成本与管理会计亨格瑞第13版英文版CA07

《成本与管理会计》习题及答案 costacctg13_SolPPT_ch12

Charles T. Horngren Srikant M. Datar George Foster Madhav Rajan Christopher Ittner

Cost Accounting A Managerial Emphasis thirteenth edition

This presentation includes: Exercises 12-17, 12-18, 12-22Biblioteka Exercise 12-17

Relevant-cost approach to short-run pricing decisions The San Carlos Company is an electronics business with eight product lines. Income data for one of the products (XT-107) for June 2009 are:

Sales, 3,000 units $75 $225,000 Variable costs: Direct materials, 3,000 units $35 105,000 Direct manufacturing labor, 3,000 units $10 30,000 Variable manufacturing overhead, 3,000 units $6 18,000 Other variable costs, 3,000 units $5 15,000 Sales commission 8,000 Total variable costs 176,000 Contribution margin $ 49,000 If the special order is accepted, operating income would be $1,000,000 + $49,000 = $1,049,000 Note that the variable costs, except for commissions, are affected by production volume, not sales dollars.

成本与管理会计-亨格瑞-第13版-英文版-CA04

2019/9/7

10

Costing Systems,conts.

Management uses two basic types of costing systems to assign costs to products or services. p79

A process-costing system is used by a company that makes a large number of identical products. Costs are accumulated by department and divided by the number of units produced to determine the cost per unit.

It is an average cost of all units produced during the period. The cost object is masses of similar units of a product or service.

2019/9/7

11

Costing Systems,conts. P79

The indirect costs of a cost object are costs that cannot be traced to the cost object in a cost-effective manner and are allocated to the cost object.

The direct costs of a cost object are costs that are related to the cost object and can be traced to the cost object in an economically feasible manner.

成本与管理会计-亨格瑞-第13版-英文版-CA04

Batch-production operations

Costs cannot be directly traced to each unit of product.

Used for production of small, identical, low cost items.

The indirect costs of a cost object are costs that cannot be traced to the cost object in a cost-effective manner and are allocated to the cost object.

Financial Accounting

Product costs are used to value

inventory and to compute cost of

goods sold.

2019/10/16

Managerial Accounting and Cost Management

Product costs are used for planning, control, directing, and management decision

A job-costing system, or a job-order system, is used by a company that makes a distinct product or service called a job.

The product or service is often a single unit. The job is frequently the cost object. Costs are accumulated separately for each job or service.

《成本与管理会计》习题及答案 costacctg13_SolPPT_ch10

Contract 1: y = $50 Contract 2: y = $30 + $0.20X Contract 3: y = $1X X is the number of miles traveled in the day.

2. Express each contract as a linear cost function of the form y= a+bX.

Identifying variable-, fixed-, and mixed-cost functions The Pacific Corporation operates car rental agencies at more than 20 airports. Customers can choose from one of three contracts for car rentals of one day or less: Contract 1: $50 for the day Contract 2: $30 for the day plus $0.20 per mile traveled Contract 3: $1 per mile traveled

3. City water bill computed as follows:

First 1,000,000 gallons or less $1,000 flat fee Next 10,000 gallons $0.003 per gallon used Next 10,000 gallons $0.006 per gallon used Next 10,000 gallons $0.009 per gallon used and so on and so on The gallons of water used vary proportionately with the quantity of production output.

成本与管理会计亨格瑞第13版英文版CA

The development of management accounting emerged in the 1920s, when the focus shifted from mere cost measurement to cost analysis and control, emphasizing the role of accounting in decision-making and management control.

It involves the identification, measurement, and allocation of costs, as well as the preparation of cost reports and other management information to assist management in making decisions about product pricing, production, and resource allocation.

Direct and indirect costs

Activity Identification

The first step in the activity-based costing method involves identifying the various activities that take place within the organization.

Cost allocation and collection

Cost Allocation

Allocating costs to specific departments, projects, or products is essential for accurate financial reporting and decision-making.

成本与管理会计-亨格瑞-第13版-英文版-CA08_图文_图文

15

Variable overhead spending variance

=($29/machine hour-$30 /machine hour) ×4 500 machine-hours =(-1machine hour) ×4 500 machine-hours =$4 500F

=1 728 000/57 600=30/hour

Budgeted variable overhead cost rate per output unit

5

=0.4hour/unit×30=12/jacket

Variable overhead cost variances(P208 )

6

Flexible-budget analysis

The variable overhead efficiency variance measures the efficiency with which the costallocation base is used.

