国际金融Finance_Test_Bank_8

国际金融IFinanceTestBank5之欧阳家百创编

Chapter 5—Currency Derivatives欧阳家百(2021.03.07)1.Kalons, Inc. is a U.S.-based MNC that frequently imports raw materialsfrom Canada. Kalons is typically invoiced for these goods in Canadian dollars and is concerned that the Canadian dollar will appreciate in the near future. Which of the following is not an appropriate hedging2.Graylon, Inc., based in Washington, exports products to a German firm andwill receive payment of €200,000 in three months. On June 1, the spot rate of the euro was $1.12, and the 3-month forward rate was $1.10. On June 1, Graylon negotiated a forward contract with a bank to sell €200,000 forward in three months. The spot rate of the euro on3.The one-year forward rate of the British pound is quoted at $1.60, and thespot rate of the British pound is quoted at $1.63. The forward ____ is4.The 90-day forward rate for the euro is $1.07, while the current spot rate ofthe euro is $1.05. What is the annualized forward premium or discount5.Thornton, Inc. needs to invest five million Nepalese rupees in its Nepalesesubsidiary to support local operations. Thornton would like its subsidiary to repay the rupees in one year. Thornton would like to6.In the U.S., the typical currency futures contract is based on a currency8.Currency options sold through an options exchange:11.Which of the following is the most likely strategy for a U.S. firm that willbe receiving Swiss francs in the future and desires to avoid exchange12.Which of the following is the most unlikely strategy for a U.S. firm thatwill be purchasing Swiss francs in the future and desires to avoid13.If your firm expects the euro to substantially depreciate, it could speculateby ____ euro call options or ____ euros forward in the forward14.When you own ____, there is no obligation on your part; however, when15.The greater the variability of a currency, the ____ will be the premium ofa call option on this currency, and the ____ will be the premium of a16.When currency options are not standardized and traded over-the-counter,17.The shorter the time to the expiration date for a currency, the ____ will bethe premium of a call option, and the ____ will be the premium of a put18.Assume that a speculator purchases a put option on British pounds (with astrike price of $1.50) for $.05 per unit. A pound option represents31,250 units. Assume that at the time of the purchase, the spot rate of the pound is $1.51 and continually rises to $1.62 by the expiration date. The highest net profit possible for the speculator based on the21.If you expect the euro to depreciate, it would be appropriate to ____ for22.If you expect the British pound to appreciate, you could speculate by ____pound call options or ____ pound put options.。

国际金融 International Finance Test Bank_09

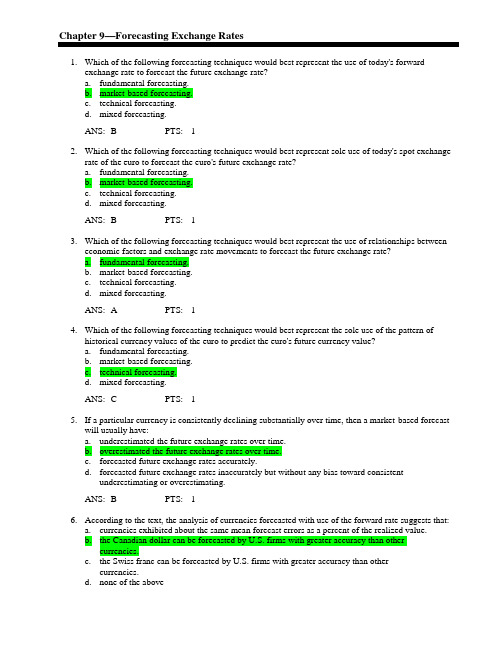

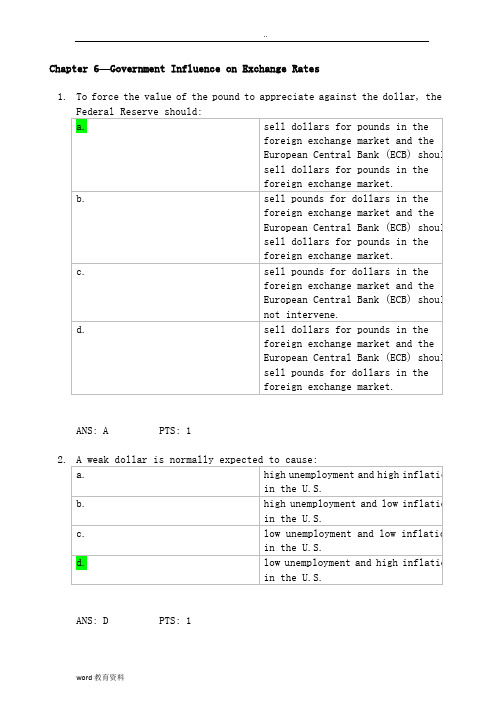

Chapter 9—Forecasting Exchange Rates1. Which of the following forecasting techniques would best represent the use of today's forwardexchange rate to forecast the future exchange rate?a. fundamental forecasting.b. market-based forecasting.c. technical forecasting.d. mixed forecasting.ANS: B PTS: 12. Which of the following forecasting techniques would best represent sole use of today's spot exchangerate of the euro to forecast the euro's future exchange rate?a. fundamental forecasting.b. market-based forecasting.c. technical forecasting.d. mixed forecasting.ANS: B PTS: 13. Which of the following forecasting techniques would best represent the use of relationships betweeneconomic factors and exchange rate movements to forecast the future exchange rate?a. fundamental forecasting.b. market-based forecasting.c. technical forecasting.d. mixed forecasting.ANS: A PTS: 14. Which of the following forecasting techniques would best represent the sole use of the pattern ofhistorical currency values of the euro to predict the euro's future currency value?a. fundamental forecasting.b. market-based forecasting.c. technical forecasting.d. mixed forecasting.ANS: C PTS: 15. If a particular currency is consistently declining substantially over time, then a market-based forecastwill usually have:a. underestimated the future exchange rates over time.b. overestimated the future exchange rates over time.c. forecasted future exchange rates accurately.d. forecasted future exchange rates inaccurately but without any bias toward consistentunderestimating or overestimating.ANS: B PTS: 16. According to the text, the analysis of currencies forecasted with use of the forward rate suggests that:a. currencies exhibited about the same mean forecast errors as a percent of the realized value.b. the Canadian dollar can be forecasted by U.S. firms with greater accuracy than othercurrencies.c. the Swiss franc can be forecasted by U.S. firms with greater accuracy than othercurrencies.d. none of the aboveANS: B PTS: 17. Assume the following information:Predicted Value of Realized Value ofPeriod New Zealand Dollar New Zealand Dollar1 $.52 $.502 .54 .603 .44 .404 .51 .50Given this information, the mean absolute forecast error as a percentage of the realized value is about:a. 1.5%.b. 26%.c. 6%.d. 6.5%.e. none of the aboveANS: DSOLUTION: [|$.52 - $.50|/$.50 + |$.54 - $.60|/$.60 + |$.44 - $.40|/$.40 + |$.51 -$.50|/$.50)]/4= [.04 + .10 + .10 + .02]/4= .065 = 6.50%PTS: 18. If it was determined that the movement of exchange rates was not related to previous exchange ratevalues, this implies that a ____ is not valuable for speculating on expected exchange rate movements.a. technical forecast techniqueb. fundamental forecast techniquec. all of the aboved. none of the aboveANS: A PTS: 19. Which of the following is true?a. Forecast errors cannot be negative.b. Forecast errors are negative when the forecasted rate exceeds the realized rate.c. Absolute forecast errors are negative when the forecasted rate exceeds the realized rate.d. None of the above.ANS: D PTS: 110. Which of the following is true according to the text?a. Forecasts in recent years have been very accurate.b. Use of the absolute forecast error as a percent of the realized value is a good measure touse in detecting a forecast bias.c. Forecasting errors are smaller when focused on longer term periods.d. None of the above.ANS: D PTS: 111. A fundamental forecast that uses multiple values of the influential factors is an example of:a. sensitivity analysis.b. discriminant analysis.c. technical analysis.d. factor analysis.ANS: A PTS: 112. When the value from the prior period of an influential factor affects the forecast in the future period,this is an example of a(n):a. lagged input.b. instantaneous input.c. simultaneous input.d. B and CANS: A PTS: 113. Assume a forecasting model uses inflation differentials and interest rate differentials to forecast theexchange rate. Assume the regression coefficient of the interest rate differential variable is -.5, and the coefficient of the inflation differential variable is .4. Which of the following is true?a. The interest rate variable is inversely related to the exchange rate, and the inflationvariable is directly (positively) related to the interest rate variable.b. The interest rate variable is inversely related to the exchange rate, and the inflationvariable is directly related to the exchange rate.c. The interest rate variable is directly related to the exchange rate, and the inflation variableis directly related to the exchange rate.d. The interest rate variable is directly related to the exchange rate, and the inflation variableis directly related to the interest rate variable.ANS: B PTS: 114. Which of the following is not a limitation of fundamental forecasting?a. uncertain timing of impact.b. forecasts are needed for factors that have a lagged impact.c. omission of other relevant factors from the model.d. possible change in sensitivity of the forecasted variable to each factor over time.e. none of the aboveANS: B PTS: 115. Assume that interest rate parity holds. The U.S. five-year interest rate is 5% annualized, and theMexican five-year interest rate is 8% annualized. Today's spot rate of the Mexican peso is $.20. What is the approximate five-year forecast of the peso's spot rate if the five-year forward rate is used as a forecast?a. $.131.b. $.226.c. $.262.d. $.140.e. $.174.ANS: ESOLUTION: (1.05)5/(1.08)5- 1 = -13%; $.20[1 + (-13%)] = $.174PTS: 116. Assume that the forward rate is used to forecast the spot rate. The forward rate of the Canadian dollarcontains a 6% discount. Today's spot rate of the Canadian dollar is $.80. The spot rate forecasted for one year ahead is:a. $.860.b. $.848.c. $.740.d. $.752.e. none of the aboveANS: DSOLUTION: $.80 ⨯ [1 + (-6%)] = $.752PTS: 117. If today's exchange rate reflects all relevant public information about the euro's exchange rate, but notall relevant private information, then ____ would be refuted.a. weak-form efficiencyb. semistrong-form efficiencyc. strong-form efficiencyd. A and Be. B and CANS: D PTS: 118. According to the text, research generally supports ____ in foreign exchange markets.a. weak-form efficiencyb. semistrong-form efficiencyc. strong-form efficiencyd. A and Be. B and CANS: D PTS: 119. Assume that the U.S. interest rate is 11 percent, while Australia's one-year interest rate is 12 percent.Assume interest rate parity holds. If the one-year forward rate of the Australian dollar was used to forecast the future spot rate, the forecast would reflect an expectation of:a. depreciation in the Australian dollar's value over the next year.b. appreciation in the Australian dollar's value over the next year.c. no change in the Australian dollar's value over the next year.d. information on future interest rates is needed to answer this question.ANS: A PTS: 120. If the forward rate was expected to be an unbiased estimate of the future spot rate, and interest rateparity holds, then:a. covered interest arbitrage is feasible.b. the international Fisher effect (IFE) is supported.c. the international Fisher effect (IFE) is refuted.d. the average absolute error from forecasting would equal zero.ANS: B PTS: 121. Which of the following is not a forecasting technique mentioned in your text?a. accounting-based forecasting.b. technical forecasting.c. fundamental forecasting.d. market-based forecasting.ANS: A PTS: 122. The following regression model was estimated to forecast the value of the Malaysian ringgit (MYR):MYR t = a0 + a1INC t- 1 + a2INF t- 1 + μt,where MYR is the quarterly change in the ringgit, INF is the previous quarterly percentage change in the inflation differential, and INC is the previous quarterly percentage change in the income growth differential. Regression results indicate coefficients of a0 = .005; a1 = .4; and a2 = .7. The most recent quarterly percentage change in the inflation differential is -5%, while the most recent quarterlypercentage change in the income differential is 3%. Using this information, the forecast for thepercentage change in the ringgit is:a. 4.60%.b. -1.80%.c. 5.2%.d. -4.60%.e. none of the aboveANS: BSOLUTION: MYR t = .005 + (.4)(.03) + (.7)(-.05) = -1.80%PTS: 123. The following regression model was estimated to forecast the value of the Indian rupee (INR):INR t = a0 + a1INT t + a2INF t- 1 + μt,where INR is the quarterly change in the rupee, INT is the real interest rate differential in period t between the U.S. and India, and INF is the inflation rate differential between the U.S. and India in the previous period. Regression results indicate coefficients of a0 = .003; a1 = -.5; and a2 = .8. Assume that INF t - 1 = 2%. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution:Probability Possible Outcome30% -2%40% -3%30% -4%The expected change in the Indian rupee in period t is:a. 3.40%.b. 0.40%.c. 3.10%.d. 1.70%.e. none of the aboveANS: ASOLUTION: E[INT t] = (-.02)(.3) + (-.03)(.4) + (-.04)(.3) = -3.00%INR t = .003 + (-.5)(-.03) + (.8)(.02) = 3.40%PTS: 124. Huge Corporation has just initiated a market-based forecast system using the forward rate as anestimate of the future spot rate of the Japanese yen (¥) and the Australian dollar (A$). Listed below are the forecasted and realized values for the last period:Currency Forecasted Value Realized ValueAustralian dollar $.60 $.55Japanese yen $.0067 $.0069According to this information and using the absolute forecast error as a percentage of the realized value, the forecast of the yen by Huge Corp. is ____ the forecast of the Australian dollar.a. more accurate thanb. less accurate thanc. more biased thand. the same asANS: ASOLUTION: Absolute forecast error for the Australian dollar = (|.60 - .55|)/.55 = 9.09%Absolute forecast error for the Japanese yen = (|.0067 - .0069|)/.0069 =2.90%Therefore, Huge Corp. has estimated the Japanese yen more accurately byapproximately 6.19%.PTS: 125. Gamma Corporation has incurred large losses over the last ten years due to exchange rate fluctuationsof the Egyptian pound (EGP), even though the company has used a market-based forecast based on the forward rate. Consequently, management believes its forecasts to be biased. The following regression model was estimated to determine if the forecasts over the last ten years were biased:S t = a0 + a1F t -1 + μt,where S t is the spot rate of the pound in year t and F t- 1 is the forward rate of the pound in year t -1.Regression results reveal coefficients of a0 = 0 and a1 = 1.3. Thus, Gamma has reason to believe that its past forecasts have ____ the realized spot rate.a. overestimatedb. underestimatedc. correctly estimatedd. none of the aboveANS: B PTS: 126. Which of the following is not a method of forecasting exchange rate volatility?a. using the absolute forecast error as a percentage of the realized value.b. using the volatility of historical exchange rate movements as a forecast for the future.c. using a time series of volatility patterns in previous periods.d. deriving the exchange rate's implied standard deviation from the currency option pricingmodel.ANS: A PTS: 127. If a foreign currency is expected to ____ substantially against the parent's currency, the parent mayprefer to ____ the remittance of subsidiary earnings.a. weaken; delayb. weaken; expeditec. appreciate; expedited. none of the aboveANS: B PTS: 128. If an MNC invests excess cash in a foreign county, it would like the foreign currency to ____; if anMNC issues bonds denominated in a foreign currency, it would like the foreign currency to ____.a. appreciate; depreciateb. appreciate; appreciatec. depreciate; depreciated. depreciate; appreciateANS: A PTS: 129. Severus Co. has to pay 5 million Canadian dollars for supplies it recently received from Canada.Today, the Canadian dollar has appreciated by 2 percent against the U.S. dollar. Severus hasdetermined that whenever the Canadian dollar appreciates against the U.S. dollar by more than 1percent, it experiences a reversal of 40 percent on the following day. Based on this information, the Canadian dollar is expected to ____ tomorrow, and Severus would prefer to make payment ____.a. depreciate by .8%; todayb. depreciate by .8%; tomorrowc. appreciate by .8%; todayd. appreciate by .8%; tomorrowANS: BSOLUTION: e t +1 = (2%) ⨯ (-40%) = -0.8%PTS: 130. Corporations tend to make only limited use of technical forecasting because it typically focuses on thenear future, which is not very helpful for developing corporate policies.a. Trueb. FalseANS: T PTS: 131. Sulsa Inc. uses fundamental forecasting. Using regression analysis, it has determined the followingequation for the euro:euro t = b0 + b1INF t- 1 + b2INC t- 1= .005 + .9INF t- 1 + 1.1INC t- 1The most recent quarterly percentage change in the inflation differential between the U.S. and Europe was 2 percent, while the most recent quarterly percentage change in the income growth differential between the U.S. and Europe was -1 percent. Based on this information, the forecast for the euro is a(n) ____ of ____%.a. appreciation; 3.4b. depreciation; 3.4c. appreciation; 0.7d. appreciation; 1.2ANS: DSOLUTION: euro t = .005 + .9(.02) + 1.1(-.01) = 1.2%PTS: 132. The U.S. inflation rate is expected to be 4 percent over the next year, while the European inflation rateis expected to be 3 percent. The current spot rate of the euro is $1.03. Using purchasing power parity, the expected spot rate at the end of one year is $____.a. 1.02b. 1.03c. 1.04d. none of the aboveANS: CSOLUTION:E(S t + 1) = $1.03(1.0097) = $1.04PTS: 133. If the one-year forward rate for the euro is $1.07, while the current spot rate is $1.05, the expectedpercentage change in the euro is ____%.a. 1.90b. 2.00c. -1.87d. none of the aboveANS: ASOLUTION: E(e) = 1.07/1.05 - 1 = 1.90%PTS: 134. If both interest rate parity and the international