PEVC法律术语英文版

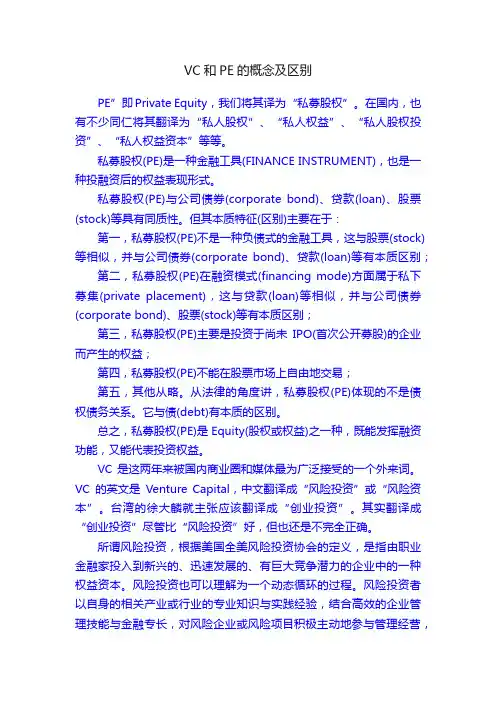

VC和PE的概念及区别

VC和PE的概念及区别PE”即Private Equity,我们将其译为“私募股权”。

在国内,也有不少同仁将其翻译为“私人股权”、“私人权益”、“私人股权投资”、“私人权益资本”等等。

私募股权(PE)是一种金融工具(FINANCE INSTRUMENT),也是一种投融资后的权益表现形式。

私募股权(PE)与公司债券(corporate bond)、贷款(loan)、股票(stock)等具有同质性。

但其本质特征(区别)主要在于:第一,私募股权(PE)不是一种负债式的金融工具,这与股票(stock)等相似,并与公司债券(corporate bond)、贷款(loan)等有本质区别;第二,私募股权(PE)在融资模式(financing mode)方面属于私下募集(private placement),这与贷款(loan)等相似,并与公司债券(corporate bond)、股票(stock)等有本质区别;第三,私募股权(PE)主要是投资于尚未IPO(首次公开募股)的企业而产生的权益;第四,私募股权(PE)不能在股票市场上自由地交易;第五,其他从略。

从法律的角度讲,私募股权(PE)体现的不是债权债务关系。

它与债(debt)有本质的区别。

总之,私募股权(PE)是Equity(股权或权益)之一种,既能发挥融资功能,又能代表投资权益。

VC是这两年来被国内商业圈和媒体最为广泛接受的一个外来词。

VC的英文是Venture Capital,中文翻译成“风险投资”或“风险资本”。

台湾的徐大麟就主张应该翻译成“创业投资”。

其实翻译成“创业投资”尽管比“风险投资”好,但也还是不完全正确。

所谓风险投资,根据美国全美风险投资协会的定义,是指由职业金融家投入到新兴的、迅速发展的、有巨大竞争潜力的企业中的一种权益资本。

风险投资也可以理解为一个动态循环的过程。

风险投资者以自身的相关产业或行业的专业知识与实践经验,结合高效的企业管理技能与金融专长,对风险企业或风险项目积极主动地参与管理经营,直至风险企业或风险项目公开交易或通过并购方式实现资本增值与资金的流动性。

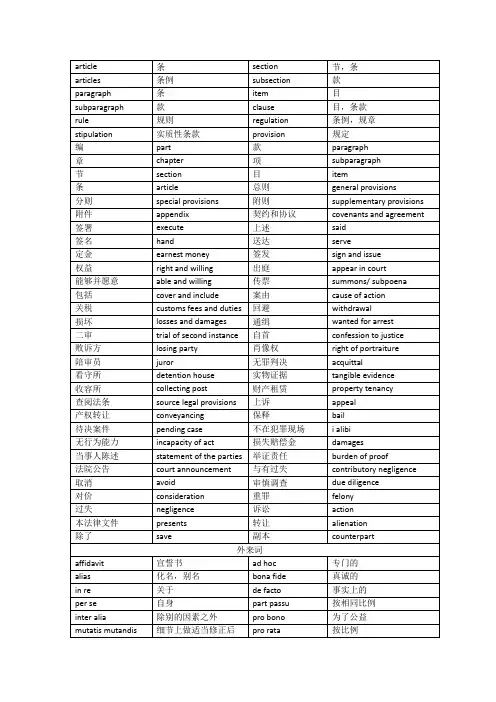

法律英语专业名词双语对照

律师卷宗

lawyer’s docile

民事诉讼

律师助理

assistant lawyer

律师资格证

lawyer qualification certificate

民事诉讼

civil litigation

判决

judgement(用于民事和行政案件)

出具律师意见书

providing legal opinion

出示证据

exhibit

答辩状

answer; reply

代理词

representation

代理仲裁

agency for arbitration

代写文书

drafting of legal instruments

待决案件

pending case

代理房地产买卖与转让

法学系

faculty of law

法院公告

court announcement

反诉讼

counterclaim

非合伙律师

associate lawyer

非诉讼业务

non-litigation practice

高级合伙人

senior partner

公诉案件

public-prosecuting case

公证书

acquittal

看守所

detention house

实物证据

tangible evidence

收容所

collecting post

财产租赁

property tenancy

查阅法条

source legal provisions

环境法法律英语术语1

Terms

• Standing 起诉权 在法院和审裁处获得聆讯的资格和权 利。某事项之起诉权的测试视乎有关 事项的性质,谋求的济助及有关的法 律。如有关的法律程序涉及公众的元 素 (例如挑战政府的决定或谋求强制 执行权利和义务),则通常才会产生 一人是否有起诉权展开法律程序的问 题,这与私人性质的法律诉讼程序有 别(例如违反合约的诉讼)。在申请

Terms

• Severe and irreversible changes to natural ecosystem 自然生态系统 会产生严重的与不可逆的改变 • Judicial review 司法审查 上诉审查 • Procedural right 程序性权利 • Air pollutant 大气污染物 • Public health or welfare 公众健康和 福利 • Reasoned explanation 合理解释

Terms

• EPA(Environmental Protection Agency)环境保护署 • Petition申诉;申请 向法院或其他官 方机构提交的正式书面文件,请求其 行使职权以纠正不法行为或授予某种 特权或许可或就特定事项采取司法措Байду номын сангаас施等。 • Petitioner请愿者;请求人;申请人 向国王、立法机关、政府官员或法院 递交请愿书、请求状或申请书的人。

Terms

• Redressability 可补偿性 • Motor-vehicle emission 机动车尾气 排放物 • Seek review 复审 • Concrete injury 实质损害 • Carbon dioxide emissions 二氧化碳 排放物 • Greenhouse gas 温室气体 • Public interest litigation 公益诉讼

