税收英语06

税收的单词

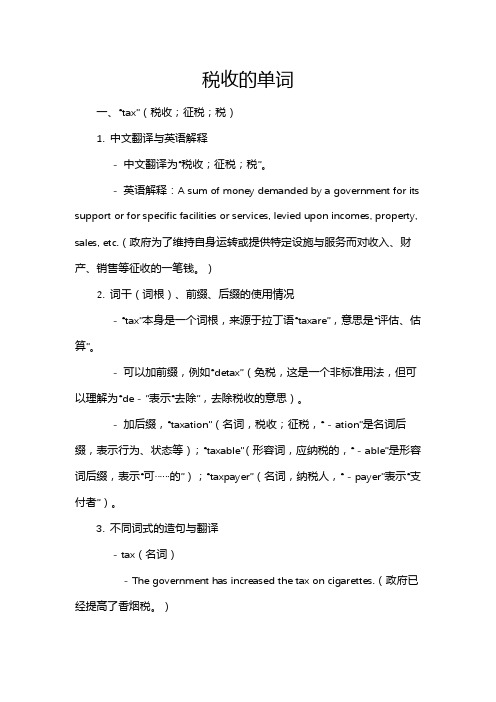

税收的单词一、“tax”(税收;征税;税)1. 中文翻译与英语解释- 中文翻译为“税收;征税;税”。

- 英语解释:A sum of money demanded by a government for its support or for specific facilities or services, levied upon incomes, property, sales, etc.(政府为了维持自身运转或提供特定设施与服务而对收入、财产、销售等征收的一笔钱。

)2. 词干(词根)、前缀、后缀的使用情况- “tax”本身是一个词根,来源于拉丁语“taxare”,意思是“评估、估算”。

- 可以加前缀,例如“detax”(免税,这是一个非标准用法,但可以理解为“de - ”表示“去除”,去除税收的意思)。

- 加后缀,“taxation”(名词,税收;征税,“ - ation”是名词后缀,表示行为、状态等);“taxable”(形容词,应纳税的,“ - able”是形容词后缀,表示“可……的”);“taxpayer”(名词,纳税人,“ - payer”表示“支付者”)。

3. 不同词式的造句与翻译- tax(名词)- The government has increased the tax on cigarettes.(政府已经提高了香烟税。

)- 这家公司必须缴纳高额的企业税。

The company has to pay a high corporate tax.- 他们正在抗议新的财产税。

They are protesting against the new property tax.- tax(动词)- The authorities decided to tax luxury goods at a higher rate.(当局决定对奢侈品征收更高的税率。

