《公司财务原理》

公司财务原理

公司财务原理

很多公司都要管理公司的财务,要熟悉财务原理,才能有效地管理财务,让它能够稳

定增长,发挥最大的效益。

财务原理的基本内容是关系到一家公司的财务管理,它可以运用到投资,成本,收入,财务表现,融资,风险管理等,也可以用来帮助改善公司的经济效益。

首先,投资原理是一流的财务原理,旨在帮助投资者更好地投资,其核心思想是通过

投资来获取最大化的收益,而不是将资金投入一个投资中获取最低的收益。

其次,成本原理是另一条重要的财务原理,主要是指从长远的成本角度,企业的生产

活动必须要尽量地把成本控制到最低限度,这样才能达到获取最大利润的目的。

第三,收入原理是指企业要尽可能发挥它最大的利润,即要将收入调整到与成本最相

适应的水平,也就是把收入最大化,而且要符合投资的价值,以及公司的经营政策,以此

获取最大的利润。

第四,财务表现原理指的是从财务表角度上,公司要尽可能发挥它的最大潜力,即从

财务报表上发现有改善的地方,可以让公司的财务状况变得更好,而不受任何境外的财务

管理约束。

最后,融资原理是财务原理中最重要的一条,它指的是企业应该根据自身的经营情况,尽可能采取尽可能有利的融资方案,也就是尽可能地减少负债,实现资金的充分利用和有

效管理,以达到最前短期获得利润最大化的目标。

以上就是财务原理的基本内容,它可以帮助公司更有效地管理公司的财务,并帮助企

业提高经济效益。

公司财务原理Principles of Corporate Finance(11th edition)_课后习题答案Chap005

CHAPTER 5Net Present Value and Other Investment CriteriaAnswers to Problem Sets1. a. A = 3 years, B = 2 years, C = 3 years.b. Bc. A, B, and Cd. B and C (NPV B = $3,378;NPV C = $2,405)e. True. The payback rule ignores all cash flows after the cutoff date,meaning that future years’ cash inflows are not considered. In addition, thepayback rule ignores the timing of cash inflows. For example, for apayback rule set at two years, a project with a payback period of one yearis given equal weight as a project with a payback period of two years.f. It will accept no negative-NPV projects, but will turn down some withpositive NPVs. A project can have positive NPV if all future cash flows areconsidered but still do not meet the stated cutoff period.Est. time: 6 – 102. Given the cash flows C0, C1, . . . , C T, IRR is defined by:It is calculated by trial and error, by financial calculators, or by spreadsheetprograms.Est. time: 1 – 53. a. $15,750; $4,250; $0b. 100%Est. time: 1 – 54. No (you are effectively “borrowing” at a rate of interest highe r than theopportunity cost of capital).Est. time: 1 – 55 a. Two. There are multiple internal rates of return for a project when thereare changes in the sign of the cash flows.b. −50% and +50%. The NPV for the project using both of these IRRs is 0.c. Yes, NPV = +14.6.Est. time: 1 – 56. The incremental flows from investing in Alpha rather than Beta are −200,000;+110,000; and 121,000. The IRR on the incremental cash flow is 10% (i.e., −200 + 110/1.10 + 121/1.102 = 0). The IRR on Beta exceeds the cost of capital and so does the IRR on the incremental investment in Alpha. Choose Alpha.Est. time: 1 – 57. 1, 2, 4, and 6The profitability index for each project is shown below:Start with the project with the highest profitability index and go from there. Project2 has the highest profitability index and has an initial investment of $5,000. Thenext highest profitability index is for Project 1, which has an initial investment of $10,000. The next highest is Project 4, which will cost $60,000 up front. So far we have spent $75,000. Projects 5 and 6 both have profitability indexes of .2, but we only have $15,000 left to spend, so we will add Project 6 to our list. This gives us Projects 1, 2, 4, and 6.Est. time: 1 – 58. a. $90.91.10)(1$10001000NPV A -=+-=$ $4,044.7310)(1.$1000(1.10)$1000(1.10)$4000(1.10)$1000(1.10)$10002000NPV 5432B +=+++++-=$ $39.4710)(1.$1000.10)(1$1000(1.10)$1000(1.10)$10003000NPV 542C +=++++-=$ Projects B and C have positive NPVs.b. Payback A = one yearPayback B = two yearsPayback C = four yearsc. A and Bd.