CPA英语

CPA英语词汇通关必备手册(审计1-4)

Auditing审计PARTⅠChina Code of Ethics for Certified Public Accountants第一部分职业道德守则1.appointment, removal and resignation of auditor 注册会计师的任命、解聘和辞职2.fundamental principles 基本原则3.professional ethics 职业道德integrity 诚信objectivity / subjectivity 客观性/主观性professional competence and due care 专业胜任能力和应有的关注confidentiality 保密professional behavior 职业行为4.independence 独立性bias 偏见5.safeguard 防范措施6.self-interest 自身利益loans and guarantees 贷款和担保close business relationships 密切的商业关系employment with an audit client 与审计客户发生雇佣关系family and personal relationships 家庭和私人关系gifts and hospitality 礼品和款待lowball (向顾客)虚报低价7.self-review 自我评价8.advocacy 过度推介9.familiarity 亲密关系10.intimidation 外在压力11.conflict of interest 利益冲突12.client acceptance 接受客户关系engagement acceptance 承接业务changes in a professional appointment 客户变更委托13.second opinion 第二次意见14.custody of client assets 保管客户资产15.terminate (使)终结;(使)结束;解雇eliminate 消除,排除16.solicit 招揽;征求17.network 网络network firms 网络事务所18.public interest entities 公共利益实体audit client that are public interest entities 属于公共利益实体的审计客户19.related entities 关联实体20.engagement period 业务期间21.financial interest 经济利益22.close family member 其他近亲属immediate family 主要近亲属23.temporary staff assignments 临时借出员工24.the member of the audit team that recently served as a director, officer or specific employee of the audit client (审计项目组成员)最近曾任审计客户的董事、高级管理人员或特定员工25.acting as a director or officer of the audit client 兼任审计客户的董事或高级管理人员26.long association with an audit client 与审计客户存在长期业务关系27.provision of non-assurance services to audit clients 为审计客户提供非鉴证业务28.valuation services 评估服务taxation services 税务服务internal audit services 内部审计服务IT systems services 信息技术系统服务litigation support services 诉讼支持服务legal services 法律服务recruiting services 招聘服务corporate finance services 公司理财服务29.overdue fee 逾期收费contingent fee 或有收费referral fee 介绍费30.compensation and evaluation policies 薪酬和业绩评价政策31.actual or threatened litigation 诉讼或诉讼威胁32.nomination 任命;指派;提名33.client screening 客户甄别,客户筛选34.successor auditor 后任注册会计师present auditor 现任注册会计师predecessor auditor 前任注册会计师PART ⅡFundamentals to Audit35.audit 审计auditor 审计师;审计人员audit objective 审计目标audit plan 审计计划audit strategy 审计策略audit evidence 审计证据audit resources 审计资源36.audit risk 审计风险inherent risk 固有风险control risk 控制风险detection risk 检查风险risk of material misstatements 重大错报风险Audit risk=Inherent risk ×Control risk ×Detection risk 37.misstatement 错报;虚假陈述factual misstatement 事实错报judgmental misstatement 判断错报projected misstatement 推断错报38.error 错误(无意识做错)39.manual voucher 手工传票;手工凭证electric voucher 电子传票;电子凭证40.contradiction 矛盾,对立,反驳,否认inconsistent 矛盾的,不一致的consistent with 与……一致,符合41.acceptable 可接受的unacceptable 不可接受的42.professional skepticism 职业怀疑professional judgment 职业判断43.combined approach 综合性方案44.sufficient 充分的,足够的sufficiency 充足,充分性adequate 充足的,足够的adequacy 充足,足够,适当45.appropriate 适当的;占用、拨出appropriateness 恰当,适当appropriation 拨款,挪用relevant 相关的relevance 相关,相关性reliable 可靠的reliability 可靠性,可靠程度46.available 可得到的,可利用的availability 可得性,可用性,有效性47.aggregate 合计,集合,总体,集合体;合计的、集合的48.proficiency 熟练,精通49.assertion 认定rights and obligations 权利和义务valuation and allocation 计价和分摊existence 存在occurrence 发生completeness 完整性accuracy 准确性classification and understandability 分类和可理解性cut-off 截止presentation 列报disclosure 披露50.CAATs(Computer-Assisted Audit Techniques) 计算机辅助审计技术51.application control 应用控制general control 一般52.NET(nature, extent and timing) 性质、范围和时间安排53.explicit 明确的,清楚的;直率的implicit 暗示的;含蓄的54.audit sampling 审计抽样statistical sampling 统计抽样non-statistical sampling 非统计抽样attribute sampling 属性抽样variable sampling 变量抽样55.population (抽样)总体sample 样本;例子;样品;取样sample size 样本量;样本大小56.sampling risk 抽样风险non-sampling risk 非抽样风险57.random selection 随机数选样systematic selection 系统选样haphazard selection 随意选样58.tolerable misstatement 可容忍错报tolerable rate of deviation 可容忍偏差率59.stratification 分层60.PPS Sampling(Probability-Proportional-to-Size Sampling) 概率比例规模抽样61.materiality 重要性material 重要的;实质性的62.truth and fairness 真实公允63.acknowledge 承认,认可;告知已收到acknowledge receipt 确认收到;证实收到64.judgment 判断;辨别力65.justify 证明……是正当的justification 理由;认为有理66.omission 漏报67.audit documentation 审计工作底稿working papers 审计工作底稿68.audit file 审计档案permanent audit file 永久性档案current audit file 当期档案69.audit procedure 审计程序inspection of tangible assets 有形资产的检查inspection of documentation or records 文档和记录的检查inquiry=enquiry 询问analytical procedures 分析性程序analytical review 分析性复核70.staff 职员,工作人员audit staff 审计工作人员audit staffing 审计工作人员配备71.audit engagement letter=letter of engagement 审计业务约定书72.audit trail 审计线索73.audit approach 审计方法(论)74.schedule=timetable 时间表,计划表;一览表75.entity 主体,实体76.reasonable assurance 合理保证inherent limitation 固有局限性77.confirmation 函证;确认,证实positive confirmation 积极函证negative confirmation 消极函证78.audit engagement 审计业务review engagement 审阅业务agreed-upon procedures (执行)商定程序compilation engagement 代编财务信息79.assurance engagement 鉴证业务80.accountability 负责responsibility 责任81.stewardship 管理工作82.those charged with governance 公司治理层corporate governance 公司治理83.deficiency 缺乏,不足;缺陷,缺点84.enhance the credibility 增强可信性85.exemption 豁免,免除;免税PART ⅢAuditing Procedures第三部分审计测试流程86.substantive procedure 实质性程序analytical procedure 分析程序87.internal control 内部控制test of control 控制测试implementation of control 控制实施segregation of duties 职责分离88.internal control system 内部控制制度control environment 控制环境entity’s risk assessment process 被审计单位风险评估过程information system relevant to financial reporting 与财务报告相关的系统信息control activities 控制活动monitoring of controls 对控制的监督detective control/preventative control 检查性控制/预防性控制89.risk assessment procedures 风险评估程序risk identification 风险识别responding to the assessed risks/responding to the risk assessment 针对评估的风险采取应对措施90.management bias 管理层偏向impartial 公平的,公正的,不偏不倚的91.account balance 账户余额classes of transactions 各类交易92.likelihood 可能性,可能93.authority 授权,权限;权力,职权authorize 授权,批准authentication 证明,认证;身份验证94.interim and final audits 期中和期末审计95.charges and commitments 费用和承诺96.predict 预测,预知predictability 可预测性;可预见性predictable 可预见的;可预测的97.narrative note 文字说明questionnaire 调查表,问卷flowchart 流程图checklist 清单,检查表98.implication 暗示;含义99.susceptible 易受影响的100.material weakness 重大缺陷;重大弱点101.overstatement 多计,虚增;夸大understatement 少报;保守的陈述102.significant risk 特别风险103.unusual transaction 非常规交易104.abnormal 异常的105.walk-through test 穿行测试PART ⅣTransaction Cycles第四部分交易循环106.cycle approach 循环法account approach 账户法107.sales and receivables cycle 销售和应收账款循环purchases and payables cycle 采购和应付账款循环requisition 请购,请购单procurement 采购;获得,取得108.sales system 销售系统selling(authorization) 销售(授权)goods outwards(custody) 发货(保管)109.perpetual inventory system 永续盘存制110.physical inventory counts 存货盘点111.obsolete 淘汰,废弃;过时的,淘汰的,老式的obsolescence 过时,陈旧112.goods received notes(GRNs) 收货单,验货单goods dispatched notes(GDNs) 发货单dispatch 派遣,分配113.reimburse 清偿;偿还,赔偿reimbursement清偿,偿付;偿还,退还remit 汇款remittance 汇款114.teeming and lading 截留移用,挪用现金window dressing 粉饰115.sequence 顺序,序列numerical sequence 数字顺序116.letter of authority 授权书117.negotiable securities 可流通证券,有价证券118.bank reconciliation 银行存款余额调节表bank statement 银行存款余额对账单cash count 现金盘点119.coherence 一致,连贯性120.accounting records 会计分录121.sales invoices 销售发票122.shipping documents 运输单据123.source documents 原始凭证;交易凭证124.supervision of physical inventory count 监盘125.accounting estimates 会计估计鉴于大家都没有联合起来进行整理,楼主一人整理实在耽误学习时间。

