宏观经济学期末试题

宏观经济学期末考试试题

宏观经济学期末考试试题一、填空题:(每一空格1分,共12分)1.宏观经济学的中心理论是国民收入决定理论。

1.宏观经济学要解决的解决问题是资源利用问题2.国内生产总值(GDP)是指一个国家领土内在一定时期内所生产的全部最终产品和劳务的市场价值。

2.国民生产总值(GNP)是指一国在某一给定时期内所生产全部最终产品和劳务的市场价值。

3边际消费倾向是指消费增量和收入增量之比,它表示每增加一个单位的收入时消费的变动情况。

3.乘数是指自发总需求的增加所引起的国民收入增加的倍数,在二部门模型中乘数的大小取决于边际消费倾向4货币的交易需求和预防需求与国民收入成同方向变动。

4货币的投机需求与利率成反方向变动。

5.IS曲线是描述产品市场上实现均衡时,利率与国民收入之间关系的曲线。

5.LM曲线是描述货币市场上实现均衡时,利率与国民收入之间关系的曲线。

6.总需求曲线是描述产品市场和货币市场同时达到均衡时,价格水平与国民收入间依存关系的曲线。

它是一条向右下倾斜的曲线。

6.总需求曲线是描述产品市场和货币市场同时达到均衡时,价格水平与国民收入之间依存关系的曲线。

它是一条向右下倾斜的曲线。

7.当就业人数为1600万,失业人数为100万时,失业率为5.9%7.若价格水平1970年为80,1980年为100,则70年代的通货膨胀率为25%8.经济周期的中心是国民收入的波动。

8.经济周期是指资本主义市场经济生产和再生产过程中出现的周期性出现的经济扩张与经济衰退交替更迭循环往复的一种现象。

9.针对单纯经济增长造成的问题,罗马俱乐部的第一个报告麦都斯的《增长的极限》提出零经济增长论。

9.针对单纯经济增长造成的问题,1967年英国经济学家米香首先对经济增长提出是否值得向往问题。

10.具有自动稳定器作用的财政政策,主要是个人和公司的所得税,以及各种转移支付。

10.功能财政思想主张财政预算不在于追求政府收支平衡,而在于追求无通货膨胀的充分就业11.可持续发展要遵循代际公平原则。

宏观经济学期末复习题

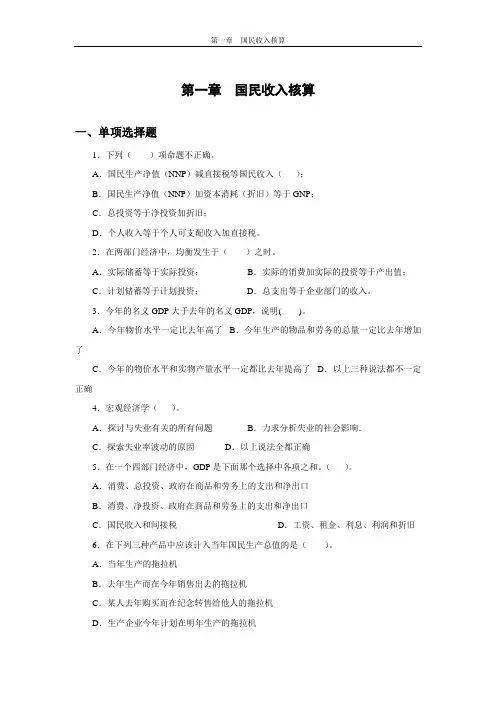

第一章国民收入核算第一章国民收入核算一、单项选择题1.下列()项命题不正确。

A.国民生产净值(NNP)减直接税等国民收入();B.国民生产净值(NNP)加资本消耗(折旧)等于GNP;C.总投资等于净投资加折旧;D.个人收入等于个人可支配收入加直接税。

2.在两部门经济中,均衡发生于()之时。

A.实际储蓄等于实际投资;B.实际的消费加实际的投资等于产出值;C.计划储蓄等于计划投资;D.总支出等于企业部门的收入。

3.今年的名义GDP大于去年的名义GDP,说明( )。

A.今年物价水平一定比去年高了B.今年生产的物品和劳务的总量一定比去年增加了C.今年的物价水平和实物产量水平一定都比去年提高了D.以上三种说法都不一定正确4.宏观经济学()。

A.探讨与失业有关的所有问题B.力求分析失业的社会影响.C.探索失业率波动的原因D.以上说法全都正确5.在一个四部门经济中,GDP是下面那个选择中各项之和。

()。

A.消费、总投资、政府在商品和劳务上的支出和净出口B.消费、净投资、政府在商品和劳务上的支出和净出口C.国民收入和间接税D.工资、租金、利息、利润和折旧6.在下列三种产品中应该计入当年国民生产总值的是()。

A.当年生产的拖拉机B.去年生产而在今年销售出去的拖拉机C.某人去年购买而在纪念转售给他人的拖拉机D.生产企业今年计划在明年生产的拖拉机西方经济学习题集宏观部分7.PDI+个人所得税等于:()。

A.PI B.NNP C.NI D.NDP8.一国的国内生产总值小于国民生产总值,则国外净要素收入()。

A.大于0 B.小于0 C.等于0 D.可能大于0也可以小于0 9.在下列项目中,()不属于政府购买A.政府投资兴办一所大学B.政府给公务人员增加薪水C.政府订购一批军事武器D.政府给贫困家庭的生活补贴10.按收入法核算GDP包括的项目有()。

A.投资B.消费C.工资D.政府购买11.下面不属于流量的是()。

A.出口B.折旧C.转移支付D.国家债务12.下面不属于国民收入部分的是()。

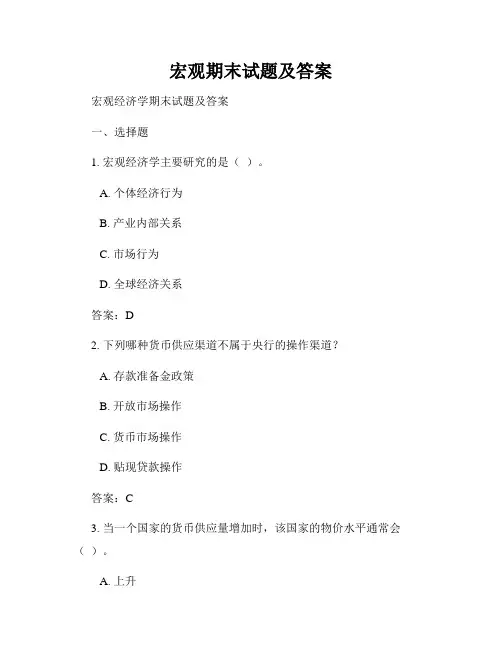

宏观期末试题及答案

宏观期末试题及答案宏观经济学期末试题及答案一、选择题1. 宏观经济学主要研究的是()。

A. 个体经济行为B. 产业内部关系C. 市场行为D. 全球经济关系答案:D2. 下列哪种货币供应渠道不属于央行的操作渠道?A. 存款准备金政策B. 开放市场操作C. 货币市场操作D. 贴现贷款操作答案:C3. 当一个国家的货币供应量增加时,该国家的物价水平通常会()。

A. 上升B. 下降C. 保持不变D. 波动答案:A4. 经济增长率的计算公式是()。

A. (GDPt - GDPt-1)/GDPt-1 × 100%B. (GDPt-1 - GDPt)/GDPt-1 × 100%C. (GDPt - GDPt-1)/GDPt × 100%D. (GDPt-1 - GDPt)/GDPt × 100%答案:A5. 下列哪种货币政策工具可以用于调控通货膨胀?A. 货币供应量B. 货币利率C. 外汇储备D. 货币市场利率答案:B二、简答题1. 请解释货币的三个职能。

