税收英语05

纳税申报英语

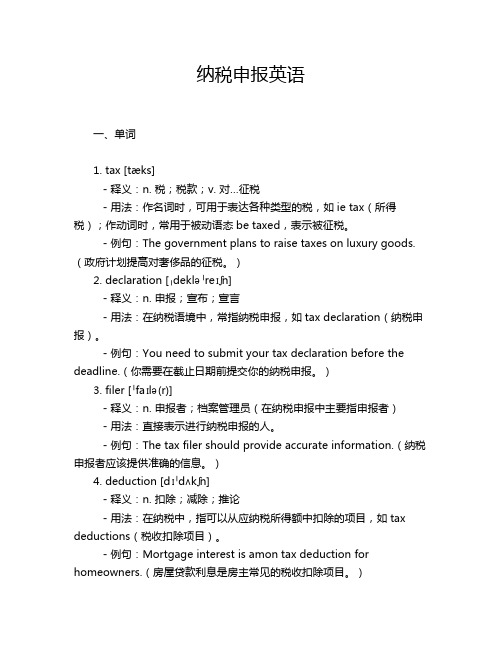

纳税申报英语一、单词1. tax [tæks]- 释义:n. 税;税款;v. 对…征税- 用法:作名词时,可用于表达各种类型的税,如ie tax(所得税);作动词时,常用于被动语态be taxed,表示被征税。

- 例句:The government plans to raise taxes on luxury goods.(政府计划提高对奢侈品的征税。

)2. declaration [ˌdekləˈreɪʃn]- 释义:n. 申报;宣布;宣言- 用法:在纳税语境中,常指纳税申报,如tax declaration(纳税申报)。

- 例句:You need to submit your tax declaration before the deadline.(你需要在截止日期前提交你的纳税申报。

)3. filer [ˈfaɪlə(r)]- 释义:n. 申报者;档案管理员(在纳税申报中主要指申报者)- 用法:直接表示进行纳税申报的人。

- 例句:The tax filer should provide accurate information.(纳税申报者应该提供准确的信息。

)4. deduction [dɪˈdʌkʃn]- 释义:n. 扣除;减除;推论- 用法:在纳税中,指可以从应纳税所得额中扣除的项目,如tax deductions(税收扣除项目)。

- 例句:Mortgage interest is amon tax deduction for homeowners.(房屋贷款利息是房主常见的税收扣除项目。

)5. exemption [ɪɡˈzempʃn]- 释义:n. 免除;豁免- 用法:表示某些情况或项目在纳税时被免除,如tax exemption (免税)。

- 例句:Some charities enjoy tax exemption.(一些慈善机构享受免税待遇。

)6. revenue [ˈrevənjuː]- 释义:n. 税收;收入;收益- 用法:指政府通过征税等方式获得的财政收入。

税收的单词

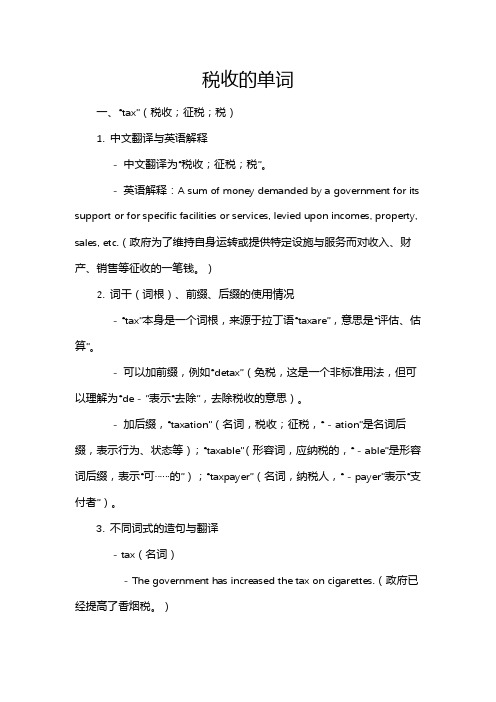

税收的单词一、“tax”(税收;征税;税)1. 中文翻译与英语解释- 中文翻译为“税收;征税;税”。

- 英语解释:A sum of money demanded by a government for its support or for specific facilities or services, levied upon incomes, property, sales, etc.(政府为了维持自身运转或提供特定设施与服务而对收入、财产、销售等征收的一笔钱。

)2. 词干(词根)、前缀、后缀的使用情况- “tax”本身是一个词根,来源于拉丁语“taxare”,意思是“评估、估算”。

- 可以加前缀,例如“detax”(免税,这是一个非标准用法,但可以理解为“de - ”表示“去除”,去除税收的意思)。

- 加后缀,“taxation”(名词,税收;征税,“ - ation”是名词后缀,表示行为、状态等);“taxable”(形容词,应纳税的,“ - able”是形容词后缀,表示“可……的”);“taxpayer”(名词,纳税人,“ - payer”表示“支付者”)。

3. 不同词式的造句与翻译- tax(名词)- The government has increased the tax on cigarettes.(政府已经提高了香烟税。

)- 这家公司必须缴纳高额的企业税。

The company has to pay a high corporate tax.- 他们正在抗议新的财产税。

They are protesting against the new property tax.- tax(动词)- The authorities decided to tax luxury goods at a higher rate.(当局决定对奢侈品征收更高的税率。

