国际经济学题库

(完整)国际经济学考试题库(答案版)

一、试述H-O模型的主要内容并予以评价。

1、基本内容:资本丰富的国家在资本密集型产品上相对供给能力较强,劳动丰富的国家则在劳动密集型产品上相对供给能力较强。

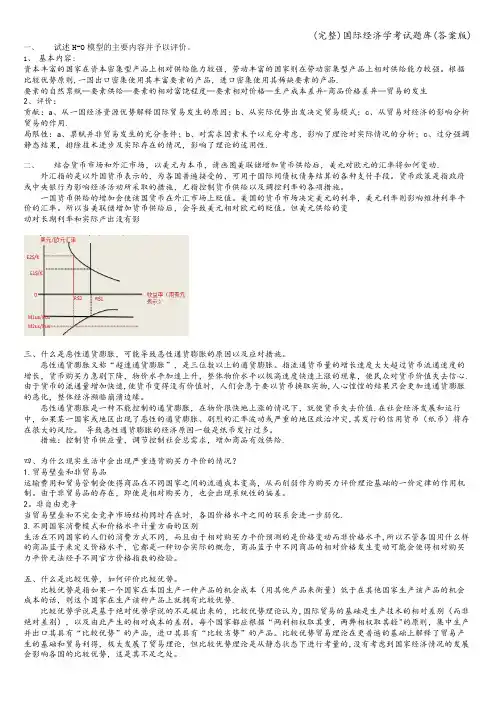

根据比较优势原则,一国出口密集使用其丰富要素的产品,进口密集使用其稀缺要素的产品.要素的自然禀赋—要素供给—要素的相对富饶程度—要素相对价格—生产成本差异-商品价格差异—贸易的发生2、评价:贡献:a、从一国经济资源优势解释国际贸易发生的原因;b、从实际优势出发决定贸易模式;c、从贸易对经济的影响分析贸易的作用.局限性:a、禀赋并非贸易发生的充分条件;b、对需求因素未予以充分考虑,影响了理论对实际情况的分析;c、过分强调静态结果,排除技术进步及实际存在的情况,影响了理论的适用性.二、结合货币市场和外汇市场,以美元为本币,请画图美联储增加货币供给后,美元对欧元的汇率将如何变动.外汇指的是以外国货币表示的,为各国普遍接受的,可用于国际间债权债务结算的各种支付手段。

货币政策是指政府或中央银行为影响经济活动所采取的措施,尤指控制货币供给以及调控利率的各项措施。

一国货币供给的增加会使该国货币在外汇市场上贬值。

美国的货币市场决定美元的利率,美元利率则影响维持利率平价的汇率。

所以当美联储增加货币供给后,会导致美元相对欧元的贬值。

但美元供给的变动对长期利率和实际产出没有影三、什么是恶性通货膨胀,可能导致恶性通货膨胀的原因以及应对措施。

恶性通货膨胀又称“超速通货膨胀”,是三位数以上的通货膨胀。

指流通货币量的增长速度大大超过货币流通速度的增长,货币购买力急剧下降,物价水平加速上升,整体物价水平以极高速度快速上涨的现象,使民众对货币价值失去信心.由于货币的流通量增加快速,使货币变得没有价值时,人们会急于要以货币换取实物,人心惶惶的结果只会更加速通货膨胀的恶化,整体经济濒临崩溃边缘。

恶性通货膨胀是一种不能控制的通货膨胀,在物价很快地上涨的情况下,就使货币失去价值.在社会经济发展和运行中,如果某一国家或地区出现了恶性的通货膨胀、剧烈的汇率波动或严重的地区政治冲突,其发行的信用货币(纸币)将存在很大的风险。

国际经济学试题_精选稿(教师用-含部分答案)_

国际经济学精选习题集第一部分国际贸易理论第1章绪论一、单项选择题1.国际经济学在研究资源配置时,划分的基本经济单位是(D)A.企业B.个人C.政府D.国家2.国际经济学研究的对象是(B)A.国际商品流动B.世界范围内的稀缺资源的最优配置C.国际收支平衡D.国际人员流动3.从国际间经济资源流动的难易度看,流动最容易的是(B)A.商品B.资本C.人员D.技术二、判断分析题1.国际经济学是建立在微观经济学与宏观经济学基础之上的一门分支科学。

√。

大部分国际经济学应用了宏微观经济学的一般原理,如无差异曲线、需求曲线、企业产量按照MR=MC确定等,但是国际经济学理论本身也获得了许多理论性的进步。

在此基础上的国际经济学研究又推动了一般经济学理论研究方法的发展。

第2章比较优势原理一、单项选择题1.比较优势理论认为,国际贸易的驱动力是(A)。

A.劳动生产率的差异B.技术水平的差异C.产品品质的差异D.价格的差异2.从15世纪初到18世纪中叶,在国际贸易和国际收支理论方面占主导地位的是(A)。

A.重商主义B.重农主义C.重金主义D.自由放任主义3.绝对成本学说是比较成本学说的(C)。

A.同一形式B.发展形式C.特殊形式D.理论形式4.亚当·斯密的绝对优势理论认为(C)。

A.所有产品均具有绝对优势的国家最终将获得全部黄金和白银B.具有绝对优势的国家将获得大量贸易余额C.如果两个国家分别出口本国劳动成本相对较低的产品,将同时从贸易中获益D.如果一国不用关税壁垒保护本国产业将丧失绝对优势5.李嘉图比较优势理论指出(B)。

A.贸易导致不完全专业化B.即使一个国家不具备绝对成本优势,也可从出口绝对成本劣势相对较小的产品中获益C.与不具备绝对成本优势的国家相比,具有绝对成本优势的国家可以从贸易中获利更多D.只有具备计较优势的国家才能获得贸易余额6.根据比较成本说,一国从国际贸易中获益的条件是(B)。

A.创造大量贸易顺差B.以较低的机会成本进口商品而不在国内生产C.本国比贸易伙伴国强大D.本国相对于贸易伙伴具备绝对效率优势7.在比较利益模型中,两种参与贸易商品的国际比价(C)。

