完整word版财务报表分析英文版

财务分析报告英文版

The short term liquid ratio has retained stable at around 1.5, indicating good short term liquid management and debt servicing ability

Intangible Assets

An evaluation of these assets as trademarks, patents, and goodwill, their value, and the impact they have on the company's operations

A breakdown of inventory by category, its value, and the carrying cost The analysis also includes an assessment of inventory turnover rates and objectivity

To assist management in making informed decisions about the future direction of the company

03

02

Overview of Financial Performance

Revenue Analysis

The company's revenue is seasonal, with the fourth quarter being the peak period due to holiday spending and end of year sales

财务报告分析双语(3篇)

第1篇Executive SummaryThis analysis aims to provide a comprehensive overview of the financial performance of XYZ Corporation over the past fiscal year. By examining the financial statements, including the balance sheet, income statement, and cash flow statement, we can gain insights into the company's profitability, liquidity, solvency, and overall financial health. This report will be presented in both English and Chinese, with key findings and conclusions translated for clarity.I. IntroductionXYZ Corporation, a leading company in the technology industry, has released its financial report for the fiscal year ending December 31, 2022. The report provides a detailed account of the company's financial activities, performance, and position during the period. This analysis will focus on the key financial indicators and ratios, highlighting the company's strengths and weaknesses, and offering recommendations for improvement.II. Financial Statements AnalysisA. Balance SheetThe balance sheet provides a snapshot of the company's financialposition at a specific point in time. The following analysis will focus on the key components of the balance sheet:1. Assets: XYZ Corporation's total assets increased by 15% from the previous fiscal year, driven by a 20% growth in current assets and a 10% increase in non-current assets. This indicates that the company has been successful in expanding its asset base.2. Liabilities: The total liabilities of XYZ Corporation also increased by 12%, with current liabilities growing by 15% and non-currentliabilities by 10%. This suggests that the company has taken on additional debt to finance its growth.3. Equity: The equity of XYZ Corporation increased by 18% over thefiscal year, reflecting the company's profitability and reinvestment in the business.B. Income StatementThe income statement shows the company's revenue, expenses, and net income over a specific period. The following points highlight the key aspects of the income statement:1. Revenue: XYZ Corporation's revenue increased by 20% from the previous fiscal year, driven by strong sales in the technology sector.2. Expenses: The company's expenses increased by 15%, with cost of goods sold (COGS) increasing by 18% and selling, general, and administrative expenses (SG&A) increasing by 12%. This indicates that the company has been able to control its cost of goods sold but has experienced some increases in SG&A expenses.3. Net Income: XYZ Corporation's net income increased by 25% over the fiscal year, reflecting the company's strong operational performance.C. Cash Flow StatementThe cash flow statement provides insights into the company's cashinflows and outflows. The following analysis focuses on the key components of the cash flow statement:1. Operating Cash Flow: XYZ Corporation's operating cash flow increased by 30% over the fiscal year, indicating strong cash-generating capabilities.2. Investing Cash Flow: The company's investing cash flow decreased by 5%, primarily due to lower capital expenditures.3. Financing Cash Flow: Financing cash flow increased by 20%, driven by higher dividends paid to shareholders and an increase in long-term debt.III. Financial Ratios AnalysisA. Liquidity Ratios1. Current Ratio: XYZ Corporation's current ratio increased from 1.5 to 1.8, indicating improved short-term liquidity.2. Quick Ratio: The quick ratio improved from 1.2 to 1.5, suggestingthat the company has a strong ability to meet its short-term obligations.B. Solvency Ratios1. Debt-to-Equity Ratio: The debt-to-equity ratio decreased from 1.2 to 1.0, indicating a more conservative financial structure.2. Interest Coverage Ratio: The interest coverage ratio improved from 5.0 to 6.0, reflecting the company's ability to cover its interest expenses.C. Profitability Ratios1. Gross Profit Margin: The gross profit margin remained stable at 40%, indicating efficient cost management.2. Net Profit Margin: The net profit margin increased from 15% to 20%, reflecting the company's improved profitability.IV. ConclusionXYZ Corporation has demonstrated strong financial performance over the past fiscal year, with significant growth in revenue, net income, and operating cash flow. The company's liquidity and solvency ratios are also healthy, indicating a strong financial position. However, there are areas of concern, such as the increase in SG&A expenses and the need to manage long-term debt.V. Recommendations1. Cost Control: XYZ Corporation should focus on managing SG&A expenses to improve profitability.2. Debt Management: The company should consider strategies to manage long-term debt, such as refinancing or paying down existing debt.3. Investment in Research and Development: Investing in research and development can help the company stay competitive in the technology industry.VI. 中文摘要本报告旨在全面分析XYZ公司过去一个财年的财务表现。

英文版财务报告分析(3篇)

