风险投资学课后思考题答案

投资学习题答案完整版机工版

习题(1章)1.根据你自身的情况,计算你自己的理想收益率与必要收益率。

这些收益率是有可能实现的吗?你觉得选择本章中讲到的哪些金融工具有可能帮助你实现这些收益率?参考解答:(1)理想收益率和必要收益率的计算请见Excel文件,可以在课堂上根据同学自身情况进行模拟计算或调整数值。

2.试讨论你对自己风险态度的认识,并询问一下你的家庭成员或者你身边的朋友的风险态度。

尝试对这些人(包括你自己)做一个风险排序。

参考解答:可以根据教材中第一章提供的专栏1-1进行打分,提供风险态度依据。

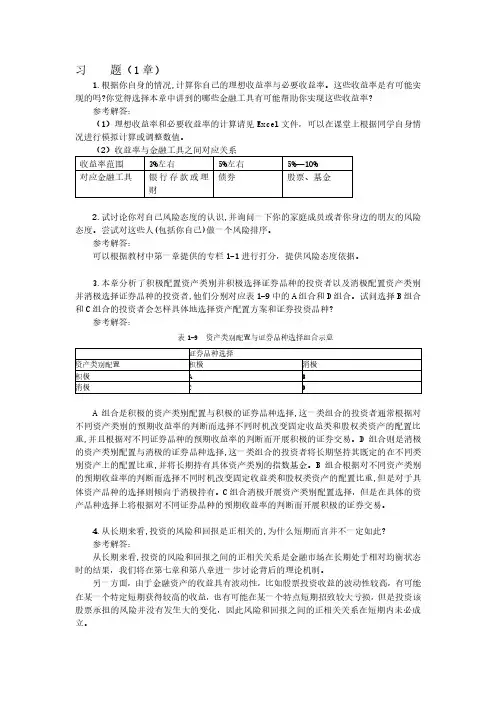

3.本章分析了积极配置资产类别并积极选择证券品种的投资者以及消极配置资产类别并消极选择证券品种的投资者,他们分别对应表1-9中的A组合和D组合。

试问选择B组合和C组合的投资者会怎样具体地选择资产配置方案和证券投资品种?参考解答:表1-9 资产类别配置与证券品种选择组合示意A组合是积极的资产类别配置与积极的证券品种选择,这一类组合的投资者通常根据对不同资产类别的预期收益率的判断而选择不同时机改变固定收益类和股权类资产的配置比重,并且根据对不同证券品种的预期收益率的判断而开展积极的证券交易。

D组合则是消极的资产类别配置与消极的证券品种选择,这一类组合的投资者将长期坚持其既定的在不同类别资产上的配置比重,并将长期持有具体资产类别的指数基金。

B组合根据对不同资产类别的预期收益率的判断而选择不同时机改变固定收益类和股权类资产的配置比重,但是对于具体资产品种的选择则倾向于消极持有。

C组合消极开展资产类别配置选择,但是在具体的资产品种选择上将根据对不同证券品种的预期收益率的判断而开展积极的证券交易。

4.从长期来看,投资的风险和回报是正相关的,为什么短期而言并不一定如此?参考解答:从长期来看,投资的风险和回报之间的正相关关系是金融市场在长期处于相对均衡状态时的结果,我们将在第七章和第八章进一步讨论背后的理论机制。

另一方面,由于金融资产的收益具有波动性,比如股票投资收益的波动性较高,有可能在某一个特定短期获得较高的收益,也有可能在某一个特点短期招致较大亏损,但是投资该股票承担的风险并没有发生大的变化,因此风险和回报之间的正相关关系在短期内未必成立。

金德环《投资学》课后习题答案

金德环《投资学》课后习题答案习题答案第一章习题答案第二章习题答案练习题1:答案:(1),公司股票的预期收益率与标准差为:Er,,,,,,,0.570.350.2206,,,,,,,,A1/2222,, ,0.5760.3560.22068.72,,,,,,,,,,,,,,A,,(2),公司和,公司股票的收益之间的协方差为:Covrr,0.5762510.50.3561010.5,,,,,,,,,,,,,,,,,AB ,,,,,,0.22062510.590.5,,,,(3),公司和,公司股票的收益之间的相关系数为:Covrr,,,,90.5AB ,,,,,0.55AB,8.7218.90,,AB练习题2:答案:如果,,,的投资投资于,公司,余下,,,投资于,公司的股票,这样得出的资产组合的概率分布如下:钢生产正常年份钢生产异常年份股市为牛市股市为熊市概率 0.5 0.3 0.2 资产组合收益率(,) ,, ,., -2.5 得出资产组合均值和标准差为:Er=0.516+0.32.5+0.2-2.5=8.25,,,,,,,,,,组合1/22222,, ,=0.516-8.25+0.32.5-8.25+0.2-2.5-8.25+0.2-2.5-8.25=7.94,,,,,,,,组合,,1/22222,=0.518.9+0.58.72+20.50.5-90.5=7.94,,,,,,,,,,,,,,,组合,,练习题3:答案:尽管黄金投资独立看来似有股市控制,黄金仍然可以在一个分散化的资产组合中起作用。

因为黄金与股市收益的相关性很小,股票投资者可以通过将其部分资金投资于黄金来分散其资产组合的风险。

练习题4:答案:通过计算两个项目的变异系数来进行比较:0.075 CV==1.88A0.040.09 CV==0.9B0.1考虑到相对离散程度,投资项目B更有利。

练习题5:答案:R(1)回归方程解释能力到底如何的一种测度方法式看的总方差中可被方程解释的方差所it2,占的比例。

投资学思考题参考答案

思考题第一讲投资环境1.假设你发现一只装有100亿美元的宝箱。

(1)这是实物资产还是金融资产?(2)社会财富会因此而增加吗?(3)你会更富有吗?(4)你能解释你回答(2)、(3)时的矛盾吗?有没有人因为这个发现而受损呢?答案:1. a. 现金是金融资产,因为它是政府的债务。

b. 不对。

现金并不能直接增加经济的生产能力,创造财富的是实物资产。

c. 是。

你可以比以前买入更多的产品和服务。

d. 如果经济已经是按其最大能力运行了,现在你要用这1 0 0亿美元使购买力有一额外增加,则你所增加的购买商品的能力必须以其他人购买力的下降为代价,因此,经济中其他人会因为你的发现而受损。