11

Variable Overhead Variances

Actual Variable Overhead Incurred

Step 3:

Identify the variable overhead costs associated with each costallocation base.

Step 4:

Compute the rate per unit of each cost-allocation base used to allocate variable overhead costs to output produced.

成本与管理会计-亨格瑞-第13版-英文版-CA08

Flexible Budget for Variable Overhead at Actual Hours

AH × SVR

Flexible Budget for Variable Overhead at

Standard Hours

SH × SVR

Spending Variance

Efficiency Variance

Workers were less skilled than expected in using machines?

Webb spend more on variable overhead costs , such as maintenance?

8

2019/10/7

Variable Overhead Variances

=$15 000U

14

2019/10/7

4500 HOURS VS 4000 HOURS

Possible causes for exceeding budget

Workers were less skilled than expected in using machines

Production scheduler inefficiently scheduled jobs ,resulting in more machinehours used than budgeted

overhead cost

Efficiency

cost-alocation base alocation based alowed

per unit of

Variance

used for actual output for actual output

《成本与管理会计》教师手册 costacctg13_im_06

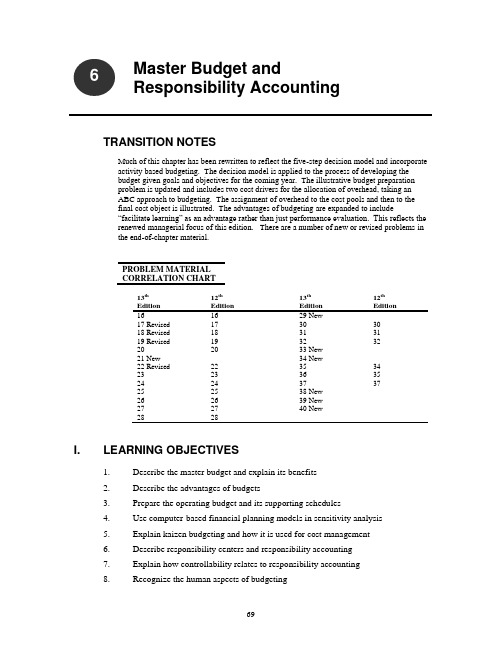

Master Budget andResponsibility AccountingTRANSITION NOTESMuch of this chapter has been rewritten to reflect the five-step decision model and incorporate activity based budgeting. The decision model is applied to the process of developing thebudget given goals and objectives for the coming year. The illustrative budget preparation problem is updated and includes two cost drivers for the allocation of overhead, taking an ABC approach to budgeting. The assignment of overhead to the cost pools and then to the final cost object is illustrated. The advantages of budgeting are expanded to include“facilitate learning” as an advantage rather than just performance evaluation. This reflects the renewed managerial focus of this edition. There are a number of new or revised problems in the end-of-chapter material.PROBLEM MATERIALCORRELATION CHART13th Edition 12thEdition13thEdition12thEdition161629 New17 Revised17 30 3018 Revised18 31 3119 Revised19 32 32202033 New21 New34 New22 Revised22 35 34232336 35242437 37252538 New262639 New272740 New2828I. LEARNING OBJECTIVES1.Describe the master budget and explain its benefits2.Describe the advantages of budgets3.Prepare the operating budget and its supporting schedulese computer-based financial planning models in sensitivity analysis5.Explain kaizen budgeting and how it is used for cost management6.Describe responsibility centers and responsibility accounting7.Explain how controllability relates to responsibility accounting8.Recognize the human aspects of budgeting6II. CHAPTER SYNOPSISThis chapter introduces the topic of budgets. Budgets are a primary financial planningtool used by businesses and other organizations. The chapter explains how businesses use and prepare budgets as part of the management process. The concept of responsibilitycenters and responsibility accounting is also discussed and are related to the concept ofcontrollability. In addition, the human factor in budgeting is covered. The cash budget is presented in the Appendix.III. POINTS OF EMPHASIS1.Students need to understand the importance of budgeting, even if the budgettargets are not achieved. Emphasize the concept that a budget is the financialexpression of the goals for the upcoming period. An effective budget requires awell-though-out strategy.2.Observe that budgets are more than just a planning tool, but help achievecoordination and communication, are useful as a framework for evaluatingperformance, and can be used to motivate employees.3.Make sure the students understand the meaning of such budgetary tools asactivity-based budgeting, sensitivity analysis, and kaizen budgeting.4.In covering responsibility accounting, be aware that students often struggle withthe distinction between a profit center and an investment center. Make sure theyunderstand when each is used, and the differences in evaluation for each type.Emphasize the concept of controllability.5.As time allows cover the cash budget. This is an important budget and it is onethe students can relate to in their own lives.IV. CHAPTER OUTLINE1Describe the master budget. . . The master budget is the initial budgetprepared before the start of a periodand explain its benefits. . . benefits include planning, coordination, andcontrol1.1 A budget is the quantitative expression of a management’s plan for the future. Italso is an aid to coordinating actions that need to be taken to implement the plan.TEACHING POINT. A quantitative expression of management’splan for the future can best be seen in governmentalbudgeting. When the governor of a state, for example,presents his budget to the legislature, it includes what thatgovernor wants to emphasize during his term. If he wants tobe known as an education governor, there will be a largeappropriation for education.1.2Effective budgeting integrates the company’s strategy into the budget process.Strategy specifies how an organization matches its own capabilities with theopportunities in the marketplace to accomplish its objectives.1.3The path to effective strategies include asking questions such as:•What are our objectives?•How do we create value for the customer while distinguishing ourselves from our competitors?•Are the markets for our products local, regional, national, or global?What are our market trends? How are we affected by the economy, ourindustry, and our competitors?