国际经济学题库9634152

(完整)国际经济学考试题库(答案版)

一、试述H-O模型的主要内容并予以评价。

1、基本内容:资本丰富的国家在资本密集型产品上相对供给能力较强,劳动丰富的国家则在劳动密集型产品上相对供给能力较强。

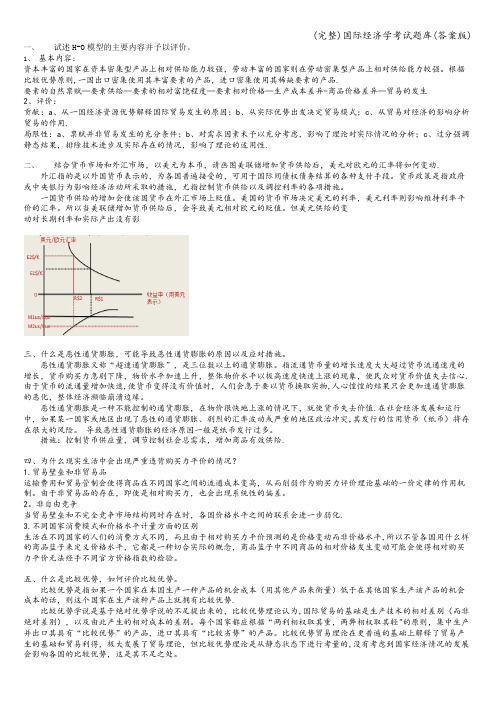

根据比较优势原则,一国出口密集使用其丰富要素的产品,进口密集使用其稀缺要素的产品.要素的自然禀赋—要素供给—要素的相对富饶程度—要素相对价格—生产成本差异-商品价格差异—贸易的发生2、评价:贡献:a、从一国经济资源优势解释国际贸易发生的原因;b、从实际优势出发决定贸易模式;c、从贸易对经济的影响分析贸易的作用.局限性:a、禀赋并非贸易发生的充分条件;b、对需求因素未予以充分考虑,影响了理论对实际情况的分析;c、过分强调静态结果,排除技术进步及实际存在的情况,影响了理论的适用性.二、结合货币市场和外汇市场,以美元为本币,请画图美联储增加货币供给后,美元对欧元的汇率将如何变动.外汇指的是以外国货币表示的,为各国普遍接受的,可用于国际间债权债务结算的各种支付手段。

货币政策是指政府或中央银行为影响经济活动所采取的措施,尤指控制货币供给以及调控利率的各项措施。

一国货币供给的增加会使该国货币在外汇市场上贬值。

美国的货币市场决定美元的利率,美元利率则影响维持利率平价的汇率。

所以当美联储增加货币供给后,会导致美元相对欧元的贬值。

但美元供给的变动对长期利率和实际产出没有影三、什么是恶性通货膨胀,可能导致恶性通货膨胀的原因以及应对措施。

恶性通货膨胀又称“超速通货膨胀”,是三位数以上的通货膨胀。

指流通货币量的增长速度大大超过货币流通速度的增长,货币购买力急剧下降,物价水平加速上升,整体物价水平以极高速度快速上涨的现象,使民众对货币价值失去信心.由于货币的流通量增加快速,使货币变得没有价值时,人们会急于要以货币换取实物,人心惶惶的结果只会更加速通货膨胀的恶化,整体经济濒临崩溃边缘。

恶性通货膨胀是一种不能控制的通货膨胀,在物价很快地上涨的情况下,就使货币失去价值.在社会经济发展和运行中,如果某一国家或地区出现了恶性的通货膨胀、剧烈的汇率波动或严重的地区政治冲突,其发行的信用货币(纸币)将存在很大的风险。

国际经济学题库及答案

国际经济学题库及答案

1. 什么是国际经济学?

国际经济学是一门研究跨国经济活动的学科,涉及如何在不同的政治

和文化环境下实现经济繁荣。

2. 国际经济学的内容有哪些?

国际经济学涵盖了货币政策、关税、贸易政策、外汇市场、国际投资、全球财富分配以及国际经济关系等诸多方面。

3. 什么是国际收支平衡?

国际收支平衡是指一国在国际支付中资源输出与货币输入之间达到平

衡的状态。

当该国的出口货币大于进口货币时,该国经济将处于收支

平衡状态。

4. 什么是外汇储备?

外汇储备是指一个国家为避免支付紧急情况而储存的外汇资金,包括

货币、黄金、央行发行的结算凭证及任何其他令外国人满意的财产。

5. 全球财富分配是什么?

全球财富分配是指各国在全球范围内实现财富均衡分配的过程。

它展

示出各国对全球财富储备的拥有比例,以及各国拥有财富经济发展地

位的差异。

国际经济学考试试题

国际经济学考试试题一、单项选择题(每题 2 分,共 30 分)1、从国际经济资源流动的难度看,最容易流动的要素是()A 商品B 资本C 人员D 技术2、假定闭关自守的状态下,X 商品的价格,在 A 国是 10 美元,在 B 国是 8 美元,C 国是 6 美元,并且 A 国是小国,不能通过贸易影响 B 国和 C 国的价格。