)- 政府不应该过度征税穷人。

The government should not over - tax the poor.- 他们计划对进口汽车征税。

各种税收名称英文翻译

accessions tax 财产增益税admission tax 通行税,入场税advertisement tax 广告税agricultural(animal husbandry)tax 农(牧)业税alcohol tax 酒精税all-phase transaction tax 全阶段交易税amusement tax 娱乐税anchorage dues 停泊税anti-dumping duty 反倾销税anti-profiteering tax 暴力税anti-subsidy/bounty/duty 反补贴税assimilation tax 入籍税automobile acquisition tax 汽车购置税aviation fuel tax 航空燃料税bazaar transaction 市场交易税benefit tax 受益税betterment tax 改良税beverage tax 饮料税bonus tax 奖金税border tax 边境税bourse tax 证券交易所税bourse transaction tax(securities exchange tax)有价证券交易税business consolidated tax 综合营业税business income tax 营利所得税business profit tax 营业利润税business receipts tax 营业收入税business tax 营业税canal dues/tolls 运河通行税capital gain tax 财产收益税capital interest tax 资本利息税capital levy 资本税capital transfer tax 资本转移税capitation tax 人头税car license 汽车执照税car tax 汽车税church tax 教堂税circulation tax 流通税city planning tax 城市规划税collective-owned enterprise income tax 集体企业奖金税collective-owned enterprise income tax 集体企业所得税commercial business tax 商业营业税commodity circulation tax 商业流通税commodity excise tax 商品国内消费税company income tax 公司所得税compensating tariff 补偿关税comprehensive income t ax 综合所得税consolidated tax 综合税consumption tax 消费税contingent duty 应变关税contract tax 契约税corn duty 谷物税corporate income tax 法人所得税corporate inhabitant tax 法人居民税corporate licensing tax 公司执照税corporate profit tax 公司利润税corporation franchise tax 法人登记税corporation tax 公司税,法人税coupon tax 息票利息税customs duties 关税death duty 遗产税deed tax 契税defense surtax 防卫附加税defense tax 国防税development land tax 改良土地税development tax 开发税direct consumption tax 直接消费税dividend tax 股息税document tax 凭证熟domestic rates 住宅税donation tax 赠与税earmarked tax 专用目的税earned income tax 劳物所得税easement tax 地役权税education duty 教育税electricity and gas tax 电力煤气税emergency import duties 临时进口税emergency special tax 非常特别税emergency tariff 非常关税employment tax 就业税enterprise income tax 企业所得税entertainment tax 娱乐税,筵席税entrepot duty 转口税environmental tax 环境税equalization charge/duty 平衡税estate tax 遗产税,地产税examination of deed tax 验契税excess profit tax 超额利润税excessive profit tax 过分利得税exchange tax 外汇税excise on eating,drinking and lodging 饮食旅店业消费税excise tax 国内消费税expenditure tax 消费支出税export duty(export tax)出口税extra duties 特税extra tax on profit increased 利润增长额特别税facilities services tax 设施和服务税factory tax 出厂税farm tax 田赋税feast tax 筵席税fixed assets betterment tax 固定资产改良税fixed assets tax 固定资产税foreign enterprise tax 外国公司税foreign personal holding company tax 外国私人控股公司税franchise tax 特许权税freight tax 运费税frontier tax 国境税gas tax 天然气税gasoline tax 汽油税general excise tax 普通消费税,一般消费税general property tax 一般财产税general sales tax 一般销售税gift and estate tax 赠与及财产税gift tax 赠与税good tax 货物税graduated income tax 分级所得税gross receipts tax 收入税harbor tax 港口税head tax/money 人头税highway hole tax 公路隧道通行税highway maintenance 养路税highway motor vehicle use tax 公路车辆使用税highway tax 公路税highway user tax 公路使用税house and land tax 房地产税house(property)tax 房产税household tax 户税hunter‘s license tax 狩猎执照税hunting tax 狩猎税immovable property tax 不动产税import duty 进口关税import surcharge/surtax 进口附加税import tax 进口税import turnover tax 进口商品流转税impost 进口关税incidental duties 杂捐income tax of urban and rural self-employed industrial and commercial household 城乡个体工商业户所得税income tax 所得税incorporate tax 法人税increment tax on land value 土地增值税indirect consumption tax 间接消费税indirect tax 间接税individual inhabitant tax 个人居民税individual/personal income tax 个人所得税industrial-commercial consolidated/unified tax 工商统一税industrial-commercial income tax 工商所得税industrial-commercial tax 工商税inhabitant income tax 居民所得税inheritance tax 遗产税,继承税insurance tax 保险税interest equilibrium tax 利息平衡税interest income tax 利息所得税interest tax 利息税internal revenue tax 国内收入税internal taxation of commodities 国内商品税internal taxes 国内税investment surcharge 投资收入附加税irregular tax(miscellaneous taxes)杂税issue tax 证券发行税joint venture with chinese and foreign investment income tax 中外合资经营企业所得税keelage 入港税,停泊税land holding tax 地产税land tax 土地税land use tax 土地使用税land value increment tax 地价增值税land value tax 地价税landing tax 入境税legacy tax/duty 遗产税license tax 牌照税,执照税liquidation tax 清算所得税liquor tax 酒税livestock transaction/trade tax 牲畜交易税local benefit tax 地方收益税local entertainment tax 地方娱乐税,地方筵席税local improvement tax 地方改良税local income tax 地方所得税local inhabitant tax 地方居民税local road tax‘地方公路税local surcharge 地方附加local surtax 地方附加税local taxes/duties 地方各税luxury(goods)tax 奢侈品税manufacturer‘s excise tax 生产者消费税mine area/lot tax mine tax(mineral product tax)矿区税mineral exploitation tax 矿产税mining tax 矿业税motor fuel tax 机动车燃料税motor vehicle tonnage tax 汽车吨位税municipal inhabitants tax 市镇居民税municipal locality tax 市地方税municipal tax市政税municipal trade tax 城市交易税negotiable note tax 有价证券税net worth tax 资产净值税nuisance tax 小额消费品税object tax 目的税objective tax 专用税occupancy tax占用税occupation tax 开业税occupational tax:开业许可税occupier‘s tax 农民所得税oil duties 石油进口税organization tax 开办税outlay tax 购货支出税passenger duty 客运税pavage 筑路税payroll tax 薪金工资税personal expenditures tax 个人消费支出税petrol duties 汽油税petroleum revenue tax 石油收益税pier tax 码头税plate tax 牌照税poll tax 人头税poor rate 贫民救济税port toll/duty 港口税,入港税premium tax 保险费税probate duty 遗嘱认证税processing tax 加工商品税product tax 产品税profit-seeking enterprise income tax 营利企业所得税progressive income tax 累进所得税progressive inheritance tax 累进遗产税property tax 财产税public utility tax 公用事业税purchase tax 购买税real estate tax 不动产税real estate transfer tax 不动产转让税real property acquisition tax 不动产购置税receipts tax 收入税recreation tax 娱乐税registration and license tax 登记及执照税registration tax 注册税regulation tax 调节税remittance tax 汇出税resident tax 居民税resource tax 资源税retail excise tax 零售消费税retail sales tax 零售营业税retaliatory tariff 报复性关税revenue tax/duty 营业收入税rural land tax农业土地税,田赋rural open fair tax农村集市交易税salaries tax 薪金税sales tax 营业税,销售税salt tax 盐税scot and lot 英国教区税seabed mining tax 海底矿产税securities exchange tax 证券交易税securities issue tax 证券发行税securities transfer /transaction tax 证券转让税selective employment tax 对一定行业课征的营业税selective sales tax 对一定范围课征的营业税self-employment tax 从业税service tax 劳务税settlement estate duty 遗产税severance tax 开采税,采掘熟shipping tax 船舶税slaughtering tax 屠宰税social security tax 社会保险税special commodity sales tax 特殊商品销售税special fuel oil tax 烧油特别税special land holding tax特种土地税special motor fuel retailers tax 汽车特种燃料零售商税special purpose tax 特种目的税special sales tax 特种销售税,特种经营税special tonnage tax/duty 特别吨位税spirit duty 烈酒税split tax 股本分散转移税stamp tax 印花税state income tax 州所得税state unemployment insurance tax 州失业保险税state-owned enterprise bonus tax 国营企业奖金熟state-owned enterprise income tax 国营企业所得税state-owned enterprise regulation tax 国企营业调节税state-owned enterprise wages regulation tax 国营企业工资调节税stock transfer tax 股票交易税stock-holders income tax股票所有者所得税succession tax 继承税,遗产税sugar excise tax 糖类消费税sumptuary tax 奢侈取缔税super tax 附加税supplementary income tax 补充所得税target job tax 临时工收入税tariff equalization tax 平衡关税tariff for bargaining purpose 谈判目的的关税tariff for military security 军事按关税tariff 关税tax for the examination of deed 契约检验税tax of energy resource 能源税tax on aggregate income 综合所得税tax on agriculture 农业税tax on alcohol and alcoholic liquors 酒精饮料税tax on bank note 银行券发行税tax on beer 啤酒税tax on business 企业税tax on capital gain 资本利得税tax on communication 交通税tax on consumption at hotel and restaurant 旅馆酒店消费税tax on deposit 股息税tax on dividends 契税tax on earning from employment 雇佣收入税tax on enterprise 企业税tax on goods and possessions 货物急财产税tax on house 房屋税tax on income and profit 所得及利润税tax on income from movable capital 动产所得税tax on land and building 土地房产税tax on land revenue 土地收入税tax on land value 地价税tax on luxury 奢侈品税tax on mine 矿税tax on pari-mutuels 赛马税,赌博税tax on produce 产品税tax on property paid to local authority for local purpose 由地方征收使用的财产税tax on property 财产税tax on receipts from public enterprises 公营企业收入税tax on revaluation 资产重估税tax on sale and turnover 货物销售及周转税tax on sale of property 财产出让税tax on specific products 特种产品税tax on stalls 摊贩税tax on the acquisition of immovable property tax 不动产购置税tax on the occupancy or use of business property 营业资产占有或使用税tax on transaction (tax on transfer of goods)商品交易税tax on transfer of property 财产转移税tax on transport 运输税tax on undistributed profit 未分配利润税tax on urban land 城市地产税tax on value add 增值税edtea duty 茶叶税television duty 电视税timber delivery tax 木材交易税tobacco consumption tax 烟草消费税toll turn 英国的牲畜市场税toll(toll on transit)通行税tonnage duty (tonnage dues)吨位税,船税tourist tax(travel tax)旅游税trade tax 贸易税transaction tax 交易税transfer tax 证券过户税,证券交易税transit dues 过境税,转口税turnover tax 周转税,流通税undertaking unit bonus 事业单位奖金税unemployment compensation tax 州失业补助税unemployment insurance tax 失业保险税unemployment tax 失业税unemployment tax 州失业税unified income tax 统一所得税unified transfer tax 财产转移统一税unitary income tax 综合所得税unused land tax 土地闲置熟urban house tax 城市房产税urban house-land tax 城市房地产水urban maintenance and construction tax 城市维护建设税urban real estate tax 城市房地产税use tax 使用税users tax 使用人头税utility tax 公用事业税vacant land tax 土地闲置税value added tax 增值税variable levy 差额税,差价税vehicle and vessel license-plate tax 车船牌照税vehicle and vessel use tax 车船使用税wages regulation tax 工资调节税wages tax 工资税war profit tax 战时利润税water utilization tax 水利受益税wealth /worth tax 财富税whisky tax 威士忌酒税windfall profit tax 暴利税window tax 窗税wine and tobacco tax 烟酒税wine duty 酒税withholding income tax 预提所得税withholding tax 预提税yield tax 收益税。

