会计英语第三章作业

会计基础第三章课后作业(含答案)

第 6页

6、 【正确答案】 错 【答案解析】 财务费用属于费用要素,损益类科目。 【该题针对“会计科目按反映的经济内容分类”知识点进行考核】 【答疑编号 10866046】 7、 【正确答案】 错 【答案解析】 合法性原则是指企业设置会计科目时应当符合国家统一的会计制度的规定,以保证会计信息的可比性。 【该题针对“会计科目的设置原则”知识点进行考核】 【答疑编号 10865900】 8、 【正确答案】 对 【答案解析】 【该题针对“账户与会计科目的联系和区别”知识点进行考核】 【答疑编号 10876811】 9、 【正确答案】 对 【答案解析】 【该题针对“账户的概念”知识点进行考核】 【答疑编号 10876782】 10、 【正确答案】 错 【答案解析】 总分类科目对明细分类科目具有统驭和控制作用,而明细分类科目是对其所属的总分类科目的补充和说明。 【该题针对“会计科目按提供信息的详细程度及其统驭关系不同分类”知识点进行考核】 【答疑编号 10865986】

3、 【正确答案】 C

第 3页

【答案解析】 制造费用属于成本类科目;长期待摊费用属于资产类科目;应交税费属于负债类科目。销售费用属于损益类科目中 反映费用的科目。 【该题针对“会计科目按反映的经济内容分类”知识点进行考核】 【答疑编号 10866037】

4、 【正确答案】 B 【答案解析】 会计科目按其提供信息的详细程度及其统驭关系,可以分为总分类科目和明细分类科目。其中总分类科目,又称总 账科目或一级科目。 【该题针对“会计科目按提供信息的详细程度及其统驭关系不同分类 ”知识点进行考核】 【答疑编号 10865938】