Fisher effect hold, then between the forward rate andthe spot rate, the ____ rate should provide more accurate forecasts for currencies in ____-inflation countries.a. spot; highb. spot; lowc. forward; highd. forward; lowANS: C PTS: 135. If a foreign country's interest rate is similar to the U.S. rate, the forward rate premium or discount willbe ____, meaning that the forward rate and spot rate will provide ____ forecasts.a. substantial; similarb. substantial; very differentc. close to zero; similard. close to zero; very differentANS: C PTS: 136. Factors such as economic growth, inflation, and interest rates are an integral part of ____ forecasting.a. technicalb. fundamentalc. market-basedd. none of the aboveANS: B PTS: 137. Silicon Co. has forecasted the Canadian dollar for the most recent period to be $0.73. The realizedvalue of the Canadian dollar in the most recent period was $0.80. Thus, the absolute forecast error as a percentage of the realized value was ____%.a. 9.6b. -9.6c. 8.8d. -8.8ANS: CSOLUTION:PTS: 138. The absolute forecast error of a currency is ____, on average, in periods when the currency is more____.a. lower; volatileb. higher; stablec. lower; stabled. none of the aboveANS: C PTS: 139. If the foreign exchange market is ____ efficient, then historical and current exchange rate informationis not useful for forecasting exchange rate movements.a. weak-formb. semistrong-formc. strong formd. all of the aboveANS: D PTS: 140. Foreign exchange markets are generally found to be at least ____ efficient.a. weak-formb. semistrong-formc. strong formd. none of the aboveANS: B PTS: 141. MNCs can forecast exchange rate volatility to determine the potential range surrounding theirexchange rate forecast.a. Trueb. FalseANS: T PTS: 142. If the pattern of currency values over time appears random, then technical forecasting is appropriate.a. Trueb. FalseANS: F PTS: 143. Inflation and interest rate differentials between the U.S. and foreign countries are examples ofvariables that could be used in fundamental forecasting.a. Trueb. FalseANS: T PTS: 144. A regression analysis of the Australian dollar value on the inflation differential between the U.S. andAustralia produced a coefficient of .8. Thus, for every 1% increase in the inflation differential, the Australian dollar is expected to depreciate by .8%.a. Trueb. FalseANS: F PTS: 145. The most sophisticated forecasting techniques provide consistently accurate forecasts.a. Trueb. FalseANS: F PTS: 146. If the forward rate is used as an indicator of the future spot rate, the spot rate is expected to appreciateor depreciate by the same amount as the forward premium or discount, respectively.a. Trueb. FalseANS: T PTS: 147. Research indicates that currency forecasting services almost always outperform forecasts based on theforward rate.a. Trueb. FalseANS: F PTS: 148. When measuring forecast performance of different currencies, it is often useful to adjust for theirrelative sizes. Thus, percentages, rather than nominal amounts, are often used to compute forecast errors.a. Trueb. FalseANS: T PTS: 149. The closer graphical points are to the perfect forecast line, the better is the forecast.a. Trueb. FalseANS: T PTS: 150. Foreign exchange markets appear to be strong-form efficient.a. Trueb. FalseANS: F PTS: 151. A motivation for forecasting exchange rate volatility is to obtain a range surrounding the forecast.a. Trueb. FalseANS: T PTS: 152. Two methods to assess exchange rate volatility are the volatility of historical exchange ratemovements and the exchange rate's implied standard deviation from the currency option pricingmodel.a. Trueb. FalseANS: T PTS: 153. Market-based forecasting involves the use of historical exchange rate data to predict future values.a. Trueb. FalseANS: F PTS: 154. Fundamental models examine moving averages over time and thus allow the development of aforecasting rule.a. Trueb. FalseANS: F PTS: 155. A forecasting technique based on fundamental relationships between economic variables and exchangerates, such as inflation, is referred to as technical forecasting.a. Trueb. FalseANS: F PTS: 156. Usually, fundamental forecasting is used for short-term forecasts, while technical forecasting is usedfor longer-term forecasts.a. Trueb. FalseANS: F PTS: 157. If points are scattered evenly on both sides of the perfect forecast line, then the forecast appears to bevery accurate.a. Trueb. FalseANS: F PTS: 158. If foreign exchange markets are strong-form efficient, then all relevant public and private informationis already reflected in today's exchange rates.a. Trueb. FalseANS: T PTS: 159. Exchange rates one year in advance are typically forecasted with almost perfect accuracy for the majorcurrencies, but not for currencies of smaller countries.a. Trueb. FalseANS: F PTS: 160. The potential forecast error is larger for currencies that are more volatile.a. Trueb. FalseANS: T PTS: 161. A forecast of a currency one year in advance is typically more accurate than a forecast one week inadvance since the currency reverts to equilibrium over a longer term period.a. Trueb. FalseANS: F PTS: 162. In general, any key managerial decision that is based on forecasted exchange rates should relycompletely on one forecast rather than alternative exchange rate scenarios.a. Trueb. FalseANS: F PTS: 163. Monson Co., based in the U.S., exports products to Japan denominated in yen. If the forecasted valueof the yen is substantially ____ than the forward rate, Monson Co. will likely decide ____ thepayments.a. higher; to hedgeb. lower; not to hedgec. higher; not to hedged. none of the aboveANS: C PTS: 164. When a U.S.-based MNC wants to determine whether to establish a subsidiary in a foreign country, itwill always accept that project if the foreign currency is expected to appreciate.a. Trueb. FalseANS: F PTS: 165. The following is not a limitation of technical forecasting:a. It's not suitable for long-term forecasts of exchange rates.b. It doesn't provide point estimates or a range of possible future values.c. It cannot be applied to currencies that exhibit random movements.d. It cannot be applied to currencies that exhibit a continuous trend for short-term forecast.ANS: D PTS: 166. The following regression model was estimated to forecast the percentage change in the AustralianDollar (AUD):AUD t = a0 + a1INT t + a2INF t- 1 + μt,where AUD is the quarterly change in the Australian Dollar, INT is the real interest rate differential in period t between the U.S. and Australia, and INF is the inflation rate differential between the U.S. and Australia in the previous period. Regression results indicate coefficients of a0 = .001; a1 = -.8; and a2 = .5. Assume that INF t- 1 = 4%. However, the interest rate differential is not known at the beginning of period t and must be estimated. You have developed the following probability distribution:Probability Possible Outcome20% -3%80% -4%There is a 20% probability that the Australian dollar will change by ____, and an 80% probability it will change by ____.a. 4.5%; 6.1%;b. 6.1%; 4.5%c. 4.5%; 5.3%d. None of the aboveANS: CSOLUTION: Probability 20% = .001 + (-.8)(-.03) + (.5)(.04) = 4.5%Probability 80% = .001 + (-.8)(-.04) + (.5)(.04) = 5.3%PTS: 167. Purchasing power parity is used in:a. technical forecasting.b. fundamental forecasting.c. market-based accounting.d. all of the above.ANS: B PTS: 168. If speculators expect the spot rate of the yen in 60 days to be ____ than the 60-day forward rate on theyen, they will ____ the yen forward and put ____ pressure on the yen's forward rate.a. higher; buy; upwardb. higher; sell; downwardc. higher; sell; upwardd. lower; buy; upwardANS: A PTS: 169. If speculators expect the spot rate of the Canadian dollar in 30 days to be ____ than the 30-day forwardrate on Canadian dollars, they will ____ Canadian dollars forward and put ____ pressure on theCanadian dollar forward rate.a. lower; sell; upwardb. lower; sell; downwardc. higher; sell; upwardd. higher; sell; downwardANS: B PTS: 170. Assume that U.S. annual inflation equals 8%, while Japanese annual inflation equals 5%. If purchasingpower parity is used to forecast the future spot rate, the forecast would reflect an expectation of:a. appreciation of yen's value over the next year.b. depreciation of yen's value over the next year.c. no change in yen's value over the next