$909.09.10)(1$1000PV 1A == The present value of the cash inflows for Project A never recovers the initialoutlay for the project, which is always the case for a negative NPV project.The present values of the cash inflows for Project B are shown in the thirdrow of the table below, and the cumulative net present values are shownin the fourth row:C 0C 1 C 2 C 3 C 4 C 5 -2,000.00+1,000.00 +1,000.00 +4,000.00 +1,000.00 +1,000.00 -2,000.00909.09 826.45 3,005.26 683.01 620.92 -1,090.91 -264.46 2,740.80 3,423.81 4,044.73Since the cumulative NPV turns positive between year 2 and year 3, the discounted payback period is:years 2.093,005.26264.462=+The present values of the cash inflows for Project C are shown in the third row of the table below, and the cumulative net present values are shown in the fourth row:C 0 C 1 C 2 C 3 C 4 C 5-3,000.00 +1,000.00 +1,000.000.00 +1,000.00 +1,000.00 -3,000.00 909.09 826.450.00 683.01 620.92 -2,090.91 -1,264.46 -1,264.46 -581.45 39.47Since the cumulative NPV turns positive between year 4 and year 5, thediscounted payback period is:years 4.94620.92581.454=+e. Using the discounted payback period rule with a cutoff of three years, thefirm would accept only Project B.Est. time: 11– 159. a. When using the IRR rule, the firm must still compare the IRR with theopportunity cost of capital. Thus, even with the IRR method, one mustspecify the appropriate discount rate.b. Risky cash flows should be discounted at a higher rate than the rate usedto discount less risky cash flows. Using the payback rule is equivalent tousing the NPV rule with a zero discount rate for cash flows before thepayback period and an infinite discount rate for cash flows thereafter.Est. time: 1 – 510.The two IRRs for this project are (approximately): –17.44% and 45.27%. Between these two discount rates, the NPV is positive.Est. time: 06 - 1011. a.The figure on the next page was drawn from the following points:Discount Rate 0% 10% 20%NPV A +20.00 +4.13 -8.33NPV B +40.00 +5.18 -18.98b. From the graph, we can estimate the IRR of each project from the pointwhere its line crosses the horizontal axis:IRR A = 13.1% and IRR B = 11.9%This can be checked by calculating the NPV for each project at theirrespective IRRs, which give an approximate NPV of 0.c.The company should accept Project A if its NPV is positive and higherthan that of Project B; that is, the company should accept Project A if thediscount rate is greater than 10.7% (the intersection of NPV A and NPV B onthe graph below) and less than 13.1% (the internal rate of return).d. The cash flows for (B–A) are:C0 = $ 0C1 = –$60C2 = –$60C3 = +$140Therefore:Discount Rate0% 10% 20%NPV B−A+20.00 +1.05 -10.65IRR B − A = 10.7%The company should accept Project A if the discount rate is greater than10.7% and less than 13.1%. As shown in the graph, for these discountrates, the IRR for the incremental investment is less than the opportunitycost of capital.Est. time: 06 - 1012. a. Because Project A requires a larger capital outlay, it ispossible that Project A has both a lower IRR and a higher NPV thanProject B. (In fact, NPV A is greater than NPV B for all discount rates lessthan 10%.) Because the goal is to maximize shareholder wealth, NPV isthe correct criterion.b. To use the IRR criterion for mutually exclusive projects, calculate theIRR for the incremental cash flows:C 0 C 1 C 2 IRRA -B −200 +110 +121 10%Because the IRR for the incremental cash flows exceeds the cost ofcapital, the additional investment in A is worthwhile. c. 81.86$(1.09)3001.09250400NPV 2A =++-= $79.10(1.09)1791.09140200NPV 2B =++-= Est. time: 06 - 1013. Use incremental analysis:C 1 C 2 C 3Current Arrangement −250,000 −250,000 +650,000Extra Shift −550,000 +650,000 0Incremental Flows −300,000 +900,000 -650,000The IRRs for the incremental flows are (approximately): 21.13% and 78.87%If the cost of capital is between these rates, Titanic should work the extra shift.Est. time: 06 - 1014.a. First calculate the NPV for each project.The