克鲁格曼 国际经济学第9版教材答案

国际经济学克鲁格曼课后习题答案章完整版

国际经济学克鲁格曼课后习题答案章集团标准化办公室:[VV986T-J682P28-JP266L8-68PNN]第一章练习与答案1.为什么说在决定生产和消费时,相对价格比绝对价格更重要?答案提示:当生产处于生产边界线上,资源则得到了充分利用,这时,要想增加某一产品的生产,必须降低另一产品的生产,也就是说,增加某一产品的生产是有机会机本(或社会成本)的。

生产可能性边界上任何一点都表示生产效率和充分就业得以实现,但究竟选择哪一点,则还要看两个商品的相对价格,即它们在市场上的交换比率。

相对价格等于机会成本时,生产点在生产可能性边界上的位置也就确定了。

所以,在决定生产和消费时,相对价格比绝对价格更重要。

2.仿效图1—6和图1—7,试推导出Y商品的国民供给曲线和国民需求曲线。

答案提示:3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?试解释原因。

答案提示:4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:5.如果改用Y商品的过剩供给曲线(B国)和过剩需求曲线(A国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?6.答案提示:国际均衡价格将依旧处于贸易前两国相对价格的中间某点。

7.说明贸易条件变化如何影响国际贸易利益在两国间的分配。

答案提示:一国出口产品价格的相对上升意味着此国可以用较少的出口换得较多的进口产品,有利于此国贸易利益的获得,不过,出口价格上升将不利于出口数量的增加,有损于出口国的贸易利益;与此类似,出口商品价格的下降有利于出口商品数量的增加,但是这意味着此国用较多的出口换得较少的进口产品。