如果 A 国对从 B 国和 C 国进口的 X 商品最初征收非歧视性的 100%的从价税,那么,A 国是()A 贸易创造国B 贸易转移国C 贸易受损国D 无法确定3、比较优势理论认为国际贸易的驱动力是()A 劳动生产率的差异B 技术水平的差异C 产品品质的差异D 价格的差异4、以下哪种贸易政策会降低本国的福利水平()A 出口补贴B 进口关税C 进口配额D 自愿出口限制5、能反映规模经济理论本意的是()A 规模报酬递减B 规模报酬递增C 规模报酬不变D 以上都不对6、幼稚产业保护论的提出者是()A 亚当·斯密B 大卫·李嘉图C 汉密尔顿D 李斯特7、当一国政府对某种产品征收进口关税时,若该产品的需求弹性大于供给弹性,生产者与消费者承担关税的程度是()A 前者大于后者B 后者大于前者C 两者相等D 不确定8、一国货币贬值对其进出口收支产生何种影响()A 出口增加,进口减少B 出口减少,进口增加C 出口增加,进口增加D 出口减少,进口减少9、在浮动汇率制下,当一国国际收支出现逆差时,该国货币汇率会()A 上升B 下降C 不变D 不确定10、以下哪项不是国际收支平衡表中的项目()A 经常项目B 资本项目C 错误与遗漏项目D 国内生产总值项目11、购买力平价理论的基础是()A 一价定律B 利率平价C 相对购买力平价D 绝对购买力平价12、国际收支调整的弹性分析法的假设前提不包括()A 不存在国际资本流动B 汇率由货币当局决定C 马歇尔勒纳条件成立D 进出口商品的供给弹性无穷大13、下列属于直接标价法的是()A 1 美元=68 人民币B 1 人民币=015 美元C 1 英镑=12 欧元D 1 欧元=085 英镑14、蒙代尔弗莱明模型主要分析在资本完全流动的情况下,()政策的有效性。

国际经济学题库(含参考答案)

国际经济学题库(含参考答案)一、单选题(共50题,每题1分,共50分)1、区域一体化组织中最松散、最低级的形式是()A、关税同盟B、自由贸易区C、共同市场D、优惠贸易安排正确答案:D2、要素价格均等化表明()A、一国丰富要素所有者受益,稀缺要素所有者受损B、一国丰富要素所有者受损,稀缺要素所有者受益C、一国丰富要素所有者和稀缺要素所有者都受益D、一国丰富要素所有者和稀缺要素所有者都受益正确答案:A3、下列不属于关税同盟动态效应的是()A、大市场效应B、加剧竞争C、吸引外资D、贸易创造效应正确答案:D4、如果开放前一国X产品的相对价格低于其贸易伙伴,则贸易后该国()A、进口 X产品B、生产者福利增加C、整体福利下降D、消费者福利增加正确答案:B5、下列()会给本国带来较大的贸易创造效应。

A、本国对贸易商品的供给弹性较大B、本国对成员国的初始关税较大C、本国与成员国之间贸易商品的成本差别较大D、本国对贸易商品的需求弹性较小正确答案:D6、初级产品的出口价格若下降,其出口量将增加,出口总收入()A、不变B、增加C、下降D、不确定正确答案:C7、马歇尔一勒纳条件所要说明的是在供给弹性()的情况下,本币贬值能够改善贸易收支的进出口需求弹性条件。

A、零B、无穷大C、1D^大于零小于1正确答案:B8、假设中国和美国都能生产小麦和布,中国将一单位劳动时间全部生产布,可以生产50米;全部生产小麦,可以生产80千克;美国将一单位劳动时间全部生产布,可以生产40米;全部生产小麦,可以生产 100千克。

如果开放后的国际交换比价为1米布=L 8千克小麦,则下列说法正确的是()A、无法比较美国和中国的获利情况B、中国从贸易开放中获利更多C、美国和中国从贸易开放中获利相同D、美国从贸易开放中获利更多正确答案:D9、下列不属于国际收支平衡表资本项目的是()A、利息收支B、短期信贷C、短期证券买卖D、票据买卖正确答案:A10、消费者剩余是()A、消费者为了商品的消费而必须向政府支付的东西B、消费者通过低于市场价格的价格而得到的收益C、消费者购买商品所需支付的价格低于其愿意支付的价格而获得的收益D、消费者可以在各种价格水平得到的收益正确答案:C11、外汇市场中的即期交易不包含()A、套汇B、投机C、国际贸易结算D、银行同业拆借正确答案:B12、如果一个中国工人能生产3匹布或者1辆汽车,一个美国工人能生产4匹布或2辆汽车,则能促进中国与美国进行贸易并各自收益的交换比率是()A、4匹布换2辆汽车B、3匹布换1辆汽车C、3匹布换2辆汽车D、5匹布换2辆汽车正确答案:D13、国际经济学的研究对象是()A、国际商品流动B、国际收支平衡C、世界范围内的稀缺资源的最优配置D^国际人员流动正确答案:C14、根据国民收入决定方程Y=C+I+G+X-M,国际收支的吸收分析法中的“吸收”是指()A、YB、C+IC、C+I+GD、X-M正确答案:C15、开放经济条件下的宏观经济政策目标是()A、追求贸易顺差B、汇率稳定C、扩大出口D、国际收支平衡正确答案:D16、在进行贸易后,一国的收入分配会发生如下变化,()A、收入由消费者转向生产者B、受到进口商品竞争压力的国内生产者遭受损失,而出口商品的生产者则会受益C、消费者受损,生产者受益D、作为整体的国家受益,而个人则会受到损失正确答案:B17、商品和服务贸易记录在国际收支平衡表中的()A、经常项目B、误差和遗漏项目C、官方结算项目D、资本项目正确答案:A18、下列哪个行业最有可能具有内部规模经济?()A、好莱坞的电影业B、加州硅谷的半导体产业C、美国的大型农场D、北京中关村的电脑城正确答案:C19、采用()的配额分配方式,配额的福利效果与关税一样。

