国际经济学第一章英文版

国际经济学(英文版)

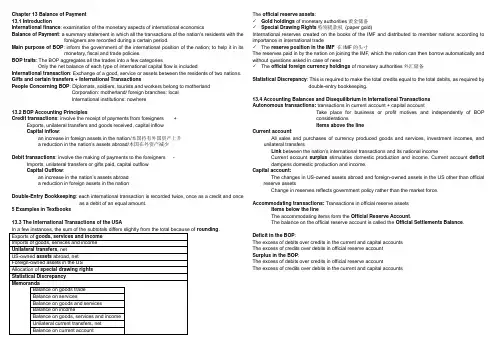

Chapter 13 Balance of Payment13.1 IntroductionInternational finance: examination of the monetary aspects of international economicsBalance of Payment: a summary statement in which all the transactions of the nation’s residents with the foreigners are recorded during a certain period.Main purpose of BOP: inform the government of the international position of the nation; to help it in its monetary, fiscal and trade policies.BOP traits: The BOP aggregates all the trades into a few categoriesOnly the net balance of each type of international capital flow is includedInternational transaction: Exchange of a good, service or assets between the residents of two nations. Gifts and certain transfers + International TransactionsPeople Concerning BOP: Diplomats, soldiers, tourists and workers belong to motherlandCorporation: motherland/ foreign branches: localInternational institutions: nowhere13.2 BOP Accounting PrinciplesCredit transactions: involve the receipt of payments from foreigners +Exports, unilateral transfers and goods received, capital inflowCapital inflow:an increase in foreign assets in the nation/本国持有外国资产上升a reduction in the nation’s assets abroad/本国在外资产减少Debit transactions: involve the making of payments to the foreigners -Imports, unilateral transfers or gifts paid, capital outflowCapital Outflow:an increase in the nation’s assets abroada reduction in foreign assets in the nationDouble-Entry Bookkeeping: each international transaction is recorded twice, once as a credit and onceas a debit of an equal amount.5 Examples in Textbooks13.3 The International Transactions of the USArounding.The official reserve assets:✓Gold holdings of monetary authorities黄金储备✓Special Drawing Rights特别提款权(paper gold)International reserves created on the books of the IMF and distributed to member nations according toimportance in international trade✓The reserve position in the IMF在IMF的头寸The reserves paid in by the nation on joining the IMF, which the nation can then borrow automatically andwithout questions asked in case of need✓The official foreign currency holdings of monetary authorities外汇储备Statistical Discrepancy: This is required to make the total credits equal to the total debits, as required bydouble-entry bookkeeping.13.4 Accounting Balances and Disequilibrium in International TransactionsAutonomous transactions: transactions in current account + capital accountTake place for business or profit motives and independently of BOPconsiderationsItems above the lineCurrent account:All sales and purchases of currency produced goods and services, investment incomes, and unilateral transfersLink between the nation’s international transactions and its national incomeCurrent account surplus stimulates domestic production and income. Current account deficitdampens domestic production and income.Capital account:The changes in US-owned assets abroad and foreign-owned assets in the US other than official reserve assetsChange in reserves reflects government policy rather than the market force.Accommodating transactions: Transactions in official reserve assetsItems below the lineThe accommodating items form the Official Reserve Account.The balance on the official reserve account is called the Official Settlements Balance.Deficit in the BOP:The excess of debits over credits in the current and capital accountsThe excess of credits over debits in official reserve accountSurplus in the BOP:The excess of debits over credits in official reserve accountThe excess of credits over debits in the current and capital accountsChapter 14 Foreign Exchange Markets and Exchange rates 14.1 IntroductionForeign exchange market : The market in which individuals, firms and banks buy and sell foreigncurrencies or foreign exchange.14.2 Functions of the Foreign Exchange Markets The principle function :The transfer of funds or purchasing power from one nation and currency to anotherThis is usually accomplished by an electronic transfer and increasingly through the Internet .Through the internet, a domestic bank instructs its correspondent bank in a foreign monetary center to pay a special amount of the local currency to a person, firm or an account.外汇供给:外国游客来访 出口 接受外国投资 外汇需求:本国人外出游 进口 对外投资4 levels of transactors or participants :Traditional users The immediate users and suppliers of foreign currencies Commercial bank A cleaning houses between the users and earners of foreign exchange Foreign exchange broker interbank or wholesale marketAs Clearinghouses for surpluses and shortages between the commercial banks Central bank Act as the seller or buyer of last resort when the nation ’s total foreignexchange earnings and expenditures are unequalInternational currency / Vehicle currencySome nations ’ currencies are globally accepted and used as vehicle currencies.The US receives a seignorage benefit when the dollar is used as a vehicle currency.铸币税:国家发行货币吸纳黄金之后,货币贬值,使得持币方财富减少,发行方财富增加。

国际经济学英文课件(萨尔瓦多第十版)ch

International investment and multinational corporations

International investment environment

Political environment: stability, policies, and regulations that affect foreign investment.

New trade theory departs from the assumption of perfect competition and focuses on the role of increasing returns to scale and monopolistic competition.

Classical trade theory posits that specialization in production based on comparative advantage results in increased production and consumption in all countries.

关税是一种税收,由政府对进口商品征收,以增加进口成本并保护国内产业。

关税定义

关税种类

关税作用

包括基本关税、附加关税、反倾销关税和报复性关税等。

通过提高进口商品价格,降低国内市场的竞争压力,保护国内产业和就业。

03

02

01

出口补贴是指政府给予出口企业的财政补贴,以降低出口成本,增加出口量。

出口补贴定义

Balance of trade

The balance of trade is a crucial component of the international balance of payments. It measures the value of a country's exports minus the value of its imports. A positive balance of trade indicates that a country is exporting more goods and services than it is importing, while a negative balance of trade indicates the opposite.

克鲁格曼国际经济学课件英文官方第10版1第一章

•

1-9

Gains from Trade (cont.)

3. Trade benefits countries by allowing them to export goods made with relatively abundant resources and import goods made with relatively scarce resources. 4. When countries specialize, they may be more efficient due to larger-scale production. 5. Countries may also gain by trading current resources for future resources (international borrowing and lending) and due to international migration.

1-8

Gains from Trade (cont.)

2. How could a country that is the moБайду номын сангаасt (least)

efficient producer of everything gain from trade?

•

Countries use finite resources to produce what they are most productive at (compared to their other production choices), then trade those products for goods and services that they want to consume. Countries can specialize in production, while consuming many goods and services through trade.

国际经济学英文原版PPT_c04

aLC /aTC > aLF/aTF Or aLC /aLF > aTC /aTF Or, we consider the total resources used in each industry

Unit factor requirements can vary at every quantity of cloth and food that could be produced.

