The Equity Premium Puzzle

市场异象的行为金融学探讨

此外,人的大脑在解决复杂问题时往往会选择一个初始参考点,然后根据获得的附加信息逐步修正答案,即抛锚性(Anchoring)思维,它常使投资者对新的信息反应不足。

依据国外行为金融学学者K ahneman和 Tversky期望理论,价值函数实际依赖于财富的相对水平,在该函数曲线的拐点以上的财富水平价值函数曲线是凹的;在这一拐点以下的财富水平价值函数曲线则是凸的。这说明投资者在损失的情况下通常是风险偏好的,而在赢利时则是风险规避的。

“股权溢价” 就可能是由于回避投资损失的心理导致一单位投资损失的效用减少是同样一单位收益带来的效用增加的两倍,因此人们对股票投资要求了过高的投资回报,或对债券要求了过低的投资回报。

而且不同于人脑会接收感官所有的输入信息这一假定,人们事实上只会关注于感兴趣的对象。在资本市场中,对某一投资的追捧或冷落并由此导致的价格波动,甚至金融市场的崩溃就与这种受事物特征影响的选择性关注(Selective Attention)所造成的注意力反复无常的特性有关。

(三)投资者心理期望中价值与权重的赋值11价值的心理赋值。

公司执行官及董事长对自身公司股票进行的交易情况也与该股票的绩效表现出相关性。

(六)处置效应(disposition effect) 。证券市场的参与者表现出存在太长时间地持有亏损股票而太短时间地卖掉赢利股票的倾向。

(七)股权溢价之谜(equity premium puzzle) 。股票市场投资与债券市场投资历史平均水平回报之间存在巨大的差额。

每只股票最终都会需要一个心理帐户的关闭也减少了投资者对投资组合的分散化。

报童模型

缺货损失厌恶的报童问题摘要:报童问题是随机存贮管理的基本问题之一。

在预期理论的框架下,我们通过引入损失厌恶参数,基于损失期望最小原则,对经典的报童问题进行了重新思考,给出了缺货损失厌恶的报童的最优定货量的计算公式及订购量与期望损失关系的数学模型.关键词:存贮管理;预期理论;期望损失1、引言不确定性决策一直都是决策理论的基本问题之一。

报童问题是随机存贮理论的基本模型之一,国内外关于报童问题的研究已有很长一段时间,人们也从不同的角度得出了一些令大家可接受且比较满意的方案和数学模型。

如Tsan rt.al[1]提出报童问题的均值方差模型,并且得出如果报童可能最大化期望利润,使得利润方差受到限制,那么其最佳订购量总是小于经典报童问题的订购量;Schweitzer, Cachon[2] 提出效用最大化的报童问题,且得出基于偏爱的不同而有不同的效用函数,(这些偏爱对报童的决策进程有着重要影响);Eeckhoudt et.al[5]研究了风险及风险厌恶对报童问题的效应;Porteus[5]通过对敏感度的定量分析,研究了带风险效用和风险厌恶的报童问题;文平[6]关于损失厌恶的报童—预期理论下的报童问题新解一文,基于Kahneman 和Tversky[6]于1979年提出的预期理论,也得出了比较理想的模型。

然而他们中的多数都是从获利期望值最大和期望效用理论的角度来考察的。

但是,报童问题也是一种经典的单阶段存贮问题。

对报童而言,他每一天的报纸都有三种结果:报纸卖不完、不够卖、刚好够卖。

这三种结局只有最后一种情况下才能达到报童的最大利润,因为报童的最大利润是订购量刚好和市场需求一致,即刚好够卖,也刚好卖完。

在过去关于报童问题的种种模型中,都很少考虑到报纸不够卖,即脱销的情况,此时大多是以刚好满足市场需求的情况来处理。

其实不然,对于这类薄利多销的报童问题而言,他们都不希望自己是做保本生意,都希望充分利用好市场,最大限度地获取利润。

行为金融学重点

一.有效市场假说(Efficient market hypothesis, EMH):若资本市场在证券价格形成中充分而准确地反映了全部信息,则认为市场是有效率的,即若证券价格不会由于向所有投资者公开信息集而受到影响,则该市场对信息集是有效率的,这意味着以证券市场信息为基础的证券交易不可能获得超额利益。