NPV for Project D is: $=-+=D 20,000NPV 10,0008,181.821.10The NPV for Project E is:=-+=E 35,000NPV 20,000$11,818.181.10Profitability index = NPV/initial investment.For Project D: Profitability index = 8,181.82/10,000 = .82.For Project E: Profitability index = 11,818.18/20,000 −.59.b. Each project has a profitability index greater than zero, and so both areacceptable projects. In order to choose between these projects, we must use incremental analysis. For the incremental cash flows:0.3610,0003,63610,000)( 1.1015,00010,000PI D E ==--+-=- The increment is thus an acceptable project, and so the larger project should be accepted, i.e., accept Project E. (Note that, in this case, the better project has the lower profitability index.)Est. time: 11 - 1515. Using the fact that profitability index = (net present value / investment), we find:ProjectProfitability Index 10.22 2−0.02 30.17 40.14 50.07 60.18 7 0.12 Thus, given the budget of $1 million, the best the company can do is to acceptProjects 1, 3, 4, and 6.If the company accepted all positive NPV projects, the market value (compared to the market value under the budget limitation) would increase by the NPV ofProject 5 plus the NPV of Project 7: $7,000 + $48,000 = $55,000.Thus, the budget limit costs the company $55,000 in terms of its market value.Est. time: 06 - 1016. The IRR is the discount rate wh ich, when applied to a project’s cash flows, yieldsNPV = 0. Thus, it does not represent an opportunity cost. However, if eachproject’s cash flows could be invested at that project’s IRR, then the NPV of each project would be zero because the IRR would then be the opportunity cost ofcapital for each project. The discount rate used in an NPV calculation is theopportunity cost of capital. Therefore, it is true that the NPV rule does assume that cash flows are reinvested at the opportunity cost of capital.Est. time: 06 - 1017.a.C 0 = –3,000 C 0 = –3,000C 1 = +3,500 C 1 = +3,500C 2 = +4,000 C 2 + PV(C 3) = +4,000 – 3,571.43 = 428.57C 3 = –4,000 MIRR = 27.84%b. 2321 1.12C 1.12xC xC -=+ (1.122)(xC 1) + (1.12)(xC 2) = –C 3(x)[(1.122)(C 1) + (1.12C 2)] = –C 3)()2123 1.12C )(C (1.12C -x += 0.4501.12)(4,00)(3,500(1.124,000x 2=+=)() 0IRR)(1x)C -(1IRR)(1x)C -(1C 2210=++++ 0IRR)(10)0.45)(4,00-(1IRR)(10)0.45)(3,50-(13,0002=++++- Now, find MIRR using either trial and error or the IRR function (on afinancial calculator or Excel). We find that MIRR = 23.53%.It is not clear that either of these modified IRRs is at all meaningful.Rather, these calculations seem to highlight the fact that MIRR really hasno economic meaning. Est. time: 11 - 15 18. Maximize:NPV = 6,700x W + 9,000x X + 0X Y – 1,500x Z subject to: 10,000x W + 0x X + 10,000x Y + 15,000x Z ≤ 20,00010,000x W + 20,000x X – 5,000x Y – 5,000x Z ≤ 20,0000x W - 5,000x X – 5,000x Y – 4,000x Z ≤ 20,0000 ≤ x W ≤ 10 ≤ x X ≤ 10 ≤ x Z ≤ 1Using Excel Spreadsheet Add-in Linear Programming Module:Optimized NPV = $13,450with x W = 1; x X = 0.75; x Y = 1 and x Z = 0If financing available at t = 0 is $21,000:Optimized NPV = $13,500with x W = 1; x X = (23/30); x Y = 1 and x Z = (2/30)Here, the shadow price for the constraint at t = 0 is $50, the increase in NPV for a $1,000 increase in financing available at t = 0.In this case, the program viewed x Z as a viable choice even though the NPV ofProject Z is negative. The reason for this result is that Project Z provides apositive cash flow in periods 1 and 2.If the financing available at t = 1 is $21,000:Optimized NPV = $13,900with x W = 1; x X = 0.8; x Y = 1 and x Z = 0Hence, the shadow price of an additional $1,000 in t =1 financing is $450.Est. time: 11 - 15。

