会计学案例及答案 (3)

(完整版)《初级会计学》案例分析题答案

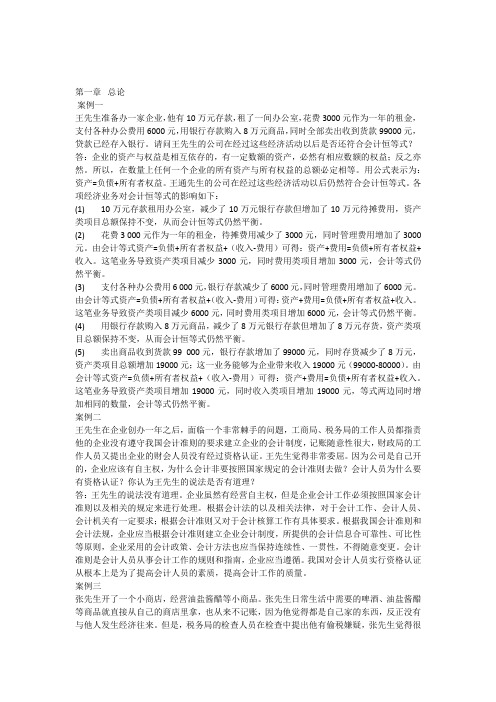

第一章总论案例一王先生准备办一家企业,他有10万元存款,租了一间办公室,花费3000元作为一年的租金,支付各种办公费用6000元,用银行存款购入8万元商品,同时全部卖出收到货款99000元,贷款已经存入银行。

请问王先生的公司在经过这些经济活动以后是否还符合会计恒等式?答:企业的资产与权益是相互依存的,有一定数额的资产,必然有相应数额的权益;反之亦然。

所以,在数量上任何一个企业的所有资产与所有权益的总额必定相等。

用公式表示为:资产=负债+所有者权益。

王通先生的公司在经过这些经济活动以后仍然符合会计恒等式。

各项经济业务对会计恒等式的影响如下:(1)10万元存款租用办公室,减少了10万元银行存款但增加了10万元待摊费用,资产类项目总额保持不变,从而会计恒等式仍然平衡。

(2)花费3 000元作为一年的租金,待摊费用减少了3000元,同时管理费用增加了3000元。

由会计等式资产=负债+所有者权益+(收入-费用)可得:资产+费用=负债+所有者权益+收入。

这笔业务导致资产类项目减少3000元,同时费用类项目增加3000元,会计等式仍然平衡。

(3)支付各种办公费用6 000元,银行存款减少了6000元,同时管理费用增加了6000元。

由会计等式资产=负债+所有者权益+(收入-费用)可得:资产+费用=负债+所有者权益+收入。

这笔业务导致资产类项目减少6000元,同时费用类项目增加6000元,会计等式仍然平衡。

(4)用银行存款购入8万元商品,减少了8万元银行存款但增加了8万元存货,资产类项目总额保持不变,从而会计恒等式仍然平衡。

(5)卖出商品收到货款99 000元,银行存款增加了99000元,同时存货减少了8万元,资产类项目总额增加19000元;这一业务能够为企业带来收入19000元(99000-80000)。

由会计等式资产=负债+所有者权益+(收入-费用)可得:资产+费用=负债+所有者权益+收入。

这笔业务导致资产类项目增加19000元,同时收入类项目增加19000元,等式两边同时增加相同的数量,会计等式仍然平衡。

《会计学》最新案例分析

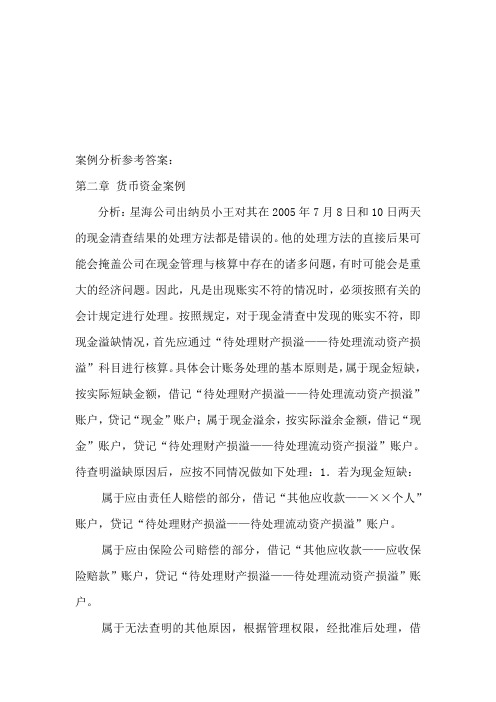

案例分析参考答案:第二章货币资金案例分析:星海公司出纳员小王对其在2005年7月8日和10日两天的现金清查结果的处理方法都是错误的。

他的处理方法的直接后果可能会掩盖公司在现金管理与核算中存在的诸多问题,有时可能会是重大的经济问题。

因此,凡是出现账实不符的情况时,必须按照有关的会计规定进行处理。

按照规定,对于现金清查中发现的账实不符,即现金溢缺情况,首先应通过“待处理财产损溢——待处理流动资产损溢”科目进行核算。

具体会计账务处理的基本原则是,属于现金短缺,按实际短缺金额,借记“待处理财产损溢——待处理流动资产损溢”账户,贷记“现金”账户;属于现金溢余,按实际溢余金额,借记“现金”账户,贷记“待处理财产损溢——待处理流动资产损溢”账户。

待查明溢缺原因后,应按不同情况做如下处理:1.若为现金短缺:属于应由责任人赔偿的部分,借记“其他应收款——××个人”账户,贷记“待处理财产损溢——待处理流动资产损溢”账户。

属于应由保险公司赔偿的部分,借记“其他应收款——应收保险赔款”账户,贷记“待处理财产损溢——待处理流动资产损溢”账户。

属于无法查明的其他原因,根据管理权限,经批准后处理,借记“管理费用——现金短缺”账户,贷记“待处理财产损溢——待处理流动资产损溢”账户。

2.若为现金溢余:属于应支付给有关人员或单位,应借记“待处理财产损溢——待处理流动资产损溢”账户,贷记“其他应付款——应付现金溢余(××人员或单位)”账户。

属于无法查明原因的溢余部分,经批准后,借记“待处理财产损溢——待处理流动资产损溢”账户,贷记“营业外收入——现金溢余”账户银行存款实有数与企业银行存款日记账余额或银行对账单余额并不总是一致,原因一般有两个方面,第一存在未达账项,;第二企业或银行双方可能存在记账错误。