关于税收英语的作文

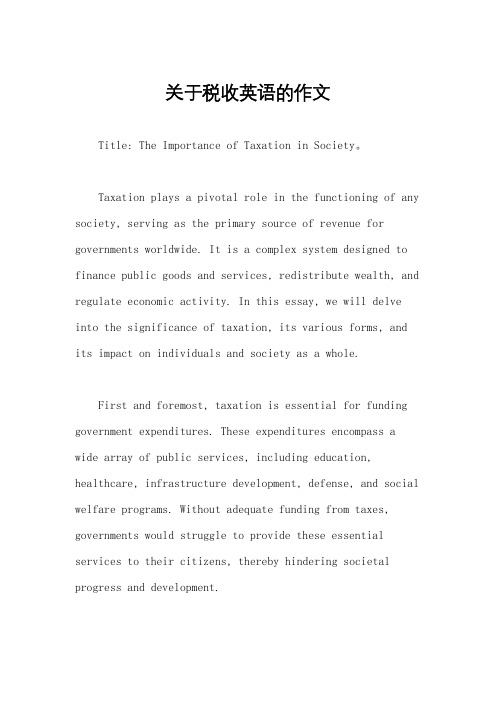

关于税收英语的作文Title: The Importance of Taxation in Society。

Taxation plays a pivotal role in the functioning of any society, serving as the primary source of revenue for governments worldwide. It is a complex system designed to finance public goods and services, redistribute wealth, and regulate economic activity. In this essay, we will delve into the significance of taxation, its various forms, and its impact on individuals and society as a whole.First and foremost, taxation is essential for funding government expenditures. These expenditures encompass a wide array of public services, including education, healthcare, infrastructure development, defense, and social welfare programs. Without adequate funding from taxes, governments would struggle to provide these essential services to their citizens, thereby hindering societal progress and development.Moreover, taxation plays a crucial role in promoting economic stability and growth. Through fiscal policy, governments can influence aggregate demand, employment levels, and inflation rates. By adjusting tax rates and implementing targeted incentives or disincentives, authorities can stimulate investment, encourage consumption, and steer the economy towards desired outcomes. Additionally, taxes can be used to address market failures and promote equitable distribution of resources, thereby fostering a more inclusive and sustainable economic environment.Furthermore, taxation serves as a tool for income redistribution and social justice. Progressive tax systems, which impose higher rates on individuals with higher incomes, help reduce income inequality by redistributing wealth from the affluent to the less fortunate. Additionally, social welfare programs funded by taxes, such as unemployment benefits, healthcare subsidies, and housing assistance, aim to alleviate poverty and improve theoverall well-being of society's most vulnerable members.However, despite its crucial role, taxation is often a subject of controversy and debate. One major point of contention is tax evasion and avoidance, wherebyindividuals and corporations seek to minimize their tax liabilities through legal loopholes or illegal means. Tax evasion deprives governments of much-needed revenue and undermines the fairness and integrity of the tax system. Addressing tax evasion requires effective enforcement mechanisms, international cooperation, and policy reforms aimed at closing loopholes and enhancing transparency.Moreover, the design and implementation of tax policies can have unintended consequences and social implications. For instance, poorly designed taxes or excessive tax burdens on certain industries or demographic groups may stifle innovation, entrepreneurship, and economic growth. Additionally, regressive taxes, which impose a proportionally higher burden on low-income earners, can exacerbate income inequality and perpetuate socioeconomic disparities.In conclusion, taxation is a fundamental instrument ofgovernance with far-reaching implications for individuals, businesses, and society as a whole. It facilitates the provision of public goods and services, promotes economic stability and growth, and fosters income redistribution and social justice. However, effective tax policies must strike a balance between revenue generation, economic efficiency, and social equity while addressing challenges such as tax evasion and unintended consequences. Ultimately, a well-designed and equitable tax system is essential for building a prosperous and inclusive society.。