货币的三个职能分别是价值尺度、流通手段和储藏手段。

首先,货币作为价值尺度,可以衡量和比较各种商品和服务的价值。

其次,货币作为流通手段,可以在市场上作为交换媒介,方便商品和服务的买卖交易。

最后,货币作为储藏手段,人们可以将其储存起来,以备将来使用。

2. 请解释通货膨胀对经济的影响。

通货膨胀对经济的影响有以下几方面:首先,通货膨胀会降低货币的购买力,导致物价上涨,减少人们的消费能力和生活水平。

其次,通货膨胀会扭曲资源配置,由于价格上涨,生产成本增加,导致企业投资意愿下降,影响经济的正常运行。

此外,通货膨胀还会引发收入分配的不平等,对固定收入者和储蓄者造成损失,而对资产持有者带来收益。

最后,通货膨胀会削弱国家货币的国际竞争力,影响国际贸易和债务偿还。

三、论述题中国经济的供给侧结构性改革供给侧结构性改革是指通过改善生产力和供给效率,推动经济结构转型升级的一种改革方式。

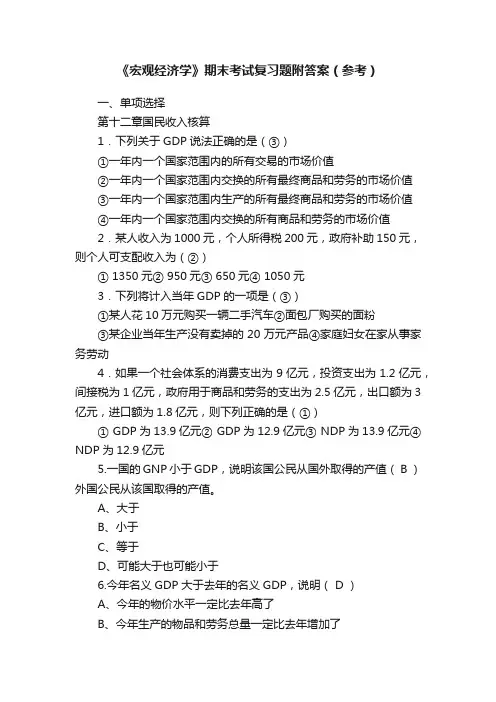

《宏观经济学》期末考试复习题附答案(参考)

《宏观经济学》期末考试复习题附答案(参考)一、单项选择第十二章国民收入核算1.下列关于GDP说法正确的是(③)①一年内一个国家范围内的所有交易的市场价值②一年内一个国家范围内交换的所有最终商品和劳务的市场价值③一年内一个国家范围内生产的所有最终商品和劳务的市场价值④一年内一个国家范围内交换的所有商品和劳务的市场价值2.某人收入为1000元,个人所得税200元,政府补助150元,则个人可支配收入为(②)① 1350元② 950元③ 650元④ 1050元3.下列将计入当年GDP的一项是(③)①某人花10万元购买一辆二手汽车②面包厂购买的面粉③某企业当年生产没有卖掉的20万元产品④家庭妇女在家从事家务劳动4.如果一个社会体系的消费支出为9亿元,投资支出为1.2亿元,间接税为1亿元,政府用于商品和劳务的支出为2.5亿元,出口额为 3亿元,进口额为1.8亿元,则下列正确的是(①)① GDP为13.9亿元② GDP为12.9亿元③ NDP为13.9亿元④ NDP为12.9亿元5.一国的GNP小于GDP,说明该国公民从国外取得的产值( B )外国公民从该国取得的产值。

A、大于B、小于C、等于D、可能大于也可能小于6.今年名义GDP大于去年的名义GDP,说明( D )A、今年的物价水平一定比去年高了B、今年生产的物品和劳务总量一定比去年增加了C、今年的物价水平和实物产量水平一定都比去年提高了D、以上三种说法都不一定正确。

7.在一般情况下,国民收入核算体系中,数值最小的是( C )A、国民生产净值;B、个人收入;C、个人可支配收入;D、国民收入8、一国国内在一定时期内生产的所有最终产品和劳务的市场价值根据价格变化调整后的数值被称为( B )A、国民生产净值;B、实际国内生产总值;C、名义国内生产总值;D、潜在国内生产总值9、在统计中,社会保险税增加对( D )项有影响。

A、国内生产总值(GDP);B、国内生产净值(NDP);C、国民收入(NI);D、个人收入(PI)。

(完整word版)宏观经济学期末考试试题(高鸿业)

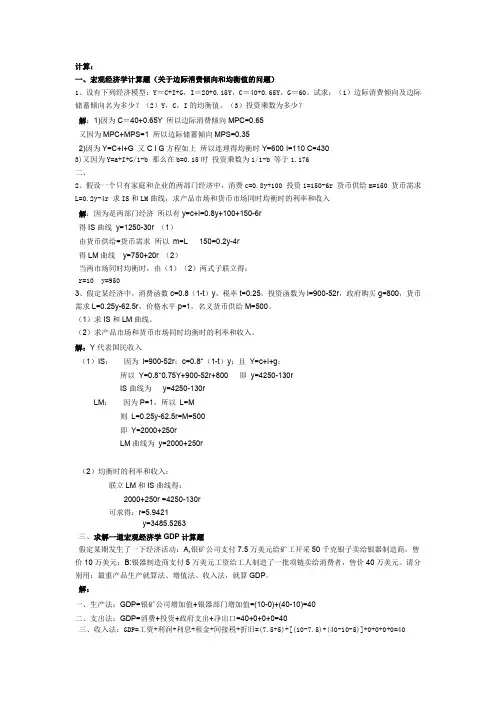

一、宏观经济学计算题(关于边际消费倾向和均衡值的问题)1、设有下列经济模型:Y=C+I+G,I=20+0.15Y,C=40+0.65Y,G=60。

试求:(1)边际消费倾向及边际储蓄倾向名为多少?(2)Y,C,I的均衡值。

(3)投资乘数为多少?解:1)因为C=40+0.65Y 所以边际消费倾向MPC=0.65又因为MPC+MPS=1 所以边际储蓄倾向MPS=0.352)因为Y=C+I+G 又C I G方程如上所以连理得均衡时Y=600 I=110 C=4303)又因为Y=a+I+G/1-b 那么在b=0.15时投资乘数为1/1-b 等于1.176二、2、假设一个只有家庭和企业的两部门经济中,消费c=0.8y+100 投资i=150-6r 货币供给m=150 货币需求L=0.2y-4r 求IS和LM曲线,求产品市场和货币市场同时均衡时的利率和收入解:因为是两部门经济所以有y=c+i=0.8y+100+150-6r得IS曲线y=1250-30r (1)由货币供给=货币需求所以m=L 150=0.2y-4r得LM曲线y=750+20r (2)当两市场同时均衡时,由(1)(2)两式子联立得:r=10 y=9503、假定某经济中,消费函数c=0.8(1-t)y,税率t=0.25,投资函数为i=900-52r,政府购买g=800,货币需求L=0.25y-62.5r,价格水平p=1,名义货币供给M=500。

(1)求IS和LM曲线。

(2)求产品市场和货币市场同时均衡时的利率和收入。

解:Y代表国民收入(1)IS:因为i=900-52r;c=0.8*(1-t)y;且Y=c+i+g;所以Y=0.8*0.75Y+900-52r+800 即y=4250-130rIS曲线为y=4250-130rLM:因为P=1,所以L=M则L=0.25y-62.5r=M=500即Y=2000+250rLM曲线为y=2000+250r(2)均衡时的利率和收入:联立LM和IS曲线得:2000+250r =4250-130r可求得:r=5.9421y=3485.5263三、求解一道宏观经济学GDP计算题假定某期发生了一下经济活动:A,银矿公司支付7.5万美元给矿工开采50千克银子卖给银器制造商,售价10万美元;B:银器制造商支付5万美元工资给工人制造了一批项链卖给消费者,售价40万美元。

