宏观经济学期末考试试卷(附答案)

宏观经济学试卷(附有答案)

«宏观经济学»期末考试试卷 A 卷姓名:学号:成绩:一、名词解释(每题4分,共20分)1、凯恩斯流动性陷阱2、菲利普斯曲线3、货币政策4、挤出效应5、名义GDP二、单项选择题(每题1分,共20分)1、在四部门经济中,GDP是指()的总和。

A.消费、净投资、政府购买和净出口B.消费、总投资、政府购买和净出口C.消费、总投资、政府购买和总出口D.消费、净投资、政府购买和总出口2、关于投资与利率的关系,以下判断正确的是()。

A.投资是利率的增函数B.投资是利率的减函数C.投资与利率是非相关关系D.以上判断都不正确3、IS曲线与LM曲线相交时表示()。

A.产品市场处于均衡状态,而货币市场处于非均衡状态B.产品市场处于非均衡状态,而货币市场处于均衡状态C.产品市场与货币市场都处于均衡状态D.产品市场与货币市场都处于非均衡状态4、抑制需求拉上的通货膨胀,应该()。

A.降低工资B.减税C.控制货币供给量D解除托拉斯组织5、在其他条件不变的情况下,政府购买增加会使IS曲线()。

A.向左移动B.向右移动C.保持不变D.发生转动6、一国贸易盈余表示该国()。

A.消费超过产出并且净出口盈余B.消费超过产出并且净出口赤字C.消费低于产出并且净出口盈余D.消费低于产出并且净出口赤字7、在两部门经济模型中,如果边际消费倾向值为0.8,那么自发支出乘数值应该是()。

A.4B.2.5C.5D.1.68、如果中央银行采取扩张性的货币政策,可以()。

A.在公开市场买入债券,以减少商业银行的准备金,促使利率上升B.在公开市场卖出债券,以增加商业银行的准备金,促使利率下跌C.在公开市场买入债券,以增加商业银行的准备金,促使利率下跌D.在公开市场卖出债券,以减少商业银行的准备金,促使利率上升9、已知,C=3000亿元,I=800亿元,G=960亿元,X=200亿元,M=160亿元,折旧=400亿元,则()不正确。

A.净出口=40亿元B.NDP=4400亿元C. GDP=3800亿元D.GDP=4800亿元10、按百分比计算,如果名义GDP上升()价格上升的幅度,则实际GDP将()。

《宏观经济学》期末考试复习题附答案(参考)

一、单项选择第十二章国民收入核算1.下列关于GDP说法正确的是(③)①一年内一个国家范围内的所有交易的市场价值②一年内一个国家范围内交换的所有最终商品和劳务的市场价值③一年内一个国家范围内生产的所有最终商品和劳务的市场价值④一年内一个国家范围内交换的所有商品和劳务的市场价值2.某人收入为1000元,个人所得税200元,政府补助150元,则个人可支配收入为(②)① 1350元② 950元③ 650元④ 1050元3.下列将计入当年GDP的一项是(③)①某人花10万元购买一辆二手汽车②面包厂购买的面粉③某企业当年生产没有卖掉的20万元产品④家庭妇女在家从事家务劳动4.如果一个社会体系的消费支出为9亿元,投资支出为1.2亿元,间接税为1亿元,政府用于商品和劳务的支出为2.5亿元,出口额为 3亿元,进口额为1.8亿元,则下列正确的是(①)① GDP为13.9亿元② GDP为12.9亿元③ NDP为13.9亿元④ NDP为12.9亿元5.一国的GNP小于GDP,说明该国公民从国外取得的产值( B )外国公民从该国取得的产值。

A、大于B、小于C、等于D、可能大于也可能小于6.今年名义GDP大于去年的名义GDP,说明( D )A、今年的物价水平一定比去年高了B、今年生产的物品和劳务总量一定比去年增加了C、今年的物价水平和实物产量水平一定都比去年提高了D、以上三种说法都不一定正确。

7.在一般情况下,国民收入核算体系中,数值最小的是( C )A、国民生产净值;B、个人收入;C、个人可支配收入;D、国民收入8、一国国内在一定时期内生产的所有最终产品和劳务的市场价值根据价格变化调整后的数值被称为( B )A、国民生产净值;B、实际国内生产总值;C、名义国内生产总值;D、潜在国内生产总值9、在统计中,社会保险税增加对( D )项有影响。