•What organizational and financial structures serve us best?•What are the risks and opportunities of alternative strategies, and what are our contingency plans if our preferred plan fails?1.4Well-managed companies usually follow an annual budget cycle including thefollowing steps:•Plan the performance of the company as a whole and of the subunits within the company.•Senior managers communicate to subordinates a set of expectationsagainst which performance will be measured.•Management accountants investigate variations from plans, andcorrective action may be taken.•Managerial accountants and managers take into account market feedback, changed conditions, and their own experiences in making plans for theupcoming period.1.5The master budget expresses management’s operating and financial plans for aspecified period (usually a year). The master budget is actually a series ofbudgets including a set of budgeted financial statements (sometimes called proforma statements).TEACHING POINT. Emphasize the components of the masterbudget, including the order that those components areprepared. For example, it would be fruitless to assign someoneto prepare a production budget until that person knows thesales plans for the upcoming period.(Exhibit 6-1 illustrates the link among strategy, planning, andbudgets.)Refer to Quiz Questions 1 and 2 Questions 6-1 and 6-22Describe the advantages of budgets. . . advantages include coordination,communication, performance evaluation andmanagerial motivation2.1 Budgets are an integral part of management control systems. There are at leastthree advantages of budgeting.•Promote coordination and communication.o Coordination is the meshing and balancing of all aspects ofproduction in a company in the best way for the company tomeet its objectives.o Communication is making sure those goals are understood by allemployees.•Budgets serve as a framework for judging performance and facilitatinglearning. Budgeting helps overcome two limitations of using pastperformance.o Past results often incorporate past mistakes and substandardperformance.o Future conditions can be expected to differ from the past,budgets account for these changed conditions.•Budgets can be used to motivate managers and other employees. Studieshave shown that challenging budgets improve employee performance.2.2 Despite the fact that budgets are advantageous, there are a number of challengesin properly administering budgets.•It is a time consuming process that involves all levels of management.TEACHING POINT. Gone are the days (if they ever existed)when the accountant was sequestered in his office slaving overthe development of a budget, only to emerge once it wascomplete. Budgets today involve employees throughout thecompany. The accountant is a budget coordinator, not abudget preparer—but this image still lives on.•Management at all levels should understand and support the budget. Iftop management support is lacking, the budget effort will be lacklusterand halfhearted.•Budgets should not be administered rigidly. Changing conditions maycall for changes in plans.TEACHING POINT. The misuse of budgets has givenbudgeting a bad name. Budgeting is not a “four letter word,”nor is it a hammer to hold over the employee’s head as anexcuse to deny funding requests. At one company the primaryqualification the VP for finance seemed to have was his abilityto say “No.” One manager of a department was often told tocut her budget, but she never saw her budget or knew what orhow much she was budgeted.2.3 Budgets typically cover a set time period including a full business cycle.Normally an annual budget would be prepared, but broken down into subperiodssuch as a month or quarter.2.4 Some companies utilize rolling budgets or continuous budgeting. This type ofbudget is created by continually adding a month or quarter to the existing budget,so that the company always has a 12-month budget in place.Refer to Quiz Question 33Prepare the operating budget. . . the budgeted income statementand its supporting schedules. . . such as cost of goods sold andnonmanufacturing costsThe process of preparing the budget incorporates the five-step decision process that was introduced in Chapter 1. (If necessary, review these steps with the students).TEACHING POINT. As each budget is covered, it is useful todemonstrate the preparation of each budget. Problem 6-28 isa useful problem for this purpose.(Exhibit 6-2 provides an overview of the budgeting process.)3.1The process of preparing the budget incorporates the five-step decision processthat was introduced in Chapter 1. (If necessary, review these steps with thestudents.) The budgeting process includes both operating budgets and financial budgets.3.2Operating budgets include budgets reflecting the planned operational aspects ofthe business, including revenues, production, manufacturing costs, and otherexpenses for the period. It culminates in a budgeted income statement.3.3 Financial budgets consist of a capital expenditures budget, a cash budget, abudgeted balance sheet, and a budgeted statement of cash flows.3.4 Although details differ among companies, the following basic steps are commonfor developing the operating budget for a manufacturing company.Step 1:The first step budget to be prepared is the revenues budget.Although this budget looks simple, the company should put agreat