公司理财第九版课后练习14

Cha04 罗斯公司理财第九版原版书课后习题

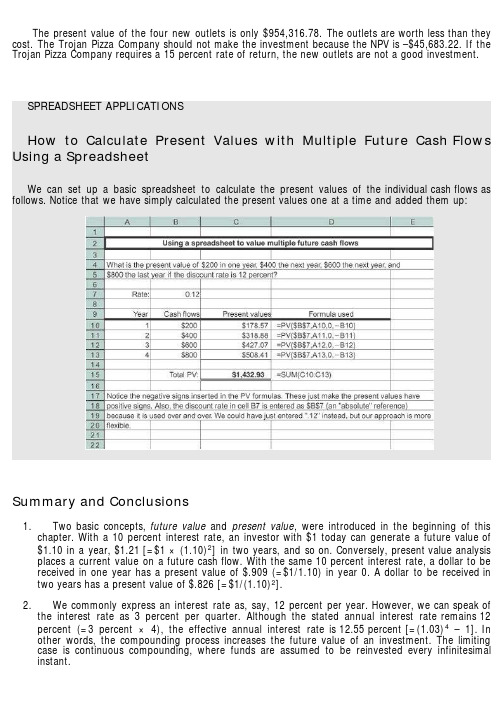

The present value of the four new outlets is only $954,316.78. The outlets are worth less than they cost. The Trojan Pizza Company should not make the investment because the NPV is –$45,683.22. If the Trojan Pizza Company requires a 15 percent rate of return, the new outlets are not a good investment.SPREADSHEET APPLICATIONSHow to Calculate Present Values with Multiple Future Cash Flows Using a SpreadsheetWe can set up a basic spreadsheet to calculate the present values of the individual cash flows as follows. Notice that we have simply calculated the present values one at a time and added them up:Summary and Conclusions1. Two basic concepts, future value and present value, were introduced in the beginning of thischapter. With a 10 percent interest rate, an investor with $1 today can generate a future value of $1.10 in a year, $1.21 [=$1 × (1.10)2] in two years, and so on. Conversely, present value analysis places a current value on a future cash flow. With the same 10 percent interest rate, a dollar to be received in one year has a present value of $.909 (=$1/1.10) in year 0. A dollar to be received in two years has a present value of $.826 [=$1/(1.10)2].2. We commonly express an interest rate as, say, 12 percent per year. However, we can speak ofthe interest rate as 3 percent per quarter. Although the stated annual interest rate remains 12 percent (=3 percent × 4), the effective annual interest rate is 12.55 percent [=(1.03)4 – 1]. In other words, the compounding process increases the future value of an investment. The limiting case is continuous compounding, where funds are assumed to be reinvested every infinitesimal instant.3. A basic quantitative technique for financial decision making is net present value analysis. Thenet present value formula for an investment that generates cash flows (C i) in future periods is:The formula assumes that the cash flow at date 0 is the initial investment (a cash outflow).4. Frequently, the actual calculation of present value is long and tedious. The computation of thepresent value of a long-term mortgage with monthly payments is a good example of this. We presented four simplifying formulas:5. We stressed a few practical considerations in the application of these formulas:1. The numerator in each of the formulas, C, is the cash flow to be received one full periodhence.2. Cash flows are generally irregular in practice. To avoid unwieldy problems, assumptions tocreate more regular cash flows are made both in this textbook and in the real world.3. A number of present value problems involve annuities (or perpetuities) beginning a fewperiods hence. Students should practice combining the annuity (or perpetuity) formula withthe discounting formula to solve these problems.4. Annuities and perpetuities may have periods of every two or every n years, rather thanonce a year. The annuity and perpetuity formulas can easily handle such circumstances.5. We frequently encounter problems where the present value of one annuity must beequated with the present value of another annuity.Concept Questions1. Compounding and Period As you increase the length of time involved, what happens tofuture values? What happens to present values?2. Interest Rates What happens to the future value of an annuity if you increase the rate r?What happens to the present value?3. Present Value Suppose two athletes sign 10-year contracts for $80 million. In one case, we’retold that the $80 million will be paid in 10 equal installments. In the other case, we’re told that the $80 million will be paid in 10 installments, but the installments will increase by 5 percent per year.Who got the better deal?4. APR and EAR Should lending laws be changed to require lenders to report EARs instead ofAPRs? Why or why not?5. Time Value On subsidized Stafford loans, a common source of financial aid for collegestudents, interest does not begin to accrue until repayment begins. Who receives a bigger subsidy,a freshman or a senior? Explain.Use the following information to answer the next five questions:Toyota Motor Credit Corporation (TMCC), a subsidiary of Toyota Motor Corporation, offered some securities for sale to the public on March 28, 2008. Under the terms of the deal, TMCC promised to repay the owner of one of these securities $100,000 on March 28, 2038, but investors would receive nothing until then. Investors paid TMCC $24,099 for each of these securities; so they gave up $24,099 on March 28, 2008, for the promise of a $100,000 payment 30 years later.6. Time Value of Money Why would TMCC be willing to accept such a small amount today($24,099) in exchange for a promise to repay about four times that amount ($100,000) in the future?7. Call Provisions TMCC has the right to buy back the securities on the anniversary date at aprice established when the securities were issued (this feature is a term of this particular deal).What impact does this feature have on the desirability of this security as an investment?8. Time Value of Money Would you be willing to pay $24,099 today in exchange for $100,000 in30 years? What would be the key considerations in answering yes or no? Would your answerdepend on who is making the promise to repay?9. Investment Comparison Suppose that when TMCC offered the security for $24,099 the U.S.Treasury had offered an essentially identical security. Do you think it would have had a higher or lower price? Why?10. Length of Investment The TMCC security is bought and sold on the New York StockExchange. If you looked at the price today, do you think the price would exceed the $24,099 original price? Why? If you looked in the year 2019, do you think the price would be higher or lower than today’s price? Why?Questions and Problems: connect™BASIC (Questions 1–20)1. Simple Interest versus Compound Interest First City Bank pays 9 percent simple intereston its savings account balances, whereas Second City Bank pays 9 percent interest compounded annually. If you made a $5,000 deposit in each bank, how much more money would you earn from your Second City Bank account at the end of 10 years?2. Calculating Future Values Compute the future value of $1,000 compounded annually for1. 10 years at 6 percent.2. 10 years at 9 percent.3. 20 years at 6 percent.4. Why is the interest earned in part (c) not twice the amount earned in part (a)?3. Calculating Present Values For each of the following, compute the present value:4. Calculating Interest Rates Solve for the unknown interest rate in each of the following:5. Calculating the Number of Periods Solve for the unknown number of years in each of thefollowing:6. Calculating the Number of Periods At 9 percent interest, how long does it take to doubleyour money? To quadruple it?7. Calculating Present Values Imprudential, Inc., has an unfunded pension liability of $750million that must be paid in 20 years. To assess the value of the firm’s stock, financial analysts want to discount this liability back to the present. If the relevant discount rate is 8.2 percent, what is the present value of this liability?8. Calculating Rates of Return Although appealing to more refined tastes, art as a collectiblehas not always performed so profitably. During 2003, Sotheby’s sold the Edgar Degas bronze sculpture Petite Danseuse de Quartorze Ans at auction for a price of $10,311,500. Unfortunately for the previous owner, he had purchased it in 1999 at a price of $12,377,500. What was his annual rate of return on this sculpture?9. Perpetuities An investor purchasing a British consol is entitled to receive annual paymentsfrom the British government forever. What is the price of a consol that pays $120 annually if the next payment occurs one year from today? The market interest rate is 5.7 percent.10. Continuous Compounding Compute the future value of $1,900 continuously compounded for1. 5 years at a stated annual interest rate of 12 percent.2. 3 years at a stated annual interest rate of 10 percent.3. 10 years at a stated annual interest rate of 5 percent.4. 