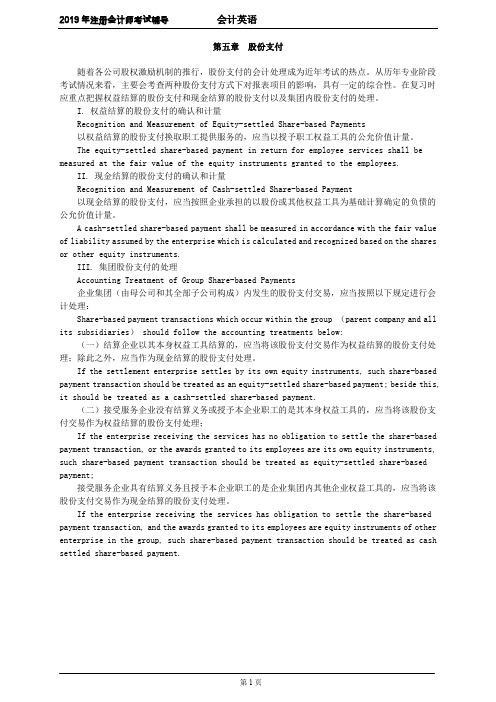

CPA 注册会计师 会计 讲义 会计英语 第五章 股份支付

2019年注册会计师考试辅导会计英语第五章股份支付随着各公司股权激励机制的推行,股份支付的会计处理成为近年考试的热点。

从历年专业阶段考试情况来看,主要会考查两种股份支付方式下对报表项目的影响,具有一定的综合性。

在复习时应重点把握权益结算的股份支付和现金结算的股份支付以及集团内股份支付的处理。

I. 权益结算的股份支付的确认和计量Recognition and Measurement of Equity-settled Share-based Payments以权益结算的股份支付换取职工提供服务的,应当以授予职工权益工具的公允价值计量。

The equity-settled share-based payment in return for employee services shall be measured at the fair value of the equity instruments granted to the employees.II. 现金结算的股份支付的确认和计量Recognition and Measurement of Cash-settled Share-based Payment以现金结算的股份支付,应当按照企业承担的以股份或其他权益工具为基础计算确定的负债的公允价值计量。

A cash-settled share-based payment shall be measured in accordance with the fair value of liability assumed by the enterprise which is calculated and recognized based on the shares or other equity instruments.III. 集团股份支付的处理Accounting Treatment of Group Share-based Payments企业集团(由母公司和其全部子公司构成)内发生的股份支付交易,应当按照以下规定进行会计处理:Share-based payment transactions which occur within the group (parent company and all its subsidiaries) should follow the accounting treatments below:(一)结算企业以其本身权益工具结算的,应当将该股份支付交易作为权益结算的股份支付处理;除此之外,应当作为现金结算的股份支付处理。

