CPI) in the year to 1 June 2006.item % change in pricerents, electricity and gas 9.0education 4.7transport 4.0restaurants and hotels 3.2health services 2.9The increase in the overall CPI over the same period was 2.5%.What can be concluded from the data above?A The CPI is not an accurate measure of inflation.B Some prices must have fallen.C The average price increase of other items was less than 2.5%.D The real value of money rose by more than 2.5%.25In Year 1 the price of a barrel of oil increased from $60 to $110.In Year 2 there was a further increase to $115 a barrel.Assume that oil price changes have an immediate impact on the general level of prices.What will be the effect of the changes in the oil price on a country’s Consumer Price Index and on its inflation rate in Year 2 compared with Year 1?effect on the Consumer Price Indexeffect on the rate of inflationA decrease decreaseB decrease increaseC increase decreaseD increase increase26 A government has low reserves of foreign currency. When would it be likely to consider a deficiton current account to be a serious problem?A when the country is experiencing a period of high, sustained growthB when the deficit alternates regularly with a surplusC when the deficit exceeds the sum of errors and omissions in the balance of paymentsaccountD when the level of international confidence in the country is low© UCLES 20109708/11/O/N/1027 The diagram shows the number of US dollars ($) and Euros (€) which exchanged for one poundsterling (£) between 2002 and 2004.1.81.71.61.51.41.3200220032004€ per £$ per £What happened to the exchange rate of the $ against the £ and € during this period?$ exchange rateagainst £$ exchange rateagainst €A appreciated appreciatedB appreciated depreciatedC depreciated appreciated Ddepreciated depreciated28 In a country the Marshall-Lerner condition for an improvement in the trade balance is satisfied inthe long run, but quantities of imports and exports are slow to respond to price changes. The government devalues its currency to reduce its trade deficit.Which curve indicates the probable behaviour of the trade balance?tradebalanceCopyright Acknowledgements:Question 27 © The Economist; 10 January 2004.Permissio n to repro duce items where third-party o wned material pro tected by co pyright is included has been so ught and cleared where po ssible. Every reasonable effort has been made by the publisher (UCLES) to trace copyright holders, but if any items requiring clearance have unwittingly been included, the publisher will be pleased to make amends at the earliest possible opportunity.University of Cambridge International Examinations is part of the Cambridge Assessment Group. Cambridge Assessment is the brand name of University of Cambridge Local Examinations Syndicate (UCLES), which is itself a department of the University of Cambridge.© UCLES 20109708/11/O/N/1029 Assume the Chinese monetary authorities are committed to maintaining the exchange rate ofChina’s currency the Yuan against the US$ between P 1 and P 2 on the diagram.price of Yuan (in US $)quantity of YuanP PWhat might they do if demand changed from D 1 to D 2? A Impose controls on Chinese investment overseas. B Increase interest rates.C Sell US$ out of foreign exchange reserves.D Sell Yuan on the foreign exchange markets.30 In 2008 the Chinese government was under pressure from other countries to reduce its currentaccount surplus on its balance of payments.Which combination of Chinese measures would help to reduce China’s current account surplus?Chinese rate of tariffsChinese subsidies to the country’s exportersA decrease decreaseB decrease increaseC increase decreaseD increase increase。

12月ACCA考试F4练习题及答案

12月ACCA考试F4练习题及答案Additional information:In January 2009 Company A received the donation of a machine.The value added tax(VAT) invoice for the machine showed that it had cost RMB 150,000 plus VAT of RMB 20,000.No entry in respect of the donation of this machine has been recorded in the accounting system of Company A.Required:(i)Briefly explain the enterprise income tax(EIT) treatment of:-the donated machine;and-each of the items listed in Notes 1 to 3.(15 marks)(ii)Calculate the correct amount of taxable profits and the enterprise income tax(EIT) payable by Company A for the year 2009.(7 marks)(b)Company B is a resident enterprise,which was incorporated in the year 1990.The table below shows the taxable profits of Company B,as agreed by the tax bureau,for the years 2002 to 2009 inclusive.Year 2002 2003 2004 2005 2006 2007 2008 2009Taxable profits (in RMB) (900,000) 100,000 (300,000) 100,000 100,000 200,000 (100,000) 850,000Required:(i)Briefly explain the tax treatment of losses,including the period for the offset of losses;(2 marks)(ii)State,giving reasons,how much enterprise income tax(EIT)will be payable by Company B for each of the years 2008 and 2009.(4 marks)(c)Define the term'resident enterprise'for the purposes of enterprise income tax(EIT)and state the differences in the scope of the assessment of EIT for resident and non-resident enterprises.