第1篇Executive SummaryThis report provides a comprehensive analysis of XYZ Corporation's financial statements for the fiscal year ending December 31, 2022. The analysis focuses on key financial metrics, liquidity, profitability, solvency, and investment activities. The report aims to provide insights into the financial health and performance of XYZ Corporation, highlighting its strengths and areas requiring improvement.IntroductionXYZ Corporation is a publicly traded company operating in the technology sector. The company specializes in the development and manufacturing of cutting-edge electronics and software solutions. The financial reportfor the fiscal year 2022 provides a snapshot of the company's financial performance during the period.Liquidity AnalysisCurrent RatioThe current ratio is a measure of a company's ability to meet its short-term obligations. XYZ Corporation's current ratio for the fiscal year 2022 was 2.5, which indicates that the company has $2.50 in current assets for every $1 of current liabilities. This ratio is well above the industry average, suggesting that XYZ Corporation has a strong liquidity position.Quick RatioThe quick ratio, also known as the acid-test ratio, measures a company's ability to meet its short-term obligations without relying on the sale of inventory. XYZ Corporation's quick ratio for the fiscal year 2022 was 1.8. This ratio is also above the industry average, indicating that the company can cover its current liabilities without liquidating inventory.Working CapitalWorking capital is the difference between a company's current assets and current liabilities. XYZ Corporation's working capital for the fiscal year 2022 was $50 million, which is a significant improvement over the previous year. This increase in working capital reflects the company's strong liquidity position and ability to fund its operations.Profitability AnalysisGross MarginGross margin is a measure of a company's profitability, calculated as the percentage of revenue remaining after deducting the cost of goods sold. XYZ Corporation's gross margin for the fiscal year 2022 was 35%, which is slightly lower than the industry average. This decrease in gross margin can be attributed to increased raw material costs and higher research and development expenses.Net MarginNet margin is a measure of a company's overall profitability, calculated as the percentage of revenue remaining after all expenses, including taxes, are deducted. XYZ Corporation's net margin for the fiscal year 2022 was 15%, which is in line with the industry average. The company's net margin has remained stable over the past few years, indicating a consistent level of profitability.Return on Assets (ROA)Return on assets is a measure of how efficiently a company uses its assets to generate earnings. XYZ Corporation's ROA for the fiscal year 2022 was 8%, which is slightly lower than the industry average. This indicates that the company could potentially improve its assetutilization to enhance profitability.Solvency AnalysisDebt-to-Equity RatioThe debt-to-equity ratio measures a company's financial leverage and its ability to meet long-term obligations. XYZ Corporation's debt-to-equityratio for the fiscal year 2022 was 1.2, which is slightly below the industry average. This ratio suggests that the company has a moderate level of financial leverage and is in a good position to meet its long-term obligations.Interest Coverage RatioThe interest coverage ratio measures a company's ability to cover its interest expenses with its operating income. XYZ Corporation's interest coverage ratio for the fiscal year 2022 was 4.5, which is well above the industry average. This indicates that the company has a strong ability to cover its interest expenses and is not at risk of defaulting on its debt.Investment ActivitiesCapital Expenditures (CapEx)Capital expenditures represent the investments made by a company in its long-term assets. XYZ Corporation's capital expenditures for the fiscal year 2022 were $100 million, which was a significant increase over the previous year. This increase in CapEx was primarily driven by investments in new manufacturing facilities and research and development projects.Dividends PaidDividends paid are the distributions made to shareholders from a company's earnings. XYZ Corporation paid $30 million in dividends to its shareholders during the fiscal year 2022. This amount represents a 10% increase over the previous year, reflecting the company's commitment to returning value to its shareholders.ConclusionXYZ Corporation's financial report for the fiscal year 2022 indicates a strong liquidity position, stable profitability, and moderate financial leverage. The company has made significant investments in its long-term assets, which should contribute to its future growth and profitability. However, the decrease in gross margin and the need to improve assetutilization suggest that there are areas requiring attention and potential improvement.Recommendations1. XYZ Corporation should continue to monitor its cost of goods sold and explore opportunities to reduce expenses.2. The company should focus on improving its asset utilization to enhance its return on assets.3. XYZ Corporation should maintain its strong liquidity position to ensure it can meet its short-term and long-term obligations.4. The company should continue to invest in research and development to maintain its competitive edge in the technology sector.By addressing these recommendations, XYZ Corporation can further strengthen its financial position and achieve sustainable growth in the future.