《企业财务原理》读后感

《企业财务原理》读后感《企业财务原理》是一本深入浅出、内容丰富的财务学教材。

在阅读这本书的过程中,我受益良多,对于企业财务管理有了更深刻的理解和认识。

首先,本书在讲解企业财务原理的过程中,通过实例和案例分析的方式,使得抽象的财务知识变得更加具体和易懂。

作者通过真实的企业案例,将财务报表、财务分析、财务决策等内容与现实生活相结合,使读者更容易理解和应用这些知识。

例如,在讲解财务报表的编制和分析时,作者通过一个虚构企业的财务报表,引导读者理解资产负债表、利润表和现金流量表的重要性和作用。

这样的案例分析对于初学者来说非常有帮助,能够更好地帮助我们理解财务管理的基本原理和技巧。

其次,本书系统地介绍了企业财务管理的各个方面。

从财务战略、财务规划、资本预算、资金管理等方面进行了全面深入的阐述。

同时,作者对企业财务决策的原则和方法也进行了详细的论述和分析,使读者对企业财务管理的全过程有了更清晰的认识。

对于想要从事财务管理工作的人来说,这本书无疑是一本很好的教材,能够帮助他们建立起坚实的财务管理基础,提高自己的综合素质。

此外,本书还特别强调了企业财务管理的内外部环境对财务决策的影响。

作者在书中阐述了宏观经济环境、行业竞争环境、政府政策等因素对企业财务管理的影响。

这使得读者能够真正理解财务决策过程中需要考虑的多方面因素,能够更准确地判断和决策。

同时,作者还介绍了财务管理与其他管理职能之间的协调和配合,这对于全面了解企业运营和管理也非常重要。

最后,本书还引入了一些新的理念和方法,如价值链管理、风险管理、财务分析工具等。

这些新的思想和方法弥补了传统财务管理中的一些不足,能够更好地适应现代企业的发展需要。

特别是在风险管理部分,作者通过一系列案例,向读者展示了风险评估、风险控制和风险应对的方法和技巧。

这对于当今企业面临的各种风险问题提供了很好的解决思路。

总的来说,《企业财务原理》是一本很好的财务学教材,能够帮助读者全面系统地理解企业财务管理的原理和方法。

公司财务原理与资本运作(公司金融) 部分课后答案(原书第10版)

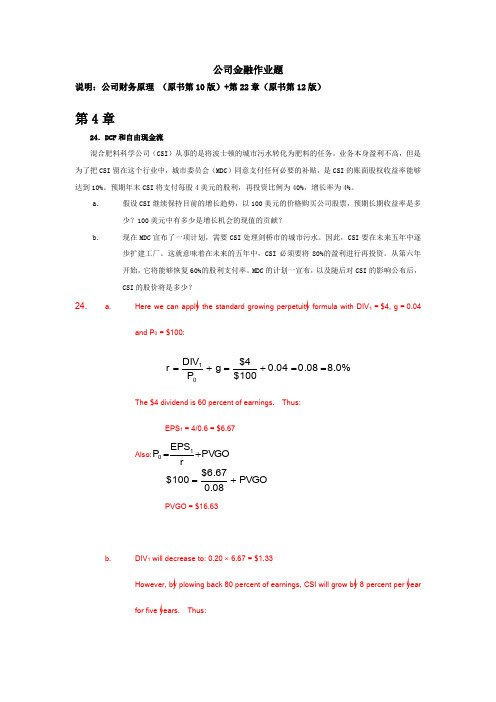

公司金融作业题说明:公司财务原理 (原书第10版)+第22章(原书第12版)第4章24.DCF 和自由现金流混合肥料科学公司(CSI )从事的是将波士顿的城市污水转化为肥料的任务。

业务本身盈利不高,但是为了把CSI 留在这个行业中,城市委员会(MDC )同意支付任何必要的补贴,是CSI 的账面股权收益率能够达到10%。

预期年末CSI 将支付每股4美元的股利,再投资比例为40%,增长率为4%。

a .假设CSI 继续保持目前的增长趋势,以100美元的价格购买公司股票,预期长期收益率是多少?100美元中有多少是增长机会的现值的贡献?b .现在MDC 宣布了一项计划,需要CSI 处理剑桥市的城市污水。

