chapter20Long-TermDebt,PreferredStock,andComm

14级财务管理专业英语习题

《14级专业英语》复习资料考试题型:一、短语中英互译(20x1=20分)二、从下列选项中选出最佳答案(20x1=20分)三、计算题(25分)四、段落中英互译(35分)同学们:考试的时候请带上没有存储功能的计算器,试卷上只要是涉及到计算的题里面的数字可能与复习资料上的数字不完全一样,但是计算方法是相似的,所以大家要掌握计算方法,考试的时候要自己计算。

预祝同学们取得好成绩。

Part I terminologytranslation (1*20 points)Directions: interpret the following terminology in English or Chinese.(范围课后核心词汇)e。

g。

:1。

financial management———译成汉语 2.普通股----译成英语Part II Choice questions (1*20 points) (Please write your answer in the following table)1. Financial statement does not include ()A。

balance sheet B. income statementC。

cash flow statement D。

working sheet2. An increase in which one of the following will increase the operating cash flow?A.employee salariesB. office rentC. building maintenance D。

equipment depreciation3。

The process of planning and managing a firm’s long—term investments is called:A。

working capital management。

国际财务管理课后习题答案chapter

CHAPTER 10 MANAGEMENT OF TRANSLATION EXPOSURESUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTERQUESTIONS AND PROBLEMSQUESTIONS1. Explain the difference in the translation process between the monetary/nonmonetary method and the temporal method.Answer: Under the monetary/nonmonetary method, all monetary balance sheet accounts of a foreign subsidiary are translated at the current exchange rate. Other balance sheet accounts are translated at the historical rate exchange rate in effect when the account was first recorded. Under the temporal method, monetary accounts are translated at the current exchange rate. Other balance sheet accounts are also translated at the current rate, if they are carried on the books at current value. If they are carried at historical value, they are translated at the rate in effect on the date the item was put on the books. Since fixed assets and inventory are usually carried at historical costs, the temporal method and the monetary/nonmonetary method will typically provide the same translation.2. How are translation gains and losses handled differently according to the current rate method in comparison to the other three methods, that is, the current/noncurrent method, the monetary/nonmonetary method, and the temporal method?Answer: Under the current rate method, translation gains and losses are handled only as an adjustment to net worth through an equity account named the “cumulative translation adjustment” account. Nothing passes through the income statement. The other three translation methods pass foreign exchange gains or losses through the income statement before they enter on to the balance sheet through the accumulated retained earnings account.3. Identify some instances under FASB 52 when a foreign enti ty’s functional currency would be the same as the parent firm’s currency.Answer: Three examples under FASB 52, where the foreign entity’s functional currency will be the same as the parent firm’s currency, are: i) the foreign entity’s cash flows directly affect the parent’s cash flows and are readily available for remittance to the parent firm; ii) the sales prices for the foreign entity’s products are responsive on a short-term basis to exchange rate changes, where sales prices are determined through wo rldwide competition; and, iii) the sales market is primarily located in the parent’s country or sales contracts are denominated in the parent’s currency.4. Describe the remeasurement and translation process under FASB 52 of a wholly owned affiliate that keeps its books in the local currency of the country in which it operates, which is different than its functional currency.Answer: For a foreign entity that keeps its books in its local currency, which is different from its functional currency, the translation process according to FASB 52 is to: first, remeasure the financial reports from the local currency into the functional currency using the temporal method of translation, and second, translate from the functional currency into the reporting currency using the current rate method of translation.5. It is, generally, not possible to completely eliminate both translation exposure and transaction exposure. In some cases, the elimination of one exposure will also eliminate the other. But in other cases, the elimination of one exposure actually creates the other. Discuss which exposure might be viewed as the most important to effectively manage, if a conflict between controlling both arises. Also, discuss and critique the common methods for controlling translation exposure.Answer: Since it is, generally, not possible to completely eliminate both transaction and translation exposure, we recommend that transaction exposure be given first priority since it involves real cash flows. The translation process, on-the-other hand, has no direct effect on reporting currency cash flows, and will only have a realizable effect on net investment upon the sale or liquidation of the assets.There are two common methods for controlling translation exposure: a balance sheet hedge and a derivatives hedge. The balance sheet hedge involves equating the amount of exposed assets in an exposure currency with the exposed liabilities in that currency, so the net exposure is zero. Thus when an exposure currency exchange rate changes versus the reporting currency, the change in assets will offset the change in liabilities. To create a balance sheet hedge, once transaction exposure has been controlled, often means creating new transaction exposure. This is not wise since real cash flow losses can result. A derivatives hedge is not really a hedge, but rather a speculative position, since the size of the “hedge” is based on the future expected spot rate of exchange for the exposure currency with the reporting currency. If the actual spot rate differs from the expected rate, the “hedge” may result in the loss of real cash flows.PROBLEMS1. Assume that FASB 8 is still in effect instead of FASB 52. Construct a translation exposure report for Centralia Corporation and its affiliates that is the counterpart to Exhibit 10.7 in the text. Centralia and its affiliates carry inventory and fixed assets on the books at historical values.Solution: The following table provides a translation exposure report for Centralia Corporation and its affiliates under FASB 8, which is essentially the temporal method of translation. The difference between the new report and Exhibit 10.7 is that nonmonetary accounts such as inventory and fixed assets are translated at the historical exchange rate if they are carried at historical costs. Thus, these accounts will not change values when exchange rates change and they do not create translation exposure.Examination of the table indicates that under FASB 8 there is negative net exposure for the Mexican peso and the euro, whereas under FASB 52 the net exposure for these currencies is positive. There is no change in net exposure for the Canadian dollar and the Swiss franc. Consequently, if the euro depreciates against the dollar from €1.1000/$1.00 to €1.1786/$1.00, as the text example assumed, exposed assets will now fall in value by a smaller amount than exposed liabilities, instead of vice versa. The associated reporting currency imbalance will be $239,415, calculated as follows:Reporting Currency Imbalance=-€3,949,0000€1.1786/$1.00--€3,949,0000€1.1000/$1.00=$239,415.Translation Exposure Report under FASB 8 for Centralia Corporation and its Mexican and Spanish Affiliates, December 31, 2005 (in 000 Currency Units)Canadian Dollar MexicanPeso EuroSwissFrancAssetsCash CD200 Ps 6,000 € 825SF 0 Accounts receivable 0 9,000 1,045 0Inventory 0 0 0 0Net fixed assets 0 0 0 0Exposed assets CD200 Ps15,000 € 1,870SF 0LiabilitiesAccounts payable CD 0 Ps 7,000 € 1,364SF 0Notes payable 0 17,000 935 1,400Long-term debt 0 27,000 3,520 0Exposed liabilities CD 0 Ps51,000 € 5,819SF1,400Net exposure CD200 (Ps36,000) (€3,949)(SF1,400)2. Assume that FASB 8 is still in effect instead of FASB 52. Construct a consolidated balance sheet for Centralia Corporation and its affiliates after a depreciation of the euro from €1.1000/$1.00 to €1.1786/$1.00 that is the counterpart to Exhibit 10.8 in the text. Centralia and its affiliates c arry inventory and fixed assets on the books at historical values.Solution: This problem is the sequel to Problem 1. The solution to Problem 1 showed that if the euro depreciated there would be a reporting currency imbalance of $239,415. Under FASB 8 this is carried through the income statement as a foreign exchange gain to the retained earnings on the balance sheet. The following table shows that consolidated retained earnings increased to $4,190,000 from $3,950,000 in Exhibit 10.8. This is an increase of $240,000, which is the same as the reporting currency imbalance after accounting for rounding error.Consolidated Balance Sheet under FASB 8 for Centralia Corporation and its Mexican and Spanisha This includes CD200,000 the parent firm has in a Canadian bank, carried as $150,000. CD200,000/(CD1.3333/$1.00) = $150,000.b$1,750,000 - $300,000 (= Ps3,000,000/(Ps10.00/$1.00)) intracompany loan = $1,450,000.c,d Investment in affiliates cancels with the net worth of the affiliates in the consolidation.e The Spanish affiliate owes a Swiss bank SF375,000 (÷ SF1.2727/€1.00 = €294,649). This is carried on the books,after the exchange rate change, as part of €1,229,649 = €294,649 + €935,000. €1,229,649/(€1.1786/$1.00) = $1,043,313.3. In Example 10.2, a f orward contract was used to establish a derivatives “hedge” to protect Centralia from a translation loss if the euro depreciated from €1.1000/$1.00 to €1.1786/$1.00. Assume that an over-the-counter put option on the euro with a strike price of €1.1393/$1.00 (or $0.8777/€1.00) can be purchased for $0.0088 per euro. Show how the potential translation loss can be “hedged” with an option contract.Solution: As in example 10.2, if the potential translation loss is $110,704, the equivalent amount in functiona l currency that needs to be hedged is €3,782,468. If in fact the euro does depreciate to €1.1786/$1.00 ($0.8485/€1.00), €3,782,468 can be purchased in the spot market for $3,209,289. At a striking price of €1.1393/$1.00, the €3,782,468 can be sold throu gh the put for $3,319,993, yielding a gross profit of $110,704. The put option cost $33,286 (= €3,782,468 x $0.0088). Thus, at an exchange rate of €1.1786/$1.00, the put option will effectively hedge $110,704 - $33,286 = $77,418 of the potential translat ion loss. At terminal exchange rates of €1.1393/$1.00 to €1.1786/$1.00, the put option hedge will be less effective. An option contract does not have to be exercised if doing so is disadvantageous to the option owner. Therefore, the put will not be exer cised at exchange rates of less than €1.1393/$1.00 (more than $0.8777/€1.00), in which case the “hedge” will lose the $33,286 cost of the option.MINI CASE: SUNDANCE SPORTING GOODS, INC.Sundance Sporting Goods, Inc., is a U.S. manufacturer of high-quality sporting goods--principally golf, tennis and other racquet equipment, and also lawn sports, such as croquet and badminton-- with administrative offices and manufacturing facilities in Chicago, Illinois. Sundance has two wholly owned manufacturing affiliates, one in Mexico and the other in Canada. The Mexican affiliate is located in Mexico City and services all