会计学--企业决策的基础 第二章作业答案

会计学 企业决策的基础 财务会计分册 版 章答案

Chapter 6Merchandising Activitie s Ex. 6.41PROBLEM 6.1AClaypool earned a gross profit rate of 32%, which is significantly higher than the industry average. Claypool’s sales were above the industry average, and it earned $77,968 more gross profit than the “average” store of its size. This higher gross profit was earned even though its cost of goods sold was $18,000 to $20,000 higher than the industry average because of the additional transportation charges.To have a higher-than-average cost of goods sold and still earn a much larger-than-average amount of gross profit, Claypool must be able to charge substantially higher sales prices than most hardware stores. Presumably, the company could not charge such prices in a highly competitive environment. Thus, the remote location appears to insulate it from competition and allow it to operate more profitably than hardware stores with nearby competitors.PROBLEM 6.5Ac. Yes. Sole Mates should take advantage of 1/10, n/30 purchase discounts, even if itmust borrow money for a short period of time at an annual rate of 11%. Bytaking advantage of the discount, the company saves 1% by making payment 20 days early. At an interest rate of 11% per year, the bank charges only 0.6%interest over a 20-day period (11% X 20/365 = 0.6%). Thus, the cost of passing up the discount is greater than the cost of short-term borrowing.Chapter 7 Financial assetsChapter 8 Inventories and the cost of goods soldSupplementary ProblemChapter 91617。

会计学 企业决策的基础 课后习题答案 chapter

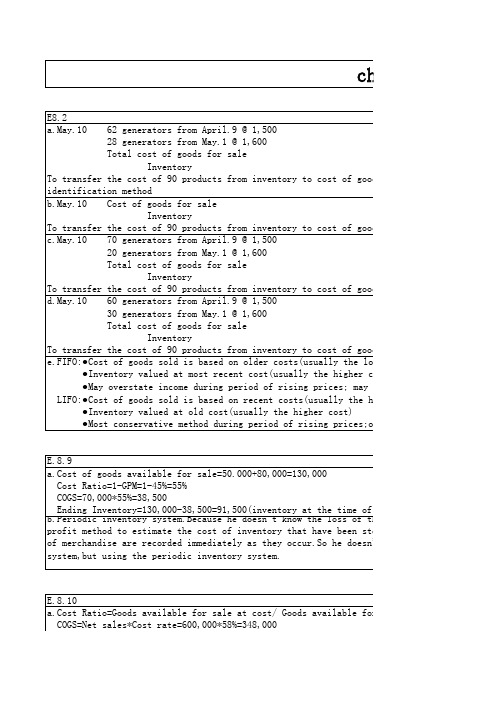

20 generators from May.1 @ 1,600 Total cost of goods for sale

chapter8

st of goods sold account by the specific

st of goods sold account by the average-cost

st of goods sold account by the FIFO method

500 generators from January 9 @ 32

Total cost of goods for sale

Inventory

To transfer the cost of 1000 products from inventory to cost of goods sold account by the

Inventory To transfer the cost of 90 products from inventory to cost of goods sold account by the LI e.FIFO:●Cost of goods sold is based on older costs(usually the lower costs)

Inventory To transfer the cost of 90 products from inventory to cost of goods sold account by the FI d.May.10 60 generators from April.9 @ 1,500