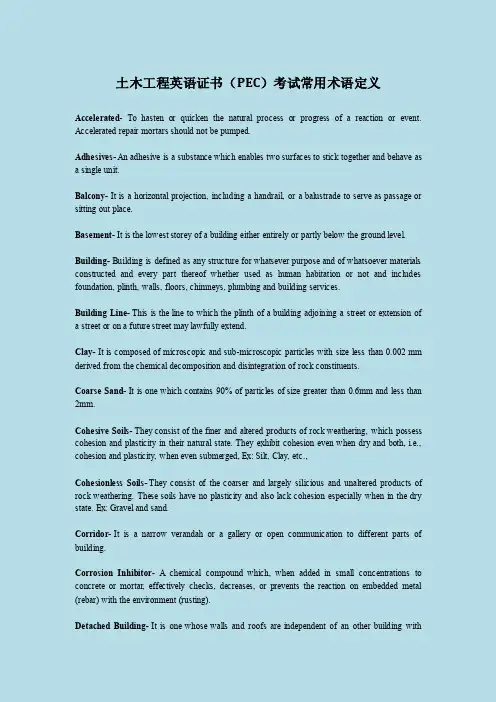

土木工程英语证书考试(PEC)常用术语定义

土木工程英语证书(PEC)考试常用术语定义Accelerated- To hasten or quicken the natural process or progress of a reaction or event. Accelerated repair mortars should not be pumped.Adhesives- An adhesive is a substance which enables two surfaces to stick together and behave as a single unit.Balcony- It is a horizontal projection, including a handrail, or a balustrade to serve as passage or sitting out place.Basement- It is the lowest storey of a building either entirely or partly below the ground level.Building- Building is defined as any structure for whatsever purpose and of whatsoever materials constructed and every part thereof whether used as human habitation or not and includes foundation, plinth, walls, floors, chimneys, plumbing and building services.Building Line- This is the line to which the plinth of a building adjoining a street or extension of a street or on a future street may lawfully extend.Clay- It is composed of microscopic and sub-microscopic particles with size less than 0.002 mm derived from the chemical decomposition and disintegration of rock constituents.Coarse Sand- It is one which contains 90% of particles of size greater than 0.6mm and less than 2mm.Cohesive Soils- They consist of the finer and altered products of rock weathering, which possess cohesion and plasticity in their natural state. They exhibit cohesion even when dry and both, i.e., cohesion and plasticity, when even submerged, Ex: Silt, Clay, etc.,Cohesionless Soils- They consist of the coarser and largely silicious and unaltered products of rock weathering. These soils have no plasticity and also lack cohesion especially when in the dry state. Ex: Gravel and sand.Corridor- It is a narrow verandah or a gallery or open communication to different parts of building.Corrosion Inhibitor- A chemical compound which, when added in small concentrations to concrete or mortar, effectively checks, decreases, or prevents the reaction on embedded metal (rebar) with the environment (rusting).Detached Building- It is one whose walls and roofs are independent of an other building withopen spaces on all sides.Dry Mix Shotcrete- Repair material is placed dry or slightly damp into shotcrete machine and mixed with compressed air. The mixture is transported via hose to the exit nozzle where water and admixtures, if any, are introduced. The ingredients are propelled onto the prepared substrate by the force of the compressed air.Fiber Reinforced- Fibers are made from steel, plastic, glass, and natural materials and come in many sizes and shapes. May improve flexural strength, impact strength, toughness, fatigue strength, and resistance to cracking.Fine Sand- It is one which contains 90% of particles of size greater than 0.06mm and less than 0.2mm.Fire Doors- The doors specially designed to resist the passage of fire are called fire doors.Foundation- It is the lowest artificially prepared part, below the surface of the surrounding ground, which is in direct contact with sub-strata and transmits all the loads to the sub-soil.Fly Ash- A mineral pozzolan added to repair mortars to reduce segregation and bleeding. Fly Ash will also reduce the heat caused by hydration by up to 40%. This enables the product to be accelerated for maximum quick setting ability.Geyser- It is an appliance or apparatus which is used for heating water and delivering it from a tap.Igneous Rocks- These are formed from the solidification of molten matter called magma, in the surface of earth or above it. Ex: Granite, Dolerite, Basalt, etc.,Integral Powdered Polymer- Dry powdered latex added the mortar and is activated when water is added to the product.Light Weight Hollow Nodule- Hollow spheres (glass like) that are added to mixes to reduce their weight for overhead applications. These products should not be used where abrasion may be a factor.Liquid Polymer Component- An emulsion of a natural or synthetic rubber in a water phase. The contents of the jug in the “jug and bag” products-often referred to as “milk”. Enables the mortar to bond better, increases density and abrasion.Load Bearing Walls- Those walls which are designed to carry any superimposed load, in addition to their own weight, are termed as load bearing walls.Loft- it is an intermediary floor between two floors on a residential space in pitched roof, above normal floor level with a maximum height of 1.5 m and which is constructed for storage purposes.Low Velocity Spray - Method for application of repair materials up to a depth where reinforcing bar is encountered. This may be by a hopper gun or with carousel pump equipment.Masonry Walls- All those walls which are built of individual blocks or material such as bricks, stone, clay or concrete usually in horizontal courses, cemented or bonded together with some form of mortar are termed as Masonry walls.Medium Sand- It is one which contains 90% of particles of size greater than 0.2mm and less than 0.6mm.Metamorphic Rocks- These are the either igneous or sedimentary rocks whose physical and chemical properties have been changed by the action of intense pressure or heat.Non-Load Bearing Walls- Those walls, which support no vertical load other than their own weight, are termed as non-load bearing walls.Pantry- This is a small room generally provided adjacent to dining room for keeping cooked food.Plinth- It is the middle part of the structure, above the surface of the surrounding ground up to the surface of the floor (i.e., floor level) immediately above the ground.Plinth Area- It is the built up covered area measured at the floor level of the beasement or of any storey.Porch- A roof supported on pillars in front of a verandah or in front of a building for parking.Residual Soils- These soils (Ex: Sands, Silts, and Clays) are the products, of disintegration of rocks and are located at the place of their formation.Safe Bearing Capacity- It is the net intensity of loading that the soil will safely carry without the risk of failure either due to shear or due to excessive settlement.Sedimentary Rocks- These rocks are the result of the accumulation of weathered deposits of igneous rocks, Ex: Gravel, Sand stone, Lime stone, Gypsum, Lignite, etc.,Semi-Detached Building- It is one whose three sides are detached with open spaces.Sewer- It is closed drain used for carrying night soil and other water-borne waste.Shear Wall- Any wall designed to carry horizontal forces acting in its plane with or without the imposed loads is termed as shear wall.Shoring- Shoring is the means of providing temporary support to unsafe structures, the stability ofwhich has been endangered due to unequal settlement of the foundation or due to removal of adjacent buildings, or due to bad work-manship, or due to any other reason.Shrinkage Compensated- A hydraulic cement that expands slightly during the early hardening period after setting of the repair mortar. They are used to compensate for the volume decrease due to drying shrinkage.Silica Fume- Highly reactive possolana, and by product of ferrosilican production. 100 times smaller than a piece of cement, these particles interlock during the hydration process making the repair mortar very dense. Also increases bonding ability and abrasion.Silt- It is a fine grained soil with particles ranging in size from 0.002mm to 0.06mm with little or no plasticity.Stair Well- It is also known as staircase. The space in a building occupied by the stair is called as stairwell or staircase.Storey- It is the portion of a building included between the surface of any floor and the structure of the floor next above it, or if there be no floor above it, then the space between any floor and the ceiling next above it.Superstructure- The part of the structure constructed above the plinth level (or ground floor level) is termed as superstructure.Tiles- The tiles are used for common purposes like roofing, flooring and drains in construction industry.Transported Soils- These are the residual soils which get transported and deposited at another location by the forces of gravity, water, wind and ice.Veneered Wall- It is a wall in which the facing is attached to the backing but not so bonded as to exert a common reaction under the load.Wet Mix Shotcrete- Pre-batched and thoroughly mixed repair material is placed into a concrete pump and transported via pump line to an exit nozzle where compressed air and admixtures, if any, are introduced. The repair material is propelled onto the surface by the compressed air.。

