公司理财第8章

【公司理财】罗斯,中文第六版课后习题详细解答05

第三部分未来现金流量估价第5章估价导论:货币的时间价值财务管理中最重要的问题之一是:未来将收到的现金流量,它在今天的价值是多少?答案取决于货币的时间价值,这也是该章的主题。

第6章贴现现金流量估价本章拓展第5章的基本结论,讨论多期现金流量的估价。

我们考虑了许多相关的问题,包括贷款估价、贷款偿付额的计算以及报酬率的决定。

第7章利率债券是一种非常重要的金融工具。

该章示范如何利用第6章的估价技术来决定债券的价格,我们讲述债券的基本特点,以及财经报章如何报道债券的价格。

我们还将考察利率对债券价格的影响。

第8章股票估价第三部分的最后一章考察股票价格的确定,讨论普通股和优先股的重要特点,例如股东的权利,该章还考察了股票价格的报价。

第5 章估价导论:货币的时间价值◆本章复习与自测题5.1 计算终值假定今天你在一个利率为6%的账户存了10 000美元。

5年后,你将有多少钱?5.2 计算现值假定你刚庆祝完19岁生日。

你富有的叔叔为你设立了一项基金,将在你30岁时付给你150 000美元。

如果贴现率是9%,那么今天这个基金的价值是多少?5.3 计算报酬率某项投资可以使你的钱在10年后翻一番。

这项投资的报酬率是多少?利用72法则来检验你的答案是否正确。

5.4 计算期数某项投资将每年付给你9%的报酬。

如果你现在投资15 000美元,多长时间以后你就会有30 000美元?多长时间以后你就会有45 000美元?◆本章复习与自测题解答5.1 我们需要计算在6%的利率下,10 000美元在5年后的终值。

终值系数为:1.065= 1.3382终值为:10 000美元×1.3382 = 13 382.26美元。

5.2 我们要算出在9%的利率下,11年后支付的150 000美元的现值。

贴现系数为:1/(1.09)11= 1/2.5804 = 0.3875这样,现值大约是58 130美元。

5.3 假定你现在投资1 000美元,10年后,你将拥有2 000美元。

罗斯公司理财第八章课后习题答案

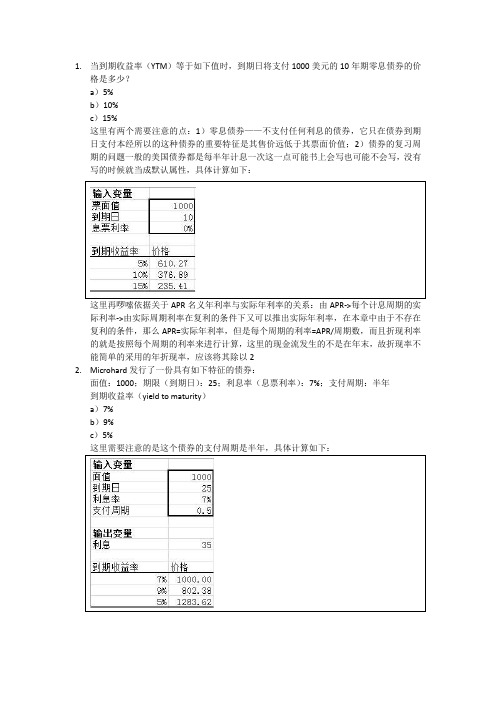

1. 当到期收益率(YTM )等于如下值时,到期日将支付1000美元的10年期零息债券的价格是多少?a )5%b )10%c )15%这里有两个需要注意的点:1)零息债券——不支付任何利息的债券,它只在债券到期日支付本经所以的这种债券的重要特征是其售价远低于其票面价值;2)债券的复习周期的问题一般的美国债券都是每半年计息一次这一点可能书上会写也可能不会写,没有写的时候就当成默认属性,具体计算如下:这里再啰嗦依据关于APR 名义年利率与实际年利率的关系:由APR->每个计息周期的实际利率->由实际周期利率在复利的条件下又可以推出实际年利率,在本章中由于不存在复利的条件,那么APR=实际年利率,但是每个周期的利率=APR/周期数,而且折现利率的就是按照每个周期的利率来进行计算,这里的现金流发生的不是在年末,故折现率不能简单的采用的年折现率,应该将其除以22. Microhard 发行了一份具有如下特征的债券:面值:1000;期限(到期日):25;利息率(息票利率):7%;支付周期:半年到期收益率(yield to maturity )a )7%b )9%c )5%3.Watters雨伞集团公司2年前发型了12年期的债券,票面利率为7.8%,该债券每半年支付一次利息。