Fig. 4-2: The Production Possibility Frontier with Factor Substitution

and say that cloth production is labor intensive and food production is land intensive if LC /TC > LF /TF.

• This assumption influences the slope of the production possibility frontier:

• The Heckscher-Ohlin theory:

Emphasizes resource differences as the only source of trade Shows that comparative advantage is influenced by:

• Relative factor abundance (refers to countries)相对要素充裕度 • Relative factor intensity (refers to goods)相对要素密集度 Is also referred to as the factor-proportions theory(要素比例理论)

克鲁格曼《国际经济学》(国际金融部分)课后习题答案(英文版)第一章

克鲁格曼《国际经济学》(国际金融部分)课后习题答案(英文版)第一章CHAPTER 1INTRODUCTIONChapter OrganizationWhat is International Economics About?The Gains from TradeThe Pattern of TradeProtectionismThe Balance of PaymentsExchange-Rate DeterminationInternational Policy CoordinationThe International Capital MarketInternational Economics: Trade and MoneyCHAPTER OVERVIEWThe intent of this chapter is to provide both an overview of the subject matter of international economics and to provide a guide to the organization of the text. It is relatively easy for an instructor to motivate the study of international trade and finance. The front pages of newspapers, the covers of magazines, and the lead reports of television news broadcasts herald the interdependence of the U.S. economy with the rest of the world. This interdependence may also be recognized by students through their purchases of imports of all sorts of goods, their personal observations of the effects of dislocations due to international competition, and their experience through travel abroad.The study of the theory of international economics generates an understanding of many key events that shape our domesticand international environment. In recent history, these events include the causes and consequences of the large current account deficits of the United States; the dramatic appreciation of the dollar during the first half of the 1980s followed by its rapid depreciation in the second half of the 1980s; the Latin American debt crisis of the 1980s and the Mexico crisis in late 1994; and the increased pressures for industry protection against foreign competition broadly voiced in the late 1980s and more vocally espoused in the first half of the 1990s. Most recently, the financial crisis that began in East Asia in 1997 andspread to many countries around the globe and the Economic and Monetary Union in Europe have highlighted the way in which various national economies are linked and how important it is for us to understand these connections. At the same time, protests at global economic meetings have highlighted opposition to globalization. The text material will enable students to understand the economic context in which such events occur.Chapter 1 of the text presents data demonstrating the growth in trade and increasing importance of international economics. This chapter also highlights and briefly discusses seven themes which arise throughout the book. These themes include: 1) the gains from trade;2) the pattern of trade; 3) protectionism; 4), the balance of payments; 5) exchange rate determination; 6) international policy coordination; and 7) the international capital market. Students will recognize that many of the central policy debates occurring today come under the rubric of one of these themes. Indeed, it is often a fruitful heuristic to use current events to illustrate the force of the key themes and arguments which are presentedthroughout the text.。

国际经济学英文PPT

Elasticity Approach

Marshall-Lerner Condition o depreciation will improve trade balance if nation’s demand elasticity for imports plus foreign demand elasticity for that nation’s expห้องสมุดไป่ตู้rts is greater than 1

o

Exchange Rate Pass Through

o o complete pass through – import prices change by full proportion of change in exchange rates partial pass through – percentage change in import prices is less than percentage change in exchange rate

Exchange Rate Effect on Costs and Prices o assume: some costs denominated in francs o assume: appreciation of dollar

o costs increase but not as much as if all costs were denominated in dollars

Exchange-rate adjustment and the BOP

Automatic mechanisms may restore balance-of-payments equilibrium, but at the cost of recession or inflation As an alternative, governments allow exchange rates to change

