修改信用证实训

修改信用证实训

信用证实训一、根据下列合同审核并修改信用证SALES CONFIRMATIONS/C NO.:SPT-211 DATE: Jan.8, 2015The Seller: SHANGHAI SPORTING GOODS IMP. & EXP. CORPAddress: 215 HUQIU ROAD SHANGHAI CHINAThe Buyer: PETRRCO INTERNATIONAL TRADING CO.Address: 1100 SHEPPARD AVENUE EAST SUITE406PORT OF LOADING AND DESTINATION: From Shanghai to Vancouver with transshipment and partial shipment allowed.TIME OF SHIPMENT: During Mar. 2015TERMS OF PAYMENT: The buyer shall open through a bank acceptable to the seller an irrevocable letter of credit at sight to reach the seller 30 days before the month of shipment valid for negotiation in Vancouver until the 15th day after the date of shipment.INSURANCE: To be covered by the seller for 110% of the invoice value against All Risks and War Risks as per the relevant ocean marine cargo clauses of the People’s Insurance Company of China dated 01/01/1981.REMARKS:1.The Buyer shall have the covering letter of credit reach the seller 30 days before shipment, falling which the Seller reserves the right to rescind without further notice, or to regard as still valid whole or any part of this contract not fulfilled by the Buyer, or to lodge a claim for losses thus sustained, if any.2.In case of any discrepancy in Quality/Quantity, claim should be filed by the Buyer within 130 days after the arrival of the goods at port of destination; while for quantity discrepancy, claim should be filed by the Buyer within 150 days after the arrival of the goods at port of destination.3.For transactions concluded on C.I.F. basis, it is understood that the insurance amount will be for 110% of the invoice value against the risks specified in the Sales Confirmation. If additional insurance amount or coverage required, the Buyer must have the consent of the Seller before Shipment, and the additional premium is to be borne by the Buyer.4.The Seller shall not hold liable for non-delivery or delay in delivery of the entire lot or a portion of the goods hereunder by reason of natural disasters, war or other causes of Force Majeure. However, the Seller shall notify the Buyer as soon as possible and furnish the Buyer within 15 days by registered airmail with a certificate issued by the China Council for the Promotion of International Trade attesting such event(S).5.All disputes arising out of the performance of, or relating to this contract, shall be settled throughnegotiation. In case no settlement can be reached through negotiation, the case shall arbitration in accordance with its arbitral rules. The arbitration shall take place in Shanghai. The arbitral award is final and binding upon both parties.6.The Buyer is requested to sign and return one copy of this contract immediately after receipt of the same. Objection, if