)- 政府不应该过度征税穷人。

The government should not over - tax the poor.- 他们计划对进口汽车征税。

税务专业英语常用词汇整理

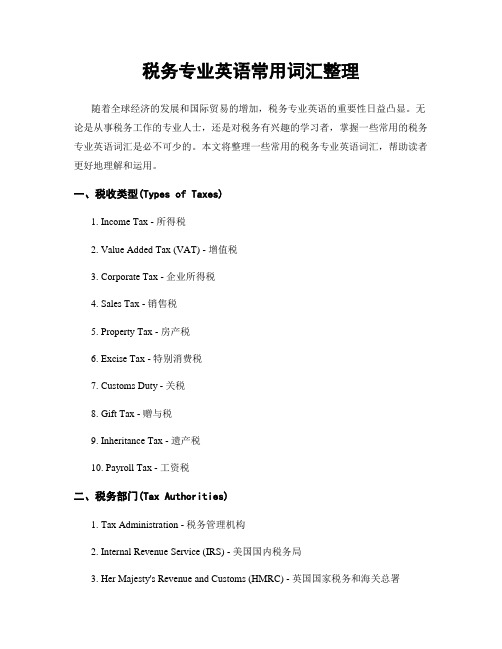

税务专业英语常用词汇整理随着全球经济的发展和国际贸易的增加,税务专业英语的重要性日益凸显。

无论是从事税务工作的专业人士,还是对税务有兴趣的学习者,掌握一些常用的税务专业英语词汇是必不可少的。

本文将整理一些常用的税务专业英语词汇,帮助读者更好地理解和运用。

一、税收类型(Types of Taxes)1. Income Tax - 所得税2. Value Added Tax (VAT) - 增值税3. Corporate Tax - 企业所得税4. Sales Tax - 销售税5. Property Tax - 房产税6. Excise Tax - 特别消费税7. Customs Duty - 关税8. Gift Tax - 赠与税9. Inheritance Tax - 遗产税10. Payroll Tax - 工资税二、税务部门(Tax Authorities)1. Tax Administration - 税务管理机构2. Internal Revenue Service (IRS) - 美国国内税务局3. Her Majesty's Revenue and Customs (HMRC) - 英国国家税务和海关总署4. State Tax Department - 州税务部门5. Tax Inspectorate - 税务检查机构6. Tax Court - 税务法院三、纳税申报(Tax Filing)1. Tax Return - 纳税申报表2. Taxpayer Identification Number (TIN) - 纳税人识别号3. Taxable Income - 应税收入4. Deductions - 扣除项5. Tax Exemptions - 免税额6. Tax Refund - 税款退还7. Tax Evasion - 逃税8. Tax Avoidance - 避税四、税务审计(Tax Auditing)1. Tax Audit - 税务审计2. Audit Trail - 审计轨迹3. Tax Compliance - 税务合规4. Taxpayer's Rights - 纳税人权益5. Tax Assessment - 税务评估6. Tax Penalty - 税务罚款7. Tax Fraud - 税务欺诈五、国际税务(International Taxation)1. Double Taxation - 双重征税2. Tax Treaty - 税收协定3. Transfer Pricing - 转让定价4. Base Erosion and Profit Shifting (BEPS) - 基地侵蚀和利润转移5. Controlled Foreign Corporation (CFC) - 受控外国公司6. Permanent Establishment (PE) - 永久机构7. Thin Capitalization - 薄资本化六、税务报告(Tax Reporting)1. Financial Statements - 财务报表2. Tax Provision - 税务准备3. Taxable Year - 纳税年度4. Taxable Period - 纳税期间5. Taxable Event - 应税事件6. Withholding Tax - 预扣税7. Taxable Gain - 应税收益8. Tax Loss - 税务损失七、税务筹划(Tax Planning)1. Tax Incentives - 税收激励措施2. Tax Credits - 税收抵免3. Tax Shelters - 避税港4. Offshore Tax Planning - 离岸税务筹划5. Tax Optimization - 税务优化6. Tax Haven - 避税天堂八、税务法律(Tax Laws)1. Tax Code - 税法典2. Tax Regulations - 税法规定3. Tax Treaties - 税收协定4. Tax Court Rulings - 税务法院裁决5. Tax Dispute Resolution - 税务争议解决结语:以上是一些常用的税务专业英语词汇,涵盖了税收类型、税务部门、纳税申报、税务审计、国际税务、税务报告、税务筹划和税务法律等方面。