8 years at a stated annual interest rate of 7 percent.11. Present Value and Multiple Cash Flows Conoly Co. has identified an investment projectwith the following cash flows. If the discount rate is 10 percent, what is the present value of these cash flows? What is the present value at 18 percent? At 24 percent?12. Present Value and Multiple Cash Flows Investment X offers to pay you $5,500 per year fornine years, whereas Investment Y offers to pay you $8,000 per year for five years. Which of these cash flow streams has the higher present value if the discount rate is 5 percent? If the discount rate is 22 percent?13. Calculating Annuity Present Value An investment offers $4,300 per year for 15 years, withthe first payment occurring one year from now. If the required return is 9 percent, what is the value of the investment? What would the value be if the payments occurred for 40 years? For 75 years? Forever?14. Calculating Perpetuity Values The Perpetual Life Insurance Co. is trying to sell you aninvestment policy that will pay you and your heirs $20,000 per year forever. If the required return on this investment is 6.5 percent, how much will you pay for the policy? Suppose the Perpetual Life Insurance Co. told you the policy costs $340,000. At what interest rate would this be a fair deal? 15. Calculating EAR Find the EAR in each of the following cases:16. Calculating APR Find the APR, or stated rate, in each of the following cases:17. Calculating EAR First National Bank charges 10.1 percent compounded monthly on itsbusiness loans. First United Bank charges 10.4 percent compounded semiannually. As a potential borrower, to which bank would you go for a new loan?18. Interest Rates Well-known financial writer Andrew Tobias argues that he can earn 177percent per year buying wine by the case. Specifically, he assumes that he will consume one $10 bottle of fine Bordeaux per week for the next 12 weeks. He can either pay $10 per week or buy a case of 12 bottles today. If he buys the case, he receives a 10 percent discount and, by doing so, earns the 177 percent. Assume he buys the wine and consumes the first bottle today. Do you agree with his analysis? Do you see a problem with his numbers?19. Calculating Number of Periods One of your customers is delinquent on his accounts payablebalance. You’ve mutually agreed to a repayment schedule of $600 per month. You will charge .9 percent per month interest on the overdue balance. If the current balance is $18,400, how long will it take for the account to be paid off?20. Calculating EAR Friendly’s Quick Loans, Inc., offers you “three for four or I knock on yourdoor.” This means you get $3 today and repay $4 when you get your paycheck in one week (orelse). What’s the effective annual return Friendly’s earns on this lending business? If you were brave enough to ask, what APR would Friendly’s say you were paying?INTERMEDIATE (Questions 21–50)21. Future Value What is the future value in seven years of $1,000 invested in an account with astated annual interest rate of 8 percent,1. Compounded annually?2. Compounded semiannually?3. Compounded monthly?4. Compounded continuously?5. Why does the future value increase as the compounding period shortens?22. Simple Interest versus Compound Interest First Simple Bank pays 6 percent simpleinterest on its investment accounts. If First Complex Bank pays interest on its accounts compounded annually, what rate should the bank set if it wants to match First Simple Bank over an investment horizon of 10 years?23. Calculating Annuities You are planning to save for retirement over the next 30 years. To dothis, you will invest $700 a month in a stock account and $300 a month in a bond account. The return of the stock account is expected to be 10 percent, and the bond account will pay 6 percent.When you retire, you will combine your money into an account with an 8 percent return. How much can you withdraw each month from your account assuming a 25-year withdrawal period?24. Calculating Rates of Return Suppose an investment offers to quadruple your money in 12months (don’t believe it). What rate of return per quarter are you being offered?25. Calculating Rates of Return You’re trying to choose between two different investments, bothof which have up-front costs of $75,000. Investment G returns $135,000 in six years. Investment H returns $195,000 in 10 years. Which of these investments has the higher return?26. Growing Perpetuities Mark Weinstein has been working on an advanced technology in lasereye surgery. His technology will be available in the near term. He anticipates his first annual cash flow from the technology to be $215,000, received two years from today. Subsequent annual cash flows will grow at 4 percent in perpetuity. What is the present value of the technology if the discount rate is 10 percent?27. Perpetuities A prestigious investment bank designed a new security that pays a quarterlydividend of $5 in perpetuity. The first dividend occurs one quarter from today. What is the price of the security if the stated annual interest rate is 7 percent, compounded quarterly?28. Annuity Present Values What is the present value of an annuity of $5,000 per year, with thefirst cash flow received three years from today and the last one received 25 years from today? Usea discount rate of 8 percent.29. Annuity Present Values What is the value today of a 15-year annuity that pays $750 a year?The annuity’s first payment occurs six years from today. The annual interest rate is 12 percent for years 1 through 5, and 15 percent thereafter.30. Balloon Payments Audrey Sanborn has just arranged to purchase a $450,000 vacation homein the Bahamas with a 20 percent down payment. The mortgage has a 7.5 percent stated annualinterest rate, compounded monthly, and calls for equal monthly payments over the next 30 years.Her first payment will be due one month from now. However, the mortgage has an eight-year balloon payment, meaning that the balance of the loan must be paid off at the end of year 8. There were no other transaction costs or finance charges. How much will Audrey’s balloon payment be in eight years?31. Calculating Interest Expense You receive a credit card application from Shady BanksSavings and Loan offering an introductory rate of 2.40 percent per year, compounded monthly for the first six months, increasing thereafter to 18 percent compounded monthly. Assuming you transfer the $6,000 balance from your existing credit card and make no subsequent payments, how much interest will you owe at the end of the first year?32. Perpetuities Barrett Pharmaceuticals is considering a drug project that costs $150,000 todayand is expected to generate end-of-year annual cash flows of $13,000, forever. At what discount rate would Barrett be indifferent between accepting or rejecting the project?33. Growing Annuity Southern California Publishing Company is trying to decide whether to reviseits popular textbook, Financial Psychoanalysis Made Simple. The company has estimated that the revision will cost $65,000. Cash flows from increased sales will be $18,000 the first year. These cash flows will increase by 4 percent per year. The book will go out of print five years from now.Assume that the initial cost is paid now and revenues are received at the end of each year. If the company requires an 11 percent return for such an investment, should it undertake the revision? 34. Growing Annuity Your job pays you only once a year for all the work you did over theprevious 12 months. Today, December 31, you just received your salary of $60,000, and you plan to spend all of it. However, you want to start saving for retirement beginning next year. You have decided that one year from today you will begin depositing 5 percent of your annual salary in an account that will earn 9 percent per year. Your salary will increase at 4 percent per year throughout your career. How much money will you have on the date of your retirement 40 years from today?35. Present Value and Interest Rates What is the relationship between the value of an annuityand the level of interest rates? Suppose you just bought a 12-year annuity of $7,500 per year at the current interest rate of 10 percent per year. What happens to the value of your investment if interest rates suddenly drop to 5 percent? What if interest rates suddenly rise to 15 percent?36. Calculating the Number of Payments You’re prepared to make monthly payments of $250,beginning at the end of this month, into an account that pays 10 percent interest compounded monthly. How many payments will you have made when your account balance reaches $30,000? 