2.Lanni Products 是一家新兴的计算机软件开发公司,它现有计算机设备价值30000美元,以及由Lanni 的所有者提供的20000美元现金。

在下面的交易中,指明交易涉及的实物资产或(和)金融资产。

在交易过程中有金融资产的产生和损失吗?(1)Lanni公司向银行贷款。

它共获得50000美元的现金,并且签发了一张票据保证3年内还款。

(2)Lanni公司使用这笔现金和它自有的20000美元为其一新的财务计划软件开发提供融资。

(3)Lanni公司将此软件产品卖给微软公司(Microsoft),微软以它的品牌供应给市场,Lanni公司获得微软股票1500股作为报酬。

(4)Lanni公司以每股80美元价格卖出微软股票,并用所获部分资金偿还贷款。

答案:a. 银行贷款是L a n n i公司的金融债务;相反的,L a n n i的借据是银行的金融资产。

L a n n i获得的现金是金融资产,新产生的金融资产是Lanni 公司签发的票据(即公司对银行的借据)。

b. L a n n i公司将其金融资产(现金)转拨给其软件开发商,作为回报,它将获得一项真实资产,即软件成品。

没有任何金融资产产生或消失;现金只不过是简单地从一方转移给了另一方。

《投资学》课后习题参考答案

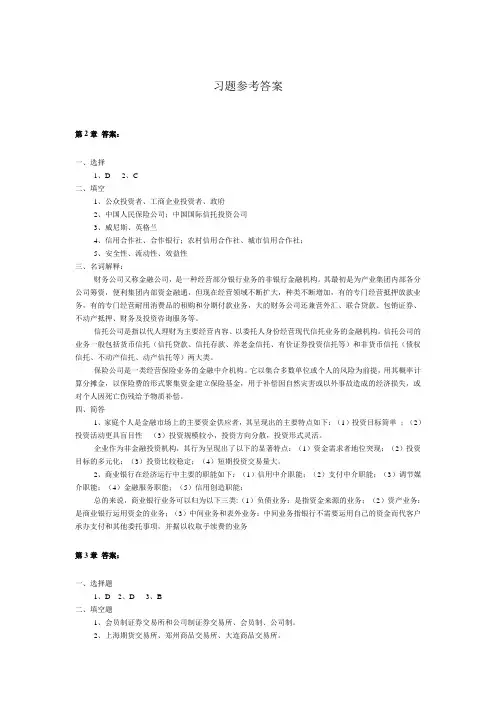

习题参考答案第2章答案:一、选择1、D2、C二、填空1、公众投资者、工商企业投资者、政府2、中国人民保险公司;中国国际信托投资公司3、威尼斯、英格兰4、信用合作社、合作银行;农村信用合作社、城市信用合作社;5、安全性、流动性、效益性三、名词解释:财务公司又称金融公司,是一种经营部分银行业务的非银行金融机构。

其最初是为产业集团内部各分公司筹资,便利集团内部资金融通,但现在经营领域不断扩大,种类不断增加,有的专门经营抵押放款业务,有的专门经营耐用消费品的租购和分期付款业务,大的财务公司还兼营外汇、联合贷款、包销证券、不动产抵押、财务及投资咨询服务等。

信托公司是指以代人理财为主要经营内容、以委托人身份经营现代信托业务的金融机构。

信托公司的业务一般包括货币信托(信托贷款、信托存款、养老金信托、有价证券投资信托等)和非货币信托(债权信托、不动产信托、动产信托等)两大类。

保险公司是一类经营保险业务的金融中介机构。

它以集合多数单位或个人的风险为前提,用其概率计算分摊金,以保险费的形式聚集资金建立保险基金,用于补偿因自然灾害或以外事故造成的经济损失,或对个人因死亡伤残给予物质补偿。

四、简答1、家庭个人是金融市场上的主要资金供应者,其呈现出的主要特点如下:(1)投资目标简单;(2)投资活动更具盲目性(3)投资规模较小,投资方向分散,投资形式灵活。

企业作为非金融投资机构,其行为呈现出了以下的显著特点:(1)资金需求者地位突现;(2)投资目标的多元化;(3)投资比较稳定;(4)短期投资交易量大。

2、商业银行在经济运行中主要的职能如下:(1)信用中介职能;(2)支付中介职能;(3)调节媒介职能;(4)金融服务职能;(5)信用创造职能;总的来说,商业银行业务可以归为以下三类:(1)负债业务:是指资金来源的业务;(2)资产业务:是商业银行运用资金的业务;(3)中间业务和表外业务:中间业务指银行不需要运用自己的资金而代客户承办支付和其他委托事项,并据以收取手续费的业务第3章答案:一、选择题1、D2、D3、B二、填空题1、会员制证券交易所和公司制证券交易所、会员制、公司制。

投资学(第2版)课后答案

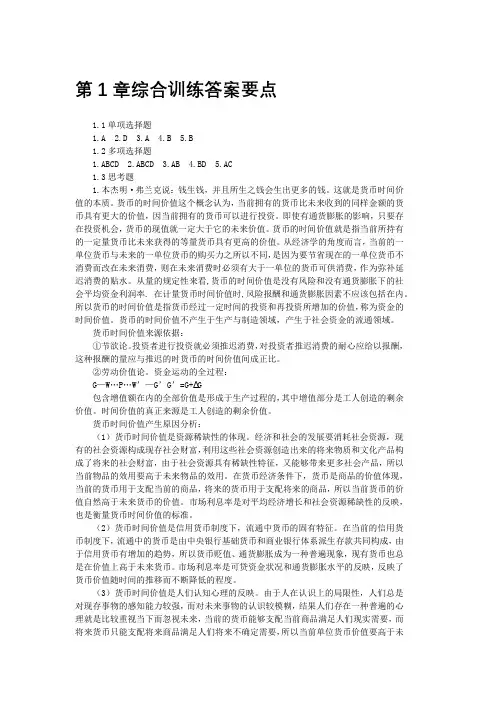

第1章综合训练答案要点1.1单项选择题1.A2.D3.A4.B5.B1.2多项选择题1.ABCD2.ABCD3.AB4.BD5.AC1.3思考题1.本杰明·弗兰克说:钱生钱,并且所生之钱会生出更多的钱。

这就是货币时间价值的本质。

货币的时间价值这个概念认为,当前拥有的货币比未来收到的同样金额的货币具有更大的价值,因当前拥有的货币可以进行投资。

即使有通货膨胀的影响,只要存在投资机会,货币的现值就一定大于它的未来价值。

货币的时间价值就是指当前所持有的一定量货币比未来获得的等量货币具有更高的价值。

从经济学的角度而言,当前的一单位货币与未来的一单位货币的购买力之所以不同,是因为要节省现在的一单位货币不消费而改在未来消费,则在未来消费时必须有大于一单位的货币可供消费,作为弥补延迟消费的贴水。

从量的规定性来看,货币的时间价值是没有风险和没有通货膨胀下的社会平均资金利润率. 在计量货币时间价值时,风险报酬和通货膨胀因素不应该包括在内。

所以货币的时间价值是指货币经过一定时间的投资和再投资所增加的价值,称为资金的时间价值。

货币的时间价值不产生于生产与制造领域,产生于社会资金的流通领域。

货币时间价值来源依据:①节欲论。

投资者进行投资就必须推迟消费,对投资者推迟消费的耐心应给以报酬,这种报酬的量应与推迟的时货币的时间价值间成正比。

②劳动价值论。

资金运动的全过程:G—W…P…W’—G’G’=G+∆G包含增值额在内的全部价值是形成于生产过程的,其中增值部分是工人创造的剩余价值。

时间价值的真正来源是工人创造的剩余价值。

货币时间价值产生原因分析:(1)货币时间价值是资源稀缺性的体现。

经济和社会的发展要消耗社会资源,现有的社会资源构成现存社会财富,利用这些社会资源创造出来的将来物质和文化产品构成了将来的社会财富,由于社会资源具有稀缺性特征,又能够带来更多社会产品,所以当前物品的效用要高于未来物品的效用。