小王在确定企业银行存款实有数时,只考虑了第一个方面的因素,而忽略了第二个方面的因素。

如果企业或银行没有记账错误的话,小王的方法可能会确定出银行存款的实有数,但如果未达账项确定不全面或错误的话,也不会确定出银行存款实有数的。

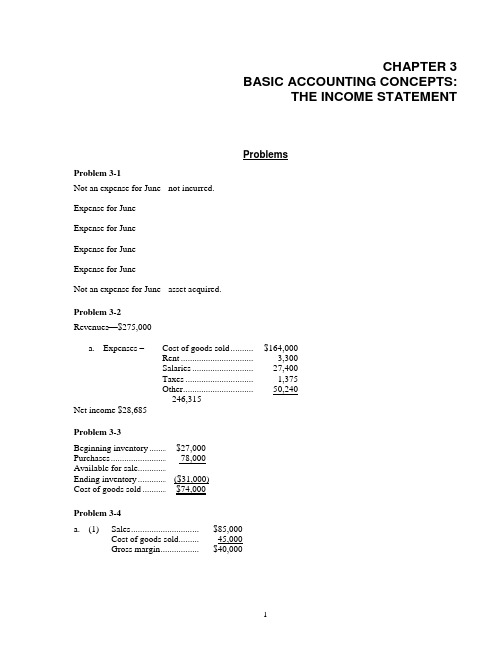

会计学教程与案例财务会计分册第十12版第3章答案

CHAPTER 3BASIC ACCOUNTING CONCEPTS:THE INCOME STATEMENTProblemsProblem 3-1Not an expense for June - not incurred.Expense for JuneExpense for JuneExpense for JuneExpense for JuneNot an expense for June - asset acquired.Problem 3-2Revenues $275,000a.Expenses –Cost of goods sold ...............$164,000Rent .....................................3,300Salaries ................................27,400Taxes ...................................1,375Other ....................................50,240246,315Net income $28,685Problem 3-3Beginning inventory ............$27,000Purchases ............................. 78,000Available for sale .................Ending inventory .................($31,000)Cost of goods sold ...............$74,000Problem 3-4a.(1) Sales ...................................$85,000Cost of goods sold..............45,000Gross margin ......................$40,0001Accounting: Text and Cases 12e –Instructor’s Manual Anthony/Hawkins/Merchant(2)47 percent gross margin ($40,000 / $85,000)(3)11 percent profit margin (9000/85000)The Woden Corporation had a tax rate of 40 percent ($6,000 / $15,000) on its pretax profit that represented 17.7 percent of its sales ($15,000 / $85,000). The company’s operating expenses were 82.3 percent of sales ($70,000 / $85,000) and its cost of goods sold was 53 percent of sales. The company’s gross margin was 47 percent of sales ($40,000 / $85,000).Problem 3-5Depreciation. Each year for the next 5 years depreciation will be charged to income.No income statement charge. Land is not depreciated.Cost of goods sold. $3,500 charged to current year’s income. $3,500 charged to next year’s income. Subscription expense. $36 charged to current year. $36 charged to next year. Alternatively, $72 charged to current year on grounds $72 is immaterial.Problem 3-6Asset value:October 1, 20X5 $30,000December 31, 20X5 26,250December 31, 20X6 11,250December 31, 20X7 0Expenses:20X5 $3,750 ($1,250 x 3 months)20X6 $15,000 ($1,250 x 12 months)20X7 $11,250 ($1,250 x 9 months)One month’s insurance charge is $1,250 ($30, 000 / 24 months)2©2007 McGraw-Hill/Irwin Chapter 3Problem 3-7QED ELECTRONICS COMPANYIncome Statement for the month of April, ----.Sales ...................................................$33,400Expenses:Bad debts .......................................$ 645Parts ...............................................2,100Interest (880)Wages ............................................10,000Utilities (800)Depreciation ..................................2,700Selling ............................................1,900Administrative ...............................4,700 ______26,925Profit before taxes .............................. 8,075Provision for taxes .............................. 2,800.Net income $6,875Truck purchase has no income statement effect. It is an asset.Sales are recorded as earned, not when cash is received. Bad debt provision of 5 percent related to sales on credit ($33,400 - $20,500) must be recognized. Wages expense is recognized as incurred, not when paid.March’s utility bill is an expense of March when the obligation was incurred.Income tax provision relates to pretax income. Must be matched with related income.Problem 3-8First calculate sales:Sales ($45,000 / (1 - .45)) .................$81,818+Beginning inventory .........................$35,000Purchases ..........................................$40,000Total available ..................................75,000Ending inventory .............................. 30,000Cost of goods sold ............................$45,000Gross margin ....................................$36,818If the gross margin percentage is 45 percent, the cost of goods sold percentage must be 55 percent.Once sales are determined, calculate net income:Net income ($81,818 x .1) $8,1823Accounting: Text and Cases 12e – Instructor’s Manual Anthony/Hawkins/Merchant4Next, prepare balance sheet:Assets LiabilitiesCurrent assets ($50,000 x 1.6) ............................ $ 80,000 Current liabilities .........................$ 50,000 Other assets ($218,182 - $50,000) ................... 138,182 Long term debt 40,000 Total liabilities ............................$ 90,000Owners’ equityBeginning balance .......................$120,000 Plus net income ........................... 8,182 Ending balance ............................$128,182Total assets ..................... $218,182+Total liabilitiesand owners’ equity ......................$218,182+Total assets = Total liabilities and Owner’s equity.Problem 3-9Sales LC 26,666,667 [LC 20,000,000 x (200 / 150)] January cash LC 1,000,000 [LC 500,000 x (200 / 100)] December cash LC 600,000At year-end the company was more liquid in terms of nominal currency (LC 600,000 versus LC 500,000) but in terms of the purchasing power of its cash it was worse off (LC 1,000,000 versus LC 600,000).CasesCase 3-1: Maynard Company (B)Note: This case is unchanged from the Eleventh Edition. Question 1 See below.Question 2This question brings out the difference between cash accounting and accrual accounting. Cash increased by $31,677 whereas net income was $19,635. Explaining the exact difference may be too difficult at this stage, but students should see that:1. The bank loan, a financing transaction, increased cash by $20,865 but did not affect net income.Cash collected on credit sales made last period ($21,798) also increased cash, but did not affect net income this period. (The same is true of the collection of the $11,700 note receivable from Diane Maynard, but it was offset by the payments of the $11,700 dividend to Diane Maynard, the sole shareholder.)©2007 McGraw-Hill/Irwin Chapter 32.MAYNARD COMPANYINCOME STATEMENT, JUNESales ($44,420 cash sales + $26,505 credit sales) .....................$70,925 Less: Cost of sales * ............................................................ 39,345Gross Margin .............................................................................31,580ExpensesWages($5,660+$2,202-$1,974) ..........................................$5,888Utilities (900)Supplies ($5,559+$1,671-$6,630) (600)Insurance($3,150-$2,826) (324)Depreciation ($157,950-$156,000)+($5,928-$5,304) .........2,574Miscellaneous ..................................................................... 135 10,421Income before income tax .........................................................21,159 Income tax expense ($7,224 - $5,700) ................................1,524Net Income ................................................................................19,635 Less: Dividends ................................................................... 11,700Increase in retained earnings .....................................................$ 7,935*Cost of sales:Merchandise purchased for cash .........................................$14,715Merchandise purchased on credit ........................................21,315 [$21,315+($8,517-$8,517)] Inventory, June 1 ................................................................. 29,835Total goods available during June ................................65,865Inventory, June 30 ............................................................... 26,520Cost of Sales .................................................................