国际经济学讲义英文版

Course Syllabus of International EconomicsFor undergraduate student who major in economics(Class hours:72)Course Description:This course is designed for undergraduate student who have had a course in economic principles, but do not have the opportunity to study international trade and money on a regular basis.Course Objective:·To grasp and retain the underlying theory of international trade and money.·To show the intellectual advances in this dynamic field.·To provide an up-to date and understandable analytical framework for illuminating trade policy, past and current.·To review principles of economics as necessary.Course Contents and Schedule:Textbook and Reference Books:Textbook·Paul , Maurice Obstfeld. International Economics , 6e, 清华大学出版社,2004. Reference Books·[美]保罗•克鲁格曼,茅瑞斯•奥伯斯法尔德,《国际经济学》,第五版,中译本,中国人民大学出版社,2003.·李坤望主编,《国际经济学》,第二版,高等教育出版社,2005.·姜波克、杨长江编著,《国际金融学》,第二版,高等教育出版社,2004. ·Dominick Salvatore. International Economics, Prentic Hall International , 8e, 清华大学出版社,2006.PREFACE§ place of this book in the economics curriculum§ Distinctive Features of International Economics: Theory and PolicyThis book emphasized several of the newer topics that previous authors failed to treat in a systematic way :·Asset market approach to exchange rate determination.·Increasing returns and market structure.·Politics and theory of trade policy.·International macroeconomic policy coordination·The world capital market and developing countries.·International factor movements.§3. Learning Features·Case studies·Special boxes·Captioned diagrams·Summary and key terms·Problems·Further readingCHAPTER 1 Introduction§1. What Is International Economics About?Seven themes recur throughout the study of international economics :·The gains from trade(national welfare and income distribution)·The pattern of trade·Protectionism·The balance of payments·Exchange rate determination·International policy coordination·International capital market§2. International Economics: Trade and Money·Part I (chapters 2 through 7) :International trade theory·Part II (chapters 8 through 11) : International trade policy·Part III (chapters 12 through 17) : International monetary theory·Part IV (chapters 18 through 22) : International monetary policyCHAPTER 2Labor Productivity and Comparative Advantage:The Ricardin Model*Countries engage in international trade for two basic reasons :·Comparative advantage : countries are different in technology (chapter 2) or resource (chapter 4).·Economics of scale (chapter 6).*All motives are at work in the real world but only one motive is present in each trade model.§1. The Concept of Comparative Advantage1.Opportunity cost: The opportunity cost of roses in terms of computers is the number of computers that could have been produced with the resources used to produce a given number of roses.Table 2-1 Hypothetical Changes in ProductionMillion Roses Thousand ComputersUnited States -10 +100South America +10 -30Total 0 +70advantage: A country has a comparative advantage in producing a good if the opportunity cost of producing that good in terms of other goods is lower in that country than it is in other countries.·Denoted by opportunity cost.·A relative concept : relative labor productivity or relative abundance.3. Comparative advantage and trade : Trade between two countries can benefit both countries if each country exports the goods in which it has a comparative advantage. §2. A One-Factor Economypossibilities : a LC Q C + a LW Q LW≤LFigure 2-1Home’s Production Possibility Frontierprice and supply·Labor will move to the sector which pays higher wage.·If P C/P W>a L C/a LW (P C/a L C>P W/a LW, wages in the cheese sector will be higher ), the economy will specialize in the production of cheese.·In a closed economy, P C/P W =a L C/a LW.§3. Trade in a One-Factor World·Model : 2×1×2·Assume: a L C/a LW< a L C*/a LW*Home has a comparative advantage in cheese.Home’s relative productivity in cheese is higher.Home’s pretrade relative price of cheese is lower than foreign.·The condition under which home has this comparative advantage involves all fourunit labor requirement, not just two.(If each country has absolute advantage in one good respectively, will there exist comparative advantage?)the relative price after trade·Relative price is more important than absolute price, when people make decisions on production and consumption.·General equilibrium analysis: RS equals RD. (world general equilibrium)·RS: a “step” with flat sections linked by a vertical section.(L/a L C)/(L*/a LW*)Figure 2-3World Relative Supply and Demand·RD: subsititution effects·Relative price after trade: between the two countries’ pretrade price.(How will the size of the trading countries affect the relative price after trade? Which country’s living condition improve more? Is it possible that a country produce both goods?)gains from tradeThe mutual gain can be demonstrated in two alternative ways.·To think of trade as an indirect method of production :(1/a L C)( P C/P W)>1/a LW or P C/P W>a L C/a LW·To examine how trade affects each country’s possibilities of consumption.Figure 2-4Trade Expands ConsumptionPossibilities(How will the terms of trade change in the long-term? Are there incomedistribution effects within countries? )numerical example :·Two crucial points :(1)When two countries specialize in producing the goods in which they have a comparative advantage, both countries gain from trade.(2)Comparative advantage must not be confused with absolute advantage; it is comparative, not absolute, advantage that determines who will and should produce a good.Table 2-2 Unit Labor RequirementsCheese WineHome a LC=1 hour per pound a LW=2 hours per gallonForeign a*L C=6 hours per pound a*L W=3 hours per gallon Analysis: absolute advantage; relative price; specialization;the gains from trade.wages·It is precisely because the relative wage is between the relative productivities that each country ends up with a cost advantage in one good.·Relative wages depend on relative productivity and relative demand on goods. Special box : Do wages reflect productivity ?Table 2-3 Changes in Wages and Unit Labor CostsCompensation Compensation Annual Rate of Increaseper Hour, 1975Per Hour,2000in Unit Labor Costs,(US=100) (US=100) 1979-2000United States 100 100South Korea 5 41Taiwan 6 30Hong Kong 12 28 NASingapore 13 37 NASource: Bureau of Labor Statistics(foreign labor statistics home page, )·Debates about relative wages and relative labor productivity.·Long-run convergence in productivity produces long-run convergence in wages.§4. Misconceptions About Comparative AdvantageThe proposition that trade is beneficial is unqualified. That is, there is no requirement that a country be “competitive” or that the trade be “fair”.and competitivenessmyth1:Free trade is beneficial only if your country is strong enough to stand up to foreign competition.·The gains from trade depend on comparative advantage rather than absolute advantage.·The competitive advantage of an industry depend on relative labor productivity and relative wage.·Absolute advantage: neither a necessary nor a sufficient condition for comparative advantage (or for the gains from trade).pauper labor argumentmyth2: Foreign competition is unfair and hurts other countries when it is based on low wages.·Whether the lower cost of foreign export goods is due to high productivity or low wages does not matter. All that matter to home is that it is more efficient to “produce” those goods indirectly than to produce directly.myth3:Trade exploits a country and make it worse off if its workers receive much lower wage than workers in other nations.·Whether they and their country are worse off?·What is the alternative ?(if it refuse to trade, real wages would be even lower ).§5. Comparative Advantage With Many Goods·Model: 2×1×n·For any good we can calculate a Li /a Li*, label the goods so that the lower the number, the lower this ratio.a L1/a L1*<a L2/a L2*<…<a LN/a LN *(or a L1*/a L1>a L2*/a L2>…>a LN*/a LN)wages and specialization·Any good for which a Li*/a Li>w/w* will be produced in home. (Relative productivity is higher than it’s relative wage, wa Li<w*a Li*, goods will always be produced where it is cheapest to make them.)·All the goods to the left of the cut end up being produced in home.Table 2-4 Home and Foreign Unit Labor RequirementsRelative HomeHome Unit Labor Foreign Unit Labor ProductivetyRequirement(a Li)Requirement(a*Li)Advantage(a*Li/a Li)Apples 1 10 10Bananas 5 40 8Caviar 3 12 4Dates 6 12 2Enchiladas 12 9If w/w*=3, A、B、C will be produced in Home and D、E in Foreign.·Is such a pattern of specialization beneficial to both countries?(Hint: Comparing the labor cost of producing an import good directly and indirectly).the relative wage in the multigood model·w/w*: RD of labor equals RS of labor.