在货币经济条件下,货币是商品的价值体现,当前的货币用于支配当前的商品,将来的货币用于支配将来的商品,所以当前货币的价值自然高于未来货币的价值。

投资学课后答案解析APT

Chapter 10 Arbitrage Pricing Theory and Multifactor Models of Risk and ReturnMultiple Choice Questions1. ___________ a relationship between expected return and risk.A. APT stipulatesB. CAPM stipulatesC. Both CAPM and APT stipulateD. Neither CAPM nor APT stipulateE. No pricing model has found2. Consider the multifactor APT with two factors. Stock A has an expected return of 17.6%, a beta of 1.45 on factor 1 and a beta of .86 on factor 2. The risk premium on the factor 1 portfolio is3.2%. The risk-free rate of return is 5%. What is the risk-premium on factor 2 if no arbitrage opportunities exit?A. 9.26%B. 3%C. 4%D. 7.75%E. 9.75%3. In a multi-factor APT model, the coefficients on the macro factors are often called ______.A. systemic riskB. factor sensitivitiesC. idiosyncratic riskD. factor betasE. both factor sensitivities and factor betas4. In a multi-factor APT model, the coefficients on the macro factors are often called ______.A. systemic riskB. firm-specific riskC. idiosyncratic riskD. factor betasE. unique risk5. In a multi-factor APT model, the coefficients on the macro factors are often called ______.A. systemic riskB. firm-specific riskC. idiosyncratic riskD. factor loadingsE. unique risk6. Which pricing model provides no guidance concerning the determination of the risk premium on factor portfolios?A. The CAPMB. The multifactor APTC. Both the CAPM and the multifactor APTD. Neither the CAPM nor the multifactor APTE. No pricing model currently exists that provides guidance concerning the determination of the risk premium on any portfolio7. An arbitrage opportunity exists if an investor can construct a __________ investment portfolio that will yield a sure profit.A. small positiveB. small negativeC. zeroD. large positiveE. large negative8. The APT was developed in 1976 by ____________.A. LintnerB. Modigliani and MillerC. RossD. SharpeE. Fama9. A _________ portfolio is a well-diversified portfolio constructed to havea beta of 1 on one of the factors and a beta of 0 on any other factor.A. factorB. marketC. indexD. factor and marketE. factor, market, and index10. The exploitation of security mispricing in such a way that risk-free economic profits may be earned is called ___________.A. arbitrageB. capital asset pricingC. factoringD. fundamental analysisE. technical analysis11. In developing the APT, Ross assumed that uncertainty in asset returns wasa result ofA. a common macroeconomic factor.B. firm-specific factors.C. pricing error.D. neither common macroeconomic factors nor firm-specific factors.E. both common macroeconomic factors and firm-specific factors.12. The ____________ provides an unequivocal statement on the expected return-beta relationship for all assets, whereas the _____________ implies that this relationship holds for all but perhaps a small number of securities.A. APT; CAPMB. APT; OPMC. CAPM; APTD. CAPM; OPME. APT and OPM; CAPM13. Consider a single factor APT. Portfolio A has a beta of 1.0 and an expected return of 16%. Portfolio B has a beta of 0.8 and an expected return of 12%. The risk-free rate of return is 6%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio __________ and a long position in portfolio _______.A. A; AB. A; BC. B; AD. B; BE. A; the riskless asset14. Consider the single factor APT. Portfolio A has a beta of 0.2 and an expected return of 13%. Portfolio B has a beta of 0.4 and an expected return of 15%. The risk-free rate of return is 10%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio _________ and a long position in portfolio _________.A. A; AB. A; BC. B; AD. B; BE. No arbitrage opportunity exists.15. Consider the one-factor APT. The variance of returns on the factor portfolio is 6%. The beta of a well-diversified portfolio on the factor is 1.1. The variance of returns on the well-diversified portfolio is approximately __________.A. 3.6%B. 6.0%C. 7.3%D. 10.1%E. 8.6%16. Consider the one-factor APT. The standard deviation of returns on a well-diversified portfolio is 18%. The standard deviation on the factor portfolio is 16%. The beta of the well-diversified portfolio is approximately __________.A. 0.80B. 1.13C. 1.25D. 1.56E. 0.9317. Consider the single-factor APT. Stocks A and B have expected returns of 15% and 18%, respectively. The risk-free rate of return is 6%. Stock B has a beta of 1.0. If arbitrage opportunities are ruled out, stock A has a beta of __________.A. 0.67B. 1.00C. 1.30D. 1.69E. 0.7518. Consider the multifactor APT with two factors. Stock A has an expected return of 16.4%, a beta of 1.4 on factor 1 and a beta of .8 on factor 2. The risk premium on the factor 1 portfolio is 3%. The risk-free rate of return is 6%. What is the risk-premium on factor 2 if no arbitrage opportunities exit?A. 2%B. 3%C. 4%D. 7.75%E. 6.89%19. Consider the multifactor model APT with two factors. Portfolio A has a beta of 0.75 on factor 1 and a beta of 1.25 on factor 2. The risk premiums on the factor 1 and factor 2 portfolios are 1% and 7%, respectively. The risk-free rate of return is 7%. The expected return on portfolio A is __________ if no arbitrage opportunities exist.A. 13.5%B. 15.0%C. 16.5%D. 23.0%E. 18.7%20. Consider the multifactor APT with two factors. The risk premiums on the factor 1 and factor 2 portfolios are 5% and 6%, respectively. Stock A has a beta of 1.2 on factor 1, and a beta of 0.7 on factor 2. The expected return on stock A is 17%. If no arbitrage opportunities exist, the risk-free rate of return is ___________.A. 6.0%B. 6.5%C. 6.8%D. 7.4%E. 7.7%21. Consider a one-factor economy. Portfolio A has a beta of 1.0 on the factor and portfolio B has a beta of 2.0 on the factor. The expected returns on portfolios A and B are 11% and 17%, respectively. Assume that the risk-free rate is 6% and that arbitrage opportunities exist. Suppose you invested $100,000 in the risk-free asset, $100,000 in portfolio B, and sold short $200,000 of portfolio A. Your expected profit from this strategy would be ______________.A. −$1,000B. $0C. $1,000D. $2,000E. $1,60022. Consider the one-factor APT. Assume that two portfolios, A and B, are well diversified. The betas of portfolios A and B are 1.0 and 1.5, respectively. The expected returns on portfolios A and B are 19% and 24%, respectively. Assuming no arbitrage opportunities exist, the risk-free rate of return must be____________.A. 4.0%B. 9.0%C. 14.0%D. 16.5%E. 8.2%23. Consider the multifactor APT. The risk premiums on the factor 1 and factor 2 portfolios are 5% and 3%, respectively. The risk-free rate of return is 10%. Stock A has an expected return of 19% and a beta on factor 1 of 0.8. Stock A has a beta on factor 2 of ________.A. 1.33B. 1.50C. 1.67D. 2.00E. 1.7324. Consider the single factor APT. Portfolios A and B have expected returns of 14% and 18%, respectively. The risk-free rate of return is 7%. Portfolio A has a beta of 0.7. If arbitrage opportunities are ruled out, portfolio B must have a beta of __________.A. 0.45B. 1.00C. 1.10D. 1.22E. 1.33There are three stocks, A, B, and C. You can either invest in these stocks or short sell them. There are three possible states of nature for economic growth in the upcoming year; economic growth may be strong, moderate, or weak. The returns for the upcoming year on stocks A, B, and C for each of these states of nature are given below:25. If you invested in an equally weighted portfolio of stocks A and B, your portfolio return would be ___________ if economic growth were moderate.A. 3.0%B. 14.5%C. 15.5%D. 16.0%E. 17.0%26. If you invested in an equally weighted portfolio of stocks A and C, your portfolio return would be ____________ if economic growth was strong.A. 17.0%B. 22.5%C. 30.0%D. 30.5%E. 25.6%27. If you invested in an equally weighted portfolio of stocks B and C, your portfolio return would be _____________ if economic growth was weak.A. −2.5%B. 0.5%C. 3.0%D. 11.0%E. 9.0%28. If you wanted to take advantage of a risk-free arbitrage opportunity, you should take a short position in _________ and a long position in an equally weighted portfolio of _______.A. A; B and CB. B; A and CC. C; A and BD. A and B; CE. No arbitrage opportunity exists.Consider the multifactor APT. There are two independent economic factors, Fand1. The risk-free rate of return is 6%. The following information is available F2about two well-diversified portfolios:29. Assuming no arbitrage opportunities exist, the risk premium on the factor Fportfolio should be __________.1A. 3%B. 4%C. 5%D. 6%E. 2%30. Assuming no arbitrage opportunities exist, the risk premium on the factor Fportfolio should be ___________.2A. 3%B. 4%C. 5%D. 6%E. 