(7 marks)(35 marks)2(a)Mr Zhang,a Chinese citizen,is a University professor.He had the following income for the month of January 2009:(1)Monthly employment income of RMB 18,000 and a bonus for the year 2008 of RMB 12,000.(2)Income of RMB 18,000 for publishing a book on 6 January 2009.One of the chapters of the book was published in a magazine as a four-day series commencing on 19 January 2009 for which Mr Zhang received income of RMB 1,000 per day.(3)A net gain of RMB 12,000 from trading in the A-shares market.(4)Income of RMB 4,800 for giving four separate seminars for Enterprise X.(5)A translation fee of RMB 5,200 from a media publisher.(6)Received RMB 300,000 from the sale of the property(50 square metres)that he had lived in for six years.Mr Zhang had acquired the property for RMB 180,000.(7)Gross interest income of RMB 6,000 from a bank deposit.(8)Received RMB 11,000 as insurance compensation.Required:Calculate the individual income tax(IIT)payable(if any)by Mr Zhang on each of his items of income for the month of January2009,clearly identifying any item which is tax exempt.(10 marks)(b)Mr Smith,who is a UK national,is employed by a UK construction company to work in Shanghai on a project that will last for a period of 18 consecutive months.Required:(i)State,giving reasons,whether Mr Smith will be a resident taxpayer or a non-resident taxpayer in the PRC and the scope of his individual income tax(IIT)assessment;(2 marks)(ii)List any THREE fringe benefits that can be provided to Mr Smith that will not be subject to individual income tax(IIT)in China;(3 marks)(iii)Briefly explain the requirements for the reporting and payment of the individual income tax(IIT)due for Mr Smith if he is paid RMB 30,000 per month.(5 marks)。

2010年12月份ACCA考试真T(F7)

2010年12月份ACCA(国际注册会计师)考试真题(F7)ALL FIVE questions are compulsory and MUST be attempted1 On 1 June 2010, Premier acquired 80% of the equity share capital of Sanford. The consideration consisted of two elements: a share exchange of three shares in Premier for every five acquired shares in Sanford and the issue of a $100 6% loan note for every 50 0 shares acquired in Sanford. The share issue has not yet been recorded by Premier, but t he issue of the loan notes has been recorded. At the date of acquisition shares in Premier had a market value of $5 each and the shares of Sanford had a stock market price of $3·50 each. Below are the summarized draft financial statements of both companies.Statements of comprehensive income for the year ended 30 September 2010Statements of financial position as at 30 September 2010The following information is relevant:(i)At the date of acquisition, the fair values of Sanford‘s assets were equal to their c arrying amounts with the exception of its property. This had a fair value of $1·2 million below its carrying amount. This would lead to a reduction of the depreciation charge (in cost of sales) of $50,000 in the post-acquisition period. Sanford has not incorporated this value change into its entity financial statements.Premier‘s group policy is to revalue all properties to current value at each year end.On 30 September 2010, the value of Sanford’s property was unchanged from its value at ac quisition, but the land element of Premier‘s property had increase d in value by $500,000 as shown in other comprehensive income.(ii)Sales from Sanford to Premier throughout the year ended 30 September 2010 had consistently been $1 million per month. Sanford made a mark-up on cost of 25% on these sales. Premier had $2 million. (at cost to Premier) of inventory that had been supplied i n the post-acquisition period by Sanford as at 30 September 2010.(iii)Premier had a trade payable balance owing to Sanford of $350,000 as at 30 Sep tember 2010. This agreed with the corre sponding receivable in Sanford‘s books.(iv)Premier‘s investments include some available-for-sale investments that have increas ed in value by $300, 000 during the year. The other equity reserve relates to these invest ments and is based on their value as at 30 September 2009.There were no acquisitions or disposals of any of these investments during the year ended 30 September 2010.(v)Premier‘s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose Sanf ord’s share price at that date can be deemed to be repr esentative of the fair value of the shares held by the non-controlling interest.(vi)There has been no impairment of consolidated goodwillRequired:(a) Prepare the consolidated statement of comprehensive income for Premier for the y ear ended 30 September 2010.(b) Prepare the consolidated statement of financial position for Premier as at 30 Septe mber 2010. The following mark allocation is provided as guidance for this question:(a) 9 marks(b) 16 marks(25 marks)2 The following trial balance relates to Cavern as at 30 September 2010:The following notes are relevant:(i)Cavern has accounted for a fully subscribed rights issue of equity shares made on1 April 2010 of one new share for every four in issue at 42 cents each. The company pa id ordinary dividends of3 cents per share on 30 November 2009 and 5 cents per share o n 31 May 2010.The dividend payments are included in administrative expenses in the trial balance.