国际经济学习题

国际经济学习题国际经济学课程习题第⼀章绪论⼀、单项选择题1、从⼗五世纪初到⼗⼋世纪中叶,在国际贸易和国际投资理论⽅⾯占主导地位的是()A.重商主义B.重农主义C.重⾦主义D.货币主义2、重商主义认为财富的唯⼀形式是( )A.⼟地B.商品C.货币D.⼈⼒资源3、最早提出贸易的利益是“⾮零和”的观点的经济学家是( )A.伊莱·赫克歇尔B.⼤卫·李嘉图C.亚当·斯密D.⽡西⾥·⾥昂惕夫4、阿根廷经济学家劳尔·普雷维什认为整个世界可以分为两类国家,其中处于“中⼼”地位的是( ) A.发达国家 B.发展中国家C.出⼝国家 D.进⼝国家5、重商主义的基本观点是⼀种( )A.国际⾦融的“乘数理论”B.国际贸易的“零和理论”C.国际⾦融的“杠杆原理”D.国际贸易的“绝对优势理论”6、第⼆次世界⼤战后没有出现的国际经济新现象是( )A.国际贸易增长速度超过世界⽣产增长速度B.跨国公司产值占世界总产量的⼀半以上C.发达国家采⽤各种⾮关税壁垒保护本国市场D.发展中国家的⾦融市场全⾯开放7、国际经济学理论体系发展阶段不包括()A.重商主义 B.古典的⾃由贸易论及其⾃由贸易的政策C.现代国际经济理论 D.重农主义8、国际经济学在研究资源配置时,作为划分界限的基本经济单位是( )A.企业B.个⼈C.政府D.国家⼆、名词解释1、国际经济学2、封闭经济3、开放经济⼆、问答题1、国际经济学的研究对象是什么?2、简述国内经济和国际经济的异同。

3、试述国际经济学理论的发展脉络。

第⼆章古典的国际贸易理论⼀、名词解释1、绝对利益学说2、机会成本3、⽣产可能性曲线⼆、选择题1、绝对利益学说的提出者是()A、斯密B、李嘉图C、奥林D、魁奈2、如果⼀个阿根廷⼯⼈能⽣产3蒲式⽿⼩麦或1辆汽车,⽽⼀个巴西⼯⼈能⽣产4蒲式⽿⼩麦或2辆汽车,则()。

A、巴西在⼩麦和汽车⽣产上都具有绝对优势,⽽阿根廷没有⽐较优势B、阿根廷在⼩麦和汽车⽣产上都具有绝对优势,⽽巴西没有⽐较优势C、巴西在⼩麦和汽车⽣产上都具有绝对优势,⽽阿根廷在汽车⽣产上具有⽐较优势D、巴西在⼩麦和汽车⽣产上都具有绝对优势,⽽阿根廷在⼩麦⽣产上具有⽐较优势3、根据⽐较优势原理的政策经验,⼀国从国际贸易中获益的条件是()。

国际经济学题库(含参考答案)

国际经济学题库(含参考答案)一、单选题(共50题,每题1分,共50分)1、区域一体化组织中最松散、最低级的形式是()A、关税同盟B、自由贸易区C、共同市场D、优惠贸易安排正确答案:D2、要素价格均等化表明()A、一国丰富要素所有者受益,稀缺要素所有者受损B、一国丰富要素所有者受损,稀缺要素所有者受益C、一国丰富要素所有者和稀缺要素所有者都受益D、一国丰富要素所有者和稀缺要素所有者都受益正确答案:A3、下列不属于关税同盟动态效应的是()A、大市场效应B、加剧竞争C、吸引外资D、贸易创造效应正确答案:D4、如果开放前一国X产品的相对价格低于其贸易伙伴,则贸易后该国()A、进口 X产品B、生产者福利增加C、整体福利下降D、消费者福利增加正确答案:B5、下列()会给本国带来较大的贸易创造效应。

A、本国对贸易商品的供给弹性较大B、本国对成员国的初始关税较大C、本国与成员国之间贸易商品的成本差别较大D、本国对贸易商品的需求弹性较小正确答案:D6、初级产品的出口价格若下降,其出口量将增加,出口总收入()A、不变B、增加C、下降D、不确定正确答案:C7、马歇尔一勒纳条件所要说明的是在供给弹性()的情况下,本币贬值能够改善贸易收支的进出口需求弹性条件。

A、零B、无穷大C、1D^大于零小于1正确答案:B8、假设中国和美国都能生产小麦和布,中国将一单位劳动时间全部生产布,可以生产50米;全部生产小麦,可以生产80千克;美国将一单位劳动时间全部生产布,可以生产40米;全部生产小麦,可以生产 100千克。

如果开放后的国际交换比价为1米布=L 8千克小麦,则下列说法正确的是()A、无法比较美国和中国的获利情况B、中国从贸易开放中获利更多C、美国和中国从贸易开放中获利相同D、美国从贸易开放中获利更多正确答案:D9、下列不属于国际收支平衡表资本项目的是()A、利息收支B、短期信贷C、短期证券买卖D、票据买卖正确答案:A10、消费者剩余是()A、消费者为了商品的消费而必须向政府支付的东西B、消费者通过低于市场价格的价格而得到的收益C、消费者购买商品所需支付的价格低于其愿意支付的价格而获得的收益D、消费者可以在各种价格水平得到的收益正确答案:C11、外汇市场中的即期交易不包含()A、套汇B、投机C、国际贸易结算D、银行同业拆借正确答案:B12、如果一个中国工人能生产3匹布或者1辆汽车,一个美国工人能生产4匹布或2辆汽车,则能促进中国与美国进行贸易并各自收益的交换比率是()A、4匹布换2辆汽车B、3匹布换1辆汽车C、3匹布换2辆汽车D、5匹布换2辆汽车正确答案:D13、国际经济学的研究对象是()A、国际商品流动B、国际收支平衡C、世界范围内的稀缺资源的最优配置D^国际人员流动正确答案:C14、根据国民收入决定方程Y=C+I+G+X-M,国际收支的吸收分析法中的“吸收”是指()A、YB、C+IC、C+I+GD、X-M正确答案:C15、开放经济条件下的宏观经济政策目标是()A、追求贸易顺差B、汇率稳定C、扩大出口D、国际收支平衡正确答案:D16、在进行贸易后,一国的收入分配会发生如下变化,()A、收入由消费者转向生产者B、受到进口商品竞争压力的国内生产者遭受损失,而出口商品的生产者则会受益C、消费者受损,生产者受益D、作为整体的国家受益,而个人则会受到损失正确答案:B17、商品和服务贸易记录在国际收支平衡表中的()A、经常项目B、误差和遗漏项目C、官方结算项目D、资本项目正确答案:A18、下列哪个行业最有可能具有内部规模经济?()A、好莱坞的电影业B、加州硅谷的半导体产业C、美国的大型农场D、北京中关村的电脑城正确答案:C19、采用()的配额分配方式,配额的福利效果与关税一样。