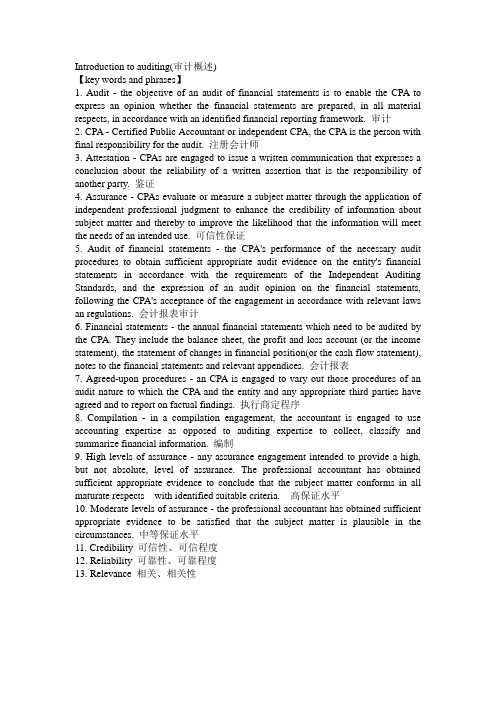

实用审计英语

Introduction to auditing(审计概述)【key words and phrases】1. Audit - the objective of an audit of financial statements is to enable the CPA to express an opinion whether the financial statements are prepared, in all material respects, in accordance with an identified financial reporting framework. 审计2. CPA - Certified Public Accountant or independent CPA, the CPA is the person with final responsibility for the audit. 注册会计师3. Attestation - CPAs are engaged to issue a written communication that expresses a conclusion about the reliability of a written assertion that is the responsibility of another party. 鉴证4. Assurance - CPAs evaluate or measure a subject matter through the application of independent professional judgment to enhance the credibility of information about subject matter and thereby to improve the likelihood that the information will meet the needs of an intended use. 可信性保证5. Audit of financial statements - the CPA's performance of the necessary audit procedures to obtain sufficient appropriate audit evidence on the entity's financial statements in accordance with the requirements of the Independent Auditing Standards, and the expression of an audit opinion on the financial statements, following the CPA's acceptance of the engagement in accordance with relevant laws an regulations. 会计报表审计6. Financial statements - the annual financial statements which need to be audited by the CPA. They include the balance sheet, the profit and loss account (or the income statement), the statement of changes in financial position(or the cash flow statement), notes to the financial statements and relevant appendices. 会计报表7. Agreed-upon procedures - an CPA is engaged to vary out those procedures of an audit nature to which the CPA and the entity and any appropriate third parties have agreed and to report on factual findings. 执行商定程序8. Compilation - in a compilation engagement, the accountant is engaged to use accounting expertise as opposed to auditing expertise to collect, classify and summarize financial information. 编制9. High levels of assurance - any assurance engagement intended to provide a high, but not absolute, level of assurance. The professional accountant has obtained sufficient appropriate evidence to conclude that the subject matter conforms in all maturate respects with identified suitable criteria. 高保证水平10. Moderate levels of assurance - the professional accountant has obtained sufficient appropriate evidence to be satisfied that the subject matter is plausible in the circumstances. 中等保证水平11. Credibility 可信性、可信程度12. Reliability 可靠性、可靠程度13. Relevance 相关、相关性Introduction to CPAs(注册会计师)【key words and phrases】1. continuing professional education(CPE)-the study and research undertaken by CPAs with a view to maintaining and improving their professional competence and the standard of their professional work, and obtaining and applying relevant new knowledge, skills, laws and regulation. 职业后续教育2. A uniform CPA examination- a uniform CPA examination administered once a year by the Chinese Institute of Certified Public Accountants for state boards of accountancy to enable them to issue CPA licenses. 统一的注册会计师考试3. Professional skepticism -an attitude that includes a questioning mind and a critical assessment of audit evidence. 职业谨慎4. Objectivity - a combination of impartiality, intellectual honesty and a freedom from conflicts of interest. 客观,客观性5. Professional competence - any CPA performing independent audit work should possess professional knowledge and experience, receive appropriate professional training and possess adequate analytical capability and judgment. 专业胜任能力6. Senior/CPA-in-charge - the senior/CPA-in-charge is an individual qualified to assume responsibility for planning and conducting an audit and drafting the audit report, subject to review and approval by the manager and partner. 项目经理Audit engagement letters(审计业务约定书)【key words and phrases】1. audit engagement letter - a written agreement or contract(usually acknowledged and accepted by the client as indicated by the client's signature)that documents and confirms the CPA's acceptance of the engagement, the objective and scope of the audit, the extent of the CPA's responsibilities to the client, and the form of any reports. 业务约定书2. recurring audit - an audit performed by a continuing CPA who also performed the prior year audit. 常年审计,连续审计3. the client - the entity or individual who engages the accounting firm and signs the audit engagement letter with the accounting firm. 委托人4. the nominated CPA 被提名审计师5. change CPA 更换审计师6. the existing CPA 现任审计师7. the successor CPA - the auditors who have accepted an engagement or who have been invited to make a proposal for an engagement to replace the CPA firm that formerly served as auditors. 后任审计师8. the preceding CPA(The predecessor CPA) - the CPA firm that formerly served as CPA but has resigned from the engagement or has been notified that its services have been terminated. 前任审计师9. audit appointment 审计委托10. the agreed term 约定条款11. accept an audit engagement 接受业务委托12. the objective of the engagement 委托目的13. the scope of the audit - the review procedures deemed necessary in the circumstances to achieve the objective of the audit. 审计范围14. issue the audit report 出具审计报告15. other CPA - the CPA of another accounting firm who is responsible for performing an audit on the accounting information of one or more components of the entity 其他注册会计师16. expert - a person or firm possessing special skill or knowledge in a field other than accounting or auditing, such as an actuary. 专家17. withdraw 撤消18. an initial audit 初次审计19. the board of directors 董事会20. a change in engagement 变更约定书21. shareholder 股东22. component - the entity's division, branch, subsidiary of associated company etc. Whose accounting information is included in the financial statements as a whole, audited by the principal CPA. 组成部分Knowledge of the entity's business【key words and phrases】1. knowledge of then entity's business - a general understanding of the economic environment and the industry within which the entity operates, and a more detailed understanding of the entity's internal condition. 了解被审计单位情况2. performing an audit of financial statements 实施财务报表审计3. assess inherent and control risks 评估固有风险和控制风险4. determine the nature, timing and extent of the audit procedures 确定审计程序的性质、时间和范围5. a general knowledge of...,a preliminary knowledge of 初步了解...的情况6. a more particular knowledge of ... 进一步了解...的情况7. prior to accepting an engagement 承接业务委托前8. following acceptance of the engagement 承接业务委托后9. update and reevaluate information gathered previously 更新并重新评价以前收集的信息10. the prior year's working papers 以前年度工作底稿11. director 董事12. senior operating personnel 高级管理人员13. internal audit personnel, internal audit's —— corporation employees who design and execute audit programs to test the effectiveness and efficiency of all aspects of internal control. The primary objective of internal audit is to evaluate improve the effectiveness and efficiency of the various operating units of an organization rather than to express an opinion as to the fairness of financial statements. 内部审计人员,内部审计师14. internal audit reports 内部审计报告15. minutes of meeting 会议纪要16. material sent to shareholders or filed with regulatory authorities 寄送给股东或报送监管部门备案的资料17. interim financial reports 中期财务报告18. management policy manual 管理政策手册19. chart of accounts 会计科目表20. exercise professional judgement 作出专业判断21. business risks (of the client) ——the risk assumed by investors or creditors that is associated with the company's survival and profitability. 经营风险22. management response thereto 管理当局的对策23. appropriateness ——the measure of the quality of audit evidence and its relevance to a particular assertion and its reliability. 适当性24. accounting estimate 会计估计25. management representations ——representations provided by management to the CPA that are related to the financial statements, either unsolicited or in response to specific inquiries. 管理当局声明26. related party ——parties are considered to be related if one party has the ability to control the other party or exercise significant influence over the other party in making financial and operating decisions. 关联方27. related party transaction ——a transfer of resources or obligations between related parties, regardless of whether a price is changed. 关联交易28. going concern assumption —— under the going concern assumption, an entity is ordinarily viewed as continuing in business for the foreseeable future with neither the intention nor the necessity of liquidation, ceasing trading or seeking protection from creditors pursuant to laws or regulations. 持续经营假设Audit planning【key words and phrases】1. audit plan ——a work plan, prepared by the CPA before performing detailed audit procedures, for completing an audit engagement of annual financial statements and achieving the expected audit objectives. 审计计划2. the overall audit plan —— the overall audit plan gives guidance on the expected scope of the audit and the way to perform the audit tests. It is a comprehensive plan of what the CPA's work basically involves throughout the whole process, from the acceptance of an audit engagement to the issuance of an audit report. 总体审计计划3. the detailed audit paln ——the detailed plan is prepared based on the overall audit plan. it sets out a detailed descriptionof the approach, nature, timing and extent of the audit procedures required in implementing the overall audit plan. 