of Latin America. The Canadian affiliate is in Toronto and serves only Canada. Each affiliate keeps its books in its local currency, which is also the functional currency for the affiliate. The current exchange rates are: $1.00 = CD1.25 = Ps3.30 = A1.00 = ¥105 = W800. The nonconsolidated balance sheets for Sundance and its two affiliates appear in the accompanying table.Nonconsolidated Balance Sheet for Sundance Sporting Goods, Inc. and Its Mexican and Canadiana The parent firm is owed Ps1,320,000 by the Mexican affiliate. This sum is included in the parent’s accounts receivable as $400,000, translated at Ps3.30/$1.00. The remainder of the parent’s (Mexican affiliate’s) a ccounts receivable (payable) is denominated in dollars (pesos).b The Mexican affiliate is wholly owned by the parent firm. It is carried on the parent firm’s books at $2,400,000. This represents the sum of the common stock (Ps4,500,000) and retained earnings (Ps3,420,000) on the Mexican affiliate’s books, translated at Ps3.30/$1.00.c The Canadian affiliate is wholly owned by the parent firm. It is carried on the parent firm’s books at $3,600,000. This represents the sum of the common stock (CD2,900,000) and the retained earnings (CD1,600,000) on the Canadian affiliate’s books, translated at CD1.25/$1.00.d The parent firm has outstanding notes payable of ¥126,000,000 due a Japanese bank. This sum is carried on th e parent firm’s books as $1,200,000, translated at ¥105/$1.00. Other notes payable are denominated in U.S. dollars.e The Mexican affiliate has sold on account A120,000 of merchandise to an Argentine import house. This sum is carried on the Mexican affi liate’s books as Ps396,000, translated at A1.00/Ps3.30. Other accounts receivable are denominated in Mexican pesos.f The Canadian affiliate has sold on account W192,000,000 of merchandise to a Korean importer. This sum is carried on the Canadian affilia te’s books as CD300,000, translated at W800/CD1.25. Other accounts receivable are denominated in Canadian dollars.You joined the International Treasury division of Sundance six months ago after spending the last two years receiving your MBA degree. The corporate treasurer has asked you to prepare a report analyzing all aspects of the translation exposure faced by Sundance as a MNC. She has also asked you to address in your analysis the relationship between the firm’s translation exposure and its transa ction exposure. After performing a forecast of future spot rates of exchange, you decide that you must do the following before any sensible report can be written.a. Using the current exchange rates and the nonconsolidated balance sheets for Sundance and its affiliates, prepare a consolidated balance sheet for the MNC according to FASB 52.b. i. Prepare a translation exposure report for Sundance Sporting Goods, Inc., and its two affiliates.ii. Using the translation exposure report you have prepared, determine if any reporting currency imbalance will result from a change in exchange rates to which the firm has currency exposure. Your forecast is that exchange rates will change from $1.00 = CD1.25 = Ps3.30 = A1.00 = ¥105 = W800 to $1.00 = CD1.30 = Ps3.30 = A1.03 = ¥105 = W800.c. Prepare a second consolidated balance sheet for the MNC using the exchange rates you expect in the future. Determine how any reporting currency imbalance will affect the new consolidated balance sheet for the MNC.d. i. Prepare a transaction exposure report for Sundance and its affiliates. Determine if any transaction exposures are also translation exposures.ii. Investigate what Sundance and its affiliates can do to control its transaction and translation exposures. Determine if any of the translation exposure should be hedged.Suggested Solution to Sundance Sporting Goods, Inc.Note to Instructor: It is not necessary to assign the entire case problem. Parts a. and b.i. can be used as self-contained problems, respectively, on basic balance sheet consolidation and the preparation of a translation exposure report.a. Below is the consolidated balance sheet for the MNC prepared according to the current rate method prescribed by FASB 52. Note that the balance sheet balances. That is, Total Assets and Total Liabilities and Net Worth equal one another. Thus, the assumption is that the current exchange rates are the same as when the affiliates were established. This assumption is relaxed in part c.Consolidated Balance Sheet for Sundance Sporting Goods, Inc. its Mexican and Canadian Affiliates, December 31, 2005: Pre-Exchange Rate Change (in 000 Dollars)Sundance, Inc. Mexican Canadian Consolidateda$2,500,000 - $400,000 (= Ps1,320,000/(Ps3.30/$1.00)) intracompany loan = $2,100,000.b,c The investment in the affiliates cancels with the net worth of the affiliates in the consolidation.d The parent owes a Japanese bank ¥126,000,000. This is carried on the books as $1,200,000 (=¥126,000,000/(¥105/$1.00)).e The Mexican affiliate has sold on account A120,000 of merchandise to an Argentine import house. This is carried on the Mexican affiliate’s books as Ps396,000 (= A120,000 x Ps3.30/A1.00).f The Canadian affiliate has sold on account W192,000,000 of merchandise to a Korean importer. This is carried on the Canadian affiliate’s books as CD300,000 (= W192,000,000/(W800/CD1.25)).b. i. Below is presented the translation exposure report for the Sundance MNC. Note, from the report that there is net positive exposure in the Mexican peso, Canadian dollar, Argentine austral and Korean won. If any of these exposure currencies appreciates (depreciates) against the U.S. dollar, exposed assets denominated in these currencies will increase (fall) in translated value by a greater amount than the exposed liabilities denominated in these currencies. There is negative net exposure in the Japanese yen. If the yen appreciates (depreciates) against the U.S. dollar, exposed assets denominated in the yen will increase (fall) in translated value by smaller amount than the exposed liabilities denominated in the yen.Translation Exposure Report for Sundance Sporting Goods, Inc. and its Mexican and Canadian Affiliates, December 31, 2005 (in 000 Currency Units)b. ii. The problem assumes that Canadian dollar depreciates from CD1.25/$1.00 to CD1.30/$1.00 and that the Argentine austral depreciates from A1.00/$1.00 to A1.03/$1.00. To determine the reporting currency imbalance in translated value caused by these exchange rate changes, we can use the following formula:Net Exposure Currency i S(i/reporting)-Net Exposure Currency i S(i/reporting)new old = Reporting Currency Imbalance.From the translation exposure report we can determine that the depreciation in the Canadian dollar will cause aCD4,200,000 CD1.30/$1.00-CD4,200,000CD1.25/$1.00= -$129,231reporting currency imbalance.Similarly, the depreciation in the Argentine austral will cause aA120,000 A1.03/$1.00-A120,000A1.00/$1.00= -$3,495reporting currency imbalance.In total, the depreciation of the Canadian dollar and the Argentine austral will cause a reporting currency imbalance in translated value equal to -$129,231 -$3,495= -$132,726.c. The new consolidated balance sheet for Sundance MNC after the depreciation of the Canadian dollar and the Argentine austral is presented below. Note that in order for the new consolidated balance sheet to balance after the exchange rate change, it is necessary to have a cumulative translation adjustment account balance of -$133 thousand, which is the amount of the reporting currency imbalance determined in part b. ii (rounded to the nearest thousand).Consolidated Balance Sheet for Sundance Sporting Goods, Inc. its Mexican and Canadian Affiliates, December 31, 2005: Post-Exchange Rate Change (in 000 Dollars)a$2,500,000 - $400,000 (= Ps1,320,000/(Ps3.30/$1.00)) intracompany loan = $2,100,000.b,c The investment in the affiliates cancels with the net worth of the affiliates in the consolidation.d The parent owes a Japanese bank ¥126,000,000. This is carried on the books as $1,200,000 (=¥126,000,000/(¥105/$1.00)).e The Mexican affiliate has sold on account A120,000 of merchandise to an Argentine import house. This is carried on the Mexican affiliate’s books as Ps384,466 (= A120,000 x Ps3.30/A1.03).f The Canadian affiliate has sold on account W192,000,000 of merchandise to a Korean importer. This is carried on the Canadian affiliate’s books as CD312,000 (=W192,000,000/(W800/CD1.30)).d. i. The transaction exposure report for Sundance, Inc. and its two affiliates is presented below. The report indicates that the Ps1,320,000 accounts receivable due from the Mexican affiliate is not also a translation exposure because this is netted out in the consolidation. However, the ¥126,000,000 notes payable of the parent is also a translation exposure. Additionally, the A120,000 accounts receivable of the Mexican affiliate and the W192,000,000 accounts receivable of the Canadian affiliate are both translation exposures.Transaction Exposure Report for Sundance Sporting Goods, Inc. andits Mexican and Canadian Affiliates, December 31, 2005d. ii. Since transaction exposure may potentially result in real cash flow losses while translation exposure does not have an immediate direct effect on operating cash flows, we will first address the transaction exposure that confronts Sundance and its affiliates. The analysis assumes the depreciation in the Canadian dollar and the Argentine austral have already taken place.The parent firm can pay off the ¥126,000,000 loan from the Japanese bank using funds from the cash account and money from accounts receivable that it will collect. Additionally, the parent firm can collect the accounts receivable of Ps1,320,000 from its Mexican affiliate that is carried on the books as $400,000. In turn, the Mexican affiliate can collect the A120,000 accounts receivable from the Argentine importer, valued at Ps384,466 after the depreciation in the austral, to guard against further depreciation and to use to partially pay off the peso liability to the parent. The Canadian affiliate can eliminate its transaction exposure by collecting the W192,000,000 accounts receivable as soon as possible, which is currently valued at CD312,000.The elimination of these transaction exposures will affect the translation exposure of Sundance MNC. A revised translation exposure report follows.Revised Translation Exposure Report for Sundance Sporting Goods, Inc. and its Mexican and Canadian Affiliates, December 31, 2005 (in 000 Currency Units)Note from the revised translation exposure report that the elimination of the transaction exposure will also eliminate the translation exposure in the Japanese yen, Argentine austral and the Korean won. Moreover, the net translation exposure in the Mexican peso has been reduced. But the net translation exposure in the Canadian dollar has increased as a result of the Canadian affiliate’s collection of the won receivable.The remaining translation exposure can be hedged using a balance sheet hedge or a derivatives hedge. Use of a balance sheet hedge is likely to create new transaction exposure, however. Use of a derivatives hedge is actually speculative, and not a real hedge, since the size of the “hedge” is based on one’s expectation as to the future spot exchange rate. An incorrect estimate will result in the “hedge” losing money for the MNC.。

