公司理财(英文版)题库15

(完整word版)公司理财(英文版)题库8

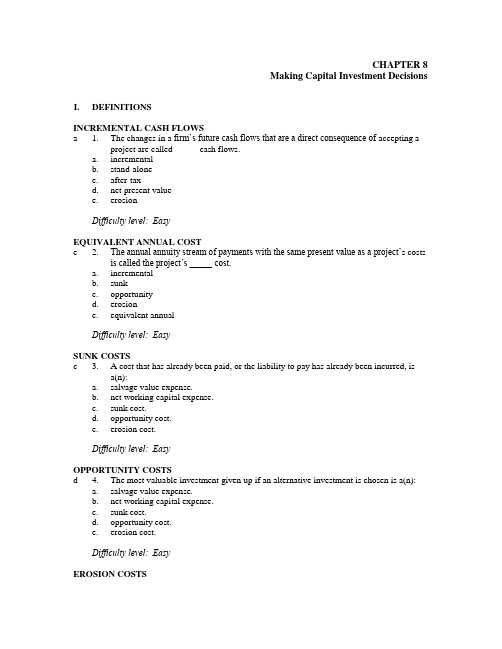

CHAPTER 8Making Capital Investment Decisions I. DEFINITIONSINCREMENTAL CASH FLOWSa 1. The changes in a firm’s future cash flows that are a direct consequence of accepting aproject are called _____ cash flows.a. incrementalb. stand-alonec. after-taxd. net present valuee. erosionDifficulty level: EasyEQUIVALENT ANNUAL COSTe 2. The annual annuity stream of payments with the same present value as a project’s costsis called the project’s _____ cost.a. incrementalb. sunkc. opportunityd. erosione. equivalent annualDifficulty level: EasySUNK COSTSc 3. A cost that has already been paid, or the liability to pay has already been incurred, isa(n):a. salvage value expense.b. net working capital expense.c. sunk cost.d. opportunity cost.e. erosion cost.Difficulty level: EasyOPPORTUNITY COSTSd 4. The most valuable investment given up if an alternative investment is chosen is a(n):a. salvage value expense.b. net working capital expense.c. sunk cost.d. opportunity cost.e. erosion cost.Difficulty level: EasyEROSION COSTSe 5. The cash flows of a new project that come at the expense of a firm’s existing projectsare called:a. salvage value expenses.b. net working capital expenses.c. sunk costs.d. opportunity costs.e. erosion costs.Difficulty level: EasyPRO FORMA FINANCIAL STATEMENTSa 6. A pro forma financial statement is one that:a. projects future years’ operations.b. is expressed as a percentage of the total assets of the firm.c. is expressed as a percentage of the total sales of the firm.d. is expressed relative to a chosen base year’s financial statement.e. reflects the past and current operations of the firm.Difficulty level: EasyMACRS DEPRECIATIONb 7. The depreciation method currently allowed under US tax law governing the acceleratedwrite-off of property under various lifetime classifications is called _____ depreciation.a. FIFOb. MACRSc. straight-lined. sum-of-years digitse. curvilinearDifficulty level: EasyDEPRECIATION TAX SHIELDc 8. The cash flow tax savings generated as a result of a firm’s tax-deductible depreciationexpense is called the:a. after-tax depreciation savings.b. depreciable basis.c. depreciation tax shield.d. operating cash flow.e. after-tax salvage value.Difficulty level: EasyCASH FLOWd 9. The cash flow from projects for a company is computed as the:a. net operating cash flow generated by the project, less any sunk costs and erosion costs.b. sum of the incremental operating cash flow and after-tax salvage value of the project.c. net income generated by the project, plus the annual depreciation expense.d. sum of the incremental operating cash flow, capital spending, and net working capitalexpenses incurred by the project.e. sum of the sunk costs, opportunity costs, and erosion costs of the project.Difficulty level: MediumII. CONCEPTSPRO FORMA INCOME STATEMENTb 10. The pro forma income statement for a cost reduction project:a. will reflect a reduction in the sales of the firm.b. will generally reflect no incremental sales.c. has to be prepared reflecting the total sales and expenses of a firm.d. cannot be prepared due to the lack of any project related sales.e. will always reflect a negative project operating cash flow.Difficulty level: EasyINCREMENTAL CASH FLOWb 11. One purpose of identifying all of the incremental cash flows related to a proposedproject is to:a. isolate the total sunk costs so they can be evaluated to determine if the project willadd value to the firm.b. eliminate any cost which has previously been incurred so that it can be omitted fromthe analysis of the project.c. make each project appear as profitable as possible for the firm.d. include both the proposed and the current operations of a firm in the analysis of theproject.e. identify any and all changes in the cash flows of the firm for the past year so they canbe included in the analysis.Difficulty level: MediumINCREMENTAL CASH FLOWe 12. Which of the following are examples of an incremental cash flow?I. an increase in accounts receivableII. a decrease in net working capitalIII. an increase in taxesIV. a decrease in the cost of goods solda. I and III onlyb. III and IV onlyc. I and IV onlyd. I, III, and IV onlye. I, II, III, and IVDifficulty level: MediumINCREMENTAL CASH FLOWc 13. Which one of the following is an example of an incremental cash flow?a. the annual salary of the company president which is a contractual obligationb. the rent on a warehouse which is currently being utilizedc. the rent on some new machinery that is required for an upcoming projectd. the property taxes on the currently owned warehouse which has been sitting idle butis going to be utilized for a new projecte. the insurance on a company-owned building which will be utilized for a new projectDifficulty level: MediumINCREMENTAL COSTSd 14. Project analysis is focused on _____ costs.a. sunkb. totalc. variabled. incrementale. fixedDifficulty level: MediumSUNK COSTc 15. Sunk costs include any cost that:a. will change if a project is undertaken.b. will be incurred if a project is accepted.c. has previously been incurred and cannot be changed.d. is paid to a third party and cannot be refunded for any reason whatsoever.e. will occur if a project is accepted and once incurred, cannot be recouped.Difficulty level: EasySUNK COSTd 16. You spent $500 last week fixing the transmission in your car. Now, the brakes areacting up and you are trying to decide whether to fix them or trade the car in for anewer model. In analyzing the brake situation, the $500 you spent fixing thetransmission is a(n) _____ cost.a. opportunityb. fixedc. incrementald. sunke. relevantDifficulty level: EasyEROSIONb 17. Erosion can be explained as the:a. additional income generated from the sales of a newly added product.b. loss of current sales due to a new project being implemented.c. loss of revenue due to employee theft.d. loss of revenue due to customer theft.e. loss of cash due to the expenses required to fix a parking lot after a heavy rain storm.Difficulty level: EasyEROSIONa 18. Which of the following are examples of erosion?I. the loss of sales due to increased competition in the product marketII. the loss of sales because your chief competitor just opened a store across the street from your storeIII. the loss of sales due to a new product which you recently introducedIV. the loss of sales due to a new product recently introduced by your competitora. III onlyb. III and IV onlyc. I, III and IV onlyd. II and IV onlye. I, II, III, and IVDifficulty level: MediumTYPES OF COSTSd 19. Which of the following should be included in the analysis of a project?I. sunk costsII. opportunity costsIII. erosion costsIV. incremental costsa. I and II onlyb. III and IV onlyc. II and IV onlyd. II, III, and IV onlye. I, II, and IV onlyDifficulty level: MediumNET WORKING CAPITALd 20. All of the following are anticipated effects of a proposed project. Which of theseshould be included in the initial project cash flow related to net working capital?I. an inventory decrease of $5,000II. an increase in accounts receivable of $1,500III. an increase in fixed assets of $7,600IV. a decrease in accounts payable of $2,100a. I and II onlyb. I and III onlyc. II and IV onlyd. I, II, and IV onlye. I, II, III, and IVDifficulty level: MediumNET WORKING CAPITALa 21. Changes in the net working capital:a. can affect the cash flows of a project every year of the project’s life.b. only affect the initial cash flows of a project.c. are included in project analysis only if they represent cash outflows.d. are generally excluded from project analysis due to their irrelevance to the totalproject.e. affect the initial and the final cash flows of a project but not the cash flows of themiddle years.Difficulty level: MediumNET WORKING CAPITALc 22. Which one of the following will decrease net working capital of a firm?a. a decrease in accounts payableb. an increase in inventoryc. a decrease in accounts receivabled. an increase in the firm’s checking account balancee. a decrease in fixed assetsDifficulty level: EasyNET WORKING CAPITALd 23. Net working capital:a. can be ignored in project analysis because any expenditure is normally recouped by theend of the project.b. requirements generally, but not always, create a cash inflow at the beginning of aproject.c. expenditures commonly occur at the end of a project.d. is frequently affected by the additional sales generated by a new project.e. is the only expenditure where at least a partial recovery can be made at the end of aproject.Difficulty level: EasyMACRSd 24. A company which uses the MACRS system of depreciation:a. will have equal depreciation costs each year of an asset’s life.b. will expense the cost of nonresidential real estate over a period of 7 years.c. can depreciate the cost of land, if they so desire.d. will write off the entire cost of an asset over the asset’s class life.e. cannot expense any of the cost of a new asset during the first year of the asset’s life.Difficulty level: EasyMACRSa 25. Bet ‘r Bilt Toys just purchased some MACRS 5-year property at a cost of $230,000.Which of the following will correctly give you the book value of this equipment at theend of year 2?MACRS 5-year propertyYear Rate1 20.00%2 32.00%3 19.20%4 11.52%5 11.52%6 5.76%I. 52% of the asset costII. 