对于进口国来讲,贸易条件变化对国际贸易利益的影响是相反的。

8.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

国际经济学(克鲁格曼)教材答案

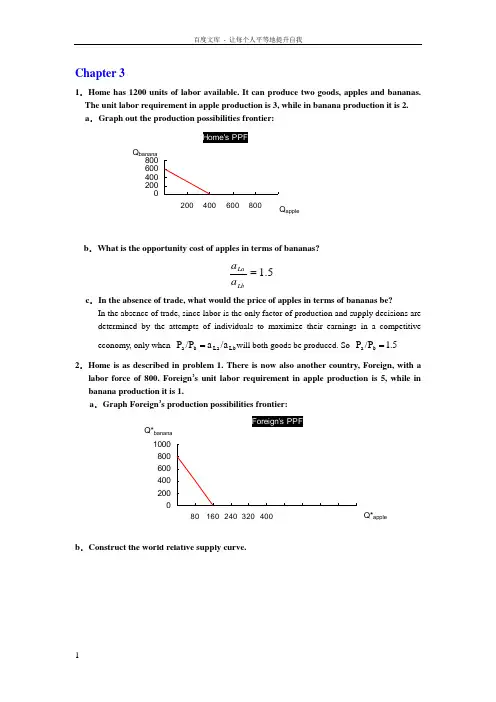

Chapter 31.Home has 1200 units of labor available. It can produce two goods, apples and bananas. The unit labor requirement in apple production is 3, while in banana production it is 2. a .Graph out the production possibilities frontier:b .What is the opportunity cost of apples in terms of bananas?5.1=LbLa a a c .In the absence of trade, what would the price of apples in terms of bananas be?In the absence of trade, since labor is the only factor of production and supply decisions aredetermined by the attempts of individuals to maximize their earnings in a competitive economy, only when Lb La b a /a a /P P =will both goods be produced. So 1.5 /P P b a =2.Home is as described in problem 1. There is now also another country, Foreign, with alabor force of 800. Foreign ’s unit labor requirement in apple production is 5, while in banana production it is 1.a .Graph Foreign ’s production possibilities frontier:b .Construct the world relative supply curve.Home's PPF 0200400600800200400600800Q apple Q banana Foreign's PPF0200400600800100080160240320400Q*apple Q*banana3.Now suppose world relative demand takes the following form: Demand for apples/demandfor bananas = price of bananas/price of apples.a .Graph the relative demand curve along with the relative supply curve:a b b a /P P /D D =∵When the market achieves its equilibrium, we have 1b a )(D D -**=++=ba b b a a P P Q Q Q Q ∴RD is a hyperbola xy 1=b .What is the equilibrium relative price of apples?The equilibrium relative price of apples is determined by the intersection of the RD and RScurves.RD: yx 1= RS: 5]5,5.1[5.1],5.0(5.0)5.0,0[=∈=⎪⎩⎪⎨⎧+∞∈=∈y y y x x x ∴25.0==y x∴2/=b P a P e ec .Describe the pattern of trade.∵b a b e a e b a P P P P P P ///>>**∴In this two-country world, Home will specialize in the apple production, export apples and import bananas. Foreign will specialize in the banana production, export bananas and import apples.d .Show that both Home and Foreign gain from trade.International trade allows Home and Foreign to consume anywhere within the coloredlines, which lie outside the countries ’ production possibility frontiers. And the indirect method, specializing in producing only one production then trade with other country, is a more efficient method than direct production. In the absence of trade, Home could gain three bananas by foregoing two apples, and Foreign could gain by one foregoing five bananas. Trade allows each country to trade two bananas for one apple. Home could then gain four bananas by foregoing two apples while Foreign could gain one apple by foregoing only two bananas. So both Home and Foreign gain from trade.4.Suppose that instead of 1200 workers, Home had 2400. Find the equilibrium relative price. What can you say about the efficiency of world production and the division of the gains from trade between Home and Foreign in this case?RD: yx 1= RS: 5]5,5.1[5.1],1(1)1,0[=∈=⎪⎩⎪⎨⎧+∞∈=∈y y y x x x ∴5.132==y x ∴5.1/=b P a P e eIn this case, Foreign will specialize in the banana production, export bananas and import apples. But Home will produce bananas and apples at the same time. And the opportunity cost of bananas in terms of apples for Home remains the same. So Home neither gains nor loses but Foreign gains from trade.5.Suppose that Home has 2400 workers, but they are only half as production in both industries as we have been assuming, Construct the world relative supply curve and determine the equilibrium relative price. How do the gains from trade compare with those in the case described in problem 4?In this case, the labor is doubled while the productivity of labor is halved, so the "effective labor"remains the same. So the answer is similar to that in 3. And both Home and Foreign can gain from trade. But Foreign gains lesser compare with that in the case 4.6.”Korean workers earn only $ an hour; if we allow Korea to export as much as it likes to the United States, our workers will be forced down to the same level. You can’t import a $5 shirt without importing the $ wage that goes with it.” Discuss.In fact, relative wage rate is determined by comparative productivity and the relative demand for goods. Korea’s low wage reflects the fact that Korea is less productive than the United States in most industries. Actually, trade with a less productive, low wage country can raise the welfare and standard of living of countries with high productivity, such as United States. Sothis pauper labor argument is wrong.7.Japanese labor productivity is roughly the same as that of the United States in the manufacturing sector (higher in some industries, lower in others), while the United States, is still considerably more productive in the service sector. But most services are non-traded. Some analysts have argued that this poses a problem for the United States, because our comparative advantage lies in things we cannot sell on world markets. What is wrong with this argument?The competitive advantage of any industry depends on both the relative productivities of the industries and the relative wages across industries. So there are four aspects should be taken into account before we reach conclusion: both the industries and service sectors of Japan and U.S., not just the two service sectors. So this statement does not bade on the reasonable logic. 8.Anyone who has visited Japan knows it is an incredibly expensive place; although Japanese workers earn about the same as their . counterparts, the purchasing power of their incomes is about one-third less. Extend your discussing from question 7 to explain this observation. (Hint: Think about wages and the implied prices of non-trade goods.) The relative higher purchasing power of U.S. is sustained and maintained by its considerably higher productivity in services. Because most of those services are non-traded, Japanese could not benefit from those lower service costs. And U.S. does not have to face a lower international price of services. So the purchasing power of Japanese is just one-third of their U.S. counterparts.9.How does the fact that many goods are non-traded affect the extent of possible gains from trade?Actually the gains from trade depended on the proportion of non-traded goods. The gains will increase as the proportion of non-traded goods decrease.10.We have focused on the case of trade involving only two countries. Suppose that there are many countries capable of producing two goods, and that each country has only one factor of production, labor. What could we say about the pattern of production and in this case? (Hint: Try constructing the world relative supply curve.)Any countries to the left of the intersection of the relative demand and relative supply curves export the good in which they have a comparative advantage relative to any country to the right of the intersection. If the intersection occurs in a horizontal portion then the country with that price ratio produces both goods.Chapter 41. In the United States where land is cheap, the ratio of land to labor used in cattle rising ishigher than that of land used in wheat growing. But in more crowded countries, where land is expensive and labor is cheap, it is common to raise cows by using less land and more labor than Americans use to grow wheat. Can we still say that raising cattle is land intensive compared with farming wheat? Why or why not?The definition of cattle growing as land intensive depends on the ratio of land to labor used inproduction, not on the ratio of land or labor to output. The ratio of land to labor in cattle exceeds the ratio in wheat in the United States, implying cattle is land intensive in the United States. Cattle is land intensive in other countries too if the ratio of land to labor in cattle production exceeds the ratio in wheat production in that country. The comparison between another country and the United States is less relevant for answering the question.2. Suppose that at current factor prices cloth is produced using 20 hours of labor for eachacre of land, and food is produced using only 5 hours of labor per acre of land.a. Suppose that the economy ’s total resources are 600 hours of labor and 60 acres ofland. Using a diagram determine the allocation of resources.5TF LF /TF LF /QF)(TF / /QF)(LF aTF / aLF 20TC LC /TC LC /QC)(TC / /QC)(LC aTC / aLC =⇒===⇒==We can solve this algebraically since L=LC+LF=600 and T=TC+TF=60. The solution is LC=400, TC=20, LF=200 and TF=40.b. Now suppose that the labor supply increase first to 800, then 1000, then 1200 hours. Using a diagram like Figure4-6, trace out the changing allocation of resources. Labor Land ClothFoodLCLF TCTFtion).specializa (complete 0.LF 0,TF 1200,LC 60,TC :1200L 66.67LF 13.33,TF 933.33,LC 46.67,TC :1000L 133.33LF 26.67,TF 666.67,LC 33.33,TC :800L ===============c. What would happen if the labor supply were to increase even further?At constant factor prices, some labor would be unused, so factor prices would have tochange, or there would be unemployment.3. “The world ’s poorest countries cannot find anything to export. There is no resource thatis abundant — certainly not capital or land, and in small poor nations not even labor is abundant.” Discuss.The gains from trade depend on comparative rather than absolute advantage. As to poor countries, what matters is not the absolute abundance of factors, but their relative abundance. Poor countries have an abundance of labor relative to capital when compared to more developed countries.4. The U.S. labor movement — which mostly represents blue-collar workers rather thanprofessionals and highly educated workers — has traditionally favored limits on imports form less-affluent countries. Is this a shortsighted policy of a rational one in view of the interests of union members? How does the answer depend on the model of trade?In the Ricardo ’s model, labor gains from trade through an increase in its purchasing power. This result does not support labor union demands for limits on imports from less affluent countries.In the Immobile Factors model labor may gain or lose from trade. Purchasing power in terms of one good will rise, but in terms of the other good it will decline.The Heckscher-Ohlin model directly discusses distribution by considering the effects of trade on the owners of factors of production. In the context of this model, unskilled U.S. labor loses from trade since this group represents the relatively scarce factors in this country. The results from the Heckscher-Ohlin model support labor union demands for import limits. 5. There is substantial inequality of wage levels between regions within the United States. Labor Land Cloth Food0l 800 0l 1000 0l 1200For example, wages of manufacturing workers in equivalent jobs are about 20 percent lower in the Southeast than they are in the Far West. Which of the explanations of failure of factor price equalization might account for this? How is this case different from the divergence of wages between the United States and Mexico (which is geographically closer to both the . Southeast and the Far West than the Southeast and Far West are to each other)?When we employ factor price equalization, we should pay attention to its conditions: both countries/regions produce both goods; both countries have the same technology of production, and the absence of barriers to trade. Inequality of wage levels between regions within the United States may caused by some or all of these reasons.Actually, the barriers to trade always exist in the real world due to transportation costs. And the trade between U.S. and Mexico, by contrast, is subject to legal limits; together with cultural differences that inhibit the flow of technology, this may explain why the difference in wage rates is so much larger.6.Explain why the Leontief paradox and the more recent Bowen, Leamer, andSveikauskas results reported in the text contradict the factor-proportions theory.The factor proportions theory states that countries export those goods whose production is intensive in factors with which they are abundantly endowed. One would expect the United States, which has a high capital/labor ratio relative to the rest of the world, to export capital-intensive goods if the Heckscher-Ohlin theory holds. Leontief found that the United States exported labor-intensive goods. Bowen, Leamer and Sveikauskas found that the correlation between factor endowment and trade patterns is weak for the world as a whole.The data do not support the predictions of the theory that countries' exports and imports reflect the relative endowments of factors.7.In the discussion of empirical results on the Heckscher-Ohlin model, we noted thatrecent work suggests that the efficiency of factors of production seems to differ internationally. Explain how this would affect the concept of factor price equalization.If the efficiency of the factors of production differs internationally, the lessons of the Heckscher-Ohlin theory would be applied to “effective factors” which adjust for the differences in technology or worker skills or land quality (for example). The adjusted model has been found to be more successful than the unadjusted model at explaining the pattern of trade between countries. Factor-price equalization concepts would apply to the effective factors. A worker with more skills or in a country with better technology could be considered to be equal to two workers in another country. Thus, the single person would be two effective units of labor. Thus, the one high-skilled worker could earn twice what lower skilled workers do and the price of one effective unit of labor would still be equalized.chapter 81. The import demand equation, MD, is found by subtracting the home supply equation from the home demand equation. This results in MD = 80 - 40 x P. Without trade, domestic prices and quantities adjust such that import demand is zero. Thus, the price in the absence of trade is2.2. a. Foreign's export supply curve, XS, is XS = -40 + 40 x P. In the absence of trade, the price is 1.b. When trade occurs export supply is equal to import demand, XS = MD. Thus, using theequations from problems 1 and 2a, P = , and the volume of trade is 20.3. a. The new MD curve is 80 - 40 x (P+t) where t is the specific tariff rate, equal to . (Note: in solving these problems you should be careful about whether a specific tariff or ad valorem tariff is imposed. With an ad valorem tariff, the MD equation would be expressed as MD =80-40 x (1+t)P). The equation for the export supply curve by the foreign country is unchanged. Solving, we find that the world price is $, and thus the internal price at home is $. The volume of trade has been reduced to 10, and the total demand for wheat at home has fallen to 65 (from the free trade level of70). The total demand for wheat in Foreign has gone up from 50 to 55.b. andc. The welfare of the home country is best studied using the combined numerical andgraphical solutions presented below in Figure 8-1. Home SupplyHome Demanda b c d e P T =1.7550556070QuantityPrice P W =1.50P T*=1.25where the areas in the figure are:a: 55 (55-50) .5(55-50) (65-55) .5(70-65) (65-55) surplus change: -(a+b+c+d)=. Producer surplus change: a=. Government revenue change: c+e=5. Efficiency losses b+d are exceeded by terms of trade gain e. [Note: in the calculations for the a, b, and d areas a figure of .5 shows up. This is because we are measuring the area of a triangle, which is one-half of the area of the rectangle defined by the product of the horizontal and vertical sides.]4. Using the same solution methodology as in problem 3, when the home country is very small relative to the foreign country, its effects on the terms of trade are expected to be much less. The small country is much more likely to be hurt by its imposition of a tariff. Indeed, this intuition is shown in this problem. The free trade equilibrium is now at the price $ and the trade volume is now $.With the imposition of a tariff of by Home, the new world price is $, the internal home price is $, home demand is units, home supply is and the volume of trade is . When Home is relatively small, the effect of a tariff on world price is smaller than when Home is relatively large. When Foreign and Home were closer in size, a tariff of .5 by home lowered world price by 25 percent, whereas in this case the same tariff lowers world price by about 5 percent. The internal Home price is now closer to the free trade price plus t than when Home was relatively large. In this case, the government revenues from the tariff equal , the consumer surplus loss is , and the producer surplus gain is . The distortionary losses associated with the tariff (areas b+d) sum to and the terms of trade gain (e) is . Clearly, in this small country example the distortionary losses from the tariff swamp the terms of trade gains. The general lesson is the smaller the economy,the larger the losses from a tariff since the terms of trade gains are smaller.5. The effective rate of protection takes into consideration the costs of imported intermediate goods. In this example, half of the cost of an aircraft represents components purchased from other countries. Without the subsidy the aircraft would cost $60 million. The European value added to the aircraft is $30 million. The subsidy cuts the cost of the value added to purchasers of the airplane to $20 million. Thus, the effective rate of protection is (30 - 20)/20 = 50%.6. We first use the foreign export supply and domestic import demand curves to determine the new world price. The foreign supply of exports curve, with a foreign subsidy of 50 percent per unit, becomes XS = -40 + 40(1+ x P. The equilibrium world price is and the internal foreign price is . The volume of trade is 32. The foreign demand and supply curves are used to determine the costs and benefits of the subsidy. Construct a diagram similar to that in the text and calculate the area of the various polygons. The government must provide - x 32 = units of output to support the subsidy. Foreign producers surplus rises due to the subsidy by the amount of units of output. Foreign consumers surplus falls due to the higher price by units of the good. Thus, the net loss to Foreign due to the subsidy is + - = units of output. Home consumers and producers face an internal price of as a result of the subsidy. Home consumers surplus rises by 70 x .3 + .5 (6= while Home producers surplus falls by 44 x .3 + .5(6 x .3) = , for a net gain of units of output.7. At a price of $10 per bag of peanuts, Acirema imports 200 bags of peanuts. A quota limiting the import of peanuts to 50 bags has the following effects:a. The price of peanuts rises to $20 per bag.b. The quota rents are ($20 - $10) x 50 = $500.c. The consumption distortion loss is .5 x 100 bags x $10 per bag = $500.d. The production distortion loss is .5 x50 bags x$10 per bag = $250.。

克鲁格曼国际经济学课后答案

克鲁格曼国际经济学课后答案【篇一:克鲁格曼《国际经济学》(国际金融)习题答案要点】lass=txt>第12章国民收入核算和国际收支1、如问题所述,gnp仅仅包括最终产品和服务的价值是为了避免重复计算的问题。