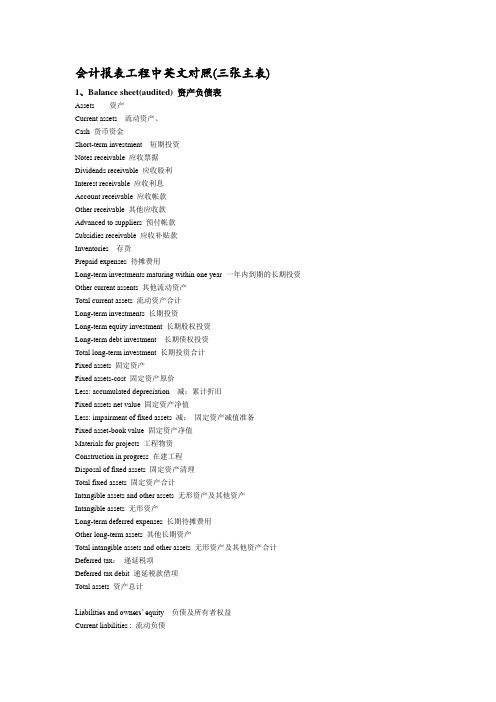

会计报表项目中英文对照(三张主表)

会计报表工程中英文对照(三张主表)1、Balance sheet(audited) 资产负债表Assets 资产Current assets 流动资产、Cash 货币资金Short-term investment 短期投资Notes receivable 应收票据Dividends receivable 应收股利Interest receivable 应收利息Account receivable 应收帐款Other receivable 其他应收款Advanced to suppliers 预付帐款Subsidies receivable 应收补贴款Inventories 存货Prepaid expenses 待摊费用Long-term investments maturing within one year 一年内到期的长期投资Other current assents 其他流动资产Total current assets 流动资产合计Long-term investments 长期投资Long-term equity investment 长期股权投资Long-term debt investment 长期债权投资Total long-term investment 长期投资合计Fixed assets 固定资产Fixed assets-cost 固定资产原价Less: accumulated depreciation 减:累计折旧Fixed assets net value 固定资产净值Less: impairment of fixed assets 减:固定资产减值准备Fixed asset-book value 固定资产净值Materials for projects 工程物资Construction in progress 在建工程Disposal of fixed assets 固定资产清理Total fixed assets 固定资产合计Intangible assets and other assets 无形资产及其他资产Intangible assets 无形资产Long-term deferred expenses 长期待摊费用Other long-term assets 其他长期资产Total intangible assets and other assets 无形资产及其他资产合计Deferred tax:递延税项Deferred tax debit 递延税款借项Total assets 资产总计Liabilities and owners’ equity负债及所有者权益Current liabilities : 流动负债Short-term loans 短期借款Notes payable 应付票据Account payable 应付帐款Advance from customers 预收帐款Accrued payroll 应付工资Accrued employee’s welfare expenses应付福利费Dividends payable 应付股利Taxes payable 应交税金Other taxes and expense payable 其他应交款Other payable 其他应付款Accrued expenses 预提费用Provisions 预计负债Long-term liabilities due within one year 一年内到期的长期负债Other current liabilities 其他流动负债Total current liabilities 流动负债合计Long-term liabilities:长期负债Long-term loans 长期借款Bonds payable 应付债券Long-term accounts payable 长期应付款Specific account payable 专项应付款Other long-term liabilities 其他长期负债Total long-term liabilities 长期负债合计Deferred tax: 递延税项Deferred tax credits 递延税款贷项Total other liabilities : 负债合计Owner’s equity:所有者权益〔股东权益〕Paid-in capital 实收资本Less :investment returned 减:已归还投资Pain-in capital-net 实收资本净额Capital surplus 资本公积Surplus from profits 盈余公积Including: statutory public welfare fund 其中:法定公益金Undistributed profit 未分配利润Total owner’s equity所有者权益〔股东权益〕Total liabilities and owner’s equities负债及所有者权益Total liabilities and owner’s equiti es 负债及所有者权益2、Income statement (audited) 利润表Item 工程Sales 产品销售收入Including :export sales 其中:出口产品销售收入Less: sales discounts and allowances 减:销售折扣与折让Net sales 产品销售净额Less: sales tax 减:产品销售税金Cost of sales 产品销售本钱Including :cost of export sales 出口产品销售本钱Gross profit 产品销售毛利Less : selling expense 减:销售费用General and administrative expense 管理费用Financial expense 财务费用Including :interest expense(less interest income) 其中:利息支出〔减利息收入〕Exchange loss (less exchange gain) 汇兑损失〔减汇兑收益〕Income from main operation 产品销售利润Add :income from other operations 加:其他业务利润Operating income 营业利润Add : investment income 加:投资收益Non-operating expense 营业外收入Less: non-operating expense 减:营业外支出Add: adjustment to pripr year’s income and expense加:以前年度损益调整Income before tax 利润总额Less: income tax 减:所得税Net income 净利润Statement of profit apropriation and distribution (audited) 利润分配表Item 工程Net income 净利润Add: undistributed profit at beginning of year 加:年初未分配利润Other transferred in 其他转入Profit available for distribution 可供分配的利润Less: statutory surplus from profits 减:提取法定盈余公积Statutory public welfare fund 提取法定公益金Staff and workers’ bonus and welfare fund职工奖励及福利基金Reserve fund 提取储藏基金Enterprise expansion fund 提取企业开展基金Profit capitalized on return of investments 利润归还投资Profit available for distribution to owners 可供投资者分配的利润Less: dividends payable for preferred stock 应付优先股股利V oluntary surplus from profits 提取任意盈余公积Dividends payable for common stock 应付普通股股利Dividends transferred to capital 转作股本的普通股股利Undistributed profit 未分配利润3、Cash flows statement 现金流量表工程 Item NO。