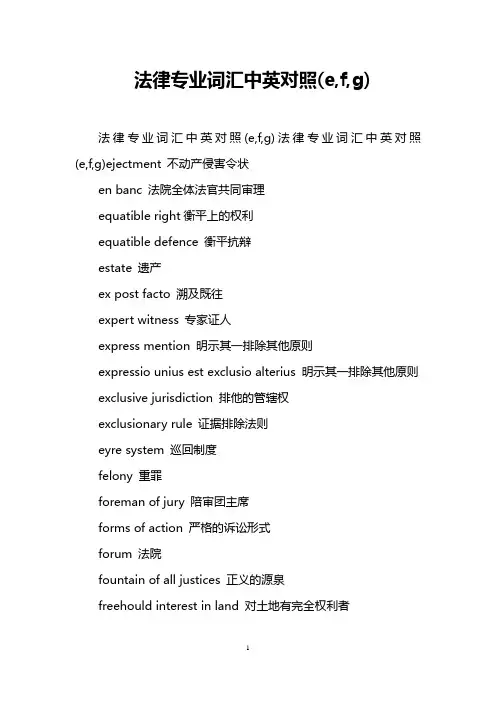

法律专业词汇中英对照(e,f,g)

法律专业词汇中英对照(e,f,g)

法律专业词汇中英对照(e,f,g)法律专业词汇中英对照(e,f,g)ejectment 不动产侵害令状

en banc 法院全体法官共同审理

equatible right衡平上的权利

equatible defence 衡平抗辩

estate 遗产

ex post facto 溯及既往

expert witness 专家证人

express mention 明示其一排除其他原则

expressio unius est exclusio alterius 明示其一排除其他原则exclusive jurisdiction 排他的管辖权

exclusionary rule 证据排除法则

eyre system 巡回制度

felony 重罪

foreman of jury 陪审团主席

forms of action 严格的诉讼形式

forum 法院

fountain of all justices 正义的源泉

freehould interest in land 对土地有完全权利者

general assumpsit 不当得利令状general jurisdiction 一般管辖权geografhic jurisdiction 地域管辖权grand jury 大陪审团

法律专业词汇中英对照(e,f,g) 相关内容:。

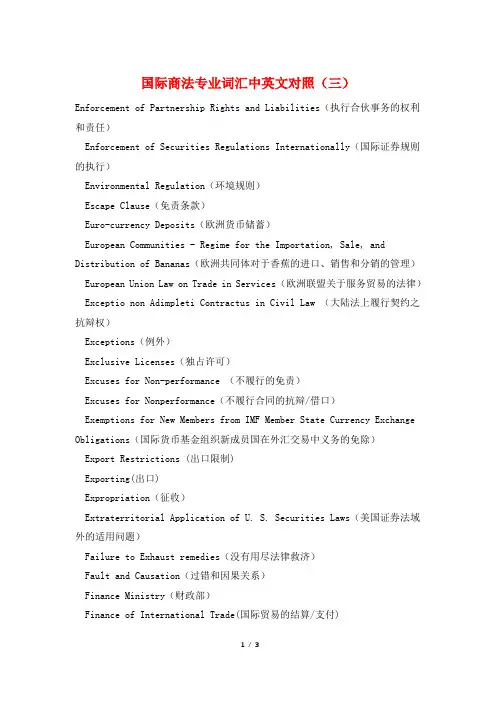

国际商法专业词汇中英文对照(三)

国际商法专业词汇中英文对照(三)Enforcement of Partnership Rights and Liabilities(执行合伙事务的权利和责任)Enforcement of Securities Regulations Internationally(国际证券规则的执行)Environmental Regulation(环境规则)Escape Clause(免责条款)Euro-currency Deposits(欧洲货币储蓄)European Communities - Regime for the Importation, Sale, and Distribution of Bananas(欧洲共同体对于香蕉的进口、销售和分销的管理) European Union Law on Trade in Services(欧洲联盟关于服务贸易的法律) Exceptio non Adimpleti Contractus in Civil Law (大陆法上履行契约之抗辩权)Exceptions(例外)Exclusive Licenses(独占许可)Excuses for Non-performance (不履行的免责)Excuses for Nonperformance(不履行合同的抗辩/借口)Exemptions for New Members from IMF Member State Currency Exchange Obligations(国际货币基金组织新成员国在外汇交易中义务的免除)Export Restrictions (出口限制)Exporting(出口)Expropriation(征收)Extraterritorial Application of U. S. Securities Laws(美国证券法域外的适用问题)Failure to Exhaust remedies(没有用尽法律救济)Fault and Causation(过错和因果关系)Finance Ministry(财政部)Finance of International Trade(国际贸易的结算/支付)Financing Foreign Trade(对外贸易的价金支付)FOB (free on hoard) (port of shipment)(FOB装运港船上交货)Force Majeure Clauses (不可抗力条款)Foreign Investment Guarantees(外国投资的担保)Foreign Investment Laws and Codes(外国投资法)Formal and Informal Application Process(正式和非正式申请程序)Formation of the Contract(合同的成立)Forsed Endorsements(虚假背书)Fraud Exception in Letters of Credit Transaction (信用证交易的欺诈例外)Frauds on Bills of Lading(提单欺诈)Fraudulent Misrepresentation(受欺诈的误解)Free Zones(保税区/自由贸易区)Fundamental Breach(根本违约)GATS Schedules of Specific Commitments(服务贸易总协定减让表中的特别承诺)General Agreement on Trade in Services (服务贸易总协定)General Requirements and Rights of the Holder in Due Course(票据持有人的一般要求和权利)General Standards of Performance(履行的一般标准)Geographic Limitations(地区限制)Government Controls over Trade (政府对贸易的管制)Government Guarantees(政府担保)Governmental Interest(政府利益原则)Governmental Sources of Capital(官方资金)Grant Back Provisions(回授的规定)Home state Regulation of Multinational Enterprises(本国对跨国企业的管理)Host State Regulation of Multinational Enterprises(东道国对跨国企业的管理)Illegality and Incompetency(行为不合法性与主体不适当资格的认定) IMF Conditionality (国际货币基金组织的制约性)IMF Facilities(国际货币基金组织的机制)IMF Operations(国际货币基金组织的运作)IMF Quotas(国际货币基金的份额)Immunities of States from the Jurisdiction of Municipal Courts(国家豁免于内国法院的管辖权)Import-Licensing Procedures(进口许可证程序协定)Income Categories(收入分类)Income Tax Rates(所得税税率)Income Taxes(所得税)Independence Principles and Rule of Strict Compliance (信用证独立原则和单证严格相符规则)Indirect Exporting(间接出口)Industrial Property Agreements (保护工业产权的协定)。