any, should be accepted the terms and condition of this contract.7.Special conditions (These shall prevail over all printed terms in case of any conflict.)Confirmed byTHE SELLER THE BUYER华海红 JONE(Signature) (Signature)信用证OUR L/C NO.PIT310JANUARY 30,2015FROM:THE ROYAL BANK OF CANADA,BRITISH, COLUMBIA INTERNATIONAL CENTER,1055 WEST GEORGIA STREET,VANCOUVER ,B.C.V6E 3P3TO: BANK OF CHINA, SHANGHAI BRANCHBENEFICIARY: SHANGHAI SPORTING GOODS IMP.& EXP .CORP.251 HUQIU ROAD, SHANGHAI CHINAAPPLICANT: PETRRCO INTERNATIONAL TRADING CO.1100 SHEPPARD AVENUE EAST SUITE 406, WILLOWDALE ONTARIO , CANADA M2K 2W2FOR USD 88,710.00(SAY U.S. DOLLARS EIGHTY EIGHT THOUSAND SEVEN HUNDRED AND TEN ONLY )TO EXPIRE ARRIL 15 TH 2015 IN OUR COUNTRY AVAILABLE BY NEGOTIATION OF YOUR DARFTS AT 30DAYS SIGHT FOR 100 PERCENT OF INVOICE VALUE DRAWN ON THE ROYAL BANK OF CANADA ACCOMPANIED FOLLOWING DOCUMENTS:1、COMMERCIAL INVOICE IN QUADRUPLICATES INDICATING THE SALES CONTRACT NUMBER.2、PACKING LIST/WEIGHT MEMO IN TRIPLICATE MENTIONING TOTAL NUMBER OF CARTONS, GROSS WEIGHT AND MEASUREMENTS PER EXPORT CARTON.3、FULL SET OF CLEAN “ON BOARD ”OCEAN BILLS OF LADING MADE OUT TO ORDER MARKED “FREIGHT COLLECT” AND NOTIFY APPLICANT.4、INSURANCE POLCIY OR CERTIFICATE IN DUPLICATE ENDORSED IN BLANK COVERING OCEAN MARIN CARGO CLAUSE ALL RISKS AND WAR RISKS FOR 100 PERCENT OF INVOICE VALUE AS PER CIC DATED 01/01/1981.5、INSPECTION CERTIFICATE IN DUPLICATE ISSUED AND SIGNED BY AUTHORIZED PERSON OF APPLICANT WHOSE SIGNATURE MUST COMPLY WITH THAT HELD IN OUR BANK’S RECORD. COVERING:2000 PCS GBW32 BASKETBALL US $16.95/PC 2000 PCS GBW322 FOOTBALL US$21.33/PC 1000 PCS ERV5 VOLLEYBALL US$12.15/PCTERMS OF SHIPMENT CIF VANCOUVER FROM SHANGHAI CHINA TO VANCOUVER CANADA DURING MARCH 2015 GOODS TO BE PACKED IN WOODEN CASES AND CONTAINER SHIPMENT PREFERABLE. TRANSSHIPMENT PERMITTED AND PARTIAL SHIPMENT PROHIBITED. SHIPPING MARKS: PITVANCOUVERNO.1-UPALL BANK CHARGES INCLUDING REIMBURSEMENT COMMISSION OUTSIDE CANADA ARE FORACCOUNT OF BENEFICIARY.DOCUMENTS TO BE PRESENTED WITHIN 3 DAYS AFTER THE DATE OF ISSUANCE OF THE SHIPPING DOCUMENTS BUT WITH THE VALIDITY OF THE CREDIT.SPECIAL INSTRUCTIONS:──T.T.REIMBURSEMENT IS NOT ACCEPTABLE── THIS CREDIT IS NOT TRANSFERABLE── DOCUMENTS PRIOR TO THE ISSUANCE OF THIS CREDIT ARE NOT ACCEPTABLE.WE HEREBY ENGAGE WITH DRAWERS AND/OR BONA FIDE HOLDERS THAT DRAFTS DRAWN AND NEGOTIATED IN CONFORMITY WITH THE TERMS OF THIS CREDIT WILL BE DULY HONOURED ON PRESENTATION AND THAT DRAFTS ACCEPTED WITHIN THE TERMS OF THIS CREDIT WILL BE DULY HONOURED ON MATURITY.THIS CREDIT IS ISSUED SUBJECT TO UNIFORM CUSTOMS AND PRACTICE FOR DOCUMENTARY CREDITS (1993 REVISION)ICC PUBLICATION NO.500.AUTHORISED SIGNATURES二、据合同审核信用证,并写出信用证不符点。

