英文版罗斯公司理财习题答案

罗斯《公司理财》英文习题答案DOCchap028

公司理财习题答案第二十八章Chapter 28: Cash Management28.1 Firms need to hold cash to:a. Satisfy the transaction needs. For example, cash is collected from sales and newfinancing and disbursed as wages, salaries, trade debts, taxes and dividends.b. Maintain compensating balances. A minimum required compensating balance atbanks providing credit service to the firm may impose a lower limit on the level ofcash a firm holds.28.2 a. Decrease. Examine the Baumol model. As the interest rate (k) increases, the optimalcash balance must also rise.b. Increase. Examine the Baumol model. As brokerage costs (F, the per transactioncosts) rise, the optimal balance increases.c. Decrease. Clearly, if the bank lowers its compensating balance requirement, a firmwill not be required to hold as much of its assets as cash.d. Decrease. If the cost of borrowing falls, a firm need not hold as much of its assets ascash because the cost of running short, i.e. the cost to borrow to fill cash needs, islower.e. Increase. As a firm’s credit rating falls, its cost to borrow increases. Thus, the firmcannot as easily afford to run short of cash and its cash balance must be higher.f. Decrease. Introduction of direct banking fees would increase the fixed costsassociated with holding cash. As fixed costs rise, the optimal balance must also rise.28.3 The average weekly cash balance is $20,750 [ ($24,000 + $34,000 + $10,000 +$15,000)/ 4].With monthly compounding, the return that the firm can earn on its average balance is$20,750 [[( 1 + 0.12/12)12 - 1] = $2,631.62Your answer may differ if you made different assumptions about the interest payments.28.4 a. The total amount of cash that will be disbursed during the year is:$345,000 * 12 = $4,140,000 Using the optimal cash balance formula,193,243$07.0)000,140,4)(500($2K 2FT*C ===$243,193 should be kept as cash. The balance, $556,807 (=$800,000-$243,193),should be invested in marketable securities.b. The number of times marketable securities will be sold during the next twelvemonths is $4,140,000 / $243,193 = 17 times28.5C*2FT K T KC *2F 7.5%(20mil)25,0007.5%200.01$3,000(mil)Average w eekly disbursement 3,00052$57.69mil222===⨯⨯=⨯===28.6 Use the Miller-Orr formula. The target cash balance = Z*3F 4K L 23=+σ The upper limit = H*=3Z*-2LThe daily opportunity cost = K= 1.0836510.000211-=Z*3($600)($1,440,00)4(0.000211)3$20,000$34,536H *$63,608=+== The average cash balance:C *4Z *L34($34,536)$20,0003$39,381=-=-=28.7 a.Z g*Hg 2L g 3200,0002100,0003$133,333Z s *Hs 2L s 3300,0002150,0003$200,000=+=+⨯==+=+⨯=b. Gold Star:()()s Z *L 4K /3F 133,333100,00040.00026132,0006,444,251K 1.1010.000261g 2g g3g g 3g 365=-=-⨯⨯⨯≈=-=Silver Star:()()s Z *L 4K /3F 200,000150,00040.00023632,000K 1.0910.000236g 2g g3g g 3g 365=-=-⨯⨯⨯≈=-=15733333,,So, Silver Star Co. has a more volatile daily cash flow.28.8 Garden Groves float = 150 ($15,000) = $2,250,000Increase in collected cash balance if a 3 day lockbox is installed = 3($2,250,000)= $6,750,000Annual earnings from this amount = $6,750,000 x 0.075 = $506,250The system should be installed if its cost is below this amount.Variable cost $ 0.5 x 150 x 365 = $27,375 Fixed cost = 80,000Total cost =$107,375The lockbox system should be installed. The net earnings from the use of the system are $398,875 (= $506,250 - $107,375)公司理财习题答案第二十八章28.9 To make the system profitable, the net earnings of installing the lockbox system must benon-negative. The lower limit for acceptability is zero profits.Let N be the number of customers per day.Earnings = ($4,500) (N) (2) (0.06) = $540 x NCosts:Variable cost: N (365) ($0.25) = $91.25 x NFixed cost: $15,000Equate Earnings to total costs:N = 33.43Salisbury Stakes needs at least 34 customers per day for the lockbox system to beprofitable.28.10 Disbursement float = $12,000 x 5 = $60,000Collection float = -$15,000 x 3 = -$45,000Net float = $60,000 - $45,000 = $15,000If funds are collected in four days rather than three, disbursement float will not change.Collection float will change to -$60,000. This change makes the net float equal to zero.28.11 a. Reduction in outstanding cash balances = $100,000 x 3 days = $300,000b. Return on savings = $300,000 (0.12) = $360,000c. Maximum monthly charge = $36,000 / 12 = $3,000Note: The calculation in part b assumes annual compounding. The answer in part cdoes not account for the time value of money. With monthly compounding of theinterest earned, the return on savings at the end of the year is$300,000 [(1.01)12 - 1] = $38,047.51The present value of this amount is $38,047.51 / (1.01) 12 = $33,765.23Compute the monthly payment as an annuity with a discount rate of 1% per periodfor twelve periods. That annuity factor is 11.2551. Thus, the payment is$33,765.23 = (Payment) (11.2551)Payment = $3,000Notice, as long as the treatment of the cash flows is the same, the payment is thesame.28.12 The cash savings are the earnings from the interest bearing account. Assuming dailycompounding, the three-day return to the delayed payment is($200,000)[(1.0004)3-1] = $240.096The interest rate for two weeks is 0.5615% (=(1.0004)14-1).Therefore, the present value of this annuity is($240.096)11(1.005615)260.005615$5,793.12 -=⎡⎣⎢⎢⎢⎢⎤⎦⎥⎥⎥⎥The Walter Company will save $5,793.12 per year.28.13 If the Miller Company divides the eastern region, collections will be accelerated by oneday freeing up $4 million per day. Compensating balances will be increased by $100,000 [=2($300,000)-$500,000]. The net effect is to have $3,900,000 to invest. If T-bills pay 7%per year, the annual net savings from the division of the eastern region is $3,900,000 x 0.07 = $273,000.28.14 Lockbox: interest saved = 7,500 x 250 x 1.5 x0.0003 = $843.75Annual saving (Annual charge) = 843.75 x 365 - 30,000 - 0.3 x 250 x 365= $250,593.75Annual saving (Concentration Banking) = 7,500 x 250 x1 x 0.0003 x 365= 562.5 x 365 = $205,312.5So the lockbox system is recommended.28.15 The important characteristics of short-term marketable securities are:i. maturityii. default riskiii. marketabilityiv. taxability。