税收英语

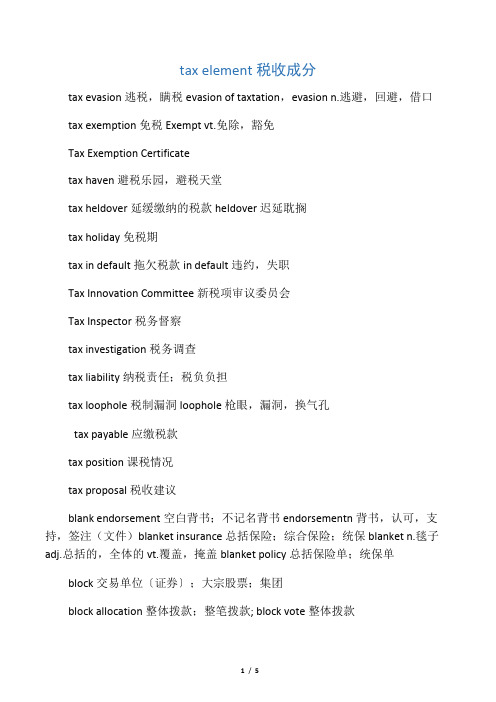

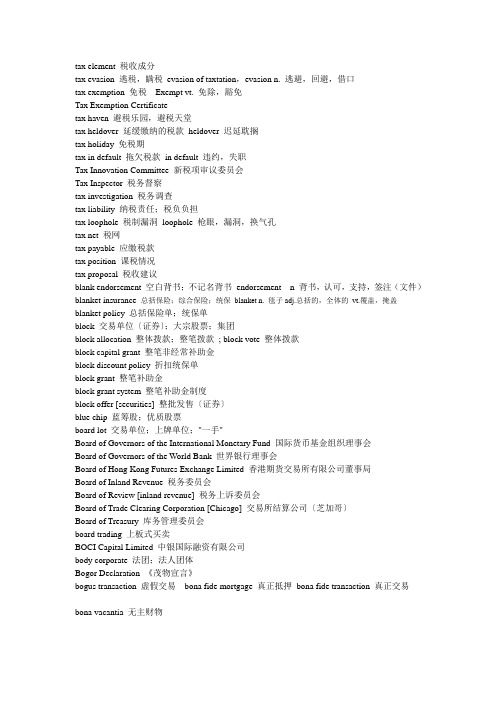

tax element税收成分tax evasion逃税,瞒税evasion of taxtation,evasion n.逃避,回避,借口tax exemption免税Exempt vt.免除,豁免Tax Exemption Certificatetax haven避税乐园,避税天堂tax heldover延缓缴纳的税款heldover迟延耽搁tax holiday免税期tax in default拖欠税款in default违约,失职Tax Innovation Committee新税项审议委员会Tax Inspector税务督察tax investigation税务调查tax liability纳税责任;税负负担tax loophole税制漏洞loophole枪眼,漏洞,换气孔tax payable应缴税款tax position课税情况tax proposal税收建议blank endorsement空白背书;不记名背书endorsementn背书,认可,支持,签注(文件)blanket insurance总括保险;综合保险;统保blanket n.毯子adj.总括的,全体的vt.覆盖,掩盖blanket policy总括保险单;统保单block交易单位〔证券〕;大宗股票;集团block allocation整体拨款;整笔拨款; block vote整体拨款block capital grant整笔非经常补助金block discount policy折扣统保单block grant整笔补助金block grant system整笔补助金制度block offer [securities]整批发售〔证券〕blue chipxx;优质股票board lot交易单位;上牌单位;"一手"Board of Governors of the World Bank世界银行理事会Board of Hong Kong Futures Exchange Limited香港期货交易所有限公司董事局Board of Inland Revenue税务委员会Board of Review [inland revenue]税务上诉委员会Board of Trade Clearing Corporation [Chicago]交易所结算公司〔芝加哥〕Board of Treasury库务管理委员会board tradingxx板式买卖BOCI Capital Limited中银国际融资有限公司body corporate法团;法人团体Bogor Declaration《茂物宣言》bogus transaction虚假交易bona fide mortgage真正抵押bona fide transaction真正交易bona vacantia无主财物bond债券;担保契据;担保书;债权证明书bond denominated in Hong Kong dollars以港元为本位的债券;港元债券bond fund债券基金bond rating债券评级bonded warehousexxbonusxx;红利;奖金bonus issue红股发行bonus share红股保护关税(Protective Tariff)保税制度(Bonded System)布鲁塞尔估价定义(Brussels Definition of Value BDV)差别关税(Differential Duties)差价关税(Variable Import Levies)产品对产品减税方式(Product by Product Reduction of Tariff)超保护贸易政策(Policy of Super-protection)成本(Cost)出厂价格(Cost Price)初级产品(Primary Commodity)初级产品的价格(The Price of Primang Products)出口补贴(Export Subsidies)出口动物产品检疫(Quarantine of Export Animal products)出口管制(Export Contral)出口税(Export Duty)出口退税(Export Rebates)出口信贷(Export Finance)·商务英语:集装箱术语缩写出口限制(Export Restriction)出口信贷国家担保制(Export credit Guarantee)出口许可证(Export Licence)储备货币(Reserve Carreacy)处于发展初级阶段(In the Early Etages of Development)处理剩余产品的指导原则(TheGuidingPrincipleofClealingWitheSurplusAgriculturalProducts)船舶(Vessel)从量税(Specific Duty)从价(Ad Valorem)从价关税(Ad Valorem Duties)单方面转移收支(Balance of Unilateral Transfers)动物产品(Animal Product)多种汇率(Multiple Rates of Exchange)反补贴税(Counter Vailing Duties)反倾销(Anti-Dumping)反倾销税(Anti-dumping Duties)关税(Customs Duty)关税和贸易总协定(The General Agreement On Tariffs And Trade)关税合作理事会(Customs Co-operation Council)·英语xx11种“钱”的表达方法关税减让(Tariff Concession)关税配额(Tariff Quota)关税升级(Tariff Escalation)关税水平(Tariff Level)关税税则(Tariff)关税同盟(Customs Union)关税和贸易总协定秘书处(Secretariat of GATT)规费(Fees)国际价格(International Price)约束税率(Bound Rate)自主关税(Autonomous Tariff)最惠国税率(The Most-favoured-nation Rate of Duty)优惠差额(Margin of Preference)优惠税率(Preferential Rate)有效保护率(Effective Vate of Protection)。

税收英语

tax element 税收成分tax evasion 逃税,瞒税evasion of taxtation,evasion n. 逃避,回避,借口tax exemption 免税Exempt vt. 免除,豁免Tax Exemption Certificatetax haven 避税乐园,避税天堂tax heldover 延缓缴纳的税款heldover 迟延耽搁tax holiday 免税期tax in default 拖欠税款in default 违约,失职Tax Innovation Committee 新税项审议委员会Tax Inspector 税务督察tax investigation 税务调查tax liability 纳税责任;税负负担tax loophole 税制漏洞loophole 枪眼,漏洞,换气孔tax net 税网tax payable 应缴税款tax position 课税情况tax proposal 税收建议blank endorsement 空白背书;不记名背书endorsement n 背书,认可,支持,签注(文件)blanket insurance 总括保险;综合保险;统保blanket n. 毯子adj.总括的,全体的vt.覆盖,掩盖blanket policy 总括保险单;统保单block 交易单位〔证券〕;大宗股票;集团block allocation 整体拨款;整笔拨款; block vote 整体拨款block capital grant 整笔非经常补助金block discount policy 折扣统保单block grant 整笔补助金block grant system 整笔补助金制度block offer [securities] 整批发售〔证券〕blue chip 蓝筹股;优质股票board lot 交易单位;上牌单位;"一手"Board of Governors of the International Monetary Fund 国际货币基金组织理事会Board of Governors of the World Bank 世界银行理事会Board of Hong Kong Futures Exchange Limited 香港期货交易所有限公司董事局Board of Inland Revenue 税务委员会Board of Review [inland revenue] 税务上诉委员会Board of Trade Clearing Corporation [Chicago] 交易所结算公司〔芝加哥〕Board of Treasury 库务管理委员会board trading 上板式买卖BOCI Capital Limited 中银国际融资有限公司body corporate 法团;法人团体Bogor Declaration 《茂物宣言》bogus transaction 虚假交易bona fide mortgage 真正抵押bona fide transaction 真正交易bona vacantia 无主财物bond 债券;担保契据;担保书;债权证明书bond denominated in Hong Kong dollars 以港元为本位的债券;港元债券bond fund 债券基金bond rating 债券评级bonded warehouse 保税仓bonus 花红;红利;奖金bonus issue 红股发行bonus share 红股保护关税(Protective Tariff)保税制度(Bonded System)布鲁塞尔估价定义(Brussels Definition of Value BDV)差别关税(Differential Duties)差价关税(Variable Import Levies)产品对产品减税方式(Product by Product Reduction of Tariff)超保护贸易政策(Policy of Super-protection)成本(Cost)出厂价格(Cost Price)初级产品(Primary Commodity)初级产品的价格(The Price of Primang Products)出口补贴(Export Subsidies)出口动物产品检疫(Quarantine of Export Animal products)出口管制(Export Contral)出口税(Export Duty)出口退税(Export Rebates)出口信贷(Export Finance)·商务英语:集装箱术语缩写出口限制(Export Restriction)出口信贷国家担保制(Export credit Guarantee)出口许可证(Export Licence)储备货币(Reserve Carreacy)处于发展初级阶段(In the Early Etages of Development)处理剩余产品的指导原则(The Guiding Principle of Clealing With the Surplus Agricultural Products)船舶(Vessel)从量税(Specific Duty)从价(Ad Valorem)从价关税(Ad Valorem Duties)单方面转移收支(Balance of Unilateral Transfers)动物产品(Animal Product)多种汇率(Multiple Rates of Exchange)反补贴税(Counter Vailing Duties)反倾销(Anti-Dumping)反倾销税(Anti-dumping Duties)关税(Customs Duty)关税和贸易总协定(The General Agreement On Tariffs And Trade)关税合作理事会(Customs Co-operation Council)·英语中11种“钱”的表达方法关税减让(Tariff Concession)关税配额(Tariff Quota)关税升级(Tariff Escalation)关税水平(Tariff Level)关税税则(Tariff)关税同盟(Customs Union)关税和贸易总协定秘书处(Secretariat of GA TT)规费(Fees)国际价格(International Price)约束税率(Bound Rate)自主关税(Autonomous Tariff)最惠国税率(The Most-favoured-nation Rate of Duty) 优惠差额(Margin of Preference)优惠税率(Preferential Rate)有效保护率(Effective Vate of Protection)。