如果债券当前售价面值为105%,那么到期收益收益率(YTM)会是多少?答:这道题就没有什么好说的了就是考察一个逼近法和一个2年前,因为售价是面值的105%所以他的期望收益率会低于票面利率,剩下的就只能通过试错来确定了(但也可以千万要注意一般会先算出来3.45%这个数但是这个是一个计息周期的折现率,要将他转换成一年的折现率,由于这里不会存在复利的情况故这里的年折现率只需将半年计的折现率乘以2即可4.公司发行在外的债券期限为13.5年,到期收益率为7.6%,当前价格为1175美元,该债券每半年支付一次利息问该债券的当前价格是多少?这道题漏了一个条件那就是该债券的票面价值是1000,需要记住的是债券的票面值一般5.公司发行了一份面值为1000欧元的债券,期限为15年,票面利率为8.4%,每年支付一6.真实利率=(1+名义利率)/(1+通货膨胀率)-18.根据公式:名义利率=(1+实际利率)*(1+通货膨胀率)-1故本题的答案=7.32%9.略:同样是根据真实利率=(1+名义利率)/(1+通货膨胀率)-1来做10.略11.这个要求了解国债报价表的组成其实就是考英语单词coupon:利息bid:购入价格asked:卖出价格chg:卖出价的变动情况asded yield:到期收益率购买价格是面值的1000(119+19/32)%其一天的卖出价格是面值的1000(120+6/32)%,美国债券市场上的债券面值一般为100012.这道题出现了一个新名词叫做当前收益率,对它的解释是:利息/卖出价格,注意不要和息票利率混淆了,默认面值=100013.这道题需要的注意的是在一道题中使用的折现率与折现周期要统一,不能前半部分是按照年14.这道题有一个隐含条件:在题目中没有明确指出债券价格的时候就将它默认为是1000美元,这里只给出敏感性分析的计算结果:由图可知期限较长的债券对利率风险较为敏感,原因是期限较长的债券的面值的现值较低,相较于期限较短的债券的它的利息年金的现值在价格所占的比重增加说实话从这幅图还真的不好判别到底谁的更加敏感,从斜率来看甚至我觉得高票面利率的债券甚至反应要稍微强一点,到底是不是这样呢?我们来看一下变化的百分比(当到期收益率改变时的价格变化/没有变化前的百分比较少,它的价格中的一大部分的比重来自与面值的现值,如果到期收益率变换那么对它将造成比较大的影响16.说实话这道题让我有点迷糊了,这里的到期收益率YTM和当前收益率都出现过了,但是这里居然冒出来一个实际收益率EAR也就是计算复利复息的那种,债券真的还会支付利息的利息吗??这点我有很大的疑问,不过答案是这么写的,知道的同学可以的话发个17.这道题参考了英文原版答案,发现题中漏了一个条件那就是票面利率=10%,这道题没有什么特点就是考察当以面值出售时,票面利率=期望收益率所以读者自作吧,只是简单的计算题18.这道题也是,首先发票价上的1090包含了四个月的利息,所以半年利息的2/3即可,具体计算留作读者自作19.同18题20.结果如下图所示21.这道题值得注意的是它的最新报价应为871.55美元,还有就是再一次提醒所有的率都是22.根据题目创建了excel电子表格模型,发现当到期收益率=票面利率时,无论期限为多少债券价格都等于票面价值,这可以单过一个定理来进行记忆,也可以通过公示推导得到,具体数学公式推导,读者自作23.本题有一个公式需要了解:资本利得=卖出价格-买入价格,不要考虑折现问题英文原版答案:24.题目比较简单,就是注意一下它的哪一个持有期收益率就是在你持有过程之中所实际得25.这道题比较简单,就是计算量大,注意求完终值再来求现值即可26.这是一道比较好的题,它让我们分清以前的实际年利率和实际利率的差别,虽然只是差了一个字,但是在这道题中却很明显的体现了出来,显示名义年利率(与计息周期有关)->名义利率(与通货膨胀率有关)->除去通货膨胀的名义年利率->周利率,在来使用年金现值计算公式,这里体现了一个重要的思想那就是以年金发生时间间隔来算年金现值27.这是一道非常好的题,具体的思路与26题相似,都是通过实际年利率->出去通货膨胀的实际年利率->除去通货膨胀的名义年利率->除去通货膨胀的名义月利率这里为什么要求出除去通货膨胀的月利率,因为现金流量的发生时间不是在年末,而是在每个月,而这一题的最后一问确是一道更好的题,它求最后一年的名义现金流量,也就是考虑通货膨胀的情况,但我们从一开始计算这道题时就去除了通货膨胀,所以通货膨胀年应该是30+25年,而且因为只是求一个时间点的现金流量,而且不存在求和的情况,故用年度通货膨胀率。