投资学课后习题答案Chapter02

投资学课后习题答案Chapter02CHAPTER 2: ASSET CLASSES ANDFINANCIAL INVESTMENTSPROBLEM SETS1. Preferred stock is like long-term debt in that it typically promises a fixed payment eachyear. In this way, it is a perpetuity. Preferred stock is also like long-term debt in that itdoes not give the holder voting rights in the firm.Preferred stock is like equity in that the firm is under no contractual obligation to make the preferred stock dividend payments. Failure to make payments does not set off corporate bankruptcy. With respect to the priority of claims to the assets of the firm in the event of corporate bankruptcy, preferred stock has a higher priority than common equity but a lower priority than bonds.2. Money market securities are called “cash equivalents” because of their great liquidity.The prices of money market securities are very stable, and they can be converted tocash (i.e., sold) on very short notice and with very low transaction costs.3. The spread will widen. Deterioration of the economy increases credit risk, that is, thelikelihood of default. Investors will demand a greater premium on debt securitiessubject to default risk.4. On the day we tried this experiment, 36 of the 50 stocks met this criterion, leading us toconclude that returns on stock investments can be quite volatile.5. a. You would have to pay the asked price of:118:31 = 118.96875% of par = $1,189.6875b. The coupon rate is 11.750% implying coupon payments of $117.50 annually or, moreprecisely, $58.75 semiannually.c.Current yield = Annual coupon income/price= $117.50/$1,189.6875 = 0.0988 = 9.88%6. P = $10,000/1.02 = $9,803.927. The total before-tax income is $4. After the 70% exclusion for preferred stock dividends, thetaxable income is: 0.30 ? $4 = $1.20Therefore, taxes are: 0.30 ? $1.20 = $0.36After-tax income is: $4.00 – $0.36 = $3.64Rate of return is: $3.64/$40.00 = 9.10%8. a. General Dynamics closed today at $74.59, which was $0.17 higher than yes terday’sprice. Yesterday’s closing price was: $74.42b. You could buy: $5,000/$74.59 = 67.03 sharesc. Your annual dividend income would be: 67.03 ? $0.92 = $61.67d. The price-to-earnings ratio is 16 and the price is $74.59. Therefore:$74.59/Earnings per share = 16 ? Earnings per share = $4.669. a. At t = 0, the value of the index is: (90 + 50 + 100)/3 = 80At t = 1, the value of the index is: (95 + 45 + 110)/3 = 83.333 The rate of return is: (83.333/80) - 1 = 4.17%b.In the absence of a split, Stock C would sell for 110, so thevalue of the indexwould be: 250/3 = 83.333After the split, Stock C sells for 55. Therefore, we need to find the divisor (d)such that:83.333 = (95 + 45 + 55)/d ? d = 2.340c. The return is zero. The index remains unchanged because the return for each stockseparately equals zero.10. a. Total market value at t = 0 is: ($9,000 + $10,000 + $20,000) = $39,000T otal market value at t = 1 is: ($9,500 + $9,000 + $22,000) = $40,500R ate of return = ($40,500/$39,000) – 1 = 3.85%b.The return on each stock is as follows:r A = (95/90) – 1 = 0.0556r B = (45/50) – 1 = –0.10r C = (110/100) – 1 = 0.10The equally-weighted average is:[0.0556 + (-0.10) + 0.10]/3 = 0.0185 = 1.85%11. The after-tax yield on the corporate bonds is: 0.09 ? (1 –0.30) = 0.0630 = 6.30%Therefore, municipals must offer at least 6.30% yields.12. Equation (2.2) shows that the equivalent taxable yield is: r = r m/(1 – t)a. 4.00%b. 4.44%c. 5.00%d. 5.71%13. a. The higher coupon bond.b. The call with the lower exercise price.c. The put on the lower priced stock.14. a. You bought the contract when the futures price was 1427.50 (see Figure 2.12). Thecontract closes at a price of 1300, which is 127.50 less than the original futures price. Thecontract multiplier is $250. Therefore, the loss will be:127.50 ? $250 = $31,875b. Open interest is 601,655 contracts.15. a. Since the stock price exceeds the exercise price, you will exercise the call.The payoff on the option will be: $42 - $40 = $2The option originally cost $2.14, so the profit is: $2.00 - $2.14 = -$0.14Rate of return = -$0.14/$2.14 = -0.0654 = -6.54%b. If the call has an exercise price of $42.50, you would not exercise for any stock price of$42.50 or less. The loss on the call would be the initial cost: $0.72c. Since the stock price is less than the exercise price, you will exercise the put.The payoff on the option will be: $42.50 - $42.00 = $0.50The option originally cost $1.83 so the profit is: $0.50 ? $1.83 = ?$1.33Rate of return = ?$1.33/$1.83 = ?0.7268 = ?72.68%。

投资学精要 博迪 第八版 课后答案 Chapter2

CHAPTER 02 ASSET CLASSES AND FINANCIAL INSTRUMENTS mon stock is an ownership share in a publicly held corporation. Commonshareholders have voting rights and may receive dividends. Preferred stockrepresents nonvoting shares in a corporation, usually paying a fixed stream ofdividends. While corporate bonds are long-term debt by corporations, typically paying semi-annual coupons and returning the face value of the bond at maturity.2.While the DJIA has 30 large corporations in the index, it does not represent theoverall market nearly as well as the 500 stocks contained in The Wilshire index.The DJIA is simply too small.3.They are short term, very safe, and highly liquid. Also, their unit value almostnever changes.4.Treasury bills, certificates of d eposit, commercial paper, bankers’ acceptances,Eurodollars, repos, reserves, federal funds and brokers’ calls.5.American Depository Receipts, or ADRs, are certificates traded in U.S. marketsthat represent ownership in shares of a foreign company. Investors may alsopurchase shares of foreign companies on foreign exchanges. Lastly, investors may use international mutual funds to own shares indirectly.6.Because they produce coupons that are tax free.7.The fed funds rate is simply the rate of interest on very short-term loans amongfinancial institutions. The London Interbank Offer Rate (LIBOR) is the rate at which large banks in London are willing to lend money among themselves.8.General obligation bonds are backed by the local governments, while revenuebonds have proceeds attached to specific projects. A revenue bond has lessguarantees, therefore, it is riskier and will have a higher yield.9.Corporations may exclude 70% of dividends received from domestic corporationsin the computation of their taxable income.10.Limited liability means that the most shareholders can lose in event of the failureof the corporation is their original investment.11.Money market securities are referred to as “cash equivalents” because of theirgreat liquidity. The prices of money market securities are very stable, and they can be converted to cash (i.e., sold) on very short notice and with very lowtransaction costs.12.Taxable equivalent yield = .0675 / (1-.35) = .103813.a.The taxable bond. With a zero tax bracket, the after-tax yield for thetaxable bond is the same as the before-tax yield (5%), which is greaterthan the yield on the municipal bond.b.The taxable bond. The after-tax yield for the taxable bond is:0.05 x (1 – 0.10) = 4.5%c.You are indifferent. The after-tax yield for the taxable bond is:0.05 x (1 – 0.20) = 4.0%The after-tax yield is the same as that of the municipal bond.d.The municipal bond offers the higher after-tax yield for investors in taxbrackets above 20%.14.The after-tax yield on the corporate bonds is: [0.09 x (1 – 0.30)] = 0.0630 =6.30%. Therefore, the municipals must offer at least 6.30% yields.15.The equivalent taxable yield (r) is: r = rm/(1 – t)a. 4.00%b. 4.44%c. 5.00%d. 5.71%16.a.You would have to pay the asked price of:107:27 = 107.8438% of par = $1,074.438b.The coupon rate is 4.875%, implying coupon payments of $48.75 annuallyor, more precisely, $24.375 semiannually.c.Current yield = Annual coupon income/price =4.875/107.8438= 0.0452 = 4.52%17.a.The closing price today is $74.92, which is $1.82 below yesterday’s price.Therefore, yesterday’s closing price was: $74.92 + $1.82 = $76.74b.You could buy: $5,000/$74.92 = 66.74 sharesc.Your annual dividend income would be 1.90 % of $5,000, or $95.d.Earnings per share can be derived from the price-earnings (PE) ratio.Price/Earnings = 13 and Price = $74.92 so that Earnings = $74.92/13 =$5.763118.a.At t = 0, the value of the index is: (90 + 50 + 100)/3 = 80At t = 1, the value of the index is: (95 + 45 + 110)/3 = 83.3333The rate of return is: (83.3333/80) – 1 = 4.167%b.In the absence of a split, stock C would sell for 110, and the value of theindex would be: (95 + 45 + 110)/3 = 83.3333After the split, stock C sells at 55. Therefore, we need to set the divisor (d)such that:83.3333 = (95 + 45 + 55)/d…..d = 2.340c.The rate of return is zero. The index remains unchanged, as it should,since the return on each stock separately equals zero.19.a.Total market value at t = 0 is: (9,000 + 10,000 + 20,000) = 39,000Total market value at t = 1 is: (9,500 + 9,000 + 22,000) = 40,500Rate of return = (40,500/39,000) – 1 = 3.85%b.The return on each stock is as follows:R a = (95/90) – 1 = 0.0556R b = (45/50) – 1 = –0.10R c = (110/100) – 1 = 0.10The equally-weighted average is: [0.0556 + (-0.10) + 0.10]/3 =0.0185 = 1.85%20.The fund would require constant readjustment since every change in the price of astock would bring the fund asset allocation out of balance.21.It would increase by 19 points. (60 – 3) / 3 = 1922.Price3.4% x (87/360) = 0.8217% or a $ price of $10,000 x (1-.008217) = $9,917.83Equivalent Yield10,000 / 9,9917.83 = 1.0083 x 365/87 = 4.23%23.a.The higher coupon bondb.The call with the lower exercise pricec.The put on the lower priced stock24.a.The December maturity futures price is $5.116 per bushel. If the contractcloses at $5.25 per bushel in December, your profit / loss on each contract(for delivery of 5,000 bushels of corn) will be: ($5.25 - $5.116) x 5000 =$ 670 gain.b.There are 5114,099 contracts outstanding, representing 570,495,000bushels of corn.25.a.Yes. As long as the stock price at expiration exceeds the exercise price, itmakes sense to exercise the call.Gross profit is: $111 - $ 105 = $6Net profit = $6 – $ 22.40 = $16.40 lossRate of return = -16.40 / 22.40 = - .7321 or 73.21% lossb.Yes, exercise.Gross profit is: $111 - $ 100 = $11Net profit = $11 – $ 22.40 = $11.40 lossRate of return = -11.40 / 22.40 = 0.5089 or 50.89 % lossc. A put with exercise price $105 would expire worthless for any stock priceequal to or greater than $105. An investor in such a put would have a rateof return over the holding period of –100%.26.a.Long callb.Long putc.Short putd.Short call27.There is always a chance that the option will expire in the money. Investors willpay something for this chance of a positive payoff.28.Value of callInitial Cost Profitat expirationa. 0 4 -4b. 0 4 -4c. 0 4 -4d. 5 4 1e. 10 4 6Value of putInitial Cost Profitat expirationa. 10 6 4b. 5 6 -1c. 0 6 -6d. 0 6 -6e. 0 6 -629.The spread will widen. Deterioration of the economy increases credit risk, that is,the likelihood of default. Investors will demand a greater premium on debtsecurities subject to default risk.30.Eleven stocks have a 52 week high at least 150% above the 52 week low.Individual stocks are much more volatile than a group of stocks.31.The total before-tax income is $4. After the 70% exclusion, taxable income is:0.30 x $4 = $1.20Therefore:Taxes = 0.30 x $1.20 = $0.36After-tax income = $4 – $0.36 = $3.64After-tax rate of return = $3.64 / $40 = 9.10%32.A put option conveys the right to sell the underlying asset at the exercise price. Ashort position in a futures contract carries an obligation to sell the underlyingasset at the futures price.33.A call option conveys the right to buy the underlying asset at the exercise price.A long position in a futures contract carries an obligation to buy the underlyingasset at the futures price.CFA 1Answer: c。