(完整版)法律专业英语词汇

完整版)法律专业英语词汇Part 1: 刑法词汇1.罪犯(criminal):犯罪行为的实施者。

2.杀人(murder):故意造成他人死亡的行为。

3.盗窃(theft):非法占有他人财产的行为。

4.强奸(rape):非法性侵他人的行为。

5.纵火(arson):故意放火的行为。

6.敲诈(___):以暴力或威胁手段获取财产的行为。

7.走私(smuggling):非法将商品或物品携带入境或出境。

8.贩毒(drug trafficking):非法交易毒品或在毒品交易中参与。

9.偷税漏税(___):通过欺诈手段逃避缴纳税款。

10.洗钱(money laundering):将非法获取的资金合法化。

Part 2: 民事法词汇1.合同(contract):双方达成的书面或口头协议,产生法律效力。

2.索赔(claim):要求对方支付损失或赔偿的权利。

3.诉讼(n):通过法律程序解决争端。

4.侵权(infringement):侵犯他人权益或利益的行为。

5.损害赔偿(n):对因他人行为受到损害的一方支付的补偿款项。

6.法定继承人(legal heir):根据法律规定,有权继承遗产的人。

7.执行(enforcement):将法律判决或裁决强制执行的行为。

8.违约(breach of contract):不履行或违反合同中规定的义务。

9.诉讼费用(n costs):诉讼过程中产生的费用,如律师费、鉴定费等。

10.司法鉴定(judicial appraisal):法院指定的专门机构对相关事实或证据进行鉴定。

Part 3: 行政法词汇1.行政机关(administrative organ):政府管理机关,行使行政权力。

2.行政处罚(administrative penalty):行政机关根据法律或法规对违法行为采取的处罚措施。

3.行政许可(administrative license):行政机关根据法律或法规对特定行为发出的批准文件。

英语词汇-法律

法律Law General 一般概念discipline 纪律accuse 控告arraign 指责bill 法案code 法典constitution 宪法convict 定罪crime 罪行decree 法令default 违约delate 控告,宣布edict 布告goal 监狱guilt 罪行illegal 不合法illicit 违法impeach 控告,挑剔judicial 司法juris- 司法jurisdiction 司法权justice 公正,司法law 法律legal 合法legislate 立法legitimate 合法litigate 诉讼martinet 严峻的军纪官ordinance 法令,条令peccant 有罪penal 刑事perpetrate 犯罪的prison 监狱prosecute 起诉sentence 判决indict 控告,起诉jail 监狱sin 罪过statute 法规sue 控告Personnel 人员clerk 书记员accessary 从犯accomplice 从犯attorney 律师bailiff 法警barrister 高级律师client 当事人cop 警察counsel 法律顾问counselor 顾问,律师court 法院court reporter 法院书记官culprit 犯人defendant 被告district attorney 地方检察官,公诉人felon 重罪犯jury 陪审团jury foreman 陪审团主席lawyer 律师minor 未成年人notary 公证人offender 罪犯plaintiff 原告police 警察probation officer 缓刑监督官procurator 代理人,检查官prosecuting attorney 检察官prosecutor 告发者public defender 公设辩护人solicitor 律师state's attorney 州检察官tribunal 法官,法庭Grand Jury 大陪审团judge 审判员,法官trustee 委托人witness 目击证人Places 处所bar 律师团,法院bench 法官席civil court 民事法庭courthouse 法院Court of Appeals 上诉法院courtroom 法庭Federal District Court 联邦地区法院gavel 木槌jury box 陪审团席judge's chambers 法官室law office 律师事务所legal aid service 法律援助服务probate court 遗嘱检验法庭State District Court 州地方法院Supreme Court 最高法院witness stand 出庭作证Adjectives 形容词alleged 有嫌疑的hung (jury) 挂起的guilty 有罪的innocent 无罪的liable 应负责的no contest 无争议nolo contendre 无争议(objection) over-ruled 驳回(objection) sustained 准许pre-trial 预审Verbs 动词allege 申述absolve 赦免acquit 开释amnesty 大赦appeal 上诉argue 辩论arrest 拘捕award 判决bail 保释capture 俘获charge 指控charge the jury 控诉commute 减刑defend 辩护deliberate 故意的deliver 释放detention 拘留dissent 持异议emancipate 解放enter a plea 抗辩exempt 豁免exonerate 免罪extradite 引渡find 裁决hear a case 审理案件imprison 监禁instruct 命令jump bail 弃保潜逃liberate 解放plead 辩护release 释放remand 拒留reprieve 缓刑reverse a decision 撤回裁决serve a sentence 服刑swear 宣誓testify 作证throw out a case 拒绝立案try 审判uphold 支持Events and Activities 活动accusation 指控acquittal 开释alimony 瞻养费allegationcase 案例claim (根据权利提出)主张conviction 定罪court order 法庭庭谕cross-examination 反诘问damage 赔偿(金)death penalty 死刑decision 决定defense 辩护deposition 作证evidence 证据exhibit 证物findings 审查结果,判决fraud 欺骗grievance 冤情hearing 听证indictment 起诉inquest 审讯libel 诽谤罪litigation 诉讼manslaughter 一般杀人罪mistrial 无效审判opinion 鉴定parole 使假释出狱perjury 伪证probation 缓刑prosecution 起诉recess 休会retrial 再审right(s) 权利ruling 裁定sequester 扣押settlement 处理suit 诉讼summons 传票testimony 证词trial 审判verdict 判决injunction 命令writ 文件inquiry 调查Idioms and Expressions 成语和表达法bail out 保释do time 在监服刑get away with murder 逍遥法外here come the judge 法官来了jailbird 累犯lay down the law 制定法律of age 成年open and shut case 一目了然的事take the law into one's hands 擅自处理take the stand 出庭作证third degree 严刑逼供throw the book at 严惩,重罚under age 未成年。

