克鲁格曼《国际经济学》计算题及答案

克鲁格曼国际经济学答案

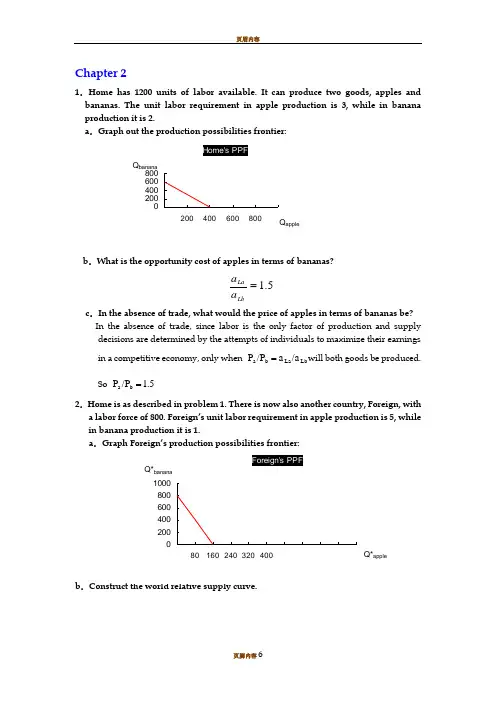

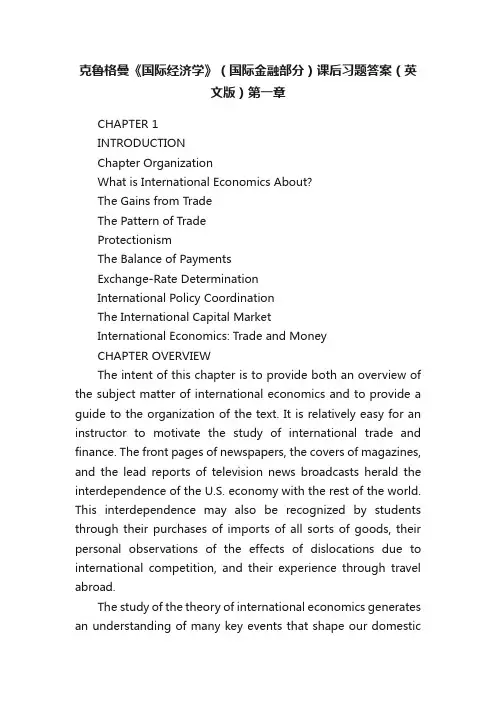

Chapter 21.Home has 1200 units of labor available. It can produce two goods, apples andbananas. The unit labor requirement in apple production is 3, while in banana production it is 2.a .Graph out the production possibilities frontier:b .What is the opportunity cost of apples in terms of bananas?5.1=LbLa a a c .In the absence of trade, what would the price of apples in terms of bananas be? In the absence of trade, since laboris the only factor of production and supplydecisions are determined by the attempts of individuals to maximize their earnings in a competitive economy, only when Lb La b a /a a /P P =will both goods be produced. So 1.5 /P P b a =2.Home is as described in problem 1. There is now also another country, Foreign, witha labor force of 800. Foreign’s unit labor requirement in apple production is 5, while in banana production it is 1.a .b .3.Now suppose world relative demand takes the following form: Demand for apples/demand for bananas = price of bananas/price of apples.a.Graph the relative demand curve along with the relative supply curve:abba/PP/DD=∵When the market achieves its equilibrium, we have 1ba)(DD-**=++=babbaaPPQQQQ∴RD is a hyperbolaxy1=b.What is the equilibrium relative price of apples?The equilibrium relative price of apples is determined by the intersection of the RD and RS curves.RD:yx1=RS:5]5,5.1[5.1],5.0(5.0)5.0,0[=∈=⎪⎩⎪⎨⎧+∞∈=∈yyyxxx∴25.0==yx∴2/=bPaP eec.Describe the pattern of trade.∵babeaeba PPPPPP///>>**∴In this two-country world, Home will specialize in the apple production, export apples and import bananas. Foreign will specialize in the banana production, export bananas and import apples.d.Show that both Home and Foreign gain from trade.International trade allows Home and Foreign to consume anywhere within the colored lines, which lie outside the countries’ production possibility frontiers. And the indirect method, specializing in producing only one production then trade with other country, is a more efficient method than direct production. In the absence of trade, Home could gain three bananas by foregoing two apples, and Foreign could gain by one foregoing five bananas. Trade allows each country to trade two bananas for one apple. Home could then gain four bananas by foregoing two apples while Foreign could gain one apple by foregoing only two bananas. So both Home and Foreign gain from trade.4.Suppose that instead of 1200 workers, Home had 2400. Find the equilibrium relative price. What can you say about the efficiency of world production and the division of the gains from trade between Home and Foreign in this case?RD:yx1=RS:5]5,5.1[5.1],1(1)1,0[=∈=⎪⎩⎪⎨⎧+∞∈=∈yyyxxx∴5.132==yx∴5.1/=bPaP eeIn this case, Foreign will specialize in the banana production, export bananas and import apples. But Home will produce bananas and apples at the same time. And the opportunity cost of bananas in terms of apples for Home remains the same. So Home neither gains nor loses but Foreign gains from trade.5.Suppose that Home has 2400 workers, but they are only half as production in both industries as we have been assuming, Construct the world relative supply curve and determine the equilibrium relative price. How do the gains from trade compare with those in the case described in problem 4?In this case, the labor is doubled while the productivity of labor is halved, so the "effective labor"remains the same. So the answer is similar to that in 3. And both Home and Foreign can gain from trade. But Foreign gains lesser compare with that in the case 4.6.”Korean workers earn only $2.50 an hour; if we allow Korea to export as much as it likes to the United States, our workers will be forced down to the same level. You can’t import a $5 shirt without importing the $2.50 w age that goes with it.” Discuss.In fact, relative wage rate is determined by comparative productivity and the relative demand for goods. Korea’s low wage reflects the fact that Korea is less productive than the United States in most industries. Actually, trade with a less productive, lowwage country can raise the welfare and standard of living of countries with high productivity, such as United States. So this pauper labor argument is wrong. 7.Japanese labor productivity is roughly the same as that of the United States in the manufacturing sector (higher in some industries, lower in others), while the United States, is still considerably more productive in the service sector. But most services are non-traded. Some analysts have argued that this poses a problem for the United States, because our comparative advantage lies in things we cannot sell on world markets. What is wrong with this argument?The competitive advantage of any industry depends on both the relative productivities of the industries and the relative wages across industries. So there are four aspects should be taken into account before we reach conclusion: both the industries and service sectors of Japan and U.S., not just the two service sectors. So this statement does not bade on the reasonable logic.8.Anyone who has visited Japan knows it is an incredibly expensive place; although Japanese workers earn about the same as their U.S. counterparts, the purchasing power of their incomes is about one-third less. Extend your discussing from question 7 to explain this observation. (Hint: Think about wages and the implied prices of non-trade goods.)The relative higher purchasing power of U.S. is sustained and maintained by its considerably higher productivity in services. Because most of those services are non-traded, Japanese could not benefit from those lower service costs. And U.S. does not have to face a lower international price of services. So the purchasing power of Japanese is just one-third of their U.S. counterparts.9.How does the fact that many goods are non-traded affect the extent of possible gains from trade?Actually the gains from trade depended on the proportion of non-traded goods. The gains will increase as the proportion of non-traded goods decrease.10.We have focused on the case of trade involving only two countries. Suppose that there are many countries capable of producing two goods, and that each country has only one factor of production, labor. What could we say about the pattern of production and in this case? (Hint: Try constructing the world relative supply curve.)Any countries to the left of the intersection of the relative demand and relative supply curves export the good in which they have a comparative advantage relative to any country to the right of the intersection. If the intersection occurs in a horizontal portion then the country with that price ratio produces both goods.。