国际经济学期末考试题

国际经济学期末考试题一、选择题(每题5分,共20题,共计100分)1. "供给"指的是:A. 指商品的市场供应量。

B. 指货币的供应量。

C. 指资金的供应量。

D. 指劳动力的供应量。

2. 比较优势理论是谁提出的?A. 亚当·斯密B. 大卫·李嘉图C. 约翰·梅纳德·凯恩斯D. 弗里德曼3. 外汇市场上的汇率是由什么决定的?A. 外汇储备的数量B. 国内物价水平C. 利率水平D. 外国利率水平4. 以下哪个国际组织主要致力于促进全球贸易自由化?A. 世界贸易组织(WTO)B. 国际货币基金组织(IMF)C. 世界银行(WB)D. 美洲国家组织(OAS)5. 货币政策的主要目标之一是:A. 维持物价稳定B. 促进经济增长C. 降低利率D. 减少失业率6. 国际分工的好处包括:A. 提高生产效率B. 扩大市场规模C. 促进技术创新D. 所有选项都正确7. 如果一个国家的汇率升值,会对该国的贸易产生什么影响?A. 减少出口,增加进口B. 增加出口,减少进口C. 减少出口和进口D. 增加出口和进口8. 当通货膨胀率高于预期的时候,央行可能会采取的货币政策措施是:A. 加息B. 降息C. 货币放松D. 不采取任何措施9. 名义利率是指:A. 不包括通货膨胀的利率B. 超额储蓄的利率C. 包括通货膨胀的利率D. 市场利率10. 直接投资是指:A. 跨国公司间的资金流动B. 外商在本国购买股票和债券C. 资本流动到国际间接投资基金D. 政府间的经济援助二、简答题(每题20分,共计40分)1. 解释比较优势理论,并举例说明其应用。

2. 简述外汇市场的功能和作用。

三、论述题(共计60分)1. 请阐述货币政策对经济的影响,以及央行在实施货币政策时需要考虑哪些因素。

2. 选择一个国际组织,介绍其目标、职责以及对国际经济的影响。

四、分析题(共计80分)某国经济遭受一次严重的金融危机,失业率飙升,通货膨胀率上升,人民币贬值,并且国内外投资都受到了打击。

国际经济学完整题库不含答案

第一章国际贸易理论的微观基础、第二章古典贸易理论一、名词解释1.重商主义2.自由贸易论3.绝对优势论4.比较优势论5.机会成本6.机会成本递增7.生产可能性边界二、判断题(在括号内填“√”,表示正确;填上“X”,表示错误)1.国际经济学研究的是全球资源的有效配置。

( )2.重商主义认为,各国在国际贸易中的利弊得失是完全相反的,你之所得就是我之所失。

( )3.我们墨西哥在与美国的竞争中得不到什么好处,美国工厂的生产效率太高了,它有那么多的计算机和机械工具,它的工程水平也太发达了。

我们需要关税,要么我们什么也不出口。

()4.国际贸易产生于各国之间生产商品的技术水平的绝对差别,这是绝对差异论的基本观点。

( )5.在现实社会中,当经济资源或生产要素从一个部门转移到另一个部门时,机会成本可以始终保持不变。

( )6.在机会成本递增条件下,只要各国在生产同样产品时,存在着价格差异,那么各国间的国际分工仍能达到完全专业化的程度。

( )7.国际贸易形成的范围是:国际比价必须在两个参加贸易的国家贸易前的国内比价之间。

( )8.如果进行贸易的两个国家具有同样的生产可能性边界,即使各国不同的生活习惯,以及嗜好差异,也不会导致国际贸易。

( )9.生产可能性边界曲线上的各点切线的斜率即为机会成本。

( )10.晚期重商主义的观点又被称为“贸易差额论”。

()11.一位美国参议员写了下面一段话:“贸易被认为是能够提高所有参与国收入的,至少亚当.斯密或大卫.李嘉图是这样教导我们的。

()12.由于发达国家工资水平高于发展中国家,所以发达国家与发展中国家进行贸易会无利可图;13.因为美国的工资水平很高,所以美国产品在世界市场缺乏竞争力;14. 发展中国家的工资水平比较低是因为国际贸易的缘故。

三、不定项选择题1.国际经济学作为独立的经济学分支科学,有自身的特点。

下列不属于这些特点的是A.国际经济学不同于区域经济学。

B.国际经济学理论的选择并不带有明显的民族性。

国际经济学习题集新

Word格式《国际经济学》习题集商务学院《国际经济学》课程组448 打印店有售绪论一、单项选择题1、国际经济学是以()为其研究对象的。

A. 国际贸易B. 国际经济关系C. 国际金融D. 贸易政策2、国际经济学的国际贸易部分又分为()两大部分。

A. 宏观与微观B. 实物面与货币面C. 理论与政策D. 开放与封闭3、在封闭条件下,一个经济社会生产均衡的条件是()。

A.MRT = P X/PYB.MRS = P X/PYC.XC=XP,YC=YPD.P X(XC-XP)= PY(Y P-YC)4、在开放条件下,一个经济社会贸易均衡的条件是()。

A.MRT = P X/PYB.MRS = P X/PYC.XC=XP,YC=YPD.P X(XC-XP)= P Y(YP-Y C)二、多项选择题1、国际经济学的研究内容包括()两部分。

A. 宏观与微观B. 实物面与货币面C. 理论与政策D. 开放与封闭E. 国际贸易与国际金融2、在封闭条件下,一个经济社会均衡的条件是()。

A.MRT = P X/PYB.MRS = P X/PYC.X C=XP,YC=YPD.PX(XC-XP)= PY(YP-Y C)E.P X=PY3、在开放条件下,一个经济社会均衡的条件是()。

A.MRT = P X/PYB.MRS = P X/PYC.X C=XP,YC=YPD.PX(XC-XP)= PY(YP-YC)E.P X=PY三、名词解释生产可能性边界无差异曲线机会成本边际替代率边际转换率四、判断改错1、在开放经济条件下,只有市场出清才能实现开放的均衡。