信用证改错练习及答案

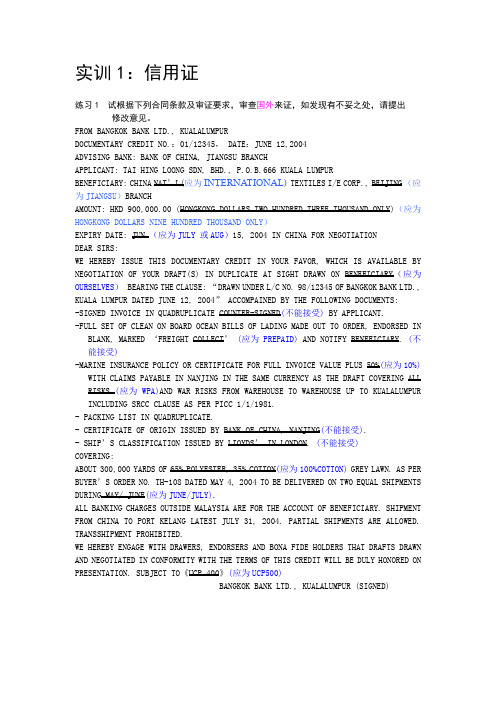

实训1:信用证练习1 试根据下列合同条款及审证要求,审查国外来证,如发现有不妥之处,请提出修改意见。

FROM BANGKOK BANK LTD., KUALALUMPURDOCUMENTARY CREDIT NO.:01/12345, DATE:JUNE 12,2004ADVISING BANK: BANK OF CHINA, JIANGSU BRANCHAPPLICANT: TAI HING LOONG SDN, BHD., P.O.B.666 KUALA LUMPURBENEFICIARY: CHINA NAT’L(应为INTERNATIONAL) TEXTILES I/E CORP., BEIJING为JIANGSU)BRANCHAMOUNT: HKD 900,000.00 (HONGKONG DOLLARS TWO HUNDRED THREE THOUSAND ONLY)(应为HONGKONG DOLLARS NINE HUNDRED THOUSAND ONLY)EXPIRY DATE: JUN (应为JULY 或AUG)15, 2004 IN CHINA FOR NEGOTIATIONDEAR SIRS:WE HEREBY ISSUE THIS DOCUMENTARY CREDIT IN YOUR FAVOR, WHICH IS AVAILABLE BY NEGOTIATION OF YOUR DRAFT(S) IN DUPLICATE AT SIGHT DRAWN ON BENEFICIARY(应为OURSELVES)BEARING THE CLAUSE: “DRAWN UNDER L/C NO. 98/12345 OF BANGKOK BANK LTD., KUALA LUMPUR DATED JUNE 12, 2004” ACCOMPAINED BY THE FOLLOWING DOCUMENTS:-SIGNED INVOICE IN QUADRUPLICATE COUNTER-SIGNED(不能接受) BY APPLICANT.-FULL SET OF CLEAN ON BOARD OCEAN BILLS OF LADING MADE OUT TO ORDER, ENDORSED IN BLANK, MARKED ‘FREIGHT COLLECT’ (应为PREPAID) AND NOTIFY BENEFICIARY. (不能接受)-MARINE INSURANCE POLICY OR CERTIFICATE FOR FULL INVOICE VALUE PLUS 50%(应为10%) WITH CLAIMS PAYABLE IN NANJING IN THE SAME CURRENCY AS THE DRAFT COVERING ALL RISKS (应为WPA)AND WAR RISKS FROM WAREHOUSE TO WAREHOUSE UP TO KUALALUMPUR INCLUDING SRCC CLAUSE AS PER PICC 1/1/1981.- PACKING LIST IN QUADRUPLICATE.- CERTIFICATE OF ORIGIN ISSUED BY BANK OF CHINA, NANJING(不能接受).- SHIP’S CLASSIFICATION ISSUED BY LIOYDS’ IN LONDON. (不能接受)COVERING:ABOUT 300,000 YARDS OF 65% POLYESTER, 35% COTTON(应为100%COTTON)GREY LAWN. AS PER BUYER’S ORDER NO. TH-108 DATED MAY 4, 2004 TO BE DELIVERED ON TWO EQUAL SHIPMENTS DURING MAY/ JUNE(应为JUNE/JULY).ALL BANKING CHARGES OUTSIDE MALAYSIA ARE FOR THE ACCOUNT OF BENEFICIARY. SHIPMENT FROM CHINA TO PORT KELANG LATEST JULY 31, 2004. PARTIAL SHIPMENTS ARE ALLOWED. TRANSSHIPMENT PROHIBITED.WE HEREBY ENGAGE WITH DRAWERS, ENDORSERS AND BONA FIDE HOLDERS THAT DRAFTS DRAWN AND NEGOTIATED IN CONFORMITY WITH THE TERMS OF THIS CREDIT WILL BE DULY HONORED ON PRESENTATION. SUBJECT TO《UCP 400》(应为UCP500)BANGKOK BANK LTD., KUALALUMPUR (SIGNED)练习2 审核下列信用证。

审证改证的实训报告

随着我国国际贸易的不断发展,信用证作为一种重要的支付方式,在进出口业务中发挥着越来越重要的作用。

审证改证是进出口贸易中的重要环节,涉及到银行、客户、供应商等多方利益。

为了提高我国进出口贸易人员的专业素质,本实训旨在通过对信用证的审核与修改进行实际操作,使学生深入了解信用证业务流程,掌握审证改证技巧,提高业务处理能力。

二、实训目的1. 熟悉信用证业务流程,掌握信用证的基本知识;2. 学会审证改证的技巧,提高业务处理能力;3. 培养团队合作精神,提高沟通协调能力;4. 提高学生对国际贸易风险的认识,增强风险防范意识。

三、实训内容1. 信用证基础知识(1)信用证的定义、特点及作用;(2)信用证的种类、格式及条款;(3)信用证业务流程及操作规范。

2. 审证技巧(1)审核信用证的真实性、有效性;(2)审核信用证的条款是否与合同相符;(3)审核信用证的金额、有效期、交单期限等关键条款;(4)审核信用证的单据要求,确保单据齐全、准确。

3. 改证技巧(1)根据客户需求,修改信用证的条款;(2)与银行、客户、供应商沟通,确保改证过程顺利进行;(3)关注改证过程中的风险,采取有效措施防范风险。

1. 案例分析(1)选取具有代表性的信用证案例,分析案例中存在的问题及解决方法;(2)通过案例分析,使学生了解审证改证的实际操作过程。

2. 实操演练(1)学生分组,每组选取一个信用证案例,进行审证改证实操;(2)各小组在规定时间内完成审证改证任务,提交操作报告;(3)教师对各组操作报告进行点评,指出优点与不足。