37. Calculating Annuity Present Values You want to borrow $80,000 from your local bank tobuy a new sailboat. You can afford to make monthly payments of $1,650, but no more. Assuming monthly compounding, what is the highest APR you can afford on a 60-month loan?38. Calculating Loan Payments You need a 30-year, fixed-rate mortgage to buy a new home for$250,000. Your mortgage bank will lend you the money at a 6.8 percent APR for this 360-month loan. However, you can only afford monthly payments of $1,200, so you offer to pay off any remaining loan balance at the end of the loan in the form of a single balloon payment. How large will this balloon payment have to be for you to keep your monthly payments at $1,200?39. Present and Future Values The present value of the following cash flow stream is $6,453when discounted at 10 percent annually. What is the value of the missing cash flow?40. Calculating Present Values You just won the TVM Lottery. You will receive $1 million todayplus another 10 annual payments that increase by $350,000 per year. Thus, in one year you receive $1.35 million. In two years, you get $1.7 million, and so on. If the appropriate interest rate is 9 percent, what is the present value of your winnings?41. EAR versus APR You have just purchased a new warehouse. To finance the purchase, you’vearranged for a 30-year mortgage for 80 percent of the $2,600,000 purchase price. The monthly payment on this loan will be $14,000. What is the APR on this loan? The EAR?42. Present Value and Break-Even Interest Consider a firm with a contract to sell an asset for$135,000 three years from now. The asset costs $96,000 to produce today. Given a relevant discount rate on this asset of 13 percent per year, will the firm make a profit on this asset? At what rate does the firm just break even?43. Present Value and Multiple Cash Flows What is the present value of $4,000 per year, at adiscount rate of 7 percent, if the first payment is received 9 years from now and the last payment is received 25 years from now?44. Variable Interest Rates A 15-year annuity pays $1,500 per month, and payments are madeat the end of each month. If the interest rate is 13 percent compounded monthly for the first seven years, and 9 percent compounded monthly thereafter, what is the present value of the annuity? 45. Comparing Cash Flow Streams You have your choice of two investment accounts.Investment A is a 15-year annuity that features end-of-month $1,200 payments and has an interest rate of 9.8 percent compounded monthly. Investment B is a 9 percent continuously compounded lump-sum investment, also good for 15 years. How much money would you need to invest in B today for it to be worth as much as Investment A 15 years from now?46. Calculating Present Value of a Perpetuity Given an interest rate of 7.3 percent per year,what is the value at date t = 7 of a perpetual stream of $2,100 annual payments that begins at date t = 15?47. Calculating EAR A local finance company quotes a 15 percent interest rate on one-year loans.So, if you borrow $26,000, the interest for the year will be $3,900. Because you must repay a total of $29,900 in one year, the finance company requires you to pay $29,900/12, or $2,491.67, per month over the next 12 months. Is this a 15 percent loan? What rate would legally have to be quoted? What is the effective annual rate?48. Calculating Present Values A 5-year annuity of ten $4,500 semiannual payments will begin 9years from now, with the first payment coming 9.5 years from now. If the discount rate is 12 percent compounded monthly, what is the value of this annuity five years from now? What is the value three years from now? What is the current value of the annuity?49. Calculating Annuities Due Suppose you are going to receive $10,000 per year for five years.The appropriate interest rate is 11 percent.1. What is the present value of the payments if they are in the form of an ordinary annuity?What is the present value if the payments are an annuity due?2. Suppose you plan to invest the payments for five years. What is the future value if thepayments are an ordinary annuity? What if the payments are an annuity due?3. Which has the highest present value, the ordinary annuity or annuity due? Which has thehighest future value? Will this always be true?50. Calculating Annuities Due You want to buy a new sports car from Muscle Motors for$65,000. The contract is in the form of a 48-month annuity due at a 6.45 percent APR. What will your monthly payment be?CHALLENGE (Questions 51–76)51. Calculating Annuities Due You want to lease a set of golf clubs from Pings Ltd. The leasecontract is in the form of 24 equal monthly payments at a 10.4 percent stated annual interest rate, compounded monthly. Because the clubs cost $3,500 retail, Pings wants the PV of the lease payments to equal $3,500. Suppose that your first payment is due immediately. What will your monthly lease payments be?52. Annuities You are saving for the college education of your two children. They are two yearsapart in age; one will begin college 15 years from today and the other will begin 17 years from today. You estimate your children’s college expenses to be $35,000 per year per child, payable at the beginning of each school year. The annual interest rate is 8.5 percent. How much money must you deposit in an account each year to fund your children’s education? Your deposits begin one year from today. You will make your last deposit when your oldest child enters college. Assume four years of college.53. Growing Annuities Tom Adams has received a job offer from a large investment bank as aclerk to an associate banker. His base salary will be $45,000. He will receive his first annual salary payment one year from the day he begins to work. In addition, he will get an immediate $10,000 bonus for joining the company. His salary will grow at 3.5 percent each year. Each year he will receive a bonus equal to 10 percent of his salary. Mr. Adams is expected to work for 25 years.What is the present value of the offer if the discount rate is 12 percent?54. Calculating Annuities You have recently won the super jackpot in the Washington StateLottery. On reading the fine print, you discover that you have the following two options:1. You will receive 31 annual payments of $175,000, with the first payment being deliveredtoday. The income will be taxed at a rate of 28 percent. Taxes will be withheld when the checks are issued.2. You will receive $530,000 now, and you will not have to pay taxes on this amount. Inaddition, beginning one year from today, you will receive $125,000 each year for 30 years.The cash flows from this annuity will be taxed at 28 percent.Using a discount rate of 10 percent, which option should you select?55. Calculating Growing Annuities You have 30 years left until retirement and want to retirewith $1.5 million. Your salary is paid annually, and you will receive $70,000 at the end of the current year. Your salary will increase at 3 percent per year, and you can earn a 10 percent return on the money you invest. If you save a constant percentage of your salary, what percentage of your salary must you save each year?56. Balloon Payments On September 1, 2007, Susan Chao bought a motorcycle for $25,000. Shepaid $1,000 down and financed the balance with a five-year loan at a stated annual interest rate of8.4 percent, compounded monthly. She started the monthly payments exactly one month after thepurchase (i.e., October 1, 2007). Two years later, at the end of October 2009, Susan got a new job and decided to pay off the loan. If the bank charges her a 1 percent prepayment penalty based on the loan balance, how much must she pay the bank on November 1, 2009?57. Calculating Annuity Values Bilbo Baggins wants to save money to meet three objectives.First, he would like to be able to retire 30 years from now with a retirement income of $20,000 per month for 20 years, with the first payment received 30 years and 1 month from now. Second, he would like to purchase a cabin in Rivendell in 10 years at an estimated cost of $320,000. Third, after he passes on at the end of the 20 years of withdrawals, he would like to leave an inheritance of $1,000,000 to his nephew Frodo. He can afford to save $1,900 per month for the next 10 years.If he can earn an 11 percent EAR before he retires and an 8 percent EAR after he retires, how much will he have to save each month in years 11 through 30?58. Calculating Annuity Values After deciding to buy a new car, you can either lease the car orpurchase it with a three-year loan. The car you wish to buy costs $38,000. The dealer has a special leasing arrangement where you pay $1 today and $520 per month for the next three years. If you purchase the car, you will pay it off in monthly payments over the next three years at an 8 percent APR. You believe that you will be able to sell the car for $26,000 in three years. Should you buy or lease the car? What break-even resale price in three years would make you indifferent between buying and leasing?59. Calculating Annuity Values An All-Pro defensive lineman is in contract negotiations. Theteam has offered the following salary structure:All salaries are to be paid in a lump sum. The player has asked you as his agent to renegotiate the terms. He wants a $9 million signing bonus payable today and a contract value increase of $750,000. He also wants an equal salary paid every three months, with the first paycheck three months from now. If the interest rate is 5 percent compounded daily, what is the amount of his quarterly check? Assume 365 days in a year.60. Discount Interest Loans This question illustrates what is known as discount interest. Imagineyou are discussing a loan with a somewhat unscrupulous lender. You want to borrow $20,000 for one year. The interest rate is 14 percent. You and the lender agree that the