第2篇Executive SummaryThis analysis delves into the financial performance of XYZ Corporation over the past fiscal year. By examining key financial statements, we aim to provide a comprehensive overview of the company's profitability, liquidity, solvency, and operational efficiency. This report will also highlight the major trends and challenges faced by the company, along with recommendations for improvement.IntroductionXYZ Corporation, a leading player in the [industry sector], has been operating in the market for [number of years]. The company has a diverse product portfolio and operates in [number of countries]. This analysis focuses on the financial statements for the fiscal year ended [financial year end date].1. Income Statement Analysis1.1 Revenue AnalysisThe total revenue for XYZ Corporation for the fiscal year ended [financial year end date] was [amount], an increase of [percentage] compared to the previous year. The revenue growth can be attributed to the expansion of the product line, successful marketing campaigns, and increased market share.1.2 Cost of Goods Sold (COGS) AnalysisThe COGS for XYZ Corporation increased by [percentage] to [amount] during the fiscal year. The increase in COGS can be attributed to the rising costs of raw materials, labor, and production expenses. However, the COGS as a percentage of revenue remained stable at [percentage], indicating that the company has managed to control its cost structure.1.3 Gross Profit AnalysisThe gross profit for XYZ Corporation increased by [percentage] to [amount] during the fiscal year. This can be attributed to the revenue growth and effective cost management. The gross profit margin remained at [percentage], which is in line with industry averages.1.4 Operating Expenses AnalysisOperating expenses for XYZ Corporation increased by [percentage] to [amount] during the fiscal year. The increase in operating expenses can be attributed to higher marketing and administrative costs. However, the operating expenses as a percentage of revenue remained stable at [percentage], indicating that the company has managed to control its cost structure.1.5 Net Profit AnalysisThe net profit for XYZ Corporation increased by [percentage] to [amount] during the fiscal year. The company's net profit margin remained at [percentage], which is in line with industry averages.2. Balance Sheet Analysis2.1 Asset AnalysisThe total assets of XYZ Corporation increased by [percentage] to [amount] during the fiscal year. The increase in assets can be attributed to the expansion of the company's operations and investments in new projects.2.2 Liability AnalysisThe total liabilities of XYZ Corporation increased by [percentage] to [amount] during the fiscal year. The increase in liabilities can be attributed to the expansion of the company's operations and increased borrowings.2.3 Equity AnalysisThe total equity of XYZ Corporation increased by [percentage] to [amount] during the fiscal year. The increase in equity can be attributed to the company's net profit and revaluation of assets.3. Cash Flow Statement Analysis3.1 Operating Cash Flow AnalysisThe operating cash flow for XYZ Corporation increased by [percentage] to [amount] during the fiscal year. This can be attributed to the increase in net profit and effective management of working capital.3.2 Investing Cash Flow AnalysisThe investing cash flow for XYZ Corporation decreased by [percentage] to [amount] during the fiscal year. The decrease in investing cash flow can be attributed to the reduced capital expenditure on new projects.3.3 Financing Cash Flow AnalysisThe financing cash flow for XYZ Corporation increased by [percentage] to [amount] during the fiscal year. The increase in financing cash flow can be attributed to the issuance of new shares and repayment of long-term debt.4. Key Ratios Analysis4.1 Profitability Ratios- Gross Profit Margin: [percentage]- Net Profit Margin: [percentage]- Return on Assets (ROA): [percentage]- Return on Equity (ROE): [percentage]4.2 Liquidity Ratios- Current Ratio: [number]- Quick Ratio: [number]4.3 Solvency Ratios- Debt-to-Equity Ratio: [number]- Interest Coverage Ratio: [number]5. Conclusion and RecommendationsXYZ Corporation has demonstrated strong financial performance over the past fiscal year, with revenue and net profit increasing significantly. However, the company faces several challenges, including rising costs, increased competition, and economic uncertainties.Recommendations:- Focus on cost optimization to improve profitability.- Invest in research and development to enhance product offerings.- Strengthen marketing strategies to maintain market share.- Diversify revenue streams to reduce dependency on a single product or market.- Monitor economic indicators and adjust strategies accordingly.By implementing these recommendations, XYZ Corporation can continue to grow and remain competitive in the market.Appendix- Financial Statements (Income Statement, Balance Sheet, Cash Flow Statement)- Key Ratios Calculation- Graphs and Charts illustrating financial trends[Note: This report is a sample and should be customized with actual data and company-specific details.]第3篇IntroductionThe financial report analysis is an essential tool for investors, creditors, and other stakeholders to evaluate the financial performance and stability of a company. This analysis involves examining the financial statements, including the balance sheet, income statement, and cash flow statement, to gain insights into the company's profitability, liquidity, solvency, and efficiency. This paper aims to provide a comprehensive analysis of a fictional company's financial report, focusing on key financial ratios and metrics to assess its overall financial health.1. Overview of the CompanyCompany XYZ is a publicly-traded multinational corporation specializing in the manufacturing and distribution of consumer goods. The company operates in various regions, with a diverse product portfolio that includes electronics, home appliances, and personal care products. Over the past few years, Company XYZ has experienced significant growth, expanding its market share and generating substantial revenue.2. Financial Statements Analysis2.1 Balance SheetThe balance sheet provides a snapshot of the company's financialposition at a specific point in time. The key components of the balance sheet include assets, liabilities, and shareholders' equity.a. AssetsCompany XYZ's assets are categorized into current assets and non-current assets. Current assets include cash, accounts