国际经济学试题库整理

国经题库整理一、名词解释1、一价定律:一价定律是绝对购置力平价理论成立的前提条件〔2分〕,指的是任何一种商品在不同国家以同种货币表示时价格都相等。

〔2分〕。

〔指在商品可以自由流动,并可以在各国自由贸易,即不存在贸易壁垒的条件下,如果不考虑运输本钱及其时间消耗,那么同一种商品在世界各地折合成同一种货币表示的价格应该是一样的。

〕2、购置力平价:指两种货币之间的汇率〔2分〕决定于它们单位货币购置力之间的比例〔2分〕。

3、国际收支:在一定时期内〔1分〕,一国居民及非本国居民〔1分〕间全部经济交易的〔1分〕的系统记录〔1分〕。

4、产品生命周期:产品生命周期是指新产品经历创造〔1分〕、应用〔1分〕、推广〔1分〕到市场饱与、产品衰落〔1分〕,进而被其他产品所替代四个阶段。

产品生命周期理论:由弗农在1966年推出。

这是对技术差距模型的总结及扩展。

根据这一模型,当一种新产品刚刚诞生时,其生产往往需要高素质的劳动力。

当这种产品成熟并广为群众承受时,它就变得标准化了,就可以用大规模生产技术与素质较低的劳动力进展生产了。

因此,对于该产品的比拟优势会从最早引入它的兴旺国家转移到劳动力相对廉价的不兴旺国家。

这一过程通常都伴随着创造国家向劳动力廉价的国家的直接投资。

5、绝对优势原理:由英国古典经济学家亚当·斯密提出,是指在某种商品的生产上,一个经济在劳动生产率上占有绝对优势,或其生产所消耗的劳动本钱绝对低于另一个经济。

〔2分〕假设各个经济都从事自己占绝对优势的产品的生产,继而进展交换,那么双方都可以通过交换得到绝对的利益,从而整个世界也可以获得分工的好处。

〔2分〕绝对优势说:当一国及另一国相比拟,在一种商品的生产上具有绝对优势,而在另一种商品的生产上具有绝对劣势,那么该国应当生产并出口其具有绝对优势的产品,并用其换取自己具有绝对劣势的产品,从而从贸易中获利。

亚当·斯密的国际分工学说-绝对优势理论( ):每一个国家都有其适宜于生产的某些特定的产品的绝对有利的生产条件,去进展专业化生产,然后彼此进展交换,那么对所有交换国家都是有利的。

(完整word版)国际经济学测试题答案

国际经济学测试题1答案一、单项选择(1’×10=10’)1.D2.C3.B4.A5.C6.C7.B8.D9.D 10.A二、多项选择(将答案填在下面的表格内,1’×10=10’)1. ABCD2. ABCDE3.ABD4.ABCDE5.ABDE6.ABD7.BCE8.ABE9.ABCD 10.ABD三、判断分析(分析不正确本题不得分。

2’×10=20’)1. 正确2. 错误。

跟大国比较接近。

3. 错误。

小国可以完全分工。

4. 正确5. 错误。

前者增加,后者下降。

6. 错误。

介于零关税和禁止性关税之间7. 错误。

国际生产折中理论8. 正确9. 错误。

动态效应更大更重要10. 正确四、名词解释(3’×4=12’)1.特定要素:只能被用来生产某些特定产品、不能在部门间自由流动的生产要素。

2.最优货币区:是指成员国相互之间的货币实行自由兑换,汇率保持长期固定不变,而对非成员国货币的汇率则实行联合浮动,通过商品和服务贸易以及要素的流动使多国经济紧密地联系在一起的地区。

3.出口替代战略:出口替代发展战略也是实现出口替代工业化的过程。

它是指一国将经济发展重点放在出口工业上,通过扩大出口本国工业制成品和半制成品来代替传统的初级产品出口,以增加外汇收入,带动工业体系的建立和推动整个国民经济的持续发展。

4.需求管理政策: 需求管理政策是通过改变国内总需求来校正国际收支失衡,它是以吸收理论为基础提出的,所以又称支出变化政策,主要政策工具包括财政政策和货币政策。

五、比较分析题(要求借助图形,每题9’,共18’)1. 比较小国利用关税和利用进口替代补贴进行贸易保护的不同效果。

征收关税之后,该国的总福利水平下降了:消费者剩余损失了(a+b+c+d),其中a被生产者所得,c为政府财政收入所得,但尚有b和d的损失,国内没有任何人能得到相应的补偿。

这是由于关税使本国的生产资源从效率较高的部门转移到了效率较低的部门,即一国的生产资源向没有比较优势的进口竞争部门集中,因此造成了国民福利净损失。

国际经济学试题及答案

国际经济学试题及答案一、选择题1. 国际经济学研究的核心问题是什么?A. 国内经济政策B. 国际贸易与投资C. 国际货币体系D. 国际政治关系答案:B2. 根据比较优势理论,一个国家应该专门生产并出口什么?A. 其资源最丰富的商品B. 其生产成本最低的商品C. 其技术最先进的商品D. 其劳动力成本最低的商品答案:B3. 以下哪项不是贸易保护主义的措施?A. 关税B. 配额C. 出口补贴D. 进口许可证答案:C二、简答题1. 简述绝对优势理论的基本内容。