2014-2015上公司金融期末考试

公司理财试卷详解单选1. A conflict of interest between the stockholders and management of a firm is called:A. stockholders' liability.B. corporate breakdown.C. the agency problem.代理问题D. corporate activism.E. legal liability.2. Agency costs refer to:A. the total dividends paid to stockholders over the lifetime of a firm.B. the costs that result from default and bankruptcy of a firm.C. corporate income subject to double taxation.D. the costs of any conflicts of interest between stockholders and management.股东和管理层利益冲突的成本E. the total interest paid to creditors over the lifetime of the firm.3. Working capital management includes decisions concerning which of the following?I. accounts payableII. long-term debtIII. accounts receivableIV. inventoryA. I and II onlyB. I and III onlyC. II and IV onlyD. I, II, and III onlyE. I, III, and IV only4. The process of planning and managing a firm's long-term investments is called:A. working capital management.B. financial depreciation.C. agency cost analysis.D. capital budgeting.资本预算E. capital structure.4. The mixture of debt and equity used by a firm to finance its operations is called:A. working capital management.B. financial depreciation.C. cost analysis.D. capital budgeting.E. capital structure.资本结构5. The management of a firm's short-term assets and liabilities is called:A. working capital management.运营资本管理B. debt management.C. equity management.D. capital budgeting.E. capital structure.6. Which of the following are advantages of the corporate form of business ownership?I. limited liability for firm debt对公司负债承担有限责任II. double taxation双重课税(缺点)III. ability to raise capital筹集资金能力强IV. unlimited firm life 无限存期性A.I and II onlyB.III and IV onlyC.I, II, and III onlyD.II, III, and IV onlyE.I, III, and IV only7. Earnings per share is equal to: 每股收益 income divided by the total number of shares outstanding.净利润/流通在外的股数 income divided by the par value of the common stock.C.gross income multiplied by the par value of the common stock.D.operating income divided by the par value of the common stock. income divided by total shareholders' equity8. Dividends per share is equal to dividends paid: 每股股利A.divided by the par value of common stock.B.divided by the total number of shares outstanding.股利/流通在外的股数C.divided by total shareholders' equity.D.multiplied by the par value of the common stock.E.multiplied by the total number of shares outstanding.9. The current ratio is measured as:A.current assets minus current liabilities.B.current assets divided by current liabilities.C.current liabilities minus inventory, divided by current assets.D.cash on hand divided by current liabilities.E.current liabilities divided by current assets.10. An investment is acceptable if its IRR:A.is exactly equal to its net present value (NPV).B.is exactly equal to zero.C.is less than the required return.D.exceeds the required return.E.is exactly equal to 100%.11.An analysis of what happens to the estimate of net present value when only one variable is changed is called _____ analysis.A. forecastingB. scenarioC. sensitivity敏感性D. simulationE. break-even12. A bond with a 7% coupon that pays interest semi-annually and is priced at parwill have a market price of _____ and interest payments in the amount of _____ each.A. $1,007; $70B. $1,070; $35C. $1,070; $70D. $1,000; $35E. $1,000; $7013.A bond with semi-annual interest payments, all else equal, would be priced _________ than one with annual interest payments.A. higherB. lowerC. the sameD. it is impossible to tellE. either higher or the same14.The constant dividend growth model:I. assumes that dividends increase at a constant rate forever.II. can be used to compute a stock price at any point of time.III. states that the market price of a stock is only affected by the amount of the dividend.IV. considers capital gains but ignores the dividend yield.A. I onlyB. II onlyC. III and IV onlyD. I and II onlyE. I, II, and III only15.Which one of the following types of securities has tended to produce the lowest real rate of return for the period 1926 through 2008A. U.S. Treasury billsB. long-term government bondsC. small company stocksD. large company stocksE. long-term corporate bonds16. The risk premium for an individual security is computed by:A. multiplying the security's beta by the market risk premium.B. multiplying the security's beta by the risk-free rate of return.C. adding the risk-free rate to the security's expected return.D. dividing the market risk premium by the quantity (1 - beta).E. dividing the market risk premium by the beta of the security.17. Which of the following statements is true?A. A well-diversified portfolio has negligible systematic risk.B. A well-diversified portfolio has negligible unsystematic risk.C. An individual security has negligible systematic risk.D. An individual security has negligible unsystematic risk.E. Both A and D.18. The beta of a firm is more likely to be high under what two c onditions?A. High cyclical business activity and low operating leverageB. High cyclical business activity and high operating leverageC. Low cyclical business activity and low financial leverageD. Low cyclical business activity and low operating leverageE. None of the above.19. Preferred stock may exist because:A.losses before income taxes prevent a company from enjoying the tax advantages of debt interest while there is no tax advantage for preferred dividends.B.an advantage exists for the firm; preferred shareholders can not force the company into bankruptcy because of unpaid dividends.C.corporations get a 70% tax exemption on preferred dividends received.D.All of the above.E.None of the above.20. Which of the following would be indicative of inefficient marketA. Overreaction and reversionB. Delayed responseC. Immediate and accurate responseD. Both A and B.E. Both A and C.21. MM Proposition I with no tax supports the argument that:A.business risk determines the return on assets.B.the cost of equity rises as leverage rises.C.it is completely irrelevant how a firm arranges its finances.D. a firm should borrow money to the point where the tax benefit from debt is equal to the cost of the increased probability of financial distress.E.financial risk is determined by the debt-equity ratio.22. The MM theory with taxes implies that firms should issue maximum debt. In practice, this is not true because:A.debt is more risky than equity.B.bankruptcy is a disadvantage to debt.C.firms will incur large agency costs of short term debt by issuing long term debt.D.Both A and B.E.Both B and C25. A financial lease has the following as its primary characteristics:A.is fully amortized, lessee maintains equipment and there is no renewal clause and no cancellation clause.B.is not fully amortized, lessor maintains equipment and there is a renewal clause but no cancellation clause.C.is fully amortized, lessor maintains equipment and there is a renewal clause and a no cancellation clause.D.is not fully amortized, lessor maintains equipment and there is a renewal clause.E.is fully amortized, lessee maintains equipment and there is a renewal clause and a no cancellation clause.26. The maximum value of a call option is equal to:A.the strike price minus the initial cost of the option.B.the exercise price plus the price of the underlying stock.C.the strike price.D.the price of the underlying stock.E.the purchase price.27.Which of the following statements are correct concerning option values?I. The value of a call increases as the price of the underlying stock increases. II. The value of a call decreases as the exercise price increases.III. The value of a put increases as the price of the underlying stock increases. IV. The value of a put decreases as the exercise price increases.A.I and III onlyB.II and IV onlyC.I and II onlyD.II and III onlyE.I, II, and IV only28. The value of a call increases when:I. the time to expiration increases.II. the stock price increases.III. the risk-free rate of return increases.IV. the volatility of the price of the underlying stock increases.A.I and III onlyB.II, III, and IV onlyC.I, III, and IV onlyD.I, II, and III onlyE.I, II, III, and IV29. An in-the-money put option is one that:A.has an exercise price greater than the underlying stock price.B.has an exercise price less than the underlying stock price.C.has an exercise price equal to the underlying stock price.D.should not be exercised at expiration.E.should not be exercised at any time.30. Options are granted to top corporate executives because:A.executives will make better business decisions in line with benefiting the shareholders.B.executive pay is at risk and linked to firm performance.C.options are tax-efficient and taxed only when they are exercised.D.All of the above.E.None of the above多选1. Preferred stock may be desirable to issue for which of following reason(s)? (第15章)A. If there is no taxable income, preferred stock does not impose a tax penalty(罚款).B. The failure to pay preferred dividends, cumulative(累积的) or noncumulative, will not cause bankruptcy.C. Preferred dividends are not tax deductible and therefore will not provide a tax shield hill will reduce net income.D. Both B and C2. Which of the following are factors that favor a high dividend policy? (第19章)A. stockholders desire for current incomeB. tendency for higher stock prices for high dividend paying firms.C. investor dislike of uncertainlyD. high percentage of tax-expense institutional stockholders3. Underpricing can possibly be explained by: (第20章)A. oversubscription(超额认购) of an issueB. strong demand by investorsC. under subscription of an issueD. both B and C4. Which of the following are uses of cash? (第8章)A. marketable securities are soldB. the amount of inventory an hand in increasedC. the firm takes out a long-term bank loanD. payment are paid on accounts payable5. To collect on the accounts receivable due to the firm, a firm can:A. send a delinquency letter of past due status to the customerB. make personal contest by telephoneC. employ a collection agencyD. take legal action against the customer as necessary6. Financial distress can involve which of the following: (第30章)A. asset restructuring(资产重组)B. financial restructuring(财务重组)C. liquidation(清算)D. raise cash(集资)7. Which of the following activities are commonly associated with takeovers(收购)? (第25章)A. the acquisition of assetsB. proxy(代理人) contestsC. managements buyouts(管理层收购)D. leveraged buyouts(杠杆收购)8. Which of the following are reasons why a firm may want to divest itself of some its assets?A. to raise cashB. to get rid of unprofitable operationC. to get rid of some assets received in an acquisitionD. to cash in on some profitable operation填空题0.The forecast of cash receipts and disbursements for the next planning period is called a Cash budget.1.The process of planning and maneging a firm's inverstments in fixed assets is called Capital budgeting.2.The mixfure of debt and quity used by a firm to finance its: operations is called: Capital structure.1.The management of a firm's short-term assets and liabilities call Working capital management.4.A business created as a distinct legal entity composed of one or more individuals or entities is called a corporation.5.The financial statement showing a firm's accounting value on a particular date is the Balance sheet. working capital refers to the difference between a firm's current assets and is current liability.7.An annuity stream where the payments occur forever is called a perpetuity.8.The difference between the present value of an investment and its cost is the net present value.9.The discount rate that makes the net present values of an inverstment exactlly equal to zero is called the internal rate of return.10. The interest rate charged per period multiplied by the number of period per year is called the annual percentage rate.11. the first public equity issue that is made by a company is referred to as initial public offering.简答题一、在以下情况下公司提供商业信用可能是有优势的:1. 如果销售企业相对于其他潜在的贷款人具有成本优势;2. 如果销售企业具有垄断力量;3. 如果销售企业可通过提供信用而减少税收;4. 如果销售企业的产品质量难以确定5. 如果销售企业打算建立长期的战略关系;6. 如果在信用管理中存在规模经济,企业的规模也可能是重要因素。