税收英语

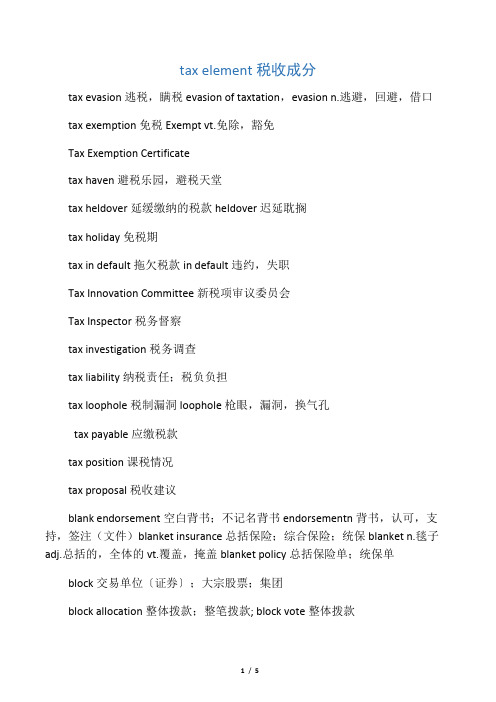

tax element税收成分tax evasion逃税,瞒税evasion of taxtation,evasion n.逃避,回避,借口tax exemption免税Exempt vt.免除,豁免Tax Exemption Certificatetax haven避税乐园,避税天堂tax heldover延缓缴纳的税款heldover迟延耽搁tax holiday免税期tax in default拖欠税款in default违约,失职Tax Innovation Committee新税项审议委员会Tax Inspector税务督察tax investigation税务调查tax liability纳税责任;税负负担tax loophole税制漏洞loophole枪眼,漏洞,换气孔tax payable应缴税款tax position课税情况tax proposal税收建议blank endorsement空白背书;不记名背书endorsementn背书,认可,支持,签注(文件)blanket insurance总括保险;综合保险;统保blanket n.毯子adj.总括的,全体的vt.覆盖,掩盖blanket policy总括保险单;统保单block交易单位〔证券〕;大宗股票;集团block allocation整体拨款;整笔拨款; block vote整体拨款block capital grant整笔非经常补助金block discount policy折扣统保单block grant整笔补助金block grant system整笔补助金制度block offer [securities]整批发售〔证券〕blue chipxx;优质股票board lot交易单位;上牌单位;"一手"Board of Governors of the World Bank世界银行理事会Board of Hong Kong Futures Exchange Limited香港期货交易所有限公司董事局Board of Inland Revenue税务委员会Board of Review [inland revenue]税务上诉委员会Board of Trade Clearing Corporation [Chicago]交易所结算公司〔芝加哥〕Board of Treasury库务管理委员会board tradingxx板式买卖BOCI Capital Limited中银国际融资有限公司body corporate法团;法人团体Bogor Declaration《茂物宣言》bogus transaction虚假交易bona fide mortgage真正抵押bona fide transaction真正交易bona vacantia无主财物bond债券;担保契据;担保书;债权证明书bond denominated in Hong Kong dollars以港元为本位的债券;港元债券bond fund债券基金bond rating债券评级bonded warehousexxbonusxx;红利;奖金bonus issue红股发行bonus share红股保护关税(Protective Tariff)保税制度(Bonded System)布鲁塞尔估价定义(Brussels Definition of Value BDV)差别关税(Differential Duties)差价关税(Variable Import Levies)产品对产品减税方式(Product by Product Reduction of Tariff)超保护贸易政策(Policy of Super-protection)成本(Cost)出厂价格(Cost Price)初级产品(Primary Commodity)初级产品的价格(The Price of Primang Products)出口补贴(Export Subsidies)出口动物产品检疫(Quarantine of Export Animal products)出口管制(Export Contral)出口税(Export Duty)出口退税(Export Rebates)出口信贷(Export Finance)·商务英语:集装箱术语缩写出口限制(Export Restriction)出口信贷国家担保制(Export credit Guarantee)出口许可证(Export Licence)储备货币(Reserve Carreacy)处于发展初级阶段(In the Early Etages of Development)处理剩余产品的指导原则(TheGuidingPrincipleofClealingWitheSurplusAgriculturalProducts)船舶(Vessel)从量税(Specific Duty)从价(Ad Valorem)从价关税(Ad Valorem Duties)单方面转移收支(Balance of Unilateral Transfers)动物产品(Animal Product)多种汇率(Multiple Rates of Exchange)反补贴税(Counter Vailing Duties)反倾销(Anti-Dumping)反倾销税(Anti-dumping Duties)关税(Customs Duty)关税和贸易总协定(The General Agreement On Tariffs And Trade)关税合作理事会(Customs Co-operation Council)·英语xx11种“钱”的表达方法关税减让(Tariff Concession)关税配额(Tariff Quota)关税升级(Tariff Escalation)关税水平(Tariff Level)关税税则(Tariff)关税同盟(Customs Union)关税和贸易总协定秘书处(Secretariat of GATT)规费(Fees)国际价格(International Price)约束税率(Bound Rate)自主关税(Autonomous Tariff)最惠国税率(The Most-favoured-nation Rate of Duty)优惠差额(Margin of Preference)优惠税率(Preferential Rate)有效保护率(Effective Vate of Protection)。