2%31. A zero-investment portfolio with a positive expected return arises when _________.A. an investor has downside risk onlyB. the law of prices is not violatedC. the opportunity set is not tangent to the capital allocation lineD. a risk-free arbitrage opportunity existsE. a risk-free arbitrage opportunity does not exist32. An investor will take as large a position as possible when an equilibrium price relationship is violated. This is an example of _________.A. a dominance argumentB. the mean-variance efficiency frontierC. a risk-free arbitrageD. the capital asset pricing modelE. the SML33. The APT differs from the CAPM because the APT _________.A. places more emphasis on market riskB. minimizes the importance of diversificationC. recognizes multiple unsystematic risk factorsD. recognizes multiple systematic risk factorsE. places more emphasis on systematic risk34. The feature of the APT that offers the greatest potential advantage over the CAPM is the ______________.A. use of several factors instead of a single market index to explain the risk-return relationshipB. identification of anticipated changes in production, inflation, and term structure as key factors in explaining the risk-return relationshipC. superior measurement of the risk-free rate of return over historical time periodsD. variability of coefficients of sensitivity to the APT factors for a given asset over timeE. superior measurement of the risk-free rate of return over historical time periods and variability of coefficients of sensitivity to the APT factors for a given asset over time35. In terms of the risk/return relationship in the APTA. only factor risk commands a risk premium in market equilibrium.B. only systematic risk is related to expected returns.C. only nonsystematic risk is related to expected returns.D. only factor risk commands a risk premium in market equilibrium and only systematic risk is related to expected returns.E. only factor risk commands a risk premium in market equilibrium and only nonsystematic risk is related to expected returns.36. The following factors might affect stock returns:A. the business cycle.B. interest rate fluctuations.C. inflation rates.D. the business cycle, interest rate fluctuations, and inflation rates.E. the relationship between past FRED spreads.37. Advantage(s) of the APT is(are)A. that the model provides specific guidance concerning the determination of the risk premiums on the factor portfolios.B. that the model does not require a specific benchmark market portfolio.C. that risk need not be considered.D. that the model provides specific guidance concerning the determination of the risk premiums on the factor portfolios and that the model does not require a specific benchmark market portfolio.E. that the model does not require a specific benchmark market portfolio and that risk need not be considered.38. Portfolio A has expected return of 10% and standard deviation of 19%. Portfolio B has expected return of 12% and standard deviation of 17%. Rational investors willA. borrow at the risk free rate and buy A.B. sell A short and buy B.C. sell B short and buy A.D. borrow at the risk free rate and buy B.E. lend at the risk free rate and buy B.39. An important difference between CAPM and APT isA. CAPM depends on risk-return dominance; APT depends on a no arbitrage condition.B. CAPM assumes many small changes are required to bring the market back to equilibrium; APT assumes a few large changes are required to bring the market back to equilibrium.C. implications for prices derived from CAPM arguments are stronger than prices derived from APT arguments.D. CAPM depends on risk-return dominance; APT depends on a no arbitrage condition, CAPM assumes many small changes are required to bring the market back to equilibrium; APT assumes a few large changes are required to bring the market back to equilibrium, implications for prices derived from CAPM arguments are stronger than prices derived from APT arguments.E. CAPM depends on risk-return dominance; APT depends on a no arbitrage condition and assumes many small changes are required to bring the market back to equilibrium.40. A professional who searches for mispriced securities in specific areas such as merger-target stocks, rather than one who seeks strict (risk-free) arbitrage opportunities is engaged inA. pure arbitrage.B. risk arbitrage.C. option arbitrage.D. equilibrium arbitrage.E. covered interest arbitrage.41. In the context of the Arbitrage Pricing Theory, as a well-diversified portfolio becomes larger its nonsystematic risk approachesA. one.B. infinity.C. zero.D. negative one.E. None of these is correct.42. A well-diversified portfolio is defined asA. one that is diversified over a large enough number of securities that the nonsystematic variance is essentially zero.B. one that contains securities from at least three different industry sectors.C. a portfolio whose factor beta equals 1.0.D. a portfolio that is equally weighted.E. a portfolio that is equally weighted and contains securities from at least three different industry sectors.43. The APT requires a benchmark portfolioA. that is equal to the true market portfolio.B. that contains all securities in proportion to their market values.C. that need not be well-diversified.D. that is well-diversified and lies on the SML.E. that is unobservable.44. Imposing the no-arbitrage condition on a single-factor security market implies which of the following statements?I) the expected return-beta relationship is maintained for all but a small number of well-diversified portfolios.II) the expected return-beta relationship is maintained for all well-diversified portfolios.III) the expected return-beta relationship is maintained for all but a small number of individual securities.IV) the expected return-beta relationship is maintained for all individual securities.A. I and III are correct.B. I and IV are correct.C. II and III are correct.D. II and IV are correct.E. Only I is correct.45. Consider a well-diversified portfolio, A, in a two-factor economy. The risk-free rate is 6%, the risk premium on the first factor portfolio is 4% and the risk premium on the second factor portfolio is 3%. If portfolio A has a beta of 1.2 on the first factor and .8 on the second factor, what is its expected return?A. 7.0%B. 8.0%C. 9.2%D. 13.0%E. 13.2%46. The term "arbitrage" refers toA. buying low and selling high.B. short selling high and buying low.C. earning risk-free economic profits.D. negotiating for favorable brokerage fees.E. hedging your portfolio through the use of options.47. To take advantage of an arbitrage opportunity, an investor wouldI) construct a zero investment portfolio that will yield a sure profit.II) construct a zero beta investment portfolio that will yield a sure profit. III) make simultaneous trades in two markets without any net investment. IV) short sell the asset in the low-priced market and buy it in the high-priced market.A. I and IVB. I and IIIC. II and IIID. I, III, and IVE. II, III, and IV48. The factor F in the APT model representsA. firm-specific risk.B. the sensitivity of the firm to that factor.C. a factor that affects all security returns.D. the deviation from its expected value of a factor that affects all security returns.E. a random amount of return attributable to firm events.49. In the APT model, what is the nonsystematic standard deviation of an equally-weighted portfolio that has an average value of σ(e) equal to 25% andi50 securities?A. 12.5%B. 625%C. 0.5%D. 3.54%E. 14.59%50. In the APT model, what is the nonsystematic standard deviation of an equally-weighted portfolio that has an average value of σ(e) equal to 20% andi20 securities?A. 12.5%B. 625%C. 4.47%D. 3.54%E. 14.59%51. In the APT model, what is the nonsystematic standard deviation of an) equal to 20% and equally-weighted portfolio that has an average value of σ(ei40 securities?A. 12.5%B. 625%C. 0.5%D. 3.54%E. 3.16%52. In the APT model, what is the nonsystematic standard deviation of an) equal to 18% and equally-weighted portfolio that has an average value of (ei250 securities?A. 1.14%B. 625%C. 0.5%D. 3.54%E. 3.16%53. Which of the following is true about the security market line (SML) derived from the APT?A. The SML has a downward slope.B. The SML for the APT shows expected return in relation to portfolio standard deviation.C. The SML for the APT has an intercept equal to the expected return on the market portfolio.D. The benchmark portfolio for the SML may be any well-diversified portfolio.E. The SML is not relevant for the APT.54. Which of the following is false about the security market line (SML) derived from the APT?A. The SML