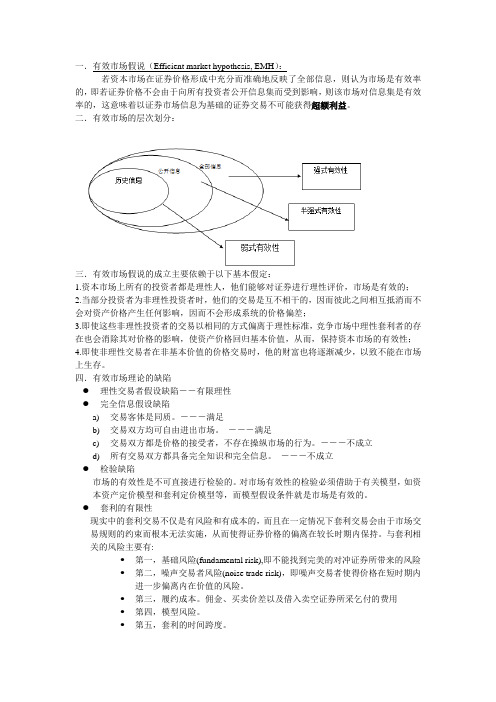

二.有效市场的层次划分:三.有效市场假说的成立主要依赖于以下基本假定:1.资本市场上所有的投资者都是理性人,他们能够对证券进行理性评价,市场是有效的;2.当部分投资者为非理性投资者时,他们的交易是互不相干的,因而彼此之间相互抵消而不会对资产价格产生任何影响,因而不会形成系统的价格偏差;3.即使这些非理性投资者的交易以相同的方式偏离于理性标准,竞争市场中理性套利者的存在也会消除其对价格的影响,使资产价格回归基本价值,从而,保持资本市场的有效性;4.即使非理性交易者在非基本价值的价格交易时,他的财富也将逐渐减少,以致不能在市场上生存。

四.有效市场理论的缺陷●理性交易者假设缺陷--有限理性●完全信息假设缺陷a)交易客体是同质。

---满足b)交易双方均可自由进出市场。

---满足c)交易双方都是价格的接受者,不存在操纵市场的行为。

---不成立d)所有交易双方都具备完全知识和完全信息。

---不成立●检验缺陷市场的有效性是不可直接进行检验的。

对市场有效性的检验必须借助于有关模型,如资本资产定价模型和套利定价模型等,而模型假设条件就是市场是有效的。

●套利的有限性现实中的套利交易不仅是有风险和有成本的,而且在一定情况下套利交易会由于市场交易规则的约束而根本无法实施,从而使得证券价格的偏离在较长时期内保持。

与套利相关的风险主要有:第一,基础风险(fundamental risk),即不能找到完美的对冲证券所带来的风险第二,噪声交易者风险(noise trade risk),即噪声交易者使得价格在短时期内进一步偏离内在价值的风险。

金融市场产生交易成本的原因

金融市场产生交易成本的原因。

非理性的交易者可能给市场带来什么结果?交易成本来自于人性因素与交易环境因素交互影响下所产生的市场失灵现象,造成交易困难所致。

威廉姆森指出六个交易成本的来源:(1)有限理性:指交易进行参与的人,因为身心,智能,情绪等限制,在追求效益最大化时所产生的限制约束。

(2)投机主义:指参与交易进行的各方,为寻求自我利益而采取的欺诈手法,同时增加彼此不信任与怀疑,因而导致交易过程监督成本的增加而降低经济效率。

(3)不确定性与复杂性:由于环境因素中充满不可预期性和各种变化,交易双方均将未来的不确定性及复杂性纳入契约中,使得交易过程增加不少制定契约的议价成本,使交易难度上升。

(4)少数交易:某些交易过程由于专属性,或因为异质性信息与资源无法流通,使得交易对象较少及造成市场被少数人把持,使得市场运作失灵。

(5)信息不对称:因为环境的不确定性和自利行为产生的机会主义,交易双方往往握有不同程度的信息,使得市场的先占者拥有较多的有利信息而获益,并形成少数交易。

(6)气氛:指交易双方若不互相信任,且又处于对立立场,无法营造一个令人满意的交易环境,将使得交易过程过于重视形式,徒增不必要的交易困难及成本。

非理性的交易者可能给市场带来什么结果?一、股票溢价之谜Mehra和Prescott(1985)提出了“股权溢价之谜”(Equity Premium Puzzle),他们指出股票投资的历史平均收益率相对于债券投资高出很多。