罗斯公司理财chap001全英文题库及答案

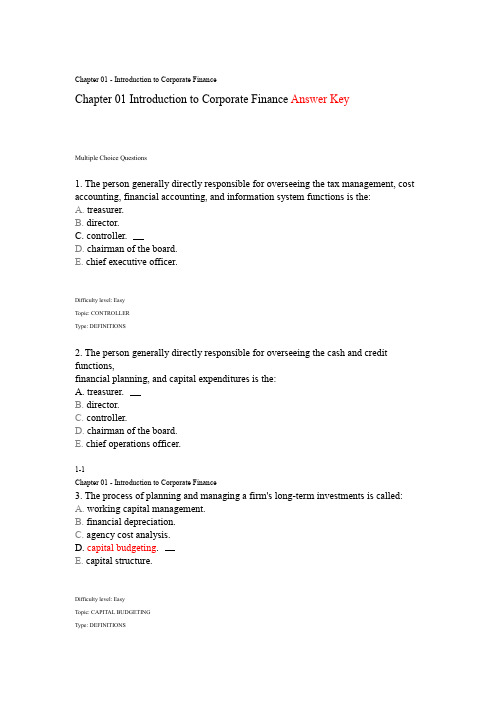

Chapter 01 - Introduction to Corporate FinanceChapter 01 Introduction to Corporate Finance Answer KeyMultiple Choice Questions1. The person generally directly responsible for overseeing the tax management, cost accounting, financial accounting, and information system functions is the:A. treasurer.B. director.C. controller.D. chairman of the board.E. chief executive officer.Difficulty level: EasyTopic: CONTROLLERType: DEFINITIONS2. The person generally directly responsible for overseeing the cash and credit functions,financial planning, and capital expenditures is the:A. treasurer.B. director.C. controller.D. chairman of the board.E. chief operations officer.1-1Chapter 01 - Introduction to Corporate Finance3. The process of planning and managing a firm's long-term investments is called:A. working capital management.B. financial depreciation.C. agency cost analysis.D. capital budgeting.E. capital structure.Difficulty level: EasyTopic: CAPITAL BUDGETINGType: DEFINITIONS4. The mixture of debt and equity used by a firm to finance its operations is called:A. working capital management.B. financial depreciation.C. cost analysis.D. capital budgeting.E. capital structure.5. The management of a firm's short-term assets and liabilities is called:A. working capital management.B. debt management.C. equity management.D. capital budgeting.E. capital structure.1-2Chapter 01 - Introduction to Corporate Finance6. A business owned by a single individual is called a:A. corporation.B. sole proprietorship.C. general partnership.D. limited partnership.E. limited liability company.7. A business formed by two or more individuals who each have unlimited liability for businessdebts is called a:A. corporation.B. sole proprietorship.C. general partnership.D. limited partnership.E. limited liability company.8. The division of profits and losses among the members of a partnership is formalized in the:A. indemnity clause.B. indenture contract.C. statement of purpose.D. partnership agreement.E. group charter.9. A business created as a distinct legal entity composed of one or more individuals or entities iscalled a:A. corporation.B. sole proprietorship.C. general partnership.D. limited partnership.E. unlimited liability company.Difficulty level: EasyTopic: CORPORATIONType: DEFINITIONS1-3Chapter 01 - Introduction to Corporate Finance10. The corporate document that sets forth the business purpose of a firm is the:A. indenture contract.B. state tax agreement.C. corporate bylaws.D. debt charter.E. articles of incorporation.11. The rules by which corporations govern themselves are called:A. indenture provisions.B. indemnity provisions.C. charter agreements.D. bylaws.E. articles of incorporation.12. A business entity operated and taxed like a partnership, but with limited liability for theowners, is called a:A. limited liability company.B. general partnership.C. limited proprietorship.D. sole proprietorship.E. corporation.13. The primary goal of financial management is to:A. maximize current dividends per share of the existing stock.B. maximize the current value per share of the existing stock.C. avoid financial distress.D. minimize operational costs and maximize firm efficiency.E. maintain steady growth in both sales and net earnings.14. A conflict of interest between the stockholders and management of a firm is called:A. stockholders' liability.B. corporate breakdown.C. the agency problem.D. corporate activism.E. legal liability.1-4Chapter 01 - Introduction to Corporate Finance15. Agency costs refer to:A. the total dividends paid to stockholders over the lifetime of a firm.B. the costs that result from default and bankruptcy of a firm.C. corporate income subject to double taxation.D. the costs of any conflicts of interest between stockholders and management.E. the total interest paid to creditors over the lifetime of the firm.16. A stakeholder is:A. any person or entity that owns shares of stock of a corporation.B. any person or entity that has voting rights based on stock ownership of a corporation.C. a person who initially started a firm and currently has management control over the cashflows of the firm due to his/her current ownership of company stock.D. a creditor to whom the firm currently owes money and who consequently has a claim on thecash flows of the firm.E. any person or entity other than a stockholder or creditor who potentially has a claim on thecash flows of the firm.17. The Sarbanes Oxley Act of 2002 is intended to:A. protect financial managers from investors.B. not have any effect on foreign companies.C. reduce corporate revenues.D. protect investors from corporate abuses.E. decrease audit costs for U.S. firms.18. The treasurer and the controller of a corporation generally report to the:A. board of directors.B. chairman of the board.C. chief executive officer.D. president.E. chief financial officer.19. Which one of the following statements is correct concerning the organizational structure ofa corporation?A. The vice president of finance reports to the chairman of the board.B. The chief executive officer reports to the board of directors.C. The controller reports to the president.D. The treasurer reports to the chief executive officer.E. The chief operations officer reports to the vice president of production.Difficulty level: MediumTopic: ORGANIZATIONAL STRUCTUREType: CONCEPTS1-5Chapter 01 - Introduction to Corporate Finance20. Which one of the following is a capital budgeting decision?A. determining how much debt should be borrowed from a particular lenderB. deciding whether or not to open a new storeC. deciding when to repay a long-term debtD. determining how much inventory to keep on handE. determining how much money should be kept in the checking account21. The Sarbanes Oxley Act was enacted in:A. 1952.B. 1967.C. 1998.D. 2002.E. 2006.22. Since the implementation of Sarbanes-Oxley, the cost of going public in the United Stateshas:A. increased.B. decreased.C. remained about the same.D. been erratic, but over time has decreased.E. It is impossible to tell since Sarbanes-Oxley compliance does not involve direct cost to thefirm.23. Working capital management includes decisions concerning which of the following?I. accounts payableII. long-term debtIII. accounts receivableIV. inventoryA. I and II onlyB. I and III onlyC. II and IV onlyD. I, II, and III onlyE. I, III, and IV onlyDifficulty level: MediumTopic: WORKING CAPITAL MANAGEMENTType: CONCEPTS1-6Chapter 01 - Introduction to Corporate Finance24. Working capital management:A. ensures that sufficient equipment is available to produce the amount of product desired on adaily basis.B. ensures that long-term debt is acquired at the lowest possible cost.C. ensures that dividends are paid to all stockholders on an annual basis.D. balances the amount of company debt to the amount of available equity.E. is concerned with the upper portion of the balance sheet.Difficulty level: EasyTopic: WORKING CAPITAL MANAGEMENTType: CONCEPTS25. Which one of the following statements concerning a sole proprietorship is correct?A. A sole proprietorship is the least common form of business ownership.B. The profits of a sole proprietorship are taxed twice.C. The owners of a sole proprietorship share profits as established by the partnership agreement.D. The owner of a sole proprietorship may be forced to sell his/her personal assets to paycompany debts.E. A sole proprietorship is often structured as a limited liability company.Difficulty level: EasyTopic: SOLE PROPRIETORSHIPType: CONCEPTS26. Which one of the following statements concerning a sole proprietorship is correct?A. The life of the firm is limited to the life span of the owner.B. The owner can generally raise large sums of capital quite easily.C. The ownership of the firm is easy to transfer to another individual.D. The company must pay separate taxes from those paid by the owner.E. The legal costs to form a sole proprietorship are quite substantial.Difficulty level: EasyTopic: SOLE PROPRIETORSHIPType: CONCEPTS1-7Chapter 01 - Introduction to Corporate Finance27. Which one of the following best describes the primary advantage of being a limited partnerrather than a general partner?A. entitlement to a larger portion of the partnership's incomeB. ability to manage the day-to-day affairs of the businessC. no potential financial lossD. greater management responsibilityE. liability for firm debts limited to the capital investedDifficulty level: EasyTopic: PARTNERSHIPType: CONCEPTS28. A general partner:A. has less legal liability than a limited partner.B. has more management responsibility than a limited partner.C. faces double taxation whereas a limited partner does not.D. cannot lose more than the amount of his/her equity investment.E. is the term applied only to corporations which invest in partnerships.Difficulty level: EasyTopic: PARTNERSHIPType: CONCEPTS29. A partnership:A. is taxed the same as a corporation.B. agreement defines whether the business income will be taxed like a partnership or acorporation.C. terminates at the death of any general partner.D. has less of an ability to raise capital than a proprietorship.E. allows for easy transfer of interest from one general partner to another.Difficulty level: EasyTopic: PARTNERSHIPType: CONCEPTS1-8Chapter 01 - Introduction to Corporate Finance30. Which of the following are disadvantages of a partnership?I. limited life of the firmII. personal liability for firm debtIII. greater ability to raise capital than a sole proprietorshipIV. lack of ability to transfer partnership interestA. I and II onlyB. III and IV onlyC. II and III onlyD. I, II, and IV onlyE. I, III, and IV onlyDifficulty level: MediumTopic: PARTNERSHIPType: CONCEPTS31. Which of the following are advantages of the corporate form of business ownership?I. limited liability for firm debtII. double taxationIII. ability to raise capitalIV. unlimited firm lifeA. I and II onlyB. III and IV onlyC. I, II, and III onlyD. II, III, and IV onlyE. I, III, and IV onlyDifficulty level: MediumTopic: CORPORATIONType: CONCEPTS32. Which one of the following statements is correct concerning corporations?A. The largest firms are usually corporations.B. The majority of firms are corporations.C. The stockholders are usually the managers of a corporation.D. The ability of a corporation to raise capital is quite limited.E. The income of a corporation is taxed as personal income of the stockholders.Difficulty level: EasyTopic: CORPORATIONType: CONCEPTS1-9Chapter 01 - Introduction to Corporate Finance33. Which one of the following statements is correct?A. Both partnerships and corporations incur double taxation.B. Both sole proprietorships and partnerships are taxed in a similar fashion.C. Partnerships are the most complicated type of business to form.D. Both partnerships and corporations have limited liability for general partners and shareholders.E. All types of business formations have limited lives.Difficulty level: MediumTopic: BUSINESS TYPESType: CONCEPTS34. The articles of incorporation:A. can be used to remove company management.B. are amended annually by the company stockholders.C. set forth the number of shares of stock that can be issued.D. set forth the rules by which the corporation regulates its existence.E. can set forth the conditions under which the firm can avoid double taxation.35. The bylaws:A. establish the name of the corporation.B. are rules which apply only to limited liability companies.C. set forth the purpose of the firm.D. mandate the procedure for electing corporate directors.E. set forth the procedure by which the stockholders elect the senior managers of the firm.36. The owners of a limited liability company prefer:A. being taxed like a corporation.B. having liability exposure similar to that of a sole proprietor.C. being taxed personally on all business income.D. having liability exposure similar to that of a general partner.E. being taxed like a corporation with liability like a partnership.Difficulty level: MediumTopic: LIMITED LIABILITY COMPANYType: CONCEPTS1-10Chapter 01 - Introduction to Corporate Finance37. Which one of the following business types is best suited to raising large amounts ofcapital?A. sole proprietorshipB. limited liability companyC. corporationD. general partnershipE. limited partnershipDifficulty level: EasyTopic: CORPORATIONType: CONCEPTS38. Which type of business organization has all the respective rights and privileges ofa legalperson?A. sole proprietorshipB. general partnershipC. limited partnershipD. corporationE. limited liability companyDifficulty level: EasyTopic: CORPORATIONType: CONCEPTS39. Financial managers should strive to maximize the current value per share of the existingstock because:A. doing so guarantees the company will grow in size at the maximum possible rate.B. doing so increases the salaries of all the employees.C. the current stockholders are the owners of the corporation.D. doing so means the firm is growing in size faster than its competitors.E. the managers often receive shares of stock as part of their compensation.Difficulty level: EasyTopic: GOAL OF FINANC IAL MANAGEMENTType: CONCEPTS1-11Chapter 01 - Introduction to Corporate Finance40. The decisions made by financial managers should all be ones which increase the:A. size of the firm.B. growth rate of the firm.C. marketability of the managers.D. market value of the existing owners' equity.E. financial distress of the firm.Difficulty level: EasyTopic: GOAL OF FINANCIAL MANAGEMENTType: CONCEPTS41. Which one of the following actions by a financial manager creates an agency problem?A. refusing to borrow money when doing so will create losses for the firmB. refusing to lower selling prices if doing so will reduce the net profitsC. agreeing to expand the company at the expense of stockholders' valueD. agreeing to pay bonuses based on the book value of the company stockE. increasing current costs in order to increase the market value of the stockholders' equity42. Which of the following help convince managers to work in the best interest of the stockholders?I. compensation based on the value of the stockII. stock option plansIII. threat of a proxy fightIV. threat of conversion to a partnershipA. I and II onlyB. II and III onlyC. I, II and III onlyD. I and III onlyE. I, II, III, and IVDifficulty level: MediumTopic: AGENCY PROBLEMType: CONCEPTS1-12Chapter 01 - Introduction to Corporate Finance43. Which form of business structure faces the greatest agency problems?A. sole proprietorshipB. general partnershipC. limited partnershipD. corporationE. limited liability company44. A proxy fight occurs when:A. the board solicits renewal of current members.B. a group solicits proxies to replace the board of directors.C. a competitor offers to sell their ownership in the firm.D. the firm files for bankruptcy.E. the firm is declared insolvent.45. Which one of the following parties is considered a stakeholder of a firm?A. employeeB. short-term creditorC. long-term creditorD. preferred stockholderE. common stockholderDifficulty level: EasyTopic: STAKEHOLDERSType: CONCEPTS46. Which of the following are key requirements of the Sarbanes-Oxley Act?I. Officers of the corporation must review and sign annual reports.II. Officers of the corporation must now own more than 5% of the firm's stock. III. Annual reports must list deficiencies in internal controlsIV. Annual reports must be filed with the SEC within 30 days of year end.A. I onlyB. II onlyC. I and III onlyD. II and III onlyE. II and IV onlyDifficulty level: MediumTopic: SARBANES-OXLEYType: CONCEPTS1-13Chapter 01 - Introduction to Corporate Finance47. Insider trading is:A. legal.B. illegal.C. impossible to have in our efficient market.D. discouraged, but legal.E. list only the securities of the largest firms.48. Sole proprietorships are predominantly started because:A. they are easily and cheaply setup.B. the proprietorship life is limited to the business owner's life.C. all business taxes are paid as individual tax.D. All of the above.E. None of the above.Difficulty level: EasyTopic: SOLE PROPRIETORSHIPSType: CONCEPTS49. Managers are encouraged to act in shareholders' interests by:A. shareholder election of a board of directors who select management.B. the threat of a takeover by another firm.C. compensation contracts that tie compensation to corporate success.D. Both A and B.E. All of the above.Difficulty level: MediumTopic: GOVERNANCEType: CONCEPTS50. The Securities Exchange Act of 1934 focuses on:A. all stock transactions.B. sales of existing securities.C. issuance of new securities.D. insider trading.E. Federal Deposit Insurance Corporation (FDIC) insurance.Difficulty level: MediumTopic: REGULATIONType: CONCEPTS1-14Chapter 01 - Introduction to Corporate Finance51. The basic regulatory framework in the United States was provided by:A. the Securities Act of 1933.B. the Securities Exchange Act of 1934.C. the monetary system.D. A and B.E. All of the above.Difficulty level: MediumTopic: REGULATIONType: CONCEPTS52. The Securities Act of 1933 focuses on:A. all stock transactions.B. sales of existing securities.C. issuance of new securities.D. insider trading.E. Federal Deposit Insurance Corporation (FDIC) insurance.Difficulty level: EasyTopic: REGULATIONType: CONCEPTS53. In a limited partnership:A. each limited partner's liability is limited to his net worth.B. each limited partner's liability is limited to the amount he put into the partnership.C. each limited partner's liability is limited to his annual salary.D. there is no limitation on liability; only a limitation on what the partner can earn.E. None of the above.Difficulty level: EasyTopic: LIMITED PARTNERSHIPType: CONCEPTS1-15Chapter 01 - Introduction to Corporate Finance54. Accounting profits and cash flows are:A. generally the same since they reflect current laws and accounting standards.B. generally the same since accounting profits reflect when the cash flows are received.C. generally not the same since GAAP allows for revenue recognition separate from the receiptof cash flows.D. generally not the same because cash inflows occur before revenue recognition.E. Both c and d.1-16。