has a downward slope.B. The SML for the APT shows expected return in relation to portfolio standard deviation.C. The SML for the APT has an intercept equal to the expected return on the market portfolio.D. The benchmark portfolio for the SML may be any well-diversified portfolio.E. The SML has a downward slope, the SML for the APT shows expected return in relation to portfolio standard deviation, and the SML for the APT has an intercept equal to the expected return on the market portfolio are all false.55. If arbitrage opportunities are to be ruled out, each well-diversified portfolio's expected excess return must beA. inversely proportional to the risk-free rate.B. inversely proportional to its standard deviation.C. proportional to its weight in the market portfolio.D. proportional to its standard deviation.E. proportional to its beta coefficient.56. Suppose you are working with two factor portfolios, Portfolio 1 and Portfolio 2. The portfolios have expected returns of 15% and 6%, respectively. Based on this information, what would be the expected return on well-diversified portfolio A, if A has a beta of 0.80 on the first factor and 0.50 on the second factor? The risk-free rate is 3%.A. 15.2%B. 14.1%C. 13.3%D. 10.7%E. 8.4%57. Which of the following is (are) true regarding the APT?I) The Security Market Line does not apply to the APT.II) More than one factor can be important in determining returns.III) Almost all individual securities satisfy the APT relationship.IV) It doesn't rely on the market portfolio that contains all assets.A. II, III, and IVB. II and IVC. II and IIID. I, II, and IVE. I, II, III, and IV58. In a factor model, the return on a stock in a particular period will be related toA. factor risk.B. non-factor risk.C. standard deviation of returns.D. both factor risk and non-factor risk.E. There is no relationship between factor risk, risk premiums, and returns.59. Which of the following factors did Chen, Roll and Ross not include in their multifactor model?A. Change in industrial productionB. Change in expected inflationC. Change in unanticipated inflationD. Excess return of long-term government bonds over T-billsE. Neither the change in industrial production, change in expected inflation, change in unanticipated inflation, nor excess return of long-term government bonds over T-bills were included in their model.60. Which of the following factors did Chen, Roll and Ross include in their multifactor model?A. Change in industrial wasteB. Change in expected inflationC. Change in unanticipated inflationD. Change in expected inflation and Change in unanticipated inflationE. All of these factors were included in their model61. Which of the following factors were used by Fama and French in their multi-factor model?A. Return on the market index.B. Excess return of small stocks over large stocks.C. Excess return of high book-to-market stocks over low book-to-market stocks.D. All of these factors were included in their model.E. None of these factors were included in their model.62. Consider the single-factor APT. Stocks A and B have expected returns of 12% and 14%, respectively. The risk-free rate of return is 5%. Stock B has a beta of 1.2. If arbitrage opportunities are ruled out, stock A has a beta of __________.A. 0.67B. 0.93C. 1.30D. 1.69E. 1.2763. Consider the one-factor APT. The standard deviation of returns on a well-diversified portfolio is 19%. The standard deviation on the factor portfolio is 12%. The beta of the well-diversified portfolio is approximately __________.A. 1.58B. 1.13C. 1.25D. 0.76E. 1.4264. Black argues that past risk premiums on firm-characteristic variables, such as those described by Fama and French, are problematic because ________.A. they may result from data snoopingB. they are sources of systematic riskC. they can be explained by security characteristic linesD. they are more appropriate for a single-factor modelE. they are macroeconomic factors65. Multifactor models seek to improve the performance of the single-index model byA. modeling the systematic component of firm returns in greater detail.B. incorporating firm-specific components into the pricing model.C. allowing for multiple economic factors to have differential effects.D. modeling the systematic component of firm returns in greater detail, incorporating firm-specific components into the pricing model, and allowing for multiple economic factors to have differential effects.E. none of these statements are true.66. Multifactor models such as the one constructed by Chen, Roll, and Ross, can better describe assets' returns byA. expanding beyond one factor to represent sources of systematic risk.B. using variables that are easier to forecast ex ante.C. calculating beta coefficients by an alternative method.D. using only stocks with relatively stable returns.E. ignoring firm-specific risk.67. Consider the multifactor model APT with three factors. Portfolio A has a beta of 0.8 on factor 1, a beta of 1.1 on factor 2, and a beta of 1.25 on factor 3. The risk premiums on the factor 1, factor 2, and factor 3 are 3%, 5% and 2%, respectively. The risk-free rate of return is 3%. The expected return on portfolio A is __________ if no arbitrage opportunities exist.A. 13.5%B. 13.4%C. 16.5%D. 23.0%E. 11.6%68. Consider the multifactor APT. The risk premiums on the factor 1 and factor 2 portfolios are 6% and 4%, respectively. The risk-free rate of return is 4%. Stock A has an expected return of 16% and a beta on factor 1 of 1.3. Stock A has a beta on factor 2 of ________.A. 1.33B. 1.05C. 1.67D. 2.00E. .9569. Consider a well-diversified portfolio, A, in a two-factor economy. The risk-free rate is 5%, the risk premium on the first factor portfolio is 4% and the risk premium on the second factor portfolio is 6%. If portfolio A has a beta of 0.6 on the first factor and 1.8 on the second factor, what is its expected return?A. 7.0%B. 8.0%C. 18.2%D. 13.0%E. 13.2%70. Consider a single factor APT. Portfolio A has a beta of 2.0 and an expected return of 22%. Portfolio B has a beta of 1.5 and an expected return of 17%. The risk-free rate of return is 4%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio __________ and a long position in portfolio _______.A. A; AB. A; BC. B; AD. B; BE. A; the riskless asset71. Consider the single factor APT. Portfolio A has a beta of 0.5 and an expected return of 12%. Portfolio B has a beta of 0.4 and an expected return of 13%. The risk-free rate of return is 5%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio _________ and a long position in portfolio _________.A. A; AB. A; BC. B; AD. B; BE. No arbitrage opportunity exists.72. Consider the one-factor APT. The variance of returns on the factor portfolio is 9%. The beta of a well-diversified portfolio on the factor is 1.25. The variance of returns on the well-diversified portfolio is approximately__________.A. 3.6%B. 6.0%C. 7.3%D. 14.1%E. 9.7%73. Consider the one-factor APT. The variance of returns on the factor portfolio is 11%. The beta of a well-diversified portfolio on the factor is 1.45. The variance of returns on the well-diversified portfolio is approximately__________.A. 23.1%B. 6.0%C. 7.3%D. 14.1%E. 11.4%74. Consider the one-factor APT. The standard deviation of returns on a well-diversified portfolio is 22%. The standard deviation on the factor portfolio is 14%. The beta of the well-diversified portfolio is approximately __________.A. 0.80B. 1.13C. 1.25D. 1.57E. 67Short Answer Questions75. Discuss the advantages of arbitrage pricing theory (APT) over the capital asset pricing model (CAPM) relative to diversified portfolios.76. Discuss the advantages of the multifactor APT over the single factor APT and the CAPM. What is one shortcoming of the multifactor APT and how does this shortcoming compare to CAPM implications?77. Discuss arbitrage opportunities in the context of violations of the law of one price.78. Discuss the similarities and the differences between the CAPM and the APT with regard to the following factors: capital market equilibrium, assumptions about risk aversion, risk-return dominance, and the number of investors required to restore equilibrium.79. Security A has a beta of 1.0 and an expected return of 12%. Security B hasa beta of 0.75 and an expected return of 11%. The risk-free rate is 6%. Explain the arbitrage opportunity that exists; explain how an investor can take advantage of it. Give specific details about how to form the portfolio, what to buy and what to sell.80. Name three variables that Chen, Roll, and Ross used to measure the impact of macroeconomic factors on security returns. Briefly explain the reasoning behind their model.。