()2、国际经济学研究的主要内容是在国际格局下西方经济学研究的资源流动和管理机制问题。

()3、在机会成本递增的条件下,生产可能性边界是一条直线。

()五、简答题1、简述国际经济学的研究对象。

2、简述国际经济学的主要研究内容。

3、简述国际经济学与西方经济学的关系。

六、图形题1、作图说明封闭均衡的条件。

国际经济学试题及答案

国际经济学试题及答案一、选择题1. 国际经济学研究的核心问题是什么?A. 国内经济政策B. 国际贸易与投资C. 国际货币体系D. 国际政治关系答案:B2. 根据比较优势理论,一个国家应该专门生产并出口什么?A. 其资源最丰富的商品B. 其生产成本最低的商品C. 其技术最先进的商品D. 其劳动力成本最低的商品答案:B3. 以下哪项不是贸易保护主义的措施?A. 关税B. 配额C. 出口补贴D. 进口许可证答案:C二、简答题1. 简述绝对优势理论的基本内容。

答案:绝对优势理论由亚当·斯密提出,主张一个国家应该生产并出口其生产效率最高的商品,进口其生产效率最低的商品。

该理论认为,即使一个国家在所有商品的生产上都没有绝对优势,它仍然可以通过专业化生产效率相对较高的商品来获得贸易利益。

2. 什么是国际收支平衡表?答案:国际收支平衡表是一个记录一个国家与其他国家之间所有经济交易的统计报表。

它包括经常账户、资本和金融账户以及官方储备账户。

经常账户记录商品和服务的交易,资本和金融账户记录资本流动和金融资产的交易,官方储备账户记录中央银行的外汇储备变动。

三、论述题1. 论述汇率变动对国际贸易的影响。

答案:汇率变动对国际贸易有重要影响。

当一个国家的货币升值时,其出口商品在国际市场上的价格上升,竞争力下降,导致出口减少;同时,进口商品的价格下降,国内消费者更倾向于购买外国商品,导致进口增加。

相反,当一个国家的货币贬值时,其出口商品的价格下降,竞争力增强,促进出口;进口商品的价格上升,抑制进口。

此外,汇率变动还会影响跨国公司的投资决策,因为投资成本和收益会随着汇率变动而变化。

2. 分析全球化对发展中国家的影响。

答案:全球化为发展中国家带来了机遇和挑战。

机遇方面,全球化促进了资本、技术和信息的流动,为发展中国家提供了更多的市场机会和投资机会,有助于提高生产效率和经济增长。

挑战方面,全球化加剧了国际竞争,对发展中国家的产业和就业产生压力,可能导致收入差距扩大。

国际经济学习题集

国际经济学习题集一、选择题1.AC.美国的布匹生产有绝对优势D.美国的布匹生产有相对优势2. 按照产品生命周期理论,新产品时期的产品通常是()产品。

A.劳力密集型B.土地密集型C.资本密集型D.技术密集型3 当某个产品的进口大国减少进口量时,其贸易条件将会()。

A.改善B.恶化C.不变D.变化不定4. 一国的本币升值,其出口将会()。

A.增加B.减少C.不变D.变化不定5. 根据赫俄理论,一国应该出口()产品。

A.丰裕要素密集型B.比较优势C.绝对优势D.稀缺要素密集型6. “贫困化增长”的一个必要条件为:()A.国家的增长偏向于出口产业。

B.外国对该国的出口需求具有价格弹性。

C.国家的消费偏好高度偏向于出口商品。

D.贸易在国民经济中比重不大。

7、从国际贸易对生产要素收入分配的短期影响来看,自由贸易会导致()A.生产进口竞争品部门使用的专门生产要素收入水平提高B.生产进口竞争品部门使用的共同生产要素收入水平下降C.生产出口品部门使用的共同生产要素收入水平提高D.生产出口品部门使用的专门生产要素收入水平提高8、在商品的国际比价保持不变的情况下,偏向出口的生产要素增长会()A.扩大出口品生产规模 B.扩大进口品生产规模C.使贸易规模保持不变 D.使贸易规模缩减9、不能解释产业内贸易现象的理论是()A.重叠需求理论 B.规模经济理论C.要素禀赋理论 D.相互倾销理论10、成员国间实行自由贸易优惠协定并统一外部关税,但成员国间要素尚未实现自由流动的是()A. 自由贸易区B. 关税同盟C. 共同市场D. 经济联盟11、通常与进口替代战略相配合的政策措施包括()A.降低关税壁垒 B.高估本币价值C.放松外汇管制 D.减少非关税壁垒12、征收进口关税对于进口国来说()A.不利于与进口产品相竞争的生产者B.使国内同类产品的生产减少C.有利于与进口产品相竞争的生产者D.使生产者剩余减少13、下列不属于绝对技术差异论与相对技术差异论共同的假设条件的是()A.生产要素在一国范围内各部门间可以自由流动B.生产要素都被充分利用C.生产要素在各国之间自由流动D.生产要素流动时机会成本不变14、国际贸易使得价格上升部门所密集使用要素的实际收入提高,价格下降部门密集使用要素的实际收入下降,这是()A.赫克歇尔-俄林定理(Heckscher-Ohlin Theorem)B.罗伯津斯基定理(Rybczynski Theorem)C.斯托尔珀-萨谬尔森定理(Stolper-Samuelson Theorem)D.赫克歇尔-俄林-萨谬尔森定理(Heckscher-Ohlin-Samuelson Theorem)15. 根据重叠需求理论,两国的人均国民收入水平差距越大,则()A. 其需求的档次越接近B. 其贸易的基础越雄厚C. 其贸易的可能性越小D. 其需求重叠的部分越大16. 如果一个贸易小国发生进口偏向型要素增长,则()A. 其出口数量增加,进口数量减少B. 其出口数量增加,进口数量增加C. 其出口数量减少,进口数量增加D. 其出口数量减少,进口数量减少17. 其他条件不变,贸易大国征收关税,将导致()A. 世界价格提高B. 世界价格降低C. 该国的社会福利水平提高D. 该国的社会福利水平降低18. 对于贸易小国而言,实施出口补贴将导致其的是:( )A. 本国生产者福利受损B. 本国消费者福利受损C. 外国消费者福利受损D. 世界市场价格下降19. 下列那种理论无法解释产业内贸易()A. 特定要素理论B. 重叠需求理论C. 相互倾销理论D. 寡头垄断市场下的贸易理论20. 当贸易伙伴的提供曲线缺乏弹性时,该国经济增长将导致( )A. 贸易条件改善B. 出口减少C. 进口增加D. 进口减少21. 下列不属于产生外部规模经济的原因的是()A. 生产设备的专业化B. 共同的要素市场C. 产业集聚产生的技术外溢D. 管理费用的节约22. 国际贸易中理论模型中得贸易小国假设与贸易大国的区别在于:()A. GDP的值B. 人口和地域的大小C. 贸易额的大小D. 该国经济变量变化对世界变量是否具有影响23. 根据相对购买力平价理论,对于一个小国经济,其他条件不变,本国名义利率提高将导致本国货币()A. 贬值B. 升值C. 汇率不变D. 不确定24. 根据利率平价理论,对于一个小国经济,其他条件不变,本国名义利率提高将导致本国货币()A. 贬值B. 升值C. 汇率不变D. 不确定25.如果A国可用1个工时生产3单位的X产品或3单位的Y产品,B国可用1个工时生产1单位的X产品或1单位的Y产品,假定劳动是唯一的投入,那么:()A.A国在两种商品的生产上均具有绝对优势。