amount of time into consideration of the projected salesnumbers.TEACHING POINT. Cover the various approaches that can beutilized in arriving at the numbers for the revenues budget.Emphasize the economy, competitors, company plans for newor discontinuing products as relevant factors.Step 2:Based on the numbers included in the revenues budget, thecompany can then prepare the production budget. Included inthis budget are projections about inventory levels. This budget isexpressed only in units, not dollars.Step 3:From the production budget, the company can then move to thedirect materials usage and direct materials purchasesbudgets. These are often prepared as one document. In additionto including projections about inventory levels for directmaterials, management must also make predictions about directmaterial prices.Step 4:The direct manufacturing labor budget is prepared next.Labor standards—the time allowed per unit of output—are usedto calculate direct labor costs. Since labor is not inventoried, theprocess for this budget is somewhat simpler than prior budgets.Step 5:The manufacturing overhead cost budget comes next. Itincludes a budget for each item of manufacturing overhead. Eventhough the budget looks simple, keep in mind that each line itemin this budget is also its own budget. From this budget, managerscan determine a predetermined overhead application rate.•The used of activity-based cost drivers in preparing themanufacturing overhead cost budget gives rise toactivity-based budgeting, or a focus on the activitiesnecessary to produce and sell products and services.Step 6:The next budget to be prepared is the ending inventories budget.This is simply a listing of the budgeted ending inventories inmaterials and finished goods. Units and dollar amounts areincluded. Work-in-process inventory is not budgeted.Step 7:The cost of goods sold budget is then prepared. Most of theinformation for this budget has already been generated. It issimply a matter of pulling the numbers already available into acost of goods sold format for this budget.Step 8:The nonmanufacturing cost budget closely resembles themanufacturing overhead cost budget in form. It includes thebudgeted amount for all nonmanufacturing costs the companyexpects to incur for the period. As with the overhead budget,each line item represents its own budget and follows afixed/variable separation.Step 9:The budgeted, or pro forma,income statement is preparednext. It simply follows the format of an income statement. Aswith the cost of goods sold budget, many of the items for thisbudget have already been generated during the budget process. Refer to Quiz Questions 4 and 5 Exercises 6-16 through 6-19, Problem 6-304Use computer-based financial planning models insensitivity analysis. . . for example, understand the effects of changesin selling prices and direct material pries onbudgeted income4.1 Financial planning models are mathematical representations of the relationshipsamong operating activities, financing activities, and other factors that affect themaster budget.4.2 Computer-based systems, such as Enterprise Resource Planning (ERP) can beused to perform calculations for these planning models.4.3 Sensitivity analysis is a “what if” technique that examines how a result willchange if the original predicted results are not achieved or if an assumptionchanges.TEACHING POINT. To bring financial planning models downto a level that can be grasped more readily by the studentspoint out that an Excel spreadsheet that includes formulas canbe a type of financial planning model. It is useful todemonstrate here how Excel can be used in sensitivity analysisin a simple spreadsheet.(Exhibits 6-4 and 6-9 display sensitivity analysis results.)Refer to Quiz Question 65Explain kaizen budgeting. . . budgeting for continuous improvement inoperationsand how it is used for cost management. . . to reduce costs5.1 Kaizen budgeting is a budgetary process that explicitly incorporates continuousimprovement during the budget period.TEACHING POINT. Students will often question limits ofimprovements and cost reductions. Point out that Kaizen isabout working smarter, not working harder. The idea is to findbetter ways, not just faster ways to produce the product orservice.Refer to Quiz Question 7 Exercises 6-24 and 6-256Describe responsibility centers. . . a part of an organization that a manager isaccountable forand responsibility accounting. . . measurement of plans and actual results that amanager is accountable for6.1 Organization structure is the arrangement of lines of responsibility within theorganization. Examples of organization structure include by business function, by product line, or geographically.6.2 A responsibility center is a part, segment, or subunit of an organization whosemanager is responsible for a specified set of activities.6.3 Responsibility accounting measures the plans, budgets, actions, and results ofeach responsibility center. Four types of responsibility centers are:•Cost center, in which the manager is responsible for costs only. The accounting department would be accounted for as a cost center.•Revenue center, in which the manager is accountable for revenues only.•Profit center, in which the manager is accountable for revenues and costs. For example, the shoe department in a department store may beaccounted for as a profit center.