A、国内生产总值(GDP);B、国内生产净值(NDP);C、国民收入(NI);D、个人收入(PI)。

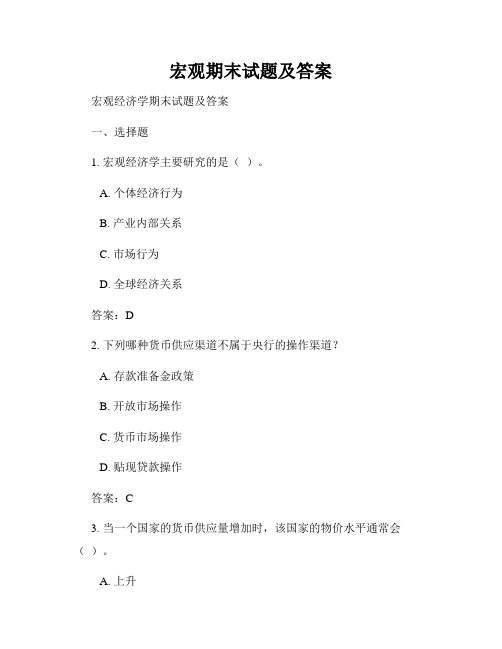

宏观期末试题及答案

宏观期末试题及答案宏观经济学期末试题及答案一、选择题1. 宏观经济学主要研究的是()。

A. 个体经济行为B. 产业内部关系C. 市场行为D. 全球经济关系答案:D2. 下列哪种货币供应渠道不属于央行的操作渠道?A. 存款准备金政策B. 开放市场操作C. 货币市场操作D. 贴现贷款操作答案:C3. 当一个国家的货币供应量增加时,该国家的物价水平通常会()。

A. 上升B. 下降C. 保持不变D. 波动答案:A4. 经济增长率的计算公式是()。

A. (GDPt - GDPt-1)/GDPt-1 × 100%B. (GDPt-1 - GDPt)/GDPt-1 × 100%C. (GDPt - GDPt-1)/GDPt × 100%D. (GDPt-1 - GDPt)/GDPt × 100%答案:A5. 下列哪种货币政策工具可以用于调控通货膨胀?A. 货币供应量B. 货币利率C. 外汇储备D. 货币市场利率答案:B二、简答题1. 请解释货币的三个职能。

货币的三个职能分别是价值尺度、流通手段和储藏手段。

首先,货币作为价值尺度,可以衡量和比较各种商品和服务的价值。

其次,货币作为流通手段,可以在市场上作为交换媒介,方便商品和服务的买卖交易。

最后,货币作为储藏手段,人们可以将其储存起来,以备将来使用。

2. 请解释通货膨胀对经济的影响。

通货膨胀对经济的影响有以下几方面:首先,通货膨胀会降低货币的购买力,导致物价上涨,减少人们的消费能力和生活水平。

其次,通货膨胀会扭曲资源配置,由于价格上涨,生产成本增加,导致企业投资意愿下降,影响经济的正常运行。

此外,通货膨胀还会引发收入分配的不平等,对固定收入者和储蓄者造成损失,而对资产持有者带来收益。

最后,通货膨胀会削弱国家货币的国际竞争力,影响国际贸易和债务偿还。

三、论述题中国经济的供给侧结构性改革供给侧结构性改革是指通过改善生产力和供给效率,推动经济结构转型升级的一种改革方式。

宏观经济学期末试卷及答案

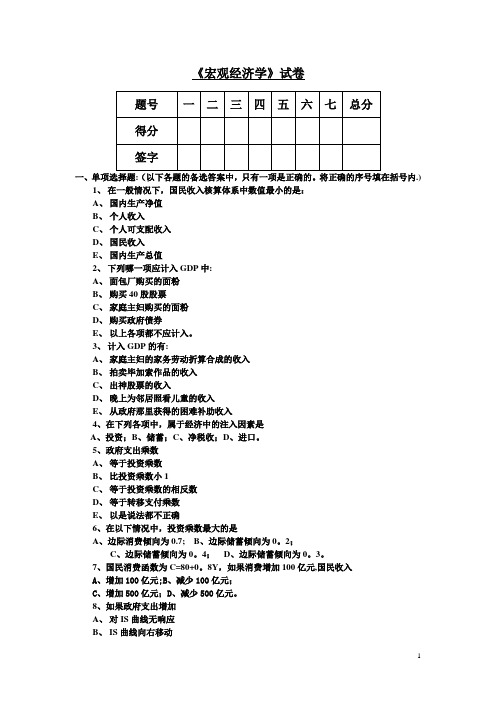

《宏观经济学》试卷一、单项选择题:(以下各题的备选答案中,只有一项是正确的。

将正确的序号填在括号内.)1、在一般情况下,国民收入核算体系中数值最小的是:A、国内生产净值B、个人收入C、个人可支配收入D、国民收入E、国内生产总值2、下列哪一项应计入GDP中:A、面包厂购买的面粉B、购买40股股票C、家庭主妇购买的面粉D、购买政府债券E、以上各项都不应计入。