(ii)The 8% loan note was issued on 1 October 2008 at its nominal (face) value of $30 million. The loan note will be redeemed on 30 September 2012 at a premium which gives the loan note an effective finance cost of 10% per annum.(iii)Non-current assets:Cavern revalues its land and building at the end of each accounting year. At 30 Septembe r 2010 the relevant value to be incorporated into the financial statements is $41·8 million. The building‘s remaining life at the beginning of the current year (1 October 2009) was18 years. Cavern does not make an annual transfer from the revaluation reserve to retained earnings in respect of the realization of the revaluation surplus. Ignore deferred tax on t he revaluation surplus.Plant and equipment includes an item of plant bought for $10 million on 1 October 2009 that will have a 10-year life(using straight-line depreciation with no residual value).P roduction using this plant involves toxic chemicals which will cause decontamination costs to be incurred at the end of its life. The present value of these costs using a discount r ate of 10% at 1 October 2009 was $4 million. Cavern has not provided any amount for t his future decontamination cost. All other plant and equipment is depreciated at 12·5% per annum using the reducing balance method.No depreciation has yet been charged on any non-current asset for the year ended 30 September 2010.All depreciation is charged to cost of sales.(iv)The available-for-sale investments held at 30 September 2010 had a fair value of $13·5 million. There were no acquisitions or disposals of these investments during the yea r ended 30 September 2010.(v)A provision for income tax for the year ended 30 September 2010 of $5·6 million is required. The balance on current tax represents the under/over provision of the tax lia bility for the year ended 30 September 2009.At 30 September 2010 the tax base of Caver n‘s net assets was $15 million less than their carrying amounts. Th e movement on deferre d tax should be taken to the income statement. The income tax rate of Cavern is 25%.Required:(a)Prepare the statement of comprehensive income for Cavern for the year ended 30 September 2010.(b)Prepare the statement of changes in equity for Cavern for the year ended 30 Septe mber 2010.(c)Prepare the statement of financial position of Cavern as at 30 September 2010.Notes to the financial statements are not required.The following mark allocation is provided as guidance for this question:(a) 11 marks(b) 5 marks(c) 9 marks(25 marks)3 Hardy is a public listed manufacturing company. Its summarized financial statement s for the year ended 30 September 2010(and 2009 comparatives) are:I n c o m e s t a t e m e n t s f o r t h e y e a r e n d e d30S e p t e m b e r:Statements of financial position as at 30 September:The following information has been obtained from the Chairman's Statement and the notes to the financial statements:'Market conditions during the year ended 30 September 2010 proved very challenging d ue largely to difficulties in the global economy as a result of a sharp recession which has led to steep falls in share prices and property values. Hardy has not been immune from these effects and our properties have suffered impairment losses of $6 million in the year.' The excess of these losses over previous surpluses has led to a charge to cost of sal es of $1·5 million in addition to the normal depreciation charge.'Our portfolio of investments at fair value through profit or loss has been 'marked to market' (fair valued) resulting in a loss of $1·6 million (included in administrative expense s).'There were no additions to or disposals of non-current assets during the year.'In response to the downturn the company has unfortunately had to make a number o f employees redundant incurring severance costs of $1·3million (included in cost of sales) and undertaken cost savings in advertising and other administrative expenses.' 'The difficulty in the credit markets has meant that the finance cost of our variable r ate bank loan has increased from 4·5% to 8%.In order to help cash flows ,the company made a rights issue during the year and reduced the dividend per share by 50%.' 'Despite the above events and associated costs, the Board believes the company's unde rlying performance has been quite resilient in these difficult times.'Required:Analyze and discuss the financial performance and position of Hardy as portrayed by the above financial statements and the additional information provided.Your analysis should be supported by profitability, liquidity and gearing and other ap propriate ratios (up to 10 marks available).