会计学原理Financial-Accounting-by-Robert-Libby第八版-第三章-答案

会计学原理Financial-Accounting-by-Rob ert-Libby第八版-第三章-答案Chapter 3Operating Decisions andthe Accounting SystemANSWERS TO QUESTIONS1. A typical business operating cycle for a manufacturer would be as follows:inventory is purchased, cash is paid to suppliers, the product is manufactured and sold on credit, and the cash is collected from the customer.2. The time period assumption means that the financial condition andperformance of a business can be reported periodically, usually every month, quarter, or year, even though the life of the business is much longer.3. Net Income = Revenues + Gains - Expenses - Losses.Each element is defined as follows:Revenues -- increases in assets or settlements of liabilities from ongoing operations.Gains -- increases in assets or settlements of liabilities from peripheral transactions.Expenses -- decreases in assets or increases in liabilities from ongoingoperations.Losses -- decreases in assets or increases in liabilities from peripheraltransactions.4. Both revenues and gains are inflows of net assets. However, revenuesoccur in the normal course of operations, whereas gains occur from transactions peripheral to the central activities of the company. An example is selling land at a price above cost (at a gain) for companies not in the business of selling land.Both expenses and losses are outflows of net assets. However, expenses occur in the normal course of operations, whereas losses occur from transactions peripheral to the central activities of the company. An example is a loss suffered from fire damage.5. Accrual accounting requires recording revenues when earned andrecording expenses when incurred, regardless of the timing of cash receipts or payments. Cash basis accounting is recording revenues when cash is received and expenses when cash is paid.Financial Accounting, 8/e 3-2 © 2014 by McGraw-Hill Global Education Holdings, LLC. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.Financial Accounting, 8/e3-3© 2014 by McGraw-Hill Global Education Holdings, LLC. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.6. The four criteria that must be met for revenue to be recognized under theaccrual basis of accounting are (1) delivery has occurred or services have been rendered, (2) there is persuasive evidence of an arrangement for customer payment, (3) the price is fixed or determinable, and (4) collection is reasonably assured.7. The expense matching principle requires that expenses be recorded whenincurred in earning revenue. For example, the cost of inventory sold during a period is recorded in the same period as the sale, not when the goods are produced and held for sale.8. Net income equals revenues minus expenses. Thus revenues increase netincome and expenses decrease net income. Because net income increases stockholders’ equity, revenues increase stockholders’ equity and expenses decrease it.9. Reve nues increase stockholders’ equity and expenses decreasestockholders’ equity. To increase stockholders’ equity, an account must be credited; to decrease stockholders’ equity, an account must be debited. Thus revenues are recorded as credits and expenses as debits. 10.11.12.13. Total net profit margin ratio is calculated as Net Income Net Sales (orOperating Revenues). The net profit margin ratio measures how much of every sales dollar is profit. An increasing ratio suggests that the company is managing its sales and expenses effectively.ANSWERS TO MULTIPLE CHOICE1. c2. a3. b4. b5. c6. c7. d8. b9. a10. bFinancial Accounting, 8/e 3-4 © 2014 by McGraw-Hill Global Education Holdings, LLC. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.Authors' Recommended Solution Time(Time in minutes)* Due to the nature of this project, it is very difficult to estimate the amount of time students will need to complete the assignment. As with any open-ended project, it is possible for students to devote a large amount of time to these assignments. While students often benefit from the extra effort, we find that some become frustrated by the perceived difficulty of the task. You can reduce student frustration and anxiety by making your expectations clear. For example, when our goal is to sharpen research skills, we devote class time discussing research strategies. When we want the students to focus on a real accounting issue, we offer suggestions about possible companies or industries.Financial Accounting, 8/e 3-5 © 2014 by McGraw-Hill Global Education Holdings, LLC. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.Financial Accounting, 8/e 3-6© 2014 by McGraw-Hill Global Education Holdings, LLC. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.MINI-EXERCISESM3–1.TERMG (1) LossesC (2) Expense matching principle F (3) RevenuesE (4) Time period assumption B(5) Operating cycleM3–2.Cash Basis Income StatementAccrual Basis Income StatementRevenues: Cash sales Customer deposits$8,000 5,000 Revenues: Sales to customers$18,000 Expenses:Inventory purchases Wages paid 1,000 900 Expenses: Cost of sales Wages expense Utilities expense 9,000 900 300Net Income$11,100Net Income $7,800Revenue Account Affected Amount of Revenue Earned in JulyM3–4.Expense Account Affected Amount of Expense Incurred in JulyFinancial Accounting, 8/e 3-7 © 2014 by McGraw-Hill Global Education Holdings, LLC. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.a. Cash (+A) ............................................................................ 15,000Games Revenue (+R, +SE) .......................................... 15,000 b. Cash (+A) ............................................................................ 3,000Accounts Receivable (+A) ................................................ 5,000 Sales Revenue (+R, +SE) ............................................. 8,000 c. Cash (+A) ............................................................................ 4,000Accounts Receivable (-A) ........................................... 4,000 d. Cash (+A) ............................................................................ 2,500Unearned Revenue (+L) ............................................... 2,500 M3–6.e. Cost of Goods Sold (+E, -SE)........................................... 6,800Inventory (-A) ............................................................... 6,800 f. Accounts Payable (–L) (800)Cash (-A) (800)g. Wages Expense (+E, -SE) ................................................. 3,500Cash (-A) ...................................................................... 3,500 h. Insurance Expense (+E, -SE) . (500)Prepaid Expenses (+A) ...................................................... 1,00 Cash (-A) ...................................................................... 1,500 i. Repairs Expense (+E, -SE) .. (700)Cash (-A) (700)j. Utilities Expense (+E, -SE) (900)Accounts Payable (+L) (900)Financial Accounting, 8/e 3-8 © 2014 by McGraw-Hill Global Education Holdings, LLC. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.Transaction (c) results in an increase in an asset (cash) and a decrease in an asset (accounts receivable). Therefore, there is no net effect on assets.M3–8.Transaction (h) results in an increase in an asset (prepaid expenses) and a decrease in an asset (cash). Therefore, the net effect on assets is 500.Financial Accounting, 8/e 3-9 © 2014 by McGraw-Hill Global Education Holdings, LLC. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.Craig’s Bowling, Inc.Income StatementFor the Month of July 2014Revenues:Games revenue $15,000Sales revenue 8,000Total revenues 23,000Expenses:Cost of goods sold 6,800Utilities expense 900Wages expense 3,500Insurance expense 500Repairs expense 700Total expenses 12,400Net income $ 10,600M3–10.Financial Accounting, 8/e 3-10 © 2014 by McGraw-Hill Global Education Holdings, LLC. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.M3–11.These results suggest that Jen’s Jewelry Company earned approximately $0.31 for every dollar of revenue in 2015, and over time, the ratio has improved. Jen’s has become more effective at managing sales and expenses.As additional analysis:Between 2013 to 2014 and 2014 to 2015, sales have increased at a lower percentage than net income. This suggests that the company has been more effective at controlling expenses than generating revenues.EXERCISESE3–1.TERMK (1) ExpensesE (2) GainsG (3) Revenue realization principleI (4) Cash basis accountingM (5) Unearned revenueC (6) Operating cycleD (7) Accrual basis accountingF (8) Prepaid expensesJ (9) Revenues - Expenses = Net IncomeL (10) Ending Retained Earnings =Beginning Retained Earnings + Net Income - Dividends DeclaredE3–2.Req. 1Cash Basis Income StatementAccrual Basis Income StatementRevenues:Cash sales Customer deposits $500,00070,000Revenues:Sales tocustomers$750,000Expenses:Inventory purchases Wages paidUtilities paid90,000180,30017,200Expenses:Cost of salesWages expenseUtilities expense485,000184,00019,130Net Income $282,500 Net Income $61,870Req. 2Accrual basis financial statements provide more useful information to external users. Financial statements created under cash basis accounting normally postpone (e.g., $250,000 credit sales) or accelerate (e.g., $70,000 customer deposits) recognition of revenues and expenses long before or after goods andservices are produced and delivered (until cash is received or paid). They also do not necessarily reflect all assets or liabilities of a company on a particular date.Activity Revenue AccountAmount of RevenueActivity Expense AccountAmount of ExpenseE3–5.Transaction (k) results in an increase in an asset (cash) and a decrease in an asset (accounts receivable). Therefore, there is no net effect on assets.* A loss affects net income negatively, as do expenses.E3–6.Transaction (f) results in an increase in an asset (property, plant, and equipment) and a decrease in an asset (cash). Therefore, there is no net effect on assets.E3–7.(in thousands)a. Plant and equipment (+A) (636)Cash ( A) (636)Debits equal credits. Assets increase and decrease by the same amount.b. Cash (+A) (181)Short-term notes payable (+L) (181)Debits equal credits. Assets and liabilities increase by the same amount.c. Cash (+A) ..........................................................................Accounts receivable (+A) ................................................ 10,765 28,558Service revenue (+R, +SE) ........................................ 39,323 Debits equal credits. Revenue increases retained earnings (part of stockholders' equity). Stockholders' equity and assets increase by the same amount.E3–7. (continued)d. Accounts payable (-L) ..................................................... 32,074Cash (-A) ................................................................... 32,074 Debits equal credits. Assets and liabilities decrease by the same amount.e. Inventory (+A) ................................................................... 32,305Accounts payable (+L) .............................................. 32,305 Debits equal credits. Assets and liabilities increase by the same amount.f. Wages expense (+E, -SE) ............................................... 3,500Cash (-A) ................................................................... 3,500 Debits equal credits. Expenses decrease retained earnings (part ofstockholders' equity). Stockholders' equity and assets decrease by thesame amount.g. Cash (+A) .......................................................................... 39,043Accounts receivable (-A) ....................................... 39,043 Debits equal credits. Assets increase and decrease by the same amount.h. Fuel expense (+E, -SE) (750)Cash (-A) (750)Debits equal credits. Expenses decrease retained earnings (part ofstockholders' equity). Stockholders' equity and assets decrease by thesame amount.i. Retained earnings (-SE) (597)Cash (-A) (597)Debits equal credits. Assets and stock holders’ equity decrease by thesame amount.j. Utilities expense (+E, -SE) (68)Cash (-A) ................................................................... Accounts payable (+L) .............................................. 55 13Debits equal credits. Expenses decrease retained earnings (part of stockholders' equity). Together, stockholders' equity and liabilities decrease by the same amount as assets.E3–8.Req. 1a.Cash (+A) ................................................................... 2,300,000Short-term note payable (+L) ........................ 2,300,000 Debits equal credits. Assets and liabilities increase by the same amount.b.Equipment (+A) ......................................................... 98,000Cash (-A) ........................................................ 98,000 Debits equal credits. Assets increase and decrease by the same amount.c.Merchandise inventory (+A) .................................... 35,000Accounts payable (+L) .................................. 35,000 Debits equal credits. Assets and liabilities increase by the same amount.d.Repairs (or maintenance) expense (+E, -SE) ......... 62,000Cash (-A) ........................................................ 62,000 Debits equal credits. Expenses decrease retained earnings (part ofstockholders' equity). Stockholders' equity and assets decrease by thesame amount.e.Cash (+A) ................................................................... 390,000Unearned pass revenue (+L) ......................... 390,000 Debits equal credits. Since the season passes are sold before Vail Resorts provides service, revenue is deferred until it is earned. Assets andliabilities increase by the same amount.f.Two transactions occur:(1) Accounts receivable (+A) (800)Ski shop sales revenue (+R, +SE) (800)Debits equal credits. Revenue increases retained earnings (a part ofstockholders' equity). Stockholders' equity and assets increase by thesame amount.(2) Cost of goods sold (+E, -SE) (500)Merchandise inventory (-A) (500)Debits equal credits. Expenses decrease retained earnings (a part ofstockholders' equity). Stockholders' equity and assets decrease by thesame amount.E3–8. (continued)g.Cash (+A) ................................................................... 320,000Lift revenue (+R, +SE) .................................... 320,000 Debits equal credits. Revenue increases retained earnings (a part ofstockholders' equity). Stockholders' equity and assets increase by thesame amount.h.Cash (+A) ................................................................... 3,500Unearned rent revenue (+L) .......................... 3,500 Debits equal credits. Since the rent is received before the townhouse isused, revenue is deferred until it is earned. Assets and liabilities increase by the same amount.i. Accounts payable (-L) ............................................. 17,500Cash (-A) ........................................................ 17,500 Debits equal credits. Assets and liabilities decrease by the same amount. j.Cash (+A) . (400)Accounts receivable (-A) (400)Debits equal credits. Assets increase and decrease by the same amount. k.Wages expense (+E, -SE) ........................................ 245,000Cash (-A) ........................................................ 245,000 Debits equal credits. Expenses decrease retained earnings (a part ofstockholders' equity). Stockholders' equity and assets decrease by thesame amount.Req. 22/1 Rent expense (+E, -SE) (275)Cash (-A) (275)2/2 Fuel expense (+E, -SE) (490)Accounts payable (+L) (490)2/4 Cash (+A) (820)Unearned revenue (+L) (820)2/7 Cash (+A) (910)Transport revenue (+R, +SE) (910)2/10 Advertising expense (+E, -SE) (175)Cash (-A) (175)2/14 Wages payable (-L) ......................................................... 2,300Cash (-A) ......................................................... 2,3002/18 Cash (+A) ..........................................................................Accounts receivable (+A) ................................................ 1,600 2,200Transport revenue (+R, +SE) ......................... 3,800 2/25 Parts supplies (+A) .......................................................... 2,550Accounts payable (+L) ................................... 