3. 交流讨论(1)各小组分享审证改证过程中的心得体会;(2)教师针对学生提出的问题进行解答,引导学生深入思考。

五、实训成果1. 学生掌握了信用证的基本知识,熟悉了信用证业务流程;2. 学会了审证改证的技巧,提高了业务处理能力;3. 培养了团队合作精神,提高了沟通协调能力;4. 增强了学生对国际贸易风险的认识,提高了风险防范意识。

实训十一 信用证的审核与修改

实训十一信用证的审核与修改实训目的与要求:1.能够审核信用证2. 能够修改信用证重点: 能够审核并修改信用证难点:能够审核并修改信用证实训项目:根据背景资料审核并修改: http://10.99.36.252/icd3实训指导:要求说明:请根据审证的一般原则和方法对收到的信用证进行认真细致的审核,列明信用证存在的问题并陈述要求改证的理由。

提示:1.审核L/C 的商品货号是否与合同不一致。

2.审核金额(大写/小写)是否与合同不一致。

3. L/C 条款是否与合同相应条款不符。

(例如:保险条款在合同中写明All Risks as perC.I.I dated 1/1/1982. 但L/C 显示War Risk and All risks. )4.付款方式是否不符合同要求。

(例如:合同中为by sight L/C, 而信用证中为draft at 30days' sight. )注意:信用证本身常出现的问题:1.注意L/C 的到期地点。

2.信开本信用证应写明"subject to UCP 600"。

3.注意信用证"三期",即:有效期、装运期和交单期。

4.L./C 中的"软条款"。

(例如:要求卖方提交客检证书;正本B/L 全部或部分直寄客户。

)修改信用证应注意:--对信用证修改内容的接受或拒绝有两种表示形式:--收到信用证修改后,应及时检查修改内容是否符合要求,并分别情况表示接受或重新提出修改---对于修改内容要么全部接受,要么全部拒绝;部分接受修改中的内容是无效的;---有关信用证修改必须通过原信用证通知行通知才算真实、有效;通过客户直接寄送的信用证修改申请书或修改书复印件不是有效的修改---明确修改费用由谁承担,一般按照责任归属来确定修改费用由谁承担。