国际经济学试题及答案

一、单项选择题1。

从国际经济资源流动的难度看,最容易流动的要素是(A)A。

商品B。

资本 C.人员 D.技术2.在比较利益模型中,两种参与贸易商品的国际比价(C)A。

在两国贸易前的两种商品的国内比价之上B。

在两国贸易前的两种商品的国内比价之下C。

在两国贸易前的两种商品的国内比价之间D。

与贸易前的任何一个国家的国内比价相同3.比较利益理论认为国际贸易的驱动力是(A)A。

劳动生产率的差异B。

技术水平的差异C.产品品质的差异D。

价格的差异4.在绝对技术差异理论与相对技术差异理论中,机会成本是(D)A。

递增B。

递减C。

先递增后递减D。

不变5。

不能解释产业内贸易现象的理论有(B)A。

重叠需求理论 B.要素比例理论C.规模经济理论D。

垄断竞争理论6。

能反映规模经济理论本意的是(B)A。

规模报酬递减 B.规模报酬递增C。

规模报酬不变D。

规模成本递增7。

不改变贸易结构,只改变贸易规模的增长方式有(C)A.偏向进口的生产要素增长B。

偏向出口的生产要素增长C。

生产要素等比例增长D。

悲惨的增长8。

最佳关税水平应等于(B)A。

零进口关税 B.零进口关税与禁止性关税之间的水平C。

禁止性关税 D.禁止性关税以上9.世界贸易组织秘书处设在(B)A.日内瓦B。

纽约C。

布鲁塞尔 D.乌拉圭10。

在国际卡特尔订价中,当产品的需求弹性越小,卡特尔订价水平就(B) A。

越低B。

越高 C.不变D。

不确定11。

下述哪一种不属于投机性外汇交易(D)A。

双边套汇B。

多边套汇C。

套利D。

套期保值12。

下述几种货币中,哪一种是实行联合浮动的货币(D)A。

英镑B。

日元C。

美元D。

人民币13。

下述哪一种属于国际收支的事后项目(D)A.进出口B。

利息收支C。

直接投资D。

特别提款权变动14.在分析货币贬值对贸易收支的影响时,小国所面临的供给弹性是(D)A。

零B。

小于需求弹性C。

大于需求弹性D。

无穷大15。

发展中国家主要采取的汇率制度是(C)A。

固定汇率制 B.浮动汇率制 C.钉住汇率制 D.联合浮动制16。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