2,550 2/27 Retained earnings (-SE) .. (200)Dividends payable (+L) (200)Req. 1 and 2Accounts Unearned Fee NoteAdditional Paid-inRebuilding Fees RentItem (f) is not a transaction; there has been no exchange.E3–10. (continued)Req. 3Net income using the accrual basis of accounting:Revenues $19,850 ($19,000 + $850)– Expenses 16,900 ($16,500 + $400)Net Income $ 2,950Assets = Liabilities + Stockholders’ Equity$12,090 $ 7,700 $ 1,70024,800 4,440 7,8202,460 48,500 9,36010,420 2,950 netincome7,40025,300$82,470 $60,640 $21,830Req. 4Net income using the cash basis of accounting:Cash receipts $27,650 (transactions a through d)–Cash disbursements 19,760 (transactions g, i, and k)Net Income $ 7,890Cash basis net income ($7,890) is higher than accrual basis net income ($2,950) because of the differences in the timing of recording revenues versus receipts and expenses versus disbursements between the two methods. The $7,800 higher amount in cash receipts over revenues includes cash received prior to being earned (from (b), $600) and cash received after being earned (in (d), $7,200). The $2,860 higher amount in cash disbursements over expenses includes cash paid after being incurred in the prior period (in (g), $2,300), plus cash paid for supplies to be used and expensed in the future (in (k), $960), less an expense incurred in January to be paid in February (in (e), $400).STACEY’S PIANO REBUILDING COMPANYIncome Statement (unadjusted)For the Month Ended January 31, 2014 Operating Revenues:Rebuilding fees revenue $ 19,000 Total operating revenues 19,000 Operating Expenses:Wages expense 16,500 Utilities expense 400 Total operating expenses 16,900 Operating Income 2,100 Other Item:Rent revenue 850 Net Income $ 2,950Req. 1 and 2Common Additional RetainedFood Sales Revenue Catering Sales RevenueE3–14.Req. 1TRAVELING GOURMET, INC.Income Statement (unadjusted)For the Month Ended March 31, 2014 Revenues:Food sales revenueCatering sales revenueTotal revenues Expenses:Supplies expenseUtilities expenseWages expenseFuel expenseTotal costs and expenses $ 11,9004,20016,10010,8304206,28036317,893Net Loss $ (1,793) Req. 2Transaction O, I, or F Activity (or No Effect) on Statement ofDirection and AmountReq. 3The company generated a small loss of 1,793 during its first month of operations, before making any adjusting entries. The adjusting entries for use of the building and equipment and interest expense on the borrowing will increase the loss. Cash flows from operating activities were also negative at $2,973 (= + 11,900 + 2,600 –10,830 –363 –6,280) . So far the company does not appear to be successful, but it is only in its first month of operating a retail store. If sales can be increased without inflating fixed costs (particularly salaries expense), the company may soon turn a profit. It is not unusual for small businesses to report a loss or have negative cash flows from operations as they start up operations.E3–15.Req. 1Transaction Brief Explanationa Issued 10,000 shares of common stock to shareholders for $82,000cash.b Purchased store fixtures for $15,400 cash.c Purchased $24,800 of inventory, paying $6,200 cash and thebalance on account.d Sold $14,000 of goods or services to customers, receiving $9,820cash and the balance on account. The cost of the goods sold was$7,000.e Used $1,480 of utilities during the month, not yet paid.f Paid $1,300 in wages to employees.g Paid $2,480 in cash for rent, $620 related to the current month and$1,860 related to future months.h Received $3,960 cash from customers, $1,450 related to currentsales and $2,510 related to goods or services to be provided in thefuture.Req. 2Kate’s Kite CompanyIncome StatementFor the Month Ended April 30, 2014Sales Revenue Expenses:Cost of salesWages expenseRent expenseUtilities expenseTotal expenses $ 15,4507,0001,3006201,48010,400Net Income $ 5,050Kate’s Kite CompanyBalance SheetAt April 30, 2014Assets Liabilities and Shareholders’ Equity Current Assets: Current Liabilities:Cash $70,400 Accounts payable $20,080 Accounts receivable 4,180 Unearned revenue 2,510 Inventory 17,800 Total current liabilities 22,590 Prepaid expenses 1,860 Shareholders’ Equity:Total current assets 94,240 Common stock 10,000 Store fixtures 15,400 Additional paid-in capital 72,000Retained earnings 5,050Total shareholders’equity87,050Total Assets $109,640 Total Liabilities &Shareholders’ Equity$109,640E3–16.Req. 1Assets = Liabilities + Stockholders’ Equity $ 3,200 $ 2,400 $ 800 8,000 5,600 4,0006,400 1,600 3,200 $17,600 $9,600 $ 8,000Req. 2Accounts Long-TermAccounts Unearned Long-TermAdditionalConsulting Fee InvestmentRent ExpenseE3–16. (continued)Req. 3Revenues $58,400 ($58,000 from sales + $400 on investments)– Expenses 56,400 ($36,000 + $12,000 + $800 + $7,600)Net Income $ 2,000Assets = Liabilities + Stockholders’ Equity$ 1,120 $ 1,600 $ 80012,400 7,200 4,0006,400 1,600 2,7202,000 net income $19,920 $10,400 $ 9,520 Req. 4Net Profit Margin = Net Income = $2,000 = 0.0345Ratio Sales (Operating) Revenues $58,000* or 3.45% * The $400 of investment income is not an operating revenue and is not included in the computation.The increasing trend in the net profit margin ratio (from 2.5% in 2013 to 2.9% in 2014 and then to 3.45% in 2015) suggests that the company is managing its sales and expenses more effectively over time.E3–17.Req. 1Accounts receivable increases with customer sales on account and decreases with cash payments received from customers.Prepaid expenses increase with cash payments of expenses related to future periods and decrease as these expenses are incurred over time.Unearned subscriptions increase with cash payments received from customers for goods or services to be provided in the future and decreases when those goods or services are provided.Req. 2Trade Accounts ReceivablePrepaidExpensesUnearnedSubscriptionsComputations:Beginning + “+”-“-”= EndingTrade accounts receivable 717 + 5,240 -??==6935,264Prepaid expenses 95 + 203 -??==107191Unearned subscriptions 224 + 2,690 -??==2312,683E3–18.ITEM LOCATION1. Description of a company’sprimary business(es). Letter to shareholders;Management’s Discussion and Analysis; Summary of significant accounting policies note2. Income taxes paid. Notes; Statement of cash flows3. Accounts receivable. Balance sheet4. Cash flow from operatingactivities.Statement of cash flows5. Description of a company’srevenue recognition policy. Summary of significant accounting policies note6. The inventory sold during theyear.Income statement (Cost of Goods Sold)7. The data needed to compute thenet profit margin ratio.Income statementPROBLEMSP3-1.Transactions Debit Credita. Example: Purchased equipment for use in the business;5 1, 8paid one-third cash and signed a note payable for thebalance.b. Paid cash for salaries and wages earned by employees thisperiod.15 1 c. Paid cash on accounts payable for expensesincurred last period.7 1d. Purchased supplies to be used later; paid cash. 3 1e. Performed services this period on credit. 2 14f. Collected cash on accounts receivable for servicesperformed last period. 1 2g. Issued stock to new investors. 1 11, 12h. Paid operating expenses incurred this period.15 1i. Incurred operating expenses this period to be paidnext period.15 7 j. Purchased a patent (an intangible asset); paid cash. 6 1 k. Collected cash for services performed this period. 1 14 l. Used some of the supplies on hand for operations.15 3 m. Paid three-fourths of the income tax expense for the year;the balance will be paid next year.16 1, 10 n. Made a payment on the equipment note in (a); the paymentwas part principal and part interest expense.8, 17 1 o. On the last day of the current period, paid cash for aninsurance policy covering the next two years. 4 1a. Cash (+A) ........................................................................... 40,000Common stock (+SE) (20)Additional paid-in capital (+SE) ................................ 39,980 b. Cash (+A) ........................................................................... 60,000Note payable (long-term) (+L) ..................................... 60,000 c. Rent expense (+E, -SE) .................................................... 1,500Prepaid rent (+A) ............................................................... 1,500 Cash (-A) ...................................................................... 3,000 d. Prepaid insurance (+A) ..................................................... 2,400Cash (-A) ..................................................................... 2,400 e. Furniture and fixtures (or Equipment) (+A) ..................... 15,000Accounts payable (+L) ............................................... 12,000Cash (-A) ..................................................................... 3,000 f. Inventory (+A) .................................................................... 2,800Cash (-A) ..................................................................... 2,800 g. Advertising expense (+E, -SE) .. (350)Cash (-A) (350)h. Cash (+A) (850)Accounts receivable (+A) (850)Sales revenue (+R, +SE) ............................................ 1,700 Cost of goods sold (+E, -SE) . (900)Inventory (-A) (900)i. Accounts payable (-L) ...................................................... 12,000Cash (-A) ..................................................................... 12,000 j. Cash (+A) (210)Accounts receivable (-A) (210)。