(25 marks)4 (a) IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors contain s guidance on the use of accounting policies and accounting estimates.Required:Explain the basis on which the management of an entity must select its accounting p olicies and distinguish, with an example, between changes in accounting policies and chan ges in accounting estimates. (5 marks)(b)The directors of Tunshill are disappointed by the draft profit for the year ended 30 September 2010.The company's assistant accountant has suggested two areas where she b elieves the reported profit may be improved:(i)A major item of plant that cost $20 million to purchase and install on 1 October 2 007 is being depreciated on a straight-line basis over a five-year period (assuming no resi dual value).The plant is wearing well and at the beginning of the current year(1 October 2009)the production manager believed that the plant was likely to last eight years in total (i.e. from the date of its purchase).The assistant accountant has calculated that, based on a n eight-year life(and no residual value)the accumulated depreciation of the plant at 30 Sep tember 2010 would be $7·5 million($20 million/8 years x 3).In the financial statements forthe year ended 30 September 2009,the accumulated depreciation was $8 million ($20 mill ion/5 years x 2).Therefore, by adopting an eight-year life, Tunshill can avoid a depreciatio n charge in the current year and instead credit $0·5 million($8 million –$7·5 million)to t he income statement in the current year to improve the reported profit.(5 marks) (ii)Most of Tunshill's competitors value their inventory using the average cost (AVCO) basis, whereas Tunshill uses the first in first out (FIFO) basis. The value of Tunshill's in ventory at 30 September 2010(on the FIFO basis) is $20 million; however on the AVCO basis it would be valued at $18 million. By adopting the same method (AVCO) as its co mpetitors, the assistant accountant says the company would improve its profit for the year ended 30 September 2010 by $2 million. Tunshill‘s inventory at 30 September 2009 was reported as $15 million, however on the AVCO basis it would have been reported as $1 3·4 million. (5 marks)Required:Comment on the acceptability of the assistant accountant‘s suggestions and quantify h ow they would affect the financial statements if they were implemented under IFRS. Ignor e taxation.Note: the mark allocation is shown against each of the two items above.(15 marks)5 Manco has been experiencing substantial losses at its furniture making operation wh ich is treated as a separate operating segment. The company‘s year end is 30 September . At a meeting on 1 July 2010 the directors decided to close down the furniture making op eration on 31 January 2011 and then dispose of its non-current assets on a piecemeal basis. Affected employees and customers were informed of the decision and a press announce ment was made immediately after the meeting. The directors have obtained the following i nformation in relation to the closure of the operation:(i)On 1 July 2010, the factory had a carrying amount of $3·6 million and is expected to be sold for net proceeds of $5 million. On the same date the plant had a carrying a mount of $2·8 million, but it is anticipated that it will only realize net proceeds of $500, 000.(ii)Of the employees affected by the closure, the majority will be made redundant at cost of $750,000,the remainder will be retrained at a cost of $200,000 and given work in one of the company's other operations.(iii)Trading losses from 1 July to 30 September 2010 are expected to be $600,000 an d from this date to the closure on 31 January 2011 a further $1 million of trading losses are expected.Required:Explain how the decision to close the furniture making operation should be treated in Manco‘s financial statements for the years ending 30 September 2010 and 2011. Your an swer should quantify the amounts involved. (10 marks)。

ACCA201012份考试真题(P1)

考试真题(P1)Section A - This ONE question is compulsory and MUST be attempted1 In the 2009 results presentation to analysts,the chief executive of ZPT,a global internet communications company,announced an excellent set of results to the waiting audience.Chief executive Clive Xu announced that, compared to 2008,sales had increased by 50%,profi ts by 100% and total assets by 80%.The dividend was to be doubled from the previous year.He also announced that based on their outstanding performance,the executive directors would be paid large bonuses in line with their contracts.His own bonus as chief executive would be $20 million.When one of the analysts asked if the bonus was excessive,Mr Xu reminded the audience that the share price had risen 45% over the course of the year because of his efforts in skilfully guiding the company.He said that he expected the share price to rise further on the results announcement,which it duly did. Because the results exceeded market expectation,the share price rose another 25% to $52.Three months later,Clive Xu called a press conference to announce a restatement of the 2009 results.This was necessary,he said,because of some 'regrettable accounting errors'.This followed a meeting between ZPT and the