虽然股票比债券风险大,但从历史来看,对于从现在开始为退休做储蓄的人来说,投资于股票市场的风险微乎其微。

股票溢价之谜的现象是,相对于债券而言,人们在股票上的投资为何如此之少?二、股利之谜股利与资本利得是投资者投资收益的两项主要来源,在一个不存在税收和交易成本的有效资本市场中,对于理性投资者而言,收益的形式是红利还是资本利得是不存在区别的,因为在有效市场理论中理性投资者并不需要依赖公司去创造红利,他们自己可以通过出售股票而获取利润,特别是在一个对红利征税比对资本利得征税更高的现实市场中,公司不派股利应该对投资者更为有利。

行为金融学(下)

• 又被称为“赢者输者效应”

4、动量效应与反转效应的解释 代表性启发法可用于解释“动量效应与 反转效应”,投资者依赖于过去的经验法 则进行判断,并将这种判断外推至将来。

七、过度反应和反应不足

1、反应不足 • 反应不足是指证券价格对影响公司价值的 基本面消息没有做出充分的、及时的反应。

2、过度反应 • 过度反应是指人们过于重视新的信息而忽 略老的信息,即使老的信息对于价格的影 响更大。

Lee,Shleifor和Thaler于1991年提出了 著名的LST模型,认为基金折价率变化反映 的是个人投资者情绪的变化。他们认为持 有封闭式基金的个人投资者中有许多噪声 交易者 。 基金价值波动风险和噪声交易者情绪波 动风险

在这一过程中,基金发行人发挥了“诱 导效应”

而当封闭式转为开放式或者清盘时,噪 声交易者和理性交易者都知道将按照资产 净值来进行

下图是历史上的折价率情况。

2003年底,封闭式基金的平均折价率为22%,

2004年6月30日达到27.07%,2005年4月29 日达到37.01%。

• • • • • • • • • • • • • • • •

代码 名称 交易价 净值代码 基金净值 升贴水值 折价率(2007年6月18日) 510880 红利ETF 3.622 495303N 3.539 -0.083 510180 180ETF 9.102 491105N 2.724 -6.378 510180 180ETF 9.102 491105N 3.119 -5.983 510050 上证50ETF 3.080 495001N 2.976 -0.104 500058 基金银丰 2.450 500058N 2.701 0.251 500056 基金科瑞 2.637 500056N 3.153 0.515 500039 基金同德 2.675 500039N 2.715 0.040 500038 基金通乾 2.297 500038N 2.646 0.349 500029 基金科讯 3.374 500029N 3.306 -0.068 500025 基金汉鼎 2.261 500025N 2.381 0.120 500018 基金兴和 2.274 500018N 2.718 0.444 500015 基金汉兴 1.719 500015N 2.076 0.357 500011 基金金鑫 2.651 500011N 2.424 -0.227 500009 基金安顺 2.510 500009N 2.916 0.406 500008 基金兴华 2.510 500008N 2.894 0.384 2.35% 4.17% 1.82% 3.49% -9.29% -16.35% -1.47% -13.18% 2.06% -5.04% -16.35% -17.20% 9.35% -13.93% -13.28%

期望理论弗鲁姆

期望理论弗鲁姆文稿归稿存档编号:[KKUY-KKIO69-OTM243-OLUI129-G00I-FDQS58-期望理论期望理论是由北美着名心理学家和行为科学家维克托·弗鲁姆于1964年在《工作与激励》中提出来的激励理论。