会计英语第三章复习

T-account

T-account: a simplest form of an account, used to help illustrate the effect of transaction.

Account name

Debit

(left side)

Credit

(right side)

Rules of debits &credits

Record transactions in the journal

Recording Phase

General ledger (Control account)

Step 1 Analyzing business documents

Step 2 Journalizing transactions

Key words, phrases and special terms

Journalize 登记日记账[‘dʒɜːn(ə)laɪz] Journal 日记账,序时账 Journal entry 日记账分录 Cash journal 现金日记账 Post 过账 Ledger accounts 分类账'ledʒə总帐,分户总帐; Account 账户

Double-Entry Accounting

“ Double-entry accounting is based on a simple concept: each party in a business transaction will receive something and give something in return. In terms, what is received is a debit and what bookkeeping is given is a credit. The T account is a representation of a scale or balance.”

会计学基础第三章课后答案

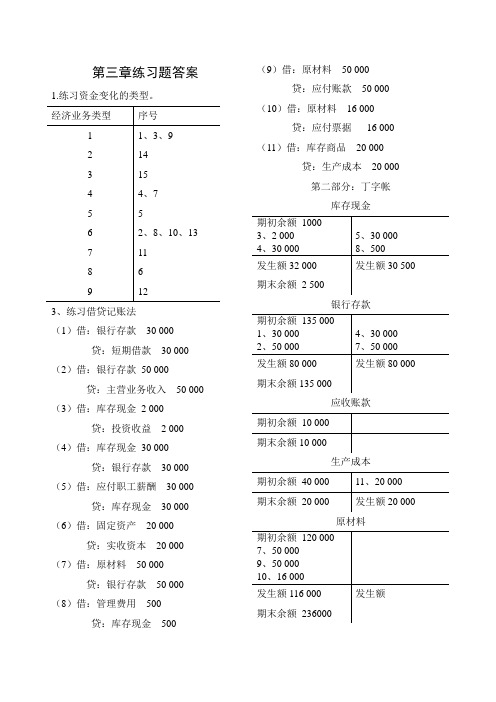

第三章练习题答案1.练习资金变化的类型。

3、练习借贷记账法

(1)借:银行存款30 000

贷:短期借款30 000 (2)借:银行存款50 000

贷:主营业务收入50 000 (3)借:库存现金 2 000

贷:投资收益 2 000 (4)借:库存现金30 000

贷:银行存款30 000 (5)借:应付职工薪酬30 000

贷:库存现金30 000 (6)借:固定资产20 000

贷:实收资本20 000 (7)借:原材料50 000

贷:银行存款50 000 (8)借:管理费用500

贷:库存现金500 (9)借:原材料50 000

贷:应付账款50 000 (10)借:原材料16 000

贷:应付票据16 000 (11)借:库存商品20 000

贷:生产成本20 000

第二部分:丁字帐

库存现金

银行存款

应收账款

生产成本

原材料

库存商品

固定资产

短期借款

应付账款

应付票据实收资本

应付职工薪酬

主营业务收入

投资收益

管理费用试算平衡表

2、练习会计方程式。

《会计基础》第三章课后练习题

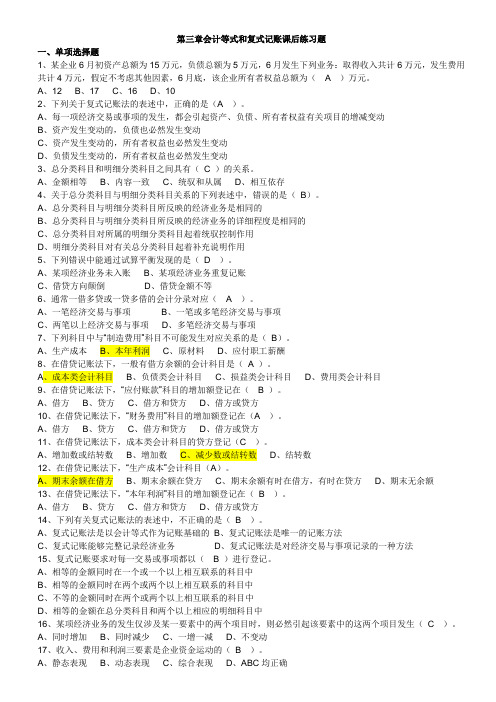

第三章会计等式和复式记账课后练习题一、单项选择题1、某企业6月初资产总额为15万元,负债总额为5万元,6月发生下列业务:取得收入共计6万元,发生费用共计4万元,假定不考虑其他因素,6月底,该企业所有者权益总额为( A )万元。