·The relative derived demand for home labor (L/L*) will fall when the ratio of hometo foreign wages (w/w*) rises, because:(1)The goods produced in home became relative more expensive.(2)Fewer foods will be produced in home and more in foreign.Figure 2-5 Determination of relative of wages.RD: derived form relative demand for home and foreign goods.RS: determined by relative size of home and foreign labor force (Labor can’t move between countries).§6. Adding Transport Costs and Nontraded Goods·There are three main reasons why specialization in the real international economy is not so extreme:(1)The existence of more than one factor of production(2)Protectionism(3)The existence of transport cost.Eg: Suppose transport cost is a uniform fraction of production cost , say 100 percents.For goods C and D in table 2-4:D: Home 6hours < 12hours×1/3×2 foreignC: Home 3hours×2 >12hours×1/3 foreignThus, C and D became nontraded goods.·In practice there is a wide range of transportation costs.In some cases transportation is virtually impossible: services such as haircut and auto repair ; goods with high weight-to-value ratio, like cement.·Nontraded goods : Because of absence of strong national cost advantage or because of high transportation cost.·Nations spend a large share of their income on nontraded goods.§7. Empirical Evidence on the Ricardian Model·Misleading predictions :(1)An extreme degree of specialization.(2)Neglect the effects on income distribution.(3)Neglect differences in resources among countries as a cause of trade.(4)Neglect economics of scale as a cause of trade.·The basic prediction of the Ricardian model has been strongly confirmed by a number of studies over years.(1)Countries tend to export those goods in which their productivity is relative high.(2)Trade depend on comparative not absolute advantage.Figure 2-6Productivity and exportsAnswers to Problems of Chapter 21. a. b. a LA/ a LB=3/2=c. P A/ P B= a LA/ a LB=2. a.b.If the relative price of apples after trade is between and 5 Home and Foreign will specialize in the production of apples and bananas respectively. The world relative supply of apples is 3. a .RD include the pointsb. the equilibrium relative price of apples is P A /P B =2c. Home produces only apples and trades them for bananasForeign produces only bananas and trade them for applesd. Home :(1/ a LA )(P A /P B )=(1/3)×2= Foreign :(1/*LB a )(P A /P B )=(1/1)× =4.211/8003/1200//**==LB LA a L a L 21/132=>LB a 51/121*=>LA a 21)212()11()2,21()5,51(,、,、、The equilibrium relative price of apples is , it equals pretread relative price of apples in Home, So Home produces both apples and bananas, neither gains nor loss form trade; Foreign produces only bananas and trades it for apples, Foreign gains from trade.answer is identical to that in problem3 since the amount of “effective labor”has not changed.6.·Pauper labor argument.·Relative wage reflects relative productivity, international trade can’t change it ·Trading with a less productive and low-wage country will rise, no lower its standard of living.7.·to determine comparative advantage need for all four unit labor requirements (forboth the manufacture and the service sectors)·is an absolute advantage in services, this is neither a necessary nor a sufficient condition for determining comparative advantage.·The competitive advantage depends on both relative productivity and relative wages.8. ·*ωω=·Since . is considerably more productive in services, Service prices are relative low.·Most services are nontraded goods·P= , . purchasing power is higher than that of Japan.9.·The gains from trade decline as the share of the nontraded goods increases, notrade, no gains.10.·Label the countries so that(a LC /a LW )1<(a LC /a LW )2…<( a LC /a LW )N·Any country to the left of RD produces cheese and trades it for countries to right of RD produces wine and trades it for cheese.·If the intersection occurs in a horizontal portion, the Country with that a LC /a LW produces both goods.*LSLSaa<*31PCHAPTER 3Specific Factors and Income Distribution* The failures of the Ricardian model·A n extreme degree of specialization.·W ithout effects on the income distribution.( because it supposes labor is the only factor )* There are two main reasons why international trade has strong effects on the distribution of income.·S hort-term: specific factor, chapter3.·L ong-term: relative abundance and relative intensity, chapter4. (resource endowment theory or factor proportions theory ).* What is a specific factor?Specific factor: --- can be used only in the particular sector.Mobile factor: --- can move between sectors.·Think of factor specificity as a matter of time.·Labor is less specific than most kinds of capital.§1. The Specific Factors Modelof the model : 2×3×2.·America and Japan;·Labor (L)、Capital (K)、Terrain (T) ;mobile factor specific factorQ M=Q M(K,L M)、Q F=Q F(T,L F)、L=L M+L F·Manufacture and Food.possibilities·Production of manufactures and food is determined by the allocation of labor.Figure 3-3·Because of diminishing returns, PP is a bowed-out curve instead of a straight line. ·The slope of PP, which measures the opportunity cost of manufacture in terms of food is =MPL F/MPL M.dQ F/dQ M=(dQ F/dL)/(dQ M/dL)=-MPL F /MPL M=-1/MPL M* MPL F; (MPL F↑/MPL M↓)↑, wages, and labor allocation·The demand for labor: MPL M*P M=W M , MPL F*P F=W F·The allocation of labor: W M=W F , L=L M+L FFigure3—4P M、P F L M、L F Q M、Q F·The production of specific factor modelMPL M*P M=MPL F*P F=W MPL F/MPL M=P M/P F(opportunity cost=relative price)Figure 3-5distribution of income within the manufacturing sectorFigure 3-2MPL M*dL Mtotal income: Q M=∫Lwages: (W/P M)*L MMPL M*dL M (W/P M)*L Mincome of capitalists: ∫L·What happens to the allocation of labor and the distribution of income when P M andP F change? ( Figure3-6. 3-7. 3-8 )① Notice that any price change can be broken into two parts : an equal proportional change in P M and P F , and a change in only one price.Eg: P M↑P M↑10% + P M↑7%P F↑F↑10%② A equal proportional change in price have no real effects on the real wage, real income of capital owner and land owner.Figure 3-6③ A change in relative priceFigure 3-7·Wage rate rise less than the increase in P M.·Labor shifts from the food sector to the manufacturing sector andQ M rises while Q F falls.Figure 3-8 P M/P F↑5. Relative prices and the distribution of income①A rise in P M benefits the owners of capital , hurts the owner of land.Figure 3A-3W/ P M↓, income of capitalists in term of P M rises (the shadow), income of capitalists in term of P M、P F rises.Figure 3A-4②Because W/P M drops and W/P F rises, the real wage of the workers is uncertain. Itdepends on their consumptions structure.§2. International Trade in the Specific Factors Model·For trade to take place, the two countries must differ in P M/ P F. If RD is the same, RS is the source of trade ; if technologies is also the same , differences in resources can affect RS.Figure 3-9and relative supplyAn increase in the capital stock (capital per worker) raises the marginal product of K↑M↑Q M↑Q F↓,RS shift to the right.Figure 3-10Correspondingly, T MPL F↑M↓Q F↑, RS shift to the left. Suppose L J=L A , K J>K A, T J<T Aor(K/L)J>(K/L)A,(T/L)J<(T/L)A).Then the situation will look like that in Figure 3-11.Figure 3-11pattern of trade·The amount of the economy can afford to import is limited by the amount it exports. ·Budget constraint: D F-Q F =( P M/ P F)×(Q M-D M)import exportFigure3-12two fectures:①slope = -P M/P F②tangent PF at the production point after trade. ·The budget constraint and the trading equilibrium.Figure 3-13Japan: ( P M/P F)↑Q M↑Q F↓, D M↓D F↑,Figure 3-13 continuedAmerican: ( P M/ P F)↑Q M↓Q F↑, D M↑D F↓,§3. Income Distribution and the Gains from Tradedistribution: who gains and who loses from international trade?·Trade benefits the factor that is specific to the export sector of each country but hurts the factor to the import-competing sectors, with ambiguous effects on mobile factors.gains from trade.Does trade make each country better off?Is trade potentially a source of gain to everyone?Figure 3-14① The pretrade production and consumption point is shown as point 2.② Part of the budget constraint (AB) represents situations in which the economyconsumes more of both manufacture and food than it could in the absence of trade (point2).③ It is possible in principle for a country’s government to use taxes and subsidiesto redistribute income to give each individual more of both goods.·The fundamental reason why trade potentially benefits a country is that it expands the economy’s choices. This expansion of choice means that it is always possible to redistribute income in such a way that everyone gains from trade.§4. The Political Economy of Trade: A Preliminary ViewThere are two ways to look at trade policy:(1) (Normative analysis) Given its objectives, what should the government do?What is the optimal trade policy?