国际经济学克鲁格曼课后习题答案章完整版

国际经济学克鲁格曼课后习题答案章集团标准化办公室:[VV986T-J682P28-JP266L8-68PNN]第一章练习与答案1.为什么说在决定生产和消费时,相对价格比绝对价格更重要?答案提示:当生产处于生产边界线上,资源则得到了充分利用,这时,要想增加某一产品的生产,必须降低另一产品的生产,也就是说,增加某一产品的生产是有机会机本(或社会成本)的。

生产可能性边界上任何一点都表示生产效率和充分就业得以实现,但究竟选择哪一点,则还要看两个商品的相对价格,即它们在市场上的交换比率。

相对价格等于机会成本时,生产点在生产可能性边界上的位置也就确定了。

所以,在决定生产和消费时,相对价格比绝对价格更重要。

2.仿效图1—6和图1—7,试推导出Y商品的国民供给曲线和国民需求曲线。

答案提示:3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?试解释原因。

答案提示:4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:5.如果改用Y商品的过剩供给曲线(B国)和过剩需求曲线(A国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?6.答案提示:国际均衡价格将依旧处于贸易前两国相对价格的中间某点。

7.说明贸易条件变化如何影响国际贸易利益在两国间的分配。

答案提示:一国出口产品价格的相对上升意味着此国可以用较少的出口换得较多的进口产品,有利于此国贸易利益的获得,不过,出口价格上升将不利于出口数量的增加,有损于出口国的贸易利益;与此类似,出口商品价格的下降有利于出口商品数量的增加,但是这意味着此国用较多的出口换得较少的进口产品。

对于进口国来讲,贸易条件变化对国际贸易利益的影响是相反的。

8.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

克鲁格曼《国际经济学》(国际金融部分)课后习题答案(英文版)第一章

克鲁格曼《国际经济学》(国际金融部分)课后习题答案(英文版)第一章CHAPTER 1INTRODUCTIONChapter OrganizationWhat is International Economics About?The Gains from TradeThe Pattern of TradeProtectionismThe Balance of PaymentsExchange-Rate DeterminationInternational Policy CoordinationThe International Capital MarketInternational Economics: Trade and MoneyCHAPTER OVERVIEWThe intent of this chapter is to provide both an overview of the subject matter of international economics and to provide a guide to the organization of the text. It is relatively easy for an instructor to motivate the study of international trade and finance. The front pages of newspapers, the covers of magazines, and the lead reports of television news broadcasts herald the interdependence of the U.S. economy with the rest of the world. This interdependence may also be recognized by students through their purchases of imports of all sorts of goods, their personal observations of the effects of dislocations due to international competition, and their experience through travel abroad.The study of the theory of international economics generates an understanding of many key events that shape our domesticand international environment. In recent history, these events include the causes and consequences of the large current account deficits of the United States; the dramatic appreciation of the dollar during the first half of the 1980s followed by its rapid depreciation in the second half of the 1980s; the Latin American debt crisis of the 1980s and the Mexico crisis in late 1994; and the increased pressures for industry protection against foreign competition broadly voiced in the late 1980s and more vocally espoused in the first half of the 1990s. Most recently, the financial crisis that began in East Asia in 1997 andspread to many countries around the globe and the Economic and Monetary Union in Europe have highlighted the way in which various national economies are linked and how important it is for us to understand these connections. At the same time, protests at global economic meetings have highlighted opposition to globalization. The text material will enable students to understand the economic context in which such events occur.Chapter 1 of the text presents data demonstrating the growth in trade and increasing importance of international economics. This chapter also highlights and briefly discusses seven themes which arise throughout the book. These themes include: 1) the gains from trade;2) the pattern of trade; 3) protectionism; 4), the balance of payments; 5) exchange rate determination; 6) international policy coordination; and 7) the international capital market. Students will recognize that many of the central policy debates occurring today come under the rubric of one of these themes. Indeed, it is often a fruitful heuristic to use current events to illustrate the force of the key themes and arguments which are presentedthroughout the text.。