法律英语词汇大全(完美版)

法律英语词汇大全(完美版)一、基本法律词汇1. 法律(Law):国家制定或认可的,用以规范社会成员行为、调整社会关系的规范总称。

2. 法规(Regulation):国家行政机关根据法律制定的具有普遍约束力的规范性文件。

3. 条款(Clause):法律、合同等文件中的具体规定。

4. 判决(Judgment):法院对案件审理后作出的结论性意见。

5. 律师(Lawyer):依法取得执业资格,为社会提供法律服务的专业人员。

6. 诉讼(Lawsuit):当事人依法向法院提起的请求保护自己合法权益的程序。

二、刑法相关词汇1. 犯罪(Crime):违反刑法规定,危害社会,依法应受刑罚处罚的行为。

2. 罪名(Charge):对犯罪嫌疑人指控的具体犯罪名称。

3. 刑罚(Punishment):国家对犯罪分子实行的一种强制措施,包括主刑和附加刑。

4. 刑事责任(Criminal Responsibility):犯罪分子因其犯罪行为所应承担的法律责任。

5. 量刑(Sentencing):法院根据犯罪分子的犯罪事实、情节和悔罪表现,依法决定刑罚的种类和幅度。

三、民法相关词汇1. 合同(Contract):当事人之间设立、变更、终止民事法律关系的协议。

2. 权利(Right):法律赋予当事人实现某种利益的可能性。

3. 义务(Obligation):当事人依法应承担的责任。

4. 赔偿(Compensation):因侵权行为给他人造成损失,依法应承担的经济补偿责任。

5. 继承(Inheritance):继承人依法取得被继承人遗产的法律制度。

四、商法相关词汇1. 公司(Company):依法设立的,以营利为目的的企业法人。

2. 股东(Shareholder):持有公司股份,享有公司权益和承担公司风险的人。

3. 破产(Bankruptcy):债务人因不能清偿到期债务,经法院宣告破产,对其财产进行清算的法律程序。

4. 票据(Bill):具有一定格式,载明一定金额,由出票人签发,无条件支付给持票人或指定人的有价证券。

(完整版)PPP专业词汇中英文对照表

中文

Advance payment guarantee

预付款担保

Affermage contracts

租赁合同

Annuity scheme

年付计划

Availability-based PPPs

政府付费PPP项目

Bankability

融资可行性

Best practice

最佳实践方案

Borrower

出口信贷机构

Expression of interest

意向书

Final business case

最终商业方案

Financial case/assessment

商业方案/评估

Financial closure

融资方案完成

Financial covenant

财务约定事项

First in last out

借款人

Competetive tension

竞争压力

Competitive dialogue

竞争性对话

Concession contract

特许经营合同

Concession monitoring unit

特许经营监督中心

Consortium

承包联合体

Contingent liability

或有负债

Contractor

Technical evaluation

技术评估/评价

Unsolicited proposals

市场投资人

Private participation in infrastructure project database

市场投资基础设施项目数据库

private sector

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

This sample document is the work product of a national coalition of attorneys who specialize in venture capital financings, working under the auspices of the NVCA. This document is intended to serve as a starting point only, and should be tailored to meet your specific requirements. This document should not be construed as legal advice for any particular facts or circumstances. Note that this sample document presents an array of (often mutually exclusive) options with respect to particular deal provisions.TERM SHEETThis term sheet maps to the NVCA Model Documents, and for convenience the provisions are grouped according to the particular Model Document in which they may be found. Although this term sheet is perhaps somewhat longer than a "typical" VC Term Sheet, the aim is to provide a level of detail that makes the term sheet useful as both a road map for the document drafters and as a reference source for the business people to quickly find deal terms without the necessity of having to consult the legal documents (assuming of course there have been no changes to the material deal terms prior to execution of the final documents).FOR SERIES A PREFERRED STOCK FINANCING OF[INSERT COMPANY NAME], INC.[ __, 20__]This Term Sheet summarizes the principal terms of the Series A Preferred Stock Financing of [___________], Inc., a [Delaware] corporation (the “Company”). In consideration of the time and expense devoted and to be devoted by the Investors with respect to this investment, the No Shop/Confidentiality [and Counsel and Expenses] provisions of this Term Sheet shall be binding obligations of the Company whether or not the financing is consummated. No other legally binding obligations will be created until definitive agreements are executed and delivered by all parties. This Term Sheet is not a commitment to invest, and is conditioned on the completion of due diligence, legal review and documentation that is satisfactory to the Investors. This Term Sheet shall be governed in all respects by the laws of [______________the ].1Offering TermsClosing Date: As soon as practicable following the Company’s acceptance of thisTerm Sheet and satisfaction of the Conditions to Closing (the“Closing”). [provide for multiple closings if applicable] Investors: Investor No. 1: [_______] shares ([__]%), $[_________]Investor No. 2: [_______] shares ([__]%), $[_________][as well other investors mutually agreed upon by Investors and theCompany]Amount Raised: $[________], [including $[________] from the conversion ofprincipal [and interest] on bridge notes].2Price Per Share: $[________] per share (based on the capitalization of the Companyset forth below) (the “Original Purchase Price”).1The choice of law governing a term sheet can be important because in some jurisdictions a term sheet that expressly states that it is nonbinding may nonetheless create an enforceable obligation to negotiate the terms set forth inthe term sheet in good faith. Compare SIGA Techs., Inc. v. PharmAthene, Inc., Case No. C.A. 2627 ( (Del. Supreme Court May 24, 2013) (holding that where parties agreed to negotiate in good faith in accordance with a term sheet, thatobligation was enforceable notwithstanding the fact that the term sheet itself was not signed and contained a footer oneach page stating “Non Binding Terms”); EQT Infrastructure Ltd. v. Smith, 861 F. Supp. 2d 220 (S.D.N.Y. 2012); Stanford Hotels Corp. v. Potomac Creek Assocs., L.P., 18 A.3d 725 (D.C. App. 2011)with Rosenfield v. United StatesTrust Co., 5 N.E. 323, 326 (Mass. 1935) (“An agreement to reach an agreement is a contradiction in terms and imposes no obligation on th e parties thereo.”); Martin v. Martin, 326 S.W.3d 741 (Tex. App. 2010); Va. Power Energy Mktg. v. EQT Energy, LLC, 2012 WL 2905110 (E.D. Va. July 16, 2012). As such, because a “nonbinding” term sheet governed by thelaw of a jurisdiction such as Delaware, New York or the District of Columbia may in fact create an enforceable obligationto negotiate in good faith to come to agreement on the terms set forth in the term sheet, parties should give considerationto the choice of law selected to govern the term sheet.2Modify this provision to account for staged investments or investments dependent on the achievement of milestones by the Company.Pre-Money Valuation: The Original Purchase Price is based upon a fully-diluted pre-moneyvaluation of $[_____] and a fully-diluted post-money valuation of$[______] (including an employee pool representing [__]% of thefully-diluted post-money capitalization).Capitalization: The Company’s capital structure before and after the Closing is setforth on Exhibit A.CHARTER3Dividends: [Alternative 1: Dividends will be paid on the Series A Preferred onan as-converted basis when, as, and if paid on the Common Stock][Alternative 2: The Series A Preferred will carry an annual [__]%cumulative dividend [payable upon a liquidation or redemption]. Forany other dividends or distributions, participation with CommonStock on an as-converted basis.] 4[Alternative 3: Non-cumulative dividends will be paid on the SeriesA Preferred in an amount equal to $[_____] per share of Series APreferred when and if declared by the Board.]Liquidation Preference: In the event of any liquidation, dissolution or winding up of theCompany, the proceeds shall be paid as follows:[Alternative 1 (non-participating Preferred Stock): First pay [one]times the Original Purchase Price [plus accrued dividends] [plusdeclared and unpaid dividends] on each share of Series A Preferred(or, if greater, the amount that the Series A Preferred would receiveon an as-converted basis). The balance of any proceeds shall bedistributed pro rata to holders of Common Stock.][Alternative 2 (full participating Preferred Stock): First pay [one]times the Original Purchase Price [plus accrued dividends] [plusdeclared and unpaid dividends] on each share of Series A Preferred.Thereafter, the Series A Preferred participates with the Common3The Charter (Certificate of Incorporation) is a public document, filed with the Secretary of State of the statein which the company is incorporated, that establishes all of the rights, preferences, privileges and restrictions of the Preferred