公司理财第八章 资本结构理论:MM理论

证明过程

二、命题II:股东的风险和期望收益率会随着 财务杠杆水平的提高而上升

MM理论(无税)的命题II: RS=R0+D/S×(R0-RD)

第五节 有税的MM理论

一、公司所得税与自制财务杠杆 假定公司所得税税率为25%

二、命题I(含公司税):杠杆公司的价值等 于无杠杆公司的价值加上税盾的价值

二、自制财务杠杆

自制财务杠杆,是指投资者通过购买无杠杆公 司的股票和借债的方式复制出有杠杆公司的权 益回报率的过程。

第四节 MM理论(无税)

无税的MM理论是在莫迪格里安尼和米勒 (1958)中提出来的。

一、命题I:公司价值与财务杠杆水平无关 完美资本市场假设:

(1)无税收; (2)无交易成本; (3)个人可以与企业以相同的利率借贷; (4)永续现金流; (5)同质预期,即股东对未来收益和风险的认知是相同的; (6)无破产成本; (7)完美信息; (8)理性人,投资者是理性的,管理者也是理性的。

但负债比率超过一定的限度后,Kd和Ke加速上 升,因而Ka随着负债比率的上升经历了先下降 后上升的过程,因而公司存在最优资本结构。

一种介于净利理论和营业净利理论之间的理论。

资本成本 P

Ke 企

业

Ka

价 值

Kd

D/V

V 负债比例

第二节 资本结构问题与财务管理目标

例8-1 资本结构与财务管理目标 假定某无杠杆公司的市场价值为1000元,目前

但权益融资投资者的风险会随着负债比 Nhomakorabea的增 加而增加,因而要求的收益率也增加,即Ke则 随着负债比率的增加而增加。

资 金 成 本

Ke

企 业

公司理财习题7-8

第七章练习题及解答一、单项选择题1.在企业有盈利情况下,下列有关外部融资需求表述正确的是()。

A.销售增加必然引起外部融资需求的增加B.销售净利率提高会引起外部融资需求的增加C.股利支付率提高会引起外部融资需求的增加D.资产周转率提高必然引起外部融资需求的增加2.从发行公司的角度看,股票包销的优点有()。

A.可获得部分溢价收入 B.降低发行费用C.可获一定租金 D.不承担发行风险3.从公司理财的角度看,与长期借款筹资相比较,普通股筹资的优点是()。

A.筹资速度快 B、筹资风险小 C.筹资成本小 D.筹资弹性大4.从筹资的角度,下列筹资方式中资本成本最高的是()。

A.债券 B.长期借款 C.融资租赁 D.普通股5.以下哪一种说法是不正确的()。

A.权益资本是一种永久性资金,负债资本是一种有限期资金B.权益资本是企业财务实力的象征C.负债比率越高,财务风险越大D.债权人要求的报酬率比股东要求的报酬率高些6.如果一个企业的负债比率很高,则下列哪种说法正确()。

A.企业的经济效益差 B.企业的经营风险大C.企业的财务风险大 D.企业的融资渠道少7.当市场利率高于债券票面利率时,该债券将()发行。

A.溢价B.折价C.平价D.无法确定单项选择题参考答案:1. C 2.D 3. B 4.D 5.D 6.C 7. B二、多项选择题1.企业所需要的外部融资量取决于()。

A.销售的增长 B.股利支付率C.销售净利率 D.可供动用金融资产2.负债融资与股票融资相比,其缺点是()。

A.资本成本较高 B.具有使用上的时间性C.形成企业固定负担 D.财务风险较大3.企业筹资必须遵循哪些原则()。

A.效益性原则 B.及时性原则C.合理性原则 D.优化资金结构原则4.吸收直接投资中的出资方式,主要有()。

A.以现金出资 B.以实物出资C.以工业产权出资 D.以土地使用权出资5.企业筹资的目的主要有()。

A.创建企业B.企业扩张C.偿还债务D. 调整资本结构6.以下属于筹资方式的是()。

公司理财第九版 -第8章

特例:Zero Growth

• If dividends are expected at regular intervals forever, then this is a perpetuity and the present value of expected future dividends can be found using the perpetuity formula,永续年金形式

– P0 = 4 / (.16 - .06) = $40 – Remember that we already have the dividend expected next year, so we don’t multiply the dividend by 1+g

8-16

Example 8.3 – Gordon Growth Company - II

D1 = $2; g = 5%

8-15

Example 8.3 Gordon Growth Company - I

• Gordon Growth Company is expected to pay a dividend of $4 next period, and dividends are expected to grow at 6% per year. The required return is 16%. • What is the current price?