克鲁格曼国际经济学课后答案

克鲁格曼国际经济学课后答案【篇一:克鲁格曼《国际经济学》(国际金融)习题答案要点】lass=txt>第12章国民收入核算和国际收支1、如问题所述,gnp仅仅包括最终产品和服务的价值是为了避免重复计算的问题。

在国民收入账户中,如果进口的中间品价值从gnp中减去,出口的中间品价值加到gnp中,重复计算的问题将不会发生。

例如:美国分别销售钢材给日本的丰田公司和美国的通用汽车公司。

其中出售给通用公司的钢材,作为中间品其价值不被计算到美国的gnp中。

出售给日本丰田公司的钢材,钢材价值通过丰田公司进入日本的gnp,而最终没有进入美国的国民收入账户。

所以这部分由美国生产要素创造的中间品价值应该从日本的gnp中减去,并加入美国的gnp。

2、(1)等式12-2可以写成ca?(sp?i)?(t?g)。

美国更高的进口壁垒对私人储蓄、投资和政府赤字有比较小或没有影响。

(2)既然强制性的关税和配额对这些变量没有影响,所以贸易壁垒不能减少经常账户赤字。

不同情况对经常账户产生不同的影响。

例如,关税保护能提高被保护行业的投资,从而使经常账户恶化。

(当然,使幼稚产业有一个设备现代化机会的关税保护是合理的。

)同时,当对投资中间品实行关税保护时,由于受保护行业成本的提高可能使该行业投资下降,从而改善经常项目。

一般地,永久性和临时性的关税保护有不同的效果。

这个问题的要点是:政策影响经常账户方式需要进行一般均衡、宏观分析。

3、(1)、购买德国股票反映在美国金融项目的借方。

相应地,当美国人通过他的瑞士银行账户用支票支付时,因为他对瑞士请求权减少,故记入美国金融项目的贷方。

这是美国用一个外国资产交易另外一种外国资产的案例。

(2)、同样,购买德国股票反映在美国金融项目的借方。

当德国销售商将美国支票存入德国银行并且银行将这笔资金贷给德国进口商(此时,记入美国经常项目的贷方)或贷给个人或公司购买美国资产(此时,记入美国金融项目的贷方)。

最后,银行采取的各项行为将导致记入美国国际收支表的贷方。

克鲁格曼《国际经济学》(第8版)课后习题详解

克鲁格曼《国际经济学》(第8版)课后习题详解克鲁格曼《国际经济学》(第8版)课后习题详解第1章绪论本章不是考试的重点章节,建议读者对本章内容只作大致了解即可,本章没有相关的课后习题。

第1篇国际贸易理论第2章世界贸易概览一、概念题1>(发展中国家(developing countries)答:发展中国家是与发达国家相对的经济上比较落后的国家,又称“欠发达国家”或“落后国家”。

通常指第三世界国家,包括亚洲、非洲、拉丁美洲及其他地区的130多个国家。

衡量一国是否为发展中国家的具体标准有很多种,如经济学家刘易斯和世界银行均提出过界定发展中国家的标准。

一般而言,凡人均收入低于美国人均收入的五分之一的国家就被定义为发展中国家。

比较贫困和落后是发展中国家的共同特点。

2>(服务外包(service outsourcing)答:服务外包是指企业将其非核心的业务外包出去,利用外部最优秀的专业化团队来承接其业务,从而使其专注于核心业务,达到降低成本、提高效率、增强企业核心竞争力和对环境应变能力的一种管理模式。

20世纪90年代以来,随着信息技术的迅速发展,特别是互联网的普遍存在及广泛应用,服务外包得到蓬勃发展。

从美国到英国,从欧洲到亚洲,无论是中小企业还是跨国公司,都把自己有限的资源集中于公司的核心能力上而将其余业务交给外部专业公司,服务外包成为“发达经济中不断成长的现象”。

3>(引力模型(gravity model)答:丁伯根和波伊赫能的引力模型基本表达式为:其中,是国与国的贸易额,为常量,是国的国内生产总值,是国的国内生产总值,是两国的距离。

、、三个参数是用来拟合实际的经济数据。

引力模型方程式表明:其他条件不变的情况下,两国间的贸易规模与两国的GDP成正比,与两国间的距离成反比。

把整个世界贸易看成整体,可利用引力模型来预测任意两国之间的贸易规模。

另外,引力模型也可以用来明确国际贸易中的异常现象。

4>(第三世界(third world)答:第三世界这个名词原本是指法国大革命中的Third Estate(第三阶级)。

克鲁格曼《国际经济学》(国际金融)习题答案要点

克鲁格曼《国际经济学》(国际金融)习题答案要点赤字。

因此,1982-1985年美国资本流入超过了其经常项目的赤字。

第13章 汇率与外汇市场:资产方法 1、汇率为每欧元1.5美元时,一条德国香肠bratwurst 等于三条hot dog 。

其他不变时,当美元升值至1.25$per Euro, 一条德国香肠bratwurst 等价于2.5个hot dog 。

相对于初始阶段,hot dog 变得更贵。

2、63、25%;20%;2%。

4、分别为:15%、10%、-8%。

5、(1)由于利率相等,根据利率平价条件,美元对英镑的预期贬值率为零,即当前汇率与预期汇率相等。

(2)1.579$per pound6、如果美元利率不久将会下调,市场会形成美元贬值的预期,即e E 值变大,从而使欧元存款的美元预期收益率增加,图13-1中的曲线I 移到I ',导致美元对欧元贬值,汇率从0E 升高到1E 。