receivable, inventory, and other liquid assets that can be converted into cash within one year.Non-current assets include property, plant, and equipment, intangible assets, and long-term investments.The analysis of Company XYZ's balance sheet reveals that the company has a strong current asset position, with a current ratio of 2.5. This indicates that the company has sufficient liquidity to meet its short-term obligations. Additionally, the company's inventory turnover ratioof 5.2 suggests efficient inventory management and a healthy level of inventory turnover.b. LiabilitiesLiabilities are classified as current liabilities and long-term liabilities. Current liabilities include accounts payable, short-term debt, and other obligations due within one year. Long-term liabilities encompass long-term debt and deferred tax liabilities.The company's current ratio of 2.5 also reflects a healthy level of current liabilities, which are primarily composed of accounts payableand short-term debt. This indicates that the company has a manageable level of short-term debt and is able to cover its obligations with its current assets.c. Shareholders' EquityShareholders' equity represents the residual interest in the assets of the company after deducting liabilities. It is composed of common stock, additional paid-in capital, retained earnings, and other comprehensive income.Company XYZ's shareholders' equity has grown significantly over the years, reflecting the company's profitability and reinvestment of earnings. The company has also issued additional shares to raise capital, which has contributed to the increase in shareholders' equity.2.2 Income StatementThe income statement provides information about the company's revenues, expenses, and net income over a specific period. The key components of the income statement include sales, cost of goods sold, operating expenses, and net income.a. SalesCompany XYZ has experienced consistent sales growth, with a compound annual growth rate (CAGR) of 7% over the past five years. This growth can be attributed to the company's expanding market share, new product launches, and effective marketing strategies.b. Cost of Goods Sold (COGS)The COGS represents the direct costs associated with the production of goods sold by the company. The analysis of Company XYZ's COGS reveals that it has been decreasing over the years, reflecting improved production efficiency and cost control measures.c. Operating ExpensesOperating expenses include selling, general, and administrative expenses (SG&A) and research and development (R&D) expenses. Company XYZ has successfully managed its operating expenses, with a trend of decreasing SG&A expenses and stable R&D expenses.d. Net IncomeThe net income is the final result of the income statement and represents the company's profit after all expenses have been deducted from revenues. Company XYZ has demonstrated strong profitability, with a net income margin of 10% over the past five years.2.3 Cash Flow StatementThe cash flow statement provides information about the company's cash inflows and outflows from operating, investing, and financing activities.a. Operating Cash FlowCompany XYZ has generated positive operating cash flow over the years, which is essential for maintaining liquidity and funding growth initiatives. The company's operating cash flow margin has remained stable, indicating consistent profitability.b. Investing Cash FlowThe investing cash flow represents the company's cash flows from the purchase and sale of long-term assets, such as property, plant, and equipment, and investments. Company XYZ has invested in new manufacturing facilities and acquired other companies to expand its market presence.c. Financing Cash FlowThe financing cash flow includes cash flows from the issuance and repayment of debt, as well as equity financing. Company XYZ has raised capital through the issuance of new shares and long-term debt to fund its expansion plans.3. Financial Ratios and Metrics3.1 Profitability Ratiosa. Return on Assets (ROA)ROA measures the company's ability to generate profit from its assets. Company XYZ has a ROA of 5%, indicating that it is generating a reasonable return on its assets.b. Return on Equity (ROE)ROE measures the company's profitability from the perspective of its shareholders. Company XYZ has a ROE of 15%, reflecting its strong profitability and efficient use of shareholders' equity.3.2 Liquidity Ratiosa. Current RatioThe current ratio of 2.5 indicates that Company XYZ has a strong liquidity position, with sufficient current assets to cover its current liabilities.b. Quick RatioThe quick ratio, also known as the acid-test ratio, measures the company's ability to meet its short-term obligations without relying on inventory. Company XYZ has a quick ratio of 2.0, suggesting a robust liquidity position.3.3 Solvency Ratiosa. Debt-to-Equity RatioThe debt-to-equity ratio of 0.8 indicates that Company XYZ has a moderate level of leverage, with debt financing accounting for a significant portion of its capital structure.b. Interest Coverage RatioThe interest coverage ratio of 5.0 indicates that Company XYZ has sufficient earnings to cover its interest expenses, reflecting a strong financial position.3.4 Efficiency Ratiosa. Inventory Turnover RatioThe inventory turnover ratio of 5.2 suggests that Company XYZ is efficiently managing its inventory, with a high level of inventory turnover.b. Receivables Turnover RatioThe receivables turnover ratio of 10.0 indicates that Company XYZ is collecting its accounts receivable quickly, reducing the risk of bad debt.ConclusionBased on the analysis of Company XYZ's financial report, it is evident that the company has demonstrated strong financial performance and stability. The company's profitability, liquidity, solvency, and efficiency ratios indicate a healthy financial position, supported by consistent revenue growth, effective cost management, and efficient use of assets and liabilities. As such, Company XYZ appears to be a solid investment opportunity for potential investors and creditors.。