信用证业务综合实训报告

一、实训目的本次信用证业务综合实训旨在通过对信用证业务的深入学习与实践,使我对信用证的基本概念、运作流程、风险控制及实际操作有更全面、深入的理解。

通过实训,我期望能够提高自己的金融业务处理能力、风险识别与防范能力,以及团队协作能力。

二、实训环境实训环境为模拟的银行信用证业务操作平台,包括信用证申请、开证、通知、议付、承兑等环节。

实训过程中,我使用了计算机系统进行操作,并查阅了相关的法律法规、业务操作手册等资料。

三、实训原理信用证业务是一种国际贸易支付方式,它以银行信用代替商业信用,保障买卖双方的权益。

信用证业务的基本原理如下:1. 买方(进口商)向银行申请开证,并提供所需文件。

2. 银行审核申请后,开出信用证,并将信用证通知卖方(出口商)。

3. 卖方在收到信用证后,按照信用证规定备货、装运货物,并准备相关单据。

4. 卖方将单据提交给开证行或议付行,申请议付或承兑。

5. 银行审核单据无误后,按照信用证规定支付货款给卖方。

四、实训过程1. 信用证申请:我首先学习了信用证申请的基本流程,包括填写申请表、提交相关文件等。

在实训过程中,我模拟了买方申请开证的过程,提交了申请表和所需文件。

2. 开证:在收到买方的申请后,银行审核申请并开出信用证。

我学习了信用证的主要内容,如信用证金额、有效期、装运期限、单据要求等。

3. 通知:银行将信用证通知卖方,卖方在收到信用证后,开始准备货物和单据。

4. 议付:卖方将货物装运完毕,准备相关单据,并提交给议付行。

我学习了议付行的审核流程,包括审核单据是否齐全、是否符合信用证要求等。

5. 承兑:在议付过程中,若买方未在规定时间内付款,议付行可以向卖方承兑,即买方在未来的某个时间内支付货款。

6. 风险控制:在实训过程中,我学习了信用证业务的风险控制方法,如信用证欺诈、单据不符等。

我了解到,银行在处理信用证业务时,需要严格审核单据,防范风险。

五、实训结果通过本次实训,我取得了以下成果:1. 熟悉了信用证业务的基本概念、运作流程和风险控制方法。

信用证的修改实训报告

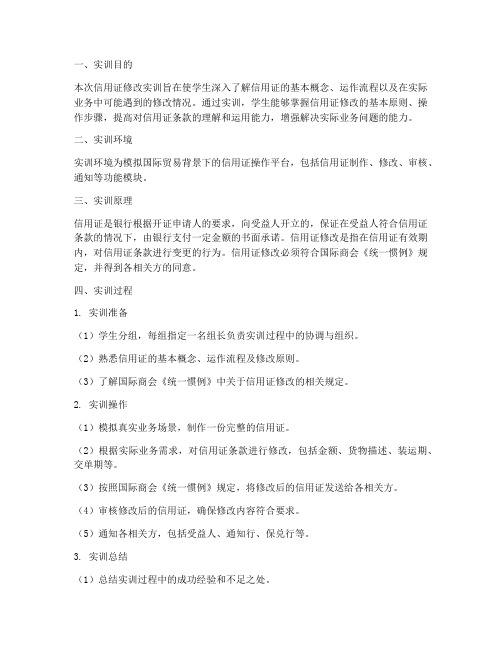

一、实训目的本次信用证修改实训旨在使学生深入了解信用证的基本概念、运作流程以及在实际业务中可能遇到的修改情况。

通过实训,学生能够掌握信用证修改的基本原则、操作步骤,提高对信用证条款的理解和运用能力,增强解决实际业务问题的能力。

二、实训环境实训环境为模拟国际贸易背景下的信用证操作平台,包括信用证制作、修改、审核、通知等功能模块。

三、实训原理信用证是银行根据开证申请人的要求,向受益人开立的,保证在受益人符合信用证条款的情况下,由银行支付一定金额的书面承诺。

信用证修改是指在信用证有效期内,对信用证条款进行变更的行为。

信用证修改必须符合国际商会《统一惯例》规定,并得到各相关方的同意。

四、实训过程1. 实训准备(1)学生分组,每组指定一名组长负责实训过程中的协调与组织。

(2)熟悉信用证的基本概念、运作流程及修改原则。

(3)了解国际商会《统一惯例》中关于信用证修改的相关规定。

2. 实训操作(1)模拟真实业务场景,制作一份完整的信用证。

(2)根据实际业务需求,对信用证条款进行修改,包括金额、货物描述、装运期、交单期等。

(3)按照国际商会《统一惯例》规定,将修改后的信用证发送给各相关方。

(4)审核修改后的信用证,确保修改内容符合要求。

(5)通知各相关方,包括受益人、通知行、保兑行等。

3. 实训总结(1)总结实训过程中的成功经验和不足之处。

(2)对信用证修改的流程、原则及注意事项进行梳理。

(3)提出改进建议,以提高实训效果。

五、实训结果1. 学生掌握了信用证修改的基本流程和原则。

2. 学生能够根据实际业务需求,对信用证条款进行修改。

3. 学生提高了对国际商会《统一惯例》中关于信用证修改规定的理解。

4. 学生增强了解决实际业务问题的能力。

六、实训总结1. 实训成果通过本次实训,学生不仅掌握了信用证修改的基本知识和技能,而且提高了在实际业务中处理信用证问题的能力。

以下是部分实训成果:(1)学生能够熟练制作、修改和审核信用证。

模拟信用证流程实训报告

一、实训背景随着全球化经济的不断发展,国际贸易活动日益频繁,信用证作为一种重要的国际贸易支付方式,在保障交易安全、促进贸易发展方面发挥着至关重要的作用。

为了提高我校学生的国际贸易业务水平,培养具备实际操作能力的专业人才,我校特组织开展了模拟信用证流程实训。

二、实训目的1. 熟悉信用证的基本概念、作用和种类。

2. 掌握信用证的开证、通知、修改、撤销、议付等流程。

3. 提高学生在国际贸易业务中的实际操作能力。

4. 培养学生的团队协作精神和沟通能力。

三、实训内容1. 信用证基础知识(1)信用证的定义及作用(2)信用证的种类及特点(3)信用证的当事人及各自职责2. 信用证流程(1)开证申请(2)开证行审核及开证(3)通知行通知受益人(4)受益人审证及修改(5)装运货物及单据准备(6)受益人提交单据(7)议付行审核及议付(8)开证行付款及单据赎回(9)单据流转及结算四、实训过程1. 实训准备(1)分组:将学生分为若干小组,每组5-6人,每个小组分别扮演信用证流程中的不同角色。