答案:绝对优势理论由亚当·斯密提出,主张一个国家应该生产并出口其生产效率最高的商品,进口其生产效率最低的商品。

该理论认为,即使一个国家在所有商品的生产上都没有绝对优势,它仍然可以通过专业化生产效率相对较高的商品来获得贸易利益。

2. 什么是国际收支平衡表?答案:国际收支平衡表是一个记录一个国家与其他国家之间所有经济交易的统计报表。

它包括经常账户、资本和金融账户以及官方储备账户。

经常账户记录商品和服务的交易,资本和金融账户记录资本流动和金融资产的交易,官方储备账户记录中央银行的外汇储备变动。

三、论述题1. 论述汇率变动对国际贸易的影响。

答案:汇率变动对国际贸易有重要影响。

当一个国家的货币升值时,其出口商品在国际市场上的价格上升,竞争力下降,导致出口减少;同时,进口商品的价格下降,国内消费者更倾向于购买外国商品,导致进口增加。

相反,当一个国家的货币贬值时,其出口商品的价格下降,竞争力增强,促进出口;进口商品的价格上升,抑制进口。

此外,汇率变动还会影响跨国公司的投资决策,因为投资成本和收益会随着汇率变动而变化。

2. 分析全球化对发展中国家的影响。

答案:全球化为发展中国家带来了机遇和挑战。

机遇方面,全球化促进了资本、技术和信息的流动,为发展中国家提供了更多的市场机会和投资机会,有助于提高生产效率和经济增长。

挑战方面,全球化加剧了国际竞争,对发展中国家的产业和就业产生压力,可能导致收入差距扩大。

国际经济学题库及答案按章节

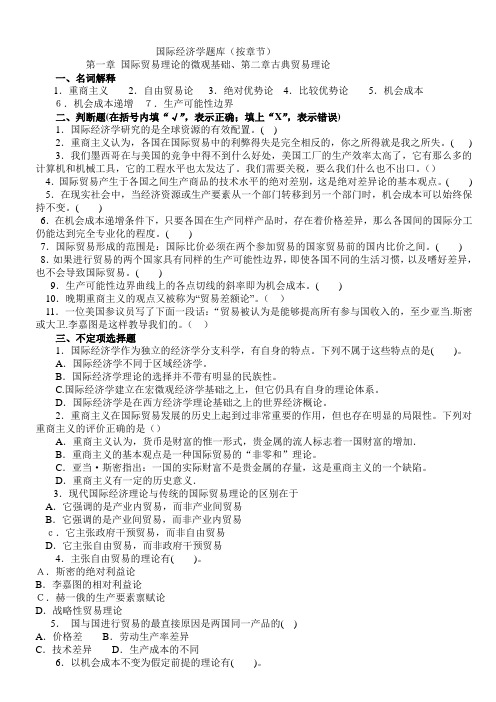

国际经济学题库(按章节)第一章国际贸易理论的微观基础、第二章古典贸易理论一、名词解释1.重商主义2.自由贸易论3.绝对优势论4.比较优势论5.机会成本6.机会成本递增7.生产可能性边界二、判断题(在括号内填“√”,表示正确;填上“X”,表示错误)1.国际经济学研究的是全球资源的有效配置。

( )2.重商主义认为,各国在国际贸易中的利弊得失是完全相反的,你之所得就是我之所失。

( ) 3.我们墨西哥在与美国的竞争中得不到什么好处,美国工厂的生产效率太高了,它有那么多的计算机和机械工具,它的工程水平也太发达了。

我们需要关税,要么我们什么也不出口。

()4.国际贸易产生于各国之间生产商品的技术水平的绝对差别,这是绝对差异论的基本观点。

( ) 5.在现实社会中,当经济资源或生产要素从一个部门转移到另一个部门时,机会成本可以始终保持不变。

( )6.在机会成本递增条件下,只要各国在生产同样产品时,存在着价格差异,那么各国间的国际分工仍能达到完全专业化的程度。

( )7.国际贸易形成的范围是:国际比价必须在两个参加贸易的国家贸易前的国内比价之间。

( ) 8.如果进行贸易的两个国家具有同样的生产可能性边界,即使各国不同的生活习惯,以及嗜好差异,也不会导致国际贸易。

( )9.生产可能性边界曲线上的各点切线的斜率即为机会成本。

( )10.晚期重商主义的观点又被称为“贸易差额论”。

()11.一位美国参议员写了下面一段话:“贸易被认为是能够提高所有参与国收入的,至少亚当.斯密或大卫.李嘉图是这样教导我们的。

()三、不定项选择题1.国际经济学作为独立的经济学分支科学,有自身的特点。

下列不属于这些特点的是( )。

A.国际经济学不同于区域经济学。

B.国际经济学理论的选择并不带有明显的民族性。

C.国际经济学建立在宏微观经济学基础之上,但它仍具有自身的理论体系。

D.国际经济学是在西方经济学理论基础之上的世界经济概论。

2.重商主义在国际贸易发展的历史上起到过非常重要的作用,但也存在明显的局限性。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