一、基本解释期望理论又称作“效价-手段-期望理论”,是管理心理学与行为科学的一种理论。

这个理论可以公式表示为:激动力量=期望值×效价。

是由北美着名心理学家和行为科学家维克托·弗鲁姆(Victor H.Vroom)于1964年在《工作与激励》中提出来的激励理论。

在这个公式中,激动力量指调动个人积极性,激发人内部潜力的强度;期望值是根据个人的经验判断达到目标的把握程度;效价则是所能达到的目标对满足个人需要的价值。

这个理论的公式说明,人的积极性被调动的大小取决于期望值与效价的乘积。

也就是说,一个人对目标的把握越大,估计达到目标的概率越高,激发起的动力越强烈,积极性也就越大,在领导与管理工作中,运用期望理论于调动下属的积极性是有一定意义的。

期望理论是以三个因素反映需要与目标之间的关系的,要激励员工,就必须让员工明确:(1)工作能提供给他们真正需要的东西。

(2)他们欲求的东西是和绩效联系在一起的。

(3)只要努力工作就能提高他们的绩效。

二、期望理论内容管理心理学理论期望理论(Expectancy Theory),又称作“效价-手段-期望理论”,期望理论这种需要与目标之间的关系用公式表示即:激励力=期望值×效价这种需要与目标之间的关系用过程模式表示即:“个人努力—→个人成绩(绩效)—→组织奖励(报酬)—→个人需要”行为金融学理论期望理论是行为金融学的重要理论基础。

Kahneman和 Tversky(1979)通过实验对比发现,大多数投资者并非是标准金融投资者而是行为投资者,他们的行为不总是理性的,也并不总是风险回避的。

期望理论认为投资者对收益的效用函数是凹函数,而对损失的效用函数是凸函数,表现为投资者在投资帐面值损失时更加厌恶风险,而在投资帐面值盈利时,随着收益的增加,其满足程度速度减缓。