会计学企业决策的基础 答案

管理会计作业(chapter16-20) Chapter 16 P757 16、5AChapter 16 P761 16、4BChapter 17 P802 17、3Aa、Department One overhead application rate based onmachine-hours:ManufacturingOverhead = $420,000 = $35 per machine-hour Machine-Hours 12,000Department Two overhead application rate based on direct labor hours:ManufacturingOverhead = $337,500 = $22、50 per direct labor hourDirect Labor Hours 15,000Chapter 17 P805 17、8Ad、The Custom Cuts product line is very labor intensive in comparison to the Basic Chunksproduct line、Thus, the company’s current practice of using direct labor hours toallocate overhead results in the assignment of a disproportionate amount of total overhead to the Custom Cuts product line、If pricing decisions are set as a fixed percentage above the manufacturing costs assigned to each product, the Custom Cuts product line isoverpriced in the marketplace whereas the Basic Chunks product line is currently priced at an artificially low price in the marketplace、This probably explains why sales of Basic Chunks remain strong while sales of Custom Cuts are on the decline、e、The benefits the company would achieve by implementing an activity-based costing systeminclude: (1) a better identification of its operating inefficiencies, (2) a better understanding of its overhead cost structure, (3) a better understanding of the resource requirements of each product line, (4) the potential to increase the selling price of Basic Chunks to make it more comparable to competitive brands and possibly do so without having to sacrificesignificant market share, and (5) the ability to decrease the selling price of Custom Cuts without having to sacrifice product quality、Chapter 18 P835 18、1B、Ex、a、job costing (each project of a construction company is unique)18、1b、both job and process costing (institutional clients may representunique jobs)c、job costing (each set of equipment is uniquely designed andmanufactured)d、process costing (the dog houses are uniformly manufactured inhigh volumes)e、process costing (the vitamins and supplements are uniformlymanufactured in high volumes)Chapter 18 P841 18、3A4,000 EU @ $61、50 = $246,000b4,000 EU @ $13、50 = $54,000Chapter 18 P845 18、2Ba、(1) $49 [($192,000 + $48,000 + $54,000) ÷ 6,000 units](2) $109 [($480,000 + $108,000 + $66,000) ÷ 6,000 units](3) $158 ($49 + $109)(4) $32 ($192,000 ÷ 6,000 units)(5) $18 ($108,000 ÷ 6,000 units)b、In evaluating the overall efficiency of the Engine Department, management wouldlook at the monthly per-unit cost incurred by that department, which is the cost of assembling and installing an engine ($109 in part a)、Chapter 20 P918 20、1Ad、No、With a unit sales price of $94, the break-even sales volume in units is 54,000 units:Unit contribution margin = $94 - $84 variable costs = $10Break-even sales volume (in units) = $540,000$10= 54,000 unitsUnless Thermal Tent has the ability to manufacture 54,000 units (or lower fixed and/or variable costs), setting the unit sales price at $94 will not enable Thermal Tent to break even、Chapter 20 P918 20、2AChapter 20 P920 20、6ASales volume required to maintain current operating income:Sales Volume = Fixed Costs + Target OperatingIncomeUnit Contribution Margin= $390,000 + $350,000= $20,000 units $37。