year.d. information about interest rates is needed to answer this question.ANS: A PTS: 171. Assume that U.S. interest rates are 6%, while British interest rates are 7%. If the international Fishereffect holds and is used to determine the future spot rate, the forecast would reflect an expectation of:a. appreciation of pound's value over the next year.b. depreciation of pound's value over the next year.c. no change in pound's value over the next year.d. not enough information to answer this question.ANS: B PTS: 172. If the foreign exchange market is ____ efficient, then technical analysis is not useful in forecastingexchange rate movements.a. weak-formb. semistrong-formc. strong formd. all of the aboveANS: D PTS: 173. If today's exchange rate reflects any historical trends in Canadian dollar exchange rate movements, butnot all relevant public information, then the Canadian dollar market is:a. weak-form efficient.b. semistrong-form efficient.c. strong-form efficient.d. all of the above.ANS: A PTS: 174. Leila Corporation used the following regression model to determine if the forecasts over the last tenyears were biased:S t = a0 + a1F t- 1 + μt,where S t is the spot rate of the yen in year t and F t- 1 is the forward rate of the yen in year t -1.Regression results reveal coefficients of a0 = 0 and a1 = .30. Thus, Leila Corporation has reason to believe that its past forecasts have ____ the realized spot rate.a. overestimatedb. underestimatedc. correctly estimatedd. none of the aboveANS: A PTS: 175. Assume that U.S. interest rate for the next three years is 5%, 6%, and 7% respectively. Also assumethat Canadian interest rates for the next three years are 3%, 6%, 9%. The current Canadian spot rate is $.840. What is the approximate three-year forecast of Canadian dollar spot rate if the three-yearforward rate is used as a forecast?a. $.840b. $.890c. $.856d. $.854ANS: CSOLUTION: {[(1.05)(1.06)(1.07)]/[(1.03)(1.05)(1.08)]} ⨯ $.84 = $.856PTS: 176. Which of the following is not one of the major reasons for MNCs to forecast exchange rates?a. to decide in which foreign market to invest the excess cash.b. to decide where to borrow at the lowest cost.c. to determine whether to require the subsidiary to remit the funds or invest them locally.d. to speculate on the exchange rate movements.ANS: D PTS: 177. Sensitivity analysis allows for all of the following except:a. accountability for uncertainty.b. focus on a single point estimate of future exchange rates.c. development of a range of possible future values.d. consideration of alternative scenarios.ANS: B PTS: 178. If graphical points lie above the perfect forecast line, than the forecast overestimated the future value.a. Trueb. FalseANS: F PTS: 179. A regression model was applied to explain movements in the Canadian dollar's value over time. Thecoefficient for the inflation differential between the U.S. and Canada was -0.2. The coefficient of the interest rate differential between the U.S. and Canada produced a coefficient of 0.8. Thus, theCanadian dollar depreciates when the inflation differential ____ and the interest rate differential ____.a. increases; increasesb. decreases; increasesc. increases; decreasesd. increases; decreasesANS: C PTS: 180. If the pattern of currency values over time appears random, then technical forecasting is appropriate.a. Trueb. FalseANS: F PTS: 181. Market-based forecasting is based on fundamental relationships between economic variables andexchange rates.。

国际金融InternationalFinanceTestBank_18

国际金融InternationalFinanceTestBank_18Chapter 18—Long-Term Financing1. Ideally, a firm desires to denominate bonds in a currency that:a. exhibits a low interest rate and is expected to appreciate.b. exhibits a low interest rate and is expected to depreciate.c. exhibits a high interest rate and is expected to depreciate.d. exhibits a high interest rate and is expected to appreciate.ANS: B PTS: 12. Floating-rate bonds are often issued with a floating coupon rate that is tied to LIBOR.a. Trueb. FalseANS: T PTS: 13. A U.S. firm could issue bonds denominated in euros and partially hedge against exchange rate riskby:a. invoicing its exports in U.S. dollars.b. requesting that any imports ordered by the firm be invoiced in U.S. dollars.c. invoicing its exports in euros.d. requesting that any imports ordered by the firm be invoiced in the currency denominatingthe bonds.ANS: C PTS: 14. Firm X conducts all business transactions in U.S. dollars. If it issues two sets of bonds, eachdenominated in a different foreign currency, it can:a. reduce exchange rate risk relative to issuing a bond denominated in U.S. dollars.b. reduce exchange rate risk relative to issuing a bond denominated in a single foreigncurrency.c. A and Bd. none of the aboveANS: B PTS: 15. Simulation is useful in the bond-denomination decision since it can:a. precisely compute the cost of financing with bonds denominated in a single foreigncurrency.b. precisely compute the cost of financing with bonds denominated in a portfolio of foreigncurrencies.c. assess the probability that a bond denominated in a foreign currency will be less costlythan a bond denominated in the home currency.d. A and BANS: C PTS: 16. An interest rate swap between two firms of different countries enables the exchange of ____ for____.a. fixed-rate payments; floating-rate paymentsb. stock; interest deductions on taxesc. interest payments on loans; ownership of debt of less developed countriesd. interest payments on loans; stockANS: A PTS: 17. If U.S. firms issue bonds in ____, the dollar outflows to cover fixed coupon payments increase asthe dollar ____.a. a foreign currency; weakensb. dollars; strengthensc. a foreign currency; strengthensd. dollars; weakensANS: A PTS: 18. The yields offered on newly issued bonds denominated in dollars have:a. consistently increased over the last 10 years.b. consistently decreased over the last 10 years.c. remained stable.d. none of the aboveANS: D PTS: 19. When ignoring exchange rate risk, bond yields:a. are the same for all currencies.b. are consistently higher for all non-U.S. bonds than U.S. bonds.c. are consistently lower for all non-U.S. bonds than U.S. bonds.d. none of the aboveANS: D PTS: 110. A U.S. firm has received a large amount of cash inflows periodically in Swiss francs as a result ofexporting goods to Switzerland. It has no other business outside the U.S. It could best reduce its exposure to exchange rate risk by:a. issuing Swiss franc-denominated bonds.b. purchasing Swiss franc-denominated bonds.c. purchasing U.S. dollar-denominated bonds.d. issuing U.S. dollar-denominated bonds.ANS: A PTS: 111. A U.S. firm has a Canadian subsidiary that remits some of its earnings to the parent on an annualbasis. The firm has no other foreign business. The firm could best reduce its exposure to exchange rate risk by issuing bonds denominated in:a. U.S. dollars.b. Canadian dollars.c. multiple currencies.d. euros.ANS: B PTS: 112. If the currency denominating a foreign bond depreciates against the firm's home currency, thefunds needed to make coupon payments will increase.a. Trueb. FalseANS: F PTS: 113. An interest rate swap is commonly used by an issuer of fixed-rate bonds to:a. convert to floating-rate debt.b. hedge exchange rate risk.c. lock in the interest payments on debt.d. remove the default risk of its debt.ANS: A PTS: 114. A currency swap between two firms of different countries enables the exchange of ____ for ____at periodic intervals.a. stock; one currencyb. stock; a portfolio of foreign currenciesc. one currency; stock optionsd. one currency; another currencyANS: D PTS: 115. Assume a U.S.