因此,CSI 要在未来五年中逐步扩建工厂。

这就意味着在未来的五年中,CSI 必须要将80%的盈利进行再投资。

从第六年开始,它将能够恢复60%的股利支付率。

MDC 的计划一宣布,以及随后对CSI 的影响公布后,CSI 的股价将是多少?24.a. Here we can apply the standard growing perpetuity formula with DIV 1 = $4, g = 0.04 and P 0 = $100:8.0%.080.040$100$4g P DIV r 01==+=+=The $4 dividend is 60 percent of earnings. Thus:EPS 1 = 4/0.6 = $6.67Also:PVGO rEPS P 10+=PVGO 0.08$6.67$100+=PVGO = $16.63b.DIV 1 will decrease to: 0.20 ⨯ 6.67 = $1.33However, by plowing back 80 percent of earnings, CSI will grow by 8 percent per year for five years. Thus:Year 1 2 3 4 5 6 7, 8 . . . DIV t 1.33 1.44 1.55 1.68 1.81 5.88 Continued growth at EPS t6.677.207.788.409.079.804 percentNote that DIV 6 increases sharply as the firm switches back to a 60 percent payout policy. Forecasted stock price in year 5 is:$147.0400.085.88g r DIV P 65=-=-=Therefore, CSI’s stock price will increase to:$106.211.081471.811.081.681.081.551.081.441.081.33P 54320=+++++=第9章6.可分散风险很多投资项目都有可分散风险。

公司财务原理

公司财务原理

公司财务原理

公司财务原理是公司财务管理的基础,是公司财务决策的核心。

这个原理既包括公司财务活动的定义,又包括公司财务管理和决策的原则。

换句话说,公司财务原理是一套完整的公司财务管理的方法,是公司财务管理的根本。

首先,公司财务原理要求公司财务管理应该从完整的角度来看待资产和负债,应该对资产和负债进行实时管理,确保资产和负债的完整性。

其次,公司财务原理要求公司财务管理应该以财务可持续发展为目标,以确保财务稳定性和长期可持续发展为根本准则,做到资产安全、财务稳定、风险可控。

此外,公司财务原理还要求公司财务管理应该做好财务分析,以有效地控制财务状况,以便更加准确地衡量公司的财务状况。

最后,公司财务原理还要求公司财务管理应该采取合理的财务决策,以便更好地适应市场变化,提高公司的财务水平。

公司财务原理是公司财务管理的基础,也是公司财务决策的根本,其基本的原则是:从完整的角度来看待资产和负债,以财务可持续发展为目标,做好财务分析,采取合理的财务决策,以保证公司的财务状况的安全性、稳定性和长期可持续发展。

公司财务原理读书笔记

公司财务原理读书笔记【篇一:公司财务原理笔记---第一部分】本笔记目录——第一部分:价值第一章:财务和财务经理 (3)第二章;现值,公司目标和公司治理 (3)1、现值以及投资成本的确定 ....................................................................................................... (3)2.2 净现值理论的前提条件 ....................................................................................................... ...................................................... 4 3、推荐读物 ....................................................................................................... . (5)chapter3 如何计算现值 (5)1、现金流贴现(dcf)公式 ....................................................................................................... (5)2、永续年金、增长型永续年金和年金 ....................................................................................................... .. (5)3、复利和单利(关于连续复利是新问题) .................................................................................................... (6)第四章:债券和普通股的价值(注意这个字:价值啊!!!) (6)1、利用现值公式评估债券价值 ....................................................................................................... .. (7)2、普通股如何定价 ....................................................................................................... . (7)3、权益资本成本r的估计 ....................................................................................................... .. (7)4、稳定增长公式应用须知 ....................................................................................................... . (8)5、股票价格和每股收益的关系 ....................................................................................................... .. (8)第五章:与其他投资准则相比,为什么净现值法则能保证较优的投资决策 (12)1、净现值法则的关键特征: .................................................................................................... . (12)2、内部收益率的缺陷 ....................................................................................................... ........................................................... 12 3、资源有限时的资本投资决策(capitalrationing) ........................................................................................ .. (14)第六章:利用净现值法则进行投资决策 (15)1、现金流预测的准则: .................................................................................................... (15)2、等价年成本(equivalent annualcosts) .............................................................................................. . (16)2、项目之间的相互影响(118页) .................................................................................................... .. (18)3、小结中一个特别说明: ...................................................................................................... (18)1、现值以及投资成本的确定财务学的基本原则:1、今天的一块钱总比明天的一块钱值钱。

公司财务管理原理(共5篇)