税收英语

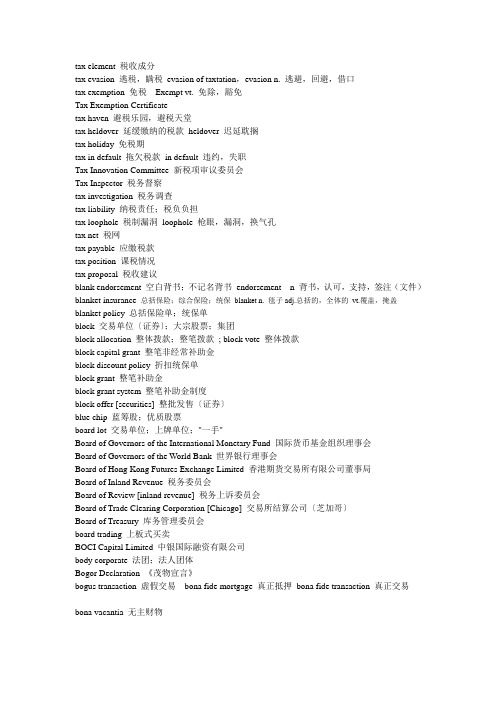

tax element 税收成分tax evasion 逃税,瞒税evasion of taxtation,evasion n. 逃避,回避,借口tax exemption 免税Exempt vt. 免除,豁免Tax Exemption Certificatetax haven 避税乐园,避税天堂tax heldover 延缓缴纳的税款heldover 迟延耽搁tax holiday 免税期tax in default 拖欠税款in default 违约,失职Tax Innovation Committee 新税项审议委员会Tax Inspector 税务督察tax investigation 税务调查tax liability 纳税责任;税负负担tax loophole 税制漏洞loophole 枪眼,漏洞,换气孔tax net 税网tax payable 应缴税款tax position 课税情况tax proposal 税收建议blank endorsement 空白背书;不记名背书endorsement n 背书,认可,支持,签注(文件)blanket insurance 总括保险;综合保险;统保blanket n. 毯子adj.总括的,全体的vt.覆盖,掩盖blanket policy 总括保险单;统保单block 交易单位〔证券〕;大宗股票;集团block allocation 整体拨款;整笔拨款; block vote 整体拨款block capital grant 整笔非经常补助金block discount policy 折扣统保单block grant 整笔补助金block grant system 整笔补助金制度block offer [securities] 整批发售〔证券〕blue chip 蓝筹股;优质股票board lot 交易单位;上牌单位;"一手"Board of Governors of the International Monetary Fund 国际货币基金组织理事会Board of Governors of the World Bank 世界银行理事会Board of Hong Kong Futures Exchange Limited 香港期货交易所有限公司董事局Board of Inland Revenue 税务委员会Board of Review [inland revenue] 税务上诉委员会Board of Trade Clearing Corporation [Chicago] 交易所结算公司〔芝加哥〕Board of Treasury 库务管理委员会board trading 上板式买卖BOCI Capital Limited 中银国际融资有限公司body corporate 法团;法人团体Bogor Declaration 《茂物宣言》bogus transaction 虚假交易bona fide mortgage 真正抵押bona fide transaction 真正交易bona vacantia 无主财物bond 债券;担保契据;担保书;债权证明书bond denominated in Hong Kong dollars 以港元为本位的债券;港元债券bond fund 债券基金bond rating 债券评级bonded warehouse 保税仓bonus 花红;红利;奖金bonus issue 红股发行bonus share 红股保护关税(Protective Tariff)保税制度(Bonded System)布鲁塞尔估价定义(Brussels Definition of Value BDV)差别关税(Differential Duties)差价关税(Variable Import Levies)产品对产品减税方式(Product by Product Reduction of Tariff)超保护贸易政策(Policy of Super-protection)成本(Cost)出厂价格(Cost Price)初级产品(Primary Commodity)初级产品的价格(The Price of Primang Products)出口补贴(Export Subsidies)出口动物产品检疫(Quarantine of Export Animal products)出口管制(Export Contral)出口税(Export Duty)出口退税(Export Rebates)出口信贷(Export Finance)·商务英语:集装箱术语缩写出口限制(Export Restriction)出口信贷国家担保制(Export credit Guarantee)出口许可证(Export Licence)储备货币(Reserve Carreacy)处于发展初级阶段(In the Early Etages of Development)处理剩余产品的指导原则(The Guiding Principle of Clealing With the Surplus Agricultural Products)船舶(Vessel)从量税(Specific Duty)从价(Ad Valorem)从价关税(Ad Valorem Duties)单方面转移收支(Balance of Unilateral Transfers)动物产品(Animal Product)多种汇率(Multiple Rates of Exchange)反补贴税(Counter Vailing Duties)反倾销(Anti-Dumping)反倾销税(Anti-dumping Duties)关税(Customs Duty)关税和贸易总协定(The General Agreement On Tariffs And Trade)关税合作理事会(Customs Co-operation Council)·英语中11种“钱”的表达方法关税减让(Tariff Concession)关税配额(Tariff Quota)关税升级(Tariff Escalation)关税水平(Tariff Level)关税税则(Tariff)关税同盟(Customs Union)关税和贸易总协定秘书处(Secretariat of GA TT)规费(Fees)国际价格(International Price)约束税率(Bound Rate)自主关税(Autonomous Tariff)最惠国税率(The Most-favoured-nation Rate of Duty) 优惠差额(Margin of Preference)优惠税率(Preferential Rate)有效保护率(Effective Vate of Protection)。