$39,3453.The purchase of equipment ($23,400) and other assets ($408) decreased cash but did not affectnet income (at least not by this full amount) this period.4.Credit sales made this period ($26,505) increased net income, but did not affect cash.5.Noncash expenses such as depreciation ($2,574) and insurance ($324) decreased net income butdid not affect cash as they relate largely, if not wholly, to cash outflows made for asset acquisition in prior periods. (Exception: such expenses on an entity’s first income statement are not related to prior period expenditures but they will be a much smaller amount than the first accounting period’s expenditures.Question 3(a)$14,715 is incorrect because it is the amount of cash purchases rather than the cost of sales. Thecost of cash purchases and cost of sales amounts would be equal for a period in which all purchases were for cash, and in which the dollar amount of beginning inventory was the same as the dollar amount of ending inventory, since Cost of Sales = Beginning Inventory + Purchases - Ending Inventory.(b)$36,030 is the sum of cash purchases ($14,715) and credit purchases ($21,315). As explainedabove, purchases equal cost of sales for the period only if beginning and ending inventory amounts are the same.5Accounting: Text and Cases 12e –Instructor’s Manual Anthony/Hawkins/MerchantCase 3-2: Lone Pine Café (B)Note:This case is updated from the Eleventh Edition.ApproachThis case introduces students to preparation of an income statement based on analyzing transactions. At this stage, students are not expected to set up accounts in the formal sense. However, in effect they do so for those income statement items that did not coincide exactly with cash flows.Question 1A suggested income statement as required by Question 1 is shown below. The following notes applyto the income statement.1.The student needs to refer back to Lone Pine Café (A) in order to construct the income statementon the accrual basis. Amounts for sales on credit, purchases on credit, beginning and ending inventory, beginning and ending prepaid operating license, and depreciation expense are to be found there. Specifically:a.Sales revenues = $43,480 cash sales + $870 credit sales to ski instructors = $44,350.b.Food and beverage expense = $2,800 beginning inventory + $10,016 cash purchases + $1,583credit purchases - $2,430 ending inventory = $11,969.2.Since the entity is unincorporated, it is also correct (though less meaningful for evaluativepurposes) to treat the $23,150 partners’ salaries as owners’ drawings. This treatment would result in an income of $12,296 and a decrease in equity (after drawings) of $10,854.LONE PINE CAFE (B)INCOME STATEMENT FOR NOVEMBER 2, 2005, THROUGHMARCH 30, 2006Sales ...........................................................................$ 44,350Expenses:Salaries to partners ................................................$23,150Part-time employee wages .....................................5,480Food and beverage supplies ...................................l1,969Telephone and electricity ......................................3,270Rent expense ..........................................................7,500Depreciation ..........................................................2,445Operating license expense (595)Interest (540)Miscellaneous expenses (255)Total expenses ............................................................55,204(Loss) ..........................................................................$(10,854)6©2007 McGraw-Hill/Irwin Chapter 3Question 2The income statement tells Mrs. Antoine that the partnership has suffered a $10,854 loss for the first five months of operation. This $10,854 loss is the correct figure for evaluative purposes, not the $12,296 income before partners’ salaries. This assumes, of course, that nonowner salaries for the cook and table servers would also have been $23,150, which is questionable. It would appear that Lone Pine Cafe cannot support three partners, even at a bare level of sustenance ($23,150 was only an average of $1,543 per partner/employee per month). Of course the three owner/employees did receive room and board, for which no value has been imputed here.Case 3-3: Dispensers of California, Inc.Note: This is a new case for the Twelfth Edition.ApproachThe case can be used for two class sessions. The first day is devoted to analyzing the accounting transactions, including a preliminary discussion of Hynes’ accounting policy d ecisions. The second class deals with preparing the financial statements and an analysis of how they may change if alternative accounting procedures had been adopted by Hynes.The first class should start with the case Question 1. Its purpose is to give the students a sense of the managerial purpose of profit plans and a context for the later accounting discussions.The use of the asset equals liability plus equity structure to answer Question 2 is recommended so that the instructor can 1) highlight the retained earnings link between net income and the balance sheet 2) illustrate how any accounting transaction can be analyzed using the basic accounting equation and 3) to lay the foundation for the debit-credit framework material in Chapter 4. (At this point in the course debit and credit terminology and analysis should not be used.)Questions 3 and 4 require the preparation of an income statement and balance sheet, respectively. Some instructors prefer to end the first class with a discussion of the balance sheet, including a completed balance sheet. Typically, these instructors want to leave time in the second class to discuss the relationship between net income and the change in cash on the balance sheet.Question 5 is designed to illustrate the role of judgment in accounting for transactions.Answers to QuestionsQuestion 1Profit plans are used for a variety of purposes. These include:▪To force short range planning▪As a basis for evaluating performance and determining compensation.▪To encourage coordination and communication between different organization units and levels.▪As a challenge to improve performance.▪As a means for training managers▪As an early warning system and▪As a guide to spending.7Accounting: Text and Cases 12e –Instructor’s Manual Anthony/Hawkins/MerchantQuestion 2TN-Exhibit 1 presents an analysis of the planned transactions using the basic accounting equation framework. This analysis follows Hynes’ accounting policy.Question 3TN-Exhibit 2 presents Hynes’ profit plan using the Question 1 transaction analysis.The instructor should expect that most students will not calculate the cost of goods sold figure correctly. The instructor will have to explain that the components of the cost of manufactured goods includes direct materials and their conversion costs, including manufacturing equipment depreciation.The distinction between operating and finance costs in the income statement is another accounting practice most students will miss. Again, the instructor will have to explain this format and its rationale, which is to permit statement users to evaluate how well management has operated the company before considering the impact of their financing decisions.Question 4TN-Exhibit 3 presents the year-end balance sheet using the Question 1 transaction analysis.Equipment is reported net. Most