-based subsidiary wants to raise $1,000,000 by issuing a bond denominated inPakistani rupees (PKR). The current exchange rate of the rupee is $.02. Thus, the MNC needs____ rupees to obtain the $1,000,000 needed.a. 50,000,000b. 20,000c. 1,000,000d. none of the aboveANS: ASOLUTION: $1,000,000/$.02 = PKR50,000,000PTS: 116. An MNC issues ten-year bonds denominated in 500,000 Philippines pesos (PHP) at par. The bondshave a coupon rate of 15%. If the peso remains stable at its current level of $.025 over the lifetime of the bonds and if the MNC holds the bonds until maturity, the financing cost to the MNC will be:a. 10.0%.b. 12.5%.c. 15.0%.d. none of the aboveANS: CSOLUTION: Since the bonds are issued at par, and since the exchange rate remains stableover the life of the bonds and the bonds are held untilmaturity, the financingcost will be exactly the coupon rate of the bond.PTS: 117. New Hampshire Corp. has decided to issue three-year bonds denominated in 5,000,000 Russianrubles at par. The bonds have a coupon rate of 17%. If the ruble is expected to appreciate from its current level of $.03 to $.032, $.034, and $.035 in years 1, 2,and 3, respectively, what is thefinancing cost of these bonds?a. 17%.b. 23.18%.c. 22.36%.d. 23.39%.ANS: DSOLUTION:Annual Cost ofYear 1 Year 2 Year 3 Financing Payments in rubles 850,000 850,000 5,850,000Forecasted exchange rate of ruble $.032 $.034$.035Payments in dollars $27,200 $28,900 $204,750 23.39% PTS: 118. In a(n) ____ swap, two parties agree to exchange payments associated with bonds; in a(n) ____swap, two parties agree to periodically exchange foreign currencies.a. interest rate; currencyb. currency; interest ratec. interest rate; interest rated. currency; currencyANS: A PTS: 119. Good Company prefers variable to fixed rate debt. Bad Company prefers fixed to variable ratedebt. Assume the following information for Good and Bad Companies:Fixed Rate Bond Variable Rate Bond Good Company 10% LIBOR + 1%Bad Company 12% LIBOR + 1.5%Given this information:a. an interest rate swap will probably not be advantageous to Good Company because it canissue both fixed and variable debt at more attractive rates than Bad Company.b. an interest rate swap attractive to both parties could result if Good Company agreed toprovide Bad Company with variable rate payments at LIBOR + 1% in exchange for fixedrate payments of 10.5%.c. an interest rate swap attractive to both parties could result if Bad Company agreed toprovide Good Company with variable rate payments at LIBOR + 1% in exchange for fixedrate payments of 10.5%.d. none of the aboveANS: B PTS: 120. ____ are beneficial because they may reduce transaction costs. However, MNCs may not be ableto obtain all the funds that they need.a. Private placementsb. Domestic equity offeringsc. Global equity offeringsd. Global debt offeringsANS: A PTS: 121. Most MNCs obtain equity funding:a. in foreign countries.b. in their home country.c. through global offerings.d. through private placements.ANS: B PTS: 122. Some firms may be uncomfortable issuing bonds denominated in foreign currencies becauseexchange rates are ____ difficult to predict over ____ time horizons.a. less; longb. more; shortc. more; longd. none of the aboveANS: C PTS: 123. If the foreign currency that was borrowed appreciates over time, an MNC will need fewer funds tocover the coupon or principal payments. [Assume the MNC has no other cash flows in thatcurrency.]a. Trueb. FalseANS: F PTS: 124. U.S.-based MNCs whose foreign subsidiary generates large earnings may be able to offsetexposure to exchange rate risk by issuing bonds denominated in the subsidiary's local currency.a. Trueb. FalseANS: T PTS: 125. Countries in emerging markets such as in Latin America tend to have ____ interest rates, and sothe yields offered on bonds issued in those countries is ____.a. low; highb. high; lowc. high; highd. none of the aboveANS: C PTS: 126. MNCs can use ____ to reduce exchange rate risk. This occurs when two parties providesimultaneous loans with an agreement to repay at a specified point in the future.a. forward contractsb. currency swapsc. parallel loansd. none of the aboveANS: C PTS: 127. An upward-sloping yield curve for a foreign country means that annualized yields there are ____for short-term debt than for long-term debt. The yield curve in this country reflects ____.a. higher; several periodsb. lower; several periodsc. higher; a specific point in timed. lower; a specific point in timeANS: D PTS: 128. The ____ for a given country represents the annualizedyield offered on debt for variousmaturities.a. LIBORb. yield curvec. parallel loand. interest rate swapANS: B PTS: 129. When an MNC finances in a currency that matches its long-term cash inflows using a relatively____ maturity, the MNC is exposed to ____ risk.a. short; interest rateb. long; interest ratec. short; exchange rated. none of the aboveANS: B PTS: 130. Some MNCs use a country's yield curve to compare annualized rates among debt maturities, sothat they can choose a maturity that has a relatively low rate.a. Trueb. FalseANS: T PTS: 131. As a(n) ____ to an interest rate swap, a financial institution simply arranges a swap between twoparties.a. ultrapartyb. brokerc. counterpartyd. none of the aboveANS: B PTS: 132. In general, the ____ rate payer in a plain vanilla swapbelieves interest rates are going to ____.a. fixed; declineb. floating; declinec. floating; increased. none of the aboveANS: B PTS: 133. In a(n) ____ swap, the fixed rate payer has the right to terminate the swap.a. callableb. putablec. amortizingd. zero-couponANS: A PTS: 134. In a(n) ____ swap, the notional value is increased over time.a. amortizingb. basisc. zero-coupond. accretionANS: D PTS: 135. A ____ gives its owner the right to enter into a swap.a. basis swapb. swaptionc. callable swapd. putable swapANS: B PTS: 136. Because bonds denominated in foreign currencies rarely have lower yields, U.S. corporationsrarely consider issuing bonds denominated in those currencies.a. Trueb. FalseANS: F PTS: 137. The actual financing cost of a U.S. corporation issuing a bond denominated in euros is affected bythe euro's value relative to the U.S. dollar during the financing period.a. Trueb. FalseANS: T PTS: 138. A floating coupon rate is an advantage to the bond issuer during periods of increasing interestrates.a. Trueb. FalseANS: F PTS: 139. An MNC issuing pound-denominated bonds may be completely insulated from exchange rate riskassociated with the bond if its foreign subsidiary makes the coupon and principal payments of the bond with its pound receivables.a. Trueb. FalseANS: T PTS: 140. If an MNC uses a long-term forward contract to hedge the exchange rate risk associated with abond denominated in euros, it would sell euros forward.a. Trueb. FalseANS: F PTS: 141. Currency swaps, whereby two parties exchangecurrencies at a specified point in time for aspecified price, are often used by MNCs to hedge against interest rate risk.a. Trueb. FalseANS: F PTS: 142. A limitation of interest rate swaps is that there is a risk to each swap participant that thecounterparticipant could default on his payments.a. Trueb. FalseANS: T PTS: 143. Many MNCs simultaneously swap interest payments and currencies.a. Trueb. FalseANS: T PTS: 144. A parallel loan represents simultaneous loans provided by two parties with an agreement to repayat a specified point in the future.a. Trueb. FalseANS: T PTS: 145. Since yield curves are identical across countries, MNCs rarely consider them when deciding on thematurity of bonds denominated in a foreign currency.a. Trueb. FalseANS: F PTS: 146. Because bonds denominated in foreign currencies rarelyhave lower yields, U.S. corporationsrarely consider issuing bonds denominated in those currencies.a. Trueb. FalseANS: F PTS: 147. If the currency denominating a foreign bond depreciates against the firm's home currency over thelifetime of the bond, the funds needed to make coupon payments will increase.a. Trueb. FalseANS: F PTS: 148. Even if the interest rate associated with a foreign country is higher than the domestic interest rate,the financing costs of a foreign bond will always be lower than the financing rate of a domestic bond as long as the currency depreciates over the lifetime of a bond.a. Trueb. FalseANS: F PTS: 149. If the currency of a foreign currency-denominated bond ____, the funds needed to make couponpayments will ____.a. appreciates; increaseb. depreciates; decreasec. appreciates; decreased. depreciates; increasee. A and BANS: E PTS: 150. Generally, the financing costs associated with a foreign currency-denominated bond will be ____volatile than the financing costs of a domestic bond because of ____.a. more; exchange rate movementsb. less; exchange rate movementsc. less; global economic conditionsd. none of the aboveANS: A PTS: 151. ____ swaps are often used by companies to hedge against ____ rate risk.a. Currency; interestb. Interest; interestc. Interest; exchanged. Currency; exchangee. B and DANS: E PTS: 152. ____ are commonly used to hedge interest rate risk.a. Currency swapsb. Parallel loansc. Interest rate swapsd. Forward contractse. None of the aboveANS: C PTS: 153. In a(n) ____ swap, the notional value is reduced over time.a. accretionb. amortizingc. forwardd. zero-coupone. putableANS: B PTS: 154. A(n) ____ swap is entered into today, but the swap payments start at a specific future point intime.a. accretionb. amortizingc. forwardd. zero-coupone. putableANS: C PTS: 155. A callable swap gives the ____ payer the right to terminate the swap; the MNC would exercise thisright if interest rates ____ substantially.a. floating-rate; riseb. floating-rate; fallc. fixed-rate; rised. fixed-rate; falle. none of the aboveANS: D PTS: 1。