International Economics, 8e (Krugman)Chapter 17 Fixed Exchange Rates and Foreign Exchange Intervention17.1 Why Study Fixed Exchange Rates?1) There are no questions for this section.Answer: TRUEQuestion Status: New17.2 Central Bank Intervention and the Money Supply1) A central bank's international reserves includeA) any gold that it owns.B) any silver that it owns.C) any gold that it owns and foreign and domestic assets.D) any silver that it owns and foreign and domestic assets.E) only foreign and domestic assets.Answer: CQuestion Status: Previous Edition2) The liabilities side of a central bank includeA) deposits held by the private banks.B) currency in circulation.C) deposits held by the private banks and currency in circulation.D) deposits held by the private banks, foreign assets, and currency in circulation.E) None of the above.Answer: CQuestion Status: Previous Edition3) Which one of the following statements is most true?A) Any central bank purchase of assets automatically results in an increase in the domestic money supply,while any central bank sale of assets automatically causes the money supply to decline.B) Any central bank purchase of assets results in an increase in the domestic money supply, while anycentral bank sale of assets causes the money supply to decline.C) Any central bank purchase of assets automatically results in a decrease in the domestic money supply,while any central bank sale of assets automatically causes the money supply to decline.D) Any central bank purchase of assets automatically results in a decrease in the domestic money supply,while any central bank sale of assets automatically causes the money supply to increase.E) None of the above.Answer: AQuestion Status: Previous EditionA) If central banks are not sterilizing and the home country has a balance of payments surplus, anyassociated increase in the home central bank's foreign asset implies an increased home money supply.B) If central banks are not sterilizing and the home country has a balance of payments surplus, anyassociated increase in the home central bank's foreign asset implies a decreased home money supply.C) If central banks are not sterilizing and the home country has a balance of payments surplus, anyassociated increase in the home central bank's foreign asset implies an increased home money demand.D) If central banks are not sterilizing and the home country has a balance of payments surplus, anyassociated decreased in the home central bank's foreign asset implies an increased home money supply.E) None of the above.Answer: AQuestion Status: Previous Edition5) Which one of the following statements is most true?A) If central banks are not sterilizing and the home country has a balance of payments surplus, anyassociated increase in a foreign central bank's claims on the home country implies a decreased foreign money supply.B) If central banks are not sterilizing and the home country has a balance of payments surplus, anyassociated decrease in a foreign central bank's claims on the home country implies a decreased foreign money demand.C) If central banks are not sterilizing and the home country has a balance of payments surplus, anyassociated decrease in a foreign central bank's claims on the home country implies a decreased foreign money supply.D) There is not a clear connection between the two.E) None of the above.Answer: CQuestion Status: Previous Edition6) A balance sheet for the central bank of Pecunia is shown below:Central Bank Balance SheetAssets LiabilitiesForeign assets $1,000 Deposits held by private banks $500Domestic assets $1,500 Currency in circulation $2,000Please write the new balance sheet if the bank sells $100 worth of foreign bonds for domestic currency.Answer: Central Bank Balance SheetAssets LiabilitiesForeign assets $900 Deposits held by private banks $500Domestic assets $1,500 Currency in circulation $1,900 Question Status: Previous EditionCentral Bank Balance SheetAssets LiabilitiesForeign assets $1,000 Deposits held by private banks $500Domestic assets $1,500 Currency in circulation $2,000Please write the new balance sheet if the bank purchased $100 in foreign bonds by writing a check on itself.Answer: Central Bank Balance SheetAssets LiabilitiesForeign assets $1,100 Deposits held by private banks $600Domestic assets $1,500 Currency in circulation $2,000Question Status: Previous Edition8) A balance sheet for the central bank of Pecunia is shown below:Central Bank Balance SheetAssets LiabilitiesForeign assets $1,000 Deposits held by private banks $500Domestic assets $1,500 Currency in circulation $2,000Please write the new balance sheet if the bank makes a sterilized transaction by selling $100 of foreign assets for domestic currency and then purchasing $100 of domestic assets by writing a check on itself.Answer: Central Bank Balance SheetAssets LiabilitiesForeign assets $900 Deposits held by private banks $600Domestic assets $1,600 Currency in circulation $1,900Question Status: Previous Edition9) Please define and give an example of sterilized foreign exchange intervention.Answer: Sterilized foreign exchange intervention occurs when a central bank carries out equal foreign and domestic asset transactions in opposite directions to nullify the impact on the domestic money supply.An example is a central bank purchasing $100 of domestic assets but selling $100 of foreign bonds.Question Status: Previous Edition10) If the central bank does not purchase foreign assets when output increases but instead holds the money stockconstant, can it still keep the exchange rate fixed at E o? Please explain.Answer: No, the rise in output leads to an excess demand for money. If the central bank does not increase supply to meet this demand, the domestic interest rate would rise above the foreign rate, R*. Thishigher rate of return (and given expectations in the foreign exchange market) would cause theexchange rate to fall below E o.Question Status: Previous Editionconstant, can it still keep the exchange rate fixed at E o? Please explain with the aid of a figure.Answer:No, the rise in output leads to an excess demand for money. If the central bank does not increasesupply to meet this demand, the domestic interest rate would rise above the foreign rate, R*. Thishigher rate of return (and given expectations in the foreign exchange market) would cause theexchange rate to fall below E o.Question Status: Previous Edition17.3 How the Central Bank Fixes the Exchange Rate1) A system of managed floating