International Economics, 8e (Krugman)Chapter 16 Output and the Exchange Rate in the Short Run16.1 Determinants of Aggregate Demand in an Open Economy1) How does an increase in the real exchange rate affect exports and imports?A) Exports increase; imports decrease.B) Exports decrease; imports increase.C) Exports increase; imports change ambiguously.D) Exports change ambiguously; imports decrease.E) Exports increase; imports are constant.Answer: CQuestion Status: Previous Edition2) Which one of the following statements is the most accurate?A) For asset markets to remain in equilibrium, a rise in domestic output must be accompanied bya depreciation of domestic currency, all else equal.B) For asset markets to remain in equilibrium, a fall in domestic output must be accompanied by adepreciation of foreign currency, all else equal.C) For asset markets to remain in equilibrium, a rise in domestic output must be accompanied byan appreciation of domestic currency, all else equal.D) For asset markets to remain in equilibrium, a fall in domestic output must be accompanied byan appreciation of domestic currency, all else equal.E) None of the above.Answer: CQuestion Status: New3) Which one of the following statements is most accurate?A) In general, consumption demand rises by less than disposable income.B) In general, consumption demand rises by more than disposable income.C) In general, consumption demand rises by more than income.D) In general, consumption demand rises by the same amount as disposable income rises.E) None of the above.Answer: AQuestion Status: Previous Edition4) The current account balance isA) the supply of a country's exports less the country's own demand for imports.B) the demand for a country's exports plus the country's own demand for imports.C) the country's own demand for imports less the demand for a country's exports.D) the demand for a country's exports less the country's own demand for imports.E) None of the above.Answer: DQuestion Status: Previous Edition5) The domestic currency price of a representative foreign expenditure basket isA) P, the domestic price level.B) E, the nominal exchange rate.C) P times E, the domestic price level times the domestic price level.D) P, the foreign price level.E) P times E, the foreign price level times the nominal exchange rate. Answer: EQuestion Status: Previous Edition6) Current account is given by the equation:A) CA=IM-EX (measured in terms of domestic output).B) CA=IM-EX (measured in terms of foreign output).C) CA=EX-IM (measured in terms of domestic output).D) CA=EX-IM (measured in terms of foreign output).E) None of the above.Answer: CQuestion Status: New7) The domestic currency price of a representative domestic expenditure basket isA) P, the domestic price level.B) E, the nominal exchange rate.C) P times E, the domestic price level times the domestic price level.D) P, the foreign price level.E) P times E, the foreign price level times the nominal exchange rate. Answer: AQuestion Status: Previous Edition8) The real exchange rate, q, is defined asA) the price of the foreign basket in terms of the domestic one.B) the price of the domestic basket in terms of the foreign one.C) the price of the foreign basket.D) the price of the domestic basket.E) None of the above.Answer: AQuestion Status: Previous Edition9) A country's domestic currency's real exchange rate, q, is defined asA) E.B) E times P.C) E times P.D) (E times P)/P.E) P/(E times P).Answer: DQuestion Status: Previous Edition10) If the representative basket of European goods and services costs 40 euros, the representative U.S.basket costs $50, and the dollar/euro exchange rate is $0.90 per euro, then the price of theEuropean basket in terms of U.S. basket isA) [(0.9 $/euro) (40 euro per a European basket)]/[(50 $/U.S. basket)].B) [(0.9 $/euro) (50 $/U.S. basket)]/[(40 euro per a European basket)].C) [(40 euro per a European basket)]/[(50 $/U.S. basket) (0.9 $/euro)].D) [(50 $/U.S. basket)].E) [(0.9 $/euro) (40 euro per a European basket) (50 $ U.S. basket)].Answer: AQuestion Status: Previous Edition11) When EP/P rises,A) IM will rise.B) IM will fall.C) IM may rise or fall.D) IM is not affected.E) None of the above.Answer: CQuestion Status: Previous Edition12) When the real exchange rate rises,A) Imports measured in terms of domestic output will rise.B) Imports measured in terms of domestic output will fall.C) Imports measured in terms of domestic output will never be affected.D) Imports measured in terms of domestic output may rise or fall.E) None of the above.Answer: DQuestion Status: Previous Edition13) Which one of the following statements is the most accurate?A) An increase in disposable income improves the current account.B) An increase in disposable income does not affect the current account.C) An increase in disposable income worsens the current account.D) An increase in income worsens the current account.E) An increase in income improves the current account.Answer: CQuestion Status: Previous Edition14) Which one of the following statements is the most accurate?A) An increase in the real exchange rate and an increase in disposable income improve the currentaccount.B) A decrease in the real exchange rate and a decrease in disposable income improve the currentaccount.C) A decrease in the real exchange rate and a increase in disposable income improve the currentaccount.D) An increase in the real exchange rate and a decrease in disposable income improve the currentaccount.E) None of the above.Answer: DQuestion Status: Previous Edition15) Disposable income is defined as:A) Y-C.B) Y-T.C) C-T.D) I-C.E) Y-I.Answer: BQuestion Status: Previous Edition16) The real exchange rate is:A) how much of a foreign currency you can buy with the domestic currency.B) foreign CPI divided by the domestic CPI.C) the price of foreign goods in terms of domestic goods.D) the price of foreign goods in dollars.E) the domestic currency divided by the price level.Answer: CQuestion Status: Previous Edition17) An increase in the real exchange rate:A) makes imports more expensive.B) makes imports less expensive.C) does not affect import values.D) always makes the number of imports rise.E) A and D.Answer: AQuestion Status: Previous Edition18) Which of the following compete to determine whether the current account improves or worsensfollowing a rise in the real exchange rate:A) appreciation and depreciation.B) crowding Out effect and producers effect.C) volume effect and value effect.D) volume effect and inflation.E) producers effect and value effect.Answer: CQuestion Status: Previous Edition19) The current account increases when:A) real exchange rate decreases.B) real exchange rate increases.C) disposable income increases.D) exports fall.E) domestic prices fall.Answer: BQuestion Status: Previous Edition20) Which of the following would NOT cause the real exchange rate to rise?A) a rise in the exchange rate, EB) depreciation of the home currencyC) a right shift of the aggregate demand curveD) a rise in foreign prices, PE) a fall in domestic prices, P Answer: CQuestion Status: Previous Edition21) What is the best way to describe aggregate demand?A) quantity required to satisfy equilibriumB) exports decrease; imports increaseC) amount of a country's goods and services demanded by household and firms throughout theworldD) individual's demandE) None of the above.Answer: CQuestion Status: Previous Edition22) What have we assumed when we conclude that a real depreciation of the currency improves thecurrent account?A) The volume effect outweighs the value effect.B) The value effect outweighs the volume effect.C) All else equal and the volume effect outweighs the value effect.D) All else equal and the value effect outweighs the volume effect.E) None of the above.Answer: CQuestion Status: Previous Edition23) A country's domestic currency's real exchange rate, q, is best described byA) the price of similar goods in the same market.B) the price of the domestic basket in terms of the foreign one.C) the price of a domestic basket.D) the price of the foreign basket in terms of the domestic basket.E) the price of different goods baskets in the same market.Answer: DQuestion Status: Previous Edition24) Explain how does an increase in the real exchange rate affect exports and imports?Answer: When the real exchange rate increases, domestic products are cheaper relative to foreign products. Due to this, exports increase as foreigners demand more of our exports. The changein imports is ambiguous because fewer units of imports are purchased (the volume effect), buteach foreign unit is now more expensive (the value