A、12B、17C、16D、102、下列关于复式记账法的表述中,正确的是(A )。

A、每一项经济交易或事项的发生,都会引起资产、负债、所有者权益有关项目的增减变动B、资产发生变动的,负债也必然发生变动C、资产发生变动的,所有者权益也必然发生变动D、负债发生变动的,所有者权益也必然发生变动3、总分类科目和明细分类科目之间具有(C )的关系。

A、金额相等B、内容一致C、统驭和从属D、相互依存4、关于总分类科目与明细分类科目关系的下列表述中,错误的是(B)。

A、总分类科目与明细分类科目所反映的经济业务是相同的B、总分类科目与明细分类科目所反映的经济业务的详细程度是相同的C、总分类科目对所属的明细分类科目起着统驭控制作用D、明细分类科目对有关总分类科目起着补充说明作用5、下列错误中能通过试算平衡发现的是(D )。

A、某项经济业务未入账B、某项经济业务重复记账C、借贷方向颠倒D、借贷金额不等6、通常一借多贷或一贷多借的会计分录对应( A )。

A、一笔经济交易与事项B、一笔或多笔经济交易与事项C、两笔以上经济交易与事项D、多笔经济交易与事项7、下列科目中与“制造费用”科目不可能发生对应关系的是(B)。

A、生产成本B、本年利润C、原材料D、应付职工薪酬8、在借贷记账法下,一般有借方余额的会计科目是(A )。

A、成本类会计科目B、负债类会计科目C、损益类会计科目D、费用类会计科目9、在借贷记账法下,“应付账款”科目的增加额登记在( B )。

A、借方B、贷方C、借方和贷方D、借方或贷方10、在借贷记账法下,“财务费用”科目的增加额登记在(A )。

A、借方B、贷方C、借方和贷方D、借方或贷方11、在借贷记账法下,成本类会计科目的贷方登记(C )。

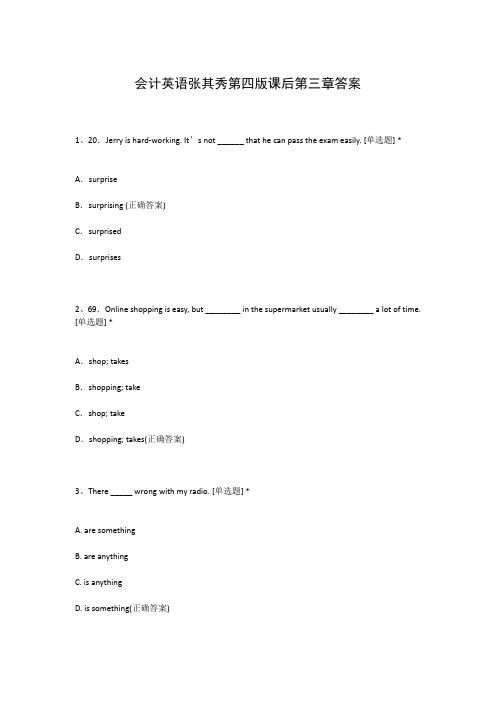

会计英语张其秀第四版课后第三章答案

会计英语张其秀第四版课后第三章答案1、20.Jerry is hard-working. It’s not ______ that he can pass the exam easily. [单选题] *A.surpriseB.surprising (正确答案)C.surprisedD.surprises2、69.Online shopping is easy, but ________ in the supermarket usually ________ a lot of time. [单选题] *A.shop; takesB.shopping; takeC.shop; takeD.shopping; takes(正确答案)3、There _____ wrong with my radio. [单选题] *A. are somethingB. are anythingC. is anythingD. is something(正确答案)4、Do not _______ me to help you unless you work harder. [单选题] *A. expect(正确答案)B. hopeC. dependD. think5、Everyone knows that the sun _______ in the east. [单选题] *A. fallsB. rises(正确答案)C. staysD. lives6、—I can’t always get good grades. What should I do?—The more ______ you are under, the worse grades you may get. So take it easy!()[单选题] *A. wasteB. interestC. stress(正确答案)D. fairness7、Alice is a ______ girl. She always smiles and says hello to others.()[单选题] *A. shyB. strictC. healthyD. friendly(正确答案)8、I don’t like snakes, so I ______ read anything about snakes.()[单选题] *A. alwaysB. usuallyC. oftenD. never(正确答案)9、I always make my daughter ______ her own room.()[单选题] *A. to cleanB. cleaningC. cleansD. clean(正确答案)10、Yesterday I _______ a book.It was very interesting. [单选题] *A. lookedB. read(正确答案)C. watchedD. saw11、8.—Will she have a picnic next week?—________. And she is ready. [单选题] * A.Yes, she doesB.No, she doesn'tC.Yes, she will(正确答案)D.No, she won't12、--All of you have passed the test!--_______ pleasant news you have told us! [单选题] *A. HowB. How aC. What(正确答案)D. What a13、The bookstore is far away. You’d better _______ the subway. [单选题] *A. sitB. take(正确答案)C. missD. get14、The story has _______ a lot of students in our class. [单选题] *A. attracted(正确答案)B. attackedC. appearedD. argued15、—Who came to your office today, Ms. Brown?—Sally came in. She hurt ______ in P. E. class. ()[单选题] *A. sheB. herC. hersD. herself(正确答案)16、Tony can _______ the guitar.Now he _______ the guitar. [单选题] *A. play; plays(正确答案)B. playing; playingC. plays; is playingD. play; is playing17、30.It is known that ipad is _________ for the old to use. [单选题] *A.enough easyB.easy enough (正确答案)C.enough easilyD.easily enough18、Mary is interested ______ hiking. [单选题] *A. onB. byC. in(正确答案)D. at19、It’s windy outside. _______ your jacket, Bob. [单选题] *A. Try onB. Put on(正确答案)C. Take offD. Wear20、At half past three she went back to the school to pick him up. [单选题] *A. 等他B. 送他(正确答案)C. 抱他D. 接他21、There is not much news in today's paper,_____? [单选题] *A. is itB. isn't itC.isn't thereD. is there(正确答案)22、Nearly everything they study at school has some practical use in their life, but is that the only reason _____ they go to school? [单选题] *A. why(正确答案)B. whichC. becauseD. what23、Bill Gates is often thought to be the richest man in the world. _____, his personal life seems not luxury. [单选题] *A. MoreoverB. ThereforeC. However(正确答案)D. Besides24、Many people believe that _________one has, _______ one is, but actually it is not true. [单选题] *A. the more money ; the happier(正确答案)B. the more money ; the more happyC. the less money ; the happierD. the less money ; the more happy25、A survey of the opinions of students()that they admit several hours of sitting in front of the computer harmful to health. [单选题] *A. show;areB. shows ;is(正确答案)C.show;isD.shows ;are26、Don’t ______. He is OK. [单选题] *A. worriedB. worry(正确答案)C. worried aboutD. worry about27、—The weather in Shanghai is cool now, ______ it? —No, not exactly. ()[单选题] *A. doesn’tB. isC. isn’t(正确答案)D. does28、Last year Polly _______ an English club and has improved her English a lot. [单选题] *A. leftB. sawC. joined(正确答案)D. heard29、E-mail is _______ than express mail, so I usually email my friends. [单选题] *A. fastB. faster(正确答案)C. the fastestD. more faster30、Sorry, I can't accept your invitation. [单选题] *A. 礼物B. 观点C. 邀请(正确答案)D. 好意。