罗斯《公司理财》英文习题答案DOCchap004

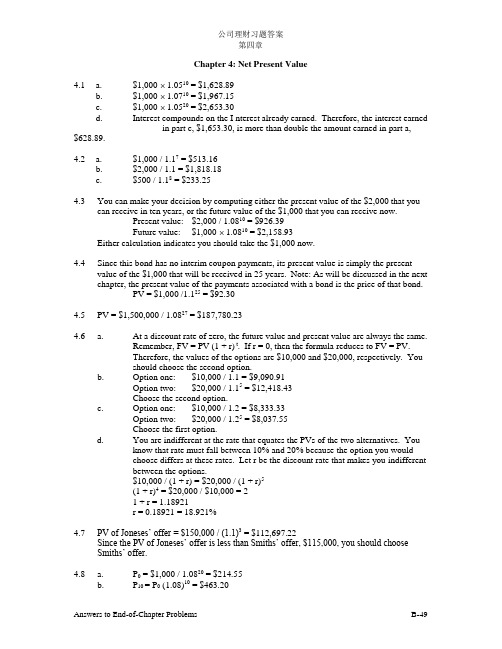

公司理财习题答案第四章Chapter 4: Net Present Value4.1 a. $1,000 ⨯ 1.0510 = $1,628.89b. $1,000 ⨯ 1.0710 = $1,967.15c. $1,000 ⨯ 1.0520 = $2,653.30d. Interest compounds on the I nterest already earned. Therefore, the interest earnedin part c, $1,653.30, is more than double the amount earned in part a, $628.89.4.2 a. $1,000 / 1.17 = $513.16b. $2,000 / 1.1 = $1,818.18c. $500 / 1.18 = $233.254.3 You can make your decision by computing either the present value of the $2,000 that youcan receive in ten years, or the future value of the $1,000 that you can receive now.Present value: $2,000 / 1.0810 = $926.39Future value: $1,000 ⨯ 1.0810 = $2,158.93Either calculation indicates you should take the $1,000 now.4.4 Since this bond has no interim coupon payments, its present value is simply the presentvalue of the $1,000 that will be received in 25 years. Note: As will be discussed in the next chapter, the present value of the payments associated with a bond is the price of that bond.PV = $1,000 /1.125 = $92.304.5 PV = $1,500,000 / 1.0827 = $187,780.234.6 a. At a discount rate of zero, the future value and present value are always the same.Remember, FV = PV (1 + r) t. If r = 0, then the formula reduces to FV = PV.Therefore, the values of the options are $10,000 and $20,000, respectively. Youshould choose the second option.b. Option one: $10,000 / 1.1 = $9,090.91Option two: $20,000 / 1.15 = $12,418.43Choose the second option.c. Option one: $10,000 / 1.2 = $8,333.33Option two: $20,000 / 1.25 = $8,037.55Choose the first option.d. You are indifferent at the rate that equates the PVs of the two alternatives. Youknow that rate must fall between 10% and 20% because the option you wouldchoose differs at these rates. Let r be the discount rate that makes you indifferentbetween the options.$10,000 / (1 + r) = $20,000 / (1 + r)5(1 + r)4 = $20,000 / $10,000 = 21 + r = 1.18921r = 0.18921 = 18.921%4.7 PV of Joneses’ offer = $150,000 / (1.1)3 = $112,697.22Since the PV of Joneses’ offer is less than Smiths’ offer, $115,000, you should chooseSmiths’ offer.4.8 a. P0 = $1,000 / 1.0820 = $214.55b. P10 = P0 (1.08)10 = $463.20c. P15 = P0 (1.08)15 = $680.594.9 The $1,000 that you place in the account at the end of the first year will earn interest for sixyears. The $1,000 that you place in the account at the end of the second year will earninterest for five years, etc. Thus, the account will have a balance of$1,000 (1.12)6 + $1,000 (1.12)5 + $1,000 (1.12)4 + $1,000 (1.12)3= $6,714.614.10 PV = $5,000,000 / 1.1210 = $1,609,866.184.11 a. The cost of investment is $900,000.PV of cash inflows = $120,000 / 1.12 + $250,000 / 1.122 + $800,000 / 1.123= $875,865.52Since the PV of cash inflows is less than the cost of investment, you should notmake the investment.b. NPV = -$900,000 + $875,865.52= -$24,134.48c. NPV = -$900,000 + $120,000 / 1.11 + $250,000 / 1.112 + $800,000 / 1.113= $-4,033.18Since the NPV is still negative, you should not make the investment.4.12 NPV = -($340,000 + $10,000) + ($100,000 - $10,000) / 1.1+ $90,000 / 1.12 + $90,000 / 1.13 + $90,000 / 1.14 + $100,000 / 1.15= -$2,619.98Since the NPV is negative, you should not buy it.If the relevant cost of capital is 9 percent,NPV = -$350,000 + $90,000 / 1.09 + $90,000 / 1.092 + $90,000 / 1.093+ $90,000 / 1.094 + $100,000 / 1.095= $6,567.93Since the NPV is positive, you should buy it.4.13 a. Profit = PV of revenue - Cost = NPVNPV = $90,000 / 1.15 - $60,000 = -$4,117.08No, the firm will not make a profit.b. Find r that makes zero NPV.$90,000 / (1+r)5 - $60,000 = $0(1+r)5 = 1.5r = 0.08447 = 8.447%4.14 The future value of the decision to own your car for one year is the sum of the trade-invalue and the benefit from owning the car. Therefore, the PV of the decision to own thecar for one year is$3,000 / 1.12 + $1,000 / 1.12 = $3,571.43Since the PV of the roommate’s offer, $3,500, is lower than the aunt’s offer, you shouldaccept aunt’s offer.4.15 a. $1.000 (1.08)3 = $1,259.71b. $1,000 [1 + (0.08 / 2)]2 ⨯ 3 = $1,000 (1.04)6 = $1,265.32c. $1,000 [1 + (0.08 / 12)]12 ⨯ 3 = $1,000 (1.00667)36 = $1,270.24d. $1,000 e0.08 ⨯ 3 = $1,271.25公司理财习题答案第四章e. The future value increases because of the compounding. The account is earninginterest on interest. Essentially, the interest is added to the account balance at theend of every compounding period. During the next period, the account earnsinterest on the new balance. When the compounding period shortens, the balancethat earns interest is rising faster.4.16 a. $1,000 e0.12 ⨯ 5 = $1,822.12b. $1,000 e0.1 ⨯ 3 = $1,349.86c. $1,000 e0.05 ⨯ 10 = $1,648.72d. $1,000 e0.07 ⨯ 8 = $1,750.674.17 PV = $5,000 / [1+ (0.1 / 4)]4 ⨯ 12 = $1,528.364.18 Effective annual interest rate of Bank America= [1 + (0.041 / 4)]4 - 1 = 0.0416 = 4.16%Effective annual interest rate of Bank USA= [1 + (0.0405 / 12)]12 - 1 = 0.0413 = 4.13%You should deposit your money in Bank America.4.19 The price of the consol bond is the present value of the coupon payments. Apply theperpetuity formula to find the present value. PV = $120 / 0.15 = $8004.20 Quarterly interest rate = 12% / 4 = 3% = 0.03Therefore, the price of the security = $10 / 0.03 = $333.334.21 The price at the end of 19 quarters (or 4.75 years) from today = $1 / (0.15 ÷ 4) = $26.67The current price = $26.67 / [1+ (.15 / 4)]19 = $13.254.22 a. $1,000 / 0.1 = $10,000b. $500 / 0.1 = $5,000 is the value one year from now of the perpetual stream. Thus,the value of the perpetuity is $5,000 / 1.1 = $4,545.45.c. $2,420 / 0.1 = $24,200 is the value two years from now of the perpetual stream.Thus, the value of the perpetuity is $24,200 / 1.12 = $20,000.4.23 The value at t = 8 is $120 / 0.1 = $1,200.Thus, the value at t = 5 is $1,200 / 1.13 = $901.58.4.24 P = $3 (1.05) / (0.12 - 0.05) = $45.004.25 P = $1 / (0.1 - 0.04) = $16.674.26 The first cash flow will be generated 2 years from today.The value at the end of 1 year from today = $200,000 / (0.1 - 0.05) = $4,000,000.Thus, PV = $4,000,000 / 1.1 = $3,636,363.64.4.27 A zero NPV-$100,000 + $50,000 / r = 0-r = 0.54.28 Apply the NPV technique. Since the inflows are an annuity you can use the present valueof an annuity factor.NPV = -$6,200 + $1,200 8A1.0= -$6,200 + $1,200 (5.3349)= $201.88Yes, you should buy the asset.4.29 Use an annuity factor to compute the value two years from today of the twenty payments.Remember, the annuity formula gives you the value of the stream one year before the first payment. Hence, the annuity factor will give you the value at the end of year two of the stream of payments. Value at the end of year two = $2,000 20A08.0= $2,000 (9.8181)= $19,636.20The present value is simply that amount discounted back two years.PV = $19,636.20 / 1.082 = $16,834.884.30 The value of annuity at the end of year five= $500 15A = $500 (5.84737) = $2,923.6915.0The present value = $2,923.69 / 1.125 = $1,658.984.31 The easiest way to do this problem is to use the annuity factor. The annuity factor must beequal to $12,800 / $2,000 = 6.4; remember PV =C A t r. The annuity factors are in theappendix to the text. To use the factor table to solve this problem, scan across the rowlabeled 10 years until you find 6.4. It is close to the factor for 9%, 6.4177. Thus, the rate you will receive on this note is slightly more than 9%.You can find a more precise answer by interpolating between nine and ten percent.10% ⎤ 6.1446 ⎤a ⎡ r ⎥bc ⎡ 6.4 ⎪ d⎣ 9% ⎦⎣ 6.4177 ⎦By interpolating, you are presuming that the ratio of a to b is equal to the ratio of c to d.(9 - r ) / (9 - 10) = (6.4177 - 6.4 ) / (6.4177 - 6.1446)r = 9.0648%The exact value could be obtained by solving the annuity formula for the interest rate.Sophisticated calculators can compute the rate directly as 9.0626%.