会计学-企业决策的基础 答案教学资料

会计学-企业决策的基础答案管理会计作业(chapter16-20)Chapter 16 P757 16.5AChapter 16 P761 16.4BChapter 17 P802 17.3Aa. Department One overhead application rate based on machine-hours:Manufacturing Overhead= $420,000= $35 per machine-hourMachine-Hours 12,000Department Two overhead application rate based on direct labor hours:Manufacturing Overhead= $337,500= $22.50 per direct labor hourDirect Labor Hours 15,000Chapter 17 P805 17.8Ad. The Custom Cuts product line is very labor intensive in comparison to the BasicChunks product line. Thus, the company’s current practice of using direct laborhours to allocate overhead results in the assignment of a disproportionate amount of total overhead to the Custom Cuts product line. If pricing decisions are set as a fixed percentage above the manufacturing costs assigned to each product, the Custom Cuts product line is overpriced in the marketplace whereas the Basic Chunks product line is currently priced at an artificially low price in the marketplace. This probablyexplains why sales of Basic Chunks remain strong while sales of Custom Cuts are on the decline.e. The benefits the company would achieve by implementing an activity-based costingsystem include: (1) a better identification of its operating inefficiencies, (2) a betterunderstanding of its overhead cost structure, (3) a better understanding of theresource requirements of each product line, (4) the potential to increase the sellingprice of Basic Chunks to make it more comparable to competitive brands and possibly do so without having to sacrifice significant market share, and (5) the ability todecrease the selling price of Custom Cuts without having to sacrifice product quality.Chapter 18 P835 18.1a. job costing (each project of a construction company is unique)B. Ex.18.1b. both job and process costing (institutional clients may represent uniquejobs)c. job costing (each set of equipment is uniquely designed andmanufactured)d. process costing (the dog houses are uniformly manufactured in highvolumes)e. process costing (the vitamins and supplements are uniformlymanufactured in high volumes)Chapter 18 P841 18.3Ab4,000 EU @ $13.50 = $54,000Chapter 18 P845 18.2Ba. (1) $49 [($192,000 + $48,000 + $54,000) ÷ 6,000 units](2) $109 [($480,000 + $108,000 + $66,000) ÷ 6,000 units](3) $158 ($49 + $109)(4) $32 ($192,000 ÷ 6,000 units)(5) $18 ($108,000 ÷ 6,000 units)b. In evaluating the overall efficiency of the Engine Department, management wouldlook at the monthly per-unit cost incurred by that department, which is the cost of assembling and installing an engine ($109 in part a).Chapter 20 P918 20.1Ad. No. With a unit sales price of $94, the break-even sales volume in units is 54,000 units:Unit contribution margin = $94 - $84 variable costs = $10Break-even sales volume (in units) = $540,000$10= 54,000 unitsUnless Thermal Tent has the ability to manufacture 54,000 units (or lower fixed and/or variable costs), setting the unit sales price at $94 will not enable Thermal Tent to break even.Chapter 20 P918 20.2AChapter 20 P920 20.6ASales volume required to maintain current operating income:Sales Volume =Fixed Costs + Target Operating IncomeUnit Contribution Margin=$390,000 + $350,000= $20,000 units$37。

会计学 企业决策的基础 16版 1-5章 课后习题答案

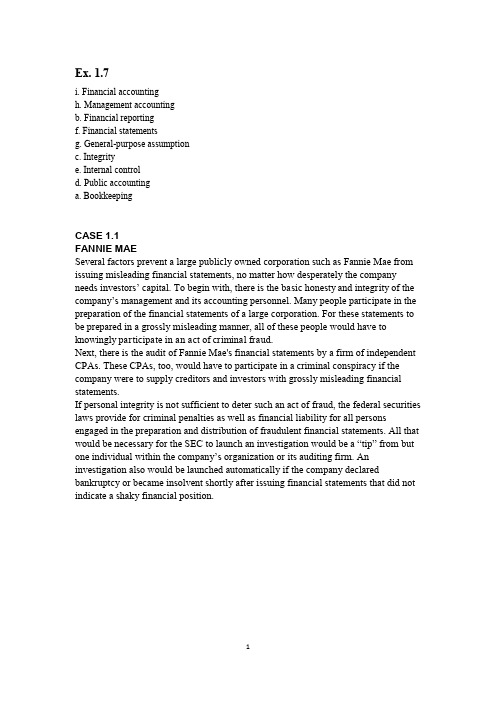

Ex. 1.7i. Financial accountingh. Management accountingb. Financial reportingf. Financial statementsg. General-purpose assumptionc. Integritye. Internal controld. Public accountinga. BookkeepingCASE 1.1FANNIE MAESeveral factors prevent a large publicly owned corporation such as Fannie Mae from issuing misleading financial statements, no matter how desperately the company needs investors’ capital. To begin with, there is the basic honesty and integrity of the company’s management and its accounting personnel. Many people participate in the preparation of the financial statements of a large corporation. For these statements to be prepared in a grossly misleading manner, all of these people would have to knowingly participate in an act of criminal fraud.Next, there is the audit of Fannie Mae's financial statements by a firm of independent CPAs. These CPAs, too, would have to participate in a criminal conspiracy if the company were to supply creditors and investors with grossly misleading financial statements.If personal integrity is not sufficient to deter such an act of fraud, the federal securities laws provide for criminal penalties as well as financial liability for all persons engaged in the preparation and distribution of fraudulent financial statements. All that would be necessary for the SEC to launch an investigation would be a “tip” from but one individual within the company’s organization or its auditing firm. An investigation also would be launched automatically if the company declared bankruptcy or became insolvent shortly after issuing financial statements that did not indicate a shaky financial position.Problem 2.1 AProblem 3.8AExercise 4.2Exercise 4.14Problem 4.5AProblem 5.2AProblem 5.5A。