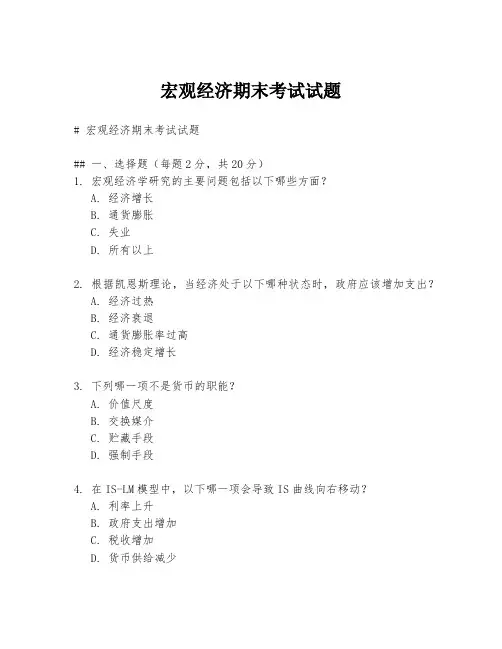

宏观经济期末考试试题

宏观经济期末考试试题# 宏观经济期末考试试题## 一、选择题(每题2分,共20分)1. 宏观经济学研究的主要问题包括以下哪些方面?A. 经济增长B. 通货膨胀C. 失业D. 所有以上2. 根据凯恩斯理论,当经济处于以下哪种状态时,政府应该增加支出?A. 经济过热B. 经济衰退C. 通货膨胀率过高D. 经济稳定增长3. 下列哪一项不是货币的职能?A. 价值尺度B. 交换媒介C. 贮藏手段D. 强制手段4. 在IS-LM模型中,以下哪一项会导致IS曲线向右移动?A. 利率上升B. 政府支出增加C. 税收增加D. 货币供给减少5. 以下哪个因素与菲利普斯曲线无关?A. 通货膨胀率B. 失业率C. 货币供应量D. 工资水平## 二、简答题(每题10分,共30分)6. 解释什么是“挤出效应”,并举例说明其在宏观经济中的影响。

7. 描述货币政策和财政政策在经济调控中的作用及其区别。

8. 简述经济增长与经济发展的区别,并举例说明。

## 三、计算题(每题25分,共50分)9. 假设一个国家的GDP为1000亿美元,消费为600亿美元,投资为200亿美元,政府支出为150亿美元,出口为100亿美元,进口为50亿美元。

请计算该国的储蓄和贸易平衡。

10. 假设一个国家的中央银行决定将利率提高2个百分点,如果市场预期到这一变化,并且货币需求对利率的弹性为1.5,货币供给不变,那么新的均衡利率和货币市场均衡量将会如何变化?## 四、论述题(共30分)11. 论述全球化对一个国家宏观经济政策的影响,并举例说明。

注意:请考生注意答题的准确性和完整性,确保答案条理清晰,逻辑严密。

[此处为答题区域,考生应在此区域内作答。

]。

宏观经济学期末考试试卷及答案

《宏观经济学》期末综合测试一、名词解释题(本题型共5题。

每题3分,共15分)1.国内生产总值:2.平衡预算乘数:3.流动性偏好:4.菲利普斯曲线:5.自动稳定器:二、单项选择题(本题型共30题。

每题正确答案只有一个。

每题1分,共30分)1.下列哪一项将不计入...当年的GDP()。

A.当年整修过的古董汽车所增加的价值;B.一辆新汽车的价值;C.一辆二手汽车按其销售价格计算的价值;D.一台磨损的高尔夫球清洁机器的替换品。

2.在以支出法计算国内生产总值时,不属于...投资的是()。

A.某企业增加一笔存货;B.某企业建造一座厂房;C.某企业购买一台计算机;D.某企业购买政府债券。

3.中央银行在公开市场上卖出政府债券是企图().A.收集一笔资金帮助政府弥补财政赤字;B.减少商业银行在中央银行的存款;C.减少流通中基础货币以紧缩货币供给;D.通过买卖债券获取差价利益。

4.当实际GDP为1500亿美元,GDP平减指数为120时,名义国民收入为()。

A.1100亿美元;B.1500亿美元;C.1700亿美元;D.1800亿美元。

5.一个家庭当其收入为零时,消费支出为2000元;而当其收入为6000元时,其消费为6000元,在图形上,消费和收入之间成一条直线,则其边际消费倾向为()。

A.2/3;B.3/4;C.4/5;D.1。

6.宏观经济学的核心理论是()。

A.经济决定理论;B.价格决定理论;C.宏观决定理论;D.国民收入决定理论。

7.由于价格水平上升,使人们持有的货币及其他资产的实际价值降低,导致人们消费水平减少,这种效应被称为()。

A.利率效应;B.实际余额效应;C.进出口效应;D.挤出效应。

8.如果边际储蓄倾向为0.3,投资支出增加60亿元时,将导致均衡GDP增加()。

A.20亿元; B.60亿元; C.180亿元; D.200亿元。

9.在IS曲线上存在储蓄和投资均衡的收入和利率的组合点有( )。

A.一个;B.无数个;C.一个或无数个;D.无法确定。

宏观经济学期末试卷和答案

一、1、在一般情况下,国民收入核算体系中数值最小的是:A、国内生产净值B、个人收入C、个人可支配收入D、国民收入E、国内生产总值2、下列哪一项应计入GDP中:A、面包厂购买的面粉B、购买40股股票C、家庭主妇购买的面粉D、购买政府债券E、以上各项都不应计入。

3、计入GDP的有:A、家庭主妇的家务劳动折算合成的收入B、拍卖毕加索作品的收入C、出神股票的收入D、晚上为邻居照看儿童的收入E、从政府那里获得的困难补助收入4、在下列各项中,属于经济中的注入因素是A、投资;B、储蓄;C、净税收;D、进口。

5、政府支出乘数A、等于投资乘数B、比投资乘数小1C、等于投资乘数的相反数D、等于转移支付乘数E、以是说法都不正确6、在以下情况中,投资乘数最大的是A、边际消费倾向为0.7;B、边际储蓄倾向为0.2;C、边际储蓄倾向为0.4;D、边际储蓄倾向为0.3。

7、国民消费函数为C=80+0.8Y,如果消费增加100亿元,国民收入A、增加100亿元;B、减少100亿元;C、增加500亿元;D、减少500亿元。

8、如果政府支出增加A、对IS曲线无响应B、IS曲线向右移动C、IS曲线向左移动D、以上说法都不正确9、政府税收的增加将A、对IS曲线无响应B、IS曲线向右移动C、IS曲线向左移动D、以上说法都不正确10、位于IS曲线左下方的收入与利率的组合,都是A、投资大于储蓄;B、投资小于储蓄;C、投资等于储蓄;D、无法确定。

11、当经济中未达到充分就业时,如果LM曲线不变,政府支出增加会导致A、收入增加、利率上升;B、收入增加、利率下降;C、收入减少、利率上升;D、收入减少、利率下降。

12、一般地,在IS曲线不变时,货币供给减少会导致A、收入增加、利率上升;B、收入增加、利率下降;C、收入减少、利率上升;D、收入减少、利率下降。

13、如果现行产出水平为10万亿元,总需求为8万亿,可以断定,若经济不是充分就业,那么:A、就业水平将下降B、收入水平将上升C、收入和就业水平将均衡D、就业量将上升E、就业水平将上升,收入将下降14、在流动陷阱(凯恩斯陷阱)中A、货币政策和财政政策都十分有效B、货币政策和财政政策都无效C、货币政策无效,财政政策有效D、货币政策有效,财政政策无效E、以上说法都不正确15、如果实施扩张性的货币政策,中央银行可采取的措施是A、卖出国债;B、提高法定准备金比率;C、降低再贴现率;D、提高再贴现率;16、如果名义利率为6%,通货膨胀率为12%,那么实际利率是A、6%;B、18%;C、12%;D、-6%。