48% of the asset costIII. 68% of 80% of the asset costIV. the asset cost, minus 20% of the asset cost, minus 32% of 80% of the asset costa. II onlyb. III and IV onlyc. I and III onlyd. II and IV onlye. I, II, III, and IVDifficulty level: EasyMACRSe 26. Will Do, Inc. just purchased some equipment at a cost of $650,000. What is theproper methodology for computing the depreciation expense for year 3 if theequipment is classified as 5-year property for MACRS?MACRS 5-year propertyYear Rate1 20.00%2 32.00%3 19.20%4 11.52%5 11.52%6 5.76%a. $650,000 ⨯ (1-.20) ⨯ (1-.32) ⨯ (1-.192)b. $650,000 ⨯ (1-.20) ⨯ (1-.32)c. $650,000 ⨯ (1+.20) ⨯ (1+.32) ⨯ (1+.192)d. $650,000 ⨯ (1-.192)e. $650,000 ⨯ .192Difficulty level: MediumBOOK VALUEd 27. The book value of an asset is primarily used to compute the:a. annual depreciation tax shield.b. amount of cash received from the sale of an asset.c. amount of tax saved annually due to the depreciation expense.d. amount of tax due on the sale of an asset.e. change in depreciation needed to reflect the market value of the asset.Difficulty level: EasySALVAGE VALUEc 28. The salvage value of an asset creates an after-tax cash inflow to the firm in an amountequal to the:a. sales price of the asset.b. sales price minus the book value.c. sales price minus the tax due based on the sales price minus the book value.d. sales price plus the tax due based on the sales price minus the book value.e. sales price plus the tax due based on the book value minus the sales price.Difficulty level: EasySALVAGE VALUEe 29. The pre-tax salvage value of an asset is equal to the:a. book value if straight-line depreciation is used.b. book value if MACRS depreciation is used.c. market value minus the book value.d. book value minus the market value.e. market value.Difficulty level: EasyPROJECT OCFa 30. A project’s operating cash flow will increase when:a. the depreciation expense increases.b. the sales projections are lowered.c. the interest expense is lowered.d. the net working capital requirement increases.e. the earnings before interest and taxes decreases.Difficulty level: EasyPROJECT CASH FLOWSc 31. The cash flows of a project should:a. be computed on a pre-tax basis.b. include all sunk costs and opportunity costs.c. include all incremental costs, including opportunity costs.d. be applied to the year when the related expense or income is recognized by GAAP.e. include all financing costs related to new debt acquired to finance the project.Difficulty level: EasyPROJECT OCFa 32. Which of the following are correct methods for computing the operating cash flow ofa project assuming that the interest expense is equal to zero?I. EBIT + Depreciation - TaxesII. EBIT + Depreciation + TaxesIII. Net Income + DepreciationIV. (Sales – Costs) ⨯ (Taxes + Depreciation) ⨯ (1-Taxes)a. I and III onlyb. II and IV onlyc. II and III onlyd. I, III, and IV onlye. II, III, and IV onlyDifficulty level: MediumBOTTOM-UP OCFb 33. The bottom-up approach to computing the operating cash flow applies only when:a. both the depreciation expense and the interest expense are equal to zero.b. the interest expense is equal to zero.c. the project is a cost-cutting project.d. no fixed assets are required for the project.e. taxes are ignored and the interest expense is equal to zero.Difficulty level: MediumTOP-DOWN OCFa 34. The top-down approach to computing the operating cash flow:a. ignores all noncash items.b. applies only if a project produces sales.c. can only be used if the entire cash flows of a firm are included.d. is equal to sales - costs - taxes + depreciation.e. includes the interest expense related to a project.Difficulty level: MediumTAX SHIELDd 35. An increase in which one of the following will increase the operating cash flow?a. employee salariesb. office rentc. building maintenanced. equipment depreciatione. equipment rentalDifficulty level: EasyTAX SHIELDc 36. Tax shield refers to a reduction in taxes created by:a. a reduction in sales.b. an increase in interest expense.c. noncash expenses.d. a project’s incremental expenses.e. opportunity costs.Difficulty level: EasyCOST-CUTTINGc 37. A project which is designed to improve the manufacturing efficiency of a firm but willgenerate no additional sales is referred to as a(n) _____ project.a. sunk costb. opportunityc. cost-cuttingd. revenue-cuttinge. revenue-generatingDifficulty level: EasyEQUIVALENT ANNUAL COSTc 38. Toni’s Tools is comparing machines to determine which one to purchase. Themachines sell for differing prices, have differing operating costs, differing machinelives, and will be replaced when worn out. These machines should be compared using:a. net present value only.b. both net present value and the internal rate of return.c. their effective annual costs.d. the depreciation tax shield approach.e. the replacement parts approach.Difficulty level: MediumEQUIVALENT ANNUAL COSTe 39. The equivalent annual cost method is useful in determining:a. the annual operating cost of a machine if the annual maintenance is performed versuswhen the maintenance is not performed as recommended.b. the tax shield benefits of depreciation given the purchase of new assets for a project.c. operating cash flows for cost-cutting projects of equal duration.d. which one of two machines to acquire given equal machine lives but unequal machinecosts.e. which one of two machines to purchase when the machines are mutually exclusive,have different machine lives, and will be replaced once they are worn out.Difficulty level: MediumIII. PROBLEMSRELEVANT CASH FLOWSd 40. Marshall’s & Co. purchased a corner lot in Eglon City five y ears ago at a cost of$640,000. The lot was recently appraised at $810,000. At the time of the purchase, thecompany spent $50,000 to grade the lot and another $4,000 to build a small buildingon the lot to house a parking lot attendant who has overseen the use of the lot for dailycommuter parking. The company now wants to build a new retail store on the site. Thebuilding cost is estimated at $1.2 million. What amount should be used as the initialcash flow for this building project?a. $1,200,000b. $1,840,000c. $1,890,000d. $2,010,000e. $2,060,000Difficulty level: MediumRELEVANT CASH FLOWSe 41. Jamestown Ltd. currently produces boat sails and is considering expanding itsoperations to include awnings for homes and travel trailers. The company owns landbeside its current manufacturing facility that could be used for the expansion. Thecompany bought this land ten years ago at a cost of $250,000. Today, the land isvalued at $425,000. The grading and excavation work necessary to build on the landwill cost $15,000. The company currently has some unused equipment which itcurrently owns valued at $60,000. This equipment could be used for producingawnings if $5,000 is spent for equipment modifications. Other equipment costing$780,000 will also be required. What is the amount of the initial cash flow for thisexpansion project?a. $800,000b. $1,050,000c. $1,110,000d. $1,225,000e. $1,285,000Difficulty level: MediumRELEVANT CASH FLOWSb 42. Wilbert’s, Inc. paid $90,000, in cash, for a piece of equipment three years ago. Lastyear, the company spent $10,000 to update the equipment with the latest technology.The company no longer uses this equipment in their current operations and hasreceived an offer of $50,000 from a firm who would like to purchase it. Wilbert’s isdebating whether to sell the equipment or to expand their operations such that theequipment can be used. When evaluating the expansion option, what value, if any,should Wilbert’s assign to this equipment as an initial cost of the project?a. $40,000b. $50,000c. $60,000d. $80,000e. $90,000Difficulty level: EasyRELEVANT CASH FLOWSa 43. Walks Softly, Inc. sells customized shoes. Currently, they sell 10,000 pairs of shoesannually at an average price of $68 a pair. They are considering adding a lower-pricedline of shoes which sell for $49 a pair. Walks Softly estimates they can sell 5,000 pairsof the lower-priced shoes but will sell 1,000 less pairs of the higher-priced shoes bydoing so. What is the amount of the sales that should be used when evaluating theaddition of the lower-priced shoes?a. $177,000b. $245,000c. $313,000d. $789,000e. $857,000Difficulty level: MediumOPPORTUNITY COSTc 44. Your firm purchased a warehouse for $335,000 six years ago. Four years ago, repairswere made to the building which cost $60,000. The annual taxes on the property are$20,000. The warehouse has a current book value of $268,000 and a market value of$295,000. The warehouse is totally paid for and solely owned by your firm. If thecompany decides to assign this warehouse to a new project, what value, if any, shouldbe included in the initial cash flow of the project for this building?a. $0b. $268,000c. $295,000d. $395,000e. $515,000Difficulty level: EasyOPPORTUNITY COSTd 45. You own a house that you rent for $1,200 a month. The maintenance expenses onthe house average $200 a month. The house cost $89,000 when you purchased itseveral years ago. A recent appraisal on the house valued it at $210,000. The annualproperty taxes are $5,000. If you sell the house you will incur $20,000 in expenses.You are deciding whether to sell the house or convert it for your own use as aprofessional office. What value should you place on this house when analyzing theoption of using it as a professional office?a. $89,000b. $120,000c. $185,000d. $190,000e. $210,000Difficulty level: MediumOPPORTUNITY COSTc 46. Big Joe’s owns a manufacturing facility that is currently sitting idle. The facility islocated on a piece of land that originally cost $129,000. The facility itself cost$650,000 to build. As of now, the book value of the land and the facility are $129,000and $186,500, respectively. Big Joe’s received an offer of $590,000 for the land andfacility last week. They rejected this offer even though they were told that it is areasonable offer in today’s market. If Big Joe’s were to consider using this land andfacility in a new project, what cost, if any, should they include in the project analysis?a. $0b. $315,500c. $590,000d. $650,000e. $779,000Difficulty level: EasyEROSION COSTb 47. Jamie’s Motor Home Sales currently sells 1,000 Class A motor homes, 2,500 Class Cmotor homes, and 4,000 pop-up trailers each year. Jamie is considering adding a mid-range camper and expects that if she does so she can sell 1,500 of them. However, ifthe new camper is added, Jamie expects that her Class A sales will decline to 950 unitswhile the Class C campers decline to 2,200. The sales of pop-ups will not be affected.Class A motor homes sell for an average of $125,000 each. Class C homes are pricedat $39,500 and the pop-ups sell for $5,000 each. The new mid-range camper will sellfor $47,900. What is the erosion cost?a. $6,250,000b. $18,100,000c. $53,750,000d. $93,150,000e. $118,789,500Difficulty level: MediumOCFe 48. Ernie’s E lectrical is evaluating a project which will increase sales by $50,000 andcosts by $30,000. The project will cost $150,000 and be depreciated straight-line to azero book value over the 10 year life of the project. The applicable tax rate is 34%.What is the operating cash flow for this project?a. $3,300b. $5,000c. $8,300d. $13,300e. $18,300Difficulty level: MediumOCFd 49. Kurt’s Kabinets is looking at a project that will require $80,000 in fixed assets andanother $20,000 in net working capital. The project is expected to produce sales of$110,000 with associated costs of $70,000. The project has a 4-year life. The companyuses straight-line depreciation to a zero book value over the life of the project. The taxrate is 35%. What is the operating cash flow for this project?a. $7,000b. $13,000c. $27,000d. $33,000e. $40,000Difficulty level: MediumBOTTOM-UP OCFc 50. Peter’s Boats has sales of $760,000 and a profit margin of 5%. The annualdepreciation expense is $80,000. What is the amount of the operating cash flow if thecompany has no long-term debt?a. $34,000b. $86,400c. $118,000d. $120,400e. $123,900Difficulty level: MediumBOTTOM-UP OCFd 51. Le Place has sales of $439,000, depreciation of $32,000, and net working capital of$56,000. The firm has a tax rate of 34% and a profit margin of 6%. Thefirm has no interest expense. What is the amount of the operating cash flow?a. $49,384b. $52,616c. $54,980d. $58,340e. $114,340Difficulty level: MediumTOP-DOWN OCFb 52. Ben’s Border Café is considering a project which will produce sales of $16,000 andincrease cash expenses by $10,000. If the project is implemented, taxes will increasefrom $23,000 to $24,500 and depreciation will increase from $4,000 to $5,500. Whatis the amount of the operating cash flow using the top-down approach?a. $4,000b. $4,500c. $6,000d. $7,500e. $8,500Difficulty level: MediumTOP-DOWN OCFc 53. Ronnie’s Coffee House i s considering a project which will produce sales of $6,000and increase cash expenses by $2,500. If the project is implemented, taxes willincrease by $1,300. The additional depreciation expense will be $1,000. An initial cashoutlay of $2,000 is required for net working capital. What is the amount of theoperating cash flow using the top-down approach?a. $200b. $1,500c. $2,200d. $3,500e. $4,200Difficulty level: MediumTAX SHIELD OCFc 54. A project will increase sales by $60,000 and cash expenses by $51,000. The projectwill cost $40,000 and be depreciated using straight-line depreciation to a zero bookvalue over the 4-year life of the project. The company has a marginal tax rate of 35%.What is the operating cash flow of the project using the tax shield approach?a. $5,850b. $8,650c. $9,350d. $9,700e. $10,350Difficulty level: MediumDEPRECIATION TAX SHIELDa 55. A project will increase sales by $140,000 and cash expenses by $95,000. The projectwill cost $100,000 and be depreciated using the straight-line method to a zero bookvalue over the 4-year life of the project. The company has a marginal tax rate of 34%.What is the value of the depreciation tax shield?a. $8,500b. $17,000c. $22,500d. $25,000e. $37,750Difficulty level: MediumMACRS DEPRECIATIONd 56. Sun Lee’s Furniture just purchased some fixed assets classified as 5-year property forMACRS. The assets cost $24,000. What is the amount of the depreciation expense forthe third year?MACRS 5-year propertyYear Rate1 20.00%2 32.00%3 19.20%4 11.52%5 11.52%6 5.76%a. $2,304b. $2,507c. $2,765d. $4,608e. $4,800Difficulty level: EasyMACRS DEPRECIATIONa 57. You just purchased some equipment that is classified as 5-year property for MACRS.The equipment cost $67,600. What will the book value of this equipment be at the endof three years should you decide to resell the equipment at that point in time?MACRS 5-year propertyYear Rate1 20.00%2 32.00%3 19.20%4 11.52%5 11.52%6 5.76%a. $19,468.80b. $20,280.20c. $27,040.00d. $48,131.20e. $48,672.00Difficulty level: MediumMACRS DEPRECIATIONd 58. LiCheng’s Enterprises just purchased some fixed assets that are classified as 3-yearproperty for MACRS. The assets cost $1,900. What is the amount of thedepreciation expense for year 2?MACRS 3-year propertyYear Rate1 33.33%2 44.44%3 14.82%4 7.41%a. $562.93b. $633.27c. $719.67d. $844.36e. $1,477.63Difficulty level: MediumMACRS DEPRECIATIONb 59. RP&A, Inc. purchased some fixed assets four years ago at a cost of $19,800. They nolonger need these assets so are going to sell them today at a price of $3,500. The assetsare classified as 5-year property for MACRS. What is the current book value of theseassets?MACRS 5-year propertyYear Rate1 20.00%2 32.00%3 19.20%4 11.52%5 11.52%6 5.76%a. $1,140.48b. $3,421.44c. $3,500.00d. $4,016.67e. $5,702.40Difficulty level: MediumSALVAGE VALUEa 60. You own some equipment which you purchased three years ago at a cost of $135,000.The equipment is 5-year property for MACRS. You are considering selling theequipment today for $82,500. Which one of the following statements is correct if yourtax rate is 34%?MACRS 5-year propertyYear Rate1 20.00%2 32.00%3 19.20%4 11.52%5 11.52%6 5.76%a. The tax due on the sale is $14,830.80.b. The book value today is $8,478.c. The book value today is $64,320.d. The taxable amount on the sale is $38,880.e. You will receive a tax refund of $13,219.20 as a result of this sale.。