interest on the loan will be .14 × $20,000 = $2,800. So, the lender deducts this interest amount from the loan up front and gives you $17,200. In this case, we say that the discount is $2,800. What’s wrong here?61. Calculating Annuity Values You are serving on a jury. A plaintiff is suing the city for injuriessustained after a freak street sweeper accident. In the trial, doctors testified that it will be five years before the plaintiff is able to return to work. The jury has already decided in favor of the plaintiff. You are the foreperson of the jury and propose that the jury give the plaintiff an award to cover the following: (1) The present value of two years’ back pay. The plaintiff’s annual salary for the last two years would have been $42,000 and $45,000, respectively. (2) The present value of five years’ future salary. You assume the salary will be $49,000 per year. (3) $150,000 for pain and suffering. (4) $25,000 for court costs. Assume that the salary payments are equal amounts paid at the end of each month. If the interest rate you choose is a 9 percent EAR, what is the size of the settlement? If you were the plaintiff, would you like to see a higher or lower interest rate?62. Calculating EAR with Points You are looking at a one-year loan of $10,000. The interest rateis quoted as 9 percent plus three points. A point on a loan is simply 1 percent (one percentage point) of the loan amount. Quotes similar to this one are very common with home mortgages. The interest rate quotation in this example requires the borrower to pay three points to the lender up front and repay the loan later with 9 percent interest. What rate would you actually be paying here? What is the EAR for a one-year loan with a quoted interest rate of 12 percent plus two points? Is your answer affected by the loan amount?63. EAR versus APR Two banks in the area offer 30-year, $200,000 mortgages at 6.8 percent andcharge a $2,100 loan application fee. However, the application fee charged by Insecurity Bank and Trust is refundable if the loan application is denied, whereas that charged by I. M. Greedy and Sons Mortgage Bank is not. The current disclosure law requires that any fees that will be refunded if the applicant is rejected be included in calculating the APR, but this is not required with nonrefundable。

公司理财罗斯第九版课后习题答案

罗斯《公司理财》第9版精要版英文原书课后部分章节答案详细»1 / 17 CH5 11,13,18,19,20 11. To find the PV of a lump sum, we use: PV = FV / (1 + r) t PV = $1,000,000 / (1.10) 80 = $488.19 13. To answer this question, we can use either the FV or the PV formula. Both will give the same answer since they are the inverse of each other. We will use the FV formula, that is: FV = PV(1 + r) t Solving for r, we get: r = (FV / PV) 1 / t –1 r = ($1,260,000 / $150) 1/112 – 1 = .0840 or 8.40% To find the FV of the first prize, we use: FV = PV(1 + r) t FV = $1,260,000(1.0840) 33 = $18,056,409.94 18. To find the FV of a lump sum, we use: FV = PV(1 + r) t FV = $4,000(1.11) 45 = $438,120.97 FV = $4,000(1.11) 35 = $154,299.40 Better start early! 19. We need to find the FV of a lump sum. However, the money will only be invested for six years, so the number of periods is six. FV = PV(1 + r) t FV = $20,000(1.084)6 = $32,449.33 20. To answer this question, we can use either the FV or the PV formula. Both will give the same answer since they are the inverse of each other. We will use the FV formula, that is: FV = PV(1 + r) t Solving for t, we get: t = ln(FV / PV) / ln(1 + r) t = ln($75,000 / $10,000) / ln(1.11) = 19.31 So, the money must be invested for 19.31 years. However, you will not receive the money for another two years. From now, you’ll wait: 2 years + 19.31 years = 21.31 years CH6 16,24,27,42,58 16. For this problem, we simply need to find the FV of a lump sum using the equation: FV = PV(1 + r) t 2 / 17 It is important to note that compounding occurs semiannually. To account for this, we will divide the interest rate by two (the number of compounding periods in a year), and multiply the number of periods by two. Doing so, we get: FV = $2,100[1 + (.084/2)] 34 = $8,505.93 24. This problem requires us to find the FVA. The equation to find the FVA is: FV A = C{[(1 + r) t – 1] / r} FV A = $300[{[1 + (.10/12) ] 360 – 1} / (.10/12)] = $678,146.38 27. The cash flows are annual and the compounding period is quarterly, so we need to calculate the EAR to make the interest rate comparable with the timing of the cash flows. Using the equation for the EAR, we get: EAR = [1 + (APR / m)] m – 1 EAR = [1 + (.11/4)] 4 – 1 = .1146 or 11.46% And now we use the EAR to find the PV of each cash flow as a lump sum and add them together: PV = $725 / 1.1146 + $980 / 1.1146 2 + $1,360 / 1.1146 4 = $2,320.36 42. The amount of principal paid on the loan is the PV of the monthly payments you make. So, the present value of the $1,150 monthly payments is: PVA = $1,150[(1 – {1 / [1 + (.0635/12)]} 360 ) / (.0635/12)] = $184,817.42 The monthly payments of $1,150 will amount to a principal payment of $184,817.42. The amount of principal you will still owe is: $240,000 – 184,817.42 = $55,182.58 This remaining principal amount will increase at the interest rate on the loan until the end of the loan period. So the balloon payment in 30 years, which is the FV of the remaining principal will be: Balloon payment = $55,182.58[1 + (.0635/12)] 360 = $368,936.54 58. To answer this question, we should find the PV of both options, and compare them. Since we are purchasing the car, the lowest PV is the best option. The PV of the leasing is simply the PV of the lease payments, plus the $99. The interest rate we would use for the leasing option is the same as the interest rate of the loan. The PV of leasing is: PV = $99 + $450{1 –[1 / (1 + .07/12) 12(3) ]} / (.07/12) = $14,672.91 The PV of purchasing the car is the current price of the car minus the PV of the resale price. The PV of the resale price is: PV = $23,000 / [1 + (.07/12)] 12(3) = $18,654.82 The PV of the decision to purchase is: $32,000 – 18,654.82 = $13,345.18 3 / 17 In this case, it is cheaper to buy the car than leasing it since the PV of the purchase cash flows is lower. To find the breakeven resale price, we need to find the resale price that makes the PV of the two options the same. In other words, the PV of the decision to buy should be: $32,000 – PV of resale price = $14,672.91 PV of resale price = $17,327.09 The resale price that would make the PV of the lease versus buy decision is the FV ofthis value, so: Breakeven resale price = $17,327.09[1 + (.07/12)] 12(3) = $21,363.01 CH7 3,18,21,22,31 3. The price of any bond is the PV of the interest payment, plus the PV of the par value. Notice this problem assumes an annual coupon. The price of the bond will be: P = $75({1 – [1/(1 + .0875)] 10 } / .0875) + $1,000[1 / (1 + .0875) 10 ] = $918.89 We would like to introduce shorthand notation here. Rather than write (or type, as the case may be) the entire equation for the PV of a lump sum, or the PV A equation, it is common to abbreviate the equations as: PVIF R,t = 1 / (1 + r) t which stands for Present Value Interest Factor PVIFA R,t = ({1 – [1/(1 + r)] t } / r ) which stands for Present Value Interest Factor of an Annuity These abbreviations are short hand notation for the equations in which the interest rate and the number of periods are substituted into the equation and solved. We will use this shorthand notation in remainder of the solutions key. 18. The bond price equation for this bond is: P 0 = $1,068 = $46(PVIFA R%,18 ) + $1,000(PVIF R%,18 ) Using a spreadsheet, financial calculator, or trial and error we find: R = 4.06% This is the semiannual interest rate, so the YTM is: YTM = 2 4.06% = 8.12% The current yield is: Current yield = Annual coupon payment / Price = $92 / $1,068 = .0861 or 8.61% The effective annual yield is the same as the EAR, so using the EAR equation from the previous chapter: Effective annual yield = (1 + 0.0406) 2 – 1 = .0829 or 8.29% 20. Accrued interest is the coupon payment for the period times the fraction of the period that has passed since the last coupon payment. Since we have a semiannual coupon bond, the coupon payment per six months is one-half of the annual coupon payment. There are four months until the next coupon payment, so two months have passed since the last coupon payment. The accrued interest for the bond is: Accrued interest = $74/2 × 2/6 = $12.33 And we calculate the clean price as: 4 / 17 Clean price = Dirty price –Accrued interest = $968 –12.33 = $955.67 21. Accrued interest is the coupon payment for the period times the fraction of the period that has passed since the last coupon payment. Since we have a semiannual coupon bond, the coupon payment per six months is one-half of the annual coupon payment. There are two months until the next coupon payment, so four months have passed since the last coupon payment. The