公司理财习题答案第四章4.32 a. The annuity amount can be computed by first calculating the PV of the $25,000which you need in five years. That amount is $17,824.65 [= $25,000 / 1.075].Next compute the annuity which has the same present value.$17,824.65 = C 5A.007$17,824.65 = C (4.1002)C = $4,347.26Thus, putting $4,347.26 into the 7% account each year will provide $25,000 fiveyears from today.b. The lump sum payment must be the present value of the $25,000, i.e., $25,000 /1.075 = $17,824.65The formula for future value of any annuity can be used to solve the problem (seefootnote 14 of the text).4.33The amount of loan is $120,000 ⨯ 0.85 = $102,000.20C A= $102,000.010The amount of equal installments isC = $102,000 / 20A = $102,000 / 8.513564 = $11,980.8810.04.34 The present value of salary is $5,000 36A = $150,537.53.001The present value of bonus is $10,000 3A = $23,740.42 (EAR = 12.68% is used since.01268bonuses are paid annually.)The present value of the contract = $150,537.53 + $23,740.42 = $174,277.944.35 The amount of loan is $15,000 ⨯ 0.8 = $12,000.C 48A = $12,0000067.0The amount of monthly installments isC = $12,000 / 48A = $12,000 / 40.96191 = $292.960067.04.36 Option one: This cash flow is an annuity due. To value it, you must use the after-taxamounts. The after-tax payment is $160,000 (1 - 0.28) = $115,200. Value all except the first payment using the standard annuity formula, then add back the first payment of$115,200 to obtain the value of this option.Value = $115,200 + $115,200 30A10.0= $115,200 + $115,200 (9.4269)= $1,201,178.88Option two: This option is valued similarly. You are able to have $446,000 now; this is already on an after-tax basis. You will receive an annuity of $101,055 for each of the next thirty years. Those payments are taxable when you receive them, so your after-taxpayment is $72,759.60 [= $101,055 (1 - 0.28)].Value = $446,000 + $72,759.60 30A.010= $446,000 + $72,759.60 (9.4269)= $1,131,897.47Since option one has a higher PV, you should choose it.4.37 The amount of loan is $9,000. The monthly payment C is given by solving the equation: C 60008.0A = $9,000 C = $9,000 / 47.5042 = $189.46In October 2000, Susan Chao has 35 (= 12 ⨯ 5 - 25) monthly payments left, including the one due in October 2000.Therefore, the balance of the loan on November 1, 2000 = $189.46 + $189.46 34008.0A = $189.46 + $189.46 (29.6651) = $5,809.81Thus, the total amount of payoff = 1.01 ($5,809.81) = $5,867.91 4.38 Let r be the rate of interest you must earn. $10,000(1 + r)12 = $80,000 (1 + r)12 = 8 r = 0.18921 = 18.921%4.39 First compute the present value of all the payments you must make for your children’s education. The value as of one year before matriculation of one child’s education is$21,000 415.0A= $21,000 (2.8550) = $59,955. This is the value of the elder child’s education fourteen years from now. It is the value of the younger child’s education sixteen years from today. The present value of these is PV = $59,955 / 1.1514 + $59,955 / 1.1516 = $14,880.44You want to make fifteen equal payments into an account that yields 15% so that the present value of the equal payments is $14,880.44. Payment = $14,880.44 / 1515.0A = $14,880.44 / 5.8474 = $2,544.804.40 The NPV of the policy isNPV = -$750 306.0A - $800306.0A / 1.063 + $250,000 / [(1.066) (1.0759)] = -$2,004.76 - $1,795.45 + $3,254.33= -$545.88 Therefore, you should not buy the policy.4.41 The NPV of the lease offer isNPV = $120,000 - $15,000 - $15,000 908.0A - $25,000 / 1.0810= $105,000 - $93,703.32 - $11,579.84 = -$283.16 Therefore, you should not accept the offer.4.42 This problem applies the growing annuity formula. The first payment is $50,000(1.04)2(0.02) = $1,081.60. PV = $1,081.60 [1 / (0.08 - 0.04) - {1 / (0.08 - 0.04)}{1.04 / 1.08}40]= $21,064.28 This is the present value of the payments, so the value forty years from today is $21,064.28 (1.0840) = $457,611.46公司理财习题答案第四章4.43 Use the discount factors to discount the individual cash flows. Then compute the NPV ofthe project. Notice that the four $1,000 cash flows form an annuity. You can still use the factor tables to compute their PV. Essentially, they form cash flows that are a six year annuity less a two year annuity. Thus, the appropriate annuity factor to use with them is 2.6198 (= 4.3553 - 1.7355).Year Cash Flow Factor PV 1 $700 0.9091 $636.37 2 900 0.8264 743.76 3 1,000 ⎤ 4 1,000 ⎥ 2.6198 2,619.80 5 1,000 ⎥ 6 1,000 ⎦ 7 1,250 0.5132 641.50 8 1,375 0.4665 641.44 Total $5,282.87NPV = -$5,000 + $5,282.87 = $282.87 Purchase the machine.4.44 Weekly inflation rate = 0.039 / 52 = 0.00075 Weekly interest rate = 0.104 / 52 = 0.002 PV = $5 [1 / (0.002 - 0.00075)] {1 – [(1 + 0.00075) / (1 + 0.002)]52 ⨯ 30} = $3,429.384.45 Engineer:NPV = -$12,000 405.0A + $20,000 / 1.055 + $25,000 / 1.056 - $15,000 / 1.057- $15,000 / 1.058 + $40,000 2505.0A / 1.058= $352,533.35 Accountant:NPV = -$13,000 405.0A + $31,000 3005.0A / 1.054= $345,958.81 Become an engineer.After your brother announces that the appropriate discount rate is 6%, you can recalculate the NPVs. Calculate them the same way as above except using the 6% discount rate. Engineer NPV = $292,419.47 Accountant NPV = $292,947.04Your brother made a poor decision. At a 6% rate, he should study accounting.4.46 Since Goose receives his first payment on July 1 and all payments in one year intervalsfrom July 1, the easiest approach to this problem is to discount the cash flows to July 1 then use the six month discount rate (0.044) to discount them the additional six months. PV = $875,000 / (1.044) + $650,000 / (1.044)(1.09) + $800,000 / (1.044)(1.092) + $1,000,000 / (1.044)(1.093) + $1,000,000/(1.044)(1.094) + $300,000 / (1.044)(1.095)+ $240,000 1709.0A / (1.044)(1.095) + $125,000 1009.0A / (1.044)(1.0922) = $5,051,150Remember that the use of annuity factors to discount the deferred payments yields the value of the annuity stream one period prior to the first payment. Thus, the annuity factor applied to the first set of deferred payments gives the value of those payments on July 1 of 1989. Discounting by 9% for five years brings the value to July 1, 1984. The use of the six month discount rate (4.4%) brings the value of the payments to January 1, 1984. Similarly, the annuity factor applied to the second set of deferred payments yields the value of those payments in 2006. Discounting for 22 years at 9% and for six months at 4.4% provides the value at January 1, 1984.The equivalent five-year, annual salary is the annuity that solves: $5,051,150 = C 509.0A C = $5,051,150/3.8897C = $1,298,596The student must be aware of possible rounding errors in this problem. The differencebetween 4.4% semiannual and 9.0% and for six months at 4.4% provides the value at January 1, 1984. 4.47 PV = $10,000 + ($35,000 + $3,500) [1 / (0.12 - 0.04)] [1 - (1.04 / 1.12) 25 ]= $415,783.604.48 NPV = -$40,000 + $10,000 [1 / (0.10 - 0.07)] [1 - (1.07 / 1.10)5 ] = $3,041.91 Revise the textbook.4.49The amount of the loan is $400,000 (0.8) = $320,000 The monthly payment is C = $320,000 / 3600067.0.0A = $ 2,348.10 Thirty years of payments $ 2,348.10 (360) = $ 845,316.00 Eight years of payments $2,348.10 (96) = $225,417.60 The difference is the balloon payment of $619,898.404.50 The lease payment is an annuity in advanceC + C 2301.0A = $4,000 C (1 + 20.4558) = $4,000 C = $186.424.51 The effective annual interest rate is[ 1 + (0.08 / 4) ] 4 – 1 = 0.0824The present value of the ten-year annuity is PV = 900 100824.0A = $5,974.24 Four remaining discount periodsPV = $5,974.24 / (1.0824) 4 = $4,352.43公司理财习题答案第四章4.52The present value of Ernie’s retirement incomePV = $300,000 20A / (1.07) 30 = $417,511.5407.0The present value of the cabinPV = $350,000 / (1.07) 10 = $177,922.25The present value of his savingsPV = $40,000 10A = $280,943.26.007In present value terms he must save an additional $313,490.53 In future value termsFV = $313,490.53 (1.07) 10 = $616,683.32He must saveC = $616.683.32 / 20A = $58,210.5407.0。

