多恩布什宏观经济学第十版课后答案

多恩布什宏观经济学第十版课后习题答案03

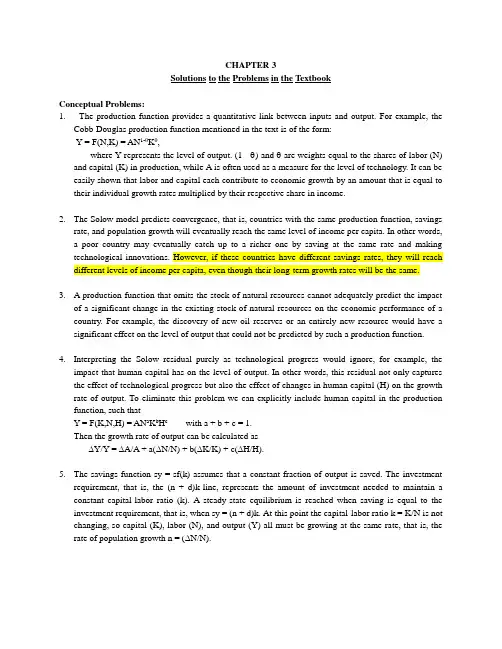

CHAPTER 3Solutions to the Problems in the TextbookConceptual Problems:1. The production function provides a quantitative link between inputs and output. For example, theCobb-Douglas production function mentioned in the text is of the form:Y = F(N,K) = AN1-θKθ,where Y represents the level of output. (1 - θ) and θ are weights equal to the shares of labor (N) and capital (K) in production, while A is often used as a measure for the level of technology. It can be easily shown that labor and capital each contribute to economic growth by an amount that is equal to their individual growth rates multiplied by their respective share in income.2. The Solow model predicts convergence, that is, countries with the same production function, savingsrate, and population growth will eventually reach the same level of income per capita. In other words,a poor country may eventually catch up to a richer one by saving at the same rate and makingtechnological innovations. However, if these countries have different savings rates, they will reach different levels of income per capita, even though their long-term growth rates will be the same.3. A production function that omits the stock of natural resources cannot adequately predict the impactof a significant change in the existing stock of natural resources on the economic performance of a country. For example, the discovery of new oil reserves or an entirely new resource would have a significant effect on the level of output that could not be predicted by such a production function.4. Interpreting the Solow residual purely as technological progress would ignore, for example, theimpact that human capital has on the level of output. In other words, this residual not only captures the effect of technological progress but also the effect of changes in human capital (H) on the growth rate of output. To eliminate this problem we can explicitly include human capital in the production function, such thatY = F(K,N,H) = AN a K b H c with a + b + c = 1.Then the growth rate of output can be calculated as∆Y/Y = ∆A/A + a(∆N/N) + b(∆K/K) + c(∆H/H).5. The savings function sy = sf(k) assumes that a constant fraction of output is saved. The investmentrequirement, that is, the (n + d)k-line, represents the amount of investment needed to maintain a constant capital-labor ratio (k). A steady-state equilibrium is reached when saving is equal to the investment requirement, that is, when sy = (n + d)k. At this point the capital-labor ratio k = K/N is not changing, so capital (K), labor (N), and output (Y) all must be growing at the same rate, that is, the rate of population growth n = (∆N/N).6. In the long run, the rate of population growth n = (∆N/N) determines the growth rate of thesteady-state output per capita. In the short run, however, the savings rate, technological progress, and the rate of depreciation can all affect the growth rate.7. Labor productivity is defined as Y/N, that is, the ratio of output (Y) to labor input (N). A surge inlabor productivity therefore occurs if output grows at a faster rate than labor input. In the U.S. we have experienced such a surge in labor productivity since the mid-1990s due to the enormous growth in GDP. This surge can be explained from the introduction of new technologies and more efficient use of existing technologies. Many claim that the increased investment in and use of computer technology has stimulated economic growth. Furthermore, increased global competition has forced many firms to cut costs by reorganizing production and eliminating some jobs. Thus, with large increases in output and a slower rate of job creation we should expect labor productivity to increase. (One should also note that a higher-skilled labor force also can contribute to an increase in labor productivity, since the same number of workers can produce more output if workers are more highly skilled.)Technical Problems:1.a. According to Equation (2), the growth of output is equal to the growth in labor times the labor shareplus the growth of capital times the capital share plus the rate of technical progress, that is, ∆Y/Y = (1 - θ)(∆N/N) + θ(∆K/K) + ∆A/A, where1 - θ is the share of labor (N) and θ is the share of capital (K). Thus if we assume that the rate oftechnological progress (∆A/A) is zero, then output grows at an annual rate of 3.6 percent, since ∆Y/Y = (0.6)(2%) + (0.4)(6%) + 0% = 1.2% + 2.4% = + 3.6%,1.b. The so-called "Rule of 70" suggests that the length of time it takes for output to double can becalculated by dividing 70 by the growth rate of output. Since 70/3.6 = 19.44, it will take just under 20 years for output to double at an annual growth rate of 3.6%,1.c. Now that ∆A/A = 2%, we can calculate economic growth as∆Y/Y = (0.6)(2%) + (0.4)(6%) + 2% = 1.2% + 2.4% + 2% = + 5.6%.Thus it will take 70/5.6 = 12.5 years for output to double at this new growth rate of 5.6%.2.a. According to Equation (2), the growth of output is equal to the growth in labor times the labor shareplus the growth of capital times the capital share plus the growth rate of total factor productivity (TFP), that is,∆Y/Y = (1 - θ)(∆N/N) + θ(∆K/K) + ∆A/A, where1 - θ is the share of labor (N) and θ is the share of capital (K). In this example θ = 0.3; therefore,if output grows at 3% and labor and capital grow at 1% each, then we can calculate the change in TFP in the following way3% = (0.3)(1%) + (0.7)(1%) + ∆A/A ==> ∆A/A = 3% - 1% = 2%,that is, the growth rate of total factor productivity is 2%.2.b. If both labor and the capital stock are fixed and output grows at 3%, then all this growth has to becontributed to the growth in factor productivity, that is, ∆A/A = 3%.3.a. If the capital stock grows by ∆K/K = 10%, the effect on output would be an additional growth rate of∆Y/Y = (.3)(10%) = 3%.3.b. If labor grows by ∆N/N = 10%, the effect on output would be an additional growth rate of∆Y/Y = (.7)(10%) = 7%.3.c. If output grows at ∆Y/Y = 7% due to an increase in labor by ∆N/N = 10%, and this increase in laboris entirely d ue to population growth, then per capita income would decrease and people’s welfare would decrease, since∆y/y = ∆Y/Y - ∆N/N = 7% - 10% = - 3%.3.d. If this increase in labor is due to an influx of women into the labor force, the overall population doesnot increase and income per capita would increase by ∆y/y = 7%. Therefore people's welfare would increase.4. Figure 3-4 shows output per head as a function of the capital-labor ratio, that is, y = f(k). Thesavings function is sy = sf(k), and it intersects the straight (n + d)k-line, representing the investment requirement. At this intersection, the economy is in a steady-state equilibrium. Now let us assume that the economy is in a steady-state equilibrium before the earthquake hits, that is, the steady-state capital-labor ratio is currently k*. Assume further, for simplicity, that the earthquake does not affect people's savings behavior.If the earthquake destroys one quarter of the capital stock but less than one quarter of the labor force, then the capital-labor ratio falls from k*to k1 and per-capita output falls from y* to y1. Now saving is greater than the investment requirement, that is, sy1 > (d + n)k1, and the capital stock and the level of output per capita will grow until the steady state at k* is reached again.However, if the earthquake destroys one quarter of the capital stock but more than one quarter of the labor force, then the capital-labor ratio increases from k*to k2. Saving now will be less than the investment requirement and thus the capital-labor ratio and the level of output per capita will fall until the steady state at k* is reached again.If exactly one quarter of both the capital stock and the labor stock are destroyed, then the steady state is maintained, that is, the capital-labor ratio and the output per capita do not change.If the severity of the earthquake has an effect on peoples’ savings behavior, then the savings function sy = sf(k) will move either up or down, depending on whether the savings rate (s) increases (if people save more, so more can be invested in an effort to rebuild) or decreases (if people save less, since they decide that life is too short not to live it up).k1k*k2 k5.a. An increase in the population growth rate (n) affects the investment requirement, and the (n + d)k-linegets steeper. As the population grows, more saving must be used to equip new workers with the same amount of capital that the existing workers already have. Therefore output per capita (y) will decrease as will the new optimal capital-labor ratio, which is determined by the intersection of the sy-curve and the (n1 + d)k-line. Since per-capita output will fall, we will have a negative growth rate in the short run. However, the steady-state growth rate of output will increase in the long run, since it will be determined by the new and higher rate of population growth.yy oy1k1k o k5.b. Starting from an initial steady-state equilibrium at a level of per-capita output y*, the increase in thepopulation growth rate (n) will cause the capital-labor ratio to decline from k* to k1. Output per capita will also decline, a process that will continue at a diminishing rate until a new steady-state level is reached at y1. The growth rate of output will gradually adjust to the new and higher level n1.yy*y1t o t1tkk*k1t o t1t6.a. Assume the production function is of the formY = F(K, N, Z) = AK a N b Z c==>∆Y/Y = ∆A/A + a(∆K/K) + b(∆N/N) + c(∆Z/Z), with a + b + c = 1.Now assume that there is no technological progress, that is, ∆A/A = 0, and that capital and labor grow at the same rate, that is, ∆K/K = ∆N/N = n. If we also assume that all natural resources available are fixed, such that ∆Z/Z = 0, then the rate of output growth will be∆Y/Y = an + bn = (a + b)n.In other words, output will grow at a rate less than n since a + b < 1. Therefore output per worker will fall.6.b. If there is technological progress, that is, ∆A/A > 0, then output will grow faster than before, namely∆Y/Y = ∆A/A + (a + b)n.If ∆A/A > c, then output will grow at a rate larger than n, in which case output per worker will increase.6.c. If the supply of natural resources is fixed, then output can only grow at a rate that is smaller than therate of population growth and we should expect limits to growth as we run out of natural resources.However, if the rate of technological progress is sufficiently large, then output can grow at a rate faster than population, even if we have a fixed supply of natural resources.7.a. If the production function is of the formY = K1/2(AN)1/2,and A is normalized to 1, then we haveY = K1/2N1/2.In this case capital's and labor's shares of income are both 50%.7.b. This is a Cobb-Douglas production function.7.c. A steady-state equilibrium is reached when sy = (n + d)k.From Y = K1/2N1/2 ==> Y/N = K1/2N-1/2==> y = k1/2==>sk1/2= (n + d)k ==> k-1/2 = (n + d)/s = (0.07 + 0.03)/(.2) = 1/2 ==> k1/2= 2 = y ==> k = 4 .8.a. If technological progress occurs, then the level of output per capita for any given capital-labor ratioincreases. The function y = f(k) increases to y = g(k), and thus the savings function increases from sf(k) to sg(k).y2k1k2k8.b. Since g(k) > f(k), it follows that sg(k) > sf(k) for each level of k. Therefore theintersection of the sg(k)-curve with the (n + d)k-line is at a higher level of k. The new steady-state equilibrium will now be at a higher level of saving and output per capita, and at a higher capital-labor ratio.8.c. After the technological progress occurs, the level of saving and investment will increaseuntil a new and higher optimal capital-labor ratio is reached. The ratio of investment to capital will also increase in the transition period, since more has to be invested to reach the higher optimal capital-labor ratio.kk2k1t1t2t9. The Cobb-Douglas production function is defined asY = F(N,K) = AN1-θKθ.The marginal product of labor can then be derived asMPN = (∆Y)/(∆N) = (1 - θ)AN-θKθ = (1 - θ)AN1-θKθ/N = = (1 - θ)(Y/N)==> labor's share of income = [MPN*(N)]/Y = (1 - θ)(Y/N)*[(N)/(Y)] = (1 - θ)。

(NEW)多恩布什《宏观经济学》(第10版)笔记和课后习题详解

答:总供给—总需求模型是把总需求与总供给结合在一起来分析国民收 入与价格水平的决定及其变动的国民收入决定模型。

在图1-4中,横轴代表国民收入( ),纵轴代表价格水平( ), 代 表原来的总需求曲线, 代表短期总供给曲线, 代表长期总供给曲 线。最初,经济在 点时实现了均衡,均衡的国民收入为 ,均衡的价 格水平为 。这时 点又在长期总供给曲线 上,所以, 代表充分就 业的国民收入水平。在短期内,政府通过扩张性的财政政策或货币政 策,增加了总需求,从而使总需求曲线从 向右上方平行地移动到了