accrued interest for the bond is: Accrued interest = $68/2 × 4/6 = $22.67 And we calculate the dirty price as: Dirty price = Clean price + Accrued interest = $1,073 + 22.67 = $1,095.67 22. To find the number of years to maturity for the bond, we need to find the price of the bond. Since we already have the coupon rate, we can use the bond price equation, and solve for the number of years to maturity. We are given the current yield of the bond, so we can calculate the price as: Current yield = .0755 = $80/P 0 P 0 = $80/.0755 = $1,059.60 Now that we have the price of the bond, the bond price equation is: P = $1,059.60 = $80[(1 – (1/1.072) t ) / .072 ] + $1,000/1.072 t We can solve this equation for t as follows: $1,059.60(1.072) t = $1,111.11(1.072) t –1,111.11 + 1,000 111.11 = 51.51(1.072) t 2.1570 = 1.072 t t = log 2.1570 / log 1.072 = 11.06 11 years The bond has 11 years to maturity.31. The price of any bond (or financial instrument) is the PV of the future cash flows. Even though Bond M makes different coupons payments, to find the price of the bond, we just find the PV of the cash flows. The PV of the cash flows for Bond M is: P M = $1,100(PVIFA 3.5%,16 )(PVIF 3.5%,12 ) + $1,400(PVIFA 3.5%,12 )(PVIF 3.5%,28 ) + $20,000(PVIF 3.5%,40 ) P M = $19,018.78 Notice that for the coupon payments of $1,400, we found the PV A for the coupon payments, and then discounted the lump sum back to today. Bond N is a zero coupon bond with a $20,000 par value, therefore, the price of the bond is the PV of the par, or: P N = $20,000(PVIF 3.5%,40 ) = $5,051.45 CH8 4,18,20,22,24 4. Using the constant growth model, we find the price of the stock today is: P 0 = D 1 / (R – g) = $3.04 / (.11 – .038) = $42.22 5 / 17 18. The priceof a share of preferred stock is the dividend payment divided by the required return. We know the dividend payment in Year 20, so we can find the price of the stock in Year 19, one year before the first dividend payment. Doing so, we get: P 19 = $20.00 / .064 P 19 = $312.50 The price of the stock today is the PV of the stock price in the future, so the price today will be: P 0 = $312.50 / (1.064) 19 P 0 = $96.15 20. We can use the two-stage dividend growth model for this problem, which is: P 0 = [D 0 (1 + g 1 )/(R – g 1 )]{1 – [(1 + g 1 )/(1 + R)] T }+ [(1 + g 1 )/(1 + R)] T [D 0 (1 + g 2 )/(R –g 2 )] P 0 = [$1.25(1.28)/(.13 – .28)][1 –(1.28/1.13) 8 ] + [(1.28)/(1.13)] 8 [$1.25(1.06)/(.13 – .06)] P 0 = $69.55 22. We are asked to find the dividend yield and capital gains yield for each of the stocks. All of the stocks have a 15 percent required return, which is the sum of the dividend yield and the capital gains yield. To find the components of the total return, we need to find the stock price for each stock. Using this stock price and the dividend, we can calculate the dividend yield. The capital gains yield for the stock will be the total return (required return) minus the dividend yield. W: P 0 = D 0 (1 + g) / (R – g) = $4.50(1.10)/(.19 – .10) = $55.00 Dividend yield = D 1 /P 0 = $4.50(1.10)/$55.00 = .09 or 9% Capital gains yield = .19 – .09 = .10 or 10% X: P 0 = D 0 (1 + g) / (R – g) = $4.50/(.19 – 0) = $23.68 Dividend yield = D 1 /P 0 = $4.50/$23.68 = .19 or 19% Capital gains yield = .19 – .19 = 0% Y: P 0 = D 0 (1 + g) / (R – g) = $4.50(1 – .05)/(.19 + .05) = $17.81 Dividend yield = D 1 /P 0 = $4.50(0.95)/$17.81 = .24 or 24% Capital gains yield = .19 – .24 = –.05 or –5% Z: P 2 = D 2 (1 + g) / (R – g) = D 0 (1 + g 1 ) 2 (1 +g 2 )/(R – g 2 ) = $4.50(1.20) 2 (1.12)/(.19 – .12) = $103.68 P 0 = $4.50 (1.20) / (1.19) + $4.50(1.20) 2 / (1.19) 2 + $103.68 / (1.19) 2 = $82.33 Dividend yield = D 1 /P 0 = $4.50(1.20)/$82.33 = .066 or 6.6% Capital gains yield = .19 – .066 = .124 or 12.4% In all cases, the required return is 19%, but the return is distributed differently between current income and capital gains. High growth stocks have an appreciable capital gains component but a relatively small current income yield; conversely, mature, negative-growth stocks provide a high current income but also price depreciation over time. 24. Here we have a stock with supernormal growth, but the dividend growth changes every year for the first four years. We can find the price of the stock in Year 3 since the dividend growth rate is constant after the third dividend. The price of the stock in Year 3 will be the dividend in Year 4, divided by the required return minus the constant dividend growth rate. So, the price in Year 3 will be: 6 / 17 P 3 = $2.45(1.20)(1.15)(1.10)(1.05) / (.11 – .05) = $65.08 The price of the stock today will be the PV of the first three dividends, plus the PV of the stock price in Year 3, so: P 0 = $2.45(1.20)/(1.11) + $2.45(1.20)(1.15)/1.11 2 + $2.45(1.20)(1.15)(1.10)/1.11 3 + $65.08/1.11 3 P 0 = $55.70 CH9 3,4,6,9,15 3. Project A has cash flows of $19,000 in Year 1, so the cash flows are short by $21,000 of recapturing the initial investment, so the payback for Project A is: Payback = 1 + ($21,000 / $25,000) = 1.84 years Project B has cash flows of: Cash flows = $14,000 + 17,000 + 24,000 = $55,000 during this first three years. The cash flows are still short by $5,000 of recapturing the initial investment, so the payback for Project B is: B: Payback = 3 + ($5,000 / $270,000) = 3.019 years Using the payback criterion and a cutoff of 3 years, accept project A and reject project B. 4. When we use discounted payback, we need to find the value of all cash flows today. The value today of the project cash flows for the first four years is: Value today of Year 1 cash flow = $4,200/1.14 = $3,684.21 Value today of Year 2 cash flow = $5,300/1.14 2 = $4,078.18 Value today of Year 3 cash flow = $6,100/1.14 3 = $4,117.33 V alue today of Year 4 cash flow = $7,400/1.14 4 = $4,381.39 To find the discounted payback, we use these values to find the payback period. The discounted first year cash flow is $3,684.21, so the discounted payback for a $7,000 initial cost is: Discounted payback= 1 + ($7,000 – 3,684.21)/$4,078.18 = 1.81 years For an initial cost of $10,000, the discounted payback is: Discounted payback = 2 + ($10,000 –3,684.21 – 4,078.18)/$4,117.33 = 2.54 years Notice the calculation of discounted payback. We know the payback period is between two and three years, so we subtract the discounted values of the Year 1 and Year 2 cash flows from the initial cost. This is the numerator, which is the discounted amount we still need to make to recover our initial investment. We divide this amount by the discounted amount we will earn in Year 3 to get the fractional portion of the discounted payback. If the initial cost is $13,000, the discounted payback is: Discounted payback = 3 + ($13,000 – 3,684.21 – 4,078.18 – 4,117.33) / $4,381.39 = 3.26 years 7 / 17 6. Our definition of AAR is the average net income divided by the average book value. The average net income for this project is: Average net income = ($1,938,200 + 2,201,600 + 1,876,000 + 1,329,500) / 4 = $1,836,325 And the average book value is: Average book value = ($15,000,000 + 0) / 2 = $7,500,000 So, the AAR for this project is: AAR = Average net income / Average book value = $1,836,325 / $7,500,000 = .2448 or 24.48% 9. The NPV of a project is the PV of the outflows minus the PV of the inflows. Since the cash inflows are an annuity, the equation for the NPV of this project at an 8 percent required return is: NPV = –$138,000 + $28,500(PVIFA 8%, 9 ) = $40,036.31 At an 8 percent required return, the NPV is positive, so we would accept the project. The equation for the NPV of the project at a 20 percent required return is: NPV = –$138,000 + $28,500(PVIFA 20%, 9 ) = –$23,117.45 At a 20 percent required return, the NPV is negative, so we would reject the project. We would be indifferent to the project if the required return was equal to the IRR of the project, since at that required return the NPV is zero. The IRR of the project is: 0 = –$138,000 + $28,500(PVIFA IRR, 9 ) IRR = 14.59% 15. The profitability index is defined as the PV of the cash inflows divided by the PV of the cash outflows. The equation for the profitability index at a required return of 10 percent is: PI = [$7,300/1.1 + $6,900/1.1 2 + $5,700/1.1 3 ] / $14,000 = 1.187 The equation for the profitability index at a required return of 15 percent is: PI = [$7,300/1.15 + $6,900/1.15 2 + $5,700/1.15 3 ] / $14,000 = 1.094 The equation for the profitability index at a required return of 22 percent is: PI = [$7,300/1.22 + $6,900/1.22 2 + $5,700/1.22 3 ] / $14,000 = 0.983 8 / 17 We would accept the project if the required return were 10 percent or 15 percent since the PI is greater than one. We would reject the project if the required return were 22 percent since the PI。

公司理财 课后答案 第九版

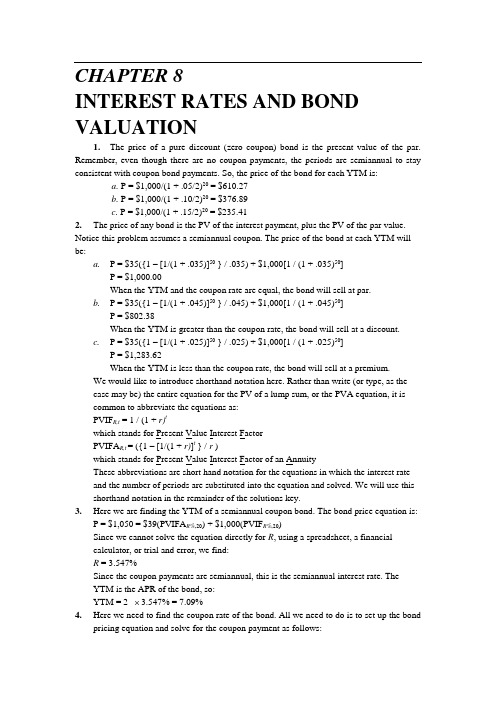