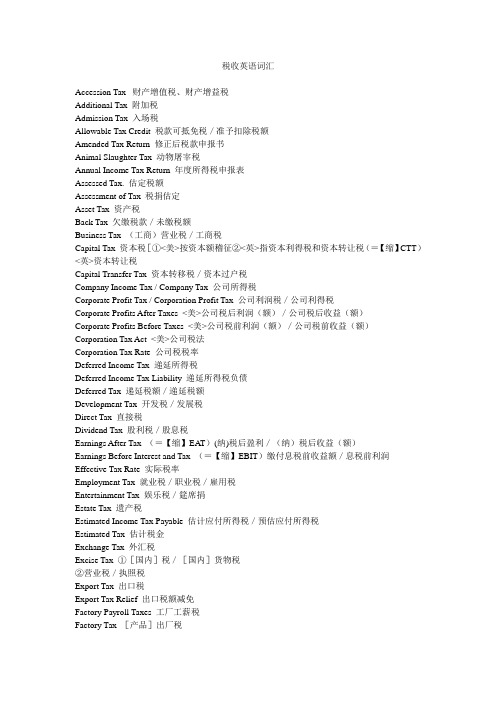

税收英语词汇

税收英语词汇Accession Tax 财产增值税、财产增益税Additional Tax 附加税Admission Tax 入场税Allowable Tax Credit 税款可抵免税/准予扣除税额Amended Tax Return 修正后税款申报书Animal Slaughter Tax 动物屠宰税Annual Income Tax Return 年度所得税申报表Assessed Tax. 估定税额Assessment of Tax 税捐估定Asset Tax 资产税Back Tax 欠缴税款/未缴税额Business Tax (工商)营业税/工商税Capital Tax 资本税[①<美>按资本额稽征②<英>指资本利得税和资本转让税(=【缩】CTT)<英>资本转让税Capital Transfer Tax 资本转移税/资本过户税Company Income Tax / Company Tax 公司所得税Corporate Profit Tax / Corporation Profit Tax 公司利润税/公司利得税Corporate Profits After Taxes <美>公司税后利润(额)/公司税后收益(额)Corporate Profits Before Taxes <美>公司税前利润(额)/公司税前收益(额)Corporation Tax Act <美>公司税法Corporation Tax Rate 公司税税率Deferred Income Tax 递延所得税Deferred Income Tax Liability 递延所得税负债Deferred Tax 递延税额/递延税额Development Tax 开发税/发展税Direct Tax 直接税Dividend Tax 股利税/股息税Earnings After Tax (=【缩】EAT)(纳)税后盈利/(纳)税后收益(额)Earnings Before Interest and Tax (=【缩】EBIT)缴付息税前收益额/息税前利润Effective Tax Rate 实际税率Employment Tax 就业税/职业税/雇用税Entertainment Tax 娱乐税/筵席捐Estate Tax 遗产税Estimated Income Tax Payable 估计应付所得税/预估应付所得税Estimated Tax 估计税金Exchange Tax 外汇税Excise Tax ①[国内]税/[国内]货物税②营业税/执照税Export Tax 出口税Export Tax Relief 出口税额减免Factory Payroll Taxes 工厂工薪税Factory Tax [产品]出厂税Fine for Tax Overdue 税款滞纳金Fine on Tax Makeup 补税罚款Franchise Tax 特许经营税/专营税Free of Income Tax (=【缩】f.i.t.)<美>免付所得税Import Tax 进口税Income Before Interest and Tax 利息前和税前收益Income After Taxes 税后收益/税后利润Income Tax (【缩】=IT)所得税Income Tax Benefit 所得税可退税款Income Tax Credit 所得税税额抵免Income Tax Deductions 所得税扣款/所得税减除额Income Tax Exemption 所得税免除额Income Tax Expense 所得税费用Income Tax Law 所得税法Income Tax Liability 所得税负债Income Tax on Enterprises 企业所得税Income Tax Payable 应付所得税Income Tax Prepaid 预交所得税Income Tax Rate 所得税率Income Tax Return 所得税申报表Income Tax Surcharge 所得附加税Income Tax Withholding 所得税代扣Increment Tax/Tax on V alue Added 增值税Individual Income Tax Return 个人所得税申报表Individual Tax 个人税Inheritance Tax <美>继承税/遗产税/遗产继承税Investment Tax Credit (=【缩】ITC/I.T.C.)<美>投资税款减除额/投资税款宽减额/投资减税额Liability for Payroll Taxes 应付工薪税Local Tax / Rates 地方税Luxury Tax 奢侈(品)税Marginal Tax Rate 边际税率Notice of Tax Payment 缴税通知/纳税通知书Nuisance Tax <美>繁杂捐税/小额消费品税Payroll Tax 工薪税/工资税/<美>工薪税Payroll Tax Expense 工薪税支出/工资税支出Payroll Tax Return 工薪所得税申报书/工资所得税申报书Personal Income Tax 个人所得税Personal Income Tax Exemption 个人所得税免除Personal Tax 对人税/个人税/直接税Prepaid Tax 预付税捐Pretax Earnings 税前收益/税前盈余/税前盈利Pretax Income 税前收入/税前收益/税前所得Pretax Profit 税前利润Product Tax 产品税Production Tax ①产品税②生产税Profit Tax 利得税/利润税Progressive Income Tax 累进所得税/累退所得税Progressive Income Tax rate 累进所得税率Progressive Tax 累进税Progressive Tax Rate 累进税率Property Tax 财产税Property Tax Payable 应付财产税Property Transfer Tax 财产转让税Rate of Taxation/Tax Rate 税率Reserve for Taxes 税捐准备(金)纳税准备(金)Retail Taxes 零售税Sales Tax 销售税/营业税Tax Accountant 税务会计师Tax Accounting 税务会计Tax Accrual Workpaper 应计税金计算表Tax Accruals 应计税金/应计税款Tax Accrued / Accrued Taxes 应计税收Tax Administration 税务管理Tax Audit 税务审计/税务稽核Tax Authority 税务当局Tax Benefit <美>纳税利益Tax Benefit Deferred 递延税款抵免Tax Bracket 税(收等)级/税别/税阶/税档Tax Collector 收税员Tax Credits <美>税款扣除数/税款减除数Tax Deductible Expense 税收可减费用Tax Deductions <美>课税所得额扣除数Tax Due (到期)应付税款Tax Evasion 逃税/漏税/偷税Tax Exemption / Exemption of Tax/ Tax Free 免税(额)Tax Law 税法Tax Liability 纳税义务Tax Loss 纳税损失/税损Tax on Capital Profit 资本利得税/资本利润税Tax on Dividends 股息税/红利税Tax Payment 支付税款/纳税Tax Penalty 税务罚款Tax Rate Reduction 降低税率Tax Rebate (出口)退税Tax Refund 退还税款Tax Return 税款申报书/纳税申报表Tax Savings 税金节约额Tax Withheld 扣缴税款/已预扣税款Tax Year 课税年度/纳税年度Taxable 可征税的/应纳税的Taxable Earnings 应税收入Taxable Income (=【缩】TI)可征税收入(额)/应(课)税所得(额)/应(课)税收益(额)Taxable Profit 应(课)税利润Taxation Guideline 税务方针/税务指南Taxes Payable 应缴税金,应付税款Tax-exempt Income 免税收入/免税收益/免税所得Tax-free Profit 免税利润Taxpayer 纳税人Transaction Tax 交易税/流通税Transfer Tax ①转让税/过户税②交易税Turnover Tax 周转税/交易税Undistributed Taxable Income 未分配课税所得/未分配应税收益Untaxed Income 未纳税所得/未上税收益Use Tax 使用税Value Added Tax (=【缩】VAT)增值税Wage Bracket Withholding Table 工新阶层扣税表Withholding Income Tax <美>预扣所得税/代扣所得税Withholding of Tax at Source 从源扣缴税款Withholding Statement 扣款清单/扣缴凭单Withholding Tax 预扣税款。

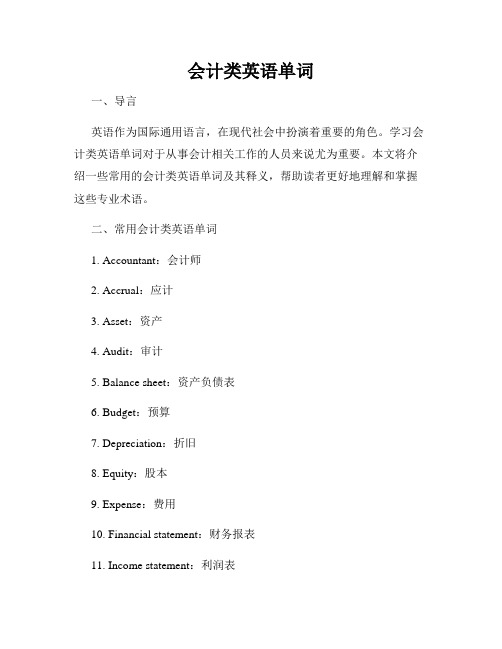

会计类英语单词

会计类英语单词一、导言英语作为国际通用语言,在现代社会中扮演着重要的角色。

学习会计类英语单词对于从事会计相关工作的人员来说尤为重要。

本文将介绍一些常用的会计类英语单词及其释义,帮助读者更好地理解和掌握这些专业术语。

二、常用会计类英语单词1. Accountant:会计师2. Accrual:应计3. Asset:资产4. Audit:审计5. Balance sheet:资产负债表6. Budget:预算7. Depreciation:折旧8. Equity:股本9. Expense:费用10. Financial statement:财务报表11. Income statement:利润表12. Interest:利息13. Ledger:总账14. Liabilities:负债15. Profit:利润16. Revenue:收入17. Tax:税收18. Trial balance:试算平衡表19. Wage:工资20. Working capital:营运资本三、对会计类英语单词的进一步解读1. Accountant(会计师)Accountant指的是负责处理和记录财务和税务事务的专业人员。