students will follow this presentation. A better presentation is:Equipment (cost) $85,000Accumulated depreciation (8,500)Equipment (net) $76,500The patent is reported net. This is the correct presentation for intangible assets.TN-Exhibit 4 presents a reconciliation of beginning (zero) and ending ($47,500) retained earnings. The instructor may want to share this exhibit with the students. It links the income statement to the balance sheet. It also illustrates that dividends are distributions of capital and not an expense.The instructor should point out to students that many intra period transactions, such as the borrowing and repaying of the bank loan, do not appear on the end of the period balance sheet.Question 5There are three accounting decisions that require Hynes to exercise judgment. They are: ▪Patent valuation▪Patent amortization period▪Equipment depreciation periodStudents might believe Hynes must exercise judgment in the accounting for the redesign and incorporation costs. Under current GAAP this is not the case. Redesign and organization costs must be expensed as incurred.8©2007 McGraw-Hill/Irwin Chapter 3 The patent can not be valued directly. There is no current liquid market for this type of patent. Hynes must value it indirectly. He chose to use the value of the comp any’s equity he received based on the cash paid by the investors for their equity interest to value the patent. This is an acceptable approach.Hopefully, the patent amoralization and depreciation periods represent Hynes’ best estimate of the related asse ts’ useful life (useful to Dispensers of California.)Students should be asked what would be the impact on the balance sheet and income statement if different lives had been used. So that students do not get the impression that differences in judgment are driven by a desire to manage earnings, the instructor should be careful during the discussion to remind the students that different reasonable life estimates can be made by responsible managers acting in good faith.Cash Flow AnalysisIf the instructor wishes to incorporate some aspect of cash flows in the case discussion, TN-Exhibit 5 and 6 present two analysis of cash flows. TN-Exhibit 5 uses a cash receipts and distribution format. TN-Exhibit 6 uses a direct method statement of cash flows format. Instructors should not use the indirect method at this point in the course. It confuses students. Chapter 11 introduces students to indirect method statement of cash flows.9Accounting: Text and Cases 12e –Instructor’s Manual Anthony/Hawkins/MerchantExhibit 1Dispensers of California, IncBalance Sheet Transaction Analysis* Beginning component parts inventory $0 **Component parts used $197,000Purchases 212,100 Manufacturing payroll 145,000Total available 212,100 Other manufacturing costs 62,000Ending component parts inventory 15,100 Depreciation 8,500Components parts used 197,000 Cost of goods sold 412,50010Exhibit 2Dispensers of California, Inc.12-month Profit PlanSales $598,500Cost of goods soldComponents $197,000Mfg payroll 145,000Other Mfg. 62,000Depreciation 8,500 412,500 Gross margin $186,000Selling, general andAdministration 63,000Patent 20,000Redesign costs 25,000Incorporation costs 2,500Operating profit $75,500Interest 500Profit before taxes $75,000Tax expense 22,500Net Income $52,500Exhibit 3Dispensers of California, Inc.Projected Year-end Balance SheetAssets LiabilitiesCash $78,400 Taxes payable $22,500 Components inventory 15,100 Current liabilities $22,500 Current assets $93,500Equipment (net) 76,500 Owner’s EquityPatent (net) 100,000 Capital stock $200,000___ Retained earnings 47,500$270,000 $270,000Exhibit 4Dispensers of California, Inc.Change in Retained EarningsBeginning retained earnings $0Net income 52,500Dividends (5,000)Ending retained earnings $47,500Exhibit 5Dispensers of California, Inc.Cash ReconciliationReceipts Disbursements New equity capital $80,000Incorporation $2,500Equipment 85,000Redesign 25,000Component parts 212,100Bank loan 30,000Bank loan 30,000Loan interest 500Manufacturing payroll 145,000Other manufacturing 62,000S G & A 63,000Sales 598,500Dividend 5,000Total $708,500 $630,100 Cash ReconciliationReceipts $708,500Disbursements 630,100Ending Balance $78,400Exhibit 6Dispensers of California, Inc.Statement of Cash Flows (Direct Method)Collections from customers $598,500Payments to suppliers (212,100)Payments to employees (295,000)Legal payments (2,500)Interest (500)Operating cash flow $89,400Equipment purchases (85,000)Investing cash flow $(85,000)Bank loan 30,000Repayment of bank loan (30,000)Capital 80,000Dividends (5,000)Financing cash flow $75,000Change in cash $78,400Beginning cash 0Ending cash $78,400Case 3-4: Pinetree MotelNote: This case is updated from the Eleventh Edition.ApproachThis case treats the transition from cash to accrual accounting; also, the inherent difficulties in comparison of data with industry averages are illustrated. The case does not require a full 80 minutes of class time, so I use the final portion of time for review.Comments on QuestionsThe operating statement called for in Question I is shown below. For many terms—e.g., revenues, advertising, depreciation is no difficulty in fitting Pinetree’s account names with the journal’s standard format; but for other items, there are problems:1.Th e Kims’ drawings conceptually should be divided between payroll costs andadministrative/general, since the Kims’apparently perform both operating and administrative tasks.2.Some students may treat replacement of glasses, bed linens, and towels as general expense ratherthan as direct operating expense (although I feel the latter is more appropriate).3.Some students may treat payroll taxes and insurance as a general expense; nevertheless, itproperly is part of payroll costs.Question 2Based on profit as a percent of sales, Pinetree Motel is only about one-third as profitable as the survey average return on sales. The key percentage disparity is on payroll costs, which may reflect two things: (1) the Kims’ tasks could be done by two employees who would work for less than $86,100 a year (which is equivalent to saying the Kims’ drawings reflect both a fair salary and a distribution of entity profits); or (2) the survey data are dominated by motels having twice as many rooms as Pinetree Motel does, thus spreading fixed labor costs over a higher volume (e.g., a motel of 20 units and one of 40 units each needs only one desk clerk). Of course, there is probably a lot of ―noise‖ in the survey data for payroll and administrative/general costs: owner-operators respond ing to the journal’s survey would encounter the same problems as a student does in answering Question 1.PINETREE MOTELOPERATING STATEMENT FOR 2005(in industry trade journal format)Dollars Percentages* Revenues:Room rentals ($236,758- $1,660) .........................................................$235,098 96.8 Other revenue ....................................................................................... 7,703 3.2 Total Revenues ..............................................................................242,801 100.0 Operating Expenses:Payroll costs($86,100+$26,305+$2,894-$795-$84+$1,128+$126) ..........................115,674 47.6 Administrative and general...................................................................