3、计入GDP的有:A、家庭主妇的家务劳动折算合成的收入B、拍卖毕加索作品的收入C、出神股票的收入D、晚上为邻居照看儿童的收入E、从政府那里获得的困难补助收入4、在下列各项中,属于经济中的注入因素是A、投资;B、储蓄;C、净税收;D、进口。

5、政府支出乘数A、等于投资乘数B、比投资乘数小1C、等于投资乘数的相反数D、等于转移支付乘数E、以是说法都不正确6、在以下情况中,投资乘数最大的是A、边际消费倾向为0.7;B、边际储蓄倾向为0。

2;C、边际储蓄倾向为0。

4;D、边际储蓄倾向为0。

3。

7、国民消费函数为C=80+0。

8Y,如果消费增加100亿元,国民收入A、增加100亿元;B、减少100亿元;C、增加500亿元;D、减少500亿元。

8、如果政府支出增加A、对IS曲线无响应B、IS曲线向右移动C、IS曲线向左移动D、以上说法都不正确9、政府税收的增加将A、对IS曲线无响应B、IS曲线向右移动C、IS曲线向左移动D、以上说法都不正确10、位于IS曲线左下方的收入与利率的组合,都是A、投资大于储蓄;B、投资小于储蓄;C、投资等于储蓄;D、无法确定。

11、当经济中未达到充分就业时,如果LM曲线不变,政府支出增加会导致A、收入增加、利率上升;B、收入增加、利率下降;C、收入减少、利率上升;D、收入减少、利率下降.12、一般地,在IS曲线不变时,货币供给减少会导致A、收入增加、利率上升;B、收入增加、利率下降;C、收入减少、利率上升;D、收入减少、利率下降。

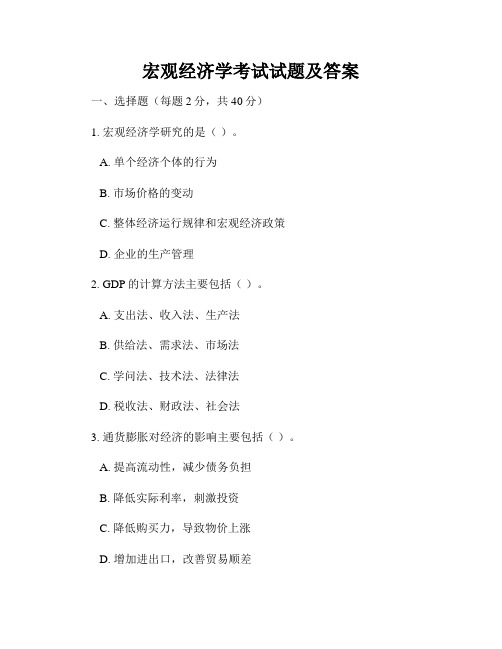

宏观经济学考试试题及答案

宏观经济学考试试题及答案一、选择题(每题2分,共40分)1. 宏观经济学研究的是()。

A. 单个经济个体的行为B. 市场价格的变动C. 整体经济运行规律和宏观经济政策D. 企业的生产管理2. GDP的计算方法主要包括()。

A. 支出法、收入法、生产法B. 供给法、需求法、市场法C. 学问法、技术法、法律法D. 税收法、财政法、社会法3. 通货膨胀对经济的影响主要包括()。

A. 提高流动性,减少债务负担B. 降低实际利率,刺激投资C. 降低购买力,导致物价上涨D. 增加进出口,改善贸易顺差4. 央行采取货币紧缩政策的目的是()。

A. 刺激经济增长,促进就业B. 降低通货膨胀压力C. 扩大货币供应,增加消费D. 促进消费升级,提高人民生活水平5. 短期经济波动主要是由()引起的。

A. 消费者需求的变化B. 政府宏观调控的效果C. 经济周期的波动D. 外部环境的变化二、填空题(每题2分,共20分)6. 宏观经济学研究的三大核心变量是()、()和()。

7. 当央行降低存款准备金率时,货币供应量()。

8. 名义利率等于实际利率加上()。

9. 通货膨胀率的计算公式是()。

10. 净出口等于出口减去()。

三、简答题(每题10分,共40分)11. 请简述宏观经济学研究的基本问题是什么?12. 什么是经济增长?列举两个促进经济增长的因素。

13. 请解释货币的三个职能分别是什么?14. 列举并解释四个影响经济增长的要素。

15. 描述央行在宏观经济调控中的作用和手段。

四、论述题(共40分)16. 请论述中国宏观经济面临的主要问题及应对策略。

参考答案:一、选择题答案:1. C2. A3. C4. B5. C二、填空题答案:6. GDP、失业率、通货膨胀率7. 增加8. 通货膨胀率9. 通货膨胀率=(今年物价指数-去年物价指数)/去年物价指数×100%10. 进口三、简答题答案:11. 宏观经济学的基本问题包括经济增长、就业与失业、通货膨胀与通货紧缩、国际收支平衡等。