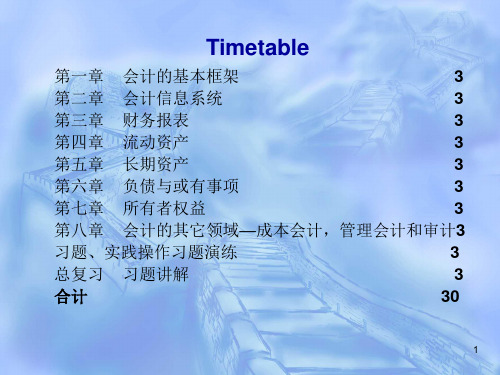

会计英语——用英语了解会计的定义和运用

第一章 会计的基本框架

3

第二章 会计信息系统

3

第三章 财务报表

3

第四章 流动资产

3

第五章 长期资产

3

第六章 负债与或有事项

3

第七章 所有者权益

3

第八章 会计的其它领域—成本会计,管理会计和审计3

习题、实践操作习题演练

3

总复习 习题讲解

3

合计

30

1

Chapter 1

I. New words: 1. Account n. statement of money paid or owed for goods or services --The accounts show a profit of $9000. Open/close an account、account payable, account receivable, On account (1) pay part of the money (2)on credit --I will give you$30 on account. --buy things on account.

bank account -- Credit $8 to a customer / an account. Credit n. (1)permission to delay payment for goods and

services --No ~ is given at this shop. Payment must be in

prediction. --There is a lack of ~ between his promises

and his actions. ~ college, ~ column, ~course, ~school Corresponding a. more or less the same ~ fingerprints, the ~ period last year

第三章作业会计信息系统

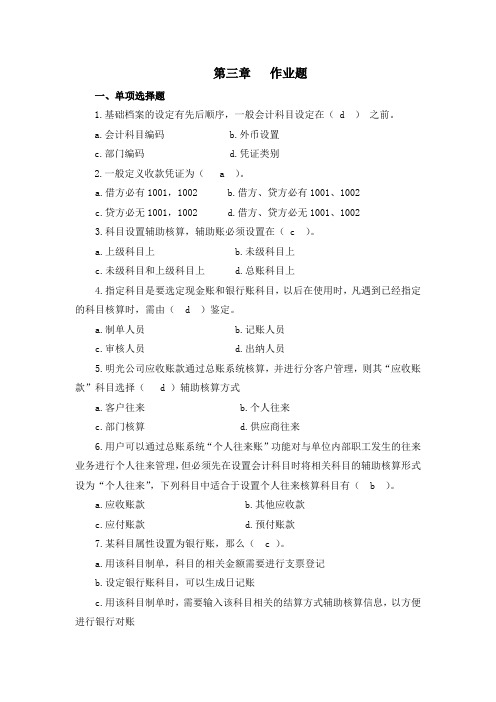

第三章作业题一、单项选择题1.基础档案的设定有先后顺序,一般会计科目设定在( d )之前。

a.会计科目编码b.外币设置c.部门编码d.凭证类别2.一般定义收款凭证为( a )。

a.借方必有1001,1002b.借方、贷方必有1001、1002c.贷方必无1001,1002d.借方、贷方必无1001、10023.科目设置辅助核算,辅助账必须设置在( c )。

a.上级科目上b.未级科目上c.未级科目和上级科目上d.总账科目上4.指定科目是要选定现金账和银行账科目,以后在使用时,凡遇到已经指定的科目核算时,需由( d )鉴定。