——Direct operating expense ($8,800 + $1,660 + $6,820) .........................17,280 7.1 Fees and commissions ..........................................................................——Advertising and promotion($2,335 - $600 + $996) ..............................2,731 1.1 Repairs and maintenance ......................................................................8,980 3.7 Utilities20,767 8.6 ($12,205+$2,789+$5,611-$933-$105-$360+$840+$75+$153+492) .......................................................................................................Total ...............................................................................................165,432 68.1 Fixed expenses:Property taxes, fees ($9,870 - $1,005 + $1,119)...................................9,984 4.1 Insurance ($11,584 - $2,025) ................................................................9,559 3.9 Depreciation .........................................................................................30,280 12.5 Interest ($10,605 - $687 + $579) ..........................................................10,497 4.3 Rent ......................................................................................................——Total ............................................................................................... 60,320 24.8 Profit(pretax) ..............................................................................................$ 17,049 7.1*May not add exactly owing to rounding.As a rough composition that attempts to adjust for the Kims’ (and probably other survey respondents’) dual roles as owners and operators, I suggest adding three accounts:Pinetree AveragePayroll costs .............................47.6 22.5Administrative/general .............— 4.2Profit ......................................... 7.1 20.7Total .........................................54.7 47.4This tends to substantiate the hypothesis that hired employees would perform the Kims’ task for less than $86,100.Pinetree’s other operating costs do not seem to be out of line compared with the survey averages. the higher-than-average utilities may reflect a location with cold winters. Insurance and taxes are essentially uncontrollable. Repairs and maintenance may be below average because the Kims’ personally do some of this work, whereas other motels pay outsiders to do it.Note that both rent and depreciation are shown in the journal’s survey data. This also causes comparison problems. For Pinetree, there is no rent, but the motel buildings are depreciated, whereas for some motels the depreciation would include only furnishings. Adding the rent and depreciation percentages may be more meaningful than working at either one in isolation; but, of course, building depreciation is only a very rough proxy for fair rental value.No final conclusion on the success of their operation can be made as information on the following is lacking:Capital (re: the average) Occupancy rateLocation Seasonality (re: Florida annual season vs. New England)Pricing Efficiency in using their own timeCheck on income calculation:Receipts in 2005 ...........................................................................$244,461Less: 2004 revenue collected ................................................. 1,660Revenues in 2005 .........................................................................$242,801Checks written in 2005 ................................................................196,558Plus: 2005 expenses not paid .......................................................5,508Depreciation .................................................................... 30,280232,346Less: 2004 expenses paid....................................................... 6,594Expenses in 2005 .........................................................................225,752Profit ............................................................................................$ 17,049Case 3-5: National Association of AccountantsNote:This case has been updated since the Eleventh Edition.ApproachThis case describes a typical problem in the management of membership associations and of many other nonprofit organizations. Each year a new governing board is elected and becomes responsible for the operations of the organization for that year. As a general rule, the governing board should so conduct affairs that the organization breaks even financially. If it operates at a deficit, it is eating into resources intended for future members, as suggested in the case. If it operates at a surplus, it is not providing the members with as many services as they are entitled to.Thus, the difference between the concept of income described in the text for business organization and the income concept appropriate for a nonprofit membership organization is that a business organization should earn satisfactory net income, while the membership organization should break even. The measurement of revenues and expenses follows the same principles in both types of organizations (at least with respect to the transactions given in this case.)The case is based, loosely, on experiences of the American Accounting Association, and instructors may wish to refer to the AAA financial statements. The case relates to the ―general fund,‖ which is the portion of the financial statements that reports normal operations. The other columns in these statements can be disregarded. (The NAA is no longer in existence.)In the interest of simplicity, students are not given balance sheets. The case can be made more complicated by assuming a beginning balance sheet, perhaps showing only cash and equity of $55,000 each. Students can then be asked to set up assets and liabilities that result from the transactions described in the case.Answers to QuestionVarious ―correct‖ answers are possible. One set is given in Exhibit A and dis cussed below.1.The grant relates to services to be performed in 2006, so it should not be counted as 2005 revenue.However, the $2,700 already spent must be matched against the grant in some way. This can be done either by subtracting it from 2005 expenses and setting it up as a prepaid asset or, more simply, by transferring $51,300 of the grant to 2006 revenue. The effect on the bottom line is the same. The fact that the president obtained the grant is irrelevant. The principle is to recognize the revenue in the period in which the services are performed. The legal question is probably also irrelevant; the intention was to perform the services in 2006, and that probably would be the governing factor. This is a debatable point, however, because it gives no credit to the 2005 president for the fine work he or she has done in obtaining the grant.2.The desktop publishing system is not an expense of 2005. It will be an expense of future yearsand is therefore an asset on December 31, 2005. Because it was acquired so near the end of the year, there is no need to deal with depreciation. The question can be asked about depreciation in future years, and this raises the question of estimating the future life. Desktop publishing systems are a ―hot‖ item. They are likely t o improve in performance and decrease in price fairly rapidly.The useful life is therefore probably not more than five years. Note that although this is not an expense of 2005, and the 2005 board has created a depreciation cost that will affect the surplus of future boards.。