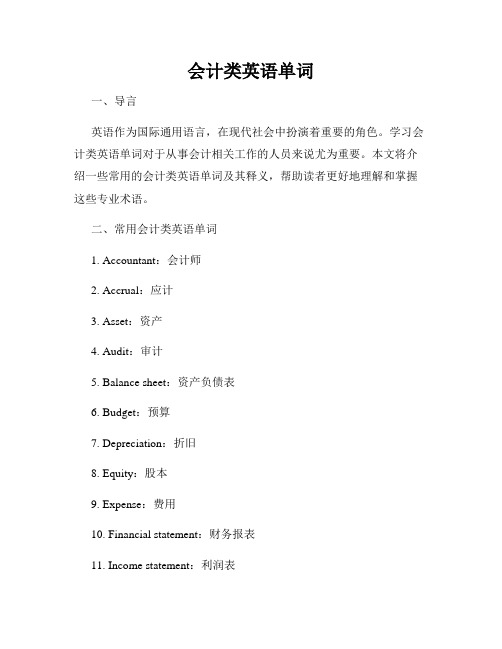

会计类英语单词

会计类英语单词一、导言英语作为国际通用语言,在现代社会中扮演着重要的角色。

学习会计类英语单词对于从事会计相关工作的人员来说尤为重要。

本文将介绍一些常用的会计类英语单词及其释义,帮助读者更好地理解和掌握这些专业术语。

二、常用会计类英语单词1. Accountant:会计师2. Accrual:应计3. Asset:资产4. Audit:审计5. Balance sheet:资产负债表6. Budget:预算7. Depreciation:折旧8. Equity:股本9. Expense:费用10. Financial statement:财务报表11. Income statement:利润表12. Interest:利息13. Ledger:总账14. Liabilities:负债15. Profit:利润16. Revenue:收入17. Tax:税收18. Trial balance:试算平衡表19. Wage:工资20. Working capital:营运资本三、对会计类英语单词的进一步解读1. Accountant(会计师)Accountant指的是负责处理和记录财务和税务事务的专业人员。

他们负责准确地记录和分析财务数据,并根据法律法规进行合规处理。

2. Accrual(应计)Accrual是指在会计报表中记录收入和费用时,以实际发生的时间为准。

这意味着即使在现金流发生之前或之后,也要将相关项目计入账目。

3. Asset(资产)Asset是指企业所拥有的有形或无形的东西,具有经济价值。

资产可以包括现金、股票、土地、建筑物等。

4. Audit(审计)Audit是指对企业的财务记录进行全面检查和评估的过程。

审计的目的是确认财务数据的真实性和准确性,以及检查企业是否遵守财务相关法规和准则。

5. Balance sheet(资产负债表)Balance sheet是一份会计报表,用于呈现企业在特定时间点上的资产、负债和所有者权益的情况。

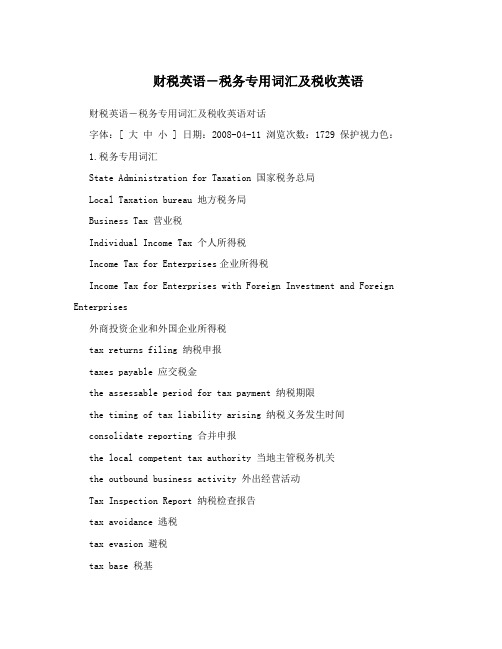

财税英语-税务专用词汇及税收英语

财税英语-税务专用词汇及税收英语财税英语-税务专用词汇及税收英语对话字体:[ 大中小 ] 日期:2008-04-11 浏览次数:1729 保护视力色:1.税务专用词汇State Administration for Taxation 国家税务总局Local Taxation bureau 地方税务局Business Tax 营业税Individual Income Tax 个人所得税Income Tax for Enterprises企业所得税Income Tax for Enterprises with Foreign Investment and Foreign Enterprises外商投资企业和外国企业所得税tax returns filing 纳税申报taxes payable 应交税金the assessable period for tax payment 纳税期限the timing of tax liability arising 纳税义务发生时间consolidate reporting 合并申报the local competent tax authority 当地主管税务机关the outbound business activity 外出经营活动Tax Inspection Report 纳税检查报告tax avoidance 逃税tax evasion 避税tax base 税基refund after collection 先征后退withhold and remit tax 代扣代缴collect and remit tax 代收代缴income from authors remuneration 稿酬所得income from remuneration for personal service 劳务报酬所得income from lease of property 财产租赁所得income from transfer of property 财产转让所得contingent income 偶然所得resident 居民non-resident 非居民tax year 纳税年度temporary trips out of 临时离境flat rate 比例税率withholding income tax 预提税withholding at source 源泉扣缴State Treasury 国库tax preference 税收优惠the first profit-making year 第一个获利年度refund of the income tax paid on the reinvested amount 再投资退税export-oriented enterprise 出口型企业technologically advanced enterprise 先进技术企业Special Economic Zone 经济特区2. 税收英语对话――营业税标题:能介绍一下营业税的知识吗TOPIC: Would you please give the general introduction of the business tax?对话内容:纳税人:我公司马上就要营业了,能介绍一下营业税的知识吗?Taxpayer: my company will begin business soon, but I have little knowledgeabout the business tax. Can you introduce it?税务局:尽我所能吧!一般地说,提供应税业务、转让无形资产和出卖不动产都要交纳营业税。