131-图 7、(1)如图13-2,当欧元利率从0i 提高到1i 时,汇率从0E 调整到1E ,欧元相对于美元升值。

I 'IE 1E $/euroE图13-2(2)如图13-3,当欧元对美元预期升值时,美元存款的欧元预期收益率提高,美元存款的欧元收益曲线从I '上升到I ,欧元对美元的汇率从E '提高到E ,欧元对美元贬值。

133-图8、(a)如果美联储降低利率,在预期不变的情况下,根据利率平价条件,美元将贬值。

如图13-4,利率从i 下降到i ' ,美元对外国货币的汇价从E 提高到E ',美元贬值。

如果软着陆,并且美联储没有降低利率,则美元不会贬值。

即使美联储稍微降低利率,假如从i 降低到*i (如图13-5),这比人们开始相信会发生的还要小。

同时,由于软着陆所产生的乐观因素,使美元预期升值,即e E 值变小,使国外资产的美元预期收益率降低(曲线I 向下移动到I '),曲线移动反映了对美国软着陆引起的乐观预期,同时由乐观因素引起的预期表明:在没有预期变化的情况下,由利I 'E E 'euro/$E IiE 1E euro/$E rate of return(in euro)0i 1i率i 下降到*i 引起美元贬值程度(从E 贬值到*E )将大于存在预期变化引起的美元贬值程度(从E 到E '')。

《国际经济学》计算题及答案

2X2

,或X=Y处,代入生产可能性曲线得X=Y=100,U0=100*1002=106

(2)开放经济中国完全分工,全部生产大米,交换曲线为Y=300-X,福利最大化必在

Y

大米的边际替代率与贸易条件相等处,即1

,或Y=2X处。代入交换曲线得

2X

X=100,Y=200,U=100*40000=4*106

吨大米的话,中国的纯收益(或纯损失)是多少?(用图和数字说明)

价格(美元)

120

100

a

b

3

数量(吨)

1000

路:若允许自由出口的情况下,中国的大米价格会上升。

如果中国以国际市场价格出口1000吨大米的话,中国的消费者会由于价格上升损失a部分

的面积的利益;而生产者将由于提价得到a+b部分面积的收益,整个经济的纯收益为b,面

计算题及答案

1.在古典贸易模型中,假设A国有120名劳动力,B国有50名劳动力,如果生

产棉花的话,A国的人均产量是2吨,B国也是2吨;要是生产大米的话,A国

的人均产量是10吨,B国则是16吨。画出两国的生产可能性曲线并分析两国中

哪一国拥有生产大米的绝对优势?哪一国拥有生产大米的比较优势?

思路:B国由于每人能生产16吨大米,而A国每人仅生产10吨大米,所以B国

令QWD=QSW得,P=1, QDV=0.5, QSV=0.9,所以V国出口量QSV- QDV=0.4,也等于M

国的进口量。

(3)