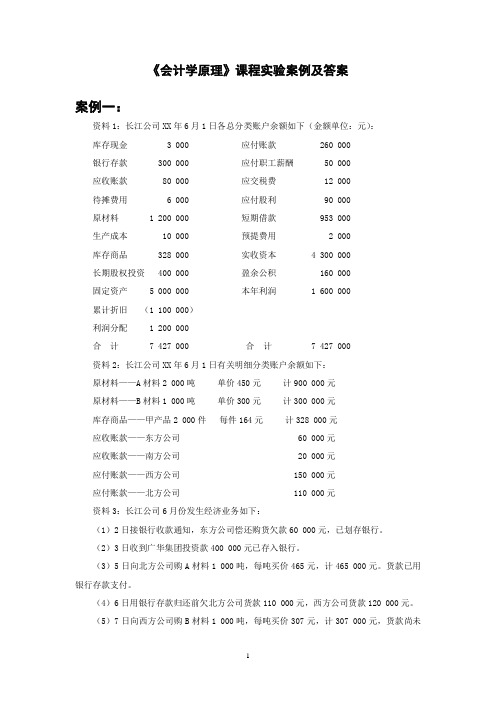

《会计学原理》课程实验案例及答案

借:短期借款 200000

贷:银行存款200000

(13)应填付款凭证:

借:应付股利 90000

贷:银行存款90000

(14)应填付款凭证:

借:制造费用——动力费 18000

贷:银行存款18000

(15)应填转账凭证:

借:生产成本——甲产品 1170000

制造费用——材料费 15000

借:利润分配——应付股利 21000

贷:应付股利21000

2、根据收款凭证、付款凭证登记现金日记账和银行存款日记账,并结账。(用“丁”字账户代替)

库存现金日记账

期初余额: 3000

(9) 44000 (10) 44000

发生额: 44000 发生额: 44000

期末余额: 3000

银行存款日记账

期初余额: 300000

(17)30日分摊应由本月负担的报刊费800元。

(18)30日预提应由本月负担的短期借款利息46 000元。

(19)30日应付本月职工工资计47 000元,其中生产工人工资35 000元,车间管理人员工资3 000元,厂部管理人员工资9 000元。

(20)30日按工资总额的14%计提职工福利费。

(21)30日汇集全月制造费用,转入“生产成本”账户。

期初余额: 260000

(4) 230000 (5) 307000

发生额: 230000 发生额:307000

生产成本

期初余额: 10000

(15) 1170000 (23)1296320

(19) 35000

(20) 4900

(21) 76420

发生额: 1286320 发生额:1296320

会计案例分析(含答案).doc

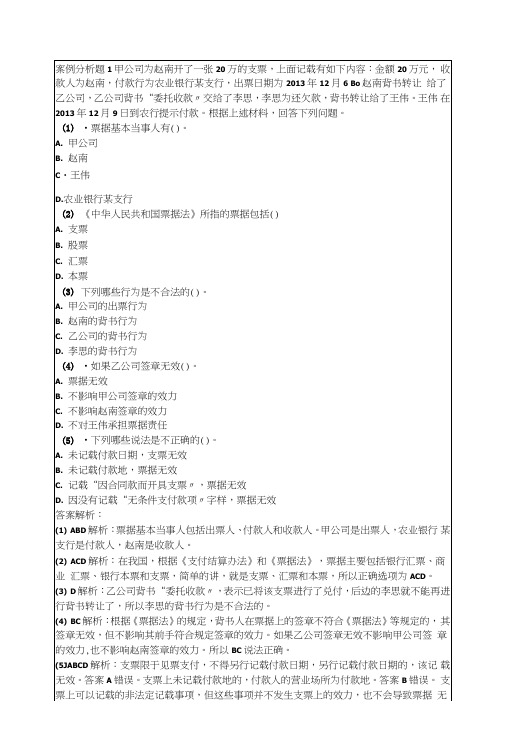

效,支票上记载“因合同款而开具支票〃,票据有效。

答案C错误。

对于无条件支付款项, 是本身汇票上印有的,所以并不是后续记载在上边的,答案D错误。

错题反馈案例分析题2某集团公司2013年发生如下业务:(1)公司为获得一项工程合同,拟向工程发包方有关人员支付好处费10万元。

财会部经理王某认为,该项支岀不符合有关规定, 但考虑到公司主要领导已作了批示,即同意拨付该笔款项。

(2)出纳人员李某热爱自己的工作岗位,对前来报销差旅费的人员笑脸相迎,并耐心解释凭证粘贴要求。

(3)会计机构负责人认真组织财务分析和财务控制,提出推行全面预算管理、促进增收节支、提高经济效益的建议。

根据上述情况,回答下列问题:(1)业务(1)中,违反的会计职业道德有()。

A.王某的行为违反了坚持准则的会计职业道德要求B.王某的行为违反了客观公正的会计职业道德要求C.王某的行为符合参与管理的会计职业道德要求D・王某的行为违反了诚实守信的会计职业道德要求(2)业务(2)中,符合的会计职业道德有()。