(公司理财)英文版罗斯公司理财习题答案C

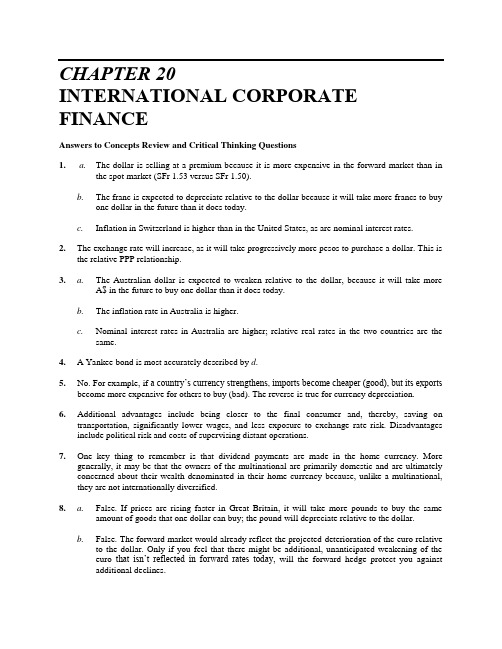

CHAPTER 20INTERNATIONAL CORPORATE FINANCEAnswers to Concepts Review and Critical Thinking Questions1. a.The dollar is selling at a premium because it is more expensive in the forward market than inthe spot market (SFr 1.53 versus SFr 1.50).b.The franc is expected to depreciate relative to the dollar because it will take more francs to buyone dollar in the future than it does today.c.Inflation in Switzerland is higher than in the United States, as are nominal interest rates.2.The exchange rate will increase, as it will take progressively more pesos to purchase a dollar. This isthe relative PPP relationship.3. a.The Australian dollar is expected to weaken relative to the dollar, because it will take moreA$ in the future to buy one dollar than it does today.b.The inflation rate in Australia is higher.c.Nominal interest rates in Australia are higher; relative real rates in the two countries are thesame.4. A Yankee bond is most accurately described by d.5. No. For example, if a country’s currency strengthens, imports become cheaper (good), but its exportsbecome more expensive for others to buy (bad). The reverse is true for currency depreciation.6.Additional advantages include being closer to the final consumer and, thereby, saving ontransportation, significantly lower wages, and less exposure to exchange rate risk. Disadvantages include political risk and costs of supervising distant operations.7.One key thing to remember is that dividend payments are made in the home currency. Moregenerally, it may be that the owners of the multinational are primarily domestic and are ultimately concerned about their wealth denominated in their home currency because, unlike a multinational, they are not internationally diversified.8. a.False. If prices are rising faster in Great Britain, it will take more pounds to buy the sameamount of goods that one dollar can buy; the pound will depreciate relative to the dollar.b.False. The forward market would already reflect the projected deterioration of the euro relativeto the dollar. Only if you feel that there might be additional, unanticipated weakening of the euro that isn’t reflected in forward rates today, will the forward hedge protect you against additional declines.c.True. The market would only be correct on average, while you would be correct all the time.9. a.American exporters: their situation in general improves because a sale of the exported goods fora fixed number of euros will be worth more dollars.American importers: their situation in general worsens because the purchase of the imported goods for a fixed number of euros will cost more in dollars.b.American exporters: they would generally be better off if the British government’s intentionsresult in a strengthened pound.American importers: they would generally be worse off if the pound strengthens.c.American exporters: they would generally be much worse off, because an extreme case of fiscalexpansion like this one will make American goods prohibitively expensive to buy, or else Brazilian sales, if fixed in cruzeiros, would become worth an unacceptably low number of dollars.American importers: they would generally be much better off, because Brazilian goods will become much cheaper to purchase in dollars.10.IRP is the most likely to hold because it presents the easiest and least costly means to exploit anyarbitrage opportunities. Relative PPP is least likely to hold since it depends on the absence of market imperfections and frictions in order to hold strictly.11.It all depends on whether the forward market expects the same appreciation over the period andwhether the expectation is accurate. Assuming that the expectation is correct and that other traders do not have the same information, there will be value to hedging the currency exposure.12.One possible reason investment in the foreign subsidiary might be preferred is if this investmentprovides direct diversification that shareholders could not attain by investing on their own. Another reason could be if the political climate in the foreign country was more stable than in the home country. Increased political risk can also be a reason you might prefer the home subsidiary investment. Indonesia can serve as a great example of political risk. If it cannot be diversified away, investing in this type of foreign country will increase the systematic risk. As a result, it will raise the cost of the capital, and could actually decrease the NPV of the investment.13.Yes, the firm should undertake the foreign investment. If, after taking into consideration all risks, aproject in a foreign country has a positive NPV, the firm should undertake it. Note that in practice, the stated assumption (that the adjustment to the discount rate has taken into consideration all political and diversification issues) is a huge task. But once that has been addressed, the net present value principle holds for foreign operations, just as for domestic.14.If the foreign currency depreciates, the U.S. parent will experience an exchange rate loss when theforeign cash flow is remitted to the U.S. This problem could be overcome by selling forward contracts. Another way of overcoming this problem would be to borrow in the country where the project is located.15.False. If the financial markets are perfectly competitive, the difference between the Eurodollar rateand the U.S. rate will be due to differences in risk and government regulation. Therefore, speculating in those markets will not be beneficial.16.The difference between a Eurobond and a foreign bond is that the foreign bond is denominated in thecurrency of the country of origin of the issuing company. Eurobonds are more popular than foreign bonds because of registration differences. Eurobonds are unregistered securities.Solutions to Questions and ProblemsNOTE: All end-of-chapter problems were solved using a spreadsheet. Many problems require multiple steps. Due to space and readability constraints, when these intermediate steps are included in this solutions manual, rounding may appear to have occurred. However, the final answer for each problem is found without rounding during any step in the problem.Basicing the quotes from the table, we get:a.$50(€0.7870/$1) = €39.35b.$1.2706c.€5M($1.2706/€) = $6,353,240d.New Zealand dollare.Mexican pesof.(P11.0023/$1)($1.2186/€1) = P13.9801/€This is a cross rate.g.The most valuable is the Kuwait dinar. The least valuable is the Indonesian rupiah.2. a.You would prefer £100, since:(£100)($.5359/£1) = $53.59b.You would still prefer £100. Using the $/£ exchange rate and the SF/£ exchange rate to find theamount of Swiss francs £100 will buy, we get:(£100)($1.8660/£1)(SF .8233) = SF 226.6489ing the quotes in the book to find the SF/£ cross rate, we find:(SF 1.2146/$1)($0.5359/£1) = SF 2.2665/£1The £/SF exchange rate is the inverse of the SF/£ exchange rate, so:£1/SF .4412 = £0.4412/SF 13. a.F180= ¥104.93 (per $). The yen is selling at a premium because it is more expensive in theforward market than in the spot market ($0.0093659 versus $0.009530).b.F90 = $1.8587/£. The pound is selling at a discount because it is less expensive in the forwardmarket than in the spot market ($0.5380 versus $0.5359).c.The value of the dollar will fall relative to the yen, since it takes more dollars to buy one yen inthe future than it does today. The value of the dollar will rise relative to the pound, because it will take fewer dollars to buy one pound in the future than it does today.4. a.The U.S. dollar, since one Canadian dollar will buy:(Can$1)/(Can$1.26/$1) = $0.7937b.The cost in U.S. dollars is:(Can$2.19)/(Can$1.26/$1) = $1.74Among the reasons that absolute PPP doe sn’t hold are tariffs and other barriers to trade, transactions costs, taxes, and different tastes.c.The U.S. dollar is selling at a discount, because it is less expensive in the forward market thanin the spot market (Can$1.22 versus Can$1.26).d.The Canadian dollar is expected to appreciate in value relative to the dollar, because it takesfewer Canadian dollars to buy one U.S. dollar in the future than it does today.e.Interest rates in the United States are probably higher than they are in Canada.5. a.The cross rate in ¥/£ terms is:(¥115/$1)($1.70/£1) = ¥195.5/£1b.The yen is quoted too low relative to the pound. Take out a loan for $1 and buy ¥115. Use the¥115 to purchase pounds at the cross-rate, which will give you:¥115(£1/¥185) = £0.6216Use the pounds to buy back dollars and repay the loan. The cost to repay the loan will be:£0.6216($1.70/£1) = $1.0568You arbitrage profit is $0.0568 per dollar used.6.We can rearrange the interest rate parity condition to answer this question. The equation we will useis:R FC = (F T– S0)/S0 + R USUsing this relationship, we find:Great Britain: R FC = (£0.5394 – £0.5359)/£0.5359 + .038 = 4.45%Japan: R FC = (¥104.93 – ¥106.77)/¥106.77 + .038 = 2.08%Switzerland: R FC = (SFr 1.1980 – SFr 1.2146)/SFr 1.2146 + .038 = 2.43%7.If we invest in the U.S. for the next three months, we will have:$30M(1.0045)3 = $30,406,825.23If we invest in Great Britain, we must exchange the dollars today for pounds, and exchange the pounds for dollars in three months. After making these transactions, the dollar amount we would have in three months would be:($30M)(£0.56/$1)(1.0060)3/(£0.59/$1) = $28,990,200.05We should invest in U.S.ing the relative purchasing power parity equation:F t = S0 × [1 + (h FC– h US)]tWe find:Z3.92 = Z3.84[1 + (h FC– h US)]3h FC– h US = (Z3.92/Z3.84)1/3– 1h FC– h US = .0069Inflation in Poland is expected to exceed that in the U.S. by 0.69% over this period.9.The profit will be the quantity sold, times the sales price minus the cost of production. Theproduction cost is in Singapore dollars, so we must convert this to U.S. dollars. Doing so, we find that if the exchange rates stay the same, the profit will be:Profit = 30,000[$145 – {(S$168.50)/(S$1.6548/$1)}]Profit = $1,295,250.18If the exchange rate rises, we must adjust the cost by the increased exchange rate, so:Profit = 30,000[$145 – {(S$168.50)/1.1(S$1.6548/$1)}]Profit = $1,572,954.71If the exchange rate falls, we must adjust the cost by the decreased exchange rate, so:Profit = 30,000[$145 – {(S$168.50)/0.9(S$1.6548/$1)}]Profit = $955,833.53To calculate the breakeven change in the exchange rate, we need to find the exchange rate that make the cost in Singapore dollars equal to the selling price in U.S. dollars, so:$145 = S$168.50/S TS T = S$1.1621/$1S T = –.2978 or –29.78% decline10. a.If IRP holds, then:F180 = (Kr 6.43)[1 + (.08 – .05)]1/2F180 = Kr 6.5257Since given F180 is Kr6.56, an arbitrage opportunity exists; the forward premium is too high.Borrow Kr1 today at 8% interest. Agree to a 180-day forward contract at Kr 6.56. Convert the loan proceeds into dollars:Kr 1 ($1/Kr 6.43) = $0.15552Invest these dollars at 5%, ending up with $0.15931. Convert the dollars back into krone as$0.15931(Kr 6.56/$1) = Kr 1.04506Repay the Kr 1 loan, ending with a profit of:Kr1.04506 – Kr1.03868 = Kr 0.00638b.To find the forward rate that eliminates arbitrage, we use the interest rate parity condition, so:F180 = (Kr 6.43)[1 + (.08 – .05)]1/2F180 = Kr 6.525711.The international Fisher effect states that the real interest rate across countries is equal. We canrearrange the international Fisher effect as follows to answer this question:R US– h US = R FC– h FCh FC = R FC + h US– R USa.h AUS = .05 + .035 – .039h AUS = .046 or 4.6%b.h CAN = .07 + .035 – .039h CAN = .066 or 6.6%c.h TAI = .10 + .035 – .039h TAI = .096 or 9.6%12. a.The yen is expected to get stronger, since it will take fewer yen to buy one dollar in the futurethan it does today.b.h US– h JAP (¥129.76 – ¥131.30)/¥131.30h US– h JAP = – .0117 or –1.17%(1 – .0117)4– 1 = –.0461 or –4.61%The approximate inflation differential between the U.S. and Japan is – 4.61% annually.13. We need to find the change in the exchange rate over time, so we need to use the relative purchasingpower parity relationship:F t = S0 × [1 + (h FC– h US)]TUsing this relationship, we find the exchange rate in one year should be:F1 = 215[1 + (.086 – .035)]1F1 = HUF 225.97The exchange rate in two years should be:F2 = 215[1 + (.086 – .035)]2F2 = HUF 237.49And the exchange rate in five years should be:F5 = 215[1 + (.086 – .035)]5F5 = HUF 275.71ing the interest-rate parity theorem:(1 + R US) / (1 + R FC) = F(0,1) / S0We can find the forward rate as:F(0,1) = [(1 + R US) / (1 + R FC)] S0F(0,1) = (1.13 / 1.08)$1.50/£F(0,1) = $1.57/£Intermediate15.First, we need to forecast the future spot rate for each of the next three years. From interest rate andpurchasing power parity, the expected exchange rate is:E(S T) = [(1 + R US) / (1 + R FC)]T S0So:E(S1) = (1.0480 / 1.0410)1 $1.22/€ = $1.2282/€E(S2) = (1.0480 / 1.0410)2 $1.22/€ = $1.2365/€E(S3) = (1.0480 / 1.0410)3 $1.22/€ = $1.2448/€Now we can use these future spot rates to find the dollar cash flows. The dollar cash flow each year will be:Year 0 cash flow = –€$12,000,000($1.22/€) = –$14,640,000.00Year 1 cash flow = €$2,700,000($1.2282/€) = $3,316,149.86Year 2 cash flow = €$3,500,000($1.2365/€) = $4,327,618.63Year 3 cash flow = (€3,300,000 + 7,400,000)($1.2448/€) = $13,319,111.90And the NPV of the project will be:NPV = –$14,640,000 + $3,316,149.86/1.13 + $4,4327,618.63/1.132 + $13,319,111.90/1.133NPV = $914,618.7316. a.Implicitly, it is assumed that interest rates won’t change over the life of the project, but theexchange rate is projected to decline because the Euroswiss rate is lower than the Eurodollar rate.b.We can use relative purchasing power parity to calculate the dollar cash flows at each time. Theequation is:E[S T] = (SFr 1.72)[1 + (.07 – .08)]TE[S T] = 1.72(.99)TSo, the cash flows each year in U.S. dollar terms will be:t SFr E[S T] US$0 –27.0M –$15,697,674.421 +7.5M 1.7028 $4,404,510.222 +7.5M 1.6858 $4,449,000.223 +7.5M 1.6689 $4,493,939.624 +7.5M 1.6522 $4,539,332.955 +7.5M 1.6357 $4,585,184.79And the NPV is:NPV = –$15,697,674.42 + $4,404,510.22/1.13 + $4,449,000.22/1.132 + $4,493,939.62/1.133 + $4,539,332.95/1.134 + $4,585,184.79/1.135NPV = $71,580.10c.Rearranging the relative purchasing power parity equation to find the required return in Swissfrancs, we get:R SFr = 1.13[1 + (.07 – .08)] – 1R SFr = 11.87%So, the NPV in Swiss francs is:NPV = –SFr 27.0M + SFr 7.5M(PVIFA11.87%,5)NPV = SFr 123,117.76Converting the NPV to dollars at the spot rate, we get the NPV in U.S. dollars as:NPV = (SFr 123,117.76)($1/SFr 1.72)NPV = $71,580.10Challenge17. a.The domestic Fisher effect is:1 + R US = (1 + r US)(1 + h US)1 + r US = (1 + R US)/(1 + h US)This relationship must hold for any country, that is:1 + r FC = (1 + R FC)/(1 + h FC)The international Fisher effect states that real rates are equal across countries, so:1 + r US = (1 + R US)/(1 + h US) = (1 + R FC)/(1 + h FC) = 1 + r FCb.The exact form of unbiased interest rate parity is:E[S t] = F t = S0 [(1 + R FC)/(1 + R US)]tc.The exact form for relative PPP is:E[S t] = S0 [(1 + h FC)/(1 + h US)]td.For the home currency approach, we calculate the expected currency spot rate at time t as:E[S t] = (€0.5)[1.07/1.05]t= (€0.5)(1.019)tWe then convert the euro cash flows using this equation at every time, and find the present value. Doing so, we find:NPV = –[€2M/(€0.5)] + {€0.9M/[1.019(€0.5)]}/1.1 + {€0.9M/[1.0192(€0.5)]}/1.12 + {€0.9M/[1.0193(€0.5/$1)]}/1.13NPV = $316,230.72For the foreign currency approach, we first find the return in the euros as:R FC = 1.10(1.07/1.05) – 1 = 0.121Next, we find the NPV in euros as:NPV = –€2M + (€0.9M)/1.121 + (€0.9M)/1.1212+ (€0.9M)/1.1213= €158,115.36And finally, we convert the euros to dollars at the current exchange rate, which is:NPV ($) = €158,115.36 /(€0.5/$1) = $316,230.72。