(2) (Positive analysis) What are the governments likely to do in practice?trade policy·Economists: to maximize the national welfare, free international trade is the optimal policy.·Three main reasons why economists do not regard the income distribution effects of trade as a good reason to limit trade (P57).distribution and trade politics·An example : an import quota : . sugar (P200).·Problems of collective action (P 231).·Typically, those who lose from trade in any particular product are a much more concentrated, informed, and organized group than those who gain.·The formulation of trade policy: A kind of political process.Special box: Specific factors and the beginning of trade theory.CHAPTER 4Resources and Trade:The Heckscher-Ohlin Model(Factor Endowment Theory)*Comparative advantage is influence by the interaction between relative abundance and relative intensity.*Relative abundance: the proportions of different factors of production are available in different countries.If(T/L)H<(T/L)F, Home is labor-abundant and Foreign is land-abundant“per captia”,“relative” , no country is abundant in everything.*Relative intensity: the proportions of different factors of production are used in producting different goods.At any given factor prices, if (T C/L C)<(T F/L F), production of Cloth is labor-intensive and production of Food is land-intensive. A good can’t be both labor-intensive and land-intensive.(Factor-proportions theory)§1. A Model of Two-Factor Economy1. Assumption of the modelThe same two factors are used in both sectors: T、L ; Cloth、Food.(1)Alternative input combinations: In each sector, the ratio of land to labor used in production depends on the cost of labor relative to the cost of land, w/r.Figure 4A-2w/r↑T↑L↓T/L↑(T C/L C↑and T F/L F↑)(2) Relative intensityAt any given wage-rental ratio, food production use a higher land-labor ratio, foodproduction is land-intensive and cloth production is labor-intensive.Figure 4-2price and goods prices(1)One-to-one relationshipBecause cloth production is labor-intensive while food production is land-intensive. The one dollar worth isoquant line of cloth and food are shown as 4-3-1 two isoquants CC and FF are tangent to the same unit isocost line.Figure 4-3-1When P C rises, the slope of the unit isocost line w/r rises, that is, there is one-to-one relationship between factor price ratio w/r and the relative price of cloth P C/P F (Figure4-3-2). The relationship is illustrated by the curve SS.(Suppose the economy produce both cloth and food).Figure 4-3-2Figure 4-3-3(2)Stolper-Sammelson effectIf the relative price of a good rises, the real income of the factor which intensivly used in that good will rise, while the real income of the other factor will fall.↑↑T C/L C↑,T F/L F↑MPL C↑, MPL F↑W/P C↑, W/P F↑Figure 4-4and output(1)Relative price、resources and productionGiven the prices of cloth and food and the supply of land and labor, it is possible to determine how much of each resource the economy devoted to the production of each good; and thus also to determine the econom y’s output of each good.Figure4-5.The slope of OcC is Tc/Lc, the slope of O F F is T F/L F(2)Rybczynski effectIf goods prices remain unchanged, an increase in the supply of land will rise the output of food more than proportion to this increase, while the output of cloth will fall.Figure4-6T↑T F↑L F↑;T C↓L C↓Q F↑Q C↓Rybczynski effect: At unchanged relative goods price, if the supply of a factor of production increases, the output of the good that are intensive in that factor will rise, while the output of the other good will fall.Figure 4-7·The economy could produce more of both cloth and food than before.·A biased expansion of production possibilities.·An economy will tend to be relatively effective at producing goods that are intensive in that factors with which the country is relative well-endowed.§of International Trade Between Two-Factor Economies1. Resources、relative prices and the pattern of tradeAs always, Home and Foreign are similar along many dimentions, such as relative demand and technology. The only difference between the countries is their resources: Home has a lower ratio of land to labor than Foreign does.·relative abundance relative supply relative prices trade(T/L)H<(T/L)F (T C/L C)<(T F/L F)RS lies to the right of RS*,(P C/P F)H<( P C/P F)F Home trade Cloth for Food,Foreign trade Food for Cloth.·H-O proposition: Countries tend to export goods whose production is intensive in factors with which they are abundantly endowed.Figure 4-82. Trade and the distribution of income·According to Stolper-Samuelson effect, a rise in the price of cloth raises the purchasing power of labour in terms of both goods, while lowering the purchasing power of land in terms of both goods. Thus,in Home,laborers are made better off while landowners are made worse off.·Owners of a country’s abundant factors gain from trade,but owners of a country’s scare factors lose.·The distinction between income distribution effects due to immobility and those due to differences in factor intensity.The specific factor model: Sectors; temporary and transitional problemThe H-O model: Factors; permanent problem·Resources and trade (factor endowment theory)Short-run analysis: The specific factor modelLong-run analysis: H-O model3. Factor price equalization·Factor price equalization proposition: International trade produces a convergence of relative goods prices. This convergence, in turns, causes the convergence of the relative factor prices. Trade leads to complete equalization of factor prices. (Figure4-8,4-4 or Figure 4A-3)Figure 4A-3·One-dollar-worth isoquant lines.·G oods’ price and technologies are the same, so CC、FF are the same inboth countries.·w/r are the same in both countries.·In an indirect way the two countries are in effect trading factors of production. (Home exports labor: more labor is embodied in Home’s exports than its imports;Foreign exports land: more land is embodied in F oreign’s exports than its imports.)·In the real world factor prices are not equalized (Table4-1). Why?Table 4-1 Comparative lnternational Wage Rates(United States=100)Hourly compensationCountry of production workers,2000United States 100Germany 121Japan 111Spain 55South Korea 41Portugal 24Mexico 12Sri Lanka* 2*1969. Source: Bureau of Labor Statistics, Foreign Labor Staistics Home Page.Three assumptions crucial to the prediction of factor price equalization are in reality certainly untrue.(1)Both countries produce both goods.(Trading countries are sufficiently similar intheir relative factor endowments)(2)Technologies are the same.(Trade actually equalizes the prices of goods in twocountries).(3)There are barriers to trade: natural barriers (such as transportation costs) andartificial barriers (such as tariffs, import quotas, and other restrictions).Case study: North-south trade and income inequality·Why has wage inequality in . increased between the late 1970s and the early 1990s?(1)Many observers attribute the change to the growth of world trade and inparticular to the growing exports of manufactured goods from NIEs.Table 4-2 Composition of Developing-Country Exports(Percent of Total)Agricultural Mining ManufacturedProducts Products Goods1973 30 221995 14Source: World Trade Organization(2)Most empirical workers believed that trade has been at most a contributingfactor to the growing inequality and that the main villain is technology.§3. Empirical Evidence on the H-O Model1.Tests on dataTable 4-3 Factor Content of and lmports for 1962Imports ExportsCapital per million dollars $2,132,000 $1,876,000 Labor(person-years) per million dollars 119 131 Capital-labor ratio (dollars per worker) $17,916 $14,321 Average years of education per workerProportion of engineers and scientists in work forceSource:Rodert Baldwin,“Determinants of the Commodity Structure of Ecomomic Review61(March1971), ·Leontief paradox: . exports were less capital-intensive than . imports. (Capital-labor ratio)·. exports were more skilled labor-intensive and technology-intensive than its imports. (Average years of education; scientists and engineers per unit of sales)·A plausible explanation: . may be exporting goods that heavily use skilled labor and innovative entrepreneurship(such as aircraft and computer chips), while importing heavy manufactures that use large amounts of capital (such as automobiles).on global dataTable 4-4 Testing the Heckscher-Ohlin ModelFactor of Production Predictive Success*CapitalLaborProfessional workersManagerial workersClerical workersSales workersService workersAgricultural workersProduction workersArable landPasture landForest*Fraction of countries for which net exports of factor runs in predicted direction.Source: Harry , Edward , and Leo Sveikauskas,“Multicountry, Multifactor Tests of the Factor Abundance Theory,”American Economic Review 77(December 1987), .·If the factor-proportion theory was right, a country would always export factors for。