(2)角色分配:每组指定一名组长,负责协调组内工作;组内成员分别担任开证申请人、开证行、通知行、受益人、议付行等角色。

2. 实训实施(1)开证申请:开证申请人根据合同要求,向开证行提交开证申请书。

(2)开证行审核及开证:开证行对开证申请书进行审核,审核通过后,开证行向受益人发出信用证。

(3)通知行通知受益人:通知行将信用证内容通知给受益人。

(4)受益人审证及修改:受益人收到信用证后,对信用证内容进行审核,如发现与合同不符,可向开证行提出修改申请。

(5)装运货物及单据准备:受益人根据信用证要求,组织货物装运,并准备相关单据。

(6)受益人提交单据:受益人将准备好的单据提交给议付行。

(7)议付行审核及议付:议付行对提交的单据进行审核,审核通过后,议付行向受益人支付货款。

(8)开证行付款及单据赎回:开证行收到议付行的付款请求后,对单据进行审核,审核通过后,开证行向议付行付款,并赎回单据。

实训任务 05 审核与修改信用证

实训项目 5 填写开证申请书 实训项目 6 信用证审核及修改

实训项目 5 填写开证申请书

项目案例导入 我某进出口公司从美国进口大豆一批,合同规定:最后 装船期为 2016 年 9 月 30 日,信用证有效期为 2016 年 10 月 15 日,交单期为提单日期后 15 天内,但必须在信用证 有效期之内。我公司于 2016 年 8 月 31 日按合同规定向本 地银行申请开立信用证,美国出口公司于 2016 年 8 月 30 日装船完毕,提单日期为 2016 年 8 月 30 日。 2016 年 8 月 31日美方收到我方银行开出的信用证,美国公司将做 好的全套单证送银行兑用。请问,美国出口商能否顺利 结汇?为什么?

分析: (1) 出口商已于 8 月 30 日装船。如果信用证中未对装运有特别要 求,其他单据也符合信用证要求,该公司于提单日期后的 15 天之内 交单议付,可顺利结汇。 (2) 若信用证中规定了所有单证的日期不能早于信用证开证日期, 而 8 月 30 日是早于开证日的,单证不符,不能顺利结汇。 (3) 若信用证中有关于装运的特殊规定,如指定某船公司等,而此 时船已开,货已走,不可能再改变,单证不符,也就不能顺利结汇。 (4) 若信用证规定,出口商必须取得某些单据,例如,提供“客检 证”等,这些单据必须在装船前完成,而收到信用证时,船已开走, 如果这些单据在装船前并没有出具,货已随船走了,无法补做,单 证不符,就可能造成结汇困难。

7. ( ) Certificate of Quality in _copies issued by( ) manufacturer/ ( ) public recognized surveyor/ ( ).

8. ( ) Certificate of Origin in _copies issued by_______.

修改信用证的实训报告

一、实训背景随着国际贸易的不断发展,信用证作为一种重要的支付方式,在保障买卖双方权益方面发挥着至关重要的作用。

为了提高我对信用证操作流程的理解和实践能力,我参加了本次修改信用证的实训课程。

通过本次实训,我对信用证的基本知识、修改流程以及注意事项有了更深入的了解。

二、实训目的1. 掌握信用证的基本概念和作用;2. 熟悉信用证的种类和适用范围;3. 了解信用证的修改流程及注意事项;4. 提高在实际工作中处理信用证问题的能力。