国际金融financetestbank4教学文案

国际金融Fi na n c e Te s t Ba nk4Chapter 4—Exchange Rate Determination加息会降低通货膨胀本国货币就增值涨价了,出口就会减少进口就会增加1. The value of the Australian dollar (A$) today is $0.73. Yesterday, thevalue of the Australian dollar was $0.69. The Australian dollar ____ by ____%.a. depreciated; 5.80b. depreciated; 4.00c. appreciated; 5.80d. appreciated; 4.00ANS: CSOLUTION: ($0.73 $0.69)/$0.69 =5.80%PTS: 12. If a currency's spot rate market is ____, its exchange rate is likely to be____ to a single large purchase or sale transaction.a. liquid; highly sensitiveb. illiquid; insensitivec. illiquid; highly sensitived. none of the above.ANS: C PTS: 13. ____ is not a factor that causes currency supply and demand schedulesto change.a. Relative inflation ratesb. Relative interest ratesc. Relative income levelsd. Expectationse. All of the above are factorsthat cause currency supplyand demand schedules tochange.ANS: E PTS: 14. A large increase in the income level in Mexico along with no growth inthe U.S. income level is normally expected to cause (assuming nochange in interest rates or other factors) a(n) ____ in Mexican demand for U.S. goods, and the Mexican peso should ____.a. increase; appreciateb. increase; depreciatec. decrease; depreciated. decrease; appreciateANS: B PTS: 15. An increase in U.S. interest rates relative to German interest rateswould likely ____ the U.S. demand for euros and ____ the supply of euros for sale.a. reduce; increaseb. increase; reducec. reduce; reduced. increase; increaseANS: A PTS: 16. Investors from Germany, the United States, and the U.K. frequentlyinvest in each other based on prevailing interest rates. If Britishinterest rates increase, German investors are likely to buy ____ dollar-denominated securities, and the euro is likely to ____ relative to the dollar.a. fewer; depreciateb. fewer; appreciatec. more; depreciated. more; appreciateANS: A PTS: 17. When the "real" interest rate is relatively low in a given country, thenthe currency of that country is typically expected to be:a. weak, since the country'squoted interest rate would behigh relative to the inflationrate.b. strong, since the country'squoted interest rate would below relative to the inflationrate.c. strong, since the country'squoted interest rate would behigh relative to the inflationrate.d. weak, since the country'squoted interest rate would below relative to the inflationrate.ANS: D PTS: 18. Assume that the inflation rate becomes much higher in the U.K.relative to the U.S. This will place ____ pressure on the value of theBritish pound. Also, assume that interest rates in the U.K. begin torise relative to interest rates in the U.S. The change in interest rateswill place ____ pressure on the value of the British pound.a. upward; downwardb. upward; upwardc. downward; upwardd. downward; downwardANS: C PTS: 19. In general, when speculating on exchange rate movements, thespeculator will borrow the currency that is expected to appreciate andinvest in the country whose currency is expected to depreciate.a. Trueb. FalseANS: F PTS: 110. Baylor Bank believes the New Zealand dollar will appreciate over thenext five days from $.48 to $.50. The following annual interest ratesapply:Currency Lending Rate Borrowing Rate Dollars 7.10% 7.50%6.80%7.25%New Zealand dollar(NZ$)Baylor Bank has the capacity to borrow either NZ$10 million or $5million. If Baylor Bank's forecast is correct, what will its dollar profitbe from speculation over the five-day period (assuming it does not useany of its existing consumer deposits to capitalize on its expectations)?a. $521,325.b. $500,520.c. $104,262.d. $413,419.e. $208,044.ANS: ESOLUTION:1. Borrow $5 million.2. Convert to NZ$:$5,000,000/$.48 =NZ$10,416,667.3. Invest the NZ$ at anannualized rate of 6.80% overfive days.NZ$10,416,667 [1+ 6.80% (5/360)]= NZ$10,426,5054. Convert the NZ$ back todollars:NZ$10,426,505$.50 = $5,213,2525. Repay the dollars borrowed.The repayment amount is:$5,000,000 [1 +7.5% (5/360)]= $5,000,000[1.00104]= $5,005,2086. After repaying the loan, theremaining dollar profit is:$5,213,252$5,005,208 = $208,044 PTS: 111. Assume the following information regarding U.S. and Europeanannualized interest rates:Currency Lending Rate Borrowing Rate U.S. Dollar ($) 6.73% 7.20%Eu ro (?) 6.80% 7.28%Trensor Bank can borrow either $20 million or ?20 million. Thecurrent spot rate of the euro is $1.13. Furthermore, Trensor Bankexpects the spot rate of the euro to be $1.10 in 90 days. What isTrensor Bank's dollar profit from speculating if the spot rate of theeuro is indeed $1.10 in 90 days?a. $579,845.b. $583,800.c. $588,200.d. $584,245.e. $980,245.ANS: ASOLUTION:1. Borrow ?20 million.2. Convert the ?20 million to?20,000,000 $1.13 =$22,600,000.3. Invest the $22,600,000 at anannualized rate of 6.73% for90 days.$22,600,000 [1 +6.73% (90/360)]= $22,980,2454. Determine euros owed:?20,000,000 [1 + 7.28%(90/360)] = ?20,364,000.5. Determine dollars needed torepay euro loan:?20,364,000 $1.10 =$22,400,400.6. The dollar profit is$22,980,245 $22,400,400= $579,845.PTS: 112. The equilibrium exchange rate of pounds is $1.70. At an exchangerate of $1.72 per pound:a. U.S. demand for pounds wouldexceed the supply of poundsfor sale and there would be ashortage of pounds in theforeign exchange market.b. U.S. demand for pounds wouldbe less than the supply ofpounds for sale and therewould be a shortage of poundsin the foreign exchangemarket.c. U.S. demand for pounds wouldexceed the supply of poundsfor sale and there would be asurplus of pounds in theforeign exchange market.d. U.S. demand for pounds wouldbe less than the supply ofpounds for sale and therewould be a surplus of poundsin the foreign exchangemarket.e. U.S. demand for pounds wouldbe equal to the supply ofpounds for sale and therewould be a shortage of poundsin the foreign exchangemarket.ANS: D PTS: 113. Assume that Swiss investors have francs available to invest insecurities, and they initially view U.S. and British interest rates asequally attractive. Now assume that U.S. interest rates increase whileBritish interest rates stay the same. This would likely cause:a. the Swiss demand for dollarsto decrease and the dollar willdepreciate against the pound.b. the Swiss demand for dollarsto increase and the dollar willdepreciate against the Swissfranc.c. the Swiss demand for dollarsto increase and the dollar willappreciate against the Swissfranc.d. the Swiss demand for dollarsto decrease and the dollar willappreciate against the pound.ANS: C PTS: 114. The real interest rate adjusts the nominal interest rate for:a. exchange rate movements.b. income growth.c. inflation.d. government controls.e. none of the aboveANS: C PTS: 115. If U.S. inflation suddenly increased while European inflation stayed thesame, there would be:a. an increased U.S. demand foreuros and an increased supplyof euros for sale.b. a decreased U.S. demand foreuros and an increased supplyof euros for sale.c. a decreased U.S. demand foreuros and a decreased supplyof euros for sale.d. an increased U.S. demand foreuros and a decreased supplyof euros for sale.ANS: D PTS: 116. If inflation in New Zealand suddenly increased while U.S. inflationstayed the same, there would be:a. an inward shift in the demandschedule for NZ$ and anoutward shift in the supplyschedule for NZ$.b. an outward shift in thedemand schedule for NZ$ andan inward shift in the supplyschedule for NZ$.c. an outward shift in thedemand schedule for NZ$ andan outward shift in the supplyschedule for NZ$.d. an inward shift in the demandschedule for NZ$ and aninward shift in the supplyschedule for NZ$.ANS: A PTS: 117. If the U.S. and Japan engage in substantial financial flows but littletrade, ____ directly influences their exchange