国际经济学 第一章

Economic interdependence

1.1 Globalization of Economic Activity

Economic interdependence reflects the historical evolution of the world’s economic and political order. Process: 1950’s European Community 1960’s multinational corporations 1970’s Organization of Petroleum Exporting Countries 21’st 1 Euro 4 Carbaugh, Chap.

Carbaugh, Chap. 1 15

Q3:Is a competitive nation one that creates jobs for its citizen? No. most important is the creation of highpaying jobs that improve a nation’s standard of living. Q4:Is a competitive nation one in which wage rates are low? No.

Carbaugh, Chap. 1 14

1.5.2 A nation’s competitiveness

It’s more difficult to assess the competitiveness of a nation. Several questions to answer: Q1:For a nation to be competitive, must all of its firms and industries be competitive? No. Q2:Does a nation have to export more than it imports to be competitive? No.

CH12National Income Accounting and the Balance of Payments 国际经济学·克鲁格曼·英文版课件

» The amount consumed by private domestic residents

– Investment

» The amount put aside by private firms to build new plant and equipment for future production

– Current account (CA) balance

»The difference between exports of goods and services and imports of goods and services (CA = EX – IM)

»A country has a CA surplus when its CA > 0. »A country has a CA deficit when its CA < 0. »CA measures the size and direction of international

National income accounting

– Records all the expenditures that contribute to a country’s income and output

Balance of payments accounting

– Helps us keep track of both changes in a country’s indebtedness to foreigners and the fortunes of its exportand import-competing industries

– It is the basic measure of a country’s output.

国际经济学第一章

OY 契约线外任一点都

不。线是比段帕如上累从任托Z一到最点A优都的的表 生Y(下生=产2列产L)K/利 五 利bM-(益个益aR/〔条〔Sb)=专件专XP业同业x/P化时化y 利满利益足益无〕,〕差:可:异是以是曲指保指线国证国与家了家预之两之算间国间线通在通相过封过切贸闭贸,1易条易也5,件,就0从下从X是差的差说能相能预扩对扩算2张价张0线Y上格上=价取完取格得全得线的相的3福同福0利,利0。从。X而B国际贸易不可能发生:

消费利益〔交换利益〕:是指国家之间通过贸易 ,消费者从价格降低上取得的福利。社会福利水 平从E点到F点,社会无差异曲线从U1扩到U2 。 〔生产未调整,价格变化〕

生产利益〔专业化利益〕:是指国家之间通过贸 易,从差能扩张上取得的福利。社会福利水平从 E点到C点,社会无差异曲线从U2扩到U3 〔假定 价格未变,仅考虑生产调整〕

PA

DA

b+d n

Q

O

P

B国出口

供给曲线

i

A国进口

hk n

供给曲线 PB

j

QO

SB

DB Q

一个没有贸易的假想世界

下列五个条件同时满足,可以保证了两国在封闭条件下 的相对价格完全相同,从而国际贸易不可能发生:

(1)两国相同商品的生产函数相同 (2)两国相对要素禀赋相同 (3)两国消费者偏好相同 (4)规模收益不变 (5)两国的商品市场和要素市场都是完全竞争的,并且 不存在外部经济

消费者愿意支付的价格和实际价格之差无国际贸易情况下的生产者剩余和消费者剩余pasadab国出口供给曲线a国进口供给曲线padbsb封闭下剩余开放下剩余贸易净效益封闭下剩余开放下剩余贸易净效益生产者剩余hk合计一个没有贸易的假想世界下列五个条件同时满足可以保证了两国在封闭条件下的相对价格完全相同从而国际贸易不可能发生