公司财务管理原理(共5篇)第一篇:公司财务管理原理简答题一简述财务预测的原则和内容财务预测是财务预测人员根据历史资料,考虑现实的要求和条件,运用特定的方法对企业未来的财务活动的状况、发展趋势及其结果所做出的科学预计和测算。

财务预测是财务决策的基础,是编制财务预算的前提,也是组织日常财务生活的必要条件。

财务预测的对象包括了企业整个财务活的的内容,即筹资、投资、利润分配、收入和成本费用等方面。

四项规律:1 连续性规律 2 相关性规律 3 相似性规律 4 统计规律性规律二简述财务控制系统财务控制是按照一定的程序和方法,确保企业及其内部机构和人员全面落实及实现财务预算的过程。

财务控制是财务管理循环中的重要环节,它对实现财务管理目标具有关键作用。

1组织保证。

控制必然涉及控制主体和被控制对象2制度保证。

围绕预算的执行,应建立相应的保证措施或制度,如人事制度、考评制度、奖罚制度等。

3预算目标。

面向整个企业的财务预算是进行财务控制的依据。

4会计信息。

财务控制必须以会计信息为前提实行实时控制,跟踪控制。

5信息反馈系统。

财务控制是一个动态的过程,要确保财务预算的贯彻落实,必须对各负责中心执行预算的情况进行跟踪监控,不断调整执行偏差。

三简述现代企业的财务关系企业的财务关系是指企业在组织财务活动过程中与有关各方所发生的经济利益关系。

有以下几方面:1 企业和政府(税收强制无偿)2企业和投资者(投入资金获得报酬)3企业和债权人(借入资金支付利息归还)4企业和被投资者(购买股票直接投资获得利润)5企业和债务人(债券借款)6企业和内部各单位(各环节相互经济关系)四简述企业利用销售百分比法来进行筹资预测的过程销售百分比法假设企业部分资产项目、负债项目与销售收入之间的稳定的百分比关系,根据预计销售收入的变动额和相应的百分比来预测资产负债项目的变动额,然后利用“资产=负债+所有者权益这一会计等式来确定筹资需要的量1 预计销售增长率2 将资产负债表中随销售额变动而变动的资产和负债项目分离出来,确定销售百分比。