公司理财实务英文版(ppt 16)

Current Assets

(Financial Decision)

Net Working Capital

Current Liabilitiesssets 1 Tangible 2 Intangible

How much shortterm cash flow does a company need to pay its bills?

Corporate Finance

Shareholders’ Equity

1-1

The Balance-Sheet Model of the Firm

The Capital Budgeting Decision

Current Assets

(Investment Decision)

Current Liabilities

Shareholders’ Equity

© Professor Ho-Mou Wu

Corporate Finance

1-4

Capital Structure

The value of the firm can be thought of as a pie.

The goal of the manager is to increase the size of the pie.

1-6

Financial Markets

• Primary Market

– When a corporation issues securities, cash flows from investors to the firm.

– Usually an underwriter is involved

Invests in assets

罗斯公司理财题库全集

Chapter 30Financial Distress Multiple Choice Questions1. Financial distress can be best described by which of the following situations in which the firm is forced to take corrective action?A. Cash payments are delayed to creditors.B. The market value of the stock declines by 10%.C. The firm's operating cash flow is insufficient to pay current obligations.D. Cash distributions are eliminated because the board of directors considers the surplus account to be low.E. None of the above.2. Insolvency can be defined as:A. not having cash.B. being illiquid.C. an inability to pay one's debts.D. an inability to increase one's debts.E. the present value of payments being less than assets.3. Stock-based insolvency is a:A. income statement measurement.B. balance sheet measurement.C. a book value measurement only.D. Both A and C.E. Both B and C.4. Flow-based insolvency is:A. a balance sheet measurement.B. a negative equity position.C. when operating cash flow is insufficient to meet current obligations.D. inability to pay one's debts.E. Both C and D.5. Financial restructuring can occur as:A. a private workout.B. an employee buy-out.C. a bankruptcy reorganization.D. Both A and C.E. Both B and C.6. Financial distress can involve which of the following:A. asset restructuring.B. financial restructuring.C. liquidation.D. All of the above.E. None of the above.7. APR, as it relates to financial distress, means the rules of:A. absolute profitability.B. arbitration priority.C. absolute priority.D. arbitration profitability.E. automatic profitability.8. The difference between liquidation and reorganization is:A. reorganization terminates all operations of the firm and liquidation only terminatesnon-profitable operations.B. liquidation terminates only profitable operations and reorganization terminates onlynon-profitable operations.C. liquidation terminates all operations and reorganization maintains the option of the firm as a going concern.D. liquidation only deals with current assets and reorganization only consolidates debt.E. None of the above.9. A firm that has a series of negative earnings, sales declines and workforce reductions is likely headed to:A. acquisition of another firm.B. a merger.C. financial distress.D. new financing.E. None of the above.10. Some of the various events which typically occur around the period of financial distress fora firm are:A. continued increase in earnings.B. steady growth.C. dividend reductions.D. Both A and B.E. Both A and C.11. Bankruptcy reorganizations are used by management to:A. forestall the inevitable liquidation in all cases.B. provide time to turn the business around.C. allow the courts time to set up an administrative structure.D. All of the above.E. None of the above.12. A firm has several options available to it in times of financial distress. The firm may:A. reduce capital and R & D spending.B. raise new funds by selling securities or major assets.C. file for bankruptcy.D. negotiate with lenders.E. All of the above statements are true.13. Most firms in financial distress do not fail and cease to exist. Many firms can actually benefit from distress by:A. forcing a firm to reevaluate their core operations.B. realigning their capital structure to reduce interest costs.C. entering Chapter 11 and liquidating the firm.D. Both A and B.E. Both A and C.14. Whether bankruptcy is entered voluntarily or involuntarily the major difference between Chapter 7 and Chapter 11 is:A. that liquidation occurs in Chapter 11 but reorganization is the objective under Chapter 7.B. that there is no priority of claims under Chapter 11.C. that liquidation occurs in Chapter 7 but reorganization is the objective under chapter 11.D. no lawyers fees are necessary under Chapter 7.E. None of the above.15. If a firm has a stock based insolvency in both book and market value terms and liquidates:A. the payoff will not be 100% to all investors.B. the unsecured creditors are likely to get less than full value.C. the equityholders typically should receive nothing.D. All of the above.E. None of the above.16. A firm in financial distress that reorganizes:A. continues to run the business as a going concern.B. must have acceptance of the plan by the creditors.C. may distribute new securities to creditors and shareholders.D. All of the above.E. None of the above.17. A corporation is adjudged bankrupt under Chapter 7. When do the shareholders receive any payment?A. After the trustee liquidates the assets and pays the administrative expenses, the shareholders are paid before the creditors.B. After the trustee liquidates the assets, the administrative expenses and secured creditors are paid, then the unsecured creditors, and then the shareholders divide any remainder.C. After the trustee liquidates the assets, the shareholders are paid, next the administrative expenses, the secured creditors, and then the unsecured creditors divide any remainder.D. After the trustee liquidates the assets the shareholders are paid first because they are the owners of the firm and have the principal stake.E. None of the above.18. What is the absolute priority rule of the following claims once a corporation is determined to be bankrupt?A. administrative expenses, wages claims, government tax claims, debtholder and then equityholder claimsB. administrative expenses, wages claims, government tax claims, equityholder and then debtholder claimsC. wage claims, administrative expenses, debtholder claims, government tax claims and equityholder claimsD. wage claims, administrative expenses, debtholder claims, equityholder claims and government tax claimsE. None of the above19. The absolute priority rule:A. is set to ensure senior claims are paid first.B. is the priority rule in liquidations.C. distributes proceeds of secured assets sales to the secured creditors first and the remainder to the unsecured.D. All of the above.E. None of the above.20. Many corporations choose Chapter 11 bankruptcy proceedings voluntarily because the management can:A. take up to 120 days to file a reorganization plan.B. continue to run the business.C. reorganize if the required fractions of creditors approve of the plan and it is confirmed when the reorganization takes place.D. All of the above.E. None of the above.21. Which of the following statements about private workouts of financial distress is NOT true?A. Senior debt is usually replaced with junior debt.B. Debt is usually replaced with equity.C. Private workouts account for about three quarters of all reorganizations.D. Top management is often dismissed or takes pay reductions.E. None of the above.22. Successful private workouts are better for firms than formal bankruptcy because:A. direct costs are considerably lower in private workouts.B. private workout firms can issue new debt senior to all prior debt.C. stock price increases are greater for private workouts than for firms emerging from formal bankruptcy.D. Both A and B.E. Both A and C.23. Equityholders may prefer a formal bankruptcy filing because:A. the firm can issue debtor in possession debt.B. the firm can delay pre-bankruptcy interest payments.C. the lack of information about the length and magnitude of the cash flow problem favors equityholders.D. All of the above.E. None of the above.24. Prepackaged bankruptcies are:A. described as a combination of a private workout and a liquidation.B. the easiest way to transfer wealth to the shareholders.C. described as a combination of a completed private workout and the formal bankruptcy filing.D. All of the above.E. None of the above.25. In a prepackaged bankruptcy the firm:A. and creditors agree to a private reorganization outside formal bankruptcy.B. must reach agreement privately with most of the creditors.C. will have difficulty when there are thousands of reluctant trade creditors.D. All of the above.E. None of the above.26. Financial distress may be more expensive if the:A. information about the permanency of the shortfall is limited.B. firm has many different types of creditors and other investors.C. firm has never entered into bankruptcy before.D. Both A and B.E. Both B and C.27. The net payoff to creditors in formal bankruptcy may be low in present value terms because:A. the financial structure may be complicated with several groups and types of creditors.B. indirect costs of bankruptcy may have been costly in lost revenues and poor maintenance.C. administrative costs are high and increase with the complexity and length of time in the formal bankruptcy process.D. All of the above.E. None of the above.28. Firms deal with financial distress by:A. selling major assets.B. merging with another firm.C. issuing new securities.D. exchanging debt for equity.E. All of the above.29. Perhaps equally, if not more damaging are the indirect costs of financial distress. Some examples of indirect costs are:A. loss of current customers.B. loss of business reputation.C. management consumed in survival and not on a strategic direction.D. All of the above.E. Both A and B.30. Credit scoring models are used by lenders to:A. determine the borrowers capacity to pay.B. aid in the prediction of default or bankruptcy.C. determine the optimal debt equity ratio.D. Both A and B.E. Both A and C.31. Altman develop the Z-score model for publicly traded manufacturing firms. Using financial statement data and multiple discriminant analysis, he found that:A. in actual use, a Z-score greater than 2.99 meant bankruptcy within one year.B. in actual use, a Z-score greater than 1.81 implied a 90% chance of bankruptcy within one year.C. in actual use, a Z-score of less than 1.81 would predict bankruptcy within one year.D. in actual use, a Z-score less than 2.99 meant non-bankruptcy within one year.E. None of the above.32. The key intuition of a Z-score model like Altman's is that:A. only publicly traded firms can be evaluated.B. one will be just as well off by guessing on default rates.C. all corporations will default at least once.D. financial profiles of bankrupt and non-bankrupt firms are very different one year before bankruptcy.E. privately traded firms have better financial information which are disclosed to lenders and need not rely on any efficient market notions.33. Approximately ____ of all firms going through a Chapter 11 bankruptcy successfully reorganize.A. 0%B. 15%C. 25%D. 50%E. 85%34. Altman's Z-score predicts the:A. percentage of payout to equityholders in liquidations.B. percentage of payout to equityholders in reorganization.C. likelihood of a private workout.D. likelihood of bankruptcy of a firm within one year.E. None of the above.35. Very small firms (i.e. firms with assets less than $100,000) are more likely to:A. file for strategic bankruptcy.B. file for bankruptcy protection earlier than large firms.C. reorganize than liquidate compared to large firms.D. liquidate than reorganize compared to large firms.E. None of the above.36. A large negative equity position will lead a firm to be more likely to try to:A. not file bankruptcy.B. liquidate.C. reorganize.D. consolidate.E. None of the above.Magic Mobile Homes is to be liquidated. All creditors, both secured and unsecured, are owed $2 million. Administrative costs of liquidation and wage payments are expected to be $500,000.A sale of assets is expected to bring $1.8 million after taxes. Secured creditors have a mortgage lien for $1,200,000 on the factory which will be liquidated for $900,000 out of the sale proceeds. The corporate tax rate is 34%.37. How much and what percentage of their claim will the unsecured creditors receive, in total?A. $100,000; 12.50%.B. $290,909; 36.36%.C. $300,000; 37.50%.D. $600,000; 75.00%.E. Not enough information to answer38. How much and what percentage of their claim will the secured creditors receive, in total?A. $900,000; 75%B. $981,818; 81.82%C. $1,009,091; 84.1%D. $1,200,000; 100%E. Not enough information to answer.The management of Magic Mobile Homes has proposed to reorganize the firm. The proposal is based on a going-concern value of $2 million. The proposed financial structure is $750,000 in new mortgage debt, $250,000 in subordinated debt and $1,000,000 in new equity. All creditors, both secured and unsecured, are owed $2.5 million dollars. Secured creditors have a mortgage lien for $1,500,000 on the factory. The corporate tax rate is 34%.39. How much should the secured creditors receive?A. $1,000,000B. $1,250,000C. $1,333,333D. $1,500,000E. None of the above.40. How much should the unsecured creditors receive?A. $500,000B. $667,000C. $750,000D. $1,000,000E. None of the above.41. What will the equityholders