legal authorities who were investigating a possible fraud at ZPT.He disclosed that in fact the fi gures for 2009 were increases of 10% for sales,20% for profi ts and 15% for total assets which were all signifi cantly below market expectations.The proposed dividend would now only be a modest 10% more than last year.He said that he expected a market reaction to the restatement but hoped that it would only be a short-term effect.The first questioner from the audience asked why the auditors had not spotted and corrected the fundamental accounting errors and the second questioner asked whether such a disparity between initial and restated results was due to fraud rather than'accounting errors'.When a journalist asked Clive Xu if he intended to pay back the $20 million bonus that had been based on the previous results,Mr Xu said he did not.The share price fell dramatically upon the restatement announcement and,because ZPT was such a large company,it made headlines in the business pages in many countries.Later that month,the company announced that following an internal investigation,there would be further restatements,all dramatically downwards,for the years 2006 and 2007.This caused another mass selling of ZPT shares resulting in a fi nal share value the following day of $1.This represented a loss of shareholder value of $12 billion from the peak share price.Clive Xu resigned and the government regulator for businessordered an investigation into what had happened at ZPT.The shares were suspended by the stock exchange.A month later, having failed to gain protection from its creditors in the courts,ZPT was declared bankrupt. Nothing was paid out to shareholders whilst suppliers received a fraction of the amounts due to them. Some non-current assets were acquired by competitors but all of ZPT‘s 54,000 employees lost their jobs,mostly with little or no termination payment.Because the ZPT employees’ pension fund was not protected from creditors,the value of that was also severely reduced to pay debts which meant that employees with many years of service would have a greatly reduced pension to rely on in old age.ced to pay debts which meant that employees with many years of service would have a greatly reduced pension to rely on in old age.ced to pay debts which meant that employees with many years of service would have a greatly reduced pension to rely on in old age.ced to pay debts which meant that employees with many years of service would have a greatly reduced pension to rely on in old age.The government investigation found that ZPT had been maintaining false accounting records for several years. This was done by developing an overly-complicated company structure that contained a network of international branches and a business model that was diffi cult to understand.Whereas ZPT had begun as a simple telecommunications company,Clive Xu had increased the complexity of the company so that he could 'hide' losses and mis-report profi ts. In the company‘s reporting,he also substantially overestimated the value of future customer supply contracts.The investigation also found a number of signifi cant internal control defi ciencies including no effective management oversight of the external reporting process and a disregard of the relevant accounting standards.In addition to Mr Xu,several other directors were complicit in the activities although Shazia Lo,a senior qualifi ed accountant working for the fi nancial director,had been unhappy about the situation for some time.She had approached the fi nance director with her concerns but having failed to get the answers she felt she needed,had threatened to tell the press that future customer supply contract values had been intentionally and materially overstated(the change in fair value would have had a profi t impact)。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

P a p e r F 5This is a blank page.The question paper begins on page 3.2ALL FIVE questions are compulsory and MUST be attempted1Carad Co is an electronics company which makes two types of televisions – plasma screen TVs and LCD TVs. It operates within a highly competitive market and is constantly under pressure to reduce prices. Carad Co operates a standard costing system and performs a detailed variance analysis of both products on a monthly basis. Extracts from the management information for the month of November are shown below:NoteT otal number of units made and sold1,4001Material price variance$28,000A2T otal labour variance$6,050A3Notes(1)The budgeted total sales volume for TVs was 1,180 units, consisting of an equal mix of plasma screen TVs andLCD screen TVs. Actual sales volume was 750 plasma TVs and 650 LCD TVs. Standard sales prices are $350 per unit for the plasma TVs and $300 per unit for the LCD TVs. The actual sales prices achieved during November were $330 per unit for plasma TVs and $290 per unit for LCD TVs. The standard contributions for plasma TVs and LCD TVs are $190 and $180 per unit respectively.