尼库尔森《微观经济学》课后答案ch18

CHAPTER 18UNCERTAINTY AND RISK AVERSIONMost of the problems in this chapter focus on illustrating the concept of risk aversion. That is, they assume that individuals have concave utility of wealth functions and therefore dislike variance in their wealth. A difficulty with this focus is that, in general, students will not have been exposed to the statistical concepts of a random variable and its moments (mean, variance, etc.). Most of the problems here do not assume such knowledge, but the Extensions do show how understanding statistical concepts is crucial to reading applications on this topic.Comments on Problems18.1 Reverses the risk-aversion logic to show that observed behavior can be used to placebounds on subjective probability estimates.18.2 This problem provides a graphical introduction to the idea of risk-taking behavior. TheFriedman-Savage analysis of coexisting insurance purchases and gambling could bepresented here.18.3 This is a nice, homey problem about diversification. Can be done graphically althoughinstructors could introduce variances into the problem if desired.18.4 A graphical introduction to the economics of health insurance that examines cost-sharingprovisions. The problem is extended in Problem 19.3.18.5 Problem provides some simple numerical calculations involving risk aversion andinsurance. The problem is extended to consider moral hazard in Problem 19.2.18.6 This is a rather difficult problem as written. It can be simplified by using a particularutility function (e.g., U(W) = ln W). With the logarithmic utility function, one cannot use the Taylor approximation until after differentiation, however. If the approximation isapplied before differentiation, concavity (and risk aversion) is lost. This problem can,with specific numbers, also be done graphically, if desired. The notion that fines aremore effective can be contrasted with the criminologist’s view that apprehension of law-breakers is more effective and some shortcomings of the economic argument (i.e., nodisutility from apprehension) might be mentioned.18.7 This is another illustration of diversification. Also shows how insurance provisions canaffect diversification.18.8 This problem stresses the close connection between the relative risk-aversion parameterand the elasticity of substitution. It is a good problem for building an intuitive9798 Solutions Manualunderstanding of risk-aversion in the state preference model. Part d uses the CRRAutility function to examine the “equity-premium puzzle.”18.9 Provides an illustration of investment theory in the state preference framework.18.10 A continuation of Problem 18.9 that analyzes the effect of taxation on risk-takingbehavior.Solutions18.1 p must be large enough so that expected utility with bet is greater than or equal to thatwithout bet: p ln(1,100,000) + (1 –p)ln(900,000) > ln(1,000,000)13.9108p +13.7102(1 –p) > 13.8155, .2006p > .1053 p > .52518.2This would be limited by the individual’s resources: he or she could run out of wealth since unfair bets are continually being accepted.18.3 a.Strategy One Outcome Probability12 Eggs .50 Eggs .5Expected Value = .5∙12 + .5∙0 = 6Strategy Two Outcome Probability12 Eggs .256 Eggs .50 Eggs .25Expected Value = .25 ∙12 + .5 ∙ 6 + .25∙ 0= 3 + 3 = 6Chapter 18/Uncertainty and Risk Aversion 99b.18.4 a. E(L) = .50(10,000) = $5,000, soWealth = $15,000 with insurance, $10,000 or $20,000 without.b. Cost of policy is .5(5000) = 2500. Hence, wealth is 17,500 with no illness, 12,500with the illness.18.5 a. E(U) = .75ln(10,000) + .25ln(9,000) = 9.1840b. E(U) = ln(9,750) = 9.1850 Insurance is preferable.c. ln(10,000 – p ) = 9.184010,000 – p = e 9.1840 = 9,740p = 26018.6 Expected utility = pU(W – f) + (1 – p)U(W). ,[()()]/U p U pU W f U W p U e p U∂=⋅=--⋅∂,()/U f U fp U W f f U e f U∂'=⋅=-⋅-⋅∂100 Solutions Manual,,()()1()U p U fU W f U W e f U W f e --=<'-- by Taylor expansion,So, fine is more effective.If U (W ) = ln W then Expected Utility = p ln (W – f ) + (1 – p ) ln W .,/[ln ()ln ]U pp p f WW f W e U U -=--⋅≈ ,/()/()U ff p f W f p U W f e U U--=--⋅= ,,1U p U fW fe W e -=<18.7 a. U (wheat) = .5 ln(28,000) + .5 ln(10,000) = 9.7251 U (corn) = .5 ln(19,000) + .5 ln(15,000) = 9.7340 Plant corn. b. With half in eachY NR = 23,500Y R = 12,500U = .5 ln(23,500) + .5 ln(12,500) = 9.7491Should plant a mixed crop. Diversification yields an increased variance relative to corn only, but takes advantage of wheat’s high yield.c. Let α = percent in wheat. U = .5 ln[ (28,000) + (1 – α )(19,000)] + .5 ln[α (10,000) + (1 – α )(15,000)] = .5 ln(19,000 + 9,000α) + .5 ln(15,000 – 5,000α)45002500019,0009,00015,0005,000dU d ααα=-=+- 45(150 – 50α) = 25(190 + 90α) α = .444 U = .5 ln(22,996) + .5 ln(12,780) = 9.7494. This is a slight improvement over the 50-50 mix. d. If the farmer plants only wheat,Y NR = 24,000Y R = 14,000U = .5 ln(24,000) + .5 ln(14,000) = 9.8163so availability of this insurance will cause the farmer to forego diversification.Chapter 18/Uncertainty and Risk Aversion 10118.8 a. A high value for 1 – R implies a low elasticity of substitution between states of theworld. A very risk-averse individual is not willing to make trades away from the certainty line except at very favorable terms.b. R = 1 implies the individual is risk-neutral. The elasticity of substitution between wealth in various states of the world is infinite. Indifference curves are linear with slopes of –1. If R =-∞, then the individual has an infinite relative risk-aversion parameter. His or her indifference curves are L-shaped implying an unwillingness to trade away from the certainty line at any price.c. A rise in b p rotates the budget constraint counterclockwise about the W g intercept. Both substitution and income effects cause W b to fall. There is a substitution effect favoring an increase in W g but an income effect favoring a decline. The substitution effect will be larger the larger is the elasticity of substitution between states (the smaller is the degree of risk-aversion).d. i. Need to find R that solves the equation:R R R W W W )955.0(5.0)055.1(5.0)(000+=This yields an approximate value for R of –3, a number consistent with some empirical studies.ii. A 2 percent premium roughly compensates for a ±10 percent gamble. That is:303030)12.1()92(.)(---+≈W W W .The “puzzle” is that the premium rate of return provided by equities seems to be much higher than this.18.9 a. See graph.Risk free option is R , risk option is R '. b. Locus RR' represents mixed portfolios.c. Risk-aversion as represented by curvature of indifference curves will determine equilibrium in RR' (say E ).102 Solutions Manuald. With constant relative risk-aversion, indifference curve map is homothetic so locus ofoptimal points for changing values of W will be along OE.18.10 a. Because of homothetic indifference map, a wealth tax will cause movement along OE(see Problem 18.9).b. A tax on risk-free assets shifts R inward to Rt (see figure below). A flatter RR t'provides incentives to increase proportion of wealth held in risk assets, especially for individuals with lower relative risk-aversion parameters. Still, as the “note” implies, it is important to differentiate between the after tax optimum and the before taxchoices that yield that optimum. In the figure below, the no-tax choice is E on RR'.* EW represents the locus of points along which the fraction of wealth held in risky assets is constant. With the constraint RR t' choices are even more likely to be to the right of EW* implying greater investment in risky assets.c. With a tax on both assets, budget constraint shifts in a parallel way to RR tt'. Even in this case (with constant relative risk aversion) the proportion of wealth devoted to risky assets will increase since the new optimum will lie along OE whereas a constant proportion of risky asset holding lies along EW O.103。