罗斯《公司理财》第9版英文原书课后部分章节答案

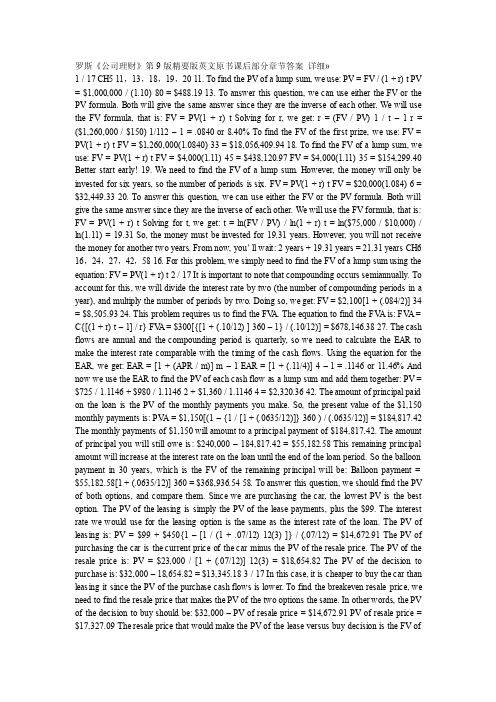

罗斯《公司理财》第9版精要版英文原书课后部分章节答案详细»1 / 17 CH5 11,13,18,19,20 11. To find the PV of a lump sum, we use: PV = FV / (1 + r) t PV = $1,000,000 / (1.10) 80 = $488.19 13. To answer this question, we can use either the FV or the PV formula. Both will give the same answer since they are the inverse of each other. We will use the FV formula, that is: FV = PV(1 + r) t Solving for r, we get: r = (FV / PV) 1 / t –1 r = ($1,260,000 / $150) 1/112 – 1 = .0840 or 8.40% To find the FV of the first prize, we use: FV = PV(1 + r) t FV = $1,260,000(1.0840) 33 = $18,056,409.94 18. To find the FV of a lump sum, we use: FV = PV(1 + r) t FV = $4,000(1.11) 45 = $438,120.97 FV = $4,000(1.11) 35 = $154,299.40 Better start early! 19. We need to find the FV of a lump sum. However, the money will only be invested for six years, so the number of periods is six. FV = PV(1 + r) t FV = $20,000(1.084)6 = $32,449.33 20. To answer this question, we can use either the FV or the PV formula. Both will give the same answer since they are the inverse of each other. We will use the FV formula, that is: FV = PV(1 + r) t Solving for t, we get: t = ln(FV / PV) / ln(1 + r) t = ln($75,000 / $10,000) / ln(1.11) = 19.31 So, the money must be invested for 19.31 years. However, you will not receive the money for another two years. From now, you’ll wait: 2 years + 19.31 years = 21.31 years CH6 16,24,27,42,58 16. For this problem, we simply need to find the FV of a lump sum using the equation: FV = PV(1 + r) t 2 / 17 It is important to note that compounding occurs semiannually. To account for this, we will divide the interest rate by two (the number of compounding periods in a year), and multiply the number of periods by two. Doing so, we get: FV = $2,100[1 + (.084/2)] 34 = $8,505.93 24. This problem requires us to find the FV A. The equation to find the FV A is: FV A = C{[(1 + r) t – 1] / r} FV A = $300[{[1 + (.10/12) ] 360 – 1} / (.10/12)] = $678,146.38 27. The cash flows are annual and the compounding period is quarterly, so we need to calculate the EAR to make the interest rate comparable with the timing of the cash flows. Using the equation for the EAR, we get: EAR = [1 + (APR / m)] m – 1 EAR = [1 + (.11/4)] 4 – 1 = .1146 or 11.46% And now we use the EAR to find the PV of each cash flow as a lump sum and add them together: PV = $725 / 1.1146 + $980 / 1.1146 2 + $1,360 / 1.1146 4 = $2,320.36 42. The amount of principal paid on the loan is the PV of the monthly payments you make. So, the present value of the $1,150 monthly payments is: PV A = $1,150[(1 – {1 / [1 + (.0635/12)]} 360 ) / (.0635/12)] = $184,817.42 The monthly payments of $1,150 will amount to a principal payment of $184,817.42. The amount of principal you will still owe is: $240,000 – 184,817.42 = $55,182.58 This remaining principal amount will increase at the interest rate on the loan until the end of the loan period. So the balloon payment in 30 years, which is the FV of the remaining principal will be: Balloon payment = $55,182.58[1 + (.0635/12)] 360 = $368,936.54 58. To answer this question, we should find the PV of both options, and compare them. Since we are purchasing the car, the lowest PV is the best option. The PV of the leasing is simply the PV of the lease payments, plus the $99. The interest rate we would use for the leasing option is the same as the interest rate of the loan. The PV of leasing is: PV = $99 + $450{1 –[1 / (1 + .07/12) 12(3) ]} / (.07/12) = $14,672.91 The PV of purchasing the car is the current price of the car minus the PV of the resale price. The PV of the resale price is: PV = $23,000 / [1 + (.07/12)] 12(3) = $18,654.82 The PV of the decision to purchase is: $32,000 – 18,654.82 = $13,345.18 3 / 17 In this case, it is cheaper to buy the car than leasing it since the PV of the purchase cash flows is lower. To find the breakeven resale price, we need to find the resale price that makes the PV of the two options the same. In other words, the PV of the decision to buy should be: $32,000 – PV of resale price = $14,672.91 PV of resale price = $17,327.09 The resale price that would make the PV of the lease versus buy decision is the FV ofthis value, so: Breakeven resale price = $17,327.09[1 + (.07/12)] 12(3) = $21,363.01 CH7 3,18,21,22,31 3. The price of any bond is the PV of the interest payment, plus the PV of the par value. Notice this problem assumes an annual coupon. The price of the bond will be: P = $75({1 – [1/(1 + .0875)] 10 } / .0875) + $1,000[1 / (1 + .0875) 10 ] = $918.89 We would like to introduce shorthand notation here. Rather than write (or type, as the case may be) the entire equation for the PV of a lump sum, or the PV A equation, it is common to abbreviate the equations as: PVIF R,t = 1 / (1 + r) t which stands for Present V alue Interest Factor PVIFA R,t = ({1 – [1/(1 + r)] t } / r ) which stands for Present V alue Interest Factor of an Annuity These abbreviations are short hand notation for the equations in which the interest rate and the number of periods are substituted into the equation and solved. We will use this shorthand notation in remainder of the solutions key. 18. The bond price equation for this bond is: P 0 = $1,068 = $46(PVIFA R%,18 ) + $1,000(PVIF R%,18 ) Using a spreadsheet, financial calculator, or trial and error we find: R = 4.06% This is thesemiannual interest rate, so the YTM is: YTM = 2 4.06% = 8.12% The current yield is:Current yield = Annual coupon payment / Price = $92 / $1,068 = .0861 or 8.61% The effective annual yield is the same as the EAR, so using the EAR equation from the previous chapter: Effective annual yield = (1 + 0.0406) 2 – 1 = .0829 or 8.29% 20. Accrued interest is the coupon payment for the period times the fraction of the period that has passed since the last coupon payment. Since we have a semiannual coupon bond, the coupon payment per six months is one-half of the annual coupon payment. There are four months until the next coupon payment, so two months have passed since the last coupon payment. The accrued interest for the bond is: Accrued interest = $74/2 × 2/6 = $12.33 And we calculate the clean price as: 4 / 17 Clean price = Dirty price –Accrued interest = $968 –12.33 = $955.67 21. Accrued interest is the coupon payment for the period times the fraction of the period that has passed since the last coupon payment. Since we have a semiannual coupon bond, the coupon payment per six months is one-half of the annual coupon payment. There are two months until the next coupon payment, so four months have passed since the last coupon payment. The accrued interest for the bond is: Accrued interest = $68/2 × 4/6 = $22.67 And we calculate the dirty price as: Dirty price = Clean price + Accrued interest = $1,073 + 22.67 = $1,095.67 22. To find the number of years to maturity for the bond, we need to find the price of the bond. Since we already have the coupon rate, we can use the bond price equation, and solve for the number of years to maturity. We are given the current yield of the bond, so we can calculate the price as: Current yield = .0755 = $80/P 0 P 0 = $80/.0755 = $1,059.60 Now that we have the price of the bond, the bond price equation is: P = $1,059.60 = $80[(1 – (1/1.072) t ) / .072 ] + $1,000/1.072 t We can solve this equation for t as follows: $1,059.60(1.072) t = $1,111.11(1.072) t –1,111.11 + 1,000 111.11 = 51.51(1.072) t2.1570 = 1.072 t t = log 2.1570 / log 1.072 = 11.06 11 years The bond has 11 years to maturity.31. The price of any bond (or financial instrument) is the PV of the future cash flows. Even though Bond M makes different coupons payments, to find the price of the