receive if they had 5 million shares with a par value of $0.50 each?A. $0B. $35,714C. $583,333D. $1,000,000E. None of the above.The management of Schroeder Books has proposed to reorganize the company. The proposal is based on a going-concern value of $2.3 million. The proposed financial structure is $500,000 in new mortgage debt, $300,000 in subordinated debt and $1,500,000 in new equity. All creditors, both secured and unsecured, are owed $3 million dollars. Secured creditors have a mortgage lien for $2,000,000 on the book bindery. The corporate tax rate is 34%.42. How much should the secured creditors receive?A. $1,500,000B. $2,000,000C. $2,300,000D. $3,000,000E. None of the above.43. How much should the unsecured creditors receive?A. $300,000B. $500,000C. $1,000,000D. $2,300,000E. None of the above.44. What will the equityholders receive if they had 5 million shares with a par value of $0.50 each?A. $0B. $35,714C. $583,333D. $1,000,000E. None of the above.Essay Questions45. The Steel Pony Company, a maker of all-terrain recreational vehicles, is having financial difficulties due to high interest payments. The estimated "going concern" value of Steel Pony is $4.0 million. The senior debt claim is on all fixed assets. The balance sheet of the firm is as shown:If Steel Pony decides to file for formal bankruptcy and expects to sell the firm for the "going concern" value and pay administrative fees which amount to 5% of the total going concern value, determine the distribution of the proceeds under the rules of absolute priority.46. The Here Today Corporation has applied to your bank for a loan. You have their financial statements and the revised Z-score model of:Z = 6.56 (Net Working Capital/Total Assets) + 3.26 (Accumulated Retained Earnings/Total Assets) + 1.05 (EBIT/Total Assets) + 6.72 (Book Value of Equity/Total Liabilities) where:Z < 1.23 predicts bankruptcy. A Z score between 1.23 and 2.90 indicates gray area. A Z score greater than 2.90 indicates no bankruptcy. From the financial statements you gathered net working capital of $237,500; accumulated retained earnings of $120,000; book value of equity of $950,000; total assets of $4,750,000; EBIT of $261,250; and total liabilities of $3,800,000. Should the bank lend to Here Today?47. When choosing between liquidation and reorganization, what are some of the empirical factors that lead a firm toward one choice or the other?Chapter 30 Financial Distress Answer KeyMultiple Choice Questions1. Financial distress can be best described by which of the following situations in which the firm is forced to take corrective action?A. Cash payments are delayed to creditors.B. The market value of the stock declines by 10%.C. The firm's operating cash flow is insufficient to pay current obligations.D. Cash distributions are eliminated because the board of directors considers the surplus account to be low.E. None of the above.Difficulty level: EasyTopic: FINANCIAL DISTRESSType: DEFINITIONS2. Insolvency can be defined as:A. not having cash.B. being illiquid.C. an inability to pay one's debts.D. an inability to increase one's debts.E. the present value of payments being less than assets.Difficulty level: EasyTopic: INSOLVENCYType: DEFINITIONS3. Stock-based insolvency is a:A. income statement measurement.B. balance sheet measurement.C. a book value measurement only.D. Both A and C.E. Both B and C.Difficulty level: EasyTopic: STOCK-BASED INSOLVENCYType: DEFINITIONS4. Flow-based insolvency is:A. a balance sheet measurement.B. a negative equity position.C. when operating cash flow is insufficient to meet current obligations.D. inability to pay one's debts.E. Both C and D.Difficulty level: EasyTopic: FLOW-BASED INSOLVENCYType: DEFINITIONS5. Financial restructuring can occur as:A. a private workout.B. an employee buy-out.C. a bankruptcy reorganization.D. Both A and C.E. Both B and C.Difficulty level: MediumTopic: FINANCIAL RESTRUCTURINGType: DEFINITIONS6. Financial distress can involve which of the following:A. asset restructuring.B. financial restructuring.C. liquidation.D. All of the above.E. None of the above.Difficulty level: EasyTopic: FINANCIAL DISTRESSType: DEFINITIONS7. APR, as it relates to financial distress, means the rules of:A. absolute profitability.B. arbitration priority.C. absolute priority.D. arbitration profitability.E. automatic profitability.Difficulty level: MediumTopic: RULES OF ABSOLUTE PRIORITYType: DEFINITIONS8. The difference between liquidation and reorganization is:A. reorganization terminates all operations of the firm and liquidation only terminatesnon-profitable operations.B. liquidation terminates only profitable operations and reorganization terminates onlynon-profitable operations.C. liquidation terminates all operations and reorganization maintains the option of the firm as a going concern.D. liquidation only deals with current assets and reorganization only consolidates debt.E. None of the above.Difficulty level: MediumTopic: REORGANIZATION AND LIQUIDATIONType: DEFINITIONS9. A firm that has a series of negative earnings, sales declines and workforce reductions is likely headed to:A. acquisition of another firm.B. a merger.C. financial distress.D. new financing.E. None of the above.Difficulty level: MediumTopic: FINANCIAL DISTRESSType: CONCEPTS10. Some of the various events which typically occur around the period of financial distress fora firm are:A. continued increase in earnings.B. steady growth.C. dividend reductions.D. Both A and B.E. Both A and C.Difficulty level: EasyTopic: FINANCIAL DISTRESSType: CONCEPTS11. Bankruptcy reorganizations are used by management to:A. forestall the inevitable liquidation in all cases.B. provide time to turn the business around.C. allow the courts time to set up an administrative structure.D. All of the above.E. None of the above.Difficulty level: EasyTopic: REORGANIZATIONType: CONCEPTS12. A firm has several options available to it in times of financial distress. The firm may:A. reduce capital and R & D spending.B. raise new funds by selling securities or major assets.C. file for bankruptcy.D. negotiate with lenders.E. All of the above statements are true.Difficulty level: MediumTopic: FINANCIAL DISTRESSType: CONCEPTS13. Most firms in financial distress do not fail and cease to exist. Many firms can actually benefit from distress by:A. forcing a firm to reevaluate their core operations.B. realigning their capital structure to reduce interest costs.C. entering Chapter 11 and liquidating the firm.D. Both A and B.E. Both A and C.Difficulty level: EasyTopic: FINANCIAL DISTRESSType: CONCEPTS14. Whether bankruptcy is entered voluntarily or involuntarily the major difference between Chapter 7 and Chapter 11 is:A. that liquidation occurs in Chapter 11 but reorganization is the objective under Chapter 7.B. that there is no priority of claims under Chapter 11.C. that liquidation occurs in Chapter 7 but reorganization is the objective under chapter 11.D. no lawyers fees are necessary under Chapter 7.E. None of the above.Difficulty level: EasyTopic: LIQUIDATION OR REORGANIZATIONType: CONCEPTS15. If a firm has a stock based insolvency in both book and market value terms and liquidates:A. the payoff will not be 100% to all investors.B. the unsecured creditors are likely to get less than full value.C. the equityholders typically should receive nothing.D. All of the above.E. None of the above.Difficulty level: EasyTopic: STOCK BASED INSOLENCYType: CONCEPTS16. A firm in financial distress that reorganizes:A. continues to run the business as a going concern.B. must have acceptance of the plan by the creditors.C. may distribute new securities to creditors and shareholders.D. All of the above.E. None of the above.Difficulty level: EasyTopic: REORGANIZATIONType: CONCEPTS17. A corporation is adjudged bankrupt under Chapter 7. When do the shareholders receive any payment?A. After the trustee liquidates the assets and pays the administrative expenses, the shareholders are paid before the creditors.B. After the trustee liquidates the assets, the administrative expenses and secured creditors are paid, then the unsecured creditors, and then the shareholders divide any remainder.C. After the trustee liquidates the assets, the shareholders are paid, next the administrative expenses, the secured creditors, and then the unsecured creditors divide any remainder.D. After the trustee liquidates the assets the shareholders are paid first because they are the owners of the firm and have the principal stake.E. None of the above.Difficulty level: EasyTopic: LIQUIDATIONType: CONCEPTS18. What is the absolute priority rule of the following claims once a corporation is determined to be bankrupt?A. administrative expenses, wages claims, government tax claims, debtholder and then equityholder claimsB. administrative expenses, wages claims, government tax claims, equityholder and then debtholder claimsC. wage claims, administrative expenses, debtholder claims, government tax claims and equityholder claimsD. wage claims, administrative expenses, debtholder claims, equityholder claims and government tax claimsE. None of the aboveDifficulty level: MediumTopic: RULES OF ABSOLUTE PRIORITYType: CONCEPTS19. The absolute priority rule:A. is set to ensure senior claims are paid first.B. is the priority rule in liquidations.C. distributes proceeds of secured assets sales to the secured creditors first and the remainder to the unsecured.D. All of the above.E. None of the above.Difficulty level: EasyTopic: RULES OF ABSOLUTE PRIORITYType: CONCEPTS20. Many corporations choose Chapter 11 bankruptcy proceedings voluntarily because the management can:A. take up to 120 days to file a reorganization plan.B. continue to run the business.C. reorganize if the required fractions of creditors approve of the plan and it is confirmed when the reorganization takes place.D. All of the above.E. None of the above.Difficulty level: EasyTopic: REORGANIZATIONType: CONCEPTS21. Which of the following statements about private workouts of financial distress is NOT true?A. Senior debt is usually replaced with junior debt.B. Debt is usually replaced with equity.C. Private workouts account for about three quarters of all reorganizations.D. Top management is often dismissed or takes pay reductions.E. None of the above.Difficulty level: MediumTopic: PRIVATE WORKOUTSType: CONCEPTS22. Successful private workouts are better for firms than formal bankruptcy because:A. direct costs are considerably lower in private workouts.B. private workout firms can issue new debt senior to all prior debt.C. stock price increases are greater for private workouts than for firms emerging from formal bankruptcy.D. Both A and B.E. Both A and C.Difficulty level: MediumTopic: PRIVATE WORKOUTSType: CONCEPTS23. Equityholders may prefer a formal bankruptcy filing because:A. the firm can issue debtor in possession debt.B. the firm can delay pre-bankruptcy interest payments.C. the lack of information about the length and magnitude of the cash flow problem favors equityholders.D. All of the above.E. None of the above.Difficulty level: MediumTopic: FINANCIAL DISTRESS- EQUITY HOLDER PREFERENCESType: CONCEPTS24. Prepackaged bankruptcies are:A. described as a combination of a private workout and a liquidation.B. the easiest way to transfer wealth to the shareholders.C. described as a combination of a completed private workout and the formal bankruptcy filing.D. All of the above.E. None of the above.Difficulty level: EasyTopic: PREPACKAGED BANKRUPTCIESType: CONCEPTS25. In a prepackaged bankruptcy the firm:A. and creditors agree to a private reorganization outside formal bankruptcy.B. must reach agreement privately with most of the creditors.C. will have difficulty when there are thousands of reluctant trade creditors.D. All of the above.E. None of the above.Difficulty level: MediumTopic: PREPACKAGED BANKRUPTCIESType: CONCEPTS26. Financial distress may be more expensive if the:A. information about the permanency of the shortfall is limited.B. firm has many different types of creditors and other investors.C. firm has never entered into bankruptcy before.D. Both A and B.E. Both B and C.Difficulty level: MediumTopic: COSTS OF FINANCIAL DISTRESSType: CONCEPTS27. The net payoff to creditors in formal bankruptcy may be low in present value terms because:A. the financial structure may be complicated with several groups and types of creditors.B. indirect costs of bankruptcy may have been costly in lost revenues and poor maintenance.C. administrative costs are high and increase with the complexity and length of time in the formal bankruptcy process.D. All of the above.E. None of the above.Difficulty level: MediumTopic: PAYOFF TO CREDITORSType: CONCEPTS28. Firms deal with financial distress by:A. selling major assets.B. merging with another firm.C. issuing new securities.D. exchanging debt for equity.E. All of the above.Difficulty level: MediumTopic: FINANCIAL DISTRESSType: CONCEPTS29. Perhaps equally, if not more damaging are the indirect costs of financial distress. Some examples of indirect costs are:A. loss of current customers.B. loss of business reputation.C. management consumed in survival and not on a strategic direction.D. All of the above.E. Both A and B.Difficulty level: EasyTopic: INDIRECT COSTS FO FINANCIAL DISTRESSType: CONCEPTS。