宏观经济学期末试卷和答案

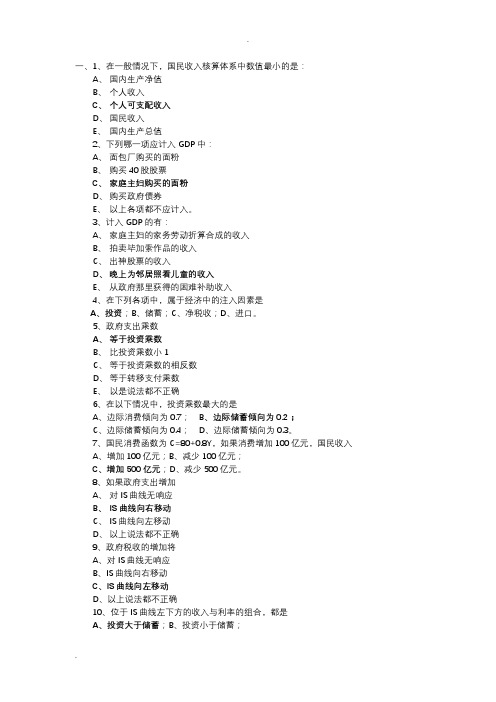

一、1、在一般情况下,国民收入核算体系中数值最小的是:A、国内生产净值B、个人收入C、个人可支配收入D、国民收入E、国内生产总值2、下列哪一项应计入GDP中:A、面包厂购买的面粉B、购买40股股票C、家庭主妇购买的面粉D、购买政府债券E、以上各项都不应计入。

3、计入GDP的有:A、家庭主妇的家务劳动折算合成的收入B、拍卖毕加索作品的收入C、出神股票的收入D、晚上为邻居照看儿童的收入E、从政府那里获得的困难补助收入4、在下列各项中,属于经济中的注入因素是A、投资;B、储蓄;C、净税收;D、进口。

5、政府支出乘数A、等于投资乘数B、比投资乘数小1C、等于投资乘数的相反数D、等于转移支付乘数E、以是说法都不正确6、在以下情况中,投资乘数最大的是A、边际消费倾向为0.7;B、边际储蓄倾向为0.2;C、边际储蓄倾向为0.4;D、边际储蓄倾向为0.3。

7、国民消费函数为C=80+0.8Y,如果消费增加100亿元,国民收入A、增加100亿元;B、减少100亿元;C、增加500亿元;D、减少500亿元。

8、如果政府支出增加A、对IS曲线无响应B、IS曲线向右移动C、IS曲线向左移动D、以上说法都不正确9、政府税收的增加将A、对IS曲线无响应B、IS曲线向右移动C、IS曲线向左移动D、以上说法都不正确10、位于IS曲线左下方的收入与利率的组合,都是A、投资大于储蓄;B、投资小于储蓄;C、投资等于储蓄;D、无法确定。

11、当经济中未达到充分就业时,如果LM曲线不变,政府支出增加会导致A、收入增加、利率上升;B、收入增加、利率下降;C、收入减少、利率上升;D、收入减少、利率下降。

12、一般地,在IS曲线不变时,货币供给减少会导致A、收入增加、利率上升;B、收入增加、利率下降;C、收入减少、利率上升;D、收入减少、利率下降。

13、如果现行产出水平为10万亿元,总需求为8万亿,可以断定,若经济不是充分就业,那么:A、就业水平将下降B、收入水平将上升C、收入和就业水平将均衡D、就业量将上升E、就业水平将上升,收入将下降14、在流动陷阱(凯恩斯陷阱)中A、货币政策和财政政策都十分有效B、货币政策和财政政策都无效C、货币政策无效,财政政策有效D、货币政策有效,财政政策无效E、以上说法都不正确15、如果实施扩张性的货币政策,中央银行可采取的措施是A、卖出国债;B、提高法定准备金比率;C、降低再贴现率;D、提高再贴现率;16、如果名义利率为6%,通货膨胀率为12%,那么实际利率是A、6%;B、18%;C、12%;D、-6%。

宏观经济学期末考试试题(含答案)