他们负责准确地记录和分析财务数据,并根据法律法规进行合规处理。

2. Accrual(应计)Accrual是指在会计报表中记录收入和费用时,以实际发生的时间为准。

这意味着即使在现金流发生之前或之后,也要将相关项目计入账目。

3. Asset(资产)Asset是指企业所拥有的有形或无形的东西,具有经济价值。

资产可以包括现金、股票、土地、建筑物等。

4. Audit(审计)Audit是指对企业的财务记录进行全面检查和评估的过程。

审计的目的是确认财务数据的真实性和准确性,以及检查企业是否遵守财务相关法规和准则。

5. Balance sheet(资产负债表)Balance sheet是一份会计报表,用于呈现企业在特定时间点上的资产、负债和所有者权益的情况。

各种税收名称英文翻译

accessions tax 财产增益税admission tax 通行税,入场税advertisement tax 广告税agricultural(animal husbandry) tax 农(牧)业税alcohol tax 酒精税all-phase transaction tax 全阶段交易税amusement tax 娱乐税anchorage dues 停泊税anti-dumping duty 反倾销税anti-profiteering tax 暴力税anti-subsidy/bounty/duty 反补贴税assimilation tax 入籍税automobile acquisition tax 汽车购置税aviation fuel tax 航空燃料税bazaar transaction 市场交易税benefit tax 受益税betterment tax 改良税beverage tax 饮料税bonus tax 奖金税border tax 边境税bourse tax 证券交易所税bourse transaction tax(securities exchange tax)有价证券交易税building tax 建筑税business consolidated tax 综合营业税business income tax 营利所得税business profit tax 营业利润税business receipts tax 营业收入税business tax 营业税canal dues/tolls 运河通行税capital gain tax 财产收益税capital interest tax 资本利息税capital levy 资本税capital transfer tax 资本转移税capitation tax 人头税car license 汽车执照税car tax 汽车税church tax 教堂税circulation tax 流通税city planning tax 城市规划税collective-owned enterprise income tax 集体企业奖金税collective-owned enterprise income tax 集体企业所得税commercial business tax 商业营业税commodity circulation tax 商业流通税commodity excise tax 商品国内消费税commodity tax 货物税company income tax 公司所得税compensating tariff 补偿关税comprehensive income t ax 综合所得税consolidated tax 综合税consumption tax 消费税contingent duty 应变关税contract tax 契约税corn duty 谷物税corporate income tax 法人所得税corporate inhabitant tax 法人居民税corporate licensing tax 公司执照税corporate profit tax 公司利润税corporation franchise tax 法人登记税corporation tax 公司税,法人税coupon tax 息票利息税customs duties 关税death duty 遗产税deed tax 契税defense surtax 防卫附加税defense tax 国防税development land tax 改良土地税development tax 开发税direct consumption tax 直接消费税dividend tax 股息税document tax 凭证熟domestic rates 住宅税donation tax 赠与税earmarked tax 专用目的税earned income tax 劳物所得税easement tax 地役权税education duty 教育税electricity and gas tax 电力煤气税emergency import duties 临时进口税emergency special tax 非常特别税emergency tariff 非常关税employment tax 就业税enterprise income tax 企业所得税entertainment tax 娱乐税,筵席税entrepot duty 转口税environmental tax 环境税equalization charge/duty 平衡税estate tax 遗产税,地产税examination of deed tax 验契税excess profit tax 超额利润税excessive profit tax 过分利得税exchange tax 外汇税excise on eating, drinking and lodging 饮食旅店业消费税excise tax 国内消费税expenditure tax 消费支出税export duty(export tax)出口税extra duties 特税extra tax on profit increased 利润增长额特别税facilities services tax 设施和服务税factory tax 出厂税farm tax 田赋税feast tax 筵席税fixed assets betterment tax 固定资产改良税fixed assets tax 固定资产税foreign enterprise tax 外国公司税foreign personal holding company tax 外国私人控股公司税franchise tax 特许权税freight tax 运费税frontier tax 国境税gas tax 天然气税gasoline tax 汽油税general excise tax 普通消费税,一般消费税general property tax 一般财产税general sales tax 一般销售税gift and estate tax 赠与及财产税gift tax 赠与税good tax 货物税graduated income tax 分级所得税gross receipts tax 收入税harbor tax 港口税head tax/money 人头税highway hole tax 公路隧道通行税highway maintenance 养路税highway motor vehicle use tax 公路车辆使用税highway tax 公路税highway user tax 公路使用税house and land tax 房地产税house(property) tax 房产税household tax 户税hunter‘s license tax 狩猎执照税hunting tax 狩猎税immovable property tax 不动产税import duty 进口关税import surcharge/surtax 进口附加税import tax 进口税import turnover tax 进口商品流转税impost 进口关税incidental duties 杂捐income tax of urban and rural self-employed industrial and commercial household 城乡个体工商业户所得税income tax 所得税incorporate tax 法人税increment tax on land value 土地增值税indirect consumption tax 间接消费税indirect tax 间接税individual inhabitant tax 个人居民税individual/personal income tax 个人所得税industrial-commercial consolidated/unified tax 工商统一税industrial-commercial income tax 工商所得税industrial-commercial tax 工商税inhabitant income tax 居民所得税inheritance tax 遗产税,继承税insurance tax 保险税interest equilibrium tax 利息平衡税interest income tax 利息所得税internal revenue tax 国内收入税internal taxation of commodities 国内商品税internal taxes 国内税investment surcharge 投资收入附加税irregular tax(miscellaneous taxes)杂税issue tax 证券发行税joint venture with chinese and foreign investment income tax 中外合资经营企业所得税keelage 入港税,停泊税land holding tax 地产税land tax 土地税land use tax 土地使用税land value increment tax 地价增值税land value tax 地价税landing tax 入境税legacy tax/duty 遗产税license tax 牌照税,执照税liquidation tax 清算所得税liquor tax 酒税livestock transaction/trade tax 牲畜交易税local benefit tax 地方收益税local entertainment tax 地方娱乐税,地方筵席税local improvement tax 地方改良税local income tax 地方所得税local inhabitant tax 地方居民税local road tax‘ 地方公路税local surcharge 地方附加local surtax 地方附加税local taxes/duties 地方各税luxury(goods) tax 奢侈品税manufacturer‘s excise tax 生产者消费税mine area/lot tax mine tax(mineral product tax)矿区税mineral exploitation tax 矿产税mining tax 矿业税motor fuel tax 机动车燃料税motor vehicle tonnage tax 汽车吨位税municipal inhabitants tax 市镇居民税municipal locality tax 市地方税municipal tax市政税municipal trade tax 城市交易税negotiable note tax 有价证券税net worth tax 资产净值税nuisance tax 小额消费品税object tax 目的税objective tax 专用税occupancy tax占用税occupation tax 开业税occupational tax:开业许可税occupier‘s tax 农民所得税oil duties 石油进口税organization tax 开办税outlay tax 购货支出税passenger duty 客运税pavage 筑路税payroll tax 薪金工资税personal expenditures tax 个人消费支出税petrol duties 汽油税petroleum revenue tax 石油收益税pier tax 码头税plate tax 牌照税poll tax 人头税poor rate 贫民救济税port toll/duty 港口税,入港税premium tax 保险费税probate duty 遗嘱认证税processing tax 加工商品税product tax 产品税profit tax 利润税profit-seeking enterprise income tax 营利企业所得税progressive income tax 累进所得税progressive inheritance tax 累进遗产税property tax 财产税public utility tax 公用事业税purchase tax 购买税real estate tax 不动产税real estate transfer tax 不动产转让税real property acquisition tax 不动产购置税receipts tax 收入税recreation tax 娱乐税registration and license tax 登记及执照税registration tax 注册税regulation tax 调节税remittance tax 汇出税resident tax 居民税resource tax 资源税retail excise tax 零售消费税retail sales tax 零售营业税retaliatory tariff 报复性关税revenue tax/duty 营业收入税river dues 内河税rural land tax农业土地税,田赋rural open fair tax农村集市交易税salaries tax 薪金税sales tax 营业税,销售税salt tax 盐税scot and lot 英国教区税seabed mining tax 海底矿产税securities exchange tax 证券交易税。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