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Chapter 1 Introduction1.1 What Is International Economics About?1) Historians of economic thought often describe ________ written by ________ and published in ________ asthe first real exposition of an economic model.A) "Of the Balance of Trade," David Hume, 1776B) "Wealth of Nations," David Hume, 1758C) "Wealth of Nations," Adam Smith, 1758D) "Wealth of Nations," Adam Smith, 1776E) "Of the Balance of Trade," David Hume, 1758Answer: EQuestion Status: Previous Edition2) From 1959 to 2004,A) the U.S. economy roughly tripled in size.B) U.S. imports roughly tripled in size.C) the share of US Trade in the economy roughly tripled in size.D) U.S. Imports roughly tripled as compared to U.S. exports.E) U.S. exports roughly tripled in size.Answer: CQuestion Status: Previous Edition3) The United States is less dependent on trade than most other countries becauseA) the United States is a relatively large country.B) the United States is a "Superpower."C) the military power of the United States makes it less dependent on anything.D) the United States invests in many other countries.E) many countries invest in the United States.Answer: AQuestion Status: Previous Edition4) Ancient theories of international economics from the 18th and 19th Centuries areA) not relevant to current policy analysis.B) are only of moderate relevance in today's modern international economy.C) are highly relevant in today's modern international economy.D) are the only theories that actually relevant to modern international economy.E) are not well understood by modern mathematically oriented theorists.Answer: CQuestion Status: Previous Edition5) An important insight of international trade theory is that when countries exchange goods and services onewith the other itA) is always beneficial to both countries.B) is usually beneficial to both countries.C) is typically beneficial only to the low wage trade partner country.D) is typically harmful to the technologically lagging country.E) tends to create unemployment in both countries.Answer: BQuestion Status: Previous EditionB) trade is likely to be harmful to the country with the high wages.C) trade is likely to be harmful to the country with the low wages.D) trade is likely to be harmful to neither country.E) trade is likely to have no effect on either country.Answer: DQuestion Status: Previous Edition7) Benefits of international trade are limited toA) tangible goods.B) intangible goods.C) all goods but not services.D) services.E) None of the above.Answer: EQuestion Status: Previous Edition8) Which of the following does not belong?A) NAFTAB) Uruguay RoundC) World Trade OrganizationD) None Tariff BarriersE) None of the above.Answer: DQuestion Status: Previous Edition9) International economics does not use the same fundamental methods of analysis as other branches ofeconomics, becauseA) the level of complexity of international issues is unique.B) the interactions associated with international economic relations is highly mathematical.C) international economics takes a different perspective on economic issues.D) international economic policy requires cooperation with other countries.E) None of the above.Answer: EQuestion Status: New10) Because the Constitution forbids restraints on interstate trade,A) the U.S. may not impose tariffs on imports from NAFTA countries.B) the U.S. may not affect the international value of the $ U.S.C) the U.S. may not put restraints on foreign investments in California if it involves a financialintermediary in New York State.D) the U.S. may not impose export duties.E) None of the aboveAnswer: EQuestion Status: NewB) the balance of paymentsC) exchange rate determinationD) Bilateral trade relations with ChinaE) None of the aboveAnswer: DQuestion Status: New12) "Trade is generally harmful if there are large disparities between countries in wages."A) This is generally true.B) This is generally false.C) Trade theory has nothing to say about this issue.D) This is true if the trade partner ignores child labor laws.E) This is true if the trade partner uses prison labor.Answer: BQuestion Status: New13) Who sells what to whomA) has been a major preoccupation of international economics.B) is not a valid concern of international economics.C) is not considered important for government foreign trade policy since such decisions are made in theprivate competitive market.D) is determined by political rather than economic factors.E) None of the aboveAnswer: AQuestion Status: New14) The insight that patterns of trade are primarily determined by international differences in labor productivitywas first proposed byA) Adam Smith.B) David Hume.C) David Ricardo.D) Eli Heckscher.E) Lerner and Samuelson.Answer: CQuestion Status: New15) Since the mid 1940s, the United States, has pursued a broad policy ofA) strengthening "Fortress America" protectionism.B) removing barriers to international trade.C) isolating Iran and other axes of evil.D) protecting the U.S. from the economic impact of oil producers.E) None of the above.Answer: BQuestion Status: NewB) the U.S. economy cannot grow when the balance of payments is in deficit.C) the U.S. has run huge trade deficits in every year since 1982.D) the U.S. never experienced a surplus in its balance of payments.E) None of the above.Answer: CQuestion Status: New17) The euro, a common currency for most of the nations of Western Europe, was introducedA) before 1900.B) before 1990.C) before 2000.D) in order to snub the pride of the U.S.E) None of the above.Answer: CQuestion Status: New18) During the first three years of its existence, the euroA) depreciated against the $U.S.B) maintained a strict parity with the $U.S.C) strengthened against the $U.S.D) proved to be an impossible dream.E) None of the above.Answer: AQuestion Status: New19) The study of exchange rate determination is a relatively new part of international economics, since,A) for much of the past century, exchange rates were fixed by government action.B) the calculations required for this were not possible before modern computers became available.C) economic theory developed by David Hume demonstrated that real exchange rates remain fixed overtime.D) dynamic overshooting asset pricing models are a recent theoretical development.E) None of the aboveAnswer: AQuestion Status: New20) A fundamental problem in international economics is how to produceA) a perfect degree of monetary harmony.B) an acceptable degree of harmony among the international tradepolicies of different countries.C) a world government that can harmonize trade and monetary policiesD) a counter-cyclical monetary policy so that all countries will not be adversely affected by a financialcrisis in one country.E) None of the above.Answer: BQuestion Status: NewB) by the International Monetary Fund.C) by the World.D) by an international treaty known as the General Agreement on Tariffs and Trade (GATT).E) None of the above.Answer: DQuestion Status: New22) The international capital market isA) the place where you can rent earth moving equipment anywhere in the world.B) a set of arrangements by which individuals and firms exchange money now for promises to pay in thefuture.C) the arrangement where banks build up their capital by borrowing from the Central Bank.D) the place where emerging economies accept capital invested by banks.E) None of the above.Answer: BQuestion Status: New23) International capital markets experience a kind of risk not faced in domestic capital markets, namelyA) "economic meltdown" risk.B) Flood and hurricane crisis risk.C) the risk of unexpected downgrading of assets by Standard and Poor.D) exchange rate risk.E) None of the above.Answer: DQuestion Status: New24) Since 1994, trade rules have been enforced byA) the WTO.B) the G10.C) the GATT.D) The U.S. Congress.E) None of the above.Answer: AQuestion Status: New25) In 1998 an economic and financial crisis in South Korea caused it to experienceA) a surplus in their balance of payments.B) a deficit in their balance of payments.C) a balanced balance of payments.D) an unbalanced balance of payments.E) None of the above.Answer: AQuestion Status: Newtrade meeting in Seattle ofA) the OECD.B) NAFTA.C) WTO.D) GATT.E) None of the above.Answer: CQuestion Status: New27) International Economists cannot discuss the effects of international trade or recommend changes ingovernment policies toward trade with any confidence unless they knowA) their theory is the best available.B) their theory is internally consistent.C) their theory passes the "reasonable person" legal criteria.D) their theory is good enough to explain the international trade that is actually observed.E) None of the above.Answer: DQuestion Status: New28) Trade theorists have proven that the gains from tradeA) must raise the economic welfare of every country engaged in trade.B) must raise the economic welfare of everyone in every country engaged in trade.C) must harm owners of "specific" factors of production.D) will always help "winners" by an amount exceeding the losses of "losers."E) None