行为金融学 中央财经大学 9 7金融市场的异象(一) (9.1.1) 7.1股票溢价之谜

上更好决策的现象。

——Benartzi & Thaler, 1995

15

短视的损失厌恶 (myopic loss aversion)

厌恶:个体对他们财富水平的减少比增加更敏感

价 值

v

损

z 收

失

益

短视:个体多久进行一次收益与损失的核算

16

短视的损失厌恶 (myopic loss aversion)

23

短视的损失厌恶 (myopic loss aversion)

对于该评估周期的投资者,怎样的股票和债券组合才能使预期效用最大化?

24

短视的损失厌恶 (myopic loss aversion)

如果评估周期延长,使股票和债券期望价值相等所隐含的股权溢价为多少?

25

短视的损失厌恶 (myopic loss aversion)

2

在美国市场中从1802年开始投资并持有某一类资产1$直到1997年

3

在美国市场中从1802年开始投资并持有某一类资产1$直到1997年 (剔除掉通胀的因素)

4

1802-1997年美国市场各类资产的平均收益率

5

国家 英国 日本 德国 法国

英国、日本、德国和法国证券市场收益

时间

市场指数平均收益率 无风险证券平均收益率

Samuelson的实验

是否愿意接受以下赌博?

50%概率赢200$ 和 50%的概率输100美元

我不赌,是因为损失 100美元比得到200美 元让我感觉更深刻

17

参加一次赌博的价值

v(z)