具体审计计划4. efficient audit (Audit in an effective manner) ——an effective audit that is performed at the lowest possible cost. 提高审计效率5. the size of the entity 被审计单位的规模6. the complexity of the audit 审计的复杂程度7. the specific methodology and technology 具体方法和技术8. financial performance 财务业绩9. material misstatement 重大虚假陈述10. significant audit areas 重点审计领域11. accounting estimate 会计估计12. coordination 协调13. review 复核14. statutory responsibility 法定责任15. time budget ——an estimate of the time required to perform each step in the audit 时间预算Error and Fraud【key words and phrases】1. error ——error refers to an unintentional misstatements or omissions in financial statements. 错误2. fraud ——fraud refers to intentional act which results in a misrepresentation of financial statement. 舞弊3. modified or additional procedures 修改或追加审计程序4. plan and perform audit procedure 计划和实施审计程序5. adequate accounting and internal control system 适当的会计和内部控制系统6. reduce but not eliminate 减少但不能消除7. manipulation 篡改8. falsification 伪造9. alteration of records or documents 更改记录和凭证10. misapproporation of assets 侵占资产11. transaction without substance 虚假交易12. misapplication of accounting policies 滥用(误用)会计政策13. the underlying records 原始凭证14. oversight or misinterpretation 疏忽或误解15. unusual pressures 异常压力16. accounting policy alternative 会计政策变更17. unusual transactions 异常交易18. incomplete files 不完整的档案19. out of balance control accounts 账户余额不平衡20. lack of proper authorization 缺乏适当的授权21. computer information systems environment 计算机信息系统环境22. inherent limitations of audit test 审计测试的固有限制23. discuss with management 与管理当局讨论24. the remedial action 纠正措施25. seek legal advice 寻求法律咨询Noncompliance with laws and regulations【key words and phrases】1. laws and regulations —— state laws, administrative regulations, departmental rulesand local laws and regulations other than the Accounting Standards for Business Enterprises and other relevant financial and accounting laws and regulations promulgated by the State. 法律与规章2. noncompliance ——noncompliance refers to acts of omission or commissionby the entity being audited, either intentional or unintentional, which are contrary to the prevailing laws or regulations. Such acts, include transtractions entered into by, or in the name of, the entity or on its behalf by its management or employees. 违反,不遵守3. withdrawal from the engagement 报销审计约定4. board of directors 董事会5. senior management 高级管理层6. detect noncompliance laws and regulations 发现违反法律和规章的行为7. deliberate failure to record transactions 故意漏记交易8. senior management override of control 高级管理层逾越控制9. intentional misrepresentations being made to the CPA 故意对注册会计师作出错误的陈述10. written representation 管理当局声明11. the suspected noncompliance 涉嫌存在违法行为12. audit committee ——a committee of a corporation's board of that engages independent auditors, reviews audit findings monitors activities of the internal staff, and intervenes in any disputes between management and the independent auditors. Preferably, members of the audit committee are directors, that is, members of the board of directors who do not also serve as corporate officers. 审计委员会13. supervisory board 监事会14. regulatory and enforcement authorities 监管和执法部门Audit materiality【key words and phrases】1. materiality ——the seriousness of misstatements or omissions in the entity's financial statements. The degree of the seriousness may affect the judgement or decisions made by users of financial statements in certain specific circumstances. 重要性2. exceed the materiality level 超过重要性水平3. approach the materiality level 接近重要性水平4. an acceptably low level 可接受水平5. the overall financial statement level and in related account balances and transaction levels 会计报表层面和相关账户、交易层面6. misstatement or omissions 错报或漏报7. the detected but uncorrected misstatements or omissions 已发现但尚未调整的错报或漏报8. the detected and the projected misstatements or omissions 已发现的和推断的错报或漏报9. aggregate 总计、合计10. subsequent events —— both events occurring between the balance sheet date andthe date of the audit report and events occurring between the date of the audit report and the date the financial statements are issued, which have an impact on the financial statements. 期后事项11. contingencies 或有事项12. extend the scope of the substantive test 扩大实质性测试范围13. adjust the financial statements 调整会计报表14. perform additional audit procedures 实施追加的审计程序15. carry out extended or additional tests of control 实施扩大或追加的控制测试16. modify the nature, timing and extent of planned substantive procedures. 修改计划的实质性测试程序的性质、时间和范围Audit risk【key words and phrases】1. audit risk ——the risk that the CPA gives an inappropriate audit opinion when the fianncial statements are materially misstated. Audit risk has three components: inherent risk, control risk and detection risk 审计风险2. inherent risk —— the susceptibility of an account balance or class of transactions to misstatement that could be material, individually or when aggregated with misstatements in other balances or classes, assuming that there were no related internal controls. 固有风险3. control risk ——the risk that a misstatement, that could occur in an account balance or class of transactions and that could be material individually or when aggregated with misstatements in other balances or classes, will not be prevented or detected and corrected on a timely basis by the accounting and internal control systems. 控制风险4. detection risk —— the risk that an CPA's substantive procedures will not detect a misstatement that exists in an account balance or class of transactions that could be material, individually or when aggregated with misstatements in other balances or classes. 检查风险5. an acceptably low level 可接受的低水平6. inappropriate audit opinion 不适当的审计意见7. material misstatement 重大的错报8. analytical procedures risk 分析性测试风险9. substantive tests of the detail risk 实质性测试风险10. tolerable misstatement 可容忍误差11. the combined level of inherent and control risks 固有风险和控制风险的综合水平12. the acceptable level of detection risk 可接受的检查风险13. planned assessed level of control risk ——the level of control risk auditor uses in developing a preliminary audit strategy which includes an appropriate combination of tests of controls and substantive tests. 控制风险的评估水平14. small business ——a business that has a low level of turnover or of total assets, few employees and limited segregation of duties. 小规模企业Internal control【key words and phrases】1. accounting system ——the series of tasks and records of an entity by which transactions are processed as a means of maintaining financial records. Such systems identify, assemble, analyze, calculate, classify, record, summarize and report transactions and other events.2. internal control system ——all the policies and procedures (internal controls) adopted by the management of an entity to assist in achieving management's objective of ensuring, as far as practicable, the orderly and efficient conduct of its business, including adherence to management policies, the safeguarding of assets, the prevention and detection of fraud and error, the accuracy and completeness of the accounting records, and the timely preparation of reliable financial information.3. control environment —— the overall attitude, awareness and actions of directors and management regarding the internal control system and its importance in the entity.4. control procedures ——those policies and procedures in addition to control environment which management has established to achieve the entity's specific objectives.5. compliance test6. test of control ——tests directed toward the design or operation of a control to assess its effectiveness in preventing or detecting material misstatements of financial statement assertions.7. walk-through test ——a test of the accuracy and completeness of the CPAs' working paper description of internal control. A walk-through is performed by tracing several transactions through each step of the related transaction cycle, noting whether the sequence of procedures actually performed corresponds to that described in the audit working papers.8. management letter —— a report to management containing the written recommendations made by the CPA with respect to material internal control weaknesses identified during the audit, which may result in material misstatements or omissions in the entity's financial statements9. material weakness in internal control —— a reportable condition in which the risk that material errors or irregularities might occur and not be detected.10. risk assessment —— the identification, analysis, and management of risk relevant to the preparation of financial statements that are fairly presented.11. control activities —— the policies and procedures that help ensure that necessary actions are taken to address the risks involve in the achievement of the entity's objectives.12. information —— the information system relevant to financial reporting objectives, which includes the accounting system, consists of methods and records established to record, process, summarize, and report an entity's transactions and to maintain accountability for the related assets and liabilities.13. communication ——communication involves providing an understanding of individual roles and responsibilities pertaining to internal control over financialreporting.14. monitoring ——monitoring is a process that assesses the quality of internal control over time.15. procedures manual16. job descriptions17. flow chart —— a graphic representation of the major steps and logic of a system or a series of procedures.18. written narrative ——memoranda that describe the flow of transaction cycles, identifying the employees performing various tasks, documents prepared, records maintained, and the division of duties. Written narratives are more flexible than questionnaires, but by themselves are practical only for describing relatively small, simply systems.19. questionnaire —— questionnaires are usually designed to describe internal control in audit working papers so that "no" answers prominently identify weaknesses in internal control.20. reperformance of internal control21. computer-assisted audit techniques22. communication with management —— a CPA's enquiring or informing the entity's management of matters relevant to the audit of financial statements or discussing such matters with the entity's management.Audit evidence【key words and phrases】1. audit evidence ——the information obtained by the CPA in arriving at the conclusions on which the audit opinions is based. 