(A)V国大米市场(B)国际大米市场(C)M国

大米市场

价格

P

价格

P

价格

S

Sx

P

S1.41.4出口

3.3

3.41.0

克鲁格曼国际经济学答案.pdf

Chapter 21.Home has 1200 units of labor available. It can produce two goods, apples and bananas. The unit labor requirement in apple production is 3, while in banana production it is 2. a .Graph out the production possibilities frontier:b .What is the opportunity cost of apples in terms of bananas?5.1=LbLa a a c .In the absence of trade, what would the price of apples in terms of bananas be?In the absence of trade, since labor is the only factor of production and supply decisions aredetermined by the attempts of individuals to maximize their earnings in a competitive economy, only when Lb La b a /a a /P P =will both goods be produced. So 1.5 /P P b a =2.Home is as described in problem 1. There is now also another country, Foreign, with alabor force of 800. Foreign’s unit labor requirement in apple production is 5, while in banana production it is 1.a .Graph Foreign’s production possibilities frontier:b .3.Now suppose world relative demand takes the following form: Demand for apples/demandfor bananas = price of bananas/price of apples.a .Graph the relative demand curve along with the relative supply curve:a b b a /P P /D D =∵When the market achieves its equilibrium, we have 1b a )(D D −**=++=ba b b a a P P Q Q Q Q ∴RD is a hyperbola xy 1=b .What is the equilibrium relative price of apples?The equilibrium relative price of apples is determined by the intersection of the RD and RScurves.RD: yx 1= RS: 5]5,5.1[5.1],5.0(5.0)5.0,0[=∈=⎪⎩⎪⎨⎧+∞∈=∈y y y x x x ∴25.0==y x∴2/=b P a P e ec .Describe the pattern of trade.∵b a b e a e b a P P P P P P ///>>**∴In this two-country world, Home will specialize in the apple production, export applesand import bananas. Foreign will specialize in the banana production, export bananas and import apples.d .Show that both Home and Foreign gain from trade.International trade allows Home and Foreign to consume anywhere within the coloredlines, which lie outside the countries’ production possibility frontiers. And the indirect method, specializing in producing only one production then trade with other country, is a more efficient method than direct production. In the absence of trade, Home could gain three bananas by foregoing two apples, and Foreign could gain by one foregoing five bananas. Trade allows each country to trade two bananas for one apple. Home could then gain four bananas by foregoing two apples while Foreign could gain one apple by foregoing only two bananas. So both Home and Foreign gain from trade.4.Suppose that instead of 1200 workers, Home had 2400. Find the equilibrium relative price. What can you say about the efficiency of world production and the division of the gains from trade between Home and Foreign in this case? RD: yx 1= RS: 5]5,5.1[5.1],1(1)1,0[=∈=⎪⎩⎪⎨⎧+∞∈=∈y y y x x x ∴5.132==y x∴5.1/=b P a P e eIn this case, Foreign will specialize in the banana production, export bananas and import apples. But Home will produce bananas and apples at the same time. And the opportunity cost of bananas in terms of apples for Home remains the same. So Home neither gains nor loses but Foreign gains from trade.5.Suppose that Home has 2400 workers, but they are only half as production in both industries as we have been assuming, Construct the world relative supply curve and determine the equilibrium relative price. How do the gains from trade compare with those in the case described in problem 4?In this case, the labor is doubled while the productivity of labor is halved, so the "effective labor"remains the same. So the answer is similar to that in 3. And both Home and Foreign can gain from trade. But Foreign gains lesser compare with that in the case 4.6.”Korean workers earn only $2.50 an hour; if we allow Korea to export as m uch as it likes to the United States, our workers will be forced down to the same level. You can’t import a $5 shirt without importing the $2.50 wage that goes with it.” Discuss.In fact, relative wage rate is determined by comparative productivity and the relative demand for goods. Korea’s low wage reflects the fact that Korea is less productive than the United States in most industries. Actually, trade with a less productive, low wage country can raise the welfare and standard of living of countries with high productivity, such as United States. Sothis pauper labor argument is wrong.7.Japanese labor productivity is roughly the same as that of the United States in the manufacturing sector (higher in some industries, lower in others), while the United States, is still considerably more productive in the service sector. But most services are non-traded. Some analysts have argued that this poses a problem for the United States, because our comparative advantage lies in things we cannot sell on world markets. What is wrong with this argument?The competitive advantage of any industry depends on both the relative productivities of the industries and the relative wages across industries. So there are four aspects should be taken into account before we reach conclusion: both the industries and service sectors of Japan and U.S., not just the two service sectors. So this statement does not bade on the reasonable logic. 8.Anyone who has visited Japan knows it is an incredibly expensive place; although Japanese workers earn about the same as their U.S. counterparts, the purchasing power of their incomes is about one-third less. Extend your discussing from question 7 to explain this observation. (Hint: Think about wages and the implied prices of non-trade goods.) The relative higher purchasing power of U.S. is sustained and maintained by its considerably higher productivity in services. Because most of those services are non-traded, Japanese could not benefit from those lower service costs. And U.S. does not have to face a lower international price of services. So the purchasing power of Japanese is just one-third of their U.S. counterparts.9.How does the fact that many goods are non-traded affect the extent of possible gains from trade?Actually the gains from trade depended on the proportion of non-traded goods. The gains will increase as the proportion of non-traded goods decrease.10.We have focused on the case of trade involving only two countries. Suppose that there are many countries capable of producing two goods, and that each country has only one factor of production, labor. What could we say about the pattern of production and in this case? (Hint: Try constructing the world relative supply curve.)Any countries to the left of the intersection of the relative demand and relative supply curves export the good in which they have a comparative advantage relative to any country to the right of the intersection. If the intersection occurs in a horizontal portion then the country with that price ratio produces both goods.。

国际经济学(克鲁格曼)课后习题答案1-8章

第一章练习与答案1.为什么说在决定生产和消费时,相对价格比绝对价格更重要?答案提示:当生产处于生产边界线上,资源则得到了充分利用,这时,要想增加某一产品的生产,必须降低另一产品的生产,也就是说,增加某一产品的生产是有机会机本(或社会成本)的。

生产可能性边界上任何一点都表示生产效率和充分就业得以实现,但究竟选择哪一点,则还要看两个商品的相对价格,即它们在市场上的交换比率。

相对价格等于机会成本时,生产点在生产可能性边界上的位置也就确定了。

所以,在决定生产和消费时,相对价格比绝对价格更重要。

2.仿效图1—6和图1—7,试推导出Y商品的国民供给曲线和国民需求曲线。

答案提示:3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?试解释原因。

答案提示:4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:5.如果改用Y商品的过剩供给曲线(B国)和过剩需求曲线(A 国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?答案提示:国际均衡价格将依旧处于贸易前两国相对价格的中间某点。

6.说明贸易条件变化如何影响国际贸易利益在两国间的分配。

答案提示:一国出口产品价格的相对上升意味着此国可以用较少的出口换得较多的进口产品,有利于此国贸易利益的获得,不过,出口价格上升将不利于出口数量的增加,有损于出口国的贸易利益;与此类似,出口商品价格的下降有利于出口商品数量的增加,但是这意味着此国用较多的出口换得较少的进口产品。

对于进口国来讲,贸易条件变化对国际贸易利益的影响是相反的。

7.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

8.根据上一题的答案,你认为哪个国家在国际贸易中福利改善程度更为明显些?答案提示:小国。

9*.为什么说两个部门要素使用比例的不同会导致生产可能性边界曲线向外凸?答案提示:第二章答案1.根据下面两个表中的数据,确定(1)贸易前的相对价格;(2)比较优势型态。