三、实训内容1. 信用证基础知识(1)信用证的定义:信用证是指银行(开证行)根据进口商的要求,向出口商发出的,保证在一定条件下支付货款的书面承诺。

(2)信用证的作用:保障出口商在履行合同后获得货款,保障进口商在收到货物后支付货款。

(3)信用证的种类:按付款方式可分为即期信用证和远期信用证;按开证行责任可分为不可撤销信用证和可撤销信用证。

2. 信用证修改流程(1)收到出口商的修改申请:出口商在发现信用证条款与合同不符时,需向开证行提出修改申请。

(2)开证行审核修改申请:开证行对出口商的修改申请进行审核,确认修改内容是否符合规定。

(3)发出修改通知:开证行将审核通过的修改内容通知进口商,并要求进口商确认。

(4)进口商确认修改:进口商在收到修改通知后,需在规定时间内确认修改内容。

(5)开证行修改信用证:开证行根据进口商的确认,对信用证进行修改。

3. 信用证修改注意事项(1)修改内容需符合信用证规定:修改内容不得违反信用证条款,如修改金额、货物描述、交货期等。

(2)修改时间:出口商应在发现信用证问题后及时提出修改申请,避免错过最佳修改时机。

(3)修改费用:信用证修改需支付一定费用,出口商需提前了解相关费用。

(4)修改风险:修改信用证存在一定风险,如修改内容被误读、遗漏等,可能导致纠纷。

四、实训总结通过本次修改信用证的实训,我深刻认识到信用证在实际操作中的重要性。

以下是我对本次实训的总结:1. 信用证是国际贸易中重要的支付方式,保障了买卖双方的权益。

信用证的缮制实训报告

一、实训背景随着国际贸易的不断发展,信用证已成为国际贸易中普遍采用的一种结算方式。

信用证作为一种银行信用,为买卖双方提供了安全保障,减少了交易风险。

为了提高我对信用证的认识和实际操作能力,学校安排了信用证的缮制实训课程。

通过本次实训,我深入了解了信用证的基本知识、操作流程以及在实际业务中的应用。

二、实训目的1. 理解信用证的概念、种类和作用。

2. 掌握信用证的条款和格式。

3. 学会信用证的缮制技巧和注意事项。

4. 提高在实际业务中运用信用证的能力。

三、实训内容1. 信用证基础知识- 信用证的概念和作用- 信用证的种类- 信用证的当事人2. 信用证条款和格式- 信用证的基本条款- 信用证的格式要求- 信用证的条款解释3. 信用证的缮制技巧- 信用证的开证申请- 信用证的审核和修改- 信用证的缮制注意事项4. 信用证的实际应用- 信用证在出口贸易中的应用- 信用证在进口贸易中的应用- 信用证的风险防范四、实训过程1. 理论学习- 阅读教材和参考资料,了解信用证的基本知识和操作流程。

- 参加课堂讲座,听取教师对信用证的讲解和分析。

2. 实际操作- 在教师的指导下,学习信用证的缮制软件操作。

- 按照信用证的条款和格式,进行信用证的缮制练习。

- 针对实际业务案例,进行信用证的审核和修改。

3. 讨论交流- 与同学进行讨论,分享实训心得和经验。

- 向教师请教问题,解决实训过程中遇到的困难。

五、实训结果1. 理论知识掌握- 对信用证的概念、种类、作用有了全面的认识。

- 掌握了信用证的条款和格式,能够正确理解条款内容。

2. 操作技能提升- 熟练掌握了信用证的缮制软件操作。

- 能够独立完成信用证的缮制,并注意到了一些常见问题。

3. 实际应用能力- 能够运用信用证解决实际业务中的问题。

- 了解信用证的风险防范措施,提高了风险意识。

六、实训总结1. 优点- 通过本次实训,我对信用证有了更加深入的了解,提高了实际操作能力。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