effect). Remember: exports and importsare measured in terms of domestic output, i.e. dollar value, not volume of units. However, weoften assume that the volume effect outweighs the value effect, so that imports decreasewhen the real exchange rate rises.Question Status: Previous Edition25) Please discuss the volume effect and the value effect in regards to how the current account willmove given a change in the real exchange rate.Answer: The volume effect takes place when consumer spending shifts on export and import quantities,while the value effect results when the domestic output worth of a given amount of foreign imports is changed. It is assumed that the volume effect outweighs the value effect, so that, other things equal, a real depreciation of the currency improves the current account.Question Status: Previous Edition26) What is the real exchange rate? What is its relationship to the current account?Answer: Defined as: EP/P (the exchange rate multiplied by foreign prices, divided by domestic prices).While the nominal exchange rate measures how much of a foreign currency one can buy witha unit of domestic currency, the real exchange rate measures how many goods and servicesone could buy.A rise in the real exchange rate (a depreciation of domestic currency) means that domesticgoods are cheaper compared to foreign goods, so exports increase and imports decrease.Aggregate demand increases and the CA rises. A fall in the real exchange rate has the oppositeeffect: Aggregate demand decreases and the CA falls.Question Status: Previous Edition27) Monetary expansion causes the current account balance to increase in the short run. Discuss. Is thesame the case for fiscal expansion?Answer: Am increase in the money supply leads to an increase in Y and E (output increases and the currency depreciates, respectively). Because of the currency depreciation, domestic goods arenow cheaper compared to foreign goods. Exports increase and imports decrease, therefore theCAB increases.An expansion of fiscal policy actually reduces the CAB: the DD curve is shifted right. ThereforeY rises, but E falls (output rises but the currency appreciates.) Domestic goods are moreexpensive, and the CAB falls.Question Status: Previous Edition28) Find the real exchange rate for the following case: Assume that the representative basket ofEuropean goods and services costs 40 euros and the representative U.S. basket costs $50, and the dollar/euro exchange rate is $0.90 per euro, then the price of the European basket in terms of U.S.basket is ________.Answer: [(0.9 $/euro) (40 euro per a European basket)]/[(50 $/U.S. basket)]Question Status: Previous Edition29) Find the real exchange rate for the following case: Assume that the representative basket ofEuropean goods costs 150 euros and the representative U.S. basket costs $90, and the dollar/euro exchange rate is $0.80 per euro, then the price of the European basket in terms of U.S. basket is:Answer: [(0.80 $/euro) (150 euro per a European basket)]/[(90 $/U.S. basket)] = 1.33 U.S.baskets/European basket.Question Status: Previous Edition30) Find the real exchange rate for the following case: Assume that the representative basket ofEuropean goods costs 150 euros and the representative U.S. basket costs $200, and the dollar/euro exchange rate is $1.20 per euro, then the price of the European basket in terms of U.S. basket is:Answer: [(1.20 $/euro) (150 euro per a European basket)]/[(200 $/U.S. basket)] = 0.9 U.S.baskets/European basket.Question Status: Previous EditionEuropean goods costs 100 euros and the representative U.S. basket costs $125, and the dollar/euro exchange rate is $0.75 per euro, then the price of the European basket in terms of U.S. basket is: Answer: [(0.75 $/euro) (100 euro per a European basket)]/[(125 $/U.S. basket)] = 0.60 U.S.baskets/European basket.Question Status: Previous EditionAnswer:Question Status: Previous EditionAnswer:Question Status: Previous Edition16.2 The Equation of Aggregate Demand1) How does a rise in real income affect aggregate demand?A) Y ↑ implies Yd ↑ implies Im ↑ implies CA ↓ implies AD ↓, but Y ↑ implies Yd ↑ implies C ↑ impliesAD ↑ by moreB) Y ↑ implies Yd ↑ implies Im ↓ implies CA ↓ implies AD ↓, but Y ↑ implies Yd ↑ implies C ↑ impliesAD ↑ by moreC) Y ↑ implies Yd ↑ implies Im ↑ implies CA ↑ implies AD ↑, and Y ↑ implies Yd ↑ implies C ↑implies AD ↑D) Y ↑implies Yd ↑ implies Im ↑ implies CA ↓ implies AD ↓, but Y ↑ implies Yd ↑ implies C ↑implies AD ↑ by lessE) Y ↑ implies Yd ↑ implies Im ↓ implies CA ↓ implies AD ↓, but Y ↑ implies Yd ↑ implies C ↑implies AD ↑ by lessAnswer: AQuestion Status: Previous EditionA) A rise in domestic real income raises aggregate demand for home output.B) A rise in domestic real income decreases aggregate demand for home output because of theincrease demand for import.C) A rise in domestic real income keeps aggregate demand for home output at the same level.D) It is difficult to tell whether a rise in domestic real income affects positively or negativelyaggregate demand for home output.E) None of the above.Answer: AQuestion Status: Previous Edition3) The aggregate demand for home input can be written as a function of:I. Real exchange rate.II. Government spending.III. Disposable income.A) I onlyB) III onlyC) I and IIID) II and IIIE) I, II, and IIIAnswer: EQuestion Status: Previous Edition4) What is an accurate implication resulting from an increase in income?A) an increase in exchange rateB) a decrease in exchange rateC) a decrease in consumptionD) a decrease in outputE) an increase in consumptionAnswer: EQuestion Status: Previous Edition5) Explain how does a rise in real income affect aggregate demand?Answer: A rise in domestic real income, Y, leads to a rise in disposable income, Yd. This raises the spending on imports, IM, thus lowering the current account, CA, and reducing aggregatedemand, AD. However, the rise in Yd also causes a rise in consumption, C, and raisesaggregate demand, AD, by more than the corresponding decrease.Question Status: Previous Edition6) Explain the difference between the following two expressions:Y = C(Y d) + I + G + CA(EP/P, Y d) andY = C + I +G + CAAnswer: The first one represents a behavioral equation and thus may express equilibrium condition for the output market or the aggregate desired demand for output. The second equation is only an identity that is always true.Question Status: Previous Edition16.3 How Output is Determined in the Short Run1) Which one of the following statements is most accurate?A) Factors of production can only be over-employed in the short run.B) Factors of production can only be under-employed in the short run.C) Factors of production can be over- or under-employed in the long run.D) Factors of production can be over- or under-employed in the short run.E) None of the above.Answer: DQuestion Status: Previous Edition2) In the short-run, any rise in the real exchange rate, EP/P, will causeA) an upward shift in the aggregate demand function and a reduction in outputB) an upward shift in the aggregate demand function and an expansion of outputC) a downward shift in the aggregate demand function and an expansion of outputD) an downward shift in the aggregate demand function and a reduction in outputE) an upward shift in the aggregate demand function but leaves output intactAnswer: BQuestion Status: Previous Edition3) In the short-run, any fall in EP/P, regardless of its causes, will causeA) an upward shift in the aggregate demand function and an expansion of outputB) an upward shift in the aggregate demand function and a reduction in outputC) a downward shift in the aggregate demand function and an expansion of outputD) an downward shift in the aggregate demand function and a reduction in outputE) an upward shift in the aggregate demand function but leaves output intactAnswer: DQuestion Status: Previous Edition4) The unique output level in the short-run is found at the intersection of the following curves:A) aggregate demand and aggregate supplyB) aggregate demand and 45 degree lineC) aggregate supply and 45 degree lineD) aggregate demand and short-run aggregate supplyE) None of the above.Answer: BQuestion Status: New5) Why is the economy at full employment in the long run?A) Only wages have the ability to adjust.B) Only price can adjust.C) Prices don't adjust.D) Wages and the price level eventually adjust to develop full employment.E) Wages don't adjust. Answer: DQuestion Status: Previous Edition6) In the short-run, we assume that the money prices of goods and services areA) temporarily fixed.B) permanently fixed.C) allowed to fluctuate.D) equal to