A.李某的行为符合会计职业道德强化服务要求B.李某的行为符合会计职业道德参与管理要求C.李某的行为符合会计职业道德爱岗敬业要求D.李某的行为符合会计职业道德坚持准则要求(3)业务(3)中,符合的会计职业道德有()。

A.符合会计职业道德强化服务要求B・符合会计职业道德参与管理要求C・符合会计职业道德爱岗敬业要求D.符合会计职业道德坚持准则要求(4)关于参与管理与强化服务的关系,正确的有()。

A.不强化服务,难以保持参与管理的热情B.参与管理是强化服务的一种表现形式C.强化服务有利于参与管理D・不参与管理,也完全可以提高服务水平和质量(5)下列各项中,属于会计职业道德规范的主要内容有()。

A•诚信为本、依法治国、民主理财、科学决策、奉献社会B.爱岗敬业、诚实守信、办事公道、服务群众、奉献社会C.文明礼貌、助人为乐、爱护公物、保护环境、遵纪守法D•爱岗敬业、诚实守信、廉洁自律、客观公正、坚持准则、提高技能、参与管理、强化服务答案解析:(1)ABD解析:王某的行为违反了坚持准则、客观公正、诚实守信的会计职业道德要求。

《会计学习题与案例》参考答案

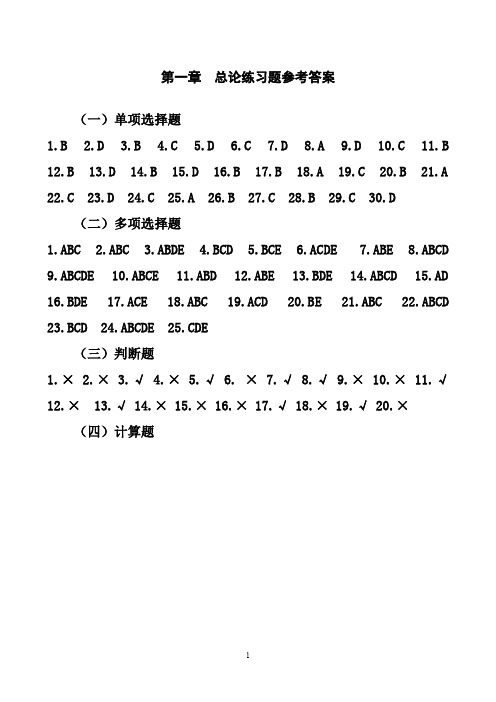

第一章总论练习题参考答案(一)单项选择题1.B2.D3.B4.C5.D6.C7.D8.A9.D 10.C 11.B 12.B 13.D 14.B 15.D 16.B 17.B 18.A 19.C 20.B 21.A 22.C 23.D 24.C 25.A 26.B 27.C 28.B 29.C 30.D(二)多项选择题1.ABC2.ABC3.ABDE4.BCD5.BCE6.ACDE7.ABE8.ABCD9.ABCDE 10.ABCE 11.ABD 12.ABE 13.BDE 14.ABCD 15.AD 16.BDE 17.ACE 18.ABC 19.ACD 20.BE 21.ABC 22.ABCD 23.BCD 24.ABCDE 25.CDE(三)判断题1.×2.×3.√4.×5.√6. ×7.√8.√9.× 10.× 11.√12.× 13.√ 14.× 15.× 16.× 17.√ 18.× 19.√ 20.×(四)计算题1.表1—1 有关会计要素及金额表由于8 930 000=1 180 000+7 750 000,即资产=负债+所有者权益,所以符合会计基本等式。

2.(A)利润=(488 000-215 000)-(358 000-190 000)=105 000(元)(B)利润=(488000-215000)-(358000-190 000)-20000=85 000(元)(C)利润=(488000-215000)-(358000-190000)+15000=120 000(元)(D)利润=(488000-215000)-(358000-190000)+32000-45000=92000(元)(五)业务处理题1.(1)向银行借入存款;(2)投资者投入固定资产;(3)投资者收回投资;(4)管理部门领用低值易耗品;(5)计提长期借款利息;(6)赊销货物。

会计学案例分析

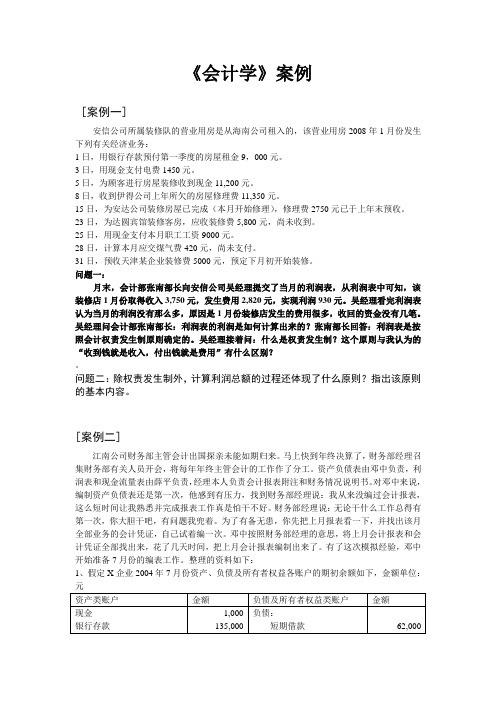

《会计学》案例[案例一]安信公司所属装修队的营业用房是从海南公司租入的,该营业用房2008年1月份发生下列有关经济业务:1日,用银行存款预付第一季度的房屋租金9,000元。