宏观经济学期末复习题库

宏观习题一、单项选择题1. GDP与NDP之间的差别是 B ;A. 间接税B. 折旧C. 直接税D. 净出口2. 国民收入核算体系中不包括如下哪个变量 C ;A. 国内生产总值B. 国内生产净值C. 政府税收D. 个人收入3. NDP与NI狭义国民收入之间的差别是 A ;A. 间接税B. 公司税前利润C. 政府转移支付D. 资本折旧4. 按国民收入核算体系,在一个只有家庭、企业和政府构成的三部门经济中,一定有 D ;A. 家庭储蓄等于净投资B. 家庭储蓄加折旧等于总投资加政府购买C. 家庭储蓄等于总投资D. 家庭储蓄加税收等于总投资加政府支出5. 用收入法核算GDP时,应包括 B ;A. 政府转移支付B. 间接税C. 政府投资兴建一所学校D. 企业投资6. 用支出法计算的GDP的公式为 A ;A. GDP=C+I+G+X-MB. GDP=C+S+G+X-MC. GDP=C+I+T+X-MD. GDP=C+S+T+X-M7. 以下可以计入GDP的有 D ;A. 购买一辆用过的卡车B. 粮站购买粮食C. 政府转移支付D. 政府购买办公用品8. 用支出法核算GDP时,应包括 C ;A. 政府转移支出B. 折旧C. 企业投资D. 间接税9. NI包括的项目有 A ;A. 利润B. 间接税C. 折旧D. 企业转移支出10. 当GNP大于GDP时,则本国居民从国外得到的收入 A 外国居民从本国取得的收入;A. 大于B. 等于C. 小于D. 可能大于也可能小于11. 在下列项目中, B 不属于政府购买;A. 地方政府办三所中学B. 政府给低收入者提供一笔住房补贴C. 政府订购一笔军火D. 政府给公务人员增加工资12. 若MPC=,则政府税收乘数值为 B ;A. 5B.C. -4D. 213. 若MPC=,则投资I增加100万美元,会使收入增加 D ;A. 40万B. 60万C. 150万D. 250万14. 若边际消费倾向MPC=,则投资I增加100万美元,会使收入增加 D ;A. 40万美元B. 60万美元C. 150万美元D. 250万美元15. 政府购买乘数Kg、政府转移支付乘数Ktr之间的关系是 C ;A. Kg<KtrB. Kg=KtrC. Kg>KtrD. 不确定16. 当消费函数为C=α+βy时,则APC A ;A. 大于MPCB. 小于MPCC. 等于MPCD. 上述三种情况都有可能17. 两部门经济中,总支出等于总收入时,说明 B ;A. 计划存货投资一定等于零B. 非计划存货投资一定等于零C. 非计划存货投资不等于零D.实际投资等于实际储蓄18. 在两部门经济中,均衡发生于 C 之时;A. 实际储蓄等于实际投资B. 实际消费加实际投资等于产出值C. 计划储蓄等于计划投资D. 总支出等于企业部门的收入19. GDP的均衡水平与充分就业的GDP水平的关系是D ;A. 两者完全等同B. GDP均衡水平通常就意味着充分就业时的GDP水平C. GDP的均衡水平完全不可能是充分就业的GDP的水平D. GDP的均衡水平可能是也可能不是充分就业的GDP水平20. 平均消费倾向和平均储蓄倾向之间存在着互补关系,两者之和 C ;A. 大于1B. 小于1C. 永远等于1D. 永远不等于121. 在以下四种情况中,乘数最大的是 A ;A. 边际消费倾向为B. 边际消费倾向为C. 边际消费倾向为D. 边际消费倾向为22. 政府税收的增加将 A ;A. 使IS曲线向左移动B. 使IS曲线向右移动C. 对IS曲线无影响D. 与投资增加对IS曲线的影响一致23. 税收的减少将 B ;A. 使计划支出曲线向上移动并使IS曲线向左移动B. 使计划支出曲线向上移动并使IS曲线向右移动C. 使计划支出曲线向下移动并使IS曲线向左移动D.使计划支出曲线向下移动并使IS曲线向右移动24. 较小的边际消费倾向导致 B ;A. 较陡的计划支出曲线B. 较小的政府支出乘数C. 较平的IS曲线D. 以上都对25. 货币供给的增加 B ;A. 将使LM曲线向左上移动B. 将使LM曲线向右下移动C. 将使IS曲线向右上移动D. 将使IS曲线向左下移动26. IS曲线右方各点代表了 C ;A. 总需求大于总供给B. 总支出大于均衡时要求的水平C. 总支出小于均衡时要求的水平D. 计划的总支出等于实际国内生产总值27. 自发投资支出增加30亿元,会使IS曲线 C ;A. 右移30亿元B. 左移30亿元C. 右移,支出乘数乘以30亿元D. 左移,支出乘数乘以30亿元28. 如果美联储减少货币供给,增加税收 D ;A. 利息率将必定提高B. 利息率将必定下降C. 收入的均衡水平将必定提高D. 收入的均衡水平将必定下降29. 当利率变得很低时,人们购买债券的风险将会 B ;A. 变的很小B. 变的很大C. 可能很大,也可能很小D. 不发生变化30. 利率和收入的组合点出现在IS曲线右上方,LM曲线的左上方的区域中,则表示 A ;A. 投资小于储蓄, 且货币需求小于货币供给B. 投资小于储蓄,且货币供给小于货币需求C. 投资大于储蓄, 且货币需求小于货币供给D. 投资大于储蓄,且货币需求大于货币供给31. 价格水平上升时,会 B ;A. 减少实际货币供给并使LM曲线右移B. 减少实际货币供给并使LM曲线左移C. 增加实际货币供给并使LM曲线右移D. 增加实际货币供给并使LM曲线左移32. 宏观经济政策的目标是 B ;A. 通货膨胀率为零,经济加速增长B. 稳定通货,减少失业,保持经济稳定的增长C. 充分就业,通货膨胀率为零D. 充分就业,实际工资的上升率等于或超过通货膨胀率33. 如果中央银行认为通货膨胀压力太大,其紧缩政策为 C ;A. 在公开市场购买政府债券B. 迫使财政部购买更多的政府债券C. 在公开市场出售政府债券D. 降低法定准备率34. 如果政府支出的增加与政府转移支付的减少相同时,收入水平会 B ;A. 不变B. 增加C. 减少D. 不相关35. 假定政府没有实行财政政策,国民收入水平的提高可能导致 B ;A. 政府支出增加B. 政府税收增加C. 政府税收减少D. 政府财政赤字增加36. 在经济衰退时期,如果政府不加干预的话, A ;A. 税收减少,政府支出减少B.税收减少,政府支出增加C. 税收增加,政府支出减少D. 税收增加,政府支出增加37. 扩张性财政政策对经济的影响是 A ;A. 缓和了经济萧条但增加了政府债务B. 缓和了萧条也减轻了政府债务C. 加剧了通货膨胀但减轻了政府债务D. 缓和了通货膨胀但增加了政府债务38. “挤出效应”发生于 C ;A. 货币供给减少使利率提高,挤出了对利率敏感的私人部门支出B. 私人部门增税,减少了私人部门的可支配收入和支出C. 所得税的减少,提高了利率,挤出了对利率敏感的私人部门支出D. 政府支出减少,引起消费支出较少39. 下列 D 的情况不会增加预算赤字;A. 政府债务的利息增加B. 政府购买的物品和劳务增加C. 政府转移支付增加D. 间接税增加40. 下列 C 的财政政策将导致国民收入水平有最大增长;A. 政府增加购买50亿元商品和劳务B. 政府购买增加50亿元,同时增加税收50亿元C. 税收减少50亿元D. 政府支出增加50亿元,其中30亿元由增加的税收弥补41. 商业银行之所以会有超额储备,是因为 D ;A. 吸收的存款太多B. 未找到那么多合适的贷款对象C. 向中央银行申请的贴现太多D. 以上几种情况都有可能42. 通常认为紧缩货币的政策是 A ;A. 提高贴现率B. 增加货币供给C. 降低法定准备率D. 中央银行增加购买政府债券43. 下列不属于中央银行扩大货币供给的手段是D ;A. 降低法定准备率以变动货币乘数B. 降低再贴现率以变动基础货币C. 公开市场业务买入国债D. 向商业银行卖出国债44. 财政部向 D 出售政府债券时,基础货币会增加;A. 居民B. 企业C. 商业银行 .D. 中央银行45. 通货膨胀是 A ;A.货币发行量过多引起物价水平的普遍的持续上涨B.货币发行量超过了流通中的货币量C.货币发行量超过了流通中商品的价值量D.以上都不是46. 需求拉动的通货膨胀 B ;A. 通常用于描述某种供给因素所引起的价格波动B. 通常用于描述某种总需求的增长引起的价格波动C. 表示经济制度已调整过的预期通货膨胀率D. 以上都不是47. 成本推进的通货膨胀 A ;A. 通常用于描述某种供给因素所引起的价格波动B. 通常用于描述某种总需求的增长所引起的价格波动C. 