(1)经济增长模型

主要解释:经济增长的源泉;各国经济增长率差异的原因;经济起飞的 原因;分析投入的积累和技术进步如何导致生活水平的提高。

(2)经济波动模型:总供给—总需求模型(如图1-1所示)

图1-1 总供给—总需求模型

总供给—总需求模型解释物价水平与产出的决定与波动。

总供给水平:现有资源和技术条件下,经济能够生产的产出量。

潜在产出水平附近接近于一条垂直的直线。

4 经济周期(business cycle)

答:经济周期又称经济波动或国民收入波动,指总体经济活动的扩张和 收缩交替反复出现的过程。现代经济学中关于经济周期的论述一般是指 经济增长率的上升和下降的交替过程,而不是经济总量的增加和减少。

一个完整的经济周期包括繁荣、衰退、萧条、复苏(也可以称为扩张、 持平、收缩、复苏)四个阶段。在繁荣阶段,经济活动全面扩张,不断 达到新的高峰。在衰退阶段,经济短时间内保持均衡后出现紧缩的趋 势。在萧条阶段,经济出现急剧的收缩和下降,很快从活动量的最高点 下降到最低点。在复苏阶段,经济从最低点恢复并逐渐上升到先前的活 动量高度,进入繁荣。衡量经济周期处于什么阶段,主要依据国民生产 总值、工业生产指数、就业和收入、价格指数、利息率等综合经济活动 指标的波动。

多恩布什《宏观经济学》第10版课后习题详解(货币、利息与收入)【圣才出品】

5. IS 曲线( IS curve)

答: IS 曲线指将满足产品市场均衡条件的收入和利率的各种组合的点连结起来而形成

的曲线。它是反映产品市场均衡状态的一幅简单图像。它表示的是任一给定的利率水平上都

M P h h kbG

h 与 k 数值越小,b 与 G 数值越大,增加实际余额对均衡收入水平的扩张性效应也越大。 b 与 G 的数值大,对应着非常平直的 IS 曲线。

4.中央银行(central bank) 答:中央银行指在一国金融体系中居于主导地位,负责制定和执行国家的金融政策,调 节货币流通与信用活动,对国家负责,在对外金融活动中代表国家,并对国内整个金融体系 和金融活动实行管理与监督的金融中心机构。中央银行具有三大职能,即它是“发行的银行”、 “银行的银行”和“政府的银行”。

2 / 21

圣才电子书 十万种考研考证电子书、题库视频学习平台

(1)中央银行是发行的银行,这一职能指中央银行服务于社会和经济发展,供应货币、 调节货币量、管理货币流通的职能。

(2)中央银行是银行的银行,这一职能指中央银行服务于商业银行和整个金融机构体 系,履行维持金融稳定、促进金融业发展的职责。

6.货币市场的均衡曲线(money market equilibrium schedule)

3 / 21

圣才电子书 十万种考研考证电子书、题库视频学习平台

答:LM 曲线即货币市场的均衡曲线,它显示能使其实际余额需求等于供给的所有利率

与收入水平的组合。沿着 LM 曲线,货币市场处于均衡状态。要使货币市场处于均衡状态,

A bi

多恩布什《宏观经济学》第10版课后习题详解(国际调整与相互依存)【圣才出品】

多恩布什《宏观经济学》第10版课后习题详解第20章国际调整与相互依存一、概念题1.自动调节机制(automatic adjustment mechanisms)答:自动调节机制指自动起作用消除国际收支失衡问题的机制。

在纯粹的自由经济中有货币—价格机制、收入机制及利率机制等国际收支自动调节机制。

货币—价格机制,也称“价格—现金流动机制”,其描述的是国内货币供给存量与一般物价水平变动以及相对价格水平变动对国际收支的影响。

当一国处于逆差状态时,对外支付大于收入,货币外流,物价下降,本国汇率也下降,由此导致本国出口商品的价格绝对或相对下降,从而出口增加,进口减少,贸易收入得到改善。

收入机制的调节作用表现为:当国际收支逆差时,国民收入下降。

国民收入下降引起社会总需求下降,从而进口需求也下降,进而改善贸易收支。

利率机制的调节作用表现为:当国际收支发生逆差时,本国货币供给存量减少,利率因此上升,这意味着本国金融资产的收益上升,从而对本国金融资产的需求上升,对外国金融资产的需求相对下降。

这样,资金外流减少或内流增加,资本与金融项目收支得到改善。

当国际收支顺差时,上述的自动调节仍然起作用,只是方向相反而已。

2.内部和外部平衡(internal and external balance)答:内部平衡指国民经济处于无通货膨胀的充分就业状态。

内部均衡时国内产品市场、货币市场和劳动市场同时达到均衡,宏观经济处于充分就业水平上,并且没有通货膨胀的压力,经济稳定增长。

内部均衡目标包括经济增长、价格稳定和充分就业。

外部均衡指国际收支平衡,也即贸易品的供求处于均衡状态。

当国际收支平衡时,既无国际收支顺差,也无国际收支逆差。

在开放经济中,宏观经济的最终目标是实现内部均衡和外部均衡。

英国经济学家詹姆斯·米德开创性地提出了“两种目标、两种工具”的理论模式,即在开放经济条件下,一国经济如果希望同时达到对内均衡和对外均衡的目标,则必须同时运用支出增减政策和支出转换政策两种工具。