3日,用现金支付电费1450元。

5日,为顾客进行房屋装修收到现金11,200元。

8日,收到伊得公司上年所欠的房屋修理费11,350元。

15日,为安达公司装修房屋已完成(本月开始修理),修理费2750元已于上年末预收。

23日,为达圆宾馆装修客房,应收装修费5,800元,尚未收到。

25日,用现金支付本月职工工资9000元。

28日,计算本月应交煤气费420元,尚未支付。

31日,预收天津某企业装修费5000元,预定下月初开始装修。

问题一:月末,会计部张南部长向安信公司吴经理提交了当月的利润表,从利润表中可知,该装修店1月份取得收入3,750元,发生费用2,820元,实现利润930元。

吴经理看完利润表认为当月的利润没有那么多,原因是1月份装修店发生的费用很多,收回的资金没有几笔。

吴经理问会计部张南部长:利润表的利润是如何计算出来的?张南部长回答:利润表是按照会计权责发生制原则确定的。

吴经理接着问:什么是权责发生制?这个原则与我认为的“收到钱就是收入,付出钱就是费用”有什么区别?。

问题二:除权责发生制外,计算利润总额的过程还体现了什么原则?指出该原则的基本内容。

[案例二]江南公司财务部主管会计出国探亲未能如期归来。

马上快到年终决算了,财务部经理召集财务部有关人员开会,将每年年终主管会计的工作作了分工。

资产负债表由邓中负责,利润表和现金流量表由薛平负责,经理本人负责会计报表附注和财务情况说明书。

对邓中来说,编制资产负债表还是第一次,他感到有压力,找到财务部经理说:我从来没编过会计报表,这么短时间让我熟悉并完成报表工作真是怕干不好。

财务部经理说:无论干什么工作总得有第一次,你大胆干吧,有问题我兜着。

为了有备无患,你先把上月报表看一下,并找出该月全部业务的会计凭证,自己试着编一次。

会计学案例分析

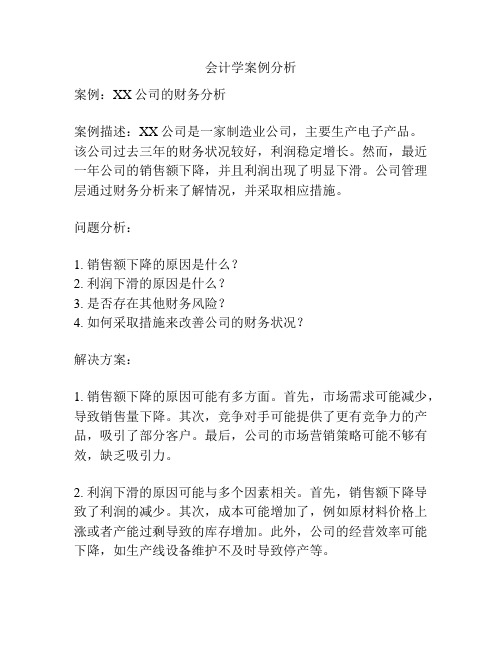

会计学案例分析案例:XX公司的财务分析案例描述:XX公司是一家制造业公司,主要生产电子产品。

该公司过去三年的财务状况较好,利润稳定增长。

然而,最近一年公司的销售额下降,并且利润出现了明显下滑。

公司管理层通过财务分析来了解情况,并采取相应措施。

问题分析:1. 销售额下降的原因是什么?2. 利润下滑的原因是什么?3. 是否存在其他财务风险?4. 如何采取措施来改善公司的财务状况?解决方案:1. 销售额下降的原因可能有多方面。

首先,市场需求可能减少,导致销售量下降。

其次,竞争对手可能提供了更有竞争力的产品,吸引了部分客户。

最后,公司的市场营销策略可能不够有效,缺乏吸引力。

2. 利润下滑的原因可能与多个因素相关。

首先,销售额下降导致了利润的减少。

其次,成本可能增加了,例如原材料价格上涨或者产能过剩导致的库存增加。

此外,公司的经营效率可能下降,如生产线设备维护不及时导致停产等。

3. 其他可能存在的财务风险包括:应收账款风险,即公司的客户未能按时支付款项;库存风险,即产品滞销或过期造成库存堆积;资金风险,即没有足够的流动资金支持日常运营。

4. 为改善公司的财务状况,可以采取以下措施:首先,调整市场营销策略,提高产品的竞争力和市场份额。

其次,加强成本控制,减少不必要的开支,通过谈判降低原材料价格等。

此外,改进生产流程,提高工作效率和质量,减少停产期间的损失。

最后,加强应收账款管理,与客户进行合理的付款协商,减少坏账风险。

综上所述,通过对XX公司的财务分析,可以发现销售额下降和利润下滑的原因,并提出了相关的解决方案。

财务分析是管理层制定决策和改进财务状况的重要工具,有助于公司的可持续发展。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

补充案例3:

某会计师事务所是由张新、李安合伙创建的,最近发生了下列经济业务,并由会计做了相应的处理:

1.6月10日,张新从事务所出纳处拿了380元现金给自己的孩子购买玩具,会计将380元记为事务所的办公费支出,理由是:张新是事务所的合伙人,事务所的钱也有张新的一部分。

2.6月15日,会计将6月1日—15日的收入、费用汇总后计算出半个月的利润,并编制了财务报表。

3.6月20日,事务所收到某外资企业支付的业务咨询费2000美元,会计没有将其折算为人民币反映,而直接记到美元账户中。

4.6月30日,事务所购买了一台电脑,买价12000元,运费80元,会计记固定资产增加12000元。

5.6月30日,收到达成公司的预付审计费用3 000元,会计将其作为6月份的收入处理。

6.6月30日,预付下季度报刊费300元,会计将其作为6月份的管理费用处理。

案例要求:根据上述资料,分析该事务所的会计在处理这些经济业务时是否完全正确,若有错误,主要是违背了哪项会计假设或会计原则。

案例提示:

该事务所的会计人员在处理经济业务时不完全正确,主要表现在:

1.张新从事务所取钱用于私人开支,不属于事务所的业务,不能作为事务所的办公费支出。

这里,会计人员违背了会计主体假设。

2.6月15日,编制6月1日—15日的财务报表是临时性的。

违背了会计分期假设。

我国会计分期假设规定的会计期间为年度、季度和月份。

3.违背了货币计量假设。

我国有关法规规定,企业应以人民币作为记账本位币,但企业业务收支以外币为主,可以选择某种外币作为记账本位币。

而该事务所直接将2 000美元记账,需看其究竟以何种货币为记账本位币。

4.违背了历史成本原则。

5.预收的审计费用不能作为当期的收入,应先记入负债,等为对方提供了审计服务后再结转,违背了权责发生制原则。

6、预付报刊费,应在受益期间内摊销,不能记入支付当期的费用,违背了权责发生制原则。