表示经济制度已调整过的预期通货膨胀率D. 以上都不是48. 通货膨胀的收入分配效应是指 C ;A. 收入普遍上升B. 收入普遍下降C. 收入结构变化D. 债权人收入上升49. 菲利普斯曲线是说明 C ;A. 通货膨胀导致失业B. 通货膨胀是由行业引起的C. 通货膨胀与失业率呈负相关D. 通货膨胀率与失业率之间呈正相关50. 失业率是指 A ;A. 失业人口占劳动力的百分比B. 失业人数占人口总数的百分比C. 失业人数占就业人数的百分比D. 以上均正确51.引起周期性失业的原因是 D ;A. 工资刚性B. 总需求不足C. 经济中劳动力的正常流动D. 经济结构的调整52. 根据菲利普斯曲线,降低通货膨胀率的办法是 C ;A. 减少货币供给量B. 降低失业率C. 提高失业率D. 增加财政赤字二、多项选择题1. 用支出法核算GDP时,应包括的项目有 AD ;A. 居民消费支出B. 政府转移支付C. 政府税收D. 居民建造房子2. 以下不能计入国民收入NI的有 ACD ;A. 利息B. 工资C. 资本折旧D. 间接税3. 下列产品中能够计入当年GDP的有 CD ;A. 纺纱厂购入的棉花B. 某人花10万元买了一幢旧房C. 小王打的支付20元D. 某企业当年生产没有卖掉的20万元产品4. 属于GDP但不属于NI的项目有或按收入法计入GDP的有 BCD ;A. 政府转移支付B. 企业转移支付C. 间接税D. 折旧5. 下列各项应计入GDP的是 ;A. 购买一辆用过的旧自行车B. 中介公司收取的中介费C. 汽车制造厂买进10吨钢板D. 银行向某企业收取一笔贷款利息6. 下列 BD 情况不会使收入水平增加;A. 自发性支出增加B. 自发性支出下降C. 净税收减少D. 净税收增加7. 在两部门经济中,乘数的大小 AD ;A. 与边际消费倾向同方向变动B. 与边际消费倾向反方向变动C. 与边际储蓄倾向同方向变动D. 与边际储蓄倾向反方向变动8. 如果由于投资支出下降而导致GDP下降,可预期 BD ;A. 消费上升B. 消费下降C. 储蓄上升D. 储蓄下降9. 根据简单国民收入决定模型,引起国民收入减少的原因可能是 ;A. 消费减少B. 储蓄减少C. 消费增加D. 储蓄增加10.已知边际储蓄倾向为,则AB ;A. 投资乘数为5B. 政府购买支出乘数为5C. 税收乘数为-5D. 政府转移支付乘数为511. 在IS曲线和LM曲线的交点, AB ;A. 实际支出等于计划支出B. 实际货币供给等于实际货币需求C. 实际支出不一定等于计划支出D. 实际货币供给不等于实际货币需求12. 下面关于LM曲线的叙述错误的是 BD ;A. LM曲线向上倾斜,并且是在收入水平给定的条件下画出的B. LM曲线向下倾斜,并且价格的增加将使其向上移动C. LM曲线向上倾斜,并且是在实际货币供给给定的条件下画出的D. 沿着LM曲线,实际支出等于计划支出13. 引起LM曲线向右方移动的原因是 AB ;A. 物价水平不变,中央银行在公开市场上购买政府债券B. 物价水平不变,中央银行降低要求的准备率C. 实际国内生产总值减少D. 使计划支出曲线向下移动并使IS曲线向右移动14 如果 ABC ,IS曲线将向右移动;A. 消费者对经济的信心增强B. 政府将增加转移支付C. 公司对经济更加乐观D. 中央银行增发货币15. 总需求曲线向右下方倾斜是由于 ABC ;A. 价格水平上升时,投资会减少B. 价格水平上升时,消费会减少C. 价格水平上升时,净出口会减少.D. 价格水平上升时,财富会增加16. 下面关于总需求曲线的叙述,正确的有 ABC ;A. 当其他条件不变,政府支出增加时会右移B. 当其他条件不变,价格水平上升时会左移C. 当其他条件不变,税收减少时会右移D.当其他条件不变,价格水平下降时会右移17. 长期总供给增加,可能原因是 BD ;A. 中央银行增发了货币B. 生产技术提高C. 中央银行降低了利率D. 发现了新的资源18. 总供给曲线左移可能是因为 CD ;A. 其他情况不变而厂商对劳动需求增加B. 其他情况不变而所得税增加C. 其他情况不变而原材料涨价D. 其他情况不变而劳动生产率下降19. 假定经济实现充分就业,总供给曲线是垂直线,名义货币供给增加, BC ;A. 实际货币供给增加B. 不影响实际货币供给C. 实际产出不变D. 利率水平下降20. 总需求曲线向右移,可能原因是 D ;A. 居民消费支出增加B. 政府转移支付增加C. 企业投资支出增加D. 政府购买支出增加21. 在通货膨胀不能完全预期的情况下,通货膨胀将有利于 AC ;A. 债务人B. 债权人C. 借款者D. 离退休人员22. 在下列引起通货膨胀的原因中,成本推动的通货膨胀的原因可能是 AC ;A. 工人要求增加工资B. 政府预算赤字C. 进口商品价格上涨D. 企业投资增加23. 关于充分就业的叙述,正确的是 BD ;A. 人人都有工作,没有失业者B. 消灭了周期性失业的就业状态C. 消灭了自然失业的就业状态D. 消灭了需求不足失业的就业状态24. 为减少经济中存在的失业,应采取的财政政策工具是 AC ;A. 增加政府支出B. 提高个人所得税C. 减少企业税收D. 增加货币供给量25. 关于通货膨胀的叙述,正确的有 ACD ;A. 一般物价水平上升B. 所有商品的价格都上升C. 有些商品的价格可能下降D. 大宗商品价格肯定上升三、判断题1. GDP被定义为经济社会在一定时期内运用生产要素所生产的全部产品的市场价值; F2. 政府转移支付应计入国内生产总值GDP中; F3. 一个在日本工作的美国公民的收入是美国GDP的一部分,也是日本GNP的一部分; F4. GDP中扣除资本折旧,就可以得到NDP;T5. 个人收入即个人可支配收入,是人们可随意用来消费或储蓄的收入; F6. 三部门经济的投资储蓄恒等式为I=S+T-G; T7. GDP折算指数是名义GDP与实际GDP的比率; T8.某出租车司机在2014年购买了一辆产于2012年的小轿车,该司机为此付出的10万元的购车费应计入2014年的GDP中; F9. 政府投资建立公办小学属于政府转移支付; T10. 居民购买商品房的支出属于居民消费支出; F11 在两部门经济中,均衡产出条件为I=S,它是指经济要达到均衡,计划投资必须等于计划储蓄; T12. 随着收入的增加,边际消费倾向MPC递减,而平均消费倾向APC递增,且APC>MPC; F13 边际消费倾向越大,投资乘数越小; F14. 改变政府购买支出水平对宏观经济活动的效果要大于改变税收和转移支付的效果; T15. 非意愿存货等于零,表明宏观经济达到了均衡; T16. 边际消费倾向递减规律说明随收入增加消费会减少; F17. 消费函数c=a+by中的y是GDP; F18. 消费函数是指随着收入的增加,消费也会增加,但消费的增加不如收入增加得多; T19. 在简单国民收入决定理论中,均衡产出是指与总需求相等的产出; T20. 两部门经济,均衡产出公式y=c+i其中c,i是指实际消费和实际投资; F21. 货币供给增加,会引起LM曲线向右下方移动; T22. 自发总需求增加,使国民收入减少,利率上升; F23. 一般来说,位于IS曲线右边的收入和利率的组合,都是投资小于储蓄的非均衡组合;T24. 按照凯恩斯的货币需求,如果利率上升,货币需求将减少; F25. IS曲线是描述产品市场达到均衡时,国民收入与价格之间关系的曲线; F26. IS曲线是描述产品市场达到均衡时,国民收入与利率之间关系的曲线; T27. 投资增加,会引起LM曲线向左下方移动; F28. 消费增加,会引起IS曲线向右下方移动; F29. LM曲线是描述产品市场达到均衡时,国民收入与利率之间关系的曲线; F30. LM曲线是描述货币市场达到均衡时,国民收入与价格之间关系的曲线; F31. 当一般价格水平变动时,由于各产品之间的相对价格保持不变,因此居民不会减少对各产品的需求,总需求水平也保持不变; F32. 当一般价格水平上升时,在名义货币供给量不变的情况下,实际货币供给降低,资产市场均衡的实际利率增加,将会使总需求下降; T33. 当一般价格水平上升时,将会使各经济主体收入增加,总需求增加;F34. 长期总供给曲线所表示的总产出是经济中的潜在产出水平; T35. 短期总供给曲线和长期总供给曲线都是向右上方倾斜的曲线,区别是斜率不同; F36. 自动稳定器不能完全抵消经济的不稳定; T37. 