税务专用词汇及税收英语对话

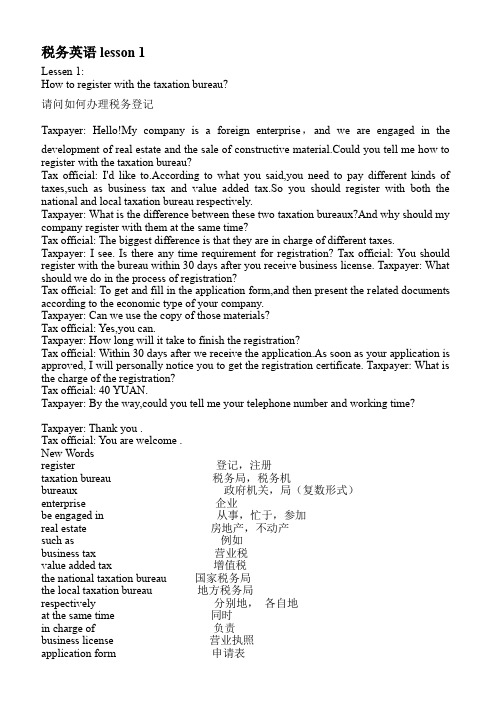

税务英语lesson 1Lessen 1:How to register with the taxation bureau?请问如何办理税务登记Taxpayer: Hello!My company is a foreign enterprise,and we are engaged in the development of real estate and the sale of constructive material.Could you tell me how to register with the taxation bureau?Tax official: I'd like to.According to what you said,you need to pay different kinds of taxes,such as business tax and value added tax.So you should register with both the national and local taxation bureau respectively.Taxpayer: What is the difference between these two taxation bureaux?And why should my company register with them at the same time?Tax official: The biggest difference is that they are in charge of different taxes. Taxpayer: I see. Is there any time requirement for registration? Tax official: You should register with the bureau within 30 days after you receive business license. Taxpayer: What should we do in the process of registration?Tax official: To get and fill in the application form,and then present the related documents according to the economic type of your company.Taxpayer: Can we use the copy of those materials?Tax official: Yes,you can.Taxpayer: How long will it take to finish the registration?Tax official: Within 30 days after we receive the application.As soon as your application is approved, I will personally notice you to get the registration certificate. Taxpayer: What is the charge of the registration?Tax official: 40 YUAN.Taxpayer: By the way,could you tell me your telephone number and working time? Taxpayer: Thank you .Tax official: You are welcome .New Wordsregister 登记,注册taxation bureau 税务局,税务机bureaux 政府机关,局(复数形式)enterprise 企业be engaged in 从事,忙于,参加real estate 房地产,不动产such as例如business tax 营业税value added tax 增值税the national taxation bureau 国家税务局the local taxation bureau 地方税务局respectively 分别地,各自地at the same time 同时in charge of 负责prescribe 规定according to 根据registration certificate 登记证approve 认可,批准,同意You are welcome. 别客气!税务英语lesson 2Lessen 2:The declaration is far more important than I have expected!纳税申报比我想象的重要的多!Tax official: Hello.You look unhappy. What can I do for you?Taxpayer: My company has been fined because we didn't file the tax returns.But we have not got any income at all.Tax official: Well,according to the Chinese law,the taxpayer must file its taxreturns within the prescribed time,no matter whether it has business income.Taxpayer: If both the tax payment and tax declaration are overdue,what will happen?Tax official: The taxation bureau will set a new deadline for the declaration and impose a fine on the taxpayer.Also at the same time,the taxation bureau will levy a overdue payment per day equal toO.2%of the overdue tax.Taxpayer: What will happen if the taxpayer files false tax returns?Tax official: If it is on purpose,it will be regarded as tax evasion. If the amount does not exceed certain limit,the taxpayer will be fined within five times as much as the amount.If the case reaches the criminal limit,we will also find out the taxpayer's criminal responsibility.Taxpayer: What is the criminal limit?Tax official: The amount exceeds ten thousand YUAN and exceeds 1O%of the amount that he should declare.The taxpayer will also be charged as criminal if he files falsely again after receiving administrative penalties twice due to false declaration. Taxpayer: What will happen then?Tax official: The taxpayer will be traced about his criminal responsibility in addition to the fine.before.What is the deadline for it?Tax official: It depends on different taxes.For business tax,it is due within the first 10 days of the following month. For individual income tax,it is within the first 7 days. If the deadline is the vacation or holiday,it can be put offinturn.Taxpayer: What you have said is very importanttous.I wish that we would not be fined again.Taxofficial: I hope so.New Wordsdeclaration 申报taxreturn 纳税申报表fine 罚款no matter 不论(连词)business income 营业所得,营业收入deadline 截止的期限impose on 加征(税,义务等)于levy on 征收,征集,强迫收集overdue payment 滞纳金overdue 过期的,过时的equal 相同的,相等的be equal to 与……相同on purpose 故意地regard as 视作,认为tax evasion 逃税,偷税,漏税exceed 超过……的范围find out 追查criminal responsibility 刑事责任penalty 处罚,罚款due to 由于,起因于responsibility 责任,职责in addition to 除了trace 追查,追究put off 延期,推迟in turn 依次,接连地individual income tax 个人所得税税务英语lesson 3Lessen 3:Could you give me some introduction of the business tax?Taxpayer: My company will begin business soon.Could you give me some introduction of the business tax?Tax official: OK.Generally speaking,the business tax is levied on the taxable service,the transfer of intangible asset and the sale of the real estate in China.Taxpayer: What is the taxable service? .Tax official: It is clearly stipulated in the tax law, such as transportation, construction, finance and insurance,post and tele-communication,culture and sport,entertainment and service.However it does not include the processing,repair and replace- ment service,because they are subject to the value added tax.Taxpayer: It is easy to understand the real estate,but what is the intangible asset?Tax official: It means the asset that is not in the form of material object but can bring profit,such as patent right,know-how,copyright,trade mark right and the land-useright,etc.Tax officid: In most case,it is the total income received,including additional fees and charges.Taxpayer: Does that include the income received in advance?Tax official: Yes,it is in the transfer of land-use right and immovable property. Taxpayer: And what about the donation?Tax official: The donation of immovable property is considered as sale,and the taxation bureau will verify the taxable income.Taxpayer: What should we do if we receive income in foreign currency?Tax official: For the financial institutions,the income will be conversed to RMB at the exchange rate of either the date on which the taxable item happened or the end of the quaner.If your company is not a financial institution,your income will be conversed into RMB at the exchange rate of either the date on which the taxable item happened or the first day of the month.Taxpayer: How about the tax rate?Tax official: In general,the rate is from 3% t05%. For the entertainment,it is from 5% to 20%.Taxpayer: What you have said is very helpful,thank you.New Wordsgenerally speaking 一般地说,一般而言taxable 应纳税的,可征税的service 劳务,服务transfer 转让,让与,转移intangible asset 无形资产stipulate 规定,订定transportation 交通运输finance 金融insurance 保险post and tele-communication 邮电通信culture 文化entertainment 娱乐be subject to 应服从…,应受制于… profit 利润patent right 专利权know-how 专有技术,技术秘密copyright 版权,着作权trade mark 商标land-useright 土地使用权etc 等等taxable income 应税收入,计税收入in advance 预先donation 捐赠,赠送verify 核定foreign currency 外币,外汇financial institution 金融机构converse 换算,兑换quarter 季度exchange rate 汇率item 项目税务英语lesson 4Lessen 4:How to pay business tax for leasing?租赁财产怎样纳营业税Taxpayer: Hello,I am from a for-eign company,would you tell me something about how to pay business tax for leasing?Tax official: I'd like to.Can you tell me what kind of property your company wants to lease?Taxpayer: We have not decided yet,is that important?Tax official: Yes,it is very important.If your company leases movable property and in China sets up organizations related to leasing,your company should pay tax. Taxpayer: Do you mean the representative office by organization?Tax official: Not only the representative office,it also includes the management and business organization,workingplace and the agent.Taxpayer: I see. What about leasing intangible asset?Tax official: If the intangible asset is used in China,the leasing operation is taxable,no matter whether the company has organizations in China.So is leasing immovable property, if the property is located in China.Taxpayer: Any other requirement?Tax official: When calculating the taxable income,we should distinguish the financial leasing from the operational leasing.Taxpayer: what is the financial leasing?Tax official: It means that the leasing operation has a financial nature and the ownership of the leased property will ultimately be passed to the borrower at the end of the leasing period.In this case,the taxable income is the net value calculated by deducting the real cost of the leased asset from the whole income (includingad-ditional fees).Taxpayer: The operational leasing does not involve the ownership,is that right?operational leasing is taxable.Taxpayer: How about the tax rate?Tax official: It is 5%.Taxpayer: Thank you very much.New Wordslease 租赁property 财产movable property 动产set up 设立,建立organization 机构,团体representative office 代表处working place 作业场所,生产区域agent 代理人financial lease 金融租赁operational lease 经营租赁nature 性质,特征ownership 所有权deduct 扣除,减除realcost 实际成本involve 涉及税务英语lesson 5Lessen 5:How do we beneficially invest the land-use right?