《公司理财》课后答案(英文版,第六版).doc

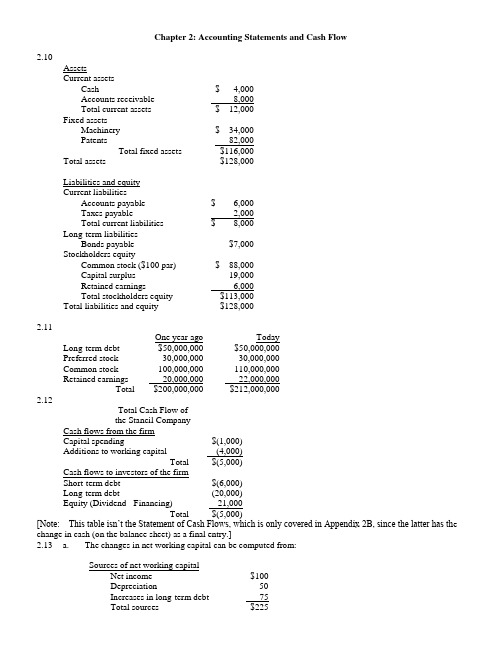

Chapter 2: Accounting Statements and Cash Flow2.10AssetsCurrent assetsCash $ 4,000Accounts receivable 8,000Total current assets $ 12,000Fixed assetsMachinery $ 34,000Patents 82,000Total fixed assets $116,000Total assets $128,000Liabilities and equityCurrent liabilitiesAccounts payable $ 6,000Taxes payable 2,000Total current liabilities $ 8,000Long-term liabilitiesBonds payable $7,000Stockholders equityCommon stock ($100 par) $ 88,000Capital surplus 19,000Retained earnings 6,000Total stockholders equity $113,000Total liabilities and equity $128,0002.11One year ago TodayLong-term debt $50,000,000 $50,000,000Preferred stock 30,000,000 30,000,000Common stock 100,000,000 110,000,000Retained earnings 20,000,000 22,000,000Total $200,000,000 $212,000,0002.12Total Cash Flow ofthe Stancil CompanyCash flows from the firmCapital spending $(1,000)Additions to working capital (4,000)Total $(5,000)Cash flows to investors of the firmShort-term debt $(6,000)Long-term debt (20,000)Equity (Dividend - Financing) 21,000Total $(5,000)[Note: This table isn’t the Statement of Cash Flows, which is only covered in Appendix 2B, since the latter has th e change in cash (on the balance sheet) as a final entry.]2.13 a. The changes in net working capital can be computed from:Sources of net working capitalNet income $100Depreciation 50Increases in long-term debt 75Total sources $225Uses of net working capitalDividends $50Increases in fixed assets* 150Total uses $200Additions to net working capital $25*Includes $50 of depreciation.b.Cash flow from the firmOperating cash flow $150Capital spending (150)Additions to net working capital (25)Total $(25)Cash flow to the investorsDebt $(75)Equity 50Total $(25)Chapter 3: Financial Markets and Net Present Value: First Principles of Finance (Advanced)3.14 $120,000 - ($150,000 - $100,000) (1.1) = $65,0003.15 $40,000 + ($50,000 - $20,000) (1.12) = $73,6003.16 a. ($7 million + $3 million) (1.10) = $11.0 millionb.i. They could spend $10 million by borrowing $5 million today.ii. They will have to spend $5.5 million [= $11 million - ($5 million x 1.1)] at t=1.Chapter 4: Net Present Valuea. $1,000 ⨯ 1.0510 = $1,628.89b. $1,000 ⨯ 1.0710 = $1,967.15c. $1,000 ⨯ 1.0520 = $2,653.30d. Interest compounds on the interest already earned. Therefore, the interest earned inSince this bond has no interim coupon payments, its present value is simply the present value of the $1,000 that will be received in 25 years. Note: As will be discussed in the next chapter, the present value of the payments associated with a bond is the price of that bond.PV = $1,000 /1.125 = $92.30PV = $1,500,000 / 1.0827 = $187,780.23a. At a discount rate of zero, the future value and present value are always the same. Remember, FV =PV (1 + r) t. If r = 0, then the formula reduces to FV = PV. Therefore, the values of the options are $10,000 and $20,000, respectively. You should choose the second option.b. Option one: $10,000 / 1.1 = $9,090.91Option two: $20,000 / 1.15 = $12,418.43Choose the second option.c. Option one: $10,000 / 1.2 = $8,333.33Option two: $20,000 / 1.25 = $8,037.55Choose the first option.d. You are indifferent at the rate that equates the PVs of the two alternatives. You know that rate mustfall between 10% and 20% because the option you would choose differs at these rates. Let r be thediscount rate that makes you indifferent between the options.$10,000 / (1 + r) = $20,000 / (1 + r)5(1 + r)4 = $20,000 / $10,000 = 21 + r = 1.18921r = 0.18921 = 18.921%The $1,000 that you place in the account at the end of the first year will earn interest for six years. The $1,000 that you place in the account at the end of the second year will earn interest for five years, etc. Thus, the account will have a balance of$1,000 (1.12)6 + $1,000 (1.12)5 + $1,000 (1.12)4 + $1,000 (1.12)3= $6,714.61PV = $5,000,000 / 1.1210 = $1,609,866.18a. $1.000 (1.08)3 = $1,259.71b. $1,000 [1 + (0.08 / 2)]2 ⨯ 3 = $1,000 (1.04)6 = $1,265.32c. $1,000 [1 + (0.08 / 12)]12 ⨯ 3 = $1,000 (1.00667)36 = $1,270.24d. $1,000 e0.08 ⨯ 3 = $1,271.25e. The future value increases because of the compounding. The account is earning interest on interest. Essentially, the interest is added to the account balance at the e nd of every compounding period. During the next period, the account earns interest on the new balance. When the compounding period shortens, the balance that earns interest is rising faster.The price of the consol bond is the present value of the coupon payments. Apply the perpetuity formula to find the present value. PV = $120 / 0.15 = $800a. $1,000 / 0.1 = $10,000b. $500 / 0.1 = $5,000 is the value one year from now of the perpetual stream. Thus, the value of theperpetuity is $5,000 / 1.1 = $4,545.45.c. $2,420 / 0.1 = $24,200 is the value two years from now of the perpetual stream. Thus, the value of the perpetuity is $24,200 / 1.12 = $20,000.pply the NPV technique. Since the inflows are an annuity you can use the present value of an annuity factor.ANPV = -$6,200 + $1,200 81.0= -$6,200 + $1,200 (5.3349)= $201.88Yes, you should buy the asset.Use an annuity factor to compute the value two years from today of the twenty payments. Remember, the annuity formula gives you the value of the stream one year before the first payment. Hence, the annuity factor will give you the value at the end of year two of the stream of payments.A= $2,000 (9.8181)Value at the end of year two = $2,000 20.008= $19,636.20The present value is simply that amount discounted back two years.PV = $19,636.20 / 1.082 = $16,834.88The easiest way to do this problem is to use the annuity factor. The annuity factor must be equal to $12,800 / $2,000 = 6.4; remember PV =C A T r. The annuity factors are in the appendix to the text. To use the factor table to solve this problem, scan across the row labeled 10 years until you find 6.4. It is close to the factor for 9%, 6.4177. Thus, the rate you will receive on this note is slightly more than 9%.You can find a more precise answer by interpolating between nine and ten percent.[ 10% ⎤[6.1446 ⎤a ⎡r ⎥bc ⎡6.4 ⎪ d⎣9%⎦⎣6.4177 ⎦By interpolating, you are presuming that the ratio of a to b is equal to the ratio of c to d.(9 - r ) / (9 - 10) = (6.4177 - 6.4 ) / (6.4177 - 6.1446)r = 9.0648%The exact value could be obtained by solving the annuity formula for the interest rate. Sophisticated calculators can compute the rate directly as 9.0626%.[Note: A standard financial calculator’s TVM keys can solve for this rate. With annuity flows, the IRR key on “advanced” financial c alculators is unnecessary.]a. The annuity amount can be computed by first calculating the PV of the $25,000 which youThat amount is $17,824.65 [= $25,000 / 1.075]. Next compute the annuity which has the same present value.A$17,824.65 = C 507.0$17,824.65 = C (4.1002)C = $4,347.26Thus, putting $4,347.26 into the 7% account each year will provide $25,000 five years from today.b. The lump sum payment must be the present value of the $25,000, i.e., $25,000 / 1.075 =$17,824.65The formula for future value of any annuity can be used to solve the problem (see footnote 11 of the text).Option one: This cash flow is an annuity due. To value it, you must use the after-tax amounts. Theafter-tax payment is $160,000 (1 - 0.28) = $115,200. Value all except the first payment using the standard annuity formula, then add back the first payment of $115,200 to obtain the value of this option.AValue = $115,200 + $115,200 30.010= $115,200 + $115,200 (9.4269)= $1,201,178.88Option two: This option is valued similarly. You are able to have $446,000 now; this is already on an after-tax basis. You will receive an annuity of $101,055 for each of the next thirty years. Those payments are taxable when you receive them, so your after-tax payment is $72,759.60 [= $101,055 (1 - 0.28)].AValue = $446,000 + $72,759.60 30.010= $446,000 + $72,759.60 (9.4269)= $1,131,897.47Since option one has a higher PV, you should choose it.et r be the rate of interest you must earn.$10,000(1 + r)12 = $80,000(1 + r)12= 8r = 0.18921 = 18.921%First compute the present value of all the payments you must make for your children’s educati on. The value as of one year before matriculation of one child’s education isA= $21,000 (2.8550) = $59,955.