• Supernormal growth 非正常增长

– Dividend growth is not consistent initially, but settles down to constant growth eventually – The price is computed using a multistage model

罗斯《公司理财》(第11版)笔记和课后习题详解

读书笔记模板

01 思维导图

03 读书笔记 05 作者介绍

目录

02 内容摘要 04 目录分析 06 精彩摘录

思维导图

本书关键字分析思维导图

习题

笔记

经典 书

第章

风险

预算

笔记

教材

习题 复习

收益

第版

笔记

市场

习题

定价

资本

期权

内容摘要

内容摘要

本书是罗斯的《公司理财》(第11版)(机械工业出版社)的学习辅导电子书。本书遵循该教材的章目编排, 包括8篇,共分31章,每章由两部分组成:第一部分为复习笔记;第二部分为课(章)后习题详解。本书具有以 下几个方面的特点:(1)浓缩内容精华,整理名校笔记。本书每章的复习笔记对本章的重难点进行了整理,并参 考了国内名校名师讲授罗斯的《公司理财》的课堂笔记,因此,本书的内容几乎浓缩了经典教材的知识精华。(2) 选编考研真题,强化知识考点。部分考研涉及到的重点章节,选编经典真题,并对相关重要知识点进行了延伸和 归纳。(3)解析课后习题,提供详尽答案。国内外教材一般没有提供课(章)后习题答案或者答案很简单,本书 参考国外教材的英文答案和相关资料对每章的习题进行了详细的分析。(4)补充相关要点,强化专业知识。一般 来说,国外英文教材的中译本不太符合中国学生的思维习惯,有些语言的表述不清或条理性不强而给学习带来了 不便,因此,对每章复习笔记的一些重要知识点和一些习题的解答,我们在不违背原书原意的基础上结合其他相 关经典教材进行了必要的整理和分析。

12.1复习笔记 12.2课后习题详解

第13章风险、资本成本和估值

13.1复习笔记 13.2课后习题详解

公司理财(第5版)第8章 资本预算中现金流量的估算

所得税

34

153

153

加:折旧

200

200

200

经营现金流量

266

497

497

4

5

240

0

81.6

0

200

200

358.4 200

ห้องสมุดไป่ตู้

• 2.测算净营运资本的变化

– 净营运资本(net working capital)指流动资产与流动负债之差。 – 把净利润调整为经营活动产生的现金流量时,需要做一个重要的调

• (一)现金流量转移

– 评价一个项目时,要考虑投资方案对公司其他项目的影响。 – 在测算增量现金流量时,我们应该把公司作为一个整体来考虑,而不

是仅仅着眼于某一独立的项目。

• (二)沉没成本

– 沉没成本是过去已经发生而且与现在决策无关的成本。 – 计算增量现金流量时应该对沉没成本忽略不计

• (三)机会成本

• 案例8-1 红光公司的资本预算项目 (详情见书P166) • 在该案例中,涉及了红光日用化工公司投资新项目的各项

收支。在进行资本预算时,关键的问题是判断和识别哪些 现金流量属于增量现金流量。

– 1.市场测试费用的处理 • 该案例中5万元的市场测试费用属于沉没成本,因为不管该项目 是否上马,市场测试环节中的现金流出已经发生,与该新产品决 策没有关系,故不应包括在洁净液项目的现金流量中。

– 经营现金流量=销售收入-经营成本-所得税

– (3)期末现金流量。指投资项目完结时所发生的现金流量,主要包括 • 固定资产的残值收入或变价收入 • 原有垫支在各种流动资产上的资金的收回 • 停止使用土地的变价收入等。