CHAPTER 8INTEREST RATES AND BOND VALUATION1.The price of a pure discount (zero coupon) bond is the present value of the par. Remember, even though there are no coupon payments, the periods are semiannual to stay consistent with coupon bond payments. So, the price of the bond for each YTM is:a. P = $1,000/(1 + .05/2)20 = $610.27b. P = $1,000/(1 + .10/2)20 = $376.89c. P = $1,000/(1 + .15/2)20 = $235.412.The price of any bond is the PV of the interest payment, plus the PV of the par value. Notice this problem assumes a semiannual coupon. The price of the bond at each YTM will be:a.P = $35({1 – [1/(1 + .035)]50 } / .035) + $1,000[1 / (1 + .035)50]P = $1,000.00When the YTM and the coupon rate are equal, the bond will sell at par.b.P = $35({1 – [1/(1 + .045)]50 } / .045) + $1,000[1 / (1 + .045)50]P = $802.38When the YTM is greater than the coupon rate, the bond will sell at a discount.c.P = $35({1 – [1/(1 + .025)]50 } / .025) + $1,000[1 / (1 + .025)50]P = $1,283.62When the YTM is less than the coupon rate, the bond will sell at a premium.We would like to introduce shorthand notation here. Rather than write (or type, as the case may be) the entire equation for the PV of a lump sum, or the PVA equation, it is common to abbreviate the equations as:PVIF R,t = 1 / (1 + r)twhich stands for Present Value Interest FactorPVIFA R,t= ({1 – [1/(1 + r)]t } / r )which stands for Present Value Interest Factor of an AnnuityThese abbreviations are short hand notation for the equations in which the interest rate and the number of periods are substituted into the equation and solved. We will use this shorthand notation in the remainder of the solutions key.3.Here we are finding the YTM of a semiannual coupon bond. The bond price equation is:P = $1,050 = $39(PVIFA R%,20) + $1,000(PVIF R%,20)Since we cannot solve the equation directly for R, using a spreadsheet, a financialcalculator, or trial and error, we find:R = 3.547%Since the coupon payments are semiannual, this is the semiannual interest rate. TheYTM is the APR of the bond, so:YTM = 2 3.547% = 7.09%4.Here we need to find the coupon rate of the bond. All we need to do is to set up the bondpricing equation and solve for the coupon payment as follows:P = $1,175 = C(PVIFA3.8%,27) + $1,000(PVIF3.8%,27)Solving for the coupon payment, we get:C = $48.48Since this is the semiannual payment, the annual coupon payment is:2 × $48.48 = $96.96And the coupon rate is the annual coupon payment divided by par value, so:Coupon rate = $96.96 / $1,000 = .09696 or 9.70%5.The price of any bond is the PV of the interest payment, plus the PV of the par value.The fact that the bond is denominated in euros is irrelevant. Notice this problem assumes an annual coupon. The price of the bond will be:P = €84({1 – [1/(1 + .076)]15 } / .076) + €1,000[1 / (1 + .076)15]P = €1,070.186.Here we are finding the YTM of an annual coupon bond. The fact that the bond is denominated in yen is irrelevant. The bond price equation is:P = ¥87,000 = ¥5,400(PVIFA R%,21) + ¥100,000(PVIF R%,21)Since we cannot solve the equation directly for R, using a spreadsheet, a financial calculator, or trial and error, we find:R = 6.56%Since the coupon payments are annual, this is the yield to maturity.7.The approximate relationship between nominal interest rates (R), real interest rates (r),and inflation (h) is:R = r + hApproximate r = .05 –.039 =.011 or 1.10%The Fisher equation, which shows the exact relationship between nominal interest rates, real interest rates, and inflation is:(1 + R) = (1 + r)(1 + h)(1 + .05) = (1 + r)(1 + .039)Exact r = [(1 + .05) / (1 + .039)] – 1 = .0106 or 1.06%8.The Fisher equation, which shows the exact relationship between nominal interest rates,real interest rates, and inflation, is:(1 + R) = (1 + r)(1 + h)R = (1 + .025)(1 + .047) – 1 = .0732 or 7.32%9. The Fisher equation, which shows the exact relationship between nominal interest rates,real interest rates, and inflation, is:(1 + R) = (1 + r)(1 + h)h = [(1 + .17) / (1 + .11)] – 1 = .0541 or 5.41%10.The Fisher equation, which shows the exact relationship between nominal interest rates,real interest rates, and inflation, is:(1 + R) = (1 + r)(1 + h)r = [(1 + .141) / (1.068)] – 1 = .0684 or 6.84%11.The coupon rate, located in the first column of the quote is 6.125%. The bid price is:Bid price = 119:19 = 119 19/32 = 119.59375% $1,000 = $1,195.9375The previous day’s ask price is found by:Previous day’s asked price = Today’s asked price – Change = 119 21/32 – (–17/32) = 120 6/32The previous day’s price in dollars was:Previous day’s dollar price = 120.1875% $1,000 = $1,201.87512.This is a premium bond because it sells for more than 100% of face value. The current yield is:Current yield = Annual coupon payment / Asked price = $75/$1,347.1875 = .0557 or 5.57%The YTM is located under the “Asked yield” column, so the YTM is 4.4817%.The bid-ask spread is the difference between the bid price and the ask price, so:Bid-Ask spread = 134:23 – 134:22 = 1/32Intermediate13. Here we are finding the YTM of semiannual coupon bonds for various maturity lengths.The bond price equation is:P = C(PVIFA R%,t) + $1,000(PVIF R%,t)Miller Corporation bond:P0 = $45(PVIFA3.5%,26) + $1,000(PVIF3.5%,26) = $1,168.90P1 = $45(PVIFA3.5%,24) + $1,000(PVIF3.5%,24) = $1,160.58P3 = $45(PVIFA3.5%,20) + $1,000(PVIF3.5%,20) = $1,142.12P8 = $45(PVIFA3.5%,10) + $1,000(PVIF3.5%,10) = $1,083.17P12= $45(PVIFA3.5%,2) +$1,000(PVIF3.5%,2) = $1,019.00P13= $1,000Modigliani Company bond:P0 = $35(PVIFA4.5%,26) + $1,000(PVIF4.5%,26) = $848.53P1 = $35(PVIFA4.5%,24) + $1,000(PVIF4.5%,24) = $855.05P3 = $35(PVIFA4.5%,20) + $1,000(PVIF4.5%,20) = $869.92P8 = $35(PVIFA4.5%,10) + $1,000(PVIF4.5%,10) = $920.87P12= $35(PVIFA4.5%,2) +$1,000(PVIF4.5%,2) = $981.27P13= $1,000All else held equal, the premium over par value for a premium bond declines as maturity approaches, and the discount from par value for a discount bond declines as maturity approaches. This is called “pull to par.” In both cases, the largest percentage price changes occur at the shortest maturity lengths.Also, notice that the price of each bond when no time is left to maturity is the par value, even though the purchaser would receive the par value plus the coupon payment immediately. This is because we calculate the clean price of the bond.14.Any bond that sells at par has a YTM equal to the coupon rate. Both bonds sell at par, sothe initial YTM on both bonds is the coupon rate, 8 percent. If the YTM suddenly rises to 10 percent:P Laurel= $40(PVIFA5%,4) + $1,000(PVIF5%,4) = $964.54P Hardy= $40(PVIFA5%,30) + $1,000(PVIF5%,30) = $846.28The percentage change in price is calculated as:Percentage change in price = (New price – Original price) / Original price∆P Laurel% = ($964.54 – 1,000) / $1,000 = –0.0355 or –3.55%∆P Hardy% = ($846.28 – 1,000) / $1,000 = –0.1537 or –15.37%If the YTM suddenly falls to 6 percent:P Laurel= $40(PVIFA3%,4) + $1,000(PVIF3%,4) = $1,037.17P Hardy= $40(PVIFA3%,30) + $1,000(PVIF3%,30) = $1,196.00∆P Laurel% = ($1,037.17 – 1,000) / $1,000 = +0.0372 or 3.72%∆P Hardy% = ($1,196.002 – 1,000) / $1,000 = +0.1960 or 19.60%All else the same, the longer the maturity of a bond, the greater is its price sensitivity to changes in interest rates. Notice also that for the same interest rate change, the gain froma decline in interest rates is larger than the loss from the same magnitude change. For aplain vanilla bond, this is always true.15.Initially, at a YTM of 10 percent, the prices of the two bonds are:P Faulk= $30(PVIFA5%,16) + $1,000(PVIF5%,16) = $783.24P Gonas= $70(PVIFA5%,16) + $1,000(PVIF5%,16) = $1,216.76If the YTM rises from 10 percent to 12 percent:P Faulk= $30(PVIFA6%,16) + $1,000(PVIF6%,16) = $696.82P Gonas= $70(PVIFA6%,16) + $1,000(PVIF6%,16) = $1,101.06The percentage change in price is calculated as:Percentage change in price = (New price – Original price) / Original price∆P Faulk% = ($696.82 – 783.24) / $783.24 = –0.1103 or –11.03%∆P Gonas% = ($1,101.06 – 1,216.76) / $1,216.76 = –0.0951 or –9.51% If the YTM declines from 10 percent to 8 percent:P Faulk= $30(PVIFA4%,16) + $1,000(PVIF4%,16) = $883.48P Gonas= $70(PVIFA4%,16) + $1,000(PVIF4%,16) = $1,349.57∆P Faulk% = ($883.48 – 783.24) / $783.24 = +0.1280 or 12.80%∆P Gonas% = ($1,349.57 – 1,216.76) / $1,216.76 = +0.1092 or 10.92% All else the same, the lower the coupon rate on a bond, the greater is its price sensitivity to changes in interest rates.16.The bond price equation for this bond is:P0 = $960 = $37(PVIFA R%,18) + $1,000(PVIF R%,18)Using a spreadsheet, financial calculator, or trial and error we find:R = 4.016%This is the semiannual interest rate, so the YTM is:YTM = 2 ⨯ 4.016% = 8.03%The current yield is:Current yield = Annual coupon payment / Price = $74 / $960 = .0771 or 7.71%The effective annual yield is the same as the EAR, so using the EAR equation from the previous chapter:Effective annual yield = (1 + 0.04016)2– 1 = .0819 or 8.19%17.The company should set the coupon rate on its new bonds