英文版财务分析报告框架(3篇)

第1篇Executive SummaryThis financial analysis report provides a comprehensive overview of [Company Name]'s financial performance over the past [time frame], including an analysis of its financial statements, profitability, liquidity, solvency, and investment activities. The report aims to assess the company's financial health, identify strengths and weaknesses, and provide recommendations for future improvement.1. Introduction1.1 Background of the Company- Brief history- Industry overview- Key products/services1.2 Objectives of the Report- To evaluate the financial performance of [Company Name]- To identify financial strengths and weaknesses- To provide recommendations for improvement2. Financial Statements Analysis2.1 Income Statement Analysis2.1.1 Revenue Analysis- Revenue trends over the past [time frame]- Revenue growth rate- Revenue sources2.1.2 Cost of Goods Sold (COGS)- COGS trends over the past [time frame]- COGS as a percentage of revenue- Comparison with industry benchmarks2.1.3 Gross Profit Margin- Gross profit margin trends over the past [time frame]- Comparison with industry benchmarks2.1.4 Operating Expenses- Trends in operating expenses over the past [time frame]- Analysis of major expense categories (e.g., selling, general, and administrative expenses)- Comparison with industry benchmarks2.1.5 Net Profit Margin- Net profit margin trends over the past [time frame]- Comparison with industry benchmarks2.2 Balance Sheet Analysis2.2.1 Assets- Analysis of current assets (e.g., cash, accounts receivable, inventory)- Analysis of fixed assets (e.g., property, plant, and equipment)- Comparison with industry benchmarks2.2.2 Liabilities- Analysis of current liabilities (e.g., accounts payable, short-term debt)- Analysis of long-term liabilities (e.g., long-term debt, deferred tax liabilities)- Comparison with industry benchmarks2.2.3 Equity- Analysis of shareholders' equity (e.g., common stock, retained earnings)- Comparison with industry benchmarks2.3 Cash Flow Statement Analysis2.3.1 Operating Cash Flow- Analysis of operating cash flow over the past [time frame]- Comparison with net income- Impact of operating activities on cash flow2.3.2 Investing Cash Flow- Analysis of investing cash flow over the past [time frame]- Comparison with capital expenditures- Impact of investing activities on cash flow2.3.3 Financing Cash Flow- Analysis of financing cash flow over the past [time frame]- Comparison with debt and equity financing activities- Impact of financing activities on cash flow3. Financial Ratios Analysis3.1 Liquidity Ratios3.1.1 Current Ratio- Current ratio trends over the past [time frame]- Comparison with industry benchmarks3.1.2 Quick Ratio- Quick ratio trends over the past [time frame]3.1.3 Cash Ratio- Cash ratio trends over the past [time frame]- Comparison with industry benchmarks3.2 Solvency Ratios3.2.1 Debt-to-Equity Ratio- Debt-to-equity ratio trends over the past [time frame]- Comparison with industry benchmarks3.2.2 Interest Coverage Ratio- Interest coverage ratio trends over the past [time frame]- Comparison with industry benchmarks3.2.3 Times Interest Earned Ratio- Times interest earned ratio trends over the past [time frame] - Comparison with industry benchmarks3.3 Profitability Ratios3.3.1 Gross Profit Margin- Gross profit margin trends over the past [time frame]- Comparison with industry benchmarks3.3.2 Net Profit Margin- Net profit margin trends over the past [time frame]- Comparison with industry benchmarks3.3.3 Return on Assets (ROA)- ROA trends over the past [time frame]3.3.4 Return on Equity (ROE)- ROE trends over the past [time frame]- Comparison with industry benchmarks3.4 Efficiency Ratios3.4.1 Inventory Turnover Ratio- Inventory turnover ratio trends over the past [time frame]- Comparison with industry benchmarks3.4.2 Accounts Receivable Turnover Ratio- Accounts receivable turnover ratio trends over the past [time frame]- Comparison with industry benchmarks3.4.3 Total Asset Turnover Ratio- Total asset turnover ratio trends over the past [time frame]- Comparison with industry benchmarks4. Key Findings and Analysis4.1 Strengths- Highlight key financial strengths identified during the analysis4.2 Weaknesses- Identify key financial weaknesses identified during the analysis4.3 Opportunities- Discuss potential opportunities for growth and improvement based on the analysis4.4 Threats- Identify potential threats to the company's financial performance based on the analysis5. Recommendations5.1 Improvement Strategies- Provide specific recommendations for improving the company's financial performance, based on the analysis5.2 Risk Mitigation- Discuss strategies for mitigating potential risks identified during the analysis5.3 Monitoring and Reporting- Suggest methods for monitoring the company's financial performance and reporting on progress6. ConclusionThis financial analysis report provides a detailed assessment of [Company Name]'s financial health and performance. By identifying strengths, weaknesses, opportunities, and threats, the report aims to provide valuable insights for decision-makers and stakeholders. Implementing the recommended strategies and monitoring the company's financial performance will be crucial in ensuring long-term success.7. Appendices7.1 Financial Statements- Include the complete set of financial statements (income statement, balance sheet, cash flow statement)7.2 Additional Data and Calculations- Provide any additional data and calculations used in the analysis7.3 References- List all sources of data and information used in the reportNote: This framework is intended to serve as a guide for creating a comprehensive financial analysis report. The actual content and depth of the report will vary based on the specific company and industry being analyzed.第2篇Executive SummaryThe executive summary provides a concise overview of the key findings of the financial analysis report. It should include the following elements:1. Purpose of the Report: Briefly state the objective of the financial analysis, such as assessing the financial health of a company, evaluating investment opportunities, or analyzing industry trends.2. Key Findings: Highlight the most significant findings from the analysis, including financial performance, profitability, liquidity, solvency, and efficiency ratios.3. Recommendations: Summarize the recommendations based on the analysis, such as investment decisions, strategic actions, or operational improvements.4. Scope of the Analysis: Mention the time period covered by the analysis and any specific financial metrics or data sources used.---1. IntroductionThis section sets the stage for the report by providing background information and context.1. Background: Describe the company or industry being analyzed,including its history, products/services, and market position.2. Objectives: Clearly define the objectives of the financial analysis, including what aspects of the company's financial performance will be evaluated.3. Methodology: Outline the methods and tools used to conduct the financial analysis, such as ratio analysis, trend analysis, and benchmarking.---2. Financial Performance AnalysisThis section delves into the financial performance of the company, focusing on key metrics and trends.1. Revenue Analysis:- Revenue trends over time- Revenue by product/service line- Revenue growth rate2. Profitability Analysis:- Net income trends- Gross margin analysis- Operating margin analysis- Net margin analysis3. Liquidity Analysis:- Current ratio- Quick ratio- Days of cash on hand- Receivables turnover ratio4. Solvency Analysis:- Debt-to-equity ratio- Interest coverage ratio- Debt service coverage ratio5. Efficiency Analysis:- Inventory turnover ratio- Accounts receivable turnover ratio- Asset turnover ratio---3. Trend AnalysisThis section examines the trends in the company's financial performance over time.1. Revenue Trends: Analyze the growth or decline in revenue over thepast few years, and identify any significant changes or outliers.2. Profitability Trends: Assess the changes in net income, gross margin, operating margin, and net margin over the past few years.3. Liquidity and Solvency Trends: Analyze the changes in liquidity ratios, solvency ratios, and interest coverage ratios over the past few years.4. Efficiency Trends: Evaluate the changes in inventory turnover, accounts receivable turnover, and asset turnover ratios over the pastfew years.---4. Comparison with PeersThis section compares the company's financial performance with that ofits peers or industry benchmarks.1. Financial Ratios: Compare key financial ratios, such as profitability, liquidity, solvency, and efficiency ratios, with industry averages or peer companies.2. Market Share: Analyze the company's market share and its position relative to its competitors.3. Strategic Positioning: Assess the company's strategic positioning in the market, including its competitive advantages and disadvantages.