=

z 2.5 z

z>0 z<0

E(v) = 0.5* 200 + 0.5* 2.5*(−100) = −25

资产定价经典文献目录

资产定价经典文献总结一、理论部分(一)开山之作Bachelier, L.,1900,1964, “Theory of Speculation, in P. Cootner (ed.)”, The Random Character of Stock Market Prices, Cambridge, MA:MIT Press, pp.17~78.(二)一般均衡理论1、Arrow, Kenneth, and Gerard Debreu, 1954, “Existence of an Equilibri um fora Competitive Economy,” Econometrica 22, 265–290.(三)证券组合选择理论1、Markowitz, M., 1952,“Portfolio Selection”, Journal of Finance, 7(1), pp.77~91.(提出最优投资组合模型,以资产回报率的均值和方差作为选择的对象,不考虑个体的效用函数)2、Jaganmatham, B. and T. Ma , 2002,“Risk Reduction in Large Portfolios: A Role for Portfolio Weight Constraints”,Working Paper, Northwestern University.(研究投资组合权重受限制时的最优投资组合问题)(四)资本资产定价理论1、Sharpe, W., 1964,“Capital Asset Prices: A Theory of Capital Market Equilibrium under Conditions of risk”, Journal of Finance, 19, pp.425~442.2、Lintner, L., 1965,“The Valuation of Risk Assets and the Selection of Risky Investments in Stock Portfolios and Capital Budgets”, Review of economics and Statistics, 47, pp.13~37.3、Mossin, J., 1965, “Equilibrium in a Capital Asset Market”, Econometrica, 35, pp.768~783.(以上三篇文献独立地得出资本资产定价理论)4、Fama, E. and K. French, 2004, “The Capital Asset Pricing Model: Theory and Evidence”, Working paper.(对CAPM的理论和实证研究作了综述性描述)(五)期权定价理论1、Sharpe, W., 1978, Investments, Englewood Cliffs, NJ:Prentice- Hall.(衍生证券定价理论之一:二叉树模型)2、Cox, J., S. Ross and M. Rubinstein, 1979, “Option Pricing: A Simplified Approach”, Journal of Financial Economics,7 , pp.229~63.(对二叉树模型的扩展;二叉树的数值算法)3、Black, F. and M. Scholes, 1973, “The Pricing of Options and Corporate Liabilities”, Journal of Political Economy, 81 (3), pp.637~654.4、Merton, R., 1973a,“Theory of Rational Option Pricing”,Bell Journal of Economics and Management Sciences, 4(1),pp.141~183.(衍生证券定价之二:连续时间模型,利用随机分析第一次对期权定价问题提出了严格的解决方法——偏微分方程法)5、Smith, C, 1976,“Option Pricing: A Review”, Journal of Financial Economics, 3, pp.3~51.6、Malliaris, A., 1983 ,“Ito' s Calculus in financial Decision Making”, Society of Industrial and Applied Mathematics Review, 25, pp.481~496.(给出了偏微分方程的具体解过程)7、Duffie, D. J., 1992, “Dynamic Asset Pricing Theory”,Princeton University Press,Princeton.(给出了BSM定价公式的数学基础以及金融解释,同时还给出了期权定价的金融解释)8、Merton, R., 1997, “Applications of Option –pricing Theory: Twenty- five Years Later”,American Economic Review, 88(3), pp.323~349.9、Scholes, M, 1997,“Derivatives in a Dynamic Environment”,American Economic Review, 88(3), pp.350~370.(两位学者在诺贝尔奖大会上对过去30年相关领域的发展回顾)10、Cox, J. and S. Ross, 1976, “The Valuation of Options for Alternative Stochastic Processes”,Journal of Financial Economics, 3, pp.145~66.(衍生证券定价之三:风险中性定价模型,引入了风险中性定价的概念)11、Harrison, J. and D. Kreps, 1979,“Martingales and Arbitrage in Multi - period Securities Markets”, Journal of Economic Theory, 20, pp.381~408.12、Harrison, J. and S. Pliska, 1981, “Martingale and Stochastic Integrals in the Theory of Continuous Trading”,Stochastic Process, Appl., 11, pp.215~260.(建立了系统的风险中性定价理论框架以及市场无套利在其中的表现形式)13、Geman, H., N. El Karoui and J. Rochet, 1995,“Changes of Numeraire, Changes of Probability Measures and Pricing of Options”, Journal of Applied Probability, 32, pp.443~458.(早期的风险中性定价是以货币市场帐户为计量单位的,该文章认为我们可以选取不同的计量单位,对于每一个计量单位,都有一个概率与其相对应,从而有不同的定价模型)14、Roll, R., 1977,“An Analytical Formula for Unprotected American Call Options on Stocks with Known Dividends”,Journal of Financial Economics, 5, pp.251~258.(美式期权与奇异期权定价之一:近似算法。

报童模型

缺货损失厌恶的报童问题摘要:报童问题是随机存贮管理的基本问题之一。

在预期理论的框架下,我们通过引入损失厌恶参数,基于损失期望最小原则,对经典的报童问题进行了重新思考,给出了缺货损失厌恶的报童的最优定货量的计算公式及订购量与期望损失关系的数学模型.关键词:存贮管理;预期理论;期望损失1、引言不确定性决策一直都是决策理论的基本问题之一。

报童问题是随机存贮理论的基本模型之一,国内外关于报童问题的研究已有很长一段时间,人们也从不同的角度得出了一些令大家可接受且比较满意的方案和数学模型。

如Tsan rt.al[1]提出报童问题的均值方差模型,并且得出如果报童可能最大化期望利润,使得利润方差受到限制,那么其最佳订购量总是小于经典报童问题的订购量;Schweitzer, Cachon[2] 提出效用最大化的报童问题,且得出基于偏爱的不同而有不同的效用函数,(这些偏爱对报童的决策进程有着重要影响);Eeckhoudt et.al[5]研究了风险及风险厌恶对报童问题的效应;Porteus[5]通过对敏感度的定量分析,研究了带风险效用和风险厌恶的报童问题;文平[6]关于损失厌恶的报童—预期理论下的报童问题新解一文,基于Kahneman 和Tversky[6]于1979年提出的预期理论,也得出了比较理想的模型。