exchange rates isA) a system in which governments may attempt to moderate exchange rate movements without keepingexchange rates rigidly fixed.B) a system in which governments use flexible exchange rates.C) a system in which governments are forbidden from attempt to moderate exchange rate movementswithout keeping exchange rates rigidly fixed.D) a system in which governments need to reach a prior agreement among them before they may attemptto moderate exchange rate movements without keeping exchange rates rigidly fixed.E) None of the above.Answer: AQuestion Status: Previous Edition2) Under fixed exchange rate, in general,A) the domestic and foreign interest rates are equal, R = R.B) R = R+ (E e- E)/E.C) There is no relation between the fixed exchange rate and the interest rates both foreign and domestic.D) E is equal to one.E) None of the above.Answer: AQuestion Status: Previous EditionA) The following condition should hold for domestic money market equilibrium: M s/P = L(R, Y).B) The following condition should hold for domestic money market equilibrium: M d/P = L(R, Y).C) The following condition should hold for domestic money market equilibrium: M s= L(R, Y).D) The following condition should hold for domestic money market equilibrium: P = L(R, Y).E) None of the above.Answer: AQuestion Status: Previous Edition4) Which one of the following statements is the most accurate?A) Under a fixed exchange rate, central bank monetary tools are powerless to affect the economy's moneysupply.B) Under a flexible exchange rate, central bank monetary tools are powerless to affect the economy'smoney supply or its output.C) Under a fixed exchange rate, fiscal policy tools are powerless to affect the economy's money supply orits output.D) Under a fixed exchange rate, central bank monetary tools are powerless to affect the economy's moneysupply or its output.E) Under a dirty float exchange rate, central bank monetary tools are powerless to affect the economy'smoney supply or its output.Answer: DQuestion Status: Previous Edition5) What is the expected dollar rate of return on dollar deposits with today's exchange rate at $1.10 per euro,next year's expected exchange rate at $1.165 per euro, the dollar interest rate at 10%, and the euro interest rate at 5%?A) 10%B) 11%C) -1%D) 0%E) None of the above.Answer: AQuestion Status: Previous Edition6) What are the factors affecting the demand for foreign currency?Answer: Three factors affect the demand for foreign currency. They are expected return, risk, and liquidity.Question Status: Previous Edition7) Explain risk and liquidity of assets.Answer: Risk is the variability an asset contributes to a savers' wealth. An asset's real return can be unpredictable and savers dislike this uncertainty if the return fluctuates widely. Liquidity refers to theease with which an asset can be sold or exchanged for goods. Cash is the most liquid of assets becauseit is always acceptable at face value as payment for goods or other assets. Thus, savers consider anasset's liquidity and its expected return and risk in deciding how much of it to hold.Question Status: Previous Edition17.4 Stabilization Policies with a Fixed Exchange Rate1) By fixing the exchange rate, the central bank gives up its ability toA) adjust taxes.B) increase government spending.C) influence the economy through fiscal policy.D) depreciate the domestic currency.E) influence the economy through monetary policy.Answer: EQuestion Status: Previous Edition2) Fiscal Expansion under a fixed exchange has what effect(s) on the economy:A) the money supply decreases.B) output decreases.C) the exchange rate increases.D) the exchange rate decreases initially but then returns to its original point.E) output is unchanged.Answer: DQuestion Status: Previous Edition3) When a country's currency is devalued:A) output decreases.B) output increases.C) the money supply decreases.D) the money supply increases.E) Both B and D.Answer: EQuestion Status: Previous Edition4) Under fixed rates, which one of the following statements is the most accurate?A) Monetary policy can affect only output.B) Monetary policy can affect only employment.C) Monetary policy can affect only international reserves.D) Monetary policy can not affect international reserves.E) None of the above.Answer: CQuestion Status: Previous Edition5) Under fixed rates, which one of the following statements is the most accurate?A) Fiscal policy can affect output, employment and international reserves at the same time.B) Fiscal policy can affect only employment.C) Fiscal policy can affect only international reserves.D) Fiscal policy can affect only output and employment.E) None of the above.Answer: AQuestion Status: Previous EditionB) Fiscal policy affects employment less under fixed than under flexible exchange rate regimes.C) Fiscal policy affects employment more under fixed than under flexible exchange rate regimes.D) Fiscal policy cannot affect employment under fixed exchange rate but does affect output under flexibleexchange rate regimes.E) None of the above.Answer: CQuestion Status: Previous Edition7) Which one of the following statements is the most accurate?A) Fiscal policy has the same effect on output under fixed and flexible exchange rate regimes.B) Fiscal policy affects output more under fixed than under flexible exchange rate regimes.C) Fiscal policy affects output less under fixed than under flexible exchange rate regimes.D) Fiscal policy cannot affect output under fixed exchange rate but does affect output under flexibleexchange rate regimes.E) None of the above.Answer: BQuestion Status: Previous Edition8) Which one of the following statements is the most accurate?A) A devaluation occurs when the central bank lowers the domestic currency price of foreign currency, E,and a revaluation occurs when the central bank raises E.B) A devaluation occurs when the central bank raises the domestic currency price of foreign currency, E,and a revaluation occurs when the central bank lowers E.C) Devaluation occurs when the domestic currency price of foreign currency, E, raises and a revaluationoccurs when E is lowered.D) A devaluation occurs when the central bank of the foreign country raises the domestic currency price offoreign currency, E, and a revaluation occurs when the central bank of the foreign country lowers E.E) None of the above.Answer: BQuestion Status: Previous Edition9) Which one of the following statements is the most accurate?A) Depreciation is a rise in E when the exchange rate is