在国民收入账户中,如果进口的中间品价值从gnp中减去,出口的中间品价值加到gnp中,重复计算的问题将不会发生。

例如:美国分别销售钢材给日本的丰田公司和美国的通用汽车公司。

其中出售给通用公司的钢材,作为中间品其价值不被计算到美国的gnp中。

出售给日本丰田公司的钢材,钢材价值通过丰田公司进入日本的gnp,而最终没有进入美国的国民收入账户。

所以这部分由美国生产要素创造的中间品价值应该从日本的gnp中减去,并加入美国的gnp。

2、(1)等式12-2可以写成ca?(sp?i)?(t?g)。

美国更高的进口壁垒对私人储蓄、投资和政府赤字有比较小或没有影响。

(2)既然强制性的关税和配额对这些变量没有影响,所以贸易壁垒不能减少经常账户赤字。

不同情况对经常账户产生不同的影响。

例如,关税保护能提高被保护行业的投资,从而使经常账户恶化。

(当然,使幼稚产业有一个设备现代化机会的关税保护是合理的。

)同时,当对投资中间品实行关税保护时,由于受保护行业成本的提高可能使该行业投资下降,从而改善经常项目。

一般地,永久性和临时性的关税保护有不同的效果。

这个问题的要点是:政策影响经常账户方式需要进行一般均衡、宏观分析。

3、(1)、购买德国股票反映在美国金融项目的借方。

相应地,当美国人通过他的瑞士银行账户用支票支付时,因为他对瑞士请求权减少,故记入美国金融项目的贷方。

这是美国用一个外国资产交易另外一种外国资产的案例。

(2)、同样,购买德国股票反映在美国金融项目的借方。

当德国销售商将美国支票存入德国银行并且银行将这笔资金贷给德国进口商(此时,记入美国经常项目的贷方)或贷给个人或公司购买美国资产(此时,记入美国金融项目的贷方)。

最后,银行采取的各项行为将导致记入美国国际收支表的贷方。

(完整word版)国际经济学第九版英文课后答案 第7单元

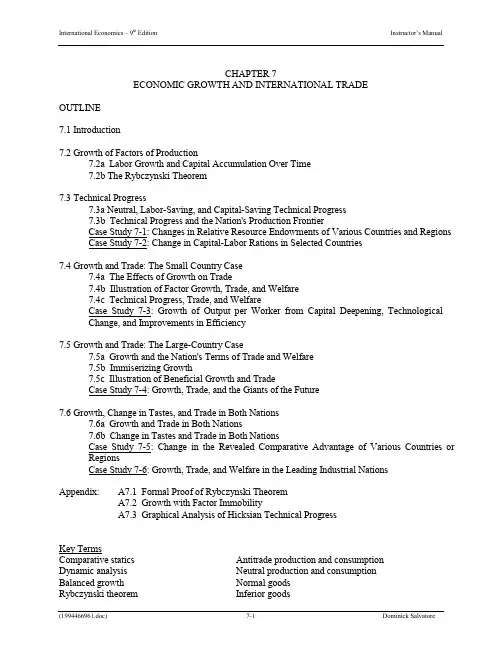

CHAPTER 7ECONOMIC GROWTH AND INTERNATIONAL TRADEOUTLINE7.1 Introduction7.2 Growth of Factors of Production7.2a Labor Growth and Capital Accumulation Over Time7.2b The Rybczynski Theorem7.3 Technical Progress7.3a Neutral, Labor-Saving, and Capital-Saving Technical Progress7.3b Technical Progress and the Nation's Production FrontierCase Study 7-1: Changes in Relative Resource Endowments of Various Countries and Regions Case Study 7-2: Change in Capital-Labor Rations in Selected Countries7.4 Growth and Trade: The Small Country Case7.4a The Effects of Growth on Trade7.4b Illustration of Factor Growth, Trade, and Welfare7.4c Technical Progress, Trade, and WelfareCase Study 7-3: Growth of Output per Worker from Capital Deepening, TechnologicalChange, and Improvements in Efficiency7.5 Growth and Trade: The Large-Country Case7.5a Growth and the Nation's Terms of Trade and Welfare7.5b Immiserizing Growth7.5c Illustration of Beneficial Growth and TradeCase Study 7-4: Growth, Trade, and the Giants of the Future7.6 Growth, Change in Tastes, and Trade in Both Nations7.6a Growth and Trade in Both Nations7.6b Change in Tastes and Trade in Both NationsCase Study 7-5: Change in the Revealed Comparative Advantage of Various Countries or RegionsCase Study 7-6: Growth, Trade, and Welfare in the Leading Industrial NationsAppendix: A7.1 Formal Proof of Rybczynski TheoremA7.2 Growth with Factor ImmobilityA7.3 Graphical Analysis of Hicksian Technical ProgressKey TermsComparative statics Antitrade production and consumptionDynamic analysis Neutral production and consumptionBalanced growth Normal goodsRybczynski theorem Inferior goodsLabor-saving technical progress Terms-of-trade effectCapital-saving technical progress Wealth effectProtrade production and consumption Immiserizing growthLecture Guide1.This is not a core chapter and it is one of the most challenging chapters in international tradetheory. It is included for more advanced students and for completeness.2.If I were to cover this chapter, I would present two sections in each of three lectures.Time permitting, I would, otherwise cover Sections 1 and 2, paying special attention to the Rybczynski theorem.Answer to Problems1. a) See Figure 1.b) See Figure 2c) See Figure 3.2. See Figure 4.3. a) See Figure 5.b) See Figure 6.c) See Figure 7.4. Compare Figure 5 to Figure 1.Compare Figure 6 to Figure 3. Note that the two production frontiers have the same vertical or Y intercept in Figure 6 but a different vertical or Y intercept in Figure 3.Compare Figure 7 to Figure 2. Note that the two production frontiers have the samehorizontal or X intercept in Figure 7 but a different horizontal or X intercept in Figure 2.5. See Figure 8 on page 66.6. See Figure 9.7. See Figure 10.8. See Figure 11.9. See Figure 12.10. See Figure 13 on page 67.11. See Figure 14.12. See Figure 15.13.The United States has become the most competitive economy in the world since the early1990’s while the data in Table 7.3 refers to the 1965-1990 period.14.The data in Table 7.4 seem to indicate that China had a comparative advantage incapital-intensive commodities and a comparative disadvantage in unskilled-labor intensive commodities in 1973. This was very likely due to the many trade restrictions and subsidies, which distorted the comparative advantage of China.Its true comparative advantage became evident by 1993 after China had started to liberalize its economy.App. 1a. See Figure 16.1b. For production and consumption to actually occur at the newequilibrium point after the doubling of K in Nation 2, we mustassume either than commodity X is inferior or that Nation 2 is toosmall to affect the relative commodity prices at which it trades.1c. Px/Py must rise (i.e., Py/Px must fall) as a result of growth only.Px/Py will fall even more with trade.1. If the supply of capital increases in Nation 1 in the production of commodity Yonly, the VMPLy curve shifts up, and w rises in both industries. Some labor shifts to the production of Y, the output of Y rises and the output of X falls, r falls, and Px/Py is likely to rise.2. Capital investments tend to increase real wages because they raise the K/L ratioand the productivity of labor. Technical progress tends to increase K/L and realwages if it is L-saving and to reduce K/L and real wages if it is K-saving. Multiple-Choice Questions1. Dynamic factors in trade theory refer to changes in:a. factor endowmentsb. technologyc. tastes*d. all of the above2. Doubling the amount of L and K under constant returns to scale:a. doubles the output of the L-intensive commodityb. doubles the output of the K-intensive commodityc. leaves the shape of the production frontier unchanged*d. all of the above.3. Doubling only the amount of L available under constant returns to scale:a. less than doubles the output of the L-intensive commodity*b. more than doubles the output of the L-intensive commodityc. doubles the output of the K-intensive commodityd. leaves the output of the K-intensive commodity unchanged4. The Rybczynski theorem postulates that doubling L at constant relative commodity prices:a. doubles the output of the L-intensive commodity*b. reduces the output of the K-intensive commodityc. increases the output of both commoditiesd. any of the above5. Doubling L is likely to:a. increases the relative price of the L-intensive commodityb. reduces the relative price of the K-intensive commodity*c. reduces the relative price of the L-intensive commodityd. any of the above6.Technical progress that increases the productivity of L proportionately more than the productivity of K is called:*a. capital savingb. labor savingc. neutrald. any of the above7. A 50 percent productivity increase in the production of commodity Y:a. increases the output of commodity Y by 50 percentb. does not affect the output of Xc. shifts the production frontier in the Y direction only*d. any of the above8. Doubling L with trade in a small L-abundant nation:*a. reduces the nation's social welfareb. reduces the nation's terms of tradec. reduces the volume of traded. all of the above9. Doubling L with trade in a large L-abundant nation:a. reduces the nation's social welfareb. reduces the nation's terms of tradec. reduces the volume of trade*d. all of the above10.If, at unchanged terms of trade, a nation wants to trade more after growth, then the nation's terms of trade can be expected to:*a. deteriorateb. improvec. remain unchangedd. any of the above11. A proportionately greater increase in the nation's supply of labor than of capital is likely to result in a deterioration in the nation's terms of trade if the nation exports:a. the K-intensive commodity*b. the L-intensive commodityc. either commodityd. both commodities12. Technical progress in the nation's export commodity:*a. may reduce the nation's welfareb. will reduce the nation's welfarec. will increase the nation's welfared. leaves the nation's welfare unchanged13. Doubling K with trade in a large L-abundant nation:a. increases the nation's welfareb. improves the nation's terms of tradec. reduces the volume of trade*d. all of the above14. An increase in tastes for the import commodity in both nations:a. reduces the volume of trade*b. increases the volume of tradec. leaves the volume of trade unchangedd. any of the above15. An increase in tastes of the import commodity of Nation A and export in B:*a. will reduce the terms of trade of Nation Ab. will increase the terms of trade of Nation Ac. will reduce the terms of trade of Nation Bd. any of the aboveADDITIONAL ESSAYS AND PROBLEMS FOR PART ONE1.Assume that both the United States and Germany produce beef and computer chipswith the following costs:United States Germany(dollars) (marks)Unit cost of beef (B) 2 8Unit cost of computer chips (C) 1 2a) What is the opportunity cost of beef (B) and computer chips (C) in each country?b)In which commodity does the United States have a comparative cost advantage?What about Germany?c)What is the range for mutually beneficial trade between the United States andGermany for each computer chip traded?d)How much would the United States and Germany gain if 1 unit of beef isexchanged for 3 chips?Ans. a) In the United States:the opportunity cost of one unit of beef is 2 chips;the opportunity cost of one chip is 1/2 unit of beef.In Germany:the opportunity cost of one unit of beef is 4 chips;the opportunity cost of one chip is 1/4 unit of beef.b) The United States has a comparative cost advantage in beef with respect toGermany, while Germany has a comparative cost advantage in computer chips.c)The range for mutually beneficial trade between the United States and Germanyfor each unit of beef that the United States exports is2C < 1B < 4Cd) Both the United States and Germany