• 2.按现金的流入、流出来表述。

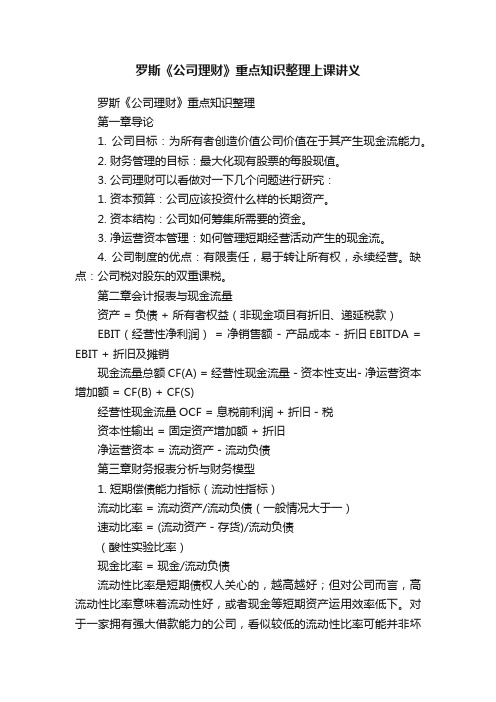

罗斯《公司理财》重点知识整理上课讲义

罗斯《公司理财》重点知识整理上课讲义罗斯《公司理财》重点知识整理第一章导论1. 公司目标:为所有者创造价值公司价值在于其产生现金流能力。

2. 财务管理的目标:最大化现有股票的每股现值。

3. 公司理财可以看做对一下几个问题进行研究:1. 资本预算:公司应该投资什么样的长期资产。

2. 资本结构:公司如何筹集所需要的资金。

3. 净运营资本管理:如何管理短期经营活动产生的现金流。

4. 公司制度的优点:有限责任,易于转让所有权,永续经营。

缺点:公司税对股东的双重课税。

第二章会计报表与现金流量资产 = 负债 + 所有者权益(非现金项目有折旧、递延税款)EBIT(经营性净利润) = 净销售额 - 产品成本 - 折旧EBITDA = EBIT + 折旧及摊销现金流量总额CF(A) = 经营性现金流量 - 资本性支出- 净运营资本增加额 = CF(B) + CF(S)经营性现金流量OCF = 息税前利润 + 折旧 - 税资本性输出 = 固定资产增加额 + 折旧净运营资本 = 流动资产 - 流动负债第三章财务报表分析与财务模型1. 短期偿债能力指标(流动性指标)流动比率 = 流动资产/流动负债(一般情况大于一)速动比率 = (流动资产 - 存货)/流动负债(酸性实验比率)现金比率 = 现金/流动负债流动性比率是短期债权人关心的,越高越好;但对公司而言,高流动性比率意味着流动性好,或者现金等短期资产运用效率低下。