a.制单人员b.记账人员c.审核人员d.出纳人员5.明光公司应收账款通过总账系统核算,并进行分客户管理,则其“应收账款”科目选择( d )辅助核算方式a.客户往来b.个人往来c.部门核算d.供应商往来6.用户可以通过总账系统“个人往来账”功能对与单位内部职工发生的往来业务进行个人往来管理,但必须先在设置会计科目时将相关科目的辅助核算形式设为“个人往来”,下列科目中适合于设置个人往来核算科目有( b )。

a.应收账款b.其他应收款c.应付账款d.预付账款7.某科目属性设置为银行账,那么( c )。

a.用该科目制单,科目的相关金额需要进行支票登记b.设定银行账科目,可以生成日记账c.用该科目制单时,需要输入该科目相关的结算方式辅助核算信息,以方便进行银行对账d.用该科目制单,该凭证需要出纳签字8.如果某企业凭证需要进行出纳签字,那么在科目设置中进行设置( a )a.指定现金流量科目b.科目属性设置为银行账c.科目属性设置为现金账d.指定现金和银行存款会计科目二、多项选择题1.下面关于系统的启用的说法,正确的是( ad )a.只有设置了系统启用的子系统才可以登录b.只能在企业应用平台中进行系统启用c.系统的启用时间必须小于等于账套的启用时间d.在各个子系统中启用以前的数据为期初数据2.在U8管理软件中,提供了三种不同性质的权限管理,包括:( abc )a.功能权限b.数据权限c.金额权限d.操作员权限3.下列说法正确的是:( abc )a.进行外币核算,如果使用固定汇率,在填制每月的凭证前,应预先录入该月的记账汇率b.进行外币核算,如果使用变化汇率,在填制该天的凭证前,应预先录入该天的记账汇率c.折算方式中直接汇率即外币*汇率=本位币,间接汇率即外币/汇率=本位币d.折算方式中间接汇率即外币*汇率=本位币,直接汇率即外币/汇率=本位币4.下列关于会计科目体系设计的原则,正确的是( abd )。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Matching Questions140. Match the following terms the appropriate definition.1. Depreciatio n expense The accounting system that recognizes revenues when earned and expenseswhen incurred.2. Time period principleThe accounting system where revenues are recognized when cash isreceived and expenses are recorded whencash is paid.3. Profit margin Items paid for in advance of receivingtheir benefits.4. Matchingprinciple Net income divided by net sales.5. Accrued revenuesThe expense created by allocating the cost of plant and equipment to the periodsin which they are used.6. Accrual basis accounting Allocates equal amounts of an asset's cost (less any salvage value) to depreciation expense during its usefullife.7. Cash basis accountingA principle that assumes that anorganization's activities can be divided into specific time periods such as months,quarters, or years.8. Prepaid expenses The principle that requires expenses to be reported in the same period as the revenues that were earned as a result ofthe expenses.9. Straight-lin e depreciation Revenues earned in a period that are both unrecorded and not yet received incash or other assets.141. Match the following terms with the appropriate definition.1. Adjusted trial balance A balance sheet that lists assets on the left side and liabilities and equity on theright.2. Adjusting entry A journal entry used at the end of an accounting period to bring an asset or liability account balance to its proper amount and update the related expenseor revenue account.3. Account form balance sheet A listing of accounts and balancesprepared before adjustments arerecorded.4. Accounting period The consecutive 12 months (or 52 weeks) selected as the organization'sannual accounting period.5. Contra accountA balance sheet that lists items vertically in the order: assets, liabilitiesand equity.6. Unadjusted trial balance The length of time covered by financialstatements.7. Interim financial reportsAn account linked with another account and having an opposite normalbalance.8. Fiscal yearFinancial reports covering less than one year, usually one, three, or six-monthperiods.9. Report form balance sheetA listing of accounts and balances prepared after adjustments are recordedand posted to the ledger.10. Natural business year A 12-month period that ends when acompany's sales activities are at theirlowest point.Problems1. On December 14 Bench Company received $3,700 cash for consulting services that will be performed in January. Bench records all such prepayments in a liability account. Prepare a general journal entry to record the $3,700 cash receipt.2. On December 31, Connelly Company had performed $5,000 of management services for clients that had not yet been billed. Prepare Connelly's adjusting entry to record these fees earned.3. A company has 20 employees who each earn $500 per week fora 5-day week that begins on Monday. December 31 of Year 1 is a Monday, and all 20 employees worked that day.a) Prepare the required adjusting journal entry to record accrued salaries on December 31, 2009.b) Prepare the journal entry to record the payment of salaries on January 4, 2010.4. Pfister Co. leases an office to a tenant at the rate of $5,000 per month. The tenant contacted Pfister and arranged to pay the rent for December 2009 on January 8, 2010. Pfister agrees to this arrangement.a.) Prepare the journal entry that Pfister must make at December 31, 2009 to record the accrued rent revenue.b.) Prepare the journal entry to record the receipt of the rent on January 8, 2010.5. Prior to recording adjusting entries on December 31, a company's Store Supplies account had an $880 debit balance. A physical count of the supplies showed $325 of unused supplies available as of December 31. Prepare the required adjusting entry.6. Prepare general journal entries on December 31 to record the following unrelated year-end adjustments.a. Estimated depreciation on office equipment for the year, $4,000.b. The Prepaid Insurance account has a $3,680 debit balance before adjustment. An examination of insurance policies shows $950 of insurance expired.c. The Prepaid Insurance account has a $2,400 debit balance before adjustment. An examination of insurance policies shows $600 of unexpired insurance.d. The company has three office employees who each earn $100 per day for a five-day workweek that ends on Friday. The employees were paid on Friday, December 26, and have worked full days on Monday, Tuesday, and Wednesday, December 29, 30, and 31.e. On November 1, the company received 6 months' rent in advance from a tenant whose rent is $700 per month. The $4,200 was credited to the Unearned Rent account.f. The company collects rent monthly from its tenants. One tenant whose rent is $750 per month has not paid his rent for December.。