多恩布什宏观经济学第十版课后答案

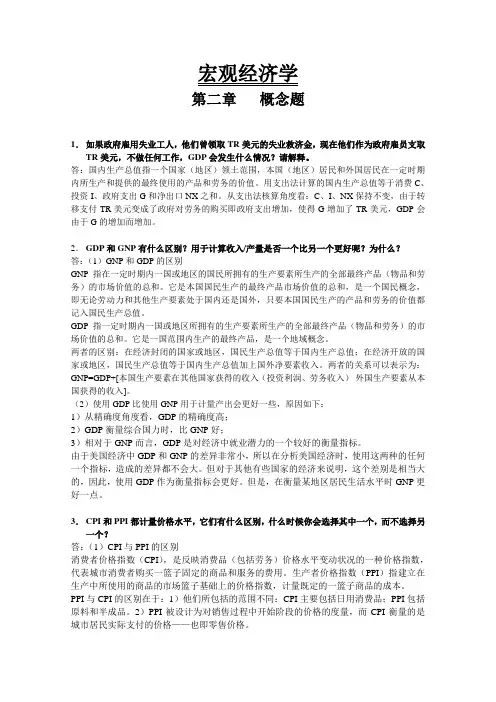

宏观经济学第二章概念题1.如果政府雇用失业工人,他们曾领取TR美元的失业救济金,现在他们作为政府雇员支取TR美元,不做任何工作,GDP会发生什么情况?请解释。

答:国内生产总值指一个国家(地区)领土范围,本国(地区)居民和外国居民在一定时期内所生产和提供的最终使用的产品和劳务的价值。

用支出法计算的国内生产总值等于消费C、投资I、政府支出G和净出口NX之和。

从支出法核算角度看:C、I、NX保持不变,由于转移支付TR美元变成了政府对劳务的购买即政府支出增加,使得G增加了TR美元,GDP会由于G的增加而增加。

2.GDP和GNP有什么区别?用于计算收入/产量是否一个比另一个更好呢?为什么?答:(1)GNP和GDP的区别GNP指在一定时期内一国或地区的国民所拥有的生产要素所生产的全部最终产品(物品和劳务)的市场价值的总和。

它是本国国民生产的最终产品市场价值的总和,是一个国民概念,即无论劳动力和其他生产要素处于国内还是国外,只要本国国民生产的产品和劳务的价值都记入国民生产总值。

GDP指一定时期内一国或地区所拥有的生产要素所生产的全部最终产品(物品和劳务)的市场价值的总和。

它是一国范围内生产的最终产品,是一个地域概念。

两者的区别:在经济封闭的国家或地区,国民生产总值等于国内生产总值;在经济开放的国家或地区,国民生产总值等于国内生产总值加上国外净要素收入。

两者的关系可以表示为:GNP=GDP+[本国生产要素在其他国家获得的收入(投资利润、劳务收入)-外国生产要素从本国获得的收入]。

(2)使用GDP比使用GNP用于计量产出会更好一些,原因如下:1)从精确度角度看,GDP的精确度高;2)GDP衡量综合国力时,比GNP好;3)相对于GNP而言,GDP是对经济中就业潜力的一个较好的衡量指标。

由于美国经济中GDP和GNP的差异非常小,所以在分析美国经济时,使用这两种的任何一个指标,造成的差异都不会大。

但对于其他有些国家的经济来说明,这个差别是相当大的,因此,使用GDP作为衡量指标会更好。

多恩布什《宏观经济学》第10版课后习题详解(货币政策与财政政策)【圣才出品】

多恩布什《宏观经济学》第10版课后习题详解第11章货币政策与财政政策一、概念题1.预期的货币政策(anticipatory monetary policy)答:预期的货币政策指为了对估计到的未来将会发生的问题(例如通货膨胀的压力)作出反应而采用的货币政策。

比如,在一个预先防范的货币政策的例子中,央行不是对总需求与通货膨胀压力的现有情况作出反应,而是对经济如果增长过快,会发生通货膨胀的这种担心作出反应。

该政策的基本问题是:确定货币政策时,应当往前看。

2.投资税减免(investment tax credit)答:投资税减免指国家以法律形式规定的在一定条件下允许纳税人以用于某些方面的投资抵免一定税款的政策措施。

实行这种政策,表明国家是鼓励税收减免的,即国家为支持投资而在税收方面作出优惠的减免税的规定。

这种政策对鼓励和吸引投资有一定成效。

我国在改革开放中也使用了这种政策。

3.政策组合(policy mix)答:政策组合指为了实现宏观经济目标而采取的财政政策、货币政策以及其他一些政策工具的组合。

扩张性的财政政策表现为IS曲线右移,在使收入增加的同时会带来利率的上升,而扩张性的货币政策表现为LM曲线右移,在使收入增加的同时会带来利率的下降。

因此,为实现收入和利率的不同组合,将两种政策搭配使用,即财政政策和货币政策的混合使用。

政府和中央银行可以根据具体情况和不同目标,选择不同的政策组合。

例如,当经济萧条但又不太严重时,用扩张性财政政策刺激总需求,又用紧缩性货币政策控制通货膨胀;当经济发生严重通货膨胀时,用紧缩货币来提高利率,降低总需求水平,又紧缩财政,以防止利率过分提高;当经济中出现通货膨胀又不太严重时,用紧缩财政压缩总需求,又用扩张性货币政策降低利率,以免财政政策紧缩而引起衰退;当经济严重萧条时,用扩张财政增加总需求,用扩张货币降低利率以克服“挤出效应”。

4.古典情况(classical case)答:古典情况即垂直的LM曲线,是货币需求对于实际利率十分敏感的情况。

多恩布什《宏观经济学》第10版课后习题详解(重大事件:萧条经济学、恶性通货膨胀和赤字)【圣才出品】

圣才电子书 十万种考研考证电子书、题库视频学习平台

6.可信的政策(credible policy) 答:可信的政策指人们相信政府将会遵循的政策。可信的政策有利于赢得公众的信心, 从而在最大程度上降低政策成本。政府政策的可信度不高,会降低公众对政府的信心,使得 政府无法引导公众预期,加大政策执行难度。因此,政府应该努力提高政策的可信性,合理 引导公众预期,降低政策成本。

4.信任奖励(credibility bonus) 答:信任奖励又称信誉红利,指在理性预期下政府政策的可信性所获得的报偿。政府在 降低通货膨胀的斗争中,由于公众相信政府的反通货膨胀政策会得到执行从而降低通货膨胀 预期,这样即使政策未执行也会使通货膨胀降低,从而避免经济的衰退,政府政策的可信性 便获得了报偿。 通货膨胀是由经济的基本方面(总需求与总供给的相对变动)所决定的。在恶性通货膨 胀中,货币的增长支配了所有的其他基本因素。但是,人们关于未来的预期也发挥了作用。 相信政策已经改变本身就会驱动预期的通货膨胀率下降,并且因此而引起短期的菲利普斯曲

2 / 38

圣才电子书 十万种考研考证电子书、题库视频学习平台

线向下移动。所以,在反通货膨胀的战斗中,一种可信任的政策会赢得社会对可信性的褒奖。 从美联储 1979 年 10 月改变其货币政策开始,在美国整个反通货膨胀时期,一直着重