罗斯公司理财题库全集 (2)

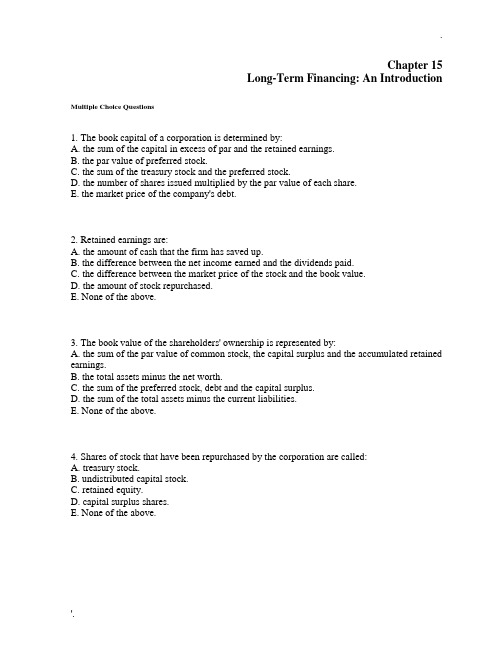

Chapter 15Long-Term Financing: An Introduction Multiple Choice Questions1. The book capital of a corporation is determined by:A. the sum of the capital in excess of par and the retained earnings.B. the par value of preferred stock.C. the sum of the treasury stock and the preferred stock.D. the number of shares issued multiplied by the par value of each share.E. the market price of the company's debt.2. Retained earnings are:A. the amount of cash that the firm has saved up.B. the difference between the net income earned and the dividends paid.C. the difference between the market price of the stock and the book value.D. the amount of stock repurchased.E. None of the above.3. The book value of the shareholders' ownership is represented by:A. the sum of the par value of common stock, the capital surplus and the accumulated retained earnings.B. the total assets minus the net worth.C. the sum of the preferred stock, debt and the capital surplus.D. the sum of the total assets minus the current liabilities.E. None of the above.4. Shares of stock that have been repurchased by the corporation are called:A. treasury stock.B. undistributed capital stock.C. retained equity.D. capital surplus shares.E. None of the above.5. The market value of the ownership of the firm equals:A. the market price of the stock times the number of shares outstanding.B. the sum of the market price of the bonds and the stock.C. the par value of the stock times the number of shares outstanding.D. the market price of the stock minus the retained earnings.E. None of the above.6. A grant of authority allowing someone else to vote shares of stock that you own is called:A. a power-of-share authorization.B. a proxy.C. a share authority grant (SAG).D. a restricted conveyance.E. None of the above.7. Unsecured corporate debt is called a(n):A. indenture.B. debenture.C. bond.D. mortgage.E. None of the above.8. A standard arrangement for the orderly retirement of long-term debt calls for the corporation to make regular payments into a(n):A. custodial account.B. sinking fund.C. retirement fund.D. irrevocable trustee fund.E. None of the above9. Debt that may be extinguished before maturity is referred to as:A. sinking-fund debt.B. debentures.C. callable debt.D. indenture debt.E. None of the above.10. If a long-term debt instrument is perpetual, it is called a(n):A. secured debt issue.B. subordinated debt issue.C. consol.D. capital debt issue.E. indenture.11. The amount of loan a person or firm borrows from a lender is the:A. creditor.B. indenture.C. debenture.D. principal.E. amortization.12. The written agreement between a corporation and its bondholders is called:A. the collateral agreement.B. the deed.C. the indenture.D. the deed of conveyance.E. None of the above.13. If cumulative voting is permitted:A. the total number of votes a shareholder has is equal to the number of shares owned.B. the total number of votes a shareholder has is equal to the number of shares owned times the average number of years the shareholder has owned the shares.C. the total number of votes a shareholder has can be calculated as the number of shares owned times the number of directors to be elected.D. the total number of votes a shareholder has is equal to the number of shares times the number of board meetings the shareholder has attended.E. None of the above.14. The market-to-book value ratio is implies growth and success when it is:A. greater than 0.B. less than 10.C. less than 0.D. less than 1.E. greater than 1.15. There are 3 directors' seats up for election. If you own 1,000 shares of stock and you can cast 3,000 votes for a particular director, this is illustrative of:A. cumulative voting.B. absolute priority voting.C. sequential voting.D. straight voting.E. None of the above.16. If you own 1,000 shares of stock and you can cast only 1,000 votes for a particular director, then the stock features:A. cumulative voting.B. absolute priority voting.C. sequential voting.D. straight voting.E. None of the above.17. If a group other than management solicits the authority to vote shares to replace management, a _____ is said to occur.A. proxy fightB. stockholder derivative actionC. tender offerD. vote of confidenceE. None of the above.18. Shareholders usually have which of the following right(s)?A. To elect board members, the authorizing of new shares and other matters of great importance to shareholders such as being acquired.B. To share proportionally in regular and liquidating dividends.C. To share proportionally in any new stock sold.D. All of the above.E. None of the above.19. Different classes of stock usually are issued to:A. maintain ownership control by holding the class of stock with greater voting rights.B. pay less in dividends between the classes of stock.C. fool investors into thinking that equity is equity and there is no difference in control or value features.D. extract perquisites without the other class of stockholders knowing.E. None of the above.20. Which of the following statements is false?A. Creditors do not have voting power.B. Payment on interest on debt in considered an expense, while payment of dividends is a return on capital.C. Unpaid debt is a liability of the firm, and if not paid, can result in liquidation of the firm. Unpaid common stock dividends cannot force liquidation.D. One of the costs of issuing equity is the possibility of financial distress, while no financial distress is associated with debt.E. None of the above.21. Corporations try to create hybrid securities that look like equity but are called debt because:A. debt interest expense is tax deductible.B. bankruptcy costs are eliminated or reduced.C. these securities have lower risk than debt.D. Both A and C.E. Both A and B.22. Technically speaking, a long-term corporate debt offering that features a specific attachment to corporate property is generally called:A. a debenture.B. a bond.C. a long-term liability.D. a preferred liability.E. None of the above.23. If a firm retires or extinguishes a debt issue before maturity, the specific amount they pay is:A. the amortization amount.B. the call price.C. the sinking fund amount.D. the spread premium.E. None of the above.24. If a debenture is subordinated, it:A. has a higher priority status than specified creditors.B. is secondary to equity.C. must give preference to the specified creditor in the event of default.D. has been issued because the company is in default.E. None of the above.25. Not paying the dividends on a cumulative preferred issue may result in:A. preferred dividend arrears that can be eliminated by the common shareholders only after common dividends are paid.B. voting rights are granted to preferred stockholders if preferred dividends are in arrears.C. no payment of dividends to common shareholders.D. Both A and B.E. Both B and C.26. Preferred stock has both a tax advantage and a tax disadvantage. These two are:A. in default there are no taxes and dividends are taxed in corporate hands at 70%.B. corporate dividends are taxed on 30% of the dividends received and expenses are deductible.C. dividends are not a tax-deductible expense but are 70% exempt from corporate taxation.D. dividends are fully tax deductible but are not equity capital.E. None of the above.27. Preferred stock may be desirable to issue for which of the following reason(s)?A. If there is no taxable income, preferred stock does not impose a tax penalty.B. The failure to pay preferred dividends, cumulative or noncumulative, will not cause bankruptcy.C. Preferred dividends are not tax deductible and therefore will not provide a tax shield but will reduce net income.D. Both B and C.E. Both A and B.28. Preferred stock may exist because:A. losses before income taxes prevent a company from enjoying the tax advantages of debt interest while there is no tax advantage for preferred dividends.B. an advantage exists for the firm; preferred shareholders can not force the company into bankruptcy because of unpaid dividends.C. corporations get a 70% tax exemption on preferred dividends received.D. All of the above.E. None of the above.29. The written agreement between a corporation and its bondholders might contain a prohibition against paying dividends in excess of current earnings. This prohibition is an example of a(n):A. maintenance of security provision.B. collateral restriction.C. affirmative indenture.D. restrictive covenant.E. None of the above.30. What percentage of the dividends received by one corporation from another is taxable?A. 15%B. 30%C. 34%D. 70%E. 100%31. Which of the following statements about preferred stock is true?A. Unlike dividends paid on common stock, dividends paid on preferred stock are atax-deductible expense.B. Unpaid dividends on preferred stock are a debt of the corporation.C. If preferred dividends are non-cumulative, then preferred dividends not paid in a particular year will be carried forward to the next year.D. There is no difference in the voting rights of preferred and common stockholders.E. None of the above.32. If a debt issue is callable, the call price is generally ____ par.A. greater thanB. less thanC. equal toD. unrelated toE. It varies widely based on the risk of the firm.33. There was an upward trend in the ratio of the book value of debt to the book value of debt and equity throughout the 1990s. Some of this was due to the repurchasing of stock. The market value ratio of debt to debt and equity exhibited no upward trend. This can be explained by:A. the change in the accounting rules of the period.B. the difference between tax accounting and accounting for financial accounting purposes.C. a large increase in the market value of equity that was greater than the increase in debt.D. All of the above.E. None of the above.34. Based on historical experience, which of the following best describes the "pecking order" of long-term financing strategy in the U.S.?A. Long-term debt first, new common equity, internal financing last.B. Long-term debt first, internal financing, new common equity last.C. Internal financing first, new common equity, long-term borrowing last.D. Internal financing first, long-term borrowing, new common equity last.E. None of the above.35. Financial deficits are created when:A. profits and retained earnings are greater than the capital-spending requirement.B. profits and retained earnings are less than the capital-spending requirement.C. profits and retained earnings are equal to the capital-spending requirement.D. All of the above.E. None of the above.36. Financial economists prefer to use market values when measuring debt ratios because:A. market values are more stable than book values.B. market values are a better reflection of current value than historical value.C. market values are readily available and do not have to be calculated like book values.D. market values are more difficult to calculate which makes financial economists more valuable.E. None of the above.37. Corporate financial officers prefer to use book values when measuring debt ratios because:A. book values are more stable than market values.B. debt covenant restriction are usually expressed in book value terms.C. rating agencies measure debt ratios in book values terms.D. All of the above.E. None of the above.38. Rockwell Corporation had net income of $150,000 for the year ending 2008. The company decided to payout 40% of earnings per share as a dividend. Rockwell has 120,000 shares issued and outstanding. What are the retained earnings for 2008?A. $40,000B. $60,000C. $90,000D. $150,000E. None of the above39. Nelson Company had equity accounts in 2008 as follows:Projected income is $150,000 and 40% of this amount will be paid out immediately as dividends. What will the ending retained earnings account be?A. $90,000B. $92,000C. $122,000D. $210,000E. $242,00040. Holden Bicycles has 1,000 shares outstanding each with a par value of $0.10. If they are sold to shareholders at $10 each, what would the capital surplus be?A. $100B. $900C. $9,900D. $10,000E. $11,00041. The Lory Bookstore used internal financing as a source of long-term financing for 80% of its total needs in 2008. The company borrowed an additional 27% of its total needs in the long-term debt markets in 2008. What were Lory's net new stock issues in that year?A. -20%B. -7%C. 7%D. 20%E. 27%42. David's Building Equipment (DBE) had net income of $200,000 for the year ending 2008. The company decided to payout 30% of earnings per share as a dividend. DBE has 50,000 shares issued and outstanding. What are the retained earnings for 2008?A. $60,000B. $140,000C. $150,000D. $200,000E. None of the above.43. Alexandra Investments had equity accounts in 2008 as follows:Projected income is $200,000 and 20% of this amount will be paid out immediately as dividends. What will the ending retained earnings account be?A. $160,000B. $250,000C. $270,000D. $410,000E. $470,00044. Michael's Motor Scooters has 1,000 shares outstanding each with a par value of $0.05. If they are sold to shareholders at $5 each, what would the capital surplus be?A. $4,400B. $4,500C. $4,750D. $4,950E. $5,00045. Calhoun Computech used internal financing as a source of long-term financing for 80% of its total needs in 2008. The company borrowed an additional 