审计证据21. enquiry —— enquiry consists of the CPA questioning the relevant staff in written form of orally. 询问22. confirmation ——confirmation consists of the CPA's written correspondence with third parties to corroborate information contained in the entity's accounting records. 函证23. computation ——computation consists of the CPA checking the arithmetical accuracy of the data in the entity’s source documents and accounting records, or of the CPA performing independent calculations. 计算24. analytical procedures ——analytical procedures consist of the CPA analyzing material ratios or trends, including the investigation of unusual fluctuations and their differences from the expected amounts and relevant information. 分析性程序25. vouch ——to verify the accuracy and authenticity of entries in the accounting records by examining the original source documents supporting the entries. 核对26. aged trial balance —— a listing of individual customers’accounts classified by the number of days subsequent to billing, that is, age, serves as a preliminary step in estimating the collectibles of accounts receivable. 账龄分析表27. trace —— the direction of testing is from selecting an accounting transaction( a source document) to the journal or ledger. 追查Audit sampling【key words and phrases】1.audit sampling —— the CPA’s performance of tests on certain number of sampleitems selected from the population when the CPA performs the audit procedures.The CPA then projects the characteristics of the population based on the results of the tests. 审计抽样2.error ——either control deviations, when performing tests of control, ormisstatements, when performing substantive procedures. Similarly, total error is used to mean either the rate of deviation or total misstatement. 误差3.anomalous error ——an error that arises from an isolated event that has notrecurred other than on specifically identifiable occasions and is therefore not representative of errors in the population. 偶发性误差4.expected error —— the error that the CPA expects to present in the population.预期误差5.population —— the entire set of data from which a sample is selected and aboutwhich the CPA wishes to draw conclusions. For example, all of the items in an account balance or a class of transactions constitute a population. A population may be divided into strata, or sub-populations, with each stratum being examined separately. The term population is used to include the term stratum. 总体6.sampling risk —— arises from the possibility that the CPA’s conclusion, based ona sample may be different from the conclusion reached if the entire populationwere subjected to the same audit procedures. 抽样风险7.non-sampling risk ——arises from factors that cause the CPA to reach anerroneous conclusion for any reason not related to the size of the sample. For example, most audit evidence is persuasive rather than conclusive, the CPA might use inappropriate procedures, or the CPA might misinterpret evidence and fail to recognize an error. 非抽样风险8.sampling unit ——the individual items constituting a population, for examplechecks listed on deposit slips, credit entries on bank statements, sales invoices or debtor s’ balances, or a monetary unit. 抽样单位9.statistical sampling ——any approach to sampling that has the followingcharacteristics: (1)random selection of a sample; and (2)use of probability theory to evaluate sample results, including measurement of sampling risk. 统计抽样A sampling approach that does not have characteristics (1) and (2) isconsidered non-statistical sampling. (非统计抽样)10.stratification —— the process of dividing a population into subpopulations, eachof which is a group of sampling units which have similar characteristics (often monetary) 分层11.tolerable error —— the maximum error in population that the CPA is willing toaccept. 可容忍误差12.the risk of under reliance ——because of the sample result, the CPA does notadequately rely on the internal controls which could actually be relied upon. 信赖不足风险13.the risk of over reliance —— because of the sample result, the reliance the CPAplaces on the internal controls exceeds the reliance exceeds the reliance that should actually be placed on them. 信赖过度风险14.the risk of incorrect rejection ——although the sample result supports theconclusion that an account balance is materially misstated, in fact it is not materially misstated. 误拒风险15.the risk of incorrect acceptance ——although the sample result supports theconclusion that an account balance is not materially misstated, in fact it is materially misstated. 误受风险16.the rate of deviation 偏离程度17.sample size 样本量18.required confidence level 可信赖水平19.the number of sampling units in the population 总体中样本单位的数量20.methods used 所选用的方法21.effective audit —— an audit that achieves the planned degree of effectiveness indetecting any material misstatement in the client’s financial statements. 审计效果22.efficient audit —— an effective audit that is performed at the lowest possible cost.审计效率Audit working papers【key words and phrases】1.audit working papers (documentation) ——the audit working records andmaterials prepared, or obtained, by CPA in connection with the performance of the audit. 审计工作底稿2.working trial balance ——the working trial balance links the amounts in thefinancial statements to the audit working papers. It contains columns for working paper references, the prior year’s balance, the unadjusted current-year balances, and columns for adjusting and reclassification entries. 试算平衡表3.adjusting and reclassification entries ——adjusting entries are made to correcterrors in the client’s records. Reclassification entries are made to provide proper presentation of information on the financial statements. Adjusting entries are posted in both the client’s records and the working trial balance. Reclassification entries are not posted to the client’s records. 调整和重分类分录4.audit mark —— CPAs use audit marks as a way of documenting work performed.Audit mark is typically explained or defined at the bottom of the working paper, although many firms use a standard set of audit marks. 审计标识5.indexing and cross-referencing ——this process of indexing andcross-referencing provides a trail from the financial statements to the individual working papers that a reviewer can easily follow. 索引和交叉索引6.permanent audit files —— those audit files which contain information that is notfrequently changed and is referred to cover a long period of time. They also contain information of continuing relevance to, or with a direct impact on, succeeding audits. 永久性档案7.current audit files ——those audit files, the contents of which vary frequently.They are primarily used for the audit of the current period and for reference in thenext subsequent period. 当期档案prehensive working papers —— audit working papers prepared by the CPAduring the audit planning and reporting states. They are used for planning, controlling and concluding the audit engagement as a whole and for documenting the audit opinion. 综合类工作底稿9.audit-oriented working papers ——audit working papers prepared by the CPAregarding his performance of specific audit procedures during the audit implementation stage. 业务性工作底稿10.reference working papers —— the audit working papers used merely for referencewhich are prepared by the CPA in the course of the audit. 备查类工作底稿11.the use of standardized working papers 使用标准的工作底稿12.checklists 核对用清单Audit reporting【key words and phrases】1.audit report —— the written document which expresses the CPA’s audit opinionon the entity’s annual financial statements, following the performance of the necessary audit procedures in accordance with the requirements of the Independent Auditing Standards. 审计报告2.the truthfulness of the audit report ——the requirement that the audit reportshould objectively reflect the CPA’s scope and basis of the audit, the audit procedures performed and the audit opinion that should be expressed. 审计报告的真实性3.the legitimacy of the audit report ——the requirement that the preparation andissuance of the audit report should be in accordance with the requirements of both the Law of PRC on CPA and the Independent Auditing Standards. 审计报告的合法性4.entity —— an enterprise, or an institution managed on a commercial basis, whichis responsible for the preparation and submission of financial statements and audited by the CPA. 被审计单位,客户5.addressee of the audit report ——the client of the audit engagement. The fullname of the addressee should be stated in the audit report. 审计报告的收件人6.unqualified opinion ——an unqualified opinion should be expressed when theCPA concludes that。