强调政策的可信性。理性预期的一些支持者衰退。

新政的主要内容包括: (1)对工商业大量的贷款和津贴,刺激私人投资; (2)提高物价,减少农业生产,克服农产品过剩; (3)兴建公共工程,增加就业机会; (4)对失业者给予最低限度救济。 新政实施的结果使美国逐渐摆脱了危机,为千百万人提供了就业和生活的保障,使经济 不平衡状况有所改善。1935 年起所有经济指标都稳步上升,失业人数大幅度下降。新政大 多是应急措施,没有完整的理论依据,但体现了凯恩斯主义国家干预经济的思潮,反映了现 代私人垄断资本主义向国家垄断资本主义过渡这一总的趋向,对美国以后历届政府的政策影 响很大。

多恩布什宏观经济学第十版课后习题答案02

多恩布什宏观经济学第十版课后习题答案02CHAPTER 2Solutions to Problems in the Textbook:Conceptual Problems:1. Government transfer payments (TR) do not arise out of anyproduction activity and are thus not counted in the value of GDP. If the government hired the people who currently receive transfer payments, then their wages would be counted as part of government purchases (G), which is counted in GDP. Therefore GDP would rise.2.a. If the firm buys a car for an executive's use, the purchase counts asinvestment (I). But if the firm pays the executive a higher salary and she then buys a car, the purchase is counted as consumption (C).2.b. The services that a homemaker provides are not counted in GDP(regardless of their value). However, if an individual officially hires his or her spouse to perform household duties at a certain wage rate, then the wages earned will be counted in GDP and GDP will increase.2.c. If you buy a German car, consumption (C) will increase but netexports (NX = X - Q) will decrease. Overall GDP will increase by the value added at the foreign car dealership, since the import price is likely to be less than the sales price. If you buy an American car, consumption and thus GDP will increase. (Note: If the car you buy comes out of the car dealer's inventory, then the increase in C will bepartially offset be a decline in I, and GDP will again only increase by the value added.)3. GDP is the market value of all final goods and services currentlyproduced within the country. (The U.S. GDP includes the value of the Hondas produced by a Japanese-owned assembly plant that is located in the U.S., but it does not include the value of Nike shoes that are produced by an American-owned shoe factory located in Malaysia.) GNP is the market value of all final goods and services currently produced using assets owned by domestic residents. (Here the value of the Hondas produced by a Japanese-owned Honda plant is not counted but the value of the Nikes by the American-owned shoe plant is.) Neither is necessarily a better measure of the output of a nation.The actual value of the GDP and GNP for the U.S. is fairly close.4. The NDP (net domestic product) is defined as GDP minusdepreciation. Depreciation measures the value of the capital that wears out during the production process and has to be replaced. Therefore NDP comes closer to measuring the net amount of goods produced in this country. If this is what you want to measure, then NDP should be used.5. Increases in real GDP do not necessarily mean increases in welfare.For example, if the population of a country increases by more than real GDP, then the population of the country is on average worse off.Also some increases in output come from welfare reducing events. For example, increased pollution may cause more lung cancer, and the treatment of the lung cancer will contribute toGDP. Similarly, an increase in crime may lead to overtime work for police officers, whose increased salary will increase GDP. But the welfare of the people in the country may not have increased in either case. On the other hand, GDP does not always accurately measure quality improvements in goods or services (faster computers or improved health care) that improve people's welfare.6. The CPI (consumer price index) and the PPI (producer price index)are both measured by looking at a certain market basket. The CPI's basket contains mostly finished goods and services that consumers tend to buy regularly in their daily lives. The PP I’s basket contains raw materials and semi-finished goods, that is, it measures costs to the producer of a product and its first user. The CPI is a concurrent economic indicator, whereas the PPI is a leading economic indicator.7. T he GDP-deflator is a price index that covers the average priceincrease of all final goods and services currently produced within an economy. It is defined as the ratio of current nominal GDP to current real GDP. Nominal GDP is measured in current dollars, while real GDP is measured in so-called base-year dollars. Even though early estimates of the GDP-deflator tend to be unreliable, the GDP-deflator can be a more useful price index than the CPI or PPI (both of which are fixed market baskets). This is true for two reasons: first it measures a much wider cross-section of goods and services; second, a fixed market basket cannot account for people substituting away from goods whose relative prices have changed, while the GDP-deflator, which includes all goods and services produced within the country, can.8. If nominal GDP has suddenly doubled, it is most likely due to anincrease in the average price level. Therefore, the first thing you would want to check is by how much the GDP-deflator has changed, to calculate by how much real output (GDP) has changed. If nominal GDP and the GDP-deflator have both doubled, then real GDP should be the same.9. Assume the loan you made yields you an annual nominal return of 7%.If the rate of inflation is 4%, then your rate of return in real terms isonly 3%. If, on the other hand, if inflation rate is 10%, then you will actually get a negative real rate of return, that is, you will lose 3% of your purchasing power. One way to protect yourself against such a loss of purchasing power is to adjust the interest rate for inflation, that is, to index the loan. In other words, you can require that, in addition to the specified interest rate of the loan of, let’s say, 3%, the borrower also has to pay an inflation premium equal to the percentage change in the CPI. In this case, a real rate of return of 3% would be guaranteed.Technical Problems:1. The text calculates the change in real GDP in 1992 prices in thefollowing way:[RGDP01- RGDP92]/RGDP92= [3.50 - 1.50]/1.50 = 1.33 = 133%.To calculate the change in real GDP in 2001 prices, we first have to calculate the GDP of 1992 in 2001 prices. Thus we take the quantities consumed in 1992 and multiply them by the prices of 2001, as follows:Beer 1 at $2.00 = $2.00Skittles 1 at $0.75 = $0.75_______________________________Total $2.75The change in real GDP can now be calculated as[6.25 - 2.75]/2.75 = 1.27 = 127%.We can see that the growth rate of real GDP calculated this way is roughly the same as the growth rate calculated above.2.a. The relationship between private domestic saving, investment, thebudget deficit and net exports is shown by the following identity:S - I ≡ (G + TR - TA) + NX.Therefore, if we assume that transfer payments (TR) remain constant, then an increase in taxes (TA) has to be offset either by an increase in government purchases (G), a decrease in net exports (NX), or a decrease in the difference between saving (S) and investment (I).2.b. From the equation YD ≡C + S it follows that an increase indisposable income (YD) will be reflected in an increase in consumption (C), saving (S), or both.2.c. From the equation YD ≡ C + S it follows that when eitherconsumption (C) or saving (S) increases, disposable income (YD) must increase as well.3.a. Since depreciation D = I g - I n = 800 - 200 = 600 ==>NDP = GDP - D = 6,000 - 600 = 5,4003.b. From GDP = C + I + G + NX ==> NX = GDP - C - I - G ==>NX = 6,000 - 4,000 - 800 - 1,100 = 100.3.c. BS = TA - G - TR ==> (TA - TR) = BS + G ==> (TA - TR) = 30 +1,100 = 1,1303.d. YD = Y - (TA - TR) = 5,400 - 1,130 = 4,2703.e. S = YD - C = 4,270 - 4,000 = 2704.a. S = YD - C = 5,100 - 3,800 = 1,3004.b. From S - I = (G + TR - TA) + NX ==> I = S - (G + TR - TA) - NX= 1,300 - 200 - (-100) = 1,200.4.c. From Y = C + I + G + NX ==> G = Y - C - I - NX ==>G = 6,000 - 3,800 - 1,200 - (-100) = 1,100.Also: YD = Y - TA + TR ==> TA - TR = Y - YD = 6,000 - 5,100 ==> TA - TR = 900From BS = TA - TR - G ==> G = (TA - TR) - BS = 900 - (-200) ==> G = 1,1005. According to Equation (2) in the text, the value of total output (inbillions of dollars) can be calculated as: Y = labor payments + capital payments + profits = $6 + $2 + $0 = $86.a. Since nominal GDP is defined as the market value of all final goodsand services currently produced in this country, we can only measure the value of the final product (bread), and therefore we get $2 million (since 1 million loaves are sold at $2 each).6.b. An alternative way of measuring total GDP would be to calculate allthe value added at each step of production. The total value of the ingredients used by the bakeries can be calculated as: 1,200,000 pounds of flour ($1 per pound) = 1,200,000100,000 pounds of yeast ($1 per pound) = 100,000100,000 pounds of sugar ($1 per pound) = 100,000100,000 pounds of salt ($1 per pound) = 100,000________________________________________________________ __= 1,500,000Since $2,000,000 worth of bread is sold, the total value added at the bakeries is $500,000.7. If the CPI increases from 2.1 to 2.3, the rate of inflation can becalculated in the following way:rate of inflation = (2.3 - 2.1)/2.1 = 0.095 = 9.5%The CPI often overstates inflation, since it is calculated by using afixed market basket of goods and services. But the fixed weights in the CPI's market basket cannot capture the tendency of consumers to substitute away from goods whose relative prices have increased.Therefore, the CPI will overstate the increase in consumers' expenditures.8.The real interest rate (r) is defined as the nominal interest rate (i)minus the rate of infla tion (π). Therefore the nominal interest rate is the real interest rate plus the rate of inflation, ori = r + π = 3% + 4% = 7%.。