怎样投资土地使权才合算Taxpayer: Our company is engaged in development of real estate. Recently,we planed to cooperate with another company to build houses.I would like to know something about paying business tax forit.Tax official: Can you explain your plan in detail?Taxpayer: My company provides the land-use right and the other party invests the money needed. At the end of project,my company will get a part of the houses.Tax official: This means that your company exchanges the land- use right for the ownership of the houses.In this case,for transfering the intangible asset,your company should pay business tax,equal to 5% of the transfering income.lf you want to resell that part of the houses,you need to pay business tax and the land appreciation tax(LAT)again for the transfer of immovable property.Taxpayer: How do we determine the taxable income if the transfer does not conduct in form of currency?Tax official: The taxation bureau will refer to the local similar price or the cost of houses to decide your income.Taxpayer: Will it be profitable if the two companies establish joint venture?Tax official: Do you mean that you invest the right as your shares in the joint venture? Taxpayer: Yes.Tax official: It depends.If your company and your partner share profits,risks and losses in proportion to respective shares,you do not pay business tax for the transfer of intangible asset.The joint venture will pay the business tax and the land appreciation tax on selling houses.Taxpayer: If we do not involve in management and only receive income or dividends in a proportion or in a solid amount,should we pay tax?Tax official: In this case,your company is not considered as real contribution,so you should pay tax as the above.Taxpayer: It looks like more beneficial that we establish the formal stock company.New Wordscooperate 合作,协力,相配合in detail 仔细,详细the land appreciation tax(LAT) 土地增值税refer to 根据,参考joint venture 合资企业share 股份(名词) 分担,分享(动词)proportion 比例in proportion to 按……的比例respective 各自的,个别的involve 使卷入,使参与dividend 股息,资本红利solid 固定的contribution 出资入股as the above 如上所述stock company 股份公司税务英语lesson 6Lessen 6:How to pay taxes for the transfer of equity?股权转让怎么纳税Taxpayer: Hello, may I ask you a question?Taxofficial: You are Welcome.Taxpayer: Well,we are planning to combine with another foreign company,and I want toTax official: It will depend on the way that the equity came into being.Taxpayer: I do not understand it.Taxofficial: Well,as you know,there are three ways to form the equity,namely intangible asset,immovable property and other forms,such as money,labor,etc. Only in the last case,the transfer of equity is exempt from taxation.Taxpayer: Can you explain the other two cases in detail?Taxofficial: There are different tax treatments in these two cases. For the first case,it is actually the transfer of intangible asset, so the business tax is exempt if it is transferred for free.Taxpayer: How about the second case?Taxofficial: For the transfer of immovable property, business tax will be levied on no matter whether it is free or not.Taxpayer: If it is for free, how do we determine the taxable income?Taxofficial: The taxation bureau will assess and determine it.Taxpayer: By the way,should we pay enterprise income tax if we received net income by the transfer?Taxofficial: I think so,but it is subject to the national taxation bureau.Finally,I would like to remind you to pay stamp tax on the contract of transfer.New wordsequity 股本权益,股权combinewith 与……合并exempt from 免除的,没有义务的treatment 对待,处置,处理for free 免费的,无偿的assess and determine 核定remind 提醒stamp tax 印花税Contract 合同税务英语lesson 7Lessen 7:Does your headquarter deal in self-employed trade?总机构是自营贸易吗Taxpayer: Welcomed to our representa-tive office.Have you received our application for tax exemp-tion presented by us?Taxofficial: Yes,we have.But I would like to know some detailed situa-tions of your company.Taxpayer: Well,let me introduce my office first. We provide liaison service in China for our headquarter.Tax official: Have you accept the consignment from other companies including the clients of your headquarter?Taxpayer: No, we have not .Tax official: Do you sign contract in China on behalf of your headquarter?Taxpayer: No, we have not either .Tax official: Can you provide the selling contract and invoice of your headquarter? Taxpayer: Yes.Tax official: Ok.Is your headquarter a group company?Taxpayer: No.Tax official: Is it an equity controlling company?Taxpayer: No.Tax Official: What is the business scope?Taxpayer: The trade in the field Of telecommunication.Tax official: Is the trade self-employed?Taxpayer: Yes.Tax official: Can you provide the contract signed between your headquarter and the foreign maker?Taxpayer: Yes,here is the copy.Tax official: Thank you. Well,from the date of signing the contract,I think that the selling is earlier than the purchasing.It means that your headquarter does not sell the product owned by itself and the transaction is not self-employed trade.New Wordsdeal in 经营,买卖self-employed trade 自营贸易application 申请situation 状况,事态,情况liaison 联络headquarter 总公司,总部consignment 委托,寄售on behalf of 代表,为了的利益invoice 发票,装货清单group company 集团公司controlling company 控股公司sign 签定税务英语lesson 8Lessen 8:How many ways to tax on the representative 0ffice?对代表处的征税方法有几种Taxpayer: Our representative office has been set up recently. Can you introduce the method of taxing on the representative office?Tax official: Yes. Generally speaking, there are three ways of taxation, namely declaration, verification, and conversion.Taxpayer: Which kind of office is applicable for declaration?Tax official: It is the one that can provide the whole materials about the contracts and commissions and can establish account books to make the receipt and expense clear.Taxpayer: We can do like that. But sometimes we serve the clients without recording commissions separately, what shall we do ?Tax official: In agency operation , commissions are calculated as the price difference of selling and purchasing .Taxpayer: Some contracts indicate the commissions orpice difference , but some do not .Tax official: In this case, if you can provide the whole contract documents, which introduce the bargain in China ,the taxable commissions can be calculated as 3% of the whole contract turnover.Taxpayer: I see .By the way , some service are provided for the clients in cooperation with the headquarter. My question is whether the service provided out of China can be exempt? Tax official: Yes. As long as you can provide valid proof, and divide correctly the commissions shared by office and headquarter respectively. Otherwise your office is applicable for the method of conversion.Taxpayer: What is conversion?Tax official: Well, since we can not acquire necessary materials, we can calculate your taxable income from your expense .Taxpayer: I see. Are there any other kinds of representative office applicable for this method?Tax official: Those that cannot determine whether their operations are taxable ,and those that can not correctly declare.Taxpayer: How can you decide the way in which our office will be taxed ?Tax official: You can apply according to the former introduction and your situation, and we will decide it after verification .New Wordsdeclaration 申报verification 核定,核算;核实conversion 换算be applicable for 对……适用的commission 佣金account book 帐簿receipt 收入agency operation 代理业务price difference 差价turnover 营业额,销售额bargain 契约,合同,交易valid 有效的,经过正当手续的,正当的,有根据的Proof 证据,依据税务英语lesson 9Lessen 9:How does the board president pay personal income tax ?董事长的所得如何纳税Tax official: Can I help you ?Taxpayer: Yes ,I am the board president of ABC company. I would like to know something about paying my personal income tax.Tax official: Can you explain you conditions in detail ? I have an obligation to keep secret for the taxpayer .Taxpayer: I obtain my income in the form of director's fees and dividends .Tax official: Do you have any management position?Taxpayer: No. But the general manager has always been abroad, so I am actually responsible for the operation in China.Tax official: According to what you said, in fact you play the role of general manager. Taxpayer: What do you mean ?Tax official: I mean that your personal income actually includes three parts: director's fees, dividends and salary of general manager.Taxpayer: How do I pay tax on it ?Tax official: Can you provide the regulation of your company and the agreement of board of directors ?Taxpayer: Yes , I can .Tax official: Are you American? Well, the dividends obtained by a foreigner are exempt from taxation .Taxpayer: Oh, that is good.Tax official: The leftparts of your income should be divided into director's fees and salaries.Taxpayer: How do you determine the salaries? After all, I do not receive salaries directly from my company.Tax official: We can refer to the salary level in the same area, in the similar industry or in the enterprise with similar scale.Taxpayer: I know a little about levying tax on salary, but how do I pay tax on director's fees?Tax official: The director's fees are regarded as remuneration and taxed in the way remuneration is taxed.Taxpayer: What is the difference between the tax on salary and the tax on remuneration? Tax official: They are different in tax rate and deduction.Now Wordsboard president 董事长personal income tax 个人所得税obligation 职责,责任keep secret 保密director's fee 董事费dividend 分红,资本红利;股息position 职位the general manager 总经理abroad 在国外in facts 事实上regulation 章程board of directors 董事会refer to 参考,参照scale 规模remuneration 酬劳,报酬deduction 扣除税务英语lesson 10Lessen 10:Should l pay tax on my income from oversea?