在萧条时为取得年度预算的平衡,政府必须降低税率; F38. 通货膨胀缺口可以通过增加政府支出和减少税收来加以解决;F39. 准备金要求的提高是为了增加银行的贷款量;40. 提高贴现率可以刺激银行增加贷款; F41. 如果中央银行希望降低利率,那么,它就可以在公开市场上出售政府债券; F42. 如果利率水平处在流动性陷阱区域,货币政策是无效的; T43. 中央银行提高再贴现率,提高法定准备率和在公开市场上卖出债券对信贷规模的影响是相同的;F44. 通货膨胀是日常用品的价格水平的持续上涨; F45. 投资增加会诱发成本推进的通货膨胀;F46. 在20世纪70年代和80年代,菲利普斯曲线右移,使得在相对比较低的通货膨胀水平上降低失业率更为容易; F47. 在市场经济条件下,政府实施工资价格指导或工资价格管制,能使通货膨胀率降低,因此这个政策是成功的; F48. 当出现需求推进通货膨胀时,中央银行可以增加货币供给量来抑制它;49. 菲利普斯曲线表明货币工资增长率与失业率之间的负相关关系,它是恒定不变的; F50. 通货膨胀会对就业和产量产生正效应,而且是无代价的; F51. 财政政策能够影响总需求曲线的位置,货币政策不能影响总需求曲线的位置; F52. 在其他条件不变时,任何影响IS曲线位置的因素变化,都会影响总需求曲线的位置; F53. 在长期总供给水平,由于生产要素等得到了充分利用,因此经济中不存在失业; F54. 当经济达到长期均衡时,总产出等于充分就业产出,失业率为自然失业率; T55. 转移支付增加1元对总需求的影响总是与政府支出增加1元相同的; F四、问答题1. 为什么说衡量一国经济增长情况可以用实际GDP,而不能用名义GDP2.举例说明什么是中间产品什么是最终产品3. 名义GDP与实际GDP有何区别4. 为什么政府发给公务员工资要计入GDP,而给灾区或困难人群发的救济金不计入GDP5. 为什么企业债券利息要算入GDP,而公债利息却不算6. 什么是货币需求人们需要货币的动机有哪些7. 简述凯恩斯的有效需求不足理论;8. 为什么一些西方经济学家认为,将一部分国民收入从富者转给贫者将提高总收入水平9. 什么是货币需求的投机动机为什么说它主要取决于利率10. 扩张性财政政策在什么情况下不会发生挤出效应至少指出两种;11. 降低工资对总需求和总供给有何影响12. 为什么进行宏观调控的财政政策和货币政策一般被称为需求管理的政策13. 说明总需求曲线为什么向右下方倾斜14. 导致长期总供给曲线移动的主要因素有哪些15. 什么是失业均衡它有什么特点16.什么是斟酌使用的财政政策和货币政策17.平衡预算的财政思想和功能财政思想有何区别18.简述累进个人所得税制度的自动稳定器机制;19.简述政府转移支付制度的自动稳定器机制;20.什么是公开市场操作这一货币政策工具有哪些优点五、图形分析题1. 什么是成本推动通货膨胀请结合图形分析;2. 什么是财政政策的挤出效应结合图形加以分析;3. 结合图形分析说明:正常情况下,中央银行减少货币供应量对利率的影响;4. 宏观经济萧条现象有什么特点结合总需求总供给模型分析说明;5. 结合图形分析说明:正常情况下,中央银行增加货币供应量对利率的影响;6. 宏观经济过热现象有什么特点结合总需求总供给模型分析说明;7. 什么是流动性陷阱请结合图形加以说明;8. 什么是需求拉动通货膨胀请结合图形加以分析;9. 什么是凯恩斯陷阱请结合图形加以说明;10. 宏观经济的滞胀现象有什么特点结合总需求总供给模型来分析说明;六、计算题1. 某年某国的经济状况为:净投资125亿元,净出口25亿元,政府转移支付100亿元,资本折旧50亿元,企业间接税75亿元,政府购买200亿元,社会保险税150亿元,个人消费支出500亿元,公司未分配利润100亿元,公司所得税50亿元,个人所得税100亿元;请计算该国该年的GDP、NDP、NI、PI和DPI;2. 假定在四部门经济中,国内生产总值是5000,个人可支配收入是4100,政府预算盈余是200,消费是3800,贸易赤字是100单位:亿元;试计算私人储蓄、投资和政府购买支出;3. 根据一国的国民收入统计资料:国内生产总值4800亿元,总投资800亿元,净投资300亿元,消费3000亿元,政府购买960亿元,政府预算盈余30亿元;试计算:1国内生产净值;2净出口;3政府税收减去转移支付后的收入;4个人可支配收入;5个人收入;4. 在某经济体中,消费函数为c=500+,投资函数为i=1250-250r,实际货币供给m=1250,货币需求函数L= +1000-250r;求IS曲线、LM曲线、均衡收入和利率;5. 考虑某三部门经济,其中消费函数为c=200+,投资函数为i=200-25r,货币需求函数为L=y-100r,名义货币供给是1000,政府购买g=50,求该经济的总需求函数;6. 若价格水平在2011年为,2012年为,2013年为,试求:12012年和2013年通货膨胀率各是多少2如果以前两年通货膨胀率的平均值作为第三年通货膨胀率的预期值,计算2014年的预期通货膨胀率;7. 假定某经济中消费函数为C= 1–ty, 税率为t= , 投资函数为I= 900–50r, 政府购买G = 800, 货币需求为L= –, 实际货币供给为500; 试求:1IS曲线;2LM曲线;3两个市场同时均衡时的利率和收入;8.如果总供给曲线为Ys=500,总需求曲线为Yd=600一50P,试求:1供求均衡点;2总需求上升10%之后新的供求均衡点;3总供给上升10%之后新的供求均衡点;4比较2与3;9.假定某经济社会的总需求函数为P=80—2y/3;总供给函数为古典学派总供给曲线形式,即可表示为y=yf=60,求:1经济均衡时的价格水平;2如果保持价格水平不变,而总需求函数变动为P =100—2y/3,将会产生什么后果10.假定法定准备率是,没有超额准备金,对现金的需求是1000亿美元;1假定总准备金是600亿美元,货币供给是多少2若中央银行把准备率提高到,货币供给变动多少假定总准备金仍是600亿美元;3中央银行买进12亿美元政府债券存款准备率仍是,货币供给变动多少11.根据下列统计资料,计算GDP、NDP、NI、PI个人收入DPI个人可支配收入:净投资150亿元;净出口30亿元;储蓄180亿元;资本折旧50亿元;政府转移支付100亿元;企业间接税75亿元;政府购买200亿元;社会保险金150亿元;个人消费支出500亿元;公司未分配利润100亿元;公司所得税50亿元;个人所得税80亿元;12.假设货币需求为L=,货币供给量为200,c=90+,t=50,i=140-5r,g=50;1导出IS和LM方程,求均衡收入,利率和投资;2若其他情况不变,g增加20,均衡收入、利率和投资各为多少3是否存在“挤出效应”4用草图表示上述情况;13.某两部门经济中,假定货币需求为L=,货币供给为200,消费为c=100+,投资i=150;1求IS和LM方程;2求均衡收入、利率、消费和投资;3若货币供给增加20,货币需求不变,收入、利率、投资和消费有什么变化4为什么货币供给增加后收入不变而利率下降14. 假设某经济的消费函数为c=100+,投资i=50,政府购买性支出g=200,政府转移支付tr=,税收t=250单位均为10亿美元;1求均衡收入2试求投资乘数、政府支出乘数、税收乘数、转移支付乘数、平衡预算乘数;3假定该社会达到充分就业所需要的国民收入为1200,试问:1增加政府购买;2减少税收;3以同一额增加政府购买和税收以便预算平衡实现充分就业,各需多少数额15.某宏观经济模型单位:亿元:c=200+,i=300-5r,L=,m=300试求:1IS-LM模型、均衡产出及利率;2若充分就业的收入水平为2020亿元,为实现充分就业,运用扩张的财政政策或货币政策,追加投资或货币供应分别为多少 16. 某年某国的最终消费为8000亿元,国内私人投资5000亿元其中500亿元为弥补当年消耗的固定资产,政府税收为3000亿元其中间接税为2000亿元,其他为个人所得税,政府支出为3000亿元其中政府购买为2500亿元、政府转移支付为500亿元,出口为2000亿元,进口为1500亿元;请计算该国该年的GDP、NDP、NI、PI 和DPI;17. 假设消费函数c=100+,投资i=50;1求均衡收入、消费和储蓄;2如果当时实际产出即收入为800,试求企业非意愿存货积累为多少3若投资增到100,试求增加的收入;。