fixed while devaluation is a rise in E when theexchange rate floats.B) Depreciation is a decrease in E when the exchange rate floats while devaluation is a rise in E when theexchange rate is fixed.C) Depreciation is a rise in E when the exchange rate floats while devaluation is a rise in E when theexchange rate is fixed.D) Depreciation is a rise in E when the exchange rate floats while devaluation is a decrease in E when theexchange rate is fixed.E) None of the above.Answer: CQuestion Status: Previous Editionexchange rate is fixed.B) Appreciation is a fall in E when the exchange rate floats while revaluation is a fall in E when theexchange rate is fixed.C) Appreciation is a fall in E when the exchange rate is fixed while revaluation is a fall in E when theexchange rate is flexible.D) Appreciation is a fall in E when the exchange rate floats while revaluation is a rise in E when theexchange rate is fixed.E) None of the above.Answer: BQuestion Status: Previous Edition11) Which one of the following statements is the most accurate?A) Devaluation reflects a deliberate government decision.B) Depreciation reflects a deliberate government decision.C) Devaluation reflects a deliberate government decision while depreciation is an outcome of governmentactions and market forces acting together.D) Depreciation reflects a deliberate government decision while devaluation is an outcome of governmentactions and market forces acting together.E) Devaluation and depreciation have the same meaning and the same causes.Answer: CQuestion Status: Previous Edition12) Which one of the following statements is the most accurate?A) Revaluation reflects an outcome of government actions and market forces acting together whileappreciation reflects a deliberate government decision.B) Revaluation reflects a deliberate government decision while appreciation is an outcome of governmentactions and market forces acting together.C) Revaluation reflects a deliberate government decision while appreciation is an outcome of governmentactions.D) Revaluation and appreciation have the same meaning and the same causes.E) None of the above.Answer: BQuestion Status: Previous Edition13) Under fixed exchange rate, which one of the following statements is the most accurate?A) Devaluation causes a decrease in output, a decrease in official reserves, and a contraction of the moneysupply.B) Devaluation causes a rise in output, a rise in official reserves, and an expansion of the money supply.C) Devaluation causes a rise in output and a rise in official reserves.D) Devaluation causes a rise in output and an expansion of the money supply.E) Devaluation causes a rise in official reserves, and an expansion of the money supply.Answer: BQuestion Status: Previous EditionB) Devaluation causes a decrease in output.C) Devaluation has no effect on output.D) Devaluation causes a rise in output and a decrease in official reserves.E) Devaluation causes a decrease in output and in official reserves.Answer: AQuestion Status: Previous Edition15) Under fixed exchange rate, which one of the following statements is the most accurate?A) Devaluation causes a reduction of the money supply.B) Devaluation has no effect on the stock of money.C) Devaluation causes an expansion of the money supply.D) Devaluation causes a reduction in output.E) Devaluation causes a reduction in official reserves.Answer: CQuestion Status: Previous Edition16) The main reason(s) why governments sometimes chose to devalue their currencies is (are):A) devaluation allows the government to fight domestic unemployment despite the lack of effectivemonetary policy.B) devaluation improves in the current account.C) devaluation increases foreign reserves held by the central bank.D) All of the above.E) None of the above.Answer: DQuestion Status: Previous Editionfollowing an increase in output.Answer:A rise in output from Y1 to Y2 will increase the real money demand, so the central bank mustpurchase foreign assets and raise the money supply from M1 to M2, in order to maintain a fixedexchange rate E0.Question Status: New17.5 Balance of Payments Crises and Capital Flight1) A balance of payments crisis is best described asA) a sharp change in interest rates sparked by a change in expectations about the level of imports.B) a sharp change in foreign reserves sparked by a change in expectations about the future exchange rate.C) a sharp change in interest rates sparked by a change in expectations about the level of exports.D) a sharp change in foreign reserves sparked by a change in expectations about the level of imports.E) None of the above.Answer: BQuestion Status: Previous Edition2) The expectation of future devaluation causes a balance of payments crisis marked byA) a sharp rise in reserves and a fall in the home interest rate below the world interest rate.B) a sharp fall in reserves and an even bigger fall in the home interest rate below the world interest rate.C) a sharp fall in reserves and a rise in the home interest rate above the world interest rate.D) a sharp rise in reserves and an even greater rise in the home interest rate above the world interest.E) None of the above.Answer: CQuestion Status: Previous EditionA) a sharp rise in reserves and a fall in the home interest rate below the world interest rate.B) a sharp fall in reserves and an even bigger fall in the home interest rate below the world interest rate.C) a sharp fall in reserves and a rise in the home interest rate above the world interest rate.D) a sharp rise in reserves and an even greater rise in the home interest rate above the world interest.E) None of the above.Answer: AQuestion Status: Previous Edition4) Capital flightA) decreases reserves.B) is often associated with the expectation of devaluation.C) may indirectly induce devaluation.D) A and B only.E) A, B, and C.Answer: EQuestion Status: Previous Edition5) Currency crises may result fromA) excessive purchases of government bonds by central banks.B) speculative attacks on the currency.C) an increase in foreign reserves.D) A and B.E) A and C.Answer: DQuestion Status: Previous Edition6) Which of the following best describes a deliberate government decision to lower the exchange rate, E?A) appreciationB) depreciationC) revaluationD) devaluationE) None of the above.Answer: CQuestion Status: New7) Please discuss the difference between the terms devaluation and depreciation.Answer: Depreciation is a rise in the exchange rate E when the exchange rate floats, while devaluation is a rise in E when