然而他们中的多数都是从获利期望值最大和期望效用理论的角度来考察的。

但是,报童问题也是一种经典的单阶段存贮问题。

对报童而言,他每一天的报纸都有三种结果:报纸卖不完、不够卖、刚好够卖。

这三种结局只有最后一种情况下才能达到报童的最大利润,因为报童的最大利润是订购量刚好和市场需求一致,即刚好够卖,也刚好卖完。

在过去关于报童问题的种种模型中,都很少考虑到报纸不够卖,即脱销的情况,此时大多是以刚好满足市场需求的情况来处理。

其实不然,对于这类薄利多销的报童问题而言,他们都不希望自己是做保本生意,都希望充分利用好市场,最大限度地获取利润。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Uncertainty for the future provides no guarantee that current expenditure (to buy stocks) will pay off To invest in equity when consumption is already high (and the marginal utility of extra investments is lower), the return realized from the stock market has to be larger To keep their consumption levels smooth over time, investors could instead resort to borrowing This, however, would indicate a rise in interest rates and this is NOT what we have witnessed over time Another side of the puzzle is that the interests rates are too low!

- The loss in marginal utility incurred by sacrificing current consumption and buying an asset at a certain price is equal to the expected gain in marginal utility next period - Investors would prefer assets whose purchase yields higher marginal utility of consumption during bad times - Investors prefer to maintain their consumption smooth over time (an empirical phenomenon); as a result, assets that help boost consumption-utility during bad time are again desirable

Furthermore, this pattern of excess returns to equity holdings is not unique to U.S. capital markets. [Other studies]… confirm that equity returns in other developed countries also exhibit this historical regularity... The annual return on the U.K. stock market, for example, was 5.7 percent in the post-WWII period, an impressive 4.6 pp premium over the average bond return of 1.1 percent. Similar statistical differences have been documented for France, Germany, and Japan.” (Mehra, 2003).

The evolution of equity risk premium

Empirical evidence

Equity is pro-cyclical; tends to do well when the economy is doing well Equity risk premium is counter-cyclical; it rises as the economy goes worse

Equity premium: the additional return realized by equity over and above that earned by a risk-free asset (e.g. government bond) This difference in returns (3.7 percent vs. 10.1 percent for the period) is puzzling and cannot be explained with neoclassical models as pointed out by Mehra and Prescott (1985) But first consider some empirical evidence

When times are good, risky assets (stocks) tend to do well. When times are good, consumption is boosted anyway, so the contribution of risky assets to investors‟ marginal utility is small When times are bad, riskless assets provide a shield to consumption by guaranteeing a steady stream of cash flow Therefore, during bad times, riskless assets contribute more to the marginal utility of investors‟ consumption

Behavioral Finance Costas Gavriilidis (with amendments by Esh Trushin)

Imagine your great grandmother had £1,000 in 1925 and decided to give it to you at you birthday (suppose in 1995) If she had invested them in treasury bills, you would get around £12,700 at you birthday But if she had invested in a stock index portfolio you would have £842,000 This difference between the returns on stocks and risk-free assets is called the equity premium

Gamma γ (RRA) must be over 20 (likely in the range of 30-40 to explain the difference in the returns of risky and risk-free assets Imagine an experiment: you are offered a gamble of double your wealth with probability ½ and losing half of your entire wealth with probability ½ If investor has RRA>30, this implies that investor is willing to pay 49% of her/his wealth to avoid such gamble, which is unlikely

In simple words, the authors assumed the historical US market returns during the 1889-1978 period They found that while the average real annual S&P500 return during that period equaled around 7 percent while the average real annual return on a US government treasury bill did not exceed 1 percent The equity premium is around 7% - 1% = 6% It looks Ok as stocks are riskier than bonds… are they riskier “enough”?

Using a new database Dimson et al (2003, p.32) come to the following conclusion: “Over the entire 103-year period, the annualized (geometric) equity risk premium, relative to bills, was 5.3% for the United States and 4.2% for the United Kingdom. Averaged across all 16 countries, the risk premium relative to bills was 4.5%.”

Stocks not always outperform government bonds

Dimson, Marsh and Staunton (Journal of Applied Corporate Finance, 2003) show that in the period 2000-2002 there were negative returns to equities in the 16 countries they examine. Government securities typically performed well over this period meaning that bonds offered a premium over equities. In contrast, the 1990s was a „golden age‟ for stocks. However, the issue is in the long run