常用职位英语

常用职位英语常用职位英语大全英语已经发展了1400多年。

英语的最早形式是由盎格鲁-撒克逊人移民于5世纪带到英国的一组西日耳曼语支(Ingvaeonic)方言,被统称为古英语。

下面为大家带来常用职位英语,快来看看吧。

职场中的.职位英语(一)Accounting Assistant会计助理Accounting Clerk记帐员Accounting Manager会计部经理Accounting Stall会计部职员Accounting Supervisor会计主管Ace Reporter名记者Acting General Manager代总经理Acting President大学代理校长Administration Controller政务总监Administration Manager行政经理Administration Staff行政人员Administrative Assistant行政助理Administrative Clerk行政办事员Advertising Staff广告工作人员Aeronautical Engineer航空工程师Agronomist农艺师Airlines Sales Representative 航空公司定座员Airlines Staff航空公司职员Ambassador大使Anaesthetist麻醉师Application Engineer应用工程师Architect建筑师Assistant Accountant助理会计师Assistant Cameraman摄影师助手Assistant Chief Engineer副总工程师Assistant Editor助理编辑Assistant Engineer助工assistant general mangaer助理总经理Assistant Manager副经理Assistant to General Manager总经理助理Assistant助理Associate Director副董事Associate Professor副教授Associate Research Fellow副研究员Associate Researcher/Associate Research Fellow 副研究员Associate Researcher副研究员Attending Doctor/Physician-in-Charge主治大夫Attending Doctor主治大夫Attorney律师Audio Operator声音操作员Automation Engineer自动工程师Bond Analyst证券分析员Bond Trader证券交易员Boom operator吊杆操作员Business Controller业务主任business manager业务部经理Business Manager业务经理Business Reporter工商记者Buyer采购员Cable Man电缆管理员Cashier出纳员Chairman of the Board/Chairman董事长Chairman主席Chancellor大学校长Chartered Accountant/CPA(Certified Public Accountant) 注册会计师Chemical Engineer化学工程师Chief AccountantChief Engineer总工程师Chief of Staff参谋长Chief Reporter采方主任Chief Reporter主任记者civil engineer土木工程师Clerk Typist & Secretary文书打字兼秘书Clerk/Receptionist职员/接待员Cold Storage Engineer冷藏工程师Commrecial Agent商业代理人Computer Data Input Operator 计算机资料输入员Computer Engineer计算机工程师Computer Processing Operator 计算机处理操作员Computer System Manager计算机系统部经理Conslar Aent领事代理Constructional engineerConsul General总领事Consul领事Consulting engineer顾问工程师Controller of sales营业总监Copywriter广告文字撰稿人Councillor参赞职场中的职位英语(二)CPA(Certified Public Accountant)注册会计师Data Processor资料员Dean of College/Head of College学院院长Dean教务长Dean院长Department Chairman/Department Head 系主任Department Chairman系主任Department Head系主任Department Manager部门经理Deputy Director General副处长Deputy General Manager副总经理Deputy Prime Minister Manager副首相Designer设计师Director General局长Director in Charge of General Affairs 总务长Director of Teaching Affairs/Dean教务长Director of Teaching and教导主任Director董事,主任Discipline Class Adviser/Head Teacher 班主任Distribution Manager发行部经理Economic Research Assistant经济研究助理Economist/Economic Manager经济师Editor in Chief总编辑Editor编辑electric engineer电机工程师Electrician电工Electronic Engineer电子工程师Engineer工程师Engineering Manager工程部经理Engineering Technician工程技术员English Instructor/Teacher英语教师Export Sales Manager外销部经理Export Sales Staff外销部职员F.X. (Foreign Exchange)Clerk外汇部职员F.X. Settlement Clerk外汇部核算员英语已经发展了1400多年。

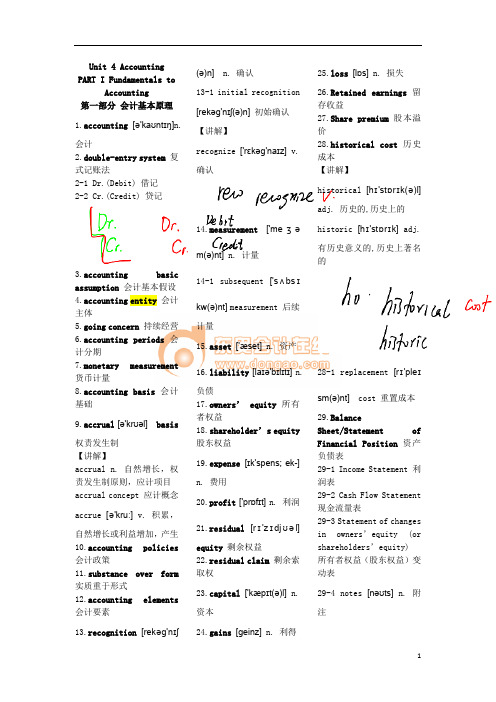

cpa会计英语词汇

Unit 4 Accounting PART I Fundamentals toAccounting第一部分会计基本原理1.accounting[ə'kaʊntɪŋ]n.会计2.double-entry system复式记账法2-1 Dr.(Debit) 借记2-2 Cr.(Credit) 贷记3.accounting basic assumption会计基本假设4.accounting entity会计主体5.going concern持续经营6.accounting periods会计分期7.monetary measurement 货币计量8.accounting basis会计基础9.accrual[ə'krʊəl]basis权责发生制【讲解】accrual n. 自然增长,权责发生制原则,应计项目accrual concept 应计概念accrue [ə'kruː] v. 积累,自然增长或利益增加,产生10.accounting policies 会计政策11.substance over form 实质重于形式12.accounting elements 会计要素13.recognition[rekəg'nɪʃ(ə)n] n. 确认13-1 initial recognition[rekəg'nɪʃ(ə)n]初始确认【讲解】recognize ['rɛkəg'naɪz] v.确认14.measurement['meʒəm(ə)nt] n. 计量14-1 subsequent ['sʌbsɪkw(ə)nt]measurement 后续计量15.asset['æset] n. 资产16.liability[laɪə'bɪlɪtɪ]n.负债17.owners’ equity所有者权益18.shareholder’s equity股东权益19.expense[ɪk'spens; ek-]n. 费用20.profit['prɒfɪt]n. 利润21.residual[rɪ'zɪdjʊəl]equity剩余权益22.residual claim剩余索取权23.capital['kæpɪt(ə)l] n.资本24.gains[ɡeinz] n. 利得25.loss[lɒs] n. 损失26.Retained earnings留存收益27.Share premium股本溢价28.historical cost历史成本【讲解】historical [hɪ'stɒrɪk(ə)l]adj. 历史的,历史上的historic [hɪ'stɒrɪk] adj.有历史意义的,历史上著名的28-1 replacement [rɪ'pleɪsm(ə)nt] cost 重置成本29.BalanceSheet/Statement ofFinancial Position 资产负债表29-1 Income Statement 利润表29-2 Cash Flow Statement现金流量表29-3 Statement of changesin owners’equity (orshareholders’equity)所有者权益(股东权益)变动表29-4 notes [nəʊts] n. 附注PART II FinancialAssets*第二部分金融资产* 30.financial assets金融资产e.g. A financial instrument is any contract that gives rise to a financial asset of one enterprise and a financial liability or equity instrument of another enterprise.【讲解】give rise to 引起,导致31.cash on hand 库存现金32.bank deposits[dɪ'pɒzɪt]银行存款33.A/R, account receivable应收账款34.notes receivable应收票据35.others receivable其他应收款项36.equity investment股权投资37.bond investment债券投资38.derivative financial instrument衍生金融工具39.active market活跃市场40.quotation[kwə(ʊ)'teɪʃ(ə)n]n. 报价41.financial assets atfair value throughprofit or loss以公允价值计量且其变动计入当期损益的金融资产41-1 those designated asat fair value throughprofit or loss 指定为以公允价值计量且其变动计入当期损益的金融资产41-2 financial assetsheld for trading 交易性金融资产42.financial liability金融负债43.transaction costs交易费用43-1 incrementalexternal cost 新增的外部费用【讲解】incremental [ɪnkrə'məntl]adj. 增量的,增值的44.cash dividenddeclared but notdistributed 已宣告但尚未发放的现金股利投资收益45.profit and lossarising from fair valuechanges公允价值变动损益46.Held-to-maturityinvestments持有至到期投资47.amortized cost摊余成本【讲解】amortized [ə'mɔ:taizd]adj.分期偿还的,已摊销的48.effective interestrate实际利率49.loan[ləʊn] n. 贷款50.receivables[ri'si:vəblz]n. 应收账款51.available-for-salefinancial assets可供出售金融资产52.impairment offinancial assets金融资产减值52-1 impairment loss offinancial assets 金融资产减值损失53.transfer of financialassets金融资产转移53-1 transfer of thefinancial asset in itsentirety 金融资产整体转移53-2 transfer of a part ofthe financial asset 金融资产部分转移54.derecognition[diː'rekəg'nɪʃən] n. 终止确认,撤销承认recognition54-1 derecognize [diː'rekəgnaɪz] v. 撤销承认e.g. An enterprise shall derecognize a financial liability (or part of it) only when the underlying present obligation (or part of it) is discharged/cancelled. 【译】金融负债的现时义务全部或部分已经解除的,才能终止确认该金融负债或其一部分。