equal to the required return.The required return can be observed in the market by finding the YTM on outstanding bonds of the company. So, the YTM on the bonds currently sold in the market is:P = $1,063 = $50(PVIFA R%,40) + $1,000(PVIF R%,40)Using a spreadsheet, financial calculator, or trial and error we find:R = 4.650%This is the semiannual interest rate, so the YTM is:YTM = 2 ⨯ 4.650% = 9.30%18. Accrued interest is the coupon payment for the period times the fraction of the periodthat has passed since the last coupon payment. Since we have a semiannual coupon bond, the coupon payment per six months is one-half of the annual coupon payment. There are two months until the next coupon payment, so four months have passed since the last coupon payment. The accrued interest for the bond is:Accrued interest = $84/2 × 4/6 = $28And we calculate the clean price as:Clean price = Dirty price – Accrued interest = $1,090 – 28 = $1,06219. Accrued interest is the coupon payment for the period times the fraction of the periodthat has passed since the last coupon payment. Since we have a semiannual coupon bond, the coupon payment per six months is one-half of the annual coupon payment. There are four months until the next coupon payment, so two months have passed since the last coupon payment. The accrued interest for the bond is:Accrued interest = $72/2 × 2/6 = $12.00And we calculate the dirty price as:Dirty price = Clean price + Accrued interest = $904 + 12 = $916.0020.To find the number of years to maturity for the bond, we need to find the price of thebond. Since we already have the coupon rate, we can use the bond price equation, and solve for the number of years to maturity. We are given the current yield of the bond, so we can calculate the price as:Current yield = .0842 = $90/P0P0 = $90/.0842 = $1,068.88Now that we have the price of the bond, the bond price equation is:P = $1,068.88 = $90{[(1 – (1/1.0781)t ] / .0781} + $1,000/1.0781tWe can solve this equation for t as follows:$1,068.88 (1.0781)t = $1,152.37 (1.0781)t– 1,152.37 + 1,000152.37 = 83.49(1.0781)t1.8251 = 1.0781tt = log 1.8251 / log 1.0781 = 8.0004 ≈ 8 yearsThe bond has 8 years to maturity.21.The bond has 10 years to maturity, so the bond price equation is:P = $871.55 = $41.25(PVIFA R%,20) + $1,000(PVIF R%,20)Using a spreadsheet, financial calculator, or trial and error we find:R = 5.171%This is the semiannual interest rate, so the YTM is:YTM = 2 5.171% = 10.34%The current yield is the annual coupon payment divided by the bond price, so:Current yield = $82.50 / $871.55 = .0947 or 9.47%22.We found the maturity of a bond in Problem 20. However, in this case, the maturity isindeterminate. A bond selling at par can have any length of maturity. In other words, when we solve the bond pricing equation as we did in Problem 20, the number of periods can be any positive number.Challenge23.To find the capital gains yield and the current yield, we need to find the price of the bond.The current price of Bond P and the price of Bond P in one year is:P: P0 = $90(PVIFA7%,5) + $1,000(PVIF7%,5) = $1,082.00P1 = $90(PVIFA7%,4) + $1,000(PVIF7%,4) = $1,067.74Current yield = $90 / $1,082.00 = .0832 or 8.32%The capital gains yield is:Capital gains yield = (New price – Original price) / Original priceCapital gains yield = ($1,067.74 – 1,082.00) / $1,082.00 = –0.0132 or –1.32% The current price of Bond D and the price of Bond D in one year is:D: P0 = $50(PVIFA7%,5) + $1,000(PVIF7%,5) = $918.00P1 = $50(PVIFA7%,4) + $1,000(PVIF7%,4) = $932.26Current yield = $50 / $918.00 = 0.0545 or 5.45%Capital gains yield = ($932.26 – 918.00) / $918.00 = 0.0155 or 1.55% All else held constant, premium bonds pay a high current income while having price depreciation as maturity nears; discount bonds pay a lower current income but have price appreciation as maturity nears. For either bond, the total return is still 7%, but this return is distributed differently between current income and capital gains.24.a. The rate of return you expect to earn if you purchase a bond and hold it until maturity is the YTM. The bond price equation for this bond is:P0 = $1,140 = $90(PVIFA R%,10) + $1,000(PVIF R%,10)Using a spreadsheet, financial calculator, or trial and error we find:R = YTM = 7.01%b. To find our HPY, we need to find the price of the bond in two years. The price ofthe bond in two years, at the new interest rate, will be:P2 = $90(PVIFA6.01%,8) + $1,000(PVIF6.01%,8) = $1,185.87To calculate the HPY, we need to find the interest rate that equates the price wepaid for the bond with the cash flows we received. The cash flows we receivedwere $90 each year for two years, and the price of the bond when we sold it. Theequation to find our HPY is:P0 = $1,140 = $90(PVIFA R%,2) + $1,185.87(PVIF R%,2)Solving for R, we get:R = HPY = 9.81%The realized HPY is greater than the expected YTM when the bond was boughtbecause interest rates dropped by 1 percent; bond prices rise when yields fall.25.The price of any bond (or financial instrument) is the PV of the future cash flows. Eventhough Bond M makes different coupons payments, to find the price of the bond, we just find the PV of the cash flows. The PV of the cash flows for Bond M is:P M = $800(PVIFA4%,16)(PVIF4%,12) + $1,000(PVIFA4%,12)(PVIF4%,28) +$20,000(PVIF4%,40)P M = $13,117.88Notice that for the coupon payments of $800, we found the PVA for the coupon payments, and then discounted the lump sum back to today.Bond N is a zero coupon bond with a $20,000 par value; therefore, the price of the bond is the PV of the par, or:P N = $20,000(PVIF4%,40) = $4,165.7826.To find the present value, we need to find the real weekly interest rate. To find the realreturn, we need to use the effective annual rates in the Fisher equation. So, we find the real EAR is:(1 + R) = (1 + r)(1 + h)1 + .107 = (1 + r)(1 + .035)r = .0696 or 6.96%Now, to find the weekly interest rate, we need to find the APR. Using the equation for discrete compounding:EAR = [1 + (APR / m)]m– 1We can solve for the APR. Doing so, we get:APR = m[(1 + EAR)1/m– 1]APR = 52[(1 + .0696)1/52– 1]APR = .0673 or 6.73%So, the weekly interest rate is:Weekly rate = APR / 52Weekly rate = .0673 / 52Weekly rate = .0013 or 0.13%Now we can find the present value of the cost of the roses. The real cash flows are an ordinary annuity, discounted at the real interest rate. So, the present value of the cost of the roses is:PVA = C({1 – [1/(1 + r)]t } / r)PVA = $8({1 – [1/(1 + .0013)]30(52)} / .0013)PVA = $5,359.6427.To answer this question, we need to find the monthly interest rate, which is the APRdivided by 12. We also must be careful to use the real interest rate. The Fisher equation uses the effective annual rate, so, the real effective annual interest rates, and the monthly interest rates for each account are:Stock account:(1 + R) = (1 + r)(1 + h)1 + .12 = (1 + r)(1 + .04)r = .0769 or 7.69%APR = m[(1 + EAR)1/m– 1]APR = 12[(1 + .0769)1/12– 1]APR = .0743 or 7.43%Monthly rate = APR / 12Monthly rate = .0743 / 12Monthly rate = .0062 or 0.62%Bond account:(1 + R) = (1 + r)(1 + h)1 + .07 = (1 + r)(1 + .04)r = .0288 or 2.88%APR = m[(1 + EAR)1/m– 1]APR = 12[(1 + .0288)1/12– 1]APR = .0285 or 2.85%Monthly rate = APR / 12Monthly rate = .0285 / 12Monthly rate = .0024 or 0.24%Now we can find the future value of the retirement account in real terms. The future value of each account will be:Stock account:FVA = C {(1 + r )t– 1] / r}FVA = $800{[(1 + .0062)360 – 1] / .0062]}FVA = $1,063,761.75Bond account:FVA = C {(1 + r )t– 1] / r}FVA = $400{[(1 + .0024)360 – 1] / .0024]}FVA = $227,089.04The total future value of the retirement account will be the sum of the two accounts, or: Account value = $1,063,761.75 + 227,089.04Account value = $1,290,850.79Now we need to find the monthly interest rate in retirement. We can use the same procedure that we used to find the monthly interest rates for the stock and bond accounts, so:(1 + R) = (1 + r)(1 + h)1 + .08 = (1 + r)(1 + .04)r = .0385 or 3.85%APR = m[(1 + EAR)1/m– 1]APR = 12[(1 + .0385)1/12– 1]APR = .0378 or 3.78%Monthly rate = APR / 12Monthly rate = .0378 / 12Monthly rate = .0031 or 0.31%Now we can find the real monthly withdrawal in retirement. Using the present value of an annuity equation and solving for the payment, we find:PVA = C({1 – [1/(1 + r)]t } / r )$1,290,850.79 = C({1 – [1/(1 + .0031)]300 } / .0031)C = $6,657.74This is the real dollar amount of the monthly withdrawals. The nominal monthly withdrawals will increase by the inflation rate each month. To find the nominal dollar amount of the last withdrawal, we can increase the real dollar withdrawal by the inflation rate. We can increase the real withdrawal by the effective annual inflation rate since we are only interested in the nominal amount of the last withdrawal. So, the last withdrawal in nominal terms will be: FV = PV(1 + r)tFV = $6,657.74(1 + .04)(30 + 25)FV = $57,565.3028.In this problem, we need to calculate the future value of the annual savings after the fiveyears of operations. The savings are the revenues minus the costs, or:Savings = Revenue – CostsSince the annual fee and the number of members are increasing, we need to calculate the effective growth rate for revenues, which is:Effective growth rate = (1 + .06)(1 + .03) – 1Effective growth rate = .0918 or 9.18%The revenue for the current year is the number of members times the annual fee, or:Current revenue = 500($500)Current revenue = $250,000The revenue will grow at 9.18 percent, and the costs will grow at 2 percent, so the savings each year for the next five years will be:Year Revenue Costs Savings1 $ 272,950.00 $ 76,500.00 $ 196,450.002 298,006.81 78,030.00 219,976.813 325,363.84 79,590.60 245,773.244 355,232.24 81,182.41 274,049.825 387,842.55 82,806.06 305,036.49Now we can find the value of each year’s savi ngs using the future value of a lump sum equation, so:FV = PV(1 + r)tYear Future Value1 $196,450.00(1 + .09)4 = $277,305.212 $219,976.81(1 + .09)3 = 284,876.353 $245,773.24(1 + .09)2 = 292,003.184 $274,049.82(1 + .09)1 = 298,714.315 305,036.49Total future value of savings = $1,457,935.54He will spend $500,000 on a luxury boat, so the value of his account will be:Value of account = $1,457,935.54 – 500,000Value of account = $957,935.54Now we can use the present value of an annuity equation to find the payment. Doing so, we find:PVA = C({1 – [1/(1 + r)]t } / r )$957,935.54 = C({1 – [1/(1 + .09)]25 } / .09)C = $97,523.83CHAPTER 91.We need to find the required return of the stock. Using the constant growth model, wecan solve the equation for R. Doing so, we find:R = (D1 / P0) + g = ($2.85 / $58) + .06 = .1091 or 10.91%2.The dividend yield is the dividend next year divided by the current price, so the dividendyield is:Dividend yield = D1 / P0 = $2.85 / $58 = .0491 or 4.91%The capital gains yield, or percentage increase in the stock price, is the same as the dividend growth rate, so:Capital gains yield = 6%3.We know the stock has a required return of 13 percent, and the dividend and capitalgains yield are equal, so:Dividend yield = 1/2(.13) = .065 = Capital gains yieldNow we know both the dividend yield and capital gains yield. The dividend is simply the stock price times the dividend yield, so:D1 = .065($64) = $4.16This is the dividend next year. The question asks for the dividend this year. Using the relationship between the dividend this year and the dividend next year:D1 = D0(1 + g)We can solve for the dividend that was just paid:$4.16 = D0 (1 + .065)D0 = $4.16 / 1.065 = $3.914.The price of a share of preferred stock is the dividend divided by the required return.This is the same equation as the constant growth model, with a dividend growth rate of zero percent. Remember that most preferred stock pays a fixed dividend, so the growth rate is zero. Using this equation, we find the price per share of the preferred stock is:R = D/P0 = $6.40/$103 = .0621 or 6.21%5.This stock has a constant growth rate of dividends, but the required return changes twice.To find the value of the stock today, we will begin by finding the price of the stock at Year 6, when both the dividend growth rate and the required return are stable forever.The price of the stock in Year 6 will be the dividend in Year 7, divided by the required return minus the growth rate in dividends. So:P6 = D6(1 + g) / (R–g) = D0(1 + g)7/ (R–g) = $2.75(1.06)7/ (.11 – .06) = $82.70Now we can find the price of the stock in Year 3. We need to find the price here since the required return changes at that time. The price of the stock in Year 3 is the PV of the dividends in Years 4, 5, and 6, plus the PV of the stock price in Year 6. The price of the stock in Year 3 is:P3= $2.75(1.06)4/ 1.14 + $2.75(1.06)5/ 1.142 + $2.75(1.06)6/ 1.143 + $82.70 / 1.143 P3= $64.33Finally, we can find the price of the stock today. The price today will be the PV of the dividends in Years 1, 2, and 3, plus the PV of the stock in Year 3. The price of the stock today is:P0= $2.75(1.06) / 1.16 + $2.75(1.06)2/ (1.16)2+ $2.75(1.06)3/ (1.16)3+ $64.33 /(1.16)3P0= $48.126.The price of a stock is the PV of the future dividends. This stock is paying five dividends,so the price of the stock is the PV of these dividends using the required return. The price of the stock is:P0 = $13 / 1.11 + $16 / 1.112 + $19 / 1.113 + $22 / 1.114 + $25 / 1.115 = $67.927.Here we need to find the dividend next year for a stock experiencing differential growth.We know the stock price, the dividend growth rates, and the required return, but not the dividend. First, we need to realize that the dividend in Year 3 is the current dividend times the FVIF. The dividend in Year 3 will be:D3 = D0(1.30)3And the dividend in Year 4 will be the dividend in Year 3 times one plus the growth rate, or:D4 = D0(1.30)3(1.18)The stock begins constant growth after the 4th dividend is paid, so we can find the price of the stock in Year 4 as the dividend in Year 5, divided by the required return minus the growth rate. The equation for the price of the stock in Year 4 is:P4= D4(1 + g) / (R– g)Now we can substitute the previous dividend in Year 4 into this equation as follows:P4 = D0(1 + g1)3(1 + g2) (1 + g3) / (R–g3)P4= D0(1.30)3(1.18) (1.08) / (.13 – .08) = 56.00D0When we solve this equation, we find that the stock price in Year 4 is 56.00 times as large as the dividend today. Now we need to find the equation for the stock price today.The stock price today is the PV of the dividends in Years 1, 2, 3, and 4, plus the PV of the Year 4 price. So:P0= D0(1.30)/1.13 + D0(1.30)2/1.132+ D0(1.30)3/1.133+ D0(1.30)3(1.18)/1.134+56.00D0/1.134We can factor out D0 in the equation, and combine the last two terms. Doing so, we get: P0 = $65.00 = D0{1.30/1.13 + 1.302/1.132 + 1.303/1.133 + [(1.30)3(1.18) + 56.00] / 1.134} Reducing the equation even further by solving all of the terms in the braces, we get:$65 = $39.86D0D0 = $65.00 / $39.86 = $1.63This is the dividend today, so the projected dividend for the next year will be:D1 = $1.63(1.30) = $2.128.The price of a share of preferred stock is the dividend payment divided by the requiredreturn. We know the dividend payment in Year 5, so we can find the price of the stock in Year 4, one year before the first dividend payment. Doing so, we get:P4 = $7.00 / .06 = $116.67The price of the stock today is the PV of the stock price in the future, so the price today will be:P0 = $116.67 / (1.06)4 = $92.419.To find the number of shares owned, we can divide the amount invested by the stockprice. The share price of any financial asset is the present value of the cash flows, so, tofind the price of the stock we need to find the cash flows. The cash flows are the two dividend payments plus the sale price. We also need to find the aftertax dividends since the assumption is all dividends are taxed at the same rate for all investors. The aftertax dividends are the dividends times one minus the tax rate, so:Year 1 aftertax dividend = $1.50(1 – .28)Year 1 aftertax dividend = $1.08Year 2 aftertax dividend = $2.25(1 – .28)Year 2 aftertax dividend = $1.62We can now discount all cash flows from the stock at the required return. Doing so, we find the price of the stock is:P = $1.08/1.15 + $1.62/(1.15)2 + $60/(1+.15)3P = $41.62The number of shares owned is the total investment divided by the stock price, which is: Shares owned = $100,000 / $41.62Shares owned = 2,402.9810.The required return of a stock consists of two components, the capital gains yield and thedividend yield. In the constant dividend growth model (growing perpetuity equation), the capital gains yield is the same as the dividend growth rate, or algebraically:R = D1/P0 + gWe can find the dividend growth rate by the growth rate equation, or:g = ROE ×bg = .16 × .80g = .1280 or 12.80%This is also the growth rate in dividends. To find the current dividend, we can use the information provided about the net income, shares outstanding, and payout ratio. The total dividends paid is the net income times the payout ratio. To find the dividend per share, we can divide the total dividends paid by the number of shares outstanding. So: Dividend per share = (Net income × Payout ratio) / Shares outstandingDividend per share = ($10,000,000 × .20) / 2,000,000Dividend per share = $1.00Now we can use the initial equation for the required return. We must remember that the equation uses the dividend in one year, so:R = D1/P0 + gR = $1(1 + .1280)/$85 + .1280R = .1413 or 14.13%11. a.If the company does not make any new investments, the stock price will be thepresent value of the constant perpetual dividends. In this case, all earnings are paiddividends, so, applying the perpetuity equation, we get:P = Dividend / RP = $8.25 / .12P = $68.75。

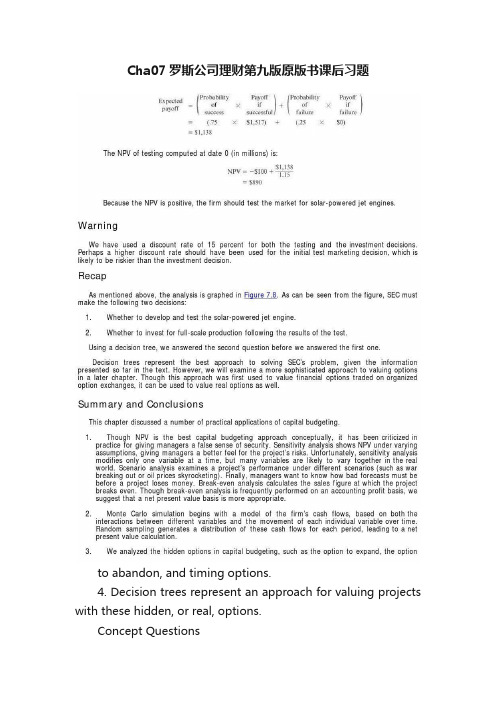

Cha07罗斯公司理财第九版原版书课后习题