(2)The sole reason for this variance was an increase in the purchase price of one of its key components, X. Eachplasma TV made and each LCD TV made requires one unit of component X, for which Carad Co’s standard cost is $60 per unit. Due to a shortage of components in the market place, the market price for November went up to $85 per unit for X. Carad Co actually paid $80 per unit for it.(3)Each plasma TV uses 2 standard hours of labour and each LCD TV uses 1·5 standard hours of labour. Thestandard cost for labour is $14 per hour and this also reflects the actual cost per labour hour for the company’s permanent staff in November. However, because of the increase in sales and production volumes in November, the company also had to use additional temporary labour at the higher cost of $18 per hour. The total capacity of Carad’s permanent workforce is 2,200 hours production per month, assuming full efficiency. In the month of November, the permanent workforce were wholly efficient, taking exactly 2 hours to complete each plasma TV and exactly 1·5 hours to produce each LCD TV. The total labour variance therefore relates solely to the temporary workers, who took twice as long as the permanent workers to complete their production.Required:(a)Calculate the following for the month of November, showing all workings clearly:(i)The sales price variance and sales volume contribution variance;(6 marks)(ii)The material price planning variance and material price operational variance;(2 marks) (iii)The labour rate variance and the labour efficiency variance.(7 marks)(b)Explain the reasons why Carad Co would be interested in the material price planning variance and thematerial price operational variance.(5 marks)(20 marks)3[P.T.O.2The Accountancy T eaching Co (AT Co) is a company specialising in the provision of accountancy tuition courses in the private sector. It makes up its accounts to 30 November each year. In the year ending 30 November 2009, it held 60% of market share. However, over the last twelve months, the accountancy tuition market in general has faceda 20% decline in demand for accountancy training leading to smaller class sizes on courses. In 2009 and before, ATCo suffered from an ongoing problem with staff retention, which had a knock-on effect on the quality of service provided to students. Following the completion of developments that have been ongoing for some time, in 2010 the company was able to offer a far-improved service to students. The developments included:– A new dedicated 24 hour student helpline–An interactive website providing instant support to students– A new training programme for staff–An electronic student enrolment system–An electronic marking system for the marking of students’ progress tests. The costs of marking electronically were expected to be $4 million less in 2010 than marking on paper. Marking expenditure is always included in cost of salesExtracts from the management accounts for 2009 and 2010 are shown below:20092010$’000$’000$’000$’000 T urnover72,02566,028Cost of sales(52,078)(42,056)–––––––––––––––Gross profit19,94723,972Indirect expenses:Marketing3,2914,678Property6,7026,690Staff training1,2873,396Interactive website running costs–3,270Student helpline running costs–2,872Enrolment costs5,032960––––––––––––T otal indirect expenses(16,312)(21,866)–––––––––––––––Net operating profit3,6352,106–––––––––––––––On 1 December 2009, management asked all ‘freelance lecturers’ to reduce their fees by at least 10% with immediate effect (‘freelance lecturers’ are not employees of the company but are used to teach students when there are not enough of AT Co’s own lecturers to meet tuition needs). All employees were also told that they would not receive a pay rise for at least one year. T otal lecture staff costs (including freelance lecturers) were $41·663 million in 2009 and were included in cost of sales, as is always the case. Freelance lecturer costs represented 35% of these total lecture staff costs. In 2010 freelance lecture costs were $12·394 million. No reduction was made to course prices in the year and the mix of trainees studying for the different qualifications remained the same. The same type and number of courses were run in both 2009 and 2010 and the percentage of these courses that was run by freelance lecturers as opposed to employed staff also remained the same.Due to the nature of the business, non-financial performance indicators are also used to assess performance, as detailed below.20092010 Percentage of students transferring to AT Co fromanother training provider8%20%Number of late enrolments due to staff error297106Percentage of students passing exams first time48%66%Labour turnover32%10%Number of student complaints31584Average no. of employees1,0801,0814Required:Assess the performance of the business in 2010 using both financial performance indicators calculated from the above information AND the non-financial performance indicators provided.NOTE: Clearly state any assumptions and show all workings clearly. Your answer should be structured around the following main headings: turnover; cost of sales; gross profit; indirect expenses; net operating profit. However, in discussing each of these areas you should also refer to the non-financial performance indicators, where relevant.