会计中级职称 英语

会计中级职称英语在会计领域,中级职称通常会有不同的称谓,具体名称可能因国家、行业和组织而异。

以下是一些通用的会计中级职称及相关表达:1.中级会计师(Intermediate Accountant)She recently earned the title of Intermediate Accountant.(她最近获得了中级会计师的职称。

)2.高级会计助理(Senior Accounting Assistant)After several years of experience, he was promoted to Senior Accounting Assistant.(经过几年的经验积累,他被提升为高级会计助理。

)3.注册会计师(Certified Public Accountant - CPA)Becoming a CPA is often considered an intermediate milestone in an accountant's career.(成为注册会计师通常被认为是会计职业中的中级里程碑。

)4.高级财务分析师(Senior Financial Analyst)She has progressed from Junior Financial Analyst to Senior Financial Analyst.(她从初级财务分析师晋升为高级财务分析师。

)5.中级内部审计师(Intermediate Internal Auditor)The company is currently seeking candidates for the position of Intermediate Internal Auditor.(公司目前正在寻找中级内部审计师的候选人。

)6.管理会计师(Management Accountant)He is working towards becoming a Management Accountant, the next step in his career progression.(他正努力成为管理会计师,这是他职业发展的下一步。

CPA 注册会计师 会计 讲义 会计英语 第六章 或有事项

2019年注册会计师考试辅导会计英语第六章或有事项本部分在历年专业阶段考试中涉及分数较少,但在2009年也独立考核过主观题,并可以选用英文作答。

本章内容比较简单,在复习中应熟练掌握或有事项的处理原则,争取在考试中对这部分题目做到“手到擒来”。

I.或有负债和或有资产或有负债无论是现时义务,还是潜在义务均不符合负债的确认条件,因而不能确认,只能在附注中披露。

No matter it is a current obligation or a potential obligation , contingent liability couldn’t be recognized because the liability recognition criteria are not met. It only can be disclosed in note.或有资产,是潜在资产,不符合资产的确认条件,因而不能确认,只有在很可能导致经济利益流入企业时才能在附注中披露。

Contingent asset is potential asset and should not be recognized because it is not satisfying the asset recognition criteria and will be disclosed in the notes once it would most likely lead to economic benefit flowing into the business.II. 预计负债的确认 Recognition of provision与或有事项相关的义务同时满足下列条件的,应当确认为预计负债:The obligation pertinent to a contingency shall be recognized as provision when the following conditions are satisfied simultaneously:(1)该义务是企业承担的现时义务;That obligation is a current obligation of the enterprise;(2)履行该义务很可能导致经济利益流出企业;It is likely to cause any economic benefit to flow out of the enterprise as a result of performance of the obligation;(3)该义务的金额能够可靠地计量。

2012CPA综合阶段英语—财管

Financial Management and Cost Management01. Financing Sources词汇:Finance lease:融资租赁Lessee:承租人Lessor:出租人Minimum lease payment:最低租赁付款额Operating lease:经营租赁Warrant:认股权证Convertible bond:可转换债券Redeemable:可赎回的Other long-term finance 其他长期筹资Finance Lease1.The lease transfers ownership of the asset to the lessee by the end of the lease term.2.The lessee has the option to buy the asset at a price expected to be lower than fair value at the time the option is exercised.3.The lease term is for the major part of the economic life of the asset.4.At the beginning of the lease, the present value of the minimum lease payments (MLPˊs)is approximately equal to the fair value of the asset.5.The leased assets are of a specialized nature so that only the lessee can use them without major modification.融资租赁:·在租赁期届满时,租赁资产的所有权转移给承租人·承租人有购买租赁资产的选择权,所订立的购买价格预计将远低于行使选择权时租赁资产的公允价值·租赁期占租赁资产可使用年限的大部分·租赁开始日最低租赁付款额的现值几乎相当于租赁开始日租赁资产的公允价值·租赁资产性质特殊,如果不做重新改制,只有承租人才能使用Warrants 认股权证Warrants is a type of certificate issued by entity to shareholders, which allows holders to purchase prescribed amount of shares at prescribed price in the given period.认股权证是公司向股东发放的一种凭证,授权其持有者在一个特定期间以特定价格购买特定数量的公司股票。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

【例】某公司采用随机模式进行现金管理。已知持 有有价证券的平均年利率为5%,公司的现金余额 的下限为1500元,现金余额的最优返回线为8000 元。如果公司现有现金20000元,则此时应当投资 于有价证券的金额是多少元。 『正确答案』H=3R-2L=3×8000-2×1500= 21000元,根据现金管理的随机模式,如果现金量 在控制上下限之间,不必进行现金与有价证券转换。 【思考】本题中假设公司现有现金30000元,此时 应投00(元)

(4)计算每年与批量相关的存货总成本; 每年与批量相关的总成本

(5)计算再订货点; 再订货点R=L×D+B=6×10000/(50×6)+ 100=300(套) (6)计算每年与储备存货相关的总成本。 计算每年与储备存货相关的总成本=与批量相关的 成本+购置成本+固定订货成本+固定储存成本+保险 储备的变动储存成本 =21000+395×10000+(10760+3000×12)+ 2500+52.5×100=4025 510(元)

【例】某生产企业使用A零件,可以外购, 也可以自制。如果外购,单价4元,一次订 货成本10元;如果自制,单位成本3元,每 次生产准备成本600元,每日产量50件。 零件的全年需求量为3600件,储存变动成 本为零件价值的20%,每日平均需求量为 10件。 下面分别计算零件外购和自制的总成本, 以选择较优的方案。

要求: (1)计算经济批量模型公式中“订货成本”; (2)计算经济批量模型公式中“储存成本”; (3)计算经济订货批量; (4)计算每年与批量相关的存货总成本; (5)计算再订货点; (6)计算每年与储备存货相关的总成本。

(1)计算经济批量模型公式中“订货成本”; 订货成本=(13400-10760)/22+280+ 8×2.5=420(元) (2)计算经济批量模型公式中“储存成本”; 储存成本=4+28.5+20=52.50(元) (3)计算经济订货批量;