宏观经济学第十版第二章课后习题完美精简中文版

多恩布什宏观经济学第十版第二章课后习题答案完美中文精简版概念题1,他们作为政府雇员支取TR美元,但是不做任何工作,实际上就是加大了政府支出,GDP会增长。

2,a..厂商为经理买车应该看成投资,经理自己购买轿车则是消费。

b.雇佣配偶的行为是消费,计算GDP时会被计入;而无偿要求她担任此工作则是无形中忽略掉了消费环节,不计入GDP。

c.买美国轿车会使GDP增长,买德国车也会使GDP增加,但是会减少净出口。

3,GDP与GNP的区别在于:GNP是指一个国家(或地区)所有国民在一定时期内新生产的产品和服务价值的总和。

GNP是按国民原则核算的,只要是本国(或地区)居民,无论是否在本国境内(或地区内)居住,其生产和经营活动新创造的增加值都应该计算在内。

GDP是指一个国家(或地区)在一定时期内所有常住单位生产经营活动的全部最终成果。

GDP是按国土原则核算的生产经营的最终成果。

使用GDP计量产出更好,GDP的精确度高。

4,NDP是国内生产净值,NDP是从国内生产总值GDP中扣除资本折旧得到的。

如果用于计算产量,它比GDP更接近产品价值,但是折旧率是人来计算,所以会存在一定误差,在计算数值非常大时用GDP计算比较好。

5,GDP的增加不代表福利的增加,比如说GDP增加,同时人口也增长了,一平均,每个人的GDP没有变化。

我觉得最大的问题是人口问题,人口的增长和减少对人均GDP有影响。

6,CPI居民消费价格指数,是反映与居民生活有关的商品及劳务价格统计出来的物价变动指标,通常作为观察通货膨胀水平的重要指标。

PPI是衡量企业购买的一篮子物品和劳务的总费用。

从消费者的立场计算时我会选择用CPI计算。

7,GDP紧缩指数=(名义GDP/实际GDP) *100区别答不出。

8,物价是否翻了一倍,以及GDP紧缩指数有没有变化。

9,伤心。

以实际利率说明的,将要支付更少利息。

技术题12,b.收入增加意味着可支配收入增加,那么此时就能够购买更多的产品。

多恩布什《宏观经济学》(第10版)【教材精讲+考研真题解析】讲义与课程【39小时】

目 录第一部分 开篇导读及本书点评[1小时高清视频讲解]一、开篇导读二、本书点评及总结(结束语)第二部分 辅导讲义[31小时高清视频讲解]第1篇 导论与国民收入核算[视频讲解]第1章 导 论1.1 本章要点1.2 重难点解读第2章 国民收入核算2.1 本章要点2.2 重难点解读第2篇 增长、总供给与总需求,以及政策[视频讲解]第3章 增长与积累3.1 本章要点3.2 重难点解读第4章 增长与政策4.1 本章要点4.2 重难点解读第5章 总供给与总需求5.1 本章要点5.2 重难点解读第6章 总供给:工资、价格与失业6.1 本章要点6.2 重难点解读第7章 通货膨胀与失业的解剖7.1 本章要点7.2 重难点解读第8章 政策预览8.1 本章要点8.2 重难点解读第3篇 首要的几个模型[视频讲解]第9章 收入与支出9.1 本章要点9.2 重难点解读第10章 货币、利息与收入10.1 本章要点10.2 重难点解读第11章 货币政策与财政政策11.1 本章要点11.2 重难点解读第12章 国际联系12.1 本章要点12.2 重难点解读第4篇 行为的基础[视频讲解]第13章 消费与储蓄13.1 本章要点13.2 重难点解读第14章 投资支出14.1 本章要点14.2 重难点解读第15章 货币需求15.1 本章要点15.2 重难点解读第16章 联邦储备、货币与信用16.1 本章要点16.2 重难点解读第17章 政 策17.1 本章要点17.2 重难点解读第18章 金融市场与资产价格18.1 本章要点18.2 重难点解读第5篇 重大事件、国际调整和前沿课题[视频讲解]第19章 重大事件:萧条经济学、恶性通货膨胀和赤字19.1 本章要点19.2 重难点解读第20章 国际调整与相互依存20.1 本章要点20.2 重难点解读第21章 前沿课题21.1 本章要点21.2 重难点解读第三部分 名校考研真题名师精讲及点评[8小时高清视频讲解]一、名词解释二、简答题三、计算题四、论述题第一部分 开篇导读及本书点评[1小时高清视频讲解]一、开篇导读[0.5小时高清视频讲解]主讲老师:郑炳一、教材及教辅、课程、题库简介► 教材:多恩布什《宏观经济学》(第10版)(多恩布什、费希尔、斯塔兹著,王志伟译,中国人民大学出版社)► 教辅(两本,文库考研网主编,中国石化出版社出版)√网授精讲班【教材精讲+考研真题串讲】精讲教材章节内容,穿插经典考研真题,分析各章考点、重点和难点。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