(20 marks)5[P.T.O.3The Cosmetic Co is a company producing a variety of cosmetic creams and lotions. The creams and lotions are sold to a variety of retailers at a price of $23·20 for each jar of face cream and $16·80 for each bottle of body lotion. Each of the products has a variety of ingredients, with the key ones being silk powder, silk amino acids and aloe vera. Six months ago, silk worms were attacked by disease causing a huge reduction in the availability of silk powder and silk amino acids. The Cosmetic Co had to dramatically reduce production and make part of its workforce, which it had trained over a number of years, redundant.The company now wants to increase production again by ensuring that it uses the limited ingredients available to maximise profits by selling the optimum mix of creams and lotions. Due to the redundancies made earlier in the year, supply of skilled labour is now limited in the short-term to 160 hours (9,600 minutes) per week, although unskilled labour is unlimited. The purchasing manager is confident that they can obtain 5,000 grams of silk powder and 1,600 grams of silk amino acids per week. All other ingredients are unlimited. The following information is available for the two products:Cream Lotion Materials required: silk powder (at $2·20 per gram) 3 grams 2 grams–silk amino acids (at $0·80 per gram) 1 gram0·5 grams–aloe vera (at $1·40 per gram) 4 grams 2 gramsLabour required: skilled ($12 per hour) 4 minutes 5 minutes–unskilled (at $8 per hour) 3 minutes1·5 minutesEach jar of cream sold generates a contribution of $9 per unit, whilst each bottle of lotion generates a contribution of $8 per unit. The maximum demand for lotions is 2,000 bottles per week, although demand for creams is unlimited.Fixed costs total $1,800 per week. The company does not keep inventory although if a product is partially complete at the end of one week, its production will be completed in the following week.Required:(a)On the graph paper provided, use linear programming to calculate the optimum number of each product thatthe Cosmetic Co should make per week, assuming that it wishes to maximise contribution. Calculate the total contribution per week for the new production plan. All workings MUST be rounded to 2 decimal places.(14 marks)(b)Calculate the shadow price for silk powder and the slack for silk amino acids. All workings MUST be roundedto 2 decimal places.(6 marks)(20 marks)64The Gadget Co produces three products, A, B and C, all made from the same material. Until now, it has used traditional absorption costing to allocate overheads to its products. The company is now considering an activity based costing system in the hope that it will improve profitability. Information for the three products for the last year is as follows:A B CProduction and sales volumes (units)15,00012,00018,000Selling price per unit$7.50$12$13Raw material usage (kg) per unit234Direct labour hours per unit0·10·150·2Machine hours per unit0·50·70·9Number of production runs per annum16128Number of purchase orders per annum242842Number of deliveries to retailers per annum483062The price for raw materials remained constant throughout the year at $1·20 per kg. Similarly, the direct labour cost for the whole workforce was $14·80 per hour. The annual overhead costs were as follows:$Machine set up costs26,550Machine running costs66,400Procurement costs48,000Delivery costs54,320Required:(a)Calculate the full cost per unit for products A, B and C under traditional absorption costing, using directlabour hours as the basis for apportionment.(5 marks)(b)Calculate the full cost per unit of each product using activity based costing.(9 marks)(c)Using your calculation from (a) and (b) above, explain how activity based costing may help The Gadget Coimprove the profitability of each product.(6 marks)(20 marks) 5Some commentators argue that: ‘With continuing pressure to control costs and maintain efficiency, the time has come for all public sector organisations to embrace zero-based budgeting. There is no longer a place for incremental budgeting in any organisation, particularly public sector ones, where zero-based budgeting is far more suitable anyway.’Required:(a)Discuss the particular difficulties encountered when budgeting in public sector organisations compared withbudgeting in private sector organisations, drawing comparisons between the two types of organisations.(5 marks)(b)Explain the terms ‘incremental budgeting’ and ‘zero-based budgeting’.(4 marks)(c)State the main stages involved in preparing zero-based budgets.(3 marks)(d)Discuss the view that ‘there is no longer a place for incremental budgeting in any organisation, particularlypublic sector ones,’ highlighting any drawbacks of zero-based budgeting that need to be considered.(8 marks)(20 marks)7[P.T.O.8。