《国际经济学》克鲁格曼(第六版)习题答案imsect3

OVERVIEW OF SECTION III: EXCHANGE RATES AND OPEN ECONOMY MACROECONOMICSSection III of the textbook is comprised of six chapters:Chapter 12 National Income Accounting and the Balance of PaymentsChapter 13 Exchange Rates and the Foreign Exchange Market: An Asset Approach Chapter 14 Money, Interest Rates, and Exchange RatesChapter 15 Price Levels and the Exchange Rate in the Long RunChapter 16 Output and the Exchange Rate in the Short RunChapter 17 Fixed Exchange Rates and Foreign Exchange InterventionSECTION III OVERVIEWThe presentation of international finance theory proceeds by building up an integrated model of exchange rate and output determination. Successive chapters in Part III construct this model step by step so students acquire a firm understanding of each component as well as the manner in which these components fit together. The resulting model presents a single unifying framework admitting the entire range of exchange rate regimes from pure float to managed float to fixed rates. The model may be used to analyze both comparative static and dynamic time path results arising from temporary or permanent policy or exogenous shocks in an open economy.The primacy given to asset markets in the model is reflected in the discussion of national income and balance of payments accounting in the first chapter of this section. Chapter 12 begins with a discussion of the focus of international finance. The discussion then proceeds to national income accounting in an open economy. The chapter points out, in the discussion on the balance of payments account, that current account transactions must be financed by financial account flows from either central bank or noncentral bank transactions. A case study uses national income accounting identities to consider the link between government budget deficits and the current account.Observed behavior of the exchange rate favors modeling it as an asset price rather than as a goods price. Thus, the core relationship for short-run exchange-rate determination in the model developed in Part III is uncovered interest parity. Chapter 13 presents a model inwhich the exchange rate adjusts to equate expected returns on interest-bearing assets denominated in different currencies given expectations about exchange rates, and the domestic and foreign interest rate. This first building block of the model lays the foundation for subsequent chapters that explore the determination of domestic interest rates and output, the basis for expectations of future exchange rates and richer specifications of the foreign-exchange market that include risk. An appendix to this chapter explains the determination of forward exchange rates.Chapter 14 introduces the domestic money market, linking monetary factors to short-run exchange-rate determination through the domestic interest rate. The chapter begins with a discussion of the determination of the domestic interest rate. Interest parity links the domestic interest rate to the exchange rate, a relationship captured in a two-quadrant diagram. Comparative statics employing this diagram demonstrate the effects of monetary expansion and contraction on the exchange rate in the short run. Dynamic considerations are introduced through an appeal to the long run neutrality of money that identifies a long-run steady-state value toward which the exchange rate evolves. The dynamic time path of the model exhibits overshooting of the exchange-rate in response to monetary changes.Chapter 15 develops a model of the long run exchange rate. The long-run exchange rate plays a role in a complete short-run macroeconomic model since one variable in that model is the expected future exchange rate. The chapter begins with a discussion of the law of one price and purchasing power parity. A model of the exchange rate in the long-run based upon purchasing power parity is developed. A review of the empirical evidence, however, casts doubt on this model. The chapter then goes on to develop a general model of exchange rates in the long run in which the neutrality of monetary shocks emerges as a special case. In contrast, shocks to the output market or changes in fiscal policy alter the long run real exchange rate. This chapter also discusses the real interest parity relationship that links the real interest rate differential to the expected change in the real exchange rate. An appendix examines the relationship of the interest rate and exchange rate under a flexible-price monetary approach.Chapter 16 presents a macroeconomic model of output and exchange-rate determination in the short run. The chapter introduces aggregate demand in a setting of short-run price stickiness to construct a model of the goods market. The exchange-rate analysis presented in previous chapters provides a model of the asset market. The resulting model is, in spirit, very close to the classic Mundell-Fleming model. This model is used to examine the effects of avariety of policies. The analysis allows a distinction to be drawn between permanent and temporary policy shifts through the pedagogic device that permanent policy shifts alter long-run expectations while temporary policy shifts do not. This distinction highlights the importance of exchange-rate expectations on macroeconomic outcomes. A case study of U.S. fiscal and monetary policy between 1979 and 1983 utilizes the model to explain notable historical events. The chapter concludes with a discussion of the links between exchange rate and import price movements which focuses on the J-curve and exchange-rate pass-through. An appendix to the chapter compares the IS-LM model to the model developed in this chapter. A second appendix considers intertemporal trade and consumption demand. A third appendix discusses the Marshall-Lerner condition and estimates of trade elasticities.The final chapter of this section discusses intervention by the central bank and the relationship of this policy to the money supply. This analysis is blended with the previous chapter's short-run macroeconomic model to analyze policy under fixed rates. The balance sheet of the central bank is used to keep track of the effects of foreign exchange intervention on the money supply. The model developed in previous chapters is extended by relaxing the interest parity condition and allowing exchange-rate risk to influence agents' decisions. This allows a discussion of sterilized intervention. Another topic discussed in this chapter is capital flight and balance of payments crises with an introduction to different models of how a balance of payments or currency crisis can occur. The analysis also is extended to a two-country framework to discuss alternative systems for fixing the exchange-rate as a prelude to Part IV. An appendix to Chapter 17 develops a model of the foreign-exchange market in which risk factors make domestic-currency and foreign-currency assets imperfect substitutes.A second appendix explores the monetary approach to the balance of payments. The third appendix discusses the timing of a balance of payments crisis.。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

1•在古典贸易模型中,假设A国有120名劳动力,B国有50名劳动力,如果生产棉花的话,A国的人均产量是2吨,B国也是2吨;要是生产大米的话,A国的人均产量是10吨,B国则是16吨。