---5. SWOT AnalysisThis section identifies the company's strengths, weaknesses, opportunities, and threats.1. Strengths: List the company's strengths, such as strong brand recognition, innovative products, or efficient operations.2. Weaknesses: Identify the company's weaknesses, such as high debt levels, poor inventory management, or limited market presence.3. Opportunities: Analyze the opportunities available to the company, such as new market segments, technological advancements, or regulatory changes.4. Threats: Identify the threats that could impact the company'sfinancial performance, such as increased competition, economic downturns, or changes in consumer preferences.---6. Conclusion and RecommendationsThis section summarizes the key findings of the financial analysis and provides recommendations for the company or investors.1. Summary of Findings: Recap the main findings from the analysis, including financial performance, trends, and comparisons with peers.2. Recommendations:- Strategic recommendations for the company, such as entering new markets, improving operational efficiency, or reducing debt levels.- Investment recommendations for investors, such as buy, hold, orsell recommendations based on the company's financial performance and future prospects.3. Limitations: Acknowledge any limitations or assumptions made during the financial analysis.---AppendicesThis section includes any additional information or data that supports the findings of the report.1. Financial Statements: Include the company's income statement, balance sheet, and cash flow statement for the relevant time period.2. Detailed Ratios: Provide a more comprehensive breakdown of the financial ratios used in the analysis.3. Industry Data: Include relevant industry data and benchmarks used for comparison.---By following this framework, you can create a comprehensive and informative financial analysis report that provides valuable insights into the company's financial health and future prospects.第3篇Executive SummaryThe executive summary provides a concise overview of the financial analysis report. It should include the following key points:- Purpose of the Report: Briefly state the purpose of the financial analysis and the specific aspects of the company's financial performance being evaluated.- Company Overview: Provide a brief description of the company,including its industry, size, and key products/services.- Key Findings: Highlight the most significant findings from the analysis, such as financial strengths, weaknesses, and areas of concern.- Recommendations: Offer a summary of the recommendations for improving the company's financial performance or addressing specific issues.Table of Contents- Executive Summary- Company Overview- Financial Analysis- Revenue Analysis- Profitability Analysis- Liquidity Analysis- Solvency Analysis- Capital Structure Analysis- Investment Analysis- Cash Flow Analysis- Comparison with Peers- SWOT Analysis- Recommendations- Appendix1. Company OverviewThis section provides a detailed background of the company, including:- History: A brief history of the company, including its founding, major milestones, and any recent developments.- Industry: An overview of the industry in which the company operates, including key trends and challenges.- Business Model: A description of the company's business model, including its revenue streams and value proposition.- Organizational Structure: Information on the company's organizational structure, including key management personnel.- Location and Operations: Details about the company's physicallocations and operational facilities.2. Financial AnalysisThis section delves into the financial performance of the company, using various ratios and metrics:2.1 Revenue Analysis- Revenue Trends: Analyze the company's revenue over the past several years, looking for trends and patterns.- Revenue Drivers: Identify the key factors that contribute to the company's revenue growth or decline.- Revenue Mix: Examine the composition of the company's revenue, including product lines, services, and geographic regions.2.2 Profitability Analysis- Net Profit Margin: Calculate and analyze the net profit margin to determine the company's profitability.- Operating Margin: Assess the company's operating margin to understand its operational efficiency.- Gross Margin: Analyze the gross margin to evaluate the company's pricing strategy and cost control.- Earnings Per Share (EPS): Calculate and discuss the company's EPS to gauge its profitability on a per-share basis.2.3 Liquidity Analysis- Current Ratio: Calculate and discuss the current ratio to assess the company's short-term liquidity.- Quick Ratio: Analyze the quick ratio to evaluate the company's ability to meet its short-term obligations without relying on inventory.- Cash Conversion Cycle: Calculate the cash conversion cycle to understand the time it takes for the company to convert its investments in inventory and accounts receivable into cash.2.4 Solvency Analysis- Debt-to-Equity Ratio: Calculate and discuss the debt-to-equity ratio to assess the company's long-term financial stability.- Interest Coverage Ratio: Analyze the interest coverage ratio to determine the company's ability to cover its interest expenses.- Times Interest Earned: Calculate the times interest earned ratio to evaluate the company's ability to meet its debt obligations.2.5 Capital Structure Analysis- Debt-to-Total Capital Ratio: Analyze the debt-to-total capital ratio to assess the company's capital structure.- Equity Ratio: Calculate the equity ratio to understand the proportion of the company's assets financed by equity.- Capital Expenditures: Discuss the company's capital expenditures and their impact on its financial health.2.6 Investment Analysis- Return on Assets (ROA): Calculate and discuss the ROA to evaluate the company's efficiency in using its assets to generate profit.- Return on Equity (ROE): Analyze the ROE to determine the return on the shareholders' investment.- Dividend Yield: Calculate the dividend yield to assess the company's dividend policy and potential returns for investors.2.7 Cash Flow Analysis- Operating Cash Flow: Analyze the company's operating cash flow to understand its cash-generating ability.- Investing Cash Flow: Evaluate the company's investing cash flow to assess its capital expenditure and investment activities.- Financing Cash Flow: Discuss the company's financing cash flow to understand its financing activities, such as debt issuance and dividends paid.3. Comparison with PeersThis section compares the company's financial performance with its peers in the industry, using relevant ratios and metrics. The comparison should include:- Market Capitalization: Compare the company's market capitalization with its peers.- Revenue Growth: Analyze the revenue growth rates of the company andits peers.- Profitability Ratios: Compare profitability ratios, such as net profit margin and return on equity.- Liquidity and Solvency Ratios: Assess liquidity and solvency ratios to evaluate the financial health of the company relative to its peers.4. SWOT AnalysisThis section provides a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) of the company, considering both internal and external factors.5. RecommendationsBased on the findings from the financial analysis and SWOT analysis,this section offers recommendations for improving the company'sfinancial performance or addressing specific issues. Recommendations may include:- Strategic Initiatives: Suggest strategic initiatives to enhance the company's competitive position and market share.- Operational Improvements: Recommend operational improvements to increase efficiency and reduce costs.- Financial Management: Propose financial management strategies to improve liquidity, solvency, and profitability.- Investment Opportunities: Identify potential investment opportunities that could enhance the company's financial performance.6. AppendixThe appendix contains any additional information or data that support the findings and recommendations of the report. This may include:- Detailed financial statements and footnotes- Charts and graphs illustrating financial trends- Additional ratios and metrics used in the analysis- Research methodology and data sourcesThis framework provides a comprehensive structure for a financial analysis report, ensuring that all key aspects of the company's financial performance are thoroughly examined and presented.。