rate the most. If the U.S.and Switzerland engage in much trade but little financial flows, ____directly influences their exchange rate the most.a. interest rate differentials;interest rate differentialsb. inflation and interest ratedifferentials; interest ratedifferentialsc. income and interest ratedifferentials; inflationdifferentialsd. interest rate differentials;inflation and incomedifferentialse. inflation and incomedifferentials; interest ratedifferentialsANS: D PTS: 118. If inflation increases substantially in Australia while U.S. inflationremains unchanged, this is expected to place ____ pressure on the value of the Australian dollar with respect to the U.S. dollar.a. upwardb. downwardc. either upward or downward(depending on the degree ofthe increase in Australianinflation)d. none of the above; there willbe no impactANS: B PTS: 119. Assume that British corporations begin to purchase more suppliesfrom the U.S. as a result of several labor strikes by British suppliers.This action reflects:a. an increased demand forBritish pounds.b. a decrease in the demand forBritish pounds.c. an increase in the supply ofBritish pounds for sale.d. a decrease in the supply ofBritish pounds for sale.ANS: C PTS: 120. The exchange rates of smaller countries are very stable because themarket for their currency is very liquid.a. Trueb. FalseANS: F PTS: 121. The phrase "the dollar was mixed in trading" means that:a. the dollar was strong in someperiods and weak in otherperiods over the last month.b. the volume of trading wasvery high in some periods andlow in other periods.c. the dollar was involved insome currency transactions,but not others.d. the dollar strengthenedagainst some currencies andweakened against others.ANS: D PTS: 122. Assume that the U.S. places a strict quota on goods imported fromChile and that Chile does not retaliate. Holding other factors constant,this event should immediately cause the U.S. demand for Chilean pesos to ____ and the value of the peso to ____.a. increase; increaseb. increase; declinec. decline; declined. decline; increaseANS: C PTS: 123. Any event that increases the U.S. demand for euros should result ina(n) ____ in the value of the euro with respect to ____, other thingsbeing equal.a. increase; U.S. dollarb. increase; nondollar currenciesc. decrease; nondollar currenciesd. decrease; U.S. dollarANS: A PTS: 124. Any event that reduces the U.S. demand for Japanese yen shouldresult in a(n) ____ in the value of the Japanese yen with respect to ____, other things being equal.a. increase; U.S. dollarb. increase; nondollar currenciesc. decrease; nondollar currenciesd. decrease; U.S. dollarANS: D PTS: 125. Any event that increases the supply of British pounds to be exchangedfor U.S. dollars should result in a(n) ____ in the value of the Britishpound with respect to ____, other things being equal.a. increase; U.S. dollarb. increase; nondollar currenciesc. decrease; nondollar currenciesd. decrease; U.S. dollarANS: D PTS: 126. Any event that reduces the supply of Swiss francs to be exchanged forU.S. dollars should result in a(n) ____ in the value of the Swiss francwith respect to ____, other things being equal.a. increase; U.S. dollarb. increase; nondollar currenciesc. decrease; nondollar currenciesd. decrease; U.S. dollarANS: A PTS: 127. Assume that the U.S. experiences a significant decline in income, whileJapan's income remains steady. This event should place ____ pressure on the value of the Japanese yen, other things being equal. (Assumethat interest rates and other factors are not affected.)a. upwardb. downwardc. nod. upward and downward(offsetting)ANS: B PTS: 128. News of a potential surge in U.S. inflation and zero Chilean inflationplaces ____ pressure on the value of the Chilean peso. The pressure will occur ____.a. upward; only after the U.S.inflation surgesb. downward; only after the U.S.inflation surgesc. upward; immediatelyd. downward; immediatelyANS: C PTS: 129. Assume that Canada places a strict quota on goods imported from theU.S. and that the U.S. does not retaliate. Holding other factorsconstant, this event should immediately cause the supply of Canadian dollars to be exchanged for U.S. dollars to ____ and the value of theCanadian dollar to ____.a. increase; increaseb. increase; declinec. decline; declined. decline; increaseANS: D PTS: 130. Assume that Japan places a strict quota on goods imported from theU.S. and the U.S. places a strict quota on goods imported from Japan.This event should immediately cause the U.S. demand for Japaneseyen to ____, and the supply of Japanese yen to be exchanged for U.S.dollars to ____.a. increase; increaseb. increase; declinec. decline; declined. decline; increaseANS: C PTS: 131. Which of the following is not mentioned in the text as a factoraffecting exchange rates?a. relative interest rates.b. relative inflation rates.c. government controls.d. expectations.e. all of the above are mentionedin the text as factors affectingexchange rates.ANS: E PTS: 132. If a country experiences high inflation relative to the U.S., its exportsto the U.S. should ____, its imports should ____, and there is ____pressure on its currency's equilibrium value.a. decrease; increase; upwardb. decrease; decrease; upwardc. increase; decrease; downwardd. decrease; increase; downwarde. increase; decrease; upwardANS: D PTS: 133. If a country experiences an increase in interest rates relative to U.S.interest rates, the inflow of U.S. funds to purchase its securities should____, the outflow of its funds to purchase U.S. securities should ____,and there is ____ pressure on its currency's equilibrium value.a. increase; decrease; downwardb. decrease; increase; upwardc. increase; decrease; upwardd. decrease; increase; downwarde. increase; increase; upwardANS: C PTS: 134. An increase in U.S. inflation relative to Singapore inflation placesupward pressure on the Singapore dollar.a. Trueb. FalseANS: T PTS: 135. When expecting a foreign currency to depreciate, a possible way tospeculate on this movement is to borrow dollars, convert the proceedsto the foreign currency, lend in the foreign country, and use theproceeds from this investment to repay the dollar loan.a. Trueb. FalseANS: F PTS: 136. Since supply and demand for a currency are constant (primarily dueto government intervention), currency values seldom fluctuate.a. Trueb. FalseANS: F PTS: 137. Relatively high Japanese inflation may result in an increase in thesupply of yen for sale and a reduction in the demand for yen.a. Trueb. FalseANS: T PTS: 138. The main effect of interest rate movements on exchange rates isthrough their effect on international trade.a. Trueb. FalseANS: F PTS: 139. Country X frequently engages in trade flows with the U.S. (such asimports and exports). Country Y frequently engages in capital flowswith the U.S. (such as financial investments). Everything else heldconstant, an increase in U.S. interest rates would affect the exchange rate of Country X's currency more than the exchange rate of Country Y's currency.a. Trueb. FalseANS: F PTS: 140. Increases in relative income in one country vs. another result in anincrease in the first country's currency value.a. Trueb. False41. Trade-related foreign exchange transactions are more responsive tonews than financial flow transactions.a. Trueb. FalseANS: F PTS: 142. Signals regarding future actions of market participants in the foreignexchange market sometimes result in overreactions.a. Trueb. FalseANS: T PTS: 143. The markets that have a smaller amount of foreign exchange tradingfor speculatory purposes than for trade purposes will likely experience more volatility than those where trade flows play a larger role.a. Trueb. FalseANS: T PTS: 144. Liquidity of a currency can affect the extent to which speculation canimpact the currency's value.a. Trueb. False45. Forecasting a currency's future value is difficult, because it is difficultto identify how the factors affecting the currency value will change,and how they will interact to impact the currency's value.a. Trueb. FalseANS: T PTS: 146. The standard deviation should be applied to values rather thanpercentage movements when comparing volatility among currencies.a. Trueb. FalseANS: F PTS: 147. Movements of foreign currencies tend to be more volatile for shortertime horizons.a. Trueb. FalseANS: F PTS: 148. If a currency's spot market is ____, its exchange rate is likely to be ____to a single large purchase or sale transaction.a. liquid; highly sensitiveb. illiquid; insensitivec. liquid; insensitived. none of the aboveANS: C PTS: 149. The value of euro was $1.30 last week. During last week the eurodepreciated by 5%. What is the value of euro today?a. $1.365b. $1.235c. $1.330d. $1.30ANS: BSOLUTION: $1.3 (1 .05) = $1.235 PTS: 150. Government controls can only affect the supply of a given currencyfor sale and not the demand.a. Trueb. FalseANS: F PTS: 151. If one foreign currency will appreciate against the dollar, then allforeign currencies will appreciate against the dollar but by differentdegrees.a. Trueb. FalseANS: F PTS: 152. Assume that the income levels in U.K. start to rise, while U.S. incomelevels remain unchanged. This will place ____ pressure on the value of British pound. Also, assume that U.S. interest rates rise, while theBritish pound remains unchanged. This will place ____ pressure on the value of British pound.a. downward; downwardb. upward; downwardc. upward; upwardd. downward; upwardANS: D PTS: 153. If the Fed announces that it will decrease the U.S. interest rates, andEuropean Central Bank takes no action, then the value of euro will____ against the value of U.S. dollar. The Fed's action is called ____intervention.a. appreciate; directb. depreciate; directc. appreciate; indirectd. depreciate; indirectANS: C PTS: 154. Assume that the total value of investment transactions between U.S.and Mexico is minimal. Also assume that total dollar value of tradetransactions between these two countries is very large. Now assumethat Mexico's inflation has suddenly increased, and Mexican interestrates have suddenly increased. Overall, this would put ____ pressure on the value of Mexican peso. The inflation effect should be ____pronounced than the interest rate effect.a. downward; moreb. upward; morec. downward; lessd. upward; lessANS: A PTS: 155. If U.S. experiences a sudden surge in inflation and surge in interestrates while Japanese inflation and interest rates remain unchanged,the value of Japanese yen will ____ against the U.S. dollar.a. appreciateb. depreciatec. remain unchangedd. cannot be determined fromthe information provided.ANS: D PTS: 156. If the Japanese yen is expected to appreciate against the U.S. dollarand interest rates in the U.S. and Japan are similar, banks may tryspeculating on this anticipated exchange rate movement by borrowing ____ and investing in ____.a. yen; dollarsb. yen; yenc. dollars; yend. dollars; dollarsANS: C PTS: 157. British investors frequently invest in the U.S. or Italy, depending onthe prevailing interest rates. If Italian interest rates suddenly rise high above U.S. rates, the investors will ____ the supply of pounds to beexchanged for dollars and thus put ____ pressure on the value of the pound against the U.S. dollar.a. increase; downwardb. decrease; upwardc. increase; upwardd. decrease; downwardANS: B PTS: 158. The equilibrium exchange rate of the Swiss franc is $0.90. At anexchange rate $.83:a. U.S. demand for Swiss francswould exceed the supply offrancs for sale and therewould be a shortage of francsin the foreign exchangemarket.b. U.S. demand for Swiss francswould be less than the supplyof francs for sale and therewould be a shortage of francsin the foreign exchangemarket.c. U.S. demand for Swiss francswould exceed the supply offrancs for sale and therewould be a surplus of francs inthe foreign exchange market.d. U.S. demand for Swiss francswould be less than the supplyof francs for sale and therewould be a surplus of Swissfrancs in the foreign exchangemarket.ANS: A PTS: 159. Financial flow foreign exchange transactions are more responsive tonews than trade-related transactions.a. Trueb. FalseANS: T PTS: 160. Assume that the British government eliminates all controls on importsby British companies. Other things being equal, the U.S. demand forpounds would ____, the supply of pounds for sale would ____, and the equilibrium value of the pound would ____.a. increase; increase; increaseb. decrease; increase; decreasec. remain unchanged; increase;decreased. remain unchanged; increase;increaseANS: C PTS: 161. Country X frequently engages in trade flows with the U.S. (such asimports and exports). Country Y frequently engages in capital flowswith the U.S. (such as financial investments). Everything else heldconstant, an increase in U.S. inflation would affect the exchange rateof Country Y's currency more than the exchange rate of Country X'scurrency.a. Trueb. FalseANS: F PTS: 162. Assume that U.S. inflation is expected to surge in the near future. Theexpectation of surge in inflation will most likely place ____ pressure on U.S. dollar immediately.a. upwardb. downwardc. nod. cannot be determinedANS: A PTS: 163. When the Japanese yen appreciates against the U.S. dollar, this meansthat the U.S. dollar is strengthening relative to the yen.a. Trueb. FalseANS: F PTS: 164. Illiquid currencies tend to exhibit less volatile exchange ratemovements than liquid currencies.a. Trueb. FalseANS: F PTS: 165. The supply curve for a currency is downward sloping since U.S.corporations would be encouraged to purchase more foreign goodswhen the foreign currency is worth less.a. Trueb. FalseANS: F PTS: 166. Relatively high Japanese inflation may result in an increase in thesupply of yen for sale and a reduction in the demand for yen, otherthings being equal.a. Trueb. FalseANS: T PTS: 167. If the British government desires an appreciation in its currency withrespect to the U.S. dollar, it would consider intervening in the foreign exchange market by buying dollars with pounds.a. Trueb. FalseANS: F PTS: 168. Country X frequently engages in trade flows with the U.S. (such asimports and exports). Country Y frequently engages in financial flows with the U.S. (such as financial investments). Everything else heldconstant, an increase in U.S. interest rates would affect the exchange rate of Country X's currency more than the exchange rate of Country Y's currency.a. Trueb. FalseANS: F PTS: 169. Illiquid currencies tend to exhibit ____ volatile exchange ratemovements, as the equilibrium prices of their currencies adjust to ____changes in supply and demand conditions.a. less; even minorb. less; only largec. more; even minord. more; only largee. none of the aboveANS: C PTS: 170. Which of the following is not mentioned in the text as a factoraffecting exchange rates?a. Relative interest ratesb. Relative inflation ratesc. Government controlsd. Expectationse. All of the above are mentionedin the text as factors affectingexchange rates.ANS: E PTS: 171. Which of the following events would most likely result in anappreciation of the U.S. dollar?a. U.S. inflation is very high.b. The Fed indicates that it willraise U.S. interest rates.c. Future U.S. interest rates areexpected to decline.d. Japan is expected to increaseinterest rates in the nearfuture.ANS: B PTS: 172. Which of the following interactions will likely have the least effect onthe dollar's value? Assume everything else is held constant.a. A reduction in U.S. inflationaccompanied by an increase inreal U.S. interest ratesb. A reduction in U.S. inflationaccompanied by an increase innominal U.S. interest ratesc. An increase in U.S. inflationaccompanied by an increase innominal, but not real, U.S.interest ratesd. An increase in Singapore'sinflation accompanied by anincrease in real U.S. interestratese. An increase in Singapore'sinterest rates accompanied byan increase in U.S. inflation.ANS: C PTS: 173. If a country experiences high inflation relative to the U.S., its exportsto the U.S. should ____, its imports should ____, and there is ____pressure on its currency's equilibrium value.a. decrease; increase; upwardb. decrease; decrease; upwardc. increase; decrease; downwardd. decrease; increase; downwarde. increase; decrease; upwardANS: D PTS: 174. If a country experiences an increase in interest rates relative to U.S.interest rates, the inflow of U.S. funds to purchase its securities should____, the outflow of its funds to purchase U.S. securities should ____,and there is ____ pressure on its currency's equilibrium value.a. increase; decrease; downwardb. decrease; increase; upwardc. increase; decrease; upwardd. decrease; increase; downwarde. increase; increase; upward ANS: C PTS: 1。

国际金融Finance_Test_Bank_7