•Investment center, in which the manager is accountable for revenues and costs, but also the investment (or assets) under his control. A singlestore or a division within the company may be accounted for as aninvestment center.TEACHING POINT. Emphasize that a key to successfulresponsibility accounting is to properly identify the costs amanager is responsible for. Any costs over which the managerlacks control should not be a part of his evaluation.6.4 Budgets and responsibility accounting may be combined to provide feedbackabout performance of managers of the different responsibility centers.6.5 These differences between budgeted and actual results are useful in at least threeways:•Early warning, These variances may alert managers to events notimmediately evident, thus allowing them to take early corrective action.•Performance evaluation. The variances are an indication of how well the manager has performed in implementing strategies.•Evaluating strategy.Variance may signal that the strategies beingpursued by management are ineffective and need changing.Refer to Quiz Question 87Explain how controllability relates to responsibilityaccounting. . . managers cannot control all of the costs thatthey are accountable for; responsibility accountingfocuses on obtaining information, not fixing blame7.1 Controllability is the degree of influence that a specific manager has over costs,revenues, or related items for which he or she is responsible.7.2 A controllable cost is any cost that is primarily subject to the influence of a givenresponsibility center manager for a given period.7.3 This controllability can be difficult to pinpoint for two reasons:•Few costs are clearly under the sole influence of one manager.•With a long enough time span, all costs will come under someone’s control.Most performance reports cover a period of one year or less, so this doesnot normally present a problem.TEACHING POINT. Emphasize that someone cannot be heldresponsible for that which they cannot control. I use anillustration in which I hypothesize that a particular studentmade a very poor grade on a test; then I blame anotherstudent for the poor grade. The students see that I cannot holdthe second student responsible for what the first student did onthe test as they had no control over the other student. Point outthat control must be equal to the responsibility given.Refer to Quiz Question 9 Exercise 6-268Recognize the human aspects of budgeting. . . to engage subordinate managers in thebudgeting process8.1 A budget is usually more effective if the lower-level managers have input intothe budget process. Through this process of participatory budgeting, the managerobtains “ownership” in the budget and is more likely to achieve budgetarysuccess.8.2 Managers frequently play games with budgets and build in budgetary slack.This is the practice of underestimating revenues, overestimating costs, oroverestimating time in order to make the budget targets more easily achievable.TEACHING POINT. Ask the students “If I gave you anassignment to report to the class on responsibility accounting,how soon could you have it ready for me?” Then probe theirresponses to bring out the fact that they have overestimatedthe time they really think they need to complete the task. Thisis an example of budgetary slack. Explore the reasons theybuilt slack into their estimates.8.3 In budgeting in multinational companies three adjustments must be made:•Operating results must be translated into a common currency for external financial reporting.• A currency gain or loss must be budgeted and recognized whencurrencies are translated.•The political, legal, and economic environments must be understood.Refer to Quiz Question 10APPENDIX: THE CASH BUDGETA.1 The cash budget is an important component of the budgeting process. Thischapter illustrates the operating budget, which is one part of the master budget.A.2 The financial budget is the other part of the master budget, and includes thecapital expenditures budget, the cash budget, the budgeted balance sheet, and thebudgeted statement of cash flows.A.3 The appendix focuses on the cash budget. It is best illustrated through example.Work through Problem 6-27 to illustrate this concept. If time is limited, use thechapter quiz, questions 11 and 12.Refer to Quiz Questions 11 and 12V. OTHER RESOURCESPlease visit the textbook companion website at . To download these and other resources, visit the Instructor’s Resource Center or access them on the Instructor’s Resource DVD (IR-DVD).The following exhibits were mentioned in this chap ter of the Instructor’s Manual, and have been included in the PowerPoint Lecture presentation created specifically for this chapter. You may use the PowerPoint Lecture presentations “as is”, or modify them to suit your individual needs.Exhibit 6-1 illustrates the link among strategy, planning, and budgets.Exhibit 6-2 provides an overview of the budgeting process.Exhibits 6-4 and 6-9 display sensitivity analysis results.Download pdf images of textbook illustrations and exhibits from the Image Library or access them via your IR-DVD.Solutions to Select End-of-Chapter Problems mentioned in this chapter, which have been fully worked out in PowerPoint, are available for download and included on the IR-DVD.CHAPTER 6 QUIZ1.Budgeting is the common accounting tool companies use for planning and controlling.Budgetsa.provide a measure of planned financial results.b.are prepared independent of the company’s long term strategies.c.do not usually reflect actual results, so they are a useless exercise.d.serve as the f inancial expression of management’s plans for the upcoming period.2.