Stock.4In some cases, accrued and unpaid dividends are payable on conversion as well as upon a liquidation event. Most typically, however, dividends are not paid if the preferred is converted. Another alternative is to give the Companythe option to pay accrued and unpaid dividends in cash or in common shares valued at fair market value. The latter are referred to as “PIK” (payment-in-kind) dividends.Stock pro rata on an as-converted basis.][Alternative 3 (cap on Preferred Stock participation rights): First pay[one] times the Original Purchase Price [plus accrued dividends][plus declared and unpaid dividends] on each share of Series APreferred. Thereafter, Series A Preferred participates with CommonStock pro rata on an as-converted basis until the holders of Series APreferred receive an aggregate of[_____] times the Original PurchasePrice (including the amount paid pursuant to the precedingsentence).]A merger or consolidation (other than one in which stockholders ofthe Company own a majority by voting power of the outstandingshares of the surviving or acquiring corporation) and a sale, lease,transfer, exclusive license or other disposition of all or substantiallyall of the assets of the Company will be treated as a liquidation event(a “Deemed Liquidation Event”), thereby triggering payment of theliquidation preferences described above [unless the holders of [___]%of the Series A Preferred elect otherwise]. [The Investors' entitlementto their liquidation preference shall not be abrogated or diminished inthe event part of the consideration is subject to escrow in connectionwith a Deemed Liquidation Event.]5Voting Rights: The Series A Preferred shall vote together with the Common Stock onan as-converted basis, and not as a separate class, except (i) [so longas [insert fixed number, or %, or “any”] shares of Series A Preferredare outstanding,] the Series A Preferred as a class shall be entitled toelect [_______] [(_)] members of the Board (the “Series ADirectors”), and (ii) as required by law. The Company’s Certificateof Incorporation will provide that the number of authorized shares ofCommon Stock may be increased or decreased with the approval of amajority of the Preferred and Common Stock, voting together as asingle class, and without a separate class vote by the Common Stock.6 Protective Provisions: [So long as[insert fixed number, or %, or “any”] shares of Series APreferred are outstanding,] in addition to any other vote or approvalr equired under the Company’s Charter or Bylaws,the Company willnot, without the written consent of the holders of at least [__]% of theCompany’s Series A Preferred, either directly or by amendment,merger, consolidation, or otherwise:(i) liquidate, dissolve or wind-up the affairs of the Company, or5See Subsection 2.3.4 of the Model Certificate of Incorporation and the detailed explanation in related footnote 25.6For corporations incorporated in California, one cannot “opt out” of the statutory requirement of a s eparate class vote by Common Stockholders to authorize shares of Common Stock. The purpose of this provision is to "opt out"of DGL 242(b)(2).effect any merger or consolidation or any other DeemedLiquidation Event; (ii) amend, alter, or repeal any provision of theCertificate of Incorporation or Bylaws [in a manner adverse to theSeries A Preferred];7 (iii) create or authorize the creation of orissue any other security convertible into or exercisable for anyequity security, having rights, preferences or privileges senior toor on parity with the Series A Preferred, or increase the authorizednumber of shares of Series A Preferred; (iv) purchase or redeemor pay any dividend on any capital stock prior to the Series APreferred, [other than stock repurchased from former employeesor consultants in connection with the cessation of theiremployment/services, at the lower of fair market value or cost;][other than as approved by the Board, including the approval of[_____] Series A Director(s)]; or (v) create or authorize thecreation of any debt security [if the Company’s aggregateindebtedness would exceed $[____][other than equipment leasesor bank lines of credit][unless such debt security has received theprior approval of the Board of Directors, including the approval of[________] Series A Director(s)]; (vi) create or hold capital stockin any subsidiary that is not a wholly-owned subsidiary or disposeof any subsidiary stock or all or substantially all of any subsidiaryassets; [or (vii) increase or decrease the size of the Board ofDirectors].8Optional Conversion: The Series A Preferred initially converts 1:1 to Common Stock at anytime at option of holder, subject to adjustments for stock dividends,splits, combinations and similar events and as described below under“Anti-dilution Provisions.”Anti-dilution Provisions: In the event that the Company issues additional securities at apurchase price less than the current Series A Preferred conversionprice, such conversion price shall be adjusted in accordance with thefollowing formula:[Alternative 1: “Typical” weighted average:CP2 = CP1 * (A+B) / (A+C)CP2= Series A Conversion Price in effect immediately afternew issueCP1= Series A Conversion Price in effect immediately priorto new issue7Note that as a matter of background law, Section 242(b)(2) of the Delaware General Corporation Law provides that if any proposed charter amendment would adversely alter the rights, preferences and powers of one series of Preferred Stock, but not similarly adversely alter the entire class of all Preferred Stock, then the holders of that series are entitled to a separate series vote on the amendment.8The board size provision may also be addressed in the Voting Agreement; see Section 1.1 of the Model Voting Agreement.A = Number of shares of Common Stock deemed to beoutstanding immediately prior to new issue (includesall shares of outstanding common stock, all shares ofoutstanding preferred stock on an as-converted basis,and all outstanding options on an as-exercised basis;and does not include any convertible securitiesconverting into this round of financing)9B = Aggregate consideration received by the Corporationwith respect to the new issue divided by CP1C = Number of shares of stock issued in the subjecttransaction][Alternative 2: Full-ratchet – the conversion price will be reduced tothe price at which the new shares are issued.][Alternative 3: No price-based anti-dilution protection.]The following issuances shall not trigger anti-dilution adjustment:10(i) securities issuable upon conversion of any of the Series APreferred, or as a dividend or distribution on the Series APreferred; (ii) securities issued upon the conversion of anydebenture, warrant, option, or other convertible security; (iii)Common Stock issuable upon a stock split, stock dividend, or anysubdivision of shares of Common Stock; and (iv) shares ofCommon Stock (or options to purchase such shares of CommonStock) issued or issuable to employees or directors of, orconsultants to, the Company pursuant to any plan approved by theCompany’s Board of Directors [including at leas t [_______]Series A Director(s)].Mandatory Conversion: Each share of Series A Preferred will automatically be converted intoCommon Stock at the then applicable conversion rate in the event ofthe closing of a [firm commitment] underwritten public offering witha price of [___]times the Original Purchase Price (subject toadjustments for stock dividends, splits, combinations and similarevents) and [net/gross] proceeds to the Company of not less than$[_______] (a “QPO”), or (ii) upon the written conse nt of the holdersof [__]%of the Series A Preferred.11[Pay-to-Play: [Unless the holders of [__]% of the Series A elect otherwise,] on any9The "broadest" base would include shares reserved in the option pool.10Note that additional exclusions are frequently negotiated, such as issuances