宏观经济学期末考试试题(含答案)

《宏观经济学》期末考试试题一、判断题(对的写“T”,错的写“F”;每小题1分,共10分)1.人均真实GDP是平均经济福利(生活水平)的主要衡量指标。

2.1963年美国的最低工资水平是每小时1.25美元,而2013年则为7.25美元,因而,在美国拿最低工资的人的生活水平大大提高了。

3.大多数失业是短期的,然而,大多数所观察到的失业是长期的。

4.通货膨胀并没有降低大多数工人的购买力。

5.家庭决定把大部分收入储蓄起来会使总供给曲线向左移动。

6.某人出售一幅旧油画所得到的收入应该计入当年的国内生产总值。

7.无论什么人,只要没有找到工作就是失业。

8.短期总供给不变时,总需求的变动会引起均衡的国内生产总值同方向变动,物价水平反方向变动。

9.扩张性货币政策的实行可以增加货币供给量,从而使利率水平提高。

10.总需求不足时,政府可以提高转移支付水平,以增加社会总需求。

二、简答题(每小题5分,共15分)1.列出并说明生产率的四个决定因素。

2.解释企业通过提高它所支付的工资增加利润的四种可能原因。

3.是什么因素可能引起总需求曲线向左移动?三、应用题(每小题5分,共20分)假设今年的货币供给是5 00亿美元,名义GDP是10万亿美元,而真实GDP是5万亿美元。

1.物价水平是多少?货币流通速度是多少?2.假设货币流通速度是不变的,而每年经济中物品与服务的产出增加5%。

如果美联储保持货币供给不变,明年的名义GDP和物价水平是多少?3.如果美联储想保持物价水平不变,它应该把明年的货币供给设定为多少?4.如果美联储想把通货膨胀率控制在10%,它应该把货币供给设定为多少?四、计算与分析说明题(每小题10分,共30分;要有计算步骤,否则扣分)b.把2015年作为基年,计算各年的真实GDP。

c.与2016年相比,2017年的名义GDP、真实GDP增长率各是多少?名义GDP增长率和真实GDP增长率孰大孰小?解释原因。

2.一个经济在产出低于其自然水平4000亿美元的水平上运行,而且财政政策制定者想弥补这种衰退性缺口。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