金融投资风险管理知识及答案

金融投资风险管理知识及答案金融投资是现代社会中常见的一种经济活动,它旨在通过将资金投入到不同的金融产品中,获取投资回报。

然而,金融投资也伴随着一定的风险。

为了降低投资风险,投资者需要了解和应用一些金融投资风险管理的知识和策略。

本文将介绍一些常见的金融投资风险,并提供相应的应对策略。

一、市场风险市场风险是指由于市场变化导致投资资产价值波动的风险。

市场风险通常与宏观经济因素、行业周期以及供需关系等相关。

投资者可以采取以下策略降低市场风险:1.分散投资:投资者可以将资金分散投资于不同行业、不同地区或不同资产类别,以减少单一投资的风险。

2.定期再平衡:投资者应定期检查投资组合,并根据市场情况进行再平衡,以确保投资资产的分配合理。

3.关注市场趋势:投资者应密切关注市场趋势和经济变化,及时做出相应的调整。

二、信用风险信用风险是指债务人无法按时或完全偿还借款本金和利息的风险。

投资者可以通过以下方式管理信用风险:1.评估债务人信用状况:在投资债券或信托产品时,投资者应评估债务人的信用状况,选择信用评级较高的债务人。

2.多元化债权组合:投资者可以将资金分散投资于多个债务人,降低单一债务人违约的风险。

3.及时回收欠款:如果投资者发现债务人出现违约情况,应及时采取法律手段追回欠款。

三、流动性风险流动性风险是指投资者在需要迅速变现资产或交易时,市场无法提供足够的买家或卖家,导致无法按照预期价格完成交易的风险。

投资者可以采取以下策略管理流动性风险:1.合理规划资金需求:投资者应合理规划资金需求,避免频繁买卖投资产品,以降低流动性风险。

2.选择流动性较好的资产:投资者可以选择流动性较好的金融产品,如交易所交易基金(ETF)等,以便在需要时迅速变现。

四、操作风险操作风险是指投资者由于自身操作不当或错误决策导致投资损失的风险。

投资者可以通过以下方式管理操作风险:1.确保充分准备:投资者应充分了解投资产品的特点和风险,做全面的调研和分析,避免盲目决策。

投资学第二版课后习题答案

投资学第二版课后习题答案投资学第二版课后习题答案投资学是一门研究投资决策的学科,它涉及到资金的配置、风险管理、资产定价等方面的知识。

为了帮助学生更好地理解和掌握这门学科,教材通常会附带一些习题,供学生练习和巩固所学知识。

本文将为大家提供投资学第二版课后习题的答案,希望能对学习投资学的同学们有所帮助。

第一章:投资学的基本概念和原理1. 什么是投资学?投资学是研究投资决策的学科,它包括资金的配置、风险管理、资产定价等方面的知识。

2. 投资决策的基本原则有哪些?投资决策的基本原则包括风险与收益的权衡、分散投资、长期投资等。

3. 什么是资产定价?资产定价是指根据资产的风险和预期收益来确定其价格的过程。

第二章:投资组合的风险与收益1. 什么是投资组合?投资组合是指将不同的资产按一定比例组合在一起形成的投资组合。

2. 如何计算投资组合的预期收益?投资组合的预期收益可以通过各个资产的预期收益率加权平均来计算。

3. 如何计算投资组合的风险?投资组合的风险可以通过计算各个资产之间的协方差和权重来得到。

第三章:投资组合的有效前沿1. 什么是有效前沿?有效前沿是指在给定风险水平下,能够获得最大预期收益的投资组合。

2. 如何构建有效前沿?构建有效前沿需要计算各个资产的预期收益率、协方差矩阵,并通过优化模型来确定最佳的投资组合。

3. 有效前沿的作用是什么?有效前沿可以帮助投资者在风险和收益之间做出最优的选择,从而实现资产配置的最佳效果。

第四章:资本市场理论1. 什么是资本市场线?资本市场线是指在风险和收益之间形成的一条直线,表示投资组合的最佳效果。

2. 如何计算资本市场线?计算资本市场线需要确定无风险利率、市场组合的预期收益率和风险,以及投资组合的风险。

3. 资本市场线的作用是什么?资本市场线可以帮助投资者确定最佳的投资组合,从而实现资产配置的最佳效果。

第五章:投资者行为与市场效率1. 什么是投资者行为?投资者行为是指投资者在进行投资决策时所表现出的心理和行为特征。

西财《投资学》教学资料包 课后习题答案 第三章

第三章风险投资一、思考题1. 如何认识风险投资对我国经济发展的作用?风险投资对技术创新和高科技产业发展有着巨大的推动作用。

风险投资在促进产业结构调整、社会就业结构转变、投资选择渠道扩大、资本市场深度加强等方面也都有着积极的意义。

随着接受风险投资企业数量的不断上升,风险企业的经营状况逐步改善,有些企业通过一定时期的发展呈现出规模化经营状态,企业赢利能力逐步提升。

在部分高科技领域形成以点带面,合力突破的发展态势,最终形成新的规模化的行业整体优势,完成由传统产业向新兴产业的过渡和转移。

新的风险企业的发展推动新兴产业的逐步壮大的同时,给社会带来的是新的就业机会和原有就业结构的调整与转变。

风险投资创造了无数个新的工作岗位,推动了高科技产业的发展。

同时,现代高科技产业的发展离不开风险投资。

因为高科技企业在创立初期很难从传统的融资渠道获得其所需的发展资金,资金成为企业发展的瓶颈,但是,它们潜在的高增长性却吸引了风险投资家的介入,风险投资与高科技自然的结合在一起。