would gain 1 chip for each unit of beeftraded.2.Given: (1) two nations (1 and 2) which have the same technology but differentfactor endowments and tastes, (2) two commodities (X and Y) produced under increasing costs conditions, and (3) no transportation costs, tariffs, or other obstructions to trade. Prove geometrically that mutually advantageous trade between the two nations is possible.Note: Your answer should show the autarky (no-trade) and free-trade points of production and consumption for each nation, the gains from trade of each nation,and express the equilibrium condition that should prevail when trade stops expanding.)Ans.: See Figure 1 on page 74.Nations 1 and 2 have different production possibilities curves and different community indifference maps. With these, they will usually end up with different relative commodity prices in autarky, thus making mutually beneficial trade possible.In the figure, Nation 1 produces and consumes at point A and Px/Py=P A in autarky, while Nation 2 produces and consumes at point A' and Px/Py=P A'. Since P A < P A',Nation 1 has a comparative advantage in X and Nation 2 in Y. Specialization inproduction proceeds until point B in Nation 1 and point B' in Nation 2, at which P B=P B' and the quantity supplied for export of each commodity exactly equals the quantity demanded for import. Thus, Nation 1 starts at point A in production and consumption in autarky, moves to point B in production, and by exchanging BC of X for CE of Y reaches point E in consumption. E > A since it involves more of both X and Y and lies on a higher community indifference curve. Nation 2 starts at A' in production and consumption in autarky, moves to point B' in production, and by exchanging B'C' of Y for C'E' of X reaches point E'in consumption (which exceeds A').At Px/Py=P B=P B', Nation 1 wants to export BC of X for CE of Y, while Nation 2 wants to export B'C' (=CE) of Y for C'E' (=BC) of X. Thus, P B=P B'is the equilibrium relative commodity price because it clears both (the X and Y) markets.3.Draw a figure showing: (1) in Panel A a nation's demand and supply curve for Atraded commodity and the nation's excess supply of the commodity, (2) in Panel C the trade partner's demand and supply curve for the same traded commodity and its excess demand for the commodity, and (3) in Panel B the supply and demand for the quantity traded of the commodity, its equilibrium price, and why a price above or below the equilibrium price will not persist. At any other price, QD QS, and P will change to P2.Ans. See Figure 2 on page 74.The equilibrium relative commodity price for commodity X (the traded commodityexported by Nation 1 and imported by Nation 2) is P2 and the equilibrium quantityof commodity X traded is Q2.4.a) Identify the conditions that may give rise to trade between two nations.b) What are some of the assumptions on which the Heckscher-Ohlin theory isbased?c) What does this theory say about the pattern of trade and effect of trade on factorprices?Ans. a) Trade can be based on a difference in factor endowments, technology, or tastes between two nations. A difference either in factor endowments or technology results in a different production possibilities frontier for each nation, which, unless neutralized by a difference in tastes, leads to a difference in relative commodity price and mutually beneficial trade. If two nations face increasing costs and have identical production possibilities frontiers but different tastes, there will also be a difference in relative commodity prices and the basis for mutually beneficial trade between the two nations. The difference in relative commodity prices is then translated into a difference in absolute commodity prices between the two nations, which is the immediate cause of trade.b) The Heckscher-Ohlin theory (sometimes referred to as the modern theory – asopposed to the classical theory - of international trade) assumes that nations have the same tastes, use the same technology, face constant returns to scale (i.e., a given percentage increase in all inputs increases output by the same percentage) but differ widely in factor endowments. It also says that in the face of identical tastes or demand conditions, this difference in factor endowments will result in a difference in relative factor prices between nations, which in turn leads to a difference in relative commodity prices and trade. Thus, in the Heckscher-Ohlin theory, the international difference in supply conditions alone determines the pattern of trade. To be noted is that the two nations need not be identical in other respects in order for international trade to be based primarily on the difference in their factor endowments.c) The Heckscher-Ohlin theorem postulates that each nation will export thecommodity intensive in its relatively abundant and cheap factor and import the commodity intensive in its relatively scarce and expensive factor. As an important corollary, it adds that under highly restrictive assumptions, trade will completely eliminate the pretrade relative and absolute differences in the price of homogeneous factors among nations. Under less restrictive and more usual conditions, however, trade will reduce, but not eliminate, the pretrade differences in relative and absolute factor prices among nations. In any event, the Heckscher-Ohlin theory does say something very useful on how trade affects factor prices and the distribution of income in each nation. Classical economists were practically silent on this point.5. consumers demand more of commodity X (the L-intensive commodity) and less ofcommodity Y (the K- intensive commodity). Suppose that Nation 1 is India, commodity X is textiles, and commodity Y is food. Starting from the no-trade equilibrium position and using the Heckscher-Ohlin model, trace the effect of this change in tastes on India's(a) relative commodity prices and demand for food and textiles,(b) production of both commodities and factor prices, and(c) comparative advantage and volume of trade.(d) Do you expect international trade to lead to the complete equalization ofrelative commodity and factor prices between India and the United States?Why?Ans. a. The change in tastes can be visualized by a shift toward the textile axis in India's indifference map in such a way that an indifference curve is tangentto the steeper segment of India's production frontier (because of increasingopportunity costs) after the increase in demand for textiles. This will causethe pretrade relative commodity price of textiles to rise in India.b. The increase in the relative price of textiles will lead domesticproducers in India to shift labor and capital from the production of food tothe production of textiles. Since textiles are L-intensive in relation to food,the demand for labor and therefore the wage rate will rise in India. At thesame time, as the demand for food falls, the demand for and thus the priceof capital will fall. With labor becoming relative more expensive,producers in India will substitute capital for labor in the production of bothtextiles and food.Even with the rise in relative wages and in the relative price of textiles,India still remains the L-abundant and low-wage nation with respect to anation such as the United States. However, the pretrade difference in therelative price of textiles between India and the United States is nowsomewhat smaller than before the change in tastes in India. As a result thevolume of trade required to equalize relative commodity prices and hencefactor prices is smaller than before. That is, India need now export asmaller quantity of textiles and import less food than before for therelative price of textiles in India and the United States to be equalized.Similarly, the gap between real wages and between India and the UnitedStates is now smaller and can be more quickly and easily closed (i.e., witha smaller volume of trade).c. Since many of the assumptions required for the complete equalization ofrelative commodity and factor prices do not hold in the real world, greatdifferences can be expected and do in fact remain between real wages inIndia and the United States. Nevertheless, trade would tend to reduce thesedifferences, and the H-O model does identify the forces that must beconsidered to analyze the effect of trade on the differences in the relative andabsolute commodity and factor prices between India and the United States.5.(a) Explain why the Heckscher-Ohlin trade model needs to be extended.(b) Indicate in what important ways the Heckscher-Ohlin trade model can beextended.(c) Explain what is meant by differentiated products and intra-industry trade.Ans. (a) The Heckscher-Ohlin trade model needs to be extended because, while generally correct, it fails to explain a significant portion of international trade, particularly the trade in manufactured products among industrial nations.(b)The international trade left unexplained by the basic Heckscher-Ohlin trade modecan be explained by(1) economies of scale,(2) intra-industry trade, and(3) trade based on imitation gaps and product differentiation.(c)Differentiated products refer to similar, but not identical, products (such as cars,typewriters, cigarettes, soaps, and so on) produced by the same industry or broad product group. Intra-industry trade refers to the international trade in differentiated products.。

克鲁格曼《国际经济学》(国际金融)习题标准答案要点

克鲁格曼《国际经济学》(国际金融)习题答案要点————————————————————————————————作者:————————————————————————————————日期:23 《国际经济学》(国际金融)习题答案要点第12章 国民收入核算与国际收支1、如问题所述,GNP 仅仅包括最终产品和服务的价值是为了避免重复计算的问题。