《宏观经济学》期末考试试题一、判断题(对的写“T”,错的写“F”;每小题1分,共10分)1.人均真实GDP是平均经济福利(生活水平)的主要衡量指标。

2.1963年美国的最低工资水平是每小时1.25美元,而2013年则为7.25美元,因而,在美国拿最低工资的人的生活水平大大提高了。

3.大多数失业是短期的,然而,大多数所观察到的失业是长期的。

4.通货膨胀并没有降低大多数工人的购买力。

5.家庭决定把大部分收入储蓄起来会使总供给曲线向左移动。

6.某人出售一幅旧油画所得到的收入应该计入当年的国内生产总值。

7.无论什么人,只要没有找到工作就是失业。

8.短期总供给不变时,总需求的变动会引起均衡的国内生产总值同方向变动,物价水平反方向变动。

9.扩张性货币政策的实行可以增加货币供给量,从而使利率水平提高。

10.总需求不足时,政府可以提高转移支付水平,以增加社会总需求。

二、简答题(每小题5分,共15分)1.列出并说明生产率的四个决定因素。

2.解释企业通过提高它所支付的工资增加利润的四种可能原因。

3.是什么因素可能引起总需求曲线向左移动?三、应用题(每小题5分,共20分)假设今年的货币供给是5 00亿美元,名义GDP是10万亿美元,而真实GDP是5万亿美元。

1.物价水平是多少?货币流通速度是多少?2.假设货币流通速度是不变的,而每年经济中物品与服务的产出增加5%。

如果美联储保持货币供给不变,明年的名义GDP和物价水平是多少?3.如果美联储想保持物价水平不变,它应该把明年的货币供给设定为多少?4.如果美联储想把通货膨胀率控制在10%,它应该把货币供给设定为多少?四、计算与分析说明题(每小题10分,共30分;要有计算步骤,否则扣分)b.把2015年作为基年,计算各年的真实GDP。

c.与2016年相比,2017年的名义GDP、真实GDP增长率各是多少?名义GDP增长率和真实GDP增长率孰大孰小?解释原因。

2.一个经济在产出低于其自然水平4000亿美元的水平上运行,而且财政政策制定者想弥补这种衰退性缺口。

宏观经济学期末考试试卷及答案

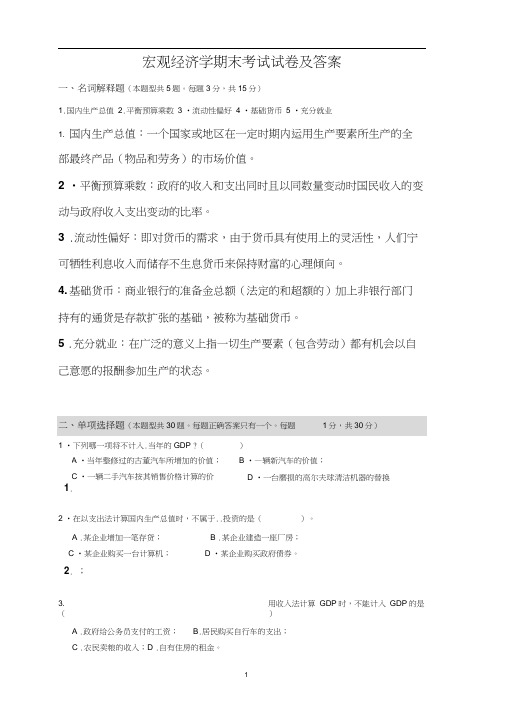

宏观经济学期末考试试卷及答案一、名词解释题(本题型共5题。

每题3分,共15分)1.国内生产总值2.平衡预算乘数 3 •流动性偏好 4 •基础货币 5 •充分就业1. 国内生产总值:一个国家或地区在一定时期内运用生产要素所生产的全部最终产品(物品和劳务)的市场价值。

2 •平衡预算乘数:政府的收入和支出同时且以同数量变动时国民收入的变 动与政府收入支出变动的比率。

3 .流动性偏好:即对货币的需求,由于货币具有使用上的灵活性,人们宁 可牺牲利息收入而储存不生息货币来保持财富的心理倾向。

4. 基础货币:商业银行的准备金总额(法定的和超额的)加上非银行部门 持有的通货是存款扩张的基础,被称为基础货币。

5 .充分就业:在广泛的意义上指一切生产要素(包含劳动)都有机会以自 己意愿的报酬参加生产的状态。

1 •下列哪一项将不计入.当年的GDP ?()1.2 •在以支出法计算国内生产总值时,不属于..投资的是()。

A .某企业增加一笔存货;B .某企业建造一座厂房;C •某企业购买一台计算机;D •某企业购买政府债券。

2. ;3. 用收入法计算 GDP 时,不能计入 GDP 的是()A .政府给公务员支付的工资;B .居民购买自行车的支出;C .农民卖粮的收入;D .自有住房的租金。