$21,000 415.0This is the value of the elder child’s education fourteen years from now. It is the value of the younger child’s education sixteen years from today. The present value of these isPV = $59,955 / 1.1514 + $59,955 / 1.1516= $14,880.44You want to make fifteen equal payments into an account that yields 15% so that the present value of the equal payments is $14,880.44.A= $14,880.44 / 5.8474 = $2,544.80Payment = $14,880.44 / 15.015This problem applies the growing annuity formula. The first payment is$50,000(1.04)2(0.02) = $1,081.60.PV = $1,081.60 [1 / (0.08 - 0.04) - {1 / (0.08 - 0.04)}{1.04 / 1.08}40]= $21,064.28This is the present value of the payments, so the value forty years from today is$21,064.28 (1.0840) = $457,611.46se the discount factors to discount the individual cash flows. Then compute the NPV of the project. NoticeYou can still use the factor tables to compute their PV. Essentially, they form cash flows that are a six year annuity less a two year annuity. Thus, the appropriate annuity factor to use with them is 2.6198 (= 4.3553 - 1.7355).Year Cash Flow Factor PV0.9091 $636.371$70020.8264 743.769003 1,000 ⎤4 1,000 ⎥ 2.6198 2,619.805 1,000 ⎥6 1,000 ⎦7 1,250 0.5132 641.508 1,375 0.4665 641.44Total $5,282.87NPV = -$5,000 + $5,282.87= $282.87Purchase the machine.Chapter 5: How to Value Bonds and StocksThe amount of the semi-annual interest payment is $40 (=$1,000 ⨯ 0.08 / 2). There are a total of 40 periods;i.e., two half years in each of the twenty years in the term to maturity. The annuity factor tables can be usedto price these bonds. The appropriate discount rate to use is the semi-annual rate. That rate is simply the annual rate divided by two. Thus, for part b the rate to be used is 5% and for part c is it 3%.A+F/(1+r)40PV=C Tra. $40 (19.7928) + $1,000 / 1.0440 = $1,000Notice that whenever the coupon rate and the market rate are the same, the bond is priced at par.b. $40 (17.1591) + $1,000 / 1.0540 = $828.41Notice that whenever the coupon rate is below the market rate, the bond is priced below par.c. $40 (23.1148) + $1,000 / 1.0340 = $1,231.15Notice that whenever the coupon rate is above the market rate, the bond is priced above par.a. The semi-annual interest rate is $60 / $1,000 = 0.06. Thus, the effective annual rate is 1.062 - 1 =0.1236 = 12.36%.A+ $1,000 / 1.0612b. Price = $30 12.006= $748.48A+ $1,000 / 1.0412c. Price = $30 1204.0= $906.15Note: In parts b and c we are implicitly assuming that the yield curve is flat. That is, the yield in year 5applies for year 6 as well.rice = $2 (0.72) / 1.15 + $4 (0.72) / 1.152 + $50 / 1.153= $36.31The number of shares you own = $100,000 / $36.31 = 2,754 sharesPrice = $1.15 (1.18) / 1.12 + $1.15 (1.182) / 1.122 + $1.152 (1.182) / 1.123+ {$1.152 (1.182)(1.06) / (0.12 - 0.06)} / 1.123= $26.95[Insert before last sentence of question: Assume that dividends are a fixed proportion of earnings.] Dividend one year from now = $5 (1 - 0.10) = $4.50Price = $5 + $4.50 / {0.14 - (-0.10)}= $23.75Since the current $5 dividend has not yet been paid, it is still included in the stock price.Chapter 6: Some Alternative Investment Rulesa. Payback period of Project A = 1 + ($7,500 - $4,000) / $3,500 = 2 yearsPayback period of Project B = 2 + ($5,000 - $2,500 -$1,200) / $3,000 = 2.43 yearsProject A should be chosen.b. NPV A = -$7,500 + $4,000 / 1.15 + $3,500 / 1.152 + $1,500 / 1.153 = -$388.96NPV B = -$5,000 + $2,500 / 1.15 + $1,200 / 1.152 + $3,000 / 1.153 = $53.83Project B should be chosen.a. Average Investment:($16,000 + $12,000 + $8,000 + $4,000 + 0) / 5 = $8,000Average accounting return:$4,500 / $8,000 = 0.5625 = 56.25%b. 1. AAR does not consider the timing of the cash flows, hence it does not consider the timevalue of money.2. AAR uses an arbitrary firm standard as the decision rule.3. AAR uses accounting data rather than net cash flows.aAverage Investment = (8000 + 4000 + 1500 + 0)/4 = 3375.00Average Net Income = 2000(1-0.75) = 1500=> AAR = 1500/3375=44.44%a. Solve x by trial and error:-$8,000 + $4,000 / (1 + x) + $3000 / (1 + x)2 + $2,000 / (1 + x)3 = 0x = 6.93%b. No, since the IRR (6.93%) is less than the discount rate of 8%.Alternatively, the NPV @ a discount rate of 0.08 = -$136.62.a. Solve r in the equation:$5,000 - $2,500 / (1 + r) - $2,000 / (1 + r)2 - $1,000 / (1 + r)3- $1,000 / (1 + r)4 = 0By trial and error,IRR = r = 13.99%b. Since this problem is the case of financing, accept the project if the IRR is less than the required rate of return.IRR = 13.99% > 10%Reject the offer.c. IRR = 13.99% < 20%Accept the offer.d. When r = 10%:NPV = $5,000 - $2,500 / 1.1 - $2,000 / 1.12 - $1,000 / 1.13 - $1,000 / 1.14When r = 20%:NPV = $5,000 - $2,500 / 1.2 - $2,000 / 1.22 - $1,000 / 1.23 - $1,000 / 1.24= $466.82Yes, they are consistent with the choices of the IRR rule since the signs of the cash flows change only once.A/ $160,000 = 1.04PI = $40,000 715.0Since the PI exceeds one accept the project.Chapter 7: Net Present Value and Capital BudgetingSince there is uncertainty surrounding the bonus payments, which McRae might receive, you must use the expected value of McRae’s bonuses in the computation of the PV of his contract. McRae’s salary plus the expected value of his bonuses in years one through three is$250,000 + 0.6 ⨯ $75,000 + 0.4 ⨯ $0 = $295,000.Thus the total PV of his three-year contract isPV = $400,000 + $295,000 [(1 - 1 / 1.12363) / 0.1236]+ {$125,000 / 1.12363} [(1 - 1 / 1.123610 / 0.1236]= $1,594,825.68EPS = $800,000 / 200,000 = $4NPVGO = (-$400,000 + $1,000,000) / 200,000 = $3Price = EPS / r + NPVGO= $4 / 0.12 + $3=$36.33Year 0 Year 1 Year 2 Year 3 Year 4 Year 51. Annual Salary$120,000 $120,000 $120,000 $120,000 $120,000 Savings2. Depreciation 100,000 160,000 96,000 57,600 57,6003. Taxable Income 20,000 -40,000 24,000 62,400 62,4004. Taxes 6,800 -13,600 8,160 21,216 21,2165. Operating Cash Flow113,200 133,600 111,840 98,784 98,784 (line 1-4)$100,000 -100,0006. ∆ Net workingcapital7. Investment $500,000 75,792*8. Total Cash Flow -$400,000 $113,200 $133,600 $111,840 $98,784 $74,576*75,792 = $100,000 - 0.34 ($100,000 - $28,800)NPV = -$400,000+ $113,200 / 1.12 + $133,600 / 1.122 + $111,840 / 1.123+ $98,784 / 1.124 + $74,576 / 1.125= -$7,722.52Real interest rate = (1.15 / 1.04) - 1 = 10.58%NPV A = -$40,000+ $20,000 / 1.1058 + $15,000 / 1.10582 + $15,000 / 1.10583= $1,446.76NPV B = -$50,000+ $10,000 / 1.15 + $20,000 / 1.152 + $40,000 / 1.153= $119.17Choose project A.PV = $120,000 / {0.11 - (-0.06)}t = 0 t = 1 t = 2 t = 3 t = 4 t = 5 t = 6 ...$12,000 $6,000 $6,000 $6,000$4,000$12,000 $6,000 $6,000 ...The present value of one cycle is:A+ $4,000 / 1.064PV = $12,000 + $6,000 306.0= $12,000 + $6,000 (2.6730) + $4,000 / 1.064= $31,206.37The cycle is four years long, so use a four year annuity factor to compute the equivalent annual cost (EAC).AEAC = $31,206.37 / 406.0= $31,206.37 / 3.4651= $9,006The present value of such a stream in perpetuity is$9,006 / 0.06 = $150,100o evaluate the word processors, compute their equivalent annual costs (EAC).BangAPV(costs) = (10 ⨯ $8,000) + (10 ⨯ $2,000) 414.0= $80,000 + $20,000 (2.9137)= $138,274EAC = $138,274 / 2.9137= $47,456IOUAPV(costs) = (11 ⨯ $5,000) + (11 ⨯ $2,500) 3.014- (11 ⨯ $500) / 1.143= $55,000 + $27,500 (2.3216) - $5,500 / 1.143= $115,132EAC = $115,132 / 2.3216= $49,592BYO should purchase the Bang word processors.Chapter 8: Strategy and Analysis in Using Net Present ValueThe accounting break-even= (120,000 + 20,000) / (1,500 - 1,100)= 350 units. The accounting break-even= 340,000 / (2.00 - 0.72)= 265,625 abalonesb. [($2.00 ⨯ 300,000) - (340,000 + 0.72 ⨯ 300,000)] (0.65)= $28,600This is the after tax profit.Chapter 9: Capital Market Theory: An Overviewa. Capital gains = $38 - $37 = $1 per shareb. Total dollar returns = Dividends + Capital Gains = $1,000 + ($1*500) = $1,500 On a per share basis, this calculation is $2 + $1 = $3 per sharec. On a per share basis, $3/$37 = 0.0811 = 8.11% On a total dollar basis, $1,500/(500*$37) = 0.0811 = 8.11%d. No, you do not need to sell the shares to include the capital gains in the computation of the returns. The capital gain is included whether or not you realize the gain. Since you could realize the gain if you choose, you should include it.The expected holding period return is:()[]%865.1515865.052$/52$75.54$50.5$==-+There appears to be a lack of clarity about the meaning of holding period returns. The method used in the answer to this question is the one used in Section 9.1. However, the correspondence is not exact, because in this question, unlike Section 9.1, there are cash flows within the holding period. The answer above ignores the dividend paid in the first year. Although the answer above technically conforms to the eqn at the bottom of Fig. 9.2, the presence of intermediate cash flows that aren’t accounted for renders th is measure questionable, at best. There