画出两国的生产可能性曲线并分析两国中哪一国拥有生产大米的绝对优势?哪一国拥有生产大米的比较优势?思路:B国由于每人能生产16吨大米,而A国每人仅生产10吨大米,所以B国具有生产大米的绝对优势。

从两国生产可能性曲线看出A国生产大米的机会成本为0.2,而B国为0.125,所以B国生产大米的机会成本或相对成本低于A国,B国生产大米具有比较优势。

2. 下表列出了加拿大和中国生产1单位计算机和1单位小麦所需的劳动时间。

假定生产计算机和小麦都只用劳动,加拿大的总劳动为600小时,中国总劳动为800小时。

(1)计算不发生贸易时各国生产计算机和小麦的产量。

(2)哪E个国家具有生产计算机的比较优势?哪个国家具有生产小麦的比较优势?(3)如果给定世界价格是1单位计算机交换22单位的小麦,加拿大参与贸易可以从每单位的进口中节省多少劳动时间?中国可以从每单位进口中节省多少劳动时间?如果给定世界价格是1单位计算机交换24单位的小麦,加拿大和中国分别可以从进口每单位的货物中节省多少劳动时间?(4)在自由贸易的情况下,各国应生产什么产品,数量是多少?整个世界的福利水平是提高还是降低了?试用图分析。

(以效用水平来衡量福利水平)思路:(1)中国生产计算机的机会成本为100/4=25,加拿大为60/3=20(2)因为加拿大生产计算机的机会成本比中国低,所以加拿大具有生产者计算机的比较优势,中国就具有生产小麦的比较优势。

(3)如果各国按照比较优势生产和出口,加拿大进口小麦出口计算机,中国进口计算机出口小麦。

加拿大进口一单位小麦需要出口1/22单位计算机,折合成劳动时间来算,生产一单位小麦本国要用3小时,但生产1/22单位计算机本国要用60/22小时劳动,所以加拿大进口一单位小麦相当于用60/22小时的劳动换回本国3小时生产的产品,节省了3-60/22=3/11小时的劳动时间。

中国进口一单位计算机需要出口22单位小麦,相当于用22*4=88小时的劳动换回本国需用100小时生产的产品,节省了100-88=12 小时的劳动时间。

如果世界价格是1单位计算机交换24单位的小麦,贝肪目当于用60/24小时的劳动换回本国3小时生产的产品,节省了3-60/24=1/2 小时的劳动时间。

中国进口一单位计算机需要出口24单位小麦,相当于用24*4=96小时的劳动换回本国需用100小时生产的产品,节省了100-96=4小时的劳动时间。

(4)在自由贸易的情况下,加拿大应专业生产计算机,数量为600/60=10单位;中国应专业生产小麦,数量为800/4=200 单位。

中国的福利水平从1°1上升到U11,加拿大的福利水平从『2上升到U12,整个世界的福利水平上升了3. 假定中国总劳动为600小时,生产每单位钢铁 Y 需要4小时,而生产每单位大米 X 需要2小时, 用图画出:(1) 封闭经济中国的福利水平。

(2) 假设开放后大米的相对价格为1,求开放后中国的福利总水平。

(3) 开放的分工所得和交换所得。

Y 1(1)封闭经济中的福利最大化必在大米的边际替代率与机会成本相等处,即Y 1,或X=Y 处,代入生产 2X 2 可能性曲线得 X=Y=100, U0=100*1002=106(2)开放经济中国完全分工,全部生产大米,交换曲线为 Y=300-X ,福利最大化必在大米的边际替代率与贸Y易条件相等处,即1,或Y=2X 处。

代入交换曲线得 X=100, Y=200, U=100*40000=4*106 2 X(3) 交换所得:假设中国没有完全专业生产大米,仍然像封闭经济那样生产 100单位大米和100单位钢铁, 但大米以1: 1的比例交换钢铁,新的交换曲线为 Y=200-X ,福利最大化仍在大米的边际替代率与贸易条7 63.2*10 _ 76*10 27 274. 、我国某型汽车的进口关税为 30%,其零部件的进口关税为10%,进口零配件占国内生产该型汽 车价值的40%,试计算我国该型汽车的有效关税保护率。

解题思路:有效关税保护率=(产品关税率-零配件关税率*零配件比例)/(1-零配件比例)=(30%-10%*40%)心-40%)=43%5. 、设中国对小汽车的关税税率为 180%,国内一典型的汽车制造商的成本结构和部件关税如下: 成本项目钢板 发动机 轮胎占汽车价格比重 20% 30% 10%关税税率 60% 120% 30%(1) 请计算对中国小汽车行业的有效保护率。

(2) 如果钢板、发动机、轮胎的关税分别降为 10%、30%、5%,计算小汽车的有效保护率。

(3) 从上面的计算中,可以推出哪些有关有效保护率的结论?思路:中国的生产可能性曲线为 2Y=300-X ,大米的机会成本为 1/2单位的钢铁, 根据福利函数知每一条效用曲线上大米对钢铁的边际替代率为 Y2XY件相等处,即云"或Y =2X 处。

代入交换曲线得X=200/3,Y=400/3,U 1 200 160000 __ * _____ 3 9 3.2*10 27交换所得为U 1 -u 06 5*10 27分工所得为U =4*10 6解题思路:(1)ERP=(180%-20%*60%-30%*120%-10%*30%)/(1-20%-30%-10%)=322.5%⑵)ERP=(180%-20%*10%-30%*30%-10%*5%”(1-20%-30%-10%)=421.25%(3)在最终产品名义保护率一定的情况下,中间投入品的平均关税越低,有效保护率越高,则反之。