信用证实训一、根据下列合同审核并修改信用证SALES CONFIRMATIONS/C NO.:SPT-211 DATE: Jan.8, 2015The Seller: SHANGHAI SPORTING GOODS IMP. & EXP. CORPAddress: 215 HUQIU ROAD SHANGHAI CHINAThe Buyer: PETRRCO INTERNATIONAL TRADING CO.Address: 1100 SHEPPARD AVENUE EAST SUITE406PORT OF LOADING AND DESTINATION: From Shanghai to Vancouver with transshipment and partial shipment allowed.TIME OF SHIPMENT: During Mar. 2015TERMS OF PAYMENT: The buyer shall open through a bank acceptable to the seller an irrevocable letter of credit at sight to reach the seller 30 days before the month of shipment valid for negotiation in Vancouver until the 15th day after the date of shipment.INSURANCE: To be covered by the seller for 110% of the invoice value against All Risks and War Risks as per the relevant ocean marine cargo clauses of the People’s Insurance Company of China dated 01/01/1981.REMARKS:1.The Buyer shall have the covering letter of credit reach the seller 30 days before shipment, falling which the Seller reserves the right to rescind without further notice, or to regard as still valid whole or any part of this contract not fulfilled by the Buyer, or to lodge a claim for losses thus sustained, if any.2.In case of any discrepancy in Quality/Quantity, claim should be filed by the Buyer within 130 days after the arrival of the goods at port of destination; while for quantity discrepancy, claim should be filed by the Buyer within 150 days after the arrival of the goods at port of destination.3.For transactions concluded on C.I.F. basis, it is understood that the insurance amount will be for 110% of the invoice value against the risks specified in the Sales Confirmation. If additional insurance amount or coverage required, the Buyer must have the consent of the Seller before Shipment, and the additional premium is to be borne by the Buyer.4.The Seller shall not hold liable for non-delivery or delay in delivery of the entire lot or a portion of the goods hereunder by reason of natural disasters, war or other causes of Force Majeure. However, the Seller shall notify the Buyer as soon as possible and furnish the Buyer within 15 days by registered airmail with a certificate issued by the China Council for the Promotion of International Trade attesting such event(S).5.All disputes arising out of the performance of, or relating to this contract, shall be settled through negotiation. In case no settlement can be reached through negotiation, the case shall arbitration inaccordance with its arbitral rules. The arbitration shall take place in Shanghai. The arbitral award is final and binding upon both parties.6.The Buyer is requested to sign and return one copy of this contract immediately after receipt of the same. Objection, if any, should be accepted the terms and condition of this contract.7.Special conditions (These shall prevail over all printed terms in case of any conflict.)Confirmed byTHE SELLER THE BUYER华海红 JONE(Signature) (Signature)信用证OUR L/C NO.PIT310JANUARY 30,2015FROM:THE ROYAL BANK OF CANADA,BRITISH, COLUMBIA INTERNATIONAL CENTER,1055 WEST GEORGIA STREET,VANCOUVER ,B.C.V6E 3P3TO: BANK OF CHINA, SHANGHAI BRANCHBENEFICIARY: SHANGHAI SPORTING GOODS IMP.& EXP .CORP.251 HUQIU ROAD, SHANGHAI CHINAAPPLICANT: PETRRCO INTERNATIONAL TRADING CO.1100 SHEPPARD AVENUE EAST SUITE 406, WILLOWDALE ONTARIO , CANADA M2K 2W2FOR USD 88,710.00(SAY U.S. DOLLARS EIGHTY EIGHT THOUSAND SEVEN HUNDRED AND TEN ONLY )TO EXPIRE ARRIL 15 TH 2015 IN OUR COUNTRY AVAILABLE BY NEGOTIATION OF YOUR DARFTS AT 30DAYS SIGHT FOR 100 PERCENT OF INVOICE VALUE DRAWN ON THE ROYAL BANK OF CANADA ACCOMPANIED FOLLOWING DOCUMENTS:1、COMMERCIAL INVOICE IN QUADRUPLICATES INDICATING THE SALES CONTRACT NUMBER.2、PACKING LIST/WEIGHT MEMO IN TRIPLICATE MENTIONING TOTAL NUMBER OF CARTONS, GROSS WEIGHT AND MEASUREMENTS PER EXPORT CARTON.3、FULL SET OF CLEAN “ON BOARD ”OCEAN BILLS OF LADING MADE OUT TO ORDER MARKED “FREIGHT COLLECT” AND NOTIFY APPLICANT.4、INSURANCE POLCIY OR CERTIFICATE IN DUPLICATE ENDORSED IN BLANK COVERING OCEAN MARIN CARGO CLAUSE ALL RISKS AND WAR RISKS FOR 100 PERCENT OF INVOICE VALUE AS PER CIC DATED 01/01/1981.5、INSPECTION CERTIFICATE IN DUPLICATE ISSUED AND SIGNED BY AUTHORIZED PERSON OF APPLICANT WHOSE SIGNATURE MUST COMPLY WITH THAT HELD IN OUR BANK’S RECORD. COVERING:2000 PCS GBW32 BASKETBALL US $16.95/PC 2000 PCS GBW322 FOOTBALL US$21.33/PC 1000 PCS ERV5 VOLLEYBALL US$12.15/PCTERMS OF SHIPMENT CIF VANCOUVER FROM SHANGHAI CHINA TO VANCOUVER CANADA DURING MARCH 2015 GOODS TO BE PACKED IN WOODEN CASES AND CONTAINER SHIPMENT PREFERABLE. TRANSSHIPMENT PERMITTED AND PARTIAL SHIPMENT PROHIBITED. SHIPPING MARKS: PITVANCOUVERNO.1-UPALL BANK CHARGES INCLUDING REIMBURSEMENT COMMISSION OUTSIDE CANADA ARE FOR ACCOUNT OF BENEFICIARY.DOCUMENTS TO BE PRESENTED WITHIN 3 DAYS AFTER THE DATE OF ISSUANCE OF THESHIPPING DOCUMENTS BUT WITH THE VALIDITY OF THE CREDIT.SPECIAL INSTRUCTIONS:──T.T.REIMBURSEMENT IS NOT ACCEPTABLE── THIS CREDIT IS NOT TRANSFERABLE── DOCUMENTS PRIOR TO THE ISSUANCE OF THIS CREDIT ARE NOT ACCEPTABLE.WE HEREBY ENGAGE WITH DRAWERS AND/OR BONA FIDE HOLDERS THAT DRAFTS DRAWN AND NEGOTIATED IN CONFORMITY WITH THE TERMS OF THIS CREDIT WILL BE DULY HONOURED ON PRESENTATION AND THAT DRAFTS ACCEPTED WITHIN THE TERMS OF THIS CREDIT WILL BE DULY HONOURED ON MATURITY.THIS CREDIT IS ISSUED SUBJECT TO UNIFORM CUSTOMS AND PRACTICE FOR DOCUMENTARY CREDITS (1993 REVISION)ICC PUBLICATION NO.500.AUTHORISED SIGNATURES二、据合同审核信用证,并写出信用证不符点。