in connection with equipment leasing and commercial borrowing. See Subsections 4.4.1(d)(v)-(viii) of the Model Certificate of Incorporation for additional exclusions.11The per share test ensures that the investor achieves a significant return on investment before the Companycan go public. Also consider allowing a non-QPO to become a QPO if an adjustment is made to the Conversion Price forthe benefit of the investor, so that the investor does not have the power to block a public offering.subsequent [down] round all [Major] Investors are required topurchase their pro rata share of the securities set aside by the Boardfor purchase by the [Major] Investors. All shares of Series APreferred12 of any [Major] Investor failing to do so will automatically[lose anti-dilution rights] [lose right to participate in future rounds][convert to Common Stock and lose the right to a Board seat ifapplicable].]13Redemption Rights:14Unless prohibited by Delaware law governing distributions tostockholders, the Series A Preferred shall be redeemable at the optionof holders of at least[__]% of the Series A Preferred commencingany time after [________] at a price equal to the Original PurchasePrice [plus all accrued but unpaid dividends]. Redemption shalloccur in three equal annual portions. Upon a redemption requestfrom the holders of the required percentage of the Series A Preferred,all Series A Preferred shares shall be redeemed [(except for anySeries A holders who affirmatively opt-out)].15STOCK PURCHASE AGREEMENTRepresentations and Warranties: Standard representations and warranties by the Company. [Representations and warranties by Founders regarding technology ownership, etc.].1612Alternatively, this provision could apply on a proportionate basis (e.g., if Investor plays for ½ of pro rata share, receives ½ of anti-dilution adjustment).13If the punishment for failure to participate is losing some but not all rights of the Preferred (e.g., anything other than a forced conversion to common), the Certificate of Incorporation will need to have so-called “blank check preferred” provisions at least to the extent necessary to enable the Board to issue a “shadow” class of preferred with diminished rights in the event an investor fails to participate. Because these provisions flow through the charter, an alternative Model Certificate of Incorporation with “pay-to-play lite” provisions (e.g., shadow Preferred) has been posted. As a drafting matter, it is far easier to simply have (some or all of) the preferred convert to common.14Redemption rights allow Investors to force the Company to redeem their shares at cost (and sometimes investors may also request a small guaranteed rate of return, in the form of a dividend). In practice, redemption rights are not often used; however, they do provide a form of exit and some possible leverage over the Company. While it is possible that the right to recei ve dividends on redemption could give rise to a Code Section 305 “deemed dividend” problem, many tax practitioners take the view that if the liquidation preference provisions in the Charter are drafted to provide that, on conversion, the holder receives the greater of its liquidation preference or its as-converted amount (as provided in the Model Certificate of Incorporation), then there is no Section 305 issue.15Due to statutory restrictions, the Company may not be legally permitted to redeem in the very circumstances where investors most want it (the so-called “sideways situation”). Accordingly, and particulary in light of the Delaware Chancery Court’s ruling in Thoughtworks (see discussion in Model Charter), investors may seek enforcement provisions to give their redemption rights more teeth - e.g., the holders of a majority of the Series A Preferred shall be entitled to elect a majority of the Company’s Board of Directors, or shall have consent rights on Company cash expenditures, until such amounts are paid in full.16Founders’ representations are controversial and may elicit significant resistance as they are found in a minority of venture deals. They are more likely to appear if Founders are receiving liquidity from the transaction, or if there is heightened concern over intellectual property (e.g., the Company is a spin-out from an academic institution or the Founder was formerly with another company whose business could be deemed competitive with the Company), or in international deals. Founders’ representations are even less common in subsequent rounds, where risk is viewed asConditions to Closing: Standard conditions to Closing, which shall include, among otherthings, satisfactory completion of financial and legal due diligence,qualification of the shares under applicable Blue Sky laws, the filingof a Certificate of Incorporation establishing the rights andpreferences of the Series A Preferred, and an opinion of counsel to theCompany.Counsel and Expenses: [Investor/Company] counsel to draft Closing documents. Companyto pay all legal and administrative costs of the financing [at Closing],including reasonable fees (not to exceed $[_____])and expenses ofInvestor counsel[, unless the transaction is not completed because theInvestors withdraw their commitment without cause].17Company Counsel: []Investor Counsel: []INVESTOR S’ RIGHTS AGREEMENTRegistration Rights:Registrable Securities: All shares of Common Stock issuable upon conversion of the SeriesA Preferred [and [any other Common Stock held by the Investors]will be deemed “Registrable Securities.”18Demand Registration: Upon earliest of (i) [three-five] years after the Closing; or (ii) [six]months19 following an in itial public offering (“IPO”), personsholding [__]% of the Registrable Securities may request [one][two](consummated) registrations by the Company of their shares. Theaggregate offering price for such registration may not be less than$[5-15] million. A registration will count for this purpose only if (i)all Registrable Securities requested to be registered are registered,and (ii) it is closed, or withdrawn at the request of the Investors (other significantly diminished and fairly shared by the investors, rather than being disproportionately borne by the Founders. A sample set of Founders Representations is attached as an Addendum at the end of the Model Stock Purchase Agreement.17The bracketed text should be deleted if this section is not designated in the introductory paragraph as one ofthe sections that is binding upon the Company regardless of whether the financing is consummated.18Note that Founders/management sometimes also seek limited registration rights.19The Company will want the percentage to be high enough so that a significant portion of the investor base is behind the demand. Companies will typically resist allowing a single investor to cause a registration. Experienced investors will want to ensure that less experienced investors do not have the right to cause a demand registration. In some cases, different series of Preferred Stock may request the right for that series to initiate a certain number of demand registrations. Companies will typically resist this due to the cost and diversion of management resources when multiple constituencies have this right.than as a result of a material adverse change to the Company).Registration on Form S-3: The holders of [10-30]% of the Registrable Securities will have theright to require the Company to register on Form S-3, if available foruse by the Company, Registrable Securities for an aggregate offeringprice of at least $[1-5 million]. There will be no limit on theaggregate number of such Form S-3 registrations, provided that thereare no more than [two] per year.Piggyback Registration: The holders of Registrable Securities will be entitled to “piggyback”registration rights on all registration statements of the Company,subject to the right, however, of the Company