对于一家拥有强大借款能力的公司,看似较低的流动性比率可能并非坏的信号2. 长期偿债能力指标(财务杠杆指标)负债比率 = (总资产 - 总权益)/总资产 or (长期负债 + 流动负债)/总资产权益乘数 = 总资产/总权益 = 1 + 负债权益比利息倍数 = EBIT/利息现金对利息的保障倍数(Cash coverage radio) = EBITDA/利息3. 资产管理或资金周转指标存货周转率 = 产品销售成本/存货存货周转天数 = 365天/存货周转率应收账款周转率 = (赊)销售额/应收账款总资产周转率 = 销售额/总资产 = 1/资本密集度4. 盈利性指标销售利润率 = 净利润/销售额资产收益率ROA = 净利润/总资产权益收益率ROE = 净利润/总权益5. 市场价值度量指标市盈率 = 每股价格/每股收益EPS 其中EPS = 净利润/发行股票数市值面值比 = 每股市场价值/每股账面价值企业价值EV = 公司市值+ 有息负债市值- 现金EV乘数= EV/EBITDA6. 杜邦恒等式ROE = 销售利润率(经营效率)x总资产周转率(资产运用效率)x权益乘数(财杠)ROA = 销售利润率x总资产周转率7. 销售百分比法假设项目随销售额变动而成比例变动,目的在于提出一个生成预测财务报表的快速实用方法。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Chapter 8: Strategy and Analysis in Using Net Present Value Concept Questions - Chapter 88.1 What are the ways a firm can create positive NPV.1.Be first to introduce a new product.2.Further develop a core competency to product goods or servicesat lower costs than competitors.3.Create a barrier that makes it difficult for the other firms tocompete effectively.4.Introduce variation on existing products to take advantage ofunsatisfied demand5.Create product differentiation by aggressive advertising andmarketing networks.e innovation in organizational processes to do all of theabove.How can managers use the market to help them screen out negative NPV projects?8.2 What is a decision tree?It is a method to help capital budgeting decision-makersevaluating projects involving sequential decisions. At everypoint in the tree, there are different alternatives that should be analyzed.What are potential problems in using a decision tree?Potential problems 1) that a different discount rate should beused for different branches in the tree and 2) it is difficult for decision trees to capture managerial options.8.3 What is a sensitivity analysis?It is a technique used to determine how the result of a decisionchanges when some of the parameters or assumptions change.Why is it important to perform a sensitivity analysis?Because it provides an analysis of the consequences of possibleprediction or assumption errors.What is a break-even analysis?It is a technique used to determine the volume of productionnecessary to break even, that is, to cover not only variable costs but fixed costs as well.Describe how sensitivity analysis interacts with break-even analysis.Sensitivity analysis can determine how the financial break-evenpoint changes when some factors (such as fixed costs, variablecosts, or revenue) change.Answers to End-of-Chapter ProblemsQUESTIONS AND PROBLEMSDecision Trees8.1 Sony Electronics, Inc., has developed a new type of VCR. If the firm directly goes to themarket with the product, there is only a 50 percent chance of success. On the other hand, ifthe firm conducts test marketing of the VCR, it will take a year andwill cost $2 million.Through the test marketing, however, the firm is able to improve the product and increase theprobability of success to 75 percent. If the new product proves successful, the present value(at the time when the firm starts selling it) of the payoff is $20 million, while if it turns out tobe a failure, the present value of the payoff is $5 million. Should the firm conduct testmarketing or go directly to the market? The appropriate discount rate is 15 percent.8.1 Go directly:NPV = 0.5 $20 million + 0.5 $5 million= $12.5 millionTest marketing:NPV = -$2 million + (0.75 $20 million + 0.25 $5 million) / 1.15= $12.13 millionGo directly to the market.8.2 The marketing manager for a growing consumer products firm is consideringlaunching anew product. To determine consumers’ interest in such a product, the manager can conducta focus group that will cost $120,000 and has a 70 percent chanceof correctly predictingthe success of the product, or hire a consulting firm that will research the market at a cost of$400,000. The consulting firm boasts a correct assessment record of 90 percent. Of coursegoing directly to the market with no prior testing will be the correct move 50 percent of thetime. If the firm launches the product, and it is a success, the payoff will be $1.2 million.Which action will result in the highest expected payoff for the firm?8.2 Focus group: -$120,000 + 0.70 $1,200,000 = $720,000Consulting firm: -$400,000 + 0.90 $1,200,000 = $680,000Direct marketing: 0.50 $1,200,000 = $600,000The manager should conduct a focus group.8.3 Tandem Bicycles is noticing a decline in sales due to the increase of lower-priced importproducts from the Far East. The CFO is considering a number of strategies to maintain itsmarket share. The options she sees are the following:• Price the products more aggressively, resulting in a $1.3 million decline in cash flows.The likelihood that Tandem will lose no cash flows to the imports is 55 percent; there is a45 percent probability that they will lose only $550,000 in cash flows to the imports. • Hire a lobbyist to convince the regulators that there should be important tariffs placedupon overseas manufacturers of bicycles. This will cost Tandem $800,000 and will have a75 percent success rate, that is, no loss