要求:(1)计算每次订货的变动成本; (2)计算每块玻璃的变动储存成本; (3)计算经济订货量; (4)计算与经济订货量有关的存货总 成本。

(1)每次订货的变动成本=33+70.8+ 6×11.5=172.8(元) (2)每块玻璃的变动储存成本=8+ 1200×1%+1200×5%=80(元) (3)经济订货量=(2×10800×172.8/ 80)1/2=216(块) (4)与经济订货量有关的存货总成本= 216×80=17280(元)

900 2400 3300 6000 495 45 450

要求: 假设A公司上述资产负债表的年末金额可以 代表全年平均水平,请分别计算A公司 2010年、2011年的净经营资产净利率、经 营差异率、杠杆贡献率和权益净利率。

【正确答案】 (1)2010年: 净经营资产净利率=294/2100×100%=14% 税后利息率=36/600×100%=6% 经营差异率=14%-6%=8% 杠杆贡献率=8%×(600/1500)=3.2% 权益净利率=14%+3.2%=17.2% 2011年: 净经营资产净利率=495/3300×100%=15% 税后利息率=45/900×100%=5% 经营差异率=15%-5%=10% 杠杆贡献率=10%×(900/2400)=3.75% 权益净利率=15%+3.75%=18.75%

【例】在使用存货模式进行最佳现金持有 量的决策时,假设持有现金的机会成本率 为8%,与最佳现金持有量对应的交易成本 为2000元,则企业的最佳现金持有量为 ( )元。 机会成本=交易成本=2000元=(最佳现 金持有量/2)×8% 所以,最佳现金持有量 =50000(元)。

【例· 计算题】F公司有关资料如下: (1)目前F公司的现金余额为70万元。 (2)未来1年,预计公司的每月现金流出比现 金流入多36万元。 (3)F公司的证券买卖都是通过一个代理员进 行的,每一笔业务将需要由公司支付500元。 (4)货币市场上的年证券收益率为6.5%。 要求计算: (1)该公司应保留多少元的现金余额? (2)公司目前应该将多少现金投资于货币市 场的有价证券? (3)公司在未来12个月内将进行多少次证券 销售?

会计英语

1.机会成本 机会成本=平均现金持有量×机会成本率= C/2×K 2.交易成本 交易成本=交易次数×每次交易成本=T/C×F 3.最佳持有量及其相关公式 机会成本、交易成本与现金持有量之间的关系, 可以图示如下:

从上图可以看出,当机会成本与交易成本 相等时,相关总成本最低,此时的持有量 即为最佳持有量。由此可以得出:

(1)年现金需求量=12×36=432(万元)

(2)公司需要投资:700 000-257 801.35= 442 198.65(元) (3)未来12个销售证券的次数=4320 000/ 257801.35=17(次)

【例· 计算题】假定某公司有价证券的年利率 为9%,每次固定转换成本为50元,公司认为 任何时候其银行活期存款及现金余额均不能低 于1000元,又根据以往经验测算出现金余额 波动的标准差为800元。求最优现金返回线R、 现金控制上限H。 『正确答案』 最优现金返回线R、现金控制上限H的计 算为: 有价证券日利率=9%÷360=0.025%

(2)保险储备量为10件 再订货点为110件。 一次订货的期望缺货量=10×0.04+20×0.01 =0.6件 全年缺货成本=0.6×12×4=28.8(元) 全年储存成本=10×2=20(元) 全年相关总成本=48.8(元) (3)保险储备量为20件 采用同样方法计算出全年相关总成本=44.8(元)

80 90 0.20 100 0.50 110 0.20 120 0.04 130 0.01

需要量 70 (10×d)

概率(P) 0.01 0.04

(1)不设置保险储备。 不设置保险储备,再订货点为:10×3600/360 =100件。当需求量为100或100以下时,不会发生缺 货。当需求量为110件时,缺货10件,概率为0.20; 当需要量为120件时,缺货量为20件,概率为0.04; 当需求量为130件时,缺货30件,概率0.01。 一次订货的期望缺货量=10×0.20+20×0.04 +30×0.01=3.1件 全年缺货成本=3.1×12×4=148.8(元) 全年储存成本=0 全年相关总成本=148.8(元)

【例· 计算题】甲公司是一家汽车挡风玻璃批发商, 为5家汽车制造商提供挡风玻璃,该公司总经理为了 降低与存货有关的总成本,请你帮助他确定最佳的采 购批量,有关资料如下: (1)单位进货成本1200元; (2)全年需求预计为10800块玻璃; (3)每次订货发生时处理订单成本33元; (4)每次订货需要支付运费70.8元; (5)每次收货后需要验货,验货时外聘一名工 程师,验货过程需要6小时,每小时支付工资11.5元; (6)为存储挡风玻璃需要租用公共仓库。仓库 租金为每年2500元,另外按平均存量加收每块挡风 玻璃8元/年; (7)挡风玻璃为易碎品,损毁成本为年平均存 货价值的1%; (8)公司的年资金成本为5%。

【自制与外购存货的决策】

『正确答案』 (1)外购零件

TC=DU+TC(Q*)=3600×4+240=14640( 元) (2)自制零件

TC=DU+TC(Q*)=3600×3+1440=12240(元) 由于自制的总成本低于外购的总成本,因此以自制为宜。

保险储备

【例】假定某存货的年需要量D=3600件,单位 储存变动成本Kc=2元,单位缺货成本Ku=4元, 交货时间L=10天,已经计算出经济订货量Q= 300件,每年订货次数N=12次。交货期内的存货 需要量及其概率分布见表。要求计算保险储备和 再订货点。

(4)保险储备量为30件 缺货成本=0 储存成本=30×2=60(元) 当保险储备量为20件时,全年相关总 成本最低。故应确定保险储备量20件,或 者再订货点120件。

【例· 计算题】上海东方公司是一家亚洲地区的玻璃套装门分销商, 套装门在香港生产然后运至上海。管理当局预计年度需求量为10000 套。套装门的购进单价为395元(包括运费,单位是人民币,下同) 。与定购和储存这些套装门的相关资料如下: (1)去年的订单共22份,总处理成本13400元,其中固定成本 10760元,预计未来成本性态不变。 (2)虽然对于香港源产地商品进入大陆已经免除关税,但是对于每 一张订单都要经双方海关的检查,其费用为280元。 (3)套装门从生产商运抵上海后,接受部门要进行检查。为此雇佣 一名检验人员,每月支付工资3000元,每个订单的抽检工作需要8小 时,发生的变动费用每小时2.5元。 (4)公司租借仓库来存储套装门,估计成本为每年2500元,另外加 上每套门4元。 (5)在储存过程中会出现破损,估计破损成本平均每套门28.5元。 (6)占用资金利息等其他储存成本每套门20元。 (7)从发出订单到货物运到上海需要6个工作日。 (8)为防止供货中断,东方公司设置了100套的保险储备。 (9)东方公司每年经营50周,每周营业6天。

A公司是一家生产企业,其财务分析采用改进的管理 用财务报表分析体系,该公司2010年、2011年改进 的管理用财务报表相关历史数据如下:

金额 2011年 2010年 600 1500 2100 4800 294 36 258

项目 资产负债表项目(年末) 净负债 股东权益 净经营资产 利润表项目(年度) 销售收入 税后经营净利润 减:税后利息费用 净利润