公司财务原理 中文版

公司财务原理中文版

企业财务原理是指企业财务管理的基本原则和规则。

根据这些原理,企业可以有效地管理和运用财务资源,实现可持续发展。

1. 独立性原则:企业应保持独立的财务账户和报表,与个人或其他企业的财务状况分开,确保财务信息真实、准确、可靠。

2. 调节性原则:企业财务原则要具备调节性,能适应不同的经济环境和经营特点,根据需要制定相应的财务制度和政策。

3. 价值原则:企业财务原则要以价值为导向,以提高财务价值为目标,通过财务管理活动增强企业的价值创造能力。

4. 财务透明度原则:企业财务原则要求财务信息公开、透明,便于利益相关方了解企业的财务状况和经营绩效。

5. 费用原则:企业财务原则要求对各项费用进行合理核算和管理,确保企业以最少的成本获取最大的利润。

6. 收入原则:企业财务原则要求按照实际发生的时间和金额确认收入,确保财务报表反映企业实际收入情况。

7. 资产价值原则:企业财务原则要求对资产进行正确计量和评估,确保财务报表反映企业的真实财务状况。

8. 市场原则:企业财务原则要遵循市场规律,根据市场需求和供求关系,调整企业的财务决策和经营策略。

9. 风险原则:企业财务原则要求合理评估和管理风险,对潜在的风险进行提前预警和应对,确保企业的财务稳健。

10.可持续发展原则:企业财务原则要考虑到环境、社会和经

济的可持续发展,寻求经济效益、社会效益和环境效益的协调。

公司财务原理读后感

公司财务原理读后感在繁忙的工作与生活间隙,我读完了《公司财务原理》这本书。

说实在的,一开始拿起这本书,我心里直犯嘀咕,担心会是一堆枯燥的理论和数字,把我搞得晕头转向。

但真正读进去之后,却发现别有一番天地。

书里那些关于资金流动、投资决策、融资策略的内容,就像是一场精彩的商业冒险中的指南针。

它没有给我那种高高在上、遥不可及的感觉,反而让我觉得公司财务这事儿,就像我们日常生活中的理财一样,只不过规模更大、更复杂一些。

让我印象特别深刻的,是书中对于风险与回报平衡的阐述。

这让我想起了之前工作中遇到的一件事儿。

当时公司准备上马一个新的项目,大家都对这个项目满怀期待,觉得是一个能赚大钱的好机会。

领导们在会议上激情澎湃地描绘着项目成功后的美好前景,听得我们这些小员工也是热血沸腾。

可当真正开始做财务分析的时候,问题就来了。

项目需要一大笔前期投资,而且市场的不确定性很大。

这就意味着,如果一切顺利,我们能获得丰厚的回报;但要是运气不好,可能就会亏得血本无归。

这时候,公司的财务团队就发挥了关键作用。

他们没有被领导们的热情冲昏头脑,而是冷静地运用各种分析工具和方法,对项目的风险和回报进行了细致的评估。

我记得有个财务大哥,拿着一叠厚厚的报表,上面密密麻麻的数字看得我眼都花了。

他一边指着那些数字,一边跟我们解释:“你们看啊,这一块儿是市场需求的预测,可这市场就像小孩儿的脸,说变就变。

还有这成本估算,稍微有点偏差,那利润可就差得老远了。

” 他说得口干舌燥,我们也听得似懂非懂,但就是感觉到这事儿没那么简单。

经过一轮又一轮的讨论和分析,财务团队最终给出了一个建议:对项目进行部分调整,降低前期投资规模,同时寻找更多的合作伙伴来分担风险。

这可让领导们有点犯难了,毕竟之前的计划那么宏伟,现在要缩水,心里难免有些失落。

但是,经过一番权衡利弊,公司还是采纳了财务团队的建议。

事实证明,这个决定是多么的明智。

项目启动后,果然遇到了一些意想不到的困难,市场需求没有达到最初的预期,成本也有所上升。

《公司财务原理》读书心得

《公司财务原理》读书心得书中讲的那些财务原理,一开始感觉就像一团乱麻,理不清头绪。

就好比你面对一桌子杂乱的拼图碎片,不知道从哪儿下手。

可一旦你静下心来,一块一块地去拼凑,慢慢就会看到一幅完整的画面。

公司财务也是这样,从最基本的概念开始,像是资产、负债、所有者权益这些,它们就像盖房子的砖头一样,一块一块搭起来,才能形成一个稳固的财务大厦。

拿一家小餐馆来说吧。

小餐馆的桌椅板凳、厨房设备那就是它的资产。

而欠供应商的食材钱呢,就是负债。

老板自己投进去的钱和赚了没分出去的利润就是所有者权益。

这三者之间的关系就像一场微妙的平衡游戏。

如果负债太多,就好像这个小餐馆借了太多钱去装修,桌椅板凳弄得特别豪华,可每天来吃饭的人没几个,那还不上钱的时候,就会出大问题,就像房子的地基不稳,随时可能塌掉。

再说说现金流。

现金流就像是人体里的血液,一刻不停地在公司这个“身体”里循环。

一个公司即使账面上有很多利润,可要是现金流断了,那就跟人失血过多一样危险。

我有个朋友开了个小工作室,接了好几个大项目,账面上看着盈利不少。

可是客户付款周期太长,他又得先给员工发工资、买设备材料,结果现金流一下子断了,差点就关门大吉。

这时候才深刻体会到现金流的重要性,可不是只看那个利润数字那么简单。

投资决策在书里也是个很重要的部分。

这就像我们平常做选择一样。

比如说你有一笔钱,是用来买股票呢,还是去投资一个小生意呢?公司做投资决策的时候也面临同样的难题。

要考虑风险,还要考虑收益。

就像走在一条两边都是迷雾的小路上,一边可能是宝藏,一边可能是陷阱。

如果盲目投资,就像闭着眼睛乱走,很容易掉进坑里。

融资呢,也不是一件轻松的事儿。

公司要发展,需要钱,就像人要成长,需要营养一样。

是找银行贷款呢,还是发行股票呢?这就好比是借钱,一种是找银行这个“大金主”借,得按规定还钱付利息;另一种是拉一帮人入伙,大家一起承担风险,分享利润。

不同的融资方式各有利弊,就像不同的交通工具,都能带你到达目的地,但过程中的体验和花费可不一样。