bond, we just find the PV of the cash flows. The PV of the cash flows for Bond M is: P M = $1,100(PVIFA 3.5%,16 )(PVIF 3.5%,12 ) + $1,400(PVIFA3.5%,12 )(PVIF 3.5%,28 ) + $20,000(PVIF 3.5%,40 ) P M = $19,018.78 Notice that for the coupon payments of $1,400, we found the PV A for the coupon payments, and then discounted the lump sum back to today. Bond N is a zero coupon bond with a $20,000 par value, therefore, the price of the bond is the PV of the par, or: P N = $20,000(PVIF3.5%,40 ) = $5,051.45 CH8 4,18,20,22,244. Using the constant growth model, we find the price of the stock today is: P 0 = D 1 / (R – g) = $3.04 / (.11 – .038) = $42.22 5 / 17 18. The price of a share of preferred stock is the dividend payment divided by the required return. We know the dividend payment in Year 20, so we can find the price of the stock in Y ear 19, one year before the first dividend payment. Doing so, we get: P 19 = $20.00 / .064 P 19 = $312.50 The price of the stock today is the PV of the stock price in the future, so the price today will be: P 0 = $312.50 / (1.064) 19 P 0 = $96.15 20. We can use the two-stage dividend growth model for this problem, which is: P 0 = [D 0 (1 + g 1 )/(R – g 1 )]{1 – [(1 + g 1 )/(1 + R)] T }+ [(1 + g 1 )/(1 + R)] T [D 0 (1 + g 2 )/(R –g 2 )] P0 = [$1.25(1.28)/(.13 –.28)][1 –(1.28/1.13) 8 ] + [(1.28)/(1.13)] 8 [$1.25(1.06)/(.13 – .06)] P 0 = $69.55 22. We are asked to find the dividend yield and capital gains yield for each of the stocks. All of the stocks have a 15 percent required return, which is the sum of the dividend yield and the capital gains yield. To find the components of the total return, we need to find the stock price for each stock. Using this stock price and the dividend, we can calculate the dividend yield. The capital gains yield for the stock will be the total return (required return) minus the dividend yield. W: P 0 = D 0 (1 + g) / (R – g) = $4.50(1.10)/(.19 – .10) = $55.00 Dividend yield = D 1 /P 0 = $4.50(1.10)/$55.00 = .09 or 9% Capital gains yield = .19 – .09 = .10 or 10% X: P 0 = D 0 (1 + g) / (R – g) = $4.50/(.19 – 0) = $23.68 Dividend yield = D 1 /P 0 = $4.50/$23.68 = .19 or 19% Capital gains yield = .19 – .19 = 0% Y: P 0 = D 0 (1 + g) / (R – g) = $4.50(1 – .05)/(.19 + .05) = $17.81 Dividend yield = D 1 /P 0 = $4.50(0.95)/$17.81 = .24 or 24% Capital gains yield = .19 – .24 = –.05 or –5% Z: P 2 = D 2 (1 + g) / (R – g) = D 0 (1 + g 1 ) 2 (1 +g 2 )/(R – g 2 ) = $4.50(1.20) 2 (1.12)/(.19 – .12) = $103.68 P 0 = $4.50 (1.20) / (1.19) + $4.50(1.20) 2 / (1.19) 2 + $103.68 / (1.19) 2 = $82.33 Dividend yield = D 1 /P 0 = $4.50(1.20)/$82.33 = .066 or 6.6% Capital gains yield = .19 – .066 = .124 or 12.4% In all cases, the required return is 19%, but the return is distributed differently between current income and capital gains. High growth stocks have an appreciable capital gains component but a relatively small current income yield; conversely, mature, negative-growth stocks provide a high current income but also price depreciation over time. 24. Here we have a stock with supernormal growth, but the dividend growth changes every year for the first four years. We can find the price of the stock in Y ear 3 since the dividend growth rate is constant after the third dividend. The price of the stock in Y ear 3 will be the dividend in Y ear 4, divided by the required return minus the constant dividend growth rate. So, the price in Y ear 3 will be: 6 / 17 P3 = $2.45(1.20)(1.15)(1.10)(1.05) / (.11 – .05) = $65.08 The price of the stock today will be the PV of the first three dividends, plus the PV of the stock price in Y ear 3, so: P 0 = $2.45(1.20)/(1.11) + $2.45(1.20)(1.15)/1.11 2 + $2.45(1.20)(1.15)(1.10)/1.11 3 + $65.08/1.11 3 P 0 = $55.70 CH9 3,4,6,9,15 3. Project A has cash flows of $19,000 in Y ear 1, so the cash flows are short by $21,000 of recapturing the initial investment, so the payback for Project A is: Payback = 1 + ($21,000 / $25,000) = 1.84 years Project B has cash flows of: Cash flows = $14,000 + 17,000 + 24,000 = $55,000 during this first three years. The cash flows are still short by $5,000 of recapturing the initial investment, so the payback for Project B is: B: Payback = 3 + ($5,000 / $270,000) = 3.019 years Using the payback criterion and a cutoff of 3 years, accept project A and reject project B. 4. When we use discounted payback, we need to find the value of all cash flows today. The value today of the project cash flows for the first four years is: V alue today of Y ear 1 cash flow = $4,200/1.14 = $3,684.21 V alue today of Y ear 2 cash flow = $5,300/1.14 2 = $4,078.18 V alue today of Y ear 3 cash flow = $6,100/1.14 3 = $4,117.33 V alue today of Y ear 4 cash flow = $7,400/1.14 4 = $4,381.39 To findthe discounted payback, we use these values to find the payback period. The discounted first year cash flow is $3,684.21, so the discounted payback for a $7,000 initial cost is: Discounted payback = 1 + ($7,000 – 3,684.21)/$4,078.18 = 1.81 years For an initial cost of $10,000, the discounted payback is: Discounted payback = 2 + ($10,000 –3,684.21 –4,078.18)/$4,117.33 = 2.54 years Notice the calculation of discounted payback. We know the payback period is between two and three years, so we subtract the discounted values of the Y ear 1 and Y ear 2 cash flows from the initial cost. This is the numerator, which is the discounted amount we still need to make to recover our initial investment. We divide this amount by the discounted amount we will earn in Y ear 3 to get the fractional portion of the discounted payback. If the initial cost is $13,000, the discounted payback is: Discounted payback = 3 + ($13,000 – 3,684.21 – 4,078.18 – 4,117.33) / $4,381.39 = 3.26 years 7 / 17 6. Our definition of AAR is the average net income divided by the average book value. The average net income for this project is: A verage net income = ($1,938,200 + 2,201,600 + 1,876,000 + 1,329,500) / 4 = $1,836,325 And the average book value is: A verage book value = ($15,000,000 + 0) / 2 = $7,500,000 So, the AAR for this project is: AAR = A verage net income / A verage book value = $1,836,325 / $7,500,000 = .2448 or 24.48% 9. The NPV of a project is the PV of the outflows minus the PV of the inflows. Since the cash inflows are an annuity, the equation for the NPV of this project at an 8 percent required return is: NPV = –$138,000 + $28,500(PVIFA 8%, 9 ) = $40,036.31 At an 8 percent required return, the NPV is positive, so we would accept the project. The equation for the NPV of the project at a 20 percent required return is: NPV = –$138,000 + $28,500(PVIFA 20%, 9 ) = –$23,117.45 At a 20 percent required return, the NPV is negative, so we would reject the project. We would be indifferent to the project if the required return was equal to the IRR of the project, since at that required return the NPV is zero. The IRR of the project is: 0 = –$138,000 + $28,500(PVIFA IRR, 9 ) IRR = 14.59% 15. The profitability index is defined as the PV of the cash inflows divided by the PV of the cash outflows. The equation for the profitability index at a required return of 10 percent is: PI = [$7,300/1.1 + $6,900/1.1 2 + $5,700/1.1 3 ] / $14,000 = 1.187 The equation for the profitability index at a required return of 15 percent is: PI = [$7,300/1.15 + $6,900/1.15 2 + $5,700/1.15 3 ] / $14,000 = 1.094 The equation for the profitability index at a required return of 22 percent is: PI = [$7,300/1.22 + $6,900/1.22 2 + $5,700/1.22 3 ] / $14,000 = 0.983 8 / 17 We would accept the project if the required return were 10 percent or 15 percent since the PI is greater than one. We would reject the project if the required return were 22 percent since the PI。