in cash flows to the importers. If the lobbyists donot succeed, Tandem Bicycles will lose $2 million in cash flows.As the assistant to the CFO, which strategy would you recommend to your boss?Accounting Break-Even Analysis8.3 Price more aggressively:-$1,300,000 + (0.55 0) + 0.45 (-$550,000)= -$1,547,500Hire lobbyist:-$800,000 + (0.75 0) + 0.25 (-$2,000,000)= -$1,300,000Tandem should hire the lobbyist.8.4 Samuelson Inc. has invested in a facility to produce calculators. The price of the machine is$600,000 and its economic life is five years. The machine is fully depreciated by thestraight-line method and will produce 20,000 units of calculators in the first year. Thevariable production cost per unit of the calculator is $15, while fixed costs are $900,000.The corporate tax rate for the company is 30 percent. What should the sales price per unit ofthe calculator be for the firm to have a zero profit?8.4 Let sales price be x.Depreciation = $600,000 / 5 = $120,000BEP: ($900,000 + $120,000) / (x - $15) = 20,000x = $668.5 What is the minimum number of units that a distributor of big-screen TVs must sell in agiven period to break even?Sales price _ $1,500Variable costs _ $1,100Fixed costs _ $120,000Depreciation _ $20,000Tax rate _ 35%8.5 The accounting break-even= (120,000 + 20,000) / (1,500 - 1,100)= 350 units8.6 You are considering investing in a fledgling company that cultivates abalone for sale tolocal restaurants. The proprietor says he’ll return all profits to you after covering operatingcosts and his salary. How many abalone must be harvested and sold in the first year ofoperations for you to get any payback? (Assume no depreciation.)Price per adult abalone _ $2.00Variable costs _ $0.72Fixed costs _ $300,000Salaries _ $40,000Tax rate _ 35%How much profit will be returned to you if he sells 300,000 abalone?8.6 a. The accounting break-even= 340,000 / (2.00 - 0.72)= 265,625 abalonesb. [($2.00 300,000) - (340,000 + 0.72 300,000)] (0.65)= $28,600This is the after tax profit.Present Value Break-Even Analysis8.7 Using the information in the problem above, what is the present value break-even point ifthe discount rate is 15 percent, initial investment is $140,000, and the lifeof the project isseven years? Assume a straight-line depreciation method with a zero salvage value.A = $33,6508.7 EAC = $140,000 / 7.015Depreciation = $140,000 / 7 = $20,000BEP = {$33,650 + $340,000 0.65 - $20,000 0.35} / {($2 - $0.72) 0.65}= 297,656.25297,657 units8.8 Kids & Toys Inc. has purchased a $200,000 machine to produce toy cars. The machine willbe fully depreciated by the straight-line method for its economic life of five years and will beworthless after its life. The firm expects that the sales price ofthe toy is $25 while its variablecost is $5. The firm should also pay $350,000 asfixed costs each year. The corporate tax ratefor the company is 25 percent, and the appropriate discount rate is 12 percent. What is thepresent value break-even point?8.8 Depreciation = $200,000 / 5 = $40,000A = $200,000 / 3.60478EAC = $200,000 / 5.012= $55,482BEP = {$55,482 + $350,000 0.75 - $40,000 0.25} / {($25 - $5)0.75}= 20,532.1320533 units8.9 The Cornchopper Company is considering the purchase of a new harvester. Thecompany is currently involved in deliberations with the manufacturer and the partieshave not come to settlement regarding the final purchase price. The management ofCornchopperhas hired you to determine the break-even purchase price of the harvester.This price is that which will make the NPV of the project zero. Base your analysis onthe following facts:• The new harvester is not expected to affect revenues, but operating expenses will bereduced by $10,000 per year for 10 years.• The old harvester is now 5 years old, with 10 years of its scheduled life remaining. It waspurchased for $45,000. It has been depreciated on a straight-line basis.• The old harvester has a current market value of $20,000.• The new harvester will be depreciated on a straight-line basis over its 10-year life.• The corporate tax rate is 34 percent.• The firm’s required rate of return is 15 percent.• All cash flows occur at year-end. However, the initial investment, the proceeds fromselling the old harvester, and any tax effects will occur immediately. Capital gains andlosses are taxed at the corporate rate of 34 percent when they are realized. • The expected market value of both harvesters at the end of their economic lives is zero.8.9 Let I be the break-even purchase price.Incremental C0Sale of the old machine $20,000Tax effect 3,400Total $23,400Depreciation per period= $45,000 / 15= $3,000Book value of the machine= $45,000 - 5 $3,000= $30,000Loss on sale of machine= $30,000 - $20,000= $10,000Tax credit due to loss= $10,000 0.34= $3,400Incremental cost savings:$10,000 (1 - 0.34) = $6,600Incremental depreciation tax shield:[I / 10 - $3,000] (0.34)The break-even purchase price is the Investment (I), which makes the NPV be zero.NPV = 0A= -I + $23,400 + $6,600 10.015A+ [I / 10 - $3,000] (0.34) 1015.0= -I + $23,400 + $6,600 (5.0188)+ I (0.034) (5.0188) - $3,000 (0.34) (5.0188)I = $61,981Scenario Analysis8.10 Ms. Thompson, as the CFO of a clock maker, is considering an investment of a $420,000machine that has a seven-year life and no salvage value. The machine is depreciated by astraight-line method with a zero salvage over the seven years. The appropriate discountrate for cash flows of the project is 13 percent, and thecorporate tax rate of the company is35 percent. Calculate the NPV of the project inthe following scenario. What is yourconclusion about the project?Pessimistic Expected OptimisticUnit sales 23,000 25,000 27,000Price $ 38 $ 40 $ 42Variable costs $ 21 $ 20 $ 19Fixed costs $320,000 $300,000 $280,000 8.10 Pessimistic:NPV = -$420,000 +(){}23,000$38$21$320,0000.65$60,0000.351.13tt17--⨯+⨯=∑= -$123,021.71 Expected:NPV = -$420,000 +(){}25,000$40$20$300,0000.65$60,0000.351.13t7--⨯+⨯=∑t1= $247,814.17 Optimistic:NPV = -$420,000 +(){}27,000$42$19$280,0000.65$60,0000.351.13tt17--⨯+⨯=∑= $653,146.42Even though the NPV of pessimistic case is negative, if we change oneinput while all others are assumed to meet their expectation, we have all positive NPVs like the one before. Thus, this project is quiteprofitable.PessimisticNPVUnit sales 23,000 $132,826.30Price $38 $104,079.33Variablecosts$21 $175,946.75Fixed costs $320,000 $190,320.248.11 You are the financial analyst for a manufacturer of tennis rackets that has identified agraphite-like material that it is considering using in its rackets. Given the followinginformation about the results of launching a new racket, will you undertake the project?(Assumptions: Tax rate _ 40%, Effective discount rate _ 13%, Depreciation _ $300,000 per year, and production will occur over the next five years only.)Pessimistic Expected OptimisticMarket size 110,000 120,000 130,000Market share 22% 25% 27%Price $ 115 $ 120 $ 125Variable costs $ 72 $ 70 $ 68Fixed costs $ 850,000 $ 800,000 $ 750,000Investment $1,500,000 $1,500,000 $1,500,0008.11 Pessimistic:NPV = -$1,500,000+(){}1100000220000600000401131,.$850,.$300,..⨯--⨯+⨯=∑$115$725tt= -$675,701.68Expected:NPV = -$1,500,000+(){}1200000250000600000401131,.$800,.$300,..⨯--⨯+⨯=∑$120$705tt= $399,304.88Optimistic:NPV = -$1,500,000+(){}130,0000.27$125$68$750,0000.60$300,0000.401.13tt15⨯--⨯+⨯=∑= $1,561,468.43The expected present value of the new tennis racket is $428,357.21.(Assuming there are equal chances of the 3 scenarios occurring.)8.12 What would happen to the analysis done above if your competitor introduces a graphitecomposite that is even lighter than your product? What factors would this likely affect? Doan NPV analysis assuming market size increases (due to more awareness of graphite-basedrackets) to the level predicted by the optimistic scenario but your market share decreases tothe pessimistic level (due to competitive forces). What does this tell you about the relativeimportance of market size versus market share?8.12 NPV =(){}-+⨯--⨯+⨯=∑1,500,000130,0000.22$120$70$800,0000.60$300,0000.401.13tt15= $251,581.17The 3% drop in market share hurt significantly more than the 10,000increase in market size helped. However, if the drop were only 2%, the effects would be about even. Market size is going up by over 8%, thus it seems market share is more important than market size.The Option to Abandon8.13 You have been hired as a financial analyst to do a feasibility study of a new video game forPassivision. Marketing research suggests Passivision can sell 12,000 units per year at$62.50 net cash flow per unit for the next 10 years. Total annual operating cash flow isforecasted to be $62.50 _ 12,000 _ $750,000. The relevant discount rate is 10 percent.The required initial investment is $10 million.a. What is the base case NPV?b. After one year, the video game project can be abandoned for $200,000. After one year,expected cash flows will be revised upward to $1.5 million or to $0 with equal probability. What is the option value of abandonment? What is the revised NPV?8.13 a. NPV = -$10,000,000 + ( $750, 000 1010.A) = -$5,391,574.67b. Revised NPV = -$10,000,000 + $750,000 / 1.10 + [(.5$1,500,000910.A )+ (.5 $200,000 )] / 1.10= -$5,300,665.58 Option value of abandonment = -$5,300,665.58 – ( -$5,391,574.67 )= $90,909.098.14 Allied Products is thinking about a new product launch. The vice president of marketingsuggests that Allied Products can sell 2 million units per year at $100 net cash flow perunit for the next 10 years. Allied Products uses a 20-percent discount rate for new productlaunches and the required initial investment is $100 million. a. What is the base case NPV?b. After the first year, the project can be dismantled and sold for scrap for $50 million. Ifexpected cash flows can be revised based on the first year ’s experience, when would itmake sense to abandon the project? (Hint: At what level of expected cash flows does itmake sense to abandon the project?)8.14 a. NPV = -$100M + ( $100 2M 1020.A ) = $738.49Millionb.$50M = C 920.AC = $12.40 Million (or 1.24 Million units )。