我的境外收入纳税吗Taxpayer: Excuse me,I am the chiefrep-resentative of the Beijing office of Japanese ABC company.My question is whether I should pay personal income tax on my income from Japan?Tax official: Well,it depends on how long you have been in China.Taxpayer: can you explain it in detail?Taxofficial: Any individual who has resided in China for less than one year will only need to pay tax on his domestic income.Income from oversea will not be taxed on. Taxpayer: What will happen if one have resided in China for a full year?Tax official: First,the concept of one full year is that one has resided in China for full 365days , not deducting temporary exit.Taxpayer: What is the meaing of the temporary exit?Tax official: The temporary exit means that any individual has left China for less than 3O days one time and for less than 90 days altogether.Taxpayer: I see.Tax official: If any individual has resided in China for more than one year but less than 5 years, he needs to pay tax on the income from oversea but paid within China. Taxpayer: What if I have resided in China for more than 5 years?Tax official: It depends on different conditions in the sixth year.Taxpayer: Can you explain it?Tax official: If you have resided in China for another full year after 5 successive full years ,you will pay tax for all your income including the income from oversea. If the sixth year is not full,the income from oversea is exempt;If less than 90 days ,the period of five year will be recounted.Taxpayer: My nationality is Japan. If I must pay tax on all sources of income in both China and Japan,what should I do?Tax official: In this case,you should provide the detailed information and rely on the negotiation made by the two countries.Taxpayer: I appreciate your explanation . Thank you .New Wordschiefrepresentatlve 首席代表domestic 国内的,境内的reside 居留,居住deduct 扣除temporary 临时的,暂时的exit 离境successive 连续的nationality 国籍appreciate 感激,重视negotiation 协商,商议,谈判税务英语lesson 11Lessen 11:Which kind of subsidy can be exempt from taxation?哪些补贴可以免税Tax official: Hello!This is the foreign taxation bureau.Taxpayer: Hello! This is George Brown from ABC company. I'd like to speak to Mr.Li. Tax official: Hold the line, please.Mr.Li. : Li Tong speaking .What can I help you ,Brown?Taxpayer: I have a question to consult with you . Is the subsidy taxed on like salary? Mr.Li. : It is different from salary, and there are many exemptions for the foreigners . Taxpayer: Could you explain it in detail?Mr.Li. : Subsidies, such as house ,meal, and laundry allowance, are exempt ,as long as they are not paid by cash and can be reimbursed for the actual expenses.Taxpayer: What about the moving house fee happening in the course of leaving office ? Mr.Li. : The amount actually happening can be exempt, but it is unreasonable if the money is paid every month in the name of moving house.Taxpayer: How about the allowance of trip on business?Mr.Li. : If you can provide the accurate evidences to the fares and lodging fees and can present the related stipulation of your company, it can be exempt.Taxpayer: Does that include the allowance of trip abroad?Mr.Li. : Yes.Taxpayer: Is the home leave fare exempt from taxation?Mr.Li. : If it is for an expatriate himself and both the amount and the frequency every year are considered reasonable, it can be exempt .Taxpayer: What about the language training and children education fees?Mr.Li. : If the expenses happen within China and the amount is reasonable , they can be exempt .Taxpayer: Thank you for your help. Bye for now .Mr.Li. : Bye .New Wordsthe foreign taxation bureau 涉外分局hold the line 请稍等(电话用语) subsidy 补助金,津贴allowance 津贴,补偿be reimbursed for the actual expense 实报实销move house 搬家in the course of 在……的过程中leave office 去职,离职in the name of 以……的名义on business 出差fare 车费,船费lodging fee 住宿费stipulation 规定home leave 探亲expatriate 居于国外之人,侨民frequency 频率中文对照:税务英语lesson 12Lessen 12:How does the foreign actor pay tax when performing in China?境外明星来华演出如何纳税Lawyer: Mr.George Brown is a famous American singer.As his lawyer,I was entrusted to consult how to pay tax on his performing in China.Tax official: Is he in the name of group or himself?Lawyer: Is there any difference?Tax official: Yes.Some treatments are same,and some are different.Lawyer: Can you explain it in detail?Tax official: Both are the same in paying business tax.The tax-able income is calculated as gross income minus the expense paid to the performance place,the performance company and the agent.The tax rate is 3%.Lawyer: What about the income tax?Tax official: In the case of group,the group should pay enterprise income tax. If the group can establish account books and make the receipts and expenses clear,the actor should pay personal income tax on the salary paid by the group.Taxpayer: What will happen if the group's account book fails to meet the requirement?Tax official: In this case,the taxation bureau will assess the taxable income, Since the expense has been considered in the assessment,the actor will not pay personal income tax. Lawyer: What about in the name of himself?Tax official: First,he should pay business tax on his total income. Then he should pay personal income tax on his remuneration. Can you give me some detailed materials about the personal income tax?Tax official: Sure.Lawyer: By the way,should the actor declare the prsonal income tax on the place ofTax official: Yes.He can file the tax return on the place of performance,or the performance company can withhold the tax when it pays salary to the actor.New Wordsentrust 委托minus 减去enterprise income tax 企业所得税fail to 不能够,没能够declare 申报withhold 扣留,扣款,扣除税务英语lesson 13Lessen 13:Can you give me some directions to fill in the tax return form?能指点我填写申报表吗Tax official: What can I do for you?Taxpayer: It is my first time to file the tax return.Can you give me any direction?Tax official: My pleasure. Look, please fill in your name,nationality and tax code here. Taxpayer: Can I use your pen? Thank you.ok.Tax official: Then please fill in your working unit and telephone number here. And your position?Taxpayer: Permanent representative.Tax official: Ok,please fill in your position here. And have you any part-time job? Taxpayer: No, I have not. Should I fill in the salary and bonus respectively?Tax official: Yes. Please indicate the period in which you made your income. And the income received in different currency should be also filled in respectively.Taxpayer: I had been back to my motherland temporary,shall I indicate it?Tax official: Yes,you should make clear the date of departure and the date when you came back.Taxpayer: Need I calculate the tax amount by myself ?Tax official: No, you needn't .Our computer can do it using the information you fill in. Taxpayer: That is great .Tax official: Please make sure all the items written in the form again, and then put on your signature or signethere .Taxpayer: All right .Tax official: Please deposit your tax money in the bank before the prescribed time . Taxpayer: Cash or check ?Tax official: Both will do .You can deposit the cash in any branch of the Industrial and Commercial Bank .If you use check, you should go to the bank in which you open your bank account .Taxpayer: Where is the nearest branch of the Industrial and Commercial Bank ?Tax official: Go west to the crossroads, then turn to the south ,and the branch is about 100 meter ahead on the western side of the road.New Wordsdirection 说明,指导,指引my pleasure 非常愿意,十分乐意tax code 纳税编码working unit 工作单位signature 签名signet 签章deposit 存款;押金;保证金branch 分支行,分理处Industrial and Commercial Bank 工商银行crossroads 十字路口税务英语lesson 14Lessen 14:I overpaid the tax last month.我上月的税款多缴了Taxpayer: Can you tell me which department is in charge of tax refund?Tax official: Please go to Room 1107 and look for Mr.Li.Taxpayer: Is Mr.Li here?Mr.Li: I am Li e in and sit down please.What can I do for you?Taxpayer: I overpaid the personal income tax last month.Mr.Li: Can you explain it in detail?Taxpayer: I am a Chinese employee in a foreign investment enterprise. I had been sent abroad to work for aperiod of time. Last month when I calculate the personal income tax, I did not separate the domestic income from the income from oversea.Mr.Li: The deduction for income from oversea should be RMB 4000,but you used RMB 800. Is that right?Taxpayer: Yes.That is what I mean.Mr. Li: First please register and get the application form. Then write clearly the reasons and fill in all the columns by referring to the instruction.Taxpayer: Are there any other materials needed ?Mr. Li: In addition to the application form, you need to provide the tax payment bill of last month .Taxpayer: Original or copy?Mr. Li: Both .。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