会计学企业决策的基础 课后习题 答案 chapter

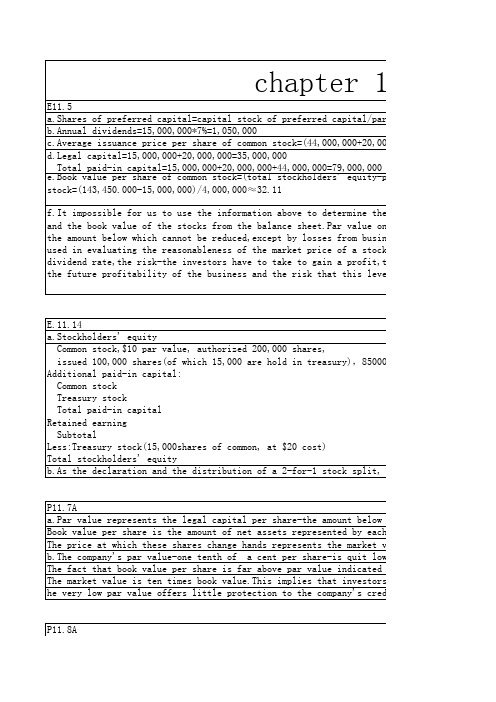

Total paid-in capital=15,000,000+20,000,000+44,000,000=79,000,000 e.Book value per share of common stock=(total stockholders' equity-preferred stock)/shares stock=(143,450.000-15,000,000)/4,000,000≈32.11

会计学企业决策的基础chapter2 答案

(5)(6)(7)(8)(9)Owner’s equity is not valued at either the original amountinvested or at the estimated market value of the business. In fact, owner’s equity cannot be valued independently of the values assigned to assets and liabilities. Rather, it is a residual figure—the excess of total assets over totalliabilities. (If liabilities exceed assets, owners' equity would be a negative amount.) Thus the amount of Berkeley's capital should be determined by subtracting the corrected figure for total liabilities ($23,100) from the corrected amount of total assets ($51,500). This indicates owners'equity of $28,400.The $22,400 described as “Other assets” is not an asset,because there is no valid legal claim or any reasonable expectation of recovering the income taxes paid. Also, the payment of federal income taxes by Pippin was not abusiness transaction by Big Screen Scripts. If a refund were obtained from the government, it would come to Pippin personally, not to the business entity.The proper valuation for the land is its historical cost of$39,000, the amount established by the transaction in which the land was purchased. Although the land may have acurrent fair value in excess of its cost, the offer by the friend to buy the land if Pippin would move the building appears to be mere conversation rather than solid, verifiable evidence of the fair value of the land. The "cost principle," although less than perfect, produces far more reliable financial statements than would result if the owners could "pull figures out of the air" in recording asset values.The accounts payable should be limited to the debts of the business, $32,700, and should not include Pippin’s personal liabilities.The amount owed to stagehands for work done throughSeptember 30 is the result of completedtransactions and should be included among the liabilities of the business. Even if agreement hasbeen reached with Mario Dane for her to perform in a future play, he has not yet performedand therefore, is not yet owed any money. Thus, this $25,000 is not yet a liability of thebusiness.therefore cannot be included in the assets. To do so would cause an overstatement of both assets and owners’ equity.The “Office furniture” amount must be reduced by $2,525.invested or at the estimated market value of the business. In fact, owner’s equity cannot be valued independently of the values assigned to assets and liabilities. Rather, it is a residual figure—the excess of total assets over total liabilities. (If liabilities exceed assets, owners' equity would be a negative amount.) Thus the amount of Berkeley's capital should be determined by subtracting the corrected figure for total liabilities ($23,100) from the corrected amount of total assets ($51,500). This indicates owners' equity of $28,400.。