15% of its total needs in thelong-term debt markets in 2008. What were Calhoun's net new stock issues, in percentage terms, for 2008?A. -10%B. -5%C. 5%D. 10%E. 15%Essay QuestionsInformation on shareholder's equity as currently shown on the books of the Eaton Corporation is given as:46. From this information, calculate Eaton's book value per share.47. Rework the shareholder's equity as it appears on the books if the company issues 40,000 new shares of common at $70 per share.48. Preferred Stock, as a hybrid security, presents somewhat of a puzzle as to why they are issued. What elements give rise to the puzzle and how is it explained?49. Different countries have different sources of funds. For example, in the United States, internally generated funds count for over 4/5 of all funds while in Japan, it is about ½ with externally generated funds making up the remainder. The disparities are less in the United Kingdom and Germany, with about 2/3 of funds coming from internal sources. Discuss this disparity and why it might exist.Chapter 15 Long-Term Financing: An Introduction Answer KeyMultiple Choice Questions1. The book capital of a corporation is determined by:A. the sum of the capital in excess of par and the retained earnings.B. the par value of preferred stock.C. the sum of the treasury stock and the preferred stock.D. the number of shares issued multiplied by the par value of each share.E. the market price of the company's debt.Difficulty level: EasyTopic: BOOK CAPITALType: DEFINITIONS2. Retained earnings are:A. the amount of cash that the firm has saved up.B. the difference between the net income earned and the dividends paid.C. the difference between the market price of the stock and the book value.D. the amount of stock repurchased.E. None of the above.Difficulty level: EasyTopic: RETAINED EARNINGSType: DEFINITIONS3. The book value of the shareholders' ownership is represented by:A. the sum of the par value of common stock, the capital surplus and the accumulated retained earnings.B. the total assets minus the net worth.C. the sum of the preferred stock, debt and the capital surplus.D. the sum of the total assets minus the current liabilities.E. None of the above.Difficulty level: MediumTopic: BOOK VALUEType: DEFINITIONS4. Shares of stock that have been repurchased by the corporation are called:A. treasury stock.B. undistributed capital stock.C. retained equity.D. capital surplus shares.E. None of the above.Difficulty level: EasyTopic: TREASURY STOCKType: DEFINITIONS5. The market value of the ownership of the firm equals:A. the market price of the stock times the number of shares outstanding.B. the sum of the market price of the bonds and the stock.C. the par value of the stock times the number of shares outstanding.D. the market price of the stock minus the retained earnings.E. None of the above.Difficulty level: EasyTopic: MARKET VALUE OF EQUITYType: DEFINITIONS6. A grant of authority allowing someone else to vote shares of stock that you own is called:A. a power-of-share authorization.B. a proxy.C. a share authority grant (SAG).D. a restricted conveyance.E. None of the above.Difficulty level: EasyTopic: PROXYType: DEFINITIONS7. Unsecured corporate debt is called a(n):A. indenture.B. debenture.C. bond.D. mortgage.E. None of the above.Difficulty level: EasyTopic: DEBENTUREType: DEFINITIONS8. A standard arrangement for the orderly retirement of long-term debt calls for the corporation to make regular payments into a(n):A. custodial account.B. sinking fund.C. retirement fund.D. irrevocable trustee fund.E. None of the aboveDifficulty level: EasyTopic: SINKING FUNDType: DEFINITIONS9. Debt that may be extinguished before maturity is referred to as:A. sinking-fund debt.B. debentures.C. callable debt.D. indenture debt.E. None of the above.Difficulty level: EasyTopic: CALLABLE DEBTType: DEFINITIONS10. If a long-term debt instrument is perpetual, it is called a(n):A. secured debt issue.B. subordinated debt issue.C. consol.D. capital debt issue.E. indenture.Difficulty level: EasyTopic: CONSOL OR PERPETUAL DEBTType: DEFINITIONS11. The amount of loan a person or firm borrows from a lender is the:A. creditor.B. indenture.C. debenture.D. principal.E. amortization.Difficulty level: EasyTopic: LOAN PRINCIPALType: DEFINITIONS12. The written agreement between a corporation and its bondholders is called:A. the collateral agreement.B. the deed.C. the indenture.D. the deed of conveyance.E. None of the above.Difficulty level: EasyTopic: INDENTUREType: DEFINITIONS13. If cumulative voting is permitted:A. the total number of votes a shareholder has is equal to the number of shares owned.B. the total number of votes a shareholder has is equal to the number of shares owned times the average number of years the shareholder has owned the shares.C. the total number of votes a shareholder has can be calculated as the number of shares owned times the number of directors to be elected.D. the total number of votes a shareholder has is equal to the number of shares times the number of board meetings the shareholder has attended.E. None of the above.Difficulty level: EasyTopic: CUMULATIVE VOTINGType: CONCEPTS14. The market-to-book value ratio is implies growth and success when it is:A. greater than 0.B. less than 10.C. less than 0.D. less than 1.E. greater than 1.Difficulty level: MediumTopic: MARKET-TO-BOOK RATIOType: CONCEPTS15. There are 3 directors' seats up for election. If you own 1,000 shares of stock and you can cast 3,000 votes for a particular director, this is illustrative of:A. cumulative voting.B. absolute priority voting.C. sequential voting.D. straight voting.E. None of the above.Difficulty level: EasyTopic: CUMULATIVE VOTINGType: CONCEPTS16. If you own 1,000 shares of stock and you can cast only 1,000 votes for a particular director, then the stock features:A. cumulative voting.B. absolute priority voting.C. sequential voting.D. straight voting.E. None of the above.Difficulty level: EasyTopic: STRAIGHT VOTINGType: CONCEPTS17. If a group other than management solicits the authority to vote shares to replace management, a _____ is said to occur.A. proxy fightB. stockholder derivative actionC. tender offerD. vote of confidenceE. None of the above.Difficulty level: EasyTopic: PROXY FIGHTType: CONCEPTS18. Shareholders usually have which of the following right(s)?A. To elect board members, the authorizing of new shares and other matters of great importance to shareholders such as being acquired.B. To share proportionally in regular and liquidating dividends.C. To share proportionally in any new stock sold.D. All of the above.E. None of the above.Difficulty level: EasyTopic: SHAREHOLDER RIGHTSType: CONCEPTS19. Different classes of stock usually are issued to:A. maintain ownership control by holding the class of stock with greater voting rights.B. pay less in dividends between the classes of stock.C. fool investors into thinking that equity is equity and there is no difference in control or value features.D. extract perquisites without the other class of stockholders knowing.E. None of the above.Difficulty level: MediumTopic: CLASSES OF STOCKType: CONCEPTS20. Which of the following statements is false?A. Creditors do not have voting power.B. Payment on interest on debt in considered an expense, while payment of dividends is a return on capital.C. Unpaid debt is a liability of the firm, and if not paid, can result in liquidation of the firm. Unpaid common stock dividends cannot force liquidation.D. One of the costs of issuing equity is the possibility of financial distress, while no financial distress is associated with debt.E. None of the above.Difficulty level: MediumTopic: COSTS OF LONG TERM FINANCINGType: CONCEPTS21. Corporations try to create hybrid securities that look like equity but are called debt because:A. debt interest expense is tax deductible.B. bankruptcy costs are eliminated or reduced.C. these securities have lower risk than debt.D. Both A and C.E. Both A and B.Difficulty level: MediumTopic: HYBRID SECURITIESType: CONCEPTS22. Technically speaking, a long-term corporate debt offering that features a specific attachment to corporate property is generally called:A. a debenture.B. a bond.C. a long-term liability.D. a preferred liability.E. None of the above.Difficulty level: EasyTopic: BONDType: CONCEPTS23. If a firm retires or extinguishes a debt issue before maturity, the specific amount they pay is:A. the amortization amount.B. the call price.C. the sinking fund amount.D. the spread premium.E. None of the above.Difficulty level: EasyTopic: CALLABLE DEBTType: CONCEPTS24. If a debenture is subordinated, it:A. has a higher priority status than specified creditors.B. is secondary to equity.C. must give preference to the specified creditor in the event of default.D. has been issued because the company is in default.E. None of the above.Difficulty level: MediumTopic: SUBORDINATED DEBENTUREType: CONCEPTS25. Not paying the dividends on a cumulative preferred issue may result in:A. preferred dividend arrears that can be eliminated by the common shareholders only after common dividends are paid.B. voting rights are granted to preferred stockholders if preferred dividends are in arrears.C. no payment of dividends to common shareholders.D. Both A and B.E. Both B and C.Difficulty level: MediumTopic: PREFERRED STOCK AND DIVIDENDSType: CONCEPTS26. Preferred stock has both a tax advantage and a tax disadvantage. These two are:A. in default there are no taxes and dividends are taxed in corporate hands at 70%.B. corporate dividends are taxed on 30% of the dividends received and expenses are deductible.C. dividends are not a tax-deductible expense but are 70% exempt from corporate taxation.D. dividends are fully tax deductible but are not equity capital.E. None of the above.Difficulty level: MediumTopic: PREFERRED STOCKType: CONCEPTS27. Preferred stock may be desirable to issue for which of the following reason(s)?A. If there is no taxable income, preferred stock does not impose a tax penalty.B. The failure to pay preferred dividends, cumulative or noncumulative, will not cause bankruptcy.C. Preferred dividends are not tax deductible and therefore will not provide a tax shield but will reduce net income.D. Both B and C.E. Both A and B.Difficulty level: ChallengeTopic: PREFERRED STOCKType: CONCEPTS28. Preferred stock may exist because:A. losses before income taxes prevent a company from enjoying the tax advantages of debt interest while there is no tax advantage for preferred dividends.B. an advantage exists for the firm; preferred shareholders can not force the company into bankruptcy because of unpaid dividends.C. corporations get a 70% tax exemption on preferred dividends received.D. All of the above.E. None of the above.Difficulty level: MediumTopic: PREFERRED STOCKType: CONCEPTS29. The written agreement between a corporation and its bondholders might contain a prohibition against paying dividends in excess of current earnings. This prohibition is an example of a(n):A. maintenance of security provision.B. collateral restriction.C. affirmative indenture.D. restrictive covenant.E. None of the above.Difficulty level: EasyTopic: RESTRICTIVE COVENANTType: CONCEPTS30. What percentage of the dividends received by one corporation from another is taxable?A. 15%B. 30%C. 34%D. 70%E. 100%Difficulty level: EasyTopic: TAXABLE CORPORATE DIVIDENDSType: CONCEPTS31. Which of the following statements about preferred stock is true?A. Unlike dividends paid on common stock, dividends paid on preferred stock are atax-deductible expense.B. Unpaid dividends on preferred stock are a debt of the corporation.C. If preferred dividends are non-cumulative, then preferred dividends not paid in a particular year will be carried forward to the next year.D. There is no difference in the voting rights of preferred and common stockholders.E. None of the above.Difficulty level: MediumTopic: PREFERRED STOCKType: CONCEPTS32. If a debt issue is callable, the call price is generally ____ par.A. greater thanB. less thanC. equal toD. unrelated toE. It varies widely based on the risk of the firm.Difficulty level: EasyTopic: CALLABLE DEBTType: CONCEPTS33. There was an upward trend in the ratio of the book value of debt to the book value of debt and equity throughout the 1990s. Some of this was due to the repurchasing of stock. The market value ratio of debt to debt and equity exhibited no upward trend. This can be explained by:A. the change in the accounting rules of the period.B. the difference between tax accounting and accounting for financial accounting purposes.C. a large increase in the market value of equity that was greater than the increase in debt.D. All of the above.E. None of the above.Difficulty level: EasyTopic: DEBT FINANCING TRENDSType: CONCEPTS34. Based on historical experience, which of the following best describes the "pecking order" of long-term financing strategy in the U.S.?A. Long-term debt first, new common equity, internal financing last.B. Long-term debt first, internal financing, new common equity last.C. Internal financing first, new common equity, long-term borrowing last.D. Internal financing first, long-term borrowing, new common equity last.E. None of the above.Difficulty level: EasyTopic: PECKING ORDERType: CONCEPTS。