The Federal Unemployment Tax Act (FUTA) tax The state tax

FUTA currently imposes a 6.2% on the first $7000 paid annually by covered employers to each employee

Main issues on Federal payroll taxes

Progressive

–

vs. regressive

Flat rate – Maximum taxable earnings base

Main issues on Federal payroll taxes In an effort to increase the progressivity of Social Security, the earned income tax credit (EITC) was introduced in 1975 Tax burden of middle class groups

(3) Unemployment insurance

Unemployment insurance (UI) payroll taxes are used to finance unemployment benefits for workers involuntarily unemployed There are two parts to the UI payroll taxes

5.1 Overview of social security contribution

Tax rates are generally fixed, but a different rate may be imposed on employers than on employees. Some systems provide an upper limit on earnings subject to the tax. A few systems provide that the tax is payable only on wages above a particular amount. Such upper or lower limits may apply for retirement but not health care components of the tax.

5.2 Payroll taxes in U.S. (federal)

Federal programs that provide benefits for retirees, the disabled, and children of deceased workers. Social Security benefits include old-age, survivors, and disability insurance (OASDI); Medicare provides hospital insurance benefits for the elderly. The amount that one pays in payroll taxes throughout one's working career is associated indirectly with the social security benefits annuity that one receives as a retiree

5.1 Overview of social security contribution

Many countries provide publicly funded retirement or health care systems. In connection with these systems, the country typically requires employers and/or employees to make compulsory payments. These payments are often computed by reference to wages or earnings from selfemployment.

5.3 The national insurance contribution in UK

the scope of national insurance

1 Scope of national insurance contribution (NIC) Class 1.

(1)

(2)

(a)

Primary, paid by employees Secondary:

5.2 Payroll taxes in U.S. (federal)

Federal payroll taxes, or social insurance contributions, consist of tax revenues from:

–

– –

–

Social Security, Medicare hospital insurance, Unemployment insurance, Railroad retirement, and other retirement

Social security contributions are actual contributions receivable by social security schemes organized and operated by government units for the benefit of the contributors to the scheme.

Chapter 5 Social security

contribution

Overview of social security contribution The payroll tax in U.S. The national insurance contribution in UK

Chapter 5 Social security contribution

(4) Railroad retirement

The retirement system has two tiers that are financed by federal payroll taxes

–

–

The tier 1 tax rate is equivalent to the combined social security and Medicare HI tax rate, both employee and employer pay taxes on covered wages up to the applicable maximum taxable earnings. Under tier 2, the employer‟s contributions are much greater.

Social security comprises the lion‟s share of federal payroll taxes

(1) Social Security

Social Security ( OASDI, or Old Age, Survivors, and Disability Insurance) began in the late 1930s as a mandatory old-age insurance program for most employees in the private sector Over time, the program was expanded to include disability insurance and mandatory coverage for almost all workers

5.2 Payroll taxes in U.S. (federal)

Federal Insurance Contributions Act (FICA) tax is a United States Federal payroll (or employment) tax imposed on both employees and employers to fund Social Security and Medicare.

(2) Medicare hospital insurance (HI)

This program is financed primarily through payroll taxes, provides hospitalization benefits to eligible persons The HI tax rate is 1.45 percent on all covered earnings Both the employee and the employer pay this tax rate, and self-employed persons pay the combined tax rate.

(1) Social Security

Benefits earned by covered workers are financed primarily by a payroll tax on a worker‟s wages Both the employee and the employer pay taxes based on the worker‟s earnings up to a maximum amount or taxable maximum earnings base