在国民收入账户中,如果进口的中间品价值从GNP 中减去,出口的中间品价值加到GNP 中,重复计算的问题将不会发生。

例如:美国分别销售钢材给日本的丰田公司和美国的通用汽车公司。

其中出售给通用公司的钢材,作为中间品其价值不被计算到美国的GNP 中。

出售给日本丰田公司的钢材,钢材价值通过丰田公司进入日本的GNP ,而最终没有进入美国的国民收入账户。

所以这部分由美国生产要素创造的中间品价值应该从日本的GNP 中减去,并加入美国的GNP 。

2、(1)等式12-2可以写成()()p CA S I T G =-+-。

美国更高的进口壁垒对私人储蓄、投资和政府赤字有比较小或没有影响。

(2)既然强制性的关税和配额对这些变量没有影响,所以贸易壁垒不能减少经常账户赤字。

不同情况对经常账户产生不同的影响。

例如,关税保护能提高被保护行业的投资,从而使经常账户恶化。

(当然,使幼稚产业有一个设备现代化机会的关税保护是合理的。

)同时,当对投资中间品实行关税保护时,由于受保护行业成本的提高可能使该行业投资下降,从而改善经常项目。

一般地,永久性和临时性的关税保护有不同的效果。

这个问题的要点是:政策影响经常账户方式需要进行一般均衡、宏观分析。

3、(1)、购买德国股票反映在美国金融项目的借方。

相应地,当美国人通过他的瑞士银行账户用支票支付时,因为他对瑞士请求权减少,故记入美国金融项目的贷方。

这是美国用一个外国资产交易另外一种外国资产的案例。

(2)、同样,购买德国股票反映在美国金融项目的借方。

当德国销售商将美国支票存入德国银行并且银行将这笔资金贷给德国进口商(此时,记入美国经常项目的贷方)或贷给个人或公司购买美国资产(此时,记入美国金融项目的贷方)。

克鲁格曼国际经济学课后答案

克鲁格曼国际经济学课后答案【篇一:克鲁格曼《国际经济学》(国际金融)习题答案要点】lass=txt>第12章国民收入核算与国际收支1、如问题所述,gnp仅仅包括最终产品和服务的价值是为了避免重复计算的问题。

在国民收入账户中,如果进口的中间品价值从gnp中减去,出口的中间品价值加到gnp中,重复计算的问题将不会发生。

例如:美国分别销售钢材给日本的丰田公司和美国的通用汽车公司。

其中出售给通用公司的钢材,作为中间品其价值不被计算到美国的gnp中。

出售给日本丰田公司的钢材,钢材价值通过丰田公司进入日本的gnp,而最终没有进入美国的国民收入账户。

所以这部分由美国生产要素创造的中间品价值应该从日本的gnp中减去,并加入美国的gnp。

2、(1)等式12-2可以写成ca?(sp?i)?(t?g)。

美国更高的进口壁垒对私人储蓄、投资和政府赤字有比较小或没有影响。

(2)既然强制性的关税和配额对这些变量没有影响,所以贸易壁垒不能减少经常账户赤字。

不同情况对经常账户产生不同的影响。

例如,关税保护能提高被保护行业的投资,从而使经常账户恶化。

(当然,使幼稚产业有一个设备现代化机会的关税保护是合理的。

)同时,当对投资中间品实行关税保护时,由于受保护行业成本的提高可能使该行业投资下降,从而改善经常项目。

一般地,永久性和临时性的关税保护有不同的效果。

这个问题的要点是:政策影响经常账户方式需要进行一般均衡、宏观分析。

3、(1)、购买德国股票反映在美国金融项目的借方。

相应地,当美国人通过他的瑞士银行账户用支票支付时,因为他对瑞士请求权减少,故记入美国金融项目的贷方。

这是美国用一个外国资产交易另外一种外国资产的案例。

(2)、同样,购买德国股票反映在美国金融项目的借方。

当德国销售商将美国支票存入德国银行并且银行将这笔资金贷给德国进口商(此时,记入美国经常项目的贷方)或贷给个人或公司购买美国资产(此时,记入美国金融项目的贷方)。

最后,银行采取的各项行为将导致记入美国国际收支表的贷方。

克鲁格曼《国际经济学》中文版·第九版课后习题答案

克鲁格曼《国际经济学》中文版·第九版课后习题答案克鲁格曼《国际经济学》中文版·第九版课后习题答案第一章练习与答案1.为什么说在决定生产和消费时,相对价格比绝对价格更重要?答案提示:当生产处于生产边界线上,资源则得到了充分利用,这时,要想增加某一产品的生产,必须降低另一产品的生产,也就是说,增加某一产品的生产是有机会机本(或社会成本)的。

生产可能性边界上任何一点都表示生产效率和充分就业得以实现,但究竟选择哪一点,则还要看两个商品的相对价格,即它们在市场上的交换比率。

相对价格等于机会成本时,生产点在生产可能性边界上的位置也就确定了。

所以,在决定生产和消费时,相对价格比绝对价格更重要。

2.仿效图1—6和图1—7,试推导出Y商品的国民供给曲线和国民需求曲线。

答案提示:3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?试解释原因。

答案提示:4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:5.如果改用Y商品的过剩供给曲线(B国)和过剩需求曲线(A 国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?答案提示:国际均衡价格将依旧处于贸易前两国相对价格的中间某点。

6.说明贸易条件变化如何影响国际贸易利益在两国间的分配。

答案提示:一国出口产品价格的相对上升意味着此国可以用较少的出口换得较多的进口产品,有利于此国贸易利益的获得,不过,出口价格上升将不利于出口数量的增加,有损于出口国的贸易利益;与此类似,出口商品价格的下降有利于出口商品数量的增加,但是这意味着此国用较多的出口换得较少的进口产品。