会计学——企业决策的基础(英文版)课后习题答案_comprehensive_problem_1(完整版)

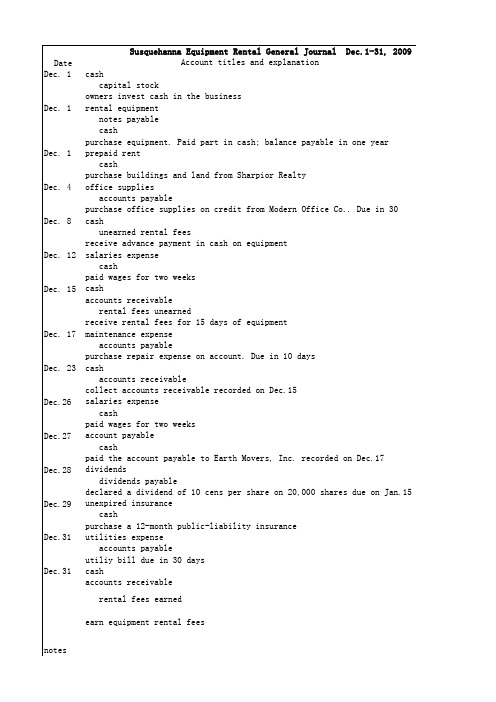

notes

unadjusted trail balance

Susquehanna Equipment Rental adjustments Dr Cr Dr Cr

work sheet for

balance sheet accounts cash accounts receivable prepaid rent unexpired insurance office supplies rental equipment accumulated depreciation: rental equipment notes payable accounts payable interest payable salaries payable dividends payable unearned rental fees income taxes payable capital stock retained earnings dividends income statement accounts rental fees earned salaries expense maintenance expense utilities expense rent expense office supplies expense depreciation expense interest expense income taxes expense income summary subtotal net income total

Dec.26

Dec.27

Dec.28

Dec.29

Dec.31

Dec.31

cash capital stock owners invest cash in the business rental equipment notes payable cash purchase equipment. Paid part in cash; balance payable in one year prepaid rent cash purchase buildings and land from Sharpior Realty office supplies accounts payable purchase office supplies on credit from Modern Office Co.. Due in 30 days cash unearned rental fees receive advance payment in cash on equipment salaries expense cash paid wages for two weeks cash accounts receivable rental fees unearned receive rental fees for 15 days of equipment maintenance expense accounts payable purchase repair expense on account. Due in 10 days cash accounts receivable collect accounts receivable recorded on Dec.15 salaries expense cash paid wages for two weeks account payable cash paid the account payable to Earth Movers, Inc. recorded on Dec.17 dividends dividends payable declared a dividend of 10 cens per share on 20,000 shares due on Jan.15 unexpired insurance cash purchase a 12-month public-liability insurance utilities expense accounts payable utiliy bill due in 30 days cash accounts receivable rental fees earned earn equipment rental fees

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

B. Ex. 2.10

The burglary on January 7 is an event after reporting date (期后事项,资产负债表日后事项) which occur between the reporting date and the date on which the financial statements are authorised for issue by the board of directors.).

(1) The burglary on January 7 is a non-adjusting event which is indicative of conditions that arose after the reporting date and has no effect on items in the financial statements, but should be disclosed by notes if material.(2) If the burglary took place before December 31, it is an adjusting event which provides additional evidence of conditions existing at the reporting date and the amounts in the financial statements should be adjusted.

b.

Yes; the form of Fellingham’s organization is relevant to a lender. If the company is

not incorporated, the owner or owners are personally liable for the debts of the business organization. Thus, if the business is organized as a sole proprietorship, it is actually Small’s personal debt-paying ability that determines the collectibility of loans to the business. If the business is a partnership, all of the partners are personally liable for the company’s debts.

If Fellingham is organized as a corporation, however, a lender may look only to the corporate entity for payment. However, some lenders would not make sizable loans to a small corporation unless one or more of the stockholders personally guaranteed the loan. This is accomplished by having the stockholder(s) cosign the note.。