2. 风险投资公司的组织形式有哪些?风险投资是一项专业性、综合性很强的经济活动,要使风险投资活动成为一个顺畅的资本循环和增殖过程,必须有风险投资运作主体的参与。

按组织形式的不同,可以把风险投资公司分为有限合伙制、公司制和信托基金制。

1. 有限合伙制:有限合伙制是由投资者(有限合伙人)和基金管理者(普通合伙人)合伙组成一个有限合伙公司。

2. 公司制:公司制是指以股份公司或有限责任公司形式设立风险投资公司的组织模式。

3. 信托基金制:风险投资领域的信托基金是指依据《信托法》、《风险投资基金法》等相关法律设立的风险投资基金,再以信托契约方式将风险投资者(持有人)、风险投资基金管理公司(管理人)和受托金融机构(托管人)三者的关系书面化和法律化,以约束和规范当事人的行为。

另外,从风险投资基金的组织形式来看,风险投资基金可以划分为两种,即契约型风险投资基金和公司型风险投资基金。

投资银行学课后思考题答案

投资银行学课后思考题答案

1.投资银行的概念是什么?

投资银行是一种尤其专门从事财务咨询、评估、融资、金融产品设计

等职能的金融机构。

主要为政府机构、公司或个人提供资助,回报投

资银行的报酬可以是利润分享或由这些客户支付的费用。

2.投资银行如何为客户提供帮助?

投资银行为客户提供各种金融服务,帮助客户解决资金短缺、资金管

理等问题。

投资银行的核心业务主要包括像财务顾问、证券发行、咨

询服务等。

它们主要为企业客户提供财务支持、投融资服务、并购服务、企业基本金融服务、境外金融服务等。

此外,投资银行也为客户

提供资产管理、欧元债券等金融产品。

3.投资银行都有哪些内部和外部风险?

内部风险主要指投资银行活动所带来的风险,包括经营风险、财务风险、市场风险、信用风险等;外部风险是指投资银行外部环境本身造

成的风险,包括非金融环境的风险、宏观经济环境风险、政治环境风

险等。

4.投资银行的核心竞争力在哪里?

投资银行的核心竞争力在于其专业知识和工具、财务处理技能、国际

业务和市场知识、客户关系管理以及运用技术开展业务的能力等方面。

此外,投资银行的核心竞争力还取决于其能够监测金融服务提供者的行情发展趋势,给客户提供更成功的金融解决方案。

5.投资银行理财最重要的原则是什么?

投资银行理财的最重要原则是客观、科学和专业性。

客观性主要包括市场趋势,行业发展趋势,资产组合分配,以及资金投资选择等因素要被全面考虑;科学性方面,主要体现在风险与回报平衡,以及灵活把握原则性等地方;而专业性则指的是金融服务的周到性,为投资者提供一个公正、安全、可靠的理财环境,以及资金管理与资讯服务。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

幻灯片 6

6、风险投资形成与发展的背景和条件

高新技术供需两旺,是风险投资业存在和发展的前提

良好的资金环境是风险投资产生和发展的外部条件

有利的政策法规有利的政策法规环境能促进风险投资的发展

完善的资本市场体系为风险投资的发展提供了保障

结金融与技术知识于一身的复合型人才的存在

幻灯片 7

7、风险投资与经济增长的关系及其作用机制

幻灯片 3 4、机构投资者概述 机构投资者的特征 在信息收集、占有、处理以及反馈上,机构投资者处于相对优势。 从运作模式上看,完整而系统的组织形式为机构投资者的决策科学化提供了保证。 机构投资者和个人投资者再投资渠道上的取向不相同,推动资本品种创新的压力和动

力也不相同。 机构投资者发展对风险投资的影响 促使风险投资向晚期阶段发展 强化了风险基金公司的激励约束机制

技术开发具有广阔的前景

风险资本市场

风险资本市场是对处于发育成长期的新兴高技术企业进行融资 的市场,以科技

企业家、风险资本家、私人风险投资者为核心 。

幻灯片 3 2、风险投资的定义 和特点 定义:风险投资是指把资金投向蕴藏着较大失败危险的高技术开发领域,以期成功后

取得高资本收益的一种商业投资行为。广义的风险投资概念,应包括对一切开拓性、 创业性经济活动的资金投放。狭义的风险投资,几乎已成为专指与现代高技术产业有 关的投资活动。 特点: 是一种高风险与高收益并举的投资 是一种流动性很小的周期性循环的中长期投资 是一种权益投资 是一种投资和融资结合的投资 是一种资金与管理结合的投资 是一种一种金融与科技相结合的投资 是一种无法从传统渠道获得资金的投资 是一种主要面向高新技术中小企业的投资 是一种积极的投资,而不是一种消极的赌博 是一种高驱动性的投资

幻灯片 4 4、企业参与风险投资的动因 动因:产品结构和产业结构调整的压力 ;更为严峻的利润压力 国外风险投资的示范效应 主要形式:企业内部风险投资 :整合式分拆 ;独立分拆 风险投资的新型机构——新创业小组 新创小组的特点:投资范围不同 ;对项目成功的衡量标准不同 ;决策机制不同 ;激励、 约束不同 公司外部风险投资 公司外部风险投资的形式主要有:中心 CVC 模式 ;创建独立的 CVC 分支机构 ;委托 CVC

产与经营技术密集型产品的投资。 2. 风险投资家

指向风险企业提供风险资本的、专业的资金管理人。风险投资家是风险资本的运作者, 他们是整个风险投资运作过程的中心环节,起着承上启下的作用 3. 风险投资基金

风险投资基金又叫创业基金,是当今世界上广泛流行的一种新型投资机构。它以一定的 方式吸收机构和个人的资金,投向于那些不具备上市资格的中小企业和新兴企业,尤其是高 新技术企业。 4. 买壳上市

幻灯片 1

第二章风险投资中的资金供应思考题

1.风险资本的主要来源有哪些?

2.政府在风险基金发展中应扮演怎样的角色?

3.什么是政府补贴和政府担保?试述两者之间的区别?

4.机构投资者的特征是什么,它的发展对风险投资有什么影响?