[AICPA Adapted] Dewitt Co. budgeted its activity for October 2004 from the followinginformation:•Sales are budgeted at $750,000. All sales are credit sales and a provision for doubtful accounts is made monthly at the rate of 2% of sales.•Merchandise inventory was $120,000 at September 30, 2004, and an increase of $10,000 is planned for the month.•All merchandise is marked up to sell at invoice cost plus 50%.•Estimated cash disbursements for selling and administrative expenses for the month are $105,000.•Depreciation for the month is projected at $25,000.Dewitt is projecting operating income for October 2004 in the amount ofa. $105,000.b. $119,000.c. $129,000.d. $230,000.3.Which of the following is not a major benefit of budgets?pels planningb.Eliminates innovationc.Provides performance criteriad.Promotes coordination and communicationThe following data apply to questions 4 and 5.Hester Company budgets on an annual basis for its fiscal year. The following beginning and ending inventory levels (in units) are planned for the fiscal year of July 1, 2004 through June 30, 2005.July 1, 2004 June 30, 2005Raw material1 40,000 10,000Work in process 8,000 8,000Finished goods 30,000 5,0001Three (3) units of raw material are needed to produce each unit of finished product.4. [CMA Adapted] If Hester Company plans to sell 500,000 units during the 2004–2005fiscal year, the number of units it would have to manufacture during the year would bea. 505,000 units.b. 500,000 units.c. 480,000 units.d. 475,000 units.5. [CMA Adapted] If 450,000 finished units were to be manufactured during the 2004–2005fiscal year by Hester Company, the units of raw material needed to be purchased wouldbea. 1,350,000 units.b. 1,360,000 units.c. 1,320,000 units.d. 1,330,000 units.6. Which of the following does not pertain to financial planning models in software form?a.Reduces computational burden and time required to prepare budgetsb.Eliminates need to update budgets as uncertainty resolvedc.Assists managers with sensitivity analysisd.Performs calculations that are mathematical representations of relationships inmaster budget7.The major cost management concept used in kaizen budgeting is that ofa.eliminating inventories of every type but materials.b.refinements in the indirect-cost categories for costing systems.c.continuous improvement.d.sensitivity analysis using computer-based financial planning models.8.Which of the following statements does not describe responsibility accounting?a.It measures the plans and actions of each responsibility center.b.It budgets to emphasize that for which each responsibility center is accountable.c.It calculates variances between budgeted and actual accountability for eachresponsibility center.d.It identifies managers at fault for operating problems by reports for eachresponsibility center.9.Controllabilitya.is always clear cut as to who has responsibility for a cost.b.is another term for responsibility.c.is the responsibility of the corporate controller.d.is the degree of influence a specific manager has over costs, revenues, and otheritems.10.Budgetary slacka.is going to be included in budget estimates, so it should just be ignored.b.provides managers with a hedge against unexpected circumstances.c.should be totally eliminated from the budget.d.is not found in governmental budgets.The following data apply to questions 11 and 12 [Appendix].Information pertaining to Brenton Corporation’s sales revenue is presented in the following table.February March AprilCash sales $160,000 $150,000 $120,000Credit sales 300,000 400,000 280,000Total sales $460,000 $550,000 $400,000Management estimates that 5% of credit sales are not collectible. Of the credit sales that are collectible, 60% are collected in the month of sale and the remainder in the month following the sale. Cost of purchases of inventory each month is 70% of the next month’s projected total sales. All purchases of inventory are on account; 25% are paid in the month of purchase, and the remainder is paid in the month following the purchase.11. [CMA Adapted] Brenton’s budgeted total cash receipts in April area. $448,000.b. $437,000.c. $431,600.d. $328,000.12. [CMA Adapted] Brenton’s budgeted total cash payments in March for inventorypurchases area. $385,000.b. $358,750.c. $306,250.d. $280,000.CHAPTER 6 QUIZ SOLUTIONS1. d2. a3. b4. d5. c6. b7. c8. d9. d10. b11. c12. bQuiz Question Calculations2. Sales $750.000Cost of goods sold (500,000) (750,000/Cost +.5 Cost)Bad debts expense (15,000)S & A expense (105,000)Depreciation expense (25,000)Operating income 105,0004.Sales 500,000+Ending inventory 5,000– Beginning inventory (30,000)Production 475,0005. Required for production 3 ⨯ 450,000 = 1,350,000+ Ending inventory 10,000– Beginning inventory (40,000)Purchases 1,320,00011.12.Cash receiptsFrom April cash sales $120,000From April credit sales .60(280,000 ⨯.95) 159,600From March credit sales .40(400,000 ⨯ .95) 152,000Total collections $431,60013.February purchases 550,000 ⨯ .7 = 385,000 75% paid in March = $288,750March purchases 400,000 ⨯ .7 = 280,000 25% paid in March = 70,000 Total cash payments in March $358,750。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