The identification of normal VAT tax payer

When

starting a new business, the enterprise which meets the requirements should make the application The state tax authority will exam the related documents within 30 days and confirm the VAT normal taxpayer with special badge

Normal taxpayer

Annual sales – over the criteria of small scale taxpayers Sound financial accounting system dividuals which the annual sales exceeds the small-scale taxpayers, could not be normal taxpayer, and Enterprises which seldom have taxable goods and services could choose to be small-scale taxpayers

VAT Taxable Items and Rates

Coverage of collection rate Exportation of goods (except those prohibited from 0 exportation and restriction from importation by the state) (1) Cereals, edible vegetable oils (2) Tap water, heating, cooling, hot water, gas, LPG (Liquefied Petroleum Gas ), natural gas, methane gas, coal/charcoal products for household use; (3) Books, newspapers, magazines; (4) Feed, chemical fertilizer, chemical pesticides, agricultural machinery, and farm-use plastic sheets; other goods and taxable services.

7.1 Definition of value added tax

VAT

is a tax on turnover, not on income VAT is considered neutral as compared with general sales tax

7.1 Definition of value added tax

Small-scale taxpayer

enterprises – the annual sales less than 0.5 million Yuan Commercial enterprises – the annual sales is less than 0.8 million

Industrial

Example of VAT computation

Firm

Sales VAT goods price Output Input (no tax) tax tax Wheat Flour Cake Cake 100 200 800 1000 0 26 136 170 0 13 26 136

Tax payable 0 13 110 34

The

Two types of VAT tax payers

Normal

taxpayer Small-scale taxpayer Criteria for classification:

Annual

taxable sales value Financial accounting system

7.3 Value-Added Tax in China

The

overview of VAT in China The design of VAT

Who

The

pays VAT Taxable items and tax rates

reform of VAT in China

The overview of VAT in China

Mixed sale

A sale activity involves both good and nontaxable labor services . Tax treatment: The mixed sale in goods manufacturing, wholesaling and retailing are deemed as sales of goods – VAT on total sales revenue Other mixed sales – business tax

A value added tax (VAT) is a form of consumption tax.

From

the perspective of the buyer, it is a tax on the purchase price. From that of the seller, it is a tax only on the value added to a product, material, or service.

7.1 Definition of value added tax

The

VAT system is based on tax collection in a staged process, with successive businesses entitled to deduct input tax on purchases and account for output tax on sales This ensure the neutrality of the tax

Chapter 7 Value added tax

Chapter 7 Value added tax

Definition of value added tax The development of VAT VAT in China Some issues of VAT

7.1 Definition of value added tax

By the method of collection, VAT can be accounts-based or invoice-based

Invoice method of collection

Each seller charges VAT rate on his output and passes the buyer a special invoice that indicates the amount of tax charged. Buyers who are subject to VAT on their own sales (output tax), consider the tax on the purchase invoices as input tax and can deduct the sum from their own VAT liability. The difference between output tax and input tax is paid to the government (or a refund is claimed, in the case of negative liability)

13%

17%

VAT taxpayers

leaseholders or the contractors – in case of business leased or contracted to others Agents or purchasers – for overseas units or individual sell taxable goods and services in China

VAT—who should pay ? Any enterprise, administration unit, institutional unit, military unit, social organization, individual engaged in: The sales of goods Goods refer to tangible movable objects, including electricity, heat and gas The importation of goods The provision of processing, repairs and replacement services (taxable services)

Introduced

in Jan.1, 1994 The biggest tax in China Administered by the Offices of SAT (State Administration of Taxation) Shared tax between central and local government

Some activities are deemed as sales of goods

Pass goods to others for sale on behalf Sell goods on commission basis Use self-manufactured or processed or purchased as investment, by distributing the goods to shareholders, investors or by donating to others with no charge Use self-manufactured or processed as nontaxable items, collective welfare for private consumption.