5.试述我国机构投资者发展现状,及为培育机构投资者要采取的措施。 6.国外投资者进入一国风险投资领域的的影响。 8.试述我国风险资本的构成及要拓展我国风险资本来源的应对方法。 幻灯片 2 1、风险资本的主要来源 富有的个人 政府 企业 机构投资者 商业银行 境外投资者

第一章 风险投资概论思考题 1.风险投资的基本构成要素有哪些? 2. 什么叫风险投资?它有哪些特点? 3.一般来说风险投资人可以分为哪几类? 4.试述风险投资在美、日、欧的发展状况,并分析今后其发展趋势。 5.风险投资的融资工具有哪些,其中最普遍采用的是哪一种?试分析原因。 6.试述风险投资形成与发展的背景和条件。 7.试述风险投资与经济增长的关系及其作用机制。

12. 市政债券是指由地方政府及其代理机构或授权机构发行的一种债券,也称地方政府债券 或地方债券。

13. 企业债券通常又称为公司债券,是企业依照法定程序发行,约定在一定期限内还本付息

的债券。

14.债券的信用评级就是由专门的信用等级评级机构根据发行人提供的信息材料,并通过调 查、预测等手段,运用科学的分析方法,对拟发行的债券资金使用的合理性和按期偿还债券 本息的能力及其风险程度所做的综合评价。

是指非上市公司购买一家上市公司一定比例的股权来取得上市的地位,然后注入自己有 关业务及资产,实现间接上市的目的。 5. 杠杆式收购

指利用借款收购公司,而以公司的资产作为借款的抵押品。之后,购买者利用被接管的 公司现金流量或出售公司资产的方式偿还贷款。

6. 借壳上市 就是非上市的集团公司将其全部或部分非上市资产置入到其控股的上市公司中,换得上

明确风险投资项目的主要战略目标 慎选投资项目, 分段投资, 控制创业风险 在企业内部建立适合风险投资特点的创业团队, 使企业内部创业能有效开展 在企业内部建立创新愿景, 培育创新文化 加强人员培训, 注重建立有关的社会关系网络

一、 名词解释

1. 风险投资 泛指一切具有高风险、高潜在收益的投资;狭义的风险投资是指以高新技术为基础,生

幻灯片 4 4、风险投资在美、日、欧的发展状况及发展趋势

发展状况:美国:1946 年,由少数富人和机构成立了波士顿美国研究开发公(AR&D),标 志着现代风险投资组织化,从此正式揭开了世界险投资的历史。1958 年美国国会通过小企 业投资法(SBIA),允许建立小企业投资公司(SBIC),极大地推动了美国风险投资的发展 。 进入 70 年代,美国风险投资开始进入低潮。80 年代风险投资进入了空前繁荣阶段。90 年 代,随着全球高新技术产业的兴起,资本市场的日趋活跃,新经济模式的提出,以及 1986 年到 1997 年平均高达 41.2%的投资回报率,都刺激美国的风险投资开始了新一轮快速增长。 日本:是通过模仿美国发展起来的。它对美国商业与技术的发展尤其是小企业的发展密切 关注并予以借鉴。欧洲:德国是欧洲创业投资比较发达的国家,他的风险投资起源于 20 世 纪 60 代中期。20 世纪 90 年代后期德国风险资本开始迅猛发展。英国风险投资业是欧洲最 大和最发达的。它的投资几乎占欧洲的 50%。除美国以外, 现在是第二重要的国家。相比之 下,起步较晚的法国和瑞士的风险投资发展比较缓慢。 发展趋势:国际化趋势越来越明显;集中化和多元化交错发展 投资规模不断增大;各国之间风险投资相互渗透的趋势在加强;投资对象的拓展和投资阶 段的延伸 ;各国加大对风险投资的力度 幻灯片 5 5、风险投资的融资工具 参考第六章 以债券作为融资工具 以普通股作为融资工具 以优先股作为融资工具

市公司的股权,从而实现上市。 7.首次公开发行(IPO) 是指股份有限公司首次公开向投资者发行股票. 8.普通股:指在公司的经营经营管理和盈利及财产的分配上享有普通权利的股份,代表满足 所有债权偿付要求及优先股股东的收益权与求偿权后对企业盈利和剩余财产的索取权。 9.优先股:指公司在筹集资金时,给予投资者关于利润分红及剩余财产分配的优先权的股票。

风险投资机构一种利用创业资本生产新企业的企业。它作为一种 金融中介,首先从投 资人那里筹集一笔以权益形式存在的资金,然后又以掌握部分股权的 形势对一些具有成长 性的企业进行投资。

幻灯片 3 3、中国政府风险投资机构概况

存在的问题 人才缺乏 缺乏风险投资的退出通道 对于其他风险投资机构存在挤出效应 改进措施 调整政府风险投资机构的运营思路 积极开拓政府对风险投资的多种支持渠道 为风险投资也创造良好发展环境是政府更加重 要的责任

幻灯片 6 6、我国企业参与风险投资的现状 现状: 1998 年开始,创业投资这种全新的投资模式和资本运作机制受到一些上市公司

的青睐,开始成为部分上市公司创新活动的正式或非正式安排,并涌现出了大众科创这 样通过资产重组将自己向创业投资定位的上市公司。但中国大多数企业投身风险投资 的目标十分盲目,投机色彩浓厚。 应该采取的对策

第三章 风险投资的运作机构思考题 1.简述风险投资机构的定义及其融资的具体方式。 2.分析政府风险投资运作模式。 3.概括中国政府参与风险投资的现状。 4.企业参与风险投资的动因及其参与的主要方式。 5.外资风险投资机构的特点是什么。 6.试论我国企业参与风险投资的现状 7.分析我国天使投资发展与美国的差异。 幻灯片 2 1、什么是风险投资机构

幻灯片 5 5、外资风险投资机构的特点 “两头在外”的运作模式 投资期主要集中在企业的扩张期和成熟期 投资的企业类型有变化 投资集中于东部发达地区 分散投资和资产组合投资相结合 外资风险投资机构和国内风险投资机构的合作正在加强 风险投资成为外资实业企业中国战略的重要组成部分 收购性投资基金存在对风险投资政策的滥用

10.债券是政府、金融机构、工商企业等机构直接向社会借债筹措资金时,向投资者发行, 并且承诺按一定利率支付利息并按约定条件偿还本金的债权债务凭证。

11. 国债是国家债券(又叫国家公债)的简称,是指中央政府为筹集资金而发行的债券,是 中央政府向投资者出具的、承诺在一定时期支付利息和到期偿还本金的债权债务凭证。

风险投资为高新技术产业提供了资金支持

风险投资的介入,可解决长期困扰技术创新的资金“瓶颈”问题,拓宽融资渠道,增

加技术创新成功的可能性,极大地促进技术创新的发展 。

风险资本促进了中小企业的发展

为中小企业提供发展所需资金

推动了中小企业的技术创新与产业结构升级

促使中小企业建立现代经营管理体制

有利于中小企业优化资源配置,提高资金使用率

幻灯片 5 6、国外投资者进入一国风险投资领域的形式 跨国公司的风险投资子公司,如在国内活跃 的 IDG 等。 传统型风险投资公司(基金) 外国金融机构的风险投资子公司

和国内资金结合组成中外合资风险基金

幻灯片 6 7、国外投资者对我国投资事业影响 国际风险投资能够为高新技术产业带来大量的资金投入 为我国风险投资提供全方位的服务 国际风险资本通过在投资协议中对治理结构作出安排, 从而有效地解决了对企业家及