1.MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. (1 point each,40 points total)1) Which of the following are parts of the business cycles? 1) _______A) inflation and recession B) peak and potential GDPC) real GDP and potential GDP D) recession and expansion2) Macroeconomic policy tools include 2) _______A) unemployment policy and inflation policy.B) monetary policy and fiscal policy.C) monetary policy and unemployment policy.D) fiscal policy and unemployment policy.3) Fiscal policy involves 3) _______A) the use of interest rates to influence the level of GDP.B) the use of tax and money policies by government to influence the level of interest rates.C) the use of tax and spending policies by the government.D) decreasing the role of the Federal Reserve in the everyday life of the economy.4) Fiscal policy might be used to increase long-term growth in real GDP by 4) _______A) motivating an increase in investment. B) encouraging saving.C) reducing unemployment. D) Both answers A and B are correct.5) When U.S. imports exceed U.S. exports, the United States experiences 5) _______A) a decrease in potential GDP. B) a government budget deficit.C) inflation. D) an international deficit.6) The largest component of income is 6) _______A) proprietors' income. B) corporate profits.C) compensation of employees. D) net interest.7) Which of the following transfer payments is included in GDP? 7) _______A) veteran's benefits B) welfare paymentsC) Social Security payments D) none of the above8) Net domestic product equals gross domestic product minus 8) _______A) depreciation. B) net exports. C) inflation. D) investment.9) U.S. investment is financed from 9) _______A) private saving, government budget deficits and borrowing from the rest of the world.C) private borrowing, government budget deficits and lending to the rest of the world.D) private saving and borrowing from the rest of the world only.10) The labor force is defined as the number of 10) ______A) people with jobs, both part-time and full-time.B) unemployed people.C) people 16 and over.D) people who are employed and unemployed.11) ______ 11) Unemployment caused by the fluctuation of the business cycle is called ________unemployment.A) frictional B) structuralC) recession-related D) cyclical12) ______12) To calculate the unemployment rate, which of the following are necessary pieces of information?I. the number of unemployed personsII. the populationIII. the number of people in the labor forceIV. the working age populationA) I and IV B) I and II C) I and III D) I, II III and IV13) A classical economist believes that 13) ______A) the economy is self-regulating and always at full employment.B) the economy is self-regulating and will normally, though not always, operate at fullemployment if monetary policy is not erratic.C) if the economy was left alone, it would rarely operate at full employment.D) the economy is self-regulating and will normally, though not always, operate at fullemployment if fiscal policy is not erratic.14) Which of the following shifts both the LAS and SAS curves? 14) ______A) a simultaneous change in both the price level and the money wage rateB) a change in the price levelC) an advance in technologyD) a change in the money wage rate15) When the quantity of money in the economy increases, the 15) ______A) aggregate demand curve shifts rightward.B) wealth effect is no longer operable.C) aggregate demand curve does not shift but the economy moves along it.D) long-run aggregate supply curve shifts leftward.16) A Keynesian economist believes that 16) ______A) the economy is self-regulating and always at full employment.employment if monetary policy is not erratic.C) if the economy was left alone, it would rarely operate at full employment.D) the economy is self-regulating and will normally, though not always, operate at fullemployment if fiscal policy is not erratic.17) ______17) In the short run, the intersection of the aggregate demand and the short-run aggregate supplycurves,A) determines the equilibrium level of real GDP.B) is a point where there is neither a surplus nor a shortage of goods.C) determines the equilibrium price level.D) All of the above answers are correct.18) ______18) As the real interest rate increases, the quantity of investment ________. Therefore, theinvestment demand curve plotted against the real interest rate is ________.A) decreases; downward sloping B) increases; upward slopingC) decreases; upward sloping D) increases; downward sloping19) Savings is an important economic growth variable because 19) ______A) it provides a fund for wages needed from any unexpected population growth.B) it helps the economy maintain the current level of total expenditures when a recessionbegins.C) it can finance new investment and capital formation.D) All of the above answers are correct.20) Banks create money whenever they 20) ______A) accept a deposit.B) lend excess reserves to a borrower.C) receive interest on existing loans.D) receive monthly payments on their loans.21) ______21) A bank with $100 million in deposits has $15 million of cash in the bank, $10 million in depositswith the Fed, and $15 million in government securities in its vault. Its total reserves equalA) $10 million. B) $40 million. C) $15 million. D) $25 million.22) ______22) If the Fed wants to fight inflation, it might ________ the quantity of money, which in the shortrun shifts the ________.A) decrease; AD curve rightward B) increase; AS curve leftwardC) decrease; AD curve leftward D) increase; AD curve rightward23) If the Federal Reserve is seeking to increase aggregate demand in the short run, it should 23) ______A) raise the discount rate. B) raise the required reserve ratio.C) increase the quantity of money. D) sell government securities.24) According to the quantity theory of money, 24) ______A) a decrease in the quantity of money will decrease the velocity of circulation.B) an increase in the quantity of money will increase real output.C) an increase in the quantity of money will decrease real output.D) a decrease in the quantity of money will decrease the price level.25) If the inflation rate is higher than expected, then 25) ______A) borrowers gain at the expense of lenders because of the low interest rate.B) lenders gain at the expense of borrowers because of the low interest rate.C) borrowers gain at the expense of lenders because of the high interest rate.D) lenders gain at the expense of borrowers because of the high interest rate.26) ______ 26) If people correctly anticipate an increase in inflation so that their money wage rate adjustsimmediately, then, assuming the economy is initially at potential GDP,A) only the price level rises with no change in real GDP.B) both the price level and real GDP increase.C) only real GDP increases with no change in the price level.D) neither the price level nor real GDP increase.27) ______ 27) Suppose the economy of Argentina experiences high anticipated inflation. As a result, we canexpectA) an increase in transactions costs. B) increases in real GDP.C) increased uncertainty. D) Both answers A and C are correct.28) The multiplier is 28) ______A) the ratio of the equilibrium level of real GDP to the change in induced expenditures.B) the ratio of the change in real GDP to the change in autonomous expenditures.C) the ratio of the change in autonomous expenditures to the change in real GDP.D) the ratio of the change in induced expenditures to the change in autonomous expenditures.29) ______ 29) When disposable income equals $800 billion, planned consumption expenditure equals $600billion, and when disposable income equals $1,000 billion, planned consumption expenditureequals $760 billion. What is the marginal propensity to save?A) 0.20 B) 0.64 C) 0.80 D) 0.2530) According to the real business cycle (RBC) theory, recessions are the result of 30) ______A) a fall in growth rate of productivity.B) a decrease in growth rate of the quantity of money.C) an increase in investment.D) an increase in growth rate of the quantity of money.31) According to the new Keynesian theory, 31) ______A) unanticipated changes in aggregate demand change real GDP.C) the money wage rate is sticky at least in the short run.D) All of the above answers are correct.32) ______32) Another severe depression is unlikely to occur because ofI. bank deposit insurance.II. stable international currency markets.III. the Fed's role as a lender of last resort.A) I and III B) II and III C) III only D) I and II33) If the federal government adopted a contractionary fiscal policy then 33) ______A) aggregate demand would decrease and real GDP would increase.B) aggregate demand and real GDP would both decrease.C) aggregate demand and real GDP would both increase.D) aggregate demand would increase and real GDP would decrease.34) If the government enacts a contractionary fiscal policy, it might 34) ______A) increase taxes. B) increase government purchases.C) increase the government budget deficit. D) None of the above answers is correct.35) The categories of federal government expenditures, listed from largest to smallest, are 35) ______A) purchases of goods and services, debt interest, and transfer payments.B) debt interest, transfer payments, and purchases of goods and services.C) transfer payments, debt interest, and purchases of goods and services.D) transfer payments, purchases of goods and services, and debt interest.36) The crowding out effect refers to 36) ______A) private investment crowding out government saving.B) government investment crowding out private investment.C) government spending crowding out private spending.D) private saving crowding out government saving.37) An advantage of automatic stabilizers over discretionary fiscal policy is that 37) ______A) only the President is involved in implementing automatic stabilizers instead of both thePresident and Congress.B) automatic stabilizers are not subject to all the same time lags that discretionary fiscal policyis.C) automatic stabilizers require only a simple majority of Congress to pass whereasdiscretionary fiscal policy requires a two-thirds majority to pass.D) automatic stabilizers can be easily fine-tuned to move the economy to full employment.38) Which of the following is a problem in pursuing a monetary policy based on feedback rules? 38) ______A) Fixed rules are illegal.B) Feedback rules are illegal.be long.D) None of the above answers is correct.39) Currently the Fed targets 39) ______A) neither the federal funds rate nor the monetary base.B) the price level.C) both the monetary base and the federal funds rate simultaneously.D) the federal funds rate.40) Suppose the United States is in a recession. If the Fed decreases interest rates because of this fact,40) ______the Fed is conducting aA) nondiscretionary policy. B) feedback-rule policy.C) fixed-rule policy. D) flexible-rule policy.2.TRUE/FALSE. Write 'T' if the statement is true and 'F' if the statement is false. (1 point each, 20 points total)41) A recession occurs when real GDP decreases for at least 6 months. 41) ______42) Changes in the amount of government purchases is an example of fiscal policy. 42) ______43) To calculate GDP using the expenditure approach, in part it is necessary to add exports and43) ______subtract imports.44) To measure economic welfare, one needs only to measure the growth in real GDP. 44) ______45) ______45) If a worker is temporarily laid off because the economy is in a recession, frictionalunemployment increases.46) The CPI is the average price of all goods and services produced within the economy. 46) ______47) The wealth effect points out that consumption decreases when people's real wealth decreases. 47) ______48) ______48) If there is an increase in technology, the long-run aggregate supply curve shifts rightward, butthe short-run aggregate supply curve does not shift.49) The long-run aggregate supply curve is upward sloping. 49) ______50) The nominal interest rate is approximately equal to the real interest rate minus the inflation rate. 50) ______51) The expected profit rate rises with business cycle expansions, technological advances, and tax51) ______cuts.52) When the Fed controls the quantity of money, it is regulating financial institutions. 52) ______53) A depository institution creates liquidity and pools risk. 53) ______54) If the Fed sells bonds in the open market, net exports will increase. 54) ______55) Unanticipated inflation causes income to be redistributed between borrowers and lenders. 55) ______56) There is a negative relationship between nominal interest rates and the inflation rate. 56) ______57) The most accurate forecast that can be made is called a rational expectation. 57) ______58) When planned aggregate expenditure is greater than real GDP, inventories decrease. 58) ______59) Induced taxes increase the size of the government purchases multiplier. 59) ______60) A tax cut decreases government saving and can thereby crowd out investment. 60) ______3.Short Answer. Write your answer in the space provided or on a separate sheet of paper. (10 points)61) Compare and contrast the Keynesian and Monetarist theories explaining the business cycle.4. Calculation problems( 10 points)62)The tables above give the purchase s of an average consumer in a small economy. (These consumers purchase only shampoo and pizza.) Suppose 2003 is the reference base period.a) What is the cost of the CPI basket in 2003 and 2004?b) What is the CPI in 2003 and in 2004?c) What is the inflation rate in 2004?5. Extended problems( 20 points)63) In the economy of Jokey Island, autonomous consumption expenditure is $60 million, and the marginalpropensity to consume is 0.6. Investment is $110 million, government purchases are $70 million, and there are no income taxes. Investment and government purchases are constant they do not vary with income.The island does not trade with the rest of the world.a) Draw the aggregate expenditure curve.b) What is the island's autonomous aggregate expenditure?c) What is the size of the multiplier in Jokey Island's economy?d) What is the island's aggregate planned expenditure and what is happening to inventories when realGDP is $800 million?e) What is the economy's equilibrium aggregate expenditur百度文库- 让每个人平等地提升自我。