the exchange rate is fixed. Devaluation reflects a deliberate government decision, whiledepreciation is an outcome of government actions and market forces ("the invisible hand") actingtogether.Question Status: Newexchange rate.Answer:The initial equilibrium rests at point 1. If the central bank wishes to use monetary policy to increaseoutput from Y1 to Y2, then they might buy domestic assets and shift the AA curve outward. However,the central bank must maintain a fixed exchange rate E0, so would have to sell foreign assets fordomestic currency, returning the economy to point 1.Question Status: New9) Use a figure to explain the potential effectiveness of fiscal policy to spur on the economy under a fixedexchange rate.Answer:With an aim toward increasing output, the government could use fiscal policy to shift the DD curveoutward. The central bank will have to take steps to maintain a fixed exchange rate E0, among theoptions is buying foreign assets with money, to shift the AA schedule outward until the equilibrium atpoint 3 is reached.Question Status: NewAnswer:A devaluation occurs when the central bank raises the domestic currency price of foreign currency. Inthe figure, the domestic currency is devalued from E0 to E1. Since nothing in the DD schedule haschanged, the new equilibrium at point 2 must be reached by an expansion of the money supply (AAcurve shifts outward). Notice also that output has increased from Y1 to Y2.Question Status: New11) Please use a figure to discuss whether or not a devaluation under a fixed exchange rate has the samelong-run effect as a proportional increase in the money supply under a floating rate.Answer:A currency devaluation shifts the AA schedule outward from equilibrium point 1 to equilibrium point2. The devaluation does not change long-run demand or supply conditions in the output market. Thus,the increase in the long-run price level will exactly offset the increase in exchange rate. Thus, adevaluation is neutral in the long run and this is the exact same scenario as for an increase in themoney supply under a floating exchange rate.Question Status: New17.6 Managed Floating and Sterilized Intervention1) Imperfect asset substitutability assumes:A) the returns on foreign and domestic currency bonds are the same.B) the returns on foreign and domestic currency are different in general.C) the returns on foreign and domestic currency are influenced by risk.D) sterilized intervention proves to be unproductive.E) Both B and C.Answer: EQuestion Status: Previous Edition2) After introducing the Real as its new currency in 1994, BrazilA) lost competitiveness in foreign markets since the Real experienced a real appreciation.B) experienced high domestic interest rates.C) reduced its annual rate of inflation.D) experienced bank failures.E) All of the above.Answer: EQuestion Status: Previous Edition3) In 1999, following the failure of a $40 billion IMF stabilization plan, BrazilA) was forced to revalue the Real.B) experienced an economic boom.C) was forced to devalue the Real.D) saw its currency become overvalued.E) received another loan from the IMF worth $86 billion.Answer: CQuestion Status: Previous Edition4) Perfect asset substitutability is the assumption thatA) the foreign exchange market is in equilibrium only when expected returns on domestic assets aregreater than returns on foreign currency bonds.B) the foreign exchange market is in equilibrium only when expected returns on foreign currency bondsare greater than returns on domestic assets.C) the foreign exchange market is in equilibrium only when expected returns on all assets are negative.D) the foreign exchange market is in equilibrium only when expected returns on domestic assets are equalto returns on foreign currency bonds.E) the foreign exchange market is in equilibrium only when domestic assets are risk-free.Answer: DQuestion Status: Previous Edition5) Imperfect asset substitutability existsA) when it is possible for the expected returns on two assets to be different.B) when the expected returns on two assets are the same.C) only when one asset is foreign and the other is domestic.D) when there is risk in the foreign exchange market.E) A and D.Answer: DQuestion Status: Previous Edition6) The interest parity condition can be written asA) R = R- (E e- E)/E.B) R = R+ (E e- E)/E.C) R = R2- (E e- E)/E.D) R = R/(E e- E).E) R = R+ (E e+ E)/E.Answer: BQuestion Status: Previous Edition7) When domestic and foreign currency bonds are imperfect substitutes, the domestic interest rate (R) can bewritten asA) R = R- (E e- E)/E +ρ.B) R = R- (E e- E)/E.C) R = R+ (E e- E)/E +ρ.D) R = R- (E e+ E)/E +ρ.E) R = R- (E e-E)ρ.Answer: CQuestion Status: Previous Edition8) In the interest rate parity condition with imperfect substitutes and a risk premium of ρA) an increased stock of domestic government debt will raise the difference between the expected returnson domestic and foreign currency bonds.B) a decreased stock of domestic government debt will raise the difference between the expected returnson domestic and foreign currency bonds.C) an increased stock of domestic government debt will reduce the difference between the expectedreturns on domestic and foreign currency bonds.D) an increased stock of domestic government debt will have no effect on the difference between theexpected returns on domestic and foreign currency bonds.E) None of the above.Answer: AQuestion Status: Previous Edition9) The signaling effect of foreign exchange interventionA) never has any affect on exchange rates.B) can alter the market's view of future monetary or fiscal policies.C) can cause an immediate exchange rate change even when bonds denominated in different currenciesare perfect substitutes.D) A and B.E) B and C.Answer: EQuestion Status: Previous Edition10) Please describe in detail a self-fulfilling currency crisis.Answer: Consider an economy in which domestic commercial banks' liabilities are mainly short-term deposits, and in which many of the banks' loans to businesses are likely to go unpaid in the event of a recession.If the market suspects there will be devaluation, interest rates will rise, banks' borrowing costs go up,and a banks' assets have lower value if a recession hits. To prevent financial collapse, the central bankwill lend money to banks and no longer be able to keep the exchange rate from rising. Thus, theemergence of devaluation expectations eventually leads to a devaluation of currency (self-fulfilling).Question Status: Previous Edition。