of the above.Answer: EQuestion Status: New1.2 International Economics: Trade and Money1) Cost-benefit analysis of international tradeA) is basically useless.B) is empirically intractable.C) focuses attention primarily on conflicts of interest within countries.D) focuses attention on conflicts of interests between countries.E) None of the above.Answer: CQuestion Status: Previous Edition2) An improvement in a country's balance of payments means a decrease in its balance of payments deficit, oran increase in its surplus. In fact we know that a surplus in a balance of paymentsA) is good.B) is usually good.C) is probably good.D) may be considered bad.E) is always bad.Answer: DQuestion Status: Previous EditionA) an international treaty.B) an international U.N. agency.C) an international IMF agency.D) a U.S. government agency.E) a collection of tariffs.Answer: AQuestion Status: Previous Edition4) The international debt crisis of early 1982 was precipitated when ________ could not pay its internationaldebts.A) RussiaB) MexicoC) BrazilD) MalaysiaE) ChinaAnswer: BQuestion Status: Previous Edition5) International economics can be divided into two broad sub-fieldsA) macro and micro.B) developed and less developed.C) monetary and barter.D) international trade and international money.E) static and dynamic.Answer: DQuestion Status: Previous Edition6) International monetary analysis focuses onA) the real side of the international economy.B) the international trade side of the international economy.C) the international investment side of the international economy.D) the issues of international cooperation between Central Banks.E) None of the above.Answer: EQuestion Status: New7) The distinction between international trade and international money is not useful sinceA) real developments in the trade accounts have monetary implications.B) the balance of payments includes both real and financial implications.C) developments caused by purely monetary changes have real effects.D) trade models focus on real, or barter relationships.E) None of the above.Answer: EQuestion Status: NewWhat are the logical underpinnings of this argument?Answer: Yes. They do not have sufficient resources to satisfy consumption needs; and also do not have a sufficiently large market to enable their industries to avail themselves of scale economy possibilities.Another answer would rely on a location argument. Assume that the "natural" market for any givenplant is a circle with a radius of n miles with the plant at its center. Assuming that the productionplants are located randomly throughout the country, then the probability that the typical circularmarket will encompass some foreign country is greater the smaller is the country.Question Status: Previous Edition9) It is argued that if a rich high wage country such as the United States were to expand trade with a relativelypoor and low wage country such as Mexico, then U.S. industry would migrate south, and U.S. wages would fall to the level of Mexico's. What do you think about this argument?Answer: The student may think anything. The purpose of the question is to set up a discussion, which will lead to the models in the following chapters.Question Status: Previous Edition10) Some patterns of international trade are easier to explain than others. Give several examples and explain.Answer: Historical circumstance can explain some patterns such as the relatively large trade flows from West Africa to France. The relatively sparse trade between countries within South America seems curious.Question Status: Previous Edition11) International trade tends to prove that international trade is beneficial to all trading countries. However,casual observation notes that official obstruction of international trade flows is widespread. How might you reconcile these two facts?Answer: This question is meant to allow students to offer preliminary discussions of issues, which will be explored in depth later in the book.Question Status: Previous Edition12) It is argued that small countries tend have more open economies than large ones. Is this empirically verified?What are the logical underpinnings of this argument?Answer: Yes. They do not have sufficient resources to satisfy consumption needs; and also do not have a sufficiently large market to enable their industries to avail themselves of scale economy possibilities.Another answer would rely on a location argument. Assume that the "natural" market for any givenplant is a circle with a radius of n miles with the plant at its center. Assuming that the productionplants are located randomly throughout the country, then the probability that the typical circularmarket will encompass some foreign country is greater the smaller is the country.Question Status: Previous Edition13) It is argued that if a rich high wage country such as the United States were to expand trade with a relativelypoor and low wage country such as Mexico, then U.S. industry would migrate south, and U.S. wages would fall to the level of Mexico's. What do you think about this argument?Answer: The student may think anything. The purpose of the question is to set up a discussion, which will lead to the models in the following chapters.Question Status: Previous Edition14) Some patterns of international trade are easier to explain than others. Give several examples and explain.Answer: Historical circumstance can explain some patterns such as the relatively large trade flows from West Africa to France. The relatively sparse trade between countries within South America seems curious.Question Status: Previous Editioncasual observation notes that official obstruction of international trade flows is widespread. How might you reconcile these two facts?Answer: This question is meant to allow students to offer preliminary discussions of issues, which will be explored in depth later in the book.Question Status: Previous Edition16) International Trade theory is one of the oldest areas of applied economic policy analysis. It is also an area forwhich data was relatively widely available very early on. Why do you suppose this is the case?Answer: In ancient times, public finance was not well developed. Most of the population was not producing and consuming within well-developed market economies, so that income and sales taxes were notefficient. One of the most convenient ways for governments to obtain resources was to set up customposts at borders and tax. Hence international trade was of great policy interest to princes and kings, aswas precise data of their main tax base.Question Status: Previous Edition17) The figure above is the Production Possibility Frontier (PPF) of Baccalia, where only two products areproduced, clothing and wine. In fact Baccalia is producing on its PPF at point A. By and large the people of Baccalia are content, as both their external and internal needs for warmth are satisfied in the mosteconomically efficient manner possible, given their available productive resources (and known technology).How much wine is being produced? How much cloth? If a person in this country wanted to purchase a liter of wine, what would be the price he or she would have to pay?Judging from what you learned in the previous paragraph, can you indicate at which point (if at all) the Community Indifference Curve is tangent to the Production Possibility Frontier? Explain your reasoning.Answer: 6 million liters of wine are being produced.3 million square yards of cloth are being produced.The price of 1 liter of wine is one half of a square yard of cloth.The tangency is at point A. We know this because otherwise the country would not be producing atthe point of maximum economic efficiency.Question Status: Previous Edition18) One day, Baccalia joined the WTO and joined the Global Village. They discovered that in the LWE (LondonWine Exchange), 1 liter of wine is worth 1 square yard of cloth. What is the logical production point they should strive for? (See figure.)Answer: 10 million liters of wine.Question Status: Previous Edition19) Baccalia wishes to enjoy to the fullest from the gains from trade, but is not willing to give up imbibing evenone drop of wine from the 6 million liters they consumed in their original autarkic state. If their newconsumption point is a point we shall designate as point b, describe where this point would be found. (See figure.)Answer: Vertically above point aQuestion Status: Previous Edition20) Where is the Community Indifference Curve family of curves tangent to their new Consumption PossibilityFrontier?Answer: At point b.Question Status: Previous Edition21) How can you prove that Baccalia has in fact gained from the availability of trade, and that their newsituation is superior to the pre-trade situation (with which they were quite content)?Answer: The country was consuming at point a before trade. It is now consuming at point b with trade. Point b represents a superior welfare combination of goods as compared to point a, since at b the country hasmore of each of the goods.Question Status: Previous Edition。