对于进口国来讲,贸易条件变化对国际贸易利益的影响是相反的。

7.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

国际经济学第九版英文课后答案第10单元

国际经济学第九版英文课后答案第10单元CHAPTER 10ECONOMIC INTEGRATION: CUSTOMS UNIONS AND FREE TRADE AREAS OUTLINE10.1 Introduction10.2 Trade-Creating Customs Unions10.2a Trade Creation10.2b Illustration of a Trade-Creating Customs Union10.3 Trade-Diverting Customs Unions10.3a Trade Diversion10.3b Illustration of a Trade-Diverting Customs Union10.4 The Theory of the Second Best and Other Static Welfare Effects10.4a The Theory of the Second Best10.4b Conditions More Likely to Lead to Increased Welfare10.4c Other Static Welfare Effects of Customs Unions10.5 Dynamic Benefits of Customs Unions*10.6 History of Attempts at Economic Integration10.6a The European UnionCase Study 10-1: Economic Profile of the EU, NAFTA, and JapanCase Study 10-2: Gains from the Single EU Market10.6b The European Free Trade Association10.6c The North American and Other Free Trade AgreementsCase Study 10-3: Mexico's Gains from NAFTA – Expectations and Outcome10.6d Attempts at Economic Integration Among Developing NationsCase Study 10-4: Economic Profile of MercosurCase Study 10-5: Changes in Trade Patterns with Economic Integration 344A10.6e Economic Integration in Central, Eastern Europe & Former Soviet RepublicsCase Study 10-6: Per Capita Income of Transition Economies Appendix: A10.1 General Equilibrium Analysis of Static Effects of a Trade-Diverting Customs UnionA10.2 Regional Trade Agreements Around the WorldKey TermsEconomic integration Variable import leviesPreferential trade arrangements European Free Trade Association (EFTA) (6920811.d oc) 10-1 Dominick Salvatore Free-trade area Trade deflectionCustoms union North American Free Trade Agreement (NAFTA) Common market Southern Common Market (Mercosur) Economic union Council of Mutual Economic Assistance (CMEA) Duty-free zones State trading companiesTrade creation Bilateral agreementsTrade diversion Bulk purchasingTrade-diverting customs union Central and Eastern European Countries (CEEC) Theory of the second best New Independent States (NIS)Tariff factories Commonwealth of Independent States (CIS) European Union (EU) Central European Free Trade Association (CEFTA)Baltic States Free Trade Area (BAFTA)Lecture Guide:1. This is not a core chapter and I would skip it except for section 6. Section 6 is animportant section and can be regarded as an extension ofChapter 9, which is a corechapter. Section 6 deals with a very important set of current events.2. Section 6 is a long section and may require two classes to be adequately presented. Iwould cover subsections a-d in one class and subsection e as well as both case studies in the second class. Case Studies 10-1 to 10-6 can be used for a very stimulating classdiscussion.3. While section 6 can be presented without covering the material in sections 1-5, someterms discussed in sections 1-5 (such as trade creation and trade diversion) need to bedefined.4. In a one-year course in international economics, I would cover the entire chapter. I wouldthen cover sections 10-1 to 10-3 in one class and sections 10-4 and 10-5 in the secondclass. In the first class, the most important aspect would be the presentation and clearexplanation of Figures 10-1 and 10-2.Answers to Problems:1. If Nation A imposes a 100 percent ad valorem tariff on imports of commodity X fromNation B and Nation C, Nation A will produce commodity X domestically because thedomestic price of commodity X is $10 as compared with the tariff-inclusive price of$16 if Nation A imported commodity X from Nation B and $12 if Nation A importedcommodity X from nation C.2. a) If Nation A forms a customs union with Nation B, NationA will import commodity (6920811.d oc) 10-2 Dominick SalvatoreX from Nation B at the price of $8 instead of producing it itself at $10 or importing itfrom Nation C at the tariff-inclusive price of $12.b) When Nation A forms a customs union with Nation B this would be a trade-creatingcustoms union because it replaces domestic production of commodity X at Px=$10with tariff-free imports of commodity X from Nation B at Px=$8.3. If Nation A imposes a 50 percent ad valorem tariff on imports of commodity X fromNation B and Nation C, Nation A will import commodity X from nation C at the tariff- inclusive price of $9 instead of producing commodity X itself or importing it fromNation B at the tariff-inclusive price of $12.4. a) If Nation A forms a customs union with Nation B, NationA will import commodityX from Nation B at the price of $8 instead of importing it from Nation C at the tariff-inclusive price of $9.b) When Nation A forms a customs union with Nation B this would be a trade-divertingcustoms union because it replaces lower-price imports of commodity X of $6 (fromthe point of view of Nation A as a whole) with higher priced imports of commodityX from Nation B at $8.Specifically, Nation A's importers do not import commodity X from Nation Cbecause the tariff-inclusive price of commodity X from Nation C is $9 as comparedwith the no-tariff price of $8 for imports of commodity X from Nation B. However,since the government of Nation A collects the $3 tariff per unit on imports ofcommodity X from Nation C, the net effective price for imports of commodity Xfrom Nation C is really $6 for Nation A as a whole.5. See Figure 10-1 in the text. Any figure similar to Figure 10-1 in the text would do.6. The welfare gains that Nation 2 receives from joining Nation 1 to form a customs unionis given by the sum of the areas of triangles CJM and BHN in Figure 10-1 in the text.Any similar figure and sum of corresponding triangles would, of course, be adequate.7. See Figure 10-2 in the text. Any figure similar to Figure 10-2 in the text would do.8. The welfare loss that Nation 2 receives from joining Nation 1 to form a customs unionis given by C'JJ'+B'HH'- MNH'J'=$11.25 in Figure 10-2 in the text.Any similar figure and sum of corresponding triangles minus the area of corresponding rectangle would, of course, be adequate.9. See Figure 1 and compare it to Figure 10-2.10. The net gain from the trade-diverting customs unionshown in Figure 1 is given byC'JJ'+B'HH'-MJ'H'N. As contrasted with the case in Figure 10-2, however, the sum (6920811.d oc) 10-3 Dominick Salvatore of the areas of the two triangles (measuring gains) is greater than the area the rectangle (measuring the loss). Thus, the nation would now gain from the formation of a custom union. Had we drawn the figure on graph paper, we would have been able to measure the net gain in monetary terms also.11. A trade-diverting customs union is more likely to lead toa welfare gain of a membernation (1) the smaller is the relative inefficiency of nation 3 with respect to nation 1,(2) the higher is the level of the tariff, and (3) the more elastic are Dx and Sx in nation2. These can seen by comparing Figure 10-2 in the text with Figure 1 on the next page.12. See Figure 2. The formation of the customs union has no effect.13. NAFTA created much more controversy because the very low wages in Mexico led togreat fears of large job losses in the U. S.14. The possible cost to the U.S. from EU92 arose from the increased efficiency andcompetitiveness of the E.U. The benefit arose because a more rapid growth in the EU spills into a greater demand for American products, which benefits the U. S.App. Compare points B' and H' in Figure 10-3 with the corresponding points inFigure 3.Multiple-choice Questions:1. Which of the following statements is correct?*a. In a customs union, member nations apply a uniform external tariffb. in a free-trade area, member nations harmonize their monetary and fiscal policiesc. within a customs union there is unrestricted factor movementd. a customs union is a higher form of economic integration than a common market2. A customs union that allows for the free movement of labor and capital among its member nations is called a:a. preferential trade arrangementb. free-trade area*c. common marketd. all of the above3. A trade-creating customs union is one where:a. lower-cost imports from outside the customs union are replaced by higher-cost imports from a union member *b. some domestic production in a member nation is replaced by lower-cost imports from another member nationc. trade among members increases but trade with nonmembers decreasesd. trade among members decreases while trade with nonmembers increases4. A trade-diverting customs union:a. increases trade among union members and with nonmember nationsb. reduces trade among union members and with nonmember nations*c. increases trade among members but reduces trade with non-membersd. reduces trade among union members but increases it with nonmembers5. A trade-diverting customs union results in:a. trade diversion onlyb. trade creation only*c. both trade creation and trade diversiond. we cannot say6. The formation of a trade-creating customs union where all economic resources of membernations are fully employed before and after the formation of the customs union leads to an:*a. increase in the welfare of member and nonmember nationsb. increase in the welfare of member nations onlyc. increase in the welfare of nonmember nations onlyd. increase or decrease in the welfare of member and nonmember nations7. A trade-diverting customs union:a. increases the welfare of member and nonmember nationsb. reduces the welfare of member and nonmember nationsc. increases the welfare of member nations but reduces that of nonmembers*d. reduces the welfare of nonmembers and may increase or reduce that of members8. A trade-diverting customs union is more likely to lead to trade creation:a. the lower are the pre-union trade barriers of the member countries*b. the lower are the customs union's barriers on trade with the rest of the worldc. the smaller is the number of countries forming the customs union and the smaller their sized. the more complementary rather than competitive are the economies of the nations forming the customs union9. The theory of customs union is a special case of the theory of:a. effective protection*b. the second bestc. the product cycled. comparative advantage10. Which is not a dynamic benefit from the formation of a customs union?a. increased competitionb. economies of scalec. stimulus to investment*d. trade creation11. The formation of the EU resulted in:a. trade creation in industrial and agricultural productsb. trade diversion in industrial and agricultural products*c. trade creation in industrial products and trade diversion in agricultural productsd. trade diversion in industrial products and trade creation in agricultural products12. The benefit that the United States is likely to receive from NAFTA:*a. increasing competition in product and resource marketsb. greater technical innovationc. improvements in its terms of traded. all of the above13. The benefit that Mexico is likely to receive from NAFTA:a. greater export-led growthb. encouraging the return of flight capitalc. more rapid structural change*d. all of the above14. Which is a stumbling block to successful economic integration among groups ofdeveloping nations?a. benefits are not evenly distributed among nationsb. many developing nations are not willing to relinquish part of their newly-acquired sovereignty to a supranational community body, as required for successful economic integrationc. the complementary nature of their economies and competition for the same world markets for their agricultural exports*d. all of the above15. The formation of a free trade area among the countries of Eastern Europe is advocatedin order to:a. restore trade trading*b. retain the traditional trade links that can be justified on market principlesc. reduce the need for structural changed. none of the above。