CFA习题笔记

CFA习题笔记FS被investor和creditor有用,还有gov regulator,tax authority和其他,提供short-term liquidity, long-term earning power, growth opportunity和asset position of the firm. 还应该是relevent,timely,reliable,material和consistent允许time-series和cross-sectional 比较。

The Financial Account Standards Board(FASB)是美国的,建立了Generally Accepted Accounting Principle(GAAP)The International Organization of Securiies Commission(IOSC)建立跨过的disclosure标准The International Accounting Standards Board(IASB)目标是提供international uniformity, 虽然没有执行力,但很多国家还是采用IASB GAAP除了Balance sheet,income statement和statement of cash flow,分析师还应该看financial statement footnotes,statement of comprehensive income,statement of stockholders’ equity,proxy statement,supplementary schedules和management dicision and analysis(MD&A).独立auditor有doubts,就说qualified opinion;auditor能提供reasonable assurance 证明报表没有material misstatement,就说unqualifiedrevenue和expense在earn和incur时候就实现了,不管cash flow是什么时候。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

In this case, subordinated debenture holders rank behind debenture holders but ahead of preferred and common stockholders in the event of liquidation.

Maturity

Bond Ratings

20-3

Trustee and Indenture

Trustee -- A person or institution designated by a bond issuer as the official

representative of the bondholders. Typically, a bank serves as trustee.

Investors receive some protection by the restrictions imposed in the bond indenture, particularly any negative-pledge clause.

A negative-pledge clause precludes the corporation from pledging any of its assets (not already pledged) to other creditors.

The bonds are unpopular with investors (usually limited to reorganizations), but are still senior to preferred and common shareholders in the event of liquidation.

Frequently, the security is convertible into common stock to lower the yield required by subordinated debenture holders (often less than regular debentures).

Indenture -- The legal agreement, also called the deed of trust, between the corporation issuing bonds and the bondholders,

establishing the terms of the bond issue and naming the trustee.

Chapter 20

Long-Term Debt, Preferred Stock, and

Common Stock

20-1

© 2001 Prentice-Hall, Inc. Fundamentals of Financial Management, 11/e

Created by: Gregory A. Kuhlemeyer, Ph.D. Carroll College, Waukesha, WI

20-6

Types of Long-Term Debt Instruments

Income Bond -- A bond where the payment of interest is contingent upon sufficient earnings of the firm.

Frequently, there is a cumulative feature, which provides that any unpaid interest in a particular year accumulates. The cumulative obligation is usually limited to no more than three years.

Long-Term Debt, Preferred Stock, and Common Stock