and its underwriters toreduce the number of shares proposed to be registered to a minimumof [20-30]% on a pro rata basis and to complete reduction on an IPOat the underwriter’s discretion. In all events, the shares to beregistered by holders of Registrable Securities will be reduced onlyafter all other stockholders’ shares are reduced.Expenses: The registration expenses (exclusive of stock transfer taxes,underwriting discounts and commissions will be borne by theCompany. The Company will also pay the reasonable fees andexpenses[, not to exceed $______,] of one special counsel torepresent all the participating stockholders.Lock-up: Investors shall agree in connection with the IPO, if requested by themanaging underwriter, not to sell or transfer any shares of CommonStock of the Company [(including/excluding shares acquired in orfollowing the IPO)] for a period of up to 180 days [plus up to anadditional 18 days to the extent necessary to comply with applicableregulatory requirements]20following the IPO (provided all directorsand officers of the Company [and [1 – 5]% stockholders] agree to thesame lock-up). [Such lock-up agreement shall provide that anydiscretionary waiver or termination of the restrictions of suchagreements by the Company or representatives of the underwritersshall apply to Investors, pro rata, based on the number of shares held.Termination: Upon a Deemed Liquidation Event, [and/or] when all shares of anInvestor are eligible to be sold without restriction under Rule 144[and/or] the [____] anniversary of the IPO.No future registration rights may be granted without consent of theholders of a[majority] of the Registrable Securities unlesssubordinate to the Investor’s rights.20See commentary in footnotes 23 and 24 of the Model Investor s’ Rights Agreement regarding possible extensions of lock-up period.Management and Information Rights: A Management Rights letter from the Company, in a form reasonably acceptable to the Investors, will be delivered prior to Closing to each Investor that requests one.21Any [Major] Investor [(who is not a competitor)] will be granted access to Company facilities and personnel during normal business hours and with reasonable advance notification. The Company will deliver to such Major Investor (i) annual, quarterly, [and monthly] financial statements, and other information as determined by the Board; (ii) thirty days prior to the end of each fiscal year, a comprehensive operating budget forecasting the Company’s revenues, expenses, and cash position on a month-to-month basis for the upcoming fiscal year[; and (iii) promptly following the end of each quarter an up-to-date capitalization table. A “Major Investor” means any Investor who purchases at least $[______] of Series A Preferred.Right to Participate Pro Rata in Future Rounds: All [Major] Investors shall have a pro rata right, based on their percentage equity ownership in the Company (assuming the conversion of all outstanding Preferred Stock into Common Stock and the exercise of all optio ns outstanding under the Company’s stock plans), to participate in subsequent issuances of equity securities of the Company (excluding those issuances listed at the end of the “Anti-dilution Provisions” section of this Term Sheet. In addition, should any [Major] Investor choose not to purchase its full pro rata share, the remaining [Major] Investors shall have the right to purchase the remaining pro rata shares.Matters Requiring Investor Director Approval: [So long as the holders of Series A Preferred are entitled to elect a Series A Director,the Company will not, without Board approval, which approval must include the affirmative vote of [one/both] of the Series A Director(s):(i) make any loan or advance to, or own any stock or othersecurities of, any subsidiary or other corporation, partnership, or other entity unless it is wholly owned by the Company; (ii) make any loan or advance to any person, including, any employee or director, except advances and similar expenditures in the ordinary course of business or under the terms of a employee stock or option plan approved by the Board of Directors; (iii) guarantee, any indebtedness except for trade accounts of the Company or any subsidiary arising in the ordinary course of business; (iv) make any investment inconsistent with any investment policy approved by the Board; (v) incur any aggregate indebtedness in excess of $[_____] that is not already included in a Board-approved budget, other than trade credit incurred in the ordinary course of business;21See commentary in introduction to Model Managements Rights Letter, explaining purpose of such letter.(vi) enter into or be a party to any transaction with any director, officer or employee of the Company or any “associate” (as defined in Rule 12b-2 promulgated under the Exchange Act) of any such person [except transactions resulting in payments to or by the Company in an amount less than $[60,000] per year], [or transactions made in the ordinary course of business and pursuant to reasonable requirements of the Company’s business and upon fair and reasonable terms that are approved by a majority of the Board of Directors];22(vii) hire, fire, or change the compensation of the executive officers, including approving any option grants; (viii) change the principal business of the Company, enter new lines of business, or exit the current line of business; (ix) sell, assign, license, pledge or encumber material technology or intellectual property, other than licenses granted in the ordinary course of business; or (x) enter into any corporate strategic relationship involving the payment contribution or assignment by the Company or to the Company of assets greater than [$100,000.00].Non-Competition andNon-Solicitation Agreements:23Each Founder and key employee will enter into a [one] year non-competition and non-solicitation agreement in a form reasonably acceptable to the Investors.Non-Disclosure and Developments Agreement: Each current and former Founder, employee and consultant will enter into a non-disclosure and proprietary rights assignment agreement in a form reasonably acceptable to the Investors.Board Matters: [Each Board Committee shall include at least one Series A Director.]The Board of Directors shall meet at least [monthly][quarterly],unless otherwise agreed by a vote of the majority of Directors.The Company will bind D&O insurance with a carrier and in anamount satisfactory to the Board of Directors. Company to enter intoIndemnification Agreement with each Series A Director [andaffiliated funds] in form acceptable to such director. In the event theCompany merges with another entity and is not the surviving22Note that Section 402 of the Sarbanes-Oxley Act of 2003 would require repayment of any loans in full priorto the Company filing a registration statement for an IPO.23Note that non-compete restrictions (other than in connection with the sale of a business) are prohibited in California, and may not be enforceable in other jurisdictions, as well. In addition, some investors do not require such agreements for fear that employees will request additional consideration in exchange for signing aNon-Compete/Non-Solicit (and indeed the agreement may arguably be invalid absent such additional consideration - although having an employee sign a non-compete contemporaneous with hiring constitutes adequate consideration in jurisdictions where non-competes are generally enforceable). Others take the view that it should be up to the Board on a case-by-case basis to determine whether any particular key employee is required to sign such an agreement.Non-competes typically have a one year duration, although state law may permit up to two years. Note also that some states may require that a new Non-Compete be signed where there is a material change in the employee’sduties/salary/title.。