国际经济学第九版英文课后答案 第6单元

CHAPTER 6ECONOMIES OF SCALE, IMPERFECT COMPETITION,AND INTERNATIONAL TRADEOUTLINE*6.1 Introduction6.2 The Heckscher-Ohlin Model and New Trade Theories*6.3 Economies of Scale and International TradeCase Study 6-1: The New International economies of Scale*6.4 Imperfect Competition and International Trade6.4a Trade Based on Product DifferentiationCase Study 6-2: U.S. Intra-Industry Trade in Automotive ProductsCase Study 6-3: Variety Gains from International Trade6.4b Measuring Intra-Industry TradeCase Study 6-4: Growth of Intra-Industry Trade6.4c Formal Model of Intra-Industry Trade6.4d Another Version of the Intra-Industry Trade Model6.5 Trade Based on Dynamic Technological Differences and Synthesis of Trade Theories6.5a The Technological Gap and Product Cycle Models6.5b Illustration of the Product Cycle ModelCase Study 6-5: The United States as the Most Competitive Economy6.6 Transportation Costs, Environmental Standards, and International Trade6.6a Transportation Costs and Nontraded CommoditiesCase Study 6-6: Transport Costs by Country Groups6.6b Transportation Costs and the Location of IndustryCase Study 6-7: The Maquiladoras: U.S. Plants Along the U.S.-Mexican Border6.6c Environmental Standards, Industry Location, and International TradeCase Study 6-8: Environmental Sustainability IndexAppendix: A6.1 External Economies and the Pattern of TradeA6.2 Dynamic External Economies and SpecializationKey TermsIncreasing returns to scale Transport or logistics costs Monopoly Nontraded goods and services Oligopoly, Outsourcing General equilibrium analysis International economies of scale Partial equilibrium analysis External economies Resource-oriented industries Differentiated products Market-oriented industriesIntra-industry trade Footloose industriesIntra-industry trade index Environmental standards Monopolistic competition Dynamic external economies Technological gap model Learning curveProduct cycle model Infant industryLecture Guide:1.Although this is not a core chapter, Sections 6.1, 6.3 and 6.4 are important ones becausethey present some of the most recent developments in international trade theory.2.I would cover sections 1, 2, and 3 in lecture 1. The material is not difficult but veryimportant. I would also assign problems 1-3.3.I would cover section 4 in lecture 2. This is the most important section in the chapter. Iwould pay very close attention to Figures 6-2 and 6-3. These require reviewing from principles of economics, the meaning of differentiated products, monopolistic competition, economies of scale, and the determination of profit maximization by the firm. I would also assign problems 4-9 problems 4-9 and go over in class problems 6-9.4. In lecture 3, I would cover sections 5 and 6 and assign problems 10-14.Answer to Problems:1. See Figure 1.2. See Figure 2.3. See Figure 3.4. a) T = 1 - /1000-1000/ = 1 - 0 = 1.1000+1000 2000b) T = 1 - /1000-750/ = 1 - 250 = 0.86.1000+750 1750c) T = 1 - /1000-500/ = 1 - 500 = 0.67.1000+500 1500d) T = 1 - /1000-250/ = 1 - 750 = 0.4.1000+250 1250e) T = 1 - /1000-0/ = 1 - 1000 = 0.1000+0 10006920748.doc) 6-3 Dominick Salvatore5. a) T = 1 - /1000-1000/ = 1 - 0 = 1.1000+1000 2000b) T = 1 - /750-1000/ = 1 - 250 = 0.86.750+1000 1750c) T = 1 - /500-1000/ = 1 - 500 = 0.67.500+1000 1500d) T = 1 - /250-1000/ = 1 - 750 = 0.4.250+1000 1250e) T = 1 - /0-1000/ = 1 - 1000 = 0.0+1000 1000Note that the results are identical to those in Problem 4 because we take the absolutevalue of exports minus imports or imports minus exports.6. See Figure 4.The AC and the MC curves in Figure 4 are the same as in Figure 6-2. However, D and the corresponding MR curve are higher on the assumption that other firms have not yet imitated this firm's product, reduced its market share, or competed this firm's profits away. In Figure 4, MR=MC at point E, so that the best level of output of the firm is 5 units and price is$4.50. Since at Q=5, AC=$3.00, the firm earns a profit of AB=$2.00 per unit and $10.00in total.7.a) Monopolistic competition resembles monopoly because under both forms of marketorganization the firm produces a product that is unique (i.e., no other firm produces an identical product).b) Monopolistic competition is different from monopoly because under monopolisticcompetition there are many other firms that produce a similar product. On the other hand, there is no close substitute for the product sold by a monopolist.Furthermore, under monopolistic competition, entry into the industry is easy. As a result,attracted by this firm's profits, more firms enter the industry to produce similarproducts. This reduces the monopolistically competitive firm's market share (i.e., itsdemand and corresponding MR curves shift down) until we get to the situationdepicted by Figure 6-2 in the text, where P=AC and our firm breaks even. On the otherhand, under monopoly, entry into the industry is blocked, so that the monopolist cancontinue to earn profits in the long run.6920748.doc) 6-4 Dominick Salvatore6920748.doc) 6-5 Dominick Salvatorec) The difference between monopoly and monopolistic competition is important forconsumer welfare because consumers get a greater variety of the commodity at a lowerprice with monopolistic competition than with monopoly.8. A perfectly competitive firm faces an infinitely elastic or horizontal demand curve. Thismeans that the firm is a price taker and can sell any quantity of the homogenous product at the price determined at the intersection of the market demand and supply curves for thecommodity.Both the demand curves faced by the monopolistic competitive firm and the monopolist are downward sloping, indicating that each can sell more units of the commodity bylowering its price. However, the demand curve facing the monopolistically competitive firm generally has a smaller inclination (i.e., it is more elastic) than the demand curve facingthe monopolist because the former sells a commodity for which many good substitute areavailable.9.If the C curve had shifted down only half as much as curve C' in Figure 6-3, the newequilibrium point would be at P=AC=$2.50 and N=350.10.See Figure 5 on the previous page.11. The increased pirating or production and sale of counterfeit American goods without payingroyalties by foreign producers shorten the U.S. product cycle or the time during which theU.S. firm can reap the benefits from the new product or technology it introduced and thusreduces the ability of U.S. firms to engage in research and development (R & D) newproduct cycles.12. See Figure 6 on the previous page.With transpo rtation costs specialization would proceed to point C in Nation 1 and point C’in Nation 2. Pc in nation 1 (the nation exporting commodity X) is smaller than Pc' in Nation2 (the country importing commodity X) by the relative cost of transporting each unit ofcommodity X from Nation 1 to Nation 2. Trade does not seem to be inequilibrium because transportation costs are expressed in terms of commodity X.13. See Figure 7 on the next page.P2 exceeds P1 by the relative cost of transporting one unit of commodity X from Nation 1 to Nation 2.14. See Figure 8.6920748.doc) 6-6 Dominick Salvatore6920748.doc) 6-7 Dominick SalvatoreApp. 1. See Figure 9.The firm's AC=AF without and BC with external economies. Thus, at agiven level of output of the firm, the firm's AC are lower (i.e., the firm's ACcurve shifts down) as cumulative industry output expands.App. 2. Parameter "a" refers to the starting AC (i.e., the AC when output or Q iszero). Parameter "b" refers to the rate of decline in AC as cumulative industry outputincreases. Thus, "b" should be negative. Furthermore, the larger the absolute valueof b, the more rapid is the decline in AC as cumulative industry expands over time. Multiple-Choice Questions:1. Relaxing the assumptions on which the Heckscher-Ohlin theory rests:a. leads to rejection of the theoryb. leaves the theory unaffected*c. requires complementary trade theoriesd. any of the above.2.Which of the following assumptions of the Heckscher-Ohlin theory, when relaxed, leavethe theory unaffected?a. Two nations, two commodities, and two factorsb. both nations use the same technologyc. the same commodity is L-intensive in both nations*d. all of the above3.Which of the following assumptions of the Heckscher-Ohlin theory, when relaxed,require new trade theories?*a. Economies of scaleb. incomplete specializationc. similar tastes in both nationsd. the existence of transportation costs4.International trade can be based on economies of scale even if both nations have identical:a. factor endowmentsb. tastesc. technology*d. all of the above6920748.doc) 6-8 Dominick Salvatore5. A great deal of international trade:a. is intra-industry tradeb. involves differentiated productsc. is based on monopolistic competition*d. all of the above6. The Heckscher-Ohlin and new trade theories explains most of the trade:a. among industrial countriesb. between developed and developing countriesc. in industrial goods*d. all of the above7.The theory that a nation exports those products for which a large domestic market exists was advanced by:*a. Linderb. Vernonc. Leontiefd. Ohlin8. Intra-industry trade takes place:a. because products are homogeneous*b. in order to take advantage of economies of scalec. because perfect competition is the prevalent form of market organizationd. all of the above9.If a nation exports twice as much of a differentiated product that it imports, its intra-industry (T) index is equal to:a. 1.00b. 0.75*c. 0.50d. 0.2510. Trade based on technological gaps is closely related to:a. the H-O theory*b. the product-cycle theoryc. Linder's theoryd. all of the above11. Which of the following statements is true with regard to the product-cycle theory?a. It depends on differences in technological changes over time among countriesb. it depends on the opening and the closing of technological gaps among countriesc. it postulates that industrial countries export more advanced products to less advanced countries *d. all of the above12. Transport costs:a. increase the price in the importing countryb. reduces the price in the exporting country*c. both of the aboved. neither a nor b.13. Transport costs can be analyzed:a. with demand and supply curvesb. production frontiersc. offer curves*d. all of the above14. The share of transport costs will fall less heavily on the nation:*a. with the more elastic demand and supply of the traded commodityb. with the less elastic demand and supply of the traded commodityc. exporting agricultural productsd. with the largest domestic market15. A footloose industry is one in which the product:a. gains weight in processingb. loses weight in processingc. both of the above*d. neither a nor b.。