A •当年整修过的古董汽车所增加的价值;C •一辆二手汽车按其销售价格计算的价值; B •—辆新汽车的价值;D •一台磨损的高尔夫球清洁机器的替换品。

3. B ;4. 当实际GDP 为1500亿美元,GDP 缩减指数为120时,名义国民收入为:()6.认为消费者不只同现期收入相关,而是以一生或可预期长期收入作为消费决策的消费理论是(6.7.由于价格水平上升,使人们持有的货币及其他资产的实际价值降低,导致人们消费水平减少,这 种效应被称为(9. 在下列情况下,投资乘数最大的是(A . 1100亿美元;B . 1500亿美元;C . 1700亿美元;D . 1800亿美元。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

一、[请单击此处编辑题目] (每小题分,共分)一、选择题(本题包含30小题,每题?分,共?分)1.Real GDPa. evaluates current production at current prices.b. evaluates current production at the prices that prevailed in some specific year inthe past.c. is not a valid measure of the economy's performance, since prices change from yearto year.d. is a measure of the value of goods only, hence, it excludes the value of services.2.The steps involved in calculating the consumer price index include, in order:a. choose a base year, fix the basket, compute the inflation rate, compute the basket'scost, and compute the index.b. choose a base year, find the prices, fix the basket, compute the basket's cost, andcompute the index.c. fix the basket, find the prices, compute the basket's cost, choose a base year andcompute the index.d. fix the basket, find the prices, compute the inflation rate, choose a base year andcompute the index.3.Suppose the price of a quart of milk rises from $1 to $1.25 and the price of a T-shirt rises from $8 to $10. If the CPI rises from 150 to 175 people will likely buya. more milk and more T-shirts.b. more milk and fewer T-shirts.c. less milk and more T-shirts.d. less milk and fewer T-shirts.4.Which of the following is correct?a. Countries with the highest growth rates over the last 100 years are the ones thathad the highest level of real GDP 100 years ago.b. Most countries have had little fluctuation around their average growth ratesduring the past 100 years.c. The ranking of countries by income changes substantially over time.d. Over the last 100 years, Japan had the highest real GDP growth rate, and now has the highest real GDPper person.5.Using the production function and notation in the text, K/L measuresa. natural resources per worker.b. human capital per worker.c. output per worker.d. physical capital per worker.6.Index fundsa. typically have about the same rate of return as more actively managed funds.b. typically have lower rates of return than more actively managed funds.c. contain the stocks and bonds from a single Standard Index Classification of industry.d. typically have higher rates of return than more actively managed funds.7.In a closed economy, national saving equalsa. investment.b. income minus the sum of consumption and government expenditures.c. private saving plus public saving.d. All of the above are correct.8.At which interest rate is the present value of $162.24 two years from today equal to $150 today?a. 4 percentb. 5 percentc. 6 percentd. None of the above are correct to the nearest penny.9.Which of the following is incorrect?a. Frictional unemployment is inevitable in a dynamic economy.b. Although the unemployment created by sectoral shifts is unfortunate, in the long run such changes leadto higher productivity and higher living standards.c. At least 10 percent of U.S. manufacturing jobs are destroyed every year.d. In a typical month more than 5 percent of workers leave their jobs.10.Use the balance sheet for the following question.Last Bank of Cedar BendAssets LiabilitiesReserves $25,000 Deposits $150,000Loans $125,000If the reserve requirement is 10 percent, this banka. is in a position to make a new loan of $15,000.b. has less reserves than required.c. has excess reserves of less than $15,000.d. None of the above are correct.11.Which of the following lists ranks the Fed's monetary policy tools from most to least frequently used?a. discount rate changes, reserve requirement changes, open market transactionsb. reserve requirement changes, open market transactions, discount rate changesc. open market transactions, discount rate changes, reserve requirement changesd. None of the above lists ranks the tools correctly.12.A decrease in the money supply creates an excessa. supply of money that is eliminated by rising prices.b. supply of money that is eliminated by falling prices.c. demand for money that is eliminated by rising prices.d. demand for money that is eliminated by falling prices.13.Given a nominal interest rate of 6 percent, in which case would you earn the lowest after-tax real rate of interest?a. Inflation is 4 percent; the tax rate is 25 percent.b. Inflation is 3 percent; the tax rate is 20 percent.c. Inflation is 2 percent; the tax rate is 15 percent.d. The after-tax real interest rate is the same for all of the above.14.In recent years, U.S. net capital outflow wasa. positive and net exports were negative.b. positive and net exports were positive.c. negative and net exports were negative.d. negative and net exports were positive.15.If a country has business opportunities that are relatively attractive to other countries, we would expect it to havea. both positive net exports and positive net capital outflow.b. both negative net exports and negative net capital outflow.c. positive net exports and negative net capital outflow.d. negative net exports and positive net capital outflow.16.On behalf of your firm, you make frequent trips to Hong Kong. You notice that you always have to pay more dollars to get enough local currency to get your hair styled than you have to pay to get your hair styled in the United States. This isa. inconsistent with purchasing-power parity, but might be explained