6. 、假设A 国X 工业进口生产要素Y ,且A 国无论在X 的产品市场还是在Y 的要素市场都是效果,请根据下列信息,求X 工业的有效保护率。

自由贸易价格名义关税率最终产品X 100 美元19% 生产要素Y (仅投入X工业) 70美元10%解题思路:因为 A 国无论在X 产品还是在Y 要素方面在国际市场上均为小国,那么在对X 产品征收19%的名义关税后,X 产品的国内价格将上升为119美元,对要素Y征收10%名义关税后,生产要素Y的价格将上升为77美元。

由于在征收关税前,X 产品的增加值V1=100-70=30 美元,在征收关税后,X 产品的增加值V2=119-77=42 美元所以X 工业的有效保护率为ERP={(42-30)/30}8100%=40%7.假设本国生产1 单位食品需要6 单位的劳动,生产1 单位服装需要8单位劳动;外国生产1 单位食品需要2单位的劳动,生产 1 单位服装需要4单位劳动。

两国各有8 单位的可用劳动。

( 1)哪国在食品生产上具有比较优势?哪国在服装生产上具有比较优势?为什么?( 2)列举一个能够使两国进行互惠贸易的交换率并计算本国与外国的贸易获利分别是多少?解:( 1)本国在食品和劳动生产上,均处于绝对劣势。

但是,本国在服装生产上具有比较优势,因为本国食品的劳动生产率是外国的1/3,服装的劳动生产率是外国的1/2,因此在服装生产上具有比较优势。

外国在食品生产上具有比较优势,因为食品的绝对优势( 1/2)比服装( 1/4)的绝对优势大。

(2)可以用本国0.6单位服装,交换外国 1 单位食品。

对本国而言,交换出的0.6单位服装需耗费 4.8 劳动,这些劳动在本国能生产0.8食品,而得到的是1单位食品,获利0.2单位食品。

对外国而言,交换出1单位食品的劳动量,可以生产0.5单位服装,而得到的是0.6单位服装,所以获利0.1单位服装。

因此,两国均获利。

8 •假设A国生产1单位小麦需要的劳动为4小时,生产1单位布需要的劳动为3小时;B国生产1 单位小麦需要的劳动为 1 小时,生产 1 单位布需要的劳动为 2 小时,则、( 1)以劳动衡量,A、B 两国生产小麦和布的机会成本各是多少?(2)如果 A 国工资率为6美元/小时,则小麦和布的价格各是多少?( 3)如果B 国工资率为 1 欧元/小时,则小麦和布的价格各是多少?解:( 1)A 过生产小麦的机会成本为4/3,生产布的机会成本为3/4;B 国生产小麦的机会成本为1/2,生产布的机会成本为2。

(2)在 A 国,小麦价格为24 美元,布价格为18美元。

(3)在 B 国,小麦价格为 1 欧元,布价格为 2 欧元。

9.本国生产球棒的单位劳动投人为6,生产网球拍的单位劳动投入为2;外国生产球棒的单位劳动投入为1,生产网球拍的单位劳动投人为4。

( 1)本国在哪种产品上拥有相对生产优势(即比较优势)?为什么?( 2)对本国和外国而言,用球棒表示的网球拍的机会成本各是多少?( 3)在贸易均衡状态下,网球拍的价格大致如何?( 4)如果在世界市场上,网球拍的价格/球棒的价格=2,为什么两国会展开专业化分工?(本国专业生产网球拍,外国专业生产球棒)( 5)证明外国通过专业生产球棒可以从贸易中获益。

解、( 1)本国在网球拍生产方面拥有比较优势。

因为本国生产一单位的网球拍只需要投入 2 单位的劳动,而外国则需要投入 4 单位的劳动;与此同时,在球棒的生产上,本国生产单位球棒需要投入 6 单位的劳动,而外国生产单位球棒只需要投入 1 单位,因此外国生产球棒具有比较优势。

(2)本国用球棒表示的网球拍的机会成本是1/3;而外国用球棒表示的网球拍的机会成本是4。

(3)世界均衡价格处于两个国家自给自足价格之间、 1 / 3v世界均衡相对价格v 4。

(4)因为一个国家专业化生产何种产品取决于在两个产业中工人所获工资的比较。

本国工人生产网球拍的收人为2/2=1 ,生产球棒的收人为1/6,工人会追逐高工资进入网球拍产业,导致本国专业生产网球拍;因为同样的理由外国将专业生产球棒。

(5)在没有贸易的情况下,外国可用4单位劳动生产 4 个球棒或1个网球拍。

而通过专业生产球棒,然后用它去交换网球拍,可以用放弃 2 个球棒的代价获得1个网球拍,这是它自己生产的 2 倍,可见外国可从贸易中获益。

10 •假设仅有劳动力和土地两种生产要素,A国拥有800万英亩土地和200万个劳动力,B国有200 万英亩土地和40 万个劳动力;如果劳动力占甲商品生产总成本的80%,占乙商品生产总成本的20% ,那么(1)哪个国家为资本充裕的国家?哪个国家为劳动充裕的国家?为什么?(2)哪个国家会出口甲商品?哪个国家出口乙产品?为什么?解:(1)A 国的TK/TL 为800/200=4 ,B 国的TK/TL 为200/40=5,所以 A 国是劳动充裕型国家, B 国是资本充裕型国家。

(2)甲商品为劳动密集型产品,应由 A 国生产并出口;乙商品为资本密集型产品,应由 B 国生产并出口。