is no similar example in the body of the text, and I have never seen holding period returns calculated in this way before.Although not discussed in this book, there are two generally accepted methods of computing holding period returns in the presence of intermediate cash flows. First, the time weighted return calculates averages (geometric or arithmetic) of returns between cash flows. Unfortunately, that method can’t be used here, because we are not given the va lue of the stock at the end of year one. Second, the dollar weighted measure calculates the internal rate of return over the entire holding period. Theoretically, that method can be applied here, as follows: 0 = -52 + 5.50/(1+r) + 60.25/(1+r)2 => r = 0.1306.This produces a two year holding period return of (1.1306)2 – 1 = 0.2782. Unfortunately, this book does not teach the dollar weighted method.In order to salvage this question in a financially meaningful way, you would need the value of the stock at the end of one year. Then an illustration of the correct use of the time-weighted return would be appropriate. A complicating factor is that, while Section 9.2 illustrates the holding period return using the geometric return for historical data, the arithmetic return is more appropriate for expected future returns.E(R) = T-Bill rate + Average Excess Return = 6.2% + (13.0% -3.8%) = 15.4%. Common Treasury Realized Stocks Bills Risk Premium -7 32.4% 11.2% 21.2%-6 -4.9 14.7 -19.6-5 21.4 10.5 10.9 -4 22.5 8.8 13.7 -3 6.3 9.9 -3.6 -2 32.2 7.7 24.5 Last 18.5 6.2 12.3 b. The average risk premium is 8.49%.49.873.125.246.37.139.106.192.21=++-++- c. Yes, it is possible for the observed risk premium to be negative. This can happen in any single year. The.b.Standard deviation = 03311.0001096.0=.b.Standard deviation = = 0.03137 = 3.137%.b.Chapter 10: Return and Risk: The Capital-Asset-Pricing Model (CAPM)a. = 0.1 (– 4.5%) + 0.2 (4.4%) + 0.5 (12.0%) + 0.2 (20.7%) = 10.57%b.σ2 = 0.1 (–0.045 – 0.1057)2 + 0.2 (0.044 – 0.1057)2 + 0.5 (0.12 – 0.1057)2+ 0.2 (0.207 – 0.1057)2 = 0.0052σ = (0.0052)1/2 = 0.072 = 7.20%Holdings of Atlas stock = 120 ⨯ $50 = $6,000 ⨯ $20 = $3,000Weight of Atlas stock = $6,000 / $9,000 = 2 / 3Weight of Babcock stock = $3,000 / $9,000 = 1 / 3a. = 0.3 (0.12) + 0.7 (0.18) = 0.162 = 16.2%σP 2= 0.32 (0.09)2 + 0.72 (0.25)2 + 2 (0.3) (0.7) (0.09) (0.25) (0.2)= 0.033244σP= (0.033244)1/2 = 0.1823 = 18.23%a.State Return on A Return on B Probability1 15% 35% 0.4 ⨯ 0.5 = 0.22 15% -5% 0.4 ⨯ 0.5 = 0.23 10% 35% 0.6 ⨯ 0.5 = 0.34 10% -5% 0.6 ⨯ 0.5 = 0.3b. = 0.2 [0.5 (0.15) + 0.5 (0.35)] + 0.2[0.5 (0.15) + 0.5 (-0.05)]+ 0.3 [0.5 (0.10) + 0.5 (0.35)] + 0.3 [0.5 (0.10) + 0.5 (-0.05)]= 0.135= 13.5%Note: The solution to this problem requires calculus.Specifically, the solution is found by minimizing a function subject to a constraint. Calculus ability is not necessary to understand the principles behind a minimum variance portfolio.Min { X A2 σA2 + X B2σB2+ 2 X A X B Cov(R A , R B)}subject to X A + X B = 1Let X A = 1 - X B. Then,Min {(1 - X B)2σA2 + X B2σB2+ 2(1 - X B) X B Cov (R A, R B)}Take a derivative with respect to X B.d{∙} / dX B = (2 X B - 2) σA2+ 2 X B σB2 + 2 Cov(R A, R B) - 4 X B Cov(R A, R B)Set the derivative equal to zero, cancel the common 2 and solve for X B.X BσA2- σA2+ X B σB2 + Cov(R A, R B) - 2 X B Cov(R A, R B) = 0X B = {σA2 - Cov(R A, R B)} / {σA2+ σB2 - 2 Cov(R A, R B)}andX A = {σB2 - Cov(R A, R B)} / {σA2+ σB2 - 2 Cov(R A, R B)}Using the data from the problem yields,X A = 0.8125 andX B = 0.1875.a. Using the weights calculated above, the expected return on the minimum variance portfolio isE(R P) = 0.8125 E(R A) + 0.1875 E(R B)= 0.8125 (5%) + 0.1875 (10%)= 5.9375%b. Using the formula derived above, the weights areX A = 2 / 3 andX B = 1 / 3c. The variance of this portfolio is zero.σP 2= X A2 σA2 + X B2σB2+ 2 X A X B Cov(R A , R B)= (4 / 9) (0.01) + (1 / 9) (0.04) + 2 (2 / 3) (1 / 3) (-0.02)= 0This demonstrates that assets can be combined to form a risk-free portfolio.14.2%= 3.7%+β(7.5%) ⇒β = 1.40.25 = R f + 1.4 [R M– R f] (I)0.14 = R f + 0.7 [R M– R f] (II)(I) – (II)=0.11 = 0.7 [R M– R f] (III)[R M– R f ]= 0.1571Put (III) into (I) 0.25 = R f + 1.4[0.1571]R f = 3%[R M– R f ]= 0.1571R M = 0.1571 + 0.03= 18.71%a. = 4.9% + βi (9.4%)βD= Cov(R D, R M) / σM 2 = 0.0635 / 0.04326 = 1.468= 4.9 + 1.468 (9.4) = 18.70%Weights:X A = 5 / 30 = 0.1667X B = 10 / 30 = 0.3333X C = 8 / 30 = 0.2667X D = 1 - X A - X B - X C = 0.2333Beta of portfolio= 0.1667 (0.75) + 0.3333 (1.10) + 0.2667 (1.36) + 0.2333 (1.88)= 1.293= 4 + 1.293 (15 - 4) = 18.22%a. (i) βA= ρA,MσA / σMρA,M= βA σM / σA= (0.9) (0.10) / 0.12= 0.75(ii) σB= βB σM / ρB,M= (1.10) (0.10) / 0.40= 0.275(iii) βC= ρC,MσC / σM= (0.75) (0.24) / 0.10= 1.80(iv) ρM,M= 1(v) βM= 1(vi) σf= 0(vii) ρf,M= 0(viii) βf= 0b. SML:E(R i) = R f + βi {E(R M) - R f}= 0.05 + (0.10) βiSecurity βi E(R i)A 0.13 0.90 0.14B 0.16 1.10 0.16C 0.25 1.80 0.23Security A performed worse than the market, while security C performed better than the market.Security B is fairly priced.c. According to the SML, security A is overpriced while security C is under-priced. Thus, you could invest in security C while sell security A (if you currently hold it).a. The typical risk-averse investor seeks high returns and low risks. To assess thetwo stocks, find theReturns:State of economy ProbabilityReturn on A*Recession 0.1 -0.20 Normal 0.8 0.10 Expansion0.10.20* Since security A pays no dividend, the return on A is simply (P 1 / P 0) - 1. = 0.1 (-0.20) + 0.8 (0.10) + 0.1 (0.20) = 0.08 = 0.09 This was given in the problem.Risk:R A - (R A -)2 P ⨯ (R A -)2 -0.28 0.0784 0.00784 0.02 0.0004 0.00032 0.12 0.0144 0.00144 Variance 0.00960Standard deviation (R A ) = 0.0980βA = {Corr(R A , R M ) σ(R A )} / σ(R M ) = 0.8 (0.0980) / 0.10= 0.784βB = {Corr(R B , R M ) σ(R B )} / σ(R M ) = 0.2 (0.12) / 0.10= 0.24The return on stock B is higher than the return on stock A. The risk of stock B, as measured by itsbeta, is lower than the risk of A. Thus, a typical risk-averse investor will prefer stock B.b. = (0.7) + (0.3) = (0.7) (0.8) + (0.3) (0.09) = 0.083σP 2= 0.72 σA 2 + 0.32 σB 2 + 2 (0.7) (0.3) Corr (R A , R B ) σA σB = (0.49) (0.0096) + (0.09) (0.0144) + (0.42) (0.6) (0.0980) (0.12) = 0.0089635 σP = = 0.0947 c. The beta of a portfolio is the weighted average of the betas of the components of the portfolio. βP = (0.7) βA + (0.3) βB = (0.7) (0.784) + (0.3) (0.240) = 0.621Chapter 11:An Alternative View of Risk and Return: The Arbitrage Pricing Theorya. Stock A:()()R R R R R A A A m m Am A=+-+=+-+βεε105%12142%...Stock B:()()R R R R R B B m m Bm B=+-+=+-+βεε130%098142%...Stock C:()R R R R R C C C m m Cm C=+-+=+-+βεε157%137142%)..(.b.()[]()[]()[]()()()()()()[]()()CB A m cB A m c m B m A m CB A P 25.045.030.0%2.14R 1435.1%925.1225.045.030.0%2.14R 37.125.098.045.02.130.0%7.1525.0%1345.0%5.1030.0%2.14R 37.1%7.1525.0%2.14R 98.0%0.1345.0%2.14R 2.1%5.1030.0R 25.0R 45.0R 30.0R ε+ε+ε+-+=ε+ε+ε+-+++++=ε+-++ε+-++ε+-+=++= c.i.()R R R A B C =+-==+-==+-=105%1215%142%)1113%09815%142%)137%157%13715%142%168%..(..46%.(......ii.R P =+-=12925%1143515%142%)138398%..(..To determine which investment investor would prefer, you must compute the variance of portfolios created bymany stocks from either market. Note, because you know that diversification is good, it is reasonable to assume that once an investor chose the market in which he or she will invest, he or she will buy many stocks in that market.Known:E EF ====001002 and and for all i.i σσεε..Assume: The weight of each stock is 1/N; that is, X N i =1/for all i.If a portfolio is composed of N stocks each forming 1/N proportion of the portfolio, the return on the portfolio is 1/N times the sum of the returns on the N stocks. Recall that the return on each stock is 0.1+βF+ε.()()()()()()[]()()()()()()()[]()[]()[]()()[]()()()()()j i 2j i 22j i i 2222222222P P P P iP ,0.04Corr 0.01,Cov s =isvariance the ,N as limit In the ,Cov 1/N 1s 1/N s )(1/N 1/N F 2F E 1/N F E 0.10.1/N F 0.1E R E R E R Var 0.101/N 00.1E 1/N F E 0.11/N F 0.1E R E 1/N F 0.1F 0.1(1/N)R 1/N R εε+β=εε+β∞⇒εε-+ε+β=ε∑+εβ+β=ε+β=-ε+β+=-==+β+=ε+β+=ε∑+β+=ε+β+=ε+β+==∑∑∑∑∑∑∑∑()()()()()()Thus,F R f E R E R Var R Corr Var R Corr ii ip P p i j PijR 1i =++=++===+=+010*********002250040002500412212111222.........,,εεεεεεa.()()()()Corr Corr Var R Var R i j i j p pεεεε112212000225000225,,..====Since Var ()()R p 1 Var R 2p 〉, a risk averse investor will prefer to invest in the second market.b. Corr ()()εεεε112090i j j ,.,== and Corr 2i()()Var R Var R pp120058500025==..。

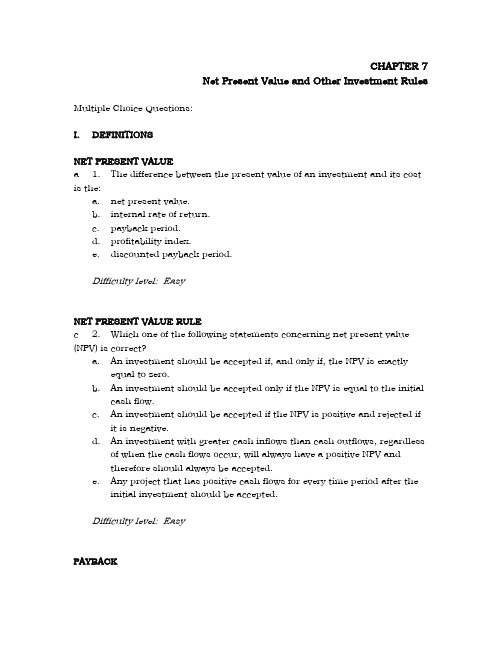

公司理财(英文版)题库