by limited opportunities forarbitrage in hairstyling across international borders.b. consistent with purchasing-power parity if prices in Hong Kong are rising more rapidly than prices inthe United States.c. consistent with purchasing-power parity if prices in Hong Kong are rising less rapidly than prices in theUnited States.d. None of the above is correct.17.Ceteris paribus, if the Canadian real interest rate were to increase, Canadian net capital outflowa. and net capital outflow of other countries would rise.b. and net capital outflow of other countries would fall.c. would rise, while net capital outflow of other countries would fall.d. would fall, while net capital outflow of other countries would rise.18.If a government increases its budget deficit, then the real exchange ratea. and domestic investment rise.b. and domestic investment fall.c. rises and domestic investment falls.d. falls and domestic investment rises.19.Which of the following is the correct way to show the effects of a new import quota?a. shift the demand for loanable funds right, the supply of dollars for foreign exchange right, and thedemand for dollars leftb. shift the demand for loanable funds right, and the supply of dollars for foreign exchange leftc. shift the demand for dollars for foreign exchange leftd. None of the above is correct.20.A large and sudden movement of funds out of a country is calleda. arbitrage.b. capital flight.c. crowding out.d. capital mobility.21.Aggregate demand shifts right when the governmenta. raises personal income taxes.b. increases the money supply.c. repeals an investment tax credit.d. All of the above are correct.22.If people want to save more for retirementa. or if the government raises taxes, aggregate demand shifts right.b. or if the government raises taxes, aggregate demand shifts left.c. aggregate demand shifts right. If the government raises taxes, aggregate demandshifts left.d. aggregate demand shifts left. If the government raises taxes, aggregate demandshifts right.23.n the mid-1970s the price of oil rose dramatically. Thisa. shifted aggregate supply left.b. caused U.S. prices to fall.c. was the consequence of OPEC increasing oil production.d. All of the above are correct.24.Liquidity refers toa. the relation between the price and interest rate of an asset.b. the risk of an asset relative to its selling price.c. the ease with which an asset is converted into a medium of exchange.d. the sensitivity of investment spending to changes in the interest rate. 25.When the interest rate increases, the opportunity cost of holding moneya. increases, so the quantity of money demanded increases.b. increases, so the quantity of money demanded decreases.c. decreases, so the quantity of money demanded increases.d. decreases, so the quantity of money demanded decreases.26.Which of the following properly describes the interest rate effect?a. As the money supply increases, the interest rate falls, so spending rises.b. As the money supply increases, the interest rate rises, so spending falls.c. As the price level increases, the interest rate falls, so spending rises.d. As the price level increases, the interest rate rises, so spending falls.27.An increase in government spending initially and primarily shiftsa. aggregate demand right.b. aggregate demand left.c. aggregate supply right.d. neither aggregate demand nor aggregate supply.28.The reduction in demand that results when a fiscal expansion raises the interest rate is called thea. multiplier effect.b. crowding-out effect.c. accelerator effect.d. Riccardian equivalence effect.29.One determinant of the natural rate of unemployment is thea. rate of growth of the money supply.b. minimum wage rate.c. expected inflation rate.d. All of the above are correct.30.An increase in the expected rate of inflation shiftsa. only the short-run Phillips curve right.b. only the short-run Phillips curve left.c. both the short-run and long-run Phillips curves to the right.d. both the short-run and long-run Phillips curves to the left.二、判断题(本题包含20小题,每题?分,共?分)T 31.If nominal GDP is 10,000 and real GDP is 8,000 the GDP deflator is 125.F 32.International data on the history of real GDP growth rates shows that the rich countriesget richer and the poor countries get poorer.T 33.One of the reasons that African countries may have grown slower than other countries is that many have high barriers to trade.F 34.When the U.S. government is in debt, it follows that they have a deficit.F 35.The future value of $1 saved today is $1/(1 + r).T 36.The market for insurance is one example of reducing risk by using diversification.F 37.Someone who is without work but is not looking for work would be counted asunemployed by the BLS.T 38.Union workers earn about 10 percent to 20 percent more than similar workers who do not belong to unions.F 39.Because of the multiple tools at its disposal, the Fed is precise in its control of themoney supply.T 40.Inflation distorts savings because people pay taxes on their nominal rather than their real interest income.T 41.In an open economy, U.S. national savings can be less than U.S. investment.F 42.If the real interest rate were above the equilibrium rate, there would be a shortage ofloanable funds.T 43.Although trade policies do not affect a country's overall trade balance, they do affect specific firms and industries.T 44.When output rises, unemployment falls.F 45.The explanations for the slopes of the aggregate demand and aggregate supply curvesare the same as the explanations for the slope of demand and supply curves forspecific goods and services.T 46.A decrease in the price level makes consumers feel wealthier, so they purchase more. This logic helps explain why the aggregate demand curve slopes downward.T 47.In liquidity preference theory, an increase in the interest rate decreases the quantity of money demanded, but does not shift the money demand curve.T 48.In principle the government could increase the money supply or government expenditures to try to offset the effects of a wave of pessimism about the future of the economy.F 49.In the long run, the natural rate of unemployment depends primarily on the growth rate of the moneysupply.F 50.A policy change that reduced the natural rate of unemployment would shift both the long-runaggregate-supply curve and the long-run Phillips curve left.