财务报表分析-英文

Introduction and Basic Concepts

Business Partnership Vision Strategy Budget Forecast

Others Treasury M&A Risk Management Insurance Auditing Compliance Hedging ….

Introduction and Basic Concepts

Minimize Working Capital Maintain Strong Cash Flow

Pay Debts As They Are Due Increase Liquidity

Maintain Strong Financial Position

Introduction and Basic Concepts

导言及基本概念 Introduction and Basic Concepts Introduction Finance Organization Finance Activity Other topics

This training will allow you to understand: Finance Function Concept of Financial KPIs (Revenue, DM, DL, VOH, FOH, SG&A, OI, OCF, EBITDA, DOH, DSO, DPO, Incremental, etc.) BS, P&L and Cash Flow Statements Concepts of Financial Statement Evaluation and Investment Appraisal

财务报告财务报表英文版

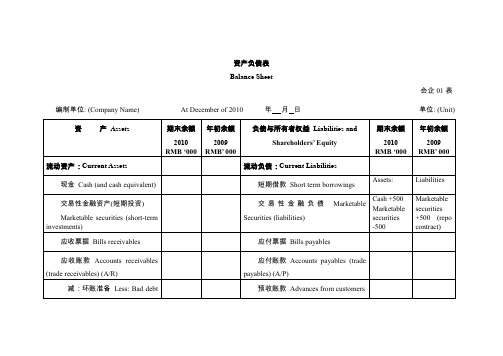

XX Co., Ltd. Annual Audit Report YZXXZ () No. 2XX56XX Certified Public Accountants Co., Ltd.ContentI. Audit report Page 1-2II. Financial statements Page 3-6 (i) Balance Sheet Page 3 (ii) Income Statement Page 4 (iii) Cash Flow Statement Page 5 (iv) Change Statement of Owners’ Equity Page 6III. Explanatory notes of financial statements Page 7-23XX CERTIFIED PUBLIC ACCOUNTANTS CO., LTDAudit ReportYZXXZ () No. 2XX56XX Co., Ltd.,We have audited the accompanying financial statements of XX Co., Ltd. (hereinafter referred to as “your company”), including the balance sheet as at December 31, , the income statement, cash flow statement and change statement of owners’ equity of as well as explanatory notes of financial statements.I. Management’s responsibility for the financial statementsManagement of your company is responsible for the preparation and fair presentation of financial statements. This responsibility includes: (1) preparing the financial statements and reflecting fair representation in accordance with provisions of the Accounting Standards for Business Enterprises; (2) designing, implementing andmaintaining the necessary internal control in order to free financial statements from material misstatement, whether due to fraud or error.II. Auditor’s responsibilityOur responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with provisions of the Chinese Certified Public Accountants Auditing Standards. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance whether the financial statements are free from material misstatement.An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the certified public accountants consider the internal control relevant to the preparation and fair presentation of the financial statements in order to design audit procedures that area appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.III. Audit opinionIn our opinion, the financial statements of your company have been prepared in accordance with provisions of the Accounting Standards for Business Enterprises in all material aspects, and present fairly the financial position of your company as of December 31, and the results of its operations and cash flows of .XX Certified Public Accountants Co., Ltd. Chinese Certified Public Accountant: Guangdong, China Chinese Certified Public Accountant:February 29,Balance SheetDecember 31,KQ 01 Enterprise name: XX Co., Ltd.Unit: RMB YuanInterest receivable Employees’ compensationpayableDividend receivable Tax payableOther accounts receivable Interest payable Inventory Dividend payableAssets divided as availableassets for saleOther accounts payableNon-current assets due within 1 year Liabilities divided as available liabilities for saleOther current assets Non-current liabilities duewithin 1 yearTotal current assets Other current liabilitiesTotal current liabilitiesNon-current liabilities:Long-term borrowingsBonds payableIncluding: Preferred sharesPerpetual capital securitiesLong-term account payableLong-term employees’compensation payableNon-current assets: Special payablesAvailable for sale financialAccrued liabilitiesassetsHeld-to-maturity investments Deferred incomeLong-term account receivable Deferred tax liabilitiesLong-term equity investment Other non-current liabilities Investing real estate Total non-current liabilitiesFixed asset7Total liabilitiesProject in construction Owners’ equity (orshareholders’ equity)16 Engineering material Paid-in capital (or sharecapital)Fixed asset disposal Other equity instruments Production biological assets Including: Preferred sharesOil and gas assets Perpetual capital securities2Income StatementYear ofKQ 02 Enterprise name: XX Co., Ltd.Unit: RMB YuanPlus: Non-business income5 Including: Gain from non-current asset disposalMinus: Non-business expenditure6 Including: Loss from non-current asset disposalIII. Total profit (total loss with “-”)Minus: Income tax expense7 IV. Net profit (net loss with “-”)V. Net after-tax amount of other comprehensive incomes(i) Other comprehensive incomes not reclassified into profit andloss in future1. Changes for net liability or net asset of remeasured and resetbenefit plan2. Shares enjoyed in other comprehensive incomes not reclassifiedinto profit and loss by the invested unit(ii) Other comprehensive incomes reclassified into profit and lossin future1. Shares enjoyed in other comprehensive incomes reclassifiedinto profit and loss by the invested unit in future4Cash Flow StatementYear ofKQ 03 Enterprise name: XX Co., Ltd.Unit: RMB YuanII. Cash flow from investing activities:Cash flow from disposal of investmentsCash received from returns of investmentsCash received from incomes on investmentsNet cash received from disposal of fixed assets, intangible assets and other long-term assetsOther cash received relating to investing activitiesSub-total of cash inflows from investing activitiesCash paid to acquire fixed assets, intangible assets and other long-term assetsCash paid to acquire investmentsNet cash received from the subsidiary company and other business unitsOther cash payments relating to investing activitiesSub-total of cash outflows from investing activitiesNet cash flows from investing activitiesIII. Cash flows from financing activities:5。