suits. What is the static-budget operating profit?

10

2020/10/8

Static Budget

Revenues (12,000 × $120) Less Expenses: Variable (12,000 × $88) Fixed Budgeted operating profit

Actual oper static-budget variance of operating profit?

12

2020/10/8

13

2020/10/8

Static-Budget Variance

A static-budget variance is : (Actual result - Budgeted amount in the static budget).

11

2020/10/8

Static Budget

What was the actual operating profit?

Revenues (10,000 × $125) $1,250,000

Less Expenses:

Variable (10,000 × $95.01)

950,100

Fixed

285,000

$88

9

2020/10/8

Static Budget

Budgeted selling price is $120 per jacket. Fixed manufacturing costs are expected to be $276,000

within a relevant range between 0 and 12,000 suits. Variable and fixed period costs are ignored in this

Key difference is the use of the actual output level in the flexible budget.

6

2020/10/8

7

2020/10/8

8

2020/10/8

Static Budget

Assume that Webb manufactures and sells jackets.

Managers focus on quantities and costs that exceed standards, a practice known as

management by exception.

Direct Labor

Direct Material

Standard

Type of Product Cost

Variance – difference between an actual and an expected (budgeted) amount

Purpose of variance

➢ Management by exception ➢ Performance evaluation ➢ Motivate managers ➢ Prompt strategy change

$1,440,000

1,056,000 276,000

$ 108,000

Assume that Webb produced and sold 10,000 suits at $125 each with actual variable costs of $95.01 per suit and fixed manufacturing costs of $285,000.

Budgeted variable costs per jacket are as follows:

Direct materials cost

$ 60

Direct manufacturing labour

16

Variable manufacturing overhead

12

Total variable costs

of the budget period. ➢ The master budget is an example of a static budget.

Flexible budget

➢ Developed using budgeted revenues or cost amounts based on the level of output actually achieved in the budget period.

A favourable (F) variance is a variance that increases operating profit relative to the budgeted amount.

An unfavourable (U) variance is a variance that decreases operating profit relative to the budgeted amount.

成本与管理会计亨格瑞第13 版英文版CA07

2020/10/8

Controlling Costs

Predetermined or Set Standard

Measure Actual

COMPARE

Actual Vs Standard

Variance

2

2020/10/8

Basic Concepts

3

2020/10/8

Basic Concepts

Management by Exception – the practice of focusing attention on areas not operating as expected (budgeted)

4

2020/10/8

Amount

Management by Exception

5

2020/10/8

Static and Flexible Budgets

Static budget

➢ Prepared for only one level of activity. ➢ It is based on the level of output planned at the start