国际经济学第九版答案.doc

国际经济学第九版答案【篇一:国际经济学第九版英文课后答案第13 单元】> balance of paymentsoutline13.1 introduction13.2 balance of payments accounting principles 13.2a debitsand credits 13.2b double-entry bookkeeping13.3 the international transactions of the united states casestudy 13-1: the major goods exports and imports of the unitedstates13.4 accounting balances and disequilibrium in internationaltransactions13.5 the postwar balance of payments of the united statescase study 13-2: the major trade partners of the united statescase study 13-3: the u.s. trade deficit with japancase study 13-4:the exploding u.s. trade deficit with china13.6 the international investment position of the unitedstatescase study 13-5: the united states as a debtor nationappendix: a13.1 the imf method of reporting internationaltransactionsa13.2 the case of the missing surplusbalance of paymentscapital account credittransactionsautonomous transactions debit transactionsaccommodating transactions capitalinflow officialreserve account capital outflowofficial settlements balancedouble-entry bookkeeping deficit in the balance ofpaymentsunilateral transferssurplus in the balance ofpayments statistical discrepancy international investmentposition current account1. in the first lecture, i would cover sections 1 and 2a. theaverage student usually finds the meaning of capital inflowsand outflows particularly difficult to understand. therefore, iwould pay special care in presenting the material in section 2a.i would also assign problems 1 to 8. 2.in the second lecture, iwould cover section 2b and go over problems 1-8.i wouldpresent sections 3 and 4 in the third lecture, and stress themeaning and measurement of balance of payments deficitsand surpluses.sections 5 and 6 (which are mostly descriptiveand not difficult) could be left for studentsto do on their own so that the chapter could still be covered in three lectures. 1. a.the u.s. debits its current account by $500 (for the merchandise imports) and credits capital by the same amount (for the increase in foreign assets in the u.s.).the u.s. credits capital by $500 (the drawing down of its bank balances in london, a capital inflow) and debits capital by an equal amount (to balance the capital credit that the u.s. importer received when the u.k. exporter accepted to be paid in three months).the u.s. is left with a $500 debit in its current account and a net credit balance of $500 in its capital account.2. a).the u.s. debits unilateral transfers by $100 and credits capital by the same amount.b).the u.s. credits its current account by $100 and debits capital by the same amount.c).the debit of $100 in unilateral transfers and the credit of $100 in current account.3. a).the same as 2a.the net result is the same, but the transaction in part a of this problem refers to tied aid while transactions a and b in problem 2 do not.4. the u.s. debits capital account by $1,000 (for the purchase of the foreign stock by the u.s. resident) and also credits the capital account (for the drawing down of the u.s. resident bank balances abroad) by the same amount.5. the u.s. credits its current account by $100 and debits its capital account by the same amount.6. the u.s. credits its capital account by $400 (for the purchase of the u.s. treasury bills by the foreign resident) and debits its capital account (for the drawing down of the foreign residents bank balances in the united states) for the by the same amount.7. the u.s. debits its current account by $40 for the interest paid, debits its capital account by $400 (for the capital outflow for the repayment of the repayment of the principal to the foreign investors by the u.s. borrower), and then credits its capital account by $440 (the increase in foreign holdings of u.s. assets, a credit).8. a). the u.s. credits its capital account by $800 and debits its official reserves account by the same amount.b). the official settlements balance of the u.s. will improve (i.e., the u.s. deficit will fall or its surplus will rise) by $800.where values are in billions of dollars and a negative balance represents a deficit while apositive balance a surplus in the balance of payments. b. because until 1972, we had a fixed exchange rate system, but from 1973 we had a managed floating exchange rate system. under the latter, the balance of payments only measures the amount of official intervention in foreign exchange markets. 9.see the july issue of the survey of current business for the most recent year.10.see the july issue of the survey of current business for the most recent year.11.see the july issue of the survey of current business for the most recent year.12. see the july and november issues of the survey of current business for the most recent year.13.see the balance of payments statistics yearbook for the most recent year. app. 1. the major difference between the way the united states keeps its balance of payments and the international monetary fund method is in the way they deal with international capital movements. the united states records international capital movements as increases in u.s.-owned assets abroad and foreign-owned assets in the united states, subdivided into government and private. the international monetary fund includes international capital flows into a financial account, which is subdivided into direct investments, portfolio investments assets and liabilities, and other investment assets and liabilities.2. see the table in april and october issue of the imfs world economic outlook for the most recent year.1. which of the following is false?a. a credit transaction leads to a payment from foreignersb.a debit transaction leads to a payment to foreigners *c. a credit transaction is entered with a negative signd. double-entry bookkeeping refers to each transaction entered twice.2. which of the following is a debit?a. the export of goodsb. the export of services*c. unilateral transfers given to foreigners d. capital inflows 3. capital inflows:a. refer to an increase in foreign assets in the nationb. referto a reduction in the nations assets abroad c. lead to apayment from foreigners *d. all of the above4. when a u.s. firm imports goods to be paid in three monthsthe u.s. credits:a. the current accountb. unilateral transfers *c. capitald. official reserves5. the receipt of an interest payment on a loan made by a u.s.commercial bank to a foreign resident is entered in the u.s.balance of payments as a:a. credit in the capital account *b. credit in the currentaccount c. credit in official reserves d. debit in unilateraltransfers6. the payment of a dividend by an american company to aforeign stockholder represents:a. a debit in the u.s. capital accountb. a credit in the u.s.capital accountc. a credit in the u.s. official reserve account *d. a debit in theu.s. current account7. when a u.s. firm imports a good from england a pays for itby drawing on its pound sterling balances in a london bank,the u.s. debits its current account and credits its:a. official reserve accountb. unilateral transfers accountc.services in its current account *d. capital account8. when the u.s. ships food aid to a developing nation, the u.s.debits:*a. unilateral transfers b. services c. capitald. official reserves9. when the resident of a foreign nation (1) sells a u.s. stockand (2) deposits the proceeds in a u.s. bank, the u.s.:a. credits capital for (1) and debits capital for (2)b. creditsthe current account and debits capital c. debits capital andcredits official reserves*d. debits capital for (1) and credits capital for (2)10. when a u.s. resident (1) purchases foreign treasury billsand pays by (2) drawing down his bank balances abroad, theu.s.:【篇二:国际经济学第九版英文课后答案第9 单元】>(core chapter)nontariff trade barriers and the new protectionism outline9.1 introduction9.2 import quotas9.2a effects of an import quota9.2b comparison of an import quota to an import tariff9.3 other nontariff barriers and the new protectionism 9.3a voluntary export restraintsstates9.3b technical, administrative, and other regulations9.3c international cartels9.3d dumping9.3e export subsidies9.4 the political economy of protectionism9.4a fallacious and questionable arguments for protection 9.4b infant-industry and other qualified arguments for protection9.4c who gets protected?welfare effects on the u.s. economy of removing all import restraintsrestraints9.5 strategic trade and industrial policies9.5a strategic trade policy9.5b strategic trade and industrial policies with game theory 9.5c the u.s. response to foreign industrial targeting and strategic trade policy9.6 history of u.s. commercial policy9.6a the trade agreements act of 19349.6b the general agreements on tariffs and trade (gatt)9.6c the 1962 trade agreements act and the kennedy round 9.6d the trade reform act of 1974 and the tokyo round9.6e the 1984 and 1988 trade acts9.7 the uruguay round and outstanding trade problems 9.7a the uruguay round9.7b outstanding trade problemsbenefits from a “likely ”doha scenario appendix: a9.1 centralized cartels a9.2 international price discriminationa9.3 tariffs, subsidies and domestic goalsquota smoot-hawley tariff act of 1930 nontariff trade barrier (ntbs)trade agreements act of 1934new protectionism most-favored-nation principle voluntary export restraints (vers) bilateral trade technical, administrative, and general agreement on tariff and other regulations trade (gatt)international cartel multilateral trade negotiationsdumpinginternational trade organization (ito) persistent dumping peril-point provisionspredatory dumping escape clausesporadic dumping national security clausetrigger-price mechanismtrade expansion act of 1962export subsidies trade adjustment assistance (taa) export- import bank kennedy roundforeign sales corporationstrade reform act of 1974countervailing duties (cvds) tokyo roundscientific tariff trade and tariff act of 1984infant-industry argumentomnibus trade and competitiveness act of 1988strategic trade policy uruguay roundindustrial policy world trade organization (wto)game theoryglobalization anti-globalization movement1. this is an important core chapter examining some of the most recentdevelopments in international trade policy.2. i would cover sections 1 and 2 in lecture 1. i would pay particular attention tofigure 9-1, which examines the partial equilibrium effects of an import quota.3. i would cover section 3 in lecture 2. here i would clearly explain the differencebetween a regular import quota and a voluntary export restraint. i would alsoclearly explain dumping and figure 9-2 (which deals with export subsidies). the five case studies serve to highlight the theory and show the relevance of thetheory in todays world.4. i would cover section 4 in lecture 3. here i would give special attention to the。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Chapter 1

Introduction

⏹Chapter Organization

What Is International Economics About?

The Gains from Trade

The Pattern of Trade

How Much Trade?

Balance of Payments

Exchange Rate Determination

International Policy Coordination

The International Capital Market

International Economics: Trade and Money

⏹Chapter Overview

The intent of this chapter is to provide both an overview of the subject matter of international economics and to provide a guide to the organization of the text. It is relatively easy for an instructor to motivate the study of international trade and finance. The front pages of newspapers, the covers of magazines, and the lead reports on television news broadcasts herald the interdependence of the U.S. economy with the rest of the world. This interdependence may also be recognized by students through their purchases of imports of all sorts of goods, their personal observations of the effects of dislocations due to international competition, and their experience through travel abroad.

The study of the theory of international economics generates an understanding of many key events that shape our domestic and international environment. In recent history, these events include the causes and consequences of the large current account deficits of the United States; the dramatic appreciation of the dollar during the first half of the 1980s followed by its rapid depreciation in the second half of the 1980s; the Latin American debt crisis of the 1980s and the Mexican crisis in late 1994; and the increased pressures for industry protection against foreign competition broadly voiced in the late 1980s and more vocally espoused in the first half of the 1990s. The financial crisis that began in East Asia in 1997 and spread to many countries around the globe and the Economic and Monetary Union in Europe highlighted the way in which various national economies are linked and how important it is for us to understand these connections. These global linkages have been highlighted yet again with the rapid spread of the financial crisis in the United States to the rest of the world. At the same time, protests at global economic meetings and a rising wave of protectionist rhetoric have highlighted opposition to globalization. The text material will enable students to understand the economic context in which such events occur.

© 2012 Pearson Education, Inc. Publishing as Addison-Wesley

2 Krugman/Obstfeld/Melitz •International Economics: Theory & Policy, Ninth Edition

Chapter 1 of the text presents data demonstrating the growth in trade and the increasing importance of international economics. This chapter also highlights and briefly discusses seven themes which arise throughout the book. These themes are (1) the gains from trade; (2) the pattern of trade; (3) protectionism; (4) the balance of payments; (5) exchange rate determination; (6) international policy coordination; and (7) the international capital market. Students will recognize that many of the central policy debates occurring today come under the rubric of one of these themes. Indeed, it is often a fruitful heuristic to use current events to illustrate the force of the key themes and arguments which are presented throughout the text.

©2012 Pearson Education, Inc. Publishing as Addison Wesley。