(完整word版)新会计准则财务报表-中英文

递延所得税资产Deferred tax

减:库存股Less: Trean-current assets

盈余公积Earnings reserve

非流动资产合计Total Non-current Assets

未分配利润Retained earnings

项目Items

期末余额

2010

RMB ‘000

年初余额

2009

RMB’ 000

一、营业收入Operating Revenue

减:营业成本Less: Cost of goods sold

营业税金及附加Sales taxes and surcharges

销售费用Selling expenses

管理费用G & A expenses

应付股利Dividend payables

存货Inventories

应付利息Interest payables

其他流动资产Other current assets

其他应付款Other payables

流动资产合计Total Current Assets

一年内到期的非流动负债

Current portion of non-current liabilities

财务费用Financial cost

资产减值损失Assets impairments

加:公允价值变动收益(+、-)Add: Gains/losses on fair value changes

投资收益(+、-)Income from investments

二、主营业务利润Operating Profit

长期应付款Long term payables

财务报表分析(双语)chapter4

Chapter 4, Slide #17

© 2011 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Single-step Form

Revenue Net sales Interest income

XYZ COMPANY Income Statement For The Year Ended December 31, 2008

$50,000 3,000 15,000 $68,000 $30,000 5,000 3,200

An income statement, known as a Profit and Loss Statement, is a summary reporting profitability or the operating result of a business for an accounting period, such as one month, one quarter, or one year.

Conception of Income Statement

What Is an Income Statement?

What is Income Statement used for? The basis of Income Statement .

What Is an Income Statement?

200

3,000 $41,400

Net Income

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

A. Measuring Business Income

a.explain why financial statements are prepared at the end of the regular accounting period.

Major Financial Statements:

The balance sheet: provides a "snapshot" of the firm's financial condition.

b.explain why the accounts must be adjusted at the end of each period. Why?

Most external transactions are recorded when they occur. The employment of an accrual system means that numerous adjustments are necessary before financial statements are prepared because certain accounts are not accurately stated.

The statement of stockholder's equity: reports the amounts and sources of changes in equity from transactions with owners.

The footnotes of the financial statements: allow uses to improve assessment of the amount, timing and uncertainty of the estimates nts.

In practice, financial reporting is done at the end of the accounting period. Accounting periods can be any length in time. Firms typically use the year as the primary accounting period. The 12-month accounting period is referred to as the fiscal year. Firms also report for periods less than a year (e.g. quarterly) on an interim basis.

Adjustme nt princip les

•The reve nue recog niti on principle

•The match ing principle

What to adjust?

Each adjusting entry affects both a real account (assets,liability, or owner's equity) and a nominal or in come stateme nt acco unt (reve nue or expen se). The four basic types of adjust ing en tries are:

A necessarystep in the accounting process, then, is the adjustment of all accounts to an accrual basis andtheir subseque nt p osti ng to the gen eral ledger. Adjusti ng en tries are therefore n ecessaryto achieve a proper match ing of reve nues and expen sesi n the determ in ati on of net in come for the curre nt p eriod and to achieve an accurate stateme nt of the assets and equities existi ng at the end of the p eriod.

deferred expen sesthat ben efits more tha n one p eriod: for exa mp le, prep aid expen ses(e.g. prep aid in sura nee, rent) are expen ses p aid in adva nee and recorded as assets before they are used or con sumed. Whe n these assets are con sumed, ex pen ses should be recog ni zed: a debit to an expense acco unt and a credit to an asset acco unt. Ano ther exa mple is dep reciati on. The cost of a Iong-term asset is allocated as an expense over its useful life. At the end of each period dep reciatio n expen seis recorded through an adjust ing en try: a debit to a dep reciati on expense acco unt and a credit to an accumulated dep reciati on acco unt (a contra acco unt used to total the p ast dep reciati on expen ses on sp ecific Ion g-term assets).

The income statement: reports on the "performance" of the firm.

The statement of cash flows: reports the cash receipts and cash outflows classified according to operating, investment and financing activities.

The most accurate way to measure the results of enterprise activity would be to measure them at the time of the enterprise's eventual liquidation. Business, government, investors, and various other user groups, however, cannot wait indefinitely for such information. If accountants did not provide financial information periodically, someone else would.

The information must be reliable and relevant. This requires that information must be consistent and comparable over time and also be provided on a timely basis. The shorter the time period, the more difficult it becomes to determine the proper net income for the period. A month's results are usually less reliable than a quarter's results, and a quarter's results are likely to be less reliable than a year's results. Investors desire and demand that information be quickly processed and disseminated; yet the quicker the information is released, the more it is subject to error. This phenomenon provides an interesting example of the trade-off between relevance and reliability in preparing financial data.

Accounting period must be of equal length. Financial statements are prepared at the end of the regular accounting period to allow comparison across time.

Some economic activities do not occur as the result of external transactions. Examples include depreciation and the expiration of prepaid expenses.