宏观经济学第二章概念题1.如果政府雇用失业工人,他们曾领取TR美元的失业救济金,现在他们作为政府雇员支取TR美元,不做任何工作,GDP会发生什么情况?请解释。

答:国内生产总值指一个国家(地区)领土范围,本国(地区)居民和外国居民在一定时期内所生产和提供的最终使用的产品和劳务的价值。

用支出法计算的国内生产总值等于消费C、投资I、政府支出G和净出口NX之和。

从支出法核算角度看:C、I、NX保持不变,由于转移支付TR美元变成了政府对劳务的购买即政府支出增加,使得G增加了TR美元,GDP会由于G的增加而增加。

2.GDP和GNP有什么区别?用于计算收入/产量是否一个比另一个更好呢?为什么?答:(1)GNP和GDP的区别GNP指在一定时期内一国或地区的国民所拥有的生产要素所生产的全部最终产品(物品和劳务)的市场价值的总和。

它是本国国民生产的最终产品市场价值的总和,是一个国民概念,即无论劳动力和其他生产要素处于国内还是国外,只要本国国民生产的产品和劳务的价值都记入国民生产总值。

GDP指一定时期内一国或地区所拥有的生产要素所生产的全部最终产品(物品和劳务)的市场价值的总和。

它是一国范围内生产的最终产品,是一个地域概念。

两者的区别:在经济封闭的国家或地区,国民生产总值等于国内生产总值;在经济开放的国家或地区,国民生产总值等于国内生产总值加上国外净要素收入。

两者的关系可以表示为:GNP=GDP+[本国生产要素在其他国家获得的收入(投资利润、劳务收入)-外国生产要素从本国获得的收入]。

(2)使用GDP比使用GNP用于计量产出会更好一些,原因如下:1)从精确度角度看,GDP的精确度高;2)GDP衡量综合国力时,比GNP好;3)相对于GNP而言,GDP是对经济中就业潜力的一个较好的衡量指标。

由于美国经济中GDP和GNP的差异非常小,所以在分析美国经济时,使用这两种的任何一个指标,造成的差异都不会大。

但对于其他有些国家的经济来说明,这个差别是相当大的,因此,使用GDP作为衡量指标会更好。

但是,在衡量某地区居民生活水平时GNP更好一点。

3.CPI和PPI都计量价格水平,它们有什么区别,什么时候你会选择其中一个,而不选择另一个?答:(1)CPI与PPI的区别消费者价格指数(CPI),是反映消费品(包括劳务)价格水平变动状况的一种价格指数,代表城市消费者购买一篮子固定的商品和服务的费用。

生产者价格指数(PPI)指建立在生产中所使用的商品的市场篮子基础上的价格指数,计量既定的一篮子商品的成本。

PPI与CPI的区别在于:1)他们所包括的范围不同:CPI主要包括日用消费品;PPI包括原料和半成品。

2)PPI被设计为对销售过程中开始阶段的价格的度量,而CPI衡量的是城市居民实际支付的价格——也即零售价格。

(2)两者选择其一的情形当关注的是消费品价格波动或通货膨胀问题时,将使用CPI 来度量;当关注的是经济周期问题或市场价格波动预期时,应该使用PPI 来度量。

这是因为PPI 是一种相对可变的价格指数,并且是经常发出一般价格水平或CPI 变化信号的价格指数,有时在它们出现之前就会发出信号。

有鉴于此,PPI 特别是其某些子指数,如“敏感材料”指数作为经济周期的指标,决策者会给与密切的关注。

4. GDP 消胀指数指的是什么?它与消费价格指数和生产价格指数有何区别?在什么情况下,它计量价格比CPI 和PPI 更有用?答:(1)GDP 消胀指数的含义GDP 消胀指数是一个关于通货膨胀的衡量指标,它是给定年份的名义GDP 与该年真实GDP 的比率。

消胀指数计量基期年与现期年度间发生的价格变动。

GDP 消胀指数以经济活动中生产的全部商品和服务为计算基础,所以它是一个经常用来计量通货膨胀的具有广泛基础的物价指数。

(2)GDP 消胀指数与消费者价格指数和生产者价格指数的区别它与CPI 和PPI 存在三个方面的区别:1)消胀指数远比CPI 和PPI 计量广泛的多的商品价格;2)CPI 计量的是一篮子给定的商品,商品无变化,消胀指数的商品年年有所不同;有可能某些商品和服务消费者已经不消费而是有其他代替品,当CPI 和PPI 却还要计量,反映不出变化,而GDP 消胀指数则能反映。

3)CPI 和PPI 直接包括进口价值,而消胀指数只包括在国内生产的产品价格。

(3)GDP 消胀指数计量价格比CPI 和PPI 更有用的情景当需要考察国内生产总值(增加值)的实际水平(如实际总量规模等),以及需要核算国内生产总值(增加值)的实际发展水平(如实际发展速度、实际增长速度或发展指数等),或者需要考察一个国家(或地区)物价变动的总水平时,GDP 消胀指数计量价格比CPI 和PPI 更有用。

第三章 概念题1.在标准生产函数Y=F (K ,N )的范围内,K 代表实物资本,N 代表非熟练劳动,如果将索洛剩余(△A/A )解释为“技术进步”,我们将犯错误。