long-run prices.E) None of the above.Answer: AQuestion Status: Previous Edition7) What would be the best description of what we assume about money prices in the Short run?A) Money prices of goods and services vary.B) Money prices of goods and services not related to each other.C) Money prices of goods are only temporarily fixed.D) Money prices of services are only temporarily fixed.E) C and D.Answer: EQuestion Status: Previous Edition16.4 Output Market Equilibrium in the Short Run: The DD Schedule1) In the short-run, a temporary increase in money supplyA) shifts the DD curve to the right, increases output and appreciates the currency.B) shifts the AA curve to the left, increases output and depreciates the currency.C) shifts the AA curve to the left, decreases output and depreciates the currency.D) shifts the AA curve to the left, increases output and appreciates the currency.E) shifts the AA curve to the right, increases output and depreciates the currency.Answer: EQuestion Status: Previous Edition2) The DD schedule shows all combinations of which 2 variables so that the output market is inequilibrium?A) imports and exportsB) exports and the exchange rateC) foreign prices and the exchange rateD) output and the exchange rateE) output and exportsAnswer: DQuestion Status: Previous Edition3) Which of the following does not affect the position of the DD curve?A) monetary policyB) government spendingC) taxesD) export DemandE) price levels Answer: AQuestion Status: Previous Edition4) Temporary tax cuts would cause:A) the AA-curve to shift left.B) the AA-curve to shift right.C) the DD-curve to shift left.D) the DD-curve to shift right.E) a shift in the AA-curve, although the direction is ambiguous.Answer: DQuestion Status: Previous Edition5) How would you define a DD schedule?A) the combinations of output and the exchange rate that must hold when the home moneymarket and the foreign exchange market are in equilibriumB) the combinations of output and the exchange rate that must hold when the output market is inshort-run equilibriumC) factors of production in the long runD) Both A and B.E) None of the above.Answer: BQuestion Status: Previous Edition6) Which of the following is the most accurate?A) Any disturbance that lower aggregate demand for domestic output shifts the DD schedule tothe right.B) Any disturbance that lowers aggregate demand for foreign output shifts the DD schedule tothe left.C) Any disturbance that raises aggregate demand for domestic output shifts the DD schedule tothe right.D) Any disturbance that raises aggregate demand for domestic output shifts the DD schedule tothe left.E) None of the above.Answer: CQuestion Status: New7) Discuss the main factors affecting the position of the DD schedule.Answer: The level of government demand, taxes, and investment; the domestic and foreign price levels;variations in domestic consumption behavior; and the foreign demand for home output.Question Status: Previous Edition8) Give 4 examples of situations that would cause the DD-curve to shift to the left.Answer: Correct answers include any situations that involve:(1) an decrease in government spending (eg. Decrease in military spending)(2) an increase in taxes(3) a fall in Investment demand (4) a price increase, which would lower net export demand (assuming E and P stay constant)(5) a fall in foreign prices (assuming E and P stay constant)(6) an autonomous fall in consumption demand (as long as it is not entirely a change in import demand)(7) a shift to demanding more foreign goods at the expense of domestic good demandQuestion Status: Previous Edition9) Explain what are the factors that shift the DD Schedule.Answer: A change in government demand, change in Taxes, a change in investment, change in domestic prices, change in foreign prices, changes in the consumption function and a demandshift between foreign and domestic goods.Question Status: Previous Edition16.5 Asset Market Equilibrium in the Short Run: The AA Schedule1) How is the AA schedule derived?A) The AA schedule has a positive slope because an increase in output leads to a depreciation ofthe currency.B) The AA schedule has a negative slope because an increase in output leads to a decrease in thedomestic interest rate.C) The AA schedule has a negative slope because an increase in output leads to an increase in thedomestic interest rate and a domestic currency appreciation.D) The AA schedule has a positive slope because an increase in the money supply leads to anincrease in the domestic interest rate.E) None of the above.Answer: CQuestion Status: Previous Edition2) Which one of the following statements is most accurate?A) In the long run, foreign output depends only on the available domestic supplies of factors ofproduction.B) In the short run, domestic output depends only on the available domestic supplies of factors ofproduction.C) In the long run, domestic output depends only on the available domestic supplies of factors ofproduction.D) In the long run and in the short run, domestic output depends only on the available domesticsupplies of factors of production.E) None of the above.Answer: CQuestion Status: Previous Edition3) In the short-run, a temporary increase in the money supplyA) shifts the AA curve to the right, increases output and depreciates the currency.B) shifts the AA curve to the left, increases output and depreciates the currency.C) shifts the AA curve to the left, decreases output and depreciates the currency.D) shifts the AA curve to the left, increases output and appreciates the currency.E) shifts the AA curve to the right, increases output and appreciates the currency.Answer: AQuestion Status: Previous Edition4) Equilibrium output is determined from the following equation(s):A) Y=C(Y d)+I+G+CA(EP*/P,Y d).B) Y=C(Y-T)+I+G+CA(EP*/P,Y-T).C) Y=D(EP*/P,Y-T,I,G).D) A and C.E) A, B, and C. Answer: E Question Status: New5) The interest parity condition requires that:A) all countries have the same interest rate.B) there is a unique exchange rate for every output level.C) purchasing power parity hold.D) interest rates are fixed in the short run.E) the money supply is held constant.Answer: BQuestion Status: Previous Edition6) How is the AA schedule derived?A) It is derived by the schedule of interest rate and output combinations that are consistent withequilibrium in the domestic money market and the foreign exchange market.B) It is derived by the schedule of exchange rate and output combinations that are consistent withequilibrium in the foreign money market and the domestic exchange market.C) It is derived by the schedule of exchange rate and output combinations that are consistent withequilibrium in the domestic money market and the foreign exchange market.D) It is derived by the schedule of exchange rate and output combinations that are consistent withequilibrium in the domestic bond market and the foreign asset market.E) None of the above.Answer: CQuestion Status: Previous Edition7) Explain how the AA schedule is derived.Answer: For a fixed real money supply, an increase in output leads to an increase in the domestic interest rate. In the foreign exchange market, an increase in the domestic interest rate leads toa lower nominal exchange rate, thus appreciating the currency. Therefore, the relationshipbetween nominal exchange rate and output is negative; this leads to a negative slope of theAA schedule, which has the nominal exchange rate and output on its axes.Question Status: Previous Edition8) Discuss the main factors affecting the position of the AA schedule.Answer: Changes in the domestic money supply; changes in the domestic price level; changes in the expected future exchange rate; changes in the foreign interest rate; and shifts in the aggregatereal money demand schedule.Question Status: Previous Edition9) What is the AA-curve? Why does it have a negative slope? What factors cause it to shift? P.219 Answer: The AA-curve is the specific levels of E and Y under which the money and foreign exchange markets are in equilibrium.The AA-curve has a negative slope because an increase in Y will cause E to fall (a domesticcurrency appreciation).The factors that affect it are: the money supply, price level, expected exchange rate, foreigninterest rates, and the level of real money demand.Question Status: Previous Edition10) Explain what are the factors that shift the AA Schedule?Answer: Changes in the domestic money supply; changes in the domestic price level; changes in the expected future exchange rates; changes in the foreign interest rate and shifts in theaggregate real money demand.Question Status: Previous Edition。