三、名词解释(本题包含5小题,每题?分,共?分)51.human capital:52.exports:53.trade policy:54.aggregate-demand curve:55.crowding-out effect:四、简答题(本题包含8小题,每题?分,共?分)56.Why is productivity related to the standard of living? In your answer be sure to explain what productivity and standard of living mean. Make a list of things that determine labor productivity.57.Draw and label a graph showing equilibrium in the market for loanable funds.58.Founders of the Federal Reserve were concerned that the Fed might form policy favorable to one part of the country or to a particular party. What are some ways that the organization of the Fed reflects suchconcerns?59.Suppose that monetary neutrality holds. Of the following variables, which ones do not change when the money supply increases?a. real interest ratesb. inflationc. the price leveld. real outpute. real wagesf. nominal wages60.The long-run trend in real GDP is upward. How is this possible given business cycles?What explains the upward trend?61.Discuss what economists believe is different about the long and short run.62.Suppose that consumers become pessimistic about the future health of the economy, andso cut back on their consumption spending. What will happen to aggregate demandand to output? What might the president and Congress have to do to keep outputstable?63.Why and in what way are fiscal policy lags different from monetary policy lags?参考答案1.b2.c3.d4.c5.d6.d7.d8.a9.d 10.c 11.c 12.d 13.a 14.c 15.b 16.a 17.d 18.c 19.d 20.b 21.b 22.b 23.a 24.c25.b 26.d 27.a 28.b 29.b 30.a31.T 32.F 33.T 34.F 35.F 36.T 37.F 38.T 39.F 40.T 41.T 42.F 43.T 44.T 45.F 46.T 47.T 48.T 49.F 50.F51.the knowledge and skills that workers acquire through education, training, and experience.52.goods and services that are produced domestically and sold abroad.53.a government policy that directly influences the quantity of goods and services thata country imports or exports.54.a curve that shows the quantity of goods and services that households, firms, and the government want to buy at each price level.55.the offset in aggregate demand that results when expansionary fiscal policy raises the interest rate and thereby reduces investment spending.56.The standard of living is a measure of how well people live. Income per person is animportant dimension of the standard of living and is positively correlated with other things such as nutrition and life expectancy that make people better off. Productivity measures how much people can produce in an hour. As productivity increases, people can produce more (and use less to produce the same amount) and so their standard of living increases.The factors that determine labor productivity include the amounts of physical capital (equipment and structures), human capital (knowledge and skills), and natural resources available to workers, as well as the state of technological knowledge insociety.57.Market for Loanable Funds58. 1. The president appoints the Board of Governors, but the Senate must approve them.2. The seven members of the Board of Governors serve 14-year terms, so it is unlikelythat a single president will have appointed most of them.3. The Federal Reserve has 12 regional banks.4. The presidents of the regional banks serve on the FOMC on a rotating basis. 59. a. real interest ratesd. real outputd. real wages60.There are occasional short-lived periods of negative real GDP growth. However, in most years real GDP increases. The years of increase are more frequent and the increases large enough that over long periods of time real GDP increases despite the occasional declines. The long-run upward trend in real GDP is due to increases in the labor force and capital stock, and advances in technological knowledge.61.Most economists believe that in the long run, real variables are not affected by nominal variables. So, forexample, changes in the money supply do not change real variables in the long run. However, mosteconomists believe that nominal variables to do change real variables in the short run.62.As consumers become pessimistic about the future of the economy, they cut their expenditures so thataggregate demand shifts left and output falls. The president and Congress could adjust fiscal policy to increase aggregate demand. They could either increase government spending, or cut taxes, or both.63.The fiscal policy lags are mostly a matter of waiting to implement the policy. By the time the president andCongress can agree to and pass legislation changing expenditures or taxes, the recession may have ended.The Federal Reserve can act to change the money supply quickly, but it may take some time before the effects of an increase in the money supply work their way through the economy.。