除了技术进步之外,对剩余还可以做什么解释呢?你将如何扩展模型来消除这个问题?答:如果只将索洛剩余解释为“技术进步”,将会忽略人力资本(即熟练劳动)对产出的重要影响。

此时的索洛剩余还应包括人力资本(H )对产出增长率的重要影响。

为了消除这种影响可以把人力资本(H )加入到生产函数中。

则生产函数就变为:Y=F(K,N,H)=A c b a H K N ⨯⨯⨯,其中a+b+c=1.此时产出增长率可以用下面的式子表达:△Y/Y=△A/A+a ⨯(△N/N)+b ⨯(△K/K)+c ⨯(△H/H)此时,索洛剩余不仅包括技术进步所带来的产出贡献,还包括了人力资本因素所带来的产出贡献。

PS :此题还可以从资源配置的改进,自然资源等方面进行论述。

2.决定人均产出稳态增长率的因素有哪些?还有什么其它因素会影响短期产出增长率呢? 答:(1)长期人口增长率n=(△N/N)决定了人均产出稳态增长率。

新古典增长理论虽然假定劳动力按一个不变的比率n 增长,但当把n 作为参数时,就可以说明人口增长对产量增长的影响。

如下图所示。

图中,经济最初位于A 点的稳态均衡。

现在假定人口增长率从n 增加到n ’,则图中的(n+d )k 线,这时新的稳态均衡点为A ’点。

比较A ’点与A 点,可知,人口增长率的增加降低了人均资本的稳态水平(从原来的ka 减少到k ’),进而降低了人均产量的稳态水平。

这是从新古典增长理论得出的又一重要理论。

西方学者进一步指出,因为人口增长率上升产生的人均产量下降正是许多发展中国家面临的问题。

两个有着相同储蓄率的国家仅仅由于其中一个国家比另一个国家的人口增长率高,就可以有非常不同的人均收入水平。

对人口增长进行比较静态分析的另一个重要结论是,人口增长率的上升增加了人均产出的稳态增长率,而储蓄率的增加不能影响到稳态增长率,但却是能提高收入的稳态水平。

也就是说储蓄率的增加只有水平效应,绝没有增长效应。

在短期内,储蓄率、技术进步和折旧率会对短期产出增长率产生影响。

储蓄率的上升和技术进步会提高短期产出增长率,而折旧率的上升会引起短期产出增长率的下降。

第四章 概念题1.什么时内生增长?内生增长模型与第三章中介绍的新古典增长模型有何不同?答:(1)内生增长理论的内容内生增长理论指用规模报酬递增和内生技术进步说明一国经济增长和各国经济增长率差异的理论。

内生增长认为通过政策影响一国的储蓄率和与投资对应成比例的GDP 从而达到经济增长。

其重要特征就是试图使增长率内生化,基本途径就是:1)将技术进步率内生化;2)如果可以被积累的生产要素有固定报酬,那么可以通过某种方式使稳态增长率被要素的积累所影响。

(2)内生增长模型与新古典增长模型的不同内生增长模型与新古典增长模型的不同主要有以下几点:1)新古典增长模型认为资本边际收益递减,而内生增长模型不存在资本边际收益递减的问题,认为资本是保持稳定上升的。

2)内生增长模型认为经济的长期增长依赖于储蓄率和其他因素,而不仅仅依赖于劳动力的增长率,其重要特征就是试图使增长率内生化,有更高储蓄率的国家有更高的长期增长并且政府可以通过执行影响储蓄率的政策来影响长期增长。

而新古典增长模型认为只有通过技术进步来达到长期的经济增长并且储蓄率的变化只能起短期作用。

3)内生增长理论认为,不是所有的投资都会有技术进步的,只有投资人力、研发时,资本边际收益才不是递减的。

内生增长理论所强调的规模收益递增、外溢效应、专业化人力资本积累等,是对传统经济增长理论的重大突破。

它不仅较好的解释了一些经济增长事实,而且其丰富的政策内涵对各国经济长期增长政策的制定和运用也有一定的参考价值。

但不可否认,内生增长理论在理论框架、生产函数、分析方法等方面仍存在一些缺陷与不足,有待于进一步完善和发展。

2.内生增长理论能解释增长率的国际差异吗?如果能,如何解释?如果不能,它有助于解释k k' (n+d)k什么?答:内生增长理论不能解释增长率的国际差异。

原因如下:(1)内生增长理论指用规模收益递增和内生技术进步来说明一国长期经济增长和各国增长率差异而展开的研究成果的总称。

其中技术的进步是很容易模仿的,后进国家可以模仿,因此,不能该理论不能用于所有的国家,但发达国家之间的比较是可以的。

(2)内生增长理论认为稳态的产出增长率受累计的产品要素的速率的影响。

储蓄率的增长会提高资本存量积累的速度,这将会提高产出增长率。

这种提法对于解释拥有一流技术、高度发展的国家的增长率非常重要,然而它不能解释更加贫穷的国家间经济增长率的不同。

对于这些国家有条件的趋同看起来适合。

3.假定一个社会能对两类资本进行投资——实物资本与人力资本。

它对投资分配的选择如何影响其长期增长潜力?答:(1)实物资本与人力资本的区别人力资本是相对于实物资本而言的一个概念,是通过花费一定的资源而投资于人自身的、最终体现为凝结于人自身的一定技能、体能、知识和认识水平的总和。

(2)投资分配的选择对长期增长潜力的影响进行实物资本投资将会在短期产生更高的资本存量和产出水平,但是对长期的经济增长是不利的,因为边际收益会递减,除非有明显的外部资本回报。

进行人力资本投资是一个比较好的战略,人力资本投资是提高人力资本存量的根本途径,它将产生高的回报并且能导致长期的经济增长的提高。

因此,从长期看,投资人力可以实现科学发展观。

第五章概念题1.凯恩斯总供给曲线与古典总供给曲线有何不同?是否其中一种的阐释比另一种更贴切?请作出解释,注意要指明你的回答所适用的时间范围。

答:(1)凯恩斯总供给曲线与古典总供给曲线的不同凯恩斯总供给曲线又称为短期总供给曲线,是一条水平线。

古典总供给曲线又称为长期总供给曲线,是一条垂直线。

凯恩斯和古典总供给曲线的区别主要表现在:1)短期总供给曲线和长期总供给曲线的差别。