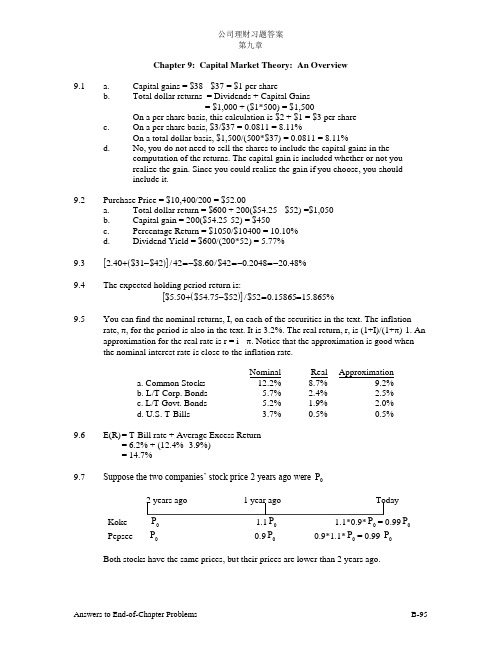

罗斯《公司理财》英文习题答案DOCchap009

公司理财习题答案第九章Chapter 9: Capital Market Theory: An Overview9.1 a. Capital gains = $38 - $37 = $1 per shareb. Total dollar returns = Dividends + Capital Gains = $1,000 + ($1*500) = $1,500On a per share basis, this calculation is $2 + $1 = $3 per share c. On a per share basis, $3/$37 = 0.0811 = 8.11%On a total dollar basis, $1,500/(500*$37) = 0.0811 = 8.11%d. No, you do not need to sell the shares to include the capital gains in the computation of the returns. The capital gain is included whether or not you realize the gain. Since you could realize the gain if you choose, you shouldinclude it.9.2 Purchase Price = $10,400/200 = $52.00 a. Total dollar return = $600 + 200($54.25 - $52) =$1,050 b. Capital gain = 200($54.25-52) = $450 c. Percentage Return = $1050/$10400 = 10.10% d. Dividend Yield = $600/(200*52) = 5.77%9.3 ()[]2.40$31$42/42$8.60/$420.204820.48%+-=-=-=-9.4 The expected holding period return is:()[]$5.50$54.75$52/$520.1586515.865%+-== 9.5 You can find the nominal returns, I, on each of the securities in the text. The inflationrate, π, for the period is also in the text. It is 3.2%. The real return, r, is (1+I)/(1+π)-1. An approximation for the real rate is r = i - π. Notice that the approximation is good when the nominal interest rate is close to the inflation rate.Nominal Real Approximationa. Common Stocks 12.2% 8.7% 9.2%b. L/T Corp. Bonds 5.7% 2.4% 2.5%c. L/T Govt. Bonds 5.2% 1.9% 2.0%d. U.S. T-Bills3.7%0.5%0.5%9.6 E(R) = T-Bill rate + Average Excess Return = 6.2% + (12.4% -3.9%) = 14.7% 9.7 Suppose the two companies’ stock price 2 years ago were P 02 years ago 1 year ago TodayKoke P 0 1.1P 0 1.1*0.9*P 0= 0.99P 0 Pepsee P 0 0.9P 0 0.9*1.1*P 0= 0.99 P 0Both stocks have the same prices, but their prices are lower than 2 years ago.9.8 Five-year Holding Period Return = (1-0.0491)⨯(1+0.2141)⨯(1+0.2251)⨯(1+0.0627)⨯(1+0.3216)-1 = 98.64% 9.9 Risk Premium = 6.1 - 3.8 = 2.3%Expected Return on the market long term corporate bonds = 4.36% + 2.3% = 6.96%9.10 159.07199.0301.0164.0047.0438.001.0026.0R .a =+++++--=b. R R R - ()R R -2-0.026 -0.1850.03423 -0.010 -0.169 0.02856 0.438 0.279 0.07784 0.047 -0.112 0.01254 0.164 0.005 0.00003 0.301 0.142 0.02016 0.199 0.0400.00160Total 0.17496 ()σσ2=-====0.17496/710.029160.029160.170817.08%Note, because the data are historical data, the appropriate denominator in the calculation of the variance is N-1. 9.11 a. Common Treasury Realized Stocks BillsRisk Premium-7 32.4% 11.2% 21.2% -6 -4.9 14.7 -19.6 -5 21.4 10.5 10.9 -4 22.5 8.8 13.7 -3 6.3 9.9 -3.6 -2 32.2 7.7 24.5Last18.56.212.3b.The average risk premium is 8.49%.49.873.125.246.37.139.106.192.21=++-++-c.Yes, it is possible for the observed risk premium to be negative. This can happen in any single year. The average risk premium over many years should bepositive.公司理财习题答案第九章9.12 a.b.Standard deviation = 03311.0001096.0= 9.13a.b.Standard deviation = 0000984.= 0.03137 = 3.137%9.14 a. R 0.120.230.400.180.250.150.150.090.080.030.153 =15.3%m =⨯+⨯+⨯+⨯+⨯=b.()R 0.120.120.400.090.250.050.150.010.080.020.0628 = 6.28%T =⨯+⨯+⨯+⨯+⨯-=9.15 a.()()R 0.040.060.090.04/40.0575R 0.050.070.100.14/40.09p Q =+++==+++=b.R R p p -()R R p p -2-0.0175 0.00031 -0.0025 0.00001 +0.0325 0.00106 -0.0175 0.000310.00169Variance of R p ==0001694000042./.Standard Deviation of 02049.000042.0R p==()R R R R Q QQ Q--2-0.04 0.0016 -0.02 0.0004 0.01 0.0001 0.05 0.0025 0.0046Variance of R Q ==000464000115./.Standard Deviation of R Q ==000115003391..9.16 S R = Average Return on the Small Company Stocks.mR= Average Return on the Market Index. 2S S = Variance in the Returns of the Small Company Stocks.S S = Standard Deviation in the Returns of the Small Company Stocks. 2m S = Variance in the Returns of the Market Index.m S = Standard Deviation in the Returns of the Market Index.a. S R = 1542.05005.0350.0339.0477.0=--+mR=1604.05004.0328.0580.0648.0402.0=++-+公司理财习题答案第九章b. Small Company StocksMarket IndexR R s s - ()R R s s -2R R m m - ()R R m m -20.3228 0.104199840.2416 0.058370560.1848 0.03415104 0.4876 0.23775376 -0.5042 0.25421764 -0.7404 0.54819216 0.1558 0.02427364 0.1676 0.02808976 -0.1592 0.02534464 -0.1564 0.02446096Total =0.896867200.473520.2242168m s 0.332490.1105467s s 0.2242168/40.896867202ms0.1105467/40.442186802ss========Note, because the data are historical returns, the appropriate denominator in the calculation of the variance is N-1.9.17Let R cs = The Returns on Common Stocks (in %) Let R ss = The Returns on Small Stocks (in %)Let R cb = The Returns on Long-term Corporate Bonds (in %) Let R gb = The Returns on Long- term Government Bonds (in %) Let R tb = The Returns on Treasury Bills (in %) Let – over a variable denote its average valueBecause these data are historical data, the proper divisor for computing the variance is N-1. Thus, the variance of the returns of each security is the sum of the squared deviations divided by six.Var ( Rcs ) = 0.018372 SD ( Rcs) = 0.1355Var ( Rss ) = 0.029734 SD ( Rss) = 0.1724Var ( Rcb ) = 0.029522 SD ( Rcb) = 0.1718Var ( Rgb ) = 0.02868 SD ( Rgb) = 0.16935Var ( Rtb ) = 0.00075 SD ( Rtb) = 0.027479.18 a. The average return on small company stocks isRs=(6.85-9.30+22.87+10.18-21.56+44.63)%/6 = 8.95% The average return on T-bills is:()R 6.16 5.47 6.358.377.81 5.60/6 6.63%T=+++++=公司理财习题答案第九章b.c. Returns on T-bills are lower than small stock returns but their variance is muchsmaller.9.19 The range with 95% probability is: []σσ,22-+M ean M ean⇒[ 17.5-2⨯ 8.5, 17.5+2⨯8.5]⇒[ 0.5%, 34.5%]9.20 a. Expected Return on the Market:= 0.25(-8.2%)+0.5(12.3%)+0.25(25.8%)= 10.55%Expected Return on T-Bills: = 3.5%b. Expected Premium = 0.25(-8.2-3.5)+0.5(12.3-3.5)+0.25(25.8-3.5) = 7.05%。

罗斯《公司理财》英文习题答案DOCchap014